UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2011

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File No. 001-34864

CHINA HGS REAL ESTATE INC.

(Exact Name of Registrant as Specified in its Charter)

Florida | 33-0961490 |

(State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification Number) |

6 Xinghan Road, 19th Floor, Hanzhong City

Shaanxi Province, PRC 723000

(Address of principal executive offices) (zip code)

(212) 232-0120

(Registrant's telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: | |

Title of each class registered: | Name of each exchange on which registered: |

Common Stock, par value $0.001 | The NASDAQ Stock Market LLC |

Securities registered under Section 12(g) of the Exchange Act: None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (ss.229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |

Non-accelerated filer (Do not check if a smaller reporting company) | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing price of a share of the registrant's common stock on March 31, 2011, the last business day of the Company's second fiscal quarter, as reported by the NASDAQ Stock Market on that date, was approximately $34,739,200. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose.

As of December 23, 2011, the number of shares outstanding of the registrant's common stock was 45,050,000.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for its 2012 Annual Meeting of Stockholders (the "Proxy Statement"), to be filed with the Securities and Exchange Commission, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

CHINA HGS REAL ESTATE, INC.

FORM 10-K

For the Fiscal Year Ended September 30, 2011

INDEX

Page | |||

PART I | |||

Item 1. | Business | 1 | |

Item 1A. | Risk Factors | 14 | |

Item 1B. | Unresolved Staff Comments | 24 | |

Item 2. | Properties | 24 | |

Item 3. | Legal Proceedings | 24 | |

Item 4. | (Removed and Reserved) | 24 | |

PART II | |||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 24 | |

Item 6. | Selected Financial Data | 26 | |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 26 | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 38 | |

Item 8. | Financial Statements and Supplementary Data | 39 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 61 | |

Item 9A. | Controls and Procedures | 61 | |

Item 9B. | Other Information | 62 | |

PART III | |||

Item 10. | Directors, Executive Officers and Corporate Governance | 63 | |

Item 11. | Executive Compensation | 63 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 63 | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 63 | |

Item 14. | Principal Accountant Fees and Services | 63 | |

PART IV | |||

Item 15. | Exhibits and Financial Statement Schedules | 64 | |

SIGNATURES | 65 |

PART I

ITEM 1. BUSINESS

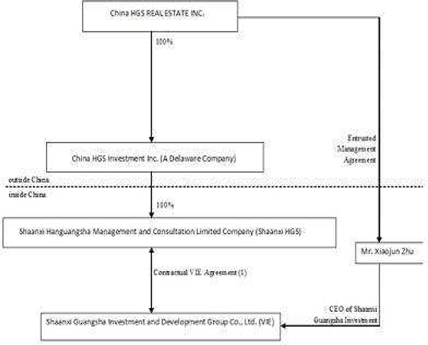

Our Organization

China HGS Real Estate Inc. (the "Company" or "China HGS," "we", "our", "us"), formerly known as China Agro Sciences Corp., is a corporation organized under the laws of the State of Florida. We were incorporated under the name M-GAB Development Corporation in March 2001. From inception through early 2003, our business was the development, marketing, and distribution of an interactive travel brochure. On May 16, 2003, we filed an election to be treated as a business development company under the Investment Company Act of 1940, which became effective on the date of filing. However, we never made any investments into eligible portfolio companies.

On March 17, 2006, China Agro Sciences Corp., a Florida corporation formerly known as M-GAB Development Corporation (hereinafter "China Agro") entered into an Agreement and Plan of Merger (the "Agreement") with Dalian Holding Corp., a Florida corporation (formerly known as China Agro Sciences Corp.) ("DHC"). This transaction closed on May 1, 2006, at which time, in accordance with the Agreement, DHC merged with DaLian Acquisition Corp, a Florida corporation that was our wholly-owned subsidiary ("DaLian") (the "Merger"). As a result of the Merger, DaLian merged into DHC, with DHC remaining as the surviving entity and our wholly-owned subsidiary, DaLian, ceased to exist, and we issued 13,449,488 shares of our common stock to the former shareholders of DHC.

Prior to DaLian's merger with DHC, DHC had acquired all the outstanding common stock of Ye Shun International ("Ye Shun"), a company that owns all the outstanding common stock of DaLian Runze Chemurgy Co., Ltd. ("Runze"). In the transaction in which DHC acquired all the outstanding common stock of Ye Shun, Ye Shun was determined to be the accounting acquirer. Ye Shun is a Hong Kong registered enterprise. Runze is classified by the Chinese government as an enterprise entity with 100% of its capital coming from Hong Kong. As a result of the Merger, on April 28, 2006, we filed a Form N-54C and terminated our status as a business development company and, through our wholly-owned subsidiary, commenced operations, specializing in the sale and distribution of low toxic pesticides and herbicides, and consequently ceased being a development stage company. Our only operations were conducted through our wholly-owned subsidiary, which controlled the assets of Runze.

On August 21, 2009, a Share Exchange Agreement ("Share Exchange") was entered into by and among the Company, Rising Pilot, Inc., a British Virgin Islands company (the "HGS Shareholder"), and China HGS Investment Inc., a Delaware corporation and wholly-owned subsidiary of the HGS Shareholder ("HGS Investment). Pursuant to the Share Exchange Agreement, the HGS Shareholder transferred and assigned to the Company all of the issued and outstanding capital stock of HGS in exchange for 14,000,000 shares of the Company's common stock, $0.001 par value. The closing of the Share Exchange transaction occurred on August 31, 2009. As a result of the Share Exchange, HGS Investment became a wholly-owned subsidiary of the Company. After the consummation of the Share Exchange transaction, the Company changed its name to China HGS Real Estate, Inc.

In addition, as a part of the Share Exchange transaction, the Company entered into an entrusted management agreement (the "Entrusted Management Agreement") with the management of the Company's PRC operating subsidiary, Shaanxi Guangsha Investment and Development Group Co., Ltd. ("Guangsha") and issued to Mr. Zhu Xiaojun, the CEO of Guangsha and his management team an aggregate of 25,000,000 shares of the Company's common stock.

Prior to and in conjunction with the consummation of the Share Exchange, the Company entered into a purchase and sale agreement with Mr. Zhengquan Wang, the Company's former CEO, pursuant to which, Mr. Wang returned 14,000,000 shares of the Company's common stock to the Company in exchange for the business and assets of Dalian Holding Corp., a Florida corporation and wholly-owned subsidiary of the Company. In addition, Mr. Wang assumed all the liabilities of Dalian Holding and released the Company from any and all claims, known or unknown, with regard to such liabilities. As a result of the Share Exchange transaction, the shareholders of Guangsha acquired the majority of the equity in the Company. In addition, the original officers and directors of the Company resigned from their positions and new directors and officers affiliated with Guangsha were appointed ten days after the notice pursuant to Rule 14f-1 was mailed to the Company's shareholders of record.

1

The transaction has been accounted for as a reverse merger under the purchase method of accounting. Accordingly, HGS Investment and its subsidiaries are treated as the continuing entity for accounting purposes.

