UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Commission File Number 1-11758

(Exact Name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 1585 Broadway New York, NY 10036 (Address of principal executive offices, including zip code) | 36-3145972 (I.R.S. Employer Identification No.) | (212) 761-4000 (Registrant's telephone number, including area code) |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☒ | Accelerated Filer ☐ | |

Non-Accelerated Filer ☐ | Smaller reporting company ☐ | |

(Do not check if a smaller reporting company) | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 1, 2017, there were 1,849,782,135 shares of the Registrant's Common Stock, par value $0.01 per share, outstanding.

QUARTERLY REPORT ON FORM 10-Q

For the quarter ended March 31, 2017

| Table of Contents | Part | Item | Page | |||||||||

Financial Information | I | 1 | ||||||||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | 2 | 1 | ||||||||||

Introduction | 1 | |||||||||||

Executive Summary | 2 | |||||||||||

Business Segments | 6 | |||||||||||

Supplemental Financial Information and Disclosures | 15 | |||||||||||

Accounting Development Updates | 15 | |||||||||||

Critical Accounting Policies | 16 | |||||||||||

Liquidity and Capital Resources | 17 | |||||||||||

Quantitative and Qualitative Disclosures about Market Risk | 3 | 29 | ||||||||||

Controls and Procedures | 4 | 39 | ||||||||||

Report of Independent Registered Public Accounting Firm | 40 | |||||||||||

Financial Statements | 1 | 41 | ||||||||||

Consolidated Financial Statements and Notes | 41 | |||||||||||

Consolidated Income Statements (Unaudited) | 41 | |||||||||||

Consolidated Comprehensive Income Statements (Unaudited) | 42 | |||||||||||

Consolidated Balance Sheets (Unaudited at March 31, 2017) | 43 | |||||||||||

Consolidated Statements of Changes in Total Equity (Unaudited) | 44 | |||||||||||

Consolidated Cash Flow Statements (Unaudited) | 45 | |||||||||||

Notes to Consolidated Financial Statements (Unaudited) | 46 | |||||||||||

1. Introduction and Basis of Presentation | 46 | |||||||||||

2. Significant Accounting Policies | 47 | |||||||||||

3. Fair Values | 48 | |||||||||||

4. Derivative Instruments and Hedging Activities | 58 | |||||||||||

5. Investment Securities | 64 | |||||||||||

6. Collateralized Transactions | 68 | |||||||||||

7. Loans and Allowance for Credit Losses | 70 | |||||||||||

8. Equity Method Investments | 73 | |||||||||||

9. Deposits | 73 | |||||||||||

10. Long-Term Borrowings and Other Secured Financings | 73 | |||||||||||

11. Commitments, Guarantees and Contingencies | 74 | |||||||||||

12. Variable Interest Entities and Securitization Activities | 79 | |||||||||||

13. Regulatory Requirements | 82 | |||||||||||

14. Total Equity | 84 | |||||||||||

15. Earnings per Common Share | 86 | |||||||||||

16. Interest Income and Interest Expense | 86 | |||||||||||

17. Employee Benefit Plans | 86 | |||||||||||

18. Income Taxes | 87 | |||||||||||

19. Segment and Geographic Information | 87 | |||||||||||

20. Subsequent Events | 88 | |||||||||||

Financial Data Supplement (Unaudited) | 89 | |||||||||||

Other Information | II | 91 | ||||||||||

Legal Proceedings | 1 | 91 | ||||||||||

Unregistered Sales of Equity Securities and Use of Proceeds | 2 | 92 | ||||||||||

Exhibits | 6 | 92 | ||||||||||

Signatures | S-1 | |||||||||||

Exhibit Index | E-1 | |||||||||||

i

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the "SEC"). You may read and copy any document we file with the SEC at the SEC's public reference room at 100 F Street, NE, Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for information on the public reference room. The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information that issuers (including us) file electronically with the SEC. Our electronic SEC filings are available to the public at the SEC's internet site, www.sec.gov.

Our internet site is www.morganstanley.com . You can access our Investor Relations webpage at www.morganstanley.com/about-us-ir . We make available free of charge, on or through our Investor Relations webpage, our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also make available, through our Investor Relations webpage, via a link to the SEC's internet site, statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

You can access information about our corporate governance at www.morganstanley.com/about-us-governance. Our Corporate Governance webpage includes:

| • | Amended and Restated Certificate of Incorporation; |

| • | Amended and Restated Bylaws; |

| • | Charters for our Audit Committee, Compensation, Management Development and Succession Committee, Nominating and Governance Committee, Operations and Technology Committee, and Risk Committee; |

| • | Corporate Governance Policies; |

| • | Policy Regarding Communication with the Board of Directors; |

| • | Policy Regarding Director Candidates Recommended by Shareholders; |

| • | Policy Regarding Corporate Political Activities; |

| • | Policy Regarding Shareholder Rights Plan; |

| • | Equity Ownership Commitment; |

| • | Code of Ethics and Business Conduct; |

| • | Code of Conduct; |

| • | Integrity Hotline Information; and |

| • | Environmental and Social Policies. |

Our Code of Ethics and Business Conduct applies to all directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer and Deputy Chief Financial Officer. We will post any amendments to the Code of Ethics and Business Conduct and any waivers that are required to be disclosed by the rules of either the SEC or the New York Stock Exchange LLC ("NYSE") on our internet site. You can request a copy of these documents, excluding exhibits, at no cost, by contacting Investor Relations, 1585 Broadway, New York, NY 10036 (212-761-4000). The information on our internet site is not incorporated by reference into this report.

ii

|

Financial Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

Introduction

Morgan Stanley, a financial holding company, is a global financial services firm that maintains significant market positions in each of its business segments-Institutional Securities, Wealth Management and Investment Management. Morgan Stanley, through its subsidiaries and affiliates, provides a wide variety of products and services to a large and diversified group of clients and customers, including corporations, governments, financial institutions and individuals. Unless the context otherwise requires, the terms "Morgan Stanley," "Firm," "us," "we," or "our" mean Morgan Stanley (the "Parent Company") together with its consolidated subsidiaries.

A description of the clients and principal products and services of each of our business segments is as follows:

Institutional Securities provides investment banking, sales and trading, lending and other services to corporations, governments, financial institutions, and high to ultra-high net worth clients. Investment banking services consist of capital raising and financial advisory services, including services relating to the underwriting of debt, equity and other securities, as well as advice on mergers and acquisitions, restructurings, real estate and project finance. Sales and trading services include sales, financing and market-making activities in equity and fixed income products, including prime brokerage services, global macro, credit and commodities products. Lending services include originating and/or purchasing corporate loans, commercial and residential mortgage lending, asset-backed lending, financing extended to equities and commodities customers, and loans to municipalities. Other services include investment and research activities.

Wealth Management provides a comprehensive array of financial services and solutions to individual investors and small to medium-sized businesses and institutions covering

brokerage and investment advisory services, financial and wealth planning services, annuity and insurance products, credit and other lending products, banking and retirement plan services.

Investment Management provides a broad range of investment strategies and products that span geographies, asset classes, and public and private markets to a diverse group of clients across institutional and intermediary channels. Strategies and products include equity, fixed income, liquidity and alternative/other products. Institutional clients include defined benefit/defined contribution plans, foundations, endowments, government entities, sovereign wealth funds, insurance companies, third-party fund sponsors and corporations. Individual clients are serviced through intermediaries, including affiliated and non-affiliated distributors.

