UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended September 30, 2011 |

Commission File Number 1-13783

Integrated Electrical Services, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 76-0542208 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

4801 Woodway Drive, Suite 200-E, Houston, Texas 77056

(Address of principal executive offices and ZIP code)

Registrant's telephone number, including area code: (713) 860-1500

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of the securities under a plan confirmed by a court.

Yes x No ¨

The aggregate market value of the voting stock of the Registrant on March 31, 2011 held by non-affiliates was approximately $20.6 million. On December 16, 2011, there were 14,938,071 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the Proxy Statement for the Annual Meeting of Stockholders of the Registrant to be held on February 28, 2012 is incorporated by reference into Part III of this Form 10-K.

FORM 10-K

INTEGRATED ELECTRICAL SERVICES, INC.

Table of Contents

Page | ||||||

| PART I | ||||||

DEFINITIONS | 3 | |||||

DISCLOSURE REGARDING FORWARD LOOKING STATEMENTS | 3 | |||||

Item 1 | BUSINESS | 5 | ||||

Item 1A | RISK FACTORS | 11 | ||||

Item 1B | UNRESOLVED STAFF COMMENTS | 14 | ||||

Item 2 | PROPERTIES | 14 | ||||

Item 3 | LEGAL PROCEEDINGS | 15 | ||||

Item 4 | (REMOVED AND RESERVED) | 15 | ||||

| PART II | ||||||

Item 5 | MARKET FOR REGISTRANT'S COMMON EQUITY; RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 15 | ||||

Item 6 | SELECTED FINANCIAL DATA | 17 | ||||

Item 7 | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 18 | ||||

Item 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 34 | ||||

Item 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 35 | ||||

Item 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 74 | ||||

Item 9A | CONTROLS AND PROCEDURES | 74 | ||||

Item 9B | OTHER INFORMATION | 74 | ||||

| PART III | ||||||

Item 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 75 | ||||

Item 11 | EXECUTIVE COMPENSATION | 76 | ||||

Item 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 76 | ||||

Item 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 77 | ||||

Item 14 | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 77 | ||||

| PART IV | ||||||

Item 15 | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 78 | ||||

SIGNATURES | 81 | |||||

EX-21.1 | ||||||

EX-23.1 | ||||||

EX-31.1 | ||||||

EX-31.2 | ||||||

EX-32.1 | ||||||

EX-32.2 | ||||||

EX-101 | ||||||

2

PART I

DEFINITIONS

In this Annual Report on Form 10-K, the words "IES", the "Company", the "Registrant", "we", "our", "ours" and "us" refer to Integrated Electrical Services, Inc. and, except as otherwise specified herein, to our subsidiaries.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes certain statements that may be deemed "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, all of which are based upon various estimates and assumptions that the Company believes to be reasonable as of the date hereof. These statements involve risks and uncertainties that could cause the Company's actual future outcomes to differ materially from those set forth in such statements. Such risks and uncertainties include, but are not limited to:

| • | fluctuations in operating activity due to downturns in levels of construction, seasonality and differing regional economic conditions; |

| • | competition in the construction industry, both from third parties and former employees, which could result in the loss of one or more customers or lead to lower margins on new contracts; |

| • | a general reduction in the demand for our services; |

| • | a change in the mix of our customers, contracts and business; |

| • | our ability to successfully manage construction projects; |

| • | possibility of errors when estimating revenue and progress to date on percentage-of-completion contracts; |

| • | inaccurate estimates used when entering into fixed-priced contracts; |

| • | challenges integrating new types of work or new processes into our divisions; |

| • | the cost and availability of qualified labor; |

| • | accidents resulting from the physical hazards associated with our work and the potential for accidents; |

| • | success in transferring, renewing and obtaining electrical and construction licenses; |

| • | our ability to pass along increases in the cost of commodities used in our business, in particular, copper, aluminum, steel, fuel and certain plastics; |

| • | potential supply chain disruptions due to credit or liquidity problems faced by our suppliers; |

| • | loss of key personnel and effective transition of new management; |

| • | warranty losses or other latent defect claims in excess of our existing reserves and accruals; |

| • | warranty losses or other unexpected liabilities stemming from former divisions which we have sold or closed; |

| • | growth in latent defect litigation in states where we provide residential electrical work for home builders not otherwise covered by insurance; |

| • | limitations on the availability of sufficient credit or cash flow to fund our working capital needs; |

| • | difficulty in fulfilling the covenant terms of our credit facilities; |

| • | increased cost of surety bonds affecting margins on work and the potential for our surety providers to refuse bonding or require additional collateral at their discretion; |

3

| • | increases in bad debt expense and days sales outstanding due to liquidity problems faced by our customers; |

| • | changes in the assumptions made regarding future events used to value our stock options and performance-based stock awards; |

| • | the recognition of potential goodwill, long-lived assets and other investment impairments; |

| • | uncertainties inherent in estimating future operating results, including revenues, operating income or cash flow; |

| • | disagreements with taxing authorities with regard to tax positions we have adopted; |

| • | the recognition of tax benefits related to uncertain tax positions; |

| • | complications associated with the incorporation of new accounting, control and operating procedures; |

| • | the financial impact of new or proposed accounting regulations; |

| • | the ability of our controlling shareholder to take action not aligned with other shareholders; |

| • | the possibility that certain tax benefits of our net operating losses may be restricted or reduced in a change in ownership; |

| • | credit and capital market conditions, including changes in interest rates that affect the cost of construction financing and mortgages, and the inability for some of our customers to retain sufficient financing which could lead to project delays or cancellations; |

| • | the sale or disposition of the shares of our common stock held by our majority shareholder, which, under certain circumstances, would trigger change of control provisions in contracts such as employment agreements and financing and surety arrangements; and |

| • | Additional closures or sales of facilities in our Commercial & Industrial segment could result in significant future charges and a significant disruption of our operations. |

You should understand that the foregoing, as well as other risk factors discussed in this document, including those listed in Part I, Item 1A of this report under the heading " Risk Factors " could cause future outcomes to differ materially from those experienced previously or those expressed in such forward-looking statements. We undertake no obligation to publicly update or revise information concerning our restructuring efforts, borrowing availability, cash position or any forward-looking statements to reflect events or circumstances that may arise after the date of this report. Forward-looking statements are provided in this Form 10-K pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of the estimates, assumptions, uncertainties and risks described herein.

