|

|

|

UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

Washington, D.C. 20549 | ||

FORM 10-K | ||

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended January 31, 2014 | ||

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to | ||

Commission File Number: 001-07982 | ||

RAVEN INDUSTRIES, INC. | ||

(Exact name of registrant as specified in its charter) | ||

| South Dakota |

| 46-0246171 |

|

| (State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) |

|

| 205 E. 6th Street, P.O. Box 5107, Sioux Falls, SD |

| 57117- 5107 |

|

| (Address of principal executive offices) |

| (zip code) |

|

| Registrant's telephone number including area code (605) 336-2750 |

| ||

Securities registered pursuant to Section 12(b) of the Act: | ||||

| Title of Each Class: |

| Name of Each Exchange on which Registered |

|

| Common Stock, $1 par value |

| The NASDAQ Stock Market |

|

Securities registered pursuant to Section 12(g) of the Act: None | ||||

|

|

|

|

|

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | o | Yes | ☑ | No |

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | o | Yes | ☑ | No |

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ☑ | Yes | o | No |

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | ☑ | Yes | o | No |

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter)is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | ☑ |

|

|

|

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "accelerated filer," "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. | |||||

Large accelerated filer | ☑ |

|

| Accelerated filer | o |

Non-accelerated filer | o |

|

| Smaller reporting company | o |

(Do not check if a smaller reporting company) |

|

|

| ||

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | o | Yes | ☑ | No |

The aggregate market value of the registrant's common stock held by non-affiliates at July 31, 2013 was approximately $1,101,789,819. The aggregate market value was computed by reference to the closing price as reported on the NASDAQ Global Select Market, $30.66, on July 31, 2013, which was as of the last business day of the registrant's most recently completed second fiscal quarter. The number of shares outstanding on March 25, 2014 was 36,427,627 . | ||||

DOCUMENTS INCORPORATED BY REFERENCE | ||||

The definitive proxy statement relating to the registrant's Annual Meeting of Shareholders, to be held May 22, 2014, is incorporated by reference into Part III to the extent described therein. | ||||

|

|

|

|

|

PART I |

|

| |

Item 1. | BUSINESS |

| 3 |

Item 1A. | RISK FACTORS |

| 6 |

Item 1B. | UNRESOLVED STAFF COMMENTS |

| 9 |

Item 2. | PROPERTIES |

| 9 |

Item 3. | LEGAL PROCEEDINGS |

| 10 |

Item 4. | MINE SAFETY DISCLOSURES |

| 10 |

|

|

|

|

PART II |

|

| |

Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

| 10 |

| Quarterly Information |

| 10 |

| Stock Performance |

| 11 |

Item 6. | SELECTED FINANCIAL DATA |

| 12 |

| Eleven-year Financial Summary |

| 12 |

| Business Segments |

| 14 |

Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| 15 |

| Executive Summary |

| 15 |

| Results of Operations - Segment Analysis |

| 17 |

| Outlook |

| 21 |

| Liquidity and Capital Resources |

| 22 |

| Off-Balance Sheet Arrangements and Contractual Obligations |

| 23 |

| Critical Accounting Estimates |

| 24 |

| Accounting Pronouncements |

| 25 |

| Forward-Looking Statements |

| 25 |

Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

| 26 |

Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

| 27 |

| Management's Report on Internal Control Over Financial Reporting |

| 28 |

| Report of Independent Registered Public Accounting Firm |

| 29 |

| Consolidated Balance Sheets |

| 30 |

| Consolidated Statements of Income and Comprehensive Income |

| 31 |

| Consolidated Statements of Shareholders' Equity |

| 32 |

| Consolidated Statements of Cash Flows |

| 33 |

| Notes to Consolidated Financial Statements |

| 34 |

Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

| 52 |

Item 9A. | CONTROLS AND PROCEDURES |

| 52 |

Item 9B. | OTHER INFORMATION |

| 52 |

|

|

|

|

PART III |

|

| |

Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

| 53 |

Item 11. | EXECUTIVE COMPENSATION |

| 53 |

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

| 53 |

Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

| 53 |

Item 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES |

| 53 |

|

|

|

|

PART IV |

|

| |

Item 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULE |

| 54 |

INDEX TO EXHIBITS |

| 55 | |

SIGNATURES |

| 57 | |

SCHEDULE II |

| 58 | |

PART I |

|

|

|

ITEM 1. | BUSINESS |

Raven Industries, Inc. (the Company or Raven) was incorporated in February 1956 under the laws of the State of South Dakota and began operations later that same year. Raven is a diversified technology company providing a variety of products to customers within the industrial, agricultural, energy, construction and military/aerospace markets. The Company markets its products around the world and has its principal operations in the United States of America. Raven began operations as a manufacturer of high-altitude research balloons before diversifying into the industrial, agricultural, energy, construction and military/aerospace markets. The Company employs approximately 1,300 people and is headquartered at 205 E. Sixth Street, Sioux Falls, SD 57104 - telephone (605) 336-2750. The Company's Internet address is http://www.ravenind.com and its common stock trades on the NASDAQ Global Select Market under the symbol RAVN. The Company has adopted a Code of Conduct applicable to all officers, directors and employees, which is available on the website. Information on the Company's website is not part of this filing.

All reports (including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and current reports on Form 8-K) and proxy and information statements filed with the Securities and Exchange Commission (SEC) are available through a link from the Company's website to the SEC website. All such information is available as soon as reasonably practicable after it has been electronically filed. Filings can also be obtained free of charge by contacting the Company or through the SEC's website at http://www.sec.gov or by contacting the SEC's Office of FOIA/PA Operations at 100 F Street N.E., Washington, DC 20549-2736, or calling the SEC at 1-800-SEC-0330.

BUSINESS SEGMENTS

The Company has three unique operating units, or divisions, that are also its reportable segments: Applied Technology Division (Applied Technology), Engineered Films Division (Engineered Films) and Aerostar Division (Aerostar). Many of the past and present product lines are an extension of technology and production methods developed in the original balloon business. Product lines have been grouped in these segments based on common technologies, production methods and inventories; however, more than one business segment may serve each of the product markets identified above. The Company measures the performance of its segments based on their operating income excluding administrative and general expenses. Other expense and income taxes are not allocated to individual operating segments, and assets not identifiable to an individual segment are included as corporate assets. Segment information is reported consistent with the Company's management reporting structure.

Business segment financial information is found on the following pages: | |

14 | Business Segments |

17 | Results of Operations – Segment Analysis |

50 | Note 13. Business Segments and Major Customer Information |

Applied Technology

Applied Technology designs, manufactures, sells and services innovative precision agriculture products and information management tools that help growers reduce costs and improve farm yields around the world. The Applied Technology product families include field computers, application controls, GPS-guidance and assisted-steering systems, automatic boom controls, yield monitoring planter controls, seeder and harvest controls and an integrated real-time kinematic (RTK) navigation and information platform called Slingshot TM . As a result of the realignment of the Company's Electronic Systems Division in 2013, these product families also include motor controls. Applied Technology's services include high-speed in-field Internet connectivity and cloud-based data management. The Company's investments in Site-Specific Technology Development Group, Inc. (SST), a software company, and the continued build-out of the Slingshot API platform have positioned Applied Technology to provide an information platform of choice that improves grower decision-making and business efficiencies for our agriculture retail partners.

Applied Technology sells its precision agriculture control products to both original equipment manufacturers (OEMs) and through aftermarket distribution in the United States and in most major agriculture areas around the world. Applied Technology has personnel and third-party distribution representatives located in the U.S. and key geographic areas throughout the world. The Company's competitive advantage in this segment is designing and selling easy to use, reliable and value-added products that are supported by an industry leading service and support team.

3

Engineered Films

Engineered Films produces high-performance plastic films and sheeting for industrial, energy, construction, geomembrane and agricultural applications.

The Company's sales force sells plastic sheeting to independent third-party distributors in each of the various markets it serves. The Company extrudes a significant portion of the film converted for its commercial products and believes it is one of the largest sheeting converters in the United States. Engineered Films believes its ability to both extrude and convert films allows it to provide a more customized solution to customer needs. A number of suppliers of sheeting compete with Raven on both price and product availability. Engineered Films is the Company's most capital-intensive business segment, requiring regular investments in new extrusion capacity along with printers and conversion equipment. This segment's capital expenditures were $6.7 million in fiscal 2014 , $ 11.5 million in fiscal 2013 and $ 10.9 million in fiscal 2012 .