HGS Investment is a Delaware corporation and owns 100% of the equity interest in Shaanxi HGS Management and Consulting Co., Ltd. ("Shaanxi HGS"), a wholly owned foreign entity incorporated under the laws of the People's Republic of China ("PRC" or "China") on June 3, 2009.

China HGS does not conduct any substantive operations of its own. Instead, through its subsidiary, Shaanxi HGS, in November 2007 it entered into certain exclusive contractual agreements with Guangsha. Pursuant to these agreements, Shaanxi HGS is obligated to absorb a majority of the risk of loss from Guangsha's activities and entitles Shaanxi HGS to receive a majority of Guangsha's expected residual returns. In addition, Guangsha's shareholders have pledged their equity interest in Guangsha to Shaanxi HGS, irrevocably granted Shaanxi HGS an exclusive option to purchase, to the extent permitted under PRC Law, all or part of the equity interests in Guangsha and agreed to entrust all the rights to exercise their voting power to the person(s) appointed by Shaanxi HGS.

Based on these contractual arrangements, we believe that Guangsha should be considered a "Variable Interest Entity" ("VIE") under ASC 810 "Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51", because the equity investors in Guangsha no longer have the characteristics of a controlling financial interest, and the Company, through Shaanxi HGS, is the primary beneficiary of Guangsha and its operations. Accordingly, Guangsha has been consolidated under ASC 810.

Our Company, along with our subsidiaries and VIE, engages in real estate development, primarily in the construction and sale of residential apartments, car parks and commercial properties.

Shaanxi Guangsha Investment and Development Group Co., Ltd. ("Guangsha")

Guangsha was organized in August 1995 as a liability limited company under the laws of the PRC. Guangsha is headquartered in the city of Hanzhong, Shaanxi Province. Due to the rapid growth of the business, the shareholders of Guangsha increased the company's registered capital twice, once in 2000, from the original registered capital of RMB 2.1 million (approximately US$0.2 million) to RMB 30 million (approximately US$3.6 million) and again in 2008 to RMB 130 million (approximately US$17.6 million). Guangsha is engaged in developing large scale and high quality commercial and residential projects, including multi-layer apartment buildings, sub-high-rise apartment buildings, high-rise apartment buildings, and office buildings.

2

Our corporate structure is set forth below:

Business Overview

We conduct substantially all of our business through our subsidiary and VIE in China. All of our business is conducted in mainland China. Guangsha was founded by Mr. Xiaojun Zhu, our Chairman and Chief Executive Officer and commenced operations in 1995 in Hanzhong, a prefecture-level city in Shaanxi Province. Since Guangsha was founded, management has focused on expanding our business in Tier 3 and Tier 4 cities and counties in China that we strategically select based on population and urbanization growth rates, general economic conditions and growth rates, income and purchasing power of resident consumers, anticipated demand for private residential properties, availability of future land supply and land prices, and governmental urban planning and development policies. We utilize a standardized and scalable model that emphasizes rapid asset turnover, efficient capital management and strict cost control. We plan to expand into strategically selected Tier 3 and Tier 4 cities and counties with real estate development potential in Shaanxi Province, and expect to benefit from rising demand for residential housing as a result of increasing income levels of consumers and growing populations.

Real Estate Industry Overview

Since early 2000s, the real estate industry in China has been transitioning from an arranged system controlled by the PRC government to a more market-oriented system. At the present, although the Chinese government still owns all urban land in China, the land use rights with terms up to 70 years can be granted to, and owned or leased by, private individuals and companies. A large and active market in the private sector has developed for sales and transfers of land use rights which were initially granted by the Chinese government. All property units built on such land belong to private developers for the term of period indicated. The recent transition in terms of real estate industry structure in China has also fostered the development of real estate-related businesses, such as property development, property management and real estate agencies.

The real estate industry in China, like elsewhere, is highly influenced by the global and domestic macroeconomic environment. The significant growth of the Chinese economy during the past decade has led to a significant expansion of its real estate industry. This expansion has been supported by other factors, including increasing urbanization, growing personal affluence, as well as the emergence of the mortgage lending market.

3

Since late 2010, global economies and markets are going through an extraordinary period of uncertainty and volatility largely owing to concerns over high government debt levels in the United States and Europe. Although this will mainly impact North America and Europe, it may also affect emerging economies including China. China's economic growth rate for the first half of 2011 has remained strong at 9.6%, but may moderate in the second half under the influence of global economic and market uncertainties. In the face of rapidly rising inflation, the PRC has been raising banks' reserve ratios and interest rates during the first half of 2011. In addition, on top of the "Ten National Notices" announced last year, which were intended to increase the supply of affordable housing and reduce housing prices to a reasonable level, the State Council further issued the "Eight National Notices" in January 2011 to expand the scope and magnitude of curbs against rising home prices. The Tier 1 cities are normally defined as Shanghai, Beijing, Shenzhen and Guangzhou. The Tier 2 cities are normally defined as China's 23 provincial capitals. The average new-home price in the Tier I and Tier II cities ranges from RMB 7,000 to RMB 18,000 per square meter. In contrast, the average selling price of the Company's properties in Tier 3 and Tier 4 cities and counties is only around RMB 2,800 per square meter in 2011. More than 40 Tier 1 and Tier 2 cities have implemented property purchase limits, the severity of which varies slightly. On January 27, 2011, a long-awaited property tax measure was approved, with Shanghai and Chongqing launching trial run measures that mark the central government's determined effort to implement certain new real estate taxes. These governmental policies will also negatively affect buyers' confidence and consumption psychology. Some buyers are taking a wait-and-see attitude and may delay their purchasing decision. Such market conditions will impact our sales revenues to a certain degree.

With respect to the real estate market in Western China, there has been an increasing demand for high quality residential housing, thanks to the "Go West" policy and accelerated urbanization. Over 50% of the Chinese population currently lives in cities, and such rate is expected to have an average increase of 0.8-1% per year. Buyers in Tier 3 and Tier 4 cities and counties want to improve their living standards, and such demand is increasing and we believe it will continue to increase in the long-term.

With respect to the supply of the real estate market, while investment in real estate in China has grown year on year and the government continues to increase the supply of residential lands and small-and-medium commodity housing with more effort being put in the construction of affordable housing, there is still additional unmet demand as the total supply on the real estate market remains insufficient due to the regular demand growth year on year and the shortage of urban residential and commercial lands.

In view of the current economic and policy environment of the real estate industry, the number of transactions and sales prices are expected to be negatively affected in the short run. In the long run, we expect that prospects for the real estate industry in Tier 3 and Tier 4 cities and counties will remain positive as a result of strong internal development of the industry, although the market is expected to experience an excess of demand and shortage of land resources.

Company Positioning:

The Company is headquartered in Hanzhong in the southwestern part of the Shaanxi province, in the center of the Hanzhong Basin, on the Han River, near the Sichuan border. According to the China City Statistical Yearbook, Hanzhong had a population of about 3.8 million as of September 30, 2011. In May 2011, the Hanzhong City 2010-2020 Development Plan was approved by the Shaanxi Provincial Government. According to the related news release, the downtown area will have a population of 1 million by 2020, and Hanzhong will have a first-class ecological environment. Currently, all the projects of the Company are located in the Hanzhong downtown and nearby satellite cities.

