UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended October 28, 2017

Commission File Number 1-6049

|

TARGET CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota |

| 41-0215170 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

1000 Nicollet Mall, Minneapolis, Minnesota |

| 55403 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code: 612/304-6073

Former name, former address and former fiscal year, if changed since last report: N/A

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company (as defined in Rule 12b-2 of the Exchange Act).

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | |||

Smaller reporting company o | Emerging growth company o | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of registrant's classes of common stock, as of the latest practicable date. Total shares of common stock, par value $0.0833, outstanding at November 14, 2017 were 543,572,649.

TARGET CORPORATION

TABLE OF CONTENTS

PART I | FINANCIAL INFORMATION |

|

Item 1. | Financial Statements (unaudited) |

|

| Consolidated Statements of Operations | 1 |

| Consolidated Statements of Comprehensive Income | 2 |

| Consolidated Statements of Financial Position | 3 |

| Consolidated Statements of Cash Flows | 4 |

| Consolidated Statements of Shareholders' Investment | 5 |

| Notes to Consolidated Financial Statements | 6 |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 12 |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 23 |

Item 4. | Controls and Procedures | 23 |

|

|

|

PART II | OTHER INFORMATION |

|

Item 1. | Legal Proceedings | 24 |

Item 1A. | Risk Factors | 24 |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 25 |

Item 3. | Defaults Upon Senior Securities | 25 |

Item 4. | Mine Safety Disclosures | 25 |

Item 5. | Other Information | 25 |

Item 6. | Exhibits | 26 |

|

|

|

Signature |

| 27 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Consolidated Statements of Operations |

|

|

|

|

|

|

| ||||||||

| Three Months Ended |

| Nine Months Ended | ||||||||||||

(millions, except per share data) (unaudited) | October 28, | |

| October 29, | |

| October 28, | |

| October 29, | | ||||

Sales | $ | 16,667 | |

| $ | 16,441 | |

| $ | 49,113 | |

| $ | 48,805 | |

Cost of sales (a) | 11,712 | |

| 11,536 | |

| 34,330 | |

| 33,957 | | ||||

Gross margin | 4,955 | |

| 4,905 | |

| 14,783 | |

| 14,848 | | ||||

Selling, general and administrative expenses | 3,512 | |

| 3,339 | |

| 10,027 | |

| 9,741 | | ||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) (a) | 574 | |

| 505 | |

| 1,596 | |

| 1,486 | | ||||

Earnings from continuing operations before interest expense and income taxes | 869 | |

| 1,061 | |

| 3,160 | |

| 3,621 | | ||||

Net interest expense | 254 | |

| 142 | |

| 532 | |

| 864 | | ||||

Earnings from continuing operations before income taxes | 615 | |

| 919 | |

| 2,628 | |

| 2,757 | | ||||

Provision for income taxes | 137 | |

| 311 | |

| 802 | |

| 910 | | ||||

Net earnings from continuing operations | 478 | |

| 608 | |

| 1,826 | |

| 1,847 | | ||||

Discontinued operations, net of tax | 2 | |

| - | |

| 7 | |

| 73 | | ||||

Net earnings | $ | 480 | |

| $ | 608 | |

| $ | 1,833 | |

| $ | 1,920 | |

Basic earnings per share |

|

|

|

|

|

|

| ||||||||

Continuing operations | $ | 0.88 | |

| $ | 1.07 | |

| $ | 3.33 | |

| $ | 3.16 | |

Discontinued operations | - | |

| - | |

| 0.01 | |

| 0.12 | | ||||

Net earnings per share | $ | 0.88 | |

| $ | 1.07 | |

| $ | 3.34 | |

| $ | 3.29 | |

Diluted earnings per share |

|

|

|

|

|

|

| ||||||||

Continuing operations | $ | 0.87 | |

| $ | 1.06 | |

| $ | 3.31 | |

| $ | 3.14 | |

Discontinued operations | - | |

| - | |

| 0.01 | |

| 0.12 | | ||||

Net earnings per share | $ | 0.88 | |

| $ | 1.06 | |

| $ | 3.32 | |

| $ | 3.26 | |

Weighted average common shares outstanding |

|

|

|

|

|

|

| ||||||||

Basic | 544.5 | |

| 570.1 | |

| 548.7 | |

| 583.5 | | ||||

Dilutive impact of share-based awards | 3.4 | |

| 4.7 | |

| 3.1 | |

| 5.0 | | ||||

Diluted | 547.9 | |

| 574.8 | |

| 551.8 | |

| 588.5 | | ||||

Antidilutive shares | 4.5 | |

| 0.2 | |

| 4.1 | |

| 0.1 | | ||||

Dividends declared per share | $ | 0.62 | |

| $ | 0.60 | |

| $ | 1.84 | |

| $ | 1.76 | |

Note: Per share amounts may not foot due to rounding.

(a) Refer to Note 3 for information about a reclassification of supply chain-related depreciation expense to cost of sales.

See accompanying Notes to Consolidated Financial Statements.

1

Consolidated Statements of Comprehensive Income |

|

| ||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||

(millions) (unaudited) | October 28, | |

| October 29, | | October 28, | |

| October 29, | | ||||

Net earnings | $ | 480 | |

| $ | 608 | | $ | 1,833 | |

| $ | 1,920 | |

Other comprehensive income |

| |

|

| |

| |

|

| | ||||

Pension and other benefit liabilities, net of taxes of $5, $3, $15 and $11 | 8 | |

| 6 | | 22 | |

| 17 | | ||||

Currency translation adjustment and cash flow hedges, net of taxes of $1, $1, $2, and $2 | (2 | ) |

| - | | 6 | |

| 5 | | ||||

Other comprehensive income | 6 | |

| 6 | | 28 | |

| 22 | | ||||

Comprehensive income | $ | 486 | |

| $ | 614 | | $ | 1,861 | |

| $ | 1,942 | |

See accompanying Notes to Consolidated Financial Statements.

2

Consolidated Statements of Financial Position |

| |

|

| |

|

| | |||

(millions) (unaudited) | October 28, | |

| January 28, | |

| October 29, | | |||

Assets |

|

|

| |

|

| |||||

Cash and cash equivalents | $ | 2,725 | |

| $ | 2,512 | |

| $ | 1,231 | |

Inventory | 10,586 | |

| 8,309 | |

| 10,057 | | |||

Assets of discontinued operations | 6 | |

| 69 | |

| 62 | | |||

Other current assets | 1,392 | |

| 1,100 | |

| 1,492 | | |||

Total current assets | 14,709 | |

| 11,990 | |

| 12,842 | | |||

Property and equipment |

| |

|

| |

|

| | |||

Land | 6,087 | |

| 6,106 | |

| 6,106 | | |||

Buildings and improvements | 28,310 | |

| 27,611 | |

| 27,518 | | |||

Fixtures and equipment | 5,548 | |

| 5,503 | |

| 5,467 | | |||

Computer hardware and software | 2,658 | |

| 2,651 | |

| 2,538 | | |||

Construction-in-progress | 389 | |

| 200 | |

| 219 | | |||

Accumulated depreciation | (17,880 | ) |

| (17,413 | ) |

| (16,946 | ) | |||

Property and equipment, net | 25,112 | |

| 24,658 | |

| 24,902 | | |||

Noncurrent assets of discontinued operations | 9 | |

| 12 | |

| 17 | | |||

Other noncurrent assets | 878 | |

| 771 | |

| 842 | | |||

Total assets | $ | 40,708 | |

| $ | 37,431 | |

| $ | 38,603 | |

Liabilities and shareholders' investment |

| |

|

| |

|

| | |||

Accounts payable | $ | 9,986 | |

| $ | 7,252 | |

| $ | 8,250 | |

Accrued and other current liabilities | 4,036 | |

| 3,737 | |

| 3,662 | | |||

Current portion of long-term debt and other borrowings | 1,354 | |

| 1,718 | |

| 729 | | |||

Total current liabilities | 15,376 | |

| 12,707 | |

| 12,641 | | |||

Long-term debt and other borrowings | 11,277 | |

| 11,031 | |

| 12,097 | | |||

Deferred income taxes | 944 | |

| 861 | |

| 920 | | |||

Liabilities of discontinued operations | 11 | |

| 19 | |

| 19 | | |||

Other noncurrent liabilities | 1,963 | |

| 1,860 | |

| 1,857 | | |||

Total noncurrent liabilities | 14,195 | |

| 13,771 | |

| 14,893 | | |||

Shareholders' investment |

| |

|

| |

|

| | |||

Common stock | 45 | |

| 46 | |

| 47 | | |||

Additional paid-in capital | 5,762 | |

| 5,661 | |

| 5,598 | | |||

Retained earnings | 5,940 | |

| 5,884 | |

| 6,031 | | |||

Accumulated other comprehensive loss | (610 | ) |

| (638 | ) |

| (607 | ) | |||

Total shareholders' investment | 11,137 | |

| 10,953 | |

| 11,069 | | |||

Total liabilities and shareholders' investment | $ | 40,708 | |

| $ | 37,431 | |

| $ | 38,603 | |

Common Stock Authorized 6,000,000,000 shares, $.0833 par value; 543,913,318 , 556,156,228 and 563,676,785 shares issued and outstanding at October 28, 2017 , January 28, 2017 and October 29, 2016 , respectively.

