Table of Contents

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------------

FORM 10-K

---------------------

x |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2016

or

o |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File number 1-04721

---------------------

SPRINT CORPORATION

(Exact name of registrant as specified in its charter)

---------------------

Delaware | 46-1170005 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

6200 Sprint Parkway, Overland Park, Kansas | 66251 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (855) 848-3280

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Name of each exchange on which registered |

Common stock, $0.01 par value |

| New York Stock Exchange |

---------------------

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act

Large accelerated filer | x | Accelerated filer | o |

Non-accelerated filer (Do not check if smaller reporting company) | o | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes o No x

Aggregate market value of voting and non-voting common stock equity held by non-affiliates of Sprint Corporation at September 30, 2015 was $2,342,009,176

COMMON STOCK OUTSTANDING AT MAY 13, 2016 : 3,974,592,358 shares

|

Table of Contents

SPRINT CORPORATION

TABLE OF CONTENTS

|

| Page Reference |

Item | PART I |

|

1. | Business | 1 |

1A. | Risk Factors | 13 |

1B. | Unresolved Staff Comments | 21 |

2. | Properties | 21 |

3. | Legal Proceedings | 21 |

4. | Mine Safety Disclosures | 22 |

|

|

|

| PART II |

|

5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases | 23 |

6. | Selected Financial Data | 25 |

7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 26 |

7A. | Quantitative and Qualitative Disclosures about Market Risk | 64 |

8. | Financial Statements and Supplementary Data | 64 |

9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 65 |

9A. | Controls and Procedures | 65 |

9B. | Other Information | 66 |

|

|

|

| PART III |

|

10. | Directors, Executive Officers and Corporate Governance | 67 |

11. | Executive Compensation | 67 |

12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 67 |

13. | Certain Relationships and Related Transactions, and Director Independence | 68 |

14. | Principal Accounting Fees and Services | 68 |

|

|

|

| PART IV |

|

15. | Exhibits and Financial Statement Schedules | 69 |

Table of Contents

SPRINT CORPORATION

SECURITIES AND EXCHANGE COMMISSION

ANNUAL REPORT ON FORM 10-K

PART I

Item 1. | Business |

FORMATION

Sprint Corporation, incorporated in 2012 under the laws of Delaware, is a holding company, with operations conducted by its subsidiaries. Our common stock trades on the New York Stock Exchange (NYSE) under the symbol "S."

On July 9, 2013, Sprint Nextel Corporation, a Kansas corporation organized in 1938 (Sprint Nextel), completed the acquisition of the remaining equity interests in Clearwire Corporation and its consolidated subsidiary Clearwire Communications LLC (together "Clearwire") that it did not previously own (Clearwire Acquisition) in an all cash transaction for approximately $3.5 billion , net of cash acquired of $198 million , which provided us with control of 2.5 gigahertz (GHz) spectrum and tower resources.

On July 10, 2013, SoftBank Corp., which subsequently changed its name to SoftBank Group Corp., and certain of its wholly-owned subsidiaries (together, "SoftBank") completed the merger (SoftBank Merger) with Sprint Nextel as contemplated by the Agreement and Plan of Merger, dated as of October 15, 2012 (as amended, the Merger Agreement) and the Bond Purchase Agreement, dated as of October 15, 2012 (as amended, the Bond Agreement). As a result of the SoftBank Merger, Starburst II, Inc. (Starburst II) became the parent company of Sprint Nextel. Immediately thereafter, Starburst II changed its name to Sprint Corporation and Sprint Nextel changed its name to Sprint Communications, Inc. (Sprint Communications). As a result of the completion of the SoftBank Merger in which SoftBank acquired an approximate 78% interest in Sprint Corporation, and subsequent open market stock purchases, SoftBank owned approximately 83% of the outstanding common stock of Sprint Corporation as of March 31, 2016 .

Successor and Predecessor Periods and Reporting Obligations

In connection with the close of the SoftBank Merger (as described above), Sprint Corporation became the successor registrant to Sprint Nextel under Rule 12g-3 of the Securities Exchange Act of 1934 (Exchange Act) and is the entity subject to the reporting requirements of the Exchange Act for filings with the Securities and Exchange Commission (SEC) subsequent to the close of the SoftBank Merger. The financial information herein distinguishes between the predecessor period (Predecessor) relating to Sprint Communications for periods prior to the SoftBank Merger and the successor period (Successor) relating to Sprint Corporation, formerly known as Starburst II, for periods subsequent to the incorporation of Starburst II on October 5, 2012. In addition, in order to align with SoftBank's reporting schedule, we changed our fiscal year end from December 31 to March 31, effective March 31, 2014. References herein to any fiscal year refer to the twelve-month period ending March 31 unless otherwise specifically noted.

OVERVIEW

Sprint Corporation and its subsidiaries is a communications company offering a comprehensive range of wireless and wireline communications products and services that are designed to meet the needs of consumers, businesses, government subscribers and resellers. Unless the context otherwise requires, references to "Sprint," "we," "us," "our" and the "Company" mean Sprint Corporation and its consolidated subsidiaries for all periods presented, inclusive of Successor and Predecessor periods, and references to "Sprint Communications" are to Sprint Communications, Inc. and its consolidated subsidiaries. We are one of the largest wireless communications companies in the United States (U.S.), as well as a provider of wireline services. Our services are provided through our ownership of extensive wireless networks, an all-digital global wireline network and a Tier 1 Internet backbone.

We offer wireless and wireline services to subscribers in all 50 states, Puerto Rico, and the U.S. Virgin Islands under the Sprint corporate brand, which includes our retail brands of Sprint ® , Boost Mobile ® , Virgin Mobile ® , and Assurance Wireless ® on our wireless networks utilizing various technologies including third generation (3G) code division multiple access (CDMA), fourth generation (4G) services utilizing Long Term Evolution (LTE). We also offered Worldwide Interoperability for Microwave Access (WiMAX) technologies until that network was shut-down on March 31, 2016. We utilize these networks to offer our wireless and wireline subscribers differentiated products and services whether through the use of a single network or a combination of these networks.

1

Table of Contents

Our Business Segments

We operate two reportable segments: Wireless and Wireline. For additional information regarding our segments, see "Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and also refer to the Notes to the Consolidated Financial Statements.

Wireless

We offer wireless services on a postpaid and prepaid payment basis to retail subscribers and also on a wholesale basis, which includes the sale of wireless services that utilize the Sprint network but are sold under the wholesaler's brand.

Postpaid

In our postpaid portfolio, we offer several price plans for both consumer and business subscribers. Many of our price plans include unlimited talk, text and data or allow subscribers to purchase monthly data allowances. We also offer family plans that include multiple lines of service under one account. We offer these plans with subsidy, installment billing or leasing programs. The subsidy program requires a service contract and allows for a subscriber to either bring their handset or purchase one at a discount for a new line of service. Our installment billing program does not require a service contract and offers service plans at lower monthly rates compared to subsidy plans, but requires the subscriber to pay full or near full price for the handset over monthly installments. Our leasing program also does not require a service contract, provides for service plans at lower monthly rates compared to subsidy plans and allows qualified subscribers to lease a device and make payments for use of the device over the term of the lease. At the end of the lease term, the subscriber can either turn in the device, continue leasing the device or purchase the device. See "Item 1A. Risk Factors-Subscribers who purchase a device on an installment billing basis are no longer required to sign a fixed-term service contract, which could result in higher churn, and higher bad debt expense" and "-Because we lease devices to subscribers, our device leasing program exposes us to new risks, including those related to the actual residual value realized on returned devices, higher churn and increased losses on devices ."

