(Exact name of Registrant

as specified in its charter)

(Exact name of Registrant

as specified in its charter) | Delaware (State or other jurisdiction of incorporation�or�organization) | 1585 Broadway New�York,�NY�10036 (Address�of�principal�executive�offices, including zip code) | 36-3145972 (I.R.S.�Employer�Identification�No.) | (212) 761-4000 (Registrant�s�telephone�number, including area code) | |||

| Title of each class | Name of exchange on which registered | |

| Securities registered pursuant to Section�12(b) of the Act: | ||

| Common Stock, $0.01 par value | New�York�Stock�Exchange | |

| Depositary Shares, each representing 1/1,000th interest in a share of Floating Rate Non-Cumulative Preferred Stock, Series�A, $0.01�par value | New York Stock Exchange | |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series�E, $0.01�par value | New York Stock Exchange | |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series�F, $0.01�par value | New York Stock Exchange | |

| Depositary Shares, each representing 1/1,000th interest in a share of 6.625% Non-Cumulative Preferred Stock, Series�G, $0.01�par value | New York Stock Exchange | |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series�I, $0.01�par value | New York Stock Exchange | |

| 6 1 / 4 % Capital Securities of Morgan Stanley Capital Trust III (and Registrant�s guaranty with respect thereto) | New York Stock Exchange | |

| 6 1 / 4 % Capital Securities of Morgan Stanley Capital Trust IV (and Registrant�s guaranty with respect thereto) | New York Stock Exchange | |

| 5 3 / 4 % Capital Securities of Morgan Stanley Capital Trust V (and Registrant�s guaranty with respect thereto) | New York Stock Exchange | |

| 6.60% Capital Securities of Morgan Stanley Capital Trust VI (and Registrant�s guaranty with respect thereto) | New York Stock Exchange | |

| 6.60% Capital Securities of Morgan Stanley Capital Trust VII (and Registrant�s guaranty with respect thereto) | New York Stock Exchange | |

| 6.45% Capital Securities of Morgan Stanley Capital Trust VIII (and Registrant�s guaranty with respect thereto) | New York Stock Exchange | |

| Market Vectors ETNs due March�31, 2020 (2 issuances); Market Vectors ETNs due April�30, 2020 (2 issuances) | NYSE Arca, Inc. | |

| Morgan Stanley Cushing � MLP High Income Index ETNs due March�21, 2031 | NYSE Arca, Inc. |

| Large Accelerated Filer x Non-Accelerated�Filer � (Do not check if a smaller reporting company) | Accelerated�Filer � Smaller reporting company � |

ANNUAL REPORT ON FORM 10-K for the year ended December�31, 2014

ANNUAL REPORT ON FORM 10-K for the year ended December�31, 2014 | Table�of�Contents | Page | |||||

| Part I | ||||||

| Item�1. | Business | 1 | ||||

| Overview | 1 | |||||

| Available Information | 1 | |||||

| Business Segments | 2 | |||||

| Institutional Securities | 2 | |||||

| Wealth Management | 4 | |||||

| Investment Management | 5 | |||||

| Competition | 6 | |||||

| Supervision and Regulation | 7 | |||||

| Executive Officers of Morgan Stanley | 22 | |||||

| Item�1A. | Risk Factors | 24 | ||||

| Item 1B. | Unresolved Staff Comments | 35 | ||||

| Item 2. | Properties | 36 | ||||

| Item 3. | Legal Proceedings | 37 | ||||

| Item 4. | Mine Safety Disclosures | 49 | ||||

| Part II | ||||||

| Item 5. | Market for Registrant�s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 50 | ||||

| Item 6. | Selected Financial Data | 53 | ||||

| Item 7. | Management�s Discussion and Analysis of Financial Condition and Results of Operations | 55 | ||||

| Introduction | 55 | |||||

| Executive Summary | 57 | |||||

| Business Segments | 64 | |||||

| Accounting Developments Updates | 85 | |||||

| Other Matters | 87 | |||||

| Critical Accounting Policies | 92 | |||||

| Liquidity and Capital Resources | 96 | |||||

| Item�7A. | Quantitative and Qualitative Disclosures about Market Risk | 123 | ||||

| Item 8. | Financial Statements and Supplementary Data | 151 | ||||

| Report of Independent Registered Public Accounting Firm | 151 | |||||

| Consolidated Statements of Financial Condition | 152 | |||||

| Consolidated Statements of Income | 153 | |||||

| Consolidated Statements of Comprehensive Income | 154 | |||||

| Consolidated Statements of Cash Flows | 155 | |||||

Table of Contents

Table of Contents| Table�of�Contents | Page | |||||

| Consolidated Statements of Changes in Total Equity | 156 | |||||

| Notes to Consolidated Financial Statements | 157 | |||||

| Financial Data Supplement (Unaudited) | 301 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 309 | ||||

| Item�9A. | Controls and Procedures | 309 | ||||

| Item�9B. | Other Information | 311 | ||||

| Part�III | ||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 312 | ||||

| Item 11. | Executive Compensation | 312 | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 313 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 313 | ||||

| Item 14. | Principal Accountant Fees and Services | 313 | ||||

| Part�IV | ||||||

| Item�15. | Exhibits and Financial Statement Schedules | 314 | ||||

| Signatures | S-1 | |||||

| Exhibit Index | E-1 | |||||

Table of Contents Forward-Looking Statements We have included in or incorporated by reference into this report, and from time to time may make in our public filings, press

releases or other public statements, certain statements, including (without limitation) those under �Legal Proceedings� in Part I, Item�3, �Management�s Discussion and Analysis of Financial Condition and Results of

Operations� in Part II, Item�7 and �Quantitative and Qualitative Disclosures about Market Risk� in Part II, Item�7A, that may constitute �forward-looking statements� within the meaning of the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and

represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control. The nature of our business makes predicting the future trends of our revenues, expenses and net income difficult. The risks and uncertainties involved in

our businesses could affect the matters referred to in such statements, and it is possible that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Important factors that

could cause actual results to differ from those in the forward-looking statements include (without limitation):

Table of Contents Forward-Looking Statements We have included in or incorporated by reference into this report, and from time to time may make in our public filings, press

releases or other public statements, certain statements, including (without limitation) those under �Legal Proceedings� in Part I, Item�3, �Management�s Discussion and Analysis of Financial Condition and Results of

Operations� in Part II, Item�7 and �Quantitative and Qualitative Disclosures about Market Risk� in Part II, Item�7A, that may constitute �forward-looking statements� within the meaning of the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and

represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control. The nature of our business makes predicting the future trends of our revenues, expenses and net income difficult. The risks and uncertainties involved in

our businesses could affect the matters referred to in such statements, and it is possible that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Important factors that

could cause actual results to differ from those in the forward-looking statements include (without limitation): | � | the effect of economic and political conditions and geopolitical events; |

| � | the effect of market conditions, particularly in the global equity, fixed income, credit and commodities markets, including corporate and mortgage (commercial and residential) lending and commercial real estate and energy markets; |

| � | the impact of current, pending and future legislation (including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the �Dodd-Frank Act�)), regulation (including capital, leverage and liquidity requirements), policies (including fiscal and monetary) and legal and regulatory actions in the United�States of America (�U.S.�) and worldwide; |

| � | the level and volatility of equity, fixed income and commodity prices (including oil prices), interest rates, currency values and other market indices; |

| � | the availability and cost of both credit and capital as well as the credit ratings assigned to our unsecured short-term and long-term debt; |

| � | investor, consumer and business sentiment and confidence in the financial markets; |

| � | the performance of our acquisitions, divestitures, joint ventures, strategic alliances or other strategic arrangements; |

| � | our reputation and the general perception of the financial services industry; |

| � | inflation, natural disasters, pandemics and acts of war or terrorism; |

| � | the actions and initiatives of current and potential competitors as well as governments, regulators and self-regulatory organizations; |

| � | the effectiveness of our risk management policies; |

| � | technological changes and risks and cybersecurity risks (including cyber attacks and business continuity risks); and |

| � | other risks and uncertainties detailed under �Business�Competition� and �Business�Supervision and Regulation� in Part I, Item�1, �Risk Factors� in Part I, Item�1A and elsewhere throughout this report. |

Table of Contents Part I

Table of Contents Part I | Item�1. | Business. |

| 1 |  |

| 2 |

| 3 |  |

| 4 |

| 5 |  |

| 6 |

| 7 |  |

| 8 |

| 9 |  |

| 10 |

| 11 |  |

| 12 |

| 13 |  |

| 14 |

| 15 |  |

| 16 |

| 17 |  |

| 18 |

| 19 |  |

| 20 |

| 21 |  |

| 22 |

| 23 |  |

| 24 |

| 25 |  |

| 26 |

| 27 |  |

| 28 |

| 29 |  |

| 30 |

| 31 |  |

| 32 |

| 33 |  |

| 34 |

| 35 |  |

| Location | Owned/ Leased | Lease�Expiration | Approximate�Square�Footage as of December�31, 2014(A) | |||||||

| U.S. Locations | ||||||||||

| 1585 Broadway New York, New York (Global Headquarters and Institutional Securities Headquarters) | Owned | N/A | 1,332,700�square�feet | |||||||

| 2000 Westchester Avenue Purchase, New York (Wealth Management Headquarters) | Owned | N/A | 597,400�square�feet | |||||||

| 522 Fifth Avenue New York, New York (Investment Management Headquarters) | Owned | N/A | 571,800�square�feet | |||||||

| New York, New York (Several locations) | Leased | 2015���2029 | 2,346,000�square�feet | |||||||

| Brooklyn, New York (Several locations) | Leased | 2016 � 2023 | 344,100�square�feet | |||||||

