UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

OR |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____ |

Commission file number 001-00035  GENERAL ELECTRIC COMPANY (Exact name of registrant as specified in its charter) |

New York | 14-0689340 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| ||

41 Farnsworth Street, Boston, MA | 02210 | |

(Address of principal executive offices) | (Zip Code) | |

| ||

(Registrant's telephone number, including area code) (617) 443-3000

_______________________________________________ (Former name, former address and former fiscal year, if changed since last report) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

| Accelerated filer

|

Non-accelerated filer

| Smaller reporting company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

There were 8,846,390,000 shares of common stock with a par value of $0.06 per share outstanding at September 30, 2016.

TABLE OF CONTENTS

Page | |

Forward Looking Statements | 3 |

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) | 4 |

Key Performance Indicators | 8 |

Consolidated Results | 11 |

Segment Operations | 15 |

Corporate Items and Eliminations | 34 |

Discontinued Operations | 37 |

Other Consolidated Information | 38 |

Statement of Financial Position | 40 |

Financial Resources and Liquidity | 41 |

Exposures | 47 |

Critical Accounting Estimates | 48 |

Other Items | 49 |

Supplemental Information | 51 |

Controls and Procedures | 58 |

Other Financial Data | 58 |

Regulations and Supervision | 59 |

Legal Proceedings | 60 |

Financial Statements and Notes | 63 |

Exhibits | 123 |

Form 10-Q Cross Reference Index | 124 |

Signatures | 125 |

FORWARD LOOKING STATEMENTS

This document contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," or "target."

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about our announced plan to combine our Oil & Gas business with Baker Hughes, including projected revenue and cost synergies, impact on our earnings per share, and the timing and structure of the proposed transaction; our announced plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with this plan and earnings per share of GE Capital's retained businesses (Verticals); expected income; earnings per share; revenues; organic growth; growth and productivity associated with our Digital business; margins; cost structure; restructuring charges; transaction-related synergies; cash flows; returns on capital and investment; capital expenditures, capital allocation or capital structure; and dividends.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

| our ability to complete incremental asset sales as part of our announced plan to reduce the size of our financial services businesses in a timely manner (or at all) and at the prices we have assumed; |

| our ability to reduce costs as we execute that plan; |

| changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets, including the impact of these conditions on our ability to execute that plan; |

| the impact of conditions in the financial and credit markets on the availability and cost of GE Capital Global Holdings, LLC's (GE Capital) funding, and GE Capital's exposure to counterparties; |

| the impact of conditions in the housing market and unemployment rates on the level of commercial credit defaults; |

| pending and future mortgage loan repurchase claims and other litigation claims and investigations in connection with WMC, which may affect our estimates of liability, including possible loss estimates; |

| our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; |

| the amount and timing of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; |

| GE Capital's ability to pay dividends to GE at the planned level, which may be affected by GE Capital's cash flows and earnings, financial services regulation and oversight, and other factors; |

| our ability to convert pre-order commitments/wins into orders/bookings; |

| the price we realize on orders/bookings since commitments/wins are stated at list prices; |

| customer actions or developments such as early aircraft retirements or reduced energy demand, changes in economic conditions, including oil prices, and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; |

| the effectiveness of our risk management framework; |

| the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of financial services regulation and litigation; |

| our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; |

| our success in completing, including obtaining regulatory approvals and satisfying other closing conditions for, announced transactions, such as our announced plans and transactions to combine our Oil & Gas business with Baker Hughes and reduce the size of our financial services businesses; |

| our success in integrating acquired businesses and operating joint ventures, including Alstom and Baker Hughes; |

| our ability to realize anticipated earnings and savings from announced transactions, acquired businesses and joint ventures, including Alstom and Baker Hughes; |

| the impact of potential information technology or data security breaches; and |

| the other factors that are described in "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015. |

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially .

2016 3Q FORM 10-Q 3

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

PRESENTATION

The consolidated financial statements of General Electric Company (the Company) combine the industrial manufacturing and services businesses of General Electric Company (GE) with the financial services businesses of GE Capital Global Holdings, LLC, and its predecessor, General Electric Capital Corporation (GE Capital or Financial Services).

We believe that investors will gain a better understanding of our company if they understand how we measure and talk about our results. Because of the diversity in our businesses, we present our financial statements in a three-column format, which allows investors to see our industrial operations separately from our Financial Services operations. We believe that this, along with further disaggregation of our results into segments and GE Capital Verticals, provides useful information to investors. When used in this report, unless otherwise indicated by the context, we use the terms to mean the following:

| General Electric or the Company – the parent company, General Electric Company. |

| GE – the adding together of all affiliates except GE Capital, whose continuing operations are presented on a one-line basis, giving effect to the elimination of transactions among such affiliates. Transactions between GE and GE Capital have not been eliminated at the GE level. We present the results of GE in the center column of our consolidated statements of earnings, financial position and cash flows. An example of a GE metric is GE cash from operating activities (GE CFOA). |

| General Electric Capital Corporation or GECC – the predecessor to GE Capital Global Holdings, LLC. |

| GE Capital Global Holdings, LLC or GECGH – the adding together of all affiliates of GECGH, giving effect to the elimination of transactions among such affiliates. |

| GE Capital or Financial Services – refers to GECGH, or its predecessor GECC, and is the adding together of all affiliates of GE Capital giving effect to the elimination of transactions among such affiliates. We present the results of GE Capital in the right-side column of our consolidated statements of earnings, financial position and cash flows. |

| GE consolidated – the adding together of GE and GE Capital, giving effect to the elimination of transactions between the two. We present the results of GE consolidated in the left-side column of our consolidated statements of earnings, financial position and cash flows. |

| Industrial – GE excluding the continuing operations of GE Capital. We believe that this provides investors with a view as to the results of our industrial businesses and corporate items. An example of an Industrial metric is Industrial CFOA (Non-GAAP), which is GE CFOA excluding the effects of dividends from GE Capital. |

| Industrial segment – the sum of our seven industrial reporting segments, without giving effect to the elimination of transactions among such segments and between these segments and our Financial Services segment. This provides investors with a view as to the results of our industrial segments, without inter-segment eliminations and corporate items. An example of an industrial segment metric is industrial segment revenue growth. |

| Total segment – the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions among such segments. This provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

| Verticals or GE Capital Verticals – the adding together of GE Capital businesses that we expect to retain, principally its vertical financing businesses-GE Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Industrial Finance (which includes Healthcare Equipment Finance, Working Capital Solutions and Industrial Financing Solutions)-that relate to the Company's core industrial domain and other operations, including our run-off insurance activities, and allocated corporate costs. |

We integrate acquisitions as quickly as possible. Revenues and earnings from the date we complete the acquisition through the end of the fourth quarter following the acquisition are considered the acquisition effect of such businesses.

2016 3Q FORM 10-Q 4

Discussion of GE Capital's total assets includes deferred income tax liabilities, which are presented within assets for purposes of our consolidated statement of financial position presentations for this filing.

Amounts reported in billions in graphs within this report are computed based on the amounts in millions. As a result, the sum of the components reported in billions may not equal the total amount reported in billions due to rounding. Certain columns and rows within the tables may not add due to the use of rounded numbers. Percentages presented are calculated from the underlying numbers in millions.

Discussions throughout this MD&A are based on continuing operations unless otherwise noted.

The MD&A should be read in conjunction with the Financial Statements and Notes to the consolidated financial statements.

OTHER TERMS USED BY GE

| Backlog – unfilled customer orders for products and product services (expected life of contract sales for product services). |

| Continuing earnings – unless otherwise indicated, we refer to captions such as "earnings from continuing operations attributable to GE common shareowners" as continuing earnings or simply as earnings. |

| Continuing earnings per share (EPS) – unless otherwise indicated, when we refer to continuing earnings per share, it is the diluted per-share amount of "earnings from continuing operations attributable to GE common shareowners". |

| Digital revenues – revenues related to software-enabled product upgrades, internally developed software (including Predix) and associated hardware, and software-enabled productivity solutions. These revenues are largely generated from our operating businesses and are included in their segment results. |

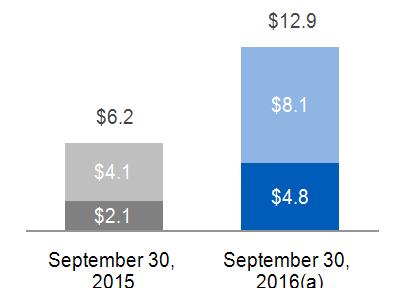

| Ending Net Investment (ENI) (Non-GAAP) – the total capital we have invested in the Financial Services business. It is the sum of short-term borrowings, long-term borrowings and equity (excluding noncontrolling interests) adjusted for unrealized gains and losses on investment securities and hedging instruments. Alternatively, it is the amount of assets of continuing operations less the amount of non-interest-bearing liabilities. |

| Equipment leased to others (ELTO) – rental equipment we own that is available to rent and is stated at cost less accumulated depreciation. |

| GE Capital Exit Plan – our plan, announced on April 10, 2015, to reduce the size of our financial services businesses through the sale of most of the assets of GE Capital, and to focus on continued investment and growth in our industrial businesses. |

| Industrial margin – GE revenues and other income excluding GE Capital earnings (loss) from continuing operations (Industrial revenues) minus GE total costs and expenses less GE interest and other financial charges divided by Industrial revenues. |

| Industrial operating profit margin (Non-GAAP) – Industrial segment profit plus corporate items and eliminations (excluding gains, restructuring, and pre-tax non-operating pension costs) divided by industrial segment revenues plus corporate items and eliminations (excluding gains and GE-GE Capital eliminations). |

| Net earnings – unless otherwise indicated, we refer to captions such as "net earnings attributable to GE common shareowners" as net earnings. |

| Net earnings per share (EPS) – unless otherwise indicated, when we refer to net earnings per share, it is the diluted per-share amount of "net earnings attributable to GE common shareowners". |

| Non-operating pension costs (Non-GAAP) – comprise the expected return on plan assets, interest cost on benefit obligations and net actuarial gain (loss) amortization for our principal pension plans. |

| Operating earnings (Non-GAAP) – GE earnings from continuing operations attributable to GE common shareowners excluding the impact of non-operating pension costs. |

| Operating earnings per share (Non-GAAP) – unless otherwise indicated, when we refer to operating earnings per share, it is the diluted per-share amount of "operating earnings". |

| Operating pension costs (Non-GAAP) – comprise the service cost of benefits earned, prior service cost amortization and curtailment gain or loss for our principal pension plans. |

| Organic revenues (Non-GAAP) – revenues excluding the effects of acquisitions, dispositions and foreign currency exchange. |

2016 3Q FORM 10-Q 5

| Product services – for purposes of the financial statement display of sales and costs of sales in our Statement of Earnings, "goods" is required by SEC regulations to include all sales of tangible products, and "services" must include all other sales, including other services activities. In our MD&A section of this report, we refer to sales under product services agreements and sales of both goods (such as spare parts and equipment upgrades) and related services (such as monitoring, maintenance and repairs) as sales of "product services," which is an important part of our operations. We refer to "product services" simply as "services" within the MD&A. |

| Product services agreements – contractual commitments, with multiple-year terms, to provide specified services for products in our Power, Renewable Energy, Oil & Gas, Aviation and Transportation installed base – for example, monitoring, maintenance, service and spare parts for a gas turbine/generator set installed in a customer's power plant. |

| Revenues – unless otherwise indicated, we refer to captions such as "revenues and other income" simply as revenues. |

| Segment profit – refers to the operating profit of the industrial segments and the net earnings of the Financial Services segment. See the Segment Operations section within the MD&A for a description of the basis for segment profits. |

NON-GAAP FINANCIAL MEASURES

In the accompanying analysis of financial information, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered "non-GAAP financial measures" under the SEC rules. Specifically, we have referred, in various sections of this report, to:

| Industrial segment organic revenues |

| Operating and non-operating pension costs |

| Adjusted corporate costs (operating) |

| Industrial operating and GE Capital earnings (loss) from continuing operations and EPS |

| Industrial operating + Verticals earnings and EPS |

| Industrial operating profit and operating profit margin (excluding certain items) |

| Industrial segment operating profit and operating profit margin (excluding Alstom) |

| Industrial cash flows from operating activities (Industrial CFOA) and Industrial CFOA excluding taxes related to the Appliances business sale |

| Capital ending net investment (ENI), excluding liquidity |

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the Supplemental Information section within this MD&A. Non-GAAP financial measures referred to in this report are either labeled as "non-GAAP" or designated as such with an asterisk (*).

2016 3Q FORM 10-Q 6

OUR OPERATING SEGMENTS

We are a global digital industrial company, transforming industry with software-defined machines and solutions that are connected, responsive and predictive, with products and services ranging from aircraft engines, locomotives, power generation and oil and gas production equipment to medical imaging, financing and industrial products. Operational and financial overviews for our operating segments are provided in the "Segment Operations" section within this MD&A.