The Company received the National Grade-I real-estate development qualification granted by the Ministry of Housing and Urban-Rural Development of the People's Republic of China ("MOHURD")"on October 12, 2011. The Grade-I real-estate development qualification is the highest qualification for real-estate developers in China and requires meeting several strict criteria, including:

· | Registered capital of at least RMB 50 million (approximately $7.9 million); |

· | At least five years of experience in real estate development and operation; |

· | The completion of construction of a total over 300,000 square meters of ground floor area (GFA) within the last three years and, in the most recent year, developed real estate projects of at least 150,000 square meters; and |

4

· | The completed real estate projects have no quality issues in each of the past five years; and an established, comprehensive quality control and guarantee system |

The Company is the first National Grade-I real estate developer in Hanzhong city as well as in the southern Shaanxi region. The qualification provides significant opportunities for the Company to expand its operations beyond Shaanxi province into new regional real-estate markets in China.

The target market of the Company is in Western China, where most of the buyers are first time home buyers. While we are focused on developing core economic areas in Hanzhong, a Tier 3 city in western China, the Company continues to expand to nearby Tier 4 cities and counties that are neighboring to major cities in Western China and under relatively less austerity control. We expect the real estate markets in the Tier 3 and Tier 4 cities and counties where the Company is active to provide steady growth for the Company.

The Company has reacted to the changes in the real estate market by being independent of bank loans and operating the business out of the cash generated from net income. In order to mitigate default risk, the Company requires from its homebuyer customers a deposit in the range of 30%-50% of the purchase price, which is higher than the percentage required by the government for the mortgage down payment.

The Company continues to focus on Tier 3 and Tier 4 cities and counties in acquiring its sizable quality land reserves at a competitive cost. Looking ahead, the Company will continue to focus on developing high quality and large scale real estate projects in the suburban areas of Tier 3 and Tier 4 cities and counties with promising economic growth potential. Leveraging on its unique competitive strengths, and under the direction and guidance of the government's macro policies, the Company will expects to further replicate its successful business model into new high growth regions through strategic selection of project locations, a short project development schedule characterized by fast asset turnover and excellent execution ability, as well as innovative product offering closely in line with market demand. The Company plans to become a leading large-scale residential property developer in Western China and a well-recognized brand name.

Pre-Sales and Sales

In the PRC, real estate developers begin to market properties before construction is completed. Like other developers, we pre-sell properties prior to completion of construction. Under PRC pre-sales regulations, property developers must satisfy specific conditions before properties under construction can be pre-sold. These mandatory conditions include:

| · | the land premium must have been paid in full; |

| · | the land use rights certificate, the construction site planning permit, the construction work planning permit and the construction permit must have been obtained; |

| · | at least 25% of the total project development cost must have been incurred; |

| · | the progress and the expected completion and delivery date of the construction must be fixed; |

| · | the pre-sale permit must have been obtained; and |

| · | the completion of certain milestones in the construction processes must be specified by the local government authorities. |

These mandatory conditions are designed to require a certain level of capital expenditure and substantial progress in project construction before the commencement of pre-sales. Generally, the local governments also require developers and property purchasers to have standard pre-sale contracts prepared under the auspices of the government. Developers are required to file all pre-sale contracts with local land bureaus and real estate administrations after entering into such contracts.

5

After-Sale Services and Delivery

We assist customers in arranging for and providing information related to financing. We also assist our customers in various title registration procedures related to their properties, and we have set up an ownership certificate team to assist purchasers to obtain their property ownership certificates. We offer various communication channels to customers to facilitate customer feedback collection. We also cooperate with property management companies that manage our properties and ancillary facilities, to handle customer feedback.

We endeavor to deliver the units to our customers on a timely basis. We closely monitor the progress of construction of our property projects and conduct pre-delivery property inspections to ensure timely delivery. The time frame for delivery is set out in the sale and purchase agreements entered into with our customers, and we are subject to penalty payments to the purchasers for any delay in delivery caused by us. The Company has never incurred any delay penalties. Once a property development has been completed, has passed the requisite government inspections and is ready for delivery, we will notify our customers and hand over keys and possession of the properties.

Marketing and Distribution Channel

We maintain a marketing and sales force for our development projects, which at September 30, 2011 consisted of 60 employees specializing in marketing and sales. We also train and use outside real estate agents to market and increase the public awareness of our projects, and spread the acceptance and influence of our brand. However, our marketing and sales is primarily conducted by our own sales force because we believe our own dedicated sales representatives are better motivated to serve our customers as well as to control our property pricing and selling expenses.

Our marketing and sales team determines the appropriate advertising and selling plan for each project. We develop public awareness through marketing and advertising as well as referrals from customers. We utilize a customer relationship management system to track customer profiles, which helps us to forecast future customer requirements and general demand for our projects. This allows us to have real-time information on the status of individual customer transactions as well as available inventory by project, which enables us to better anticipate the preferences of current and future customers. We develop customer awareness through advertising.

We use various advertising media to market our developments and enhance our brand name, including newspapers, magazines, television, radio, e-marketing and outdoor billboards. We also participate in real estate exhibitions.

We have also developed a strong relationship with local institutional purchasers and governments. The Company entered a residential-apartment bulk-purchase agreement with Hanzhong Municipal Public Security Bureau on May 28, 2011. Pursuant to this Agreement, the purchaser will purchase a total of 224 residential-apartment units in Tower C1 and Tower C3 of the Company's "Mingzhu Beiyuan" project located in downtown Hanzhong for a total price of RMB 120 million (approximately $18.5 million) and approximately $82,000 per unit. The Company also entered a residential-apartment bulk-purchase agreement with Hanzhong Municipal Bureau of Justice on June 8, 2011. Pursuant to this Agreement, the purchaser will purchase a total of 112 residential-apartment units in Tower B3 of the Company's "Mingzhu Beiyuan" project located in downtown Hanzhong for a total price of RMB 60 million (approximately $9.2 million) and approximately $82,000 per unit. On October 18, 2011, the Company signed another bulk-purchase agreement with the Hanzhong Local Tax Bureau and the Hanzhong Social Insurance Center for the Company's "Mingzhu Beiyuan" project. According to the Agreements, the Hanzhong Local Tax Bureau and the Hanzhong Social Insurance Center will purchase the residential apartments in the "Mingzhu Beiyuan" project at fixed price of RMB 278 per sq. ft. (approximately $43.78 per sq. ft.) for the first floor of each building. The unit price will increase by RMB 2.30 per sq. ft. (approximately $0.36 per sq. ft.) per floor, starting on the second floor of each building. All of these bulk purchase agreements are expected to be completed in the next three years. For the properties under these bulk purchase agreements, the institutional buyers are not allowed to resell immediately, so these institutional buyers will not be in competition with us by reason of the sale of units in these projects. The Company believes these institutional sales will not reduce the overall margins and salability of other units. In addition, the Company entered into a preliminary contract with Yan County to develop affordable apartment buildings with total Gross Floor Area ("GFA") of 40,000 square meters. The related price terms have not yet been finalized. The project is expected to be completed by December 2012.