The results of operations in the past have been, and in the future may continue to be, materially affected by competition; risk factors; and legislative, legal and regulatory developments; as well as other factors. These factors also may have an adverse impact on our ability to achieve our strategic objectives. Additionally, the discussion of our results of operations herein may contain forward-looking statements. These statements, which reflect management's beliefs and expectations, are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of the risks and uncertainties that may affect our future results, see "Forward-Looking Statements" immediately preceding Part I, Item 1, "Business-Competition" and "Business-Supervision and Regulation" in Part I, Item 1, "Risk Factors" in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2016 (the "2016 Form 10-K") and "Liquidity and Capital Resources-Regulatory Requirements" herein.

| 1 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

Executive Summary

Overview of Financial Results

Consolidated Results

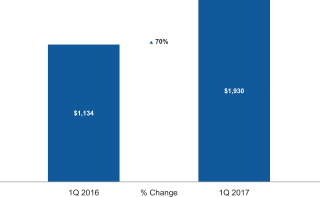

Net Revenues

($ in millions)

Net Income Applicable to Morgan Stanley

($ in millions)

Earnings per Common Share 1

| 1. | For the calculation of basic and diluted earnings per common share, see Note 15 to the consolidated financial statements. |

| • | We reported net revenues of $9,745 million in the quarter ended March 31, 2017 ("current quarter," or "1Q 2017"), compared with $7,792 million in the quarter ended March 31, 2016 ("prior year quarter," or "1Q 2016"). For the current quarter, net income applicable to Morgan Stanley was $1,930 million, or $1.00 per diluted common share, compared with $1,134 million, or $0.55 per diluted common share, in the prior year quarter. |

| • | Results for the current quarter included a recurring-type of discrete tax benefit of $112 million associated with the accounting update related to employee share-based payments. |

Non-interest Expenses

($ in millions)

| • | Compensation and benefits expenses of $4,466 million in the current quarter increased 21% from $3,683 million in the prior year quarter, primarily due to increases in discretionary incentive compensation driven mainly by higher revenues and increases in the fair value of investments to which certain deferred compensation plans are referenced. |

| • | Non-compensation expenses were $2,471 million in the current quarter compared with $2,371 million in the prior year quarter, representing a 4% increase, primarily as a result of higher litigation costs and volume-driven expenses. |

| March 2017 Form 10-Q | 2 |

| Management's Discussion and Analysis |  |

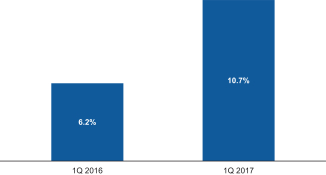

Return on Average Common Equity

| • | The annualized return on average common equity ("ROE") was 10.7% in the current quarter compared with 6.2% in the prior year quarter (see "Selected Non-Generally Accepted Accounting Principles ("Non-GAAP") Financial Information" herein). |

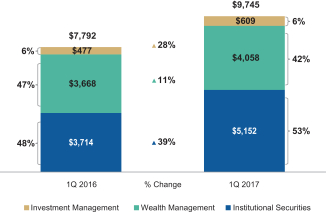

Business Segment Results

Net Revenues by Segment 1, 2

($ in millions)

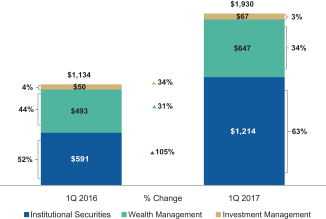

Net Income Applicable to Morgan Stanley by Segment 2, 3

($ in millions)

| 1. | The total amount of Net Revenues by Segment also includes intersegment eliminations of $(74) million and $(67) million in the current quarter and prior year quarter, respectively. |

| 2. | The percentages on the sides of the charts represent the contribution of each business segment to the total. Amounts do not necessarily total to 100% due to intersegment eliminations, where applicable. |

| 3. | The total amount of Net Income Applicable to Morgan Stanley by Segment also includes intersegment eliminations of $2 million in the current quarter. |

| • | Institutional Securities net revenues of $5,152 million in the current quarter increased 39% compared with $3,714 million in the prior year quarter, primarily as a result of higher sales and trading and Investment banking revenues. |

| • | Wealth Management net revenues of $4,058 million in the current quarter increased 11% from $3,668 million in the prior year quarter, primarily as a result of growth in Net interest income and higher transactional and asset management fee revenues. |

| • | Investment Management net revenues of $609 million in the current quarter increased 28% from $477 million in the prior year quarter, primarily driven by investment gains in certain private equity and real estate funds compared with losses in the prior year quarter. |

Net Revenues by Region 1

($ in millions)

EMEA-Europe, Middle East and Africa

| 1. | For a discussion of how the geographic breakdown for net revenues is determined, see Note 21 to the consolidated financial statements in Item 8 of the 2016 Form 10-K. |

| 3 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

Selected Financial Information and Other Statistical Data

| Three Months Ended March 31, | ||||||||

| $ in millions | 2017 | 2016 | ||||||

Income from continuing operations applicable to Morgan Stanley | $ | 1,952 | $ | 1,137 | ||||

Income (loss) from discontinued operations applicable to Morgan Stanley | (22 | ) | (3 | ) | ||||

Net income applicable to Morgan Stanley | 1,930 | 1,134 | ||||||

Preferred stock dividends and other | 90 | 79 | ||||||

Earnings applicable to Morgan Stanley common shareholders | $ | 1,840 | $ | 1,055 | ||||

Effective income tax rate from continuing operations | 29.0 | % | 33.3 | % | ||||

| At March 31, 2017 | At December 31, 2016 | |||||||

Capital ratios (Transitional-Advanced) 1 |

| |||||||

Common Equity Tier 1 capital ratio | 17.4 | % | 16.9 | % | ||||

Tier 1 capital ratio | 19.9 | % | 19.0 | % | ||||

Total capital ratio | 22.9 | % | 22.0 | % | ||||

Capital ratios (Transitional-Standardized) 1 |

| |||||||

Tier 1 leverage ratio 2 | 8.5 | % | 8.4 | % | ||||

| in millions, except per share amounts | At March 31, 2017 | At December 31, 2016 | ||||||

Loans 3 | $ | 95,953 | $ | 94,248 | ||||

Total assets | $ | 832,391 | $ | 814,949 | ||||

Global Liquidity Reserve 4 | $ | 197,647 | $ | 202,297 | ||||

Deposits | $ | 152,109 | $ | 155,863 | ||||

Long-term borrowings | $ | 172,688 | $ | 164,775 | ||||

Common shareholders' equity | $ | 69,404 | $ | 68,530 | ||||

Common shares outstanding | 1,852 | 1,852 | ||||||

Book value per common share 5 | $ | 37.48 | $ | 36.99 | ||||

Worldwide employees | 55,607 | 55,311 | ||||||

| 1. | For a discussion of our regulatory capital ratios, see "Liquidity and Capital Resources-Regulatory Requirements" herein. |

| 2. | See Note 13 to the consolidated financial statements for information on the Tier 1 leverage ratio. |

| 3. | Amounts include loans held for investment (net of allowance) and loans held for sale but exclude loans at fair value, which are included in Trading assets in the consolidated balance sheets (see Note 7 to the consolidated financial statements). |

| 4. | For a discussion of Global Liquidity Reserve, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Liquidity Risk Management Framework-Global Liquidity Reserve" in Part II, Item 7 of the 2016 Form 10-K. |

| 5. | Book value per common share equals common shareholders' equity divided by common shares outstanding. |

Selected Non-Generally Accepted Accounting Principles ("Non-GAAP") Financial Information

We prepare our consolidated financial statements using accounting principles generally accepted in the United States of America ("U.S. GAAP"). From time to time, we may disclose certain "non-GAAP financial measures" in this document, or in the course of our earnings releases, earnings and other conference calls, financial presentations, definitive proxy statement and otherwise. A "non-GAAP financial measure" excludes, or includes, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by us are provided as additional information to investors and analysts in order to provide them with further transparency about, or as an alternative method for assessing, our financial condition, operating results or prospective regulatory capital requirements. These measures are not in accordance with, or a substitute for, U.S. GAAP and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the U.S. GAAP financial measure and the non-GAAP financial measure.

The principal non-GAAP financial measures presented in this document are set forth below.