Preferred Stock Authorized 5,000,000 shares, $.01 par value; no shares were issued or outstanding during any period presented.

See accompanying Notes to Consolidated Financial Statements.

3

Consolidated Statements of Cash Flows |

|

|

| ||||

| Nine Months Ended | ||||||

(millions) (unaudited) | October 28, | |

| October 29, | | ||

Operating activities |

| |

|

| | ||

Net earnings | $ | 1,833 | |

| $ | 1,920 | |

Earnings from discontinued operations, net of tax | 7 | |

| 73 | | ||

Net earnings from continuing operations | 1,826 | |

| 1,847 | | ||

Adjustments to reconcile net earnings to cash provided by operations |

| |

|

| | ||

Depreciation and amortization | 1,784 | |

| 1,686 | | ||

Share-based compensation expense | 81 | |

| 85 | | ||

Deferred income taxes | 37 | |

| 83 | | ||

Loss on debt extinguishment | 123 | |

| 422 | | ||

Noncash losses / (gains) and other, net | 189 | |

| (5 | ) | ||

Changes in operating accounts |

| |

|

| |||

Inventory | (2,277 | ) |

| (1,455 | ) | ||

Other assets | (89 | ) |

| (14 | ) | ||

Accounts payable | 2,738 | |

| 832 | | ||

Accrued and other liabilities | 2 | |

| (711 | ) | ||

Cash provided by operating activities-continuing operations | 4,414 | |

| 2,770 | | ||

Cash provided by operating activities-discontinued operations | 75 | |

| 111 | | ||

Cash provided by operations | 4,489 | |

| 2,881 | | ||

Investing activities |

| |

|

| | ||

Expenditures for property and equipment | (2,049 | ) |

| (1,184 | ) | ||

Proceeds from disposal of property and equipment | 27 | |

| 23 | | ||

Other investments | (62 | ) |

| 23 | | ||

Cash required for investing activities | (2,084 | ) |

| (1,138 | ) | ||

Financing activities |

| |

|

| | ||

Change in commercial paper, net | - | |

| 89 | | ||

Additions to long-term debt | 739 | |

| 1,977 | | ||

Reductions of long-term debt | (1,087 | ) |

| (2,625 | ) | ||

Dividends paid | (1,001 | ) |

| (1,011 | ) | ||

Repurchase of stock | (757 | ) |

| (3,034 | ) | ||

Prepayment of accelerated share repurchase | (111 | ) |

| (120 | ) | ||

Stock option exercises | 25 | |

| 166 | | ||

Cash required for financing activities | (2,192 | ) |

| (4,558 | ) | ||

Net increase / (decrease) in cash and cash equivalents | 213 | |

| (2,815 | ) | ||

Cash and cash equivalents at beginning of period | 2,512 | |

| 4,046 | | ||

Cash and cash equivalents at end of period | $ | 2,725 | |

| $ | 1,231 | |

See accompanying Notes to Consolidated Financial Statements.

4

Consolidated Statements of Shareholders' Investment | ||||||||||||||||||||||

| Common | |

| Stock | |

| Additional | |

|

| |

| Accumulated Other | |

|

| | |||||

| Stock | |

| Par | |

| Paid-in | |

| Retained | |

| Comprehensive | |

|

| | |||||

(millions) (unaudited) | Shares | |

| Value | |

| Capital | |

| Earnings | |

| (Loss) / Income | |

| Total | | |||||

January 30, 2016 | 602.2 | |

| $ | 50 | |

| $ | 5,348 | |

| $ | 8,188 | |

| $ | (629 | ) |

| $ | 12,957 | |

Net earnings | - | |

| - | |

| - | |

| 2,737 | |

| - | |

| 2,737 | | |||||

Other comprehensive loss | - | |

| - | |

| - | |

| - | |

| (9 | ) |

| (9 | ) | |||||

Dividends declared | - | |

| - | |

| - | |

| (1,359 | ) |

| - | |

| (1,359 | ) | |||||

Repurchase of stock | (50.9 | ) |

| (4 | ) |

| - | |

| (3,682 | ) |

| - | |

| (3,686 | ) | |||||

Stock options and awards | 4.9 | |

| - | |

| 313 | |

| - | |

| - | |

| 313 | | |||||

January 28, 2017 | 556.2 | |

| $ | 46 | |

| $ | 5,661 | |

| $ | 5,884 | |

| $ | (638 | ) |

| $ | 10,953 | |

Net earnings | - | |

| - | |

| - | |

| 1,833 | |

| - | |

| 1,833 | | |||||

Other comprehensive income | - | |

| - | |

| - | |

| - | |

| 28 | |

| 28 | | |||||

Dividends declared | - | |

| - | |

| - | |

| (1,016 | ) |

| - | |

| (1,016 | ) | |||||

Repurchase of stock | (13.3 | ) |

| (1 | ) |

| - | |

| (750 | ) |

| - | |

| (751 | ) | |||||

Stock to be received upon settlement of ASR | - | |

| - | |

| - | |

| (11 | ) |

| - | |

| (11 | ) | |||||

Stock options and awards | 1.0 | |

| - | |

| 101 | |

| - | |

| - | |

| 101 | | |||||

October 28, 2017 | 543.9 | |

| $ | 45 | |

| $ | 5,762 | |

| $ | 5,940 | |

| $ | (610 | ) |

| $ | 11,137 | |

See accompanying Notes to Consolidated Financial Statements.

5

Notes to Consolidated Financial Statements (unaudited)

1. Accounting Policies

These financial statements should be read in conjunction with the financial statement disclosures in our 2016 Form 10-K.

We use the same accounting policies in preparing quarterly and annual financial statements. All adjustments necessary for a fair presentation of quarterly operating results are reflected herein and are of a normal, recurring nature. Certain prior-year amounts have been reclassified to conform to the current year presentation. Note 3 provides more information about a reclassification of supply chain-related depreciation expense to cost of sales. Unless otherwise noted, amounts presented within the Notes to Consolidated Financial Statements refer to our continuing operations.

Due to the seasonal nature of our business, quarterly revenues, expenses, earnings, and cash flows are not necessarily indicative of the results that may be expected for the full year.

2. Revenues

In May 2014, the FASB issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606). We plan to adopt the standard in the first quarter of fiscal 2018 using the full retrospective approach. We do not expect the standard to materially affect our consolidated net earnings, financial position, or cash flows. We expect minor changes to the timing of recognition of revenues related to promotional gift cards.

We are nearly complete with our evaluation of the impact the standard has on our determination of whether we act as principal or agent in certain vendor arrangements where the purchase and sale of inventory are virtually simultaneous. We record revenue and related costs on a gross basis for the vast majority of these arrangements, which represent approximately 3 percent of our consolidated sales. We expect to conclude that we should continue to record these transactions on a gross basis.

We expect to present certain other income streams, including credit card profit sharing income, in an other revenue line on our Consolidated Statements of Operations upon adoption.

3 . Cost of Sales and Selling, General and Administrative Expenses

Beginning in the second quarter of 2017, we reclassified supply chain-related depreciation expense to cost of sales whereas it was previously included in depreciation and amortization on our Consolidated Statements of Operations. We reclassified prior year amounts to reflect this change. This reclassification increased cost of sales by $60 million and $189 million for the three and nine months ended October 28, 2017, respectively, and $65 million and $200 million for the three and nine months ended October 29, 2016, respectively, with equal and offsetting decreases to depreciation and amortization. This reclassification had no impact on sales, earnings before interest expense and income taxes, net earnings or earnings per share.