Prepaid

Our prepaid portfolio currently includes multiple brands, each designed to appeal to specific subscriber uses and demographics. Sprint prepaid primarily serves subscribers who want plans that are affordable, simple and flexible without a long-term commitment. Boost Mobile primarily serves subscribers with plans that offer unlimited text and talk with step pricing based on their preferred data usage. Virgin Mobile primarily serves subscribers through plans that offer control, flexibility and connectivity through various plan options. Virgin Mobile is also designated as a Lifeline-only Eligible Telecommunications Carrier in certain states and provides service for the Lifeline program under our Assurance Wireless brand. Assurance Wireless provides eligible subscribers, in certain states, who meet income requirements or are receiving government assistance, with a free wireless phone, 350 free local and long-distance voice minutes each month and unlimited free texts under the Lifeline Program. The Lifeline Program requires applicants to meet certain eligibility requirements and existing subscribers must recertify as to those requirements annually.

Wholesale

We have focused our wholesale business on enabling our diverse network of customers to successfully grow their business by providing them with an array of network, product and device solutions. This allows our customers to customize this full suite of value-added solutions to meet the growing demands of their businesses. As part of these growing demands, some of our wholesale mobile virtual network operators (MVNO) are also selling prepaid services under the Lifeline program.

We continue to support the open development of applications, content, and devices on the Sprint platform. In addition, we enable a variety of business and consumer third-party relationships through our portfolio of machine-to-machine solutions, which we offer on a retail postpaid and wholesale basis. Our machine-to-machine solutions portfolio provides a secure, real-time and reliable wireless two-way data connection across a broad range of connected devices.

Services and Products

Data & Voice Services

Wireless data communications services are provided throughout the U.S. and include mobile productivity applications, such as Internet access, messaging and email services; wireless photo and video offerings; location-based capabilities, including asset and fleet management, dispatch services and navigation tools; and mobile entertainment applications, including the ability to listen to satellite radio, download and listen to music, and play games. Wireless voice communications services provided throughout the U.S. include basic local and long-distance wireless voice services, as well as voicemail, call waiting, three-way calling, caller identification, directory assistance and call forwarding. We also provide voice

2

Table of Contents

and data services in numerous countries outside of the U.S. through roaming arrangements. We offer customized design, development, implementation and support for wireless services provided to large companies and government agencies.

Products

Our services are provided using a broad array of devices and applications and services that run on these devices to meet the growing needs of subscriber mobility. Our device portfolio includes many cutting edge handsets from various original equipment manufacturers as well as hotspots, which allow the connection of multiple WiFi enabled devices to the Sprint platform and embedded tablets and laptop devices. We have historically sold devices at prices below our cost in response to competition to attract new subscribers and as retention inducements for existing subscribers. Subscribers also have the option to purchase eligible devices through our installment billing program, or to lease eligible devices through our leasing program. In addition, we sell accessories, such as carrying cases, hands-free devices and other items to subscribers, and we sell devices and accessories to agents and other third-party distributors for resale.

Wireless Network Technologies

We deliver wireless services to subscribers primarily through our Sprint platform network. Our Sprint platform uses primarily 3G CDMA and 4G LTE wireless technologies. We served customers utilizing WiMAX technology until the network was shutdown on March 31, 2016. Our 3G CDMA wireless technology uses a digital spread-spectrum technique that allows a large number of users to access the band by assigning a code to all voice and data bits, sending a scrambled transmission of the encoded bits over the air and reassembling the voice and data into its original format. Our 4G LTE wireless data communications technology utilizes an all-internet protocol (IP) network to deliver high-speed data communications. We provide nationwide service through a combination of operating our own network in both major and smaller U.S. metropolitan areas and rural connecting routes, affiliations under commercial arrangements with third-party affiliates and roaming on other providers' networks.

Sales, Marketing and Customer Care

We focus the marketing and sales of wireless services on targeted groups of retail subscribers: individual consumers, businesses and government.

We use a variety of sales channels to attract new subscribers of wireless services, including:

• | direct sales representatives whose efforts are focused on marketing and selling wireless services primarily to mid-sized to large businesses and government agencies; |

• | retail outlets, owned and operated by us, that focus on sales to the small business and consumer markets; |

• | co-branded Sprint-RadioShack retail stores-within-a-store exclusively selling or leasing Sprint devices and the associated postpaid and prepaid service plans; |

• | indirect sales agents and third-party retailers that primarily consist of local and national non-affiliated dealers and independent contractors that market and sell services to businesses and the consumer market, and are generally paid through commissions; and |

• | subscriber-convenient channels, including Internet sales and telesales. |

We market our postpaid services under the Sprint brand. We market our prepaid services under the Sprint, Boost Mobile, Virgin Mobile, and Assurance Wireless brands as a means to provide value-driven prepaid service plans to particular markets. Our wholesale customers are resellers of our wireless services rather than end-use subscribers and market their products and services using their own brands.

Although we market our services using traditional print, digital and television advertising, we also provide exposure to our brand names and wireless services through various sponsorships. The goal of these marketing initiatives is to increase brand awareness and sales.

Our customer care organization works to improve our subscribers' experience, with the goal of retaining subscribers of our wireless services and growing their long-term relationships with Sprint. Customer service call centers receive and resolve inquiries from subscribers and proactively address subscriber needs.

Competition

We believe that the market for wireless services has been and will continue to be characterized by competition on the basis of price, the types of services and devices offered and quality of service. We compete with a number of wireless carriers, including three other national wireless companies: AT&T, Verizon Wireless and T-Mobile. Our prepaid services compete with a number of carriers and resellers, which offers competitively-priced calling plans that include unlimited local

3

Table of Contents

calling. AT&T, T-Mobile and Verizon Wireless offer competitive prepaid services and wholesale services to resellers. Competition may intensify as a result of mergers and acquisitions, as new firms enter the market, and as a result of the introduction of other technologies, the availability of additional commercial spectrum bands, such as the 600 megahertz (MHz) band, the AWS-3 band and the AWS-4 band, and the potential introduction of new services using unlicensed spectrum. Wholesale services and products also contribute to increased competition. In some instances, resellers that use our network and offer similar services compete against our offerings. The wireless industry also faces competition from other communications and technology companies seeking to increase their brand recognition and capture customer revenue with respect to the provision of wireless products and services, in addition to non-traditional offerings in mobile data. For example, Microsoft, Google, Apple and others are offering alternative means for making wireless voice calls that, in certain cases, can be used in lieu of the wireless provider's voice service, as well as alternative means of accessing video content.

