United States Securities and Exchange Commission

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One) |

R Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2014 |

or |

r Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ___________to ___________ |

Commission file number 001-00035 |

General Electric Company

|

New York | 14-0689340 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

| ||||

3135 Easton Turnpike, Fairfield, CT | 06828-0001 | 203/373-2211 | ||

(Address of principal executive offices) | (Zip Code) | (Telephone No.) | ||

Securities Registered Pursuant to Section 12(b) of the Act: | ||||

Title of each class | Name of each exchange on which registered | |||

Common stock, par value $0.06 per share | New York Stock Exchange | |||

Securities Registered Pursuant to Section 12(g) of the Act: |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes R No r

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes r No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No r

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No r

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10K. r

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer R | Accelerated filer r |

Non-accelerated filer r | Smaller reporting company r |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes r No R

The aggregate market value of the outstanding common equity of the registrant not held by affiliates as of the last business day of the registrant's most recently completed second fiscal quarter was at least $261.1 billion. There were 10,064,909,484 shares of voting common stock with a par value of $0.06 outstanding at January 31, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant's Annual Meeting of Shareowners, to be held April 22, 2015, is incorporated by reference into Part III to the extent described therein.

ABOUT GENERAL ELECTRIC |

ABOUT GENERAL ELECTRIC

ABOUT GENERAL ELECTRIC OUR BUSINESS AND HOW WE TALK ABOUT IT

We are one of the largest and most diversified infrastructure and financial services corporations in the world. With products and services ranging from aircraft engines, power generation, oil and gas production equipment, and household appliances to medical imaging, business and consumer financing and industrial products, we serve customers in approximately 175 countries and employ approximately 305,000 people worldwide. Since our incorporation in 1892, we have developed or acquired new technologies and services that have considerably broadened and changed the scope of our activities.

We believe that investors will gain a better understanding of our company if they understand how we measure and talk about our results. Because of the diversity in our businesses, we present our financial statements in a three- column format, which allows investors to see our industrial operations separately from our financial services operations. We believe that this provides useful information to investors. When used in this report, unless otherwise indicated by the context, we use the terms to mean the following:

| General Electric or the Company - the parent company, General Electric Company. |

| GE - the adding together of all affiliates other than General Electric Capital Corp., whose continuing operations are presented on a one-line basis, giving effect to the elimination of transactions among such affiliates. Transactions between GE and GECC have not been eliminated at the GE level. We present the results of GE in the center columns of our consolidated statements of earnings, financial position and cash flows. An example of a GE metric is GE cash from operating activities (GE CFOA). |

| General Electric Capital Corporation or GECC or Financial Services – the adding together of all affiliates of GECC, giving effect to the elimination of transactions among such affiliates. We present the results of GECC in the right- side columns of our consolidated statements of earnings, financial position and cash flows. It should be noted that GECC is sometimes referred to as GE Capital or Capital, when not in the context of discussing segment results. |

| GE consolidated – the adding together of GE and GECC, giving effect to the elimination of transactions between GE and GECC. We present the results of GE consolidated in the left side columns of our consolidated statements of earnings, financial position and cash flows. |

| Industrial – GE excluding GECC. We believe that this provides investors with a view as to the results of our industrial businesses and corporate items. An example of an Industrial metric is Industrial CFOA, which is GE CFOA excluding the effects of dividends from GECC. |

| Industrial segment – the sum of our seven industrial reporting segments shown below, without giving effect to the elimination of transactions among such segments. We believe that this provides investors with a view as to the results of our industrial segments, without inter-segment eliminations and corporate items. An example of an industrial segment metric is industrial segment revenue growth. |

| Total segment – the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions among such segments. We believe that this provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

GE 2014 FORM 10-K 19

ABOUT GENERAL ELECTRIC |

OUR INDUSTRIAL OPERATING SEGMENTS

| Power & Water |  | Aviation |  | Transportation |

| Oil & Gas |  | Healthcare |  | Appliances & Lighting |

| Energy Management |

OUR FINANCIAL SERVICES OPERATING SEGMENT

| GE Capital |

Business, operation and financial overviews for our operating segments are provided in the "Segment Operations" section within "Management's Discussion and Analysis of Financial Condition and Results of Operations" section of this Form 10-K Report.

OTHER TERMS USED BY GE

| Revenues – unless otherwise indicated, we refer to captions such as "revenues and other income", simply as revenues. |

| Organic revenues – revenues excluding the effects of acquisitions, dispositions and foreign currency exchange. |

| Earnings – unless otherwise indicated, we refer to captions such as "earnings from continuing operations attributable to the company" simply as earnings |

| Earnings per share – unless otherwise indicated, we refer to earnings per share as "earnings from continuing operations attributable to the company" simply as earnings per share |

| Operating earnings – GE earnings from continuing operations attributable to the company excluding the impact of non-operating pension costs. |

| Segment profit – refers to the operating profit of the industrial segments and the net earnings of the financial services segment. See page 30 for a description of the basis for segment profits. |

| Operating pension costs – comprise the service cost of benefits earned, prior service cost amortization and curtailment loss for our principal pension plans. |

| Non-operating pension costs – comprise the expected return on plan assets, interest cost on benefit obligations and net actuarial loss amortization for our principal pension plans. |

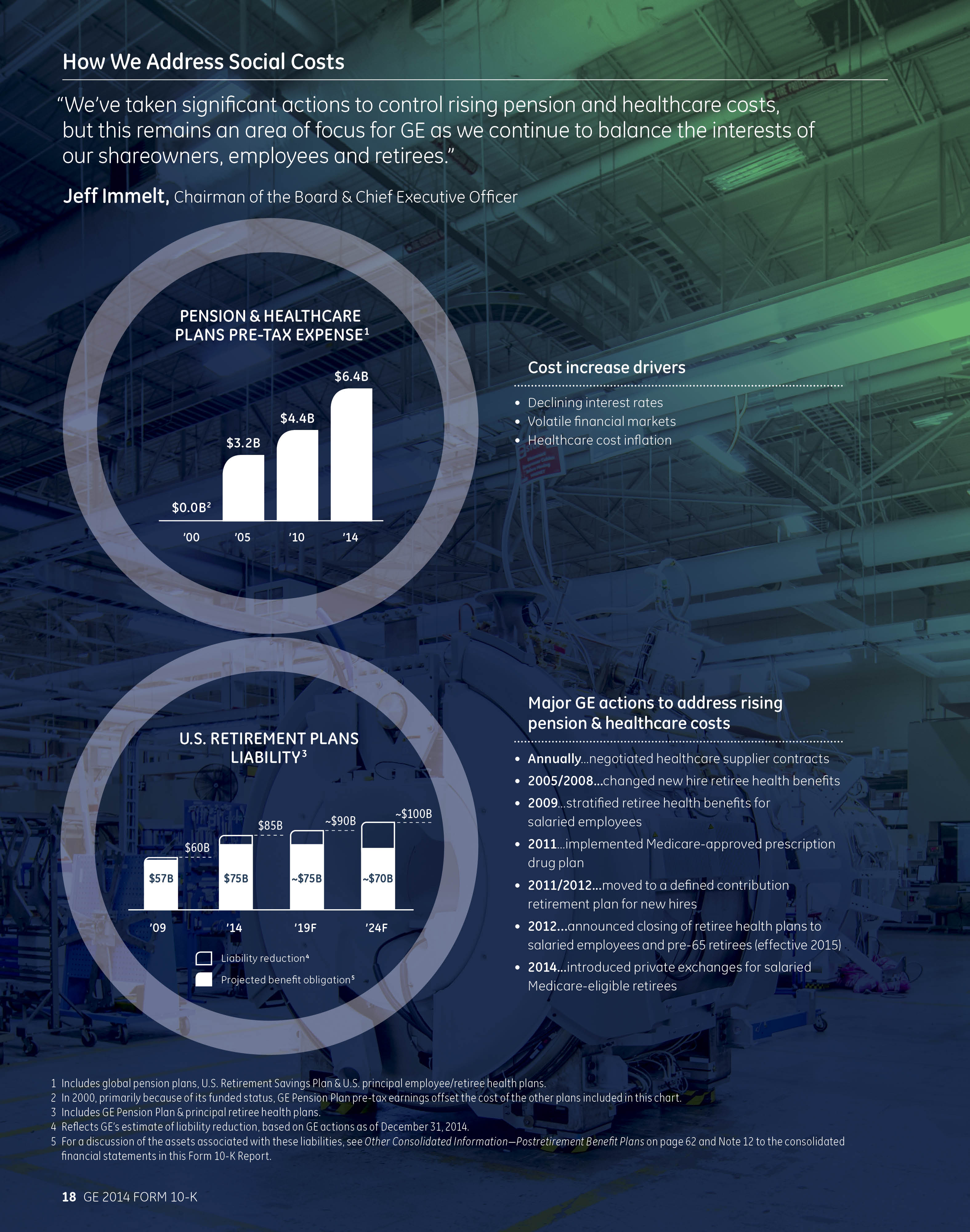

| Social cost – include the costs of our pension and healthcare costs for employees and retirees. |

GE 2014 FORM 10-K 20

ABOUT GENERAL ELECTRIC |

NON-GAAP FINANCIAL MEASURES

In the accompanying analysis of financial information, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered "non-GAAP financial measures" under the SEC rules. Specifically, we have referred, in various sections of this Form 10-K Report, to:

| Operating earnings and operating EPS |

| Industrial operating earnings |

| Industrial segment organic revenue growth |

| Industrial cash flows from operating activities (Industrial CFOA) |

| Operating and non-operating pension costs (income) |

| GE pre-tax earnings from continuing operations, excluding GECC earnings from continuing operations and the corresponding effective tax rates |

| GE Capital ending net investment (ENI), excluding liquidity |

| GECC Tier 1 common ratio estimate |

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the "Supplemental Information" section within the MD&A of this Form 10-K Report. Non-GAAP financial measures referred to in this Form 10-K Report are designated with an asterisk (*).

COMPETITIVE CONDITIONS AND ENVIRONMENT

In virtually all of our global business activities, we encounter aggressive and able competition. In many instances, the competitive climate is characterized by changing technology that requires continuing research and development. With respect to manufacturing operations, we believe that, in general, we are one of the leading firms in most of the major industries in which we participate. The businesses in which General Electric Capital Corporation (GECC) engages are subject to competition from various types of financial institutions, including commercial banks, thrifts, investment banks, broker-dealers, credit unions, leasing companies, consumer loan companies, independent finance companies, finance companies associated with manufacturers and insurance and reinsurance companies.

As a diverse global company, we are affected by world economies, instability in certain regions, commodity prices, such as the price of oil, and foreign currency volatility. Other factors impacting our business include:

| product development cycles for many of our products are long and product quality and efficiency are critical to success, |

| research and development expenditures are important to our business and |

| many of our products are subject to a number of regulatory standards. |

These factors are discussed throughout Management's Discussion and Analysis of Financial Condition and Results of Operations.

GE 2014 FORM 10-K 21

ABOUT GENERAL ELECTRIC |

OUR EMPLOYEES AND EMPLOYEE RELATIONS

At year-end 2014, General Electric Company and consolidated affiliates employed approximately 305,000 persons, of whom approximately 136,000 were employed in the United States. For further information about employees, see the "Other Financial Data" section of this Form 10K Report.

Approximately 16,400 GE manufacturing and service employees in the United States are represented for collective bargaining purposes by one of 11 unions (approximately 82 different locals within such unions). A majority of such employees are represented by union locals that are affiliated with the IUE-CWA, The Industrial Division of the Communication Workers of America, AFL-CIO, CLC. During 2011, we negotiated four-year agreements with most of our U.S. unions. Most of these contracts will terminate in June 2015, and we will be engaged in negotiations to attain new agreements. While results of 2015 union negotiations cannot be predicted, our recent past negotiations have resulted in agreements that increased costs.

Other GE affiliates are parties to labor contracts with various labor unions, also with varying terms and expiration dates that cover approximately 3,800 employees.

PROPERTIES

Manufacturing operations are carried out at approximately 227 manufacturing plants located in 39 states in the United States and Puerto Rico and at approximately 275 manufacturing plants located in 39 other countries.

CORPORATE INFORMATION AND WEBSITES

General Electric's address is 1 River Road, Schenectady, NY, 12345-6999; we also maintain executive offices at 3135 Easton Turnpike, Fairfield, CT 06828-0001.

The Company's Internet address is www.ge.com . Our annual report on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K, and amendments to those reports are available, without charge, on our website, www.ge.com/investor-relations/investor-services/personal-investing/sec-filing , as soon as reasonably practicable after they are filed electronically with the U.S. Securities and Exchange Commission (SEC). Copies are also available, without charge, from GE Corporate Investor Communications, 3135 Easton Turnpike, Fairfield, CT 06828-0001. Reports filed with the SEC may be viewed at www.sec.gov or obtained at the SEC Public Reference Room in Washington, D.C. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. References to our website addressed in this report are provided as a convenience and do not constitute, and should not be viewed as, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

General Electric Capital Corporation filed a Form 10-K Report with the SEC, and this can also be viewed at www.ge.com/investor-relations/investor-services/personal-investing/sec-filing .

GE's Investor Relations website at www.ge.com/investor-relations and our corporate blog at www.gereports.com , as well as GE's Facebook page and Twitter accounts, including @GE_Reports, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.

GE 2014 FORM 10-K 22

MD&A |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

PRESENTATION

The consolidated financial statements of General Electric Company (the Company) combine the industrial manufacturing and services businesses of General Electric Company (GE) with the financial services businesses of General Electric Capital Corporation (GECC or financial services). Unless otherwise indicated by the context, we use the terms "GE" and "GECC" on the basis of consolidation described in Note 1 to the consolidated financial statements in this Form 10-K Report.

Net earnings of GECC and the effect of transactions between segments are eliminated to arrive at total consolidated data.

Prior to January 28, 2011, we operated a media company, NBC Universal, Inc. (NBCU). Effective January 28, 2011, we held a 49% interest in a media entity that included the NBC Universal businesses (NBCU LLC). On March 19, 2013, we completed the sale of our remaining 49% common equity interest to Comcast Corporation.

