UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017 OR |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____ |

Commission file number 001-00035  GENERAL ELECTRIC COMPANY (Exact name of registrant as specified in its charter) |

New York | 14-0689340 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| ||

41 Farnsworth Street, Boston, MA | 02210 | |

(Address of principal executive offices) | (Zip Code) | |

| ||

(Registrant's telephone number, including area code) (617) 443-3000

_______________________________________________ (Former name, former address and former fiscal year, if changed since last report) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer |

Non-accelerated filer | Smaller reporting company |

Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act . | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

There were 8,683,963,000 shares of common stock with a par value of $0.06 per share outstanding at March 31, 2017.

TABLE OF CONTENTS

Page | |

Forward Looking Statements | 3 |

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) | 4 |

Key Performance Indicators | 8 |

Consolidated Results | 10 |

Segment Operations | 13 |

Corporate Items and Eliminations | 31 |

Discontinued Operations | 33 |

Other Consolidated Information | 34 |

Statement of Financial Position | 36 |

Financial Resources and Liquidity | 37 |

Critical Accounting Estimates | 44 |

Other Items | 45 |

Supplemental Information | 48 |

Controls and Procedures | 55 |

Other Financial Data | 56 |

Legal Proceedings | 57 |

Financial Statements and Notes | 59 |

Exhibits | 109 |

Form 10-Q Cross Reference Index | 110 |

Signatures | 111 |

FORWARD LOOKING STATEMENTS

This document contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," "estimate," "forecast" or "target."

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about our announced plan to combine our Oil & Gas business with Baker Hughes, including projected revenue and cost synergies, impact on our earnings per share, and the timing and structure of the proposed transaction; the completion of our announced plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with this plan and earnings per share of GE Capital Global Holdings, LLC's (GE Capital) retained businesses (Verticals); expected income and Industrial operating profit; earnings per share, including our 2018 target; revenues; organic growth; growth and productivity associated with our Digital and Additive businesses; margins; cost structure and plans to reduce costs; restructuring charges; transaction-related synergies and gains; cash flows, including the impact of working capital, contract assets and pension funding contributions; returns on capital and investment; capital expenditures; capital allocation, including dividends, share repurchases and acquisitions; or capital structure, including leverage.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

| our ability to reduce costs as we execute our announced plan to reduce the size of our financial services businesses; |

| changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets; |

| the impact of conditions in the financial and credit markets on the availability and cost of GE Capital funding, and GE Capital's exposure to counterparties; |

| pending and future mortgage loan repurchase claims, other litigation claims and the U.S. Department of Justice's investigation under the Financial Institutions Reform, Recovery and Enforcement Act of 1989 and other investigations in connection with WMC, which may affect our estimates of liability, including possible loss estimates; |

| our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; |

| our ability to convert Industrial earnings into cash and the amount and timing of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; |

| GE Capital's ability to pay dividends to GE at the planned level, which may be affected by GE Capital's cash flows and earnings, claims and investigations relating to WMC and other factors; |

| our ability to launch new products in a cost-effective manner; |

| our ability to increase margins through restructuring and other cost reduction measures; |

| our ability to convert pre-order commitments/wins into orders/bookings; |

| the price we realize on orders/bookings since commitments/wins are stated at list prices; |

| customer actions or developments such as early aircraft retirements or reduced energy demand, changes in economic conditions, including oil prices, and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; |

| the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of Alstom investigative and legal proceedings; |

| our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; |

| our success in completing, including obtaining regulatory approvals and satisfying other closing conditions for, announced transactions, such as our announced plans and transactions to combine our Oil & Gas business with Baker Hughes, to reduce the size of our financial services businesses and to sell our Water and Industrial Solutions businesses; |

| our success in integrating acquired businesses and operating joint ventures, including Baker Hughes; |

| our ability to realize revenue and cost synergies from announced transactions, acquired businesses and joint ventures, including Alstom and Baker Hughes; |

| the impact of potential information technology or data security breaches; and |

| the other factors that are described in the Risk Factors section in our Annual Report on Form 10-K for the year ended December 31, 2016. |

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially .

2017 1Q FORM 10-Q 3

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

PRESENTATION

The consolidated financial statements of General Electric Company (the Company) combine the industrial manufacturing and services businesses of General Electric Company (GE) with the financial services businesses of GE Capital Global Holdings, LLC (GE Capital or Financial Services) and its predecessor, General Electric Capital Corporation.

We believe that investors will gain a better understanding of our company if they understand how we measure and talk about our results. Because of the diversity in our businesses, we present our financial statements in a three-column format, which allows investors to see our industrial operations separately from our Financial Services operations. We believe that this provides useful information to investors. When used in this report, unless otherwise indicated by the context, we use the terms to mean the following:

| General Electric or the Company – the parent company, General Electric Company. |

| GE – the adding together of all affiliates except GE Capital, whose continuing operations are presented on a one-line basis, giving effect to the elimination of transactions among such affiliates. Transactions between GE and GE Capital have not been eliminated at the GE level. We present the results of GE in the center column of our consolidated statements of earnings, financial position and cash flows. An example of a GE metric is GE cash from operating activities (GE CFOA). |

| General Electric Capital Corporation or GECC – predecessor to GE Capital Global Holdings, LLC. |

| GE Capital Global Holdings, LLC or GECGH – the adding together of all affiliates of GECGH, giving effect to the elimination of transactions among such affiliates. |

| GE Capital or Financial Services – refers to GECGH, or its predecessor GECC, and is the adding together of all affiliates of GE Capital giving effect to the elimination of transactions among such affiliates. We present the results of GE Capital in the right-side column of our consolidated statements of earnings, financial position and cash flows. |

| GE consolidated – the adding together of GE and GE Capital, giving effect to the elimination of transactions between the two. We present the results of GE consolidated in the left-side column of our consolidated statements of earnings, financial position and cash flows. |

| Industrial – GE excluding the continuing operations of GE Capital. We believe that this provides investors with a view as to the results of our industrial businesses and corporate items. An example of an Industrial metric is Industrial CFOA (Non-GAAP), which is GE CFOA excluding the effects of dividends from GE Capital. |

| Industrial segment – the sum of our seven industrial reporting segments, without giving effect to the elimination of transactions among such segments and between these segments and our Financial Services segment. This provides investors with a view as to the results of our industrial segments, without inter-segment eliminations and corporate items. An example of an industrial segment metric is industrial segment revenue growth. |

| Total segment – the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions between such segments. This provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

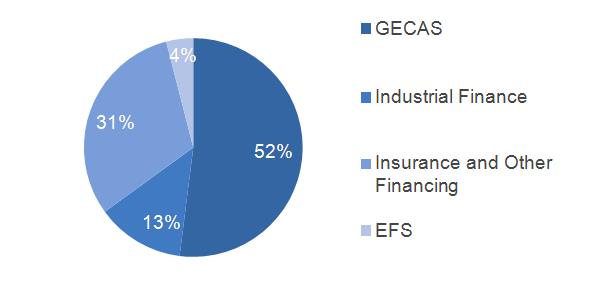

| Verticals or GE Capital Verticals – the adding together of GE Capital businesses that we expect to retain, principally its vertical financing businesses-GE Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Industrial Finance (which includes Healthcare Equipment Finance, Working Capital Solutions and Industrial Financing Solutions)-that relate to the Company's core industrial domain and other operations, including our run-off insurance activities, and allocated corporate costs. |

We integrate acquisitions as quickly as possible. Revenues and earnings from the date we complete the acquisition through the end of the fourth quarter following the acquisition are considered the acquisition effect of such businesses.

2017 1Q FORM 10-Q 4

Discussion of GE Capital's total assets includes deferred income tax liabilities, which are presented within assets for purposes of our consolidated statement of financial position presentations for this filing.

Amounts reported in billions in graphs within this report are computed based on the amounts in millions. As a result, the sum of the components reported in billions may not equal the total amount reported in billions due to rounding. Certain columns and rows within the tables may not add due to the use of rounded numbers. Percentages presented are calculated from the underlying numbers in millions.

Discussions throughout this MD&A are based on continuing operations unless otherwise noted.

The MD&A should be read in conjunction with the Financial Statements and Notes to the consolidated financial statements.

OTHER TERMS USED BY GE

| Backlog – unfilled customer orders for products and product services (expected life of contract sales for product services). |

| Continuing earnings – unless otherwise indicated, we refer to the caption "earnings from continuing operations attributable to GE common shareowners" as continuing earnings or simply as earnings. |

| Continuing earnings per share (EPS) – unless otherwise indicated, when we refer to continuing earnings per share, it is the diluted per-share amount of "earnings from continuing operations attributable to GE common shareowners". |

| Digital revenues – revenues related to internally developed software and associated hardware, including Predix TM and software solutions that improve our customers' asset performance. In 2016, we reassessed the span of our digital product offerings, which now excludes software-enabled product upgrades. These revenues are largely generated from our operating businesses and are included in their segment results. Revenues of "Non-GE Verticals" refer to GE Digital revenues from customers operating in industries where GE does not have a presence. |

| Equipment leased to others (ELTO) – rental equipment we own that is available to rent and is stated at cost less accumulated depreciation. |

| GE Capital Exit Plan – our plan, announced on April 10, 2015, to reduce the size of our financial services businesses through the sale of most of the assets of GE Capital, and to focus on continued investment and growth in our industrial businesses. |

| Industrial margin – GE revenues and other income excluding GE Capital earnings (loss) from continuing operations (Industrial revenues) minus GE total costs and expenses less GE interest and other financial charges divided by Industrial revenues. |

| Industrial operating profit margin (Non-GAAP) – Industrial segment profit plus corporate items and eliminations (excluding gains, restructuring, and non-operating pension cost) divided by industrial segment revenues plus corporate items and eliminations (excluding gains and GE-GE Capital eliminations). |

| Industrial segment gross margin – industrial segment sales less industrial segment cost of sales. |

| Net earnings – unless otherwise indicated, we refer to the caption "net earnings attributable to GE common shareowners" as net earnings. |

| Net earnings per share (EPS) – unless otherwise indicated, when we refer to net earnings per share, it is the diluted per-share amount of "net earnings attributable to GE common shareowners". |

| Non-operating pension cost (Non-GAAP) – comprises the expected return on plan assets, interest cost on benefit obligations and net actuarial gain (loss) amortization for our principal pension plans. |

| Operating earnings (Non-GAAP) – GE earnings from continuing operations attributable to common shareowners excluding the impact of non-operating pension costs. |

| Operating earnings per share (Non-GAAP) – unless otherwise indicated, when we refer to operating earnings per share, it is the diluted per-share amount of "operating earnings". |

| Operating pension cost (Non-GAAP) – comprises the service cost of benefits earned, prior service cost amortization and curtailment gain (loss) for our principal pension plans. |

| Organic revenues (Non-GAAP) – revenues excluding the effects of acquisitions, dispositions and translational foreign currency exchange. |

2017 1Q FORM 10-Q 5

| Product services – for purposes of the financial statement display of sales and costs of sales in our Statement of Earnings, "goods" is required by SEC regulations to include all sales of tangible products, and "services" must include all other sales, including other services activities. In our MD&A section of this report, we refer to sales under product services agreements and sales of both goods (such as spare parts and equipment upgrades) and related services (such as monitoring, maintenance and repairs) as sales of "product services," which is an important part of our operations. We refer to "product services" simply as "services" within the MD&A. |

| Product services agreements – contractual commitments, with multiple-year terms, to provide specified services for products in our Power, Renewable Energy, Oil & Gas, Aviation and Transportation installed base – for example, monitoring, maintenance, service and spare parts for a gas turbine/generator set installed in a customer's power plant. |

| Revenues – unless otherwise indicated, we refer to captions such as "revenues and other income" simply as revenues. |

| Segment profit – refers to the operating profit of the industrial segments and the net earnings of the Financial Services segment. See the Segment Operations section within the MD&A for a description of the basis for segment profits. |

NON-GAAP FINANCIAL MEASURES

In the accompanying analysis of financial information, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered "non-GAAP financial measures" under the SEC rules. Specifically, we have referred, in various sections of this report, to:

| Industrial segment organic revenues |

| Operating and non-operating pension cost |

| Adjusted corporate costs (operating) |

| Industrial operating and GE Capital earnings (loss) from continuing operations and EPS |

| Industrial operating + Verticals earnings and EPS |

| Industrial operating profit and operating profit margin (excluding certain items) |

| Industrial cash flows from operating activities (Industrial CFOA) |

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the Supplemental Information section within the MD&A. Non-GAAP financial measures referred to in this report are either labeled as "non-GAAP" or designated as such with an asterisk (*).