4

Item 1. Business

Integrated Electrical Services, Inc., a Delaware corporation, is a leading national provider of electrical infrastructure services to the communications, residential, commercial and industrial industries. Originally established as IES in 1997, we provide services from 53 locations serving the continental 48 states as of September 30, 2011. Our operations are organized into three business segments, based upon the nature of its products and services (more complete descriptions follow):

| • | Communications – Nationwide provider of products and services for mission critical infrastructure, such as data centers, of large corporations. |

| • | Residential – Regional provider of electrical installation services for single-family housing and multi-family apartment complexes. |

| • | Commercial & Industrial – Provider of electrical design, construction, and maintenance services to the commercial and industrial markets in various regional markets and nationwide in certain areas of expertise, such as the power infrastructure market. |

The table below describes the percentage of our total revenues attributable to each of our three segments over each of the last three years:

| Years Ended September 30, | ||||||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

| (Dollars in thousands, Percentage of revenues) | ||||||||||||||||||||||||

Communications | $ | 93,579 | 19.4 | % | $ | 79,344 | 17.2 | % | $ | 78,724 | 11.8 | % | ||||||||||||

Residential | 114,732 | 23.8 | % | 116,012 | 25.2 | % | 157,521 | 23.7 | % | |||||||||||||||

Commercial & Industrial | 273,296 | 56.8 | % | 265,277 | 57.6 | % | 429,752 | 64.5 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total Consolidated | $ | 481,607 | 100.0 | % | $ | 460,633 | 100.0 | % | $ | 665,997 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

For additional financial information by segment, see Note 11, "Operating Segments" to the Consolidated Financial Statements, which is incorporated herein by reference.

Net Operating Loss Carry Forward

The Company and certain of its subsidiaries have federal net operating loss carry forwards of approximately $435 million at September 30, 2011, including approximately $136 million resulting from the additional amortization of personal goodwill. For more information see Item 8, " Financial Statements and Supplementary " Data of this Form 10-K.

Operating Segments

Communications

Business Description

Originally established in 1984, our Communications division is a leading provider of network infrastructure products and services for data centers and other mission critical environments. Services offered include the design, installation and maintenance of network infrastructure for the financial, medical, hospitality, government, hi-tech manufacturing, educational and information technology industries. We also provide the design and installation of audio/visual, telephone, fire, wireless and intrusion alarm systems as well as design/build, service and maintenance of data network systems. We perform services across the United States from our 7 offices and our Communications headquarters located in Tempe, Arizona allowing dedicated onsite maintenance teams at our customer's sites. In 2010, our Communications segment was separated from our Commercial & Industrial segment to form a new operating segment. The decision to report Communications as a separate segment was made as the Company changed its internal reporting structure and the segment gained greater significance as a percentage of consolidated revenues, gross profit and operating income. Moreover, the Communications segment is a separate and specific part of future strategic growth plans of the Company.

Sales and Marketing

We primarily specialize in installations of communication systems, and site and national account support for the mission critical infrastructure of Fortune 500 corporations. Our sales strategy relies on a concentrated business development effort, with centralized corporate marketing programs and direct end-customer communications and relationships. Due to the mission critical nature of the facilities we service, our end customers significantly rely upon our past performance record, technical expertise and specialized

5

knowledge. Our long term strategy is to improve our position as a preferred mission critical solutions and services provider to large national corporations and strategic local companies. Key elements of our long term strategy include continued investment in our employees' technical expertise, expansion of our onsite maintenance and recurring revenue model and improving our financial performance with a focus on risk adjusted returns on capital.

Competition

The mission critical infrastructure services industry is highly competitive. We compete on quality service and/or price, and seek to emphasize our long history of delivering a high quality solution. Our competitors include a variety of nationwide, regional and local firms.

Residential

Business Description

Our Residential business provides electrical installation services for single-family housing and multi-family apartment complexes and CATV cabling installations for residential and light commercial applications. In addition to our core electrical construction work, the Residential segment is expanding its offerings by providing services for the installation of residential solar power, smart meters, electric car charging stations and stand-by generators, both for new construction and existing residences. The division has 26 locations in Texas, and Sun-Belt, western and the Mid-Atlantic regions of the United States.

Sales and Marketing

Demand for our Residential services is highly dependent on the number of single-family and multi-family home starts in the markets we serve. Although we operate in multiple states throughout the Sun-Belt, Mid-Atlantic and western regions of the United States, 66.5 % of our revenues are derived from services provided in the state of Texas. Our sales efforts include a variety of strategies, including a concentrated focus on national homebuilders and multi-family developers and a local sales strategy for single and multi-family housing projects. Our cable, solar and electric car charging station revenues are typically generated through industry-specific third parties to which we act as a preferred provider of installation services.

Our long term strategy is to continue to be the leading national provider of electrical services to the residential market. Although the key elements of our long term strategy include a continued focus on a maintaining a low and variable cost structure and cash generation, we have modified our strategy during the housing downturn by expanding into markets less exposed to national building cycles, such as solar panel and electric car charging installations.

Competition

Our competition primarily consists of small, privately owned contractors who have limited access to capital. We believe that we have a competitive advantage over these smaller competitors due to our long-standing customer relationships, financial capabilities, local market knowledge and competitive pricing.

Commercial & Industrial

Business Description

Our electrical contracting division is one of the largest providers of electrical contracting services in the United States. The division offers a broad range of electrical design, construction, renovation, engineering and maintenance services to the commercial and industrial markets. The division has 18 locations in Texas, Nebraska, Colorado, Oregon and the Mid-Atlantic region.

Services include the design of electrical systems within a building or complex, procurement and installation of wiring and connection to power sources, end-use equipment and fixtures, as well as contract maintenance. We focus on projects that require special expertise, such as design-and-build projects that utilize the capabilities of our in-house experts, or projects which require specific market expertise, such as transmission and distribution and power generation facilities. We also focus on service, maintenance and certain renovation and upgrade work, which tends to be either recurring or have lower sensitivity to economic cycles, or both. We provide services for a variety of projects, including: high-rise residential and office buildings, power plants, manufacturing facilities, data centers, chemical plants, refineries, wind farms, solar facilities, municipal infrastructure and health care facilities and residential developments. Our utility services consist of overhead and underground installation and maintenance of electrical and other utilities transmission and distribution networks, installation and splicing of high-voltage transmission and distribution lines, substation construction and substation and right-of-way maintenance. Our maintenance services generally provide recurring revenues that are typically less affected by levels of construction activity. Service and maintenance revenues are derived from service calls and routine maintenance contracts, which tend to be recurring and less sensitive to short term economic fluctuations.

6

Sales and Marketing

Demand for our Commercial & Industrial services is driven by construction and renovation activity levels, economic growth, and availability of bank lending. Commercial construction starts began to slow in mid 2008, and with a more severe decline starting in 2009 and continuing through 2011 due to the recession and tightening of the credit markets. Certain of our industrial projects have longer cycle times than our typical Commercial & Industrial services and generally follow the economic trends with a lag. Our sales focus varies by location, but is primarily based upon regional and local relationships with general contractors and a demonstrated expertise in certain industries, such as transmission and distribution.