Most markets in which we operate have high rates of penetration for wireless services, thereby limiting the growth of subscribers of wireless services. As the wireless market has matured, it has become increasingly important to retain existing subscribers in addition to attracting new subscribers, particularly in less saturated growth markets such as those with non-traditional data demands. Wireless carriers also try to appeal to subscribers by offering certain devices at prices lower than their acquisition cost, which we refer to as our traditional subsidy program. We may offer higher cost devices at greater discounts than our competitors, with the expectation that the loss incurred on the cost of the device will be offset by future service revenue. Wireless carriers now also offer plans that allow subscribers to purchase or lease a device at or near full retail price in exchange for lower monthly service fees, early upgrade options, or both. AT&T, Verizon Wireless and T-Mobile also offer programs that include an option to purchase a device using an installment billing program. Our installment billing and device leasing programs do not require a service contract, provide for service plans at lower monthly rates compared to the traditional subsidy program and allow qualified subscribers to either purchase a device by paying monthly installments generally over 24 months or lease a device and make payments for the device over the term of the lease. At the end of the lease term, the subscriber has the option to turn in their device, continue leasing their device, or purchase the device. See "Item 1A. Risk Factors-If we are not able to retain and attract profitable wireless subscribers, our financial performance will be impaired" and "-Because we lease devices to subscribers, our device leasing program exposes us to new risks including those related to the actual residual value realized on returned devices, higher churn and increased losses on devices " and "-Subscribers who purchase a device on an installment billing basis are no longer required to sign a fixed-term service contract, which could result in higher churn, and higher bad debt expense."

Wireline

We provide a broad suite of wireline voice and data communication services to other communications companies and targeted business subscribers. In addition, our Wireline segment provides voice, data and IP communication services to our Wireless segment. We provide long distance services and operate all-digital global long distance and Tier 1 IP networks.

Services and Products

Our services and products include domestic and international data communications using various protocols such as multiprotocol label switching technologies (MPLS), IP, managed network services, Voice over Internet Protocol (VoIP), Session Initiated Protocol (SIP) and traditional voice services. Our IP services can also be combined with wireless services. Such services include our Sprint Mobile Integration service, which enables a wireless handset to operate as part of a subscriber's wireline voice network, and our DataLink SM service, which uses our wireless networks to connect a subscriber location into their primarily wireline wide-area IP/MPLS data network, making it easier for businesses to adapt their network to changing business requirements. In addition to providing services to our business customers, the wireline network is carrying increasing amounts of voice and data traffic for our Wireless segment as a result of growing usage by our wireless subscribers.

We continue to assess the portfolio of services provided by our Wireline business and are focusing our efforts on IP-based data services and de-emphasizing stand-alone voice services and non-IP-based data services. We also continue to provide voice services primarily to business subscribers. Our Wireline segment markets and sells its services primarily through direct sales representatives.

Competition

Our Wireline segment competes with AT&T, Verizon Communications, CenturyLink, Level 3 Communications, Inc., other major local incumbent operating companies and cable operators, as well as a host of smaller competitors in the provision of wireline services. Over the past few years, our voice services have experienced an industry-wide trend of lower revenue from lower prices and increased competition from other wireline and wireless communications companies, as well as cable multiple system operators (MSOs) and Internet service providers.

4

Table of Contents

Some competitors are targeting the high-end data market and are offering deeply discounted rates in exchange for high-volume traffic as they attempt to utilize excess capacity in their networks. In addition, we face increasing competition from other wireless and IP-based service providers. Many carriers, including cable companies, are competing in the residential and small business markets by offering bundled packages of both voice and data services. Competition in wireline services is based on price and pricing plans, the types of services offered, customer service and communications quality, reliability and availability. Our ability to compete successfully will depend on our ability to anticipate and respond to various competitive factors affecting the industry, including new services that may be introduced, changes in consumer preferences, demographic trends, economic conditions and pricing strategies. See "Item 1A. Risk Factors-Competition, industry consolidation, and technological changes in the market for wireless services could negatively affect our operations, resulting in adverse effects on our revenues, cash flows, growth, and profitability."

Legislative and Regulatory Developments

Overview

Communications services are subject to regulation at the federal level by the Federal Communications Commission (FCC) and in certain states by public utilities commissions (PUCs). Since the SoftBank Merger, we have been subject to regulatory conditions imposed by the Committee on Foreign Investment in the United States (CFIUS) pursuant to a National Security Agreement (NSA) among SoftBank, Sprint, the Department of Justice, the Department of Homeland Security and the Department of Defense (the latter three collectively, the USG Parties). Other federal agencies, such as the Federal Trade Commission and Consumer Financial Protection Bureau, have also asserted jurisdiction over our business.

The following is a summary of the regulatory environment in which we operate and does not describe all present and proposed federal, state and local legislation and regulations affecting the communications industry. Some legislation and regulations are the subject of judicial proceedings, legislative hearings and administrative proceedings that could change the way our industry operates. We cannot predict the outcome of any of these matters or their potential impact on our business. See "Item 1A. Risk Factors-Government regulation could adversely affect our prospects and results of operations; the federal and state regulatory commissions may adopt new regulations or take other actions that could adversely affect our business prospects, future growth or results of operations."

Regulation and Wireless Operations

The FCC regulates the licensing, construction, operation, acquisition and sale of our wireless operations and wireless spectrum holdings. FCC requirements impose operating and other restrictions on our wireless operations that increase our costs. The FCC does not currently regulate rates for services offered by commercial mobile radio service (CMRS) providers, and states are legally preempted from regulating such rates and entry into any market, although states may regulate other terms and conditions. The Communications Act of 1934 (Communications Act) and FCC rules also require the FCC's prior approval of the assignment or transfer of control of an FCC license, although the FCC's rules permit spectrum lease arrangements for a range of wireless radio service licenses, including our licenses, with FCC oversight. Approval from the Federal Trade Commission and the Department of Justice, as well as state or local regulatory authorities, also may be required if we sell or acquire spectrum interests. The FCC sets rules, regulations and policies to, among other things:

• | grant and renew licenses in the 800 MHz, 1.9 GHz and 2.5 GHz bands; |

• | rule on assignments and transfers of control of FCC licenses, and leases covering our use of FCC licenses held by other persons and organizations; |

• | govern the interconnection of our networks with other wireless and wireline carriers; |

• | establish access and universal service funding provisions; |

• | impose rules related to unauthorized use of and access to subscriber information; |

• | impose fines and forfeitures for violations of FCC rules; |

• | regulate the technical standards governing wireless services; and |

• | impose other obligations that it determines to be in the public interest. |

We hold 800 MHz, 1.9 GHz and 2.5 GHz FCC licenses authorizing the use of radio frequency spectrum to deploy our wireless services.

5

Table of Contents

800 MHz License Conditions

Spectrum in our 800 MHz band originally was licensed in small groups of channels, therefore, we hold thousands of these licenses, which together allow us to provide coverage across much of the continental U.S. Our 800 MHz licenses are subject to requirements that we meet population coverage benchmarks tied to the initial license grant dates. To date, we have met all of the construction requirements applicable to these licenses, except in the case of licenses that are not material to our business. Our 800 MHz licenses have ten-year terms, at the end of which each license is subject to renewal requirements that are similar to those for our 1.9 GHz licenses described below.

1.9 GHz PCS License Conditions

All PCS licenses are granted for ten-year terms. For purposes of issuing PCS licenses, the FCC utilizes major trading areas (MTAs) and basic trading areas (BTAs) with several BTAs making up each MTA. Each license is subject to build-out requirements, which we have met in all of our MTA and BTA markets.

If applicable build-out conditions are met, these licenses may be renewed for additional ten-year terms. Renewal applications are not subject to auctions. If a renewal application is challenged, the FCC grants a preference commonly referred to as a license renewal expectancy to the applicant if the applicant can demonstrate that it has provided "substantial service" during the past license term and has substantially complied with applicable FCC rules and policies and the Communications Act.