2017 1Q FORM 10-Q 6

OUR OPERATING SEGMENTS

We are a global digital industrial company, transforming industry with software-defined machines and solutions that are connected, responsive and predictive, with products and services ranging from aircraft engines, locomotives, power generation and oil and gas production equipment to medical imaging, financing and industrial products. Operational and financial overviews for our operating segments are provided in the "Segment Operations" section within this MD&A.

OUR INDUSTRIAL OPERATING SEGMENTS

| Power |  | Aviation |  | Energy Connections & Lighting (a) |

| Renewable Energy |  | Healthcare | ||

| Oil & Gas |  | Transportation |

OUR FINANCIAL SERVICES OPERATING SEGMENT

| Capital |

(a) | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes the historical results of the Appliances business prior to its sale. |

CORPORATE INFORMATION

GE's Internet address a t www.ge.com , Investor Relations website at www.ge.com/investor-relations and our corporate blog at www.gereports.com , as well as GE's Facebook page and Twitter accounts and other social media, including @GE_Reports, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.

2017 1Q FORM 10-Q 7

KEY PERFORMANCE INDICATORS

(Dollars in billions; per-share amounts in dollars)

REVENUES PERFORMANCE |

GE CFOA | |||||

|

|

GE Capital Dividend

Industrial CFOA* | ||||

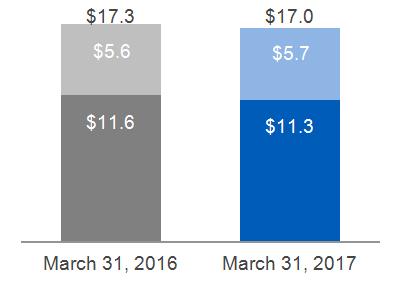

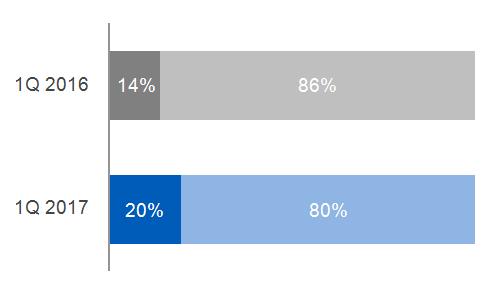

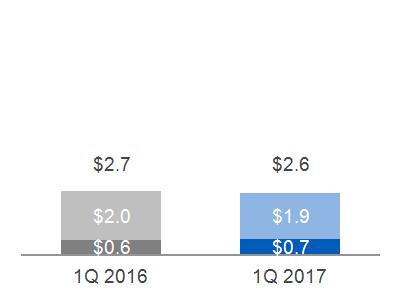

INDUSTRIAL ORDERS |

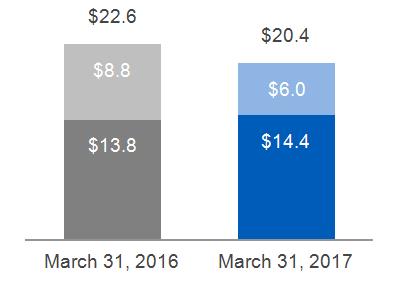

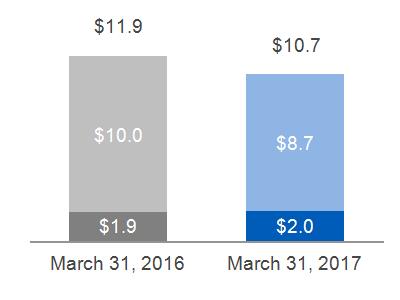

INDUSTRIAL BACKLOG | |||||

|

Equipment

Services |

|

Equipment

Services

| |||

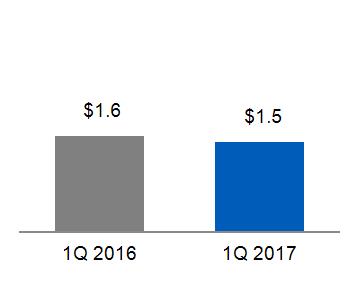

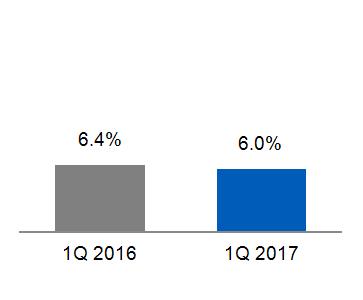

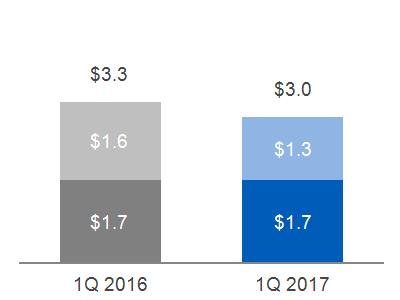

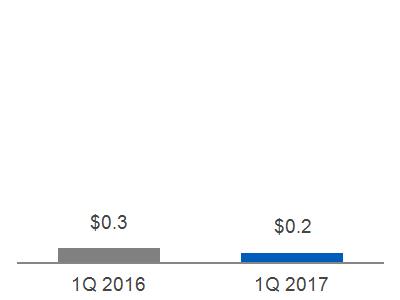

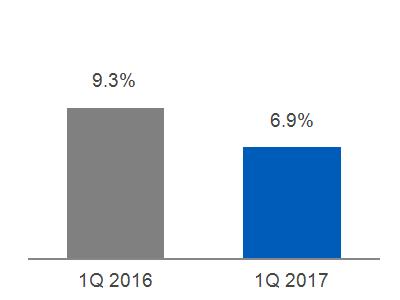

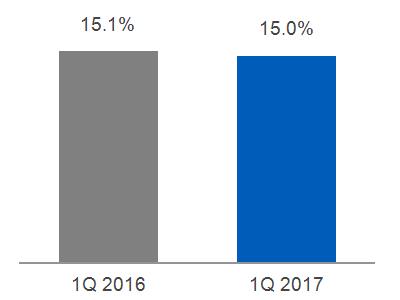

INDUSTRIAL PROFIT & MARGINS | INDUSTRIAL OPERATING PROFIT & MARGINS (NON-GAAP) (a) | |||||

|

|

|

| |||

(a) Excluded gains on disposals, non-operating pension cost, restructuring and other charges, and noncontrolling interests | ||||||

* Non-GAAP Financial Measure

2017 1Q FORM 10-Q 8

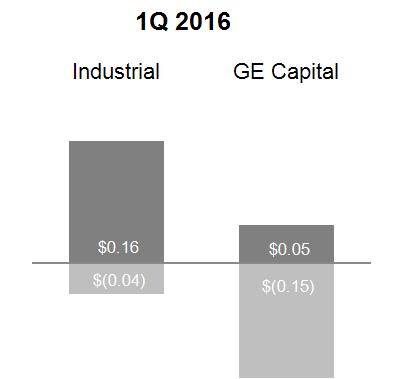

KEY PERFORMANCE INDICATORS

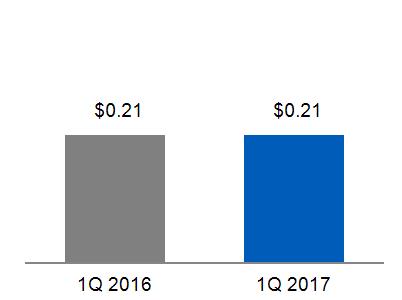

(Dollars in billions; per-share amounts in dollars and diluted; attributable to GE common shareowners)

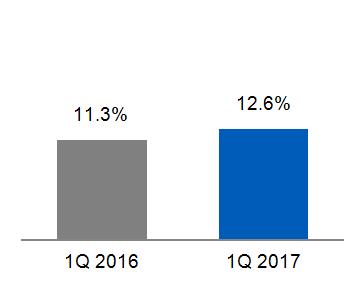

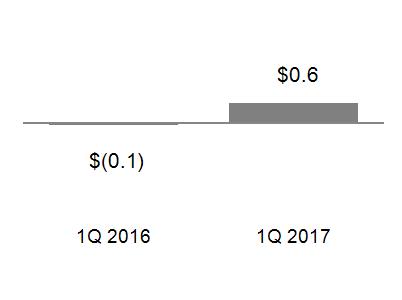

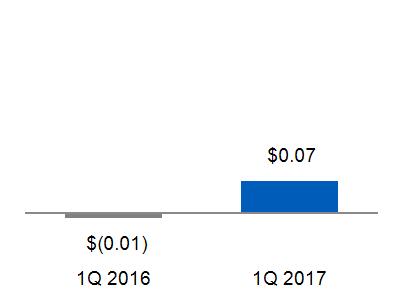

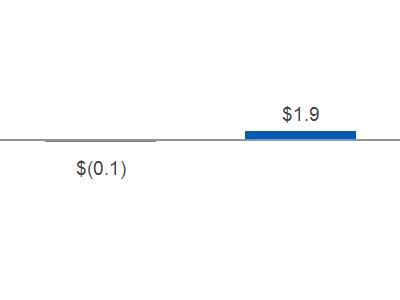

NET EARNINGS (LOSS) |

NET EARNINGS (LOSS) PER SHARE | |

|

| |

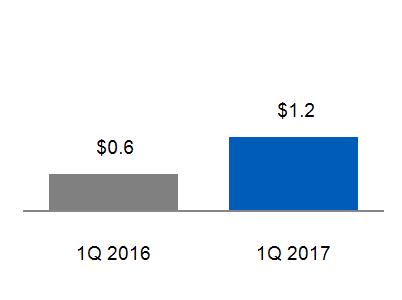

OPERATING EARNINGS (NON-GAAP) |

OPERATING EARNINGS PER SHARE (NON-GAAP) | |

|

| |

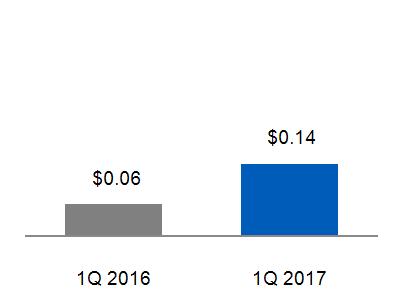

INDUSTRIAL OPERATING + VERTICALS EARNINGS (NON-GAAP) |

INDUSTRIAL OPERATING + VERTICALS EPS (NON-GAAP) | |

|

|

2017 1Q FORM 10-Q 9

CONSOLIDATED RESULTS

SIGNIFICANT DEVELOPMENTS IN 2017 |

Our consolidated results for 2017 were significantly affected by recent portfolio changes, including the 2015 acquisition of Alstom, the disposal of financial services businesses under the GE Capital Exit Plan initiated in 2015 and the 2016 sale of our Appliances business.

|

2017 SIGNIFICANT TRANSACTIONS Transactions completed in 2017 included the following:

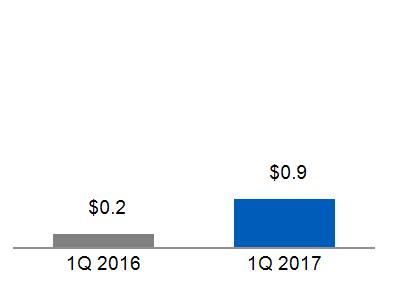

On January 10, 2017, we completed the acquisition of ServiceMax, a leader in cloud-based field service management (FSM) solutions, for $0.9 billion, net of cash acquired. This acquisition is expected to provide enhanced capabilities to advance our Industrial Internet vision, enabling customers to immediately gain more value from their assets and find greater efficiency in their field service processes. On April 20, 2017, we completed the acquisition of LM Wind Power, one of the world's largest wind turbine blade manufacturers for an estimated $1.7 billion.