Non-GAAP Financial Measures by Business Segment

| Three Months Ended March 31, | ||||||||

| $ in billions | 2017 | 2016 | ||||||

Pre-tax profit margin 1

| ||||||||

Institutional Securities | 34 | % | 24 | % | ||||

Wealth Management | 24 | % | 21 | % | ||||

Investment Management | 17 | % | 9 | % | ||||

Consolidated | 29 | % | 22 | % | ||||

Average common equity 2

| ||||||||

Institutional Securities | $ | 40.2 | $ | 43.2 | ||||

Wealth Management | 17.2 | 15.3 | ||||||

Investment Management | 2.4 | 2.8 | ||||||

Parent Company | 9.2 | 6.9 | ||||||

Consolidated average common equity | $ | 69.0 | $ | 68.2 | ||||

Return on average common equity 2

| ||||||||

Institutional Securities | 11.4 | % | 4.9 | % | ||||

Wealth Management | 14.6 | % | 12.6 | % | ||||

Investment Management | 11.1 | % | 6.9 | % | ||||

Consolidated | 10.7 | % | 6.2 | % | ||||

| March 2017 Form 10-Q | 4 |

| Management's Discussion and Analysis |  |

Reconciliations from U.S. GAAP to Non-GAAP Consolidated Financial Measures

| Three Months Ended March 31, | ||||||||

| $ in millions, except per share data | 2017 | 2016 | ||||||

Net income applicable to Morgan Stanley

|

| |||||||

U.S. GAAP | $ | 1,930 | $ | 1,134 | ||||

Impact of discrete tax provision 3 | 14 | - | ||||||

Net income applicable to Morgan Stanley, excluding discrete tax provision-non-GAAP 4 | $ | 1,944 | $ | 1,134 | ||||

Earnings per diluted common share

|

| |||||||

U.S. GAAP | $ | 1.00 | $ | 0.55 | ||||

Impact of discrete tax provision 3 | 0.01 | - | ||||||

Earnings per diluted common share, excluding discrete tax provision-non-GAAP 4 | $ | 1.01 | $ | 0.55 | ||||

Effective income tax rate

| ||||||||

U.S. GAAP | 29.0 | % | 33.3 | % | ||||

Impact of discrete tax provision 3 | (0.5 | )% | - | |||||

Effective income tax rate from continuing operations, excluding discrete tax provision-non-GAAP 4 | 28.5 | % | 33.3 | % | ||||

| 1. | Pre-tax profit margin is a non-GAAP financial measure that we consider to be a useful measure to us, investors and analysts to assess operating performance and represents income from continuing operations before income taxes as a percentage of net revenues. |

| 2. | Average common equity and return on average common equity are non-GAAP financial measures we consider to be useful measures to us, investors and analysts to assess capital adequacy and to allow better comparability of period-to-period operating performance. Average common equity for each business segment is determined at the beginning of each year using our Required Capital framework, an internal capital adequacy measure (see "Liquidity and Capital Resources-Regulatory Requirements-Attribution of Average Common Equity According to the Required Capital Framework" herein) and will remain fixed throughout the year until the next annual reset. Each business segment's return on average common equity equals annualized net income applicable to Morgan Stanley less an allocation of preferred dividends as a percentage of average common equity for that segment. Consolidated return on average common equity equals annualized consolidated net income applicable to Morgan Stanley less preferred dividends as a percentage of average common equity. |

| 3. | Beginning in 2017, with the adoption of the accounting update Improvements to Employee Share-Based Payment Accounting , the income tax consequences related to share-based payments are required to be recognized in Provision for income taxes in the consolidated income statements, and treated as a discrete item, upon the conversion of employee share-based awards. The impact of the income tax consequences upon conversion of the awards may be either a benefit or a provision. Conversion of employee share-based awards to Firm shares will primarily occur in the first quarter of each year. The above exclusion calculations for net income applicable to Morgan Stanley, earnings per diluted common share and effective income tax rate have not been adjusted for these income tax consequences as we anticipate conversion activity each quarter. See Note 2 to the consolidated financial statements for information on the adoption of the accounting update Improvements to Employee Share-Based Payment Accounting . For further information on the discrete tax provision, see "Supplemental Financial Information and Disclosures-Income Tax Matters" herein. |

| 4. | Net income applicable to Morgan Stanley, excluding discrete tax provision, earnings per diluted common share, excluding discrete tax provision and effective income tax rate from continuing operations, excluding discrete tax provision, are non-GAAP financial measures we consider to be useful measures to us, investors and analysts to allow better comparability of period-to-period operating performance. |

Consolidated Non-GAAP Financial Measures

| Three Months Ended March 31, | ||||||||

| $ in billions | 2017 | 2016 | ||||||

Average common equity 1, 3, 4, 5

| ||||||||

Unadjusted | $ | 69.0 | $ | 68.2 | ||||

Excluding DVA | 69.6 | 68.3 | ||||||

Excluding DVA and discrete tax provision | 69.6 | 68.3 | ||||||

Return on average common equity 1, 2, 3, 4

|

| |||||||

Unadjusted | 10.7 | % | 6.2 | % | ||||

Excluding DVA | 10.6 | % | 6.2 | % | ||||

Excluding DVA and discrete tax provision | 10.7 | % | 6.2 | % | ||||

Average tangible common equity 1, 3, 4, 5

|

| |||||||

Unadjusted | $ | 59.7 | $ | 58.7 | ||||

Excluding DVA | 60.3 | 58.8 | ||||||

Excluding DVA and discrete tax provision | 60.3 | 58.8 | ||||||

Return on average tangible common equity 1, 2, 3, 4

|

| |||||||

Unadjusted | 12.3 | % | 7.2 | % | ||||

Excluding DVA | 12.2 | % | 7.2 | % | ||||

Excluding DVA and discrete tax provision | 12.3 | % | 7.2 | % | ||||

Expense efficiency ratio 1, 6 | 71.2 | % | 77.7 | % | ||||

| At March 31, 2017 | At December 31, 2016 | |||||||

Tangible book value per common share 1, 7 | $ | 32.49 | $ | 31.98 | ||||

DVA-Debt valuation adjustment represents the change in the fair value resulting from fluctuations in our credit spreads and other credit factors related to liabilities carried at fair value under the fair value option, primarily certain Long-term and Short-term borrowings.

| 1. | The average common equity, return on average common equity, average tangible common equity, return on average tangible common equity, the expense efficiency ratio and the tangible book value per common share measures set forth in this table are all non-GAAP financial measures we consider to be useful measures to us, investors and analysts to assess capital adequacy and to allow better comparability of period-to-period operating performance. For a discussion of tangible common equity, see "Liquidity and Capital Resources-Tangible Equity" herein. |

| 2. | Return on average common equity equals annualized consolidated net income applicable to Morgan Stanley less preferred dividends as a percentage of average common equity. Return on average tangible common equity equals annualized net income applicable to Morgan Stanley less preferred dividends as a percentage of average tangible common equity. |

| 3. | When excluding DVA, it is only excluded from the denominator. When excluding the discrete tax provision, both the numerator and denominator are adjusted to exclude that item. |

| 4. | The calculation used in determining the Firm's "ROE Target" is return on average common equity excluding DVA and discrete tax items as set forth above. Beginning in 2017, with the adoption of the accounting update Improvements to Employee Share-Based Payment Accounting , the income tax consequences related to share-based payments are required to be recognized in Provision for income taxes in the consolidated income statements, and treated as a discrete item, upon the conversion of employee share-based awards. The impact of the income tax consequences upon conversion of the awards may be either a benefit or a provision. Conversion of employee share-based awards to Firm shares will primarily occur in the first quarter of each year. The above exclusion calculations for returns on average common equity and tangible common equity have not been adjusted for these income tax consequences as we anticipate conversion activity each quarter. See Note 2 to the consolidated financial statements for information on the adoption of the accounting update Improvements to Employee Share-Based Payment Accounting . |

| 5. | The impact of DVA on average common equity and average tangible common equity was approximately $(584) million and $(144) million in the current quarter and prior year quarter, respectively. |

| 6. | The expense efficiency ratio represents total non-interest expenses as a percentage of net revenues. |

7. Tangible book value per common share equals tangible common equity of $60,175 million at March 31, 2017 and $59,234 million at December 31, 2016 divided by common shares outstanding of 1,852 million at both March 31, 2017 and December 31, 2016.

| 5 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

Return on Equity Target

We have an ROE Target of 9% to 11% to be achieved by 2017. Our ROE Target and the related strategies and goals are forward-looking statements that may be materially affected by many factors, including, among other things: macroeconomic and market conditions; legislative and regulatory developments; industry trading and investment banking volumes; equity market levels; interest rate environment; legal expenses and the ability to reduce expenses in general; capital levels; and discrete tax items. For further information on our ROE Target and related assumptions, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Executive Summary-Return on Equity Target" in Part II, Item 7 of the 2016 Form 10-K.

Business Segments

Substantially all of our operating revenues and operating expenses are directly attributable to the business segments. Certain revenues and expenses have been allocated to each business segment, generally in proportion to its respective net revenues, non-interest expenses or other relevant measures.

As a result of treating certain intersegment transactions as transactions with external parties, we include an Intersegment Eliminations category to reconcile the business segment results to our consolidated results.