OUR INDUSTRIAL OPERATING SEGMENTS

| Power |  | Transportation |  | Energy Connections & Lighting (a) |

| Renewable Energy |  | Aviation | ||

| Oil & Gas |  | Healthcare |

OUR FINANCIAL SERVICES OPERATING SEGMENT

| Capital |

(a) | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes the historical results of the Appliances business prior to its sale. |

CORPORATE INFORMATION

GE's Internet address a t www.ge.com , Investor Relations website at www.ge.com/investor-relations and our corporate blog at www.gereports.com , as well as GE's Facebook page and Twitter accounts, including @GE_Reports, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.

2016 3Q FORM 10-Q 7

KEY PERFORMANCE INDICATORS

(Dollars in billions; per-share amounts in dollars)

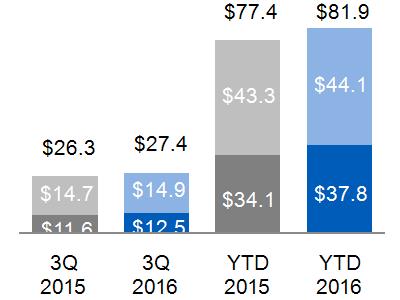

REVENUES PERFORMANCE |

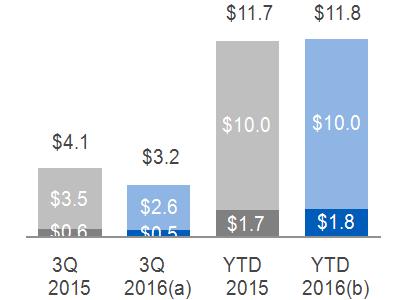

INDUSTRIAL ORDERS |

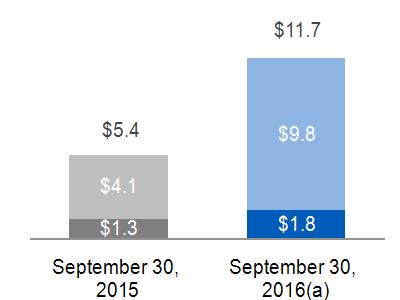

INDUSTRIAL BACKLOG | |||||||

3Q 2016 | YTD 2016 |

|

Equipment

Services

|

|

Equipment

Services

| ||||

Industrial Segment | 4% | 6% | |||||||

Industrial Segment Organic* | 1% | -% | |||||||

Capital | (2)% | -% | |||||||

(a) Included $5.2 billion related to Alstom (b) Included $12.7 billion related to Alstom | (a) Included $31.9 billion related to Alstom

| ||||||||

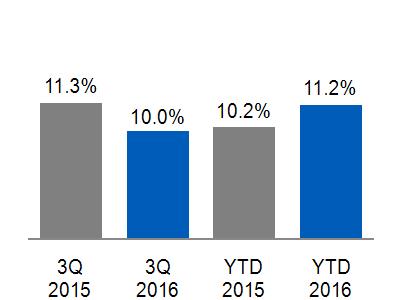

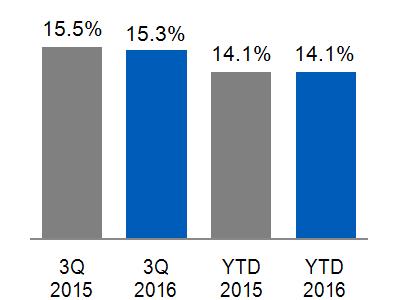

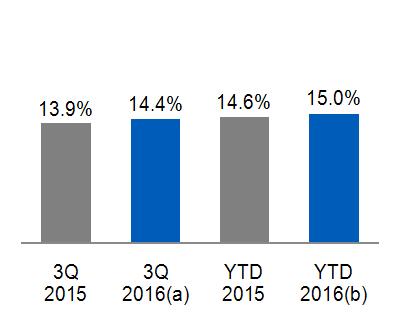

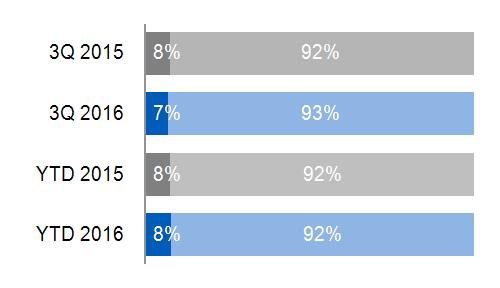

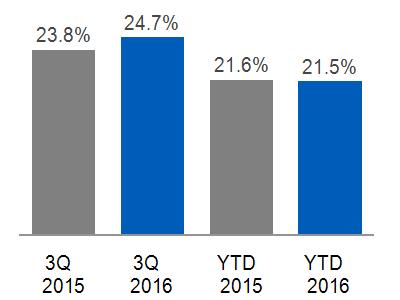

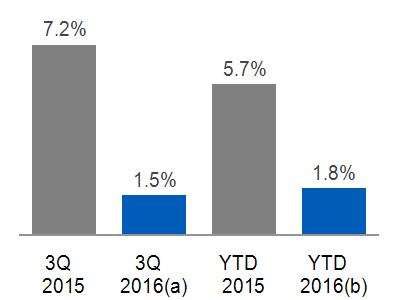

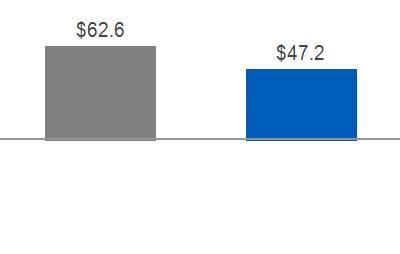

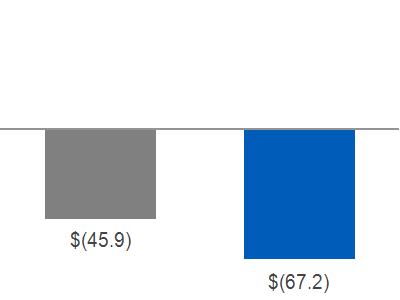

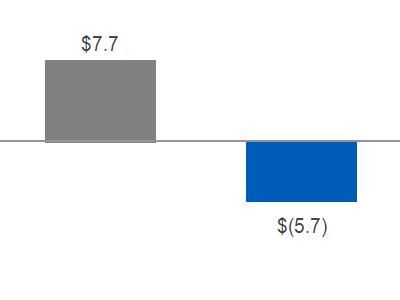

INDUSTRIAL MARGINS |

INDUSTRIAL OPERATING PROFIT MARGINS (NON-GAAP) (a) |

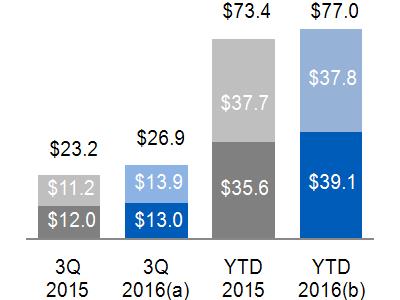

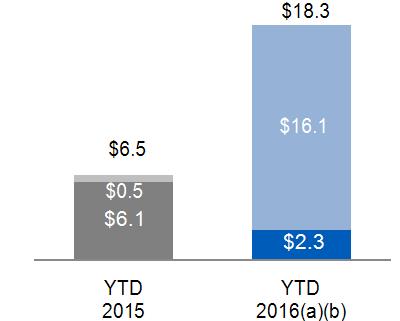

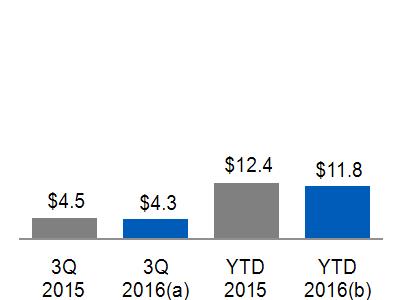

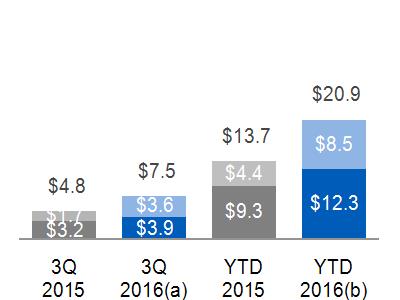

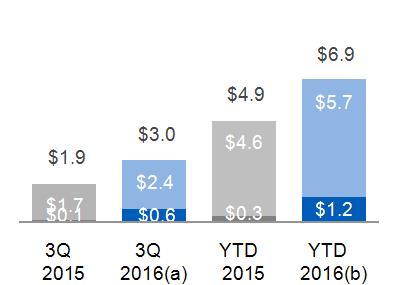

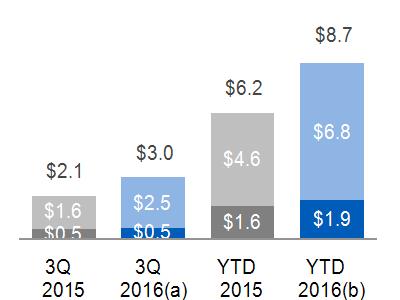

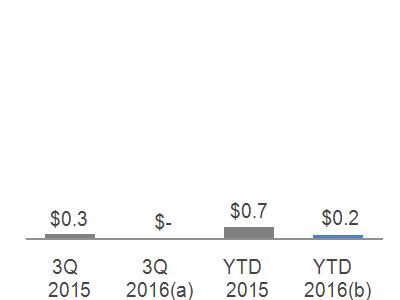

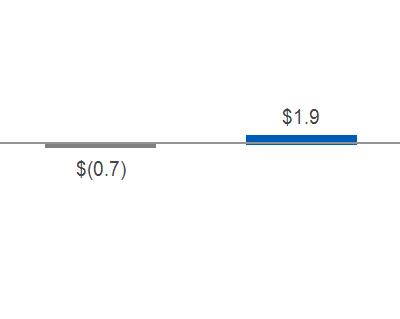

GE CFOA | |||||||

|

|

|

GE Capital Dividend

Industrial CFOA(b)* | ||||||

(a) Excluded gains, non-operating pension costs, restructuring and other, noncontrolling interests, GE Capital preferred stock dividends, as well as the results of Alstom | (a) Included $(0.8) billion related to Alstom (b) 2016 included deal taxes of $(1.1) billion related to the sale of our Appliances business | ||||||||

* Non-GAAP Financial Measure

2016 3Q FORM 10-Q 8

KEY PERFORMANCE INDICATORS

(Dollars in billions; per-share amounts in dollars)