PLANNED TRANSACTIONS We also announced a number of strategic transactions that we expect to complete in 2017, including the following:

In October 2016, we announced an agreement with Baker Hughes Incorporated (Baker Hughes) to combine our Oil & Gas business and Baker Hughes to create a new company in which GE will hold a 62.5% interest and existing Baker Hughes shareholders will hold a 37.5% interest. Baker Hughes shareholders will also receive a cash dividend funded by a $7.4 billion cash contribution from GE. The transaction is subject to the approval of Baker Hughes shareholders, regulatory approvals and other customary closing conditions. The deal is expected to close mid-2017. In October 2016, we announced our plan to sell our Water & Process Technologies business. In March 2017, we announced an agreement to sell the business for approximately $3.4 billion to Suez Environnement S.A. (Suez), a French-based utility company operating primarily in the water treatment and waste management sectors. The deal is expected to close mid-2017, subject to customary closing conditions and regulatory approval. I n the first quarter of 2017, we classified our Industrial Solutions business within our Energy Connections & Lighting segment as held for sale. We expect to complete the sale of the business within the next twelve months. |

2017 1Q FORM 10-Q 10

CONSOLIDATED RESULTS

THREE MONTHS ENDED MARCH 31

(Dollars in billions)

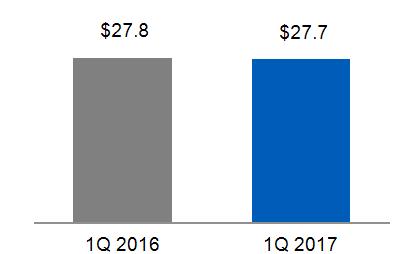

REVENUES |

INDUSTRIAL AND FINANCIAL SERVICES REVENUES | ||

|  |

| |

COMMENTARY: 2017 - 2016 | ||

Consolidated revenues decreased $0.2 billion, or 1%. Industrial revenues remained flat due to an increase in industrial segment revenues of approximately $0.1 billion, offset by a decrease at Corporate of $0.1 billion. Industrial segment revenues increased as organic revenue* increases ($1.7 billion) and the net effects of acquisitions ($0.1 billion) were partially offset by the net effects of dispositions ($1.5 billion) and the effects of a stronger U.S. dollar ($0.1 billion). In the first quarter of 2016, the net effects of acquisitions increased industrial revenues $2.8 billion while the net effects of dispositions and a stronger U.S. dollar decreased industrial revenues $0.5 billion and $0.5 billion, respectively. Financial Services revenues decreased by $0.2 billion, or 7%, primarily due to organic revenue declines and lower gains, partially offset by lower impairments.

| ||

*Non-GAAP Financial Measure

2017 1Q FORM 10-Q 11

THREE MONTHS ENDED MARCH 31

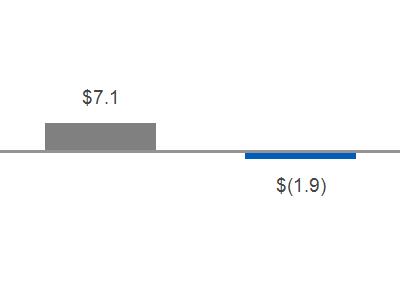

(Dollars in billions; attributable to GE common shareowners)

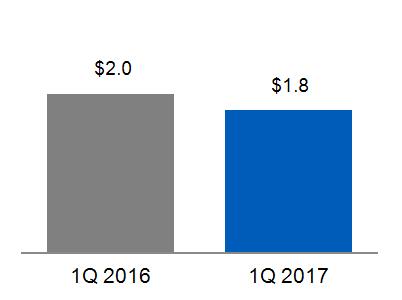

CONTINUING EARNINGS (LOSS) |

OPERATING EARNINGS (LOSS)* | |

|  |

COMMENTARY: 2017 - 2016 |

Consolidated earnings increased $0.6 billion. Financial Services losses decreased $0.8 billion, or 95%, primarily due to lower treasury operation expenses, lower preferred dividend expenses, and lower restructuring expenses associated with the GE Capital Exit Plan. Industrial earnings decreased $0.1 billion, or 3%, due to increased Corporate restructuring charges of $0.3 billion and decreased gains of $0.1 billion, partially offset by an increase in industrial segment profit of $0.3 billion. Industrial segment profit increased $0.3 billion, or 9%, as organic operating increases ($0.5 billion) were partially offset by the net effects of dispositions ($0.1 billion). The net effect of acquisitions on our consolidated operating earnings was an insignificant amount in 2017 and 2016. The net effect of dispositions on consolidated net earnings was a loss of $0.1 billion in 2017 and an insignificant amount in 2016. Foreign exchange adversely affected industrial operating earnings by $0.1 billion as a result of both translational and transactional impacts related to remeasurement and mark-to-market charges on open hedges. Earnings per share amounts for the first quarter of 2017 were positively impacted by the reduction in number of outstanding common shares compared to the first quarter of 2016. The average number of shares outstanding used to calculate first quarter 2017 earnings per share was 6% lower than in the first quarter of 2016 as a result of previously disclosed actions, primarily ongoing share buyback activities over the last 12 months funded in large part by dividends from GE Capital. |

*Non-GAAP Financial Measure

2017 1Q FORM 10-Q 12

SEGMENT OPERATIONS

SUMMARY OF OPERATING SEGMENTS | ||||||||

Three months ended March 31 | ||||||||

(In millions) | 2017 | 2016 | V% | |||||

Revenues | ||||||||

Power | $ | 6,089 | $ | 5,204 | 17 % | |||

Renewable Energy | 2,044 | 1,669 | 22 % | |||||

Oil & Gas | 3,001 | 3,314 | (9)% | |||||

Aviation | 6,804 | 6,262 | 9 % | |||||

Healthcare | 4,291 | 4,183 | 3 % | |||||

Transportation | 1,039 | 981 | 6 % | |||||

Energy Connections & Lighting(a) | 2,747 | 4,256 | (35)% | |||||

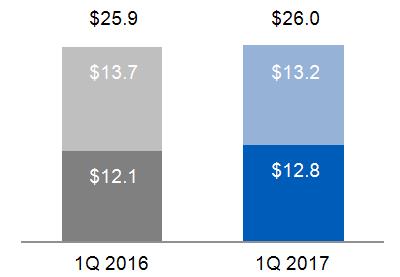

Total industrial segment revenues | 26,016 | 25,869 | 1 % | |||||

Capital | 2,681 | 2,885 | (7)% | |||||

Total segment revenues | 28,697 | 28,754 | - % | |||||

Corporate items and eliminations | (1,037) | (909) | ||||||

Consolidated revenues | $ | 27,660 | $ | 27,845 | (1)% | |||

Segment profit (loss) | ||||||||

Power | $ | 797 | $ | 573 | 39 % | |||

Renewable Energy | 107 | 83 | 29 % | |||||

Oil & Gas | 207 | 308 | (33)% | |||||

Aviation | 1,684 | 1,524 | 10 % | |||||

Healthcare | 643 | 631 | 2 % | |||||

Transportation | 156 | 164 | (5)% | |||||

Energy Connections & Lighting(a) | 28 | 31 | (10)% | |||||

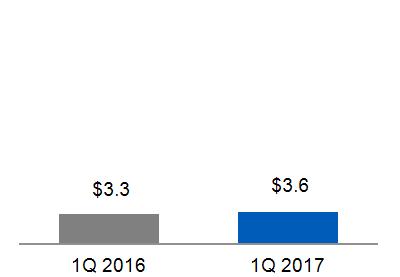

Total industrial segment profit | 3,622 | 3,314 | 9 % | |||||

Capital | (47) | (892) | 95 % | |||||

Total segment profit (loss) | 3,575 | 2,422 | 48 % | |||||

Corporate items and eliminations | (2,009) | (1,571) | ||||||

GE interest and other financial charges | (564) | (440) | ||||||

GE provision for income taxes | (143) | (164) | ||||||

Earnings (loss) from continuing operations attributable to GE common shareowners | 858 | 248 | F | |||||

Earnings (loss) from discontinued operations, net of taxes | (239) | (308) | 22 % | |||||

Less net earnings attributable to | ||||||||

noncontrolling interests, discontinued operations | - | - | - % | |||||

Earnings (loss) from discontinued operations, | ||||||||

net of tax and noncontrolling interest | (239) | (309) | 23 % | |||||

Consolidated net earnings (loss) | ||||||||

attributable to GE common shareowners | $ | 619 | $ | (61) | F | |||

\ | ||||||||

| (a) | Beginning in the third quarter of 2016, the former Energy Connections and Appliances & Lighting segments are presented as one reporting segment called Energy Connections & Lighting. This segment includes the historical results of the Appliances business prior to its sale in June 2016. |

2017 1Q FORM 10-Q 13

REVENUES AND PROFIT

Segment revenues include revenues and other income related to the segment.

Segment profit is determined based on internal performance measures used by the Chief Executive Officer (CEO) to assess the performance of each business in a given period. In connection with that assessment, the CEO may exclude matters, such as charges for restructuring, rationalization and other similar expenses, acquisition costs and other related charges, technology and product development costs, certain gains and losses from acquisitions or dispositions, and litigation settlements or other charges, for which responsibility preceded the current management team. See the Corporate Items and Eliminations section within this MD&A for additional information about costs excluded from segment profit.

Segment profit excludes results reported as discontinued operations and material accounting changes. Segment profit also excludes the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries.

Segment profit excludes or includes interest and other financial charges, income taxes, and preferred stock dividends according to how a particular segment's management is measured:

| Interest and other financial charges, income taxes and GE preferred stock dividends are excluded in determining segment profit (which we sometimes refer to as "operating profit") for the industrial segments. |

| Interest and other financial charges, income taxes and GE Capital preferred stock dividends are included in determining segment profit (which we sometimes refer to as "net earnings") for the Capital segment. |

Certain corporate costs, such as shared services, employee benefits, and information technology, are allocated to our segments based on usage. A portion of the remaining corporate costs is allocated based on each segment's relative net cost of operations.

With respect to the segment revenue and profit walks, the overall effect of foreign exchange is included within multiple captions as follows:

| The translational foreign exchange impact is included within Foreign Exchange. |

| The transactional impact of foreign exchange hedging is included in operating cost within Productivity and in other income within Other. |

SIGNIFICANT SEGMENT DEVELOPMENTS

SALE OF APPLIANCES

On January 15, 2016, we announced the signing of an agreement to sell our Appliances business to Haier. On June 6, 2016, we completed the sale for proceeds of $5.6 billion (including $0.8 billion from the sale of receivables originated in our Appliances business and sold from GE Capital to Haier) and recognized an after-tax gain of $1.8 billion in 2016. For the three months ended March 31, 2016, Appliances contributed revenues of $1.5 billion and an operating profit of $0.1 billion.