The following table illustrates the primary items classified in each major expense category:

Cost of Sales | Selling, General and Administrative Expenses |

Total cost of products sold including: | Compensation and benefit costs for stores and Advertising, offset by vendor income that is a |

6

4. Fair Value Measurements

Fair value measurements are reported in one of three levels reflecting the valuation techniques used to determine fair value.

Fair Value Measurements - Recurring Basis |

| Fair Value at | ||||||||||

(millions) | Pricing Category | October 28, | |

| January 28, | |

| October 29, | | |||

Assets |

|

| |

|

| |

|

| | |||

Cash and cash equivalents |

|

| |

|

| |

|

| | |||

Short-term investments held by U.S. entities | Level 1 | $ | 953 | |

| $ | 1,110 | |

| $ | - | |

Short-term investments held by entities located outside the U.S. (a) | Level 1 | 1,050 | |

| 762 | |

| 514 | | |||

Other current assets |

|

| |

|

| |

|

| | |||

Prepaid forward contracts | Level 1 | 30 | |

| 26 | |

| 28 | | |||

Beneficial interest asset | Level 3 | 3 | |

| 12 | |

| 10 | | |||

Interest rate swaps (b) | Level 2 | - | |

| 1 | |

| - | | |||

Other noncurrent assets |

|

| |

|

| |

|

| | |||

Interest rate swaps (b) | Level 2 | 1 | |

| 4 | |

| 19 | | |||

Beneficial interest asset | Level 3 | - | |

| - | |

| 5 | | |||

(a) Amounts may be subject to tax if repatriated.

(b) See Note 8 for additional information on interest rate swaps.

Significant Financial Instruments not Measured at Fair Value (a) (millions) | October 28, 2017 |

| January 28, 2017 |

| October 29, 2016 | |||||||||||||||

Carrying Amount | | Fair Value | |

| Carrying Amount | | Fair Value | |

| Carrying Amount | | Fair Value | | |||||||

Debt (b) | $ | 11,522 | | $ | 12,403 | |

| $ | 11,715 | | $ | 12,545 | |

| $ | 11,802 | | $ | 13,171 | |

(a) The carrying amounts of certain other current assets, accounts payable, and certain accrued and other current liabilities approximate fair value due to their short-term nature.

(b) The carrying amount and estimated fair value of debt exclude unamortized swap valuation adjustments and capital lease obligations.

5. Cash and Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less from the time of purchase. Cash equivalents also include amounts due from third-party financial institutions for credit and debit card transactions, which typically settle in 5 days or less.

(millions) | October 28, | | January 28, | | October 29, | | |||

|

|

|

| ||||||

Cash held by U.S. entities | $ | 242 | | $ | 257 | | $ | 247 | |

Cash held by entities located outside the U.S. (a) | 34 | | 17 | | 35 | | |||

Short-term investments held by U.S. entities | 953 | | 1,110 | | - | | |||

Short-term investments held by entities located outside the U.S. (a) | 1,050 | | 762 | | 514 | | |||

Receivables from third-party financial institutions for credit and debit card transactions | 446 | | 366 | | 435 | | |||

Cash and cash equivalents | $ | 2,725 | | $ | 2,512 | | $ | 1,231 | |

(a) Amounts may be subject to tax if repatriated.

7

6. Property and Equipment

We review long-lived assets for impairment when events or changes in circumstances-such as a decision to relocate or close a store or distribution center, make significant software changes or discontinue projects-indicate that the asset's carrying value may not be recoverable. We recognized impairment losses of $1 million and $89 million during the three and nine months ended October 28, 2017 , respectively, primarily resulting from planned or completed store closures and supply chain changes for the nine month period. Storm-related write-offs of property and equipment, net of insurance recoveries, were immaterial. We recognized impairment losses of $9 million and $37 million during the three and nine months ended October 29, 2016 , respectively, primarily resulting from planned or completed store closures. The impairments are recorded in selling, general and administrative expense on the Consolidated Statements of Operations and are included in segment results.

7. Notes Payable and Long-Term Debt

In October 2017, we issued unsecured fixed rate debt of $750 million at 3.9% that matures in November 2047. During the three months ended October 28, 2017, we repurchased $344 million of debt before its maturity at a market value of $463 million . We recognized a loss on early retirement of approximately $123 million , which was recorded in net interest expense in our Consolidated Statements of Operations.

In May 2017, we used cash on hand to repay $598 million of debt at its maturity.

In April 2016, we issued unsecured fixed rate debt of $1 billion at 2.5% that matures in April 2026 and $1 billion at 3.625% that matures in April 2046. During the first and second quarter of 2016, we repurchased $565 million and $824 million of debt, respectively, before its maturity at a market value of $820 million and $981 million , respectively. We recognized a loss on early retirement of approximately $261 million and $161 million in first and second quarter of 2016, respectively, which was recorded in net interest expense in our Consolidated Statements of Operations.

We obtain short-term financing from time to time under our commercial paper program, a form of notes payable. No balances were outstanding at any time during the nine months ended October 28, 2017 . For the three and nine months ended October 29, 2016 , the maximum amount outstanding was $89 million and the average daily amounts outstanding were $3 million and $1 million , respectively, at a weighted average annual interest rate of 0.43 percent . At October 29, 2016, $89 million was outstanding.

8. Derivative Financial Instruments

Our derivative instruments primarily consist of interest rate swaps, which we use to mitigate interest rate risk. As a result of our use of derivative instruments, we have counterparty credit exposure to large global financial institutions. We monitor this concentration of counterparty credit risk on an ongoing basis. See Note 4 for a description of the fair value measurement of our derivative instruments and their classification on the Consolidated Statements of Financial Position.

As of October 28, 2017 and October 29, 2016 , interest rate swaps with notional amounts totaling $1,000 million were designated fair value hedges. No ineffectiveness was recognized during the three and nine months ended October 28, 2017 or October 29, 2016 .

As of October 28, 2017 and October 29, 2016 , one interest rate swap with a notional amount of $250 million was not designated a fair value hedge because it was de-designated concurrent with the repurchase of debt during the first half of 2016.

We recorded income of $2 million and $8 million during the three and nine months ended October 28, 2017 , respectively, and $5 million and $21 million during the three and nine months ended October 29, 2016 , respectively, within net interest expense on our Consolidated Statements of Operations related to periodic payments, valuation adjustments, and amortization of gains or losses on our interest rate swaps.

9. Leases

In February 2016, the FASB issued ASU No. 2016-02, Leases. The new standard requires lessees to record assets and liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement.

We must adopt the standard no later than the first quarter of 2019, which begins on February 3, 2019. A modified retrospective transition approach is required for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements.

8

We plan to adopt the standard in the first quarter of 2018. We will take advantage of the transition package of practical expedients permitted within the new standard, which among other things, allows us to carryforward the historical lease classification. In addition, we are electing the hindsight practical expedient to determine the reasonably certain lease term for existing leases. While lease classification will remain unchanged, hindsight will result in generally shorter accounting lease terms and useful lives of the corresponding leasehold improvements. We will make an accounting policy election that will keep leases with an initial term of 12 months or less off of the balance sheet and will result in recognizing those lease payments in the Consolidated Statements of Operations on a straight-line basis over the lease term.

While we are continuing to assess all potential impacts of the standard, we expect total liabilities to increase by $1.3 - $1.5 billion , with an offsetting increase to leased assets of $1.2 - $1.4 billion as of the date of adoption. The difference between these amounts will be recorded as an adjustment to retained earnings. We do not believe the standard will materially affect our consolidated net earnings. These estimates - based on our current lease portfolio - may change as we continue to evaluate the new standard and as we implement a new lease accounting information system. The estimates could also change due to changes in the lease portfolio, which could include (a) lease volume, (b) lease commencement dates, and (c) renewal option and lease termination expectations. We will update our estimates each quarter as changes occur.

We do not believe the new standard will have a notable impact on our liquidity. The standard will have no impact on our debt-covenant compliance under our current agreements.