We integrate acquisitions as quickly as possible. Revenues and earnings from the date we complete the acquisition through the end of the following fourth quarter are considered the acquisition effect of such businesses.

Discussion of GECC's total assets excludes deferred income tax liabilities, which are presented within assets for purposes of our consolidating statement of financial position presentations for this filing.

See the Glossary section of this Form 10-K for a definition of equipment and services sales as used in this Form 10-K Report as compared to the product and services split on the Statement of Earnings.

Amounts reported in billions in graphs and tables within this Form 10-K report are computed based on the amounts in millions. As a result, the sum of the components reported in billions may not equal the total amount reported in billions due to rounding.

Discussions throughout this MD&A are based on continuing operations unless otherwise noted.

REFERENCES

The MD&A should be read in conjunction with the Financial Statements and Notes to the consolidated financial statements.

For additional information related to GE Capital segment operations and the portfolio quality of financing receivables, refer to the General Electric Capital Corporation annual report on Form 10-K for the year ended December 31, 2014.

NON-GAAP FINANCIAL MEASURES

As discussed in the "About GE" section of this Form 10-K, we use certain "non-GAAP financial measures" throughout the MD&A. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the "Supplemental Information" section within the MD&A of this Form 10-K Report.

Non-GAAP financial measures referred to in this Form 10-K Report are designated with an asterisk (*).

GE 2014 FORM 10-K 23

MD&A | KEY PERFORMANCE INDICATORS |

KEY PERFORMANCE INDICATORS

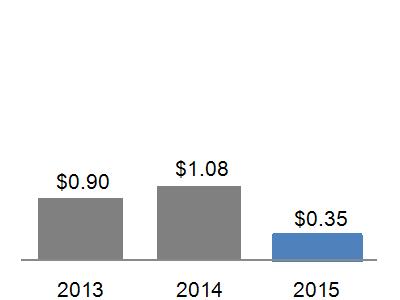

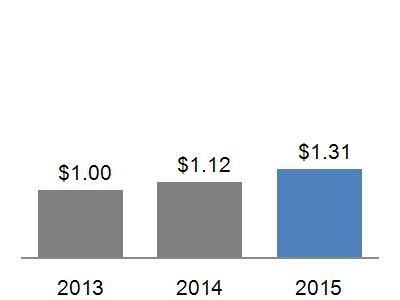

(Dollars in billions; per-share amounts in dollars)

REVENUES PERFORMANCE | EARNINGS PER SHARE | ||||

- - Earnings - - Operating Earnings *  | |||||

2013 | 2014 | ||||

Industrial Segment | 1% | 6% | |||

Industrial Segment Organic * | Flat | 7% | |||

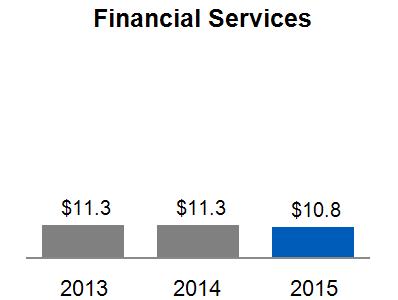

Financial Services |

(3)% |

(3)% | |||

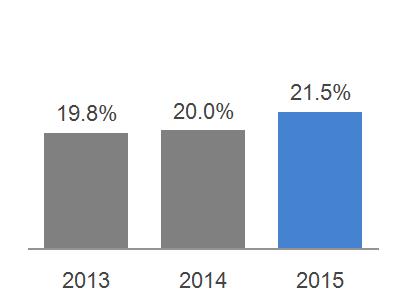

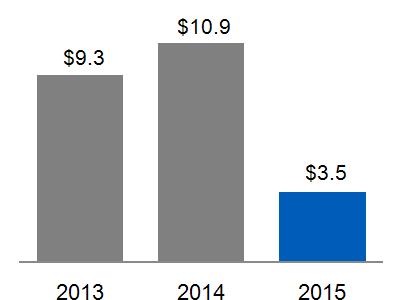

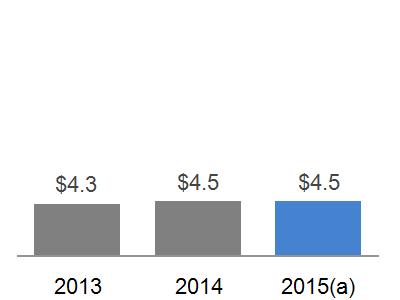

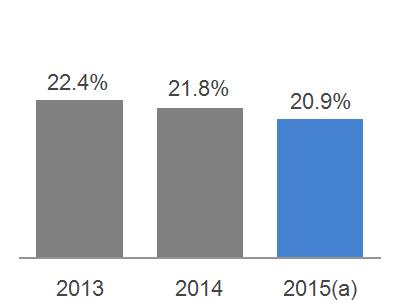

INDUSTRIAL SEGMENT PROFIT |

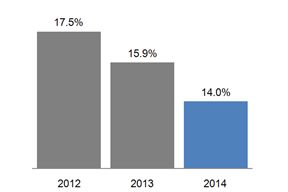

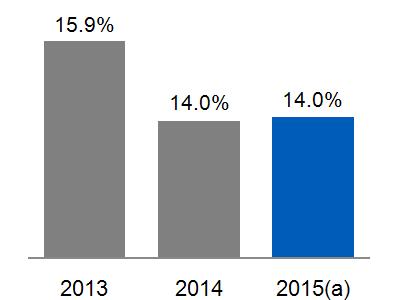

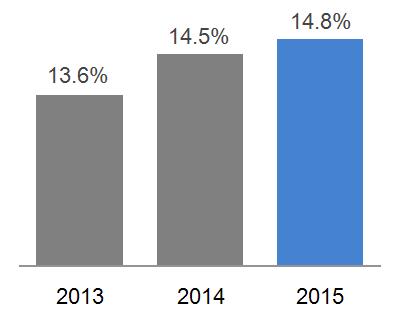

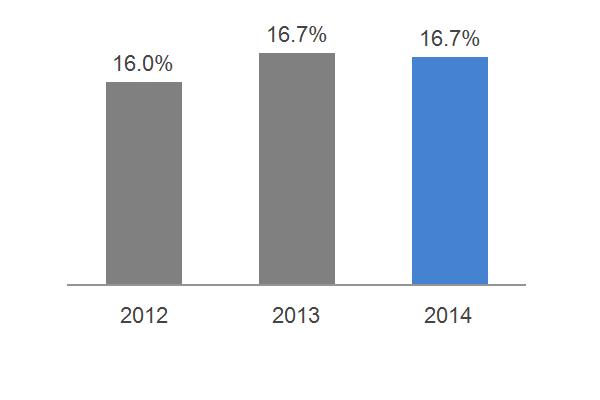

INDUSTRIAL SEGMENT MARGIN | ||||

|  | ||||

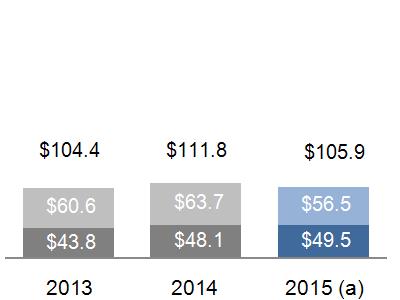

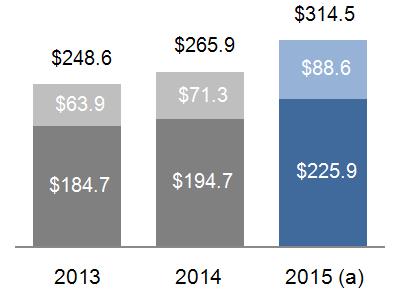

INDUSTRIAL ORDERS |

INDUSTRIAL BACKLOG | ||||

|

Equipment

Services |  | Equipment

Services | ||

*Non-GAAP Financial Measure

GE 2014 FORM 10-K 24

MD&A | KEY PERFORMANCE INDICATORS |

KEY PERFORMANCE INDICATORS

(Dollars in billions)

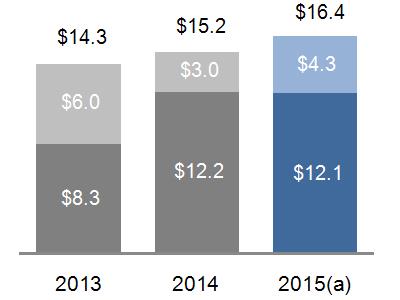

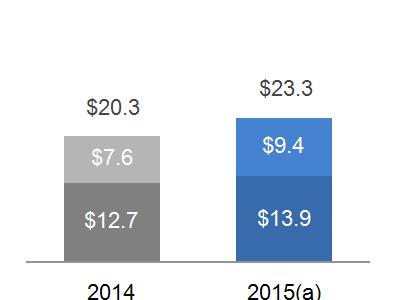

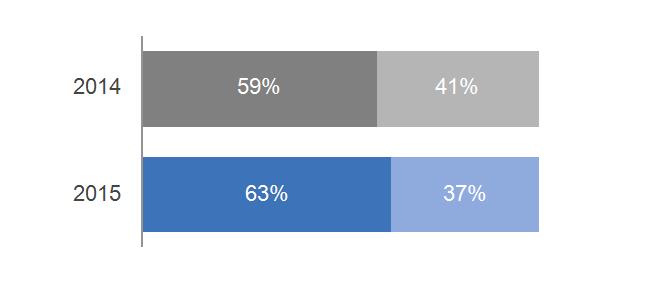

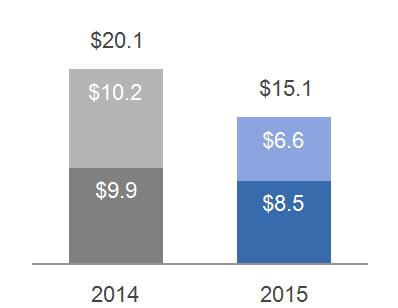

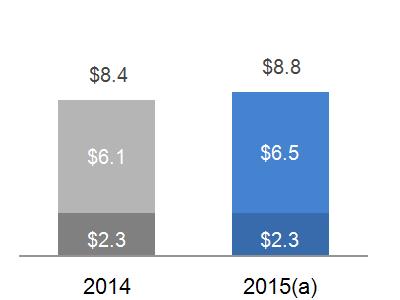

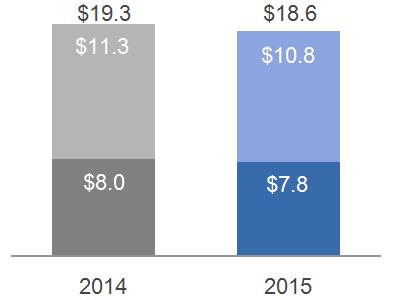

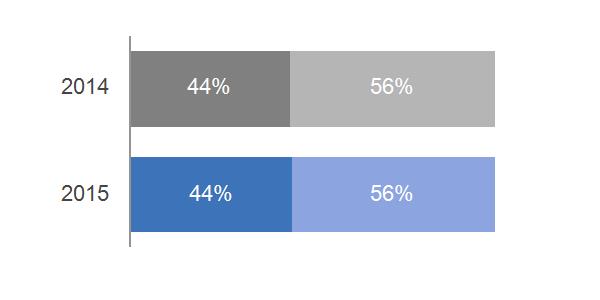

INDUSTRIAL/GE CAPITAL OPERATING EARNINGS* | |||

2014 Actual*  |

GE IS EXECUTING ON ITS STRATEGY TO ACHIEVE 75% OF ITS OPERATING EARNINGS FROM ITS INDUSTRIAL BUSINESSES BY 2016 .

The effects of the Synchrony Financial split-off and the Alstom acquisition and alliances will result in progression towards this target. | ||

2016 Goal  | |||

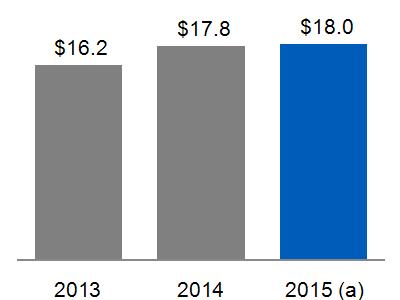

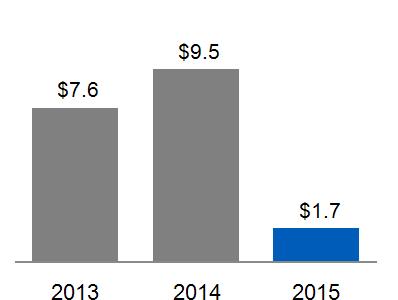

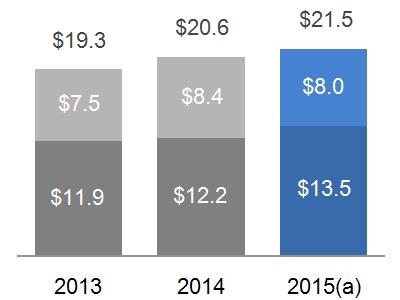

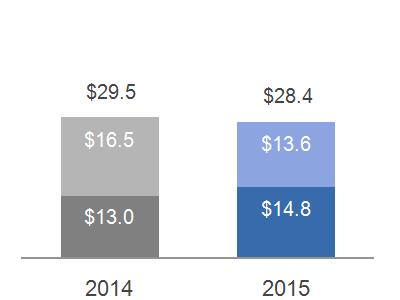

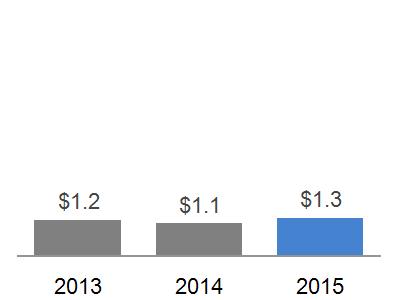

GE CFOA | SHAREHOLDER INFORMATION | ||

|

GECC Dividend

Industrial CFOA* |

RETURNED $10.8 BILLION TO SHAREOWNERS IN 2014

Dividends $8.9 billion Stock buyback $1.9 billion

ANNUAL MEETING

General Electric's 2015 Annual Meeting of Shareowners will be held on April 22, 2015, in Oklahoma City, Oklahoma. | |