2017 1Q FORM 10-Q 14

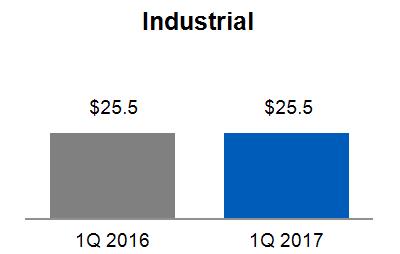

SEGMENT RESULTS – THREE MONTHS ENDED MARCH 31

(Dollars in billions)

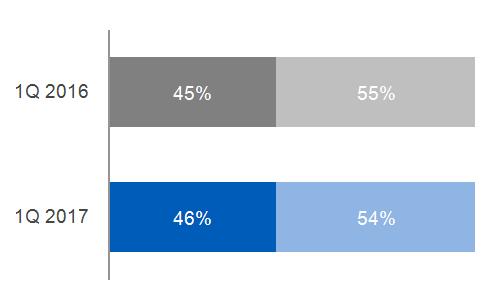

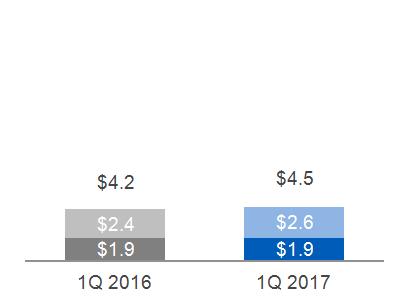

INDUSTRIAL SEGMENT EQUIPMENT & SERVICES REVENUES |

INDUSTRIAL SEGMENT PROFIT | |

|

Equipment

Services |  |

2017 – 2016 COMMENTARY |

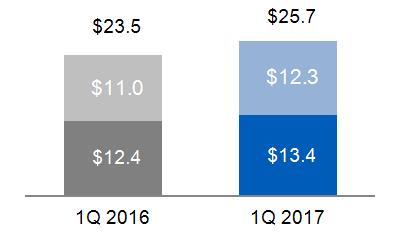

Industrial segment revenues increased $0.1 billion, or 1%, driven primarily by increases at Power, Renewable Energy and Aviation, partially offset by a decrease at Energy Connections & Lighting primarily due to the sale of the Appliances business in the second quarter of 2016, a decrease at Oil & Gas primarily due to market conditions, and an unfavorable foreign exchange impact. Industrial segment profit increased $0.3 billion, or 9%, driven primarily by higher earnings at Power and Aviation, partially offset by lower earnings at Oil & Gas as well as an unfavorable foreign exchange impact. Industrial segment margin increased 110 bps to 13.9% in 2017 from 12.8% in 2016 d riven by higher cost productivity and simplification, partially offset by negative business mix and the effects of inflation. The increase in industrial segment margin reflects increases at Power, Aviation and Energy Connections & Lighting, offset by decreases at Oil & Gas and Transportation. |

2017 1Q FORM 10-Q 15

POWER

POWER OPERATIONAL OVERVIEW

(Dollars in billions)

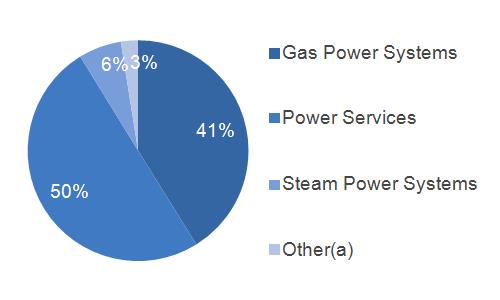

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

| (a) Includes Water & Process Technologies, Distributed Power and GE Hitachi Nuclear | Services Equipment

| |||

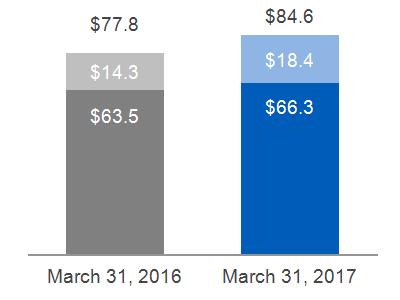

ORDERS | BACKLOG | |||

|

Equipment

Services

|

|

Equipment

Services

| |

UNIT SALES | ||||

| ||||

2017 1Q FORM 10-Q 16

FINANCIAL OVERVIEW

(Dollars in billions)

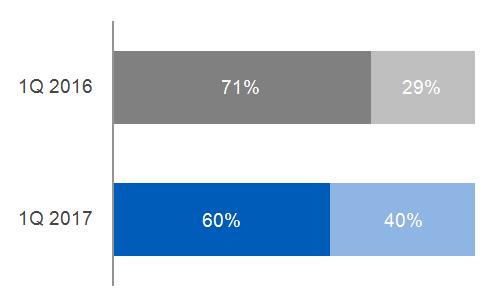

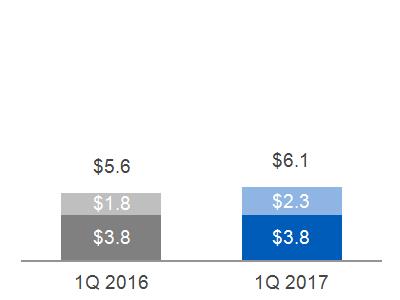

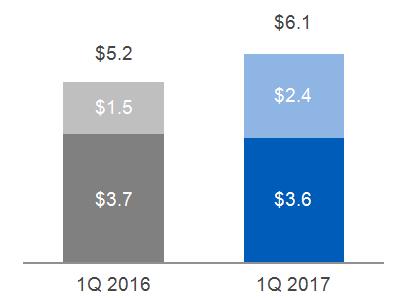

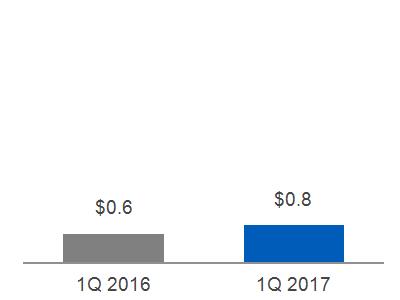

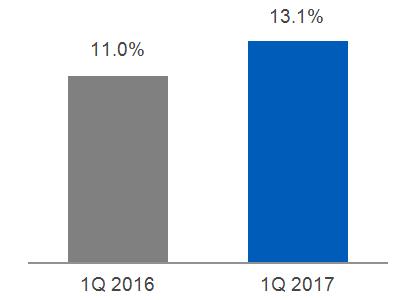

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services |

|  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

Segment revenues up $0.9 billion (17%); Segment profit up $0.2 billion (39%):

The increase in revenues was driven by higher equipment volume, primarily at Gas Power Systems as a result of 7 more gas turbine shipments and 23 more Heat Recovery Steam Generator shipments than in the prior year. The increase in revenues was partially offset by the effects of a stronger U.S. dollar versus the Euro. The increase in profit was due to higher cost productivity on higher volume, partially offset by an unfavorable business mix due to higher equipment volume versus services volume. | ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 5.2 | $ | 0.6 | ||

Volume | 0.9 | 0.1 | ||||

Price | - | - | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | (0.2) | ||||

Productivity | N/A | 0.3 | ||||

Other | - | - | ||||

March 31, 2017 | $ | 6.1 | $ | 0.8 | ||

2017 1Q FORM 10-Q 17

RENEWABLE ENERGY

RENEWABLE ENERGY OPERATIONAL OVERVIEW

(Dollars in billions)

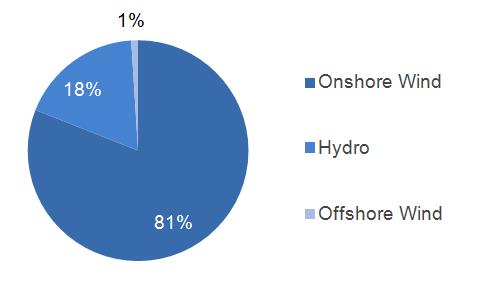

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|

| |||

Services Equipment

| ||||

ORDERS | BACKLOG | |||

|

Equipment

Services |

|

Equipment

Services | |

UNIT SALES | ||||

| ||||

2017 1Q FORM 10-Q 18

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

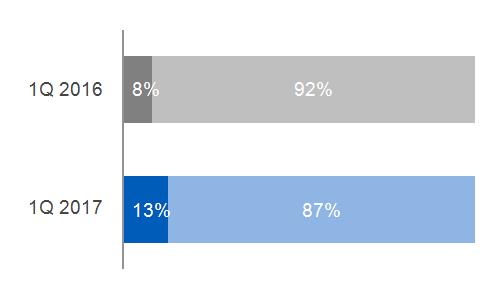

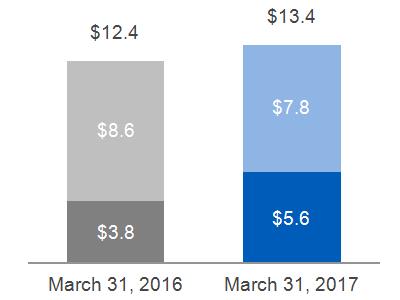

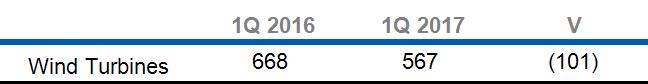

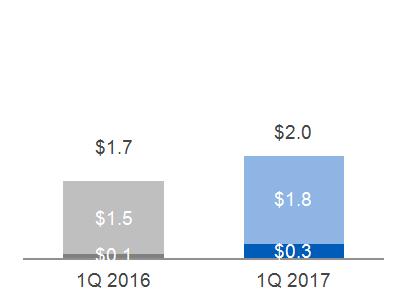

Segment revenues up $0.4 billion (22%); Segment profit up 29%:

The increase in revenues was primarily driven by higher volume due to higher equipment sales at Hydro and increased repowering projects at Onshore Wind, partially offset by 101 fewer wind turbine shipments than in the prior year. Revenue also increased due to the effects of a weaker U.S. dollar versus the Brazilian Real and increased other income including a favorable foreign exchange transactional impact. The increase in profit was due to material deflation and increased other income including a favorable foreign exchange transactional impact. These increases were partially offset by lower cost productivity.

| ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 1.7 | $ | 0.1 | ||

Volume | 0.3 | - | ||||

Price | - | - | ||||

Foreign Exchange | 0.1 | - | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | - | ||||

Productivity | N/A | (0.1) | ||||

Other | 0.1 | 0.1 | ||||

March 31, 2017 | $ | 2.0 | $ | 0.1 | ||

2017 1Q FORM 10-Q 19

OIL & GAS

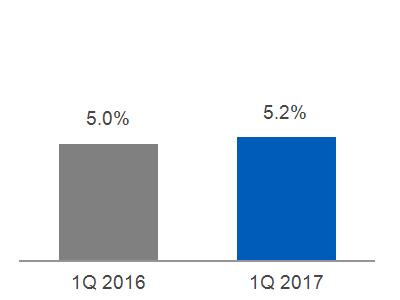

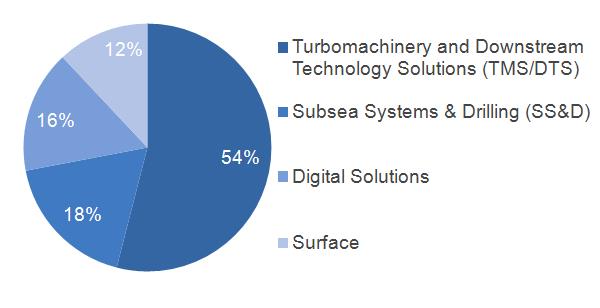

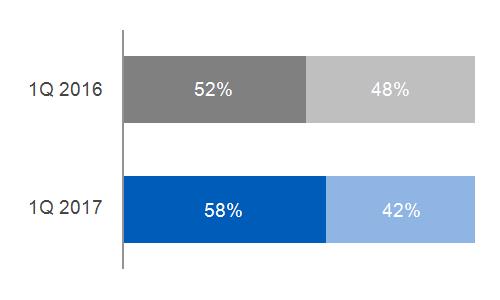

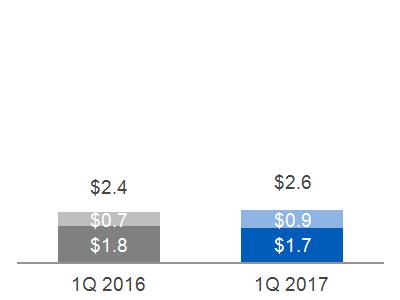

OIL & GAS OPERATIONAL OVERVIEW

(Dollars in billions)