Net Revenues, Compensation Expense and Income Taxes

For discussions of our net revenues, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Net Revenues" and "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Net Revenues by Segment" in Part II, Item 7 of the 2016 Form 10-K. For a discussion of our compensation expense, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Compensation Expense" in Part II, Item 7 of the 2016 Form 10-K. For a discussion of our Income Tax expense, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Income Taxes" in Part II, Item 7 of the 2016 Form 10-K.

| March 2017 Form 10-Q | 6 |

| Management's Discussion and Analysis |  |

Institutional Securities

Income Statement Information

| Three Months Ended March 31, | ||||||||||||

| $ in millions | 2017 | 2016 | % Change | |||||||||

Revenues | ||||||||||||

Investment banking | $ | 1,417 | $ | 990 | 43 | % | ||||||

Trading | 3,012 | 1,891 | 59 | % | ||||||||

Investments | 66 | 32 | 106 | % | ||||||||

Commissions and fees | 620 | 655 | (5 | )% | ||||||||

Asset management, distribution and administration fees | 91 | 73 | 25 | % | ||||||||

Other | 173 | 4 | N/ | M | ||||||||

Total non-interest revenues | 5,379 | 3,645 | 48 | % | ||||||||

Interest income | 1,124 | 1,053 | 7 | % | ||||||||

Interest expense | 1,351 | 984 | 37 | % | ||||||||

Net interest | (227 | ) | 69 | N/ | M | |||||||

Net revenues | 5,152 | 3,714 | 39 | % | ||||||||

Compensation and benefits | 1,870 | 1,382 | 35 | % | ||||||||

Non-compensation expenses | 1,552 | 1,424 | 9 | % | ||||||||

Total non-interest expenses | 3,422 | 2,806 | 22 | % | ||||||||

Income from continuing operations before income taxes | 1,730 | 908 | 91 | % | ||||||||

Provision for income taxes | 459 | 275 | 67 | % | ||||||||

Income from continuing operations | 1,271 | 633 | 101 | % | ||||||||

Income (loss) from discontinued operations, net of income taxes | (22 | ) | (3 | ) | N/ | M | ||||||

Net income | 1,249 | 630 | 98 | % | ||||||||

Net income applicable to noncontrolling interests | 35 | 39 | (10 | )% | ||||||||

Net income applicable to Morgan Stanley | $ | 1,214 | $ | 591 | 105 | % | ||||||

N/M-Not Meaningful

Investment Banking

Investment Banking Revenues

| Three Months Ended March 31, | ||||||||||||

| $ in millions | 2017 | 2016 | % Change | |||||||||

Advisory | $ | 496 | $ | 591 | (16)% | |||||||

Underwriting revenues: | ||||||||||||

Equity | 390 | 160 | 144% | |||||||||

Fixed income | 531 | 239 | 122% | |||||||||

Total underwriting | 921 | 399 | 131% | |||||||||

Total investment banking | $ | 1,417 | $ | 990 | 43% | |||||||

Investment Banking Volumes

| Three Months Ended March 31, | ||||||||

| $ in billions | 2017 1 | 2016 1 | ||||||

Completed mergers and acquisitions 2 | $ | 150 | $ | 297 | ||||

Equity and equity-related offerings 3 | 10 | 7 | ||||||

Fixed income offerings 4 | 71 | 51 | ||||||

| 1. | Source: Thomson Reuters, data at April 3, 2017. Completed mergers and acquisitions volumes are based on full credit to each of the advisors in a transaction. Equity and equity-related offerings and fixed income offerings are based on full credit for single book managers and equal credit for joint book managers. Transaction volumes may not be indicative of net revenues in a given period. In addition, transaction volumes for prior periods may vary from amounts previously reported due to the subsequent withdrawal or change in the value of a transaction. |

| 2. | Amounts include transactions of $100 million or more. |

| 3. | Amounts include Rule 144A issuances and registered public offerings of common stock and convertible securities and rights offerings. |

| 4. | Amounts include non-convertible preferred stock, mortgage-backed and asset-backed securities, and taxable municipal debt. Amounts include publicly registered and Rule 144A issues. Amounts exclude leveraged loans and self-led issuances. |

Investment banking revenues are composed of fees from advisory services and revenues from the underwriting of securities offerings and syndication of loans, net of syndication expenses.

Investment banking revenues of $1,417 million in the current quarter increased 43% from the prior year quarter due to higher underwriting revenues, partially offset by a decrease in advisory revenues in the current quarter.

| • | Advisory revenues decreased reflecting the lower levels of global completed merger, acquisition and restructuring transactions ("M&A") activity (see Investment Banking Volumes table), partially offset by higher fee realization. |

| • | Equity underwriting revenues increased as a result of higher global market volumes in both initial public offerings and follow-on offerings (see Investment Banking Volumes table), as well as higher fee realization. Fixed income underwriting revenues increased in the current quarter, primarily due to higher bond and non-investment grade loan fees. |

Sales and Trading Net Revenues

By Income Statement Line Item

| Three Months Ended March 31, | ||||||||||||

| $ in millions | 2017 | 2016 | % Change | |||||||||

Trading | $ | 3,012 | $ | 1,891 | 59 | % | ||||||

Commissions and fees | 620 | 655 | (5 | )% | ||||||||

Asset management, distribution and administration fees | 91 | 73 | 25 | % | ||||||||

Net interest | (227 | ) | 69 | N/ | M | |||||||

Total | $ | 3,496 | $ | 2,688 | 30 | % | ||||||

N/M-Not Meaningful

| 7 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

By Business

| Three Months Ended March 31, | ||||||||

| $ in millions | 2017 | 2016 | ||||||

Equity | $ | 2,016 | $ | 2,056 | ||||

Fixed income | 1,714 | 873 | ||||||

Other | (234 | ) | (241 | ) | ||||

Total | $ | 3,496 | $ | 2,688 | ||||

Sales and Trading Activities - Equity and Fixed Income

Following is a description of the sales and trading activities within our equities and fixed income businesses as well as how their results impact the income statement line items, followed by a presentation and explanation of results.

Equities-Financing. We provide financing and prime brokerage services to our clients active in the equity markets through a variety of products including margin lending, securities lending and swaps. Results from this business are largely driven by the difference between financing income earned and financing costs incurred, which are reflected in Net interest for securities and equity lending products and in Trading revenues for derivative products.

Equities-Execution services. We make markets for our clients in equity-related securities and derivative products, including providing liquidity and hedging products. A significant portion of the results for this business is generated by commissions and fees from executing and clearing client transactions on major stock and derivative exchanges as well as from over-the-counter ("OTC") transactions. Market-making also generates gains and losses on inventory, which are reflected in Trading revenues.

Fixed income- Within fixed income we make markets in order to facilitate client activity as part of the following products and services.

| • | Global macro products. We make markets for our clients in interest rate, foreign exchange and emerging market products, including exchange-traded and OTC securities, loans and derivative instruments. The results of this market-making activity are primarily driven by gains and losses from buying and selling positions to stand ready for and satisfy client demand and are recorded in Trading revenues. |

| • | Credit products. We make markets in credit-sensitive products, such as corporate bonds and mortgage securities and other securitized products, and related derivative instruments. The values of positions in this business are sensitive to changes in credit spreads and interest rates, which result in gains and losses reflected in Trading revenues. Due to the amount and type of the interest-bearing securities and loans |

making up this business, a significant portion of the results is also reflected in Net interest revenues. |

| • | Commodities products. We make markets in various commodity products related primarily to electricity, natural gas, oil, and precious metals, with the results primarily reflected in Trading revenues. |

Sales and Trading Net Revenues-Equity and Fixed Income

| Three Months Ended March 31, 2017 | ||||||||||||||||

| $ in millions | Trading | Fees 1 | Net Interest 2 | Total | ||||||||||||

Financing | $ | 931 | $ | 89 | $ | (188 | ) | $ | 832 | |||||||

Execution services | 664 | 568 | (48 | ) | 1,184 | |||||||||||

Total Equity | $ | 1,595 | $ | 657 | $ | (236 | ) | $ | 2,016 | |||||||

Total Fixed Income | $ | 1,598 | $ | 54 | $ | 62 | $ | 1,714 | ||||||||

| Three Months Ended | ||||||||||||||||

| March 31, 2016 | ||||||||||||||||

| $ in millions | Trading | Fees 1 | Net Interest 2 | Total | ||||||||||||

Financing | $ | 886 | $ | 86 | $ | 40 | $ | 1,012 | ||||||||

Execution services | 509 | 600 | (65 | ) | 1,044 | |||||||||||

Total Equity | $ | 1,395 | $ | 686 | $ | (25 | ) | $ | 2,056 | |||||||

Total Fixed Income | $ | 555 | $ | 40 | $ | 278 | $ | 873 | ||||||||

| 1. | Includes Commissions and fees and Asset management, distribution and administration fees. |

| 2. | Funding costs are allocated to the businesses based on funding usage and are included in Net interest. |

We manage each of the sales and trading businesses based on its aggregate net revenues, which are comprised of the consolidated income statement line items quantified in the previous table. Trading revenues are affected by a variety of market dynamics, including volumes, bid-offer spreads, and inventory prices, as well as impacts from hedging activity, which are interrelated. We provide qualitative commentary in the discussion of results that follow on the key drivers of period over period variances, as the quantitative impact of the various market dynamics typically cannot be disaggregated.

