|

|

|

UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 |

|

FORM 10-K | ||

(Mark One) |

|

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 3, 2018 | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 1-6049 | |

TARGET CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota (State or other jurisdiction of incorporation or organization) |

| 41-0215170 (I.R.S. Employer Identification No.) |

1000 Nicollet Mall, Minneapolis, Minnesota (Address of principal executive offices) |

| 55403 (Zip Code) |

Registrant's telephone number, including area code: 612/304-6073

Securities Registered Pursuant To Section 12(B) Of The Act:

Title of Each Class |

| Name of Each Exchange on Which Registered |

Common Stock, par value $0.0833 per share |

| New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company (as defined in Rule 12b-2 of the Exchange Act).

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | |||

Smaller reporting company o | Emerging growth company o | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of July 29, 2017 was $30,595,914,184 , based on the closing price of $56.11 per share of Common Stock as reported on the New York Stock Exchange Composite Index.

Indicate the number of shares outstanding of each of registrant's classes of Common Stock, as of the latest practicable date. Total shares of Common Stock, par value $0.0833, outstanding at March 8, 2018 were 538,796,010.

DOCUMENTS INCORPORATED BY REFERENCE |

Portions of Target's Proxy Statement for the Annual Meeting of Shareholders to be held on June 13, 2018 are incorporated into Part III. |

|

TABLE OF CONTENTS

PART I |

| ||

Item 1 |

| Business | 2 |

Item 1A |

| Risk Factors | 5 |

Item 1B |

| Unresolved Staff Comments | 10 |

Item 2 |

| Properties | 11 |

Item 3 |

| Legal Proceedings | 12 |

Item 4 |

| Mine Safety Disclosures | 13 |

Item 4A |

| Executive Officers | 13 |

PART II |

| ||

Item 5 |

| Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 14 |

Item 6 |

| Selected Financial Data | 16 |

Item 7 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 16 |

Item 7A |

| Quantitative and Qualitative Disclosures About Market Risk | 32 |

Item 8 |

| Financial Statements and Supplementary Data | 33 |

Item 9 |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 63 |

Item 9A |

| Controls and Procedures | 63 |

Item 9B |

| Other Information | 63 |

PART III |

| ||

Item 10 |

| Directors, Executive Officers and Corporate Governance | 63 |

Item 11 |

| Executive Compensation | 64 |

Item 12 |

| Security Ownership of Certain Beneficial Owners and Management and | 64 |

Item 13 |

| Certain Relationships and Related Transactions, and Director Independence | 64 |

Item 14 |

| Principal Accountant Fees and Services | 64 |

PART IV |

| ||

Item 15 |

| Exhibits, Financial Statement Schedules | 66 |

Signatures | 69 | ||

1

PART I

Item 1. Business

General

Target Corporation (Target, the Corporation or the Company) was incorporated in Minnesota in 1902. We offer our customers, referred to as "guests," everyday essentials and fashionable, differentiated merchandise at discounted prices. Our ability to deliver a preferred shopping experience to our guests is supported by our supply chain and technology, our devotion to innovation, our loyalty offerings, and our disciplined approach to managing our business and investing in future growth. We operate as a single segment designed to enable guests to purchase products seamlessly in stores or through our digital channels. Since 1946, we have given 5 percent of our profit to communities.

In 2014, we announced our exit from the Canadian market. Canadian financial results are included in our financial statements as our only discontinued operations.

CVS Pharmacy, Inc. (CVS) operates pharmacies and clinics in our stores under a perpetual operating agreement, subject to termination in limited circumstances. We sold our pharmacy and clinic businesses (Pharmacy Transaction) to CVS in December of 2015. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and Note 6 of Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data (the Financial Statements) for more information.

Financial Highlights

For information on key financial highlights and segment financial information, see Item 6, Selected Financial Data, MD&A, and Note 30 of the Financial Statements.

Seasonality

A larger share of annual revenues and earnings traditionally occurs in the fourth quarter because it includes the November and December holiday sales period.

Merchandise

We sell a wide assortment of general merchandise and food. The majority of our general merchandise stores offer an edited food assortment, including perishables, dry grocery, dairy, and frozen items. Nearly all of our stores larger than 170,000 square feet offer a full line of food items comparable to traditional supermarkets. Our small format stores, generally smaller than 50,000 square feet, offer curated general merchandise and food assortments. Our digital channels include a wide merchandise assortment, including many items found in our stores, along with a complementary assortment such as additional sizes and colors sold only online.

2

A significant portion of our sales is from national brand merchandise. Approximately one-third of 2017 sales is related to our owned and exclusive brands, including but not limited to the following:

Owned Brands |

|

|

A New Day™ | Goodfellow & Co.™ | Sonia Kashuk® |

Archer Farms® | JoyLab™ | Spritz™ |

Art Class™ | Knox Rose™ | Sutton & Dodge® |

Ava & Viv® | Market Pantry® | Threshold™ |

Boots & Barkley® | Merona® | up & up® |

Bullseye's Playground™ | Pillowfort™ | Who What Wear™ |

Cat & Jack™ | Project 62™ | Wine Cube® |

Cloud Island™ | Room Essentials® | Wondershop™ |

Embark® | Simply Balanced™ | Xhilaration® |

Gilligan & O'Malley® | Smith & Hawken® |

|

|

|

|

Exclusive Brands |

|

|

C9 by Champion® | Hearth & Hand™ with Magnolia | Mossimo® |

DENIZEN® from Levi's® | Isabel Maternity™ by Ingrid & Isabel® | Nate Berkus™ for Target |

Fieldcrest® | Just One You® made by carter's® | Oh Joy!® for Target |

Genuine Kids® from OshKosh® | Kid Made Modern® |

|

Hand Made Modern® |

|

|

We also sell merchandise through periodic exclusive design and creative partnerships and generate revenue from in-store amenities such as Target Café and leased or licensed departments such as Target Optical, Starbucks, and other food service offerings. The majority of our stores also have a CVS pharmacy from which we will generate ongoing annual occupancy-related income (see MD&A and Note 6 of the Financial Statements for more information).

Distribution

The vast majority of merchandise is distributed to our stores through our network of 41 distribution centers. Common carriers ship general merchandise to and from our distribution centers. Vendors or third party distributors ship certain food items and other merchandise directly to our stores. Merchandise sold through our digital channels is distributed to our guests via common carriers (from stores, distribution centers, vendors and third party distributors) and through guest pick-up at our stores. Using our stores as fulfillment points allows improved product availability and delivery times and also reduces shipping costs. We continue to expand other delivery options, including store drive-up and delivery via our wholly-owned subsidiary, Shipt, Inc. (Shipt).

Employees

At February 3, 2018 , we employed approximately 345,000 full-time, part-time and seasonal employees, referred to as "team members." Because of the seasonal nature of the retail business, employment levels peak in the holiday season. We offer a broad range of company-paid benefits to our team members. Eligibility for and the level of benefits vary depending on team members' full-time or part-time status, compensation level, date of hire, and/or length of service. Company-paid benefits include a 401(k) plan, medical and dental plans, disability insurance, paid vacation, tuition reimbursement, various team member assistance programs, life insurance, a pension plan (closed to new participants, with limited exceptions), and merchandise and other discounts. We believe our team member relations are good.

3

Working Capital

Effective inventory management is key to our ongoing success, and we use various techniques including demand forecasting and planning and various forms of replenishment management. We achieve effective inventory management by staying in-stock in core product offerings, maintaining positive vendor relationships, and carefully planning inventory levels for seasonal and apparel items to minimize markdowns.

We expect less variability in working capital needs throughout the year than we have historically experienced due to efforts to better match payables to inventory levels.

The Liquidity and Capital Resources section in MD&A provides additional details.

Competition

We compete with traditional and internet retailers, including off-price general merchandise retailers, apparel retailers, wholesale clubs, category specific retailers, drug stores, supermarkets, and other forms of retail commerce. Our ability to positively differentiate ourselves from other retailers and provide compelling value to our guests largely determines our competitive position within the retail industry.

Intellectual Property

Our brand image is a critical element of our business strategy. Our principal trademarks, including Target, SuperTarget and our "Bullseye Design," have been registered with the United States Patent and Trademark Office. We also seek to obtain and preserve intellectual property protection for our owned brands.

