United States Securities and Exchange Commission

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☑ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2016 |

or

|

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ___________to ___________ |

Commission file number 001-00035 |

|

General Electric Company |

New York | 14-0689340 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

| ||||

41 Farnsworth Street, Boston, MA | 02210 | (617) 443-3000 | ||

(Address of principal executive offices) | (Zip Code) | (Telephone No.) | ||

Securities Registered Pursuant to Section 12(b) of the Act: | ||||

Title of each class | Name of each exchange on which registered | |||

Common stock, par value $0.06 per share | New York Stock Exchange | |||

Securities Registered Pursuant to Section 12(g) of the Act: |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10‑K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☑

| Accelerated filer ☐

|

Non-accelerated filer ☐

| Smaller reporting company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the outstanding common equity of the registrant not held by affiliates as of the last business day of the registrant's most recently completed second fiscal quarter was at least $279.3 billion. There were 8,724,783,000 shares of voting common stock with a par value of $0.06 outstanding at January 31, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant's Annual Meeting of Shareowners, to be held April 26, 2017, is incorporated by reference into Part III to the extent described therein.

GE 2016 FORM 10-K 2

GE 2016 FORM 10-K 3

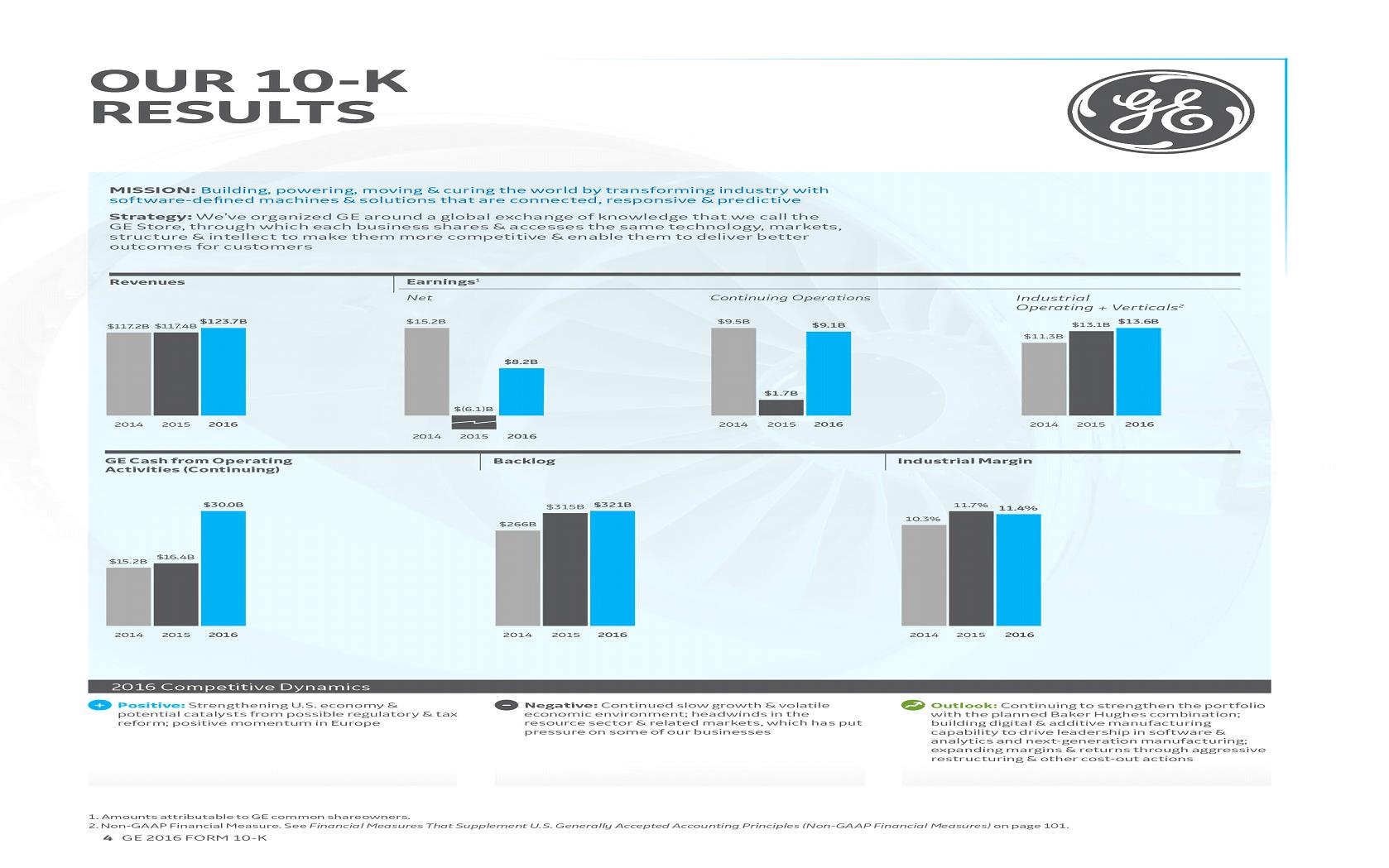

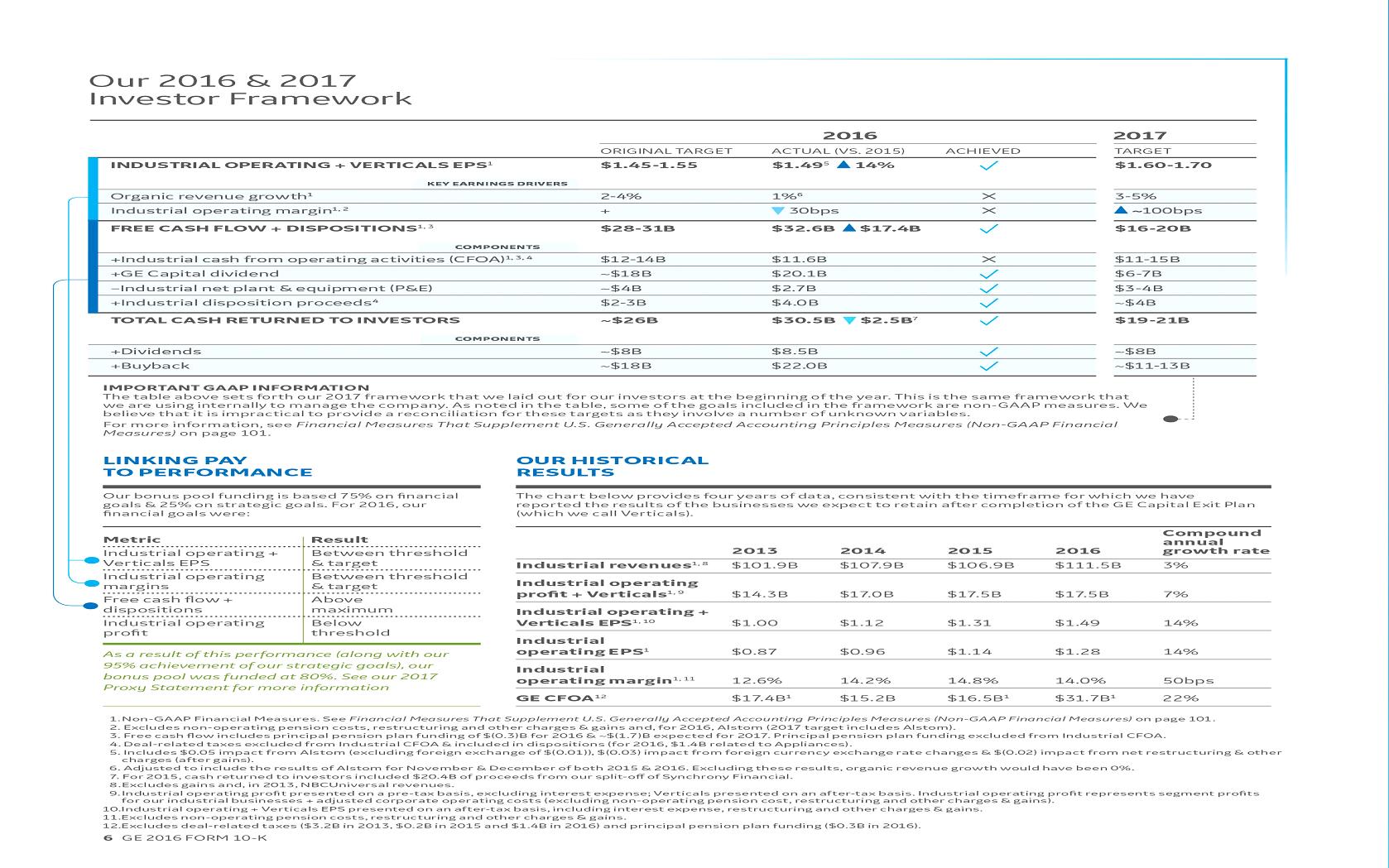

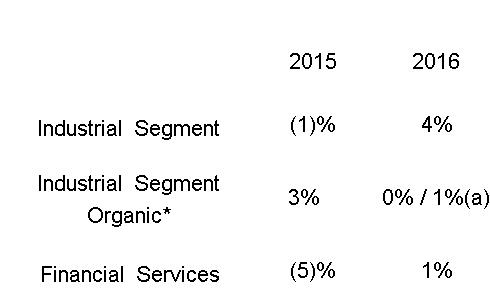

See "Consolidated Results" section on page 27

GE 2016 FORM 10-K 4

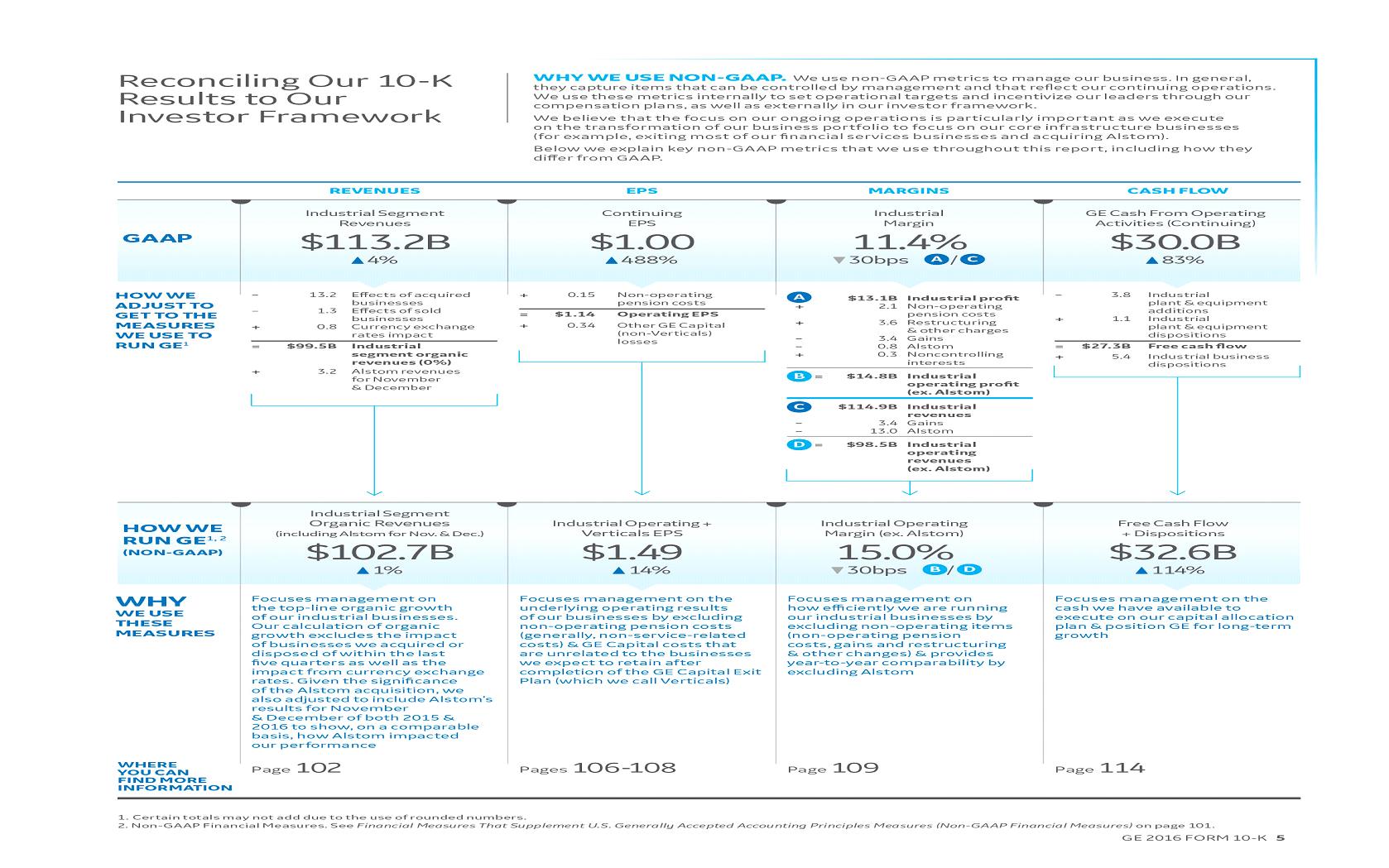

See "Supplemental Information" section on page 101

GE 2016 FORM 10-K 5

See "Supplemental Information" section on page 101

GE 2016 FORM 10-K 6

GE 2016 FORM 10-K 7

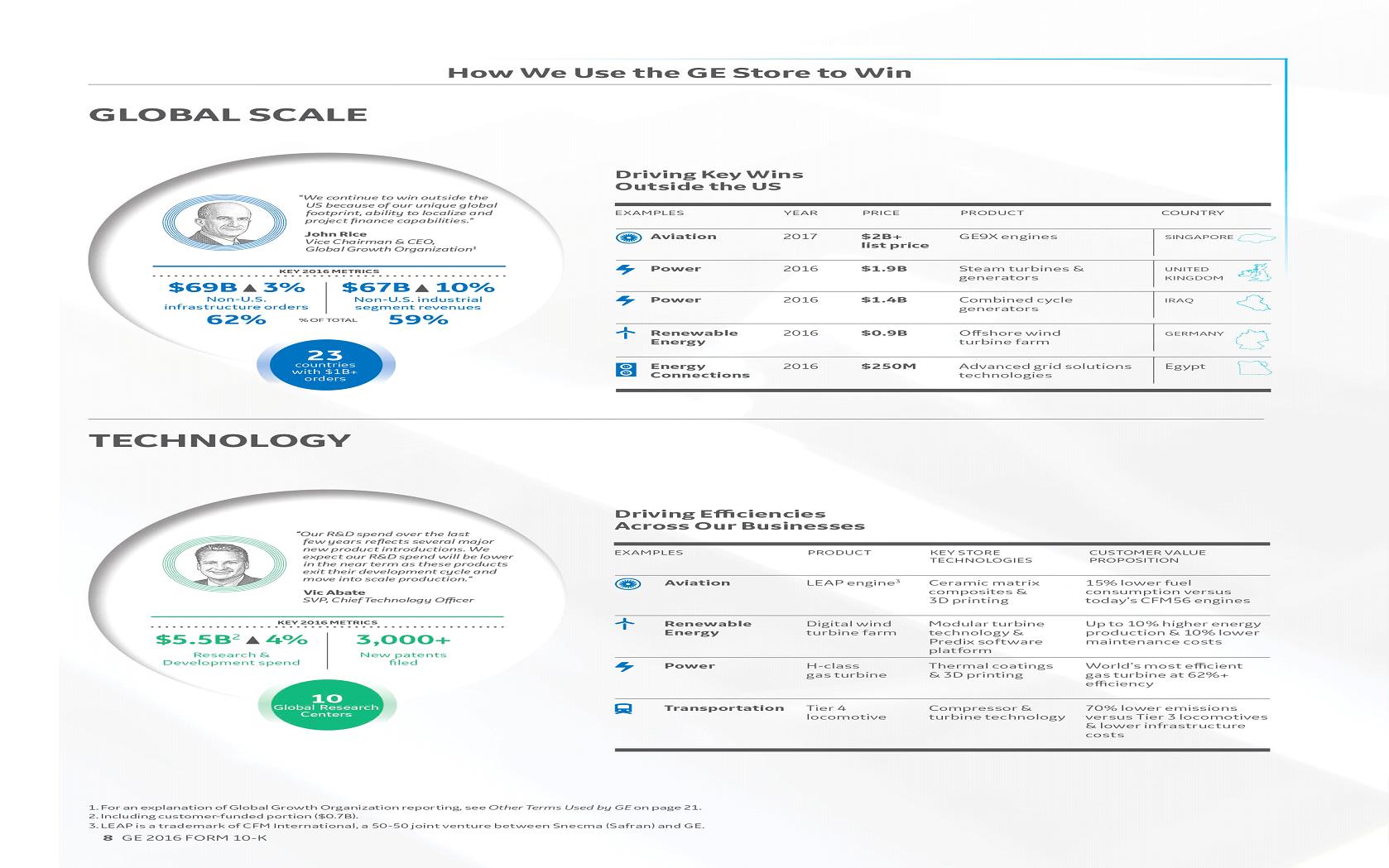

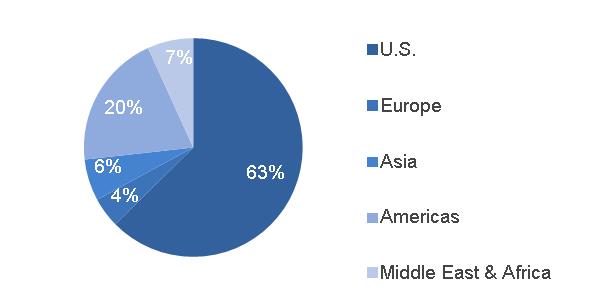

See "Research and Development" section on page 100

GE 2016 FORM 10-K 8

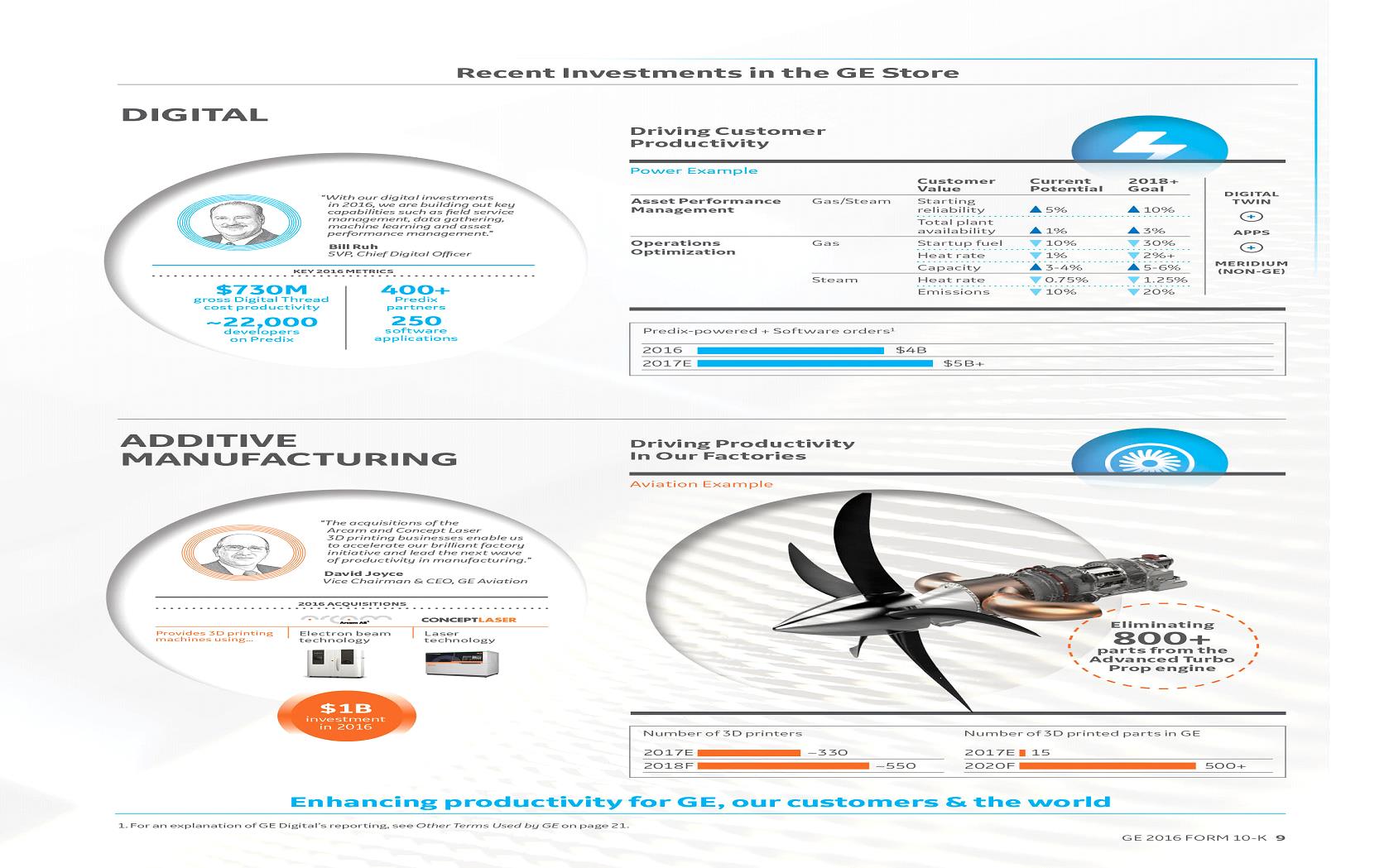

See "GE Digital" section on page 98

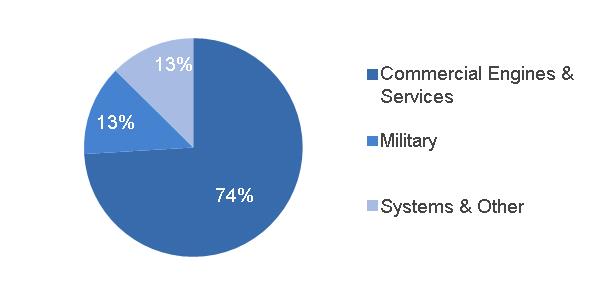

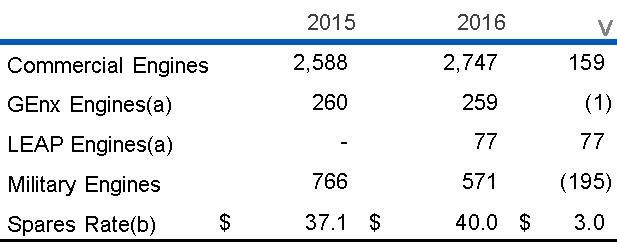

See "Aviation" segment section on page 46

GE 2016 FORM 10-K 9

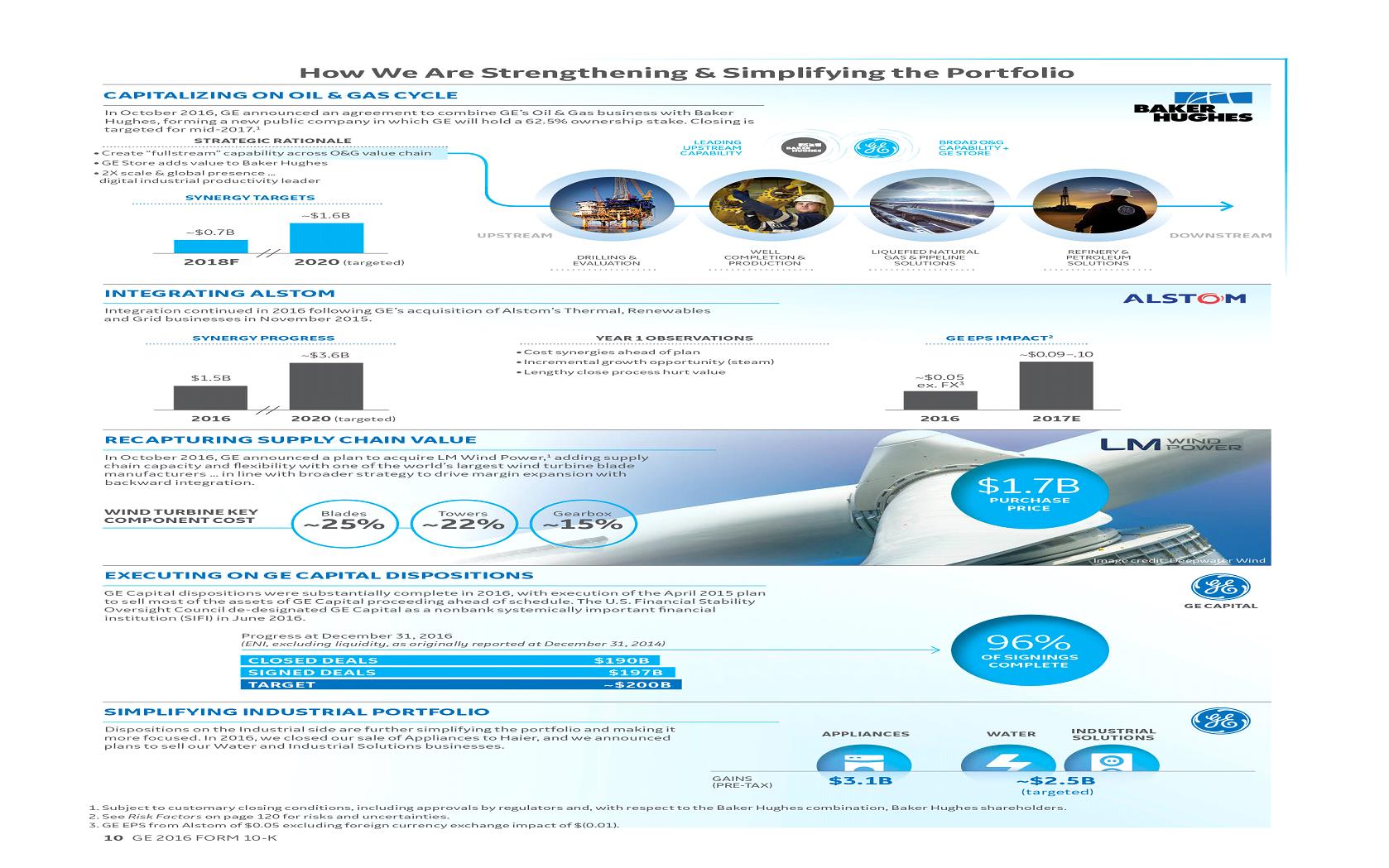

See "Consolidated Results" section on page 27

See "Segment Operations" section on page 33

GE 2016 FORM 10-K 10

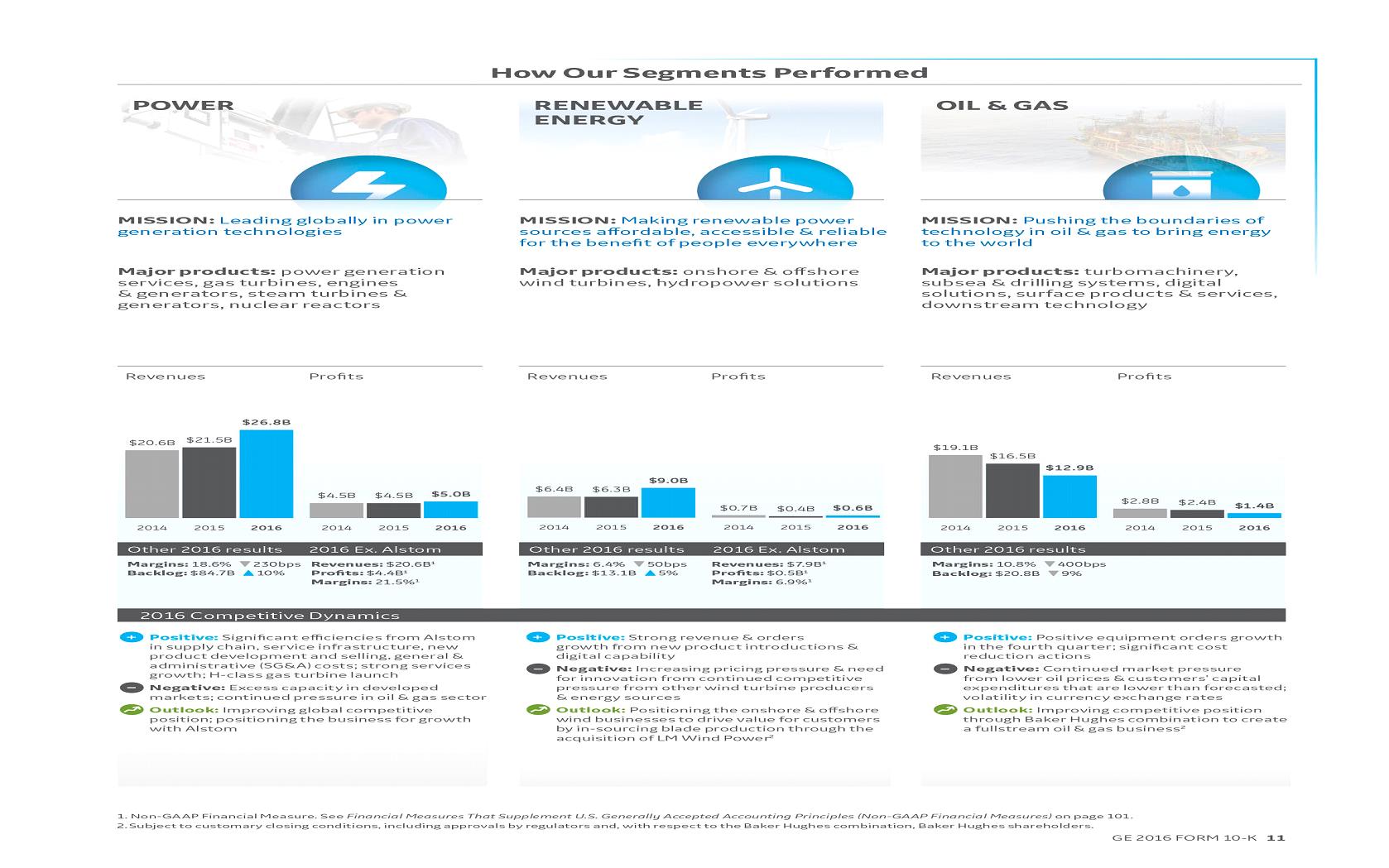

See "Segment Operations" section on page 33

GE 2016 FORM 10-K 11

See "Segment Operations" section on page 33

GE 2016 FORM 10-K 12

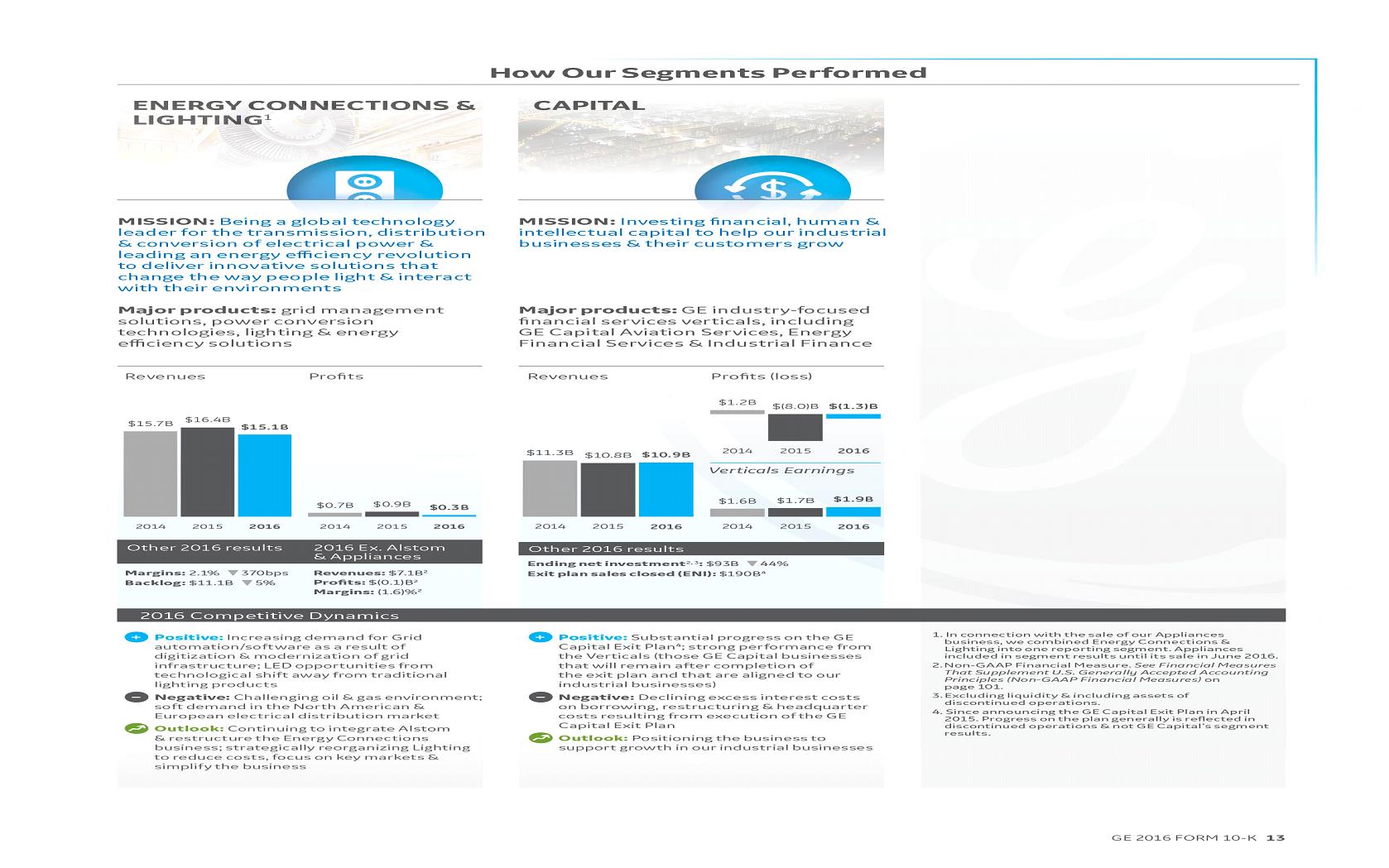

See "Segment Operations" section on page 33

GE 2016 FORM 10-K 13

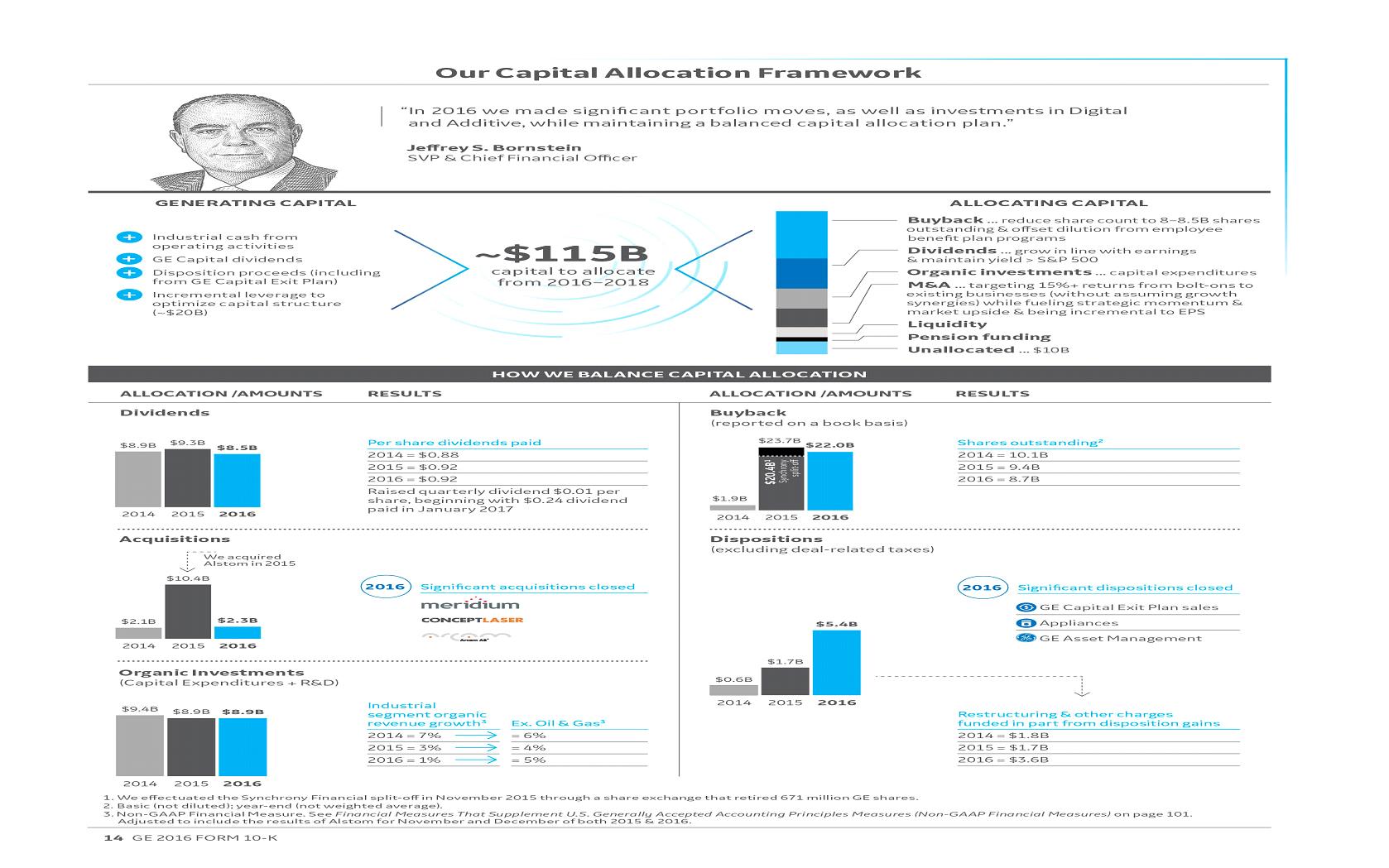

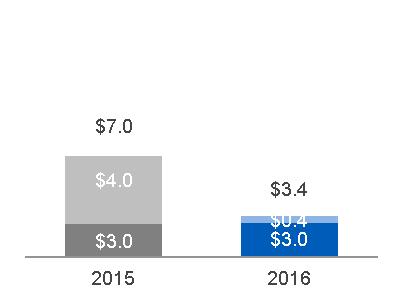

See "Statement of Cash Flows – Overview from 2014 Through 2016" section on page 82