| 655 Howard Avenue Somerset, New Jersey (Data Center) | Owned | N/A | 369,600�square�feet | |||||||

| International Locations | ||||||||||

| 20 Bank Street London (London Headquarters) | Leased | 2038 | 546,500�square�feet | |||||||

| 25 Cabot Square Canary Wharf London | Leased | 2020 | 454,600�square�feet | |||||||

| 1 Austin Road West Kowloon (Hong Kong Headquarters) | Leased | 2019 | 499,900�square�feet | |||||||

| Otemachi Financial City South Tower Otemachi, Chiyoda-ku (Tokyo Headquarters) | Leased | 2023 | 246,700�square feet | |||||||

| (A) | The indicated total aggregate square footage leased does not include space occupied by Morgan Stanley branch offices. |

| 36 |

| Item�3. | Legal Proceedings. |

| 37 |  |

| 38 |

| 39 |  |

| 40 |

| 41 |  |

| 42 |

| 43 |  |

| 44 |

| 45 |  |

| 46 |

| 47 |  |

| 48 |

| 49 |  |

| Item�5. | Market for Registrant�s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

| Low Sale�Price | High Sale�Price | Dividends | ||||||||||

| 2014: | ||||||||||||

| Fourth Quarter | $ | 31.35 | $ | 39.19 | $ | 0.10 | ||||||

| Third Quarter | $ | 31.12 | $ | 36.44 | $ | 0.10 | ||||||

| Second Quarter | $ | 28.31 | $ | 32.82 | $ | 0.10 | ||||||

| First Quarter | $ | 28.78 | $ | 33.52 | $ | 0.05 | ||||||

| 2013: | ||||||||||||

| Fourth Quarter | $ | 26.41 | $ | 31.85 | $ | 0.05 | ||||||

| Third Quarter | $ | 23.83 | $ | 29.50 | $ | 0.05 | ||||||

| Second Quarter | $ | 20.16 | $ | 27.17 | $ | 0.05 | ||||||

| First Quarter | $ | 19.32 | $ | 24.47 | $ | 0.05 | ||||||

| 50 |

| Period | Total Number of Shares Purchased | Average Price Paid�Per Share | Total Number�of Shares Purchased As�Part�of�Publicly Announced Plans or Programs(C) | Approximate�Dollar Value of Shares that May Yet Be Purchased Under the Plans�or Programs | ||||||||||||

| Month�#1�(October 1, 2014�October 31, 2014) | ||||||||||||||||

| Share Repurchase Program(A) | 1,372,885 | $ | 33.87 | 1,372,885 | $ | 534 | ||||||||||

| Employee Transactions(B) | 83,415 | $ | 34.12 | � | � | |||||||||||

| Month #2 (November 1, 2014�November 30, 2014) | ||||||||||||||||

| Share Repurchase Program(A) | 2,563,394 | $ | 35.32 | 2,563,394 | $ | 443 | ||||||||||

| Employee Transactions(B) | 71,601 | $ | 35.50 | � | � | |||||||||||

| Month #3 (December 1, 2014�December 31, 2014) | ||||||||||||||||

| Share Repurchase Program(A) | 3,628,350 | $ | 36.69 | 3,628,350 | $ | 310 | ||||||||||

| Employee Transactions(B) | 254,550 | $ | 35.87 | � | � | |||||||||||

| Total | ||||||||||||||||

| Share Repurchase Program(A) | 7,564,629 | $ | 35.71 | 7,564,629 | $ | 310 | ||||||||||

| Employee Transactions(B) | 409,566 | $ | 35.45 | � | � | |||||||||||

| (A) | The Company�s Board of Directors has authorized the repurchase of the Company�s outstanding stock under a share repurchase program (the �Share Repurchase Program�). The Share Repurchase Program is a program for capital management purposes that considers, among other things, business segment capital needs, as well as equity-based compensation and benefit plan requirements. The Share Repurchase Program has no set expiration or termination date. Share repurchases by the Company are subject to regulatory approval. In March 2014, the Company received no objection from the Federal Reserve to repurchase up to $1 billion of the Company�s outstanding common stock beginning in the second quarter of 2014 through the end of the first quarter of 2015 under the Company�s 2014 capital plan. During the quarter ended December�31, 2014, the Company repurchased approximately $271 million of the Company�s outstanding common stock as part of its Share Repurchase Program. For further information, see �Management�s Discussion and Analysis of Financial Condition and Results of Operations�Liquidity and Capital Resources�Capital Management� in Part II, Item�7. |

| (B) | Includes: (1)�shares delivered or attested in satisfaction of the exercise price and/or tax withholding obligations by holders of employee and director stock options (granted under employee and director stock compensation plans) who exercised options; (2)�shares withheld, delivered or attested (under the terms of grants under employee and director stock compensation plans) to offset tax withholding obligations that occur upon vesting and release of restricted shares; (3)�shares withheld, delivered and attested (under the terms of grants under employee and director stock compensation plans) to offset tax withholding obligations that occur upon the delivery of outstanding shares underlying restricted stock units; and (4)�shares withheld, delivered and attested (under the terms of grants under employee and director stock compensation plans) to offset the cash payment for fractional shares. The Company�s employee and director stock compensation plans provide that the value of the shares withheld, delivered or attested, shall be valued using the fair market value of the Company�s common stock on the date the relevant transaction occurs, using a valuation methodology established by the Company. |

| (C) | Share purchases under publicly announced programs are made pursuant to open-market purchases, Rule 10b5-1 plans or privately negotiated transactions (including with employee benefit plans) as market conditions warrant and at prices the Company deems appropriate and may be suspended at any time. |

| 51 |  |

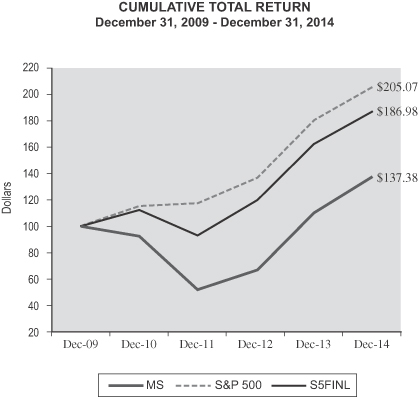

| MS | S&P 500 | S5FINL | ||||||||||

| 12/31/2009 | $ | 100.00 | $ | 100.00 | $ | 100.00 | ||||||

| 12/31/2010 | $ | 92.60 | $ | 115.06 | $ | 112.12 | ||||||

| 12/31/2011 | $ | 51.93 | $ | 117.48 | $ | 93.00 | ||||||

| 12/30/2012 | $ | 66.43 | $ | 136.27 | $ | 119.73 | ||||||

| 12/31/2013 | $ | 109.83 | $ | 180.83 | $ | 162.34 | ||||||

| 12/31/2014 | $ | 137.38 | $ | 205.07 | $ | 186.98 | ||||||

| 52 |

| Item�6. | Selected Financial Data. |

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Income Statement Data: | ||||||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Total non-interest revenues | $ | 32,540 | $ | 31,715 | $ | 26,383 | $ | 31,953 | $ | 30,407 | ||||||||||

| Interest income | 5,413 | 5,209 | 5,692 | 7,234 | 7,288 | |||||||||||||||

| Interest expense | 3,678 | 4,431 | 5,897 | 6,883 | 6,394 | |||||||||||||||

| Net interest | 1,735 | 778 | (205 | ) | 351 | 894 | ||||||||||||||

| Net revenues | 34,275 | 32,493 | 26,178 | 32,304 | 31,301 | |||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||

| Compensation and benefits | 17,824 | 16,277 | 15,615 | 16,325 | 15,860 | |||||||||||||||

| Other | 12,860 | 11,658 | 9,967 | 9,792 | 9,154 | |||||||||||||||

| Total non-interest expenses | 30,684 | 27,935 | 25,582 | 26,117 | 25,014 | |||||||||||||||

| Income from continuing operations before income taxes | 3,591 | 4,558 | 596 | 6,187 | 6,287 | |||||||||||||||

| Provision for (benefit from) income taxes | (90 | ) | 902 | (161 | ) | 1,491 | 823 | |||||||||||||

| Income from continuing operations | 3,681 | 3,656 | 757 | 4,696 | 5,464 | |||||||||||||||

| Discontinued operations(1): | ||||||||||||||||||||

| Income (loss) from discontinued operations before income taxes | (19 | ) | (72 | ) | (48 | ) | (170 | ) | 600 | |||||||||||

| Provision for (benefit from) income taxes | (5 | ) | (29 | ) | (7 | ) | (119 | ) | 362 | |||||||||||

| Income (loss) from discontinued operations | (14 | ) | (43 | ) | (41 | ) | (51 | ) | 238 | |||||||||||

| Net income | 3,667 | 3,613 | 716 | 4,645 | 5,702 | |||||||||||||||

| Net income applicable to redeemable noncontrolling interests(2) | � | 222 | 124 | � | � | |||||||||||||||

| Net income applicable to nonredeemable noncontrolling interests(2) | 200 | 459 | 524 | 535 | 999 | |||||||||||||||

| Net income applicable to Morgan Stanley | $ | 3,467 | $ | 2,932 | $ | 68 | $ | 4,110 | $ | 4,703 | ||||||||||

| Preferred stock dividends and other | 315 | 277 | 98 | 2,043 | 1,109 | |||||||||||||||

| Earnings (loss) applicable to Morgan Stanley common shareholders(3) | $ | 3,152 | $ | 2,655 | $ | (30 | ) | $ | 2,067 | $ | 3,594 | |||||||||

| Amounts applicable to Morgan Stanley: | ||||||||||||||||||||

| Income from continuing operations | $ | 3,481 | $ | 2,975 | $ | 138 | $ | 4,168 | $ | 4,478 | ||||||||||