Geographic Information

Virtually all of our revenues are generated within the United States. The vast majority of our property and equipment is located within the United States.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge at investors.target.com as soon as reasonably practicable after we file such material with, or furnish it to, the U.S. Securities and Exchange Commission (SEC). Our Corporate Governance Guidelines, Business Conduct Guide, Corporate Responsibility Report, and the charters for the committees of our Board of Directors are also available free of charge in print upon request or at investors.target.com.

4

Item 1A. Risk Factors

Our business is subject to many risks. Set forth below are the material risks we face. Risks are listed in the categories where they primarily apply, but other categories may also apply.

Competitive and Reputational Risks

Our continued success is dependent on positive perceptions of Target which, if eroded, could adversely affect our business and our relationships with our guests and team members.

We believe that one of the reasons our guests prefer to shop at Target, our team members choose Target as a place of employment and our vendors choose to do business with us is the reputation we have built over many years for serving our four primary constituencies: guests, team members, shareholders, and the communities in which we operate. To be successful in the future, we must continue to preserve Target's reputation. Reputational value is based in large part on perceptions, and broad access to social media makes it easy for anyone to provide public feedback that can influence perceptions of Target. It may be difficult to control negative publicity, regardless of whether it is accurate. While reputations may take decades to build, any negative incidents can quickly erode trust and confidence, particularly if they result in negative mainstream and social media publicity, consumer boycotts, governmental investigations, or litigation. In addition, vendors and others with whom we choose to do business may affect our reputation. For example, CVS operates clinics and pharmacies within our stores, and our guests' perceptions of and experiences with CVS may affect our reputation. Negative reputational incidents could adversely affect our business through lost sales, loss of new store and technology development opportunities, or team member retention and recruiting difficulties.

If we are unable to positively differentiate ourselves from other retailers, our results of operations could be adversely affected.

In the past, we have been able to compete successfully by differentiating our guests' shopping experience through a careful combination of price, merchandise assortment, store environment, convenience, guest service, loyalty programs, and marketing efforts. Our ability to create a personalized guest experience through the collection and use of accurate and relevant guest data is important to our ability to differentiate from other retailers. Guest perceptions regarding the cleanliness and safety of our stores, the functionality, reliability, and speed of our digital channels and fulfillment options, our in-stock levels, the effectiveness of our promotions, the attractiveness of our third party offerings, such as the clinics and pharmacies owned and operated by CVS, and other factors also affect our ability to compete. No single competitive factor is dominant, and actions by our competitors on any of these factors or the failure of our strategies could adversely affect our sales, gross margins, and expenses.

We sell many products under our owned and exclusive brands, which help differentiate us from other retailers, generally carry higher margins than equivalent national brand products and represent a significant portion of our overall sales. If we are unable to successfully develop, support, and evolve our owned and exclusive brands, if one or more of these brands experiences a loss of consumer acceptance or confidence, or if we are unable to successfully protect our intellectual property rights in these brands, our sales and gross margins could be adversely affected.

The continuing migration of retailing to digital channels has increased our challenges in differentiating ourselves from other retailers. In particular, consumers are able to quickly and conveniently comparison shop and determine real-time product availability using digital tools, which can lead to decisions based solely on price, the functionality of the digital tools or a combination of factors. We must compete by offering a consistent, convenient shopping experience and value for our guests regardless of sales channel and by providing our guests and team members with reliable, effective, and easy-to-use digital tools. Any difficulties in executing our differentiation efforts, actions by our competitors in response to these efforts, or failures by vendors in managing their own channels, content and technology systems could hurt our ability to differentiate ourselves from other retailers and adversely affect our sales, gross margins, and expenses.

If we are unable to successfully provide a relevant and reliable experience for our guests, regardless of where our guest demand is ultimately fulfilled, our sales, results of operations and reputation could be adversely affected.

Our business has evolved from an in-store experience to interaction with guests across multiple channels (in-store, online, mobile and social media, among others). Our guests are using a variety of electronic devices and platforms to

5

shop in our stores and online and provide feedback and public commentary about all aspects of our business. We must anticipate and meet changing guest expectations and counteract new developments and technology investments by our competitors. Our evolving retailing efforts include implementing new technology, software and processes to be able to cost-effectively fulfill guest orders directly from our vendors and from any point within our system of stores and distribution centers. Providing flexible fulfillment options is complex and may not meet guest expectations for accurate order fulfillment, faster and guaranteed delivery times, and low-price or free shipping. If we are unable to attract and retain team members, contract with third parties, or make selective acquisitions to obtain the specialized skills needed to support these efforts, collect accurate, relevant, and usable guest data to support our personalization efforts, allow real-time and accurate visibility to product availability when guests are ready to purchase, quickly and efficiently fulfill orders using the fulfillment and payment methods guests demand, or provide a convenient and consistent experience for our guests across all sales channels, our ability to compete and our results of operations could be adversely affected. In addition, if Target.com and our other technology systems do not appeal to our guests, integrate with our vendors or other third parties, reliably function as designed, integrate across all sales channels, or maintain the privacy of data, we may experience a loss of guest confidence and lost sales, which could adversely affect our reputation and results of operations.

If we do not anticipate and respond quickly to changing consumer preferences, our sales, gross margins and profitability could suffer.

A large part of our business is dependent on our ability to make trend‑right decisions and effectively manage our inventory in a broad range of merchandise categories, including apparel, accessories, home décor, electronics, toys, seasonal offerings, food, and other merchandise. If we do not obtain accurate and relevant data on guest preferences, predict changing consumer tastes, preferences, spending patterns and other lifestyle decisions, emphasize the correct categories, implement competitive and effective pricing and promotion strategies, or personalize our offerings to our guests, we may experience lost sales, spoilage, and increased inventory markdowns, which would adversely affect our results of operations by reducing our gross margins and hurting our profitability.

Investments and Infrastructure Risks

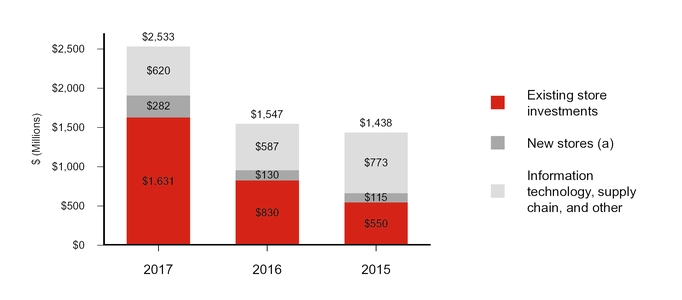

If our capital investments in remodeling existing stores, building new stores, and improving technology and supply chain infrastructure do not achieve appropriate returns, our competitive position, financial condition and results of operations may be adversely affected.

Our business depends, in part, on our ability to remodel existing stores and build new stores in a manner that achieves appropriate returns on our capital investment. Our current store remodel program is larger than historic levels and is being implemented using a custom approach based on the condition of each store and characteristics of the surrounding neighborhood. When building new stores, we compete with other retailers and businesses for suitable locations for our stores. Many of our expected new store sites are smaller, non-standard footprints located in fully developed markets, which require changes to our supply chain practices and are generally more time-consuming, expensive and uncertain undertakings than expansion into undeveloped suburban and ex-urban markets. Pursuing the wrong remodel or new store opportunities, any delays, cost increases, disruptions or other uncertainties related to those opportunities, and lower than expected sales from those opportunities, could adversely impact our results of operations.

Our business also relies on investments in technology and selective acquisitions, and the returns on these investments can be less predictable than remodeling and building stores. We are currently making, and expect to continue to make, significant investments in technology and selective acquisitions to improve guest experiences across sales channels and improve our supply chain and inventory management systems. These investments might not provide the anticipated benefits or desired return. In addition, if we are unable to successfully protect any intellectual property rights resulting from our investments, the value received from those investments may be eroded, which could adversely affect our financial condition.

Targeting the wrong investment opportunities, failing to successfully meet our strategic objectives when making the correct investments, being unable to make new concepts scalable, making an investment commitment significantly above or below our needs, or failing to effectively incorporate acquired businesses into our business could result in the loss of our competitive position and adversely affect our financial condition or results of operations.

6

A significant disruption in our computer systems and our inability to adequately maintain and update those systems could adversely affect our operations and our ability to maintain guest confidence.