See "Supplemental Information" section on page 101

See "Restructuring" section on page 66

GE 2016 FORM 10-K 14

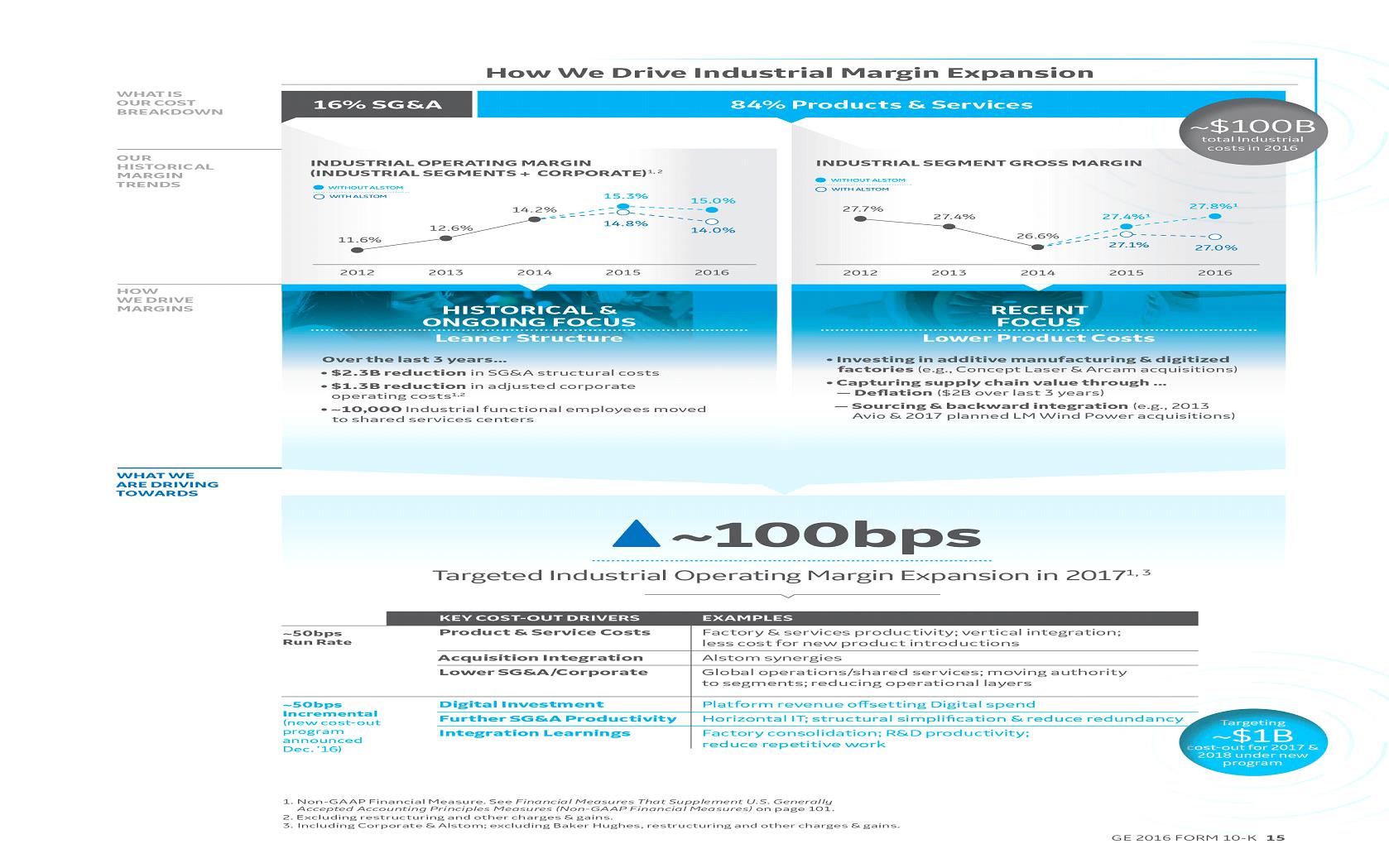

See "Supplemental Information" section on page 101

GE 2016 FORM 10-K 15

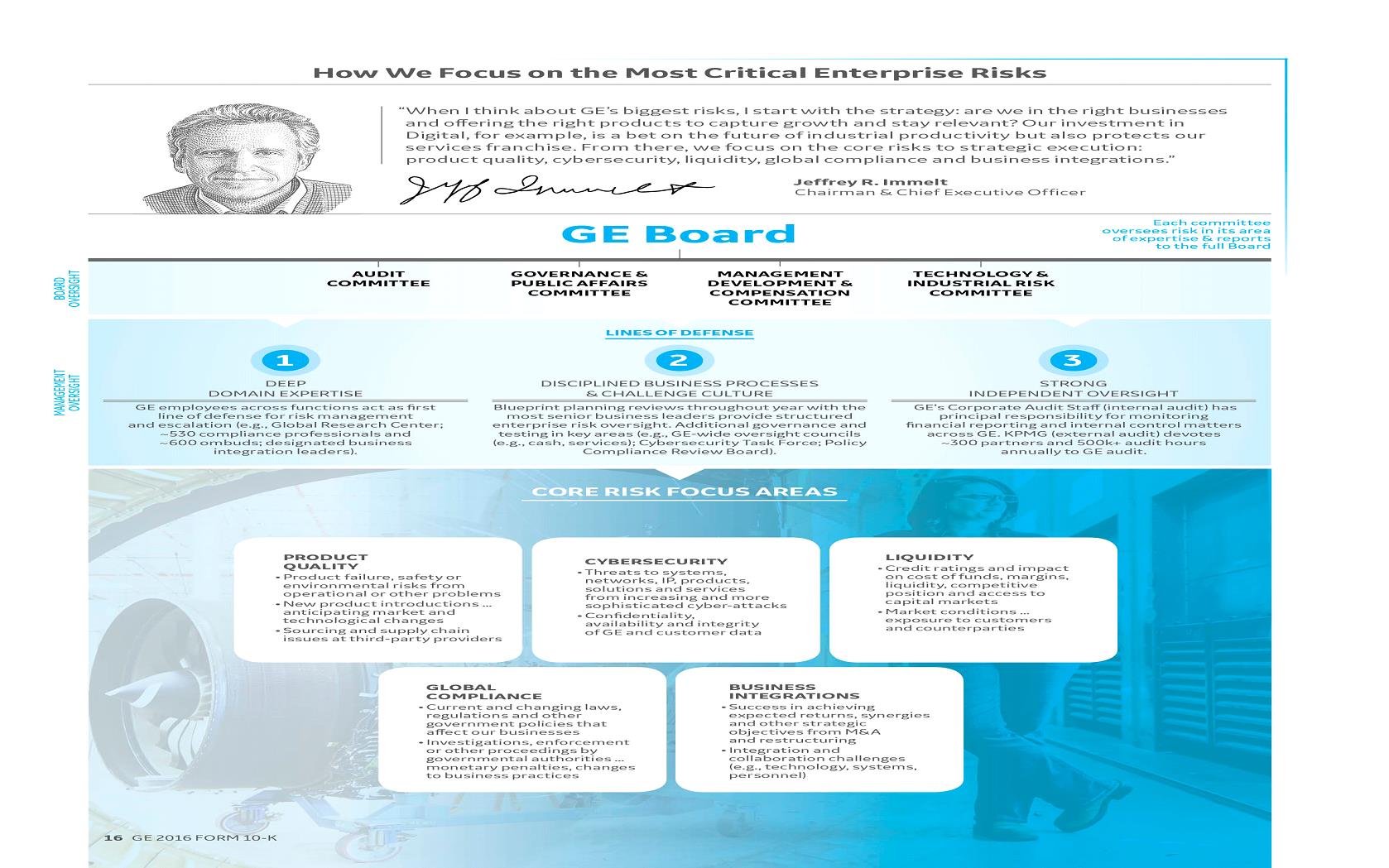

See "Risk Management" section on page 118

See "Risk Factors" section on page 120

GE 2016 FORM 10-K 16

FORWARD LOOKING STATEMENTS

This document contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," "estimate," "forecast" or "target."

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about our announced plan to combine our Oil & Gas business with Baker Hughes, including projected revenue and cost synergies, impact on our earnings per share, and the timing and structure of the proposed transaction; the completion of our announced plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with this plan and earnings per share of GE Capital's retained businesses (Verticals); expected income; earnings per share, including our 2018 target; revenues; organic growth; growth and productivity associated with our Digital business; margins; cost structure and plans to reduce costs; restructuring charges; transaction-related synergies and gains; cash flows, including the impact of pension funding contributions; returns on capital and investment; capital expenditures; capital allocation, including dividends, share repurchases and acquisitions; or capital structure, including leverage.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

· | our ability to complete incremental asset sales as we complete our announced plan to reduce the size of our financial services businesses and our ability to reduce costs as we execute that plan; |

· | changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets; |

· | the impact of conditions in the financial and credit markets on the availability and cost of GE Capital Global Holdings, LLC's (GE Capital) funding, and GE Capital's exposure to counterparties; |

· | pending and future mortgage loan repurchase claims and other litigation claims and investigations in connection with WMC, which may affect our estimates of liability, including possible loss estimates; |

· | our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; |

· | the amount and timing of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; |

· | GE Capital's ability to pay dividends to GE at the planned level, which may be affected by GE Capital's cash flows and earnings, financial services regulation and oversight, claims and investigations relating to WMC and other factors; |

· | our ability to launch new products in a cost-effective manner; |

· | our ability to increase margins through restructuring and other cost reduction measures; |

· | our ability to convert pre-order commitments/wins into orders/bookings; |

· | the price we realize on orders/bookings since commitments/wins are stated at list prices; |

· | customer actions or developments such as early aircraft retirements or reduced energy demand, changes in economic conditions, including oil prices, and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; |

· | the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of Alstom investigative and legal proceedings; |

· | our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; |

· | our success in completing, including obtaining regulatory approvals and satisfying other closing conditions for, announced transactions, such as our announced plans and transactions to combine our Oil & Gas business with Baker Hughes, to reduce the size of our financial services businesses, and to acquire LM Wind Power; |

· | our success in integrating acquired businesses and operating joint ventures, including Baker Hughes; |

· | our ability to realize revenue and cost synergies from announced transactions, acquired businesses and joint ventures, including Alstom and Baker Hughes; |

· | the impact of potential information technology or data security breaches; and |

· | the other factors that are described in the Risk Factors section of this Form 10-K report. |

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially .

GE 2016 FORM 10-K 17

|

ABOUT GENERAL ELECTRIC |

OUR BUSINESS AND HOW WE TALK ABOUT IT

We are a global digital industrial company, transforming industry with software-defined machines and solutions that are connected, responsive and predictive. With products and services ranging from aircraft engines, power generation and oil and gas production equipment to medical imaging, financing and industrial products, we serve customers in approximately 180 countries and employ approximately 295,000 people worldwide. Since our incorporation in 1892, we have developed or acquired new technologies and services that have considerably broadened and changed the scope of our activities.

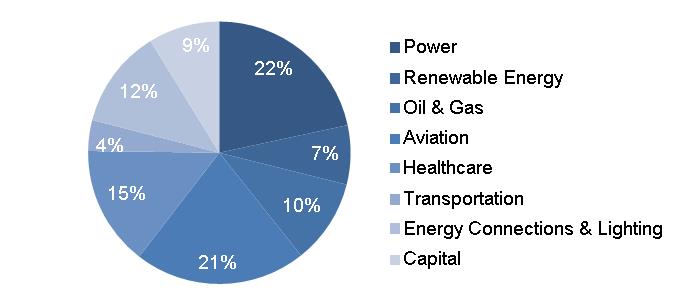

OUR INDUSTRIAL OPERATING SEGMENTS

| Power |  | Aviation |  | Energy Connections & Lighting (a) |

| Renewable Energy |  | Healthcare | ||

| Oil & Gas |  | Transportation |

OUR FINANCIAL SERVICES OPERATING SEGMENT

| Capital |

(a) | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes historical results of the Appliances business prior to its sale in June 2016. |

Business, operation and financial overviews for our operating segments are provided in the Segment Operations section within the Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) section.

COMPETITIVE CONDITIONS AND ENVIRONMENT

In all of our global business activities, we encounter aggressive and able competition. In many instances, the competitive climate is characterized by changing technology that requires continuing research and development. With respect to manufacturing operations, we believe that, in general, we are one of the leading firms in most of the major industries in which we participate. The businesses in which GE Capital engages are subject to competition from various types of financial institutions, including commercial banks, investment banks, leasing companies, independent finance companies, finance companies associated with manufacturers and insurance and reinsurance companies.

As a diverse global company, we are affected by world economies, instability in certain regions, commodity prices, such as the price of oil, and foreign currency volatility. Other factors impacting our business include:

· | product development cycles for many of our products are long and product quality and efficiency are critical to success, |

· | research and development expenditures are important to our business and |

· | many of our products are subject to a number of regulatory standards. |

These factors are discussed throughout MD&A.

GE 2016 FORM 10-K 18

OUR EMPLOYEES AND EMPLOYEE RELATIONS

At year-end 2016, General Electric Company and consolidated affiliates employed approximately 295,000 persons, of whom approximately 104,000 were employed in the United States. For further information about employees, see the Other Financial Data section within the MD&A.

Approximately 9,300 GE manufacturing and service employees in the United States are represented for collective bargaining purposes by one of 9 unions (approximately 48 different locals within such unions). A majority of such employees are represented by union locals that are affiliated with the IUE-CWA, The Industrial Division of the Communication Workers of America, AFL-CIO, CLC. In June 2015, we negotiated new four-year collective bargaining agreements with most of our U.S unions. These agreements continue to provide employees with good wages and benefits while addressing competitive realities facing the Company.

Other GE affiliates are parties to labor contracts with various labor unions, also with varying terms and expiration dates that cover approximately 1,700 employees.

PROPERTIES

Manufacturing operations are carried out at 184 manufacturing plants located in 38 states in the United States and Puerto Rico and at 325 manufacturing plants located in 40 other countries.

CORPORATE INFORMATION AND WEBSITES

General Electric's address is 1 River Road, Schenectady, NY 12345-6999; we also maintain executive offices at 41 Farnsworth Street, Boston, MA 02210.

GE's Internet address a t www.ge.com , Investor Relations website at www.ge.com/investor-relations and our corporate blog at www.gereports.com , as well as GE's Facebook page, Twitter accounts and other social media, including @GE_Reports, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.

Website references in this report are provided as a convenience and do not constitute, and should not be viewed as, incorporation by reference of the information contained on, or available through, the websites. Therefore, such information should not be considered part of this report.

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available, without charge, on our website, www.ge.com/investor-relations/events-reports , as soon as reasonably practicable after they are filed electronically with the U.S. Securities and Exchange Commission (SEC). Copies are also available, without charge, from GE Corporate Investor Communications, 41 Farnsworth Street, Boston, MA 02210.

Reports filed with the SEC may be viewed at www.sec.gov or obtained at the SEC Public Reference Room in Washington, D.C. Information about the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

GE 2016 FORM 10-K 19

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

PRESENTATION

The consolidated financial statements of General Electric Company (the Company) combine the industrial manufacturing and services businesses of General Electric Company (GE) with the financial services businesses of GE Capital Global Holdings, LLC (GE Capital or Financial Services) and its predecessor, General Electric Capital Corporation.

We believe that investors will gain a better understanding of our company if they understand how we measure and talk about our results. Because of the diversity in our businesses, we present our financial statements in a three-column format, which allows investors to see our industrial operations separately from our Financial Services operations. We believe that this provides useful information to investors. When used in this report, unless otherwise indicated by the context, we use the terms to mean the following:

· | General Electric or the Company – the parent company, General Electric Company. |

· | GE – the adding together of all affiliates except GE Capital, whose continuing operations are presented on a one-line basis, giving effect to the elimination of transactions among such affiliates. Transactions between GE and GE Capital have not been eliminated at the GE level. We present the results of GE in the center column of our consolidated statements of earnings, financial position and cash flows. An example of a GE metric is GE cash from operating activities (GE CFOA). |

· | General Electric Capital Corporation or GECC – predecessor to GE Capital Global Holdings, LLC. |

· | GE Capital Global Holdings, LLC or GECGH – the adding together of all affiliates of GECGH, giving effect to the elimination of transactions among such affiliates. |

· | GE Capital or Financial Services – refers to GECGH, or its predecessor GECC, and is the adding together of all affiliates of GE Capital giving effect to the elimination of transactions among such affiliates. We present the results of GE Capital in the right-side column of our consolidated statements of earnings, financial position and cash flows. |

· | GE consolidated – the adding together of GE and GE Capital, giving effect to the elimination of transactions between the two. We present the results of GE consolidated in the left-side column of our consolidated statements of earnings, financial position and cash flows. |

· | Industrial – GE excluding the continuing operations of GE Capital. We believe that this provides investors with a view as to the results of our industrial businesses and corporate items. An example of an Industrial metric is Industrial CFOA (Non-GAAP), which is GE CFOA excluding the effects of dividends from GE Capital. |

· | Industrial segment – the sum of our seven industrial reporting segments, without giving effect to the elimination of transactions among such segments and between these segments and our Financial Services segment. This provides investors with a view as to the results of our industrial segments, without inter-segment eliminations and corporate items. An example of an industrial segment metric is industrial segment revenue growth. |

· | Total segment – the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions between such segments. This provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

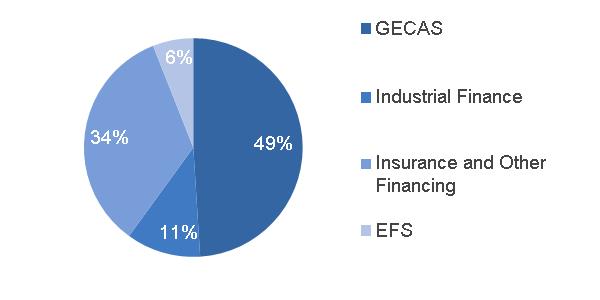

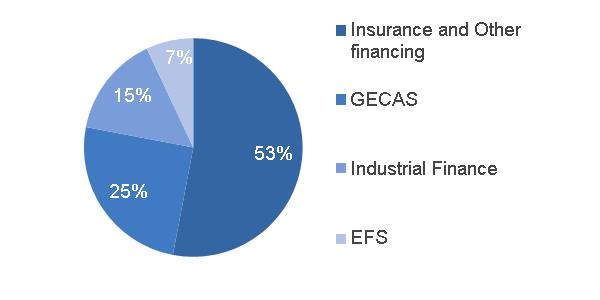

· | Verticals or GE Capital Verticals – the adding together of GE Capital businesses that we expect to retain, principally its vertical financing businesses-GE Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Industrial Finance (which includes Healthcare Equipment Finance, Working Capital Solutions and Industrial Financing Solutions)-that relate to the Company's core industrial domain and other operations, including our run-off insurance activities, and allocated corporate costs. |

GE 2016 FORM 10-K 20

We integrate acquisitions as quickly as possible. Revenues and earnings from the date we complete the acquisition through the end of the fourth quarter following the acquisition are considered the acquisition effect of such businesses.