Aerostar

Aerostar's growth strategy emphasizes the design and manufacture of proprietary products. These include high-altitude balloons, tethered aerostats and radar processing systems. These products can be integrated with additional third-party sensors to provide research, communications and situational awareness to government and commercial customers. Aerostar also produces products as a contract manufacturing services provider. These include military parachutes, uniforms and protective wear as well as being a total solutions provider of electronics manufacturing services. Sales are made in response to competitive bid requests.

Aerostar sells to government agencies or commercial users as a prime or sub-contractor. The projects Aerostar bids on can be large-scale, with opportunities in the $10-$100 million range. These opportunities can result in volatility in Aerostar's results. For example, completion of Aerostar's U.S. Army contract to manufacture T-11 parachutes reduced sales in the second half of fiscal 2014.

Through Vista Research, Inc. (Vista) and a separate business venture that is majority-owned by the Company, Aerostar pursues potential product and support services contracts for agencies and instrumentalities of the U.S. government. The acquisition of Vista in January 2012 positioned the Company to meet growing global demand for lower-cost detection and tracking systems used by government and law enforcement agencies. As a leading provider of surveillance systems that enhance the effectiveness of radar using sophisticated algorithms, Vista will also allow Aerostar to enhance its tethered aerostat security solutions.

MAJOR CUSTOMER INFORMATION

One customer accounted for 10% or more of consolidated sales in fiscal 2014. Sales to Brawler Industrial Fabrics, a customer in the Engineered Films Division, accounted for 13% of consolidated sales in fiscal year 2014 and 11% of consolidated sales in both fiscal 2013 and 2012 . In addition to this customer, sales to Goodrich Corporation accounted for 10% of consolidated sales in fiscal year 2012 . As expected, revenue from this customer has declined as Aerostar continues to change its focus to proprietary products and away from contract manufacturing.

SEASONAL WORKING CAPITAL REQUIREMENTS

Some seasonal demand exists in Applied Technology's agricultural market. Applied Technology builds product in the fall for winter and spring delivery. Certain sales to agricultural customers offer spring payment terms for fall and early winter shipments. The resulting fluctuations in inventory and accounts receivable have required, and may require, seasonal short-term financing.

FINANCIAL INSTRUMENTS

The principal financial instruments that the Company maintains are cash, cash equivalents, short-term investments, accounts receivable, accounts payable and acquisition-related contingent payments. The Company manages the interest rate, credit and market risks associated with these accounts through periodic reviews of the carrying value of assets and liabilities and establishment of appropriate allowances in accordance with Company policies. The Company does not use off-balance sheet financing, except to enter into operating leases.

The Company uses derivative financial instruments to manage foreign currency risk. The use of these financial instruments has had no material effect on consolidated results of operations, financial condition or cash flows.

4

RAW MATERIALS

The Company obtains a wide variety of materials from several vendors. Principal materials include numerous electronic components for Aerostar and Applied Technology, various plastic resins for Engineered Films and fabrics for Aerostar. Engineered Films has experienced volatile resin prices over the past three years. Price increases could not always be passed on to customers due to weak demand and a competitive pricing environment. Aerostar experiences variability in lead times for components as business cycles impact demand. However, predicting future material shortages and the related potential impact on Raven is not possible.

PATENTS

The Company owns a number of patents. While Raven does not believe that its business, as a whole is materially dependent on any one patent or related group of patents, as Raven continues to develop as a strong technology-based company protection of the Company's intellectual property has become an increasingly important strategic objective. Along with a more aggressive posture toward patenting new technology and protecting trade secrets, the Company is tightening restrictions on the disclosure of our technology to industry and business partners to ensure that our technological edge is maintained and our markets for new products are protected.

RESEARCH AND DEVELOPMENT

The business segments conduct ongoing research and development efforts. Most of the Company's research and development expenditures are directed toward new products in the Applied Technology, Engineered Films and Aerostar Divisions. Total Company research and development costs are presented in the Consolidated Statements of Income and Comprehensive Income.

ENVIRONMENTAL MATTERS

Except as described below, the Company believes that, in all material respects, it is in compliance with applicable federal, state and local environmental laws and regulations. Expenditures incurred in the past relating to compliance for operating facilities have not significantly affected the Company's capital expenditures, earnings or competitive position.

In connection with the sale of substantially all of the assets of the Company's Glasstite, Inc. subsidiary in fiscal 2000, the Company agreed to assume responsibility for the investigation and remediation of any pre-October 29, 1999, environmental contamination at the Company's former Glasstite pickup-truck topper facility in Dunnell, Minnesota, as required by the Minnesota Pollution Control Agency (MPCA) or the United States Environmental Protection Agency (EPA).

The Company and the purchasers of the Company's Glasstite subsidiary conducted environmental assessments of the properties. Although these assessments continue to be evaluated by the MPCA on the basis of the data available, the Company believes that any activities that might be required as a result of the findings of the assessments will not have a material effect on the Company's results of operations, financial position or cash flows. The Company had $38 thousand accrued at January 31, 2014 , representing its best estimate of probable costs to be incurred related to these matters.

BACKLOG

As of February 1, 2014 , the Company's order backlog totaled $51.8 million . Backlog amounts as of February 1, 2013 and 2012 were $51.1 million and $66.6 million , respectively. Because the length of time between order and shipment varies considerably by business segment and customers can change delivery schedules or potentially cancel orders, the Company does not believe that backlog, as of any particular date, is necessarily indicative of actual net sales for any future period.

EMPLOYEES

As of January 31, 2014 , the Company had 1,286 employees, 1,265 in an active status. Following is a summary of active employees by segment: Applied Technology - 497 ; Engineered Films - 309 ; Aerostar - 366 ; Corporate Services - 93 . Management believes its employee relations are satisfactory.

5

EXECUTIVE OFFICERS |

|

|

|

|

|

Name, Age and Position |

| Biographical Data |

Daniel A. Rykhus, 49 |

| Mr. Rykhus became the Company's President and Chief Executive Officer in 2010. He joined Raven in 1990 as Director of World Class Manufacturing, was General Manager of the Applied Technology Division from 1998 through 2009, and served as Executive Vice President from 2004 through 2010. |

President and Chief Executive Officer |

| |

|

| |

|

|

|

Thomas Iacarella, 60 |

| Mr. Iacarella joined Raven in 1991 as Corporate Controller and has been the Company's Chief Financial Officer and Treasurer since 1998. Prior to joining the Company, he held positions with Tonka Corporation and the accounting firm now known as EY. |

Vice President and Chief Financial Officer |

| |

|

| |

|

|

|

Stephanie Herseth Sandlin, 43 |

| Ms. Herseth Sandlin joined Raven in August 2012 as General Counsel and Vice President of Corporate Development and also became the Company's Secretary in March 2013. Prior to joining Raven, Ms. Herseth Sandlin was a partner at OFW Law in Washington, D.C. from 2011 to 2012 and served as South Dakota's lone member of the United States House of Representatives from 2004 through 2011. |

General Counsel and Vice President of Corporate Development |

| |

|

| |

|

|

|

Janet L. Matthiesen, 56 |

| Ms. Matthiesen joined Raven in 2010 as Director of Administration and has been the Company's Vice President of Human Resources since 2012. Prior to joining Raven, Ms. Matthiesen was a Human Resource Manager at Science Applications International Corporation from 2002 to 2010. |

Vice President of Human Resources |

| |

|

| |

|

|

|

Matthew T. Burkhart, 38 |

| Mr. Burkhart was named Division Vice President and General Manager of the Applied Technology Division in 2010. He joined Raven in 2008 as Director of Sales and became General Manager - Applied Technology Division in 2009. Prior to joining the Company, he was a Branch Manager for Johnson Controls. |

Division Vice President and General Manager - |

| |

Applied Technology Division |

| |

|

|

|

Anthony D. Schmidt, 42 |

| Mr. Schmidt was named Division Vice President and General Manager of the Engineered Films Division in 2012. He joined Raven in 1995 in the Applied Technology Division performing various leadership roles within manufacturing and engineering. He transitioned to Engineered Films Division in 2011 as Manufacturing Manager. |

Division Vice President and General Manager - |

| |

Engineered Films Division |

| |

|

|

|

Lon E. Stroschein, 39 |

| Mr. Stroschein was named Vice President and General Manager of the Aerostar Division in 2010. He joined Raven in 2008 as International Sales Manager for Applied Technology. Prior to joining Raven, he was a bank vice president and was a member of the executive staff for a U.S. Senator. |

Division Vice President and General Manager - |

| |

Aerostar Division |

| |

ITEM 1A. | RISK FACTORS |

RISKS RELATING TO THE COMPANY

The Company's business is subject to many risks. Set forth below are the most important risks that we face. In evaluating our business and your investment in us, you should also consider the other information presented in or incorporated by reference into this Annual Report on Form 10-K

Weather conditions could affect certain of the Company's markets such as agriculture and construction.