2.5 GHz License Conditions

We hold licenses for or lease spectrum located within the 2496 to 2690 MHz band, commonly referred to as the 2.5 GHz band, which is designated for Broadband Radio Services (BRS) and Educational Broadband Service (EBS). Most BRS and EBS licenses are allocated to specific, relatively small geographic service areas. Other BRS licenses provide for one of 493 separate BTAs. Under current FCC rules, the BRS and EBS band in each territory is generally divided into 33 channels consisting of a total of 186 MHz of spectrum, with an additional eight MHz of guard band spectrum, which further protects against interference from other license holders. Under current FCC rules, we can access BRS spectrum either through outright ownership of a BRS license issued by the FCC or through a leasing arrangement with a BRS license holder. The FCC rules generally limit eligibility to hold EBS licenses to accredited educational institutions and certain governmental, religious and nonprofit entities, but permit those license holders to lease up to 95% of their capacity for non-educational purposes. Therefore, we primarily access EBS spectrum through long-term leasing arrangements with EBS license holders. Our EBS spectrum leases typically have an initial term equal to the remaining term of the EBS license, with an option to renew the lease for additional terms, for a total lease term of up to 30 years. In addition, we generally have a right of first refusal for a period of time after our leases expire or otherwise terminate to match another party's offer to lease the same spectrum. Our leases are generally transferable, assuming we obtain required governmental approvals. Achieving optimal broadband network speeds, capacity and coverage using 2.5 GHz spectrum relies in significant part on operationalizing a complex mixture of BRS and EBS spectrum licenses and leases in the desired service areas, which is subject to the EBS licensing limitations described above and the technical limitations of the frequencies in the 2.5 GHz range.

Spectrum Reconfiguration Obligations

In 2004, the FCC adopted a Report and Order that included new rules regarding interference in the 800 MHz band and a comprehensive plan to reconfigure the 800 MHz band (the "Report and Order"). The Report and Order provides for the exchange of a portion of our 800 MHz FCC spectrum licenses, and requires us to fund the cost incurred by public safety systems and other incumbent licensees to reconfigure the 800 MHz spectrum band. Also, in exchange, we received licenses for 10 MHz of nationwide spectrum in the 1.9 GHz band.

The minimum cash obligation is $2.8 billion under the Report and Order. We are, however, obligated to pay the full amount of the costs relating to the reconfiguration plan, even if those costs exceed $2.8 billion . As required under the terms of the Report and Order, a letter of credit has been secured to provide assurance that funds will be available to pay the relocation costs of the incumbent users of the 800 MHz spectrum. The letter of credit was initially $2.5 billion, but has been reduced during the course of the proceeding to $256 million as of March 31, 2016 . Since the inception of the program, we have incurred payments of approximately $3.5 billion directly attributable to our performance under the Report and Order. When incurred, substantially all costs are accounted for as additions to FCC licenses with the remainder as property, plant and equipment. Although costs incurred through March 31, 2016 have exceeded $2.8 billion , not all of those costs have been reviewed and accepted as eligible by the transition administrator.

Completion of the 800 MHz band reconfiguration was initially required by June 26, 2008 and public safety reconfiguration is nearly complete across the country with the exception of States of Washington, Arizona, California, Texas and New Mexico. The FCC continues to grant the remaining 800 MHz public safety licensees additional time to complete their

6

Table of Contents

band reconfigurations which, in turn, delays our access to our 800 MHz replacement channels in these areas. In the areas where band reconfiguration is complete, Sprint has received its replacement spectrum in the 800 MHz band and Sprint is deploying 3G CDMA and 4G LTE on this spectrum in combination with its spectrum in the 1.9 GHz and 2.5 GHz bands.

911 Services

Pursuant to FCC rules, CMRS providers, including us, are required to provide enhanced 911 (E911) services including, depending upon the capabilities of the requesting public safety answering point (PSAP), the location of the cell site from which the call is being made or the location of the subscriber's handset using latitude and longitude. CMRS providers are also now required to provide text-to-911 services upon request by a capable PSAP. The FCC recently revised the location accuracy standards for the provision of wireless 911 services indoors and these requirements may impose additional obligations.

Cybersecurity

Cybersecurity continues to receive attention at the federal, state and local levels. Congress has passed and continues to consider various forms of cybersecurity legislation to increase the security and resiliency of the nation's digital infrastructure. In addition, over the past few years the President has issued executive orders directing the Department of Homeland Security and other government agencies to take a number of steps to improve the security of the nation's critical infrastructure. Additionally, the Communications Security, Reliability and Interoperability Council approved Cybersecurity Risk Management and Best Practices, a report providing the communication industry guidance in using the National Institute of Standards and Technology Cybersecurity Framework. Implementation of these guidelines or the adoption of further cybersecurity laws or regulation may impose additional costs on Sprint. See "Item 1A. Risk Factors- Our reputation and business may be harmed and we may be subject to legal claims if there is a loss, disclosure, misappropriation of, unauthorized access to, or other security breach of our proprietary or sensitive information ."

National Security Agreement

As a precondition to CFIUS approval of the SoftBank Merger, the USG Parties required that SoftBank and Sprint enter into the NSA, under which SoftBank and Sprint have agreed to implement certain measures to protect national security, certain of which may materially and adversely affect our operating results due to the increased cost of compliance with security measures, and limits over our control of certain U.S. facilities, contracts, personnel, vendor selection and operations. If we fail to comply with our obligations under the NSA our ability to operate our business may be adversely affected. See "Item 1A. Risk Factors-Regulatory authorities have imposed measures to protect national security and classified projects as well as other conditions that could have an adverse effect on Sprint."

State and Local Regulation

While the Communications Act generally preempts state and local governments from regulating entry of, or the rates charged by, wireless carriers, certain state PUCs and local governments regulate customer billing, termination of service arrangements, advertising, certification of operation, use of handsets when driving, service quality, sales practices, management of customer call records and protected information and many other areas. Also, some state attorneys general have become more active in bringing lawsuits related to the sales practices and services of wireless carriers. Varying practices among the states may make it more difficult for us to implement national sales and marketing programs. States also may impose their own universal service support requirements on wireless and other communications carriers, similar to the contribution requirements that have been established by the FCC, and some states are requiring wireless carriers to help fund additional programs, including the implementation of E911 and the provision of intrastate relay services for consumers who are hearing impaired. We anticipate that these trends will continue to require us to devote legal and other resources to work with the states to respond to their concerns while attempting to minimize any new regulation and enforcement actions that could increase our costs of doing business.

Regulation and Wireline Operations

Competitive Local Service

The Telecommunications Act of 1996 (Telecom Act), which was the first comprehensive update of the Communications Act, was designed to promote competition, and it eliminated legal and regulatory barriers for entry into local and long distance communications markets. It also required incumbent local exchange carriers (ILECs) to allow resale of specified local services at wholesale rates, negotiate interconnection agreements, provide nondiscriminatory access to certain unbundled network elements and allow co-location of interconnection equipment by competitors. The rules implementing the Telecom Act continue to be interpreted by the courts, state PUCs and the FCC , and Congress is considering possible changes

7

Table of Contents

to the Telecom Act. Further restrictions on the pro-competitive aspects of the Telecom Act could adversely affect Sprint's operations.

International Regulation

The wireline services we provide outside the U.S. are subject to the regulatory jurisdiction of foreign governments and international bodies. In general, we are required to obtain licenses to provide wireline services and comply with certain government requirements.