2013 GE CFOA excluding NBC Universal deal-related taxes was $17.4 billion* | |||

*Non-GAAP Financial Measure

GE 2014 FORM 10-K 25

MD&A | KEY PERFORMANCE INDICATORS |

KEY PERFORMANCE INDICATORS

(Amounts in dollars)

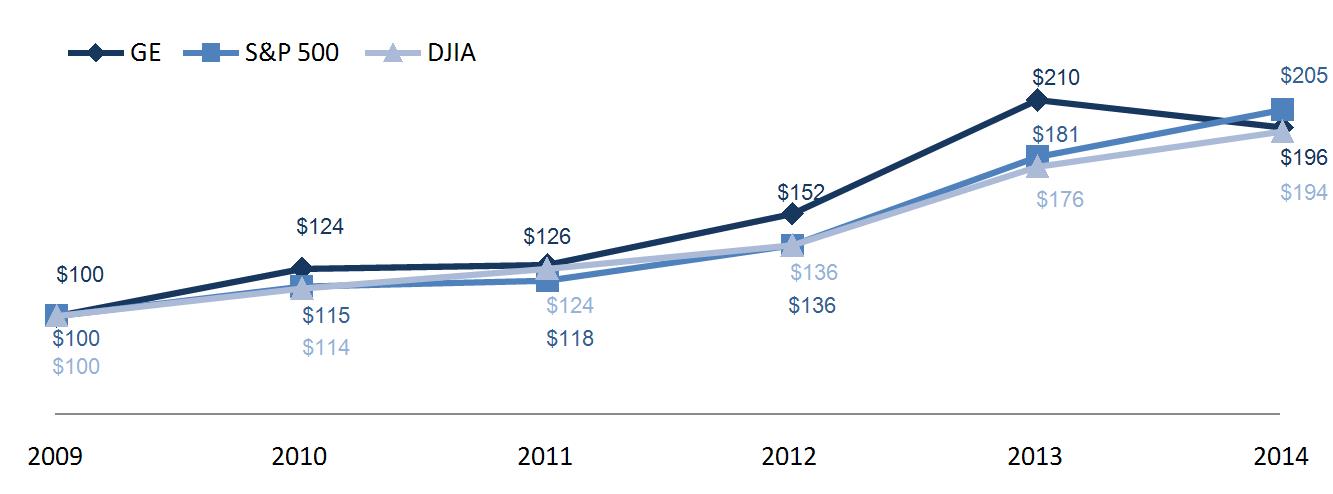

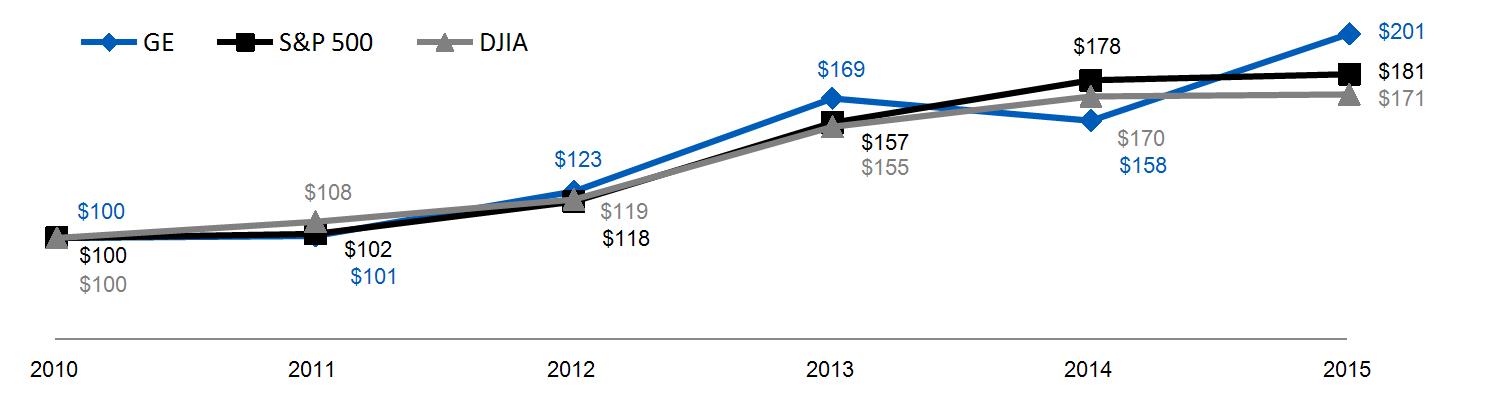

FIVE-YEAR PERFORMANCE GRAPH |

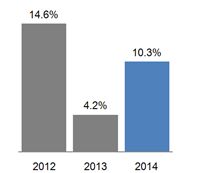

|

The annual changes for the five-year period shown in the graph on this page are based on the assumption that $100 had been invested in General Electric common stock, the Standard & Poor's 500 Stock Index (S&P 500) and the Dow Jones Industrial Average (DJIA) on December 31, 2009, and that all quarterly dividends were reinvested. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on December 31, 2014.

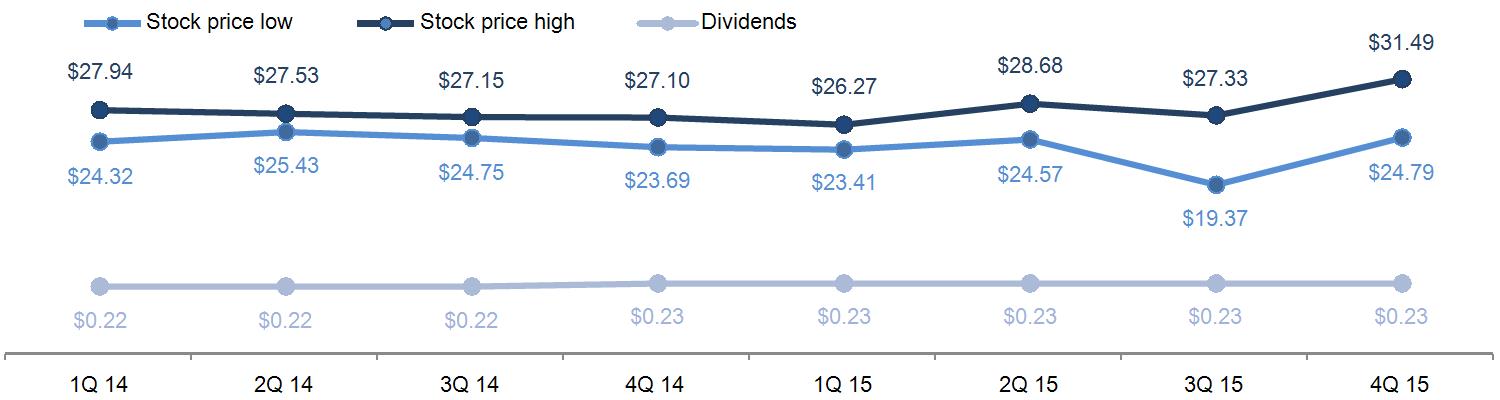

STOCK PRICE RANGE AND DIVIDENDS |

|

With respect to "Market Information," in the United States, General Electric common stock is listed on the New York Stock Exchange (its principal market). General Electric common stock is also listed on the London Stock Exchange and the Frankfurt Stock Exchange. The chart above shows trading prices, as reported on the New York Stock Exchange, Inc., Composite Transactions Tape.

As of January 31, 2015, there were approximately 480,000 shareowner accounts of record.

On February 6, 2015, our Board of Directors approved a quarterly dividend of $0.23 per share of common stock, which is payable April 27, 2015, to shareowners of record at close of business on February 23, 2015.

GE 2014 FORM 10-K 26

MD&A | CONSOLIDATED RESULTS |

CONSOLIDATED RESULTS

(Dollars in billions)

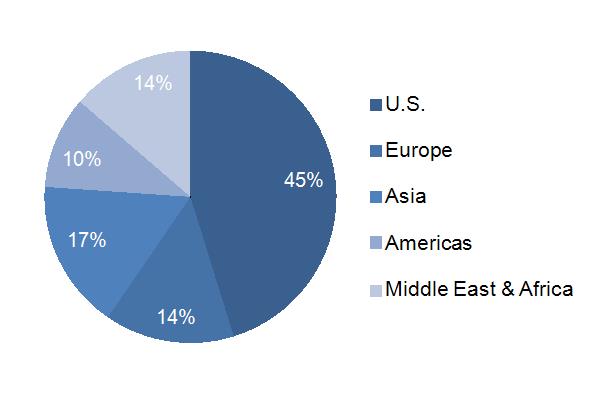

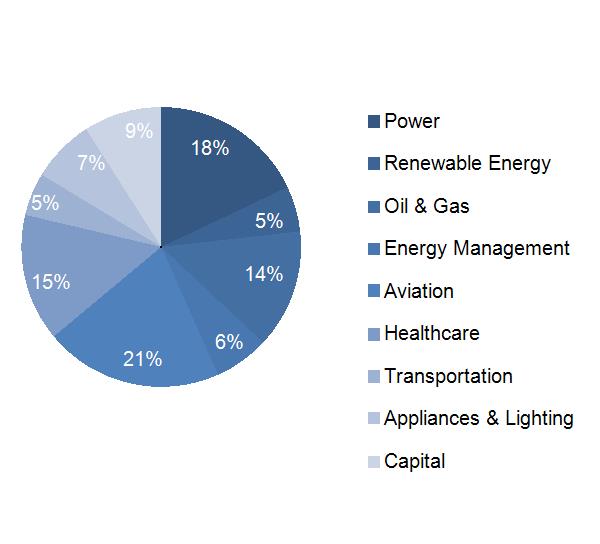

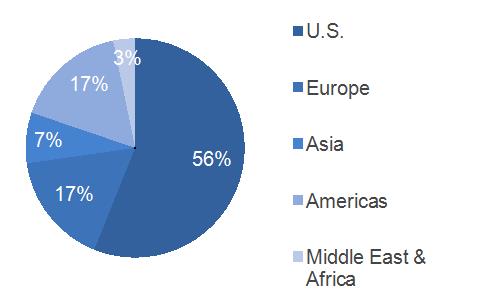

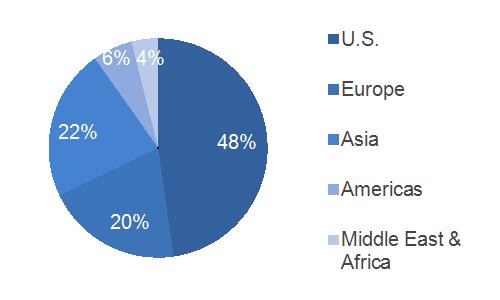

2014 GEOGRAPHIC REVENUES |

2014 SEGMENT REVENUES | |

|  |

SIGNIFICANT DEVELOPMENTS IN 2014 | |||

|

We completed the initial public offering of our North American Retail Finance business, Synchrony Financial, resulting in proceeds of $2.8 billion and target to complete the exit through a split-off transaction.

We sold GE Money Bank AB, our consumer finance business in Sweden, Denmark and Norway to Santander for $2.3 billion.

We acquired Milestone Aviation Group for $1.8 billion on January 30, 2015.

We signed an agreement to sell our consumer finance business in Hungary (Budapest Bank) to Hungary's government.

| ||

|

We agreed to sell our Appliances business to Electrolux for $3.3 billion; targeted to close in mid-2015.

| ||

|

We acquired Cameron's Reciprocating Compression division for $0.6 billion.

| ||

|

We acquired API Healthcare for $0.3 billion and certain Thermo Fisher Scientific Inc. life-science businesses for $1.1 billion.

| ||

|

We signed an agreement to sell our Signaling business to Alstom for approximately $0.8 billion.

| ||

|

We offered to acquire the Thermal, Renewables and Grid businesses of Alstom. The proposed transaction is targeted to close in 2015. See the "Segment Operations" section within the MD&A of this Form 10-K for additional information related to the proposed transaction.

| ||

GE 2014 FORM 10-K 27

MD&A | CONSOLIDATED RESULTS |

CONSOLIDATED RESULTS

(Dollars in billions)

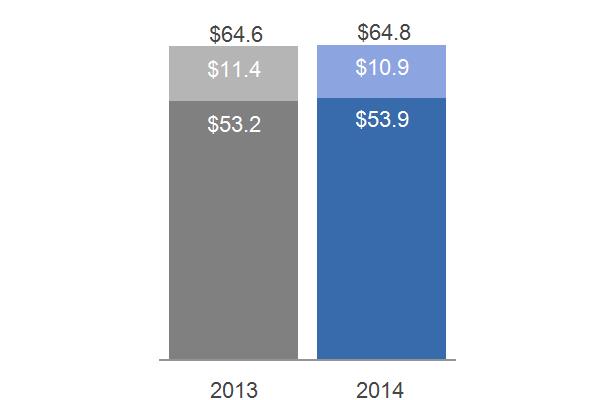

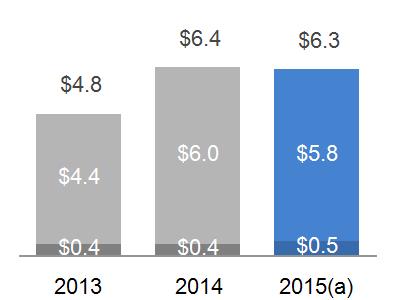

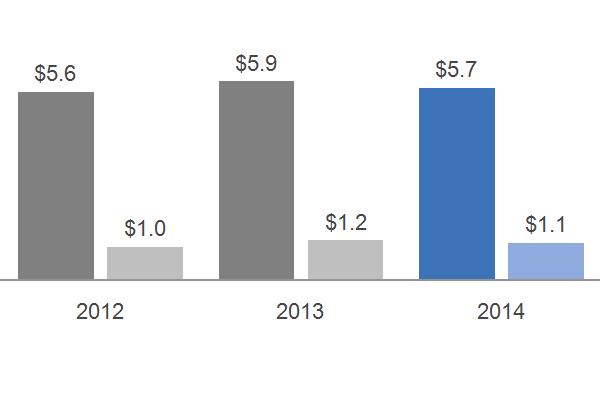

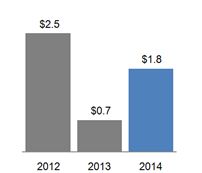

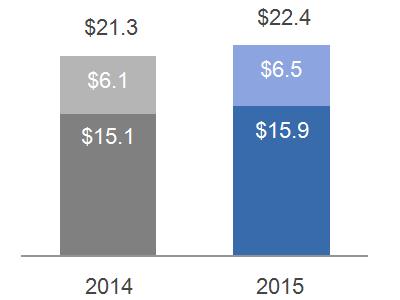

REVENUES | INDUSTRIAL SEGMENT EQUIPMENT & SERVICES REVENUES | ||

|  |

Equipment

Services | |

COMMENTARY: 2014 – 2013 |

2013 – 2012 | ||

Consolidated revenues increased $2.5 billion, or 2%.