Discussion of GE Capital's total assets includes deferred income tax liabilities, which are presented within assets for purposes of our consolidated statement of financial position presentations for this filing.

Amounts reported in billions in graphs within this report are computed based on the amounts in millions. As a result, the sum of the components reported in billions may not equal the total amount reported in billions due to rounding. Certain columns and rows within the tables may not add due to the use of rounded numbers. Percentages presented are calculated from the underlying numbers in millions.

Discussions throughout this MD&A are based on continuing operations unless otherwise noted.

The MD&A should be read in conjunction with the Financial Statements and Notes to the consolidated financial statements.

OTHER TERMS USED BY GE

· | Backlog – unfilled customer orders for products and product services (expected life of contract sales for product services). |

· | Borrowings as a percentage of total capital invested – for GE, the sum of borrowings and mandatorily redeemable preferred stock, divided by the sum of borrowings, mandatorily redeemable preferred stock, redeemable noncontrolling interest, noncontrolling interests and total shareowners' equity. |

· | Continuing earnings – unless otherwise indicated, we refer to the caption "earnings from continuing operations attributable to GE common shareowners" as continuing earnings or simply as earnings. |

· | Continuing earnings per share (EPS) – unless otherwise indicated, when we refer to continuing earnings per share, it is the diluted per-share amount of "earnings from continuing operations attributable to GE common shareowners". |

· | Digital revenues – revenues related to internally developed software (including Predix TM ) and associated hardware, and software solutions that improve our customers' asset performance. In 2016, we reassessed the span of our digital product offerings, which now excludes software-enabled product upgrades. These revenues are largely generated from our operating businesses and are included in their segment results. |

· | Ending Net Investment (ENI) (Non-GAAP) – the total capital we have invested in the Financial Services business. It is the sum of short-term borrowings, long-term borrowings and equity (excluding noncontrolling interests) adjusted for unrealized gains and losses on investment securities and hedging instruments. Alternatively, it is the amount of assets of continuing operations less the amount of non-interest-bearing liabilities. |

· | Equipment leased to others (ELTO) – rental equipment we own that is available to rent and is stated at cost less accumulated depreciation. |

· | Free cash flow (Non-GAAP) – GE's cash from operating activities (continuing operations) less GE additions to property, plant and equipment, plus GE dispositions of property, plant and equipment, which are included in cash flows from investing activities. |

· | GE Capital Exit Plan – our plan, announced on April 10, 2015, to reduce the size of our financial services businesses through the sale of most of the assets of GE Capital, and to focus on continued investment and growth in our industrial businesses. |

· | Global Growth Organization (GGO ) – organization that provides operational processes through a shared services structure for the enabling functions: commercial, enterprise data management, finance, HR, IT, legal, supply chain and tax through a partnership with the businesses and global functions. |

· | Growth markets – consist of countries/regions which are expected to grow at above average world GDP rates over the long term and typically are resource rich and/or have large infrastructure needs. They encompass the following: Australasia; Canada; Latin America; Middle East, North Africa and Turkey; Russia and CIS; Sub-Saharan Africa; Greater China; South Asia; South East Asia (ASEAN). |

· | Industrial margin – GE revenues and other income excluding GE Capital earnings (loss) from continuing operations (Industrial revenues) minus GE total costs and expenses less GE interest and other financial charges divided by Industrial revenues. |

GE 2016 FORM 10-K 21

· | Industrial operating profit margin (Non-GAAP) – Industrial segment profit plus corporate items and eliminations (excluding gains, restructuring, and pre-tax non-operating pension costs) divided by industrial segment revenues plus corporate items and eliminations (excluding gains and GE-GE Capital eliminations). |

· | Industrial return on total capital (Industrial ROTC) (Non-GAAP) – earnings from continuing operations attributable to GE common shareowners less GE Capital earnings from continuing operations plus GE after-tax interest, divided by average Industrial shareholders' equity, less average GE Capital's shareholders' equity, plus average debt and other, net. |

· | Industrial segment gross margin – industrial segment sales less industrial segment cost of sales. |

· | Industrial shareholders' equity and GE Capital shareholders' equity – for purposes of the Industrial ROTC calculation excludes the effects of discontinued operations and is calculated on an annual basis using a five-point average. |

· | Net earnings – unless otherwise indicated, we refer to the caption "net earnings attributable to GE common shareowners" as net earnings. |

· | Net earnings per share (EPS) – unless otherwise indicated, when we refer to net earnings per share, it is the diluted per-share amount of "net earnings attributable to GE common shareowners". |

· | Non-operating pension cost (Non-GAAP) – comprises the expected return on plan assets, interest cost on benefit obligations and net actuarial gain (loss) amortization for our principal pension plans. |

· | Operating earnings (Non-GAAP) – GE earnings from continuing operations attributable to common shareowners excluding the impact of non-operating pension costs. |

· | Operating earnings per share (Non-GAAP) – unless otherwise indicated, when we refer to operating earnings per share, it is the diluted per-share amount of "operating earnings". |

· | Operating pension cost (Non-GAAP) – comprises the service cost of benefits earned, prior service cost amortization and curtailment gain (loss) for our principal pension plans. |

· | Organic revenues (Non-GAAP) – revenues excluding the effects of acquisitions, dispositions and translational foreign currency exchange. |

· | Product services – for purposes of the financial statement display of sales and costs of sales in our Statement of Earnings, "goods" is required by SEC regulations to include all sales of tangible products, and "services" must include all other sales, including other services activities. In our MD&A section of this report, we refer to sales under product services agreements and sales of both goods (such as spare parts and equipment upgrades) and related services (such as monitoring, maintenance and repairs) as sales of "product services," which is an important part of our operations. We refer to "product services" simply as "services" within the MD&A. |

· | Product services agreements – contractual commitments, with multiple-year terms, to provide specified services for products in our Power, Renewable Energy, Oil & Gas, Aviation and Transportation installed base – for example, monitoring, maintenance, service and spare parts for a gas turbine/generator set installed in a customer's power plant. |

· | Revenues – unless otherwise indicated, we refer to captions such as "revenues and other income" simply as revenues. |

· | Segment profit – refers to the operating profit of the industrial segments and the net earnings of the Financial Services segment. See the Segment Operations section within the MD&A for a description of the basis for segment profits. |

· | Shared Services – sharing of business processes in order to standardize and consolidate services to provide value to the businesses in the form of simplified processes, reduced overall costs and increased service performance. |

GE 2016 FORM 10-K 22

NON-GAAP FINANCIAL MEASURES

In the accompanying analysis of financial information, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered "non-GAAP financial measures" under the SEC rules. Specifically, we have referred, in various sections of this report, to:

· | Industrial segment organic revenues and industrial segment organic revenues excluding Oil & Gas |

· | Industrial segment organic operating profit |

· | Oil & Gas organic revenue and operating profit growth |

· | Operating and non-operating pension cost |

· | Adjusted corporate costs (operating) |

· | GE pre-tax earnings from continuing operations, excluding GE Capital earnings (loss) from continuing operations and the corresponding effective tax rates, and the reconciliation of the U.S. federal statutory income tax rate to GE effective tax rate, excluding GE Capital earnings |

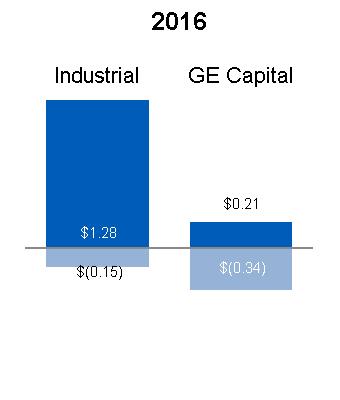

· | Industrial operating earnings and GE Capital earnings (loss) from continuing operations and EPS |

· | Industrial operating + Verticals earnings and EPS |

· | Industrial operating profit and operating profit margin (excluding certain items) |

· | Industrial operating profit + Verticals |

· | Industrial segment gross margin (excluding Alstom) |

· | Industrial segment operating profit and operating margin (excluding Alstom) |

· | Average GE shareowners' equity, excluding effects of discontinued operations |

· | Average GE Capital shareowners' equity, excluding effects of discontinued operations |

· | Industrial return on total capital (Industrial ROTC) |

· | Industrial cash flows from operating activities (Industrial CFOA) and Industrial CFOA excluding taxes related to business sales and principal pension plan funding |

· | GE cash flows from operating activities (GE CFOA) excluding taxes related to business sales and principal pension plan funding |

· | Free cash flow (FCF) and FCF plus dispositions |

· | Ratio of adjusted debt to equity at GE Capital, net of liquidity |

· | Capital ending net investment (ENI), excluding liquidity |

· | 2017 operating framework including 2017 Industrial operating + Verticals EPS target |

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the Supplemental Information section within the MD&A. Non-GAAP financial measures referred to in this report are either labeled as "non-GAAP" or designated as such with an asterisk (*).

GE 2016 FORM 10-K 23

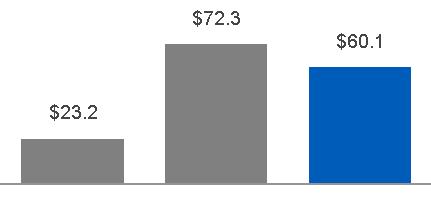

KEY PERFORMANCE INDICATORS

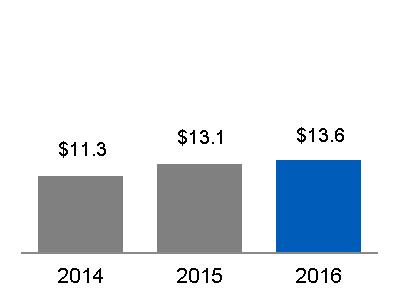

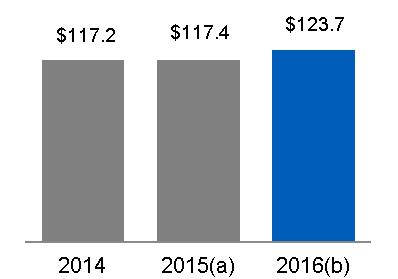

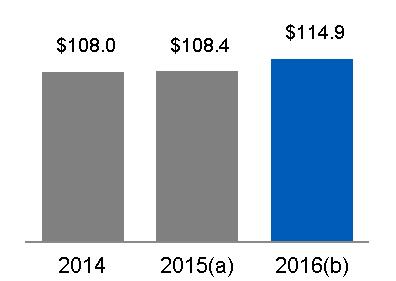

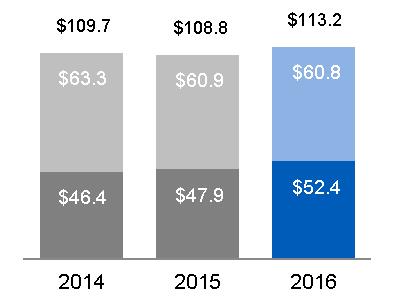

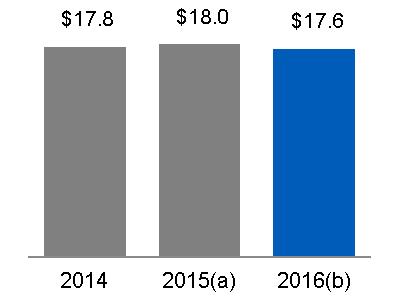

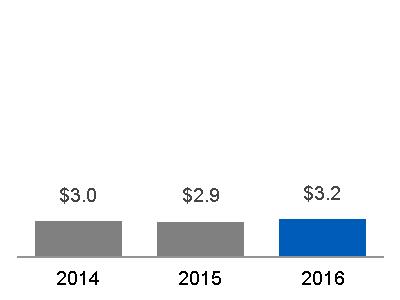

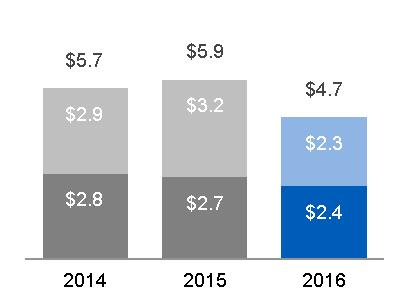

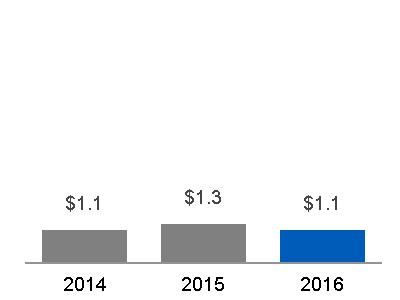

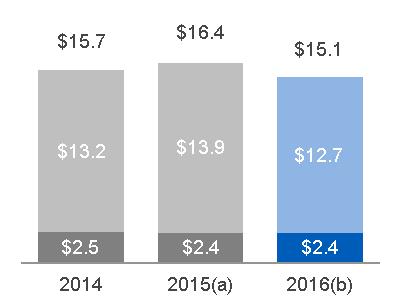

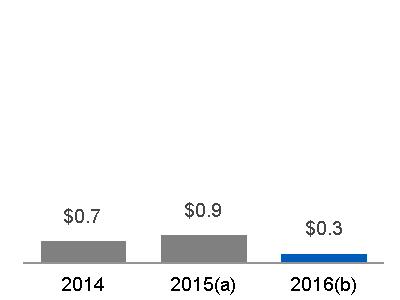

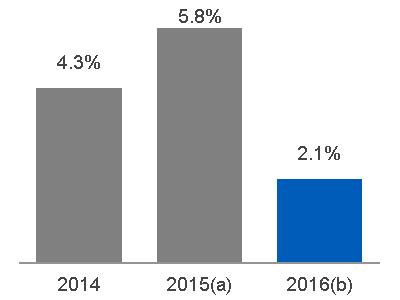

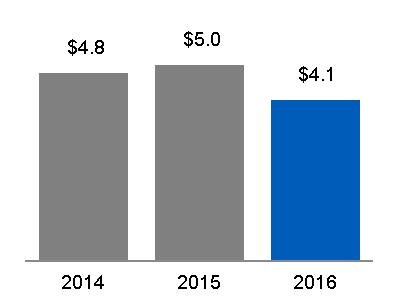

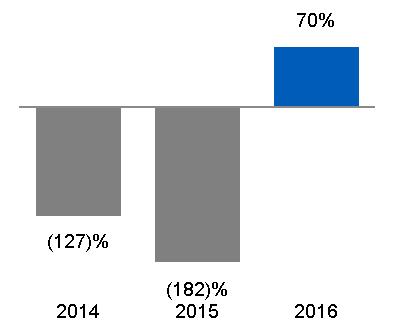

(Dollars in billions; per-share amounts in dollars)

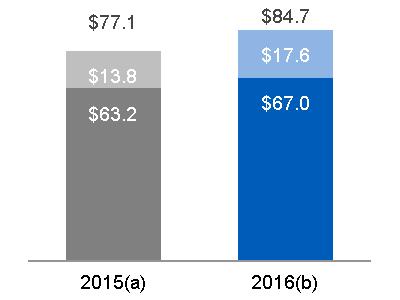

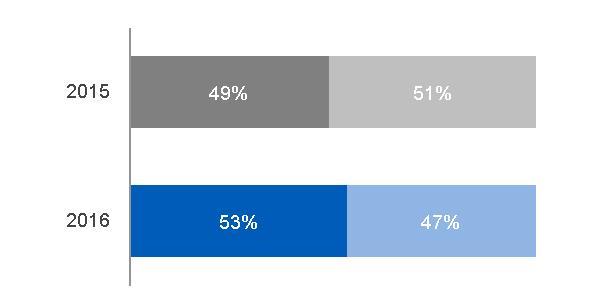

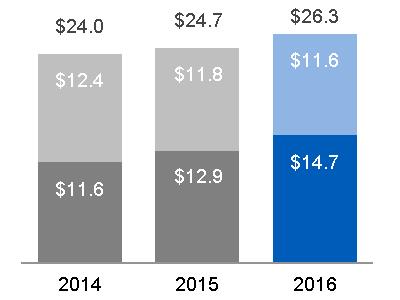

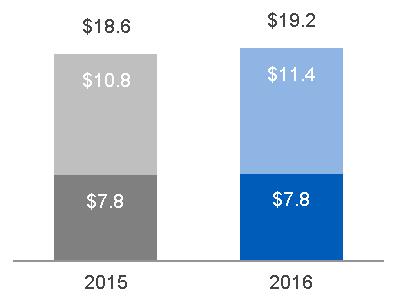

REVENUES PERFORMANCE |

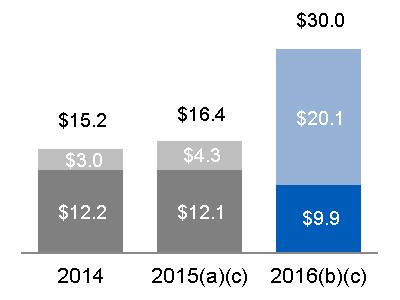

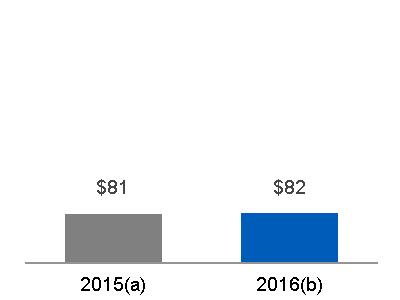

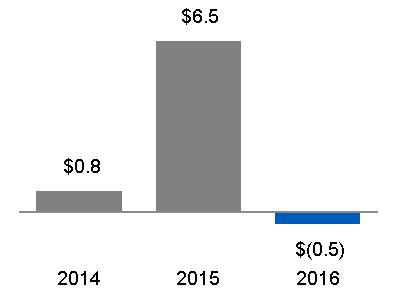

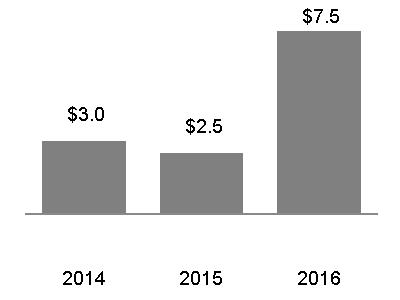

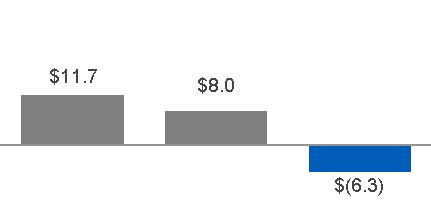

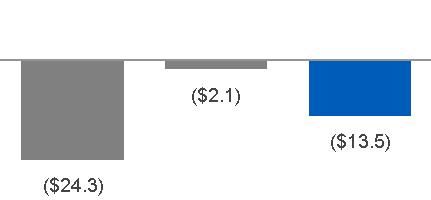

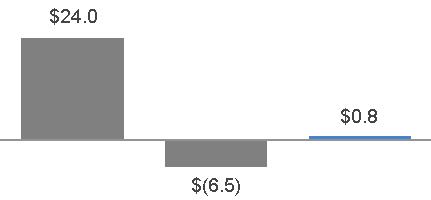

GE CFOA | |||

|  |

GE Capital Dividend

Industrial CFOA* | ||

(a) Including the results of Alstom for November and December of both 2015 and 2016 | (a) Industrial CFOA was $12.2 billion excluding deal taxes of $(0.2) billion related to the sale of our Signaling business (b) Industrial CFOA was $11.6 billion excluding deal taxes of $(1.4) billion related to the sale of our Appliances business and $(0.3) billion of pension funding (c) Included $(0.3) billion related to Alstom in both 2015 and 2016

