|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☑ | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the Fiscal Year Ended December 31, 2017 |

OR

¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from to . |

Commission file number 333-199861

MYLAN N.V.

(Exact name of registrant as specified in its charter)

The Netherlands |

| 98-1189497 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England

(Address of principal executive offices)

+44 (0) 1707-853-000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class: |

| Name of Each Exchange on Which Registered: |

Ordinary shares, nominal value €0.01 |

| The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

Large accelerated filer | ☑ |

|

| Accelerated filer |

| ¨ |

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) |

| Smaller reporting company |

| ¨ |

|

|

|

| Emerging growth company |

| ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ☑

The aggregate market value of the outstanding ordinary shares, nominal value €0.01 , of the registrant other than shares held by persons who may be deemed affiliates of the registrant, as of June 30, 2017 , the last business day of the registrant's most recently completed second fiscal quarter, was approximately $20,669,862,339 .

The number of ordinary shares outstanding, nominal value €0.01 , of the registrant as of February 23, 2018 was 514,781,709 .

INCORPORATED BY REFERENCE

Document | Part of Form 10-K into Which Document is Incorporated |

An amendment to this Form 10-K will be filed no later than 120 days after the close of registrant's fiscal year. | III |

|

Table of Contents

MYLAN N.V.

INDEX TO FORM 10-K

For the Year Ended December 31, 2017

|

| Page |

PART I |

| |

ITEM 1. | Business | 3 |

ITEM 1A. | Risk Factors | 25 |

ITEM 1B. | Unresolved Staff Comments | 49 |

ITEM 2. | Properties | 49 |

ITEM 3. | Legal Proceedings | 49 |

|

|

|

PART II |

| |

ITEM 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 50 |

ITEM 6. | Selected Financial Data | 53 |

ITEM 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 55 |

ITEM 7A. | Quantitative and Qualitative Disclosures about Market Risk | 82 |

ITEM 8. | Financial Statements and Supplementary Data | 83 |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 172 |

ITEM 9A. | Controls and Procedures | 172 |

ITEM 9B. | Other Information | 172 |

|

|

|

PART III |

| |

ITEM 10. | Directors, Executive Officers and Corporate Governance | 173 |

ITEM 11. | Executive Compensation | 173 |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 173 |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 173 |

ITEM 14. | Principal Accounting Fees and Services | 173 |

|

|

|

PART IV |

| |

ITEM 15. | Exhibits and Consolidated Financial Statement Schedules | 174 |

Signatures | 182 | |

2

Table of Contents

PART I

ITEM 1. | Business |

Mylan N.V. , along with its subsidiaries (collectively, the "Company," " Mylan ," "our" or "we"), is a leading global pharmaceutical company, which develops, licenses, manufactures, markets and distributes generics, branded generics, brand name and over-the-counter ("OTC") products in a variety of dosage forms and therapeutic categories. Mylan is committed to setting new standards in healthcare by creating better health for a better world, and our mission is to provide the world's 7 billion people access to high quality medicine. To do so, we innovate to satisfy unmet needs; make reliability and service excellence a habit; do what's right, not what's easy; and impact the future through passionate global leadership. We believe access to healthcare should be a right, not a privilege. That makes our mission very personal. While a great deal of progress has been made over the years to expand access to healthcare, there's still much to be done. With our strong foundation in pharmaceuticals and long track record of doing good, Mylan is uniquely positioned to address the world's most pressing health concerns.

Mylan offers one of the industry's broadest product portfolios, including more than 7,500 marketed products around the world, to customers in more than 165 countries and territories. We operate a global, high quality, vertically-integrated manufacturing platform around the world and one of the world's largest active pharmaceutical ingredient ("API") operations. We also operate a strong and innovative research and development ("R&D") network that has consistently delivered a robust product pipeline including a variety of dosage forms, therapeutic categories and biosimilars.

Overview

Throughout its history, Mylan has been recognized as a leader in the United States ("U.S.") generic pharmaceutical industry. Our leadership position is the result of, among other factors, our ability to efficiently obtain Abbreviated New Drug Application ("ANDA") approvals and our reliable high quality supply chain. Mylan is one of the largest pharmaceutical companies in the world today in terms of revenue and is recognized as an industry leader because of our organic growth and transformative acquisitions beginning in 2007.

Our most recent significant acquisitions include the June 2016 acquisition of the non-sterile, topicals-focused business (the "Topicals Business") of Renaissance Acquisition Holdings, LLC ("Renaissance") for approximately $1.01 billion in cash at closing, including amounts that were deposited into escrow for potential contingent payments. The Topicals Business provided the Company with a complementary portfolio of commercial and pipeline products, and an established U.S. sales and marketing infrastructure targeting dermatologists. The Topicals Business also provided an integrated manufacturing and development platform.

Also, in August 2016, we acquired Meda AB (publ.) ("Meda") for a total purchase price of approximately $6.92 billion , net of cash acquired. Meda provided a diversified and expansive portfolio of branded and generic medicines along with a strong and growing portfolio of OTC products. The combined company has a balanced global footprint with significant scale in key geographic markets, particularly the U.S. and Europe. The acquisition of Meda also expanded our presence in key emerging markets, including, China, Russia, Turkey, and Mexico, and in countries in South East Asia, and the Middle East, which complemented Mylan's existing presence in India, Brazil and Africa (including South Africa).

One Mylan

Through our recent significant transactions, along with our previous transformative acquisitions of Mylan Inc. and Abbott Laboratories ' (" Abbott ") non-U.S. developed markets specialty and branded generics business (the "EPD Business"), Agila Specialties (‘‘ Agila ''), Matrix Laboratories Limited (now known as Mylan Laboratories Limited or "Mylan India"), Merck KGaA's generics and specialty pharmaceutical business, Bioniche Pharma Holdings Limited and Pfizer Inc.'s ("Pfizer") respiratory delivery platform (the "respiratory delivery platform"), we have created a horizontally and vertically integrated platform with global scale, augmented our diversified product portfolio and further expanded our range of capabilities, all of which we believe position us well for the future.

Today, Mylan has a robust worldwide commercial presence, including leadership positions in the U.S., Australia and France as well as other markets around the world. Mylan 's global portfolio of more than 7,500 marketed generic and branded generic, brand name, and OTC products around the world covers a vast array of therapeutic categories. We offer an extensive range of dosage forms and delivery systems, including oral solids, topicals, liquids and semisolids while focusing on those products that are difficult to formulate and manufacture, and typically have longer life cycles than traditional generic pharmaceuticals, including transdermal patches, high potency formulations, injectables, controlled-release and respiratory

3

Table of Contents

products. OTC products are key complements to prescribed drugs because they are easily accessible, save patients' time and reduce cost pressures on healthcare systems. Mylan also operates one of the largest API manufacturers, supplying low cost, high quality API for our own products and pipeline, as well as for a number of third parties.

We believe that the breadth and depth of our business and platform provide certain competitive advantages in major markets in which we operate, including less dependency on any single market or product. As a result, we are better able to successfully compete on a global basis than many of our competitors.

Our Operations

Mylan N.V. was originally incorporated as a private limited liability company, New Moon B.V., in the Netherlands in 2014. Mylan became a public limited liability company in the Netherlands through its acquisition of the EPD Business on February 27, 2015 . Mylan's corporate seat is located in Amsterdam, the Netherlands , its principal executive offices are located in Hatfield, Hertfordshire, England and Mylan N.V. group's global headquarters are located in Canonsburg, Pennsylvania .