Our long term strategy has been modified over the past twelve months due to the downturn in the construction industry. Our long term strategy is to be the preferred provider of electrical services in the markets where we have demonstrated expertise or are a local market leader. Key elements of our long term strategy include leveraging our expertise in certain markets, such as transmission and distribution, expansion of our service and maintenance business and maintaining our focus on our returns on risk adjusted capital.

Competition

The electrical infrastructure services industry is generally highly competitive and includes a number of regional or small privately-held local firms. There are few significant barriers to entry in the electrical infrastructure services industry, which limits our advantages when competing for projects. Industry expertise, project size, location and past performance will determine our bidding strategy, the level of involvement from competitors and our level of success in winning awards. Our primary advantages vary by location, but mostly are based upon local individual relationships or a demonstrated industry expertise. Additionally, due to the size of many of our projects, our financial resources help us compete effectively against local competitors.

Recent Developments

We are focused on return on capital and cash flow to maximize long-term shareholder value. As a result, we have increased our focus on a number of initiatives to return the Company to profitability. Included in these initiatives has been the closure or sale of a number of facilities within our Commercial & Industrial segment. During 2011, we initiated the sale or closure of all or portions of our Commercial & Industrial facilities in Arizona, Florida, Iowa, Louisiana, Massachusetts, Nevada and Texas. We continue to evaluate the performance of the remaining operations in our Commercial & Industrial segment, which continues to operate in a very challenging environment. If we were to elect to dispose of a substantial portion of our remaining Commercial & Industrial segment, the realized values of such actions would be substantially less than current book values, which would likely result in a material adverse impact on our financial results.

Safety Culture

Performance of our contracting and maintenance services exposes us to unique potential hazards associated specifically with the electrical contracting industry. In light of these risks, we are resolute in our commitment to safety and maintaining a strong safety culture, which is reflected in our safety program and the significant reductions in loss time cases and OSHA recordable incidents over the past ten years. We employ eight full-time regional safety managers, under the supervision of our full-time Vice President of Safety. We have standardized safety policies, programs, procedures and personal protection equipment throughout all operating locations, including programs to train new employees, which applies to employees new to the industry and those new to IES. To further emphasize our commitment to safety, we have also tied management incentives to their specific safety performance results.

Business Operations

We have 53 locations serving the continental 48 states. In addition to our corporate office, we have 8 locations within our Communications business, 26 locations within our Residential business and 18 locations within our Commercial & Industrial business. This diversity helps to reduce our exposure to unfavorable economic developments in any given region.

Access to Bonding

Our ability to post surety bonds provides us with an advantage over competitors that are smaller or have fewer financial resources. We believe that the strength of our balance sheet, as well as a good relationship with our bonding provider, enhances our ability to obtain adequate financing and surety bonds.

Industry Overview

Slowing economic conditions have lead to a sharp decrease in demand for residential housing since the middle of 2007, with commercial demand beginning to slow, thereafter, in 2008. A more severe decline was experienced during 2009 for commercial as well as industrial and multi-family construction.

The 2010 and 2011 decline, while less severe, did not meet previous expectations for recovery. According to McGraw Hill Construction's Dodge Construction Outlook dated October 2011, new construction starts for 2012 are forecasted at $412 billion, which is flat with the 2011 new construction figure of $410 billion. This forecast remains well below peak activity in 2006 due to the slow recovery of jobs and consumer spending affecting the economic recovery.

7

The McGraw Hill Construction Outlook included the following information which we consider key points for the construction markets we compete within:

| • | Single family housing is forecasted to increase approximately 10% in 2012, but the activity level may remain weak as the excess supply of home foreclosures continue to depress the market. |

| • | Multifamily housing is forecasted to improve by approximately 18% in 2012, due to its more stable revenue stream, despite restrained financing. Restrictive home lending, high unemployment and anemic economic growth have created a level of uncertainty among prospective homebuyers sufficient to keep them on the sidelines; thus improving demand for multi-family housing. |

| • | Commercial construction is forecasted to increase approximately 8% in 2012. Warehouses and hotels are expected to improve the most in this sector during 2012. Activity levels for stores should remain weak by historical standards, as a significant portion of the growth in consumer spending were gasoline stations and e-commerce, two sectors that do not require any meaningful investment in retail commercial buildings. |

| • | Institutional building construction is forecasted to decrease 2% in 2012, retreating for the fourth straight year, due to the difficult fiscal climate for states and localities. School construction should be dampened as K-12 enrollments are projected to grow by 5.9% for the 2010-2020 periods, while health care facilities will be tentative until a clearer picture develops with respect to health care legislation and Medicare funding issues are dealt with by Congress. |

| • | Public works construction is forecasted to decline 5% in 2012, given the fading benefits of the federal stimulus together with the lower budgets from state and local governmental entities. Spending cuts in the absence of a multi-year federal transportation bill will negatively impact highways and bridge construction. |

| • | Electric utility construction activity is forecasted to drop 24% in 2012, falling for the fourth year in a row since the record high in 2008. Alternative power projects, such as wind and solar, are expected to decline as federal and state loan guarantees expire as a result of budget constraints from these entities. On a positive note the Nuclear Regulatory Commission is expect to issue final approvals for two new facilities in early 2012. These projects are valued at $8.0 billion a piece. |

FMI 2012 U.S. Markets Construction Overview indicated communications construction should increase by approximately 5% in 2012 to approximately $20.0 billion. The trend towards data storage and retrieval on the "cloud" will increase the growth of the data center segment of this industry. Additionally, devices such as smart phones and laptops are requiring greater bandwidth and interconnectivity. Communications construction is technology-driven and primarily limited by consumer demand.

Looking well beyond the recent economic downturn and prolonged recovery, numerous factors could positively affect construction industry growth, including (i) population growth, which will increase the need for commercial, industrial and residential facilities, (ii) aging public infrastructure which must be replaced or repaired, and (iii) increased emphasis on environmental and energy efficiency, which may lead to both increased public and private spending. We believe these factors will continue to drive demand for the electrical infrastructure services we offer over the long-term.

Customers

We have a diverse customer base. During the twelve-month periods ended September 30, 2011, 2010 and 2009, no single customer accounted for more than 10% of our revenues. We will continue our emphasis on developing and maintaining relationships with our customers by providing superior, high-quality service. Management at each of our segments is responsible for determining sales strategy and sales activities.

Backlog

Backlog is a measure of revenue that we expect to recognize from work that has yet to be performed on uncompleted contracts, and from work that has been contracted but has not started. Backlog is not a guarantee of future revenues, as contractual commitments may change. As of September 30, 2011, our backlog was approximately $174.5 million compared to $219.3 million as of September 30, 2010. This decline is primarily due to actions taken to close certain unprofitable operations in our Commercial & Industrial segment, which are more fully described in Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations - The 2011 Restructuring Plan " of this Form 10-K. The Communications segment backlog was $26.6 million, essentially unchanged form the prior year. The Residential segment experienced a 31.7% increase to $32.0 million as of September 30, 2011 as compared to fiscal 2010, as multi-family housing starts have increased. We do not include single-family housing or time and material work as a component of our Residential backlog. The Commercial & Industrial segment backlog not associated with the wind-down of operations described in the 2011 Restructuring Plan, declined modestly year-over-year, due to competitive market pressures, project selection delays and project cancellations. We do not include service or time and material work as a component of our Commercial & Industrial backlog.