| |||

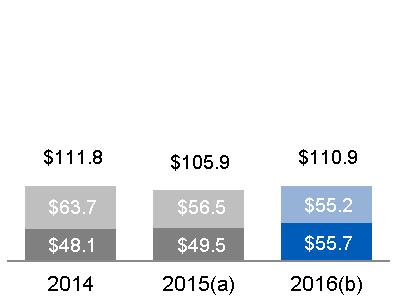

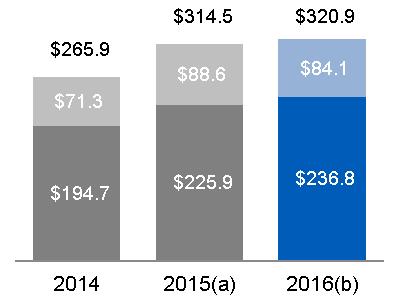

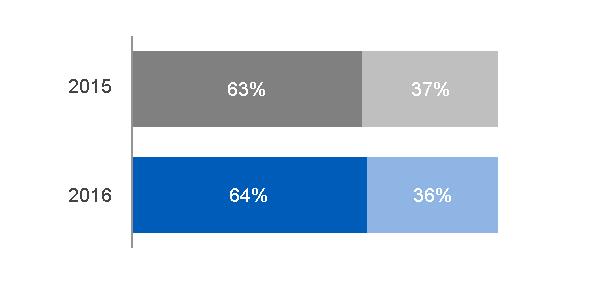

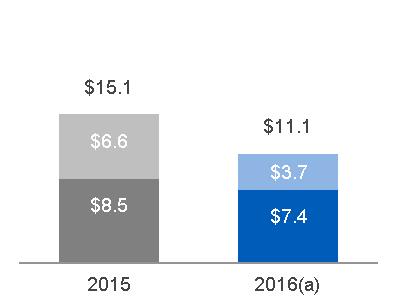

INDUSTRIAL ORDERS |

INDUSTRIAL BACKLOG | |||

|

Equipment

Services |

|

Equipment

Services

| |

(a) Included $2.5 billion related to Alstom (b) Included $17.4 billion related to Alstom | (a) Included $29.2 billion related to Alstom (b) Included $31.2 billion related to Alstom | |||

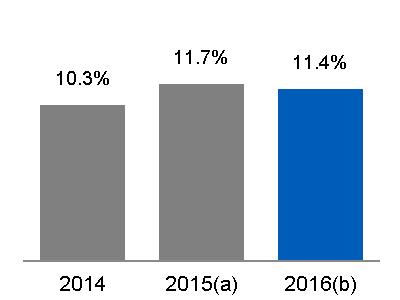

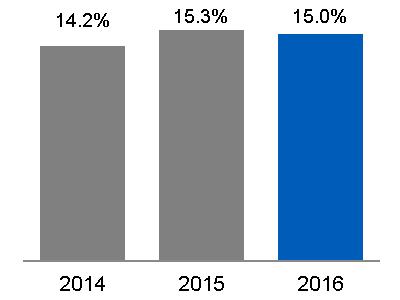

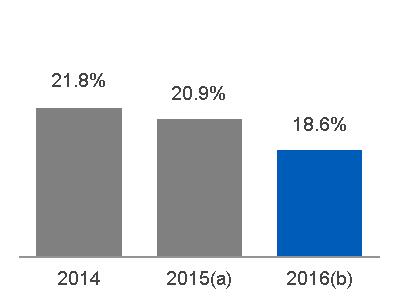

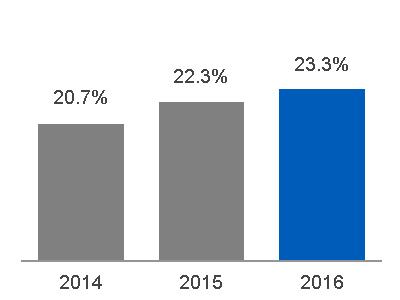

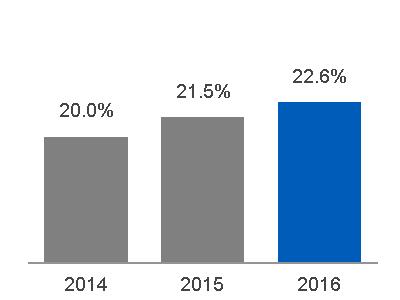

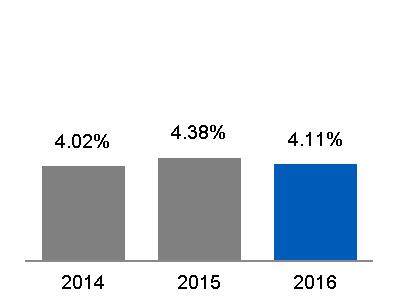

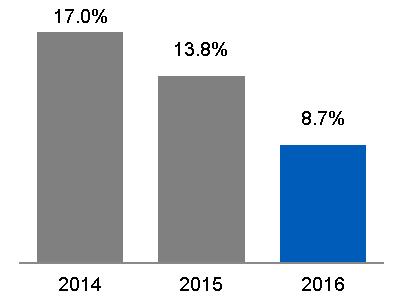

INDUSTRIAL MARGINS |

INDUSTRIAL OPERATING PROFIT MARGINS (NON-GAAP) (a) | |||

|

| |||

(a) 12.0%, excluding (7.9)% related to Alstom* (b) 12.1%, excluding 5.9% related to Alstom*

| (a) Excluded gains, non-operating pension costs, restructuring and other, noncontrolling interests, GE Capital preferred stock dividends, as well as the results of Alstom | |||

* Non-GAAP Financial Measure

GE 2016 FORM 10-K 24

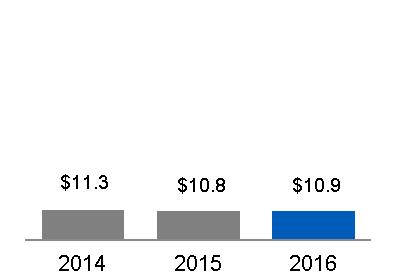

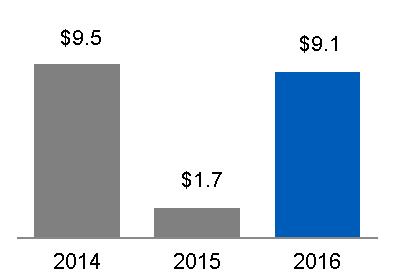

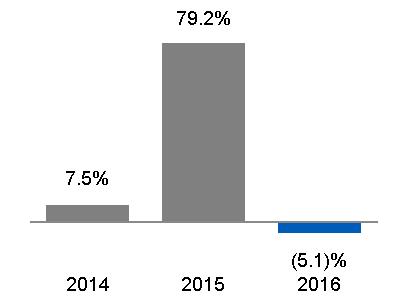

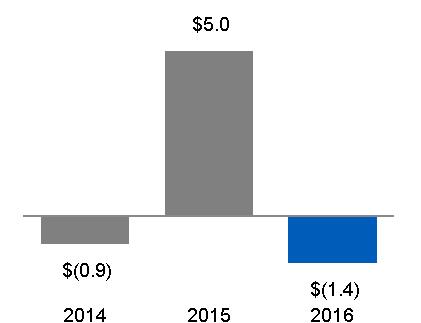

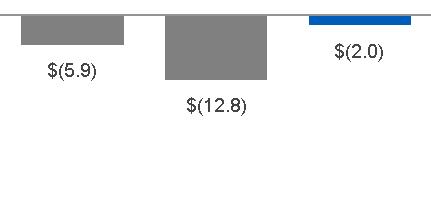

KEY PERFORMANCE INDICATORS

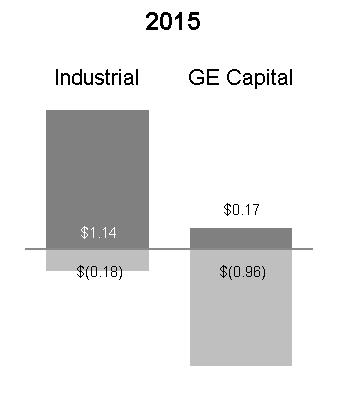

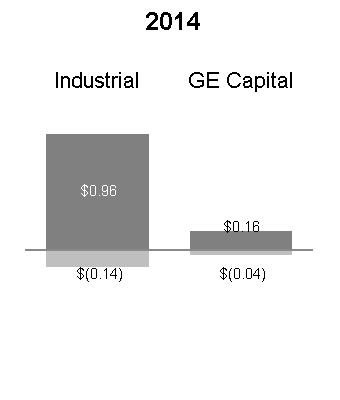

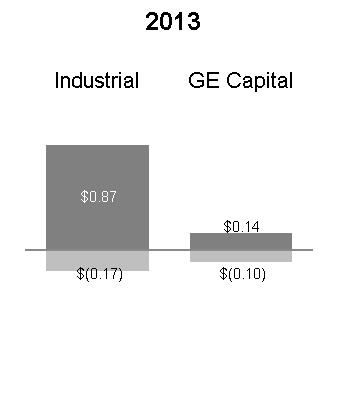

(Dollars in billions; per-share amounts in dollars; attributable to GE common shareowners)

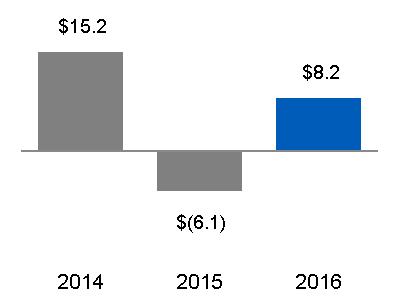

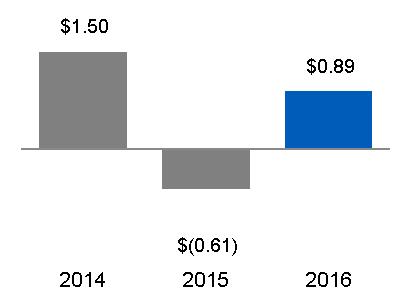

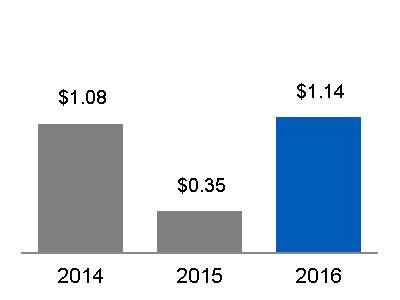

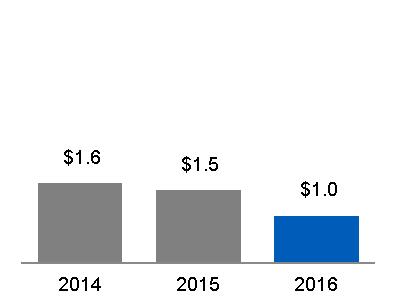

NET EARNINGS (LOSS) |

NET EARNINGS (LOSS) PER SHARE | |

|

| |

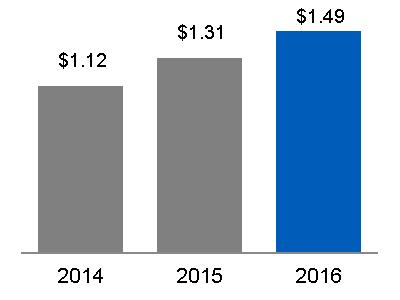

OPERATING EARNINGS (NON-GAAP) |

OPERATING EARNINGS PER SHARE (NON-GAAP) | |

|

| |

INDUSTRIAL OPERATING + VERTICALS EARNINGS (NON-GAAP) |

INDUSTRIAL OPERATING + VERTICALS EPS (NON-GAAP) | |

|

|

GE 2016 FORM 10-K 25

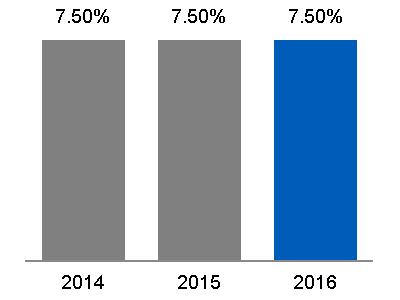

KEY PERFORMANCE INDICATORS

(Dollars in billions; per-share amounts in dollars)

SHAREHOLDER INFORMATION | |

RETURNED $30.5 BILLION TO SHAREOWNERS IN 2016

Dividends $8.5 billion Stock buyback $22.0 billion

| ANNUAL MEETING

General Electric's 2017 Annual Meeting of Shareowners will be held on April 26, 2017, in Asheville, NC |

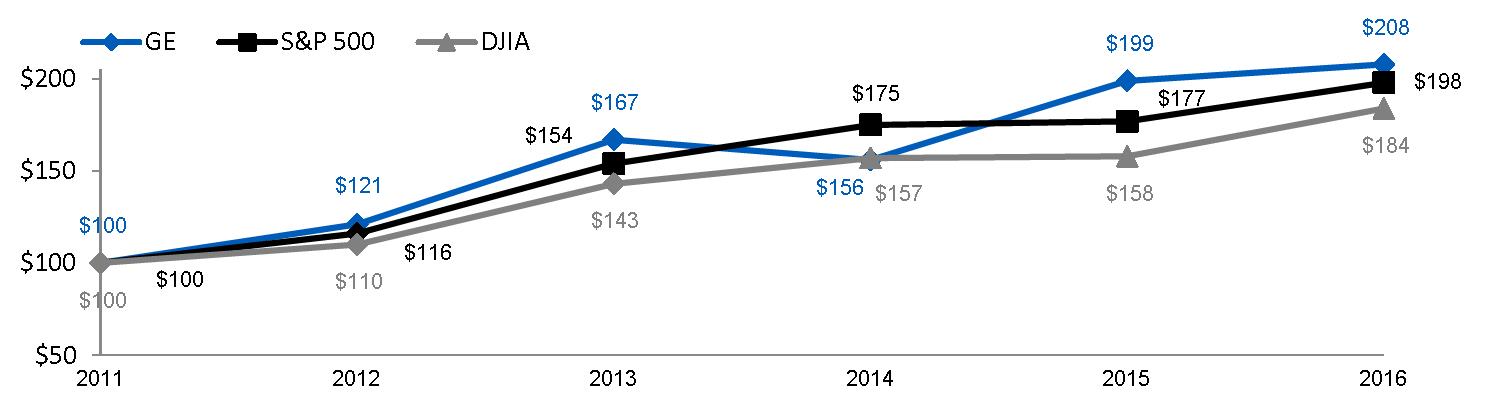

FIVE-YEAR PERFORMANCE GRAPH | |

| |

The annual changes for the five-year period shown in the graph on this page are based on the assumption that $100 had been invested in General Electric common stock, the Standard & Poor's 500 Stock Index (S&P 500) and the Dow Jones Industrial Average (DJIA) on December 31, 2011, and that all quarterly dividends were reinvested. The cumulative dollar returns shown on the graph represent the value that such investments would have had on December 31 for each year indicated.

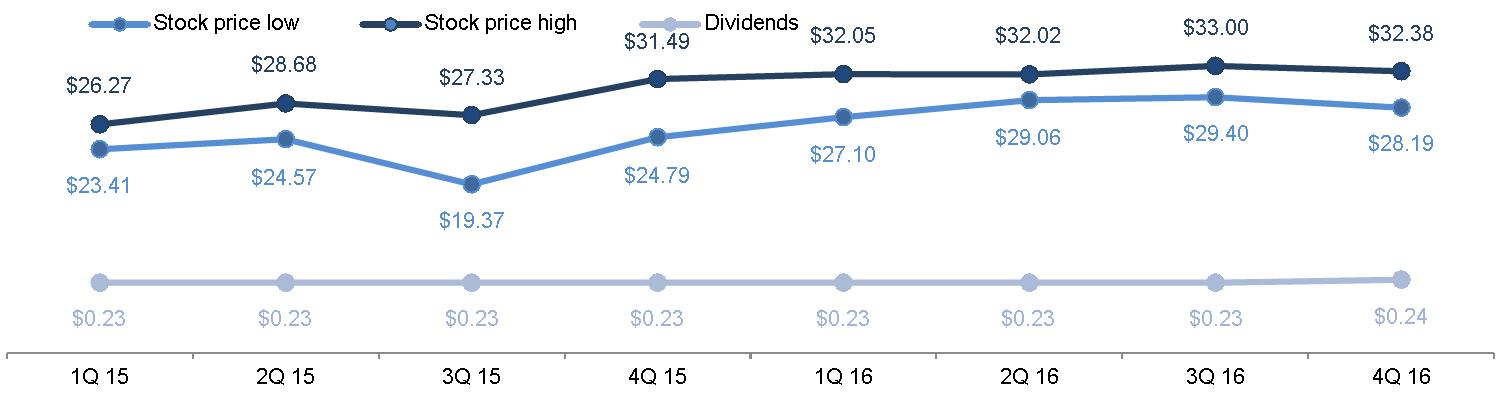

STOCK PRICE RANGE AND DIVIDENDS |

|

With respect to "Market Information," in the United States, General Electric common stock is listed on the New York Stock Exchange (its principal market). General Electric common stock is also listed on the London Stock Exchange, Euronext Paris, the SIX Swiss Exchange and the Frankfurt Stock Exchange. The chart above shows trading prices, as reported on the New York Stock Exchange, Inc., Composite Transactions Tape.