| Income (loss) from discontinued operations | (14 | ) | (43 | ) | (70 | ) | (58 | ) | 225 | |||||||||||

| Net income applicable to Morgan Stanley | $ | 3,467 | $ | 2,932 | $ | 68 | $ | 4,110 | $ | 4,703 | ||||||||||

| 53 |  |

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Per Share Data: | ||||||||||||||||||||

| Earnings (loss) per basic common share(4): | ||||||||||||||||||||

| Income from continuing operations | $ | 1.65 | $ | 1.42 | $ | 0.02 | $ | 1.28 | $ | 2.49 | ||||||||||

| Income (loss) from discontinued operations | (0.01 | ) | (0.03 | ) | (0.04 | ) | (0.03 | ) | 0.15 | |||||||||||

| Earnings (loss) per basic common share | $ | 1.64 | $ | 1.39 | $ | (0.02 | ) | $ | 1.25 | $ | 2.64 | |||||||||

| Earnings (loss) per diluted common share(4): | ||||||||||||||||||||

| Income from continuing operations | $ | 1.61 | $ | 1.38 | $ | 0.02 | $ | 1.27 | $ | 2.45 | ||||||||||

| Income (loss) from discontinued operations | (0.01 | ) | (0.02 | ) | (0.04 | ) | (0.04 | ) | 0.18 | |||||||||||

| Earnings (loss) per diluted common share | $ | 1.60 | $ | 1.36 | $ | (0.02 | ) | $ | 1.23 | $ | 2.63 | |||||||||

| Book value per common share(5) | $ | 33.25 | $ | 32.24 | $ | 30.70 | $ | 31.42 | $ | 31.49 | ||||||||||

| Dividends declared per common share | 0.35 | 0.20 | 0.20 | 0.20 | 0.20 | |||||||||||||||

| Average common shares outstanding(3): | ||||||||||||||||||||

| Basic | 1,923,805,397 | 1,905,823,882 | 1,885,774,276 | 1,654,708,640 | 1,361,670,938 | |||||||||||||||

| Diluted | 1,970,535,560 | 1,956,519,738 | 1,918,811,270 | 1,675,271,669 | 1,411,268,971 | |||||||||||||||

| Balance Sheet and Other Operating Data: | ||||||||||||||||||||

| Trading assets | $ | 256,801 | $ | 280,744 | $ | 267,603 | $ | 275,353 | $ | 306,746 | ||||||||||

| Loans(6) | 66,577 | 42,874 | 29,046 | 15,369 | 10,576 | |||||||||||||||

| Total assets | 801,510 | 832,702 | 780,960 | 749,898 | 807,698 | |||||||||||||||

| Total deposits | 133,544 | 112,379 | 83,266 | 65,662 | 63,812 | |||||||||||||||

| Long-term borrowings | 152,772 | 153,575 | 169,571 | 184,234 | 192,457 | |||||||||||||||

| Morgan Stanley shareholders� equity | 70,900 | 65,921 | 62,109 | 62,049 | 57,211 | |||||||||||||||

| Return on average common equity(7) | 4.8 | % | 4.3 | % | N/M | 3.8 | % | 9.0 | % | |||||||||||

| (1) | Prior-period amounts have been recast for discontinued operations. See Note 1 to the Company�s consolidated financial statements in Item�8 for information on discontinued operations. |

| (2) | Information includes 100%, 65% and 51% ownership of the retail securities joint venture between the Company and Citigroup Inc. (the �Wealth Management JV�) effective June�28, 2013,�September�17, 2012 and May�31, 2009, respectively (see Note 3 to the Company�s consolidated financial statements in Item�8). |

| (3) | Amounts shown are used to calculate earnings (loss) per basic and diluted common share. |

| (4) | For the calculation of basic and diluted earnings (loss) per common share, see Note 16 to the Company�s consolidated financial statements in Item�8. |

| (5) | Book value per common share equals common shareholders� equity of $64,880 million at December�31, 2014, $62,701 million at December�31, 2013, $60,601 million at December�31, 2012, $60,541 million at December�31, 2011 and $47,614 million at December�31, 2010, divided by common shares outstanding of 1,951�million at December�31, 2014, 1,945�million at December�31, 2013, 1,974�million at December�31, 2012, 1,927�million at December�31, 2011 and 1,512�million at December�31, 2010. |

| (6) | Amounts include loans held for investment and loans held for sale and exclude loans at fair value which are included in Trading assets in the Company�s consolidated statements of financial condition (see Note 8 to the Company�s consolidated financial statements in Item�8). |

| (7) | The calculation of return on average common equity uses net income applicable to Morgan Stanley less preferred dividends as a percentage of average common equity. The return on average common equity is a non-generally accepted accounting principle financial measure that the Company considers to be a useful measure to the Company and investors to assess operating performance. |

| 54 |

| Item�7. | Management�s Discussion and Analysis of Financial Condition and Results of Operations. |

| 55 |  |

| 56 |

| 2014 | 2013 | 2012 | ||||||||||

| Net revenues: | ||||||||||||

| Institutional Securities | $ | 16,871 | $ | 15,519 | $ | 11,101 | ||||||

| Wealth Management(1) | 14,888 | 14,143 | 12,947 | |||||||||

| Investment Management(1) | 2,712 | 3,059 | 2,306 | |||||||||

| Intersegment Eliminations | (196 | ) | (228 | ) | (176 | ) | ||||||

| Consolidated net revenues | $ | 34,275 | $ | 32,493 | $ | 26,178 | ||||||

| Net income | $ | 3,667 | $ | 3,613 | $ | 716 | ||||||

| Net income applicable to redeemable noncontrolling interests(2) | � | 222 | 124 | |||||||||

| Net income applicable to nonredeemable noncontrolling interests(2) | 200 | 459 | 524 | |||||||||

| Net income applicable to Morgan Stanley | $ | 3,467 | $ | 2,932 | $ | 68 | ||||||

| Income (loss) from continuing operations applicable to Morgan Stanley: | ||||||||||||

| Institutional Securities | $ | (77 | ) | $ | 983 | $ | (797 | ) | ||||

| Wealth Management(1) | 3,192 | 1,473 | 772 | |||||||||

| Investment Management(1) | 366 | 519 | 167 | |||||||||

| Intersegment Eliminations | � | � | (4 | ) | ||||||||

| Income from continuing operations applicable to Morgan Stanley | $ | 3,481 | $ | 2,975 | $ | 138 | ||||||

| Income (loss) from discontinued operations applicable to Morgan Stanley(3) | (14 | ) | (43 | ) | (70 | ) | ||||||

| Net income applicable to Morgan Stanley | $ | 3,467 | $ | 2,932 | $ | 68 | ||||||

| Preferred stock dividend and other | 315 | 277 | 98 | |||||||||

| Earnings (loss) applicable to Morgan Stanley common shareholders | $ | 3,152 | $ | 2,655 | $ | (30 | ) | |||||

| Earnings (loss) per basic common share: | ||||||||||||

| Income from continuing operations | $ | 1.65 | $ | 1.42 | $ | 0.02 | ||||||

| Income (loss) from discontinued operations(3) | (0.01 | ) | (0.03 | ) | (0.04 | ) | ||||||

| Earnings (loss) per basic common share(4) | $ | 1.64 | $ | 1.39 | $ | (0.02 | ) | |||||

| Earnings (loss) per diluted common share: | ||||||||||||

| Income from continuing operations | $ | 1.61 | $ | 1.38 | $ | 0.02 | ||||||

| Income (loss) from discontinued operations(3) | (0.01 | ) | (0.02 | ) | (0.04 | ) | ||||||

| Earnings (loss) per diluted common share(4) | $ | 1.60 | $ | 1.36 | $ | (0.02 | ) | |||||

| Regional net revenues(5): | ||||||||||||

| Americas | $ | 25,140 | $ | 23,358 | $ | 20,276 | ||||||

| EMEA | 4,772 | 4,542 | 3,078 | |||||||||

| Asia-Pacific | 4,363 | 4,593 | 2,824 | |||||||||

| Net revenues | $ | 34,275 | $ | 32,493 | $ | 26,178 | ||||||

| Pre-tax profit margin(6): | ||||||||||||

| Institutional Securities | N/M | 6 | % | N/M | ||||||||

| Wealth Management | 20 | % | 18 | % | 12 | % | ||||||

| Investment Management | 24 | % | 33 | % | 28 | % | ||||||

| Consolidated | 10 | % | 14 | % | 2 | % | ||||||

| Effective income tax rate from continuing operations(7) | (2.5 | )% | 19.8 | % | (27.0 | )% | ||||||

| 57 |  |

| 2014 | 2013 | 2012 | ||||||||||

| Average common equity (dollars in billions)(8): | ||||||||||||

| Institutional Securities | $ | 32.2 | $ | 37.9 | $ | 29.0 | ||||||

| Wealth Management | 11.2 | 13.2 | 13.3 | |||||||||

| Investment Management | 2.9 | 2.8 | 2.4 | |||||||||

| Parent capital | 19.0 | 8.0 | 16.1 | |||||||||

| Consolidated average common equity | $ | 65.3 | $ | 61.9 | $ | 60.8 | ||||||

| Return on average common equity from continuing operations(9): | ||||||||||||

| Institutional Securities | N/M | 2.3 | % | N/M | ||||||||

| Wealth Management | 27.5 | % | 9.9 | % | 5.7 | % | ||||||

| Investment Management | 12.8 | % | 18.1 | % | 6.7 | % | ||||||

| Consolidated | 4.9 | % | 4.4 | % | 0.1 | % | ||||||

| Average tangible common equity (dollars in billions)(10) | $ | 55.5 | $ | 53.0 | $ | 53.9 | ||||||

| Return on average tangible common equity from continuing operations(11) | 5.7 | % | 5.1 | % | 0.1 | % | ||||||