The Company's Applied Technology Division is largely dependent on the ability of farmers and agricultural subcontractors known as custom operators to purchase agricultural equipment that includes its products. If such farmers experience adverse weather conditions resulting in poor growing conditions, or experience unfavorable crop prices or expenses, potential buyers may be less likely to purchase agricultural equipment. Accordingly, weather conditions may adversely affect sales in the Applied Technology Division.

Weather conditions can also adversely affect sales in the Company's Engineered Films Division. To the extent weather conditions curtail construction or agricultural activity, sales of the segment's plastic sheeting will likely decrease.

6

Price fluctuations in and shortages of raw materials could have a significant impact on the Company's ability to sustain and grow earnings.

The Company's Engineered Films Division consumes significant amounts of plastic resin, the costs of which reflect market prices for natural gas, oil and other market forces. These prices are subject to worldwide supply and demand as well as other factors beyond the control of the Company. Although the Engineered Films Division is sometimes able to pass such price increases to its customers, significant variations in the cost of plastic resins can affect the Company's operating results from period to period. Unusual supply disruptions, such as caused by a natural disaster, could cause suppliers to invoke "force majeure" clauses in their supply agreements, causing shortages of material. Success in offsetting higher raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the market served. If the Company is not able to fully offset the effects of material availability and costs, financial results could be adversely affected.

Electronic components, used by both the Applied Technology Division and Aerostar Division, are sometimes in short supply, impacting our ability to meet customer demand.

If a supplier of raw materials or components were unable to deliver due to shortage or financial difficulty, any of the Company's segments could be adversely affected.

Fluctuations in commodity prices can increase our costs and decrease our sales.

Agricultural income levels are affected by agricultural commodity prices and input costs. As a result, changes in commodity prices that reduce agricultural income levels could have a negative effect on the ability of growers and their contractors to purchase the Company's precision agriculture products manufactured by its Applied Technology Division.

Exploration for oil and natural gas fluctuates with their price. Plastic sheeting manufactured and sold by our Engineered Films Division is sold as pit and pond liners to contain water used in the drilling process. Lower prices for oil and natural gas could reduce exploration activities and demand for our products. Plastic sheeting manufacture uses plastic resins, which can be subject to change in price as the cost of natural gas or oil changes. Accordingly, volatility in oil and natural gas prices may negatively affect our cost of goods sold or cause us to change prices, which could adversely affect our sales and profitability.

Failure to develop and market new technologies and products could impact the Company's competitive position and have an adverse effect on the Company's financial results.

The Company's operating results in Applied Technology, Engineered Films and Aerostar depend upon the ability to renew the pipeline of new products and to bring those products to market. This ability could be adversely affected by difficulties or delays in product development such as the inability to identify viable new products, successfully complete research and development, obtain relevant regulatory approvals, obtain intellectual property protection or gain market acceptance of new products and services. Because of the lengthy development process, technological challenges and intense competition, there can be no assurance that any of the products the Company is currently developing, or could begin to develop in the future, will achieve substantial commercial success. Technical advancements in products may also increase the risk of product failure, increasing product returns or warranty claims and settlements. In addition, sales of the Company's new products could replace sales of some of its current products, offsetting the benefit of even a successful product introduction.

The Company's sales of proprietary products are subject to uncertainties, start-up costs and inefficiencies and faces competitive risks.

The growth strategy for the Company's Aerostar segment emphasizes the design and manufacture of proprietary products while transitioning its contract manufacturing services capabilities principally to support proprietary market opportunities. This transition from contract manufacturing services could take too long or be unsuccessful and have an adverse effect on the Company's financial results.

The Company's contract electronic manufacturing services (EMS) business and sewing businesses in the Aerostar Division have been dependent on the continued growth, viability and financial stability of a small group of customers. Aerostar is moving to transform itself into a proprietary manufacturer and service provider. Reductions in the Company's existing contract revenues, unless offset by other programs and opportunities, will adversely affect its ability to sustain and grow its future sales and earnings. Future sales will be dependent on the success of Aerostar's growth drivers, including advanced radar systems, high-altitude balloons and aerostats to international markets. To compete effectively, Aerostar must continue to provide technologically advanced products and services, maintain strict quality standards, respond flexibly and rapidly to customer needs and deliver products globally on a reliable basis at competitive prices. Start-up costs and inefficiencies can adversely affect operating results and such costs may not be recoverable in a proprietary product environment, because the Company may not receive reimbursement from its customers for such costs.

7

The Company's Aerostar segment depends on the U.S. government for a significant portion of its sales, creating uncertainty in the timing of and funding for projected contracts.

A significant portion of Aerostar's sales are to the U.S. government or U.S. government agencies as a prime or sub-contractor. Government spending has historically been cyclical. A decrease in U.S. government defense or near-space research spending or changes in spending allocation could result in one or more of the Company's programs being reduced, delayed or terminated. Reductions in the Company's existing programs, unless offset by other programs and opportunities, could adversely affect its ability to sustain and grow its future sales and earnings. The Company's U.S. government sales are funded by the federal budget, which operates on an October-to-September fiscal year. Changes in congressional schedules, negotiations for program funding levels, reduced program funding due to U.S government debt limitations, automatic budget cuts ("sequestration") or unforeseen world events can interrupt the funding for a program or contract. Funds for multi-year contracts can be changed in subsequent years in the appropriations process.

In addition, the U.S. government has increasingly relied on indefinite delivery, indefinite quantity (IDIQ) contracts and other procurement vehicles that are subject to a competitive bidding and funding process even after the award of the basic contract, adding an additional element of uncertainty to future funding levels. Delays in the funding process or changes in funding can impact the timing of available funds or can lead to changes in program content or termination at the government's convenience. The loss of anticipated funding or the termination of multiple or large programs could have an adverse effect on the Company's future sales and earnings.

The Company derives a portion of its revenues from foreign markets, which subjects the Company to business risks, including risk of changes in government policies and laws or worldwide economic conditions.

The Company's sales outside the U.S. were $45.9 million in fiscal 2014 , representing 12% of consolidated net sales. The Company's financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations. These conditions include, but are not limited to, changes in a country's or region's economic or political conditions; trade regulations affecting production, pricing and marketing of products; local labor conditions and regulations; reduced protection of intellectual property rights in some countries; changes in the regulatory or legal environment; restrictions on currency exchange activities; burdensome taxes and tariffs and other trade barriers. International risks and uncertainties also include changing social and economic conditions, terrorism, political hostilities and war, difficulty in enforcing agreements or collecting receivables and increased transportation or other shipping costs. Any of such risks could lead to reduced sales and reduced profitability associated with such sales.

Adverse economic conditions in the major industries the Company serves may materially affect segment performance and consolidated results of operations.

The Company's results of operations are impacted by the market fundamentals of the primary industries served. Significant declines of economic activity in the agricultural, oil and gas exploration, construction, industrial, aerospace/aviation, communication, defense and other major markets served may adversely affect segment performance and consolidated results of operations.

The Company may pursue or complete acquisitions which represent additional risk and could impact future financial results.