Industrial segment revenues increased 6%, reflecting organic growth* of 7% and the effects of acquisitions (primarily Lufkin Industries, Inc. (Lufkin), Avio S.p.A. (Avio) and certain Thermo Fisher Scientific Inc. businesses).

Financial Services revenues decreased 3% as a result of the effects of dispositions, organic revenue declines, primarily due to lower ending net investment (ENI)* and lower gains, partially offset by lower impairments.

Other income decreased $2.3 billion, primarily due to the sale of our remaining 49% common equity interest in NBCU LLC in 2013 ($1.6 billion).

The effects of acquisitions increased consolidated revenues $1.7 billion and $1.6 billion in 2014 and 2013, respectively. Dispositions affected our ongoing results through lower revenues of $4.1 billion and $0.1 billion in 2014 and 2013, respectively.

The effects of a stronger U.S. dollar compared to mainly the Japanese yen, Canadian dollar and Brazilian real, partially offset by the British pound, decreased consolidated revenues by $0.9 billion. |

Consolidated revenues decreased $0.6 billion, or less than 1%.

Industrial segment revenues increased 1%. Organic revenue growth* was flat.

Financial Services revenues decreased 3%, as a result of organic revenue declines, primarily due to lower ENI* and higher impairments, partially offset by higher gains.

Other income increased $0.5 billion, primarily due to gains related to the sale of NBCU LLC.

The effects of acquisitions increased consolidated revenues $1.6 billion and $2.0 billion in 2013 and 2012, respectively. Dispositions affected our ongoing results through lower revenues of $0.1 billion and $5.1 billion in 2013 and 2012, respectively.

The effects of a stronger U.S. dollar compared to mainly the Japanese yen and Brazilian real, partially offset by the euro, decreased consolidated revenues by $0.5 billion. | ||

* Non-GAAP Financial Measure

GE 2014 FORM 10-K 28

MD&A | CONSOLIDATED RESULTS |

CONSOLIDATED RESULTS

(Dollars in billions)

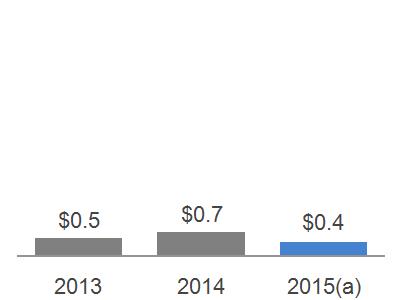

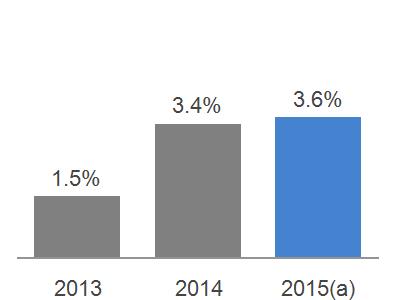

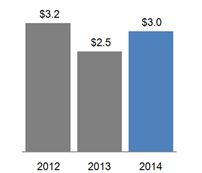

EARNINGS | INDUSTRIAL SELLING, GENERAL & ADIMINSTRATIVE (SG&A) AS A % OF SALES | |

- - Earnings - - Operating Earnings *  |  | |

COMMENTARY: 2014 – 2013 |

2013 – 2012 | |

Consolidated earnings increased 1% primarily due to an increase in the operating profit of the industrial segments, partially offset by lower financial services income and the absence of the NBCU LLC related income.

Industrial segment profit increased 10% with growth driven by Aviation, Oil & Gas and Power & Water.

Industrial segment margin increased 50 basis points (bps) driven by higher productivity and pricing, partially offset by negative business mix and the effects of inflation.

Financial Services earnings decreased 12% as a result of the effects of dispositions, core decreases and lower gains, partially offset by lower impairments and lower provisions for losses on financing receivables.

The effects of acquisitions on our consolidated net earnings were increases of $0.2 billion and $0.1 billion in 2014 and 2013, respectively. The effects of dispositions on net earnings were a decrease of $2.6 billion in 2014 and an increase of $1.4 billion in 2013.

Industrial SG&A as a percentage of total sales decreased to 14.0% as a result of global cost reduction initiatives, primarily at Power & Water and Healthcare. This was partially offset by higher acquisition-related costs. |

Consolidated earnings increased 4% on strong industrial segment growth and continued stabilization in financial services.

Industrial segment profit increased 5% with growth driven by Aviation and Oil & Gas.

Industrial segment margin increased 60 bps driven by higher pricing and favorable business mix, partially offset by the effects of inflation.

Financial Services earnings increased 10%, as a result of the effects of dispositions and higher gains, partially offset by higher impairments and higher provisions for losses on financing receivables.

The effects of acquisitions on our consolidated net earnings were increases of $0.1 billion in both 2013 and 2012. The effects of dispositions on net earnings were an increase of $1.4 billion in 2013 and a decrease of $0.3 billion in 2012.

Industrial SG&A as a percentage of total sales decreased to 15.9% as a result of global cost reduction initiatives related to simplification efforts both in the industrial segments and corporate. This was partially offset by increased acquisition-related costs and higher restructuring. |

See the "Other Consolidated Information" section within the MD&A of this Form 10-K for a discussion of postretirement benefit plans costs, income taxes and geographic data.

*Non-GAAP Financial Measure

GE 2014 FORM 10-K 29

MD&A | SEGMENT OPERATIONS |

SEGMENT OPERATIONS

SEGMENT REVENUES AND PROFIT

Segment revenues include both revenues and other income related to the segment.

Segment profit is determined based on internal performance measures used by the Chief Executive Officer (CEO) to assess the performance of each business in a given period. In connection with that assessment, the CEO may exclude matters such as charges for restructuring; rationalization and other similar expenses; acquisition costs and other related charges; technology and product development costs; certain gains and losses from acquisitions or dispositions; and litigation settlements or other charges, for which responsibility preceded the current management team.

Segment profit excludes results reported as discontinued operations and accounting changes. Segment profit also excludes the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries.

Segment profit excludes or includes interest and other financial charges and income taxes according to how a particular segment's management is measured:

| Interest and other financial charges and income taxes are excluded in determining segment profit (which we sometimes refer to as "operating profit") for the industrial segments. |

| Interest and other financial charges and income taxes are included in determining segment profit (which we sometimes refer to as "net earnings") for the GE Capital segment. |

Certain corporate costs, such as shared services, employee benefits and information technology are allocated to our segments based on usage. A portion of the remaining corporate costs are allocated based on each segment's relative net cost of operations.

Effective in the second quarter of 2014, we began including the effects of the GECC preferred stock dividends in our GE Capital segment. Previously, such dividends had been reported in the caption "Corporate items and eliminations" in the Company's Summary of Operating Segments table. Presenting GE Capital segment results including the effects of the GECC preferred stock dividends is consistent with the way management measures the results of our financial services business. Prior-period segment information has been recast to be consistent with how we currently evaluate the performance of the GE Capital segment.

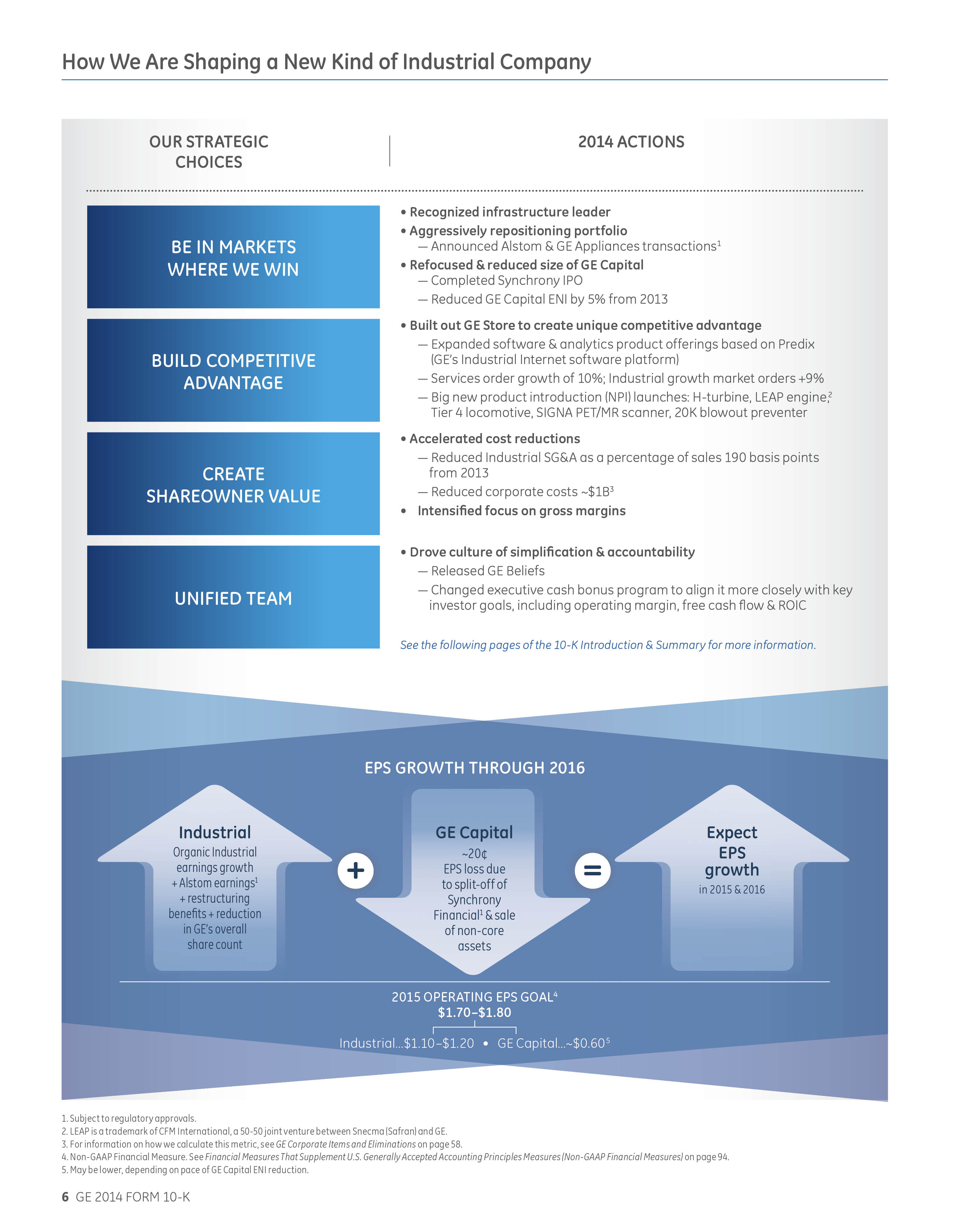

POTENTIAL ACQUISITIONS IMPACTING MULTIPLE SEGMENTS

GE's offer to acquire the Thermal, Renewables and Grid businesses of Alstom for approximately €12.4 billion (to be adjusted for the assumed net cash or liability at closing) was positively recommended by Alstom's board of directors. In addition, GE, Alstom and the French Government signed a memorandum of understanding for the formation of three joint ventures in grid technology, renewable energy, and global nuclear and French steam power and Alstom will invest approximately €2.6 billion in these joint ventures. In the fourth quarter of 2014, Alstom completed its review of the proposed transaction with the works council and obtained approval from its shareholders. Also in the fourth quarter of 2014, GE and Alstom entered into an amendment to the original agreement where GE has agreed to pay Alstom a net amount of approximately €0.3 billion of additional consideration at closing. In exchange for this funding, Alstom has agreed to extend the trademark licensing of the Alstom name from 5 years to 25 years as well as other contractual amendments. The proposed transaction continues to be subject to regulatory approvals. The transaction is targeted to close in 2015. The acquisition and alliances will impact our Power & Water and Energy Management segments.