The Company has made a number of significant acquisitions since 2015, and as part of the holistic, global integration of these acquisitions, the Company is focused on how to best optimize and maximize all of its assets across the organization and across all geographies. On December 5, 2016, the Company announced restructuring programs in certain locations representing initial steps in a series of actions that are anticipated to further streamline its operations globally. The Company continues to develop the details of the cost reduction initiatives, including workforce actions and other potential restructuring activities beyond the programs already announced, including potential shutdown or consolidation of certain operations. The continued restructuring actions are expected to be implemented through fiscal year 2018. Refer to Note 16 Restructuring included in Item 8 in this Annual Report on Form 10-K for additional information related to our restructuring initiatives.

We report our results in three segments on a geographic basis as follows: North America, Europe and Rest of World. The operations in each of our segments is described in more detail below.

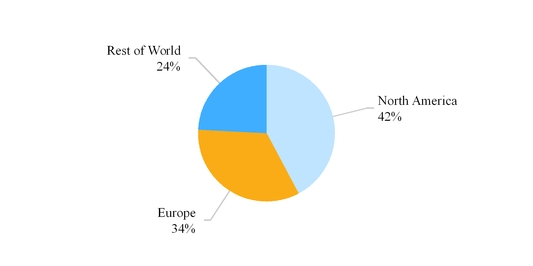

The chart below reflects third party net sales by reportable segment for the year ended December 31, 2017 .

Our third party net sales are derived primarily from the sale of generic and branded generic pharmaceuticals, branded pharmaceuticals, OTC products and API. Our API business is conducted through Mylan India , which is included within our Rest of World segment. Refer to Note 13 Segment Information included in Item 8 in this Annual Report on Form 10-K for additional information related to our reportable segments.

4

Table of Contents

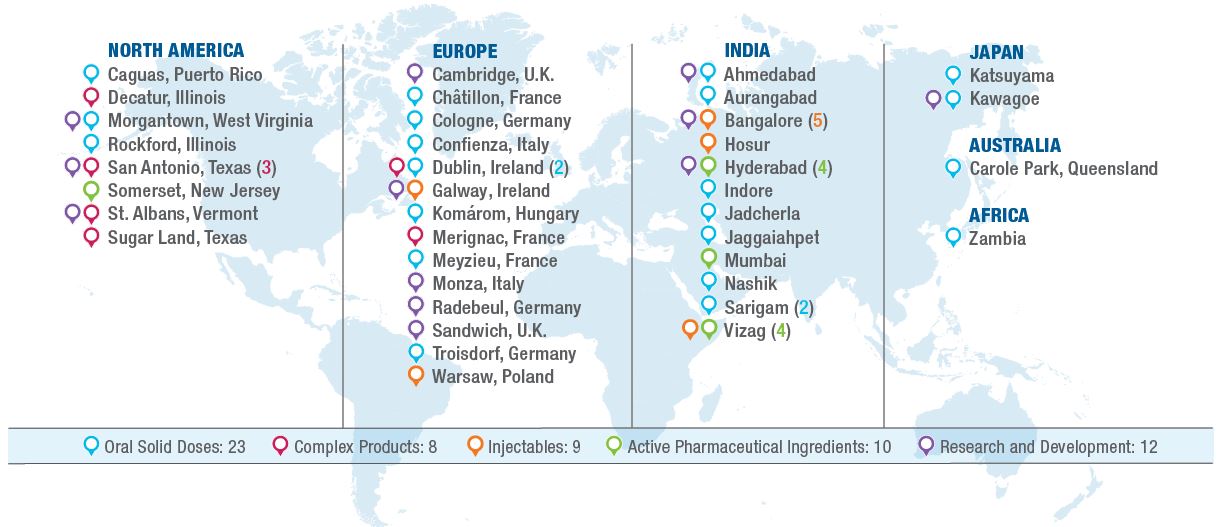

Our global operational footprint, including the locations of our manufacturing, packaging and R&D facilities and capabilities, along with the individual site's primary activities, are detailed on the map below.

Our global manufacturing platform is an important component of our business model. We own twelve manufacturing and distribution facilities in the U.S. including Puerto Rico, with significant sites in Morgantown, West Virginia; San Antonio, Texas; St. Albans, Vermont; Caguas, Puerto Rico; and Greensboro, North Carolina. Outside the U.S. and Puerto Rico, we utilize production and distribution facilities in eleven countries, including key facilities in India, Australia, Japan, Ireland, Hungary and France. Our manufacturing facilities, which operate around the globe, are capable of producing approximately 80 billion oral solid doses, 4,800 kiloliters of APIs, 500 million injectable units, and 1.5 billion complex products (transdermals, dermals, topicals, respiratory, oral films, and other specialty items) per year.

The Company also leases manufacturing, warehousing, distribution and administrative facilities in numerous locations, both within and outside of the U.S., including properties in New York, Canada, France, India, Ireland and the United Kingdom (the "U.K."). All of the facilities listed above are included in our reportable segments primarily based on the location of the facility. Our global R&D centers of excellence are located in Morgantown, West Virginia and Hyderabad, India. We also have specific technology focused development sites in Texas, Vermont, Canada, Ireland, Germany, Italy, the U.K., India and Japan. In addition, under our collaboration agreements with Biocon Limited ("Biocon") for the development of biosimilar compounds and insulin analog products, certain state of the art manufacturing facilities owned by Biocon in India and Malaysia are to be used for the manufacture of products developed under the agreements, which are excluded from the chart above.

We believe that all of our facilities are in good operating condition, the machinery and equipment are well-maintained, the facilities are suitable for their intended purposes and they have capacities adequate for the current operations.

Unless otherwise indicated, industry data included in Item 1 is sourced from IQVIA Holdings Inc. ("IQVIA") and is for the twelve months ended November 2017 .

North America Segment

Our North America segment primarily develops, manufactures, sells and distributes pharmaceutical products in tablet, capsule, injectable, transdermal patch, gel, nebulized and cream or ointment form. For the year ended December 31, 2017 , North America segment third party net sales were $4.97 billion . Our North America segment includes our operations in the U.S. and Canada, each of which is discussed further below.

The U.S. generics market is the largest in the world, in terms of value, with generic prescription sales of approximately $60.0 billion for the twelve months ended November 2017 and approximately 90% of all pharmaceutical products sold in the U.S. were generic products, which demonstrates the high level of generic penetration in this market. Mylan holds a top two ranking within the U.S. generics prescription market in terms of both sales and prescriptions dispensed. Approximately one in every 14 prescriptions dispensed in the U.S. is a Mylan product. Our sales of products in the U.S. are derived primarily from the sale of oral solid dosages, injectables, transdermal patches, gels, creams, ointments and unit dose offerings. In the U.S., we have one of the largest product portfolios among all generic pharmaceutical companies. With the

5

Table of Contents

acquisition of the Topicals Business, we gained a complementary portfolio of branded and generic topical products, including an active pipeline of products in development as well as an established U.S. sales and marketing infrastructure targeting dermatologists. The Topicals Business added to Mylan an integrated manufacturing and development platform along with a leading topicals-focused contract development and manufacturing organization.

In addition, we manufacture and sell a diverse portfolio of injectable products across several key therapeutic areas, including respiratory and allergy, infectious disease, cardiovascular, oncology and central nervous system and anesthesia. Mylan's injectable manufacturing capabilities include vials, pre-filled syringes, ampoules and lyophilization with a focus on oncology, penems, penicillins, ophthalmics and peptides.