10. Income Taxes

| Three Months Ended |

| Nine Months Ended | ||||||||||||

(dollars in millions) | October 28, | |

| October 29, | |

| October 28, | |

| October 29, | | ||||

Income tax expense | $ | 137 | |

| $ | 311 | |

| $ | 802 | |

| $ | 910 | |

Effective tax rate (a) | 22.3 | % |

| 33.8 | % |

| 30.5 | % |

| 33.0 | % | ||||

(a) For the three months ended October 28, 2017, the income tax rate decreased 11.5% compared with the three months ended October 29, 2016. Benefits from our global sourcing operations drove 9.6 percentage points of the decline ( 3.7 percentage points of which is due to lower earnings before income taxes). This includes $55 million of prior-period discrete tax benefits primarily related to our global sourcing operations. For the nine months ended October 28, 2017, the income tax rate decreased 2.5% compared with the nine months ended October 29, 2016. Benefits from our global sourcing operations drove 2.7 percentage points of rate decline. This includes $56 million of prior-period discrete tax benefits primarily related to our global sourcing operations.

11. Share Repurchase

| Nine Months Ended | ||||||

(millions, except per share data) | October 28, | |

| October 29, | | ||

Total number of shares purchased | 10.8 | |

| 38.5 | | ||

Average price paid per share | $ | 56.80 | |

| $ | 72.87 | |

Total investment | $ | 611 | |

| $ | 2,807 | |

Note: Accelerated share repurchase (ASR) activity in 2017 and 2016 is omitted because the transactions were not fully settled as of October 28, 2017 and October 29, 2016.

During the third quarter of 2017, we entered into an ASR to repurchase $150 to $250 million of our common stock under the existing $5 billion share repurchase program. Under the agreement, we prepaid $250 million and received an initial delivery of 2.5 million shares, which were retired, resulting in a $139 million reduction to shareholders' investment. As of October 28, 2017, $11 million is included in the Consolidated Statement of Financial Position as an additional reduction to shareholders' investment because the minimum repurchase will be $150 million . The remaining $100 million is included in other current assets. The ASR is not accounted for as a derivative instrument.

In November 2017, the ASR settled. We received an additional 0.3 million shares, which were retired, and $89 million for the remaining amount not settled in shares. In total, we repurchased 2.8 million shares under the ASR for a total cash investment of $161 million ( $57.78 per share).

9

During the third quarter of 2016, we entered into an ASR to repurchase $250 to $350 million of our common stock. Under the agreement, we prepaid $350 million and received an initial delivery of 3.4 million shares, which were retired, resulting in a $230 million reduction to shareholders' investment. As of October 29, 2016, $20 million was included in the Consolidated Statement of Financial Position as an additional reduction to shareholders' investment because the minimum repurchase was $250 million . The remaining $100 million was included in other current assets. The ASR was not accounted for as a derivative instrument.

In November 2016, the ASR settled. We received an additional 1.3 million shares, which were retired, and $36 million for the remaining amount not settled in shares. In total, we repurchased 4.6 million shares under the ASR for a total cash investment of $314 million ( $67.67 per share).

12. Pension Benefits

We provide pension plan benefits to certain eligible team members.

Net Pension Benefits Expense | Three Months Ended |

| Nine Months Ended | ||||||||||||

(millions) | October 28, | |

| October 29, | |

| October 28, | |

| October 29, | | ||||

Service cost | $ | 21 | |

| $ | 20 | |

| $ | 63 | |

| $ | 61 | |

Interest cost | 34 | |

| 34 | |

| 103 | |

| 103 | | ||||

Expected return on assets | (61 | ) |

| (64 | ) |

| (184 | ) |

| (193 | ) | ||||

Amortization of losses | 15 | |

| 12 | |

| 45 | |

| 37 | | ||||

Amortization of prior service cost | (3 | ) |

| (2 | ) |

| (8 | ) |

| (8 | ) | ||||

Total | $ | 6 | |

| $ | - | |

| $ | 19 | |

| $ | - | |

In March 2017, the FASB issued ASU 2017-07, Compensation – Retirement Benefits (Topic 715) , which requires employers to disaggregate and present separately the current service cost component from the other components of net benefit cost within the Consolidated Statement of Operations. We plan to adopt the standard in the first quarter of fiscal 2018. We expect to reclassify the other components of net benefit cost to an other income and expense line on our Consolidated Statements of Operations upon adoption.

13. Accumulated Other Comprehensive (Loss) / Income

(millions) | Cash Flow Hedges | |

| Currency Translation Adjustment | |

| Pension and Other Benefits | |

| Total | | ||||

January 28, 2017 | $ | (16 | ) |

| $ | (21 | ) |

| $ | (601 | ) |

| $ | (638 | ) |

Other comprehensive income before reclassifications | - | |

| 3 | |

| 1 | |

| 4 | | ||||

Amounts reclassified from AOCI | 3 | | (a) | - | |

| 21 | | (b) | 24 | | ||||

October 28, 2017 | $ | (13 | ) |

| $ | (18 | ) |

| $ | (579 | ) |

| $ | (610 | ) |

(a) Represents amortization of gains and losses on cash flow hedges, net of $2 million of taxes.

(b) Represents amortization of pension and other benefit liabilities, net of $15 million of taxes.

10

14. Segment Reporting

Our segment measure of profit (segment earnings before interest expense and income taxes) is used by management to evaluate performance and make operating decisions. We operate as a single segment that includes all of our continuing operations, which are designed to enable guests to purchase products seamlessly in stores or through our digital channels. Virtually all of our consolidated revenues are generated in the United States. The vast majority of our long–lived assets are located within the United States.

Business Segment Results | Three Months Ended |

| Nine Months Ended | ||||||||||||

(millions) | October 28, | |

| October 29, | |

| October 28, | |

| October 29, | | ||||

Sales | $ | 16,667 | |

| $ | 16,441 | |

| $ | 49,113 | |

| $ | 48,805 | |

Cost of sales (a) | 11,712 | |

| 11,536 | |

| 34,330 | |

| 33,957 | | ||||

Gross margin | 4,955 | |

| 4,905 | |

| 14,783 | |

| 14,848 | | ||||

Selling, general, and administrative expenses (c) | 3,512 | |

| 3,343 | |

| 10,027 | |

| 9,741 | | ||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) (a) | 574 | |

| 505 | |

| 1,596 | |

| 1,486 | | ||||

Segment earnings before interest expense and income taxes | 869 | |

| 1,057 | |

| 3,160 | |

| 3,621 | | ||||

Pharmacy Transaction-related costs (b)(c) | - | |

| 4 | |

| - | |

| - | | ||||

Earnings from continuing operations before interest expense and income taxes | 869 | |

| 1,061 | |

| 3,160 | |

| 3,621 | | ||||

Net interest expense | 254 | |

| 142 | |

| 532 | |

| 864 | | ||||

Earnings from continuing operations before income taxes | $ | 615 | |

| $ | 919 | |

| $ | 2,628 | |

| $ | 2,757 | |

Note: Amounts may not foot due to rounding.

(a) Refer to Note 3 for information about the impact of a reclassification of supply chain-related depreciation expense.

(b) Represents items related to the December 2015 sale of our former pharmacy and clinic businesses to CVS (Pharmacy Transaction).

(c) The sum of segment SG&A expenses and Pharmacy Transaction-related costs equal consolidated SG&A expenses.

Reconciliation of Segment Assets to Total Assets (millions) | October 28, | |

| January 28, | |

| October 29, | | |||

Segment assets | $ | 40,693 | |

| $ | 37,350 | |

| $ | 38,524 | |

Assets of discontinued operations | 15 | |

| 81 | |

| 79 | | |||

Total assets | $ | 40,708 | |

| $ | 37,431 | |

| $ | 38,603 | |

11

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Third quarter 2017 includes the following notable items:

• | GAAP earnings per share from continuing operations were $0.87 . |

• | Adjusted earnings per share from continuing operations were $0.91 . |

• | Comparable sales increased 0.9 percent, driven by a 1.4 percent increase in traffic. |

• | Comparable digital channel sales increased 24 percent. |

• | We devoted $847 million to capital investment, paid dividends of $339 million, and returned $171 million through share repurchases, including ASR transactions initiated during the quarter and settled in November 2017. |

Sales were $16,667 million for the three months ended October 28, 2017 , an increase of $226 million or 1.4 percent from the same period in the prior year. During the third quarter of 2017, Hurricanes Harvey and Irma caused widespread damage in Texas and Florida and resulted in temporary closure of some of our stores. The net sales impact and storm-related costs, net of insurance recoveries, was immaterial. Operating cash flow provided by continuing operations was $4,414 million and $2,770 million for the nine months ended October 28, 2017 and October 29, 2016 , respectively. The operating cash flow increase is primarily due to increased payables leverage driven by changes in vendor payment terms during the nine months ended October 28, 2017, compared to the nine months ended October 29, 2016. The operating cash flow increase is also partially due to the payment of approximately $500 million of taxes during the first quarter of 2016, primarily related to the December 2015 sale of our pharmacy and clinic businesses (Pharmacy Transaction). These increases were partially offset by a larger inventory increase during the nine months ended October 28, 2017 compared to the nine months ended October 29, 2016, due to an earlier increase for the holiday season.