8

Employees

At September 30, 2011, we had 2,724 employees. We are not a party to any collective bargaining agreements with our employees. We believe that our relationship with our employees is strong.

Competition

The markets in which we operate are highly competitive. Many of the industries in which we operate are highly fragmented and are served by many small, owner-operated private companies. There are also several large private regional companies and a small number of large public companies in our industries. In addition, there are relatively few barriers to entry into some of the industries in which we operate and, as a result, any organization that has adequate financial resources and access to technical expertise may become a competitor. We believe that our strengths such as our safety performance, technical expertise and experience, financial and operational resources, nationwide presence, and industry reputation put us in a strong position. There can be no assurance, however, that our competitors will not develop the expertise, experience and resources to provide services that are superior in both price and quality to our services, or that we will be able to maintain or enhance our competitive position.

Regulations

| • | Our operations are subject to various federal, state and local laws and regulations, including: |

| • | licensing requirements applicable to electricians; |

| • | building and electrical codes; |

| • | regulations relating to worker safety and protection of the environment; |

| • | regulations relating to consumer protection, including those governing residential service agreements; and |

| • | qualifications of our business legal structure in the jurisdictions where we do business. |

Many state and local regulations governing electricians require permits and licenses to be held by individuals. In some cases, a required permit or license held by a single individual may be sufficient to authorize specified activities for all our electricians who work in the state or county that issued the permit or license. It is our policy to ensure that, where possible, any permits or licenses that may be material to our operations in a particular geographic area are held by multiple employees within that area.

We believe we have all licenses required to conduct our operations and are in compliance with applicable regulatory requirements. Failure to comply with applicable regulations could result in substantial fines or revocation of our operating licenses or an inability to perform government work.

Risk Management and Insurance

The primary risks in our operations include bodily injury, property damage and construction defects. We maintain automobile, general liability and construction defect insurance for third party health, bodily injury and property damage and workers' compensation coverage, which we consider appropriate to insure against these risks. Our third-party insurance is subject to deductibles for which we establish reserves.

Seasonality and Quarterly Fluctuations

Results of operations from our Residential segment are more seasonal, depending on weather trends, with typically higher revenues generated during spring and summer and lower revenues during fall and winter. The Communications and Commercial & Industrial segments of our business are less subject to seasonal trends, as work generally is performed inside structures protected from the weather. Our service and maintenance business is generally not affected by seasonality. In addition, the construction industry has historically been highly cyclical. Our volume of business may be adversely affected by declines in construction projects resulting from adverse regional or national economic conditions. Quarterly results may also be materially affected by the timing of new construction projects. Accordingly, operating results for any fiscal period are not necessarily indicative of results that may be achieved for any subsequent fiscal period.

Available Information

General information about us can be found on our website at www.ies-co.com under "Investor Relations." We file our interim and annual financial reports, as well as other reports required by the Securities Exchange Act of 1934, as amended (the "Exchange Act"), with the United States Securities and Exchange Commission (the "SEC").

9

Our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports are available free of charge through our website as soon as it is reasonably practicable after we file them with, or furnish them to, the SEC. You may also contact our Investor Relations department and they will provide you with a copy of these reports. The materials that we file with the SEC are also available free of charge through the SEC website at www.sec.gov . You may also read and copy these materials at the SEC's Public Reference Room at 100 F Street, NE., Washington, D.C. 20549. Information on the operation of the Public Reference Room is available by calling the SEC at 1–800–SEC–0330.

We have adopted a Code of Ethics for Financial Executives, a Code of Business Conduct and Ethics for directors, officers and employees (the Legal Compliance and Corporate Policy Manual), and established Corporate Governance Guidelines and adopted charters outlining the duties of our Audit, Human Resources and Compensation and Nominating/Governance Committees, copies of which may be found on our website. Paper copies of these documents are also available free of charge upon written request to us. We have designated an "audit committee financial expert" as that term is defined by the SEC. Further information about this designee may be found in the Proxy Statement for the Annual Meeting of Stockholders of the Company.

10

Item 1A. Risk Factors

You should consider carefully the risks described below, as well as the other information included in this document before making an investment decision. Our business, results of operations or financial condition could be materially and adversely affected by any of these risks, and the value of your investment may decrease due to any of these risks.

Existence of a controlling shareholder.

A majority of our outstanding common stock is owned by Tontine Capital Partners, L.P. and its affiliates (collectively, "Tontine"). On July 21, 2011, Tontine, filed an amended Schedule 13D indicating its ownership level of 57.4%. As a result, Tontine can control most of our affairs, including the election of directors who in turn appoint executive management and control any action requiring the approval of shareholders, including the adoption of amendments to our corporate charter and approval of any potential merger or sale of all or substantially all assets, divisions, or the Company itself. This control also gives Tontine the ability to bring matters to a shareholder vote that may not be in the best interest of our other stakeholders. Additionally, Tontine is in the business of investing in companies and may, from time to time, acquire and hold interests in businesses that compete directly or indirectly with us or act as suppliers or customers of the Company.

We may incur significant charges or be adversely impacted by the closure or sale of additional facilities.

We have increased our focus on a number of initiatives to return the Company to profitability. Included in these initiatives has been the closure or sale of a number of facilities within our Commercial & Industrial segment. During 2011, we initiated the sale or closure of all or portions of our Commercial & Industrial facilities in Arizona, Florida, Iowa, Louisiana, Massachusetts, Nevada and Texas. We continue to evaluate the performance of the remaining operations in our Commercial & Industrial segment, which continues to operate in a very challenging environment. If we were to elect to dispose of a substantial portion of our remaining Commercial & Industrial segment, the realized values of such actions would be substantially less than current book values, which would likely result in a material adverse impact on our financial results.

Availability of net operating losses may be reduced by a change in ownership.

A change in ownership, as defined by Internal Revenue Code Section 382, could reduce the availability of net operating losses for federal and state income tax purposes. Should Tontine sell or exchange all or a portion of its position in IES, a change in ownership could occur. In addition a change in ownership could occur resulting from the purchase of common stock by an existing or a new 5% shareholder as defined by Internal Revenue Code Section 382. Currently, we have approximately $286.5 million of federal net operating losses that are available to use to offset taxable income, exclusive of net operating losses from the amortization of additional tax goodwill. In addition, we have approximately $12.6 million of net operating loss not currently available due to the limitation imposed by Internal Revenue Code Section 382, exclusive of net operating losses from the amortization of additional tax goodwill, and will be available to offset taxable income in future periods. Should a change in ownership occur, all net operating losses incurred prior to the change in ownership would be subject to limitation imposed by Internal Revenue Code Section 382 and this would substantially reduce the amount of net operating loss currently available to offset taxable income.