Our unit dose business focuses on providing one of the largest product portfolios along with innovative packaging and barcoding that supports bedside verification throughout the U.S. and Canada for hospitals, group purchasing organizations ("GPOs"), long term care facilities, wholesalers, surgical services, home infusion service providers, correctional facilities, specialty pharmacies and retail outlets.

In October 2017, Mylan launched in the U.S. the first Glatiramer Acetate Injection 40 mg/mL for 3-times-a-week injection that is an AP-rated substitutable generic version of Copaxone® 40 mg/mL, as well as Glatiramer Acetate Injection 20 mg/mL for once-daily injection, an AP-rated, substitutable generic version of Copaxone® 20 mg/mL. These products are indicated for the treatment of patients with relapsing forms of multiple sclerosis, a chronic inflammatory disease of the central nervous system.

The EpiPen® Auto-Injector , which is used in the treatment of severe allergic reactions, is an epinephrine auto-injector that has been sold in the U.S. and internationally since the mid-1980s. Mylan markets the EpiPen® Auto-Injector , which is supplied to Mylan by a wholly owned subsidiary of Pfizer. Anaphylaxis is a severe allergic reaction that is rapid in onset and may cause death, either through swelling that shuts off airways or through a significant drop in blood pressure. In December 2010, the National Institute of Allergy and Infectious Diseases, a division of the National Institutes of Health, introduced the "Guidelines for the Diagnosis and Management of Food Allergy in the United States." These guidelines state that epinephrine is the first line treatment for anaphylaxis. The EpiPen® Auto-Injector is the number one dispensed epinephrine auto-injector. On December 16, 2016, Mylan launched the first authorized generic for the EpiPen® Auto-Injector , which has the same drug formulation and device functionality as the branded product.

Perforomist® Inhalation Solution , Mylan's Formoterol Fumarate Inhalation Solution, was launched in October 2007. Perforomist® Inhalation Solution is a long-acting beta 2 -adrenergic agonist indicated for long-term, twice-daily administration in the maintenance treatment of bronchoconstriction in chronic obstructive pulmonary disorder ("COPD") patients, including those with chronic bronchitis and emphysema. Mylan holds several U.S. and international patents protecting Perforomist® Inhalation Solution .

With the acquisition of Meda, we acquired certain key branded products, including Dymista® which is used for the treatment of seasonal allergic rhinitis and was launched in the U.S. in 2012. We also market several OTC products including Cold-EEZE, Midnite, and Vivarin.

We believe that the breadth and quality of our product offerings help us to successfully meet our customers' needs and to better compete in the generics industry over the long-term. The future growth of our U.S. generics business is partially dependent upon continued acceptance of generic products as affordable alternatives to branded pharmaceuticals, a trend which is largely outside of our control. However, we believe that we can maximize the value of our generic product opportunities by continuing our proven track record of bringing to market high quality products that are difficult to formulate or manufacture. Throughout Mylan's history, we have successfully introduced many generic products that are difficult to formulate or manufacture and continue to be meaningful contributors to our business several years after their initial launch. Additionally, we expect to achieve growth in our U.S. business by launching new products for which we may attain U.S. Food and Drug Administration ("FDA") first-to-file status with Paragraph IV certification. As described further in the "Product Development and Government Regulation" discussion below, a first-filed ANDA with a Paragraph IV certification qualifies the product approval holder for a period of generic marketing and distribution exclusivity.

In Canada , we have successfully leveraged the acquired EPD Business to further broaden our presence in this market. We currently rank sixth in terms of market share in the generic prescription market. As in the U.S., growth in Canada will be dependent upon acceptance of generic products as affordable alternatives to branded pharmaceuticals. Further, we plan to leverage the strength and reliability of the collective Mylan brand to foster continued brand awareness and growth throughout the region.

6

Table of Contents

Europe Segment

Our European operations are conducted through our wholly owned subsidiaries in 35 countries across the region, including France, Italy, Germany, the U.K. and Spain. For the year ended December 31, 2017 , Europe segment third party net sales were $3.96 billion . The types of markets within Europe vary from country to country; however, when combined, the European market is the second largest generic pharmaceutical market in the world in terms of value. Within Europe, by value, the generic prescription market in Germany is the largest , followed by the U.K., France, Spain and Italy, respectively.

In Europe, the manner in which products are marketed varies by country. In addition to selling pharmaceuticals under their International Nonproprietary Name ("INN") (i.e., API), in certain European countries, branded generic pharmaceutical products are given a unique brand name, as these markets tend to be more responsive to the promotion efforts generally used to promote brand products.

The European generic prescription market also varies significantly by country in terms of the extent of generic penetration, the key decision maker in terms of drug choice and other important aspects. Some countries, including Germany, the U.K., the Netherlands, Denmark and Poland, are characterized by relatively high generic penetration, ranging between 70% and 75% of total prescription market sales in the twelve months ended November 2017 , based on volume. Conversely, other major European markets, including France, Italy and Spain, are characterized by much lower generic penetration, ranging between 22% and 44% of total prescription sales in the twelve months ended November 2017 , based on volume. However, actions taken by governments, particularly in these latter under-penetrated countries, to reduce healthcare costs could encourage further use of generic pharmaceutical products. In some of these under-penetrated markets, in addition to growth from new product launches, we expect our future growth to be driven by increased generic utilization and penetration.

As a result of the acquisitions of Meda and the EPD Business, our product portfolio has been diversified with OTC products and additional branded and branded generic products in Europe. In addition, Mylan has significantly expanded and strengthened its presence in Europe. In particular, we have grown our presence in several markets in Central and Eastern Europe, including Poland, Greece, the Czech Republic and Slovakia and gained access into new markets, such as Romania and Bulgaria. As a result of these acquisitions, our revenues in Europe are now significantly diversified across our generics, branded and branded generic portfolios.

Our branded products include Creon, Influvac, EpiPen®, Dymista, Betadine and Elidel. Our OTC products include Dona, Saugella, CB12, Brufen, Endwarts, and Armolipid.

In October 2017, the Company announced that its partner, Synthon, received marketing authorization approval in Europe for Glatiramer Acetate Injection 40 mg/mL. Mylan is partnered with Synthon, the developer and supplier of its European Glatiramer Acetate Injection products, and has exclusive distribution and supply rights in certain key European markets. We have launched the product in several countries in 2018.

Of the top ten generic prescription markets in Europe, we hold leadership positions in several of the markets, including the number one market share position in France and the number two market share position in Italy. In France , we believe the generic market is underpenetrated. Our growth in the French market is expected to come from brand leadership, new product launches, and increased generic utilization and penetration through government initiatives, such as a communication plan to promote generics in France. The acquisition of the EPD Business in 2015 followed by the acquisition of Meda in 2016 strengthened Mylan's position as a major participant across the healthcare system covering prescribers, hospitals and pharmacists and provided growth opportunities and synergies throughout the market.

In Italy , we have the second highest market share in the generic prescription market in terms of volume and value. We believe that the Italian generic market is still under-penetrated, with generics representing approximately 22% of the Italian pharmaceutical market, based on volume. The Italian government has put forth only limited measures aimed at encouraging generic use, and as a result, generic substitution is still in its early stages. As leaders of the generic market, we can benefit from increased generic utilization.

In addition to France and Italy, we have grown our presence in several European markets including Germany, the U.K., Spain and markets in Eastern Europe. In the U.K. , Mylan is ranked third in the U.K. generic prescription market, in terms of value. Mylan is well positioned in the U.K. as a preferred supplier to wholesalers and is also focused on areas such as retail pharmacy chains and hospitals. The acquisition of the EPD and Meda businesses in the U.K. has provided us with an additional branded market presence, particularly in the areas of pancreatic enzyme replacement, hormone replacement therapy, anaphylaxis and allergy.