We rely extensively on our computer systems to manage and account for inventory, process guest transactions, manage and maintain the privacy of guest data, communicate with our vendors and other third parties, service Target-branded credit and debit card accounts, and summarize and analyze results. We also rely on continued and unimpeded access to the Internet to use our computer systems. Our systems are subject to damage or interruption from power outages, telecommunications failures, computer viruses, malicious attacks, security breaches, and catastrophic events. If our systems are damaged or fail to function properly or reliably, we may incur substantial repair or replacement costs, experience data loss or theft and impediments to our ability to manage inventories or process guest transactions, engage in additional promotional activities to retain our guests, and encounter lost guest confidence, which could adversely affect our results of operations.

We continually invest to maintain and update our computer systems. Implementing significant system changes increases the risk of computer system disruption. The potential problems and interruptions associated with implementing technology initiatives, as well as providing training and support for those initiatives, could disrupt or reduce our operational efficiency, and could negatively impact guest experience and guest confidence.

Data Security and Privacy Risks

If our efforts to protect the security of information about our guests, team members, vendors and other third parties are unsuccessful, we may face additional costly government enforcement actions and private litigation, and our sales and reputation could suffer.

We regularly receive and store information about our guests, team members, vendors and other third parties. We have programs in place to detect, contain, and respond to data security incidents. However, because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be difficult to detect for long periods of time, we may be unable to anticipate these techniques or implement adequate preventive measures. In addition, hardware, software, or applications we develop or procure from third parties or through open source solutions may contain defects in design or manufacture or other problems that could unexpectedly compromise information security. Unauthorized parties may also attempt to gain access to our systems or facilities, or those of third parties with whom we do business, through fraud, trickery, or other forms of deceiving our team members, contractors, and vendors.

Until the data breach we experienced in the fourth quarter of 2013, all incidents we encountered were insignificant. The data breach we experienced in 2013 was significant and went undetected for several weeks. Both we and our vendors had data security incidents subsequent to the 2013 data breach; however, to date these other incidents have not been material to our consolidated financial statements. Based on the prominence and notoriety of the 2013 data breach, even minor additional data security incidents could draw greater scrutiny. If we, our vendors, or other third parties with whom we do business experience additional significant data security breaches or fail to detect and appropriately respond to significant data security breaches, we could be exposed to additional government enforcement actions and private litigation. In addition, our guests could lose confidence in our ability to protect their information, which could cause them to discontinue using our REDcards or loyalty programs, or stop shopping with us altogether.

Supply Chain and Third Party Risks

Changes in our relationships with our vendors, changes in tax policy or trade relations, interruptions in our supply chain or increased commodity or supply chain costs could adversely affect our results of operations.

We are dependent on our vendors to supply merchandise to our distribution centers, stores, and guests. As we continue to add capabilities, operating our fulfillment network becomes more complex and challenging. If our fulfillment network does not operate properly or if a vendor fails to deliver on its commitments, we could experience merchandise out-of-stocks, delivery delays or increased delivery costs, which could lead to lost sales and decreased guest confidence, and adversely affect our results of operations.

A large portion of our merchandise is sourced, directly or indirectly, from outside the United States, with China as our single largest source, so any major changes in tax policy or trade relations, such as the imposition of additional tariffs

7

or duties on imported products, could adversely affect our business, results of operations, effective income tax rate, liquidity and net income.

Political or financial instability, currency fluctuations, changes in trade policy, trade restrictions, tariffs or duties, the outbreak of pandemics, labor unrest, transport capacity and costs, port security, weather conditions, natural disasters or other events that could slow or disrupt port activities and affect foreign trade are beyond our control and could materially disrupt our supply of merchandise, increase our costs, and/or adversely affect our results of operations. There have been periodic labor disputes impacting the United States ports that have caused us to make alternative arrangements to continue the flow of inventory, and if these types of disputes recur, worsen, or occur in other countries through which we source products, it may have a material impact on our costs or inventory supply. Changes in the costs of procuring commodities used in our merchandise or the costs related to our supply chain, including vendor costs, labor, fuel, tariffs, duties, currency exchange rates, and supply chain transparency initiatives, could have an adverse effect on gross margins, expenses, and results of operations. Changes in our relationships with our vendors also have the potential to increase our expenses and adversely affect results of operations.

A disruption in relationships with third party service providers could adversely affect our operations.

We rely on third parties to support our business, including portions of our technology development and support, our digital platforms and fulfillment operations, credit and debit card transaction processing, extensions of credit for our 5% REDcard Rewards loyalty program, the clinics and pharmacies operated by CVS within our stores, the infrastructure supporting our guest contact centers, aspects of our food offerings, and delivery services. If we are unable to contract with third parties having the specialized skills needed to support those strategies or integrate their products and services with our business, if we fail to properly manage those third parties, if they fail to meet our performance standards and expectations, including with respect to data security, then our reputation, sales, and results of operations could be adversely affected. In addition, we could face increased costs or be limited in finding replacement providers or hiring and retaining team members to provide these services in-house. For example, if our guests unfavorably view CVS's operations or if our relationship with CVS does not meet our strategic objectives, our ability to discontinue the relationship is limited and our results of operations may be adversely affected.

Legal, Regulatory, Global and Other External Risks

Our earnings depend on the state of macroeconomic conditions and consumer confidence in the United States.

Virtually all of our sales are in the United States, making our results highly dependent on United States consumer confidence and the health of the United States economy. In addition, a significant portion of our total sales is derived from stores located in five states: California, Texas, Florida, Minnesota and Illinois, resulting in further dependence on local economic conditions in these states. Deterioration in macroeconomic conditions or consumer confidence could negatively affect our business in many ways, including slowing sales growth, reducing overall sales, and reducing gross margins.

These same considerations impact the success of our credit card program. Although we no longer own a consumer credit card receivables portfolio, we share in the profits generated by the credit card program with TD Bank Group (TD), which owns the receivables generated by our proprietary credit cards. Deterioration in macroeconomic conditions could adversely affect the volume of new credit accounts, the amount of credit card program balances and the ability of credit card holders to pay their balances. These conditions could result in us receiving lower profit‑sharing payments.

Uncharacteristic or significant weather conditions, alone or together with natural disasters, could adversely affect our operations.

Uncharacteristic or significant weather conditions can affect consumer shopping patterns, particularly in apparel and seasonal items, which could lead to lost sales or greater than expected markdowns and adversely affect our short-term results of operations. In addition, our three largest states by total sales are California, Texas and Florida, areas where natural disasters are more prevalent. Natural disasters in those states or in other areas where our sales are concentrated could result in significant physical damage to or closure of one or more of our stores, distribution centers or key vendors, and cause delays in the distribution of merchandise from our vendors to our distribution centers, stores, and guests, which could adversely affect our results of operations by increasing our costs and lowering our sales.

8

We rely on a large, global and changing workforce of team members, contractors and temporary staffing. If we do not effectively manage our workforce and the concentration of work in certain global locations, our labor costs and results of operations could be adversely affected.

With over 300,000 team members, our workforce costs represent our largest operating expense, and our business is dependent on our ability to attract, train, and retain the appropriate mix of qualified team members, contractors, and temporary staffing and effectively organize and manage those resources as our business and strategic priorities change. Many team members are in entry-level or part-time positions with historically high turnover rates. Our ability to meet our changing labor needs while controlling our costs is subject to external factors such as labor laws and regulations, unemployment levels, prevailing wage rates, collective bargaining efforts, health care and other benefit costs, changing demographics, and our reputation and relevance within the labor market. If we are unable to attract and retain adequate numbers and an appropriate mix of qualified team members, contractors and temporary staffing, our operations, guest service levels, support functions, and competitiveness could suffer. Those factors, together with increasing wage and benefit costs, could adversely affect our results of operations. We are periodically subject to labor organizing efforts. If we become subject to one or more collective bargaining agreements in the future, it could adversely affect our labor costs and how we operate our business.

We have offices in India and China where there has generally been greater political, financial, environmental and health instability than the United States. An extended disruption of our operations in India or offices in China could adversely affect our operations and financial results.

Failure to address product safety and sourcing concerns could adversely affect our sales and results of operations.