The Company's business strategy includes the potential for future acquisitions. Acquisitions involve a number of risks including integration of the acquired company with the Company's operations and unanticipated liabilities or contingencies related to the acquired company. The Company cannot ensure that the expected benefits of any acquisition will be realized. Costs could be incurred on pursuits or proposed acquisitions that have not yet or may not close which could significantly impact the operating results, financial condition or cash flows. Additionally, after the acquisition, unforeseen issues could arise which adversely affect the anticipated returns or which are otherwise not recoverable as an adjustment to the purchase price. Other acquisition risks include delays in realizing benefits from the acquired companies or products; difficulties due to lack of or limited prior experience in any new product or geographic markets we enter; unforeseen adjustments, charges or write-offs; unforeseen losses of customers or, or suppliers to, acquired businesses; difficulties in retaining key employees of the acquired businesses; or challenges arising from increased geographic diversity and complexity of our operations and our information technology systems.

Total goodwill and intangible assets account for approximately $30.0 million, or 10%, of Raven's total assets as of January 31, 2014 . The Company evaluates goodwill and intangible assets for impairment annually, or when evidence of potential impairment exists. The annual impairment test is based on several factors requiring judgment. Principally, a significant decrease in expected cash flows or changes in market conditions may indicate potential impairment of recorded goodwill or intangible assets. An impairment would adversely impact the Company's results of operations and financial condition.

The Company may fail to continue to attract, develop and retain key management and other key employees, which could negatively impact our operating results.

We depend on the performance of our senior management team and other key employees, including experienced and skilled technical personnel. The loss of certain members of our senior management, including our Chief Executive Officer, could

8

negatively impact our operating results and ability to execute our business strategy. Our future success will also depend in part upon our ability to attract, train, motivate and retain qualified personnel.

The Company may fail to protect its intellectual property effectively, or may infringe upon the intellectual property of others.

The Company has developed significant proprietary technology and other rights that are used in its businesses. The Company relies on trade secret, copyright, trademark and patent laws and contractual provisions to protect the Company's intellectual property. While the Company takes enforcement of these rights seriously, other companies such as competitors, or analogous persons in markets the Company does not participate, may attempt to copy or use the Company's intellectual property for their own benefit.

In addition, intellectual property of others also has an impact on the Company's ability to offer some of its products and services for specific uses or at competitive prices. Competitors' patents or other intellectual property may limit the Company's ability to offer products and services to its customers. Any infringement or claimed infringement of the intellectual property rights of others could result in litigation and adversely affect the Company's ability to continue to provide, or could increase the cost of providing, products and services.

Intellectual property litigation is very costly and could result in substantial expense and diversions of the Company's resources, both of which could adversely affect its businesses and financial condition and results. In addition, there may be no effective legal recourse against infringement of the Company's intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

Technology failures or cyber-attacks on the Company's systems could disrupt the Company's operations or the functionality of its products and negatively impact the Company's business.

The Company increasingly relies on information technology systems to process, transmit and store electronic information. In addition, a significant portion of internal communications, as well as communication with customers and suppliers depends on information technology. Further, the products in our Applied Technology segment depend upon GPS and other systems through which our products interact with government computer systems and other centralized information sources. We are exposed to the risk of cyber incidents in the normal course of business. Cyber incidents may be deliberate attacks for the theft of intellectual property or other sensitive information or may be the result of unintentional events. Like most companies, the Company's information technology systems may be vulnerable to interruption due to a variety of events beyond the Company's control, including, but not limited to, natural disasters, terrorist attacks, telecommunications failures, computer viruses, hackers and other security issues. Further, attacks on centralized information sources could affect the operation of our products or cause them to malfunction. The Company has technology security initiatives and disaster recovery plans in place to mitigate the Company's risk to these vulnerabilities, but these measures may not be adequate or implemented properly to ensure that the Company's operations are not disrupted. Potential consequences of a material cyber incident include damage to our reputation, litigation and increased cyber security protection and remediation costs. Such consequences could adversely affect our results of operations.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

ITEM 2. | PROPERTIES |

Raven's corporate office is at an owned premises located in Sioux Falls, South Dakota. The Company also owns separate manufacturing facilities for each of our business segments as well as various warehouses, training and product development facilities. In addition to these facilities, Applied Technology owns a product development facility in Austin, Texas and a manufacturing facility located in St. Louis, Missouri as well as leasing smaller research and office facilities in South Dakota. Aerostar has additional owned manufacturing, sewing and research facilities located in Huron and Madison, South Dakota, and Sulphur Springs, Texas. Aerostar also leases facilities in Arlington, Virginia; Duncansville, Pennsylvania and Monterey, Chatsworth and Sunnyvale, California. Most of the Company's manufacturing plants also serve as distribution centers and contain offices for sales, engineering and manufacturing support staff. The Company believes that its properties are suitable and adequate to meet existing production needs. Additionally, the productive capacity in the Company's facilities is substantially being utilized. The Company also owns approximately 24.6 acres of undeveloped land adjacent to the other owned property, which is available for expansion.

The following is the approximate square footage of the Company's owned or leased facilities by segment: Applied Technology - 175,000; Engineered Films - 310,000; Aerostar - 370,000; and Corporate - 150,000.

9

ITEM 3. | LEGAL PROCEEDINGS |

The Company is responsible for investigation and remediation of environmental contamination at one of its sold facilities (see Item 1, Business - Environmental Matters of this Annual Report on Form 10-K). In addition, the Company is involved as a defendant in lawsuits, claims or disputes arising in the normal course of its business. The potential costs and liability of such claims cannot be determined at this time. Management believes that any liability resulting from these claims will be substantially mitigated by insurance coverage. Accordingly, management does not believe the ultimate outcome of these matters will be significant to its results of operations, financial position or cash flows.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II |

|

|

|

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Raven's common stock is traded on the NASDAQ Global Select Market under the symbol RAVN. The following table shows quarterly unaudited financial results, quarterly high and low sales prices per share of Raven's common stock as reported by NASDAQ and dividends declared for the periods indicated:

QUARTERLY INFORMATION (UNAUDITED) | |||||||||||||||||||||||||||||||

(Dollars in thousands, except per-share amounts) | |||||||||||||||||||||||||||||||

| Net Sales | Gross Profit | Operating Income | Pre-tax Income | Net Income Attributable to Raven | Net Income Per Share (a) (b) | Common Stock Market Price (b) | Cash Dividends Per Share (b) | |||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| Basic | Diluted | High | Low | |||||||||||||||||||||||||||

FISCAL 2014 |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

First Quarter | $ | 103,680 | | $ | 34,916 | | $ | 20,934 | | $ | 20,736 | | $ | 14,003 | | $ | 0.38 | | $ | 0.38 | | $ | 34.04 | | $ | 25.46 | | $ | 0.12 | | |

Second Quarter | 93,421 | | 26,735 | | 12,568 | | 12,349 | | 8,333 | | 0.23 | | 0.23 | | 35.68 | | 28.82 | | 0.12 | | |||||||||||

Third Quarter | 104,938 | | 31,940 | | 18,132 | | 18,089 | | 12,289 | | 0.34 | | 0.34 | | 34.83 | | 28.38 | | 0.12 | | |||||||||||

Fourth Quarter | 92,638 | | 25,763 | | 12,360 | | 12,449 | | 8,278 | | 0.23 | | 0.23 | | 42.99 | | 32.64 | | 0.12 | | |||||||||||

Total Year | $ | 394,677 | | $ | 119,354 | | $ | 63,994 | | $ | 63,623 | | $ | 42,903 | | $ | 1.18 | | $ | 1.17 | | $ | 42.99 | | $ | 25.46 | | $ | 0.48 | | |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

FISCAL 2013 |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

First Quarter | $ | 117,915 | | $ | 41,135 | | $ | 28,432 | | $ | 28,380 | | $ | 19,043 | | $ | 0.53 | | $ | 0.52 | | $ | 35.56 | | $ | 28.16 | | $ | 0.105 | | |

Second Quarter | 101,674 | | 30,064 | | 17,407 | | 17,311 | | 11,546 | | 0.32 | | 0.32 | | 37.73 | | 28.59 | | 0.105 | | |||||||||||