GE 2014 FORM 10-K 30

MD&A | SEGMENT OPERATIONS |

SUMMARY OF OPERATING SEGMENTS | ||||||||||||||

General Electric Company and consolidated affiliates | ||||||||||||||

(In millions) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||

Revenues | ||||||||||||||

Power & Water | $ | 27,564 | $ | 24,724 | $ | 28,299 | $ | 25,675 | $ | 24,779 | ||||

Oil & Gas | 18,676 | 16,975 | 15,241 | 13,608 | 9,433 | |||||||||

Energy Management | 7,319 | 7,569 | 7,412 | 6,422 | 5,161 | |||||||||

Aviation | 23,990 | 21,911 | 19,994 | 18,859 | 17,619 | |||||||||

Healthcare | 18,299 | 18,200 | 18,290 | 18,083 | 16,897 | |||||||||

Transportation | 5,650 | 5,885 | 5,608 | 4,885 | 3,370 | |||||||||

Appliances & Lighting | 8,404 | 8,338 | 7,967 | 7,693 | 7,957 | |||||||||

Total industrial segment revenues | 109,902 | 103,602 | 102,811 | 95,225 | 85,216 | |||||||||

GE Capital | 42,725 | 44,067 | 45,364 | 48,324 | 49,163 | |||||||||

Total segment revenues | 152,627 | 147,669 | 148,175 | 143,549 | 134,379 | |||||||||

Corporate items and eliminations | (4,038) | (1,624) | (1,491) | 2,993 | 14,496 | |||||||||

Consolidated revenues | $ | 148,589 | $ | 146,045 | $ | 146,684 | $ | 146,542 | $ | 148,875 | ||||

Segment profit | ||||||||||||||

Power & Water | $ | 5,352 | $ | 4,992 | $ | 5,422 | $ | 5,021 | $ | 5,804 | ||||

Oil & Gas | 2,585 | 2,178 | 1,924 | 1,660 | 1,406 | |||||||||

Energy Management | 246 | 110 | 131 | 78 | 156 | |||||||||

Aviation | 4,973 | 4,345 | 3,747 | 3,512 | 3,304 | |||||||||

Healthcare | 3,047 | 3,048 | 2,920 | 2,803 | 2,741 | |||||||||

Transportation | 1,130 | 1,166 | 1,031 | 757 | 315 | |||||||||

Appliances & Lighting | 431 | 381 | 311 | 237 | 404 | |||||||||

Total industrial segment profit | 17,764 | 16,220 | 15,486 | 14,068 | 14,130 | |||||||||

GE Capital | 7,019 | 7,960 | 7,222 | 6,480 | 3,083 | |||||||||

Total segment profit | 24,783 | 24,180 | 22,708 | 20,548 | 17,213 | |||||||||

Corporate items and eliminations | (6,225) | (6,002) | (4,718) | (288) | (1,012) | |||||||||

GE interest and other financial charges | (1,579) | (1,333) | (1,353) | (1,299) | (1,600) | |||||||||

GE provision for income taxes | (1,634) | (1,668) | (2,013) | (4,839) | (2,024) | |||||||||

Earnings from continuing operations | ||||||||||||||

attributable to the Company | 15,345 | 15,177 | 14,624 | 14,122 | 12,577 | |||||||||

Earnings (loss) from discontinued | ||||||||||||||

operations, net of taxes | (112) | (2,120) | (983) | 29 | (933) | |||||||||

Consolidated net earnings | ||||||||||||||

attributable to the Company | $ | 15,233 | $ | 13,057 | $ | 13,641 | $ | 14,151 | $ | 11,644 | ||||

GE 2014 FORM 10-K 31

MD&A | SEGMENT OPERATIONS | POWER & WATER |

POWER & WATER

POWER & WATER BUSINESS OVERVIEW

Leader: Steve Bolze

| Headquarters & Operations

| |||

| Senior Vice President (SVP) and President & CEO, GE Power & Water Over 20 years of service with General Electric |  | 18% of segment revenues in 2014 25% of industrial segment revenues 30% of industrial segment profit Headquarters: Schenectady, NY Serving customers in125+ countries Employees: approximately 38,000 | |

Products & Services | |||

|

Power & Water serves power generation, industrial, government and other customers worldwide with products and services related to energy production and water reuse. Our products and technologies harness resources such as wind, oil, gas, diesel, nuclear and water to produce electric power.

| ||

| Power Generation Products and Services (PGP and PGS) – offers a wide spectrum of heavy-duty gas turbines and supplies machines and services for utilities, independent power producers, and industrial application, from pure power generation to cogeneration and district heating. |

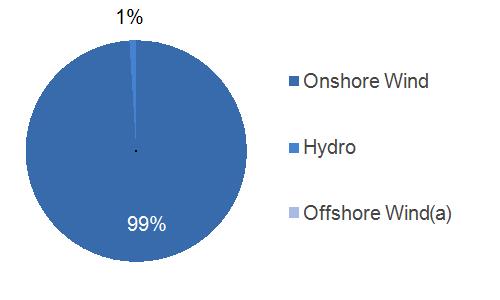

| Renewable Energy – primarily our Wind business, which manufactures wind turbines and provides support services ranging from development assistance to operation and maintenance. |

| Distributed Power – provides technology-based products to generate reliable and efficient power at or near the point of use. The product portfolio features aero derivative gas turbines, Jenbacher gas engines, and Waukesha gas engines. |

| Water Process Technologies – provides water treatment, wastewater treatment and process system solutions. |

| Nuclear – offers advanced reactor technologies solutions, including reactors, fuels and support services for boiling water reactors, and is offered through joint ventures with Hitachi and Toshiba, for safety, reliability and performance for nuclear fleets. |

Competition & Regulation |

Worldwide competition for power generation products and services is intense. Demand for power generation is global and, as a result, is sensitive to the economic and political environments of each country in which we do business.

Our Wind business is subject to certain global policies and regulation including the U.S. Production Tax Credit and incentive structures in China and various European countries. Changes in such policies may create unknown impacts or opportunities for the business.

GE 2014 FORM 10-K 32

MD&A | SEGMENT OPERATIONS | POWER & WATER |

OPERATIONAL OVERVIEW

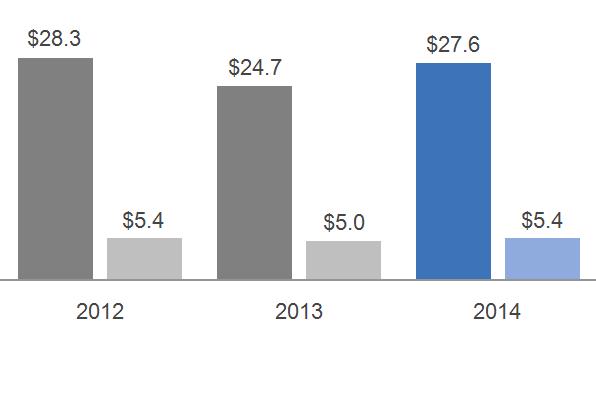

(Dollars in billions)

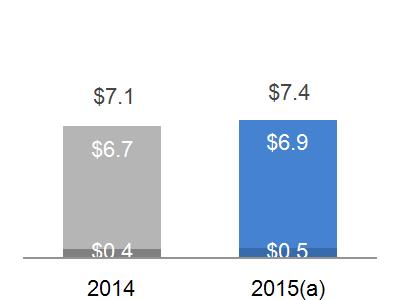

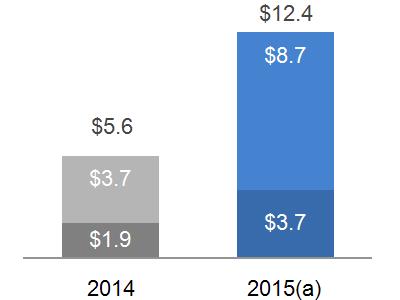

2014 GEOGRAPHIC REVENUES: $27.6 BILLION | ORDERS | ||

|

|

Equipment

Services | |

2014 SUB-SEGMENT REVENUES | BACKLOG | ||

|

|

Equipment

Services | |

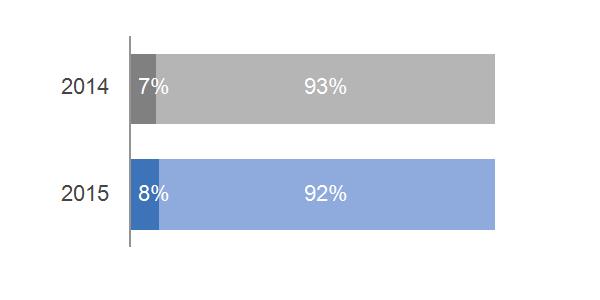

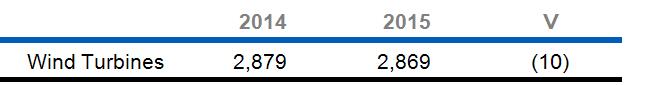

EQUIPMENT/SERVICES REVENUES | UNIT SALES | ||

|  | ||

Services Equipment | |||

SIGNIFICANT TRENDS & DEVELOPMENTS |

| The Alstom transaction is expected to advance our strategic priorities and industrial growth. Alstom's Thermal and Renewables businesses are complementary in technology, operations and geography to our business. We expect the integration to yield efficiencies in supply chain, service infrastructure, new product development and SG&A. |

| The business continues to invest in new product development, such as our new H-Turbine, larger wind turbines and advanced upgrades, to expand our equipment and services offerings. |

| Excess capacity in developed markets and macroeconomic and geopolitical environments result in uncertainty for the industry and business. |

|

|

GE 2014 FORM 10-K 33

MD&A | SEGMENT OPERATIONS | POWER & WATER |

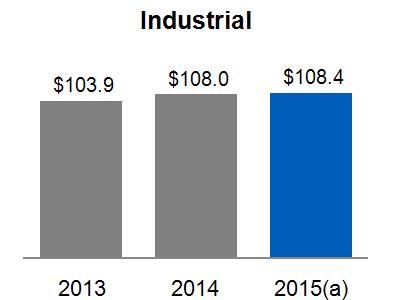

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN | |||||

|  | |||||

- - Revenue - - Profit

| ||||||

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: | |||||

2014 – 2013 | 2014 – 2013 | |||||

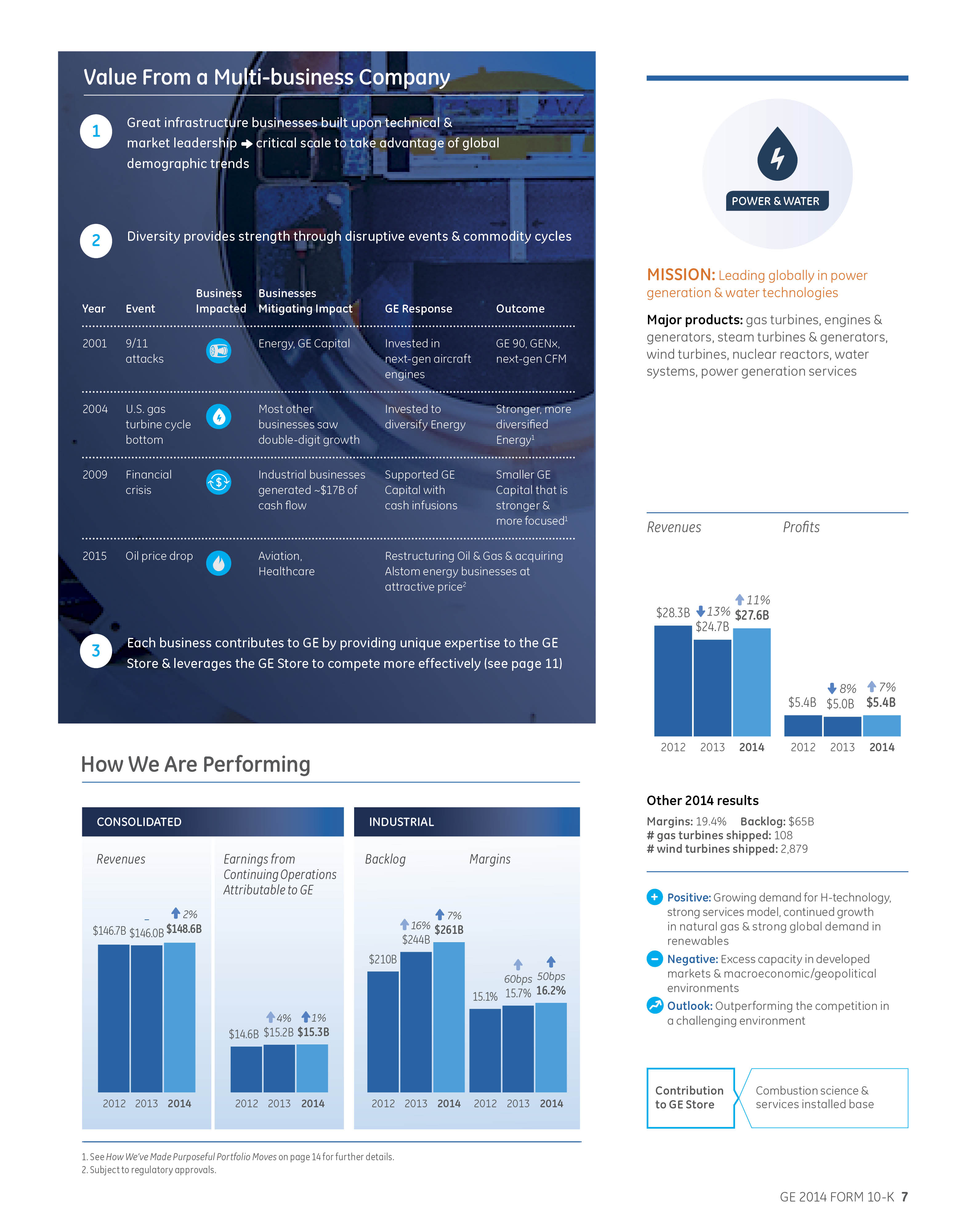

Segment revenues up $2.8 billion (11%); Segment profit up $0.4 billion (7%) as a result of:

The increase in revenues was driven by higher volume, primarily higher equipment sales at PGP and Renewables, partially offset by lower prices at PGP and Renewables and the impact of a stronger U.S. dollar.

The increase in profit was mainly due to the higher volume at PGP and Renewables, and higher productivity reflecting a 10% reduction in SG&A cost, partially offset by negative business mix with equipment revenue up 20% and lower prices. | ||||||

Revenues | Profit | |||||

2013 | $ | 24.7 | $ | 5.0 | ||

Volume | 3.7 | 0.7 | ||||

Price | (0.4) | (0.4) | ||||

Foreign Exchange | (0.2) | - | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | (0.5) | ||||

Productivity | N/A | 0.7 | ||||

Other | (0.2) | (0.2) | ||||

2014 | $ | 27.6 | $ | 5.4 | ||

2013 – 2012 | 2013 – 2012 | |||||

Segment revenues down $3.6 billion (13%); Segment profit down $0.4 billion (8%) as a result of:

The decrease in revenues was driven by lower volume, primarily equipment sales at PGP and Renewables, and the impact of a stronger U.S. dollar. These decreases were partially offset by higher prices and higher other income related to a sale of assets.