| Selected management financial measures, excluding DVA: | ||||||||||||

| Net revenues, excluding DVA(12) | $ | 33,624 | $ | 33,174 | $ | 30,580 | ||||||

| Income from continuing operations applicable to Morgan Stanley, excluding DVA(12) | $ | 3,063 | $ | 3,427 | $ | 3,256 | ||||||

| Income per diluted common share from continuing operations, excluding DVA(12) | $ | 1.39 | $ | 1.61 | $ | 1.64 | ||||||

| Return on average common equity, excluding DVA(9) | 4.1 | % | 5.0 | % | 5.2 | % | ||||||

| Return on average tangible common equity, excluding DVA(11) | 4.9 | % | 5.8 | % | 5.9 | % | ||||||

| 58 |

| At December�31,� 2014 | At December�31,� 2013 | |||||||

| Total loans(13) | $ | 66,577 | $ | 42,874 | ||||

| Total assets | $ | 801,510 | $ | 832,702 | ||||

| U.S. Subsidiary Banks loans(13)(14) | $ | 59,622 | $ | 35,039 | ||||

| U.S. Subsidiary Banks assets(14) | $ | 151,157 | $ | 125,341 | ||||

| Total deposits | $ | 133,544 | $ | 112,379 | ||||

| Long-term borrowings | $ | 152,772 | $ | 153,575 | ||||

| Maturities of long-term borrowings outstanding (next 12 months) | $ | 20,740 | $ | 24,193 | ||||

| Worldwide employees | 55,802 | 55,794 | ||||||

| Book value per common share(15) | $ | 33.25 | $ | 32.24 | ||||

| Tangible book value per common share(16) | $ | 28.26 | $ | 27.16 | ||||

| Global Liquidity Reserve held by bank and non-bank legal entities (dollars in billions)(17) | $ | 193 | $ | 202 | ||||

| Average Global Liquidity Reserve (dollars in billions)(17)(18): | ||||||||

| Bank legal entities | $ | 87 | $ | 75 | ||||

| Non-bank legal entities | 108 | 117 | ||||||

| Total average Global Liquidity Reserve | $ | 195 | $ | 192 | ||||

| Capital ratios(19): | ||||||||

| Common Equity Tier 1 capital ratio (Transitional/Advanced Approach in 2014) | 12.6 | % | N/A | |||||

| Tier 1 common capital ratio | N/A | 12.8 | % | |||||

| Tier 1 capital ratio (Transitional/Advanced Approach in 2014) | 14.1 | % | 15.6 | % | ||||

| Total capital ratio (Transitional/Advanced Approach in 2014) | 16.4 | % | 16.9 | % | ||||

| Tier 1 leverage ratio (Transitional/Advanced Approach in 2014)(20) | 7.9 | % | 7.6 | % | ||||

| Consolidated assets under management or supervision (dollars in billions)(1)(21): | ||||||||

| Investment Management(22) | $ | 403 | $ | 377 | ||||

| Wealth Management | 778 | 688 | ||||||

| Total | $ | 1,181 | $ | 1,065 | ||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment. All prior-period amounts have been recast to conform to the current year�s presentation. |

| (2) | See Notes 2, 3 and 15 to the Company�s consolidated financial statements in Item�8 for information on redeemable and nonredeemable noncontrolling interests. |

| (3) | See Note 1 to the Company�s consolidated financial statements in Item�8 for information on discontinued operations. |

| (4) | For the calculation of basic and diluted earnings per share (�EPS�), see Note 16 to the Company�s consolidated financial statements in Item�8. |

| (5) | Regional net revenues reflect the regional view of the Company�s consolidated net revenues, on a managed basis. For a further discussion regarding the geographic methodology for net revenues, see Note 21 to the Company�s consolidated financial statements in Item�8. |

| (6) | Pre-tax profit margin is a non-generally accepted accounting principle (�non-GAAP�) financial measure that the Company considers to be a useful measure to the Company and investors to assess operating performance. Percentages represent income from continuing operations before income taxes as a percentage of net revenues. |

| (7) | For a discussion of the effective income tax rate, see �Overview of 2014 Financial Results� herein and Note 20 to the Company�s consolidated financial statements in Item�8. |

| 59 |  |

| (8) | The computation of average common equity for each business segment is determined using the Company�s Required Capital framework, an internal capital adequacy measure (see �Liquidity and Capital Resources�Regulatory Requirements�Required Capital� herein). Average common equity for each business segment is a non-GAAP financial measure that the Company considers to be a useful measure to the Company and investors to assess capital adequacy. |

| (9) | The calculation of each business segment�s return on average common equity uses income from continuing operations applicable to Morgan Stanley less preferred dividends as a percentage of each business segment�s average common equity. The return on average common equity is a non-GAAP financial measure that the Company considers to be a useful measure to the Company and investors to assess operating performance. The effective tax rates used in the computation of business segments� return on average common equity were determined on a separate legal entity basis. To determine the return on consolidated average common equity, excluding the impact of DVA, also a non-GAAP financial measure, both the numerator and the denominator were adjusted to exclude the impact of DVA. The impact of DVA in 2014, 2013 and 2012 was 0.8%, (0.6)% and (5.1)%, respectively. |

| (10) | Average tangible common equity is a non-GAAP financial measure that the Company considers to be a useful measure to the Company and investors to assess capital adequacy. For a discussion of tangible common equity, see �Liquidity and Capital Resources�Capital Management� herein. |

| (11) | Return on average tangible common equity is a non-GAAP financial measure that the Company considers to be a useful measure to the Company and investors to assess capital adequacy. The calculation of return on average tangible common equity uses income from continuing operations applicable to Morgan Stanley less preferred dividends as a percentage of average tangible common equity. To determine the return on average tangible common equity, excluding the impact of DVA, also a non-GAAP financial measure, both the numerator and the denominator were adjusted to exclude the impact of DVA. The impact of DVA in 2014, 2013 and 2012 was 0.8%, (0.7)% and (5.8)%, respectively. |

| (12) | From time to time, the Company may disclose certain �non-GAAP financial measures� in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. For these purposes, �U.S. GAAP� refers to accounting principles generally accepted in the U.S. The U.S. Securities and Exchange Commission (the �SEC�) defines a �non-GAAP financial measure� as a numerical measure of historical or future financial performance, financial positions, or cash flows that excludes or includes amounts or is subject to adjustments that effectively exclude, or include, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by the Company are provided as additional information to investors in order to provide them with further transparency about, or as an alternative method for assessing, the Company�s financial condition and operating results. These measures are not in accordance with, or a substitute for, U.S. GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever the Company refers to a non-GAAP financial measure, the Company will also generally present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the non-GAAP financial measure and the U.S. GAAP financial measure. |

| 2014 | 2013 | 2012 | ||||||||||

| Reconciliation of selected management financial measures from a Non-GAAP to a U.S. GAAP basis (dollars in millions, except per share amounts): | ||||||||||||

| Net revenues | ||||||||||||

| Net revenues�non-GAAP | $ | 33,624 | $ | 33,174 | $ | 30,580 | ||||||

| Impact of DVA | 651 | (681 | ) | (4,402 | ) | |||||||

| Net revenues�U.S. GAAP | $ | 34,275 | $ | 32,493 | $ | 26,178 | ||||||

| Income from continuing operations applicable to Morgan Stanley | ||||||||||||

| Income applicable to Morgan Stanley�non-GAAP | $ | 3,063 | $ | 3,427 | $ | 3,256 | ||||||

| Impact of DVA | 418 | (452 | ) | (3,118 | ) | |||||||

| Income applicable to Morgan Stanley�U.S. GAAP | $ | 3,481 | $ | 2,975 | $ | 138 | ||||||

| Earnings per diluted common share | ||||||||||||

| Income from continuing operations per diluted common share�non-GAAP | $ | 1.39 | $ | 1.61 | $ | 1.64 | ||||||

| Impact of DVA | 0.22 | (0.23 | ) | (1.62 | ) | |||||||

| Income from continuing operations per diluted common share�U.S. GAAP | $ | 1.61 | $ | 1.38 | $ | 0.02 | ||||||

| (13) | Amounts include loans held for investment and loans held for sale and exclude loans at fair value which are included in Trading assets in the Company�s consolidated statements of financial condition (see Note 8 to the Company�s consolidated financial statements in Item�8). |

| (14) | Morgan Stanley Bank, N.A. (�MSBNA�) and Morgan Stanley Private Bank, National Association (�MSPBNA�) represent the Company�s U.S. bank operating subsidiaries (�U.S. Subsidiary Banks�) and amounts exclude transactions with affiliated entities. |

| (15) | Book value per common share equals common shareholders� equity of $64,880 million at December�31, 2014 and $62,701 million at December�31, 2013 divided by common shares outstanding of 1,951�million at December�31, 2014 and 1,945�million at December�31, 2013. |

| (16) | Tangible book value per common share equals tangible common equity of $55,138 million at December�31, 2014 and $52,828 million at December�31, 2013 divided by common shares outstanding of 1,951�million at December�31, 2014 and 1,945�million at December�31, 2013. Tangible book value per common share is a non-GAAP financial measure that the Company considers to be a useful measure that the Company and investors use to assess capital adequacy. |

| (17) | Global Liquidity Reserve, which is held within the Company�s bank and non-bank legal entities, is composed of highly liquid and diversified cash and cash equivalents and unencumbered securities. Eligible unencumbered securities include U.S. government securities, |

| 60 |

| U.S. agency securities, U.S. agency mortgage-backed securities, non-U.S. government securities and other highly liquid investment-grade securities. For a discussion of Global Liquidity Reserve, see �Liquidity and Capital Resources�Liquidity Risk Management Framework�Global Liquidity Reserve� herein. |