7

Table of Contents

In Spain , we have the ninth highest market share in the generic prescription market based on volume. The generic market comprised approximately 35% of the total Spanish pharmaceutical market by volume for the twelve months ended November 2017 . Our portfolio and depth in this market were further expanded with the acquisitions of the EPD Business and Meda by adding branded and OTC products. As a result of these acquisitions, we have diversified our product offerings in Spain and generic prescription products now account for less than a quarter of our sales in Spain. New product introductions in all of our categories will be the drivers of our growth in Spain.

As a result of the acquisitions of Meda and the EPD Business, we have strengthened and expanded our presence in Germany and have diversified our portfolio to reduce our reliance on the tender system. A tender system is part of the market in Germany, and as a result, health insurers play a major role. Under a tender system, health insurers invite manufacturers to submit bids that establish prices for generic pharmaceuticals.

In the Nordic region, which we define as Sweden, Norway, Denmark, Finland and Iceland, our presence has expanded significantly as a result of our recent acquisitions. For instance, we now have the fourth highest market share in Sweden, in terms of volume and value, and the fifth highest market share in Norway, based on volume.

We also have a notable presence in other European generic prescription markets, including Portugal and Belgium, where we hold the third and fifth highest market share, respectively, in terms of volume. In the Netherlands, we have the third highest market share in the generic prescription market, which is characterized by relatively high generic penetration.

Rest of World Segment

We market pharmaceuticals in Rest of World primarily through our sales forces in approximately 30 countries and through partners and distributors in approximately 90 additional emerging markets. Our key Rest of World markets include Japan, Australia, China, Brazil, Russia, India, South Africa, and certain markets in the Middle-East and South East Asia. Additionally, through Mylan India , we market API to third parties and also supply other Mylan subsidiaries. For the year ended December 31, 2017 , Rest of World segment third party net sales were $2.83 billion .

The Indian generics market is the largest in the world, in terms of volume. We operate our API business out of Mylan India . We are also one of the world's largest API manufacturers as measured by the number of drug master files ("DMFs") filed with regulatory agencies. Mylan India 's manufacturing capabilities include a range of dosage forms, such as tablets, capsules and injectables, in a wide variety of therapeutic categories. Mylan India has ten API and intermediate manufacturing facilities and a total of fifteen finished dosage form ("FDF") facilities, which includes eight oral solid dose facilities and seven injectable facilities, all located in India. Our presence in India goes beyond manufacturing, sales and marketing. With a global R&D center of excellence in Hyderabad, India and technology driven R&D sites in Bangalore, India, we are able to create unique and efficient R&D capabilities.

Mylan India markets API to third parties around the world and produces anti-retroviral therapy ("ARV") products for people living with HIV/AIDS. Mylan India has a growing commercial presence, with its Hepatitis C products representing approximately 20% of the Hepatitis C market share in India. In addition, our current areas of focus include Critical Care, Hepato Care, HIV Care, Onco Care and Women's Care. We continue to expand our products in the therapeutic categories such as hepatology, oncology and critical care. In November 2015, we completed our acquisition of certain women's healthcare businesses from Famy Care Limited (such businesses "Jai Pharma Limited"), which significantly broadened our women's care portfolio and strengthened our technical capabilities in terms of dedicated hormone manufacturing.

Through Mylan India, we have long been a champion for those living with or at risk for infection of HIV/AIDS. It is part of our belief that access to high quality medicine is a right, not a privilege. Mylan offers a wide range of ARVs, and close to 50% of patients being treated for HIV/AIDS in the developing world depend on our ARVs. Mylan is unique among western pharmaceutical companies in its commitment to providing access to high quality medicines to millions of patients in developing countries. We have invested more than $250 million to expand our ARV production capacity and we now manufacture more than 4 billion ARV tablets and capsules each year. Eight years ago, Mylan was the first company to launch a single pill, once-a-day regimen called TLE. In March 2017, we were the first - and to date, the only - company to launch a lower-cost, reduced-dose version of this treatment. Today, over half of the Company's API manufacturing capacity is devoted to the production of ARVs. In September 2017 at the United Nations, Mylan announced its most recent step in the fight against the HIV epidemic. In partnership with institutions such as the Clinton Health Access Initiative, UNAIDS, the Bill & Melinda Gates Foundation and the U.K.'s Department for International Development, Mylan entered into a unique public/private partnership to accelerate the availability of a next-generation antiretroviral treatment called TLD to patients in more than 90 low and middle income countries. As part of this alliance, Mylan has committed to selling this product (a combination tablet,

8

Table of Contents

taken once daily, of the three molecules Dolutegravir, Lamivudine and Tenofovir Disoproxil Fumarate) to public-sector purchasers in countries such as South Africa and Kenya at a cost of approximately $75 per person per year.

In Australia , we have the highest market share in the generic pharmaceutical market by volume. Mylan is the number one supplier by volume to Australia's national pharmaceuticals program. The generic pharmaceutical market in Australia had sales of approximately $1.30 billion during the twelve months ended November 2017 . The acquired EPD Business and Meda businesses have enabled Mylan to broaden its product portfolio of branded and OTC products. Today Mylan Australia has a diverse platform and sales infrastructure capable of targeting most major market segments.

In Japan, we have a strong generics business which has has been among the fastest growing companies in the market over the past several years. The acquisition of the EPD Business has provided us with additional branded market presence and commercial reach. We also maintain manufacturing capabilities in Japan, which play a key role in supplying our businesses throughout the country. Currently, the market in Japan is largely composed of hospitals and clinics, but pharmacies are playing a greater role as generic substitution, aided by recent pro-generics government action, becomes more prevalent. Japan is the third largest single pharmaceutical market in the world by value, behind the U.S. and China, and the fifth largest generic prescription market worldwide by volume, with sales of approximately $8.0 billion during the twelve months ended November 2017 . According to the Japan Generic Medicines Association, the generic penetration rate reached approximately 69% as of the quarter ended September 2017 , up from approximately 65% in the comparable 2016 period. Beginning in 2013, we established an exclusive long-term strategic collaboration with Pfizer Japan Inc. ("Pfizer Japan") to develop, manufacture, distribute and market generic drugs in Japan. Under the agreement, both parties operate separate legal entities in Japan and collaborate on current and future generic products, sharing the costs and profits resulting from such collaboration. Mylan 's responsibilities, under the agreement, primarily consist of managing operations, including R&D and manufacturing. Pfizer Japan's responsibilities primarily consist of the commercialization of the combined generics portfolio and managing the marketing and sales effort. The acquired EPD Business, with its portfolio of branded products, is being promoted by our own sales force, and is run independently from our strategic collaboration with Pfizer Japan,

In Brazil , we operate a commercial business focused on providing high quality generic and branded injectable products to the Brazilian hospital segment. Our sales in this market segment are made through distributors, tenders, and more recently, direct sales to private hospitals. Brazil is the fourth largest generic pharmaceutical market in the world, behind the U.S., the combined European market and China, in terms of value. In the coming years, the Brazilian generic and branded generic pharmaceutical markets are expected to continue their growth trajectory primarily because of the increase of off patent reference drugs, the growth of biosimilars and the overall growth of the market. Our goal is to continue to build upon this local platform in order to further access the $13.0 billion Brazilian generic pharmaceutical market.