The decrease in profit was mainly due to lower volume, primarily equipment sales at PGP and Renewables, and lower productivity despite decreases in SG&A cost. These decreases were partially offset by positive business mix, the effects of deflation, higher prices and higher other income. | ||||||

Revenues | Profit | |||||

2012 | $ | 28.3 | $ | 5.4 | ||

Volume | (3.9) | (0.7) | ||||

Price | 0.2 | 0.2 | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | 0.2 | ||||

Mix | N/A | 0.3 | ||||

Productivity | N/A | (0.6) | ||||

Other | 0.2 | 0.2 | ||||

2013 | $ | 24.7 | $ | 5.0 | ||

GE 2014 FORM 10-K 34

MD&A | SEGMENT OPERATIONS | OIL & GAS |

OIL & GAS

OIL & GAS BUSINESS OVERVIEW

Leader: Lorenzo Simonelli

| Headquarters & Operations

| |||||

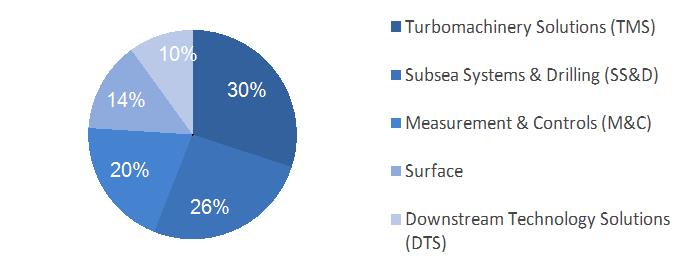

| President & CEO, GE Oil & Gas 20 years of service with General Electric |  | 12% of segment revenues in 2014 17% of industrial segment revenues 15% of industrial segment profit HQ: London, UK Serving customers in 150+ countries Employees: approximately 44,000 | |||

Products & Services | ||||||

| Oil & Gas serves all segments of the oil and gas industry, from drilling, completion, production and oil field operations, to transportation via liquefied natural gas (LNG) and pipelines. In addition, Oil & Gas provides industrial power generation and compression solutions to the refining and petrochemicals segments. Oil & Gas also delivers pipeline integrity solutions and a wide range of sensing, inspection and monitoring technologies. Oil & Gas exploits technological innovation from other GE businesses, such as Aviation and Healthcare, to continuously improve oil and gas industry performance, output and productivity. |

| Turbomachinery Solutions (TMS) – provides equipment and related services for mechanical-drive, compression and power-generation applications across the oil and gas industry. Our designs deliver high capacities and efficiencies, increase product flow and decrease both operational and environmental risks in the most extreme conditions, pressures and temperatures. Our portfolio includes drivers (aero-derivative gas turbines, heavy-duty gas turbines and synchronous and induction electric motors), compressors (centrifugal and axial, direct drive high speed, integrated, subsea compressors and turbo expanders), and turn-key solutions (industrial modules and waste heat recovery). |

| Drilling & Surface (D&S) – provides drilling, completion and production products and services for onshore & offshore oil & gas wells, and manufactures artificial lift equipment for well production and gears. The products & services portfolio includes blowout preventers, choke valves, drilling systems, drill stem valves, elastomers, pulsation dampeners wellheads, and surface production equipment. |

| Measurement & Controls (M&C) – provides equipment and services for a wide range of industries, including oil & gas, power generation, aerospace, metals, and transportation. The offerings include sensor-based measurement; non-destructive testing and inspection; flow and process control; turbine, generator and plant controls and condition monitoring, as well as pipeline integrity solutions. |

| Subsea Systems (SS) – offers our customers equipment and services for subsea well completion and production and integrated systems for enhanced recovery and comprehensive well lifecycle support. From new subsea field design and installation to mature field intervention and enhancement, SS offers all the equipment and expertise needed to safely and reliably maximize long-term resource value and overall efficiency. Specific products include flow control valves (known as "Christmas trees"), pressure control systems, wellheads, manifolds, integrated work over control systems and flexible subsea risers. |

| Downstream Technology Solutions (DTS) – provides products and services to serve the downstream segments of the industry including refining, petrochemical, distributed gas, and other industrial applications. Products include steam turbines, reciprocating and centrifugal compressors, blowers, pumps, valves, and compressed natural gas (CNG) and small-scale LNG solutions used primarily for shale oil and gas field development. |

Competition & Regulation |

GE 2014 FORM 10-K 35

MD&A | SEGMENT OPERATIONS | OIL & GAS |

OPERATIONAL OVERVIEW

(Dollars in billions)

2014 GEOGRAPHIC REVENUES: $18.7 BILLION | ORDERS | ||

|  |

Equipment

Services | |

2014 SUB-SEGMENT REVENUES | BACKLOG | ||

|  |

Equipment

Services | |

EQUIPMENT/SERVICES REVENUES | |||

Services Equipment | |||

SIGNIFICANT TRENDS & DEVELOPMENTS |

| On June 2, 2014, we acquired Cameron's Reciprocating Compression division for $0.6 billion. The division provides reciprocating compression equipment and aftermarket services for oil and gas production, gas processing, gas distribution and independent power industries. |

| In July 2013, we completed the acquisition of Lufkin, a leading provider of artificial lift technologies for the oil and gas industry and a manufacturer of gears, for $3.3 billion. Revenues for Lufkin are included in the D&S sub-segment. |

| Relatively lower oil prices leading to reductions in customers' forecasted capital expenditures create industry challenges, the effects of which are uncertain. |

| We are impacted by volatility in foreign currency exchange rates mainly due to a high concentration of non-U.S. dollar denominated business as well as long-term contracts denominated in multiple currencies. |

GE 2014 FORM 10-K 36

MD&A | SEGMENT OPERATIONS | OIL & GAS |

FINANCIAL OVERVIEW

(Dollars in billions)

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN | |||||

- - Revenue - - Profit

|  | |||||

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: | |||||

2014 – 2013 | 2014 – 2013 | |||||

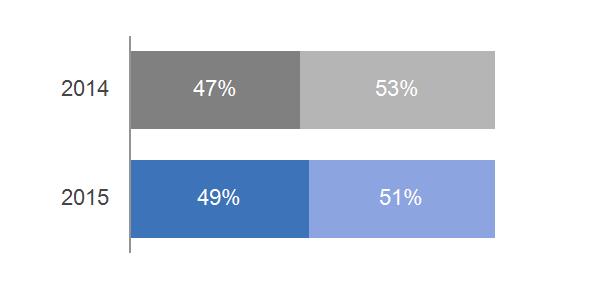

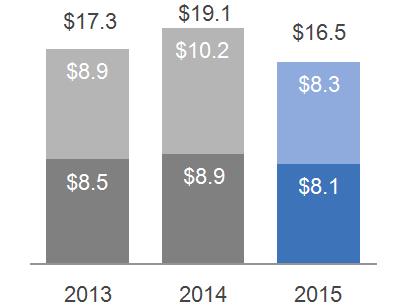

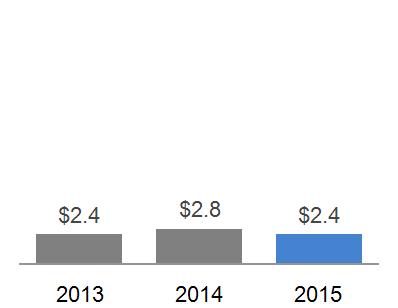

Segment revenues up $1.7 billion (10%); Segment profit up $0.4 billion (19%) as a result of:

The increase in revenues was primarily due to higher volume, mainly driven by higher equipment sales at SS, D&S and TMS, as well as the $0.3 billion net impact of acquisitions, primarily Lufkin, and dispositions, primarily Wayne. Higher prices primarily at SS also increased revenues. These increases were partially offset by the effects of a stronger U.S. dollar.

The increase in profit was primarily due to higher productivity, higher volume and higher prices. These increases were partially offset by negative business mix. | ||||||

Revenues | Profit | |||||

2013 | $ | 17.0 | $ | 2.2 | ||

Volume | 1.7 | 0.2 | ||||

Price | 0.1 | 0.1 | ||||

Foreign Exchange | (0.1) | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | (0.2) | ||||

Productivity | N/A | 0.4 | ||||

Other | - | - | ||||

2014 | $ | 18.7 | $ | 2.6 | ||

2013 – 2012 | 2013 – 2012 | |||||

Segment revenues up $1.7 billion (11%); Segment profit up $0.3 billion (13%) as a result of:

The increase in revenues was primarily due to higher volume, mainly driven by increased equipment sales as well as the impact of acquisitions ($0.7 billion), higher prices at TMS, and the effects of a weaker U.S. dollar.

The increase in profit was due to higher volume, which was positively impacted by acquisitions and organic growth in the SS and D&S business, as well as higher prices at TMS. This was partially offset by lower cost productivity. | ||||||

Revenues | Profit | |||||

2012 | $ | 15.2 | $ | 1.9 | ||

Volume | 1.5 | 0.2 | ||||

Price | 0.2 | 0.2 | ||||

Foreign Exchange | 0.1 | - | ||||

(Inflation)/Deflation | N/A | - | ||||

Mix | N/A | - | ||||

Productivity | N/A | (0.1) | ||||

Other | - | - | ||||

2013 | $ | 17.0 | $ | 2.2 | ||

GE 2014 FORM 10-K 37

MD&A | SEGMENT OPERATIONS | ENERGY MANAGEMENT |

ENERGY MANAGEMENT

ENERGY MANAGEMENT BUSINESS OVERVIEW

Leader: Mark W. Begor

| Headquarters & Operations

| ||||||||

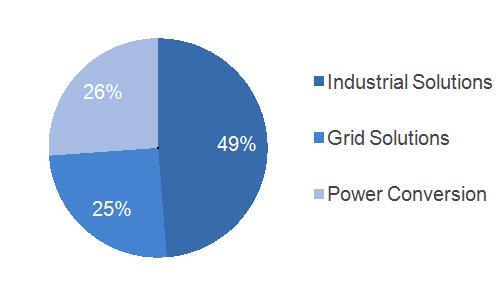

| President & CEO, GE Energy Management Over 30 years of service with General Electric |  | 5% of segment revenues in 2014 7% of industrial segment revenues 1% of industrial segment profit Headquarters: Atlanta, GA Serving customers in 150+ countries Employees: approximately 30,000 | ||||||

Products & Services | |||||||||

|

Energy Management designs, manufactures and services leading technology solutions for the delivery, management, conversion and optimization of electrical power. Our energy solutions allow customers across multiple energy-intensive industries such as oil & gas, marine, data centers, metals and mining to efficiently manage electricity from the point of generation to the point of consumption. | ||||||||

| Industrial Solutions – creates advanced technologies that safely, reliably and efficiently distribute and control electricity to protect people, property and equipment. We provide high performance software and control solutions and offer products such as circuit breakers, relays, arresters, switchgear, panel boards and repair for the commercial, data center, healthcare, mining, renewables, oil & gas, water and telecom markets. |

| Digital Energy – maximizes the reliability, efficiency and resiliency of the grid by preventing and detecting grid power failures, digitizing substations, and reducing outages. We provide advanced products and services that modernize the grid, from the power plant to the power consumer, such as protection and control, industrial strength communications, smart meters, monitoring & diagnostics, visualization software and advanced analytics. We provide high voltage and medium voltage (HV/MV) equipment, smart controls and sensors, software solutions and power projects for industries such as generation, transmission, distribution, oil and gas, telecommunication, mining and water. We currently have several strategic partnership ventures, primarily in Mexico and China, which allow us to support our customers through various product and service offerings. |

| Power Conversion – applies the science and systems of power conversion to help drive the electric transformation of the world's energy infrastructure. Our product portfolio includes motors, generators, automation & control equipment & drives for energy intensive industries such as marine, oil & gas, renewable energy, mining, rail, metals, test systems and water. |

Competition & Regulation |

Energy Management faces competition from businesses operating with global presence and with deep energy domain expertise. Our products and services sold to end customers are often subject to a number of regulatory specification and performance standards under different federal, state, foreign and energy industry standards.

GE 2014 FORM 10-K 38

MD&A | SEGMENT OPERATIONS | ENERGY MANAGEMENT |

OPERATIONAL OVERVIEW

(Dollars in billions)

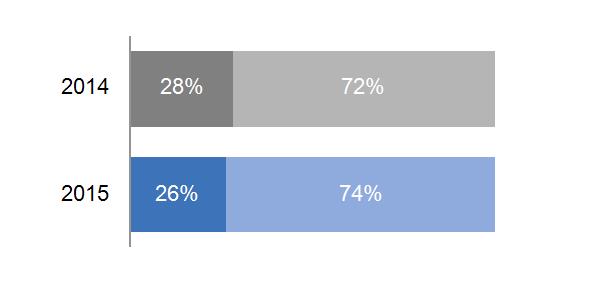

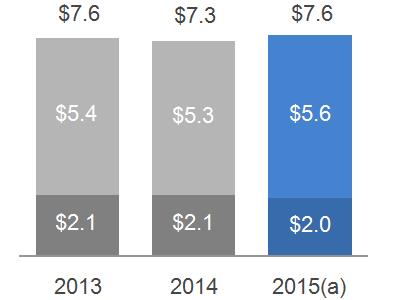

2014 GEOGRAPHIC REVENUES: $7.3 BILLION | ORDERS | ||

|  |

Equipment

Services | |

2014 SUB-SEGMENT REVENUES | BACKLOG | ||

|  |

Equipment

Services | |

EQUIPMENT/SERVICES REVENUES | |||

Services Equipment | |||

SIGNIFICANT TRENDS & DEVELOPMENTS |

| We are seeing growth in the liquefied natural gas, onshore electrification, offshore marine, and wind & solar industries, which is driving demand in our Power Conversion business for equipment and services. |

| While we see signs of growth in the North American electrical distribution market, the European economic recovery is slow, and demand remains soft in other parts of the developed world. |

| The U.S. electrical grid capacity is high and load growth is expected to be slow in the near term; spending by utilities in the U.S. continues to be focused more heavily on sustaining operations versus capital investment. |

| We plan to complement and expand the Digital Energy business with the acquisition of Alstom's Grid business. |

| We expect continued reinvestment in our key products to drive growth and continued margin accretion in 2015 and beyond. |

GE 2014 FORM 10-K 39

MD&A | SEGMENT OPERATIONS | ENERGY MANAGEMENT |

|

|

FINANCIAL OVERVIEW

(Dollars in billions)

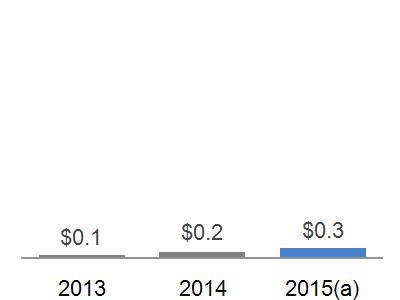

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN

| |

- - Revenue - - Profit

|

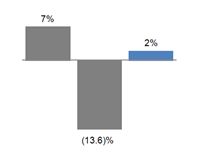

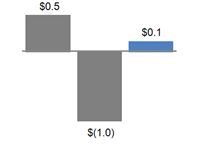

COMMENTARY: 2014 – 2013 |

2013 – 2012 | |

Segment revenues down $0.3 billion (3%) as a result of: Lower volume ($0.2 billion) from weakness in North American utility and electrical distribution markets, partially offset by higher sales in Power Conversion.