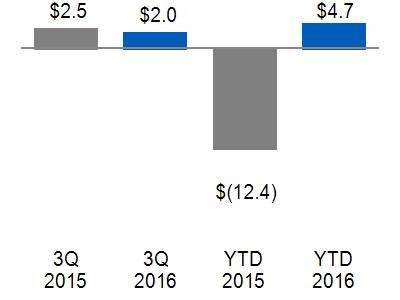

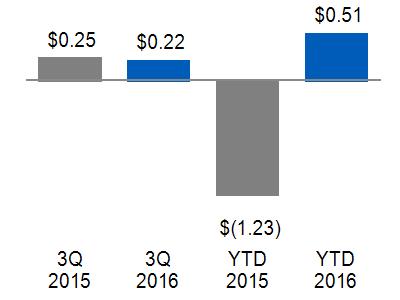

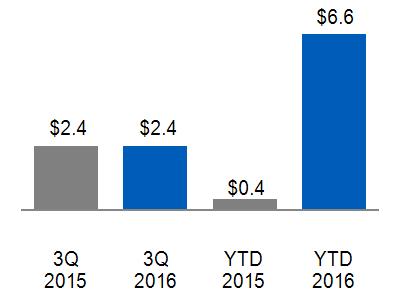

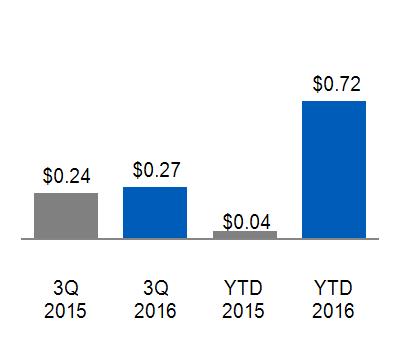

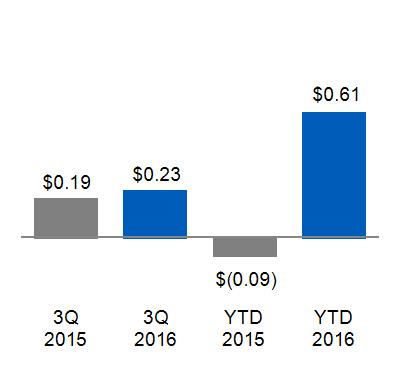

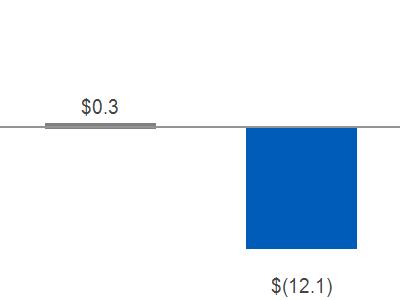

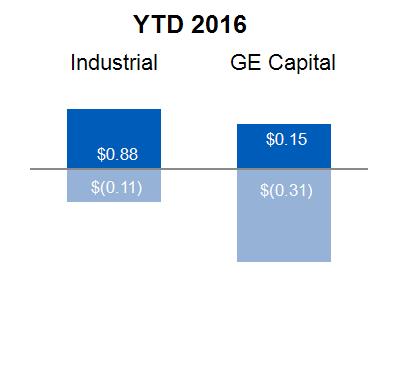

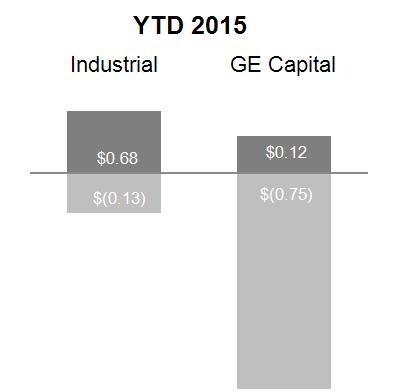

NET EARNINGS (LOSS) | NET EARNINGS (LOSS) PER SHARE | |

|

| |

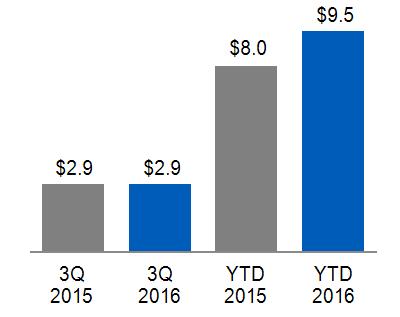

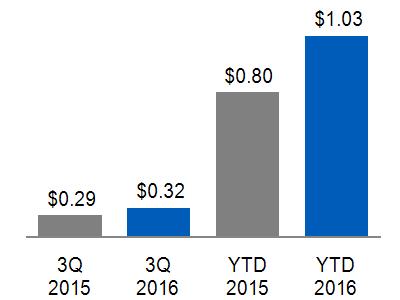

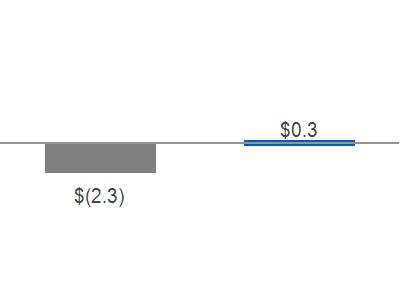

OPERATING EARNINGS (NON-GAAP) | OPERATING EARNINGS PER SHARE (NON-GAAP) | |

|  | |

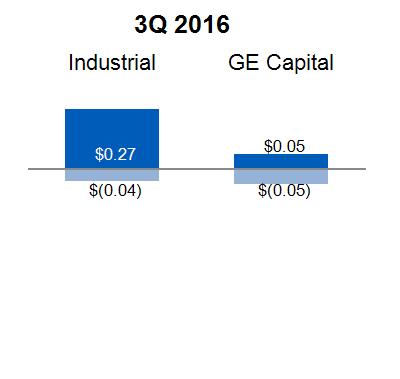

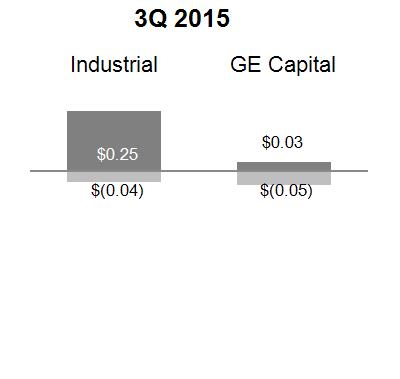

INDUSTRIAL OPERATING + VERTICALS EARNINGS (NON-GAAP) | INDUSTRIAL OPERATING + VERTICALS EPS (NON-GAAP) | |

|

|

2016 3Q FORM 10-Q 9

SIGNIFICANT DEVELOPMENTS IN 2016 | |

| During the first nine months of 2016, we returned $24.5 billion to shareholders including $18.1 billion through buyback of our common stock and $6.4 billion in dividends.

For the nine months ended September 30, 2016, Alstom contributed revenues of $9.2 billion and operating earnings of $0.5 billion, which included the effects of purchase accounting and acquisition related charges at Corporate of $0.7 billion. Including the effects of tax benefits of $0.6 billion, net earnings were less than $0.1 billion for the nine months ended September 30, 2016. In addition, Alstom used cash flow from operating activities of $0.8 billion for the nine months ended September 30, 2016.

|

| On October 31, 2016, we announced an agreement with Baker Hughes Incorporated (Baker Hughes) to combine GE's Oil & Gas business and Baker Hughes to create a new company. The transaction will be executed using a partnership structure, pursuant to which GE Oil & Gas and Baker Hughes will each contribute their operating assets to a newly formed partnership. GE will have a 62.5% interest in this partnership and existing Baker Hughes shareholders will have a 37.5% interest through a newly NYSE listed corporation. Baker Hughes shareholders will also receive a special one-time cash dividend of $17.50 per share at closing. GE will contribute $7.4 billon to the new partnership to fund the cash dividend to existing Baker Hughes shareholders. The transaction is subject to the approval of Baker Hughes shareholders, regulatory approvals and other customary closing conditions.

|

| On October 11, 2016, we announced a plan to acquire LM Wind Power, the Danish maker of rotor blades for $1.7 billion. LM Wind is one of the world's largest wind turbine blade manufacturers (a) .

|

On September 14, 2016, we acquired the remaining 74% of the software developer Meridium Inc. for cash proceeds of $0.4 billion. The acquisition is expected to enhance and accelerate our asset performance-management capabilities across our Industrial businesses.

| |

| On September 6, 2016, we announced public tender offers to acquire two European 3-D printing companies, Arcam AB and SLM Solutions Group AG for a total of $1.4 billion. On October 26, 2016, we announced that the conditions for the acquisition of SLM Solutions were not satisfied at the expiration of the tender period and that the offer to acquire SLM Solutions had lapsed. On October 27, 2016, we announced that the tender period for Arcam would be extended to November 10, 2016. On October 27, 2016, we also announced an agreement to acquire a 75% interest in Concept Laser GmbH, another European 3-D printing company, for $0.6 billion (a) . Both Arcam and Concept Laser make machines that can print metal parts used in aircraft components, tapping into manufacturers' growing demand for digital technologies.

|

| On June 6, 2016, we completed the sale of our Appliances business to Qingdao Haier Co., Ltd. (Haier) for proceeds of $5.6 billion (including $0.8 billion from the sale of receivables originated in our Appliances business and sold from GE Capital to Haier) and recognized an after-tax gain of $1.9 billion in the nine months ended September 30, 2016.

On March 30, 2016, we announced an agreement to sell GE Asset Management (GEAM), GE's asset management arm with assets under management of approximately $100 billion, to State Street Corporation. On July 1, 2016, we completed the sale for proceeds of $0.4 billion and recognized an after-tax gain of $0.3 billion. |

| As of September 30, 2016, we have signed agreements with buyers for $193 billion of GE Capital ending net investment (ENI), excluding liquidity (as originally reported at December 31, 2014), of which $173 billion have closed.

On June 28, 2016, we received approval of our request to the Financial Stability Oversight Council (FSOC) for rescission of GE Capital's designation as a nonbank Systemically Important Financial Institution (SIFI).

GE Capital paid common dividends of $5.1 billion and $16.1 billion for the three and nine months ended September 30, 2016, respectively. In October 2016, we received an additional $2.0 billion of common dividends from GE Capital bringing our year-to-date total to $18.1 billion.

(a) Subject to customary closing conditions. |

2016 3Q FORM 10-Q 10

CONSOLIDATED RESULTS

THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

REVENUES |

INDUSTRIAL AND FINANCIAL SERVICES REVENUES | ||||||

|  |

| |||||

(a) Included $3.2 billion related to Alstom (b) Included $9.2 billion related to Alstom | (a) Included $3.2 billion related to Alstom (b) Included $9.2 billion related to Alstom | ||||||

COMMENTARY: 2016 - 2015 | |||||||

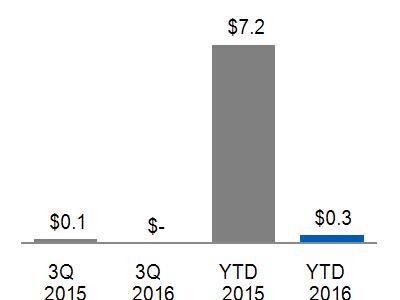

THREE MONTHS Consolidated revenues increased $1.2 billion, or 4%. Industrial revenues increased $1.3 billion, or 5%, mainly from the effects of acquisitions of $3.3 billion, primarily Alstom, and an increase in Industrial organic revenue* of $0.1 billion. These increases were partially offset by the effects of dispositions of $2.0 billion, primarily from the sale of our Appliances business to Haier in the second quarter of 2016. In 2015, the effects of acquisitions and dispositions on Industrial revenues were an insignificant amount and a decrease of $0.1 billion, respectively. Financial Services revenues decreased $0.1 billion, or 2%, as a result of the effects of dispositions and organic revenue declines, partially offset by higher gains and lower impairments.

|

NINE MONTHS Consolidated revenues increased $7.1 billion, or 9%. Industrial revenues increased $7.2 billion, or 9%, mainly from the effects of acquisitions of $9.3 billion, primarily Alstom. The increase was partially offset by the effects of dispositions of $0.9 billion, primarily from the sale of our Appliances business to Haier in the second quarter of 2016, the effects of a stronger U.S. dollar of $0.7 billion and a decrease in Industrial organic revenue* of $0.5 billion. In 2015, the effects of acquisitions and dispositions on Industrial revenues were an increase of $0.2 billion and a decrease of $0.1 billion, respectively. Financial Services revenues increased less than $0.1 billion, primarily due to lower impairments, higher gains and the effects of acquisitions, partially offset by the effects of dispositions, organic revenue declines and the effects of currency exchange.

| ||||||

* Non-GAAP Financial Measure

2016 3Q FORM 10-Q 11

THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

CONTINUING EARNINGS (LOSS) |

CONTINUING EARNINGS (LOSS) PER SHARE | INDUSTRIAL SELLING, GENERAL & ADMINISTRATIVE (SG&A) AS A % OF SALES | ||||

|

|

(a) 14.3% excluding $3.3 billion of Alstom sales and $0.5 billion of Alstom SG&A* (b) 15.0% excluding $9.3 billion of Alstom sales and $1.6 billion of Alstom SG&A* | ||||

COMMENTARY: 2016 - 2015 | ||||||

THREE MONTHS Consolidated continuing earnings increased $0.1 billion, or 7%. Financial Services net loss decreased $0.2 billion, primarily due to lower impairments and higher gains, partially offset by the effects of dispositions and core decreases. Core decreases reflect excess interest expense, higher restructuring expenses and higher insurance reserve provisions, partially offset by increased tax benefits resulting from an IRS tax settlement and tax adjustments in the three months ended September 30, 2016, to bring Capital's nine-month tax rate in line with the projected full-year tax rate. The effects of acquisitions on consolidated continuing earnings were a decrease of $0.1 billion in 2016 and an insignificant amount in 2015. The net effects of dispositions on consolidated continuing earnings were decreases of $0.1 billion in 2016 and an increase of $0.1 billion in 2015. Earnings per share amounts for the third quarter of 2016 were positively impacted by the reduction in number of outstanding common shares compared to the third quarter of 2015. The average number of shares outstanding used to calculate third quarter 2016 earnings per share amounts was 11% lower than in the third quarter of 2015 as a result of previously disclosed actions, primarily the 2015 Synchrony Financial share exchange and ongoing share buyback activities over the last 12 months funded in large part by dividends from GE Capital. Industrial SG&A costs increased $0.3 billion as the favorable impact of cost reductions at Corporate, lower SG&A relating to dispositions and non-operating pension costs were more than offset by increases in SG&A relating to Alstom and higher restructuring charges. | NINE MONTHS Consolidated continuing earnings increased $6.5 billion. Financial Services losses decreased $4.9 billion, or 77%, primarily due to the absence of the 2015 charges associated with the GE Capital Exit Plan. The net effects of dispositions on consolidated continuing earnings were increases of $1.8 billion in 2016, primarily due to an after-tax gain of $1.9 billion from the sale of our Appliances business to Haier, and $0.3 billion in 2015. The effects of acquisitions on consolidated continuing earnings were a decrease of $0.2 billion in 2016 and an increase of $0.1 billion in 2015. In addition to the effects on net earnings described above, earnings per share amounts for the first nine months of 2016 were also positively impacted by the reduction in number of outstanding common shares compared to the first nine months of 2015. The average number of shares outstanding used to calculate first nine-month 2016 earnings per share amounts was 9% lower than in the first nine-month of 2015 as a result of previously disclosed actions, primarily the 2015 Synchrony Financial share exchange and ongoing share buyback activities over the last 12 months funded in large part by dividends from GE Capital. Industrial SG&A costs increased $1.1 billion as the favorable impact of cost reductions at Corporate and lower SG&A relating to dispositions and non-operating pension costs were more than offset by increases in SG&A relating to Alstom and higher restructuring charges.

| |||||

See the "Other Consolidated Information" section within the MD&A for a discussion of income taxes.