For additional information on total Trading revenues, see the table "Trading Revenues by Product Type" in Note 4 to the consolidated financial statements.

Equity

Equity sales and trading net revenues of $2,016 million in the current quarter were lower than the prior year quarter, reflecting lower results in our financing businesses driven by higher funding costs, partially offset by strong results in our execution services revenues.

| • | Financing revenues decreased 18% from the prior year quarter as Net interest revenues declined from higher net |

| March 2017 Form 10-Q | 8 |

| Management's Discussion and Analysis |  |

interest costs, reflecting increased liquidity requirements, and an increased proportion of lower spread transactions. |

| • | Execution services increased 13% from the prior year quarter, primarily reflecting improved results in Trading revenues due to a lower volatility environment compared with the prior year quarter when increased volatility resulted in inventory losses. This was partially offset by lower fees in cash products driven by reduced market volumes. |

Fixed Income

Fixed income net revenues of $1,714 million in the current quarter were 96% higher than the prior year quarter, driven by an increase in Trading revenues reflecting strong performance across products and regions on improved market conditions.

| • | Credit products increased due to a more favorable credit environment in the current quarter compared with the widening spread environment in the prior year quarter that resulted in inventory losses. This was partially offset by a lower level of interest realized in securitized products in the current quarter. |

| • | Global macro products increased due to a more favorable environment across products compared with the prior year quarter when results were impacted by inventory losses. This was partially offset by higher interest costs in the current quarter which were impacted by interest products inventory management. |

| • | Commodities products increased due to increased structured transactions and customer flow in electricity and natural gas products and an improved credit environment. |

Investments, Other Revenues, Non-interest Expenses and Other Items

Investments

| • | Net investment gains of $66 million in the current quarter increased from the prior year quarter, primarily as a result of gains on investments associated with our compensation plans compared with losses in the prior year quarter. |

Other

| • | Other revenues of $173 million in the current quarter increased from the prior year quarter, primarily reflecting mark-to-market gains on loans held for sale in the current quarter compared with mark-to-market losses in the prior year quarter and a decrease in the provision on loans held for investment. |

Non-interest Expenses

Non-interest expenses of $3,422 million in the current quarter increased from the prior year quarter, primarily reflecting a 35% increase in Compensation and benefits expenses and a 9% increase in Non-compensation expenses in the current quarter.

| • | Compensation and benefits expenses increased in the current quarter, primarily due to increases in discretionary incentive compensation driven mainly by higher revenues and the fair value of investments to which certain deferred compensation plans are referenced. |

| • | Non-compensation expenses increased in the current quarter, primarily due to higher litigation costs and Brokerage, clearing and exchange fees expense due to higher volumes. |

| 9 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

Wealth Management

Income Statement Information

| Three Months Ended March 31, | % Change | |||||||||||

| $ in millions | 2017 | 2016 1 | ||||||||||

Revenues | ||||||||||||

Investment banking | $ | 145 | $ | 121 | 20% | |||||||

Trading | 238 | 194 | 23% | |||||||||

Investments | 1 | (2 | ) | 150% | ||||||||

Commissions and fees | 440 | 412 | 7% | |||||||||

Asset management, distribution and administration fees | 2,184 | 2,054 | 6% | |||||||||

Other | 56 | 58 | (3)% | |||||||||

Total non-interest revenues | 3,064 | 2,837 | 8% | |||||||||

Interest income | 1,079 | 914 | 18% | |||||||||

Interest expense | 85 | 83 | 2% | |||||||||

Net interest | 994 | 831 | 20% | |||||||||

Net revenues | 4,058 | 3,668 | 11% | |||||||||

Compensation and benefits | 2,317 | 2,088 | 11% | |||||||||

Non-compensation expenses | 768 | 794 | (3)% | |||||||||

Total non-interest expenses | 3,085 | 2,882 | 7% | |||||||||

Income from continuing operations before income taxes | 973 | 786 | 24% | |||||||||

Provision for income taxes | 326 | 293 | 11% | |||||||||

Net income applicable to Morgan Stanley | $ | 647 | $ | 493 | 31% | |||||||

| 1. | Effective July 1, 2016, the Institutional Securities and Wealth Management business segments entered into an agreement, whereby Institutional Securities assumed management of Wealth Management's fixed income client-driven trading activities and employees. Institutional Securities now pays fees to Wealth Management based on distribution activity (collectively, the "Fixed Income Integration"). Prior periods have not been recast for this new intersegment agreement due to immateriality. |

Statistical Data

Financial Information and Statistical Data

| $ in billions | At March 31, 2017 | At December 31, 2016 | ||||||

Client assets | $ | 2,187 | $ | 2,103 | ||||

Fee-based client assets 1 | $ | 927 | $ | 877 | ||||

Fee-based client assets as a percentage of total client assets | 42% | 42% | ||||||

Client liabilities 2 | $ | 74 | $ | 73 | ||||

Bank deposit program | $ | 149 | $ | 153 | ||||

Investment securities portfolio | $ | 62.6 | $ | 63.9 | ||||

Loans and lending commitments | $ | 70.3 | $ | 68.7 | ||||

Wealth Management representatives | 15,777 | 15,763 | ||||||

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

Annualized revenues per representative | ||||||||

(dollars in thousands) 3 | $ | 1,029 | $ | 923 | ||||

Client assets per representative | ||||||||

(dollars in millions) 4 | $ | 139 | $ | 126 | ||||

Fee-based asset flows 5 | ||||||||

(dollars in billions) | $ | 18.8 | $ | 5.9 | ||||

| 1. | Fee-based client assets represent the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets. |

| 2. | Client liabilities include securities-based and tailored lending, residential real estate loans and margin lending. |

| 3. | Annualized revenues per representative equal Wealth Management's annualized revenues divided by the average representative headcount. |

| 4. | Client assets per representative equal total period-end client assets divided by period-end representative headcount. |

| 5. | Fee-based asset flows include net new fee-based assets, net account transfers, dividends, interest and client fees and exclude institutional cash management-related activity. |

Transactional Revenues

| Three Months Ended March 31, | % Change | |||||||||||

| $ in millions | 2017 | 2016 | ||||||||||

Investment banking | $ | 145 | $ | 121 | 20% | |||||||

Trading | 238 | 194 | 23% | |||||||||

Commissions and fees | 440 | 412 | 7% | |||||||||

Total | $ | 823 | $ | 727 | 13% | |||||||

| March 2017 Form 10-Q | 10 |

| Management's Discussion and Analysis |  |

Net Revenues

Transactional Revenues

Transactional revenues of $823 million in the current quarter increased 13% from the prior year quarter primarily reflecting higher revenues related to investments associated with certain employee deferred compensation plans.

| • | Investment banking revenues increased in the current quarter due to higher revenues from the distribution of structured products and equities, partially offset by lower preferred stock underwriting activity. |

| • | Trading revenues increased in the current quarter primarily due to gains related to investments associated with certain employee deferred compensation plans, partially offset by decreases from the Fixed Income Integration. |

| • | Commissions and fees increased in the current quarter primarily related to the Fixed Income Integration and to higher equities activity, partially offset by lower annuity product revenues. |

Asset Management

| • | Asset management, distribution and administration fees of $2,184 million in the current quarter increased 6% from the prior year quarter primarily due to market appreciation and positive flows, partially offset by lower average client fee rates. See "Fee-Based Client Assets Activity and Average Fee Rate by Account Type" herein. |

Net Interest

| • | Net interest of $994 million in the current quarter increased 20% from the prior year quarter primarily due to higher loan balances and higher interest rates. |

Non-interest Expenses

Non-interest expenses of $3,085 million in the current quarter increased 7% from the prior year quarter.

| • | Compensation and benefits expenses increased in the current quarter primarily due to higher revenues and increases in the fair value of investments to which certain deferred compensation plans are referenced. |

| • | Non-compensation expenses decreased in the current quarter primarily due to lower professional service costs. |

Fee-Based Client Assets Activity and Average Fee Rate by Account Type

For a description of fee-based client assets, including descriptions for the fee based client asset types and rollforward items in the following tables, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Wealth Management-Fee-Based Client Assets Activity and Average Fee Rate by Account Type" in Part II, Item 7 of the 2016 Form 10-K.