Third Quarter | 97,011 | | 29,575 | | 16,372 | | 16,316 | | 10,859 | | 0.30 | | 0.30 | | 34.61 | | 26.78 | | 0.105 | | |||||||||||

Fourth Quarter | 89,575 | | 26,899 | | 15,481 | | 15,639 | | 11,097 | | 0.31 | | 0.30 | | 28.19 | | 23.01 | | 0.105 | | |||||||||||

Total Year | $ | 406,175 | | $ | 127,673 | | $ | 77,692 | | $ | 77,646 | | $ | 52,545 | | $ | 1.45 | | $ | 1.44 | | $ | 37.73 | | $ | 23.01 | | $ | 0.42 | | |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

FISCAL 2012 |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

First Quarter | $ | 101,541 | | $ | 32,936 | | $ | 23,533 | | $ | 23,520 | | $ | 15,716 | | $ | 0.44 | | $ | 0.43 | | $ | 30.96 | | $ | 23.60 | | $ | 0.09 | | |

Second Quarter | 90,344 | | 28,130 | | 18,674 | | 18,598 | | 12,461 | | 0.34 | | 0.34 | | 29.80 | | 24.68 | | 0.09 | | |||||||||||

Third Quarter | 93,300 | | 27,254 | | 16,875 | | 16,871 | | 11,390 | | 0.32 | | 0.32 | | 32.44 | | 21.62 | | 0.09 | | |||||||||||

Fourth Quarter | 96,326 | | 27,872 | | 16,559 | | 16,709 | | 11,002 | | 0.31 | | 0.30 | | 34.65 | | 25.09 | | 0.09 | | |||||||||||

Total Year | $ | 381,511 | | $ | 116,192 | | $ | 75,641 | | $ | 75,698 | | $ | 50,569 | | $ | 1.40 | | $ | 1.39 | | $ | 34.65 | | $ | 21.62 | | $ | 0.36 | | |

(a) | Net income per share is computed discretely by quarter and may not add to the full year. | ||||||||||||||||||||||||||||||

(b) | All per-share and market data reflect the July 2012 two-for-one stock split. | ||||||||||||||||||||||||||||||

As of January 31, 2014 , the Company had approximately 11,800 beneficial holders, which includes a substantial amount of the Company's common stock held of record by banks, brokers and other financial institutions.

# 10

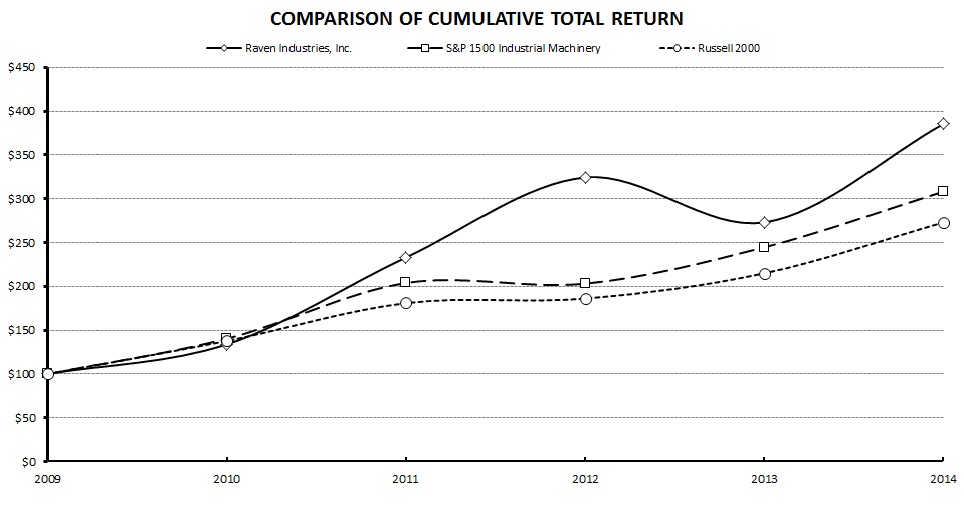

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG RAVEN INDUSTRIES, INC.,

S&P 1500 INDUSTRIAL MACHINERY INDEX AND RUSSELL 2000 INDEX

Raven outperformed its industrial peers and the overall market in shareholder return. Investors who bought $100 of the Company's stock on January 31, 2009 , held this for five years and reinvested the dividends, have seen its value increase to $385.40 .

|

| Years Ended January 31, |

| 5-Year | |||||||||||||||||||||||

Company / Index |

| 2009 |

| 2010 |

| 2011 |

| 2012 |

| 2013 |

| 2014 |

| CAGR (a) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Raven Industries, Inc. |