*Non-GAAP Financial Measure

2016 3Q FORM 10-Q 12

GE CAPITAL

GE Capital results include continuing operations, which are reported in the Capital segment (see Segment discussion), and discontinued operations (see Discontinued Operations section and Note 2).

THE GE CAPITAL EXIT PLAN

On April 10, 2015, the Company announced a plan (the GE Capital Exit Plan) to create a simple, more valuable company by reducing the size of its financial services businesses through the sale of most of the assets of GE Capital over the following 24 months and aligning a smaller GE Capital with GE's industrial businesses.

Under the GE Capital Exit Plan, which was approved on April 2, 2015 and aspects of which were approved on March 31, 2015, the Company is retaining certain GE Capital businesses, principally its vertical financing businesses-GE Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Industrial Finance (which includes Healthcare Equipment Finance, Working Capital Solutions and Industrial Financing Solutions)-that relate to the Company's core industrial domain and other operations, including our run-off insurance activities, and allocated corporate costs (together referred to as GE Capital Verticals or Verticals).

We expect GE Capital to release approximately $35 billion in dividends to GE (subject to regulatory approval) as a result of the sale of GE Capital assets. We received $4.3 billion in dividends from GE Capital in 2015 and $16.1 billion in the first nine months of 2016. In October 2016, we received and additional $2.0 billion of common dividends from GE Capital bringing our year-to-date total to $18.1 billion. As of September 30, 2016, we are ahead of our plan, having signed agreements with buyers for $193 billion of ending net investment (ENI), excluding liquidity (as originally reported at December 31, 2014), of which $173 billion has closed. In addition, as part of our initiative to reduce the size of our financial services businesses, we completed the split-off of our remaining interest in GE Capital's North American Retail Finance business, Synchrony Financial, to holders of GE common stock, which resulted in a $20.4 billion buyback of GE common stock (671.4 million shares) in 2015. In connection with the GE Capital Exit Plan, we completed a legal reorganization of GE Capital that included a merger of GE Capital into GE, a guarantee by GE of GE Capital debt, and an exchange of $36 billion of GE Capital debt for new notes guaranteed by GE. The result of all these actions reduced GE Capital's total assets by 59% from $501 billion at December 31, 2014 to $203 billion at September 30, 2016. As of September 30, 2016, we incurred charges of $22.9 billion. Due to anticipated tax benefits and gains, we do not expect total after-tax charges through the completion of the GE Capital Exit Plan to exceed our initial $23 billion estimate.

Given the progress of the GE Capital Exit Plan to date, we expect to largely complete that plan by the end of 2016. On March 31, 2016, GE filed its request to the Financial Stability Oversight Council (FSOC) for rescission of GE Capital's designation as a nonbank Systemically Important Financial Institution (SIFI). On June 28, 2016, we received approval of our request to the FSOC for rescission of GE Capital's designation as a nonbank SIFI.

SALES AGREEMENTS

During the nine months ended September 30, 2016, GE signed agreements to sell approximately $36 billion of ENI, excluding liquidity (as originally reported at December 31, 2014), of which approximately $16 billion, $20 billion and less than $1 billion related to our Commercial Lending and Leasing (CLL), Consumer and Real Estate businesses, respectively.

Of the signed agreements, sales representing approximately $69 billion of ENI, excluding liquidity (as originally reported at December 31, 2014) have closed during the first nine months of 2016, including approximately $60 billion, $9 billion and less than $1 billion related to our CLL, Consumer and Real Estate businesses, respectively.

2016 3Q FORM 10-Q 13

AFTER-TAX CHARGES RELATED TO THE GE CAPITAL EXIT PLAN

In the nine months ended September 30, 2016, GE recorded $0.9 billion of after-tax charges related to the GE Capital Exit Plan of which $0.1 billion was recorded in continuing operations and $0.8 billion was recorded in discontinued operations. Of these after-tax charges, $0.3 billion of net benefits were recorded in the third quarter of 2016 . A description of these after-tax charges for the nine months ended September 30, 2016 is provided below.

| $1.3 billion of net loss primarily related to the completed and planned dispositions of Consumer and most of the CLL businesses, which was recorded in discontinued operations under the caption "Earnings (loss) from discontinued operations, net of taxes" in the Statement of Earnings. |

| $0.3 billion of charges associated with the preferred equity exchange that was completed in January 2016, which was recorded in continuing operations and reported in GE Capital's corporate component under the caption "Preferred stock dividends" in the Statement of Earnings. |

| These charges were partially offset by tax benefits of $0.6 billion related to an IRS tax settlement. Of these benefits $0.3 billion was recorded in continuing operations and reported in GE Capital's corporate component under the captions "Benefit (provision) for income taxes" and "Interest and other financial charges" in the Statement of Earnings and $0.2 billion was recorded in discontinued operations under the caption "Earnings (loss) from discontinued operations, net of taxes" in the Statement of Earnings. |

For additional information about the GE Capital Exit Plan 2015 sales agreements and after-tax charges, refer to our Form 8-K filed on June 3, 2016 related to the Annual Report on Form 10-K for the year ended December 31, 2015.

In addition to the above charges, during the nine months ended September 30, 2016, we have incurred other costs related to our ongoing liability management actions, including $0.6 billion of pre-tax losses related to the repurchase of $12.5 billion of long-term unsecured debt and subordinated debentures which were recorded in continuing operations. These charges will result in lower future interest costs, more than offsetting the initial charges. We expect to continue these actions when economically beneficial.

2016 3Q FORM 10-Q 14

SEGMENT OPERATIONS

SUMMARY OF OPERATING SEGMENTS | |||||||||||||||||

Three months ended September 30 | Nine months ended September 30 | ||||||||||||||||

(In millions) | 2016 | 2015 | V% | 2016 | 2015 | V% | |||||||||||

Revenues | |||||||||||||||||

Power | $ | 6,506 | $ | 4,738 | 37 % | $ | 18,348 | $ | 14,405 | 27 % | |||||||

Renewable Energy | 2,770 | 1,666 | 66 % | 6,533 | 4,335 | 51 % | |||||||||||

Oil & Gas | 2,964 | 3,938 | (25)% | 9,497 | 12,096 | (21)% | |||||||||||

Aviation | 6,300 | 6,001 | 5 % | 19,074 | 17,927 | 6 % | |||||||||||

Healthcare | 4,482 | 4,255 | 5 % | 13,190 | 12,666 | 4 % | |||||||||||

Transportation | 1,249 | 1,593 | (22)% | 3,471 | 4,322 | (20)% | |||||||||||

Energy Connections & Lighting(a) | 3,151 | 4,065 | (22)% | 11,808 | 11,695 | 1 % | |||||||||||

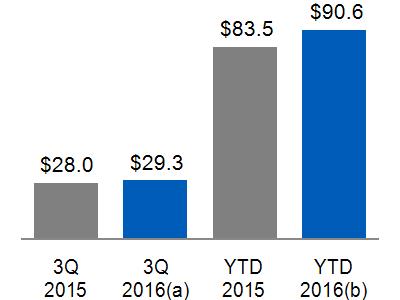

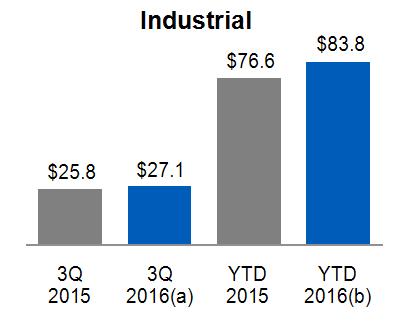

Total industrial segment revenues | 27,421 | 26,256 | 4 % | 81,920 | 77,445 | 6 % | |||||||||||

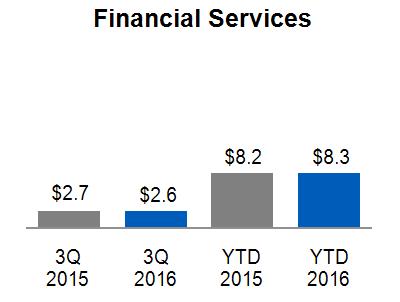

Capital | 2,600 | 2,660 | (2)% | 8,256 | 8,215 | - % | |||||||||||

Total segment revenues | 30,021 | 28,916 | 4 % | 90,176 | 85,660 | 5 % | |||||||||||

Corporate items and eliminations | (755) | (888) | 429 | (2,166) | |||||||||||||

Consolidated revenues | $ | 29,266 | $ | 28,028 | 4 % | $ | 90,604 | $ | 83,494 | 9 % | |||||||

Segment profit (loss) | |||||||||||||||||

Power | $ | 1,197 | $ | 1,071 | 12 % | $ | 2,910 | $ | 2,874 | 1 % | |||||||

Renewable Energy | 202 | 174 | 16 % | 413 | 375 | 10 % | |||||||||||

Oil & Gas | 353 | 610 | (42)% | 981 | 1,712 | (43)% | |||||||||||

Aviation | 1,494 | 1,353 | 10 % | 4,366 | 3,936 | 11 % | |||||||||||

Healthcare | 717 | 652 | 10 % | 2,130 | 1,944 | 10 % | |||||||||||

Transportation | 309 | 379 | (18)% | 747 | 934 | (20)% | |||||||||||

Energy Connections & Lighting(a) | 48 | 292 | (84)% | 209 | 669 | (69)% | |||||||||||

Total industrial segment profit | 4,320 | 4,530 | (5)% | 11,756 | 12,445 | (6)% | |||||||||||

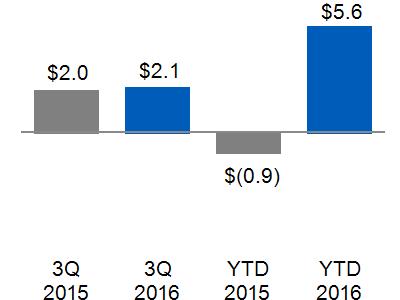

Capital | 26 | (154) | F | (1,466) | (6,368) | 77 % | |||||||||||

Total segment profit (loss) | 4,345 | 4,376 | (1)% | 10,290 | 6,076 | 69 % | |||||||||||

Corporate items and eliminations | (1,524) | (1,559) | (2,120) | (4,436) | |||||||||||||

GE interest and other financial charges | (483) | (440) | (1,490) | (1,243) | |||||||||||||

GE provision for income taxes | (241) | (413) | (1,034) | (1,302) | |||||||||||||

Earnings (loss) from continuing operations | |||||||||||||||||

attributable to GE common shareowners | 2,097 | 1,965 | 7 % | 5,645 | (904) | F | |||||||||||

Earnings (loss) from discontinued operations, net of tax | (105) | 629 | U | (954) | (11,253) | 92 % | |||||||||||

Less net earnings attributable to noncontrolling | |||||||||||||||||

interests, discontinued operations | (2) | 89 | U | 2 | 270 | (99)% | |||||||||||

Earnings (loss) from discontinued operations, | |||||||||||||||||

net of tax and noncontrolling interest | (103) | 541 | U | (956) | (11,523) | 92 % | |||||||||||

Consolidated net earnings (loss) | |||||||||||||||||

attributable to the GE common shareowners | $ | 1,994 | $ | 2,506 | (20)% | $ | 4,689 | $ | (12,427) | F | |||||||

\ | \ | ||||||||||||||||

| (a) | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes the historical results of the Appliances business prior to its sale in June 2016. |

2016 3Q FORM 10-Q 15

REVENUES AND PROFIT

Segment revenues include revenues and other income related to the segment.

Segment profit is determined based on internal performance measures used by the Chief Executive Officer (CEO) to assess the performance of each business in a given period. In connection with that assessment, the CEO may exclude matters such as charges for restructuring; rationalization and other similar expenses; acquisition costs and other related charges; technology and product development costs; certain gains and losses from acquisitions or dispositions; and litigation settlements or other charges, for which responsibility preceded the current management team. For additional information about costs excluded from segment profit, see Corporate Items and Eliminations section within this MD&A.