Other Regulations

Network Neutrality

On February 26, 2015, the FCC issued an order reclassifying broadband Internet access service as a telecommunications service subject to Title II of the Communications Act and promulgated new net neutrality rules applicable to both mobile and fixed service providers. The rules prohibit: (1) blocking of lawful content, applications, services and non-harmful devices; (2) impairing or degrading Internet traffic on the basis of content, application, or service, or use of a non-harmful device; and (3) prioritization or favoring of some network traffic over other traffic either in exchange for consideration (monetary or otherwise) from a third party, or to benefit an affiliated entity. All of these prohibitions are subject to a "reasonable network management" exception. The rules also include a "transparency" rule that requires us to disclose information about our commercial terms, performance characteristics, and network practices. In addition, the order established a future conduct rule, to be applied on a case by case basis, prohibiting broadband Internet access providers from unreasonably interfering with or disadvantaging end users' ability to use the Internet to access lawful content, applications, service, or devices of their choice, or edge providers' ability to make such content applications, services, or devices available to end users. Depending upon the interpretation and application of these rules, we may incur additional costs or be limited in the services we can provide.

Truth in Billing and Consumer Protection

The FCC's Truth in Billing rules require both wireline and wireless telecommunications carriers, such as us, to provide full and fair disclosure of all charges on their bills, including brief, clear, and non-misleading plain language descriptions of the services provided. The FCC has opened several proceedings to address issues of consumer protection, including the use of early termination fees, "bill shock" ( i.e. , overage charges for voice, data and text usage) and has proposed new rules to address cramming. The wireless industry has proactively addressed many of these consumer issues by adopting industry best practices, such as the addition of free notifications regarding voice, data, messaging and international roaming usage. If these FCC proceedings or individual state proceedings create changes in the Truth in Billing rules, our billing and customer service costs could increase.

Access Charges

ILECs and competitive local exchange carriers (CLECs) impose access charges for the origination and termination of calls upon wireless and long distance carriers, including our Wireless and Wireline segments. In addition, ILECs and CLECs charge other carriers special access charges for access to dedicated facilities that are paid by both our Wireless and Wireline segments. These fees and charges are a significant cost for our Wireless and Wireline segments and continue to be the subject of interpretation and litigation.

The FCC also has initiated a proceeding to consider whether special access pricing rules need to be changed, and whether the terms and conditions governing the provision of special access are just and reasonable. As a part of that proceeding, the FCC initiated a mandatory data collection effort, which was completed in early 2015. In May of 2016, the FCC released an Order and Further Notice of Proposed Rule Making which would create a new regulatory framework governing the rates, terms and conditions for the provision of TDM and Ethernet services in non-competitive markets. These changes could reduce Sprint's costs of providing service in some areas. The FCC is expected to complete this rule making in 2016.

Universal Service

Communications carriers contribute to and receive support from various Universal Service Funds (USF) established by the FCC and many states. The federal USF program funds services provided in high-cost areas, reduced-rate services to low-income consumers, and discounted communications and Internet services for schools, libraries and rural health care facilities. Similarly, many states have established their own USFs to which we contribute. The FCC has considered changing its USF contribution methodology, which could impact the amount of our assessments.

8

Table of Contents

The Lifeline program is included within the USFs. Virgin Mobile was designated as a Lifeline-only Eligible Telecom Carrier (ETC) in 42 jurisdictions as of March 31, 2016 , and provides service under our Assurance Wireless brand. As a Lifeline provider, Assurance Wireless receives support from the USF. Changes in the Lifeline program , including adoption of minimum service standards and the phase-out of Lifeline support for standalone voice service, and enforcement actions by the FCC and other regulatory/legislative bodies could negatively impact growth in the Assurance Wireless and wholesale subscriber base and/or the profitability of the Assurance Wireless and wholesale business over all. The decline in standalone voice support, which is expected to begin in December 2019 and will decline annually for all existing subscribers through December 2021, may be offset by the expansion of the Lifeline program to include support for broadband service.

Electronic Surveillance Obligations

The Communications Assistance for Law Enforcement Act (CALEA) requires telecommunications carriers, including us, to modify equipment, facilities and services to allow for authorized electronic surveillance based on either industry or FCC standards. Our CALEA obligations have been extended to data and VoIP networks, and we are in compliance with these requirements. Certain laws and regulations require that we assist various government agencies with electronic surveillance of communications and provide records concerning those communications. We do not disclose customer information to the government or assist government agencies in electronic surveillance unless we have been provided a lawful request for such information. If our obligations under these laws and regulations were to change or were to become the focus of any inquiry or investigation, it could require us to incur additional costs and expenses, which could adversely affect our financial condition or results of operation.

Environmental Compliance

Our environmental compliance and remediation obligations relate primarily to the operation of standby power generators, batteries and fuel storage for our telecommunications equipment. These obligations require compliance with storage and related standards, obtaining of permits and occasional remediation. Although we cannot assess with certainty the impact of any future compliance and remediation obligations, we do not believe that any such expenditures will adversely affect our financial condition or results of operations.

Patents, Trademarks and Licenses

We own numerous patents, patent applications, service marks, trademarks and other intellectual property in the U.S. and other countries, including "Sprint ® ," "Boost Mobile ® ," and "Assurance Wireless ® ." Our services often use the intellectual property of others, such as licensed software, and we often license copyrights, patents and trademarks of others, like "Virgin Mobile." In total, these licenses and our copyrights, patents, trademarks and service marks are of material importance to our business. Generally, our trademarks and service marks endure and are enforceable so long as they continue to be used. Our patents and licensed patents have remaining terms of up to 10 years. We occasionally license our intellectual property to others, including licenses to others to use the "Sprint" trademark.

We have received claims in the past, and may in the future receive claims, that we, or third parties from whom we license or purchase goods or services, have infringed on the intellectual property of others. These claims can be time-consuming and costly to defend, and divert management resources. If these claims are successful, we could be forced to pay significant damages or stop selling certain products or services or stop using certain trademarks. We, or third parties from whom we license or purchase goods or services, also could enter into licenses with unfavorable terms, including royalty payments, which could adversely affect our business.

Access to Public Filings and Board Committee Charters

Important information is routinely posted on our website at www.sprint.com . Public access is provided to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to these reports filed with or furnished to the SEC under the Exchange Act. These documents may be accessed free of charge on our website at the following address: http://www.sprint.com/investors . These documents are available as soon as reasonably practicable after filing with the SEC and may also be found at the SEC's website at www.sec.gov . Information contained on or accessible through our website or the SEC's website is not part of this annual report on Form 10-K.

Our Code of Ethics, the Sprint Code of Conduct (Code of Conduct), our Corporate Governance Guidelines and the charters of the following committees of our board of directors: the Audit Committee, the Compensation Committee, the Finance Committee, and the Nominating and Corporate Governance Committee may be accessed free of charge on our website at the following address: www.sprint.com/governance . Copies of any of these documents can be obtained free of charge by writing to: Sprint Shareholder Relations, 6200 Sprint Parkway, Mailstop KSOPHF0302-3B424, Overland Park, Kansas 66251 or by email at [email protected] . If a provision of the Code of Conduct required under the NYSE corporate governance standards is materially modified, or if a waiver of the Code of Conduct is granted to a director or executive officer,

9

Table of Contents

a notice of such action will be posted on our website at the following address: www.sprint.com/governance . Only the Audit Committee may consider a waiver of the Code of Conduct for an executive officer or director.