With the acquisition of Meda, we have grown our presence in other markets, such as China which is the third largest generic market in the world by value behind the U.S. and combined European market, with generic market sales of approximately $28.0 billion for the twelve months ended November 2017 . We also gained access to other markets including Russia, Turkey, and Mexico, and countries in South East Asia, and the Middle East. Our portfolio in these markets includes branded prescription, non-prescription and OTC products, and we now have the opportunity to reach these markets through an organized sales forces and direct access to the healthcare providers, as well as through distributor relationships.

Within the Rest of World region our key products include Amitiza in Japan, Dona, Elidel and our ARV products, Tenofovir, Lamivudine and Efavirenz ("TLE") and Tenofovir, Emtricitabine and Efavirenz ("TEE").

Product Development and Government Regulation

North America

U.S.

Prescription pharmaceutical products in the U.S. are generally marketed as either brand or generic drugs, while generic biologics are referred to as biosimilars. Brand products are usually marketed under brand names through marketing programs that are designed to generate physician and consumer loyalty. Brand products are generally patent protected, which provides a period of market exclusivity during which time they are sold with little or no competition, although there are typically other participants in the therapeutic area. Additionally, brand products may benefit from other periods of non-patent market exclusivity.

Generic pharmaceutical products are the pharmaceutical and therapeutic equivalents of an approved brand drug, known as the reference listed drug ("RLD") that is listed in the FDA publication entitled Approved Drug Products with

9

Table of Contents

Therapeutic Equivalence Evaluations , popularly known as the "Orange Book." The Drug Price Competition and Patent Term Restoration Act of 1984 (the "Hatch-Waxman Act") provides that generic drugs may enter the market after the approval of an ANDA, which generally requires that similarity to an RLD, including bioequivalence, be demonstrated, any patents on the RLD have expired or been found to be invalid or not infringed, and any market exclusivity periods related to the RLD have ended. Because approved generic drugs have been found to be the same as their respective RLDs, they can be expected to have the same safety and effectiveness profile as the RLD. Accordingly, generic products provide a safe, effective and cost-efficient alternative to users of these reference brand products. Branded generic pharmaceutical products are generic products that are more responsive to the promotion efforts generally used to promote brand products. Growth in the generic pharmaceutical industry has been, and will continue to be, driven by the increased market acceptance of generic drugs and biosimilars, as well as the number of brand drugs for which patent terms and/or other market exclusivities have expired.

We obtain new generic products primarily through internal product development. Additionally, we increasingly collaborate with other companies by entering into licensing or co-development agreements, including R&D partnerships for biosimilars. All applications for FDA approval must contain information relating to product formulation, raw material suppliers, stability, manufacturing processes, packaging, labeling and quality control. Information to support the bioequivalence of generic drug products or the safety and effectiveness of new drug products for their intended use is also required to be submitted. There are generally four types of applications used for obtaining FDA approval of new products:

New Drug Application ("NDA") - An NDA is filed when approval is sought to market a newly developed branded product and, in certain instances, for a new dosage form, a new delivery system or a new indication for a previously approved drug.

ANDA - An ANDA is filed when approval is sought to market a generic equivalent of a drug product previously approved under an NDA and listed in the FDA's Orange Book or for a new dosage strength for a drug previously approved under an ANDA.

Biologics License Application ("BLA") - A BLA is similar to an NDA, but is submitted to seek approval to market a drug product that is a biologic, which generally is a product derived from a living organism.

Biosimilars Application - This is an abbreviated approval pathway for a biologic product that is "highly similar" to a product previously approved under a BLA.

The ANDA development process is generally less time-consuming and complex than the NDA development process. It typically does not require new preclinical and clinical studies, because it relies on the studies establishing safety and efficacy conducted for the RLD previously approved through the NDA process. The ANDA process, however, does typically require one or more bioequivalence studies to show that the ANDA drug is bioequivalent to the previously approved reference listed brand drug. Bioequivalence studies compare the bioavailability of the proposed drug product with that of the RLD product containing the same active ingredient. Bioavailability is a measure of the rate and extent to which the active ingredient or active moiety is absorbed from a drug product and becomes available at the site of action. Thus, a demonstration of bioequivalence confirms the absence of a significant difference between the proposed product and the reference listed brand drug in terms of the rate and extent to which the active ingredient or active moiety becomes available at the site of drug action when administered at the same molar dose under similar conditions. An ANDA also typically must show that the proposed generic product is the same as the RLD in terms of active ingredient(s), strength, dosage form, route of administration and labeling.

Generic products are generally introduced to the marketplace at the expiration of patent protection for the brand product or at the end of a period of non-patent market exclusivity. However, if an ANDA applicant files an ANDA containing a certification of invalidity, non-infringement or unenforceability related to a patent listed in the Orange Book with respect to a reference drug product, the applicant may be able to market the generic equivalent prior to the expiration of patent protection for the brand product. Such patent certification is commonly referred to as a Paragraph IV certification. Generally, if the patent owner brings an infringement action within 45 days from receiving notification by the applicant, the FDA may not approve the ANDA application until the earlier of the rendering of a court decision favorable to the ANDA applicant or the expiration of 30 months. An ANDA applicant that is first to file a substantially complete ANDA containing a Paragraph IV certification is eligible for a period of generic marketing exclusivity. This exclusivity, which under certain circumstances may be required to be shared with other applicable ANDA sponsors with Paragraph IV certifications, lasts for 180 days, during which the FDA cannot grant final approval to other ANDA sponsors holding applications for a generic equivalent to the same reference drug.

In addition to patent exclusivity, the holder of the NDA for the listed drug may be entitled to a period of non-patent market exclusivity, during which the FDA cannot approve (or in some cases, accept for review) an application for a generic version product. If the reference drug is a new chemical entity (which generally means the active moiety has not previously been approved), the FDA may not accept an ANDA for a generic product for up to five years following approval of the NDA for the new chemical entity. If it is not a new chemical entity, but the holder of the NDA conducted clinical trials essential to

10

Table of Contents

approval of the NDA or a supplement thereto, the FDA may not approve an ANDA for the reference NDA product before the expiration of three years from the date of approval of the NDA or supplement. Certain other periods of exclusivity may be available if the RLD is indicated for treatment of a rare disease or the sponsor conducts pediatric studies in accordance with FDA requirements.

Supplemental ANDAs are required for approval of various types of changes to an approved application and these supplements may be under review for six months or more. In addition, certain types of changes may only be approved once new bioequivalence studies are conducted or other requirements are satisfied.

A number of branded pharmaceutical patent expirations are expected over the next several years. These patent expirations should provide additional generic product opportunities. We intend to concentrate our generic product development activities on branded products with significant sales in specialized or growing markets or in areas that offer significant opportunities and other competitive advantages. In addition, we intend to continue to focus our development efforts on technically difficult-to-formulate products or products that require advanced manufacturing technology.

The Biologics Price Competition and Innovation Act ("BPCIA") authorizes the FDA to license a biological product that is a "biosimilar" to an FDA-licensed biologic through an abbreviated pathway. The BPCIA establishes criteria for determining that a product is biosimilar to an already licensed biologic, known as the "reference product," and establishes a process by which an abbreviated BLA for a biosimilar product is submitted, reviewed and approved. This abbreviated approval pathway is intended to permit a biosimilar product to come to market more quickly and less expensively than if a full BLA were submitted, by relying to some extent on FDA's previous review and approval of the reference product. Generally, a biosimilar must be shown to be highly similar to, and have no clinically meaningful differences in safety, purity or potency from, the reference product. The BPCIA provides periods of exclusivity that protect a reference product from biosimilars competition. Under the BPCIA, the FDA may not accept a biosimilar application for review until four years after the date of first licensure of the reference product, and the biosimilar may not be licensed until twelve years after the reference product's approval. Additionally, the BPCIA establishes procedures by which the biosimilar applicant must provide information about its application and product to the reference product sponsor, and by which information about potentially relevant patents is shared and litigation over patents may proceed in advance of approval. The BPCIA also provides a period of exclusivity for the first biosimilar to be determined by the FDA to be interchangeable with the reference product.