If our merchandise offerings do not meet applicable safety standards or Target's or our guests' expectations regarding safety, supply chain transparency and integrity of sources of supply, we could experience lost sales and increased costs and be exposed to legal and reputational risk. All of our vendors must comply with applicable product safety laws, and we are dependent on them to ensure that the products we buy comply with all safety standards. Events that give rise to actual, potential or perceived product safety concerns, including food or drug contamination, could expose us to government enforcement action or private litigation and result in costly product recalls and other liabilities. Our sourcing vendors must also meet our expectations across multiple areas of social compliance, including supply chain transparency and sources of supply. We have a social compliance audit process, but we are also dependent on our vendors to ensure that the products we buy comply with our standards. Negative guest perceptions regarding the safety of the products we sell and events that give rise to actual, potential or perceived social compliance concerns could hurt our reputation, result in lost sales, cause our guests to seek alternative sources for their needs, and make it difficult and costly for us to regain the confidence of our guests.

Our failure to comply with federal, state, local, and international laws, or changes in these laws could increase our costs, reduce our margins, and lower our sales.

Our business is subject to a wide array of laws and regulations in the United States and other countries in which we operate. Our expenses could increase, and our operations could be adversely affected by significant legislative changes to workforce-related issues, including an employer's obligation to recognize collective bargaining units, the process by which collective bargaining agreements are negotiated or imposed, the classification of exempt and non-exempt employees, the distinction between employees and contractors, minimum wage requirements, advance scheduling notice requirements, and health care mandates. In addition, changes in the regulatory environment affecting privacy and information security, product safety, payment methods and related fees, responsible sourcing, supply chain transparency, or environmental protection, among others, could cause our expenses to increase without an ability to pass through any increased expenses through higher prices. In addition, if we fail to comply with other applicable laws and regulations, including wage and hour laws, the Foreign Corrupt Practices Act and local anti-bribery laws, we could be subject to reputation and legal risk, including government enforcement action and class action civil litigation, which could adversely affect our results of operations by increasing our costs, reducing our margins, and lowering our sales.

9

Financial Risks

Changes in our effective income tax rate could adversely affect our business, results of operations, liquidity, and net income.

A number of factors influence our effective income tax rate, including changes in tax law and related regulations, tax treaties, interpretation of existing laws, and our ability to sustain our reporting positions on examination. Changes in any of those factors could change our effective tax rate, which could adversely affect our net income. In addition, our operations outside of the United States may cause greater volatility in our effective tax rate.

If we are unable to access the capital markets or obtain bank credit, our financial position, liquidity, and results of operations could suffer.

We are dependent on a stable, liquid, and well-functioning financial system to fund our operations and capital investments. Our continued access to financial markets depends on multiple factors including the condition of debt capital markets, our operating performance, and maintaining strong credit ratings. If rating agencies lower our credit ratings, it could adversely impact our ability to access the debt markets, our cost of funds, and other terms for new debt issuances. Each of the credit rating agencies reviews its rating periodically, and there is no guarantee our current credit rating will remain the same. In addition, we use a variety of derivative products to manage our exposure to market risk, principally interest rate and equity price fluctuations. Disruptions or turmoil in the financial markets could reduce our ability to fund our operations and capital investments, and lead to losses on derivative positions resulting from counterparty failures, which could adversely affect our financial position and results of operations.

Item 1B. Unresolved Staff Comments

Not applicable.

10

Item 2. Properties

Stores at February 3, 2018 | Stores | | Retail Sq. Ft. (in thousands) | |

|

| Stores | | Retail Sq. Ft. (in thousands) | |

Alabama | 22 | | 3,150 | |

| Montana | 7 | | 780 | |

Alaska | 3 | | 504 | |

| Nebraska | 14 | | 2,006 | |

Arizona | 47 | | 6,187 | |

| Nevada | 17 | | 2,242 | |

Arkansas | 9 | | 1,165 | |

| New Hampshire | 9 | | 1,148 | |

California | 283 | | 35,948 | |

| New Jersey | 45 | | 5,882 | |

Colorado | 41 | | 6,215 | |

| New Mexico | 10 | | 1,185 | |

Connecticut | 20 | | 2,672 | |

| New York | 79 | | 10,117 | |

Delaware | 3 | | 440 | |

| North Carolina | 51 | | 6,540 | |

District of Columbia | 1 | | 179 | |

| North Dakota | 4 | | 554 | |

Florida | 122 | | 16,985 | |

| Ohio | 62 | | 7,675 | |

Georgia | 50 | | 6,820 | |

| Oklahoma | 15 | | 2,168 | |

Hawaii | 7 | | 1,111 | |

| Oregon | 19 | | 2,280 | |

Idaho | 6 | | 664 | |

| Pennsylvania | 71 | | 8,827 | |

Illinois | 94 | | 12,152 | |

| Rhode Island | 4 | | 517 | |

Indiana | 31 | | 4,174 | |

| South Carolina | 19 | | 2,359 | |

Iowa | 20 | | 2,835 | |

| South Dakota | 5 | | 580 | |

Kansas | 17 | | 2,385 | |

| Tennessee | 31 | | 3,990 | |

Kentucky | 13 | | 1,551 | |

| Texas | 149 | | 20,863 | |

Louisiana | 15 | | 2,120 | |

| Utah | 13 | | 1,954 | |

Maine | 5 | | 630 | |

| Vermont | - | | - | |

Maryland | 39 | | 4,860 | |

| Virginia | 58 | | 7,689 | |

Massachusetts | 42 | | 5,260 | |

| Washington | 37 | | 4,329 | |

Michigan | 53 | | 6,370 | |

| West Virginia | 6 | | 755 | |

Minnesota | 74 | | 10,440 | |

| Wisconsin | 37 | | 4,560 | |

Mississippi | 6 | | 743 | |

| Wyoming | 2 | | 187 | |

Missouri | 35 | | 4,608 | |

|

|

| |

| |

|

| |

| |

| Total | 1,822 | | 239,355 | |

Stores and Distribution Centers at February 3, 2018 | Stores | | Distribution Centers (a) | |

Owned | 1,526 | | 33 | |

Leased | 136 | | 8 | |

Owned buildings on leased land | 160 | | - | |

Total | 1,822 | | 41 | |

(a) The 41 distribution centers have a total of 52,549 thousand square feet.

We own our corporate headquarters buildings located in and around Minneapolis, Minnesota, and we lease and own additional office space elsewhere in the United States. We also lease office space in 12 countries for various support functions. Our properties are in good condition, well maintained, and suitable to carry on our business.

For additional information on our properties, see the Capital Expenditures section in MD&A and Notes 14 and 22 of the Financial Statements.

11

Item 3. Legal Proceedings

The following proceedings are being reported pursuant to Item 103 of Regulation S-K:

The Federal Securities Law Class Actions and ERISA Class Actions defined below relate to certain prior disclosures by Target about its expansion of retail operations into Canada (the Canada Disclosure). Target intends to continue to vigorously defend these actions.

Federal Securities Law Class Actions

On May 17, 2016 and May 24, 2016, Target Corporation and certain present and former officers were named as defendants in two purported federal securities law class actions filed in the United States District Court for the District of Minnesota (the Court). The plaintiffs filed a Consolidated Amended Class Action Complaint (the First Complaint) on November 14, 2016, alleging violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, and Rule 10b-5 relating to the Canada Disclosure and naming Target, its former chief executive officer, its present chief operating officer, and the former president of Target Canada as defendants. The plaintiff sought to represent a class consisting of all purchasers of Target common stock between March 20, 2013 and August 4, 2014 and sought damages and other relief, including attorneys' fees, based on allegations that the defendants misled investors about the performance and prospects of Target Canada and that such conduct affected the value of Target common stock. On July 31, 2017 the Court issued a combined order dismissing the Federal Securities Law Class Actions. On August 29, 2017 the plaintiff filed a motion to alter or amend the final judgment entered by the Court dismissing the Federal Securities Law Class Actions. The plaintiffs also asked the Court for permission to file a Second Amended Class Action Complaint (the Second Complaint), which has substantially similar allegations, defendants, class representation, and damages sought as the First Complaint. On October 16, 2017, Target and the other defendants filed their opposition to plaintiff's motion to alter or amend the final judgment dismissing the Federal Securities Law Class Actions. That motion has not yet been heard or decided.