Employee Relations

As of March 31, 2016 , we had approximately 30,000 employees.

Executive Officers of the Registrant

The following people are serving as our executive officers as of May 17, 2016 . These executive officers were elected to serve until their successors have been elected. There is no familial relationship between any of our executive officers and directors.

Name | Business Experience | Current Position Held Since | Age |

Marcelo Claure | President and Chief Executive Officer. Mr. Claure was named President and CEO, effective August 11, 2014, and has served on the Sprint board of directors since January 2014. Prior to this, he was CEO of Brightstar, a company he founded in 1997 and grew from a small Miami-based distributor of mobile devices into a global business with more than $10 billion in gross revenue for the year ended 2013. Mr. Claure serves as vice chairman of the board of directors of CTIA-The Wireless Association. He also is a member of the board of directors of My Brother's Keeper Alliance. | 2014 | 45 |

Tarek Robbiati | Chief Financial Officer. Mr. Robbiati was appointed Chief Financial Officer in August 2015. From January 2013 until August 2015, Mr. Robbiati served as Chief Executive Officer and Managing Director of FlexiGroup Limited in Australia, where he oversaw all segments of the company and reported to the board of directors. From December 2009 until December 2012, Mr. Robbiati was Group Managing Director and Regional President of Telstra International Group, where he oversaw operating and financial aspects of the telecommunications company. From December 2009 until December 2012, Mr. Robbiati was Executive Chairman of Hong Kong CSL Limited ("CSL"), and from July 2007 until May 2010, Mr. Robbiati served as the Chief Executive Officer of CSL, during which time he spearheaded and implemented transformation strategies and strengthened CSL's position as a Market Leader in Hong Kong. | 2015 | 50 |

Guenther Ottendorfer | Chief Operating Officer, Technology. Mr. Ottendorfer was appointed Chief Operating Officer, Technology in August 2015. He is responsible for overseeing Sprint's network, technology and IT organizations, including related strategy, network operations and performance, as well as partnerships with network, technology and IT vendors. From September 2013 until April 2015, he served as Group CTO at Telekom Austria Group, where he was responsible for driving major wireless expansion, convergence and network function virtualization projects across the countries of the group. From January 2011 until July 2013 Mr. Ottendorfer served as Managing Director - Networks at Optus Singtel, Australia's second largest telecommunications provider with over 11 million customers in cable, fixed, mobile and satellite networks, where he was responsible for the day-to-day running of all Optus networks. | 2015 | 47 |

Robert Hackl | Chief Experience Officer and President of National Sales. Dr. Hackl was appointed Chief Experience Officer and President of National Sales in March 2016. Dr. Hackl is responsible for Customer Care, Omni-Channel Operations, and the management and measurement of the Sprint Promoter Score and is also responsible for direct and indirect sales, as well as telesales. From August 2013 until March 2016, he served as Director of Customer Operations at Vodafone GmbH, where he established service and customer experience leadership while reducing costs yearly. From October 2010 to May 2013, he served as Senior Vice President of Channel Management at TMobile USA, where he established its channel management function and oversaw customer channel initiatives. From 1996 to 2010, he worked as a consultant for McKinsey & Company. | 2016 | 46 |

10

Table of Contents

Name | Business Experience | Current Position Held Since | Age |

John Saw Ph.D. | Chief Technology Officer. Dr. Saw was appointed as Chief Technology Officer in August 2015. Previously he was Chief Network Officer and Senior Vice President, Technology Architecture. Dr. Saw is responsible for network engineering, deployment and operations. Prior to this, he was Senior Vice President, Technology Architecture. Before Sprint's acquisition of Clearwire, Dr. Saw was Chief Technology Officer of Clearwire Corp. He joined Clearwire as its second employee in 2003 and was instrumental in scaling the company's technical expertise and organization. In 2009 and 2010, he led the Clearwire Team that built the first 4G network in North America, covering more than 130 million people. | 2015 | 54 |

Roger Sole | Chief Marketing Officer. Mr. Sole was appointed Chief Marketing Officer in January 2016. From May 2015 until December 2015, Mr. Sole served as Senior Vice President of Marketing, Innovation, and Hispanic Market. From August 2011 until May 2015, Mr. Sole served as the Chief Marketing Officer of TIM Brasil. Under his leadership, TIM Brasil, Telecom Italia's mobile carrier in Brazil, emerged as that country's fastest growing mobile operator by introducing new offers and services and providing innovative ways for customers to get new smartphones. Mr. Sole helped grow TIM Brasil to become the top seller of smartphones in Brazil with a 40% market share and nearly 75 million customers. | 2016 | 42 |

Dow Draper | President - Global Wholesale and Prepaid Services. Mr. Draper was appointed President - Global Wholesale and Prepaid Services in September 2013. Mr. Draper manages the sales and marketing for Sprint's prepaid brands, Virgin Mobile USA, Boost Mobile and Assurance Wireless as well as Sprint's overall Wholesale business. Previously, he was Senior Vice President and General Manager of Retail for CLEAR, the retail brand of Clearwire, where he oversaw the brand's sales, marketing, customer care and product development. He served in various executive positions at Clearwire since 2009. Before joining Clearwire, Mr. Draper held various roles at Alltel Wireless, including senior vice president of Voice & Data Solutions and senior vice president of Financial Planning and Analysis. He has also held various roles at Western Wireless and McKinsey & Company. | 2013 | 46 |

Jaime Jones | President, South Area. Mr. Jones was appointed President, South Area in November 2015 and covers 10 Southern states and Central Texas. Based in Atlanta, Mr. Jones is responsible for sales strategy and execution, network oversight, customer service, marketing communications and general operations. Previously, Mr. Jones was appointed as President, Postpaid and General Business in August 2014. Before being named to this role, Mr. Jones was responsible for the consumer sales strategy, distribution and customer experience for Sprint's Postpaid and Prepaid product brands. Mr. Jones has also served Sprint as senior vice president for the General Business and Public Sector organizations, as well as numerous vice president roles at the area, regional and national levels for Local, Emerging and Mid-Markets and General Business units. Mr. Jones has more than 30 years of experience with technology companies, including management and operations roles for Siemens Communications Inc. (formerly IBM, ROLM Systems Division) and Harris/3MCentral Penn Office Products Inc. (formerly 3M Copying Products Division). | 2015 | 55 |

Jorge Gracia | Senior Vice President, General Counsel and Chief Ethics Officer. Mr. Gracia was appointed to his position in January 2016. He oversees all strategic, transactional, dispute, and preventative legal and government affairs matters, provides advice to the board and senior management on various matters, and has responsibility for ethics training and legal compliance. Mr. Gracia has over 25 years of experience in international corporate law, most recently with Samsung Electronics America, Inc., where he served as Senior Vice President and General Counsel from October 2013 until December 2015. Mr. Gracia previously spent 17 years at Alcatel-Lucent, where he held a series of positions, each with increasing responsibility. Mr. Gracia last served as Deputy General Counsel - Global Commercial Law, a role in which he led an international team of approximately 200 professionals supporting all commercial matters, including serving as general counsel for global sales and marketing, the team responsible for worldwide revenue-generating activities. | 2016 | 50 |

11

Table of Contents

Name | Business Experience | Current Position Held Since | Age |

Paul Schieber, Jr. | Controller. Mr. Schieber was appointed as Controller in December 2013. Mr. Schieber previously served in various positions at Sprint since 1991. Most recently, he served as Vice President, Access and Roaming Planning, where he was responsible for managing Sprint's roaming costs as well as its wireless and wireline access costs. Prior to that, Mr. Schieber held various leadership roles in Sprint's Finance organization including heading Sprint's internal audit function as well as serving in various Vice President - Finance roles. He was also a director in Sprint's Tax department and a director on its Mergers and Acquisitions team. Before joining Sprint, Mr. Schieber was a senior manager with the public accounting firm Ernst & Young, where he worked as an auditor and a tax consultant. In addition, he served as corporate controller for a small publicly held company. | 2013 | 58 |

12

Table of Contents

Item 1A. | Risk Factors |

In addition to the other information contained in this annual report on Form 10-K, the following risk factors should be considered carefully in evaluating us. Our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these risks.