To service our indebtedness and to fund working capital, we will require a significant amount of cash. Our ability to generate cash depends on many factors that are beyond our control.

Our ability to make payments on and to refinance our indebtedness and to fund working capital requirements will depend on our ability to generate cash in the future. This is subject to our operational performance, as well as general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot provide assurance that our business will generate sufficient cash flow from operations or asset sales and, that future borrowings will be available to us under our credit facility in an amount sufficient to enable us to pay our indebtedness, or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, on or before maturity. We cannot provide assurance that we will be able to refinance any of our indebtedness on commercially reasonable terms, or at all. Our inability to refinance our debt on commercially reasonable terms could have a material adverse effect on our business.

The highly competitive nature of our industries could affect our profitability by reducing our profit margins.

The industries in which we compete are highly fragmented and are served by many small, owner-operated private companies. There are also several large private regional companies and a small number of large public companies from which we face competition in these industries. In the future, we could also face competition from new competitors entering these markets because certain segments, such as our electrical contracting services, have a relatively low barrier for entry while other segments such as our services for mission critical infrastructure have attractive dynamics. Some of our competitors offer a greater range of services, including mechanical construction, facilities management, plumbing and heating, ventilation and air conditioning services. Competition in our markets depends on a number of factors, including price. Some of our competitors may have lower overhead cost structures and may, therefore, be able to provide services comparable to ours at lower rates than we do. If we are unable to offer our services at competitive prices or if we have to reduce our prices to remain competitive, our profitability would be impaired.

11

Backlog may not be realized or may not result in profits.

Customers often have no obligation under our contracts to assign or release work to us, and many contracts may be terminated on short notice. Reductions in backlog due to cancellation of one or more contracts by a customer or for other reasons could significantly reduce the revenue and profit we actually receive from contracts included in backlog. In the event of a project cancellation, we may be reimbursed for certain costs but typically have no contractual right to the total revenues reflected in our backlog.

Our use of percentage-of-completion accounting could result in a reduction or elimination of previously reported profits.

As discussed in Item 7 " Management's Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies" and in the notes to our Consolidated Financial Statements included in Item 8 " Financial Statements and Supplementary Data" hereof, a significant portion of our revenues are recognized using the percentage-of-completion method of accounting, utilizing the cost-to-cost method. This method is used because management considers expended costs to be the best available measure of progress on these contracts. The percentage-of-completion accounting practice we use results in our recognizing contract revenues and earnings ratably over the contract term in proportion to our incurrence of contract costs. The earnings or losses recognized on individual contracts are based on estimates of contract revenues, costs and profitability. Contract losses are recognized in full when determined to be probable and reasonably estimable and contract profit estimates are adjusted based on ongoing reviews of contract profitability. Further, a portion of our contracts contain various cost and performance incentives. Penalties are recorded when known or finalized, which generally occurs during the latter stages of the contract. In addition, we record cost recovery claims when we believe recovery is probable and the amounts can be reasonably estimated. Actual collection of claims could differ from estimated amounts and could result in a reduction or elimination of previously recognized earnings. In certain circumstances, it is possible that such adjustments could be significant.

The availability and cost of surety bonds affect our ability to enter into new contracts and our margins on those engagements.

Many of our customers require us to post performance and payment bonds issued by a surety. Those bonds guarantee the customer that we will perform under the terms of a contract and that we will pay subcontractors and vendors. We obtain surety bonds from one primary surety provider; however, there is no commitment from this provider to guarantee our ability to issue bonds for projects as they are required. Our ability to access this bonding capacity is at the sole discretion of our surety provider.

Due to seasonality and differing regional economic conditions, our results may fluctuate from period to period.

Our business is subject to seasonal variations in operations and demand that affect the construction business, particularly in the Residential and Commercial & Industrial segments. Untimely weather delay from rain, heat, ice, cold or snow can not only delay our work but can negatively impact our schedules and profitability by delaying the work of other trades on a construction site. Our quarterly results may also be affected by regional economic conditions that affect the construction market. Accordingly, our performance in any particular quarter may not be indicative of the results that can be expected for any other quarter or for the entire year. Additionally, cost increases in construction materials such as steel, aluminum, copper and lumber can alter the rate of new construction.

The estimates we use in placing bids could be materially incorrect. The use of incorrect estimates could result in losses on a fixed price contract. These losses could be material to our business.

We currently generate, and expect to continue to generate, more than half of our revenues under fixed price contracts. The cost of fuel, labor and materials, including copper wire, may vary significantly from the costs we originally estimate. Variations from estimated contract costs along with other risks inherent in performing fixed price contracts may result in actual revenue and gross profits for a project differing from those we originally estimated and could result in losses on projects. Depending upon the size of a particular project, variations from estimated contract costs can have a significant impact on our operating results.

Commodity costs may fluctuate materially and we may not be able to pass on all cost increases during the term of a contract.

We enter into many contracts at fixed prices and if the cost associated with commodities such as copper, aluminum, steel, fuel and certain plastics increase, losses may be incurred.

We may be unsuccessful at integrating companies that we may acquire.

We may engage in acquisitions and dispositions of operations, assets and investments from time to time in the future. If we are unable to successfully integrate newly acquired assets or operations or make untimely or unfavorable dispositions of operations or investments, it could negatively impact the market value of our common stock. Additionally, any future acquisition or disposition

12

may result in significant changes in the composition of our assets and liabilities, and as a result, our financial condition, results of operations and the market value of our common stock following any such acquisition or disposition may be affected by factors different from those currently affecting our financial condition, results of operations and trading price of our common stock.

We may experience difficulties in managing our billings and collections.

Our billings under fixed price contracts are generally based upon achieving certain milestones and will be accepted by the customer once we demonstrate those milestones have been met. If we are unable to demonstrate compliance with billing requests, or if we fail to issue a project billing, our likelihood of collection could be delayed or impaired, which, if experienced across several large projects, could have a materially adverse effect on our results of operations.

We have restrictions and covenants under our credit facility.

We may not be able to remain in compliance with the covenants in our credit facility. A failure to fulfill the terms and requirements of our credit facility may result in a default under one or more of our material agreements, which could have a material adverse effect on our ability to conduct our operations and our financial condition.

Our reported operating results could be adversely affected as a result of goodwill impairment write-offs.