ERISA Class Actions

On July 12, 2016 and July 15, 2016, Target Corporation, the Plan Investment Committee and Target's current chief operating officer were named as defendants in two purported Employee Retirement Income Security Act of 1974 (ERISA) class actions filed in the Court. The plaintiffs filed an Amended Class Action Complaint (the First ERISA Class Action) on December 14, 2016, alleging violations of Sections 404 and 405 of ERISA relating to the Canada Disclosure and naming Target, the Plan Investment Committee, and seven present or former officers as defendants. The plaintiffs sought to represent a class consisting of all persons who were participants in or beneficiaries of the Target Corporation 401(k) Plan or the Target Corporation Ventures 401(k) Plan (collectively, the Plans) at any time between February 27, 2013 and May 19, 2014 and whose Plan accounts included investments in Target stock and sought damages, an injunction and other unspecified equitable relief, and attorneys' fees, expenses, and costs, based on allegations that the defendants breached their fiduciary duties by failing to take action to prevent Plan participants from continuing to purchase Target stock during the class period at prices that allegedly were artificially inflated. On July 31, 2017 the Court issued a combined order dismissing the ERISA Class Actions. On August 30, 2017 the plaintiffs filed a new ERISA Class Action (the Second ERISA Class Action) in the Court, which has substantially similar allegations, defendants, class representation, and damages sought as the First ERISA Class Action, except that the class period is extended to August 6, 2014. On November 13, 2017, Target and the other defendants filed a motion to dismiss the Second ERISA Class Action. A hearing on that motion was held on February 22, 2018, but it has not yet been decided.

The following governmental enforcement proceedings relating to environmental matters are reported pursuant to instruction 5(C) of Item 103 of Regulation S-K because they involve potential monetary sanctions in excess of $100,000:

On February 27, 2015, the California Attorney General sent us a letter alleging, based on a series of compliance checks, that we have not achieved compliance with California's environmental laws and the provisions of the injunction that was part of a settlement reached in 2011. Representatives of Target have had a series of meetings with representatives of the Attorney General's Office and certain California District Attorneys' Offices to discuss the allegations. No formal legal action has been commenced, but the parties are discussing resolution of the matter.

For a description of other legal proceedings, see Note 19 of the Financial Statements.

12

Item 4. Mine Safety Disclosures

Not applicable.

Item 4A. Executive Officers

Executive officers are elected by, and serve at the pleasure of, the Board of Directors. There are no family relationships between any of the officers named and any other executive officer or member of the Board of Directors, or any arrangement or understanding pursuant to which any person was selected as an officer.

Name | Title and Business Experience | Age | |

|

|

| |

Brian C. Cornell | Chairman of the Board and Chief Executive Officer since August 2014. Chief Executive Officer of PepsiCo Americas Foods, a division of PepsiCo, Inc., a multinational food and beverage corporation, from March 2012 to July 2014. | 59 | |

Rick H. Gomez | Executive Vice President and Chief Marketing Officer since January 2017. Senior Vice President, Brand and Category Marketing from April 2013 to January 2017. Vice President, Brand Marketing at MillerCoors, a multinational brewing company, from April 2011 to April 2013. | 48 | |

Don H. Liu | Executive Vice President, Chief Legal & Risk Officer and Corporate Secretary since October 2017. Executive Vice President, Chief Legal Officer and Corporate Secretary from August 2016 to September 2017. Executive Vice President, General Counsel and Corporate Secretary of Xerox Corporation from July 2014 to August 2016, and Senior Vice President, General Counsel and Corporate Secretary from March 2007 to July 2014. | 56 | |

Stephanie A. Lundquist | Executive Vice President and Chief Human Resources Officer since February 2016. Senior Vice President, Human Resources from January 2015 to February 2016. Senior Vice President, Stores and Distribution Human Resources from February 2014 to January 2015. From March 2011 to January 2014, Ms. Lundquist held several leadership positions with Target Canada. | 42 | |

Michael E. McNamara | Executive Vice President and Chief Information & Digital Officer since September 2016. Executive Vice President and Chief Information Officer from June 2015 to September 2016. Chief Information Officer of Tesco PLC, a multinational grocery and general merchandise retailer, from March 2011 to May 2015. | 53 | |

John J. Mulligan | Executive Vice President and Chief Operating Officer since September 2015. Executive Vice President and Chief Financial Officer from April 2012 to August 2015. | 52 | |

Minsok Pak | Executive Vice President and Chief Strategy & Innovation Officer since August 2017. Senior Vice President of Shopper Marketing & Channel Development, LEGO Retail, LEGO Group, a developer and producer of toys, from April 2016 to July 2017. Partner, Digital Transformation, McKinsey & Company, a global management consulting firm, from April 2014 to April 2016. Managing Director, Actium Corporation, a private equity firm, from June 2010 to April 2014. | 49 | |

Janna A. Potts | Executive Vice President and Chief Stores Officer since January 2016. Senior Vice President, Stores and Supply Chain Human Resources from February 2015 to January 2016. Senior Vice President, Target Canada Stores and Distribution from March 2014 to January 2015. Senior Vice President, Store Operations from August 2009 to March 2014. | 50 | |

Cathy R. Smith | Executive Vice President and Chief Financial Officer since September 2015. Executive Vice President and Chief Financial Officer of Express Scripts Holding Company, a pharmacy benefit manager, from February 2014 to December 2014. Executive Vice President of Strategy and Chief Financial Officer for Walmart International, a division of Wal-Mart Stores, Inc., a discount retailer, from March 2010 to January 2014. | 54 | |

Mark J. Tritton | Executive Vice President and Chief Merchandising Officer since June 2016. President of Nordstrom Product Group, of Nordstrom Inc., a fashion specialty retailer, from June 2009 to June 2016. | 54 | |

Laysha L. Ward | Executive Vice President and Chief External Engagement Officer since January 2017. Chief Corporate Social Responsibility Officer from December 2014 to January 2017. President, Community Relations and Target Foundation from July 2008 to December 2014. | 50 | |

13

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the symbol "TGT." We are authorized to issue up to 6,000,000,000 shares of common stock, par value $0.0833, and up to 5,000,000 shares of preferred stock, par value $0.01. At March 8, 2018 , there were 14,710 shareholders of record. Dividends declared per share and the high and low closing common stock price for each fiscal quarter during 2017 and 2016 are disclosed in Note 31 of the Financial Statements.

On September 20, 2016, our Board of Directors authorized a $5 billion share repurchase program. We began repurchasing shares under this authorization during the fourth quarter of 2016. There is no stated expiration for the share repurchase program. Under this program, we repurchased 21.3 million shares of common stock through February 3, 2018, at an average price of $60.52, for a total investment of $1.3 billion. The table below presents information with respect to Target common stock purchases made during the three months ended February 3, 2018 , by Target or any "affiliated purchaser" of Target, as defined in Rule 10b-18(a)(3) under the Exchange Act.

Period | Total Number of Shares Purchased | |

| Average Price Paid per Share | |

| Total Number of Shares Purchased as Part of Publicly Announced Programs | |

| Dollar Value of Shares that May Yet Be Purchased Under Publicly Announced Programs | | ||

October 29, 2017 through November 25, 2017 |

|

|

|

|

|

|

| ||||||

Open market and privately negotiated purchases | 583,027 | |

| $ | 55.36 | |

| 583,027 | |

| $ | 3,841,829,136 | |

August 2017 ASR (a) | 279,645 | |

| 57.78 | |

| 279,645 | |

| 3,931,213,840 | | ||

November 2017 ASR | 2,350,000 | |

| 65.97 | |

| 2,350,000 | |

| 3,681,213,840 | | ||

November 26, 2017 through December 30, 2017 |

|

|

|

|

|

|

| ||||||

Open market and privately negotiated purchases | 548,183 | |

| 57.37 | |

| 548,183 | |

| 3,649,761,870 | | ||

December 31, 2017 through February 3, 2018 |

|

|

|

|

|

|

| ||||||

Open market and privately negotiated purchases | 527,361 | |

| 66.45 | |

| 527,361 | |

| 3,614,721,098 | | ||

November 2017 ASR (b) | - | |

| - | |

| - | |

| 3,709,702,895 | | ||

Total | 4,288,216 | |

| $ | 62.95 | |

| 4,288,216 | |

| $ | 3,709,702,895 | |

(a) | Represents the incremental shares received upon final settlement of the accelerated share repurchase agreement (ASR) initiated in third quarter 2017. |