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|

| |||

Services Equipment

| ||||

ORDERS | BACKLOG | |||

|

Equipment Services |

|

Equipment

Services | |

2017 1Q FORM 10-Q 20

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

Segment revenues down $0.3 billion (9%); Segment profit down $0.1 billion (33%):

The decrease in revenues was primarily driven by negative market conditions which resulted in lower equipment volume across all sub-segments. Revenues also decreased due to lower prices. The decrease in operating profit was primarily market driven resulting in lower prices and volume. Despite the effects of restructuring actions and an increase in earnings in our long-term service contracts, profit also decreased due to lower cost productivity. | ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 3.3 | $ | 0.3 | ||

Volume | (0.2) | - | ||||

Price | (0.1) | (0.1) | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | - | ||||

Other | - | - | ||||

March 31, 2017 | $ | 3.0 | $ | 0.2 | ||

2017 1Q FORM 10-Q 21

AVIATION

AVIATION OPERATIONAL OVERVIEW

(Dollars in billions)

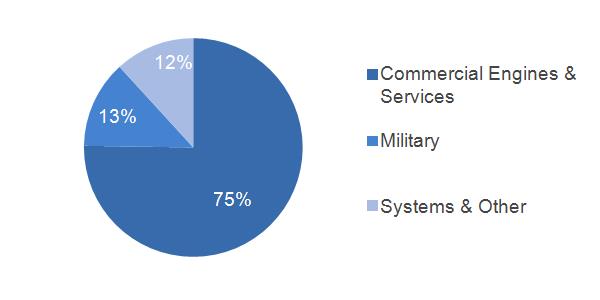

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

Services Equipment

| ||||

ORDERS | BACKLOG | |||

|

Equipment Services |

|

Equipment

Services | |

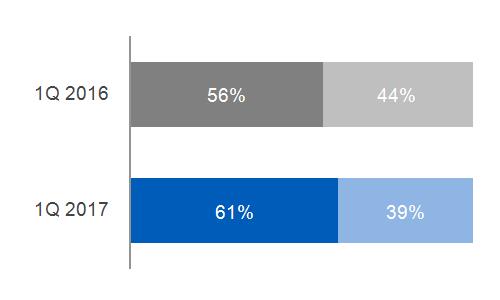

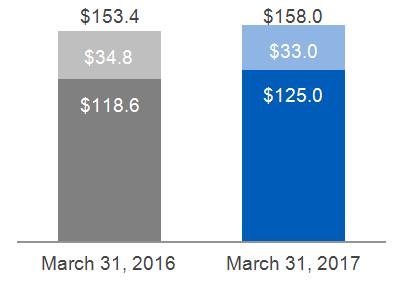

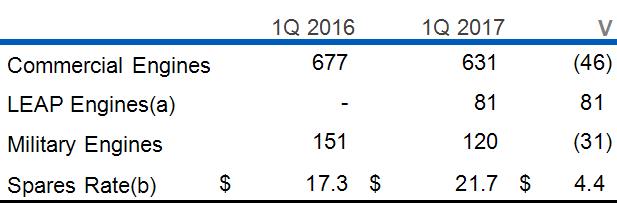

UNIT SALES | ||||

(a) LEAP engines are a subset of commercial engines (b) Commercial externally shipped spares and spares used in time & material shop visits in millions of dollars per day | ||||

2017 1Q FORM 10-Q 22

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|

|

|

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

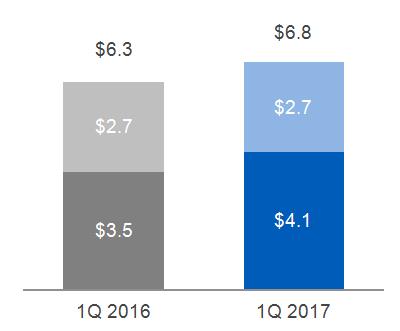

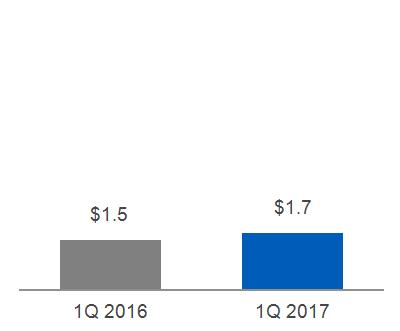

Segment revenues up $0.5 billion (9%); Segment profit up $0.2 billion (10%):

The increase in revenues was primarily due to higher services volume including an increase in the commercial spares shipment rate as well as military spares shipments. Equipment revenue decreased slightly due to 31 fewer Military engine shipments than in the prior year. This was partially offset by higher valued commercial shipments including 81 more LEAP and 16 more GEnx engine shipments than in the prior year. The increase in profit was mainly due to higher services volume and higher prices, partially offset by the unfavorable effects of inflation. | ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 6.3 | $ | 1.5 | ||

Volume | 0.5 | 0.1 | ||||

Price | 0.1 | 0.1 | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | (0.1) | ||||

Mix | N/A | - | ||||

Productivity | N/A | - | ||||

Other | - | - | ||||

March 31, 2017 | $ | 6.8 | $ | 1.7 | ||

2017 1Q FORM 10-Q 23

HEALTHCARE

HEALTHCARE OPERATIONAL OVERVIEW

(Dollars in billions)

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

Services Equipment

| ||||

ORDERS | BACKLOG | |||

|

Equipment Services |

|

Equipment

Services | |

2017 1Q FORM 10-Q 24

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|  |  |

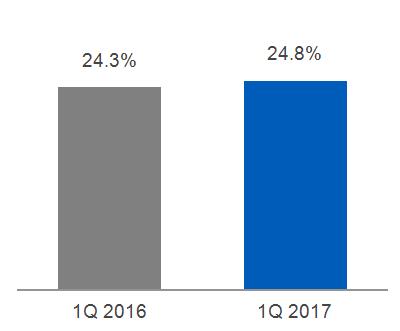

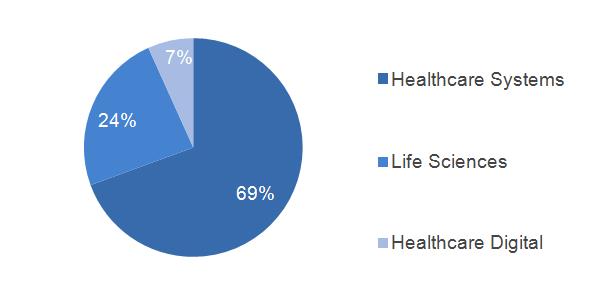

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

Segment revenues up $0.1 billion (3%); Segment profit up 2%:

The increase in revenues was due to higher services and equipment volume driven by Healthcare Systems and Life Sciences, partially offset by lower prices at Healthcare Systems. The increase in profit was mainly due to higher cost productivity driven by cost savings resulting from previous restructuring actions, partially offset by lower prices at Healthcare Systems. | ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 4.2 | $ | 0.6 | ||

Volume | 0.2 | - | ||||

Price | (0.1) | (0.1) | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.1 | ||||

Other | - | - | ||||

March 31, 2017 | $ | 4.3 | $ | 0.6 | ||

2017 1Q FORM 10-Q 25

TRANSPORTATION

TRANSPORTATION OPERATIONAL OVERVIEW

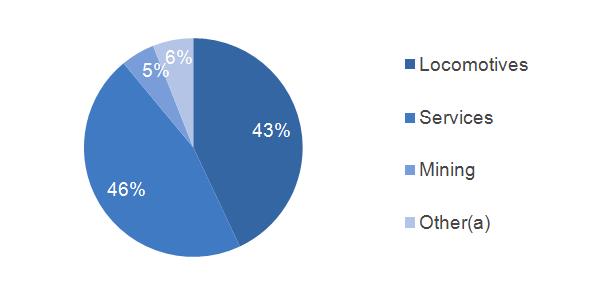

(Dollars in billions)

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|  | |||

(a) Includes Digital Solutions and Marine, Stationary & Drilling | Services Equipment

| |||

ORDERS | BACKLOG | |||

|

Equipment Services |

|

Equipment

Services | |

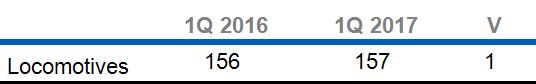

UNIT SALES | ||||

2017 1Q FORM 10-Q 26

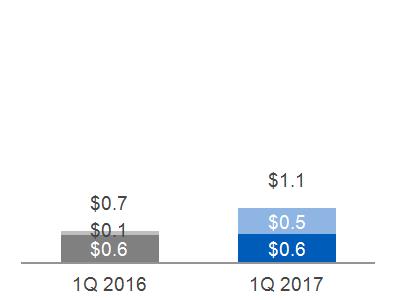

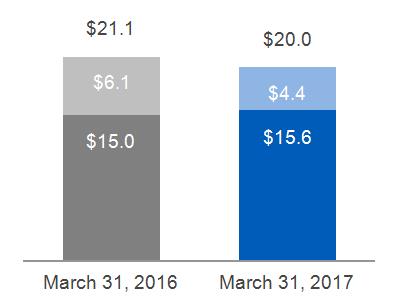

FINANCIAL OVERVIEW

(Dollars in billions)

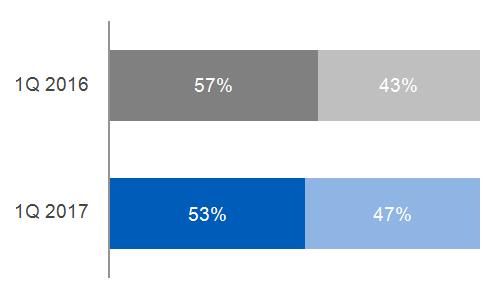

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

Segment revenues up $0.1 billion (6%); Segment profit down 5%:

The increase in revenues was due to higher locomotive equipment volume as a result of increased international shipments, offset by decreased North America shipments. The increase in equipment volume was partially offset by lower services volume. The decrease in profit was due to unfavorable business mix and decreased other income including an unfavorable foreign exchange transactional impact. These decreases were partially offset by higher volume and higher cost productivity. | ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 1.0 | $ | 0.2 | ||

Volume | 0.1 | - | ||||

Price | - | - | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | - | ||||

Other | - | - | ||||

March 31, 2017 | $ | 1.0 | $ | 0.2 | ||

2017 1Q FORM 10-Q 27

ENERGY CONNECTIONS & LIGHTING

ENERGY CONNECTIONS & LIGHTING OPERATIONAL OVERVIEW

(Dollars in billions)

2017 YTD SUB-SEGMENT REVENUES | EQUIPMENT/SERVICES REVENUES | |||

|

| |||

(a) Includes Current, powered by GE | Services Equipment

| |||

ORDERS | BACKLOG | |||

|

Equipment Services |

|

Equipment

Services | |

2017 1Q FORM 10-Q 28

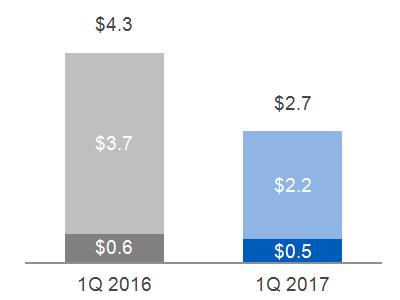

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES | SEGMENT PROFIT (LOSS) | SEGMENT PROFIT MARGIN | ||

|

Equipment

Services

|  |  |

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2017 - 2016 | |||||

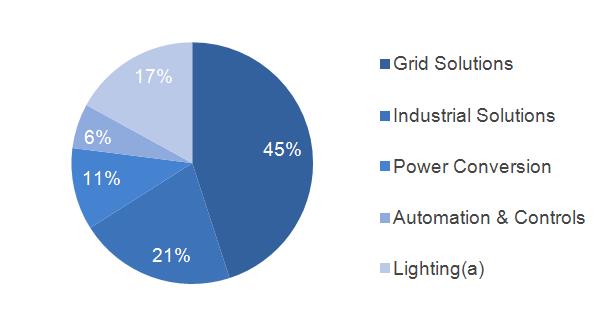

Segment revenues down $1.5 billion (35%); Segment profit down 10%:

The decrease in revenues was mainly due to the Appliances disposition in June 2016 as well as lower Lighting revenues driven by declines in traditional lighting, partially offset by increases in LED and Solar at Current. Energy Connections revenues increased primarily due to increased volume at Grid Solutions, partially offset by a decrease at Power Conversion. The decrease in profit was due to lower volume driven by the Appliances disposition in June 2016, partially offset by increases across Energy Connections, Current, and Lighting due to increased cost productivity. | ||||||

Revenues | Profit | |||||

March 31, 2016 | $ | 4.3 | $ | - | ||

Volume | (1.5) | (0.1) | ||||

Price | - | - | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.1 | ||||

Other | - | - | ||||

March 31, 2017 | $ | 2.7 | $ | - | ||

2017 1Q FORM 10-Q 29

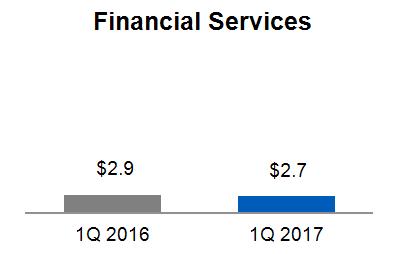

CAPITAL

CAPITAL OPERATIONAL AND FINANCIAL OVERVIEW

(Dollars in billions)

2017 YTD SUB-SEGMENT REVENUES | SEGMENT REVENUES | |||

|  |

Total Capital Other Continuing

Verticals | ||

SEGMENT PROFIT (LOSS) (a) | ||||

|

Verticals

Other Continuing

Total Capital | |||

(a) Includes interest and other financial charges and income taxes.

SIGNIFICANT TRENDS & DEVELOPMENTS |

As of March 30, 2017, GE Capital's non-US activities are no longer subject to consolidated supervision by the U.K.'s Prudential Regulation Authority (PRA). This completes GE Capital's global exit from consolidated supervision, having had its designation as a Systemically Important Financial Institution (SIFI) removed in June 2016.

GE Capital paid common dividends of $2.0 billion and $7.5 billion to GE in the three months ended March 31, 2017 and 2016, respectively. In April 2017, GE received an additional $2.0 billion in common dividends from GE Capital.

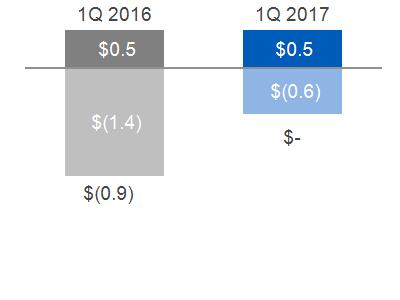

COMMENTARY: 2017 - 2016 |

Capital revenues decreased by $0.2 billion, or 7%, primarily due to organic revenue declines and lower gains, partially offset by lower impairments.

Capital losses decreased $0.8 billion, or 95%, primarily due to lower treasury operation expenses, lower preferred dividend expenses and lower restructuring expenses associated with the GE Capital Exit Plan.

| Within Capital, Verticals net earnings increased due to lower impairments ($0.1 billion) and core increases ($0.1 billion), partially offset by lower gains ($0.1 billion). |

| Other Capital losses decreased by $0.8 billion, or 58%, primarily associated with the GE Capital Exit Plan as follows: |

· | Lower treasury operation expenses of $0.4 billion reflecting lower excess interest expense, including costs associated with the February 2016 hybrid tender and derivative activities that reduce or eliminate interest rate, currency or market risk between financial assets and liabilities. |

· | Lower preferred dividend expenses of $0.3 billion associated with the January 2016 preferred equity exchange. |

· | Lower restructuring expenses of $0.1 billion. |

2017 1Q FORM 10-Q 30

CORPORATE ITEMS AND ELIMINATIONS | ||||||

REVENUES AND OPERATING PROFIT (COST) | ||||||

Three months ended March 31 | ||||||

(In millions) | 2017 | 2016 | ||||

Revenues | ||||||

Gains (losses) on disposals | $ | 2 | $ | 59 | ||

Eliminations and other | (1,039) | (968) | ||||

Total Corporate Items and Eliminations | $ | (1,037) | $ | (909) | ||

Operating profit (cost) | ||||||

Gains (losses) on disposals | 2 | 59 | ||||

Restructuring and other charges | $ | (1,020) | $ | (686) | ||

Principal retirement plans(a) | (534) | (468) | ||||

Eliminations and other | (457) | (476) | ||||

Total Corporate Items and Eliminations | $ | (2,009) | $ | (1,571) | ||

CORPORATE COSTS | ||||||

Three months ended March 31 | ||||||

(In millions) | 2017 | 2016 | ||||

Total Corporate Items and Eliminations | $ | (2,009) | $ | (1,571) | ||

Less non-operating pension cost | (578) | (512) | ||||

Total Corporate costs (operating) * | $ | (1,431) | $ | (1,059) | ||

Less restructuring and other charges | (1,020) | (686) | ||||

Less gains (losses) on disposals | 2 | 59 | ||||

Adjusted total corporate costs (operating)* | $ | (414) | $ | (431) | ||

(a) | Included non-operating pension cost* of $0.6 billion and $0.5 billion in the three months ended March 31, 2017 and 2016, respectively, which includes expected return on plan assets, interest costs and non-cash amortization of actuarial gains and losses. |

2017 – 2016 COMMENTARY

Revenues and other income decreased $0.1 billion, primarily as a result of:

| $0.1 billion of lower gains due to the nonrecurrence of the sale of two floors in 30 Rockefeller Plaza, New York City in the first quarter of 2016, and |

| $0.1 billion increase in inter-segment eliminations. |

Operating costs increased $0.4 billion, primarily as a result of:

• | $0.3 billion higher restructuring and other charges, which included $0.2 billion of increased restructuring and other charges associated with Alstom synergy investments, |

• | $0.1 billion of lower gains due to the nonrecurrence of the sale of two floors in 30 Rockefeller Plaza, New York City in the first quarter of 2016, and |

• | $0.1 billion of higher costs associated with our principal retirement plans, including the effects of lower discount rates |

*Non-GAAP Financial Measure

2017 1Q FORM 10-Q 31

RESTRUCTURING

Restructuring actions are an essential component of our cost improvement efforts to both existing operations and those recently acquired. Restructuring and other charges relate primarily to workforce reductions, facility exit costs associated with the consolidation of sales, service and manufacturing facilities, the integration of recent acquisitions, including Alstom, and other asset write-downs. We continue to closely monitor the economic environment and may undertake further restructuring actions to more closely align our cost structure with earnings goals.

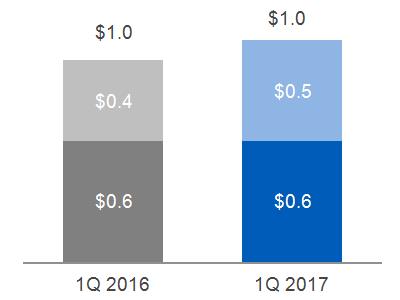

RESTRUCTURING & OTHER CHARGES | |||||

Three months ended March 31 | |||||

(In billions) | 2017 | 2016 | |||

Workforce reductions | $ | 0.5 | $ | 0.2 | |

Plant closures & associated costs and other asset write-downs | 0.3 | 0.1 | |||

Acquisition/disposition net charges | 0.2 | 0.2 | |||

Other | - | 0.1 | |||

Total | $ | 1.0 | $ | 0.7 | |

For the three months ended March 31, 2017, restructuring and other charges were $1.0 billion of which approximately $0.7 billion was reported in cost of products/services and $0.4 billion was reported in other costs and expenses (SG&A). These activities were primarily at Power, Corporate and Energy Connections & Lighting. Cash expenditures for restructuring and other charges were approximately $0.6 billion for three months ended March 31, 2017.

For the three months ended March 31, 2016, restructuring and other charges were $0.7 billion of which approximately $0.4 billion was reported in cost of products/services and $0.2 billion was reported in other costs and expenses (SG&A). These activities were primarily at Oil & Gas, Power and Healthcare. Cash expenditures for restructuring and other charges were approximately $0.4 billion for the three months ended March 31, 2016.

COSTS NOT INCLUDED IN SEGMENT RESULTS

As discussed in the Segment Operations section within the MD&A, certain amounts are not included in industrial operating segment results because they are excluded from measurement of their operating performance for internal and external purposes. The amount of costs not included in segment results follows.

COSTS | |||||

Three months ended March 31 | |||||

(In billions) | 2017 | 2016 | |||

Power | $ | 0.4 | $ | 0.2 | |

Renewable Energy | - | - | |||

Oil & Gas | 0.1 | 0.2 | |||

Aviation | - | - | |||

Healthcare | 0.1 | 0.1 | |||

Transportation | 0.1 | - | |||

Energy Connections & Lighting | 0.2 | 0.1 | |||

Total | $ | 0.8 | $ | 0.7 | |

2017 1Q FORM 10-Q 32

DISCONTINUED OPERATIONS

Discontinued operations primarily relate to our financial services businesses as a result of the GE Capital Exit Plan and includes our U.S. mortgage business (WMC). All of these operations were previously reported in the Capital segment.

We have entered into Transitional Service Agreements (TSA) with and provided certain indemnifications to buyers of GE Capital's assets. Under the TSAs, GE Capital provides various services for terms generally between 12 and 24 months and receives a level of cost reimbursement from the buyers.

At March 31, 2017 , we provided specific indemnifications to buyers of GE Capital's assets that amounted to $2.6 billion, for which we have recognized related liabilities of $0.3 billion. In addition, in connection with the 2015 public offering and sale of our North American Retail Finance business, Synchrony Financial, GE Capital indemnified Synchrony Financial and its directors, officers, and employees against the liabilities of GECC's businesses other than historical liabilities of the businesses that are part of Synchrony Financial's ongoing operations.

Results of operations, financial position and cash flows for these businesses are reported as discontinued operations for all periods presented.

FINANCIAL INFORMATION FOR DISCONTINUED OPERATIONS | |||||

Three months ended March 31 | |||||

(In millions) | 2017 | 2016 | |||

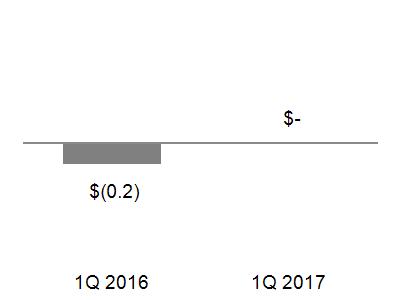

Earnings (loss) from discontinued operations, net of taxes | $ | (239) | $ | (308) | |

The first quarter 2017 loss from discontinued operations, net of taxes, primarily reflected the following:

| $0.1 billion after-tax loss from operations, and |

| $0.1 billion after-tax loss on disposals. |

The first quarter 2016 loss from discontinued operations, net of taxes, primarily reflected the following:

| $0.4 billion after-tax loss on disposals, and |

| $0.1 billion after-tax earnings from operations. |

See Note 2 to the consolidated financial statements for additional information related to discontinued operations.

2017 1Q FORM 10-Q 33

OTHER CONSOLIDATED INFORMATION

INCOME TAXES

GE pays the income taxes it owes in every country it does business. While GE and GE Capital file a consolidated U.S. federal income tax return, many factors impact our income tax expense and cash tax payments. The most significant factor is that we conduct business in approximately 180 countries and more than half of our revenue is earned outside the U.S., often in countries with lower tax rates than in the U.S. We reinvest most of our foreign earnings overseas to be able to fund our active non-U.S. business operations. Our tax liability is also affected by U.S. and foreign tax incentives designed to encourage certain investments, such as research and development, and by acquisitions, dispositions and tax law changes. Finally, our tax returns are routinely audited, and settlements of issues raised in these audits sometimes affect our tax rates.