When we acquire a business, we record an asset called "goodwill" if the amount we pay for the business, including liabilities assumed, is in excess of the fair value of the assets of the business we acquire. Accounting principles generally accepted in the United States of America ("GAAP") requires that goodwill attributable to each of our reporting units be tested at least annually. The testing includes comparing the fair value of each reporting unit with its carrying value. Fair value is determined using discounted cash flows, market multiples and market capitalization. Significant estimates used in the methodologies include estimates of future cash flows, future short-term and long-term growth rates, weighted average cost of capital and estimates of market multiples for each of the reportable units. On an ongoing basis, we expect to perform impairment tests at least annually as of September 30. Impairment adjustments, if any, are required to be recognized as operating expenses. We cannot assure that we will not have future impairment adjustments to our recorded goodwill.

The vendors who make up our supply chain may be adversely affected by the current operating environment and credit market conditions.

We are dependent upon the vendors within our supply chain to maintain a steady supply of inventory, parts and materials. Many of our divisions are dependent upon a limited number of suppliers, and significant supply disruptions could adversely affect our operations. Under recent market conditions, including both the construction slowdown and the tightening credit market, it is possible that one or more of our suppliers will be unable to meet the terms of our operating agreements due to financial hardships, liquidity issues or other reasons related to the prolonged market recovery.

Our operations are subject to numerous physical hazards associated with the construction of electrical systems. If an accident occurs, it could result in an adverse effect on our business.

Hazards related to our industry include, but are not limited to, electrocutions, fires, machinery-caused injuries, mechanical failures and transportation accidents. These hazards can cause personal injury and loss of life, severe damage to or destruction of property and equipment, and may result in suspension of operations. Our insurance does not cover all types or amounts of liabilities. Our third-party insurance is subject to deductibles for which we establish reserves. No assurance can be given that our insurance or our provisions for incurred claims and incurred but not reported claims will be adequate to cover all losses or liabilities we may incur in our operations; nor can we provide assurance that we will be able to maintain adequate insurance at reasonable rates.

Our internal controls over financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur. Internal controls over financial reporting and disclosure controls and procedures, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system's objective will be met.

On a quarterly basis, we evaluate our internal controls over financial reporting and our disclosure controls and procedures, which include a review of the objectives, design, implementation and effectiveness of the controls and the information generated for use in our periodic reports. In the course of our controls evaluation, we sought (and seek) to identify data errors, control problems and to confirm that appropriate corrective action, including process improvements, are being undertaken. This type of evaluation is conducted on a quarterly basis so that the conclusions concerning the effectiveness of our controls can be reported in our periodic reports.

A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system's objectives will be satisfied. Internal controls over financial reporting and disclosure controls and procedures are designed to give reasonable assurance that they are effective and achieve their objectives. We cannot provide absolute assurance that all possible

13

future control issues have been detected. These inherent limitations include the possibility that our judgments can be faulty, and that isolated breakdowns can occur because of human error or mistake. The design of our system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed absolutely in achieving our stated goals under all potential future or unforeseeable conditions. Because of the inherent limitations in a cost-effect control system, misstatements due to error could occur without being detected.

We have adopted tax positions that a taxing authority may view differently. If a taxing authority differs with our tax positions, our results may be adversely affected.

Our effective tax rate and cash paid for taxes are impacted by the tax positions that we have adopted. Taxing authorities may not always agree with the positions we have taken. We have established reserves for tax positions that we have determined to be less likely than not to be sustained by taxing authorities. However, there can be no assurance that our results of operations will not be adversely affected in the event that disagreement over our tax positions does arise.

Litigation and claims can cause unexpected losses.

In the construction business there are frequently claims and litigation. There are also inherent claims and litigation risk associated with the number of people that work on construction sites and the fleet of vehicles on the road everyday. Claims are sometimes made and lawsuits filed for amounts in excess of their value or in excess of the amounts for which they are eventually resolved. Claims and litigation normally follow a predictable course of time to resolution. However, there may be periods of time in which a disproportionate amount of our claims and litigation are concluded in the same quarter or year. If multiple matters are resolved during a given period, then the cumulative effect of these matters may be higher than the ordinary level in any one reporting period.

Latent defect claims could expand.

Latent defect litigation is normal for residential home builders in some parts of the country; however, such litigation is increasing in certain states where we perform work. Also, in recent years, latent defect litigation has expanded to aspects of the commercial market. Should we experience similar increases in our latent defect claims and litigation, additional pressure may be placed on the profitability of the Residential and Commercial & Industrial segments of our business.

The loss of a group or several key personnel, either at the corporate or operating level, could adversely affect our business.

The loss of key personnel or the inability to hire and retain qualified employees could have an adverse effect on our business, financial condition and results of operations. Our operations depend on the continued efforts of our executive officers, senior management and management personnel at our divisions. We cannot guarantee that any member of management at the corporate or subsidiary level will continue in their capacity for any particular period of time. We have employment agreements in place with our executives and many of our key senior leadership; however, such employment agreements cannot guarantee that we will not lose key employees, nor prevent them from competing against us, which is often dependent on state and local employment laws. If we lose a group of key personnel or even one key person at a division, we may not be able to recruit suitable replacements at comparable salaries or at all, which could adversely affect our operations. Additionally, we do not maintain key man life insurance for members of our management.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Equipment

We operate a fleet of approximately 1,000 owned and leased trucks, vans, trailers, support vehicles and specialty equipment. We believe these vehicles are adequate for our current operations.

Facilities

At September 30, 2011, we maintained branch offices, warehouses, sales facilities and administrative offices at 53 locations. Substantially all of our facilities are leased. We lease our corporate office located in Houston, Texas. We believe that our properties are adequate for our present needs, and that suitable additional or replacement space will be available as required.

14

Item 3. Legal Proceedings

For further information regarding legal proceedings, see Note 16, "Commitments and Contingencies - Legal Matters " to the Consolidated Financial Statements, which is incorporated herein by reference.

Item 4. (Removed and Reserved)

Item 5. Market for Registrant's Common Equity; Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock trades on the NASDAQ Global Select Market under the ticker symbol "IESC." The following table sets forth the daily high and low close price for our common stock as reported on NASDAQ for each of the four quarters of the years ended September 30, 2011 and 2010.

| High | Low | |||||||

Year Ended September 30, 2011 | ||||||||

First Quarter | $ | 3.80 | $ | 3.14 | ||||

Second Quarter | $ | 4.38 | $ | 3.41 | ||||

Third Quarter | $ | 3.50 | $ | 3.11 | ||||

Fourth Quarter | $ | 3.36 | $ | 1.88 | ||||

Year Ended September 30, 2010 | ||||||||

First Quarter | $ | 7.66 | $ | 5.85 | ||||

Second Quarter | $ | 5.93 | $ | 4.65 | ||||

Third Quarter | $ | 6.39 | $ | 3.43 | ||||

Fourth Quarter | $ | 3.84 | $ | 3.10 | ||||

As of December 16, 2011, the closing market price of our common stock was $2.00 per share and there were approximately 370 holders of record.