Segment profit up $0.1 billion as a result of : Higher productivity ($0.1 billion) reflecting an 8% reduction in SG&A cost.

|

Segment revenues up $0.2 billion (2%) as a result of: Higher volume ($0.2 billion), partially offset by the effects of the stronger U.S. dollar ($0.1 billion).

Segment profit down 16% as a result of : Lower productivity ($0.1 billion).

|

GE 2014 FORM 10-K 40

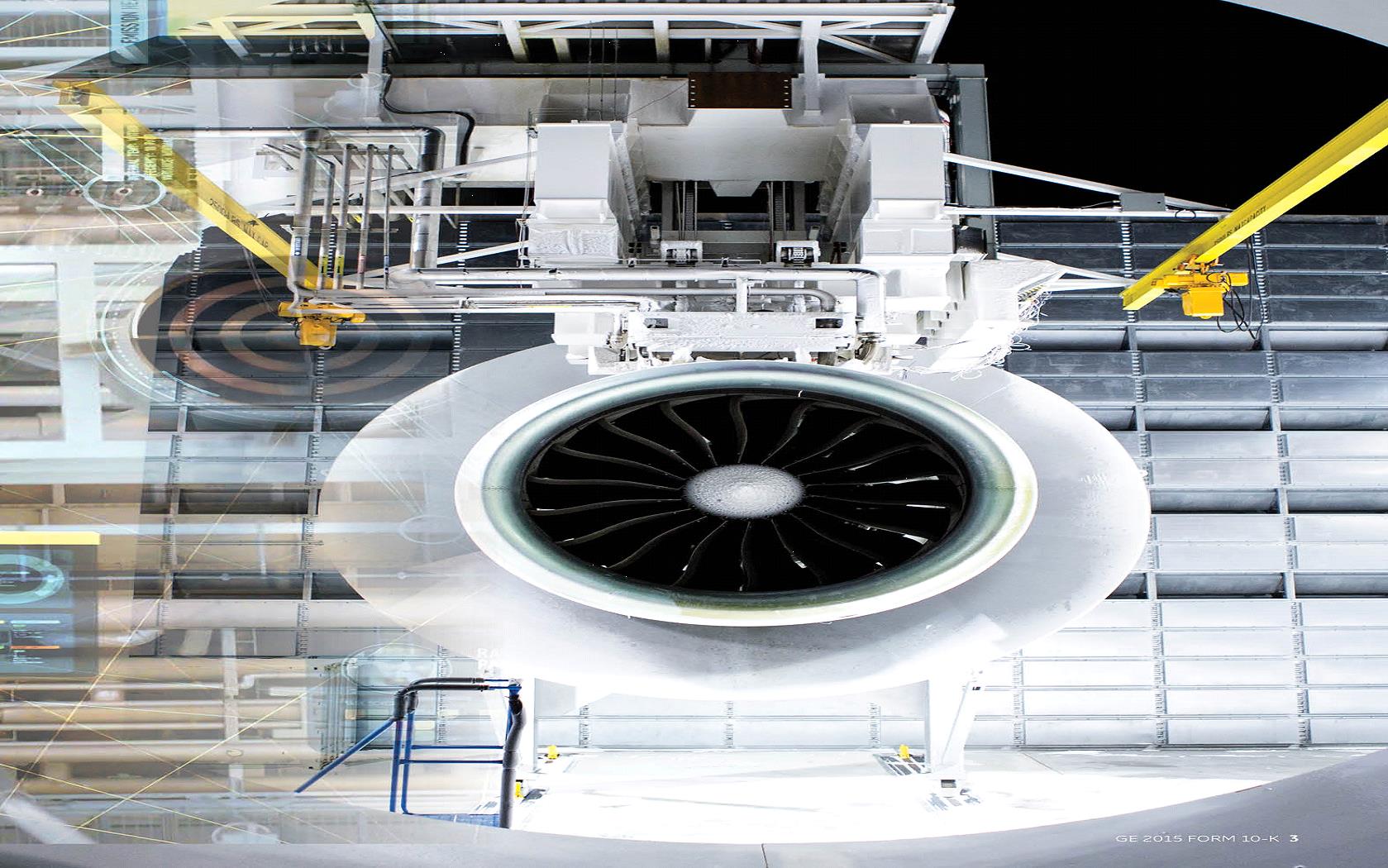

MD&A | SEGMENT OPERATIONS | AVIATION |

AVIATION

AVIATION BUSINESS OVERVIEW

Leader: David Joyce

| Headquarters & Operations

| ||||||||

| SVP and President & CEO, GE Aviation Over 30 years of service with General Electric |  | 16% of segment revenues in 2014 22% of industrial segment revenues 28% of industrial segment profit Headquarters: Cincinnati, OH Serving customers in 125+ countries Employees: approximately 44,000 | ||||||

Products & Services | |||||||||

|

Aviation designs and produces commercial and military aircraft engines, integrated digital components, electric power and mechanical aircraft systems. We also provide aftermarket services to support our products.

| ||||||||

| Commercial Engines (CEO) – manufactures jet engines and turboprops for commercial airframes. Our commercial engines power aircraft in all categories; regional, narrowbody and widebody. We also manufacture for Business and General Aviation segments. |

| Commercial Services – provides maintenance, component repair and overhaul services (MRO), including sales of replacement parts. |

| Military – manufactures jet engines for military airframes. Our military engines power a wide variety of military aircraft including fighters, bombers, tankers, helicopters and surveillance aircraft, as well as marine applications. We provide maintenance, component repair and overhaul services (MRO), including sales of replacement parts. |

| Systems – provides components, systems and services for commercial and military segments. This includes avionics systems, aviation electric power systems, flight efficiency and intelligent operation services, aircraft structures and Avio Aero. |

| We also produce and market engines through CFM International, a company jointly owned by GE and Snecma, a subsidiary of SAFRAN of France, and Engine Alliance, LLC, a company jointly owned by GE and the Pratt & Whitney division of United Technologies Corporation. New engines are also being designed and marketed in a joint venture with Honda Aero, Inc., a division of Honda Motor Co., Ltd. |

Competition & Regulation |

The global businesses for aircraft jet engines, maintenance component repair and overhaul services (including parts sales) are highly competitive. Both U.S. and non-U.S. markets are important to the growth and success of the business. Product development cycles are long and product quality and efficiency are critical to success. Research and development expenditures are important in this business, as are focused intellectual property strategies and protection of key aircraft engine design, manufacture, repair and product upgrade technologies. Aircraft engine orders and systems tend to follow military and airline procurement transactions.

Our product, services and activities are subject to a number of regulators such as by the U.S. Federal Aviation Administration (FAA), European Aviation Safety Agency (EASA) and other regulatory bodies.

GE 2014 FORM 10-K 41

MD&A | SEGMENT OPERATIONS | AVIATION |

OPERATIONAL OVERVIEW

(Dollars in billions)

2014 GEOGRAPHIC REVENUES: $24.0 BILLION | ORDERS | ||||

|

|

Equipment

Services | |||

2014 SUB-SEGMENT REVENUES | BACKLOG | ||||

|  |

Equipment

Services | |||

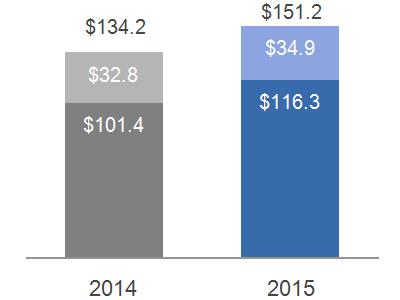

EQUIPMENT/SERVICES REVENUES | UNIT SALES | ||||

Services Equipment

|  (a) GEnx engines are a subset of commercial engines (b) Commercial spares shipment rate in millions of dollars per day | ||||

SIGNIFICANT TRENDS & DEVELOPMENTS | |||||

| On August 1, 2013, we completed the acquisition of the aviation business of Avio, a manufacturer of aviation propulsion components and systems for $4.4 billion. |

| We expect military shipments to be lower due to continued pressure on the U.S. military budget. |

| The installed base continues to grow with new product launches. |

| Lower fuel costs are expected to result in increased airline profitability and continued growth in passenger traffic and freight. |

| Revenue sharing programs are a standard form of cooperation for specific product programs in the aviation industry. These programs are controlled by Aviation, but counterparties (with interests ranging from 1% to 39%) have an agreed share of revenues as well as development and component production responsibilities. |

|

|

GE 2014 FORM 10-K 42

MD&A | SEGMENT OPERATIONS | AVIATION |

FINANCIAL OVERVIEW

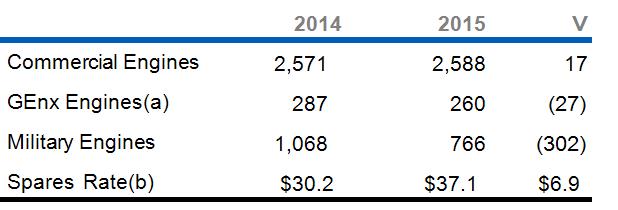

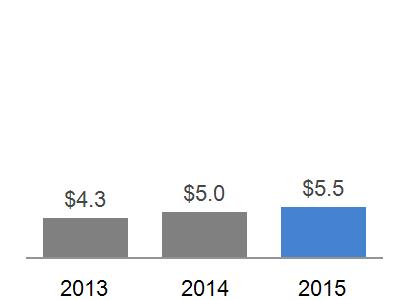

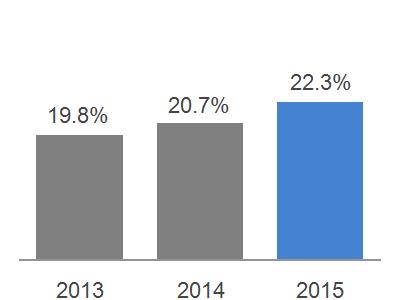

(Dollars in billions)

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN | |||||

- - Revenue - - Profit

|  | |||||

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: | |||||

2014 – 2013 | 2014 – 2013 | |||||

Segment revenues up $2.1 billion (9%); Segment profit up $0.6 billion (14%) as a result of:

The increase in revenues was due to higher volume and higher prices driven by Commercial Engines volume, spare parts volume and the third-quarter 2013 acquisition of Avio.

The increase in profit was mainly due to higher prices in our Commercial Engines and Commercial Services businesses and higher volume discussed above. These increases were partially offset by effects of inflation and negative business mix. | ||||||

Revenues | Profit | |||||

2013 | $ | 21.9 | $ | 4.3 | ||

Volume | 1.2 | 0.2 | ||||

Price | 0.8 | 0.8 | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | (0.3) | ||||

Mix | N/A | (0.2) | ||||

Productivity | N/A | - | ||||

Other | 0.1 | 0.1 | ||||

2014 | $ | 24.0 | $ | 5.0 | ||

2013 – 2012 | 2013 – 2012 | |||||

Segment revenues up $1.9 billion (10%) (including $0.5 billion from acquisitions); Segment profit up $0.6 billion (16%) as a result of:

The increase in revenues was primarily due to higher volume and higher prices. Higher volume and prices were driven by increased services revenues ($0.7 billion) and equipment ($1.2 billion). The increase in service revenue was primarily due to higher commercial spares sales, while the increase in equipment was primarily due to increased Commercial Engine shipments.