At December 31, 2016 | Inflows | Outflows | Market Impact | At March 31, 2017 | Average for the Three Months Ended March 31, 2017 | |||||||||||||||||

| $ in billions, Fee Rate in bps | Fee Rate 1 | |||||||||||||||||||||

Separately managed accounts 2,3 | $ | 222 | $ | 9 | $ | (5 | ) | $ | 4 | $ | 230 | 16 | ||||||||||

Unified managed accounts 3 | 204 | 13 | (9 | ) | 9 | 217 | 100 | |||||||||||||||

Mutual fund advisory | 21 | - | (1 | ) | 1 | 21 | 120 | |||||||||||||||

Representative as advisor | 125 | 10 | (7 | ) | 5 | 133 | 86 | |||||||||||||||

Representative as portfolio manager | 285 | 20 | (11 | ) | 11 | 305 | 98 | |||||||||||||||

Subtotal | $ | 857 | $ | 52 | $ | (33 | ) | $ | 30 | $ | 906 | 77 | ||||||||||

Cash management | 20 | 3 | (2 | ) | - | 21 | 6 | |||||||||||||||

Total fee-based client assets | $ | 877 | $ | 55 | $ | (35 | ) | $ | 30 | $ | 927 | 75 | ||||||||||

| 11 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

At December 31, 2015 | Inflows | Outflows | Market Impact | At March 31, 2016 | Average for the Three Months Ended March 31, 2016 | |||||||||||||||||

| $ in billions, Fee Rate in bps | Fee Rate 1 | |||||||||||||||||||||

Separately managed accounts 2 | $ | 283 | $ | 9 | $ | (10 | ) | $ | (4 | ) | $ | 278 | 37 | |||||||||

Unified managed accounts | 105 | 10 | (5 | ) | 2 | 112 | 109 | |||||||||||||||

Mutual fund advisory | 25 | - | (1 | ) | - | 24 | 121 | |||||||||||||||

Representative as advisor | 115 | 6 | (7 | ) | - | 114 | 87 | |||||||||||||||

Representative as portfolio manager | 252 | 15 | (11 | ) | (1 | ) | 255 | 102 | ||||||||||||||

Subtotal | $ | 780 | $ | 40 | $ | (34 | ) | $ | (3 | ) | $ | 783 | 78 | |||||||||

Cash management | 15 | 2 | (2 | ) | - | 15 | 6 | |||||||||||||||

Total fee-based client assets | $ | 795 | $ | 42 | $ | (36 | ) | $ | (3 | ) | $ | 798 | 77 | |||||||||

bps-Basis points

| 1. | Certain data enhancements during the current quarter resulted in a modification to the "Fee Rate" calculations. Prior periods have been restated to reflect the revised calculations. |

| 2. | Includes non-custody account values reflecting prior quarter-end balances due to a lag in the reporting of asset values by third-party custodians. |

| 3. | A shift in client assets of approximately $66 billion in the fourth quarter of 2016 from separately managed accounts to unified managed accounts resulted in a lower average fee rate for those platforms but did not impact the average fee rate for total fee-based client assets. |

| March 2017 Form 10-Q | 12 |

| Management's Discussion and Analysis |  |

Investment Management

| Three Months Ended March 31, | ||||||||||||

| $ in millions | 2017 | 2016 | % Change | |||||||||

Revenues | ||||||||||||

Investment banking | $ | - | $ | 1 | (100 | )% | ||||||

Trading | (11 | ) | (10 | ) | (10 | )% | ||||||

Investments | 98 | (64 | ) | N | /M | |||||||

Commissions and fees | - | 3 | (100 | )% | ||||||||

Asset management, distribution and administration fees | 517 | 526 | (2 | )% | ||||||||

Other | 4 | 22 | (82 | )% | ||||||||

Total non-interest revenues | 608 | 478 | 27 | % | ||||||||

Interest income | 1 | 1 | - | |||||||||

Interest expense | - | 2 | (100 | )% | ||||||||

Net interest | 1 | (1 | ) | 200 | % | |||||||

Net revenues | 609 | 477 | 28 | % | ||||||||

Compensation and benefits | 279 | 213 | 31 | % | ||||||||

Non-compensation expenses | 227 | 220 | 3 | % | ||||||||

Total non-interest expenses | 506 | 433 | 17 | % | ||||||||

Income from continuing operations before income taxes | 103 | 44 | 134 | % | ||||||||

Provision for income taxes | 30 | 10 | 200 | % | ||||||||

Net income | 73 | 34 | 115 | % | ||||||||

Net income (loss) applicable to noncontrolling interests | 6 | (16 | ) | 138 | % | |||||||

Net income applicable to Morgan Stanley | $ | 67 | $ | 50 | 34 | % | ||||||

N/M-Not Meaningful

Net Revenues

Investments

| • | Investments gains of $98 million in the current quarter increased from the prior year quarter primarily driven by |

gains in certain private equity and real estate funds compared with losses in the prior year quarter. |

Asset Management, Distribution and Administration Fees

| • | Asset management, distribution and administration fees of $517 million in the current quarter decreased 2% from the prior year quarter primarily reflecting higher management fees in the prior year quarter from the completion of certain fund raisings in alternative/other products. This decrease was partially offset by higher fee rates and higher average assets under management or supervision ("AUM") for the other product areas in the current quarter (see "AUM and Average Fee Rate by Asset Class" herein). |

Non-interest Expenses

Non-interest expenses of $506 million in the current quarter increased 17% from the prior year quarter, primarily due to higher Compensation and benefits expenses.

| • | Compensation and benefits expenses increased in the current quarter primarily due to an increase in deferred compensation associated with carried interest. |

| • | Non-compensation expenses increased, primarily due to higher brokerage clearing and exchange fees, partially offset by lower professional service fees. |

Assets Under Management or Supervision

Effective in the second quarter of 2016, the presentation of AUM for Investment Management has been revised to better align asset classes with its present organizational structure. All prior period information has been recast in the new format.

| 13 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

AUM and Average Fee Rate by Asset Class

For a description of the rollforward items in the following tables, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Investment Management-Assets Under Management or Supervision" in Part II, Item 7 of the 2016 Form 10-K.

At December 31, 2016 | Inflows | Outflows | Market Impact | Other 1 | At March 31, | Average for the Three Months Ended March 31, 2017 | ||||||||||||||||||||||||||

| $ in billions, Fee Rate in bps | Total AUM | Fee Rate | ||||||||||||||||||||||||||||||

Equity | $ | 79 | $ | 5 | $ | (5 | ) | $ | 8 | $ | - | $ | 87 | $ | 83 | 74 | ||||||||||||||||

Fixed income | 60 | 5 | (5 | ) | 1 | 1 | 62 | 62 | 33 | |||||||||||||||||||||||

Liquidity | 163 | 328 | (338 | ) | - | - | 153 | 157 | 18 | |||||||||||||||||||||||

Alternative / Other products | 115 | 7 | (4 | ) | 1 | - | 119 | 117 | 71 | |||||||||||||||||||||||

Total assets under management or supervision | $ | 417 | $ | 345 | $ | (352 | ) | $ | 10 | $ | 1 | $ | 421 | $ | 419 | 46 | ||||||||||||||||

Shares of minority stake assets | 8 | 7 | 7 | |||||||||||||||||||||||||||||

At December 31, 2015 | Inflows | Outflows | Market Impact | Other 1 | At March 31, 2016 | Average for the Three Months Ended March 31, 2016 | ||||||||||||||||||||||||||

| $ in billions, Fee Rate in bps | Total AUM | Fee Rate | ||||||||||||||||||||||||||||||