6

The majority of our customers purchase properties from us using mortgage financing. Under current PRC laws, the minimum down payment is 30% of the total purchase price for the purchase of the first self-use residential unit with total GFA of 90 square meters (about 970 square feet) or more on all existing units and those yet to be completed, and a down payment of 20% on the first residential units for self-use with total GFA of under 90 square meters. In order to mitigate the default risk, the Company requires from its homebuyer customers deposits ranging from 30%-50% of the purchase price, which is higher than the percentage required by the government for the mortgage down payment. The loan-to-value ratio of the mortgage loan is also subject to change according to the economic policies of the central and local governments and banks in China of where the applicants apply for the mortgage loan.

A typical sales transaction usually consists of three steps. First, the customer pays a deposit to us. Within seven days after paying the deposit, the customer will sign a purchase contract with us and make a down payment to us in cash. After making the down payment, the customer arranges for a mortgage loan for the balance of the purchase price. Once the loan is approved, the mortgage loan proceeds are paid to us directly by the bank. Finally, we deliver the property to the customer. Legal title, as evidenced by a property ownership certificate issued by local land and construction bureaus, will be delivered to the customer in 12 months from the property delivery date.

Like most real estate companies in China, we generally provide guarantees to mortgagee banks in respect of the mortgage loans provided to the purchasers of our properties up until completion of the registration of the mortgage with the relevant mortgage registration authorities. Guarantees for mortgages on residential properties are typically discharged when the individual property ownership certificates are issued. In our experience, the issuance of the individual property ownership certificates typically takes six to twelve months, so our mortgage guarantees typically remain outstanding for up to twelve months after we deliver the underlying property.

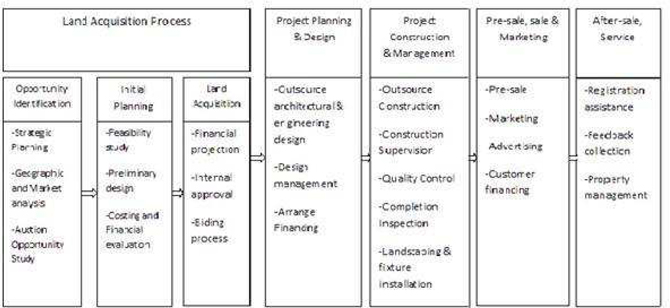

Our Property Development Operations

We have a systematic and standardized process of project development, which we implement through several well-defined phases. One critically significant portion of our process is the land acquisition process, which is segmented into three stages: (i) opportunity identification, (ii) initial planning and budgeting, and (iii) land acquisition. The following diagram sets forth the key stages of our property development process.

Our Projects

Overview

We develop the following three types of real estate projects, which may be developed in one or more phases:

7

| · | multi-layer apartment buildings, which are typically six stories or less; |

| · | sub-high-rise apartment buildings, which are typically seven to 11 stories; and |

| · | high-rise apartment buildings, which are typically 12 to 33 stories. |

At any one time, our projects (or phases of our projects) are in one of the following three stages:

| · | completed projects , meaning construction has been completed; |

| · | properties under construction , meaning properties for which construction permits have been obtained but construction has not been completed; and |

| · | properties under planning , meaning properties for which we have entered into land grant contracts and are in the process of obtaining the required permits to begin construction. |

We have three projects that we are developing in Hanzhong City and one in Yang County, which is adjacent to Hanzhong City. Our projects located in Hanzhong City are: Mingzhu Garden -Mingzhu Nanyuan, Mingzhu Beiyuan (Mingzhu Nanyuan and Mingzhu Beiyuan are treated as one project in different phases), Oriental Mingzhu Garden and NanDajie (Mingzhu Xinju). In Yang County, our project is Yangzhou Pearl Garden. Most projects are being developed in multiple phases.

Mingzhu Garden -Mingzhu Nanyuan consists of one sub-high-rise and two high-rise residential buildings with commercial shops located on the first floor. The completed portions of Mingzhu Nanyuan include one sub-high-rise residential building. As at September 30, 2011, the completed area is 11,502 square meters. The Mingzhu Nanyuan project under development includes two high-rise buildings, with total GFA of 35,220 square meters.

Mingzhu Garden -Mingzhu Beiyuan consists of high-rise residential buildings. The completed portion of the Mingzhou Beiyuan project includes two high-rise residential buildings with commercial shops located on the first floor. The completed area is 33,474 square meters. The Mingzhou Beiyuan project under development includes high-rise residential buildings with a total GFA of 350,000 square meters.

NanDajie (Mingzhu Xinju) consists of two residential high-rise buildings, with commercial shops located on the first floors. One building was completed at September 30, 2010 and one completed at September 30, 2011 with total GFA of 21,137 square meters.

Oriental Mingzhu Garden consists of high-rise residential buildings with commercial shops on the first and second floors. As at September 30, 2011, it is still in the planning stage with a total GFA of 258,000 square meters.

Yangzhou Pearl Garden consists of multi-layer residential buildings and sub-high-rise and high-rise residential buildings with commercial shops on the first floors. As at September 30, 2011, the completed portion of Yangzhou Pearl Garden includes multi-layer residential buildings, sub-high-rise and high-rise residential buildings, with a total GFA of 94,208 square meters. Yangzhou Pearl Garden under development consists of multi-layer residential buildings and high-rise residential buildings, with a total GFA of 62,352 square meters. Yangzhou Pearl Garden under planning includes multi-layer residential buildings, a sub-high-rise residential building, and high-rise residential buildings, with a total GFA of 87,000 square meters.

8

Completed Projects

The following table sets forth our completed projects in the year ending September 30, 2011:

Project Name | Location | Type of Buildings | Total GFA(1) square meters completed during the year | Total Number of Units completed during the year | Number of units sold during the year | |||||||||||

Yangzhou Pearl Garden | Yang County | Multi-layer residential Sub-high-rise residential | 94,208 | 799 | 643 | |||||||||||

| ||||||||||||||||

Mingzhu Garden (Mingzhu Nanyuan) | Hanzhong City | Sub-high-rise residential | 11,502 | 76 | 74 | |||||||||||

Mingzhu Garden (Mingzhu Beiyuan) | Hanzhong City | High-rise residential | 33,473 | 265 | 176 | |||||||||||

NanDajie (Mingzhu Xinjun) | Hanzhong City | High-rise residential | 21,137 | 128 | 119 | |||||||||||

Total | 160,320 | 1,268 | 1,012 | |||||||||||||

(1) The amounts for "total GFA" in this table are the amounts of total saleable gross floor area and are derived on the following basis:

| · | for properties that are sold, the stated GFA is based on that sales contracts relating to such property; |

| · | for unsold properties that are completed, the stated GFA is calculated based on the detailed construction blueprint and the calculation method approved by the PRC government for saleable GFA, after necessary adjustments; |

| · | for properties that are under planning, the stated GFA is based on the land grant contract and our internal projections |

Properties under Construction and Properties under Planning

The following table sets forth each of our properties currently under construction or planning as of September 30, 2011:

Projects under Construction | Location | Type of Projects | Total GFA(1) (square meters) | Total Number of Units | Number of Pre-sold Units | |||||||||||

Mingzhu Garden (Mingzhu Nanyuan) | Hanzhong | High-rise residential | 35,220 | 316 | 41 | |||||||||||

Mingzhu Garden (Mingzhu Beiyuan) | Hanzhong | High-rise residential | 350,000 | N/A | 336 | |||||||||||

Yangzhou Pearl Garden | Yang County | Sub-high-rise residential High-rise residential | 62,352 | 348 | 172 | |||||||||||

Total | 447,572 | 664 | 549 | |||||||||||||

Projects under Planning | ||||||||||||||||

Oriental Mingzhu Garden | Hanzhong | Multi-layer residential and commercial units | 258,000 | 1,917 | - | |||||||||||

Yangzhou Pearl Garden | Yang County | Multi-layer residential, Sub-high-rise residential, High-rise residential | 87,000 | N/A | - | |||||||||||

Total | 345,000 | 1,917 | - | |||||||||||||

9

(1) The amounts for "total GFA" in this table are the amounts of total saleable GFA and are derived on the following basis:

| · | for properties that are sold, the stated GFA is based on that sales contracts relating to such property; |

| · | for unsold properties that are completed, the stated GFA is calculated based on the detailed construction blueprint and the calculation method approved by the PRC government for saleable GFA, after necessary adjustments; |

| · | for properties that are under planning, the stated GFA is based on the land grant contract and our internal projections. |

Suppliers

Land Use Rights

In China, the supply of land is controlled by the government. Since the early 2000s, the real estate industry in China has been transitioning from an arranged system controlled by the PRC government to a more market-oriented system. At present, although the Chinese government still owns all urban land in China, land use rights with terms up to 70 years, can be granted to, and owned or leased by, private individuals and companies. Generally, there are two ways the Company applies to acquire land use rights.

In July 2008, the Company acquired the land use rights of a bankrupt company, Hanzhong Energy Company, which covered an area of 30 acres in Hanzhong City. After the acquisition, the Company started the construction of its NanDajie project and part of Mingzhu Garden on the acquired land use rights, with a total Gross Floor Area ("GFA") of 42,476 square meters. The projects were completed in 2011.

In 2009, the Company successfully acquired additional land use rights covering 180 acres through bidding on an auction held by the local Land Consolidation and Rehabilitation Center of Hanzhong City. After the acquisition, the Company started the construction of its Mingzhu Garden project, which consisted of two large sub projects: Mingzhu Nanyuan and Mingzhu Beiyuanon. Both of these sub projects were further developed under multiple phases. As of September 30, 2011, a significant portion of Mingzhu Nanyuan has been completed while most of Mingzhu Beiyuan was still under construction.

In March 2011, the Company entered into a land use rights transfer agreement with Hanzhong Guangxia Real Estate Development Limited ("Hanzhong"), which is a related party controlled by our Chief Executive Officer and major shareholder Mr. Xiaojun Zhu. Pursuant to the agreement, Hanzhong agreed to transfer land use rights covering 66 acres (GFA 44,000 square meters) to the Company at the fair value of $12,509,380 (RMB80,000,000) based on an independent valuation report. The Company paid the full purchase price and received the land use rights in March, 2011. The land use rights were originally purchased by Hanzhong during 2001 - 2003.

In May 2011, the Company successfully acquired additional land use rights covering GFA 62,700 square meters through bidding on an auction held by the local Land Consolidation and Rehabilitation Center of Hanzhong City. After the acquisition, the Company planned to start the construction of Oriental Mingzhu Garden project. As of September 30, 2011, the Oriental Mingzhu Garden project is still in the preliminary planning stage.

In May 2011, the Company entered into a development agreement with the local government of Hanzhong City. Pursuant to the agreement, the Company is required to prepay the development cost of $18,717,163 (RMB119, 700,000) and obtain the right to acquire the land use rights through public bidding. The prepaid development cost will be deducted from the final purchase price of the land use rights. As of September 30, 2011, a deposit of $3,127,345 (RMB20, 000,000) had been paid by the Company with respect to such prepaid development cost. The public bidding has not yet occurred, and the Company has not yet acquired the property.

10

In August 2011, the Company entered into a land transfer agreement with an unrelated party Hanzhong Shijin Real Estate Development Limited ("Shijin"). Pursuant to the agreement, Shijin agreed to transfer certain land use rights to the Company for a total price of $7,114,711 (RMB45, 500,000). As of September 30, 2011, a deposit of $3,127,346 (RMB20, 000,000) had been paid by the Company with respect to such purchase price.

On November 18, 2011, the Company won two bids for certain land use rights by auction. The first bid is for the land use right for a parcel of land in Yangxian at a total consideration of approximately $9,578,700 (RMB 60,824,600). The land has a total area of 69,913 square meters. The second bid is for the land use rights for another parcel of land in the same area in Yangxian. The total consideration for the second bid is approximately $2,760,300 (RMB 17,528,000). The land has a total area of 20,863 square meters. Both of these sets of acquired land use rights will be used for the construction of multi-layer residential buildings.

All land transactions are required to be reported to and authorized by the Xi'an Bureau of Land and Natural Resources. As to real estate project design and construction services, the Company typically selects the lowest-cost provider based on quality selected through an open bidding process. Such service providers are numerous in China and the Company foresees no difficulties in securing alternative sources of services as needed.

Other Suppliers

The Company uses various suppliers in the construction of its projects. One supplier accounted for 20% and 38% of project expenditures for the years ended September 30, 2011 and 2010, respectively.

Competition

The real estate industry in China is highly competitive. In the Tier 3 and Tier 4 cities and counties that we focus on the markets are relatively more fragmented than in the Tier 1 or Tier 2 cities. We compete primarily with local and regional property developers and an increasing number of large national property developers who have also started to enter these markets. Competitive factors include the geographical location of the projects, the types of products offered, brand recognition, price, designing and quality. In the regional markets in which we operate, our major competitors include Wanbang Real Estate Development Co. Ltd., and other national real estate developers who have also started their projects in these local markets.

Nationally, there are numerous companies that have real estate projects across China. There are 55 housing and land development companies listed on the Shanghai and Shenzhen Stock Exchanges. However, such companies usually undertake large scale projects and are unlikely to compete with the Company for business as the Company targets small to medium sized projects in Tier 3-4 cities and counties.

In the regional market, the Company's only direct competitor with meaningful market share in the market is Wanbang Real Estate Development Co. Ltd. This company generally undertakes medium and small scale projects and focuses on development of commercial real estate properties, such as hotels and shopping centers. By the end of December 2010, Wanbang had developed realty of about 700 acres across Hangzhong City and other surrounding counties. As of September 30, 2011, Wanbang completed the construction of approximately 40,000 square meters of residential properties. Since April 2010, Wanbang has undertaken small government-supported projects, including the construction of residential apartments for low-income buyers.

Competitive Strengths:

We believe the following strengths allow us to compete effectively:

Well Positioned to Capture Opportunities in Tier 3 and Tier 4 Cities and Counties .