Earnings Per Share from Continuing Operations | Three Months Ended |

|

| |

| Nine Months Ended |

|

| | ||||||||||||

October 28, | |

| October 29, | |

| Change | |

| October 28, | |

| October 29, | |

| Change | | |||||

GAAP diluted earnings per share | $ | 0.87 | |

| $ | 1.06 | |

| (17.7 | )% |

| $ | 3.31 | |

| $ | 3.14 | |

| 5.4 | % |

Adjustments | 0.04 | |

| (0.01 | ) |

|

|

| 0.03 | |

| 0.42 | |

|

| | |||||

Adjusted diluted earnings per share | $ | 0.91 | |

| $ | 1.04 | |

| (13.1 | )% |

| $ | 3.34 | |

| $ | 3.56 | |

| (6.2 | )% |

Note: Amounts may not foot due to rounding. Adjusted diluted earnings per share from continuing operations (Adjusted EPS), a non-GAAP metric, excludes the impact of certain items not related to our routine retail operations. Management believes that Adjusted EPS is meaningful to provide period-to-period comparisons of our operating results. A reconciliation of non-GAAP financial measures to GAAP measures is provided on page 18.

We report after-tax return on invested capital (ROIC) from continuing operations because we believe ROIC provides a meaningful measure of the effectiveness of our capital allocation over time. For the trailing twelve months ended October 28, 2017 , ROIC was 13.7 percent, compared with 16.3 percent for the trailing twelve months ended October 29, 2016 . Excluding the net gain on the Pharmacy Transaction, ROIC was 14.3 percent for the trailing twelve months ended October 29, 2016 . A reconciliation of ROIC is provided on page 20.

12

Analysis of Results of Operations

Segment Results

| Three Months Ended |

|

| |

| Nine Months Ended |

|

| | ||||||||||||

(dollars in millions) | October 28, | |

| October 29, | |

| Change | |

| October 28, | |

| October 29, | |

| Change | | ||||

Sales | $ | 16,667 | |

| $ | 16,441 | |

| 1.4 | % |

| $ | 49,113 | |

| $ | 48,805 | |

| 0.6 | % |

Cost of sales (a) | 11,712 | |

| 11,536 | |

| 1.5 | |

| 34,330 | |

| 33,957 | |

| 1.1 | | ||||

Gross margin | 4,955 | |

| 4,905 | |

| 1.0 | |

| 14,783 | |

| 14,848 | |

| (0.4 | ) | ||||

SG&A expenses (b) | 3,512 | |

| 3,343 | |

| 5.1 | |

| 10,027 | |

| 9,741 | |

| 2.9 | | ||||

Depreciation and amortization (exclusive of depreciation included in cost of sales) (a) | 574 | |

| 505 | |

| 13.7 | |

| 1,596 | |

| 1,486 | |

| 7.4 | | ||||

EBIT | $ | 869 | |

| $ | 1,057 | |

| (17.8 | )% |

| $ | 3,160 | |

| $ | 3,621 | |

| (12.7 | )% |

Note: See Note 14 of our Financial Statements for a reconciliation of our segment results to earnings before income taxes.

(a) Refer to Note 3 of the Financial Statements for information about a reclassification of supply chain-related depreciation expense to cost of sales.

(b) SG&A expenses include $170 million and $512 million net profit-sharing income under our credit card program agreement for the three and nine months ended October 28, 2017 , respectively, and $168 million and $489 million for the three and nine months ended October 29, 2016 , respectively.

Rate Analysis | Three Months Ended | Nine Months Ended | ||||||||

| October 28, | |

| October 29, | | October 28, | |

| October 29, | |

Gross margin rate (a) | 29.7 | % |

| 29.8 | % | 30.1 | % |

| 30.4 | % |

SG&A expense rate | 21.1 | |

| 20.3 | | 20.4 | |

| 20.0 | |

Depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate (a) | 3.4 | |

| 3.1 | | 3.2 | |

| 3.0 | |

EBIT margin rate | 5.2 | |

| 6.4 | | 6.4 | |

| 7.4 | |

Note: Rate analysis metrics are computed by dividing the applicable amount by sales.

(a) Reclassifying supply chain-related depreciation expense to cost of sales reduced the gross margin and depreciation and amortization rates by 0.4 percentage points for all periods presented.

13

Sales

Sales include all merchandise sales, net of expected returns, and gift card breakage. Digital channel sales include all sales initiated through mobile applications and our conventional websites. Digital channel sales may be fulfilled through our distribution centers, our vendors, or our stores.

Sales by Channel | Three Months Ended |

| Nine Months Ended | ||||||||

| October 28, | |

| October 29, | |

| October 28, | |

| October 29, | |

Stores | 95.7 | % |

| 96.5 | % |

| 95.7 | % |

| 96.5 | % |

Digital | 4.3 | |

| 3.5 | |

| 4.3 | |

| 3.5 | |

Total | 100 | % |

| 100 | % |

| 100 | % |

| 100 | % |

Sales by Product Category | Three Months Ended |

| Nine Months Ended | ||||||||

| October 28, | |

| October 29, | |

| October 28, | |

| October 29, | |

Household essentials (a) | 25 | % |

| 25 | % |

| 25 | % |

| 25 | % |

Apparel and accessories | 21 | |

| 21 | |

| 21 | |

| 21 | |

Food and beverage (a) | 20 | |

| 21 | |

| 21 | |

| 21 | |

Home furnishings and décor | 20 | |

| 19 | |

| 18 | |

| 19 | |

Hardlines | 14 | |

| 14 | |

| 15 | |

| 14 | |

Total | 100 | % |

| 100 | % |

| 100 | % |

| 100 | % |

(a) For all periods presented, pet supplies, which represented approximately 2 percent of total sales, has been reclassified from food and beverage to household essentials.

Comparable sales is a measure that highlights the performance of our stores and digital channels by measuring the change in sales for a period over the comparable, prior-year period of equivalent length. Comparable sales include all sales, except sales from stores open less than 13 months, digital acquisitions we have owned less than 13 months, stores that have been closed, and digital acquisitions that we no longer operate. Comparable sales measures vary across the retail industry. As a result, our comparable sales calculation is not necessarily comparable to similarly titled measures reported by other companies.

Comparable Sales | Three Months Ended |

| Nine Months Ended | ||||||||

| October 28, | |

| October 29, | |

| October 28, | |

| October 29, | |

Comparable sales change | 0.9 | % |

| (0.2 | )% |

| 0.3 | % |

| - | % |

Drivers of change in comparable sales |

| |

|

| |

|

| |

|

| |

Number of transactions | 1.4 | |

| (1.2 | ) |

| 0.9 | |

| (1.0 | ) |

Average transaction amount | (0.5 | ) |

| 1.0 | |

| (0.6 | ) |

| 1.0 | |

Note: Amounts may not foot due to rounding.

Contribution to Comparable Sales Change | Three Months Ended |

| Nine Months Ended | ||||||||

| October 28, | |

| October 29, | |

| October 28, | |

| October 29, | |

Stores channel comparable sales change | - | % |

| (1.0 | )% |

| (0.6 | )% |

| (0.7 | )% |

Digital channel contribution to comparable sales change | 0.8 | |

| 0.7 | |

| 0.9 | |

| 0.6 | |

Total comparable sales change | 0.9 | % |

| (0.2 | )% |

| 0.3 | % |

| - | % |

Note: Amounts may not foot due to rounding.

The collective interaction of a broad array of macroeconomic, competitive, and consumer behavioral factors, as well as sales mix, and transfer of sales to new stores makes further analysis of sales metrics infeasible.