| (18) | The Company calculates the average Global Liquidity Reserve based upon daily amounts. |

| (19) | The Company calculates its applicable risk-based capital ratios and risk-weighted assets (�RWAs�) in accordance with the capital adequacy standards for financial holding companies adopted by the Board of Governors of the Federal Reserve System (the �Federal Reserve�). For a further discussion of the Company�s methods for calculating its risk-based capital ratios and RWAs, see �Liquidity and Capital Resources�Regulatory Requirements� herein. |

| (20) | Beginning with the first quarter of 2014, Tier 1 leverage ratio equals Tier 1 capital (calculated under U.S. Basel III Transitional rules) divided by adjusted average total assets (which reflects adjustments for disallowed goodwill, transitional intangible assets, certain deferred tax assets, certain financial equity investments and other adjustments). In 2013, Tier 1 leverage ratio equaled Tier 1 capital (calculated under U.S. Basel I) divided by adjusted average total assets (which reflects adjustments for disallowed goodwill, certain intangible assets, deferred tax assets, and financial and non-financial equity investments). |

| (21) | Revenues and expenses associated with these assets are included in the Company�s Wealth Management and Investment Management business segments. |

| (22) | Amounts exclude the Company�s Investment Management business segment�s proportionate share of assets managed by entities in which it owns a minority stake. |

| 61 |  |

| 62 |

| 63 |  |

| 64 |

| 65 |  |

| 66 |

| Institutional Securities | Wealth Management | Investment Management | Total | |||||||||||||

| (dollars�in�millions) | ||||||||||||||||

| Pro forma 2014 compensation and benefits expense(1) | $ | 6,882 | $ | 8,737 | $ | 1,068 | $ | 16,687 | ||||||||

| Fourth quarter actions: | ||||||||||||||||

| Change in 2014 level of deferrals(2) | 610 | 66 | 80 | 756 | ||||||||||||

| Acceleration of prior-year cash-based deferred awards(3) | 294 | 22 | 65 | 381 | ||||||||||||

| Fourth quarter actions total | $ | 904 | $ | 88 | $ | 145 | $ | 1,137 | ||||||||

| Actual 2014 compensation and benefits expense | $ | 7,786 | $ | 8,825 | $ | 1,213 | $ | 17,824 | ||||||||

| (1) | Pro forma 2014 represents compensation and benefits expense at pre-adjustment accrual levels ( i.e. , at an approximate average baseline 74% deferral rate and with no acceleration of cash-based award vesting that was utilized for the first three quarters of 2014). |

| (2) | Amounts reflect reduction in deferral level from an approximate average baseline of 74% to an approximate average baseline of 50%. |

| (3) | Amounts represent acceleration of vesting for certain cash-based awards. |

| 67 |  |

| 2014 | 2013 | 2012 | ||||||||||

| (dollars in millions) | ||||||||||||

| Revenues: | ||||||||||||

| Investment banking | $ | 5,203 | $ | 4,377 | $ | 3,930 | ||||||

| Trading | 8,445 | 8,147 | 6,003 | |||||||||

| Investments | 240 | 707 | 219 | |||||||||

| Commissions and fees | 2,610 | 2,425 | 2,175 | |||||||||

| Asset management, distribution and administration fees | 281 | 280 | 241 | |||||||||

| Other | 684 | 684 | 279 | |||||||||

| Total non-interest revenues | 17,463 | 16,620 | 12,847 | |||||||||

| Interest income | 3,389 | 3,572 | 4,224 | |||||||||

| Interest expense | 3,981 | 4,673 | 5,970 | |||||||||

| Net interest | (592 | ) | (1,101 | ) | (1,746 | ) | ||||||

| Net revenues | 16,871 | 15,519 | 11,101 | |||||||||

| Compensation and benefits | 7,786 | 6,823 | 6,979 | |||||||||

| Non-compensation expenses | 9,143 | 7,750 | 5,734 | |||||||||

| Total non-interest expenses | 16,929 | 14,573 | 12,713 | |||||||||

| Income (loss) from continuing operations before income taxes | (58 | ) | 946 | (1,612 | ) | |||||||

| Provision for (benefit from) income taxes | (90 | ) | (315 | ) | (985 | ) | ||||||

| Income (loss) from continuing operations | 32 | 1,261 | (627 | ) | ||||||||

| Discontinued operations: | ||||||||||||

| Income (loss) from discontinued operations before income taxes | (26 | ) | (81 | ) | (158 | ) | ||||||

| Provision for (benefit from) income taxes | (7 | ) | (29 | ) | (36 | ) | ||||||

| Income (losses) from discontinued operations | (19 | ) | (52 | ) | (122 | ) | ||||||

| Net income (loss) | 13 | 1,209 | (749 | ) | ||||||||

| Net income applicable to redeemable noncontrolling interests | � | 1 | 4 | |||||||||

| Net income applicable to nonredeemable noncontrolling interests | 109 | 277 | 170 | |||||||||

| Net income (loss) applicable to Morgan Stanley | $ | (96 | ) | $ | 931 | $ | (923 | ) | ||||

| Amounts applicable to Morgan Stanley: | ||||||||||||

| Income (loss) from continuing operations | $ | (77 | ) | $ | 983 | $ | (797 | ) | ||||

| Income (loss) from discontinued operations | (19 | ) | (52 | ) | (126 | ) | ||||||

| Net income (loss) applicable to Morgan Stanley | $ | (96 | ) | $ | 931 | $ | (923 | ) | ||||

| 68 |

| 2014 | 2013 | 2012 | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Advisory revenues | $ | 1,634 | $ | 1,310 | $ | 1,369 | ||||||

| Underwriting revenues: | ||||||||||||

| Equity underwriting revenues | 1,613 | 1,262 | 892 | |||||||||

| Fixed income underwriting revenues | 1,956 | 1,805 | 1,669 | |||||||||

| Total underwriting revenues | 3,569 | 3,067 | 2,561 | |||||||||

| Total investment banking revenues | $ | 5,203 | $ | 4,377 | $ | 3,930 | ||||||

| 2014(1) | 2013(1) | 2012(1) | ||||||||||

| (dollars�in�billions) | ||||||||||||

| Announced mergers and acquisitions(2) | $ | 745 | $ | 518 | $ | 464 | ||||||

| Completed mergers and acquisitions(2) | 620 | 526 | 391 | |||||||||

| Equity and equity-related offerings(3) | 72 | 61 | 52 | |||||||||

| Fixed income offerings(4) | 260 | 289 | 277 | |||||||||

| (1) | Source: Thomson Reuters, data at January�20, 2015. Announced and completed mergers and acquisitions volumes are based on full credit to each of the advisors in a transaction. Equity and equity-related offerings and fixed income offerings are based on full credit for single book managers and equal credit for joint book managers. Transaction volumes may not be indicative of net revenues in a given period. In addition, transaction volumes for prior periods may vary from amounts previously reported due to the subsequent withdrawal or change in the value of a transaction. |

| (2) | Amounts include transactions of $100 million or more. Announced mergers and acquisitions exclude terminated transactions. |

| (3) | Amounts include Rule 144A and public common stock, convertible and rights offerings. |

| (4) | Amounts include non-convertible preferred stock, mortgage-backed and asset-backed securities and taxable municipal debt. Amounts also include publicly registered and Rule 144A issues. Amounts exclude leveraged loans and self-led issuances. |

| 69 |  |

| 2014 | 2013 | 2012 | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Trading(1) | $ | 8,445 | $ | 8,147 | $ | 6,003 | ||||||

| Commissions and fees | 2,610 | 2,425 | 2,175 | |||||||||

| Asset management, distribution and administration fees | 281 | 280 | 241 | |||||||||

| Net interest | (592 | ) | (1,101 | ) | (1,746 | ) | ||||||

| Total sales and trading net revenues | $ | 10,744 | $ | 9,751 | $ | 6,673 | ||||||

| 2014 | 2013 | 2012 | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Equity(1) | $ | 7,135 | $ | 6,529 | $ | 4,811 | ||||||

| Fixed income and commodities(1) | 4,214 | 3,594 | 2,358 | |||||||||

| Other(2) | (605 | ) | (372 | ) | (496 | ) | ||||||

| Total sales and trading net revenues | $ | 10,744 | $ | 9,751 | $ | 6,673 | ||||||

| (1) | Results in 2014 included a charge of $468 million related to the implementation of FVA (Equity: $2 million; Fixed income and commodities: $466 million). |

| (2) | Amounts include net losses associated with costs related to the amount of liquidity held (�negative carry�), net gains (losses) on economic hedges related to the Company�s long-term borrowings, and revenues from corporate loans and lending commitments. |

| 2014 | 2013 | 2012 | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Total sales and trading net revenues�non-GAAP(1) | $ | 10,093 | $ | 10,432 | $ | 11,075 | ||||||

| Impact of DVA | 651 | (681 | ) | (4,402 | ) | |||||||

| Total sales and trading net revenues(2) | $ | 10,744 | $ | 9,751 | $ | 6,673 | ||||||

| Equity sales and trading net revenues�non-GAAP(1) | $ | 6,903 | $ | 6,607 | $ | 5,941 | ||||||

| Impact of DVA | 232 | (78 | ) | (1,130 | ) | |||||||

| Equity sales and trading net revenues(2) | $ | 7,135 | $ | 6,529 | $ | 4,811 | ||||||

| Fixed income and commodities sales and trading net revenues | ||||||||||||

| �non-GAAP(1) | $ | 3,795 | $ | 4,197 | $ | 5,630 | ||||||

| Impact of DVA | 419 | (603 | ) | (3,272 | ) | |||||||

| Fixed income and commodities sales and trading net revenues(2) | $ | 4,214 | $ | 3,594 | $ | 2,358 | ||||||