We anticipate that the BPCIA will continue to evolve as the statute is implemented over a period of years. This likely will be accomplished by a variety of means, including FDA issuance of guidance documents, proposed regulations, and decisions in the course of considering specific applications. In that regard, the FDA has to date issued various guidance documents and other materials providing indications of the agency's thinking regarding any number of issues implicated by the BPCIA. Additionally, as the FDA continues to approve biosimilar applications, the agency's approach to certain issues will continue to be defined.

An additional requirement for FDA approval of NDAs and ANDAs is that our manufacturing procedures and operations conform to FDA requirements and guidelines, generally referred to as current Good Manufacturing Practices ("cGMP"). The requirements for FDA approval encompass all aspects of the production process, including validation and recordkeeping, the standards around which are continuously changing and evolving.

Facilities, procedures, operations and/or testing of products are subject to periodic inspection by the FDA, the Drug Enforcement Administration ("DEA") and other authorities. In addition, the FDA conducts pre-approval and post-approval reviews and plant inspections to determine whether our systems and processes are in compliance with cGMP and other FDA regulations. Our suppliers are subject to similar regulations and periodic inspections.

In 2012, the Food and Drug Administration Safety and Innovation Act ("FDASIA") was enacted into law. FDASIA is intended to enhance the safety and security of the U.S. drug supply chain by holding all drug manufacturers supplying products to the U.S. to the same FDA inspection standards. Specifically, prior to the passage of FDASIA, U.S. law required U.S. based manufacturers to be inspected by FDA every two years but remained silent with respect to foreign manufacturers, causing some foreign manufacturers to go as many as nine years without a routine FDA cGMP inspection, according to the Government Accountability Office.

FDASIA also includes the Generic Drug User Fee Agreement ("GDUFA"), a novel user fee program to provide funding to the FDA that focused on three key aims:

Safety – Ensure that industry participants, foreign or domestic, are held to consistent quality standards and are inspected with foreign and domestic parity using a risk-based approach.

11

Table of Contents

Access – Expedite the availability of generic drugs by bringing greater predictability to the review times for ANDAs, amendments and supplements and improving timeliness in the review process.

Transparency – Enhance FDA's visibility into the complex global supply environment by requiring the identification of facilities involved in the manufacture of drugs and associated APIs, and improve FDA's communications and feedback with industry.

In August 2017, the Food and Drug Administration Reauthorization Act reauthorized the generic drug user fee program, which provides for an updated fee structure through September 2022 ("GDUFA II"). Under GDUFA II, approximately 27% of the total fees paid to FDA are derived from facility fees paid by FDF manufacturers, API facilities, and contract manufacturers listed or referenced in pending or approved generic drug applications while approximately 35% derive from newly-implemented, tiered program fees based on the size of a company's ANDA product portfolio. The remaining approximately 38% of the total fees derive from application fees, including generic drug application fees and DMF fees. The objective of GDUFA II is to continue to ensure patients have access to safe, high-quality, and affordable generic medicines.

The process required by the FDA before a pharmaceutical product with active ingredients that have not been previously approved may be marketed in the U.S. generally involves the following:

• | laboratory and preclinical tests; |

• | submission of an Investigational New Drug ("IND") application, which must become effective before clinical studies may begin; |

• | adequate and well-controlled human clinical studies to establish the safety and efficacy of the proposed product for its intended use; |

• | submission of an NDA or BLA containing the results of the preclinical tests and clinical studies establishing the safety and efficacy of the proposed product for its intended use, as well as extensive data addressing matters such as manufacturing and quality assurance; |

• | scale-up to commercial manufacturing; and |

• | FDA approval of an NDA or BLA. |

Preclinical tests include laboratory evaluation of the product and its chemistry, formulation and stability, as well as toxicology and pharmacology studies to help define the pharmacological profile of the drug and assess the potential safety and efficacy of the product. The results of these studies are submitted to the FDA as part of the IND. They must demonstrate that the product delivers sufficient quantities of the drug to the bloodstream or intended site of action to produce the desired therapeutic results before human clinical trials may begin. These studies must also provide the appropriate supportive safety information necessary for the FDA to determine whether the clinical studies proposed to be conducted under the IND can safely proceed. The IND automatically becomes effective 30 days after receipt by the FDA unless the FDA, during that 30-day period, raises concerns or questions about the conduct of the proposed trials, as outlined in the IND. In such cases, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials may begin. In addition, an independent institutional review board must review and approve any clinical study prior to initiation.

Human clinical studies are typically conducted in three sequential phases, which may overlap:

• | Phase I – The drug is initially introduced into a relatively small number of healthy human subjects or patients and is tested for safety, dosage tolerance, mechanism of action, absorption, metabolism, distribution and excretion. |

• | Phase II – Studies are performed with a limited patient population to identify possible adverse effects and safety risks, to assess the efficacy of the product for specific targeted diseases or conditions, and to determine dosage tolerance and optimal dosage. |

• | Phase III – When Phase II evaluations demonstrate that a dosage range of the product is effective and has an acceptable safety profile, Phase III trials are undertaken to evaluate further dosage and clinical efficacy and to test further for safety in an expanded patient population at geographically dispersed clinical study sites. |

The results of the product development, preclinical studies and clinical studies are then submitted to the FDA as part of the NDA or BLA. The NDA/BLA drug development and approval process could take from three to more than ten years.

12

Table of Contents

Canada

In Canada, the approval process for innovative ("brand") pharmaceuticals is governed by Health Canada, the agency responsible for national public health, to ensure that the quality, safety and efficacy of the product have been established. A brand company may seek approval to sell an innovative product by submitting a new drug submission ("NDS") to Health Canada. The NDS will contain quality, safety and efficacy data from clinical trials of the drug in relevant patient populations. If Health Canada is satisfied with the quality, safety and efficacy described in the NDS, it issues a Notice of Compliance ("NOC") for that product. Once a NOC is obtained, the owner or exclusive licensee of patents relating to the brand drug may list patents relating to the medicinal ingredient, formulation, dosage form or the use of the drug on the Patent Register, which links the patent system to the generic regulatory approval process (discussed below).

The approval process for generic pharmaceuticals has two tracks that may proceed in parallel. The first track involves an examination of the product by Health Canada. Second persons (i.e., generic companies) may seek approval to sell a product by submitting an abbreviated new drug submission ("ANDS") to Health Canada to demonstrate that its product is bioequivalent to the brand reference product already marketed in Canada under an NOC. When Health Canada is satisfied with the quality, safety and efficacy described in the ANDS, it issues a NOC for that product, subject to any brand patents in the second track of the approval process.