14

We monitor the percentage of sales that are paid for using REDcards (REDcard Penetration) because our internal analysis has indicated that a meaningful portion of the incremental purchases on REDcards are also incremental sales for Target. Guests receive a 5 percent discount on virtually all purchases when they use a REDcard at Target.

REDcard Penetration | Three Months Ended |

| Nine Months Ended | ||||||||

| October 28, | |

| October 29, | |

| October 28, | |

| October 29, | |

Target Debit Card | 12.9 | % |

| 12.9 | % |

| 13.1 | % |

| 12.9 | % |

Target Credit Cards | 11.4 | |

| 11.4 | |

| 11.3 | |

| 11.0 | |

Total REDcard Penetration | 24.2 | % |

| 24.3 | % |

| 24.4 | % |

| 23.9 | % |

Note: Amounts may not foot due to rounding.

Gross Margin Rate

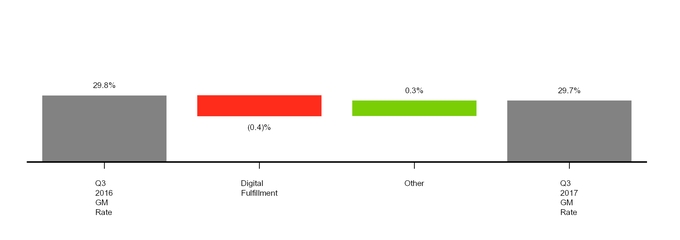

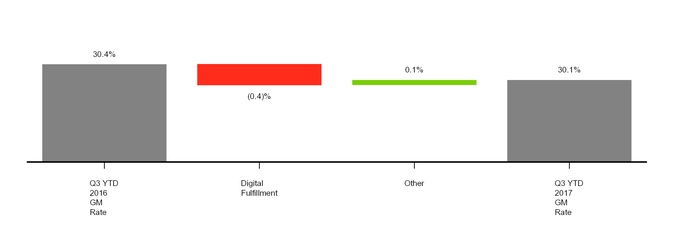

For the three and nine months ended October 28, 2017 , our gross margin rate was 29.7 percent and 30.1 percent, respectively, compared with 29.8 percent and 30.4 percent in the comparable periods last year. For the three and nine months ended October 28, 2017, the decrease was primarily due to increased digital fulfillment costs. The rate was also affected by other items, including benefits from cost savings initiatives, partially offset by the net impacts of our efforts to improve pricing and promotions.

15

Selling, General, and Administrative Expense Rate

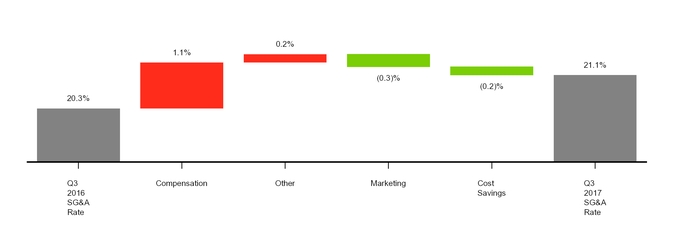

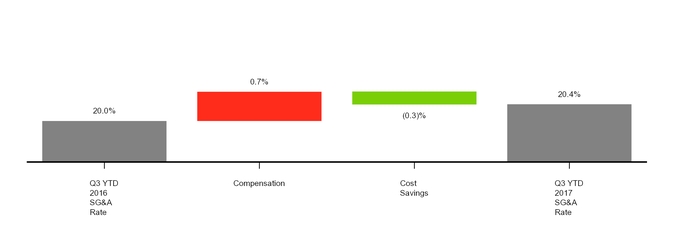

For the three and nine months ended October 28, 2017 , our SG&A expense rate was 21.1 percent and 20.4 percent, respectively, compared to 20.3 percent and 20.0 percent in the comparable periods last year. The increase was primarily due to higher compensation due to both bonus expense and store wages, partially offset by cost savings driven by efficiency in our technology operations and, for the third quarter, timing of marketing campaigns.

Depreciation and Amortization Expense Rate

For the three and nine months ended October 28, 2017 , our depreciation and amortization (exclusive of depreciation included in cost of sales) expense rate was 3.4 percent and 3.2 percent, respectively, compared to 3.1 percent and 3.0 percent in the comparable periods last year. These increases were primarily due to higher accelerated depreciation for planned store remodels.

Store Data

Change in Number of Stores | Three Months Ended |

| Nine Months Ended | ||||||||

| October 28, | |

| October 29, | |

| October 28, | |

| October 29, | |

Beginning store count | 1,816 | |

| 1,797 | |

| 1,802 | |

| 1,792 | |

Opened | 12 | |

| 5 | |

| 26 | |

| 11 | |

Closed | - | |

| (2 | ) |

| - | |

| (3 | ) |

Ending store count | 1,828 | |

| 1,800 | |

| 1,828 | |

| 1,800 | |

16

Number of Stores and | Number of Stores |

| Retail Square Feet (a) | ||||||||||

October 28, | | January 28, | | October 29, | |

| October 28, | | January 28, | | October 29, | | |

170,000 or more sq. ft. | 276 | | 276 | | 278 | |

| 49,326 | | 49,328 | | 49,685 | |

50,000 to 169,999 sq. ft. | 1,508 | | 1,504 | | 1,503 | |

| 190,038 | | 189,620 | | 189,496 | |

49,999 or less sq. ft. | 44 | | 22 | | 19 | |

| 1,268 | | 554 | | 464 | |

Total | 1,828 | | 1,802 | | 1,800 | |

| 240,632 | | 239,502 | | 239,645 | |

(a) In thousands, reflects total square feet, less office, distribution center, and vacant space.

Other Performance Factors

Net Interest Expense

Net interest expense from continuing operations was $254 million and $532 million for the three and nine months ended October 28, 2017 , respectively, compared to $142 million and $864 million for the comparable periods last year. Net interest expense for the three and nine months ended October 28, 2017 included a net loss on early retirement of debt of $123 million. Net interest expense for the nine months ended October 29, 2016 included a loss on early retirement of debt of $422 million .

Provision for Income Taxes

Our effective income tax rate from continuing operations for the three and nine months ended October 28, 2017 was 22.3 percent and 30.5 percent, respectively, compared with 33.8 percent and 33.0 percent for the comparable periods last year. For the three and nine months ended October 28, 2017, the decrease was primarily due to prior-period discrete tax benefits related to our global sourcing operations. The rate decrease for both the three and nine months ended October 28, 2017, was also due to a benefit from our global sourcing operations related to our 2017 taxes, the rate impact of lower pretax earnings, and the resolution of other tax matters. For the nine months ended October 28, 2017, these items were partially offset by the recognition of excess tax benefits related to share-based payments for the nine months ended October 29, 2016.

17

Reconciliation of Non-GAAP Financial Measures to GAAP Measures

To provide additional transparency, we have disclosed non-GAAP adjusted diluted earnings per share from continuing operations (Adjusted EPS). This metric excludes certain items presented below. We believe this information is useful in providing period-to-period comparisons of the results of our continuing operations. This measure is not in accordance with, or an alternative for, generally accepted accounting principles in the United States (GAAP). The most comparable GAAP measure is diluted earnings per share from continuing operations. Adjusted EPS should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Other companies may calculate Adjusted EPS differently, limiting the usefulness of the measure for comparisons with other companies.

|

| Three Months Ended | ||||||||||||||||||||||

|

| October 28, 2017 |

| October 29, 2016 | ||||||||||||||||||||

(millions, except per share data) |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | | ||||||

GAAP diluted earnings per share from continuing operations |

|

|

|

|

| $ | 0.87 | |

|

|

|

|

| $ | 1.06 | | ||||||||

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Loss on early retirement of debt |

| $ | 123 | |

| $ | 75 | |

| $ | 0.14 | |

| $ | - | |

| $ | - | |

| $ | - | |

Pharmacy Transaction-related costs |

| - | |

| - | |

| - | |

| (4 | ) |

| (3 | ) |

| - | | ||||||

Income tax matters (a) |

| - | |

| (55 | ) |

| (0.10 | ) |

| - | |

| (5 | ) |

| (0.01 | ) | ||||||

Adjusted diluted earnings per share from continuing operations |

|

|

|

|

| $ | 0.91 | |

|

|

|

|

| $ | 1.04 | | ||||||||

|

| Nine Months Ended | ||||||||||||||||||||||

|

| October 28, 2017 |

| October 29, 2016 | ||||||||||||||||||||

(millions, except per share data) |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | | ||||||

GAAP diluted earnings per share from continuing operations |

|

|

|

|

| $ | 3.31 | |

|

|

|

|

| $ | 3.14 | | ||||||||

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Loss on early retirement of debt |

| $ | 123 | |

| $ | 75 | |

| $ | 0.14 | |

| $ | 422 | |

| $ | 257 | |

| $ | 0.44 | |

Pharmacy Transaction-related costs |

| - | |

| - | |

| - | |

| - | |

| - | |

| - | | ||||||

Income tax matters (a) |

| - | |

| (56 | ) |

| (0.10 | ) |

| - | |

| (8 | ) |

| (0.01 | ) | ||||||

Adjusted diluted earnings per share from continuing operations |

|

|

|

|

| $ | 3.34 | |

|

|

|

|

| $ | 3.56 | | ||||||||

Note: Amounts may not foot due to rounding.