With the increase in consumer disposable income and urbanization rates, a growing middle-income consumer market has emerged driving demand for affordable and high quality housing in many cities across northwest China. We focus on building large communities of modern, mid-sized residential properties for this market segment and have accumulated substantial knowledge and experience about the residential preferences and demands of mid-income customers. We believe we can leverage our experience to capture the growth opportunities in the markets.

11

Standardized and Scalable Business Model.

Our business model focuses on a standardized property development process designed for rapid asset turnover. We break up the overall process into well-defined stages and closely monitor costs and development schedules through each stage. These stages include (i) identifying land, (ii) pre-planning and budgeting, (iii) land acquisition, (iv) detailed project design, (v) construction management, (vi) pre-sales, sales and (vii) after-sale service. We commence pre-planning and budgeting prior to the land acquisition, which enables us to acquire land at costs that meet our pre-set investment targeted returns and to quickly begin the development process upon acquisition. Our enterprise resource planning enables us to collect and analyze information on a real-time basis throughout the entire property development process. We utilize our customer relationship management system to track customer profiles and sales to forecast future individual preferences and market demand.

Experienced Management Team Supported by Trained and Motivated Workforce.

Our CEO and founder Mr. Xiaojun Zhu has over 15 years' experience in the real estate industry and has gained considerable strategic planning and business management expertise in the past decade. Our management and workforce are well-trained and motivated. Employees receive on-going training in their areas of specialization at our head office in Hanzhong.

Guangsha is also an "AAA Enterprise in Shaanxi Construction Industry", the highest credit ranking, as recognized by the Credit Association of Agricultural Bank of China, Shaanxi Branch.

Strategies

Our goal is to become the leading residential property developer focused on China's Tier 3 and Tier 4 cities and counties by implementing the following strategies:

Continue Expanding in Selected Tier 3 and Tier 4 Cities. We believe that Tier 3 and Tier 4 cities and counties present development opportunities that are well suited for our scalable business model of rapid asset turnover. Furthermore, Tier 3 and Tier 4 cities and counties currently tend to be in an early stage of market maturity and have fewer large national developers. We believe that the fragmented market and relative abundance of land supply in Tier 3 and Tier 4 cities, as compared to Tier I and 2 cities, offer more opportunities for us to generate attractive margins and we also believe that our experience affords us the opportunity to emerge as a leading developer in these markets. In the near future, we plan to enter into other Tier 3 and Tier 4 cities that have:

| · | Increasing urbanization rates and population growth; |

| · | High economic growth and increasing individual income; and |

| · | Sustainable land supply for future developments. |

We plan to continue to closely monitor our capital and cash positions and carefully manage our cost for land use rights, construction costs and operating expenses. We believe that we will be able to use our working capital more efficiently by adhering to prudent cost management, which will help to maintain our profit margins. When selecting a property project for development, we will continue to follow our established internal evaluation process, including utilizing the analysis and input of our experienced management team and choosing third-party contractors through a tender process open only to bids which meet our budgeted costs.

Quality Control

We emphasize quality control to ensure that our buildings and residential units meet our standards and provide high quality service. We select only experienced design and construction companies. We, through our contracts with construction contractors, provide customers with warranties covering the building structure and certain fittings and facilities of our property developments in accordance with the relevant regulations. To ensure construction quality, our construction contracts contain quality warranties and penalty provisions for poor work quality. In the event of delay or poor work quality, the contractor may be required to pay pre-agreed damages under our construction contracts. Our construction contracts do not allow our contractors to subcontract or transfer their contractual arrangements with us to third parties. We typically withhold 2% of the agreed construction fees for two to five years after completion of the construction as security to guarantee quality, which provides us assurance for our contractors' work quality.

12

Our contractors are also subject to our quality control procedures, including examination of materials and supplies, on-site inspection and production of progress reports. We require our contractors to comply with relevant PRC laws and regulations, as well as our own standards and specifications. We set up a profile for each and every unit constructed and monitor the quality of such unit throughout its construction period until its delivery. We also employ independent surveyors to supervise the construction progress. In addition, the construction of real estate projects is regularly inspected and supervised by the PRC governmental authorities.

Environmental Matters

As a developer of property in the PRC, we are subject to various environmental laws and regulations set by the PRC national, provincial and municipal governments. These include regulations on air pollution, noise emissions, as well as water and waste discharge. As of September 30, 2011, we have never paid any penalties associated with the breach of any such laws and regulations. Compliance with existing environmental laws and regulations has not had a material adverse effect on our financial condition and results of operations, and we do not believe it will have such an impact in the future.

Our projects are normally required to undergo an environmental impact assessment by government-appointed third parties, and a report of such assessment needs to be submitted to the relevant environmental authorities in order to obtain their approval before commencing construction.

Upon completion of each project, the relevant environmental authorities inspect the site to ensure the applicable environmental standards have been complied with, and the resulting report is presented together with other specified documents to the relevant construction administration authorities for their approval and record. Approval from the environmental authorities on such report is required before we can deliver our completed work to our customers. As of September 30, 2011, we have not experienced any difficulties in obtaining those approvals for commencement of construction and delivery of completed projects.

Employees

We currently have 87 full-time staff and employees.

Department | ||||

Management | 15 | |||

Accounting staff | 5 | |||

Sales and marketing staff | 60 | |||

Administrative | 7 | |||

Total | 87 | |||

13

ITEM 1A. RISK FACTORS

Risks Relating to Our Business

If we are unable to successfully manage our expansion into other Tier 3 and Tier 4 cities, we will not be able to execute our business plan.

Historically, our business and operations have been concentrated in Hanzhong City and other surrounding counties. If we are unable to successfully develop and sell projects outside Hanzhong City, our future growth may be limited and we may not generate adequate returns to cover our investments in these Tier 3 and Tier 4 cities. In addition, as we expand our operations to Tier 3 and Tier 4 cities with higher land prices, our costs may increase, which may lead to a decrease in our profit margin.

We require substantial capital resources to fund our land use rights acquisition and property developments, which may not be available.

Property development is capital intensive. Our ability to secure sufficient financing for land use rights acquisition and property development depends on a number of factors that are beyond our control, including market conditions in the capital markets, the PRC economy and the PRC government regulations that affect the availability and cost of financing for real estate companies.

In order to strengthen liquidity management and regulate money and credit supply, the People's Bank of China raised the RMB reserve requirement ratio for depository financial institutions from 13.5% as of September 30, 2009 to 18.5%, effective on December 20, 2010. Prior to December 2011, the People's Bank of China raised the reserve requirement ratio by an additional 1.5%. Effective on December 5, 2011, the People's Bank of China reduced the RMB reserve requirement ratio by 0.5%. The reserve requirement ratio refers to the amount of funds that banks must hold in reserve against deposits made by their customers. These increases in the reserve requirement ratio have reduced the amount of commercial bank credit available to businesses in China, including us.

We may be unable to acquire desired development sites at commercially reasonable costs.