Segment profit excludes results reported as discontinued operations and material accounting changes. Segment profit also excludes the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries.

Segment profit excludes or includes interest and other financial charges and income taxes according to how a particular segment's management is measured:

| Interest and other financial charges, income taxes and GE preferred stock dividends are excluded in determining segment profit (which we sometimes refer to as "operating profit") for the industrial segments. |

| Interest and other financial charges, income taxes and GE Capital preferred stock dividends are included in determining segment profit (which we sometimes refer to as "net earnings") for the Capital segment. |

Certain corporate costs, such as shared services, employee benefits and information technology are allocated to our segments based on usage. A portion of the remaining corporate costs is allocated based on each segment's relative net cost of operations.

With respect to the segment revenue and profit walks, the overall effect of foreign exchange is included within multiple captions as follows:

| The translational foreign exchange impact is included within Foreign Exchange. |

| The transactional impact of foreign exchange hedging is included in operating cost within Productivity and in other income within Other. |

SEGMENT RESULTS – THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2016

(Dollars in billions)

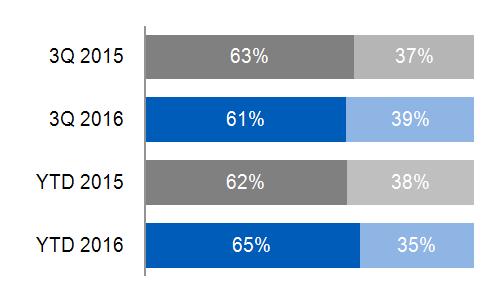

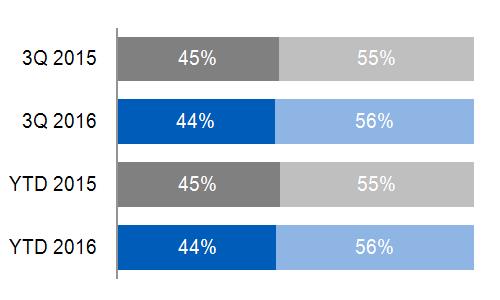

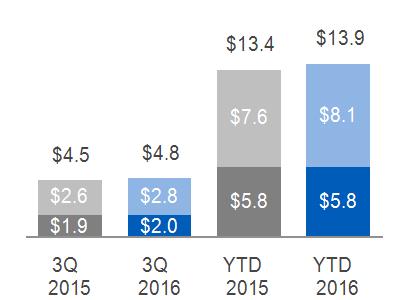

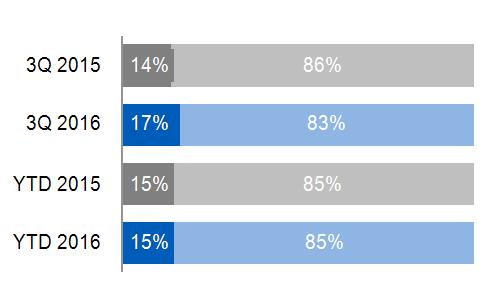

INDUSTRIAL SEGMENT EQUIPMENT & SERVICES REVENUES |

INDUSTRIAL SEGMENT PROFIT | |||

|

Equipment(a)

Services(b)

|

| ||

(a) $12.9 billion, excluding $2.0 billion related to Alstom*, and $38.4 billion, excluding $5.7 billion related to Alstom* for the three and nine months ended September 30, 2016, respectively (b) $11.3 billion, excluding $1.2 billion related to Alstom*, and $34.3 billion, excluding $3.5 billion related to Alstom* for the three and nine months ended September 30, 2016, respectively *Non-GAAP Financial Measure

| (a) $4.2 billion, excluding $0.1 billion related to Alstom* (b) $11.5 billion, excluding $0.3 billion related to Alstom* | |||

2016 3Q FORM 10-Q 16

2016 – 2015 COMMENTARY: THREE MONTHS ENDED SEPTEMBER 30 | ||

Industrial segment revenues increased $1.2 billion (4%), driven by increases at Power and Renewable Energy, mainly as a result of the effects of acquisitions (primarily Alstom). This increase was partially offset by lower revenues at Oil & Gas and Energy Connections & Lighting (due to the sale of the Appliances business in the second quarter of 2016). Industrial segment profit decreased $0.2 billion (5%), mainly driven by lower earnings at Oil & Gas, as well as an unfavorable impact of foreign exchange, partially offset by higher earnings at Power, Aviation and Healthcare. Industrial segment margin decreased 150 bps primarily driven by the effects of Alstom results. Excluding Alstom, industrial segment margin was 17.3%*, compared with 17.3%* in the same period of 2015.

| ||

2016 – 2015 COMMENTARY: NINE MONTHS ENDED SEPTEMBER 30 | ||

Industrial segment revenues increased $4.5 billion (6%), driven by increases at Power and Renewable Energy, mainly as a result of the effects of acquisitions (primarily Alstom). This increase was partially offset by lower revenues at Oil & Gas, as well as an unfavorable impact of foreign exchange. Industrial segment profit decreased $0.6 billion (6%), mainly driven by lower earnings at Oil & Gas, Energy Connections & Lighting and Transportation, as well as an unfavorable impact of foreign exchange, partially offset by higher earnings at Aviation and Healthcare. Industrial segment margin decreased 170 bps primarily driven by the effects of Alstom results. Excluding Alstom, industrial segment margin was 15.8%*, compared with 16.1%* in the same period of 2015 reflecting core decreases at Renewable Energy, Energy Connections & Lighting and Oil & Gas.

| ||

SIGNIFICANT SEGMENT DEVELOPMENTS

ALSTOM ACQUISITION

On November 2, 2015, we completed the acquisition of Alstom's Thermal, Renewables and Grid businesses. The completion of the transaction followed the regulatory approval of the deal in over 20 countries and regions including the EU, U.S., China, India, Japan and Brazil. The cash purchase price was €9.2 billion (approximately $10.1 billion), net of cash acquired. The acquisition and alliances with Alstom affected our Power, Energy Connections & Lighting and Renewable Energy segments, and to a lesser extent our Oil & Gas segment.

At year-end 2015, our preliminary allocation of purchase price resulted in recognition of approximately $13.5 billion of goodwill, $5.2 billion of intangible assets, and $1.1 billion of unfavorable customer contract liabilities. The preliminary fair value of the associated noncontrolling interest was approximately $3.6 billion. As of the end of the third quarter of 2016, the preliminary amount of goodwill, intangible assets and unfavorable customer contract liabilities recognized was adjusted to approximately $17.2 billion, $4.4 billion, and $2.4 billion, respectively. The adjustments reflected revisions in estimates primarily related to cash flow and other valuation assumptions for customer contracts, increases to legal reserves, and other fair value adjustments related to acquired assets and liabilities. Deferred taxes, unrecognized tax benefits and other tax uncertainties were also adjusted. We will finalize our purchase accounting analysis in the fourth quarter. See Note 7 to the consolidated financial statements for further information.

For the nine months ended September 30, 2016, Alstom contributed revenues of $9.2 billion and an operating loss of $0.5 billion, which included the effects of purchase accounting and acquisition related charges at Corporate of $0.7 billion. Including the effects of tax benefits of $0.6 billion, net earnings were less than $0.1 billion for the nine months ended September 30, 2016. In addition, Alstom used cash flow from operating activities of $0.8 billion for the nine months ended September 30, 2016. Alstom related revenues and operating profit are presented separately in the segment revenues and profit walks that follow.

SALE OF APPLIANCES

On January 15, 2016, we announced the signing of an agreement to sell our Appliances business to Qingdao Haier Co., Ltd. (Haier). On June 6, 2016, we completed the sale for proceeds of $5.6 billion (including $0.8 billion from the sale of receivables originated in our Appliances business and sold from GE Capital to Haier) and recognized an after-tax gain of $1.9 billion in the nine months ended September 30, 2016. Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes the historical results of the Appliances business prior to its sale.

*Non-GAAP Financial Measure

2016 3Q FORM 10-Q 17

POWER

POWER OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

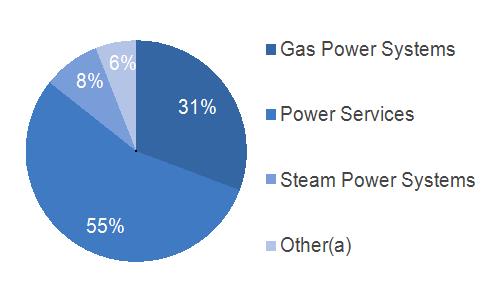

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

(a) Includes Water & Distributed Power and GE Hitachi Nuclear | Services Equipment | |||

ORDERS |

BACKLOG | |||

|

Equipment

Services

|

|

Equipment

Services

| |

(a) Included $2.8 billion related to Alstom (b) Included $7.1 billion related to Alstom

| (a) Included $17.7 billion related to Alstom | |||

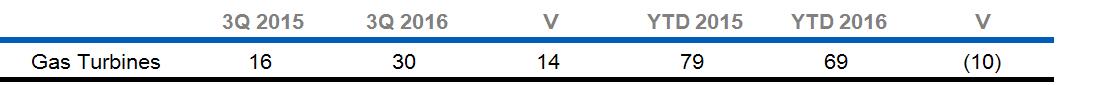

UNIT SALES | ||||

| ||||

2016 3Q FORM 10-Q 18

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

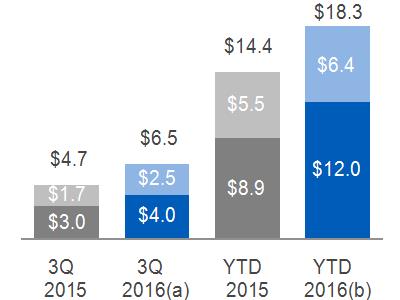

SEGMENT REVENUES

(a) $5.1 billion, excluding $1.4 billion related to Alstom* (b) $14.0 billion, excluding $4.3 billion related to Alstom*

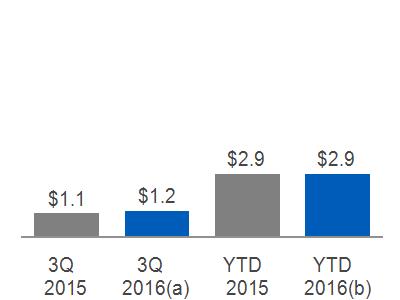

| SEGMENT PROFIT

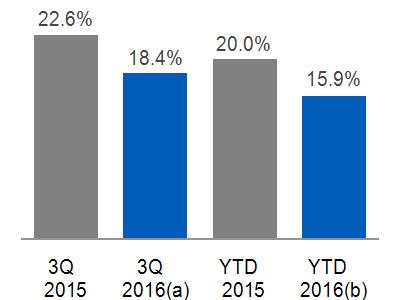

(a) $1.1 billion, excluding $0.1 billion related to Alstom* (b) $2.7 billion, excluding $0.2 billion related to Alstom* | SEGMENT PROFIT MARGIN

(a) 21.9%, excluding 6.3% related to Alstom* (b) 19.3%, excluding 4.8% related to Alstom* | |||||||||

Equipment

Services | |||||||||||

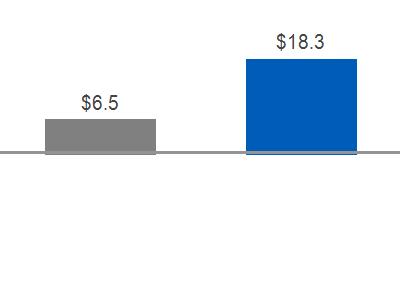

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | ||||||||||

THREE MONTHS | Segment revenues up $1.8 billion (37%); Segment profit up $0.1 billion (12%) as a result of:

The increase in revenues was primarily driven by the effects of Alstom. Revenues also increased due to higher equipment volume and prices at Gas Power Systems as a result of 14 more gas turbine shipments than in the prior year, as well as higher services volume at Power Services, partially offset by lower services volume at Water and Nuclear. The increase in revenues was partially offset by lower other income. The increase in profit was primarily driven by the effects of Alstom, higher volume, prices and cost productivity, partially offset by an unfavorable business mix, driven by 7 more H-Turbine shipments than in the prior year, and lower other income.

| ||||||||||

Revenues | Profit | ||||||||||

September 30, 2015 | $ | 4.7 | $ | 1.1 | |||||||

Volume | 0.3 | 0.1 | |||||||||

Price | 0.1 | 0.1 | |||||||||

Foreign Exchange | - | - | |||||||||

(Inflation)/Deflation | N/A | - | |||||||||

Mix | N/A | (0.1) | |||||||||

Productivity | N/A | 0.1 | |||||||||

Other | (0.1) | (0.1) | |||||||||

Alstom | 1.4 | 0.1 | |||||||||

September 30, 2016 | $ | 6.5 | $ | 1.2 | |||||||

NINE MONTHS | Segment revenues up $3.9 billion (27%); Segment profit up 1% as a result of:

The increase in revenues was primarily driven by the effects of Alstom and increased services volume at Power Services, partially offset by lower equipment volume at Gas Power Systems as a result of 10 fewer gas turbine shipments than in the prior year. The increase was partially offset by lower other income, including negative foreign exchange transactional hedge impacts, as well as the effects of a stronger U.S. dollar. The increase in profit was primarily driven by the effects of Alstom, higher prices, material deflation and a favorable business mix. The increase was partially offset by lower other income, including negative foreign exchange transactional hedge impacts and lower cost productivity.

| ||||||||||

Revenues | Profit | ||||||||||

September 30, 2015 | $ | 14.4 | $ | 2.9 | |||||||

Volume | (0.1) | - | |||||||||

Price | 0.1 | 0.1 | |||||||||

Foreign Exchange | (0.1) | - | |||||||||

(Inflation)/Deflation | N/A | 0.1 | |||||||||

Mix | N/A | 0.1 | |||||||||

Productivity | N/A | (0.1) | |||||||||

Other | (0.2) | (0.3) | |||||||||

Alstom | 4.3 | 0.2 | |||||||||

September 30, 2016 | $ | 18.3 | $ | 2.9 | |||||||

*Non-GAAP Financial Measure

2016 3Q FORM 10-Q 19

RENEWABLE ENERGY

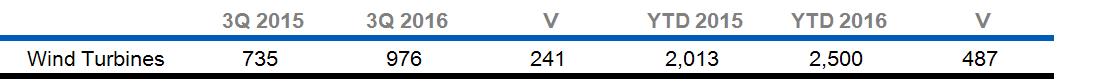

RENEWABLE ENERGY OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

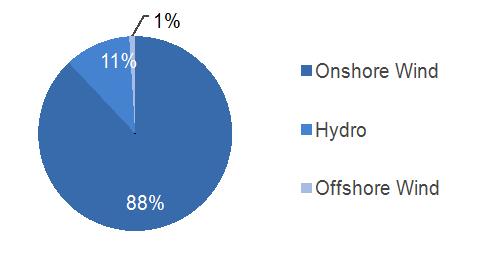

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||||||

|  | |||||||

Services Equipment

| ||||||||

ORDERS |

BACKLOG | |||||||

|

Equipment

Services

|  |

Equipment

Services

| |||||

(a) Included $1.0 billion related to Alstom (b) Included $1.5 billion related to Alstom

| (a) Included $5.7 billion related to Alstom | |||||||

UNIT SALES | ||||||||

| ||||||||

2016 3Q FORM 10-Q 20

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

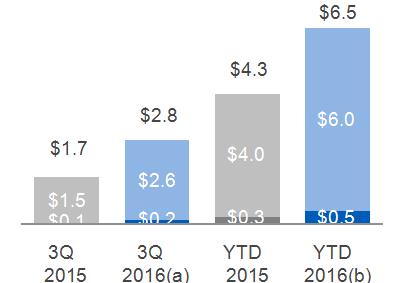

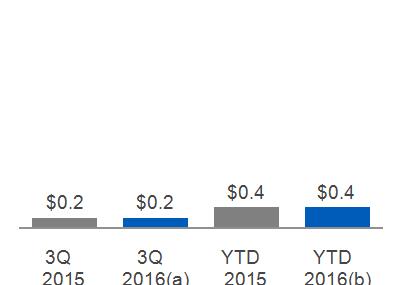

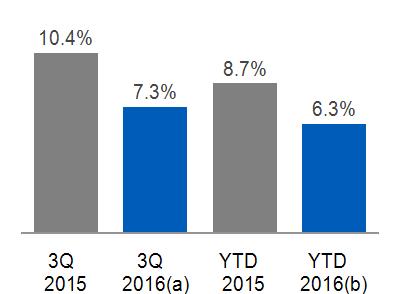

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||||||||

(a) $2.4 billion, excluding $0.4 billion related to Alstom* (b) $5.6 billion, excluding $0.9 billion related to Alstom*

|

Equipment

Services |

(a) $0.2 billion, excluding an insignificant amount related to Alstom* (b) $0.4 billion, excluding an insignificant amount related to Alstom*

|

(a) 8.9%, excluding (3.1)% related to Alstom* (b) 7.6%, excluding (2.1)% related to Alstom*

| |||||||

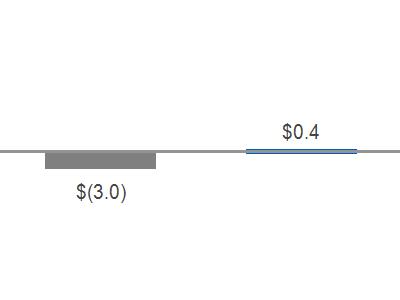

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | |||||||||

THREE MONTHS | Segment revenues up $1.1 billion (66%); Segment profit up 16% as a result of:

The increase in revenues was primarily due to higher volume, mainly driven by higher equipment sales in Onshore Wind as a result of shipping 235 more onshore wind turbines than in the prior year, as well as the effects of Alstom, partially offset by lower other income, including negative foreign exchange transactional hedge impacts. The increase in profit was mainly due to higher volume and material deflation, partially offset by lower other income, including negative foreign exchange transactional hedge impacts.

| |||||||||

Revenues | Profit | |||||||||

September 30, 2015 | $ | 1.7 | $ | 0.2 | ||||||

Volume | 0.8 | 0.1 | ||||||||

Price | - | - | ||||||||

Foreign Exchange | - | - | ||||||||

(Inflation)/Deflation | N/A | 0.1 | ||||||||

Mix | N/A | - | ||||||||

Productivity | N/A | - | ||||||||

Other | (0.1) | (0.1) | ||||||||

Alstom | 0.4 | - | ||||||||

September 30, 2016 | $ | 2.8 | $ | 0.2 | ||||||

NINE MONTHS | Segment revenues up $2.2 billion (51%); Segment profit up 10% as a result of:

The increase in revenues was primarily due to higher volume, mainly driven by the increase in Onshore Wind turbine shipments, as a result of shipping 429 more units than in the prior year, and the effects of Alstom. The increase was partially offset by the effects of a stronger U.S. dollar and lower other income, including negative foreign exchange transactional hedge impacts. The increase in profit was primarily due to higher volume, material deflation and cost productivity, partially offset by an unfavorable business mix and lower other income, including negative foreign exchange transactional hedge impacts.

| |||||||||

Revenues | Profit | |||||||||

September 30, 2015 | $ | 4.3 | $ | 0.4 | ||||||

Volume | 1.6 | 0.1 | ||||||||

Price | - | - | ||||||||

Foreign Exchange | (0.1) | - | ||||||||

(Inflation)/Deflation | N/A | 0.1 | ||||||||

Mix | N/A | (0.1) | ||||||||

Productivity | N/A | 0.1 | ||||||||

Other | (0.1) | (0.1) | ||||||||

Alstom | 0.9 | - | ||||||||

September 30, 2016 | $ | 6.5 | $ | 0.4 | ||||||

*Non-GAAP Financial Measure

2016 3Q FORM 10-Q 21

OIL & GAS

OIL & GAS OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

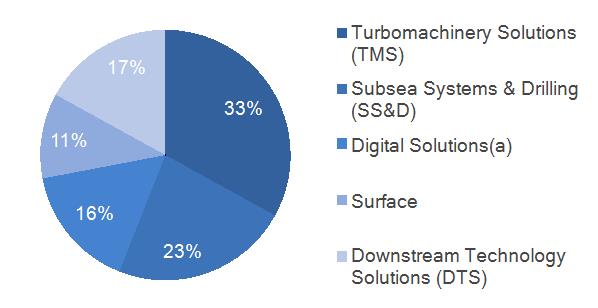

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

(a ) Previously referred to as Measurement & Controls (M&C)

|

Services Equipment

| |||

ORDERS |

BACKLOG | |||

|

Equipment

Services |

|

Equipment

Services

| |

(a) Included an insignificant amount related to Alstom (b) Included $0.1 billion related to Alstom

| (a) Included $0.2 billion related to Alstom | |||

2016 3Q FORM 10-Q 22

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

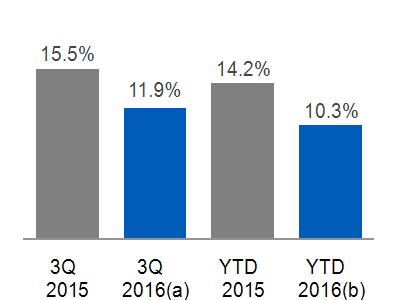

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | |||||||||

(a) $2.9 billion, excluding an insignificant amount related to Alstom* (b) $9.4 billion, excluding $0.1 billion related to Alstom* |

Equipment

Services |

(a) $0.4 billion, excluding an insignificant amount related to Alstom* (b) $1.0 billion, excluding an insignificant amount related to Alstom*

|

(a) 11.9%, excluding 5.9% related to Alstom* (b) 10.4%, excluding 3.8% related to Alstom* | ||||||||

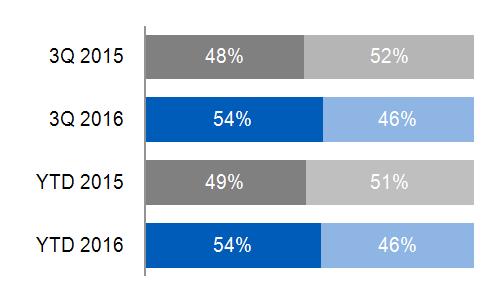

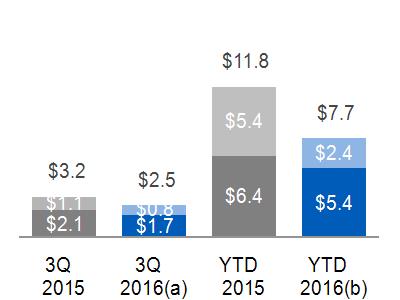

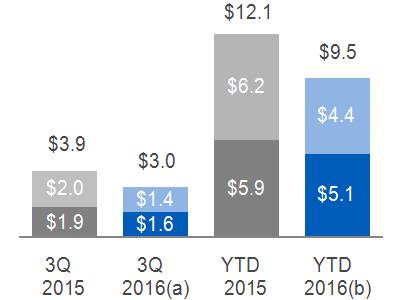

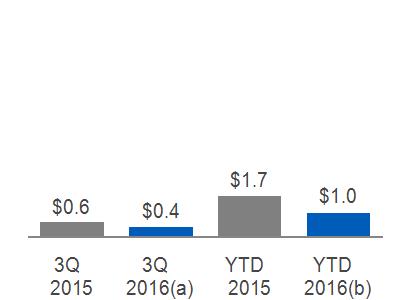

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | ||||||||||

THREE MONTHS | Segment revenues down $1.0 billion (25%); Segment profit down $0.3 billion (42%) as a result of:

The decrease in revenues was primarily driven by market conditions resulting in a decrease in equipment and services volume across all sub-segments, with the exception of increased equipment volume at DTS. Revenues also decreased due to lower prices at TMS and DTS, as well as lower other income, including negative foreign exchange transactional hedge impacts. The decrease in profit was also driven by negative market conditions, mainly due to lower volume and prices, which, despite the effects of restructuring actions, drove lower cost productivity. Profit also decreased due to lower other income, including negative foreign exchange transactional hedge impacts. These decreases were partially offset by material deflation.

| ||||||||||

Revenues | Profit | ||||||||||

September 30, 2015 | $ | 3.9 | $ | 0.6 | |||||||

Volume | (0.8) | (0.1) | |||||||||

Price | (0.1) | (0.1) | |||||||||

Foreign Exchange | - | - | |||||||||

(Inflation)/Deflation | N/A | 0.1 | |||||||||

Mix | N/A | - | |||||||||

Productivity | N/A | (0.1) | |||||||||

Other | (0.1) | (0.1) | |||||||||

Alstom | - | - | |||||||||

September 30, 2016 | $ | 3.0 | $ | 0.4 | |||||||

NINE MONTHS | Segment revenues down $2.6 billion (21%); Segment profit down $0.7 billion (43%) as a result of:

The decrease in revenues was primarily due to lower equipment volume across all sub-segments, the effects of a stronger U.S. dollar, lower prices and lower other income, partially offset by the effects of Alstom. The decrease in profit was primarily market driven, mainly due to lower equipment volume and prices, which, despite the effects of restructuring actions, drove lower cost productivity. These decreases were partially offset by material deflation and lower other income, including negative foreign exchange transactional hedge impacts.