| (1) | Sales and trading net revenues, including equity and fixed income and commodities sales and trading net revenues that exclude the impact of DVA, are non-GAAP financial measures that the Company considers useful for the Company and investors to allow further comparability of period-to-period operating performance. |

| (2) | Results in 2014 included a charge of $468 million related to the implementation of FVA (Equity: $2 million; Fixed income and commodities: $466 million). |

| 70 |

| 71 |  |

| 72 |

| 73 |  |

| 74 |

| 75 |  |

| 2014 | 2013(1) | 2012(1) | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Revenues: | ||||||||||||

| Investment banking | $ | 791 | $ | 923 | $ | 835 | ||||||

| Trading | 957 | 1,161 | 1,041 | |||||||||

| Investments | 9 | 14 | 10 | |||||||||

| Commissions and fees | 2,127 | 2,209 | 2,087 | |||||||||

| Asset management, distribution and administration fees | 8,345 | 7,571 | 7,101 | |||||||||

| Other | 320 | 390 | 313 | |||||||||

| Total non-interest revenues | 12,549 | 12,268 | 11,387 | |||||||||

| Interest income | 2,516 | 2,100 | 1,886 | |||||||||

| Interest expense | 177 | 225 | 326 | |||||||||

| Net interest | 2,339 | 1,875 | 1,560 | |||||||||

| Net revenues | 14,888 | 14,143 | 12,947 | |||||||||

| Compensation and benefits | 8,825 | 8,265 | 7,788 | |||||||||

| Non-compensation expenses | 3,078 | 3,274 | 3,587 | |||||||||

| Total non-interest expenses | 11,903 | 11,539 | 11,375 | |||||||||

| Income from continuing operations before income taxes | 2,985 | 2,604 | 1,572 | |||||||||

| Provision for (benefit from) income taxes | (207 | ) | 910 | 538 | ||||||||

| Income from continuing operations | 3,192 | 1,694 | 1,034 | |||||||||

| Discontinued operations: | ||||||||||||

| Income (loss) from discontinued operations before income taxes | � | (1 | ) | 94 | ||||||||

| Provision for income taxes | � | � | 26 | |||||||||

| Income (loss) from discontinued operations | � | (1 | ) | 68 | ||||||||

| Net income | 3,192 | 1,693 | 1,102 | |||||||||

| Net income applicable to redeemable noncontrolling interests | � | 221 | 120 | |||||||||

| Net income applicable to nonredeemable noncontrolling interests | � | � | 167 | |||||||||

| Net income applicable to Morgan Stanley | $ | 3,192 | $ | 1,472 | $ | 815 | ||||||

| Amounts applicable to Morgan Stanley: | ||||||||||||

| Income from continuing operations | $ | 3,192 | $ | 1,473 | $ | 772 | ||||||

| Income (loss) from discontinued operations | � | (1 | ) | 43 | ||||||||

| Net income applicable to Morgan Stanley | $ | 3,192 | $ | 1,472 | $ | 815 | ||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment.�All prior-period amounts have been recast to conform to the current year�s presentation. |

| 76 |

| 2014 | 2013(1) | 2012(1) | ||||||||||

| Annual revenues per representative (dollars in thousands)(2) | $ | 914 | $ | 863 | $ | 780 | ||||||

| Client assets per representative (dollars in millions)(3) | $ | 126 | $ | 116 | $ | 104 | ||||||

| Fee-based asset flows(4) | $ | 58.8 | $ | 51.9 | $ | 26.9 | ||||||

| At December�31, 2014 | At December�31, 2013 | |||||||

| Client assets | $ | 2,025 | $ | 1,909 | ||||

| Fee-based client assets(5) | $ | 785 | $ | 697 | ||||

| Fee-based client assets as a percentage of total client assets(5) | 39 | % | 37 | % | ||||

| Client liabilities | $ | 51 | $ | 39 | ||||

| Bank deposit program(6) | $ | 137 | $ | 134 | ||||

| Wealth Management U.S. Subsidiary Banks data(7): | ||||||||

| Investment securities portfolio | $ | 57.3 | $ | 53.4 | ||||

| Loans and lending commitments | $ | 42.7 | $ | 29.5 | ||||

| Wealth Management representatives | 16,076 | 16,456 | ||||||

| Retail locations | 622 | 649 | ||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment.�All prior-period amounts have been recast to conform to the current year�s presentation. |

| (2) | Annual revenues per representative for 2014, 2013 and 2012 equal the Company�s Wealth Management business segment�s annual revenues divided by the average representative headcount in 2014, 2013 and 2012, respectively. |

| (3) | Client assets per representative equal total period-end client assets divided by period-end representative headcount. |

| (4) | Fee-based asset flows include net new fee-based assets, net account transfers, dividends, interest and client fees and exclude cash management-related activity. |

| (5) | Fee-based client assets represent the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets. |

| (6) | Balances in the bank deposit program included deposits held by the Company�s U.S. Subsidiary Banks of $128 billion and $104 billion at December�31, 2014 and December�31, 2013, respectively, with the remainder held at Citi-affiliated FDIC-insured depositories. See�Note 3 to the Company�s consolidated financial statements in Item�8 for further discussion of the Company�s customer deposits held by Citi. |

| (7) | Wealth Management U.S. Subsidiary Banks refers to the Company�s U.S. bank operating subsidiaries MSBNA and MSPBNA. |

| 77 |  |

| 2014 | 2013(1) | 2012(1) | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Net revenues: | ||||||||||||

| Transactional | $ | 3,875 | $ | 4,293 | $ | 3,963 | ||||||

| Asset management | 8,345 | 7,571 | 7,101 | |||||||||

| Net interest | 2,339 | 1,875 | 1,560 | |||||||||

| Other | 329 | 404 | 323 | |||||||||

| Net revenues | $ | 14,888 | $ | 14,143 | $ | 12,947 | ||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment.�All prior-period amounts have been recast to conform to the current year�s presentation. |

| 78 |

| 79 |  |

| 80 |

| 2014 | 2013(1) | 2012(1) | ||||||||||

| (dollars in millions) | ||||||||||||

| Revenues: | ||||||||||||

| Investment banking | $ | 5 | $ | 11 | $ | 17 | ||||||

| Trading | (19 | ) | 41 | (44 | ) | |||||||

| Investments | 587 | 1,056 | 513 | |||||||||

| Commissions and fees | � | � | (6 | ) | ||||||||

| Asset management, distribution and administration fees | 2,049 | 1,920 | 1,793 | |||||||||

| Other | 106 | 32 | 51 | |||||||||

| Total non-interest revenues | 2,728 | 3,060 | 2,324 | |||||||||

| Interest income | 2 | 9 | 10 | |||||||||

| Interest expense | 18 | 10 | 28 | |||||||||

| Net interest | (16 | ) | (1 | ) | (18 | ) | ||||||

| Net revenues | 2,712 | 3,059 | 2,306 | |||||||||

| Compensation and benefits | 1,213 | 1,189 | 848 | |||||||||

| Non-compensation expenses | 835 | 862 | 818 | |||||||||

| Total non-interest expenses | 2,048 | 2,051 | 1,666 | |||||||||

| Income from continuing operations before income taxes | 664 | 1,008 | 640 | |||||||||

| Provision for income taxes | 207 | 307 | 286 | |||||||||

| Income from continuing operations | 457 | 701 | 354 | |||||||||

| Discontinued operations: | ||||||||||||

| Income from discontinued operations before income taxes | 7 | 9 | 13 | |||||||||

| Provision for income taxes | 2 | � | 4 | |||||||||

| Income from discontinued operations | 5 | 9 | 9 | |||||||||

| Net income | 462 | 710 | 363 | |||||||||

| Net income applicable to nonredeemable noncontrolling interests | 91 | 182 | 187 | |||||||||

| Net income applicable to Morgan Stanley | $ | 371 | $ | 528 | $ | 176 | ||||||

| Amounts applicable to Morgan Stanley: | ||||||||||||

| Income from continuing operations | $ | 366 | $ | 519 | $ | 167 | ||||||

| Income from discontinued operations | 5 | 9 | 9 | |||||||||

| Net income applicable to Morgan Stanley | $ | 371 | $ | 528 | $ | 176 | ||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment. All prior-period amounts have been recast to conform to the current year�s presentation. |

| 81 |  |

| At December�31, | Average for | |||||||||||||||||||

| 2014 | 2013(1) | 2014 | 2013(1) | 2012(1) | ||||||||||||||||

| (dollars in billions) | ||||||||||||||||||||

| Assets under management or supervision by asset class: | ||||||||||||||||||||

| Traditional Asset Management: | ||||||||||||||||||||

| Equity | $ | 141 | $ | 140 | $ | 145 | $ | 130 | $ | 114 | ||||||||||

| Fixed income | 65 | 60 | 63 | 61 | 59 | |||||||||||||||

| Liquidity | 128 | 112 | 119 | 104 | 87 | |||||||||||||||

| Alternatives(2) | 36 | 31 | 34 | 29 | 26 | |||||||||||||||

| Managed Futures(1) | 3 | 4 | 3 | 5 | 6 | |||||||||||||||

| Total Traditional Asset Management | 373 | 347 | 364 | 329 | 292 | |||||||||||||||

| Real Estate Investing | 20 | 21 | 21 | 20 | 19 | |||||||||||||||

| Merchant Banking | 10 | 9 | 9 | 9 | 9 | |||||||||||||||

| Total assets under management or supervision | $ | 403 | $ | 377 | $ | 394 | $ | 358 | $ | 320 | ||||||||||

| Share of minority stake assets(3) | $ | 7 | $ | 6 | $ | 7 | $ | 6 | $ | 5 | ||||||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment. All prior-period amounts have been recast to conform to the current year�s presentation. |