Our revenue depends on the completion and sale of our projects, which in turn depends on our ability to acquire development sites. Our land use rights costs are a major component of our cost of real estate sales and increases in such costs could diminish our gross margin. In China, the PRC government controls the supply of land and regulates land sales and transfers in the secondary market. As a result, the policies of the PRC government, including those related to land supply and urban planning, affect our ability to acquire, and our costs of acquiring, land use rights for our projects. In recent years, the government has introduced various measures attempting to moderate investment in the property market in China.

Although we believe that these measures are generally targeted at the luxury property market and speculative purchases of land and properties, the PRC government could introduce other measures in the future that may adversely affect our ability to obtain land for development. We currently acquire our development sites primarily by bidding for government land. Under current regulations, land use rights acquired from government authorities for commercial and residential development purposes must be purchased through a public tender, auction or listing-for-sale. Competition in these bidding processes has resulted in higher land use rights costs for us. We may also need to acquire land use rights through acquisition, which could increase our costs. Moreover, the supply of potential development sites in any given city will diminish over time and we may find it increasingly difficult to identify and acquire attractive development sites at commercially reasonable costs in the future.

14

We provide guarantees for the mortgage loans of our customers which expose us to risks of default by our customers.

We pre-sell properties before actual completion and, in accordance with industry practice, our customers' mortgage banks require us to guarantee our customers' mortgage loans. Typically, we provide guarantees to PRC banks with respect to loans procured by the purchasers of our properties for the total mortgage loan amount until the completion of the registration of the mortgage with the relevant mortgage registration authorities, which generally occurs within six to twelve months after the purchasers take possession of the relevant properties. In line with what we believe to be industry practice, we rely on the credit evaluation conducted by mortgagee banks and do not conduct our own independent credit checks on our customers. The mortgagee banks typically require us to maintain, as restricted cash, 5% to 10% of the mortgage proceeds paid to us as security for our obligations under such guarantees (the security deposit).

If a purchaser defaults on its payment obligations during the term of our guarantee, the mortgagee bank may deduct the delinquent mortgage payment from the security deposit. If the delinquent mortgage payments exceed the security deposit, the banks may require us to pay the excess amount. If multiple purchasers default on their payment obligations at around the same time, we will be required to make significant payments to the banks to satisfy our guarantee obligations. If we are unable to resell the properties underlying defaulted mortgages on a timely basis or at prices higher than the amounts of our guarantees and related expenses, we will suffer financial losses.

We rely on third-party contractors.

Substantially all of our project construction and related work are outsourced to third-party contractors. We are exposed to risks that the performance of our contractors may not meet our standards or specifications. Negligence or poor work quality by any contractors may result in defects in our buildings or residential units, which could in turn cause us to suffer financial losses, harm our reputation or expose us to third-party claims. We work with multiple contractors on different projects and we cannot guarantee that we can effectively monitor their work at all times.

Although our construction and other contracts contain provisions designed to protect us, we may be unable to successfully enforce these rights and, even if we are able to successfully enforce these rights, the third-party contractor may not have sufficient financial resources to compensate us. Moreover, the contractors may undertake projects from other property developers, engage in risky undertakings or encounter financial or other difficulties, such as supply shortages, labor disputes or work accidents, which may cause delays in the completion of our property projects or increases in our costs.

We may be unable to complete our property developments on time or at all.

The progress and costs for a development project can be adversely affected by many factors, including, without limitation:

| · | delays in obtaining necessary licenses, permits or approvals from government agencies or authorities; |

| · | shortages of materials, equipment, contractors and skilled labor; |

| · | disputes with our third-party contractors; |

| · | failure by our third-party contractors to comply with our designs, specifications or standards; |

| · | difficult geological situations or other geotechnical issues; |

| · | onsite labor disputes or work accidents; and natural catastrophes or adverse weather conditions. |

Any construction delays, or failure to complete a project according to our planned specifications or budget, may delay our property sales, which could harm our revenues, cash flows and our reputation.

Changes of laws and regulations with respect to pre-sales may adversely affect our cash flow position and performance.

We depend on cash flows from pre-sale of properties as an important source of funding for our property projects and servicing our indebtedness. Under current PRC laws and regulations, property developers must fulfill certain conditions before they can commence pre-sale of the relevant properties and may only use pre-sale proceeds to finance the construction of specific developments.

15

Our results of operations may fluctuate from period to period.

Our results of operations tend to fluctuate from period to period. The number of properties that we can develop or complete during any particular period is limited due to the substantial capital required for land acquisition and construction, as well as the lengthy development periods required before positive cash flows may be generated. In addition, several properties that we have developed or that are under development are large scale and are developed in multiple phases over the course of one to several years. The selling prices of the residential units in larger scale property developments tend to change over time, which may impact our sales proceeds and, accordingly, our revenues for any given period.

We rely on our key management members.

We depend on the services provided by key management members. Competition for management talent is intense in the property development sector. In particular, we are highly dependent on Mr. Xiaojun Zhu, our founder, Chairman and Chief Executive Officer. We do not maintain key employee insurance. In the event that we lose the services of any key management member, we may be unable to identify and recruit suitable successors in a timely manner or at all, which will adversely affect our business and operations. Moreover, we need to employ and retain more management personnel to support our expansion into other Tier 3 and Tier 4 cities and counties. If we cannot attract and retain suitable human resources, especially at the management level, our business and future growth will be adversely affected.

Increases in the price of raw materials may increase our cost of sales and reduce our earnings.

Our third-party contractors are responsible for procuring almost all of the raw materials used in our project developments. Our construction contracts typically provide for fixed or capped payments, but the payments are subject to changes in government-suggested steel prices. The increase in steel prices could result in an increase in our construction cost. In addition, the increases in the price of raw materials, such as cement, concrete blocks and bricks, in the long run could be passed on to us by our contractors, which will increase our construction cost. Any such cost increase could reduce our earnings to the extent we are unable to pass these increased costs to our customers.

Any unauthorized use of our brand or trademark may adversely affect our business.

We own trademarks for " 汉中广厦 ", in the form of Chinese characters and our company logo. We rely on the PRC intellectual property and anti-unfair competition laws and contractual restrictions to protect brand name and trademarks. We believe our brand, trademarks and other intellectual property rights are important to our success. Any unauthorized use of our brand, trademarks and other intellectual property rights could harm our competitive advantages and business. Historically, China has not protected intellectual property rights to the same extent as the United States, and infringement of intellectual property rights continues to pose a serious risk of doing business in China. Monitoring and preventing unauthorized use is difficult. The measures we take to protect our intellectual property rights may not be adequate. Furthermore, the application of laws governing intellectual property rights in China and abroad is uncertain and evolving, and could involve substantial risks to us. If we are unable to adequately protect our brand, trademarks and other intellectual property rights, our reputation may be harmed and our business may be adversely affected.

We may fail to obtain, or may experience material delays in obtaining necessary government approvals for any major property development, which will adversely affect our business.