| ||||||||||

Revenues | Profit | ||||||||||

September 30, 2015 | $ | 12.1 | $ | 1.7 | |||||||

Volume | (2.2) | (0.3) | |||||||||

Price | (0.2) | (0.2) | |||||||||

Foreign Exchange | (0.3) | - | |||||||||

(Inflation)/Deflation | N/A | 0.2 | |||||||||

Mix | N/A | - | |||||||||

Productivity | N/A | (0.4) | |||||||||

Other | (0.1) | - | |||||||||

Alstom | 0.1 | - | |||||||||

September 30, 2016 | $ | 9.5 | $ | 1.0 | |||||||

*Non-GAAP Financial Measure

2016 3Q FORM 10-Q 23

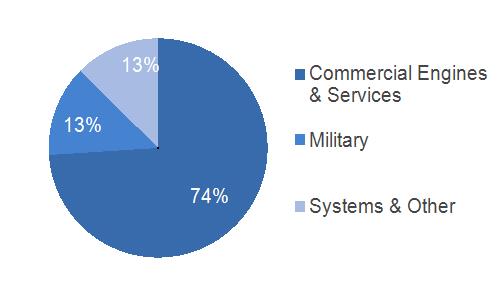

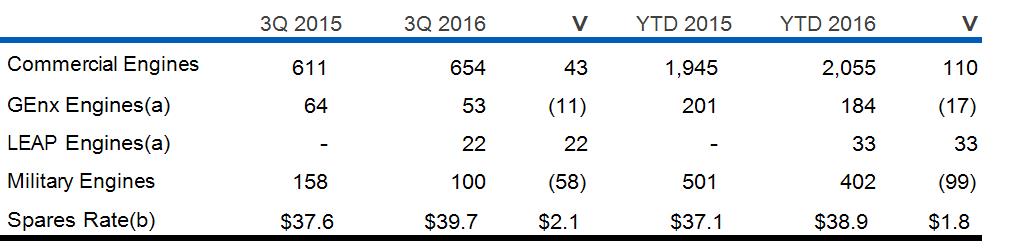

AVIATION

AVIATION OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions; except where noted)

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

Services Equipment

| ||||

ORDERS |

BACKLOG | |||

|

Equipment

Services

|  |

Equipment

Services

| |

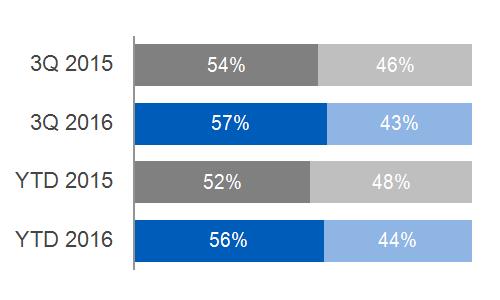

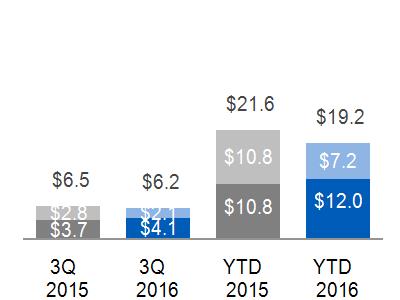

UNIT SALES | ||||

(a) GEnx and LEAP engines are a subset of commercial engines (b) Commercial spares shipment rate in millions of dollars per day | ||||

2016 3Q FORM 10-Q 24

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | |||||

THREE MONTHS | Segment revenues up $0.3 billion (5%); Segment profit up $0.1 billion (10%) as a result of:

The increase in revenues was primarily due to higher services volume, partially offset by lower equipment volume driven by lower GEnx shipments and Military, despite an increase in Commercial Engines driven by LEAP engine shipments. The increase in profit was primarily due to higher services volume and higher cost productivity, partially offset by the effects of inflation.

| |||||

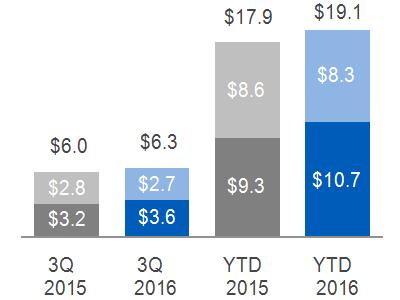

Revenues | Profit | |||||

September 30, 2015 | $ | 6.0 | $ | 1.4 | ||

Volume | 0.2 | 0.1 | ||||

Price | - | - | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | (0.1) | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.1 | ||||

Other | - | - | ||||

September 30, 2016 | $ | 6.3 | $ | 1.5 | ||

NINE MONTHS | Segment revenues up $1.1 billion (6%); Segment profit up $0.4 billion (11%) as a result of:

The increase in revenues was primarily driven by higher services volume and prices, partially offset by lower equipment volume in Military. The increase in profit was primarily driven by higher cost productivity, higher services volume and prices, partially offset by the effects of inflation and lower other income.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 17.9 | $ | 3.9 | ||

Volume | 1.1 | 0.2 | ||||

Price | 0.1 | 0.1 | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | (0.1) | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.3 | ||||

Other | - | (0.1) | ||||

September 30, 2016 | $ | 19.1 | $ | 4.4 | ||

2016 3Q FORM 10-Q 25

HEALTHCARE

HEALTHCARE OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

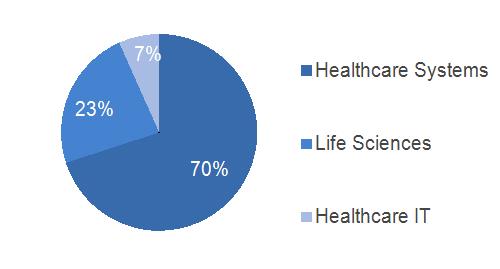

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

Services Equipment | ||||

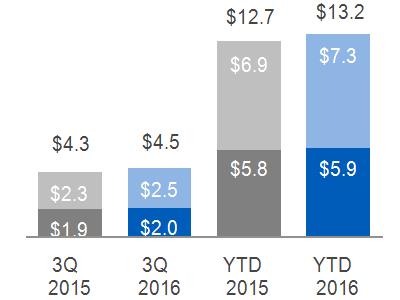

ORDERS |

BACKLOG | |||

|

Equipment

Services

|  |

Equipment

Services

| |

2016 3Q FORM 10-Q 26

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services |  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | |||||

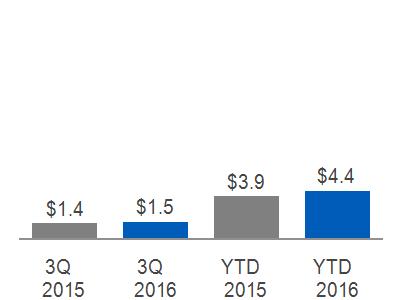

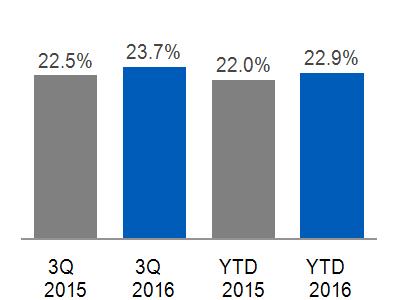

THREE MONTHS | Segment revenues up $0.2 billion (5%); Segment profit up $0.1 billion (10%) as a result of:

The increase in revenues was primarily due to higher volume driven by Life Sciences and Healthcare Systems, partially offset by lower prices at Healthcare Systems. The increase in profit was primarily driven by higher cost productivity, including the effects of previous restructuring actions and volume growth, partially offset by lower prices at Healthcare Systems.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 4.3 | $ | 0.7 | ||

Volume | 0.3 | - | ||||

Price | (0.1) | (0.1) | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.1 | ||||

Other | - | - | ||||

September 30, 2016 | $ | 4.5 | $ | 0.7 | ||

NINE MONTHS | Segment revenues up $0.5 billion (4%); Segment profit up $0.2 billion (10%) as a result of:

The increase in revenues was primarily due to higher volume driven by Life Sciences and Healthcare Systems, partially offset by lower prices at Healthcare Systems and the effects of a stronger U.S. dollar. The increase in profit was primarily driven by higher cost productivity, including the effects of previous restructuring actions and strong volume growth, partially offset by lower prices at Healthcare Systems.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 12.7 | $ | 1.9 | ||

Volume | 0.8 | 0.1 | ||||

Price | (0.2) | (0.2) | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.3 | ||||

Other | - | - | ||||

September 30, 2016 | $ | 13.2 | $ | 2.1 | ||

2016 3Q FORM 10-Q 27

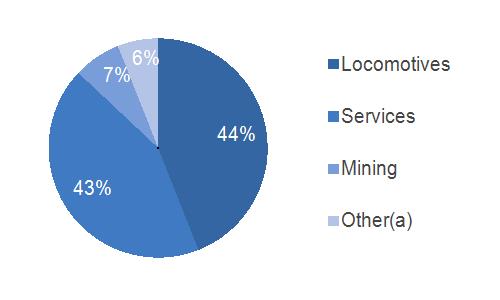

TRANSPORTATION

TRANSPORTATION OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

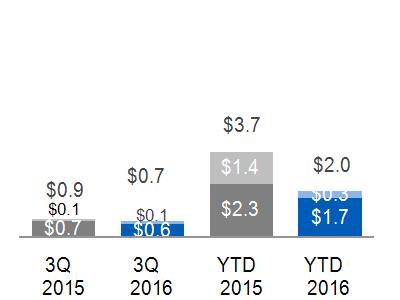

(Dollars in billions)

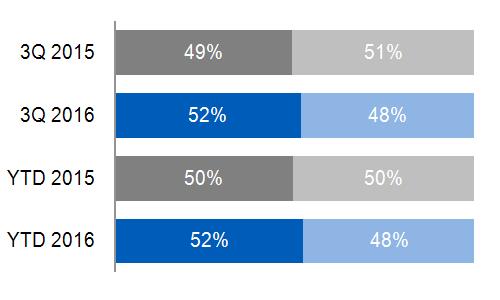

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

(a) Includes Marine, Stationary, Drilling and Digital | Services Equipment | |||

ORDERS |

BACKLOG | |||

|

Equipment

Services

|  |

Equipment

Services

| |

UNIT SALES | ||||

| ||||

2016 3Q FORM 10-Q 28

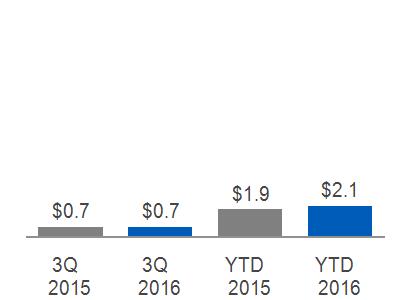

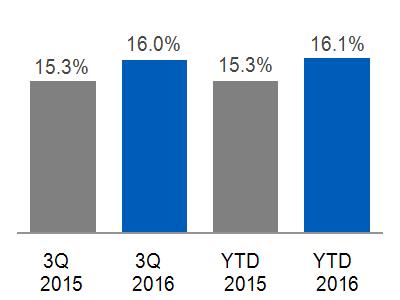

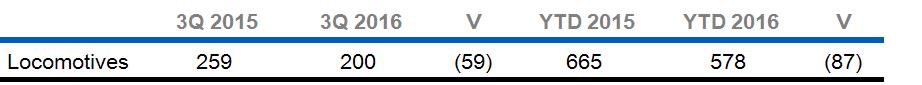

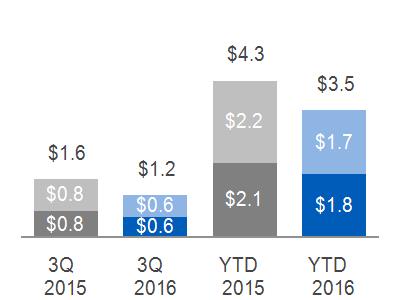

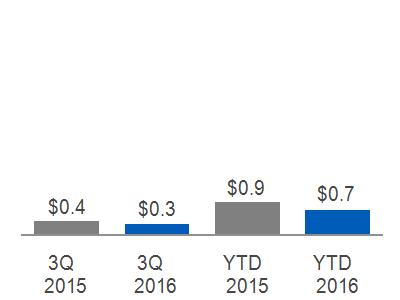

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services |  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | |||||

THREE MONTHS | Segment revenues down $0.3 billion (22%); Segment profit down $0.1 billion (18%) as a result of:

The decrease in revenues was primarily due to lower equipment volume driven by 59 fewer locomotive shipments than in the prior year. The decrease in revenues was also impacted by the Signaling business disposition in November 2015. The decrease in profit was driven by lower volume due to lower locomotive shipments and lower services volume, partially offset by the effects of previous restructuring actions.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 1.6 | $ | 0.4 | ||