As of January 31, 2017, there were approximately 440,000 shareowner accounts of record.

On February 10, 2017, our Board of Directors approved a quarterly dividend of $0.24 per share of common stock, which is payable April 25, 2017, to shareowners of record at close of business on February 27, 2017.

GE 2016 FORM 10-K 26

CONSOLIDATED RESULTS

SIGNIFICANT DEVELOPMENTS IN 2016 |

Our consolidated results for 2016 were significantly affected by recent portfolio changes, including the 2015 acquisition of Alstom, the disposal of financial services businesses under the GE Capital Exit Plan initiated in 2015 and the 2016 sale of our Appliances business.

|

ALSTOM In 2016, Alstom contributed revenues of $13.0 billion and an operating loss of $0.3 billion, of which $0.8 billion of profit is included in the segment results and $1.0 billion of charges is included in Corporate, primarily related to purchase accounting and acquisition related charges. Including the effects of tax benefits of $0.8 billion, net earnings were $0.4 billion for the year ended December 31, 2016. In addition, Alstom used cash flows from operating activities of $0.3 billion for the year ended December 31, 2016.

|

GE CAPITAL EXIT PLAN As of December 31, 2016, we have signed agreements with buyers for $197 billion of GE Capital ending net investment (ENI), excluding liquidity (as originally reported at December 31, 2014), of which $190 billion have closed by the end of 2016. In June 2016, we received approval of our request to the Financial Stability Oversight Council (FSOC) for rescission of GE Capital's designation as a nonbank Systemically Important Financial Institution (SIFI).

|

2016 SIGNIFICANT TRANSACTIONS Transactions completed in 2016 included the following.

· The June 2016 sale of our Appliances business to Qingdao Haier Co., Ltd. (Haier) for $5.6 billion (including $0.8 billion from sale of receivables originated in our Appliances business and sold from GE Capital to Haier) on which we recognized an after-tax gain of $1.8 billion. · Acquisition of the remaining 74% of software developer Meridium Inc. in September 2016, for $0.4 billion to enhance and accelerate our asset performance-management capabilities across our industrial businesses. · The acquisitions of a 76.2% interest in Arcam AB for $0.5 billion and a 75% interest in Concept Laser GmbH for $0.6 billion, two European 3-D printing companies that print metal parts for aircraft and other industrial components, to expand our additive manufacturing capabilities.

|

PLANNED TRANSACTIONS We also announced a number of strategic transactions during 2016 that we expect to complete in 2017, including the following.

· In October 2016, we announced an agreement with Baker Hughes Incorporated (Baker Hughes) to combine our Oil & Gas business and Baker Hughes to create a new entity in which GE will hold a 62.5% interest and existing Baker Hughes shareholders will have a 37.5% interest. Baker Hughes shareholders will also receive a cash dividend funded by a $7.4 billion cash contribution by GE. The transaction is subject to the approval of Baker Hughes shareholders, regulatory approvals and other customary closing conditions. · In October 2016, we announced a plan to acquire LM Wind Power, one of the world's largest wind turbine blade manufacturers for $1.7 billion, subject to customary closing conditions. · In October 2016, we also announced our plan to sell our Water & Process Technologies business and in December 2016, we announced our plan to sell our Industrial Solutions business.

|

GE 2016 FORM 10-K 27

CONSOLIDATED RESULTS

(Dollars in billions)

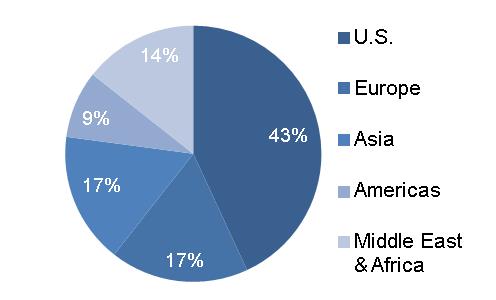

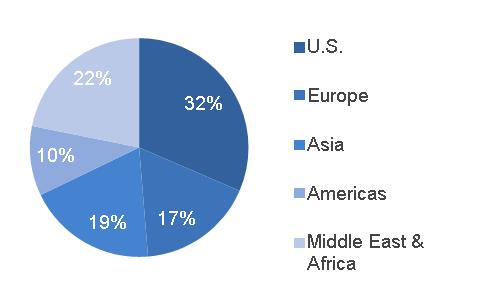

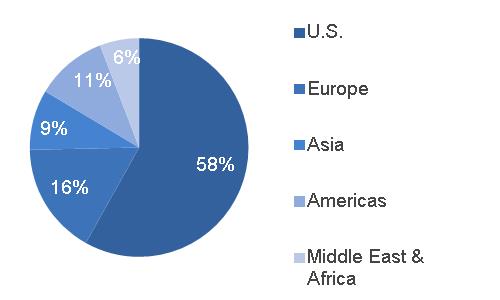

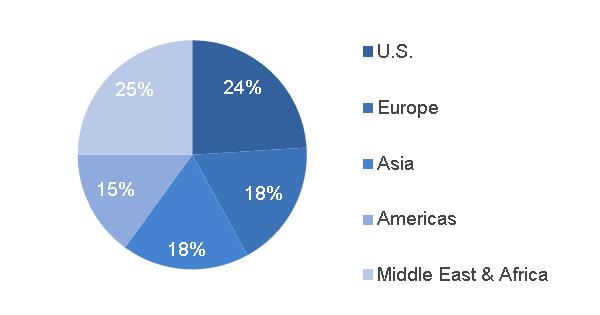

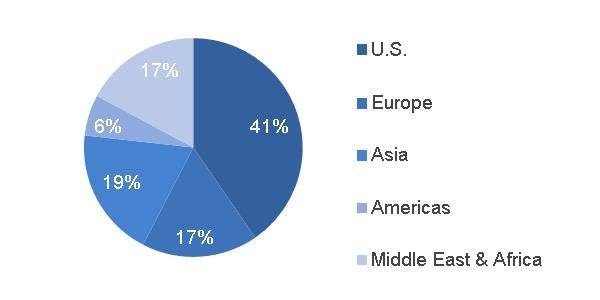

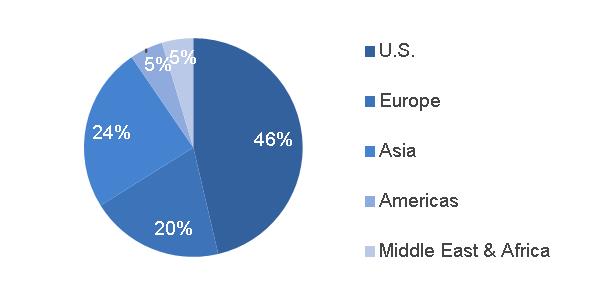

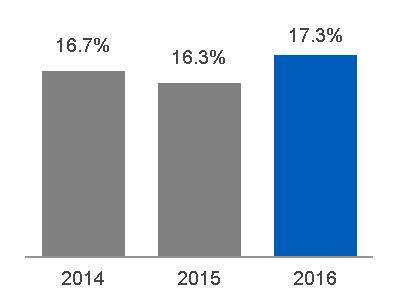

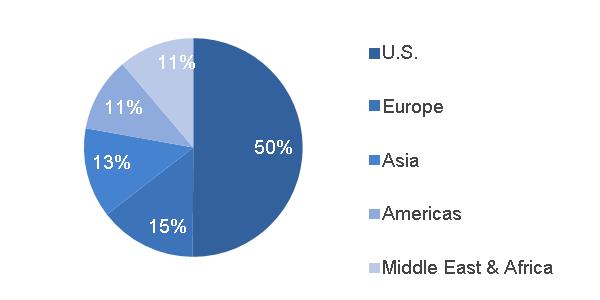

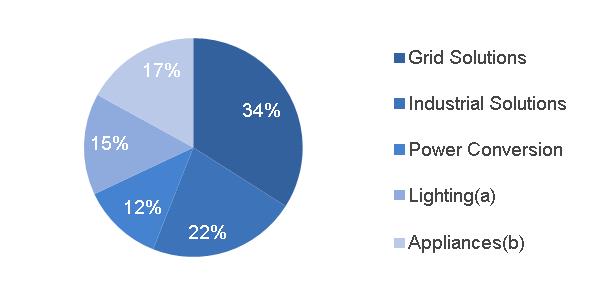

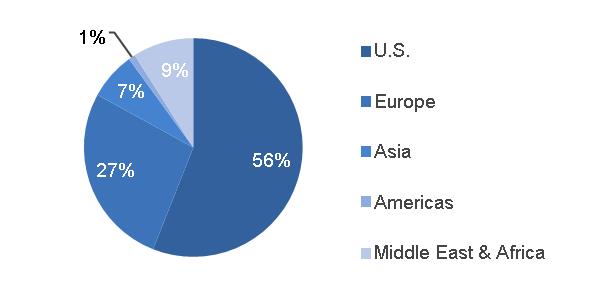

2016 GEOGRAPHIC REVENUES |

2016 SEGMENT REVENUES | ||||||

|  | ||||||

REVENUES |

INDUSTRIAL REVENUES |

FINANCIAL SERVICES REVENUES | |||||

|

|

| |||||

(a) Includes $2.0 billion related to Alstom (b) Includes $13.0 billion related to Alstom | (a) Includes $2.0 billion related to Alstom (b) Includes $13.0 billion related to Alstom | ||||||

CONTINUING EARNINGS(a) |

CONTINUING EARNINGS PER SHARE(a) | ||||||

|  | ||||||

(a) Attributable to GE common shareowners

| |||||||

GE 2016 FORM 10-K 28

CONSOLIDATED RESULTS

(Dollars in billions)

REVENUE COMMENTARY: 2016 – 2015 |

EARNINGS COMMENTARY: 2016 – 2015 | |

Consolidated revenues increased $6.3 billion, or 5%, primarily driven by increased Industrial revenues of $6.6 billion and increased Financial Services revenues of $0.1 billion, partially offset by an increase in eliminations between Industrial and Financial Services of $0.4 billion. The overall foreign currency impact on consolidated revenues was a decrease of $1.3 billion. · Industrial revenues increased $6.6 billion, or 6% due to increased industrial segment revenues of $4.4 billion, or 4%, as increases at Power, Renewable Energy, Aviation and Healthcare were partially offset by decreases at Oil & Gas, Transportation and Energy Connections & Lighting. This increase in industrial segment revenues was primarily driven by the net effects of acquisitions of $11.2 billion, offset by the net effects of dispositions of $5.6 billion and the effects of a stronger U.S. dollar of $0.8 billion. Excluding the effects of acquisitions, dispositions and translational currency exchange, industrial segment organic revenues* decreased $0.5 billion. Industrial revenues increased an additional $2.2 billion at Corporate as current year gains were $1.9 billion higher than 2015 gains. · Financial Services revenues increased $0.1 billion, or 1% , primarily due to lower impairments, higher gains and the effects of acquisitions, partially offset by organic revenue declines, the effects of dispositions and the effects of translational currency exchange.

|

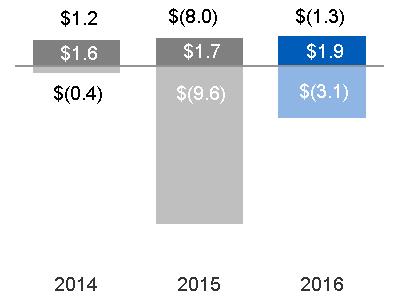

Consolidated continuing earnings increased $7.5 billion, primarily driven by decreased Financial Services losses of $6.7 billion, increased Industrial continuing earnings of $0.5 billion and a net decrease of $0.2 billion resulting from income taxes, and interest and other financial charges. The overall foreign currency impact on consolidated earnings was a decrease of $0.3 billion. · Industrial earnings increased $0.5 billion due to increased earnings at Corporate of $0.8 billion, or 17%, as current year gains were $1.9 billion higher and pension costs were $0.7 billion lower than 2015. These increases to earnings were partially offset by $1.8 billion of higher restructuring and other charges. Industrial earnings decreased due to decreased industrial segment earnings of $0.4 billion, or 2%, as decreases at Oil & Gas, Energy Connections & Lighting, and Transportation were partially offset by increases at Aviation, Power, Healthcare and Renewable Energy. This decrease in industrial segment earnings, was primarily driven by decreases in organic operating profit* of $0.8 billion and the net effect of dispositions of $0.5 billion, partially offset by the net effect of acquisitions of $0.9 billion. · Financial Services losses decreased $6.7 billion, or 84% , primarily due to the absence of the 2015 charges associated with the GE Capital Exit Plan. · In addition to the effects on net earnings described above, earnings per share amounts were also positively impacted by the reduction in number of outstanding common shares compared to 2015. The average number of shares outstanding used to calculate 2016 earnings per share amounts was 9% lower than 2015, primarily due to the 2015 Synchrony Financial share exchange and ongoing share buyback activities funded in large part by dividends from GE Capital.

|

* Non-GAAP Financial Measure

GE 2016 FORM 10-K 29

CONSOLIDATED RESULTS

(Dollars in billions)

REVENUE COMMENTARY: 2015 – 2014 |

EARNINGS COMMENTARY: 2015 – 2014 | |

Consolidated revenues increased $0.2 billion, primarily driven by increased Industrial revenues of $0.4 billion and a decrease in eliminations between Industrial and Financial Services of $0.4 billion, partially offset by decreased Financial Services revenues of $0.5 billion. The overall foreign currency impact on consolidated revenues was a decrease of $4.9 billion. · Industrial revenues increased $0.4 billion due an increase at Corporate of $1.3 billion, or 75%, as 2015 gains were $1.4 billion higher than 2014 year gains. This was offset by decreases in industrial segment revenues of $0.9 billion, or 1%, as decreases at Oil & Gas, Healthcare and Renewable Energy were partially offset by increases at Power, Aviation, Energy Connections & Lighting and Transportation. The $0.9 billion decrease in industrial segment revenues was primarily driven by the translational effects of a stronger U.S. dollar of $4.8 billion and the net effects of dispositions of $1.1 billion, partially offset by the net effects of acquisitions of $2.2 billion. Excluding the effects of acquisitions, dispositions and currency exchange, industrial segment organic revenues* increased by $2.8 billion, or 3%. · Financial Services revenues decreased $0.5 billion, or 5% , primarily due to organic revenue declines, primarily resulting from lower ending net investment (ENI), lower gains and higher impairments, partially offset by the effects of acquisitions and dispositions.

|

Consolidated continuing earnings decreased $7.9 billion, or 83%, primarily driven by decreased Financial Services net earnings of $9.2 billion, partially offset by an increase in Industrial continuing earnings of $1.3 billion. The overall foreign currency impact on consolidated earnings was a decrease of $0.6 billion.

· Industrial earnings increased 1.3 billion, or 11%, due to increased industrial segment earnings of $0.2 billion, or 1%, as increases at Aviation, Energy Connections & Lighting, Transportation and Power were partially offset by decreases at Oil & Gas, Renewable Energy and Healthcare. This increase in industrial segment earnings was primarily driven by increases in organic operating profit* of $1.2 billion, partially offset by the translational currency exchange effects of a stronger U.S. dollar of $0.7 billion, net acquisitions of $0.1 billion and net dispositions of $0.2 billion. Industrial earnings at Corporate increased an additional $1.1 billion, or 18%, as 2015 gains were $1.4 billion higher than 2014 gains, partially offset by $0.5 billion of higher Principal retirement plan costs in 2015. · Financial Services net earnings decreased $9.2 billion , primarily due to 2015 charges associated with the GE Capital Exit Plan.

|

See Segment Results and Corporate Items & Eliminations sections within the MD&A for more information.

Also, see the Other Consolidated Information section within the MD&A for a discussion of postretirement benefit plans costs, income taxes and geographic data.

*Non-GAAP Financial Measure

GE 2016 FORM 10-K 30

GE CAPITAL

GE Capital results include continuing operations, which are reported in the Capital segment (see Segment discussion), and discontinued operations (see Discontinued Operations section and Note 2).

THE GE CAPITAL EXIT PLAN

On April 10, 2015, the Company announced a plan (the GE Capital Exit Plan) to create a simple, more valuable company by reducing the size of its financial services businesses through the sale of most of the assets of GE Capital over the following 24 months and aligning a smaller GE Capital with GE's industrial businesses.

Under the GE Capital Exit Plan, the Company is retaining certain GE Capital businesses, principally its vertical financing businesses-GE Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Industrial Finance (which includes Healthcare Equipment Finance, Working Capital Solutions and Industrial Financing Solutions)-that relate to the Company's core industrial domain and other operations, including our run-off insurance activities, and allocated corporate costs (together referred to as GE Capital Verticals or Verticals).

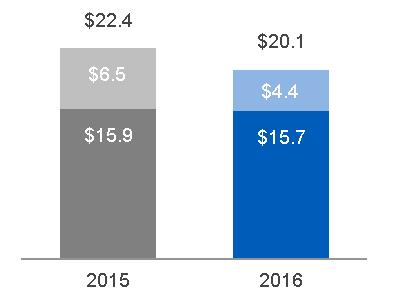

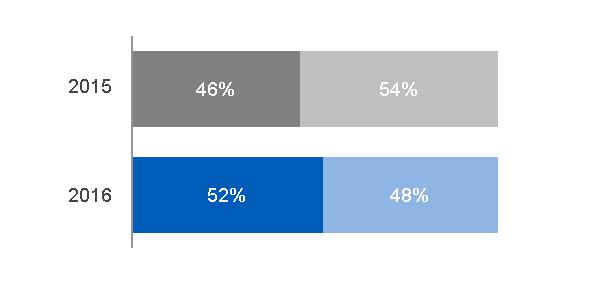

As a result of the GE Capital Exit Plan dispositions, GE Capital has paid $24.4 billion in dividends to GE in 2015 and 2016 ($4.3 billion and $20.1 billion, respectively). We expect GE Capital to release additional dividends of up to approximately $10 billion through the remainder of the plan. In January 2017, GE received an additional $2.0 billion of common dividends from GE Capital. As of December 31, 2016, we are ahead of our plan, having signed agreements with buyers for $197 billion of ending net investment (ENI), excluding liquidity (as originally reported at December 31, 2014), of which $190 billion has closed. As of December 31, 2016, we have substantially completed the dispositions related to the GE Capital Exit Plan. In addition, as part of our initiative to reduce the size of our financial services businesses, we completed the split-off of our remaining interest in GE Capital's North American Retail Finance business, Synchrony Financial, to holders of GE common stock, which resulted in a $20.4 billion buyback of GE common stock (671.4 million shares) in 2015. In connection with the GE Capital Exit Plan, we completed a legal reorganization of GE Capital that included a merger of GE Capital into GE, a guarantee by GE of GE Capital debt, and an exchange of $36 billion of GE Capital debt for new notes guaranteed by GE. The result of all these actions reduced GE Capital's total assets by 63% from $500 billion at December 31, 2014 to $183 billion at December 31, 2016. From inception of plan through December 31, 2016, we incurred charges of $22.0 billion. Due to anticipated tax benefits and gains, we do not expect total after-tax charges through the completion of the GE Capital Exit Plan to exceed our initial $23 billion estimate.