(a) Represents income from income tax matters not related to current period operations. For the three and nine months ended October 28, 2017, primarily represents prior-period discrete tax benefits related to our global sourcing operations.

18

We have presented consolidated earnings from continuing operations before interest expense and income taxes (EBIT) and earnings before interest, taxes, depreciation and amortization (EBITDA), non-GAAP financial measures, because we believe that these measures provide meaningful information about our operational efficiency compared to our competitors by excluding the impact of differences in tax jurisdictions and structures, debt levels, and for EBITDA, capital investment. These measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States (GAAP). The most comparable GAAP measure is net earnings from continuing operations. Consolidated EBIT and EBITDA should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Other companies may calculate consolidated EBIT and EBITDA differently, limiting the usefulness of the measure for comparisons with other companies.

EBIT and EBITDA |

| Three Months Ended |

|

|

| Nine Months Ended |

|

| ||||||||||||||

(millions) (unaudited) |

| October 28, |

| October 29, |

| Change |

| October 28, |

| October 29, |

| Change | ||||||||||

Net earnings from continuing operations |

| $ | 478 | |

| $ | 608 | |

| (21.5 | )% |

| $ | 1,826 | |

| $ | 1,847 | |

| (1.1 | )% |

+ Provision for income taxes |

| 137 | |

| 311 | |

| (55.8 | ) |

| 802 | |

| 910 | |

| (11.9 | ) | ||||

+ Net interest expense |

| 254 | |

| 142 | |

| 79.1 | |

| 532 | |

| 864 | |

| (38.4 | ) | ||||

EBIT |

| 869 | |

| 1,061 | |

| (18.1 | ) |

| 3,160 | |

| 3,621 | |

| (12.7 | ) | ||||

+ Total depreciation and amortization (a) |

| 633 | |

| 570 | |

| 11.1 | |

| 1,784 | |

| 1,686 | |

| 5.8 | | ||||

EBITDA |

| $ | 1,502 | |

| $ | 1,631 | |

| (7.9 | )% |

| $ | 4,944 | |

| $ | 5,307 | |

| (6.8 | )% |

(a) Represents total depreciation and amortization, including amounts classified within depreciation and amortization and within cost of sales on our Consolidated Statements of Operations.

19

We have also disclosed after-tax ROIC, which is a ratio based on GAAP information, with the exception of adjustments made to capitalize operating leases. Operating leases are capitalized as part of the ROIC calculation to control for differences in capital structure between us and our competitors. We believe this metric provides a meaningful measure of the effectiveness of our capital allocation over time. Other companies may calculate ROIC differently, limiting the usefulness of the measure for comparisons with other companies.

After-Tax Return on Invested Capital |

|

| ||||||||||

|

|

|

|

| ||||||||

Numerator |

| Trailing Twelve Months |

|

| ||||||||

(dollars in millions) |

| October 28, | |

| October 29, | |

|

| ||||

Earnings from continuing operations before interest expense and income taxes |

| $ | 4,508 | |

| $ | 5,790 | |

|

| ||

+ Operating lease interest (a)(b) |

| 78 | |

| 72 | |

|

| ||||

Adjusted earnings from continuing operations before interest expense and income taxes |

| 4,586 | |

| 5,862 | |

|

| ||||

- Income taxes (c) |

| 1,420 | |

| 1,849 | |

|

| ||||

Net operating profit after taxes |

| $ | 3,166 | |

| $ | 4,013 | |

|

| ||

Denominator (dollars in millions) |

| October 28, | |

| October 29, | |

| October 31, | | |||

Current portion of long-term debt and other borrowings |

| $ | 1,354 | |

| $ | 729 | |

| $ | 825 | |

+ Noncurrent portion of long-term debt |

| 11,277 | |

| 12,097 | |

| 11,887 | | |||

+ Shareholders' equity |

| 11,137 | |

| 11,069 | |

| 13,256 | | |||

+ Capitalized operating lease obligations (b)(d) |

| 1,298 | |

| 1,192 | |

| 1,503 | | |||

- Cash and cash equivalents |

| 2,725 | |

| 1,231 | |

| 1,977 | | |||

- Net assets of discontinued operations |

| 4 | |

| 60 | |

| 197 | | |||

Invested capital |

| $ | 22,337 | |

| $ | 23,796 | |

| $ | 25,298 | |

Average invested capital (e) |

| $ | 23,067 | |

| $ | 24,547 | |

|

| ||

After-tax return on invested capital (f) |

| 13.7 | % |

| 16.3 | % |

|

|

(a) Represents the add-back to operating income to reflect the hypothetical interest expense we would incur if the property under our operating leases were owned or accounted for as capital leases, using eight times our trailing twelve months rent expense and an estimated interest rate of six percent.

(b) See the following Reconciliation of Capitalized Operating Leases table for the adjustments to our GAAP total rent expense to obtain the hypothetical capitalization of operating leases and related operating lease interest.

(c) Calculated using the effective tax rate for continuing operations, which was 31.0 percent and 31.5 percent for the trailing twelve months ended October 28, 2017 and October 29, 2016 , respectively. For the trailing twelve months ended October 28, 2017 and October 29, 2016 , includes tax effect of $1,396 million and $1,826 million , respectively, related to EBIT and $24 million and $23 million , respectively, related to operating lease interest.

(d) Calculated as eight times our trailing twelve months rent expense.

(e) Average based on the invested capital at the end of the current period and the invested capital at the end of the comparable prior period.

(f) Excluding the net gain on the Pharmacy Transaction, ROIC was 14.3 percent for the trailing twelve months ended October 29, 2016 .

Capitalized operating lease obligations and operating lease interest are not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The most comparable GAAP measure is total rent expense. Capitalized operating lease obligations and operating lease interest should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP.

20

Reconciliation of Capitalized Operating Leases |

| Trailing Twelve Months | ||||||||||||

(dollars in millions) |

| October 28, | |

| October 29, | |

| October 31, | | |||||

Total rent expense |

| $ | 162 | |

| $ | 149 | |

| $ | 188 | | ||

Capitalized operating lease obligations (total rent expense x 8) |

| 1,298 | |

| 1,192 | |

| 1,503 | | |||||

Operating lease interest (capitalized operating lease obligations x 6%) |

| 78 | |

| 72 | |

| n/a | | |||||

Analysis of Financial Condition

Liquidity and Capital Resources

Our cash and cash equivalents balance was $2,725 million at October 28, 2017 , compared with $1,231 million for the same period in 2016 . As of October 28, 2017 , $1,084 million of cash and cash equivalents were held at entities located outside the United States and may be subject to taxation if repatriated. Our investment policy is designed to preserve principal and liquidity of our short-term investments. This policy allows investments in large money market funds or in highly rated direct short-term instruments that mature in 60 days or less. We also place certain dollar limits on our investments in individual funds or instruments.

Capital Allocation

We follow a disciplined and balanced approach to capital allocation, based on the following priorities, ranked in order of importance: first, we fully invest in opportunities to grow our business profitably, create sustainable long-term value, and maintain our current operations and assets; second, we maintain a competitive quarterly dividend and seek to grow it annually; and finally, we return excess cash to shareholders by repurchasing shares within the limits of our credit rating goals.