We have never paid cash dividends on our common stock, and we do not anticipate paying cash dividends in the foreseeable future. We expect that we will utilize all available earnings generated by our operations and borrowings under our credit facility for the development and operation of our business, to retire existing debt, or to repurchase our common stock. Any future determination as to the payment of dividends will be made at the discretion of our Board of Directors and will depend upon our operating results, financial condition, capital requirements, general business conditions and other factors that the Board of Directors deems relevant. Our debt instruments restrict us from paying cash dividends and also place limitations on our ability to repurchase our common stock. See Item 7, " Management's Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources ".

On December 12, 2007, our Board of Directors authorized the repurchase of up to one million shares of our common stock, and the Company established a Rule 10b5-1 plan to facilitate this repurchase. This share repurchase program was authorized through, and terminated in December 2009. During the year ended September 30, 2009, we repurchased 301,418 common shares under the share repurchase program at an average price of $13.36 per share.

Five-Year Stock Performance Graph

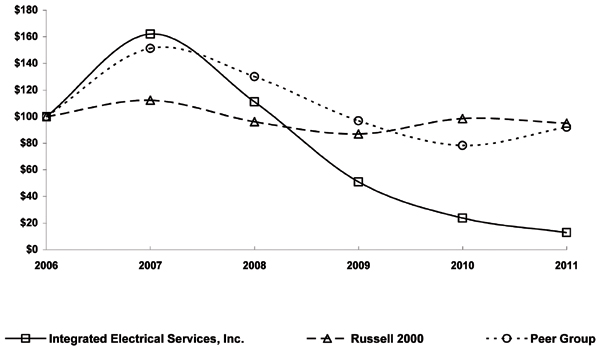

The following performance graph compares the Company's cumulative total stockholder return on its common stock with the cumulative total return of (i) the Russell 2000, (ii) the peer group stock index (the "Peer Group"), which was selected in good faith by the Company and comprised of the following publicly traded companies: Mastec, Inc., Willbros Group, Inc., Comfort Systems USA Inc., Dycom Industries, Inc., Matrix Service Company, Pike Electric Corp., Insituform Technologies, Powell Industries, MYR Group, Inc., Team, Inc., Primoris Services Corp., Englobal Corp. and Furmanite Corp. The cumulative total return computations set forth in the following performance graph assume (i) the investment of $100 in each of the Company's common stock, the Russell 2000, and the Peer Group on September 30, 2006, and (ii) that all dividends have been reinvested. Shareholder returns over the period indicated should not be considered indicative of future shareholder returns.

The information contained in the following performance graph shall not be deemed "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such filing.

15

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Integrated Electrical Services, Inc., the Russell 2000 Index

and a Peer Group

*$100 invested on 9/30/06 in stock or index, including reinvestment of dividends.

Fiscal year ending September 30.

| Years ended September 30, | ||||||||||||||||||||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||||||||||||

Integrated Electrical Services, Inc. | $ | 100.00 | 161.99 | 111.07 | 50.92 | 23.78 | 12.81 | |||||||||||||||||||||||||||

Russell 2000 | $ | 100.00 | 112.34 | 96.07 | 86.90 | 98.50 | 95.02 | |||||||||||||||||||||||||||

Peer Group | $ | 100.00 | 151.23 | 129.99 | 96.82 | 78.30 | 91.98 | |||||||||||||||||||||||||||

16

Item 6. Selected Financial Data

The following selected consolidated historical financial information for IES should be read in conjunction with the audited historical Consolidated Financial Statements of Integrated Electrical Services, Inc. and subsidiaries, and the notes thereto, set forth in Item 8 " Financial Statements and Supplementary Data" to this Form 10-K.

| Years Ended September 30, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In Thousands, Except Share Information) | ||||||||||||||||||||

Continuing Operations: | ||||||||||||||||||||

Revenues | $ | 481,607 | $ | 460,633 | $ | 665,997 | $ | 818,287 | $ | 890,351 | ||||||||||

Cost of services | 445,585 | 404,140 | 556,469 | 686,358 | 745,429 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross profit | 36,022 | 56,493 | 109,528 | 131,929 | 144,922 | |||||||||||||||

Selling, general and administrative expenses | 69,365 | 84,920 | 108,328 | 119,160 | 136,969 | |||||||||||||||

Gain on sale of Assets | (6,583 | ) | (174 | ) | (465 | ) | (114 | ) | (46 | ) | ||||||||||

Asset impairment | 4,804 | - | - | - | - | |||||||||||||||

Restructuring charges | 3,784 | 763 | 7,407 | 4,598 | 824 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

(Loss) Income from Operations | (35,348 | ) | (29,016 | ) | (5,742 | ) | 8,285 | 7,175 | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Other (income) expense: | ||||||||||||||||||||

Interest expense, net | 2,209 | 3,271 | 4,094 | 6,529 | 5,835 | |||||||||||||||

Other expense (income), net | (10 | ) | (109 | ) | 1,608 | (888 | ) | (336 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Interest and other expense, net | 2,199 | 3,162 | 5,702 | 5,641 | 5,499 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

(Loss) income from operations before income taxes | (37,547 | ) | (32,178 | ) | (11,444 | ) | 2,644 | 1,676 | ||||||||||||

Provision (benefit) for income taxes | 146 | (31 | ) | 495 | 2,436 | 2,276 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net (loss) income from continuing operations | $ | (37,693 | ) | $ | (32,147 | ) | $ | (11,939 | ) | $ | 208 | $ | (600 | ) | ||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Discontinued Operations: | ||||||||||||||||||||

Income (loss) from discontinued operations | - | - | 187 | (616 | ) | (4,977 | ) | |||||||||||||

Provision (benefit) for income taxes | - | - | 68 | (221 | ) | (1,165 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income (loss) discontinued operations | - | - | 119 | (395 | ) | (3,812 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net (loss) | $ | (37,693 | ) | $ | (32,147 | ) | $ | (11,820 | ) | $ | (187 | ) | $ | (4,412 | ) | |||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Basic (loss) earnings per share: | ||||||||||||||||||||

Continuing operations | $ | (2.60 | ) | $ | (2.23 | ) | $ | (0.83 | ) | $ | 0.01 | $ | (0.04 | ) | ||||||

Discontinued operations | $ | - | $ | - | $ | 0.01 | $ | (0.02 | ) | $ | (0.25 | ) | ||||||||

Total | $ | (2.60 | ) | $ | (2.23 | ) | $ | (0.82 | ) | $ | (0.01 | ) | $ | (0.29 | ) | |||||

Diluted (loss) earnings per share: | ||||||||||||||||||||

Continuing operations | $ | (2.60 | ) | $ | (2.23 | ) | $ | (0.83 | ) | $ | 0.01 | $ | (0.04 | ) | ||||||