The real estate industry is strictly regulated by the PRC government. Property developers in China must abide by various laws and regulations, including implementation rules promulgated by local governments to enforce these laws and regulations. Before commencing, and during the course of, development of a property project, we need to apply for various licenses, permits, certificates and approvals, including land use rights certificates, construction site planning permits, construction work planning permits, construction permits, pre-sale permits and completion acceptance certificates. We need to satisfy various requirements to obtain these certificates and permits. To date, we have not encountered serious delays or difficulties in the process of applying for these certificates and permits, but we cannot guarantee that we will not encounter serious delays or difficulties in the future. In the event that we fail to obtain the necessary governmental approvals for any of our major property projects, or a serious delay occurs in the government's examination and approval progress, we may not be able to maintain our development schedule and our business and cash flows may be adversely affected.

16

We may forfeit land to the PRC government if we fail to comply with procedural requirements applicable to land grants from the government or the terms of the land use rights grant contracts.

According to the relevant PRC regulations, if we fail to develop a property project according to the terms of the land use rights grant contract, including those relating to the payment of land premiums, specified use of the land and the time for commencement and completion of the property development, the PRC government may issue a warning, may impose a penalty or may order us to forfeit the land. Specifically, under current PRC law, if we fail to commence development within one year after the commencement date stipulated in the land use rights grant contract, the relevant PRC land bureau may issue a warning notice to us and impose an idle land fee on the land of up to 20% of the land premium. If we fail to commence development within two years, the land will be subject to forfeiture to the PRC government, unless the delay in development is caused by government actions or force majeure. Even if the commencement of the land development is compliant with the land use rights grant contract, if the developed GFA on the land is less than one-third of the total GFA of the project or the total capital invested is less than one-fourth of the total investment of the project and the suspension of the development of the land continues for more than one year without government approval, the land will also be treated as idle land and be subject to penalty or forfeiture. We cannot assure you that circumstances leading to significant delays in our development schedule or forfeiture of land will not arise in the future. If we forfeit land, we will not only lose the opportunity to develop the property projects on such land, but may also lose all past investments in such land, including land premiums paid and development costs incurred.

Any non-compliant GFA of our uncompleted and future property developments will be subject to governmental approval and additional payments.

The local government authorities inspect property developments after their completion and issue the completion acceptance certificates if the developments are in compliance with the relevant laws and regulations. If the total constructed GFA of a property development exceeds the GFA originally authorized in the relevant land grant contracts or construction permit, or if the completed property contains built-up areas that do not conform with the plan authorized by the construction permit, the property developer may be required to pay additional amounts or take corrective actions with respect to such non-compliant GFA before a completion acceptance certificate can be issued to the property development.

Our failure to assist our customers in applying for property ownership certificates in a timely manner may lead to compensatory liabilities to our customers.

We are required to meet various requirements within 90 days after delivery of property, or such other period contracted with our customers, in order for our customers to apply for their property ownership certificates, including passing various governmental clearances, formalities and procedures. Under our sales contract, we are liable for any delay in the submission of the required documents as a result of our failure to meet such requirements, and are required to compensate our customers for delays. In the case of serious delays on one or more property projects, we may be required to pay significant compensation to our customers and our reputation may be adversely affected.

17

We are subject to potential environmental liability.

We are subject to a variety of laws and regulations concerning the protection of health and the environment. The particular environmental laws and regulations that apply to any given development site vary significantly according to the site's location and environmental condition, the present and former uses of the site and the nature of the adjoining properties. Environmental laws and conditions may result in delays, may cause us to incur substantial compliance and other costs and can prohibit or severely restrict project development activity in environmentally-sensitive regions or areas. Although the environmental investigations conducted by local environmental authorities have not revealed any environmental liability that we believe would have a material adverse effect on our business, financial condition or results of operations to date, it is possible that these investigations did not reveal all environmental liabilities and that there are material environmental liabilities of which we are unaware. We cannot assure you that future environmental investigations will not reveal material environmental liability. Also, we cannot assure you that the PRC government will not change the existing laws and regulations or impose additional or stricter laws or regulations, the compliance with which may cause us to incur significant capital expenditure.

We have never paid cash dividends and are not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

We need to improve our internal financial reporting controls. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth.

Lack of experience as officers of publicly-traded companies of our management team may hinder our ability to comply with Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act's internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies (other than smaller reporting companies) to obtain on the adequacy of the control system. This may not prevent us from obtaining an unqualified opinion on the presentation of the financial statements in accordance with U.S. Generally Accepted Accounting Principles.

Risk Relating to the Residential Property Industry in China

The PRC government may adopt further measures to slow the increase in prices of real property and real property development.

Along with the economic growth in China, investments in the property sectors have increased significantly in the past few years. In response to concerns over the scale of the increase in property investments, the PRC government has introduced policies to curtail property development. We believe the following regulations, among others, significantly affect the property industry in China.

18

These restrictive regulations and measures could increase our operating costs in adapting to these regulations and measures, limit our access to capital resources or even restrict our business operations. We cannot be certain that the PRC government will not issue additional and more stringent regulations or measures, which could further slow down property development in China and adversely affect our business and prospects.

We are heavily dependent on the performance of the residential property market in China, which is at a relatively early development stage.

The residential property industry in the PRC is still in a relatively early stage of development. Although demand for residential property in the PRC has been growing rapidly in recent years, such growth is often coupled with volatility in market conditions and fluctuation in property prices. It is extremely difficult to predict how much and when demand will develop, as many social, political, economic, legal and other factors, most of which are beyond our control, may affect the development of the market. The level of uncertainty is increased by the limited availability of accurate financial and market information as well as the overall low level of transparency in the PRC, especially in Tier 3 and 4 cities which have lagged in progress in these aspects when compared to Tier 1 cities.

The lack of a liquid secondary market for residential property may discourage investors from acquiring new properties. The limited amount of property mortgage financing available to PRC individuals may further inhibit demand for residential developments.

We face intense competition from other real estate developers.

The property industry in the PRC is highly competitive. In the Tier 3 and Tier 4 cities we focus on, local and regional property developers are our major competitors, and an increasing number of large state-owned and private national property developers have started entering these markets. Many of our competitors, especially the state-owned and private national property developers, are well capitalized and have greater financial, marketing and other resources than we have. Some also have larger land banks, greater economies of scale, broader name recognition, a longer track record and more established relationships in certain markets. In addition, the PRC government's recent measures designed to reduce land supply further increased competition for land among property developers.

Competition among property developers may result in increased costs for the acquisition of land for development, increased costs for raw materials, shortages of skilled contractors, oversupply of properties, decrease in property prices in certain parts of the PRC, a slowdown in the rate at which new property developments will be approved and/or reviewed by the relevant government authorities and an increase in administrative costs for hiring or retaining qualified personnel, any of which may adversely affect our business and financial condition. Furthermore, property developers that are better capitalized than we are may be more competitive in acquiring land through the auction process. If we cannot respond to changes in market conditions as promptly and effectively as our competitors, or effectively compete for land acquisition through the auction systems and acquire other factors of production, our business and financial condition will be adversely affected.

In addition, risk of property over-supply is increasing in parts of China, where property investment, trading and speculation have become overly active. We are exposed to the risk that in the event of actual or perceived over-supply, property prices may fall drastically, and our revenue and profitability will be adversely affected.