| (2) | The alternatives asset class includes a range of investment products such as funds of hedge funds, funds of private equity funds and funds of real estate funds. |

| (3) | Amounts represent the Company�s Investment Management business segment�s proportional share of assets managed by entities in which it owns a minority stake. |

| 2014 | 2013(1) | 2012(1) | ||||||||||

| (dollars�in�billions) | ||||||||||||

| Balance at beginning of period | $ | 377 | $ | 343 | $ | 293 | ||||||

| Net flows by asset class: | ||||||||||||

| Traditional Asset Management: | ||||||||||||

| Equity | (2 | ) | (1 | ) | (2 | ) | ||||||

| Fixed income | 5 | � | (1 | ) | ||||||||

| Liquidity | 17 | 12 | 26 | |||||||||

| Alternatives(2) | 4 | 2 | 1 | |||||||||

| Managed Futures(1) | (1 | ) | (1 | ) | � | |||||||

| Total Traditional Asset Management | 23 | 12 | 24 | |||||||||

| Real Estate Investing | (2 | ) | (1 | ) | 1 | |||||||

| Merchant Banking | 3 | 1 | � | |||||||||

| Total net flows | 24 | 12 | 25 | |||||||||

| Net market appreciation | 2 | 22 | 25 | |||||||||

| Total net increase | 26 | 34 | 50 | |||||||||

| Balance at end of period | $ | 403 | $ | 377 | $ | 343 | ||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment. All prior-period amounts have been recast to conform to the current year�s presentation. |

| (2) | The alternatives asset class includes a range of investment products such as funds of hedge funds, funds of private equity funds and funds of real estate funds. |

| 82 |

| 83 |  |

| 84 |

| 85 |  |

| 86 |

| 87 |  |

| At December�31, 2014 | At December�31, 2013 | |||||||

| (dollars�in�billions) | ||||||||

| Institutional Securities U.S. Subsidiary Banks data: | ||||||||

| Corporate lending | $ | 9.6 | $ | 8.8 | ||||

| Other lending(1): | ||||||||

| Corporate loans | 8.0 | 2.3 | ||||||

| Wholesale real estate loans | 8.6 | 1.8 | ||||||

| Wealth Management U.S. Subsidiary Banks data: | ||||||||

| Securities-based lending and other loans | $ | 21.9 | $ | 14.7 | ||||

| Residential real estate loans | 15.8 | 10.1 | ||||||

| (1) | In addition to primary corporate lending activity, the Company�s Institutional Securities business segment engages in other lending activities. These activities include commercial and residential mortgage lending, asset-backed lending, corporate loans purchased in the secondary market, financing extended to Institutional equities clients and loans to municipalities. The increase in other lending from 2013 primarily reflects growth in commercial mortgage and asset-backed loans. |

| 88 |

| 89 |  |

| 90 |

| 91 |  |

| � | Trading assets and Trading liabilities; |

| � | AFS securities; |

| � | Securities received as collateral and Obligation to return securities received as collateral; |

| � | Certain Securities purchased under agreements to resell; |

| � | Certain Deposits; |

| � | Certain Commercial paper and other short-term borrowings, primarily structured notes; |

| � | Certain Securities sold under agreements to repurchase; |

| � | Certain Other secured financings; and |

| � | Certain Long-term borrowings, primarily structured notes. |

| � | Determining when sufficient market evidence exists to indicate that FVA should be incorporated into the fair value measurements; |

| 92 |

| � | Estimating the fair value of funding costs and benefits in the principal exit market; and |

| � | Determining the interaction between Credit Valuation Adjustment (�CVA�) and FVA, given that CVA already reflects credit spreads, which are related to and can impact funding spreads. |

| 93 |  |

| 94 |

| 95 |  |

| At December�31, 2014 | ||||||||||||||||

| Institutional Securities | Wealth Management | Investment Management | Total | |||||||||||||

| (dollars in millions) | ||||||||||||||||

| Assets | ||||||||||||||||

| Cash and cash equivalents(1) | $ | 23,161 | $ | 23,363 | $ | 460 | $ | 46,984 | ||||||||

| Cash deposited with clearing organizations or segregated under federal and other regulations or requirements(2) | 37,841 | 2,766 | � | 40,607 | ||||||||||||

| Trading assets | 252,021 | 1,300 | 3,480 | 256,801 | ||||||||||||

| Investment securities(3) | 11,999 | 57,317 | � | 69,316 | ||||||||||||

| Securities received as collateral(2) | 21,316 | � | � | 21,316 | ||||||||||||

| Securities purchased under agreements to resell(2) | 73,299 | 9,989 | � | 83,288 | ||||||||||||

| Securities borrowed(2) | 136,336 | 372 | � | 136,708 | ||||||||||||

| Customer and other receivables(2) | 27,328 | 21,022 | 611 | 48,961 | ||||||||||||

| Loans, net of allowance(4) | 28,755 | 37,822 | � | 66,577 | ||||||||||||

| Other assets(5) | 18,285 | 11,196 | 1,471 | 30,952 | ||||||||||||

| Total assets(6) | $ | 630,341 | $ | 165,147 | $ | 6,022 | $ | 801,510 | ||||||||

| (1) | Cash and cash equivalents include Cash and due from banks and Interest bearing deposits with banks. |

| (2) | Certain of these assets are included in secured financing assets (see �Secured Financing� herein). |

| (3) | Investment securities include both AFS securities and HTM securities. |

| (4) | Amounts include loans held for sale and loans held for investment but exclude loans at fair value, which are included in Trading assets in the Company�s consolidated statements of financial condition (see Note 8 to the Company�s consolidated financial statements in Item�8). |

| (5) | Other assets include Other investments; Premises, equipment and software costs; Goodwill; Intangible assets; and Other assets. |

| (6) | Total assets include Global Liquidity Reserve of $193�billion at December�31, 2014. |

| 96 |

| At December�31, 2013 | ||||||||||||||||

| Institutional Securities | Wealth Management(1) | Investment Management(1) | Total | |||||||||||||

| (dollars in millions) | ||||||||||||||||

| Assets | ||||||||||||||||

| Cash and cash equivalents(2) | $ | 30,169 | $ | 28,966 | $ | 748 | $ | 59,883 | ||||||||

| Cash deposited with clearing organizations or segregated under federal and other regulations or requirements(3) | 36,422 | 2,781 | � | 39,203 | ||||||||||||

| Trading assets | 273,959 | 2,104 | 4,681 | 280,744 | ||||||||||||

| Investment securities(4) | � | 53,430 | � | 53,430 | ||||||||||||

| Securities received as collateral(3) | 20,508 | � | � | 20,508 | ||||||||||||

| Securities purchased under agreements to resell(3) | 106,812 | 11,318 | � | 118,130 | ||||||||||||

| Securities borrowed(3) | 129,366 | 341 | � | 129,707 | ||||||||||||

| Customer and other receivables(3) | 33,927 | 22,493 | 684 | 57,104 | ||||||||||||

| Loans, net of allowance(5) | 17,890 | 24,984 | � | 42,874 | ||||||||||||

| Other assets(6) | 19,543 | 10,086 | 1,490 | 31,119 | ||||||||||||

| Total assets(7) | $ | 668,596 | $ | 156,503 | $ | 7,603 | $ | 832,702 | ||||||||

| (1) | On October�1, 2014, the Managed Futures business was transferred from the Company�s Wealth Management business segment to the Company�s Investment Management business segment. |

| (2) | Cash and cash equivalents include Cash and due from banks and Interest bearing deposits with banks. |

| (3) | Certain of these assets are included in secured financing assets (see �Secured Financing� herein). |

| (4) | Investment securities include only AFS securities. |

| (5) | Amounts include loans held for sale and loans held for investment but exclude loans at fair value, which are included in Trading assets in the Company�s consolidated statements of financial condition (see Note 8 to the Company�s consolidated financial statements in Item�8). |

| (6) | Other assets include Other investments; Premises, equipment and software costs; Goodwill; Intangible assets; and Other assets. |

| (7) | Total assets include Global Liquidity Reserve of $202�billion at December�31, 2013. |

| 97 |  |

| � | Sufficient liquid assets should be maintained to cover maturing liabilities and other planned and contingent outflows; |

| � | Maturity profile of assets and liabilities should be aligned, with limited reliance on short-term funding; |

| � | Source, counterparty, currency, region, and term of funding should be diversified; and |

| � | Contingency Funding Plan (�CFP�) should anticipate, and account for, periods of limited access to funding. |

| � | No government support; |

| � | No access to equity and unsecured debt markets; |

| � | Repayment of all unsecured debt maturing within the stress horizon; |

| � | Higher haircuts and significantly lower availability of secured funding; |

| � | Additional collateral that would be required by trading counterparties, certain exchanges and clearing organizations related to credit rating downgrades; |

| � | Additional collateral that would be required due to collateral substitutions, collateral disputes and uncalled collateral; |

| 98 |

| � | Discretionary unsecured debt buybacks; |

| � | Drawdowns on unfunded commitments provided to third parties; |

| � | Client cash withdrawals and reduction in customer short positions that fund long positions; |

| � | Limited access to the foreign exchange swap markets; and |

| � | Maturity roll-off of outstanding letters of credit with no further issuance. |

| At December�31, 2014 | At December�31, 2013 | |||||||

| (dollars�in�billions) | ||||||||

| Cash deposits with banks | $ | 12 | $ | 18 | ||||

| Cash deposits with central banks | 30 | 36 | ||||||

| Unencumbered highly liquid securities: | ||||||||

| U.S. government obligations | 76 | 84 | ||||||

| U.S. agency and agency mortgage-backed securities | 32 | 23 | ||||||

| Non-U.S. sovereign obligations(1) | 26 | 23 | ||||||

| Investments in money market funds | 1 | 1 | ||||||

| Other investment grade securities | 16 | 17 | ||||||

| Global Liquidity Reserve | $ | 193 | $ | 202 | ||||

| (1) | Non-U.S. sovereign obligations are composed of unencumbered�German, French, Dutch, U.K., Brazilian and Japanese government obligations. |