Discontinued operations | $ | - | $ | - | $ | 0.01 | $ | (0.02 | ) | $ | (0.25 | ) | ||||||||

Total | $ | (2.60 | ) | $ | (2.23 | ) | $ | (0.82 | ) | $ | (0.01 | ) | $ | (0.29 | ) | |||||

Shares used to calculate loss per share | ||||||||||||||||||||

Basic | 14,493,747 | 14,409,368 | 14,331,614 | 14,938,619 | 15,058,972 | |||||||||||||||

Diluted | 14,493,747 | 14,409,368 | 14,331,614 | 15,025,023 | 15,058,972 | |||||||||||||||

17

| Years Ended September 30, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In Thousands, Except Share Information) | ||||||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 35,577 | $ | 32,924 | $ | 64,174 | $ | 64,709 | $ | 69,676 | ||||||||||

Working capital | 62,837 | 83,240 | 121,611 | 127,129 | 157,690 | |||||||||||||||

Total assets | 180,266 | 205,105 | 268,425 | 320,538 | 353,422 | |||||||||||||||

Total debt | 10,498 | 11,256 | 28,687 | 29,644 | 45,776 | |||||||||||||||

Total stockholders' equity | 64,810 | 101,581 | 132,593 | 146,235 | 153,925 | |||||||||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our Consolidated Financial Statements and the notes thereto, set forth in Item 8 "Financial Statements and Supplementary Data" of this Form 10-K. For additional information, see "Disclosure Regarding Forward Looking Statements" in Part I of this Form 10-K.

General

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based on our Consolidated Financial Statements, which have been prepared in accordance with GAAP. The preparation of our Consolidated Financial Statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities known to exist as of the date the Consolidated Financial Statements are published and the reported amounts of revenues and expenses recognized during the periods presented. We review all significant estimates affecting our Consolidated Financial Statements on a recurring basis and record the effect of any necessary adjustments prior to their publication. Judgments and estimates are based on our beliefs and assumptions derived from information available at the time such judgments and estimates are made. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of financial statements. There can be no assurance that actual results will not differ from those estimates.

Accordingly, we have identified the accounting principles, which we believe are most critical to our reported financial status by considering accounting policies that involve the most complex or subjective decisions or assessments. We identified our most critical accounting policies to be those related to revenue recognition, the assessment of goodwill and asset impairment, our allowance for doubtful accounts receivable, the recording of our insurance liabilities and estimation of the valuation allowance for deferred tax assets. These accounting policies, as well as others, are described in Note 2, "Summary of Significant Accounting Policies" of our Consolidated Financial Statements, set forth in Item 8 " Financial Statements and Supplementary Data" of this Form 10-K, and at relevant sections in this discussion and analysis.

Revenue Recognition. We enter into contracts principally on the basis of competitive bids. We frequently negotiate the final terms and prices of those contracts with the customer. Although the terms of our contracts vary considerably, most are made on either a fixed price or unit price basis in which we agree to do the work for a fixed amount for the entire project (fixed price) or for units of work performed (unit price). We also perform services on a cost-plus or time and materials basis. Our most significant cost drivers are the cost of labor, the cost of materials and the cost of casualty and health insurance. These costs may vary from the costs we originally estimated. Variations from estimated contract costs along with other risks inherent in performing fixed price and unit price contracts may result in actual revenue and gross profits or interim projected revenue and gross profits for a project differing from those we originally estimated and could result in losses on projects. Depending on the size of a particular project, variations from estimated project costs could have a significant impact on our operating results for any fiscal quarter or year.

We complete most of our projects within one year. We frequently provide service and maintenance work under open-ended, unit price master service agreements which are renewable annually. We recognize revenue on service, time and material work when services are performed. Work performed under a construction contract generally provides that the customers accept completion of progress to date and compensate us for services rendered, measured in terms of units installed, hours expended or some other measure of progress. Revenues from construction contracts are recognized on the percentage-of-completion method. The percentage-of-completion method for construction contracts is measured principally by the percentage of costs incurred and accrued to date for each contract to the estimated total costs for each contract at completion. We generally consider contracts substantially complete upon departure from the work site and acceptance by the customer. Contract costs include all direct material and labor costs and those indirect costs related to contract performance, such as indirect labor, supplies, tools, repairs and depreciation costs. Changes in job performance, job conditions, estimated contract costs, profitability and final contract settlements may result in revisions to costs and income, and the effects of such revisions are recognized in the period in which the revisions are determined. Provisions for total estimated losses on uncompleted contracts are made in the period in which such losses are determined.

The current asset "Costs and estimated earnings in excess of billings on uncompleted contracts" represents revenues recognized in excess of amounts billed that management believes will be billed and collected within the next twelve months. The current liability "Billings in excess of costs and estimated earnings on uncompleted contracts" represents billings in excess of revenues recognized.

18

Costs and estimated earnings in excess of billings on uncompleted contracts are amounts considered recoverable from customers based on different measures of performance, including achievement of specific milestones, completion of specified units or completion of the contract. Also included in this asset, from time to time, are claims and unapproved change orders, which include amounts that we are in the process of collecting from our customers or agencies for changes in contract specifications or design, contract change orders in dispute or unapproved as to scope and price, or other related causes of unanticipated additional contract costs. Claims and unapproved change orders are recorded at estimated realizable value when collection is probable and can be reasonably estimated. We do not recognize profits on construction costs incurred in connection with claims. Claims made by us involve negotiation and, in certain cases, litigation. Such litigation costs are expensed as incurred.

Valuation of Intangibles and Long-Lived Assets. We evaluate goodwill for potential impairment at least annually at year end, however, if impairment indicators exist, we will evaluate as needed. Included in this evaluation are certain assumptions and estimates to determine the fair values of reporting units such as estimates of future cash flows and discount rates, as well as assumptions and estimates related to the valuation of other identified intangible assets. Changes in these assumptions and estimates or significant changes to the market value of our common stock could materially impact our results of operations or financial position. We recorded goodwill impairment during the year ended September 30, 2011, of $0.1 million. We did not record goodwill impairment during the years ended September 30, 2010 and 2009.

We assess impairment indicators related to long-lived assets and intangible assets at least annually at year end. If we determine impairment indicators exist, we conduct an evaluation to determine whether any impairment has occurred. This evaluation includes certain assumptions and estimates to determine fair value of asset groups, including estimates about future cash flows and discount rates, among others. Changes in these assumptions and estimates could materially impact our results of operations or financial projections. We recorded long-lived or intangible asset impairment during the year ended September 30, 2011, of $0.1 million; primarily attributable to real estate we are offering to sell. The write down was made to reduce the carrying value of the property to its current expected fair value. We did not record long-lived or intangible asset impairment during the years ended September 30, 2010 and 2009.