The second track of the approval process is governed by the Patented Medicines NOC Regulations. Where a generic applicant makes direct or indirect reference in its ANDS to a brand product for which there are patents listed on the Patent Register, the generic must make at least one of the statutory allegations with respect to each patent listed (e.g., that the generic will await patent expiry, or the patent is invalid and/or would not be infringed). If the generic challenges the listed patent, it is required to serve the originator with a Notice of Allegation ("NOA"), which gives a detailed statement of the factual and legal basis for its allegations. If the brand wishes to seek an order prohibiting the issuance of the NOC to the generic, it must commence a court action within 45 days after it has been served with the NOA. The brand may elect whether to take advantage of a 24-month stay of the issuance of the NOC to the generic during the pendency of the PM (NOC) litigation. If an action is commenced and the brand elects to stay, Health Canada may not issue a NOC until the earlier of the determination of the proceeding by the court, or the expiration of 24 months. To obtain a prohibition order / declaration of infringement, the brand must satisfy the court that the generics' allegations of invalidity and/or non-infringement are not justified.

Section C.08.004.1 of the Canadian Food and Drug Regulations is the so-called data protection provision. A generic applicant does not need to perform duplicate clinical trials similar to those conducted by the first NOC holder (i.e., the brand), but is permitted to demonstrate safety and efficacy by submitting data demonstrating that its formulation is bioequivalent to the approved brand formulation. The first party to obtain an NOC for a drug in Canada will have an eight-year period of exclusivity starting from the date it received its NOC based on that clinical data. A subsequent applicant who seeks to establish safety and efficacy by comparing its product to the product that received the first NOC will not be able to file its own application until six years after the issuance of the first NOC, and cannot receive ultimate approval for an additional two years. If the first NOC holder also conducts clinical trials in pediatric populations, it will be entitled to an extra six months of data protection. A drug is only entitled to data protection so long as it is being marketed in Canada.

Facilities, procedures, operations and/or testing of products are subject to periodic inspection by Health Canada and the Health Products and Food Branch Inspectorate. In addition, Health Canada conducts reviews and plant inspections to determine whether our systems are in compliance with the good manufacturing practices in Canada, Drug Establishment Licensing ("EL") requirements and other provisions of the Regulations. Competitors are subject to similar regulations and inspections.

13

Table of Contents

Europe

The European Union ("EU") presents complex challenges from a regulatory perspective. There is over-arching legislation which is then implemented at a local level by the 28 individual member states, Iceland, Liechtenstein and Norway. Between 1995 and 1998, the legislation was revised in an attempt to simplify and harmonize product registration. This revised legislation introduced the mutual recognition ("MR") procedure, whereby after submission and approval by the authorities of the so-called reference member state ("RMS"), further applications can be submitted into the other chosen member states (known as concerned member states). Theoretically, the authorization of the RMS should be mutually recognized by the concerned member states. More typically, however, a degree of re-evaluation is carried out by the concerned member states. In November 2005, this legislation was further revised. In addition to the MR procedure, the decentralized procedure ("DCP") was introduced. The DCP is also led by the RMS, but applications are simultaneously submitted to all selected countries, provided that no national marketing authorization has been granted yet for the medicinal product in question. From 2005, the centralized procedure operated by the European Medicines Agency ("EMA") became available for generic versions of innovator products approved through the centralized authorization procedure. The centralized procedure results in a single marketing authorization (in addition to separate marketing authorizations for Iceland, Lichtenstein and Norway) which, once granted, can be used by the marketing-authorization holder to file for individual country reimbursement and make the medicine available in all of the EU countries listed on the application.

In the EU, the manufacture and sale of pharmaceutical products is regulated in a manner substantially similar to that of the U.S. requirements, which generally prohibit the handling, manufacture, marketing and importation of any pharmaceutical product unless it is properly registered in accordance with applicable law. The registration file relating to any particular product must contain medical data related to product efficacy and safety, including results of clinical testing and references to medical publications, as well as detailed information regarding production methods and quality control. Health ministries are authorized to cancel the registration of a product if it is found to be harmful or ineffective or if it is manufactured or marketed other than in accordance with registration conditions.

Pursuant to the MR procedure, a marketing authorization is first sought in one member state from the national regulatory agency. The RMS makes its assessment report on the quality, efficacy and safety of the medicinal product available to the other concerned member states where marketing authorizations are also sought under the MR procedure.

The DCP is based on the same fundamental idea as the MR procedure. In contrast to the MR procedure, however, the DCP requires that no national marketing authorization has yet been granted for the medicinal product. The pharmaceutical company applies for marketing authorization simultaneously in all the member states of the EU in which it wants to market the product. After consultation with the pharmaceutical company, one of the member states concerned in the DCP will become the RMS. The competent agency of the RMS undertakes the scientific evaluation of the medicinal product on behalf of the other concerned member states and coordinates the procedure. If all the member states involved (both RMSs and concerned member states) agree to grant marketing authorizations, this decision forms the basis for the granting of the national marketing authorizations in the respective member states.

Neither the MR nor DCPs result in automatic approval in all member states. If any member state has objections, particularly in relation to potential serious risk to public health, which cannot be resolved within the procedure scope and timelines, they will be referred to the coordination group for MR and DCPs and reviewed in a 60 -day procedure. If this 60 -day procedure does not result in a consensus by all member states, the product can be marketed in the countries whose health authorities agree that the product can be licensed. The issue raised will then enter a second referral procedure.

As with the MR procedure, the advantage of the DCP is that the pharmaceutical company receives identical marketing authorizations for its medicinal product in all the member states of the EU in which it wants to market the product. This leads to considerable streamlining of all regulatory activities in regard to the product. Variations, line extensions, renewals, and more are also handled in a coordinated manner with the RMS leading the activity.

Once a DCP has been completed, the pharmaceutical company can subsequently apply for marketing authorizations for the medicinal product in additional EU member states by means of the MR procedure.

All products, whether centrally authorized or authorized by the MR or DCP, may only be sold in other member states if the product information is in the official language of the state in which the product will be sold, which effectively requires specific packaging and labeling of the product.

Before a generic pharmaceutical product can be marketed in the EU, a marketing authorization must be obtained. If a generic pharmaceutical product is shown to be essentially the same as, or bioequivalent to, one that is already on the market

14

Table of Contents

and which has been authorized in the EU for a specified number of years, as explained in the section on data exclusivity below, no further preclinical or clinical trials are required for that new generic pharmaceutical product to be authorized. The generic applicant can file an abridged application for marketing authorization, but in order to take advantage of the abridged procedure, the generic manufacturer must demonstrate specific similarities, including bioequivalence, to the already authorized product. Access to clinical data of the reference drug is governed by the European laws relating to data exclusivity, which are outlined below. Other products, such as new dosages of established products, must be subjected to further testing, and "bridging data" in respect of these further tests must be submitted along with the abridged application.

An applicant for a generic marketing authorization currently cannot avail itself of the abridged procedure in the EU by relying on the originator pharmaceutical company's data until expiry of the relevant period of exclusivity given to that data. Since October 30, 2015, EU directive (2004/27/EC) provides for an eight -year data exclusivity period commencing from the grant of first marketing authorization. After the eight -year period has expired, a generic applicant can refer to the data of the originator pharmaceutical company in order to file an abridged application for approval of its generic equivalent product. Yet, conducting the necessary studies and trials for an abridged application, within the data exclusivity period, is not regarded as contrary to patent rights or to supplementary protection certificates for medicinal products. However, the applicant will not be able to launch its product for an additional two years. This ten -year total period may be extended to 11 years if the original marketing authorization holder obtains, within those initial eight years, a further authorization for a new therapeutic use of the product which is shown to be of significant clinical benefit. Further, specific data exclusivity for one year may be obtained for a new indication for a well-established substance, provided that significant preclinical or clinical studies were carried out in relation to the new indication.

Under the national procedure, a company applies for a marketing authorization in one member state. The national procedure can now only be used if the pharmaceutical company does not seek authorization in more than one member state. If it does seek wider marketing authorizations, it must use the MR or DCP.