(b) | No additional shares were received upon final settlement of the ASR initiated in November 2017. |

14

| Fiscal Years Ended | |||||||||||||||||

| February 2, | | February 1, | | January 31, | | January 30, | | January 28, | | February 3, | | ||||||

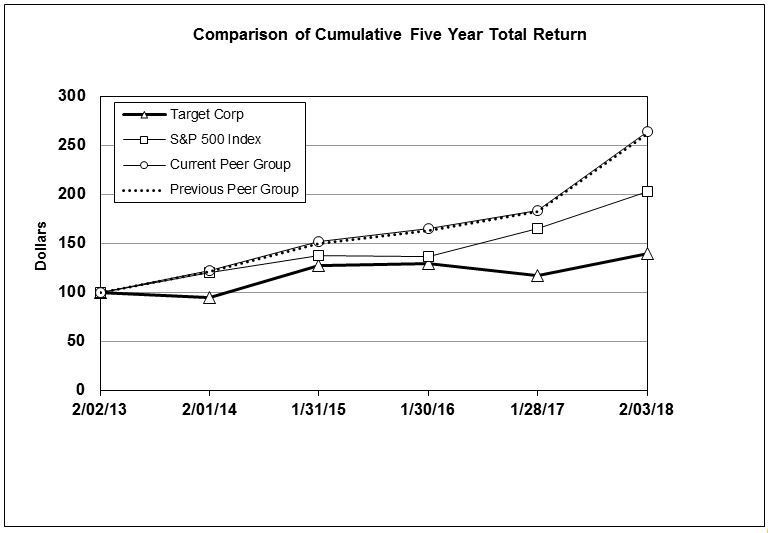

Target | $ | 100.00 | | $ | 94.85 | | $ | 127.22 | | $ | 128.74 | | $ | 116.88 | | $ | 139.50 | |

S&P 500 Index | 100.00 | | 120.30 | | 137.42 | | 136.50 | | 164.99 | | 202.66 | | ||||||

Current Peer Group | 100.00 | | 121.51 | | 151.16 | | 164.97 | | 183.17 | | 263.52 | | ||||||

Previous Peer Group | 100.00 | | 120.95 | | 149.92 | | 163.25 | | 181.67 | | 261.95 | | ||||||

The graph above compares the cumulative total shareholder return on our common stock for the last five fiscal years with (i) the cumulative total return on the S&P 500 Index, (ii) the peer group used in previous filings consisting of 18 online, general merchandise, department store, food, and specialty retailers, which are large and meaningful competitors (Amazon.com, Inc., Best Buy Co., Inc., Costco Wholesale Corporation, CVS Health Corporation, Dollar General Corporation, The Gap, Inc., The Home Depot, Inc., Kohl's Corporation, The Kroger Co., Lowe's Companies, Inc., Macy's, Inc., Publix Super Markets, Inc., Rite Aid Corporation, Sears Holdings Corporation, Staples, Inc., The TJX Companies, Inc., Walgreens Boots Alliance, Inc., and Walmart Inc.) (Previous Peer Group), and (iii) a new peer group consisting of the companies in the Previous Peer Group excluding Publix Super Markets, Inc., which is no longer quoted on a public stock exchange and Staples, Inc., which is no longer publicly traded, plus Dollar Tree, Inc. (Current Peer Group). The Current Peer Group is consistent with the retail peer group used for our definitive Proxy Statement for the Annual Meeting of Shareholders to be held on June 13, 2018.

The peer group is weighted by the market capitalization of each component company. The graph assumes the investment of $100 in Target common stock, the S&P 500 Index and the Peer Group on February 2, 2013, and reinvestment of all dividends.

15

Item 6. Selected Financial Data

| As of or for the Fiscal Year Ended | ||||||||||||||

(millions, except per share data) | 2017 (a) | | 2016 | | 2015 | | 2014 | | 2013 | | |||||

Sales | $ | 71,879 | | $ | 69,495 | | $ | 73,785 | | $ | 72,618 | | $ | 71,279 | |

Net Earnings / (Loss) |

|

|

|

|

| ||||||||||

Continuing operations | 2,928 | | 2,669 | | 3,321 | | 2,449 | | 2,694 | | |||||

Discontinued operations | 6 | | 68 | | 42 | | (4,085 | ) | (723 | ) | |||||

Net earnings / (loss) | 2,934 | | 2,737 | | 3,363 | | (1,636 | ) | 1,971 | | |||||

Basic Earnings / (Loss) Per Share |

|

|

|

|

| ||||||||||

Continuing operations | 5.35 | | 4.62 | | 5.29 | | 3.86 | | 4.24 | | |||||

Discontinued operations | 0.01 | | 0.12 | | 0.07 | | (6.44 | ) | (1.14 | ) | |||||

Basic earnings / (loss) per share | 5.36 | | 4.74 | | 5.35 | | (2.58 | ) | 3.10 | | |||||

Diluted Earnings / (Loss) Per Share |

|

|

|

|

| ||||||||||

Continuing operations | 5.32 | | 4.58 | | 5.25 | | 3.83 | | 4.20 | | |||||

Discontinued operations | 0.01 | | 0.12 | | 0.07 | | (6.38 | ) | (1.13 | ) | |||||

Diluted earnings / (loss) per share | 5.33 | | 4.70 | | 5.31 | | (2.56 | ) | 3.07 | | |||||

Cash dividends declared per share | 2.46 | | 2.36 | | 2.20 | | 1.99 | | 1.65 | | |||||

|

|

|

|

|

| ||||||||||

Total assets | 38,999 | | 37,431 | | 40,262 | | 41,172 | | 44,325 | | |||||

Long-term debt, including current portion | 11,587 | | 12,749 | | 12,760 | | 12,725 | | 12,494 | | |||||

Note: This information should be read in conjunction with MD&A and the Financial Statements. Per share amounts may not foot due to rounding.

(a) | Consisted of 53 weeks. |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Fiscal 2017 (a 53-week year) included the following notable items:

• | GAAP earnings per share from continuing operations were $5.32 , including discrete benefits related to the Tax Cuts and Jobs Act (the Tax Act). |

• | Adjusted earnings per share were $4.71 , which excludes discrete benefits related to the Tax Act and other items described on page 22. |

• | Comparable sales increased 1.3 percent , driven by a 1.6 percent increase in traffic. |

• | Comparable digital channel sales growth of 27 percent contributed 1.2 percentage points of comparable sales growth. |

• | We returned $2.4 billion to shareholders through dividends and share repurchases. |

• | We made several investments to improve and expand our delivery capabilities; most notably, we purchased Shipt, an online same-day delivery company, for approximately $550 million. |

Sales were $71,879 million for 2017 , an increase of $2,384 million or 3.4 percent from the prior year, due to a comparable sales increase of 1.3 percent , the extra week in 2017, and the contribution from new stores. Earnings from continuing operations before interest expense and income taxes in 2017 decreased by $657 million or 13.2 percent from 2016 to $4,312 million . The Analysis of Results of Operations discussion provides more information. Operating cash flow provided by continuing operations was $6,849 million for 2017, an increase of $1,520 million, or 28.5 percent from $5,329 million for 2016. Refer to the Cash Flows discussion within the Liquidity and Capital Resources section of MD&A on page 25 for additional information.

16

Earnings Per Share From Continuing Operations |

|

|

| Percent Change | |||||||||

2017 (a) | | 2016 | | 2015 | | 2017/2016 | | 2016/2015 | | ||||

GAAP diluted earnings per share | $ | 5.32 | | $ | 4.58 | | $ | 5.25 | | 16.2 | % | (12.7 | )% |

Adjustments | (0.61 | ) | 0.42 | | (0.56 | ) |

| |

| | |||

Adjusted diluted earnings per share | $ | 4.71 | | $ | 5.01 | | $ | 4.69 | | (5.9 | )% | 6.7 | % |

(a) Consisted of 53 weeks.