Cash Flows

Operating cash flow provided by continuing operations was $4,414 million for the nine months ended October 28, 2017 , compared with $2,770 million for the same period in 2016 . The operating cash flow increase is due to increased payables leverage primarily driven by changes in vendor payment terms during the nine months ended October 28, 2017, compared to the nine months ended October 29, 2016. The operating cash flow increase is also partially due to the payment of approximately $500 million of taxes during the first quarter of 2016, primarily related to the Pharmacy Transaction. These increases were partially offset by a larger inventory increase during the nine months ended October 28, 2017 compared to the nine months ended October 29, 2016, due to an earlier increase for the holiday season. In October 2017, we issued $750 million of unsecured debt that matures in 2047. Combined with our prior year-end cash position, these proceeds and operating cash flows allowed us to invest in the business, retire debt, pay dividends, and repurchase shares under our share repurchase program.

Share Repurchases

We returned $171 million and $772 million to shareholders through share repurchase during the three and nine months ended October 28, 2017 , respectively, and $878 million and $3,121 million during the three and nine months ended October 29, 2016 , respectively. For the three and nine months ended October 28, 2017 and October 29, 2016, these amounts include $161 million and $314 million, respectively, repurchased through ASR transactions initiated during the third quarter with the final settlement in November 2017 and November 2016, respectively. See Part II, Item 2 of this Quarterly Report on Form 10-Q and Note 11 to the Financial Statements for more information.

Dividends

We paid dividends totaling $339 million ( $0.62 per share) and $1,001 million ( $1.82 per share) for the three and nine months ended October 28, 2017 , respectively, and $345 million ( $0.60 per share) and $1,011 million ( $1.72 per share) for the three and nine months ended October 29, 2016 , respectively, a per share increase of 3.3 percent and 5.8 percent, respectively. We declared dividends totaling $341 million ( $0.62 per share) in third quarter 2017 , a per share increase of 3.3 percent over the $342 million ($0.60 per share) of declared dividends during the third quarter of 2016 . We have paid dividends every quarter since our 1967 initial public offering, and it is our intent to continue to do so in the future.

21

Short-term and Long-term Financing

Our financing strategy is to ensure liquidity and access to capital markets, to maintain a balanced spectrum of debt maturities, and to manage our net exposure to floating interest rate volatility. Within these parameters, we seek to minimize our borrowing costs. Our ability to access the long-term debt and commercial paper markets has provided us with ample sources of liquidity. Our continued access to these markets depends on multiple factors, including the condition of debt capital markets, our operating performance, and maintaining strong credit ratings. As of October 28, 2017 our credit ratings were as follows:

Credit Ratings | Moody's | Standard and Poor's | Fitch |

Long-term debt | A2 | A | A- |

Commercial paper | P-1 | A-1 | F2 |

If our credit ratings were lowered, our ability to access the debt markets, our cost of funds, and other terms for new debt issuances could be adversely impacted. Each of the credit rating agencies reviews its rating periodically and there is no guarantee our current credit ratings will remain the same as described above.

We have additional liquidity through a committed $2.5 billion revolving credit facility obtained through a group of banks in October 2016. In October 2017, we extended this credit facility by one year, which now expires in October 2022. This unsecured revolving credit facility replaced a $2.25 billion unsecured revolving credit facility that was scheduled to expire in October 2018. No balances were outstanding under either credit facility at any time during 2017 or 2016 .

Most of our long-term debt obligations contain covenants related to secured debt levels. In addition to a secured debt level covenant, our credit facility also contains a debt leverage covenant. We are, and expect to remain, in compliance with these covenants. Additionally, as of October 28, 2017 , no notes or debentures contained provisions requiring acceleration of payment upon a credit rating downgrade, except that certain outstanding notes allow the note holders to put the notes to us if within a matter of months of each other we experience both (i) a change in control; and (ii) our long-term debt ratings are either reduced and the resulting rating is noninvestment grade, or our long-term debt ratings are placed on watch for possible reduction and those ratings are subsequently reduced and the resulting rating is noninvestment grade.

We believe our sources of liquidity will continue to be adequate to maintain operations, finance anticipated expansion and strategic initiatives, fund debt maturities, pay dividends, and execute purchases under our share repurchase program for the foreseeable future. We continue to anticipate ample access to commercial paper and long-term financing.

Contractual Obligations and Commitments

As of the date of this report, other than the new borrowings and payments discussed in Note 7 of the Financial Statements, there were no material changes to our contractual obligations and commitments outside the ordinary course of business since January 28, 2017 as reported in our 2016 Form 10-K.

New Accounting Pronouncements

Refer to Note 2, Note 9, and Note 12 of the Financial Statements for a description of new accounting pronouncements related to revenues, leases, and pension benefits, respectively. We do not expect any other recently issued accounting pronouncements will have a material effect on our financial statements.

Forward-Looking Statements

This report contains forward-looking statements, which are based on our current assumptions and expectations. These statements are typically accompanied by the words "expect," "may," "could," "believe," "would," "might," "anticipates," or words of similar import. The principal forward-looking statements in this report include: our financial performance, statements regarding the adequacy of and costs associated with our sources of liquidity, the funding of debt maturities, the continued execution of our share repurchase program, our expected capital expenditures, the impact of changes in the expected effective income tax rate on net income, the expected compliance with debt covenants, the expected impact of new accounting pronouncements, our intentions regarding future dividends, the expected return on plan assets, the expected outcome of, and adequacy of our reserves for, claims, litigation and the resolution of tax matters, and changes in our assumptions and expectations.

22

All such forward-looking statements are intended to enjoy the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Although we believe there is a reasonable basis for the forward-looking statements, our actual results could be materially different. The most important factors which could cause our actual results to differ from our forward-looking statements are set forth on our description of risk factors in Item 1A of our Form 10-K for the fiscal year ended January 28, 2017 , which should be read in conjunction with the forward-looking statements in this report. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There have been no material changes in our primary risk exposures or management of market risks from those disclosed in our Form 10-K for the fiscal year ended January 28, 2017 .

Item 4. Controls and Procedures

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the third quarter of 2017 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this quarterly report, we conducted an evaluation, under supervision and with the participation of management, including the chief executive officer and chief financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Rules 13a-15 and 15d-15 of the Securities Exchange Act of 1934, as amended (Exchange Act). Based upon that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures are effective at the reasonable assurance level. Disclosure controls and procedures are defined by Rules 13a-15(e) and 15d-15(e) of the Exchange Act as controls and other procedures that are designed to ensure that information required to be disclosed by us in reports filed with the Securities and Exchange Commission (SEC) under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in reports filed under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

23

PART II. OTHER INFORMATION

Item 1. Legal Proceedings

The following update to a previously reported proceeding is being reported pursuant to Item 103 of Regulation S-K:

The Federal Securities Law Class Actions and ERISA Class Actions relating to certain prior disclosures of Target about its expansion of retail operations into Canada (the "Canada Disclosure") were previously described in described in Target's annual report on Form 10-K for the fiscal year ended January 28, 2017 and in Target's quarterly report on Form 10-Q for the fiscal quarter ended July 29, 2017. Both the Federal Securities Law Class Actions and the ERISA Class Actions were dismissed by the United States District Court for the District of Minnesota on July 31, 2017. During the quarter ended October 28, 2017, the plaintiffs in both cases sought to refile their claims, as described below. Target intends to continue to vigorously defend these actions.

Federal Securities Law Class Actions

On August 29, 2017 the plaintiff filed a motion to alter or amend the final judgment entered by the United States District Court for the District of Minnesota on July 31, 2017 dismissing the Federal Securities Law Class Actions. The plaintiffs also asked the Court for permission to file a Second Amended Class Action Complaint (the "Second Complaint)", which, like the prior complaint, alleges violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, and Rule 10b-5 relating to the Canada Disclosure. Target, its former chief executive officer, its present chief operating officer, and the former president of Target Canada are named as defendants in the Second Complaint. The plaintiff seeks to represent a class consisting of all purchasers of Target common stock between March 20, 2013 and August 4, 2014. The plaintiff seeks damages and other relief, including attorneys' fees, based on allegations that the defendants misled investors about the performance and prospects of Target Canada and that such conduct affected the market price of Target common stock. On October 16, 2017, Target and the other defendants filed their opposition to plaintiff's motion to alter or amend the final judgment dismissing the Federal Securities Law Class Actions. The plaintiff's motion has not yet been heard or decided.

ERISA Class Actions