GE and GE Capital file a consolidated U.S. federal income tax return. This enables GE and GE Capital to use tax deductions and credits of one member of the group to reduce the tax that otherwise would have been payable by another member of the group. The effective tax rate reflects the benefit of these tax reductions in the consolidated return. GE makes cash payments to GE Capital for tax reductions and GE Capital pays for tax increases at the time GE's tax payments are due.

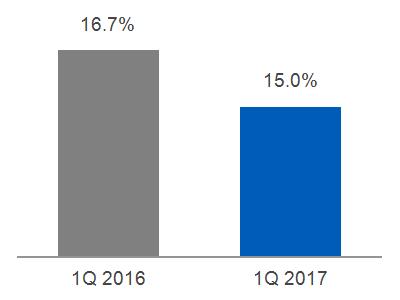

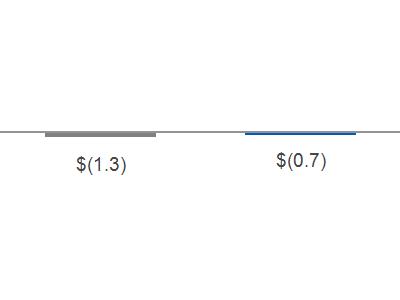

CONSOLIDATED – THREE MONTHS ENDED MARCH 31

(Dollars in billions)

PROVISION (BENEFIT) FOR INCOME TAXES |

|

2017 – 2016 COMMENTARY

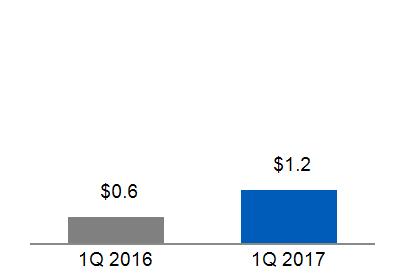

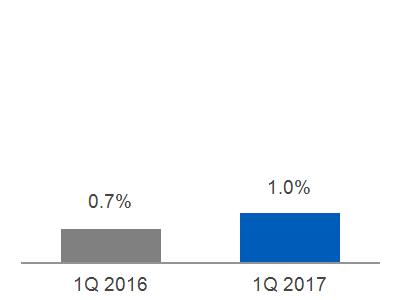

| The consolidated income tax rate was 2% and a negative 74% for the quarters ended March 31, 2017 and 2016, respectively. |

| The first quarter 2017 consolidated tax rate reflects a 92% tax rate on $0.1 billion of pre-tax loss at GE Capital and a 15% tax rate on $1.0 billion of pre-tax income at GE. |

| The first quarter 2016 consolidated tax rate reflects a 36% tax rate on $0.9 billion of pre-tax loss at GE Capital and a 14% tax rate on $1.2 billion of pre-tax income at GE. |

| Consolidated income tax expense was insignificant in the first quarter of 2017 and a tax benefit of $0.2 billion for the first quarter of 2016. The increase in tax expense is primarily due to a larger adjustment to bring the first quarter rate in-line with the higher projected full-year rate, the increase in pretax income taxed at above the average tax rate, partially offset by a larger benefit from global activities. |

| The consolidated tax provision includes $0.1 billion and $0.2 billion for GE (excluding GE Capital) for the first quarters of 2017 and 2016, respectively. |

| The effective tax rate in future periods is expected to increase as a result of changes in our income profile due to changes in GE Capital earnings as we continue to execute on the GE Capital Exit Plan. We expect the GE effective tax rate to be in the mid-teens for the full year of 2017. |

2017 1Q FORM 10-Q 34

BENEFITS FROM GLOBAL OPERATIONS

Our consolidated income tax provision is reduced because of the benefits of lower-taxed global operations. There is a benefit from global operations as non-U.S. income is subject to local country tax rates that are significantly below the 35% U.S. statutory rate. These non-U.S. earnings have been indefinitely reinvested outside the U.S. and are not subject to current U.S. income tax. Most of these earnings have been reinvested in active non-U.S. business operations and we do not intend to repatriate these earnings to fund U.S. operations. The rate of tax on our indefinitely reinvested non-U.S. earnings is below the 35% U.S. statutory tax rate because we have significant business operations subject to tax in countries where the tax on that income is lower than the U.S. statutory rate and because GE funds certain non-U.S. operations through foreign companies that are subject to low foreign taxes.

A substantial portion of the benefit related to business operations subject to tax in countries where the tax on that income is lower than the U.S. statutory rate is derived from our GECAS aircraft leasing operations located in Ireland, from our Power operations located in Switzerland and Hungary, and our Healthcare operations in Europe.

We expect our ability to benefit from non-U.S. income taxed at less than the U.S. rate to continue, subject to changes in U.S. or foreign law. In addition, since this benefit depends on management's intention to indefinitely reinvest amounts outside the U.S., our tax provision will increase to the extent we no longer indefinitely reinvest foreign earnings .

2017 1Q FORM 10-Q 35

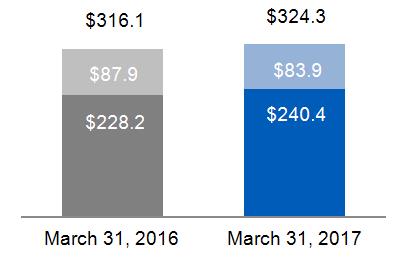

STATEMENT OF FINANCIAL POSITION

Because GE and GE Capital share certain significant elements of their Statements of Financial Position, the following discussion addresses significant captions in the consolidated statement. Within the following discussions, however, we distinguish between GE and GE Capital activities in order to permit meaningful analysis of each individual consolidating statement.

MAJOR CHANGES IN OUR FINANCIAL POSITION FOR THE THREE MONTHS ENDED

MARCH 31, 2017

| Cash and equivalents decreased $6.6 billion. GE Cash and equivalents decreased $2.7 billion due to dividends of $2.1 billion, cash used for industrial operating activities of $1.6 billion, treasury stock net purchases of $1.6 billion (cash basis), settlement of the remaining portion of a short-term loan from GE Capital of $1.3 billion, business acquisitions of $1.0 billion and net PP&E additions of $0.6 billion. The decrease was partially offset by long-term intercompany loans from GE Capital of $4.1 billion and common dividends from GE Capital of $2.0 billion. GE Capital Cash and equivalents decreased $3.9 billion primarily driven by $8.2 billion net repayments of debt, long-term intercompany loans to GE of $4.1 billion and $2.0 billion in payments of dividends to shareowners, partially offset by $3.0 billion in net collections of financing receivables, $2.7 billion in maturities of liquidity investments, $1.8 billion of proceeds from borrowings assumed by the buyer in a business disposition, $1.5 billion related to cash collections from discontinued operations and $1.3 billion maturity of a short-term loan to GE. See the Statement of Cash Flows section for additional information. |

| Contract assets increased $2.2 billion , primarily due to adjustments driven by lower forecasted cost to complete the contracts and timing of billings relative to revenue recognition on our long-term equipment and service contracts. |

| Assets of discontinued operations decreased $5.0 billion , primarily due to the disposition of businesses. See Note 2 to the consolidated financial statements for additional information. |

| Borrowings decreased $7.8 billion , primarily due to net repayment of debt at GE Capital. See Note 10 to the consolidated financial statements for additional information. |

| Liabilities of discontinued operations decreased $2.4 billion , primarily driven by the disposition of businesses. See Note 2 to the consolidated financial statements for additional information. |

| Common stock held in treasury increased $1.8 billion, primarily due to treasury stock purchases of $2.3 billion (book basis), partially offset by treasury stock issuances of $0.6 billion. |

2017 1Q FORM 10-Q 36

FINANCIAL RESOURCES AND LIQUIDITY

LIQUIDITY AND BORROWINGS

We maintain a strong focus on liquidity. At both GE and GE Capital we manage our liquidity to help provide access to sufficient funding to meet our business needs and financial obligations throughout business cycles.

Our liquidity and borrowing plans for GE and GE Capital are established within the context of our annual financial and strategic planning processes. At GE, our liquidity and funding plans take into account the liquidity necessary to fund our operating commitments, which include primarily purchase obligations for inventory and equipment, payroll and general expenses (including pension funding). We also take into account our capital allocation and growth objectives, including paying dividends, repurchasing shares, investing in research and development and acquiring industrial businesses. At GE, we rely primarily on cash generated through our operating activities, any dividend payments from GE Capital, and also have historically maintained a commercial paper program, with a balance of $2.0 billion at March 31, 2017, that we regularly use to fund operations in the U.S., principally within the quarters.

During 2017, GE plans to incur new long-term debt to refinance existing unsecured term debt, finance the Baker Hughes transaction, and for other corporate purposes. This new debt may consist of new unsecured term debt issued by GE or intercompany arrangements between GE and GE Capital utilizing GE Capital's excess unsecured term debt. During the first quarter of 2017, GE and GE Capital entered into a series of intercompany loans totaling $4.1 billion, which utilized a portion of GE Capital's excess unsecured term debt. Such intercompany loans collectively have a weighted average interest rate and term of 3.6% and approximately 15 years, respectively. The remaining $1.3 billion short-term intercompany loan balance at December 31, 2016 was paid by GE in January 2017.

Based on asset and liability management actions we have taken, GE Capital does not plan to issue any incremental GE Capital senior unsecured term debt until 2019. GE Capital's global commercial paper balance totaled $5.0 billion at March 31, 2017. GE Capital mainly relies on excess cash positions, cash generated through dispositions, and the cash flow from our Verticals to fund our debt maturities, including the current portion of long-term debt ($16.3 billion at March 31, 2017), and our operating and interest costs. GE Capital's liquidity position is targeted to meet its obligations under both normal and stressed conditions. We expect to maintain an elevated liquidity position as we generate cash from asset sales, returning to more normalized levels in 2019. During this period we expect to continue to have excess interest costs as asset sales have outpaced our debt maturities. While we maintain elevated liquidity levels, we may engage in liability management actions, such as buying back debt, based on market and economic conditions in order to reduce our excess interest costs.

We maintain a detailed liquidity policy for GE Capital that defines GE Capital's liquidity risk tolerance under stress based on its liquidity sources, and a comprehensive framework for managing liquidity risk including metrics to identify and monitor liquidity risk and procedures to escalate and address potential issues.

In 2015, senior unsecured notes and commercial paper were assumed by GE upon its merger with GE Capital resulting in an intercompany receivable and payable between GE and GE Capital. On the GE balance sheet, assumed debt is presented within borrowings with an offsetting receivable from GE Capital and on the GE Capital balance sheet, this is reflected as an intercompany payable to GE within borrowings. The intercompany receivable and payable are further reduced by certain intercompany loans from GE Capital to GE, which bear the right of offset against amounts owed under the assumed debt agreement (see Note 10 for additional information). The following table illustrates total GE and GE Capital external debt and debt assumed by GE as of March 31, 2017.

March 31, 2017 (In billions) | GE | GE Capital | Consolidated(a) | ||||||

External debt | $ | 74.0 | $ | 55.8 | $ | 128.7 | |||

Debt assumed by GE from GE Capital | (54.4) | 54.4 | - | ||||||

Intercompany loans | 4.1 | (4.1) | - | ||||||

Total intercompany payable (receivable) between GE and GE Capital | (50.3) | 50.3 | - | ||||||

Debt adjusted for assumed debt and intercompany loans | $ | 23.7 | $ | 106.1 | $ | 128.7 | |||

(a) Includes $1.2 billion elimination of other intercompany borrowings between GE and GE Capital.