If we are not able to retain and attract profitable wireless subscribers, our financial performance will be impaired.

Our success is based on our ability to retain current subscribers and attract new subscribers. If we are unable to attract and retain profitable wireless subscribers, our financial performance will be impaired, and we could fail to meet our financial obligations. From 2008 through March 31, 2016 , we have experienced an aggregate net decrease of approximately 11.8 million subscribers in our total retail postpaid subscriber base (excluding the impact of our acquisitions).

Our ability to retain our existing subscribers, to compete successfully for new subscribers, and reduce our churn rate depends on, among other things:

• | our ability to anticipate and respond to various competitive factors, including our successful execution of marketing and sales strategies; the acceptance of our value proposition; service delivery and customer care activities, including new account set up and billing; and execution under credit and collection policies; |

• | actual or perceived quality and coverage of our network; |

• | public perception about our brands; |

• | our ability to anticipate, develop, and deploy new or enhanced technologies, products, and services that are attractive to existing or potential subscribers; |

• | our ability to continue to access spectrum and acquire additional spectrum capacity; and |

• | our ability to maintain our current mobile virtual network operator (MVNO) relationships and to enter into new MVNO arrangements . |

Our ability to retain subscribers may be negatively affected by industry trends related to subscriber contracts. Recently, we have seen aggressive customer acquisition efforts by our competitors. For example, most service providers are offering wireless service plans without any long-term commitment. Furthermore, some service providers are reimbursing contract termination fees, including paying off the outstanding balance on devices, incurred by new customers in connection with such customers terminating service with their current wireless service providers. Our competitors' aggressive customer contract terms, such as those described above, could negatively affect our ability to retain subscribers and could lead to an increase in our churn rates if we are not successful in providing an attractive product, price, and service mix.

We expect to continue to incur expenses such as the reimbursement of subscriber termination fees, and other subscriber acquisition and retention expenses, to attract and retain subscribers, but there can be no assurance that our efforts will generate new subscribers or result in a lower churn rate. Subscriber losses and a high churn rate could adversely affect our business, financial condition, and results of operations because they result in lost revenues and cash flow.

Moreover, we and our competitors continue to seek a greater proportion of new subscribers from each other's existing subscriber bases rather than from first-time purchasers. To the extent we cannot compete effectively for new subscribers or if we attract more subscribers that are not creditworthy, our revenues and results of operations could be adversely affected.

The success of our network improvements will depend on the timing, extent, and cost of implementation; access to spectrum; the performance of third-parties and related parties; upgrade requirements; and the availability and reliability of the various technologies required to provide such modernization.

We must continually invest in our wireless network, including expanding our network capacity and coverage through macro sites and small cells, in order to improve our wireless services and remain competitive. The development and deployment of new technologies and services requires us to anticipate the changing demands of our customers and to respond accordingly, which we may not be able to do in a timely or efficient manner.

Improvements in our service depend on many factors, including our ability to predict and adapt to future changes in technologies, changes in consumer demands, changes in pricing and service offerings by our competitors, and continued access to and deployment of adequate spectrum, including any leased spectrum. If we are unable to access spectrum to increase capacity or to deploy the services subscribers desire on a timely basis or at acceptable costs while maintaining network quality levels, our ability to attract and retain subscribers could be adversely affected, which would negatively impact our operating results.

13

Table of Contents

If we fail to provide a competitive network, our ability to provide wireless services to our subscribers, to attract and retain subscribers, and to maintain and grow our subscriber revenues could be adversely affected. For example, achieving optimal broadband network speeds, capacity, and coverage using 2.5 GHz spectrum relies in significant part on operationalizing a complex mixture of BRS and EBS spectrum licenses and leases in the desired service areas. The EBS is subject to licensing limitations and the technical limitations of the frequencies in the 2.5 GHz range. See "Item 1. Business-Legislative and Regulatory Developments-Regulation and Wireless Operations-2.5 GHz License Conditions." If we are unable to operationalize this mixture of licenses and leases, our targeted network modernization goals could be affected.

Using new and sophisticated technologies on a very large scale entails risks. For example, deployment of new technologies from time to time has adversely affected, and in the future may adversely affect, the performance of existing services on our network and result in increased churn or failure to attract wireless subscribers. Should implementation of our modernized network, which also includes expanding our network through densification using both macro sites and small cells, be delayed or costs exceed expected amounts, our margins could be adversely affected and such effects could be material. Should the delivery of services expected to be deployed on our modernized network be delayed due to technological constraints or changes, performance of third-party suppliers, regulatory restrictions, including zoning and leasing restrictions, or permit issues, subscriber dissatisfaction, or other reasons, the cost of providing such services could become higher than expected, ultimately increasing our cost to subscribers and resulting in decreases in net subscribers, which would adversely affect our revenues, profitability, and cash flow from operations.

Our high debt levels and restrictive debt covenants could negatively impact our ability to access future financing at attractive rates or at all, which could limit our operating flexibility and ability to repay our outstanding debt as it matures.

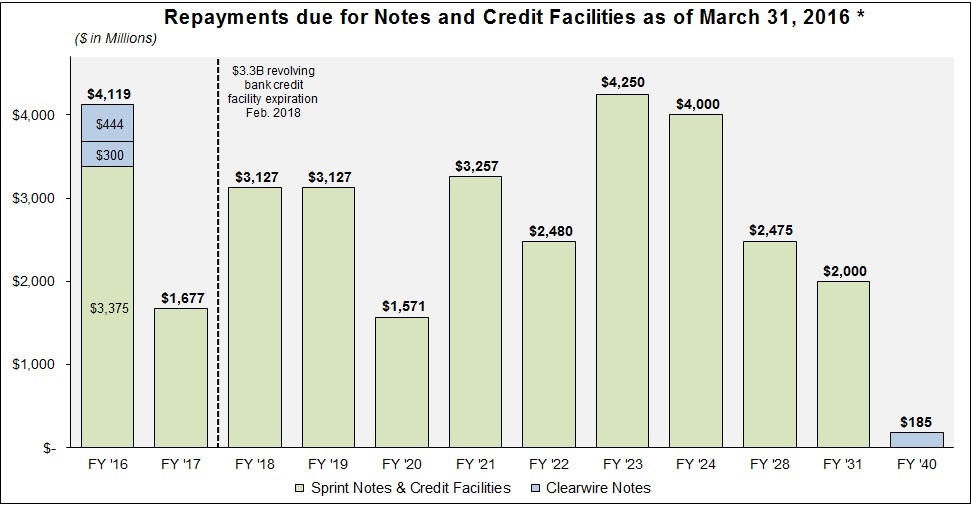

As of March 31, 2016 , our consolidated principal amount of indebtedness was $33.4 billion, and we had $3.0 billion of undrawn borrowing capacity under the revolving bank credit facility. Our high debt levels and debt service requirements are significant in relation to our revenues and cash flow, which may reduce our ability to respond to competition and economic trends in our industry or in the economy generally. Our high debt levels and debt service requirements may also limit our financing options as a result of the restrictions placed on certain of our assets in our recent financing transactions. In addition, certain agreements governing our indebtedness impose operating restrictions on us, subject to exceptions, including our ability to:

• | pay dividends; |

• | create liens on our assets; |

• | receive dividend or other payments from certain of our subsidiaries; |

• | enter into transactions with affiliates; and |

• | engage in certain asset sale or business combination transactions. |

Our revolving bank credit facility and other financing facilities also require that we maintain certain financial ratios, including a leverage ratio, which could limit our ability to incur additional debt. Our failure to comply with our debt covenants would trigger defaults under those obligations, which could result in the maturities of those debt obligations being accelerated and could in turn result in cross defaults with other debt obligations. If we are forced to refinance our debt obligations prior to maturity on terms that are less favorable or if we were to experience difficulty in refinancing the debt prior to maturity, our results of operations or financial condition could be materially harmed. In addition, our recent asset-based financings, which we expect to continue to rely on in the future as a source of funds, could subject us to an increased risk of loss of assets secured under those facilities. Limitations on our ability to obtain suitable financing when needed, or at all, or a failure to execute on our cost-reduction initiatives, could result in an inability to continue to expand our business, timely execute network modernization plans, and meet competitive challenges.

Subscribers who purchase a device on an installment billing basis are no longer required to sign a fixed-term service contract, which could result in higher churn, and higher bad debt expense.

Our service plans allow certain subscribers to purchase an eligible device under an installment contract payable over a period of up to 24 months. Subscribers who take advantage of these plans are no longer required to sign a fixed-term service contract to obtain postpaid service; rather, their service is provided on a month to month contract basis with no early termination fee. These service plans may not meet our subscribers' or potential subscribers' needs, expectations, or demands. In addition, subscribers on these plans can discontinue their service at any time without penalty, other than the obligation of any residual commitment they may have for unpaid service or for amounts due under the installment contract for the device. We could experience a higher churn rate than we expect due to the ability of subscribers to more easily change service providers, which could adversely affect our results of operations. Our operational and financial performance may be

14

Table of Contents

adversely affected if we are unable to grow our customer base and achieve the customer penetration levels that we anticipate with this business model.

Subscribers who have financed their devices through these plans have the option to pay for their devices in installments over a period of up to 24 months. This program subjects us to increased risks relating to consumer credit issues, which could result in increased costs, including increases to our bad debt expense and write-offs of installment billing receivables. These arrangements may be particularly sensitive to changes in general economic conditions, and any declines in the credit quality of our subscriber base could have a material adverse effect on our financial position and results of operations.

Because we lease devices to subscribers, our device leasing program exposes us to new risks, including those related to the actual residual value realized on returned devices, higher churn and increased losses on devices.

We also lease devices to certain of our subscribers. Our financial condition and results of operations depend, in part, on our ability to appropriately assess the credit risk of our lease subscribers and the ability of our lease subscribers to perform under our device leases. In addition to monthly lease payments, we expect to realize economic benefit from the estimated residual value of a leased device, which is the estimated value of a leased device at the time of the expiration of the lease term. Changes in residual value assumptions made at lease inception would affect the amount of depreciation expense and the net amount of equipment under operating leases. If estimated residual values, in the aggregate, significantly decline due to economic factors, obsolescence, or other circumstances, we may not realize such residual value, which could have a material adverse effect on our financial position and results of operations. We may also suffer negative consequences including increased costs and increased losses on devices as a result of a lease subscriber default , the related termination of a lease, and the attempted repossession of the device, including failure of a lease subscriber to return a leased device at the end of the lease. Sustained failure of subscribers to return leased devices could also negatively impact our ability to obtain financing based on leased devices in the future. In addition, subscribers who lease a device are no longer required to sign a fixed-term service contract, which could result in higher churn, and increased losses on devices.

Adverse economic conditions may negatively impact our business and financial performance, as well as our access to financing on acceptable terms or at all.

Our business and financial performance are sensitive to changes in macro-economic conditions, including changes in interest rates, consumer credit conditions, consumer debt levels, consumer confidence, inflation rates (or concerns about deflation), unemployment rates, energy costs, and other factors. Concerns about these and other factors may contribute to market volatility and economic uncertainty.

Market turbulence and weak economic conditions may materially adversely affect our business and financial performance in a number of ways. Our services are available to a broad customer base, a significant portion of which may be more vulnerable to weak economic conditions. We may have greater difficulty in gaining new subscribers within this segment and existing subscribers may be more likely to terminate service due to an inability to pay.

We will need to reduce costs and raise additional capital in the future to provide us with sufficient capital resources and liquidity to meet our commitments and execute our business strategy. Our ability to raise additional capital will depend on, among other things, conditions in the capital markets at that time, which are outside of our control, and our financial performance. Instability in the global financial markets has resulted in periodic volatility in the credit, equity, and fixed income markets. This volatility could limit our access to the credit markets, leading to higher borrowing costs or, in some cases, the inability to obtain financing on terms that are acceptable to us, or at all.

Weak economic conditions and credit conditions may also adversely impact various third parties on which we rely, some of which have filed for or may be considering bankruptcy, experiencing cash flow or liquidity problems, or are unable to obtain credit such that they may no longer be able to operate. Any of these could adversely impact our ability to distribute, market, or sell our products and services.

Government regulation could adversely affect our prospects and results of operations; federal and state regulatory commissions may adopt new regulations or take other actions that could adversely affect our business prospects, future growth, or results of operations.

The FCC, Federal Trade Commission, Consumer Financial Protection Bureau, and other federal, state and local, as well as international, governmental authorities assert jurisdiction over our business and could adopt regulations or take other actions that would adversely affect our business prospects or results of operations.

15

Table of Contents

The licensing, construction, operation, sale and interconnection arrangements of wireless telecommunications systems are regulated by the FCC and, depending on the jurisdiction, international, state and local regulatory agencies. In particular, the FCC imposes significant regulation on licensees of wireless spectrum with respect to how radio spectrum is used by licensees, the nature of the services that licensees may offer and how the services may be offered, and resolution of issues of interference between spectrum bands. The FCC grants wireless licenses for terms of generally ten years that are subject to renewal and revocation. There is no guarantee that our licenses will be renewed. Failure to comply with the FCC requirements applicable to a given license could result in revocation of that license and, depending on the nature of the non-compliance, other Sprint licenses.

The FCC uses its transactional "spectrum screen" to identify prospective wireless transactions that may require additional competitive scrutiny. If a proposed transaction would exceed the spectrum screen threshold, the FCC undertakes a more detailed analysis of relevant market conditions in the impacted geographic areas to determine whether the transaction would reduce competition without offsetting public benefits. The revised screen now includes substantial portions of the 2.5 GHz band previously excluded from the screen and that are licensed or leased to Sprint in numerous markets. As a result, future Sprint spectrum acquisitions may exceed the spectrum screen trigger for additional FCC review. Such additional review could extend the duration of the regulatory review process and there can be no assurance that such transactions will ultimately be completed in whole or in part.