Volume | (0.3) | (0.1) | ||||

Price | - | - | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | - | ||||

Other | - | - | ||||

September 30, 2016 | $ | 1.2 | $ | 0.3 | ||

NINE MONTHS | Segment revenues down $0.9 billion (20%); Segment profit down $0.2 billion (20%) as a result of:

The decrease in revenues was primarily driven by lower equipment volume, driven by 87 fewer locomotive shipments than in the prior year, as well as lower services volume due to higher parked locomotives. The decrease in revenues was also impacted by the Signaling business disposition in November 2015. The decrease in profit was primarily driven by lower equipment volume, partially offset by material deflation and the effects of previous restructuring actions.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 4.3 | $ | 0.9 | ||

Volume | (0.8) | (0.2) | ||||

Price | - | - | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | - | ||||

Productivity | N/A | - | ||||

Other | - | - | ||||

September 30, 2016 | $ | 3.5 | $ | 0.7 | ||

2016 3Q FORM 10-Q 29

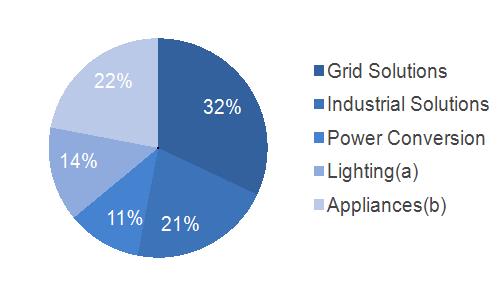

ENERGY CONNECTIONS & LIGHTING

ENERGY CONNECTIONS & LIGHTING OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

2016 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

(a) Includes Current, powered by GE (b) Reflects historical results of Appliances prior to its sale in June 2016 | Services Equipment

| |||

ORDERS |

BACKLOG | |||

|

Equipment

Services

|  |

Equipment

Services

| |

(a) Included $1.4 billion related to Alstom (b) Included $4.0 billion related to Alstom | (a) Included $8.3 billion related to Alstom | |||

2016 3Q FORM 10-Q 30

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT (LOSS) | SEGMENT PROFIT MARGIN | ||

(a) $1.8 billion, excluding $1.4 billion related to Alstom* (b) $7.9 billion, excluding $3.9 billion related to Alstom* |

Equipment

Services |

(a) Includes $0.1 billion related to Alstom* (b) $(0.1) billion, excluding $0.1 billion related to Alstom* |

(a) (1.0)%, excluding 4.6% related to Alstom* (b) 1.8%, excluding 1.8% related to Alstom* |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2016 - 2015 | |||||

THREE MONTHS | Segment revenues down $0.9 billion (22%); Segment profit down $0.2 billion (84%) as a result of:

The decrease in revenues was driven primarily by the Appliances disposition in June 2016, as well as lower Lighting revenues, as traditional lighting sales were partially offset by an increase in LED revenues and Current. The decrease in revenues was partially offset by the effects of Alstom, including higher equipment sales at Grid. The decrease in profit was due to lower core volume, lower cost productivity and the effects of the Appliances disposition, partially offset by the effects of Alstom, including higher equipment sales at Grid.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 4.1 | $ | 0.3 | ||

Volume | (2.2) | (0.2) | ||||

Price | - | - | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | (0.1) | ||||

Other | - | - | ||||

Alstom | 1.4 | 0.1 | ||||

September 30, 2016 | $ | 3.2 | $ | - | ||

NINE MONTHS | Segment revenues up $0.1 billion (1%); Segment profit down $0.5 billion (69%)as a result of:

The increase in revenues was driven by the effects of Alstom, including higher equipment sales at Grid, partially offset by a decrease in core volume driven by Industrial Solutions and Power Conversion, the effects of the Appliances disposition and traditional lighting sales. The increase was also partially offset by lower prices, the effects of a stronger U.S. dollar and lower other income, including negative foreign exchange hedge impacts. The decrease in profit was due to lower cost productivity, driven by lower core volume and prices, as well as the effects of the Appliances disposition and lower other income, including negative foreign exchange transactional hedge impacts, partially offset by material deflation, a favorable business mix and the effects of Alstom.

| |||||

Revenues | Profit | |||||

September 30, 2015 | $ | 11.7 | $ | 0.7 | ||

Volume | (3.5) | (0.2) | ||||

Price | (0.1) | (0.1) | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | - | ||||

Productivity | N/A | (0.2) | ||||

Other | (0.1) | (0.1) | ||||

Alstom | 3.9 | 0.1 | ||||

September 30, 2016 | $ | 11.8 | $ | 0.2 | ||

*Non-GAAP Financial Measure

2016 3Q FORM 10-Q 31

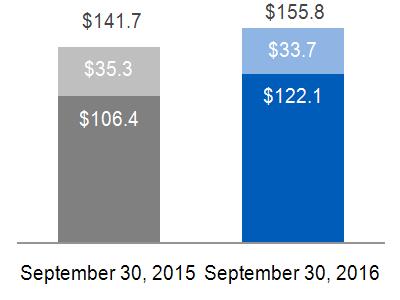

CAPITAL

CAPITAL OPERATIONAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

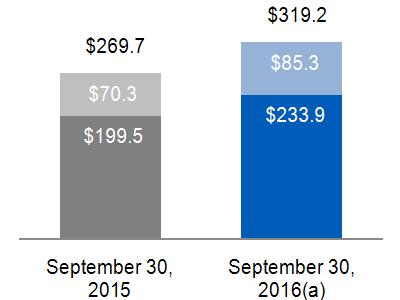

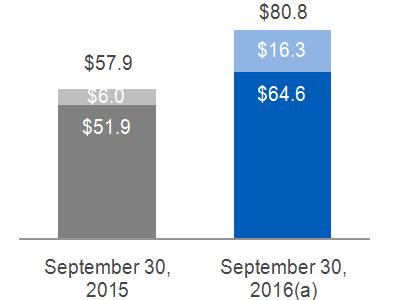

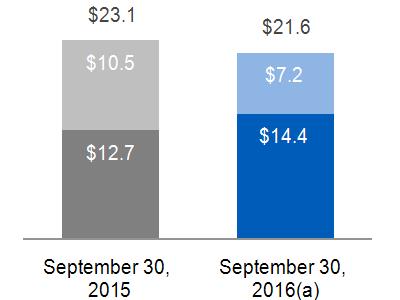

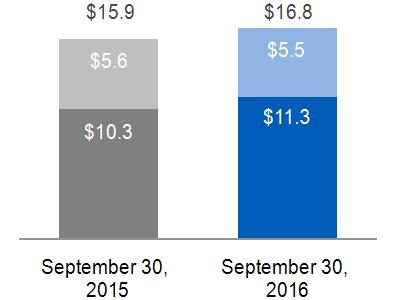

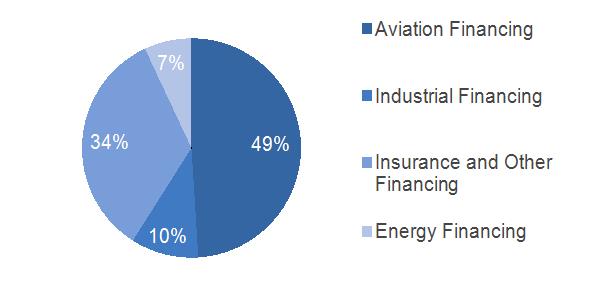

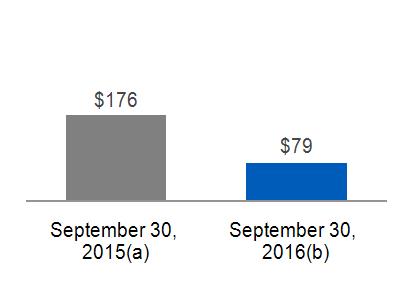

2016 YTD SUB-SEGMENT REVENUES | ENDING NET INVESTMENT, EXCLUDING LIQUIDITY* | |

|

(a) As originally reported; $271 billion including discontinued operations (b) $103 billion including discontinued operations |

FINANCIAL OVERVIEW - THREE AND NINE MONTHS ENDED SEPTEMBER 30

(Dollars in billions)

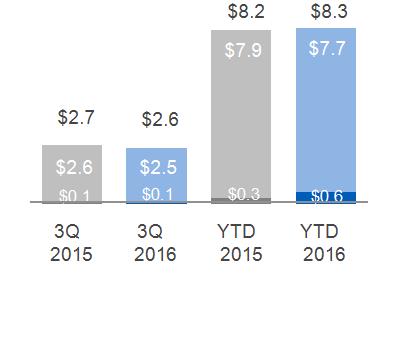

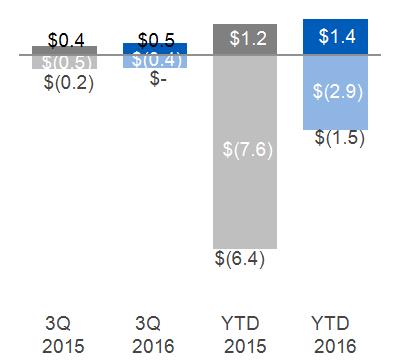

SEGMENT REVENUES | SEGMENT PROFIT (LOSS) (a) | |||

| Total Capital

Verticals

Other Continuing

|

|

Verticals

Other Continuing

Total Capital

| |

(a) Interest and other financial charges and income taxes are included in determining segment profit (loss) for the Capital segment | ||||

* Non-GAAP Financial Measure

2016 3Q FORM 10-Q 32

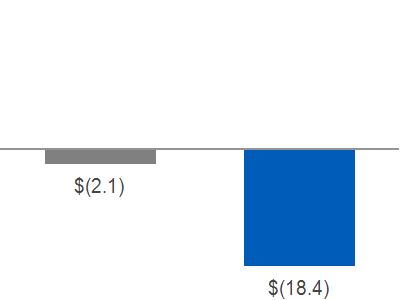

COMMENTARY: 2016 - 2015

THREE MONTHS

Capital revenues decreased $0.1 billion, or 2%, as a result of the effects of dispositions and organic revenue declines, partially offset by higher gains and lower impairments.

| Within Capital, Verticals revenues decreased by $0.1 billion as a result of the effects of dispositions ($0.2 billion) and organic revenue declines ($0.2 billion), partially offset by lower impairments ($0.2 billion) and higher gains ($0.1 billion). |

| Other Capital revenues increased less than $0.1 billion as a result of higher gains ($0.1 billion) and organic revenue growth ($0.1 billion), partially offset by higher impairments ($0.1 billion). |

Capital net loss decreased $0.2 billion, primarily due to lower impairments and higher gains, partially offset by the effects of dispositions and core decreases. Core decreases reflect excess interest expense, higher restructuring expenses and higher insurance reserve provisions, partially offset by increased tax benefits resulting from an IRS tax settlement and tax adjustments in the three months ended September 30, 2016, to bring Capital's nine-month tax rate in line with the projected full-year tax rate.

| Within Capital, Verticals net earnings increased by $0.1 billion due to lower impairments ($0.2 billion) and higher gains, partially offset by the effects of dispositions ($0.1 billion) and core decreases ($0.1 billion). |

| Other Capital net loss decreased by $0.1 billion primarily as a result of: |

| Increased tax benefits related to an IRS settlement of $0.3 billion. |

| Tax adjustments of $0.1 billion in the three months ended September 30, 2016, to bring Capital's nine-month tax rate in line with the projected full-year tax rate. |

| Higher treasury operation expenses of $0.3 billion reflecting excess interest expense and derivative activities that reduce or eliminate interest rate, currency or market risk between financial assets and liabilities. We expect to continue to have excess interest costs in 2016 as asset sales outpace our debt maturities. We may engage in liability management actions, such as buying back debt, based on market and economic conditions. |

| Higher restructuring expenses of $0.1 billion. |

NINE MONTHS

Capital revenues increased less than $0.1 billion primarily due to lower impairments, higher gains and the effects of acquisitions, partially offset by the effects of dispositions, organic revenue declines and the effects of currency exchange.

| Within Capital, Verticals revenues decreased by $0.2 billion as a result of organic revenue declines ($0.5 billion) and the effects of dispositions ($0.2 billion), partially offset by higher gains ($0.3 billion), lower impairments ($0.1 billion) and the effects of acquisitions. |

| Other Capital revenues increased $0.3 billion as a result of organic revenue growth ($0.4 billion) and lower impairments ($0.1 billion), partially offset by lower gains ($0.2 billion) and the effects of currency exchange ($0.1 billion). |

Capital net loss decreased by $4.9 billion, or 77%, primarily due to the absence of the 2015 charges associated with the GE Capital Exit Plan.

| Within Capital, Verticals net earnings increased by $0.2 billion as a result of higher gains ($0.2 billion) and lower impairments ($0.1 billion), partially offset by the effects of dispositions ($0.1 billion) and core decreases ($0.1 billion). |

| Other Capital net loss decreased by $4.7 billion primarily as a result of: |