| $ | 100.00 | |

| $ | 133.82 | |

| $ | 233.03 | |

| $ | 324.33 | |

| $ | 273.10 | |

| $ | 385.40 | |

| 31.0 | % |

S&P 1500 Industrial Machinery Index |

| 100.00 | |

| 140.29 | |

| 203.82 | |

| 203.06 | |

| 244.59 | |

| 308.15 | |

| 25.2 | % | ||||||

Russell 2000 Index |

| 100.00 | |

| 137.73 | |

| 180.87 | |

| 186.04 | |

| 214.90 | |

| 272.99 | |

| 22.2 | % | ||||||

(a) compound annual growth rate (CAGR) |

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

# 11

ITEM 6. | SELECTED FINANCIAL DATA |

ELEVEN-YEAR FINANCIAL SUMMARY | ||||||||||||

(In thousands, except employee counts and per-share amounts) |

| For the years ended January 31, | ||||||||||

|

| 2014 |

| 2013 |

| 2012 | ||||||

OPERATIONS |

|

|

|

|

|

| ||||||

Net sales |

| $ | 394,677 | |

| $ | 406,175 | |

| $ | 381,511 | |

Gross profit |

| 119,354 | |

| 127,673 | |

| 116,192 | | |||

Operating income |

| 63,994 | |

| 77,692 | |

| 75,641 | | |||

Income before income taxes |

| 63,623 | |

| 77,646 | |

| 75,698 | | |||

Net income attributable to Raven Industries, Inc. |

| $ | 42,903 | |

| $ | 52,545 | |

| $ | 50,569 | |

Net income % of sales |

| 10.9 | % |

| 12.9 | % |

| 13.3 | % | |||

Net income % of beginning equity |

| 19.4 | % |

| 29.1 | % |

| 35.8 | % | |||

Cash dividends (a) |

| $ | 17,465 | |

| $ | 15,244 | |

| $ | 13,025 | |

FINANCIAL POSITION |

|

|

|

|

|

| ||||||

Current assets |

| $ | 169,405 | |

| $ | 156,748 | |

| $ | 147,559 | |

Current liabilities |

| 29,819 | |

| 33,061 | |

| 40,646 | | |||

Working capital |

| $ | 139,586 | |

| $ | 123,687 | |

| $ | 106,913 | |

Current ratio |

| 5.68 | |

| 4.74 | |

| 3.63 | | |||

Property, plant and equipment |

| $ | 98,076 | |

| $ | 81,238 | |

| $ | 61,894 | |

Total assets |

| 301,819 | |

| 273,210 | |

| 245,703 | | |||

Long-term debt, less current portion |

| - | |

| - | |

| - | | |||

Raven Industries, Inc. shareholders' equity |

| $ | 251,362 | |

| $ | 221,346 | |

| $ | 180,499 | |

Long-term debt / total capitalization |

| - | % |

| - | % |

| - | % | |||

Inventory turnover (cost of sales / average inventory) |

| 5.2 | |

| 5.4 | |

| 5.4 | | |||

CASH FLOWS PROVIDED BY (USED IN) |

|

|

|

|

|

| ||||||

Operating activities |

| $ | 52,836 | |

| $ | 76,456 | |

| $ | 43,831 | |

Investing activities |

| (31,615 | ) |

| (29,930 | ) |

| (40,313 | ) | |||

Financing activities |

| (17,354 | ) |

| (23,007 | ) |

| (15,234 | ) | |||

Change in cash |

| 3,634 | |

| 23,511 | |

| (11,721 | ) | |||

COMMON STOCK DATA |

|

|

|

|

|

| ||||||

EPS - basic |

| $ | 1.18 | |

| $ | 1.45 | |

| $ | 1.40 | |

EPS - diluted |

| 1.17 | |

| 1.44 | |

| 1.39 | | |||

Cash dividends per share (a) |

| 0.48 | |

| 0.42 | |

| 0.36 | | |||

Book value per share (b) |

| 6.89 | |

| 6.09 | |

| 4.97 | | |||

Stock price range during the year |

|

|

|

|

|

| ||||||

High |

| $ | 42.99 | |

| $ | 37.73 | |

| $ | 34.65 | |

Low |

| 25.46 | |

| 23.01 | |

| 21.62 | | |||

Close |

| $ | 37.45 | |

| $ | 26.93 | |

| $ | 32.45 | |

Shares and stock units outstanding, year-end |

| 36,492 | |

| 36,326 | |

| 36,284 | | |||

Number of shareholders, year-end |

| 11,764 | |

| 10,439 | |

| 10,618 | | |||

OTHER DATA |

|

|

|

|

|

| ||||||

Price / earnings ratio (c) |

| 32.0 | |

| 18.7 | |

| 23.4 | | |||

Average number of employees |

| 1,264 | |

| 1,350 | |

| 1,252 | | |||

Sales per employee |

| $ | 312 | |

| $ | 301 | |

| $ | 305 | |

Backlog |

| $ | 51,793 | |

| $ | 51,121 | |

| $ | 66,641 | |

|

|

|

|

|

|

| ||||||

All per-share, shares outstanding and market price data reflect the July 2012 two-for-one stock split, the October 2004 two-for-one stock split and the January 2003 two-for-one stock split. | ||||||||||||

| ||||||||||||

(a) Includes special dividends of $0.625 per share in fiscal 2011 and 2009; and $0.3125 per share in fiscal 2005 | ||||||||||||

(b) Raven Industries, Inc. shareholders' equity, excluding equity attributable to noncontrolling interests, divided by common shares and stock units outstanding. | ||||||||||||

(c) Closing stock price divided by EPS - diluted. |

|

|

|

|

|

| ||||||

# 12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| 2011 |

| 2010 |

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

| 2004 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| $ | 314,708 | |

| $ | 237,782 | |

| $ | 279,913 | |

| $ | 233,957 | |

| $ | 217,529 | |

| $ | 204,528 | |

| $ | 168,086 | |

| $ | 142,727 | |

| 91,429 | |

| 67,852 | |

| 73,448 | |

| 63,676 | |

| 57,540 | |

| 55,714 | |

| 45,212 | |

| 35,488 | | ||||||||

| 60,203 | |

| 43,220 | |

| 46,394 | |

| 41,145 | |

| 38,302 | |

| 37,284 | |

| 27,862 | |

| 21,626 | | ||||||||

| 60,282 | |

| 43,322 | |

| 46,901 | |

| 42,224 | |

| 38,835 | |

| 37,494 | |

| 27,955 | |

| 21,716 | | ||||||||

| $ | 40,537 | |

| $ | 28,574 | |

| $ | 30,770 | |

| $ | 27,802 | |

| $ | 25,441 | |

| $ | 24,262 | |

| $ | 17,891 | |

| $ | 13,836 | |

| 12.9 | % |

| 12.0 | % |

| 11.0 | % |

| 11.9 | % |

| 11.7 | % |

| 11.9 | % |

| 10.6 | % |

| 9.7 | % | ||||||||

| 30.4 | % |

| 25.2 | % |

| 26.0 | % |

| 28.3 | % |

| 30.1 | % |

| 36.7 | % |

| 26.9 | % |

| 23.8 | % | ||||||||

| $ | 34,095 | |

| $ | 9,911 | |

| $ | 31,884 | |

| $ | 7,966 | |

| $ | 6,507 | |

| $ | 5,056 | |

| $ | 15,298 | |

| $ | 3,075 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| $ | 128,181 | |