We report after-tax return on invested capital (ROIC) from continuing operations because we believe ROIC provides a meaningful measure of our capital-allocation effectiveness over time. For the trailing twelve months ended February 3, 2018 , ROIC was 15.9 percent, compared with 15.0 percent for the trailing twelve months ended January 28, 2017 . Excluding the discrete impacts of the Tax Act, ROIC was 14.0 percent for the trailing twelve months ended February 3, 2018 . A reconciliation of ROIC is provided on page 24.

Analysis of Results of Operations

Segment Results

|

|

|

| Percent Change | |||||||||

(dollars in millions) | 2017 (a) | | 2016 | | 2015 (b) | | 2017/2016 | | 2016/2015 | | |||

Sales | $ | 71,879 | | $ | 69,495 | | $ | 73,785 | | 3.4 | % | (5.8 | )% |

Cost of sales (c) | 51,125 | | 49,145 | | 52,241 | | 4.0 | | (5.9 | ) | |||

Gross margin | 20,754 | | 20,350 | | 21,544 | | 2.0 | | (5.5 | ) | |||

SG&A expenses (d) | 14,248 | | 13,360 | | 14,448 | | 6.6 | | (7.5 | ) | |||

Depreciation and amortization (exclusive of depreciation included in cost of sales) (c) | 2,194 | | 2,025 | | 1,969 | | 8.4 | | 2.8 | | |||

EBIT | $ | 4,312 | | $ | 4,965 | | $ | 5,127 | | (13.2 | )% | (3.2 | )% |

Note: See Note 30 of our Financial Statements for a reconciliation of our segment results to Earnings Before Income Taxes and more information about items recorded outside of segment SG&A.

(a) | Consisted of 53 weeks. |

(b) | Sales and Cost of Sales include $3,815 million and $3,076 million, respectively, related to our former pharmacy and clinic businesses for 2015. The sale of these businesses had no notable impact on EBIT. |

(c) | Refer to Note 3 of the Financial Statements for information about the reclassification of supply chain-related depreciation expense to Cost of Sales. |

(d) | For 2017, 2016, and 2015, SG&A Expenses includes $694 million, $663 million, and $641 million, respectively, of net profit-sharing income under our credit card program agreement. |

Rate Analysis | 2017 (a) | | 2016 | | 2015 | |

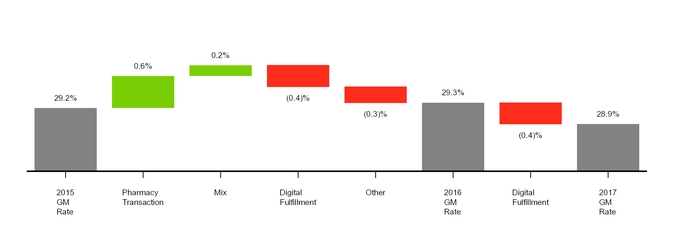

Gross margin rate (b) | 28.9 | % | 29.3 | % | 29.2 | % |

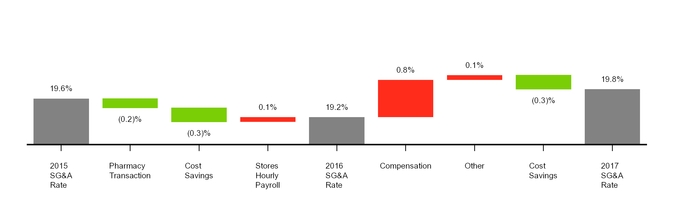

SG&A expense rate | 19.8 | | 19.2 | | 19.6 | |

Depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate (b) | 3.1 | | 2.9 | | 2.7 | |

EBIT margin rate (c) | 6.0 | | 7.1 | | 6.9 | |

Note: Rate analysis metrics are computed by dividing the applicable amount by Sales.

(a) | Consisted of 53 weeks. |

(b) | Reclassifying supply chain-related depreciation expense to Cost of Sales reduced the gross margin and depreciation and amortization rates by 0.3-0.4 percentage points for all periods presented. |

(c) | Excluding sales of our former pharmacy and clinic businesses, EBIT margin rate was 7.3 percent for 2015. |

17

Sales

Sales include all merchandise sales, net of expected returns, and gift card breakage. Note 2 of the Financial Statements provides a gift card "breakage" definition. Digital channel sales include all sales initiated through mobile applications and our websites. Digital channel sales may be fulfilled through our stores, our distribution centers, our vendors, or other delivery options, including store drive-up and delivery via our wholly own subsidiary, Shipt.

The increase in 2017 sales is due to a comparable sales increase of 1.3 percent , the extra week in 2017, and the contribution from new stores. The extra week contributed $1,167 million of sales, or 1.7 percentage points of increase over 2016. The decrease in 2016 sales compared to 2015 reflects a decrease of approximately $3,815 million due to the Pharmacy Transaction and a 0.5 percent comparable sales decrease, partially offset by the contribution from new stores. Inflation did not materially affect sales in any period presented.

Sales by Channel | 2017 | | 2016 | | 2015 (a) | |

Stores | 94.5 | % | 95.6 | % | 96.6 | % |

Digital | 5.5 | | 4.4 | | 3.4 | |

Total | 100 | % | 100 | % | 100 | % |

(a) | Excluding sales of our former pharmacy and clinic businesses, stores and digital channels sales were 96.4 percent and 3.6 percent of total sales, respectively, for 2015. |

Comparable sales is a measure that highlights the performance of our stores and digital channel sales by measuring the change in sales for a period over the comparable, prior-year period of equivalent length. Comparable sales include all sales, except sales from stores open less than 13 months, digital acquisitions we have owned less than 13 months, stores that have been closed, and digital acquisitions that we no longer operate. We removed pharmacy and clinic sales from the 2015 sales amounts when calculating 2016 comparable sales. Comparable sales measures vary across the retail industry. As a result, our comparable sales calculation is not necessarily comparable to similarly titled measures reported by other companies.

Comparable Sales | 2017 | | 2016 | | 2015 | |

Comparable sales change | 1.3 | % | (0.5 | )% | 2.1 | % |

Drivers of change in comparable sales |

|

|

| |||

Number of transactions | 1.6 | | (0.8 | ) | 1.3 | |

Average transaction amount | (0.3 | ) | 0.3 | | 0.8 | |

Contribution to Comparable Sales Change | 2017 | | 2016 | | 2015 | |

Stores channel comparable sales change | 0.1 | % | (1.5 | )% | 1.3 | % |

Digital channel contribution to comparable sales change | 1.2 | | 1.0 | | 0.8 | |

Total comparable sales change | 1.3 | % | (0.5 | )% | 2.1 | % |

Note: Amounts may not foot due to rounding .

18

Sales by Product Category | Percentage of Sales | |||||

| 2017 | | 2016 | | 2015 | |

Beauty and household essentials (a)(b) | 23 | % | 24 | % | 28 | % |

Food and beverage (a)(c) | 20 | | 20 | | 19 | |

Apparel and accessories (d) | 20 | | 20 | | 19 | |

Home furnishings and décor (e) | 19 | | 19 | | 17 | |

Hardlines (f) | 18 | | 17 | | 17 | |

Total | 100 | % | 100 | % | 100 | % |

(a) | For all periods presented, pet supplies, which represented approximately 2 percent of total sales, has been reclassified from food and beverage to beauty and household essentials. |

(b) | Includes pharmacy, beauty, personal care, baby care, cleaning, paper products, and pet supplies. Pharmacy represented 5 percent of total sales in 2015. |

(c) | Includes dry grocery, dairy, frozen food, beverages, candy, snacks, deli, bakery, meat, and produce. |

(d) | Includes apparel for women, men, boys, girls, toddlers, infants and newborns, as well as intimate apparel, jewelry, accessories, and shoes. |

(e) | Includes furniture, lighting, kitchenware, small appliances, home décor, bed and bath, home improvement, automotive, and seasonal merchandise such as patio furniture and holiday décor. |

(f) | Includes electronics (including video game hardware and software), music, movies, books, computer software, sporting goods, and toys. |

The collective interaction of a broad array of macroeconomic, competitive, and consumer behavioral factors, as well as sales mix and transfer of sales to new stores makes further analysis of sales metrics infeasible.