2017 1Q FORM 10-Q 37

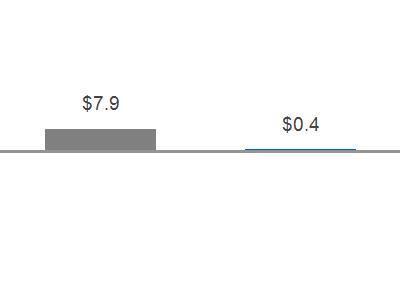

LIQUIDITY SOURCES

In addition to GE cash of $7.9 billion at March 31, 2017, GE Capital maintained liquidity sources of $43.4 billion that consisted of cash and equivalents of $33.7 billion, high-quality investments of $8.9 billion and cash and equivalents of $0.8 billion classified as discontinued operations. Additionally, at March 31, 2017, GE has $20.0 billion of committed unused credit lines extended by 36 banks in a syndicated credit facility agreement, as well as $5.1 billion of committed unused operating lines extended by nine banks. GE Capital has the right to compel GE to borrow under these credit lines and transfer the proceeds as loans to GE Capital.

CASH AND EQUIVALENTS | |||||||

(In billions) | March 31, 2017 | March 31, 2017 | |||||

GE(a) | $ | 7.9 | U.S. | $ | 6.6 | ||

GE Capital(b) | 33.7 | Non-U.S.(c) | 35.0 | ||||

(a) | At March 31, 2017, $3.5 billion of GE cash and equivalents was held in countries with currency controls that may restrict the transfer of funds to the U.S. or limit our ability to transfer funds to the U.S. without incurring substantial costs. These funds are available to fund operations and growth in these countries and we do not currently anticipate a need to transfer these funds to the U.S. |

(b) | At March 31, 2017, GE Capital cash and equivalents of about $0.3 billion was primarily in insurance entities and was subject to regulatory restrictions. |

(c) | Of this amount at March 31, 2017, $0.7 billion is held outside of the U.S. and is available to fund operations and other growth of non-U.S. subsidiaries; it is also available to fund our needs in the U.S. on a short-term basis through short-term loans, without being subject to U.S. tax. Under the Internal Revenue Code, these loans are permitted to be outstanding for 30 days or less and the total of all such loans is required to be outstanding for less than 60 days during the year. If we were to repatriate this cash, we would be subject to additional U.S. income taxes and foreign withholding taxes. |

During the first quarter of 2017, there were no new senior unsecured debt issuances.

COMMERCIAL PAPER | |||||

(In billions) | GE | GE Capital | |||

Average commercial paper borrowings during the first quarter of 2017 | $ | 14.8 | $ | 5.0 | |

Maximum commercial paper borrowings outstanding during the first quarter of 2017 | 19.7 | 5.2 | |||

GE Capital commercial paper maturities have historically been funded principally through new commercial paper issuances and at GE are substantially repaid before quarter-end using indefinitely reinvested overseas cash, which as discussed above, is available for use in the U.S. on a short-term basis without being subject to U.S. tax.

We securitize financial assets as an alternative source of funding. At March 31, 2017, consolidated non-recourse securitization borrowings were $0.7 billion.

GE GUARANTEE OF CERTAIN GE CAPITAL DEBT

GE provides implicit and explicit support to GE Capital through commitments, capital contributions and operating support. At March 31, 2017, debt assumed by GE from GE Capital in connection with the merger of GE Capital into GE was $54.4 billion, and GE guaranteed $45.3 billion of GE Capital debt. See Note 20 to the consolidated financial statements for further information on the guarantor financial statements.

FOREIGN CURRENCY EXPOSURE

As a result of our global operations, we generate and incur a significant portion of our revenues and expenses in currencies other than the U.S. dollar. Such principal currencies are euro, the pound sterling, the Brazilian real and the Chinese renminbi. The results of operating entities reported in currencies other than U.S. dollar are translated to the U.S. dollar at the applicable exchange rate for inclusion in the financial statements. We use a number of techniques to manage the effects of currency exchange, including selective borrowings in local currencies and selective hedging of significant cross-currency transactions. The foreign currency effect arising from operating activities outside of the U.S., including the remeasurement of derivatives, can result in significant transactional foreign currency fluctuations at points in time, but will generally be offset as the underlying hedged item is recognized in earnings. The effects of foreign currency fluctuations, decreased net earnings by $0.1 billion f or the three months ended March 31, 2017 .

2017 1Q FORM 10-Q 38

See Notes 16 and 21 to the consolidated financial statements for further information about our risk exposures, our use of derivatives, and the effects of this activity on our financial statements.

STATEMENT OF CASH FLOWS - THREE MONTHS ENDED MARCH 31, 2017 VERSUS 2016

CONSOLIDATED CASH FLOWS

We evaluate our cash flow performance by reviewing our industrial (non-GE Capital) businesses and GE Capital businesses separately. Cash from operating activities (CFOA) is the principal source of cash generation for our industrial businesses.

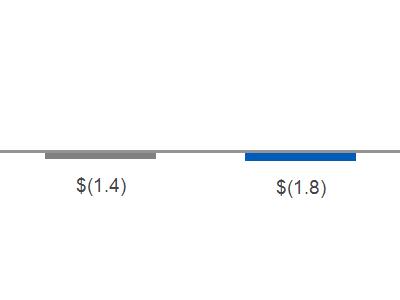

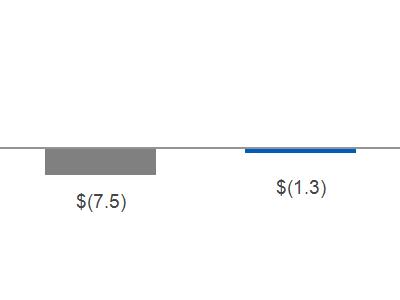

GE CASH FLOWS – THREE MONTHS ENDED MARCH 31

(In billions)

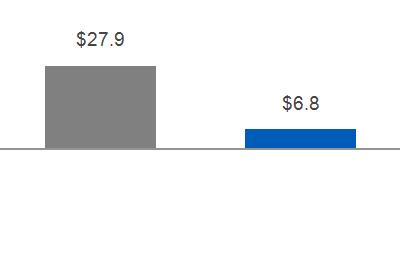

OPERATING CASH FLOWS | INVESTING CASH FLOWS | FINANCING CASH FLOWS | ||||||||

2016 | 2017 | 2016 | 2017 | 2016 | 2017 | |||||

|

|

| ||||||||

With respect to GE CFOA, we believe that it is useful to supplement our GE Statement of Cash Flows and to examine in a broader context the business activities that provide and require cash.

The most significant source of cash in GE CFOA is customer-related activities, the largest of which is collecting cash resulting from product or services sales. The most significant operating use of cash is to pay our suppliers, employees, tax authorities and others for a wide range of material and services. Dividends from GE Capital represent the distribution of a portion of GE Capital retained earnings, and are distinct from cash from continuing operations within the GE Capital businesses.

All other operating activities reflect cash sources and uses as well as non-cash adjustments to net income including those related to taxes, interest, pension, contract assets and gains (losses) on principal business dispositions. See Note 21 to the consolidated financial statements for further information.

See the Intercompany Transactions between GE and GE Capital section within the MD&A and Notes 4 and 19 to the consolidated financial statements for further information regarding certain transactions affecting our consolidated Statement of Cash Flows.

2017 1Q FORM 10-Q 39

2017 – 2016 COMMENTARY

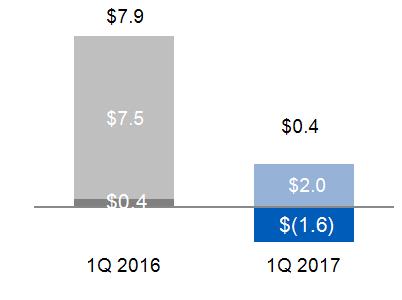

GE cash from operating activities decreased $7.5 billion primarily due to the following:

| GE Capital paid common dividends totaling $2.0 billion and $7.5 billion to GE in the three months ended March 31, 2017 and 2016, respectively. |

| Cash used for industrial operating activities of $1.6 billion in the three months ended March 31, 2017, compared to cash generated of $0.4 billion in the three months ended March 31, 2016, primarily due to the following: |

| Net income plus depreciation of $1.5 billion and $1.8 billion in the three months ended March 31, 2017 and 2016, respectively. |

| Cash used for working capital of $1.3 billion and $1.1 billion in the three months ended March 31, 2017 and 2016, respectively. The increase in cash used for working capital was primarily due to decreases in progress collections, partially offset by a decrease in inventory build. |

| An increase in contract assets of $1.9 billion and $0.7 billion in the three months ended March 31, 2017 and 2016, respectively, primarily due to adjustments driven by lower forecasted cost to complete the contracts and timing of billings relative to revenue recognition on our long-term equipment and service contracts. |

| See Note 21 to the consolidated financial statements for further information regarding cash sources and uses as well as non-cash adjustments to net income reported as All other operating activities. |

GE cash used for investing activities increased $0.5 billion primarily due to the following:

| An increase in business acquisition activities of $1.0 billion, primarily driven by the acquisition of ServiceMax for $0.9 billion (net of cash acquired) in the three months ended March 31, 2017. |

| This is partially offset by the funding of a joint venture at our Aviation business of $0.3 billion in the three months ended March 31, 2016. |

GE cash used for financing activities decreased $6.2 billion primarily due to the following:

| Net repurchases of GE treasury shares of $1.6 billion and $6.3 billion (including $2.0 billion paid under ASR agreements) in the three months ended March 31, 2017 and 2016, respectively. |

| A net increase in borrowings of $1.4 billion, driven by long-term loans from GE Capital to GE of $4.1 billion in the three months ended March 31, 2017, partially offset by the settlement of the remaining balance of a short-term loan from GE Capital to GE of $1.3 billion and a decrease of GE issued unsecured notes of $0.5 billion. |

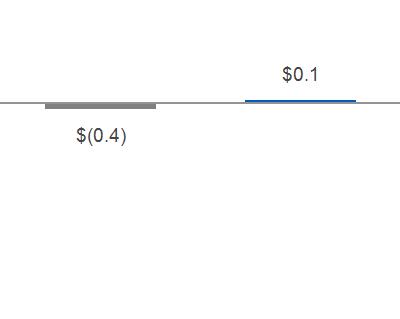

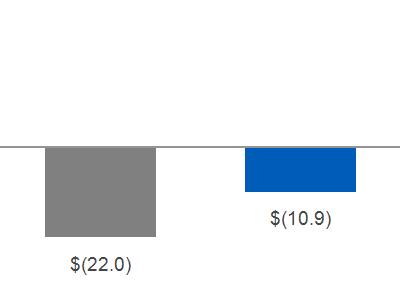

GE CAPITAL CASH FLOWS – THREE MONTHS ENDED MARCH 31

(In billions)

OPERATING CASH FLOWS | INVESTING CASH FLOWS | FINANCING CASH FLOWS | ||||||||

2016 | 2017 | 2016 | 2017 | 2016 | 2017 | |||||

|  |

| ||||||||

2017 1Q FORM 10-Q 40

2017 – 2016 COMMENTARY – CONTINUING OPERATIONS:

GE Capital cash from operating activities-continuing operations increased $0.5 billion primarily due to the following:

| Lower income tax payments of $1.8 billion, lower assets originated as held for sale of $0.5 billion and a general increase in cash generated from earnings of continuing operations. |

| These increases were partially offset by a net decrease in cash collateral received from counterparties on derivative contracts of $2.0 billion. |

GE Capital cash from investing activities-continuing operations decreased $21.1 billion primarily due to the following:

| Net proceeds from the sales of our discontinued operations of $0.8 billion compared to $36.5 billion in 2016. |

| Loans originated from GE Capital to GE of $4.1 billion offset by a $1.3 billion settlement of the remaining portion of a 2016 short-term loan from GE Capital to GE. |

| Net cash received from derivative settlements of $0.2 billion compared to $0.7 billion in 2016. |

| These decreases were partially offset by the following increases: |

| Investment in interest bearing deposits of $3.6 billion in 2016. |

| Maturity of liquidity investments of $2.7 billion in 2017. |

| Higher net collections of financing receivables of $1.5 billion in 2017. |

| Reduction in funding related to discontinued operations . |