Equity | $ | 83 | $ | 5 | $ | (6 | ) | $ | (1 | ) | - | $ | 81 | $ | 79 | 71 | ||||||||||||||||

Fixed income | 60 | 5 | (6 | ) | 2 | 1 | 62 | 60 | 32 | |||||||||||||||||||||||

Liquidity | 149 | 336 | (338 | ) | (1 | ) | - | 146 | 149 | 17 | ||||||||||||||||||||||

Alternative / Other products | 114 | 5 | (4 | ) | - | 1 | 116 | 115 | 81 | |||||||||||||||||||||||

Total assets under management or supervision | $ | 406 | $ | 351 | $ | (354 | ) | $ | - | 2 | $ | 405 | $ | 403 | 48 | |||||||||||||||||

Shares of minority stake assets | 8 | 8 | 8 | |||||||||||||||||||||||||||||

bps-Basis points

| 1. | Includes distributions and foreign currency impact. |

| March 2017 Form 10-Q | 14 |

| Management's Discussion and Analysis |  |

Supplemental Financial Information and Disclosures

U.S. Bank Subsidiaries

We provide loans to a variety of customers, from large corporate and institutional clients to high net worth individuals, primarily through our U.S. bank subsidiaries, Morgan Stanley Bank, N.A. ("MSBNA") and Morgan Stanley Private Bank, National Association ("MSPBNA") (collectively, "U.S. Bank Subsidiaries"). The lending activities in the Institutional Securities business segment primarily include loans or lending commitments to corporate clients. The lending activities in the Wealth Management business segment primarily include securities-based lending that allows clients to borrow money against the value of qualifying securities and also include residential real estate loans. We expect our lending activities to continue to grow through further market penetration of the Wealth Management business segment's client base. For a further discussion of our credit risks, see "Quantitative and Qualitative Disclosures about Market Risk-Risk Management-Credit Risk." For further discussion about loans and lending commitments, see Notes 7 and 11 to the consolidated financial statements.

U.S. Bank Subsidiaries' Supplemental Financial Information Excluding Transactions with the Parent Company

| $ in billions | At March 31, | At December 31, 2016 | ||||||

U.S. Bank Subsidiaries assets | $ | 179.4 | $ | 180.7 | ||||

U.S. Bank Subsidiaries investment securities portfolio: | ||||||||

Investment securities-AFS | 48.5 | 50.3 | ||||||

Investment securities-HTM | 14.1 | 13.6 | ||||||

Total | $ | 62.6 | $ | 63.9 | ||||

Wealth Management U.S. Bank Subsidiaries data |

| |||||||

Securities-based lending and other loans 1 | $ | 36.6 | $ | 36.0 | ||||

Residential real estate loans | 25.0 | 24.4 | ||||||

Total | $ | 61.6 | $ | 60.4 | ||||

Institutional Securities U.S. Bank Subsidiaries data |

| |||||||

Corporate loans | $ | 19.2 | $ | 20.3 | ||||

Wholesale real estate loans | 10.3 | 9.9 | ||||||

Total | $ | 29.5 | $ | 30.2 | ||||

AFS-Available for sale

HTM-Held to maturity

| 1. | Other loans primarily include tailored lending. |

Income Tax Matters

Effective Tax Rate

| Three Months Ended | ||||||||

| March 31, 2017 | March 31, 2016 | |||||||

From continuing operations | 29.0 | % | 33.3 | % | ||||

The effective tax rate for the current quarter includes a net discrete tax benefit of $98 million, primarily resulting from a $112 million recurring-type benefit associated with the adoption of new accounting guidance related to employee share-based payments. See Note 2 to the consolidated financial statements for information on the adoption of the accounting update Improvements to Employee Share-Based Payment Accounting .

Accounting Development Updates

The Financial Accounting Standards Board issued the following accounting updates that apply to us.

Accounting updates not listed below were assessed and determined to be either not applicable or are not expected to have a significant impact on our consolidated financial statements.

The following accounting updates are currently being evaluated to determine the potential impact of adoption:

| • | Revenue from Contracts with Customers. This accounting update aims to clarify the principles of revenue recognition, to develop a common revenue recognition standard across all industries for U.S. GAAP and International Financial Reporting Standards, and to provide enhanced disclosures for users of the financial statements. The core principle of this guidance is that an entity should recognize revenues to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. We will adopt the guidance on January 1, 2018 and are currently evaluating the method of adoption. |

We expect this accounting update to potentially change the timing and presentation of certain revenues, as well as the timing and presentation of certain related costs, for Investment banking fees and Asset management, distribution and administration fees. Outside of Investment Management performance fees in the form of carried interest, discussed further in the following paragraph, these changes are not expected to be significant.

Regarding the recognition of performance fees from fund management activities in the form of carried interest that are subject to reversal, we are currently assessing the alternative accounting approaches available for these arrangements. If we consider the equity method of accounting

| 15 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

principles to apply to carried interest, the current recognition of such fees would remain essentially unchanged. If the fees are deemed in the scope of the new revenue guidance, we would defer recognition until such fees are no longer subject to reversal, which would cause a significant delay in the recognition of these fees as revenue.

We will continue to assess the impact of the new rule as we progress through the implementation of the new standard; therefore, additional impacts may be identified prior to adoption.

| • | Gains and Losses from the Derecognition of Nonfinancial Assets. This accounting update clarifies the guidance on how to account for the derecognition of nonfinancial assets and in substance nonfinancial assets and also provides guidance on the accounting for partial sales of nonfinancial assets. This update is effective as of January 1, 2018. |

| • | Leases. This accounting update requires lessees to recognize on the balance sheet all leases with terms exceeding one year, which results in the recognition of a right of use asset and corresponding lease liability, including for those leases that we currently classify as operating leases. The right of use asset and lease liability will initially be measured using the present value of the remaining rental payments. The accounting for leases where we are the lessor is largely unchanged. This update is effective as of January 1, 2019. |

| • | Financial Instruments-Credit Losses. This accounting update impacts the impairment model for certain financial assets measured at amortized cost such as loans held for investment and HTM securities. The amendments in this update will accelerate the recognition of credit losses by replacing the incurred loss impairment methodology with a current expected credit loss ("CECL") methodology that requires an estimate of expected credit losses over the entire life of the financial asset. Additionally, although the CECL methodology will not apply to AFS debt securities, the update will require establishment of an allowance to reflect impairment of these securities, thereby eliminating the concept of a permanent write-down. This update is effective as of January 1, 2020. |

Critical Accounting Policies

Our consolidated financial statements are prepared in accordance with U.S. GAAP, which require us to make estimates and assumptions (see Note 1 to the consolidated financial statements). We believe that of our significant accounting policies (see Note 2 to the consolidated financial statements in Item 8 of the 2016 Form 10-K and Note 2 to the consolidated financial statements), the fair value, goodwill and intangible assets, legal and regulatory contingencies and income taxes policies involve a higher degree of judgment and complexity. For a further discussion about our critical accounting policies, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies" in Part II, Item 7 of the 2016 Form 10-K.

| March 2017 Form 10-Q | 16 |

| Management's Discussion and Analysis |  |

Liquidity and Capital Resources

Senior management establishes liquidity and capital policies. Through various risk and control committees, senior management reviews business performance relative to these policies, monitors the availability of alternative sources of financing, and oversees the liquidity, interest rate and currency sensitivity of our asset and liability position. The Treasury Department, Firm Risk Committee, Asset and Liability Management Committee, and other committees and control groups assist in evaluating, monitoring and controlling the impact that our business activities have on our consolidated balance sheets, liquidity and capital structure. Liquidity and capital matters are reported regularly to the Board and the Board's Risk Committee.

The Balance Sheet

We monitor and evaluate the composition and size of our balance sheet on a regular basis. Our balance sheet management process includes quarterly planning, business-specific thresholds, monitoring of business-specific usage versus key performance metrics and new business impact assessments.

We establish balance sheet thresholds at the consolidated, business segment and business unit levels. We monitor balance sheet utilization and review variances resulting from business activity or market fluctuations. On a regular basis, we review current performance versus established thresholds and assess the need to re-allocate our balance sheet based on business unit needs. We also monitor key metrics, including asset and liability size and capital usage.