| $ | 117,747 | |

| $ | 98,073 | |

| $ | 100,869 | |

| $ | 73,219 | |

| $ | 71,345 | |

| $ | 61,592 | |

| $ | 55,710 | |

| 34,335 | |

| 25,960 | |

| 23,322 | |

| 22,108 | |

| 16,464 | |

| 20,050 | |

| 20,950 | |

| 11,895 | | ||||||||

| $ | 93,846 | |

| $ | 91,787 | |

| $ | 74,751 | |

| $ | 78,761 | |

| $ | 56,755 | |

| $ | 51,295 | |

| $ | 40,642 | |

| $ | 43,815 | |

| 3.73 | |

| 4.54 | |

| 4.21 | |

| 4.56 | |

| 4.45 | |

| 3.56 | |

| 2.94 | |

| 4.68 | | ||||||||

| $ | 41,522 | |

| $ | 33,029 | |

| $ | 35,880 | |

| $ | 35,743 | |

| $ | 36,264 | |

| $ | 25,602 | |

| $ | 19,964 | |

| $ | 15,950 | |

| 187,760 | |

| 170,309 | |

| 144,415 | |

| 147,861 | |

| 119,764 | |

| 106,157 | |

| 88,509 | |

| 79,508 | | ||||||||

| - | |

| - | |

| - | |

| - | |

| - | |

| 9 | |

| - | |

| 57 | | ||||||||

| $ | 141,214 | |

| $ | 133,251 | |

| $ | 113,556 | |

| $ | 118,275 | |

| $ | 98,268 | |

| $ | 84,389 | |

| $ | 66,082 | |

| $ | 66,471 | |

| - | % |

| - | % |

| - | % |

| - | % |

| - | % |

| - | % |

| - | % |

| 0.1 | % | ||||||||

| 5.6 | |

| 5.3 | |

| 5.2 | |

| 5.3 | |

| 5.4 | |

| 5.9 | |

| 5.8 | |

| 6.1 | | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| $ | 42,085 | |

| $ | 47,643 | |

| $ | 39,037 | |

| $ | 27,151 | |

| $ | 26,313 | |

| $ | 21,189 | |

| $ | 18,871 | |

| $ | 19,732 | |

| (11,418 | ) |

| (13,396 | ) |

| (7,000 | ) |

| (4,433 | ) |

| (18,664 | ) |

| (11,435 | ) |

| (7,631 | ) |

| (4,352 | ) | ||||||||

| (33,834 | ) |

| (9,867 | ) |

| (36,969 | ) |

| (8,270 | ) |

| (10,277 | ) |

| (6,946 | ) |

| (19,063 | ) |

| (6,155 | ) | ||||||||

| (3,121 | ) |

| 24,417 | |

| (5,005 | ) |

| 14,489 | |

| (2,626 | ) |

| 2,790 | |

| (7,823 | ) |

| 9,225 | | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| $ | 1.12 | |

| $ | 0.79 | |

| $ | 0.86 | |

| $ | 0.77 | |

| $ | 0.71 | |

| $ | 0.67 | |

| $ | 0.50 | |

| $ | 0.39 | |

| 1.12 | |

| 0.79 | |

| 0.85 | |

| 0.77 | |

| 0.70 | |

| 0.66 | |

| 0.49 | |

| 0.38 | | ||||||||

| 0.95 | |

| 0.28 | |

| 0.89 | |

| 0.22 | |

| 0.18 | |

| 0.14 | |

| 0.43 | |

| 0.09 | | ||||||||

| 3.91 | |

| 3.69 | |

| 3.15 | |

| 3.26 | |

| 2.73 | |

| 2.34 | |

| 1.84 | |

| 1.84 | | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| $ | 24.80 | |

| $ | 16.59 | |

| $ | 23.91 | |

| $ | 22.93 | |

| $ | 21.35 | |

| $ | 16.58 | |

| $ | 13.47 | |

| $ | 7.62 | |

| 13.27 | |

| 7.69 | |

| 10.30 | |

| 13.10 | |

| 12.73 | |

| 8.27 | |

| 6.54 | |

| 3.78 | | ||||||||

| $ | 23.62 | |

| $ | 14.29 | |

| $ | 10.91 | |

| $ | 15.01 | |

| $ | 14.22 | |

| $ | 15.80 | |

| $ | 9.19 | |

| $ | 7.06 | |

| 36,178 | |

| 36,102 | |

| 36,054 | |

| 36,260 | |

| 36,088 | |

| 36,144 | |

| 35,998 | |

| 36,082 | | ||||||||

| 7,456 | |

| 7,767 | |

| 8,268 | |

| 8,700 | |

| 8,992 | |

| 9,263 | |

| 6,269 | |

| 3,560 | | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| 21.1 | |

| 18.1 | |

| 12.8 | |

| 19.6 | |

| 20.5 | |

| 23.9 | |

| 18.9 | |

| 18.8 | | ||||||||

| 1,036 | |

| 930 | |

| 1,070 | |

| 930 | |

| 884 | |

| 845 | |

| 835 | |

| 787 | | ||||||||

| $ | 304 | |

| $ | 256 | |

| $ | 262 | |

| $ | 252 | |

| $ | 246 | |

| $ | 242 | |

| $ | 201 | |

| $ | 181 | |

| $ | 75,972 | |

| $ | 74,718 | |

| $ | 80,361 | |

| $ | 66,628 | |

| $ | 44,237 | |

| $ | 43,619 | |

| $ | 43,646 | |

| $ | 47,120 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

# 13

BUSINESS SEGMENTS |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

(Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

|

| For the years ended January 31, | ||||||||||||||||||||||

|

| 2014 |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 | ||||||||||||

APPLIED TECHNOLOGY DIVISION |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Sales |

| $ | 170,461 | |

| $ | 171,778 | |

| $ | 145,261 | |

| $ | 107,910 | |

| $ | 94,005 | |

| $ | 111,512 | |

Operating income |

| 57,000 | |

| 59,590 | |

| 49,750 | |

| 33,197 | |

| 27,538 | |

| 35,034 | | ||||||

Assets |

| 93,395 | |

| 84,224 | |

| 73,872 | |

| 55,740 | |

| 54,007 | |

| 51,608 | | ||||||

Capital expenditures |

| 9,324 | |

| 10,780 | |

| 11,971 | |

| 1,947 | |

| 1,092 | |

| 2,857 | | ||||||

Depreciation and amortization |

| 4,332 | |

| 3,874 | |

| 2,571 | |

| 2,483 | |

| 1,863 | |

| 1,646 | | ||||||

ENGINEERED FILMS DIVISION |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Sales |

| $ | 147,620 | |

| $ | 141,976 | |

| $ | 133,481 | |

| $ | 105,838 | |

| $ | 63,783 | |

| $ | 89,858 | |

Operating income (b) |

| 18,154 | |

| 25,115 | |

| 21,501 | |

| 19,622 | |

| 10,232 | |

| 10,919 | | ||||||

Assets |

| 71,602 | |

| 65,801 | |

| 65,100 | |

| 46,519 | |

| 35,999 | |

| 35,862 | | ||||||

Capital expenditures |

| 6,681 | |

| 11,539 | |

| 10,937 | |

| 8,450 | |

| 1,460 | |

| 3,120 | | ||||||

Depreciation and amortization |

| 5,808 | |

| 5,814 | |

| 4,313 | |

| 3,452 | |

| 3,707 | |

| 4,303 | | ||||||

AEROSTAR DIVISION |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Sales |

| $ | 90,605 | |

| $ | 102,051 | |

| $ | 107,811 | |

| $ | 104,384 | |

| $ | 81,617 | |

| $ | 78,783 | |

Operating income |

| 7,816 | |

| 10,341 | |

| 18,308 | |

| 17,209 | |

| 12,849 | |

| 8,924 | | ||||||

Assets |

| 63,017 | |

| 60,689 | |

| 72,089 | |

| 38,366 | |

| 28,665 | |

| 32,777 | | ||||||

Capital expenditures |

| 7,507 | |

| 2,081 | |

| 4,105 | |

| 2,621 | |

| 471 | |

| 1,599 | | ||||||

Depreciation and amortization |

| 2,616 | |

| 2,272 | |

| 1,684 | |

| 1,335 | |

| 1,151 | |

| 1,340 | | ||||||

INTERSEGMENT ELIMINATIONS |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Sales |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Applied Technology Division |

| $ | (386 | ) |

| $ | (974 | ) |

| $ | (460 | ) |

| $ | (226 | ) |

| $ | (31 | ) |

| $ | (5 | ) |

Engineered Films Division |

| (505 | ) |

| (124 | ) |

| (193 | ) |

| (307 | ) |

| (210 | ) |

| (210 | ) | ||||||

Aerostar Division |

| (13,118 | ) |

| (8,532 | ) |

| (4,389 | ) |

| (2,891 | ) |

| (1,382 | ) |

| (25 | ) | ||||||

Operating income |

| (111 | ) |

| (61 | ) |

| (188 | ) |

| (41 | ) |

| 8 | |

| 19 | | ||||||

Assets |

| (311 | ) |

| (347 | ) |

| (286 | ) |

| (98 | ) |

| (57 | ) |

| (65 | ) | ||||||

CORPORATE & OTHER (a) |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Operating (loss) from administrative expenses |

| $ | (18,865 | ) |

| $ | (17,293 | ) |

| $ | (13,730 | ) |

| $ | (9,784 | ) |

| $ | (7,407 | ) |

| $ | (8,502 | ) |

Assets |

| 74,116 | |

| 62,843 | |

| 34,928 | |

| 47,233 | |

| 51,695 | |

| 24,233 | | ||||||

Capital expenditures |

| 7,189 | |

| 5,275 | |

| 2,002 | |

| 954 | |

| 279 | |

| 425 | | ||||||

Depreciation and amortization |

| 1,439 | |

| 1,138 | |

| 700 | |

| 361 | |

| 387 | |

| 469 | | ||||||

TOTAL COMPANY |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Sales |

| $ | 394,677 | |

| $ | 406,175 | |

| $ | 381,511 | |

| $ | 314,708 | |

| $ | 237,782 | |

| $ | 279,913 | |

Operating income (b) |

| 63,994 | |

| 77,692 | |

| 75,641 | |

| 60,203 | |

| 43,220 | |

| 46,394 | | ||||||

Assets |

| 301,819 | |

| 273,210 | |

| 245,703 | |

| 187,760 | |

| 170,309 | |

| 144,415 | | ||||||

Capital expenditures |

| 30,701 | |

| 29,675 | |

| 29,015 | |

| 13,972 | |

| 3,302 | |

| 8,001 | | ||||||

Depreciation and amortization |

| 14,195 | |

| 13,098 | |

| 9,268 | |

| 7,631 | |

| 7,108 | |

| 7,758 | | ||||||

| ||||||||||||||||||||||||

(a) Assets are principally cash, investments, deferred taxes and other receivables. |

|

|

|

| ||||||||||||||||||||

(b) The year ended January 31, 2011 includes a $451 pre-tax gain on disposition of assets. |

|

|

|

| ||||||||||||||||||||

# 14

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to enhance overall financial disclosure with commentary on the operating results, liquidity, capital resources and financial condition of Raven Industries, Inc. (the Company or Raven). This commentary provides management's analysis of the primary drivers of year-over-year changes in key financial statement elements, business segment results and the impact of accounting principles on the Company's financial statements. The most significant risks and uncertainties impacting the operating performance and financial condition of the Company are discussed in Item 1A., Risk Factors, of this Annual Report on Form 10-K.

This discussion should be read in conjunction with Raven's Consolidated Financial Statements and notes thereto in Item 8 of this Form 10-K.

The MD&A is organized as follows:

• | Executive Summary |

• | Results of Operations - Segment Analysis |

• | Outlook |

• | Liquidity and Capital Resources |

• | Off-balance Sheet Arrangements and Contractual Obligations |

• | Critical Accounting Estimates |

• | Accounting Pronouncements |

EXECUTIVE SUMMARY

Raven is a diversified technology company providing a variety of products to customers within the industrial, agricultural, energy, construction and military/aerospace markets. The Company is comprised of three unique operating units, classified into reportable segments: Applied Technology Division, Engineered Films Division and Aerostar Division. While each segment has distinct characteristics, the products and technologies are largely extensions of durable competitive advantages rooted in the original research balloon business. As strategic actions have changed the Company's business over the last several years, Raven has remained committed to providing high-quality, high-value products. The Company's performance reflects our ongoing adjustment to conditions and opportunities.