On March 31, 2016, GE filed its request to the Financial Stability Oversight Council (FSOC) for rescission of GE Capital's designation as a nonbank Systemically Important Financial Institution (SIFI). On June 28, 2016, the FSOC rescinded GE Capital's designation as a nonbank SIFI.

SALES AGREEMENTS

During 2016, GE signed agreements to sell approximately $40 billion of ENI, excluding liquidity (as originally reported at December 31, 2014), of which approximately $19 billion, $21 billion and less than $1 billion related to our Commercial Lending and Leasing (CLL), Consumer and Real Estate businesses, respectively.

Sales representing approximately $86 billion of ENI, excluding liquidity (as originally reported at December 31, 2014) closed during 2016, including approximately $70 billion, $16 billion and less than $1 billion related to our CLL, Consumer and Real Estate businesses, respectively.

GE 2016 FORM 10-K 31

AFTER-TAX CHARGES RELATED TO THE GE CAPITAL EXIT PLAN

During 2016, GE recorded less than $0.1 billion of after-tax charges related to the GE Capital Exit Plan of which $0.7 billion of net benefits were recorded in continuing operations and $0.7 billion of after-tax charges were recorded in discontinued operations. A description of these after-tax charges for 2016 is provided below.

· | $1.3 billion of net loss primarily related to the completed and planned dispositions of Consumer and most of the CLL businesses, which was recorded in discontinued operations under the caption "Earnings (loss) from discontinued operations, net of taxes" in the Statement of Earnings. |

· | $0.3 billion of charges associated with the preferred equity exchange that was completed in January 2016, which was recorded in continuing operations and reported in GE Capital's corporate component under the caption "Preferred stock dividends" in the Statement of Earnings. |

· | These charges were offset by tax benefits of $1.4 billion primarily related to increased tax efficiency of planned cash repatriations through increased foreign tax credit utilization of $0.8 billion and an IRS tax settlement of $0.6 billion. Of these benefits $1.1 billion was recorded in continuing operations and reported in GE Capital's corporate component under the caption "Benefit (provision) for income taxes" in the Statement of Earnings and $0.2 billion was recorded in discontinued operations under the caption "Earnings (loss) from discontinued operations, net of taxes" in the Statement of Earnings. |

For additional information about the GE Capital Exit Plan 2015 sales agreements and after-tax charges, refer to our Form 8-K filed on June 3, 2016 related to the Annual Report on Form 10-K for the year ended December 31, 2015.

In addition to the above charges, during the year ended December 31, 2016, we have incurred other costs related to our ongoing liability management actions, including $0.6 billion of pre-tax losses related to the repurchase of $12.5 billion of long-term unsecured debt and subordinated debentures which were recorded in continuing operations.

GE 2016 FORM 10-K 32

SEGMENT OPERATIONS

SEGMENT CHANGES

· | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes historical results of the Appliances business prior to its sale in June 2016. |

REVENUES AND PROFIT

Segment revenues include revenues and other income related to the segment.

Segment profit is determined based on internal performance measures used by the Chief Executive Officer (CEO) to assess the performance of each business in a given period. In connection with that assessment, the CEO may exclude matters such as charges for restructuring; rationalization and other similar expenses; acquisition costs and other related charges; technology and product development costs; certain gains and losses from acquisitions or dispositions; and litigation settlements or other charges, for which responsibility preceded the current management team. For additional information about costs excluded from segment profit, see Corporate Items and Eliminations section within this MD&A.

Segment profit excludes results reported as discontinued operations and material accounting changes. Segment profit also excludes the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries.

Segment profit excludes or includes interest and other financial charges and income taxes according to how a particular segment's management is measured:

· | Interest and other financial charges, income taxes and GE preferred stock dividends are excluded in determining segment profit (which we sometimes refer to as "operating profit") for the industrial segments. |

· | Interest and other financial charges, income taxes and GE Capital preferred stock dividends are included in determining segment profit (which we sometimes refer to as "net earnings") for the Capital segment. |

Certain corporate costs, such as shared services, employee benefits and information technology are allocated to our segments based on usage. A portion of the remaining corporate costs is allocated based on each segment's relative net cost of operations.

With respect to the segment revenue and profit walks, the overall effect of foreign exchange is included within multiple captions as follows:

· | The translational foreign exchange impact is included within Foreign Exchange. |

· | The transactional impact of foreign exchange hedging is included in operating cost within Productivity and in other income within Other. |

GE 2016 FORM 10-K 33

SIGNIFICANT SEGMENT DEVELOPMENTS

ALSTOM ACQUISITION

On November 2, 2015, we completed the acquisition of Alstom's Thermal, Renewables and Grid businesses, resulting in two months of activity in 2015 results and a full year of activity in 2016 results. The completion of the transaction followed the regulatory approval of the deal in over 20 countries and regions including the EU, U.S., China, India, Japan and Brazil. The cash purchase price was €9.2 billion (approximately $10.1 billion), net of cash acquired. The acquisition and alliances with Alstom affected our Power, Energy Connections & Lighting and Renewable Energy segments, and to a lesser extent our Oil & Gas segment.

At year-end 2015, our preliminary allocation of purchase price resulted in recognition of approximately $13.5 billion of goodwill, $5.2 billion of intangible assets, and $1.1 billion of unfavorable customer contract liabilities. The preliminary fair value of the associated noncontrolling interest was approximately $3.6 billion. As of the end of 2016, the amount of goodwill, intangible assets and unfavorable customer contract liabilities recognized was adjusted to approximately $17.3 billion, $4.4 billion, and $2.7 billion, respectively. The adjustments reflected revisions in estimates primarily related to cash flows and other valuation assumptions for customer contracts, increases to legal reserves, and other fair value adjustments related to acquired assets and liabilities . Deferred taxes, unrecognized tax benefits and other tax uncertainties were also adjusted under applicable accounting rules. We finalized our purchase accounting analysis in the fourth quarter of 2016. See Note 8 to the consolidated financial statements for further information.

For the year ended December 31, 2016, Alstom contributed revenues of $13.0 billion and an operating loss of $0.3 billion, of which $0.8 billion of profit is included in the segment results and $1.0 billion of charges is included in Corporate, primarily related to purchase accounting and acquisition related charges. Including the effects of tax benefits of $0.8 billion, net earnings were $0.4 billion for the year ended December 31, 2016. In addition, Alstom used cash flows from operating activities of $0.3 billion for the year ended December 31, 2016. Alstom related revenues and operating profit are presented separately in the segment revenues and profit walks that follow.

SALE OF APPLIANCES

On January 15, 2016, we announced the signing of an agreement to sell our Appliances business to Haier. On June 6, 2016, we completed the sale for proceeds of $5.6 billion (including $0.8 billion from the sale of receivables originated in our Appliances business and sold from GE Capital to Haier) and recognized an after-tax gain of $1.8 billion in 2016.

GE 2016 FORM 10-K 34

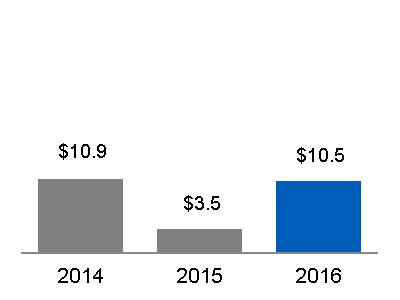

SUMMARY OF OPERATING SEGMENTS | ||||||||||||||

General Electric Company and consolidated affiliates | ||||||||||||||

(In millions) | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||

Revenues | ||||||||||||||

Power | $ | 26,827 | $ | 21,490 | $ | 20,580 | $ | 19,315 | $ | 20,364 | ||||

Renewable Energy | 9,033 | 6,273 | 6,399 | 4,824 | 7,373 | |||||||||

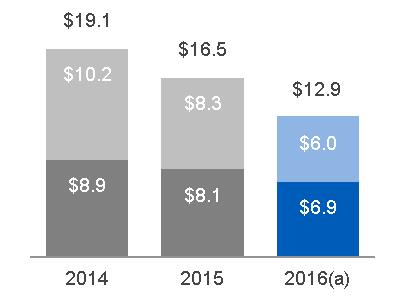

Oil & Gas | 12,898 | 16,450 | 19,085 | 17,341 | 15,539 | |||||||||

Aviation | 26,261 | 24,660 | 23,990 | 21,911 | 19,994 | |||||||||

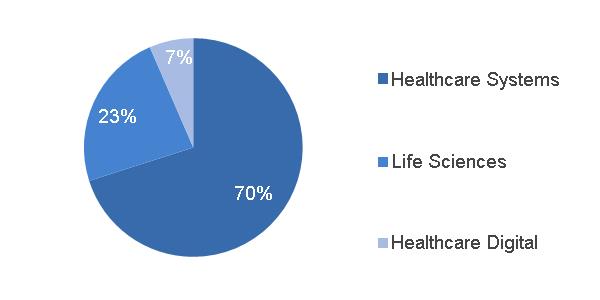

Healthcare | 18,291 | 17,639 | 18,299 | 18,200 | 18,290 | |||||||||

Transportation | 4,713 | 5,933 | 5,650 | 5,885 | 5,608 | |||||||||

Energy Connections & Lighting | 15,133 | 16,351 | 15,724 | 15,907 | 15,379 | |||||||||

Total industrial segment revenues | 113,156 | 108,796 | 109,727 | 103,383 | 102,548 | |||||||||

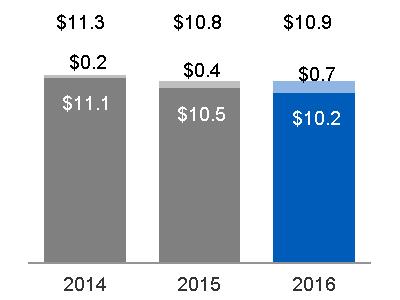

Capital | 10,905 | 10,801 | 11,320 | 11,267 | 11,268 | |||||||||

Total segment revenues | 124,061 | 119,597 | 121,047 | 114,650 | 113,816 | |||||||||

Corporate items and eliminations | (368) | (2,211) | (3,863) | (1,405) | (1,228) | |||||||||

Consolidated revenues | $ | 123,693 | $ | 117,386 | $ | 117,184 | $ | 113,245 | $ | 112,588 | ||||

Segment profit | ||||||||||||||

Power | $ | 4,979 | $ | 4,502 | $ | 4,486 | $ | 4,328 | $ | 4,368 | ||||

Renewable Energy | 576 | 431 | 694 | 485 | 914 | |||||||||

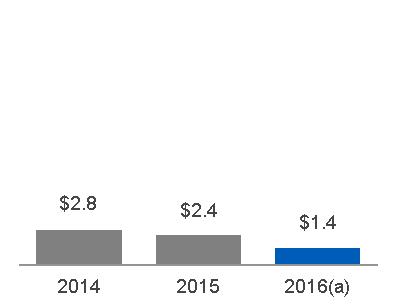

Oil & Gas | 1,392 | 2,427 | 2,758 | 2,357 | 2,064 | |||||||||

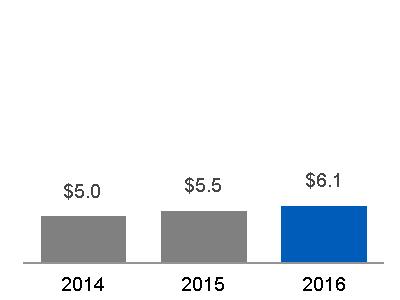

Aviation | 6,115 | 5,507 | 4,973 | 4,345 | 3,747 | |||||||||

Healthcare | 3,161 | 2,882 | 3,047 | 3,048 | 2,920 | |||||||||

Transportation | 1,064 | 1,273 | 1,130 | 1,166 | 1,031 | |||||||||

Energy Connections & Lighting | 311 | 944 | 677 | 491 | 442 | |||||||||

Total industrial segment profit | 17,598 | 17,966 | 17,764 | 16,220 | 15,487 | |||||||||

Capital | (1,251) | (7,983) | 1,209 | 401 | 1,245 | |||||||||

Total segment profit | 16,347 | 9,983 | 18,973 | 16,621 | 16,731 | |||||||||

Corporate items and eliminations | (4,226) | (5,108) | (6,225) | (6,002) | (4,719) | |||||||||

GE interest and other financial charges | (2,026) | (1,706) | (1,579) | (1,333) | (1,353) | |||||||||

GE provision for income taxes | (967) | (1,506) | (1,634) | (1,667) | (2,013) | |||||||||

Earnings from continuing operations | ||||||||||||||

attributable to GE common shareowners | 9,128 | 1,663 | 9,535 | 7,618 | 8,646 | |||||||||

Earnings (loss) from discontinued | ||||||||||||||

operations, net of taxes | (954) | (7,495) | 5,855 | 5,475 | 5,047 | |||||||||

Less net earnings (loss) attributable to | ||||||||||||||

noncontrolling interests, discontinued operations | (1) | 312 | 157 | 36 | 53 | |||||||||

Earnings (loss) from discontinued operations, | ||||||||||||||

net of taxes and noncontrolling interests | (952) | (7,807) | 5,698 | 5,439 | 4,995 | |||||||||

Consolidated net earnings (loss) | ||||||||||||||

attributable to GE common shareowners | $ | 8,176 | $ | (6,145) | $ | 15,233 | $ | 13,057 | $ | 13,641 | ||||

GE 2016 FORM 10-K 35

SEGMENT RESULTS

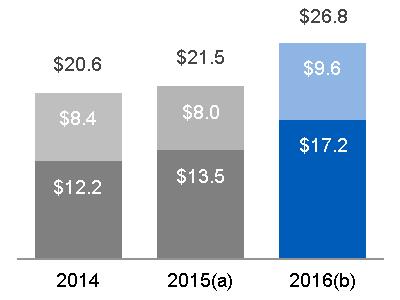

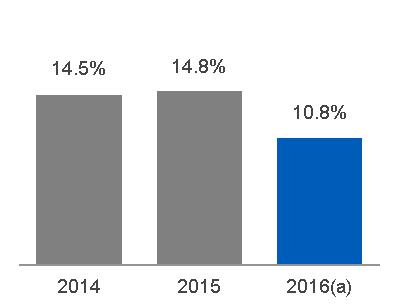

(Dollars in billions)

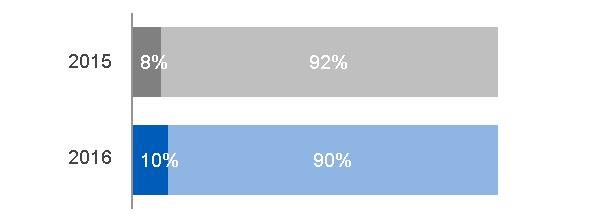

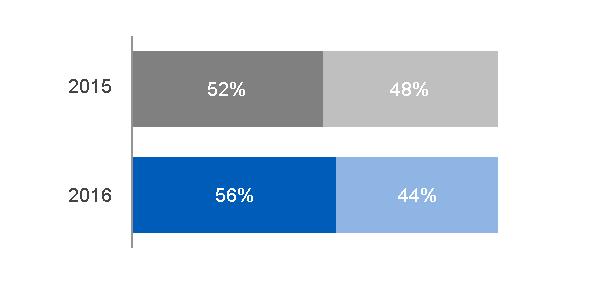

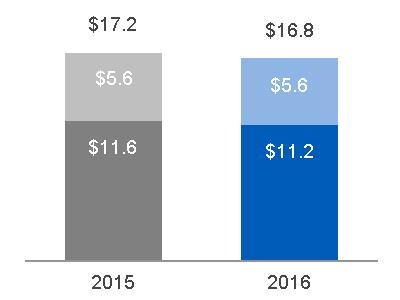

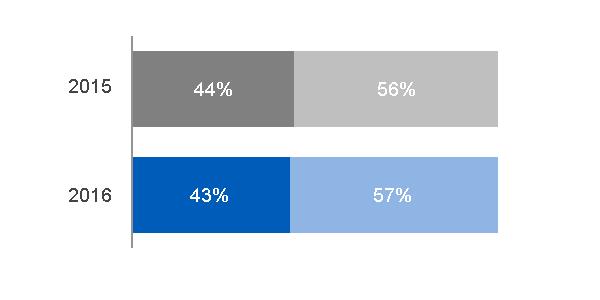

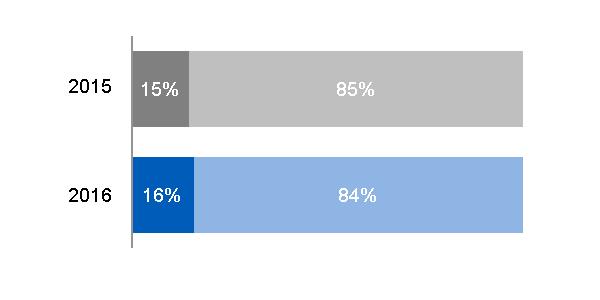

INDUSTRIAL SEGMENT EQUIPMENT & SERVICES REVENUES

|

INDUSTRIAL SEGMENT PROFIT | |||

|

Equipment(a)

Services(b) |  | ||

(a) In 2015, $59.8 billion, excluding $1.1 billion related to Alstom.* In 2016, $52.7 billion, excluding $8.1 billion related to Alstom* (b) In 2015, $47.1 billion, excluding $0.8 billion related to Alstom.* In 2016, $47.5 billion, excluding $4.9 billion related to Alstom* | (a) $18.1 billion, excluding $(0.2) billion related to Alstom* (b) $16.8 billion, excluding $0.8 billion related to Alstom* | |||

2016 – 2015 COMMENTARY | ||||

· Industrial segment revenues increased $4.4 billion, or 4%, primarily driven by increases at Power and Renewable Energy, mainly due to the effects of the Alstom acquisition, and an organic increase at Renewable Energy. This increase in industrial segment revenues was partially offset by lower revenues at Oil & Gas and Transportation, including the effects of foreign currency exchange of $0.3 billion at Oil & Gas. · Industrial segment acquisition revenues, driven by Alstom, also positively affected Energy Connections & Lighting, however, this was mostly offset by the effects of disposition revenues related to the sale of Appliances in the second quarter of 2016 and sales of Meters, Intelligent Platforms Embedded Systems Products and Signaling businesses in 2015. · Industrial segment profit decreased $0.4 billion, or 2%, mainly driven by lower earnings organically at Oil & Gas and Energy Connections & Lighting, as well as an unfavorable impact of foreign exchange, partially offset by higher earnings at Aviation, Power, Healthcare and Renewable Energy. · Industrial segment operating profit margin decreased 90 bps to 15.6%, primarily driven by the effects of Alstom results. Excluding Alstom*, industrial segment operating profit margin was 16.8%, compared with 17.0% in 2015, reflecting core decreases at Power, Oil & Gas and Energy Connections & Lighting, that more than offset increases at Aviation, Healthcare and Transportation.