In addition to obtaining approval for each product, in most EU countries the pharmaceutical product manufacturer's facilities must obtain approval from the national supervisory authority. The EU has a code of good manufacturing practice, with which the marketing authorization holder must comply. Regulatory authorities in the EU may conduct inspections of the manufacturing facilities to review procedures, operating systems and personnel qualifications.

In order to control expenditures on pharmaceuticals, most member states in the EU regulate the pricing and reimbursement of products and in some cases limit the range of different forms of drugs available for prescription by national health services. These controls can result in considerable price differences between member states. In addition, in past years, as part of overall programs to reduce healthcare costs, certain European governments have prohibited price increases and have introduced various systems designed to lower prices. Some European governments have also set minimum targets for generics prescribing.

Certain European markets in which Mylan does business have recently undergone, some for the first time, or will soon undergo, government-imposed price reductions or similar pricing pressures on pharmaceutical products. In addition, a number of markets in which we operate have implemented or may implement tender, or tender-like, systems for generic pharmaceuticals in an effort to lower prices. Under tender systems, health insurers invite manufacturers to submit bids that establish prices for generic pharmaceuticals. Upon winning the tender, the winning company may receive a preferential reimbursement for a period of time. Such measures are likely to have a negative impact on sales and gross profit in these markets. However, some pro-generic government initiatives in certain markets could help to offset some of this unfavorable effect by potentially increasing generic utilization.

Rest of World

Australia

The pharmaceutical industry is one of the most highly regulated industries in Australia. The Australian government is heavily involved in the operation of the industry, through the registration of medicines and licensing of manufacturing facilities, as well as subsidizing patient cost of most prescription medicines sold in Australia. The Australian government authority, the Therapeutic Goods Administration (the "TGA"), regulates the quality, safety and efficacy of therapeutic goods and is responsible for granting authorization to market pharmaceutical products in Australia and for inspecting and approving manufacturing facilities.

The TGA operates according to the Commonwealth of Australia's Therapeutic Goods Act 1989 (Cth) (the "Act"). Specifically, the Act regulates the registration, listing, quality, safety, efficacy, promotion and sale of therapeutic goods,

15

Table of Contents

including pharmaceuticals, supplied in Australia. The TGA carries out a range of assessment and monitoring activities to ensure that therapeutic goods available in Australia are of an acceptable standard with a goal of ensuring that the Australian community has access within a reasonable time to therapeutic advances. Australian manufacturers of all medicines must be licensed under Part 3-3 of the Act and their manufacturing processes must comply with the principles of good manufacturing practices in Australia. Similar standards and audits apply for both domestic and foreign manufactured products.

Generic medicines are subject to an abbreviated review process by the TGA, if the product can demonstrate essential similarity to the originator brand. Essential similarity means the same active ingredient in the same dose form, delivering the active ingredient to the patient at the same rate and extent, compared to the original brand. If proven, safety and efficacy is assumed to be the same.

All therapeutic goods manufactured for supply in Australia must be listed or registered in the Australian Register of Therapeutic Goods (the "ARTG") before they can be promoted or supplied for use and/or sale in Australia. The ARTG is a database kept for the purpose of compiling information in relation to therapeutic goods for use in humans and lists therapeutic goods which are approved for supply in Australia.

Medicines assessed as having a higher level of risk must be registered, while those with a lower level of risk can be listed. The majority of listed medicines are self-selected by consumers and used for self-treatment. In assessing the level of risk, factors such as the strength of a product, side effects, potential harm through prolonged use, toxicity and the seriousness of the medical condition for which the product is intended to be used are taken into account.

Labeling, packaging and advertising of pharmaceutical products are also regulated by the Act and other relevant statutes including fair trading laws and pharmaceutical industry codes.

Australia has a five-year data exclusivity period, whereby any data relating to a pharmaceutical product cannot be referred to or used in the examination by the TGA of another company's dossier, until five years after the original product was approved.

The Pharmaceutical Benefits Scheme (the "PBS"), which has been in place since 1948, subsidizes the cost to consumers of medicines listed on the PBS, if the medicines have demonstrated acceptable clinical need, cost and effectiveness. The goal of the PBS is to make medicines available at the lowest cost compatible with reliable supply and to base access on medical need rather than ability to pay.

The government exerts a significant degree of control over the pharmaceuticals market through the PBS. More than 80% of all prescription medicine sold in Australia is reimbursed by the PBS. The PBS is operated under the Commonwealth of Australia's National Health Act 1953. This statute governs matters such as who may sell pharmaceutical products, the prices at which pharmaceutical products may be sold to consumers and the prices government pays manufacturers, wholesalers and pharmacists for subsidized medicines.

If a new medicine is to be considered for listing on the PBS, the price is determined through a full health economic analysis submitted to the government's advisory committee, the Pharmaceutical Benefits Advisory Committee (the "PBAC"), based on incremental benefit to health outcome. If the incremental benefit justifies the price requested, the PBAC then makes a recommendation to the government to consider listing the product on the PBS. In May 2014, as part of a government reform program in Australia, the Pharmaceutical Benefits Pricing Authority was abolished and the Minister for Health ("Minister"), or delegate, considers pricing matters for approximately five to six weeks following PBAC meetings. Factors contributing to pricing decisions include items such as information on the claims made in a submission, advice from the PBAC, information about the proposed price, the price and use of comparative medicines and the cost of producing the medicine, although with additional associated costs. The Minister may recommend that the proposed price is accepted; further negotiations take place for a lower price or prices within a specific range; or for some products, risk sharing arrangements to be developed and agreed upon. The Australian government's purchasing power is used to obtain lower prices as a means of controlling the cost of the program. The PBS also stipulates the wholesaler margin for drugs listed on the PBS. Wholesalers therefore have little pricing power over the majority of their product range and as a result are unable to increase profitability by increasing prices.

Following entry of the first generic product(s) onto the market, the PBS price reimbursed to pharmacies decreases by 16% for both the originator product and generic products with a brand equivalence indicator permitting substitution at the pharmacy level. Thereafter, both the originator and generic suppliers are required to disclose pricing information relating to the sale of medicines to the Price Disclosure Data Administrator, and twelve months after initial generic entry, there is a further PBS price reduction based on the weighted average disclosed price if the weighted average disclosed price is 10% or more below the existing PBS price. Ongoing price disclosure cycles and calculation of the weighted average disclosed price occur

16

Table of Contents

every six months, and further reductions are made to the PBS price whenever the weighted average disclosed price is 10% or more below the existing PBS price. Effective from April 2016 to April 2020, the government introduced an annual 5% statutory price reduction for medicines in the F1 (originator) formulary. In addition, during 2017, the government proposed additional measures including an extension of the price reductions to 2022 and additional one-time statutory price reductions. The legislation for these proposals was passed by the Australian Parliament in February 2018. The price disclosure system has had, and will continue to have, a negative impact on sales and gross profit in this market.

Japan

In Japan, we are governed by various laws and regulations, including the Pharmaceutical Affairs Law (Law No. 145, 1960), as amended by the Pharmaceuticals and Medical Devices Law ("PMDL"), and the Products Liability Law (Law No. 85, 1994). The PMDL was amended in November 2014 to establish a fast-track authorization process for regenerative medicine products, restructure medical device regulation and establish reporting obligations for package inserts for drugs and medical devices. Regenerative medicine products are newly defined under the amended PMDL as a product for medical use in humans to reconstruct, restore, or form the structure or function of a human body, in which cells of humans are cultured or otherwise processed.