Total Assets by Business Segment

| At March 31, 2017 | ||||||||||||||||

| $ in millions | Institutional Securities | Wealth Management | Investment Management | Total | ||||||||||||

Assets | ||||||||||||||||

Cash and cash equivalents 1 | $ | 26,254 | $ | 16,537 | $ | 63 | $ | 42,854 | ||||||||

Trading assets at fair value | 281,804 | 74 | 2,463 | 284,341 | ||||||||||||

Investment securities | 18,544 | 62,595 | - | 81,139 | ||||||||||||

Securities purchased under agreements to resell | 98,988 | 5,835 | - | 104,823 | ||||||||||||

Securities borrowed | 111,499 | 304 | - | 111,803 | ||||||||||||

Customer and other receivables | 29,621 | 18,180 | 543 | 48,344 | ||||||||||||

Loans, net of allowance | 34,312 | 61,636 | 5 | 95,953 | ||||||||||||

Other assets 2 | 48,744 | 12,859 | 1,531 | 63,134 | ||||||||||||

Total assets | $ | 649,766 | $ | 178,020 | $ | 4,605 | $ | 832,391 | ||||||||

| At December 31, 2016 | ||||||||||||||||

| $ in millions | Institutional Securities | Wealth Management | Investment Management | Total | ||||||||||||

Assets | ||||||||||||||||

Cash and cash equivalents 1 | $ | 25,291 | $ | 18,022 | $ | 68 | $ | 43,381 | ||||||||

Trading assets at fair value | 259,680 | 64 | 2,410 | 262,154 | ||||||||||||

Investment securities | 16,222 | 63,870 | - | 80,092 | ||||||||||||

Securities purchased under agreements to resell | 96,735 | 5,220 | - | 101,955 | ||||||||||||

Securities borrowed | 124,840 | 396 | - | 125,236 | ||||||||||||

Customer and other receivables | 26,624 | 19,268 | 568 | 46,460 | ||||||||||||

Loans, net of allowance | 33,816 | 60,427 | 5 | 94,248 | ||||||||||||

Other assets 2 | 45,941 | 13,868 | 1,614 | 61,423 | ||||||||||||

Total assets | $ | 629,149 | $ | 181,135 | $ | 4,665 | $ | 814,949 | ||||||||

| 1. | Cash and cash equivalents include cash and due from banks and interest bearing deposits with banks. |

| 2. | Other assets primarily includes Cash deposited with clearing organizations or segregated under federal and other regulations or requirements; Other investments; Premises, equipment and software costs; Goodwill; Intangible assets and deferred tax assets. |

A substantial portion of total assets consists of liquid marketable securities and short-term receivables arising principally from sales and trading activities in the Institutional Securities business segment. Total assets increased to $832.4 billion at March 31, 2017 from $814.9 billion at December 31, 2016, primarily driven by an increase in trading inventory within Institutional Securities. The increase reflects higher market values for corporate equities compared with December 31, 2016, along with increased trading activity across fixed income in U.S. government and agency securities and Other sovereign government obligations.

Securities Repurchase Agreements and Securities Lending

Securities borrowed or securities purchased under agreements to resell and securities loaned or securities sold under agreements to repurchase are treated as collateralized financings (see Note 2 to the consolidated financial statements in the 2016 Form 10-K and Note 6 to the consolidated financial statements).

Collateralized Financing Transactions

| $ in millions | At March 31, 2017 | At December 31, 2016 | ||||||

Securities purchased under agreements to resell and Securities borrowed | $ | 216,626 | $ | 227,191 | ||||

Securities sold under agreements to repurchase and Securities loaned | $ | 75,459 | $ | 70,472 | ||||

Securities received as collateral 1 | $ | 13,339 | $ | 13,737 | ||||

Daily Average Balance Three Months Ended | ||||||||

| $ in millions | March 31, 2017 | December 31, 2016 | ||||||

Securities purchased under agreements to resell and Securities borrowed | $ | 222,224 | $ | 224,355 | ||||

Securities sold under agreements to repurchase and Securities loaned | $ | 73,674 | $ | 68,908 | ||||

| 1. | Included in Trading assets in the consolidated balance sheets. |

| 17 | March 2017 Form 10-Q |

| Management's Discussion and Analysis |  |

At March 31, 2017 and December 31, 2016, differences between period end balances and average balances in the previous table were not significant.

Customer Securities Financing

The customer receivable portion of the securities financing transactions primarily includes customer margin loans, collateralized by customer-owned securities, which are segregated in accordance with regulatory requirements. The customer payable portion of the securities financing transactions primarily includes payables to our prime brokerage customers. Our risk exposure on these transactions is mitigated by collateral maintenance policies that limit our credit exposure to customers and liquidity reserves held against this risk exposure.

Liquidity Risk Management Framework

The primary goal of our Liquidity Risk Management Framework is to ensure that we have access to adequate funding across a wide range of market conditions and time horizons. The framework is designed to enable us to fulfill our financial obligations and support the execution of our business strategies.

The following principles guide our Liquidity Risk Management Framework:

| • | Sufficient liquid assets should be maintained to cover maturing liabilities and other planned and contingent outflows; |

| • | Maturity profile of assets and liabilities should be aligned, with limited reliance on short-term funding; |

| • | Source, counterparty, currency, region and term of funding should be diversified; and |

| • | Liquidity Stress Tests should anticipate, and account for, periods of limited access to funding. |

The core components of our Liquidity Risk Management Framework are the Required Liquidity Framework, Liquidity Stress Tests and the Global Liquidity Reserve, which support our target liquidity profile. For further discussion about the Firm's Required Liquidity Framework and Liquidity Stress Tests, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Liquidity Risk Management Framework-Global Liquidity Reserve" in Part II, Item 7 of the 2016 Form 10-K.

At March 31, 2017 and December 31, 2016, we maintained sufficient liquidity to meet current and contingent funding obligations as modeled in our Liquidity Stress Tests.

Global Liquidity Reserve

We maintain sufficient global liquidity reserves pursuant to our Required Liquidity Framework. For further discussion of our Global Liquidity Reserve, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Liquidity Risk Management Framework-Global Liquidity Reserve" in Part II, Item 7 of the 2016 Form 10-K.

Global Liquidity Reserve by Type of Investment

| $ in millions | At March 31, | At December 31, 2016 | ||||||

Cash deposits with banks | $ | 10,336 | $ | 8,679 | ||||

Cash deposits with central banks | 27,896 | 30,568 | ||||||

Unencumbered highly liquid securities: | ||||||||

U.S. government obligations | 83,133 | 78,615 | ||||||

U.S. agency and agency mortgage-backed securities | 51,892 | 46,360 | ||||||

Non-U.S. sovereign obligations 1 | 17,997 | 30,884 | ||||||

Other investment grade securities | 6,393 | 7,191 | ||||||

Global Liquidity Reserve | $ | 197,647 | $ | 202,297 | ||||

| 1. | Non-U.S. sovereign obligations are primarily composed of unencumbered German, French, Dutch, United Kingdom ("U.K.") and Japanese government obligations. |

Global Liquidity Reserve Managed by Bank and Non-Bank Legal Entities

Daily Average Balance Three Months Ended | ||||||||||||

| $ in millions | At March 31, | At December 31, 2016 | March 31, 2017 | |||||||||

Bank legal entities | ||||||||||||

Domestic | $ | 71,520 | $ | 74,411 | $ | 72,477 | ||||||

Foreign | 3,678 | 4,238 | 4,126 | |||||||||

Total Bank legal entities | 75,198 | 78,649 | 76,603 | |||||||||

Non-Bank legal entities | ||||||||||||

Domestic: | ||||||||||||

Parent Company | 60,375 | 66,514 | 64,436 | |||||||||

Non-Parent Company | 21,035 | 18,801 | 21,178 | |||||||||

Total Domestic | 81,410 | 85,315 | 85,614 | |||||||||

Foreign | 41,039 | 38,333 | 41,932 | |||||||||

Total Non-Bank legal entities | 122,449 | 123,648 | 127,546 | |||||||||

Total | $ | 197,647 | $ | 202,297 | $ | 204,149 | ||||||

Regulatory Liquidity Framework

Liquidity Coverage Ratio

The Basel Committee on Banking Supervision's ("Basel Committee") Liquidity Coverage Ratio ("LCR") standard is designed to ensure that banking organizations have sufficient high-quality liquid assets to cover net cash outflows arising from significant stress over 30 calendar days. The standard's objective is to promote the short-term resilience of the liquidity risk profile of banking organizations.

| March 2017 Form 10-Q | 18 |

| Management's Discussion and Analysis |  |