TD offers credit to qualified guests through Target-branded credit cards: the Target Credit Card and the Target MasterCard Credit Card (Target Credit Cards). Additionally, we offer a branded proprietary Target Debit Card. Collectively, we refer to these products as REDcards ® . Guests receive a 5 percent discount on virtually all purchases and free shipping when they use a REDcard. We monitor the percentage of sales that are paid for using REDcards (REDcard Penetration) because our internal analysis has indicated that a meaningful portion of incremental purchases on our REDcards are also incremental sales for Target.

REDcard Penetration | 2017 | | 2016 | | 2015 | |

Target Debit Card | 13.0 | % | 12.8 | % | 12.1 | % |

Target Credit Cards | 11.3 | | 11.2 | | 10.1 | |

Total REDcard Penetration | 24.3 | % | 24.0 | % | 22.3 | % |

Note: Excluding pharmacy and clinic sales, total REDcard penetration would have been 23.2 percent for 2015. The sum of Target Credit Cards and Target Debit Card penetration may not equal Total REDcard Penetration due to rounding.

Gross Margin Rate

Our gross margin rate was 28.9 percent in 2017 , 29.3 percent in 2016 , and 29.2 percent in 2015 . The 2017 decrease was primarily due to increased digital fulfillment costs. Benefits from cost savings initiatives were offset by net investments in pricing and promotions.

19

The 2016 increase was primarily due to the Pharmacy Transaction and favorable category sales mix, partially offset by increased digital fulfillment costs. Cost of goods savings helped offset the impact of a competitive promotional environment.

Selling, General and Administrative Expense Rate

Our SG&A expense rate was 19.8 percent in 2017 , 19.2 percent in 2016 , and 19.6 percent in 2015 . The increase in 2017 was primarily due to higher compensation costs, including both bonus expense and store wages, partially offset by cost savings primarily driven by efficiency in our technology operations.

The decrease in 2016 primarily resulted from the benefit of the Pharmacy Transaction and technology-related cost savings, partially offset by increased stores hourly payroll.

Depreciation and Amortization Expense Rate

Our depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate was 3.1 percent in 2017 , 2.9 percent in 2016 , and 2.7 percent in 2015 . The 2017 increase was primarily due to higher accelerated depreciation for planned store remodels, partially offset by the rate impact of the 53rd week of sales. The 2016 increase was due to the rate impact of lower sales in 2016 than 2015.

Store Data

Change in Number of Stores | 2017 | | 2016 | |

Beginning store count | 1,802 | | 1,792 | |

Opened | 32 | | 15 | |

Closed | (12 | ) | (5 | ) |

Ending store count | 1,822 | | 1,802 | |

Number of Stores and | Number of Stores |

| Retail Square Feet (a) | ||||||

February 3, 2018 | | January 28, 2017 | |

| February 3, 2018 | | January 28, 2017 | | |

170,000 or more sq. ft. | 274 | | 276 | |

| 48,966 | | 49,328 | |

50,000 to 169,999 sq. ft. | 1,500 | | 1,504 | |

| 189,030 | | 189,620 | |

49,999 or less sq. ft. | 48 | | 22 | |

| 1,359 | | 554 | |

Total | 1,822 | | 1,802 | |

| 239,355 | | 239,502 | |

(a) | In thousands, reflects total square feet less office, distribution center and vacant space. |

20

Other Performance Factors

Other Selling, General and Administrative Expenses

We recorded $(4) million and $216 million of selling, general and administrative expenses outside of the segment during 2016 and 2015 , respectively, because they relate to discretely managed matters. Additional information about these discretely managed items is provided within Note 30 of the Financial Statements.

Net Interest Expense

Net interest expense from continuing operations was $666 million , $1,004 million , and $607 million for 2017 , 2016 , and 2015 , respectively. Net interest expense for 2017 and 2016 included losses on early retirement of debt of $123 million and $422 million, respectively.

Provision for Income Taxes

Our 2017 effective income tax rate from continuing operations decreased to 19.7 percent, from 32.7 percent in 2016 , driven primarily by the impact of the Tax Act, which among other matters reduced the U.S. corporate income tax rate from 35 percent to 21 percent effective January 1, 2018.

The Tax Act reduced our 2017 income tax expense by $388 million, comprised of the following:

• | The new lower tax rate reduced tax expense by $36 million. Target's U.S. federal statutory tax rate was 33.7 percent for 2017, which reflects a blended federal statutory rate of 35% for approximately 11 months and 21% for approximately 1 month. |

• | We recognized a provisional net tax benefit of $352 million related to remeasurement of our net deferred tax liabilities, including $381 million of benefit from the new lower rate, partially offset by $29 million of deferred income tax expense from our foreign operations. In 2017, due to changes effected by the Tax Act and other reasons, we have not asserted i ndefinite reinvestment in our foreign operations. |

Certain other provisions of the Tax Act not expected to have a material impact on net income are as follows:

• | Through 2022, the Tax Act allows companies to immediately deduct the cost of certain capital expenditures from taxable income instead of deducting the costs over time. This provision phases out over 2023-2027. |

• | The Tax Act implements a territorial tax system and imposes a one-time repatriation tax on deemed repatriated accumulated foreign earnings as of December 31, 2017. The one-time repatriation tax did not materially affect our net tax expense because in the aggregate our foreign entities have an accumulated earnings deficit, driven by our discontinued operations. |

• | Although the Tax Act generally eliminates U.S. federal income tax on dividends from foreign subsidiaries, it creates a new requirement that certain income referred to as global intangible low-taxed income earned by controlled foreign corporations must be included currently in the gross income of the entity's U.S. shareholder. |

• | The Tax Act limits the deductibility of interest, executive compensation, and certain other expenses. |

As described in Note 23 of the Financial Statements, certain aspects of our 2017 income tax provision related to the Tax Act amounts are provisional.

We expect a 2018 effective tax rate of 22 percent to 25 percent. We expect a corresponding 2018 operating cash flow benefit from the lower rate and, to a lesser degree, additional operating cash flow benefits from the immediate deductibility provision described above.

21

Our 2016 effective income tax rate from continuing operations increased to 32.7 percent, from 32.5 percent in 2015 , driven primarily by the 2015 rate impact of the $112 million tax benefit from releasing the valuation allowance on a capital loss carryforward. This comparative rate impact was partially offset by $27 million of excess tax benefit in 2016 related to shared-based payments after the adoption of Accounting Standards Update (ASU) No. 2016-09, Improvements to Employee Share-Based Payment Accounting, and lower pretax earnings.

Note 23 of the Financial Statements provides additional information.

Discontinued Operations

See Note 7 of the Financial Statements for information about our Canada exit.

Reconciliation of Non-GAAP Financial Measures to GAAP Measures

To provide additional transparency, we have disclosed non-GAAP adjusted diluted earnings per share from continuing operations (Adjusted EPS). This metric excludes certain items presented below. We believe this information is useful in providing period-to-period comparisons of the results of our continuing operations. This measure is not in accordance with, or an alternative to, generally accepted accounting principles in the United States (GAAP). The most comparable GAAP measure is diluted earnings per share from continuing operations. Adjusted EPS should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Other companies may calculate Adjusted EPS differently than we do, limiting the usefulness of the measure for comparisons with other companies.

|

| 2017 (a) |

| 2016 |

| 2015 | ||||||||||||||||||||||||||||||

(millions, except per share data) |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | | |||||||||

GAAP diluted earnings per share from continuing operations |

|

|

|

|

| $ | 5.32 | |

|

|

|

|

| $ | 4.58 | |

|

|

|

|

| $ | 5.25 | | ||||||||||||

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||

Tax Act (b) |

| $ | - | |

| $ | (352 | ) |

| $ | (0.64 | ) |

| $ | - | |

| $ | - | |

| $ | - | |

| $ | - | |

| $ | - | |

| $ | - | |

Loss on early retirement of debt |

| 123 | |

| 75 | |

| 0.14 | |

| 422 | |

| 257 | |

| 0.44 | |

| - | |

| - | |

| - | | |||||||||

Gain on sale (c) |

| - | |

| - | |

| - | |

| - | |

| - | |

| - | |

| (620 | ) |

| (487 | ) |

| (0.77 | ) | |||||||||

Restructuring costs (d) |

| - | |

| - | |

| - | |

| - | |

| - | |

| - | |

| 138 | |

| 87 | |

| 0.14 | | |||||||||