Management uses a number of metrics to assess the Company's performance:

• | Consolidated net sales, gross margins, operating income, operating margins, net income and earnings per share |

• | Cash flow from operations and shareholder returns |

• | Return on sales, assets and equity |

• | Segment net sales, gross profit, gross margins, operating income and operating margins |

Vision and Strategy

At Raven, there is a singular purpose behind everything we do. It is: to solve great challenges. Great challenges require great solutions. Raven's three unique divisions share resources, ideas and a passion to create technology that helps the world grow more food, produce more energy, protect the environment and live safely.

The Raven business model is our platform for success. Our business model is defensible, sustainable and gives us a consistent approach in the pursuit of quality financial results. This overall approach to creating value, which is employed across the three business segments, is summarized as follows:

• | Intentionally serve a set of diversified market segments with attractive near- and long-term growth prospects; |

• | Consistently manage a pipeline of growth initiatives within our market segments; |

• | Aggressively compete on quality, service, innovation and peak performance; |

• | Hold ourselves accountable for continuous improvement; |

• | Value our balance sheet as a source of strength and stability; and |

• | Make corporate responsibility a top priority. |

This diversified business model enables us to weather near-term challenges, while continuing to grow and build for our future. It is our culture and it is woven into how we do business.

# 15

The following discussion highlights the consolidated operating results. Segment operating results are more fully explained in the Results of Operations - Segment Analysis section.

|

| For the years ended January 31, | ||||||||||||||||

dollars in thousands, except per-share data |

| 2014 |

| % change |

| 2013 |

| % change |

| 2012 | ||||||||

Results of Operations |

|

|

|

|

|

|

|

|

|

| ||||||||

Net sales |

| $ | 394,677 | |

| (3 | )% |

| $ | 406,175 | |

| 6 | % |

| $ | 381,511 | |

Gross margins (a) |

| 29.2 | % |

|

|

| 31.4 | % |

|

|

| 30.5 | % | |||||

Operating income |

| $ | 63,994 | |

| (18 | )% |

| $ | 77,692 | |

| 3 | % |

| $ | 75,641 | |

Operating margins (a) |

| 16.2 | % |

|

|

| 19.1 | % |

|

|

| 19.8 | % | |||||

Net income attributable to Raven Industries, Inc. |

| $ | 42,903 | |

| (18 | )% |

| $ | 52,545 | |

| 4 | % |

| $ | 50,569 | |

Diluted income per share (b) |

| $ | 1.17 | |

| (19 | )% |

| $ | 1.44 | |

| 4 | % |

| $ | 1.39 | |

|

|

|

|

|

|

|

|

|

|

| ||||||||

Cash Flow and Payments to Shareholders |

|

|

|

|

|

|

|

|

|

| ||||||||

Cash flow from operating activities |

| $ | 52,836 | |

|

|

| $ | 76,456 | |

|

|

| $ | 43,831 | | ||

Cash outflow for capital expenditures |

| $ | 30,701 | |

|

|

| $ | 29,675 | |

|

|

| $ | 29,015 | | ||

Cash dividends |

| $ | 17,465 | |

|

|

| $ | 15,244 | |

|

|

| $ | 13,025 | | ||

|

|

|

|

|

|

|

|

|

|

| ||||||||

Performance Measures |

|

|

|

|

|

|

|

|

|

| ||||||||

Return on net sales (c) |

| 10.9 | % |

|

|

| 12.9 | % |

|

|

| 13.3 | % | |||||

Return on average assets (d) |

| 14.9 | % |

|

|

| 20.3 | % |

|

|

| 23.3 | % | |||||

Return on beginning equity (e) |

| 19.4 | % |

|

|

| 29.1 | % |

|

|

| 35.8 | % | |||||

|

|

|

|

|

|

|

|

|

|

| ||||||||

(a) The Company's gross and operating margins may not be comparable to industry peers due to variability in the classification of expenses | ||||||||||||||||||

across industries in which the Company operates. | ||||||||||||||||||

(b) Diluted income per share reflects a two-for-one stock split effective July 25, 2012. | ||||||||||||||||||

(c) Net income divided by sales. | ||||||||||||||||||

(d) Net income divided by average assets. | ||||||||||||||||||

(e) Net income divided by beginning equity. | ||||||||||||||||||

Results of Operations - Fiscal 2014 compared to Fiscal 2013

The Company's net sales in fiscal 2014 were $394.7 million, a decrease of $11.5 million, or 3%, from last year's record net sales of $406.2 million. Changes in net sales levels varied across the divisions. Engineered Films' fiscal 2014 net sales were up 4% over fiscal 2013 with a strong second half, led by higher agricultural sales and a recovery in demand for pit liners in the energy markets. The introduction of new products in fiscal 2014 and higher original equipment manufacturer (OEM) demand offset by weaker demand in the U.S. aftermarket led to Applied Technology's 1% net sales decline in fiscal 2014 compared to fiscal 2013. In Aerostar, higher radar sales and high-altitude balloon and service related revenues were not enough to offset the expected lower contract manufacturing, parachutes and protective wear revenues. Overall Aerostar net sales decreased 11% from fiscal 2013 to fiscal 2014.

Fiscal 2014 operating income decreased 18% from fiscal 2013 due primarily to the overall sales decline, lower gross profit margins and higher investment in research and development (R&D) expenses across all divisions. Applied Technology's operating income decreased by 4% due to lower sales volumes and product mix. Substantially higher resin costs combined with market conditions that did not allow for pass-through costs caused Engineered Films' operating income to decrease 28%. Aerostar posted a decline of 24% from the prior year operating income due primarily to lower sales and higher operating expense.

Results of Operations - Fiscal 2013 compared to Fiscal 2012

The Company posted record sales, operating income, net income and diluted earnings per share for fiscal 2013 . These record levels resulted in large part from continued higher demand for Applied Technology's products as well as increased demand in Engineered Films' geomembrane and agriculture markets. With additional support from the demand for pit liners in the energy market through the first half of fiscal 2013, Engineered Films' net sales increased 6% as compared to fiscal 2012. Strong OEM demand, international growth and new product sales fueled an 18% increase in net sales for Applied Technology in fiscal 2013 as compared to fiscal 2012. Aerostar's net sales decreased 5% resulting from a lack of tethered aerostat deliveries; however, in spite of this decrease, the Company's net sales increased 6% compared to the prior fiscal year.

# 16

Fiscal 2013 operating income increased 3% from fiscal 2012 primarily due to sales growth partially offset by higher investment in R&D, selling and administrative expenses. Applied Technology increased its operating income by 20% due to higher sales and associated operating leverage. Engineered Films' operating income growth of 17% reflected higher sales and increased operating efficiencies and favorable price versus material cost spread seen in the first half of fiscal 2013. Aerostar posted a decline of 44% from the prior year operating income due primarily to lower sales.

Cash Flow and Payments to Shareholders

The Company continues to generate strong operating cash flows and maintain a strong capital base as reflected in the $53.2 million cash and short-term investments balance as of January 31, 2014. Capital expenditures totaled $30.7 million in fiscal 2014 compared to $29.7 million in fiscal 2013 . Capital spending consisted primarily of expenditures to expand Engineered Films' manufacturing capacity, facility expansion for Aerostar and renovation of the Company's headquarters.

During fiscal 2014 , $17.5 million was returned to shareholders though quarterly dividends. In the first quarter of fiscal 2014, the quarterly dividend was raised from 10.5 cents per share to 12.0 cents per share, representing the 27th consecutive annual increase in the dividend (excluding special dividends). During fiscal 2013 , $15.2 million was returned to shareholders through quarterly dividends.

Performance Measures

Returns on net sales, average assets and beginning equity are important gauges of Raven's ability to efficiently produce profits. Although the Company's fiscal 2014 returns were not at the level of the prior two years' results, they have remained at strong levels as the Company has capitalized on competitive advantages in niche markets while investing in future product development.