| ||||

2015 – 2014 COMMENTARY | |

· Industrial segment revenues decreased $0.9 billion, or 1%, primarily driven by decreases at Oil & Gas, mainly related to the effects of foreign currency exchange and a decrease at Oil & Gas organically. This decrease was partially offset by higher revenues at Power, Energy Connections & Lighting, and Aviation, mainly as a result of organic increases, as well as the effects of the Alstom acquisition at Power and Energy Connections & Lighting, partially offset by the effects of dispositions related to the sale of Intelligent Platforms Embedded Systems Products and Wayne in 2015. · Industrial segment profit increased $0.2 billion, or 1%, mainly driven by higher earnings at Aviation, Energy Connections & Lighting and Transportation, partially offset by lower earnings at Oil & Gas and Renewable Energy, as well as an unfavorable impact of foreign exchange. · Industrial segment operating profit margin increased 30 bps to 16.5% primarily driven by Aviation and Transportation, partially offset by the effects of the Alstom acquisition. Excluding Alstom*, industrial segment operating profit margin was 17.0%, compared with 16.2% in 2014, reflecting core increases at Power and Energy Connections & Lighting.

| |

*Non-GAAP Financial Measure

GE 2016 FORM 10-K 36

POWER

POWER BUSINESS OVERVIEW

Leader: Steve Bolze

| Headquarters & Operations

| |||

| · Senior Vice President, GE and President & CEO, GE Power · Over 20 years of service with General Electric

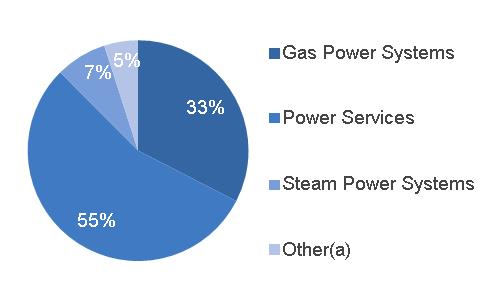

|  | · 22% of segment revenues · 24% of industrial segment revenues · 28% of industrial segment profit · Headquarters: Schenectady, NY · Serving customers in 140+ countries · Employees: approximately 57,000 | |

Products & Services | ||||

|

Power serves power generation, industrial, government and other customers worldwide with products and services related to energy production and water reuse. Our products and technologies harness resources such as oil, gas, coal, diesel, nuclear and water to produce electric power and include gas and steam turbines, full balance of plant, upgrade and service solutions, as well as data-leveraging software. | |||

· | Gas Power Systems – offers a wide spectrum of heavy-duty and aeroderivative gas turbines for utilities, independent power producers and numerous industrial applications, ranging from small, mobile power to utility scale power plants. |

· | Steam Power Systems – offers steam power technology for coal and nuclear applications including boilers, generators, steam turbines, and Air Quality Control Systems (AQCS) to help efficiently produce power and provide performance over the life of a power plant. |

· | Power Services – delivers maintenance, service and upgrade solutions across total plant assets and over their operational lifecycle, leveraging the Industrial Internet to improve the performance of such solutions. |

· | Distributed Power – provides technology-based products and services to generate reliable and efficient power at or near the point of use. The product portfolio features highly efficient, fuel flexible industrial gas engines, including Jenbacher and Waukesha engines, that generate power for numerous industries globally. |

· | Water & Process Technologies – provides comprehensive chemical and equipment solutions and services to help manage and optimize water resources across numerous industries and municipalities, including water treatment, wastewater treatment and process system solutions. |

· | GE Hitachi Nuclear – offers advanced reactor technologies solutions, including reactors, fuels and support services for boiling water reactors, and is offered through joint ventures with Hitachi and Toshiba, for safety, reliability and performance for nuclear fleets. |

Competition & Regulation |

Worldwide competition for power generation products and services is intense. Demand for power generation is global and, as a result, is sensitive to the economic and political environments of each country in which we do business.

GE 2016 FORM 10-K 37

OPERATIONAL OVERVIEW

(Dollars in billions)

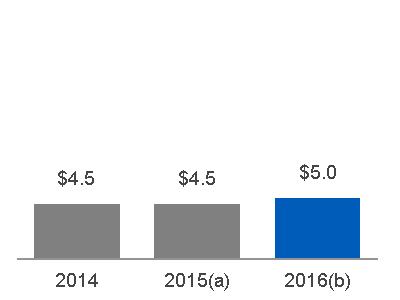

2016 GEOGRAPHIC REVENUES: $ 26.8 BILLION | ORDERS | ||||

|  |

Equipment Services

| |||

(a) Includes $1.0 billion related to Alstom (b) Includes $10.0 billion related to Alstom | |||||

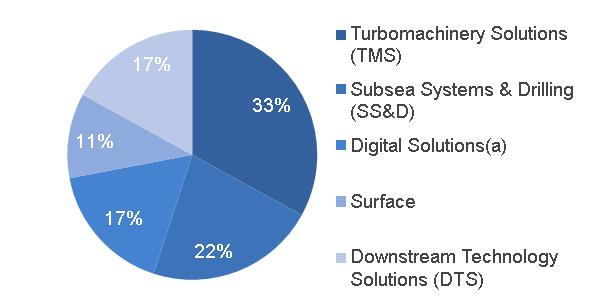

2016 SUB-SEGMENT REVENUES |

BACKLOG | ||||

(a) Includes Water & Process Technologies, Distributed Power and GE Hitachi Nuclear |  |

Equipment

Services

| |||

(a) Includes $15.5 billion related to Alstom (b) Includes $18.3 billion related to Alstom | |||||

EQUIPMENT/SERVICES REVENUES |

UNIT SALES | ||||

|  | ||||

Services Equipment

| |||||

SIGNIFICANT TRENDS & DEVELOPMENTS | |||||

· | The integration of Alstom's Thermal business has yielded significant efficiencies in supply chain, service infrastructure, new product development and SG&A costs. |

· | We announced our plan to sell our Water & Process Technologies business that will further position the business for long-term growth. |

· | We expanded our capabilities surrounding the manufacturing and supply of power plant equipment by acquiring Metem Corporation and a unit of South Korea's Doosan Engineering and Construction Company, which provides Heat Steam Recovery Generators. |

· | Digital offerings have been developed to further complement our equipment and services business and drive value and better outcomes for our customers. |

· | The business continues to invest in new product development, such as our new HA-Turbine, reciprocating engines and advanced upgrades, to expand our equipment and services offerings. |

· | Excess capacity in developed markets, continued pressure in oil and gas applications and macroeconomic and geopolitical environments result in uncertainty for the industry and business. |

GE 2016 FORM 10-K 38

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

(a) $20.6 billion, excluding $0.9 billion related to Alstom* (b) $20.6 billion, excluding $6.3 billion related to Alstom* |

Equipment

Services

|

(a) $4.6 billion, excluding $(0.1) billion related to Alstom* (b) $4.4 billion, excluding $0.6 billion related to Alstom*

|

(a) 22.3%, excluding (8.7)% related to Alstom* (b) 21.5%, excluding 9.0% related to Alstom* |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: | |||||

2016 – 2015 | 2016 – 2015 | |||||

Segment revenues up $5.3 billion (25%); Segment profit up $0.5 billion (11%) as a result of:

· The increase in revenues was driven primarily by the effects of the Alstom acquisition, including higher sales at Steam Power Systems, as well as higher volume at Power Services, partially offset by the impact of a stronger U.S. dollar and lower other income. Core revenues were flat. · The increase in profit was mainly driven by the effects of the Alstom acquisition, as well as material deflation, partially offset by lower cost productivity and an unfavorable business mix, driven by HA-Turbine shipments in the current year.

| ||||||

Revenues | Profit | |||||

2015 | $ | 21.5 | $ | 4.5 | ||

Volume | 0.1 | - | ||||

Price | - | - | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | (0.1) | ||||

Productivity | N/A | (0.1) | ||||

Other | (0.1) | (0.1) | ||||

Alstom | 5.3 | 0.6 | ||||

2016 | $ | 26.8 | $ | 5.0 | ||

2015 – 2014 | 2015 – 2014 | |||||

Segment revenues up $0.9 billion (4%); Segment profit was flat as a result of:

· The increase in revenues was mainly driven by higher volume, primarily at Power Services, as well as the effects of the Alstom acquisition, partially offset by the impact of a stronger U.S. dollar. · Profit was flat as higher volume, the effects of deflation, higher prices, and favorable business mix were offset by lower productivity, including an increase in SG&A cost, the impact of a stronger U.S. dollar, and the effects of the Alstom acquisition.

| ||||||

Revenues | Profit | |||||

2014 | $ | 20.6 | $ | 4.5 | ||

Volume | 0.8 | 0.2 | ||||

Price | 0.1 | 0.1 | ||||

Foreign Exchange | (0.8) | (0.1) | ||||

(Inflation)/Deflation | N/A | 0.2 | ||||

Mix | N/A | 0.1 | ||||

Productivity | N/A | (0.4) | ||||

Other | - | - | ||||

Alstom | 0.9 | (0.1) | ||||

2015 | $ | 21.5 | $ | 4.5 | ||

*Non-GAAP Financial Measure

GE 2016 FORM 10-K 39

RENEWABLE ENERGY

RENEWABLE ENERGY BUSINESS OVERVIEW

Leader: Jérôme Pécresse

| Headquarters & Operations

| |||

| · Senior Vice President, GE and President & CEO, GE Renewable Energy · Former Alstom Renewable Power Executive Vice President

|  | · 7% of segment revenues · 8% of industrial segment revenues · 3% of industrial segment profit · Headquarters: Paris, France · Serving customers in 80+ countries · Employees: approximately 12,000 | |

Products & Services

| ||||

| GE Renewable Energy makes renewable power sources affordable, accessible, and reliable for the benefit of people everywhere. With one of the broadest technology portfolios in the industry, Renewable Energy creates value for customers with solutions from onshore and offshore wind, hydro, and emerging low carbon technologies. With operations in 40+ countries around the world, Renewable Energy can deliver solutions to where its customers need them most.

| |||

· | Onshore Wind – provides technology and services for the onshore wind power industry by providing wind turbine platforms and hardware and software to optimize wind resources. Wind services help customers improve availability and value of their assets over the lifetime of the fleet. Digital Wind Farm is a site level solution, creating a dynamic, connected and adaptable ecosystem that improves our customers' fleet operations. |

· | Offshore Wind – offers its high-yield offshore wind turbine, Haliade 150-6MW, which is compatible with bottom fixed and floating foundations. It uses the innovative pure torque design and the Advanced High Density direct-drive Permanent Magnet Generator. Wind services support customers over the lifetime of their fleet. |

· | Hydro – provides a full range of solutions, products and services to serve the hydropower industry from initial design to final commissioning, from Low Head / Medium / High Head hydropower plants to pumped storage hydropower plants, small hydropower plants, concentrated solar power plants, geothermal power plants and biomass power plants. |

Competition & Regulation |

Renewable energy is now mainstream and more able to compete with other sources of power generation. While many factors, including government incentives and specific market rules, affect how renewable energy can deliver outcomes for customers in a given region, the point is the same: renewable energy is increasingly able to compete with fossil fuels. That is in large part due to technology. New innovations such as the digitization of renewable energy continue to drive down costs. We are also helping to make renewable energy more competitive through wind turbine product improvements, including larger rotors, taller towers and higher nameplate ratings that continue to drive down the cost of wind energy. As industry models continue to evolve, our digital strategy and investments in technical innovation will position us to add value for customers looking for clean, renewable energy.

GE 2016 FORM 10-K 40

OPERATIONAL OVERVIEW

(Dollars in billions)

2016 GEOGRAPHIC REVENUES: $ 9.0 BILLION | ORDERS | ||||

|  |

Equipment

Services | |||

(a) Includes $0.5 billion related to Alstom (b) Includes $1.8 billion related to Alstom | |||||

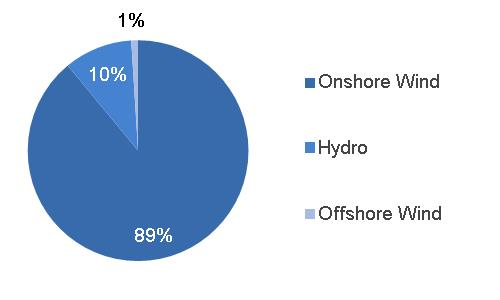

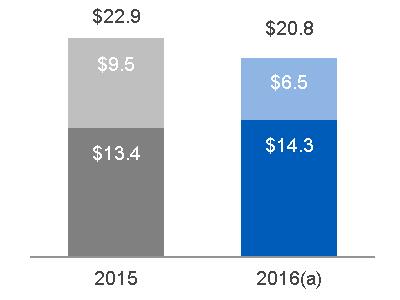

2016 SUB-SEGMENT REVENUES |

BACKLOG | ||||

|  |

Equipment

Services | |||

(a) Includes $5.3 billion related to Alstom (b) Includes $5.5 billion related to Alstom | |||||

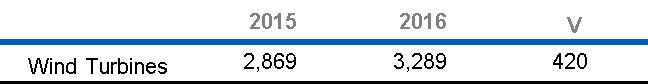

EQUIPMENT/SERVICES REVENUES |

UNIT SALES | ||||

|  | ||||

Services Equipment | |||||

SIGNIFICANT TRENDS & DEVELOPMENTS | |||||

· | Renewable energy has experienced a surge of development in the last decade. Renewable energy capacity additions account for approximately half of all power plant additions worldwide. |

· | The market to "repower" existing wind turbines – i.e., upgrade units that have been in service for a number of years to increase their efficiency and performance – is growing as the existing Onshore Wind turbine fleet is aging. Repowering allows customers to increase the annual energy output of their installed base, provide more competitively priced energy, and extend the life of their assets. |

· | New Product Introductions continue to be a key lever as our customers show a willingness to invest in new technology that decreases the levelized cost of energy. |

· | The $1.7 billion planned acquisition of LM Wind Power will bolster the ability of the GE Onshore and Offshore wind businesses to add value for customers while in-sourcing production and also better serve the customers of LM Wind Power. |

· | In 2016, we introduced new software applications suite for the Digital Wind Farm. The new apps, which streamline wind farm operations, are compatible with the company's latest 2 and 3 MW wind turbine platforms and GE's broader Predix software and diagnostics platform. The new applications can reduce maintenance costs by up to 10 percent and deliver one-to-three percent of additional revenue per site. |

· | The Offshore Wind business supported its customer, Deepwater Wind, in bringing the first ever offshore wind farm – the 30MW Block Island Wind Farm near Rhode Island – into commercial operation in the U.S. |

· | Continued competitive pressure from other wind turbine producers, as well as from other energy sources such as primarily solar photovoltaic, reinforced by a general move to auction mechanisms, increases price pressure and the need for innovation in the wind market. |

GE 2016 FORM 10-K 41

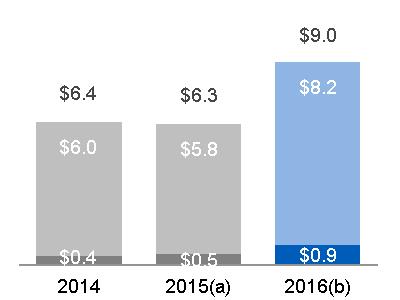

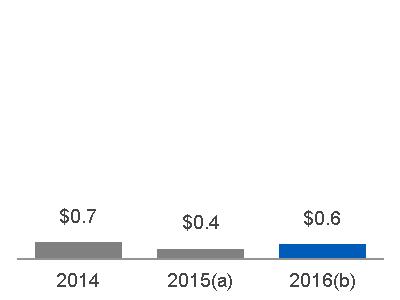

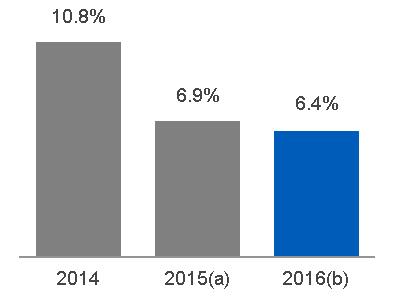

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

(a) $6.2 billion, excluding $0.1 billion related to Alstom* (b) $7.9 billion, excluding $1.2 billion related to Alstom* |

Equipment

Services

|

(a) $0.5 billion, excluding $(0.1) billion related to Alstom* (b) $0.5 billion, excluding an insignificant amount related to Alstom* |

(a) 8.1%, excluding (79.3)% related to Alstom* (b) 6.9%, excluding 2.6% related to Alstom* |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: | |||||

2016 – 2015 | 2016 – 2015 | |||||

Segment revenues up $2.8 billion (44%); Segment profit up $0.1 billion (34%) as a result of:

· The increase in revenues was due to higher volume, mainly driven by higher core equipment sales at Onshore Wind as a result of shipping 420 more onshore wind turbines than in the prior year, as well as higher sales at Hydro, driven by the effects of the Alstom acquisition. The increase was partially offset by lower other income, including negative foreign exchange transactional hedge impacts, and lower prices. · The increase in profit was due to material deflation and higher volume, driven primarily by Onshore Wind, partially offset by lower other income, including negative foreign exchange transactional hedge impacts, lower prices and an unfavorable business mix, driven by low margin projects with higher services margins.

| ||||||

Revenues | Profit | |||||

2015 | $ | 6.3 | $ | 0.4 | ||

Volume | 2.0 | 0.1 | ||||

Price | (0.1) | (0.1) | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | 0.2 | ||||

Mix | N/A | (0.1) | ||||

Productivity | N/A | - | ||||

Other | (0.1) | (0.1) | ||||

Alstom | 1.1 | 0.1 | ||||

2016 | $ | 9.0 | $ | 0.6 | ||

2015 – 2014 | 2015 – 2014 | |||||

Segment revenues down $0.1 billion (2%); Segment profit down $0.3 billion (38%) as a result of:

· The decrease in revenues was primarily driven by the effects of a stronger U.S. dollar, partially offset by higher volume, driven by the sale of 2 MW onshore units, higher prices, the effects of the Alstom acquisition and other income. · The decrease in profit was due to lower productivity, primarily driven by a shift to new products and technology, the effects of inflation, the effects of the Alstom acquisition and negative business mix, partially offset by higher prices and other income.

| ||||||

Revenues | Profit | |||||