| 99 |  |

| Average�Balance(1) | ||||||||||||||||

| At�December�31, 2014 | At�December�31, 2013 | 2014 | 2013 | |||||||||||||

| (dollars in billions) | ||||||||||||||||

| Bank legal entities: | ||||||||||||||||

| Domestic | $ | 83 | $ | 85 | $ | 82 | $ | 70 | ||||||||

| Foreign | 5 | 4 | 5 | 5 | ||||||||||||

| Total Bank legal entities | 88 | 89 | 87 | 75 | ||||||||||||

| Non-Bank legal entities: | ||||||||||||||||

| Domestic(2) | 70 | 80 | 76 | 83 | ||||||||||||

| Foreign | 35 | 33 | 32 | 34 | ||||||||||||

| Total Non-Bank legal entities | 105 | 113 | 108 | 117 | ||||||||||||

| Total | $ | 193 | $ | 202 | $ | 195 | $ | 192 | ||||||||

| (1) | The Company calculates the average Global Liquidity Reserve based upon daily amounts. |

| (2) | The Parent held $55 billion and $58 billion at December�31, 2014 and December�31, 2013, respectively, which averaged $57 billion and $63 billion during 2014 and 2013, respectively. |

| 100 |

| 101 |  |

| At December� 31, 2014 | At December� 31, 2013 | |||||||

| (dollars�in�millions) | ||||||||

| Commercial paper | $ | � | $ | 8 | ||||

| Other short-term borrowings | 2,261 | 2,134 | ||||||

| Total | $ | 2,261 | $ | 2,142 | ||||

| At December� 31, 2014(1) | At December� 31, 2013(1) | |||||||

| (dollars in millions) | ||||||||

| Savings and demand deposits | $ | 132,159 | $ | 109,908 | ||||

| Time deposits(2) | 1,385 | 2,471 | ||||||

| Total(3) | $ | 133,544 | $ | 112,379 | ||||

| (1) | Total deposits subject to FDIC insurance at December�31, 2014 and December�31, 2013 were $99 billion and $84 billion, respectively. |

| (2) | Certain time deposit accounts are carried at fair value under the fair value option (see Note 4 to the Company�s consolidated financial statements in Item�8). |

| (3) | At December�31, 2014 and December�31, 2013, approximately $128 billion and $104 billion, respectively, were attributed to the Company�s Wealth Management business segment. These total deposits exclude deposits held by Citi relating to the Company�s customer accounts. |

| 102 |

| Parent | Subsidiaries | Total | ||||||||||

| (dollars�in�millions) | ||||||||||||

| Due in 2015 | $ | 17,781 | $ | 2,959 | $ | 20,740 | ||||||

| Due in 2016 | 18,963 | 1,680 | 20,643 | |||||||||

| Due in 2017 | 22,643 | 1,357 | 24,000 | |||||||||

| Due in 2018 | 16,728 | 951 | 17,679 | |||||||||

| Due in 2019 | 16,660 | 911 | 17,571 | |||||||||

| Thereafter | 50,292 | 1,847 | 52,139 | |||||||||

| Total | $ | 143,067 | $ | 9,705 | $ | 152,772 | ||||||

| 103 |  |

| Parent | Morgan Stanley Bank, N.A. | |||||||||||

| Short-Term Debt | Long-Term Debt | Rating Outlook | Short-Term Debt | Long-Term Debt | Rating Outlook | |||||||

| DBRS, Inc.(1) | R-1�(middle) | A�(high) | Stable | � | � | � | ||||||

| Fitch Ratings, Inc. | F1 | A | Stable | F1 | A | Stable | ||||||

| Moody�s Investors Service(2) | P-2 | Baa2 | Positive | P-2 | A3 | Positive | ||||||

| Rating and Investment Information, Inc. | a-1 | A | Negative | � | � | � | ||||||

| Standard�& Poor�s Ratings Services(3) | A-2 | A- | Negative | A-1 | A | Stable | ||||||

| (1) | On June�12, 2014, DBRS, Inc. confirmed the ratings for the Company, including its long-term debt rating of A (high) and short-term instruments rating of R-1 (middle). The rating outlook trend on all long-term ratings was revised to Stable from Negative, while the rating outlook trend on all short-term ratings remained Stable. |

| (2) | On July�24, 2014, Moody�s Investors Service (�Moody�s�) affirmed the Company�s long-term debt rating as well as the ratings of its subsidiaries and revised its ratings outlook to Positive from Stable. |

| (3) | On November�26, 2014, Standard�& Poor�s Ratings Services (�S&P�) revised its rating outlook on the Company�s operating subsidiaries, including Morgan Stanley Bank, N.A. to Stable from Negative and affirmed its rating on Morgan Stanley Bank, N.A. short-term and long-term debt of A-1 and A, respectively. |

| 104 |

| 105 |  |

| Series | Preferred Stock Description | Quarterly Dividend Per� Share(1) | ||||

| A | Floating Rate Non-Cumulative Preferred Stock (represented by Depositary Shares, each representing a 1/1,000th interest in a share of preferred stock and each having a dividend of $0.25556) | $ | 255.56 | |||

| C | 10% Non-Cumulative Non-Voting Perpetual Preferred Stock | 25.00 | ||||

| E | Fixed-to-Floating Rate Non-Cumulative Preferred Stock (represented by Depositary Shares, each representing a 1/1,000th interest in a share of preferred stock and each having a dividend of $0.44531) | 445.31 | ||||

| F | Fixed-to-Floating Rate Non-Cumulative Preferred Stock (represented by Depositary Shares, each representing a 1/1,000th interest in a share of preferred stock and each having a dividend of $0.42969) | 429.69 | ||||

| G | 6.625% Non-Cumulative Preferred Stock (represented by Depositary Shares, each representing a 1/1,000th interest in a share and each having a dividend of $0.41406) | 414.06 | ||||

| H | Fixed-to-Floating Rate Non-Cumulative Preferred Stock (represented by Depositary Shares, each representing a 1/25th interest in a share of preferred stock and each having a dividend of $27.25)(1) | 681.25 | ||||

| I | Fixed-to-Floating Rate Non-Cumulative Preferred Stock (represented by Depositary Shares, each representing a 1/1,000th interest in a share of preferred stock and each having a dividend of $0.51797) | 517.97 | ||||

| (1) | Dividend on Series H is payable semi-annually until July�15, 2019. |

| 106 |

| Balance at | Average Balance(1) | |||||||||||||||

| December�31, 2014 | December�31, 2013 | 2014 | 2013 | |||||||||||||

| (dollars in millions) | ||||||||||||||||

| Common equity | $ | 64,880 | $ | 62,701 | $ | 65,284 | $ | 61,895 | ||||||||

| Preferred equity | 6,020 | 3,220 | 4,774 | 1,839 | ||||||||||||

| Morgan Stanley shareholders� equity | 70,900 | 65,921 | 70,058 | 63,734 | ||||||||||||

| Junior subordinated debentures issued to capital trusts | 4,868 | 4,849 | 4,866 | 4,826 | ||||||||||||

| Less: Goodwill and net intangible assets(2) | (9,742 | ) | (9,873 | ) | (9,737 | ) | (8,900 | ) | ||||||||

| Tangible Morgan Stanley shareholders� equity(3) | $ | 66,026 | $ | 60,897 | $ | 65,187 | $ | 59,660 | ||||||||

| Common equity | $ | 64,880 | $ | 62,701 | $ | 65,284 | $ | 61,895 | ||||||||

| Less: Goodwill and net intangible assets(2) | (9,742 | ) | (9,873 | ) | (9,737 | ) | (8,900 | ) | ||||||||

| Tangible common equity(3) | $ | 55,138 | $ | 52,828 | $ | 55,547 | $ | 52,995 | ||||||||

| (1) | The Company calculates its average balances based upon month-end balances. |

| (2) | The deduction for Goodwill and net intangible assets is partially offset by mortgage servicing rights (�MSR�) (net of disallowable MSR) of $6 million and $7 million at December�31, 2014 and December�31, 2013, respectively. |

| (3) | Tangible Morgan Stanley shareholders� equity, and tangible common equity, non-GAAP financial measures, equals Morgan Stanley shareholders� equity or common equity, respectively less goodwill and net intangible assets as defined above. The Company views tangible Morgan Stanley shareholders� equity and tangible common equity as a useful measure to the Company and investors to assess capital adequacy. |

| 107 |  |

| 108 |

| Transition Period | Fully�Phased-In(1) | |||||||||

| First�Quarter of 2014 | Second�to�Fourth Quarter of 2014 | 2015�to�2017 | 2018�and�onward | |||||||

| Regulatory Capital (Numerator of risk-based capital and leverage ratios) | U.S.�Basel�III�Transitional(2) | U.S.�Basel�III | ||||||||

| RWAs (Denominator of risk-based capital ratios) | Standardized Approach(3) | U.S.�Basel�I�and�Basel� 2.5 | U.S.�Basel�III Standardized�Approach | |||||

| Advanced Approach(4) | U.S.�Basel�III�Advanced�Approach | |||||

| Denominator of leverage ratios | Tier�1�Leverage�Ratio | Adjusted� Average�On-Balance�Sheet�Assets(5) |

| Supplementary�Leverage�Ratio(6) | Adjusted�Average On-Balance�Sheet�Assets(5) and�Certain�Off-Balance Sheet Exposures |