The increase in profit was due to higher prices, higher volume and increased other income, partially offset by the effects of inflation and lower cost productivity. | ||||||

Revenues | Profit | |||||

2012 | $ | 20.0 | $ | 3.7 | ||

Volume | 1.4 | 0.2 | ||||

Price | 0.6 | 0.6 | ||||

Foreign Exchange | - | - | ||||

(Inflation)/Deflation | N/A | (0.2) | ||||

Mix | N/A | - | ||||

Productivity | N/A | (0.1) | ||||

Other | - | 0.1 | ||||

2013 | $ | 21.9 | $ | 4.3 | ||

GE 2014 FORM 10-K 43

MD&A | SEGMENT OPERATIONS | HEALTHCARE |

HEALTHCARE

HEALTHCARE BUSINESS OVERVIEW

Leader: John L. Flannery

| Headquarters & Operations

| ||||||||

| President & CEO, GE Healthcare Over 25 years of service with General Electric |  | 12% of segment revenues in 2014 17% of industrial segment revenues 17% of industrial segment profit Headquarters: Little Chalfont, UK Serving customers in 140+ countries Employees: approximately 51,000 | ||||||

Products & Services | |||||||||

|

Healthcare provides essential healthcare technologies to developed and emerging markets and has expertise in medical imaging, software and information technology (IT), patient monitoring and diagnostics, drug discovery, biopharmaceutical manufacturing technologies and performance improvement solutions. Products and services are sold worldwide primarily to hospitals, medical facilities, pharmaceutical and biotechnology companies, and to the life science research market. | ||||||||

| Healthcare Systems – provides a wide range of technologies and services that include diagnostic imaging and clinical systems. Diagnostic imaging systems such as X-ray, digital mammography, computed tomography (CT), magnetic resonance (MR), interventional imaging and molecular imaging technologies allow clinicians to see inside the human body more clearly. Clinical systems such as ultrasound, electrocardiography (ECG), bone densitometry, patient monitoring, incubators and infant warmers, respiratory care, and anesthesia management that enable clinicians to provide better care for patients every day - from wellness screening to advanced diagnostics to life-saving treatment. Healthcare systems also offers product services that include remote diagnostic and repair services for medical equipment manufactured by GE and by others. |

| Life Sciences – delivers products and services for drug discovery, biopharmaceutical manufacturing and cellular technologies, so scientists and specialists discover new ways to predict, diagnose and treat disease. It also researches, manufactures and markets innovative imaging agents used during medical scanning procedures to highlight organs, tissue and functions inside the human body, to aid physicians in the early detection, diagnosis and management of disease through advanced in-vivo and in-vitro diagnostics. |

| Healthcare IT – provides IT solutions including enterprise and departmental Information Technology products, Picture Archiving System (PACS), Radiology Information System (RIS), Cardiovascular Information System (CVIS), revenue cycle management and practice applications, to help customers streamline healthcare costs and improve the quality of care. |

Competition & Regulation |

Healthcare competes with a variety of U.S. and non-U.S. manufacturers and services providers. Customers require products and services that allow them to provide better access to healthcare, improve the affordability of care, and improve the quality of patient outcomes. Technology innovation to provide products that improve these customer requirements and competitive pricing are among the key factors affecting competition for these products and services. New technologies could make our products and services obsolete unless we continue to develop new and improved products and services.

Our products are subject to regulation by numerous government agencies, including the U.S. Food and Drug Administration (U.S. FDA), as well as various laws that apply to claims submitted under Medicare, Medicaid or other government funded healthcare programs.

GE 2014 FORM 10-K 44

MD&A | SEGMENT OPERATIONS | HEALTHCARE |

OPERATIONAL OVERVIEW

(Dollars in billions)

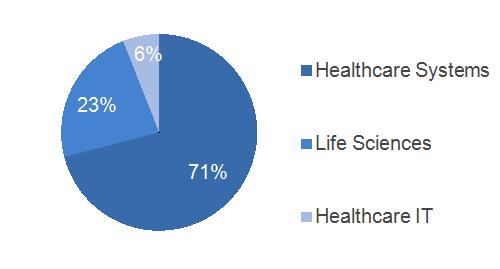

2014 GEOGRAPHIC REVENUES: $18.3 BILLION | ORDERS | ||

|  |

Equipment

Services | |

2014 SUB-SEGMENT REVENUES | BACKLOG | ||

|  |

Equipment

Services | |

EQUIPMENT/SERVICES REVENUES | |||

Services Equipment | |||

SIGNIFICANT TRENDS & DEVELOPMENTS |

| We continue to lead in technology innovation with greater focus on productivity based technology, services, and IT solutions as healthcare providers seek greater productivity and efficiency. |

| The U.S. market is improving but uncertainty remains regarding the impact of the Affordable Care Act. Emerging markets are expected to grow long-term with short-term volatility. |

| API Healthcare (API), a healthcare workforce management software and analytics solutions provider, was acquired in February 2014 for $0.3 billion. |

| Life Sciences is expanding its business through bioprocess growth and the acquisition of certain Thermo Fisher Scientific Inc. life-science businesses, which were acquired in March 2014 for $1.1 billion. |

GE 2014 FORM 10-K 45

MD&A | SEGMENT OPERATIONS | HEALTHCARE |

FINANCIAL OVERVIEW

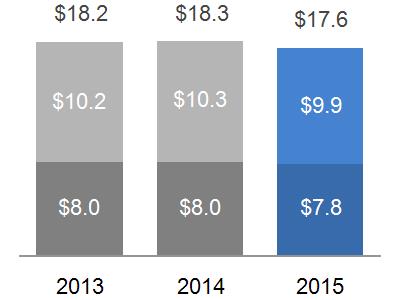

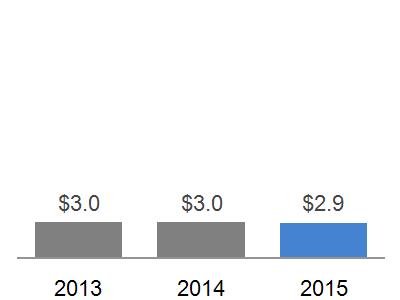

(Dollars in billions)

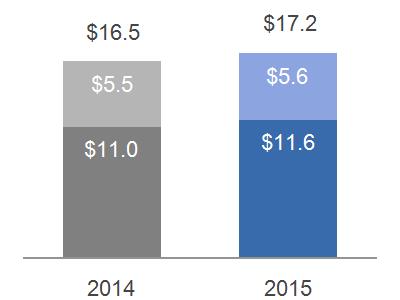

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN | |||||

- - Revenue - - Profit

|  | |||||

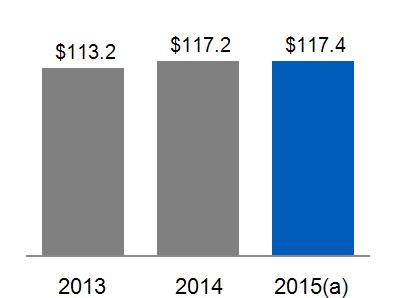

SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: | |||||

2014 – 2013 | 2014 – 2013 | |||||

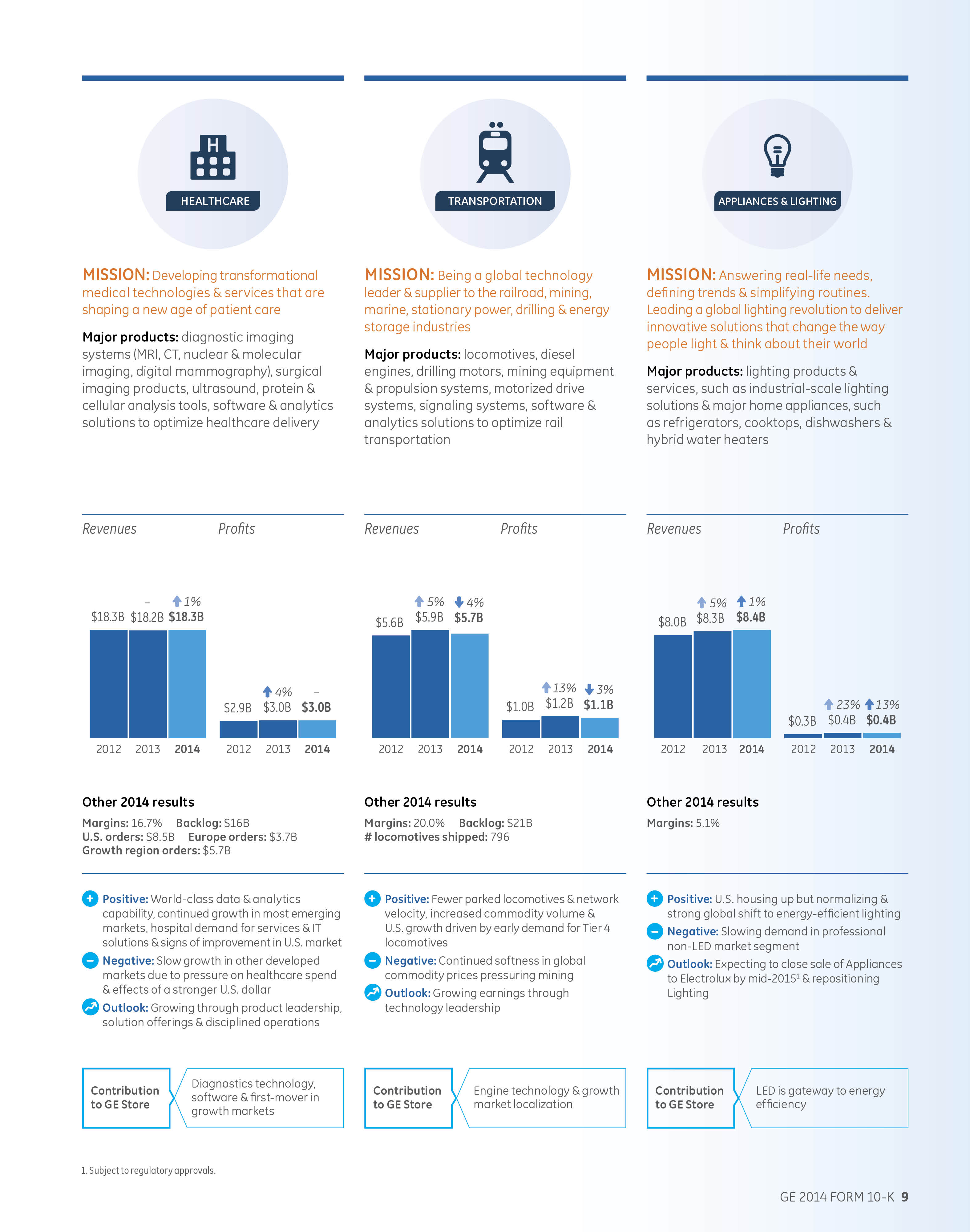

Segment revenues up $0.1 billion (1%); Segment profit flat as a result of:

The increase in revenues was due to higher volume, driven by the higher sales in Life Sciences. This increase was partially offset by lower prices mainly at Healthcare Systems and the effects of a stronger U.S. dollar.

Profit was flat as higher productivity, driven by SG&A cost reductions, and higher volume, were offset by lower prices, mainly at Healthcare Systems, inflation and effects of a stronger U.S. dollar. | ||||||

Revenues | Profit | |||||

2013 | $ | 18.2 | $ | 3.0 | ||

Volume | 0.6 | 0.1 | ||||

Price | (0.3) | (0.3) | ||||

Foreign Exchange | (0.2) | (0.1) | ||||

(Inflation)/Deflation | N/A | (0.2) | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.5 | ||||

Other | - | - | ||||

2014 | $ | 18.3 | $ | 3.0 | ||

2013 – 2012 | 2013 – 2012 | |||||

Segment revenues down $0.1 billion; Segment profit up $0.1 billion (4%) as a result of:

The decrease in revenues was driven by lower prices mainly at Healthcare Systems, effects of a stronger U.S. dollar and lower other income, partially offset by higher volume.

The increase in profit was mainly driven by higher productivity resulting from SG&A cost reductions and higher volume, partially offset by lower prices mainly at Healthcare Systems, the effects of inflation and the stronger U.S. dollar. | ||||||

Revenues | Profit | |||||

2012 | $ | 18.3 | $ | 2.9 | ||

Volume | 0.5 | 0.1 | ||||

Price | (0.3) | (0.3) | ||||

Foreign Exchange | (0.2) | (0.1) | ||||

(Inflation)/Deflation | N/A | (0.2) | ||||

Mix | N/A | - | ||||

Productivity | N/A | 0.6 | ||||

Other | - | - | ||||

2013 | $ | 18.2 | $ | 3.0 | ||

GE 2014 FORM 10-K 46

MD&A | SEGMENT OPERATIONS | TRANSPORTATION |

TRANSPORTATION

TRANSPORTATION BUSINESS OVERVIEW

Leader: Russell Stokes

| Headquarters & Operations

| ||||

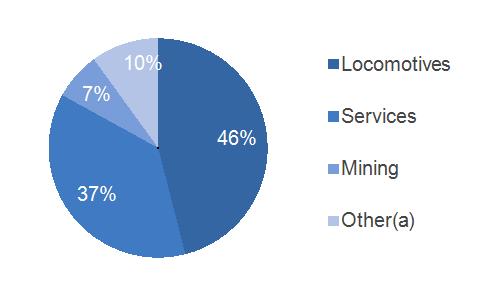

| President & CEO, GE Transportation Over 15 years of service with General Electric |  | 4% of segment revenues in 2014 5% of industrial segment revenues 6% of industrial segment profit Headquarters: Chicago, IL Serving customers in 60+ countries Employees: approximately 13,000 | ||

Products & Services | |||

|

Transportation is a global technology leader and supplier to the railroad, marine, drilling and mining industries. Products and services offered by Transportation include: | ||

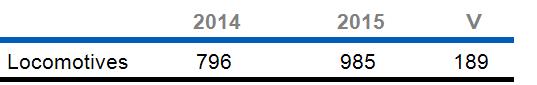

| Locomotives – we provide freight and passenger locomotives, signaling and communications systems as well as rail services to help solve rail challenges. We manufacture high-horsepower, diesel-electric locomotives including the Evolution Series TM , which meets or exceeds the U.S. Environmental Protection Agency's (EPA) Tier 4 requirements for freight and passenger applications. |

| Locomotive Services & Solutions – we develop partnerships that support advisory services, parts, integrated software solutions and data analytics. Our comprehensive offerings include tailored service programs, high-quality parts for GE and other locomotive platforms, overhaul, repair and upgrade services, and wreck repair. Our portfolio provides the people, partnerships and leading software to optimize operations and asset utilization. |

| Mining – we provide mining equipment and services. The portfolio includes drive systems for off-highway vehicles, mining equipment, mining power and productivity. |

| Marine, Stationary & Drilling – we offer motors for land and offshore drilling rigs, marine diesel engines and stationary power diesel engines. |

Competition & Regulation |

The competitive environment for locomotives and mining equipment and services consists of large global competitors and a number of smaller competitors that compete in a limited-size product range, and or geographic region. North America will be of particular focus for the rail industry in 2015 as the EPA Tier 4 emissions standards are implemented. We are positioned with the only locomotive currently available that meets the Tier 4 standards.

GE 2014 FORM 10-K 47

MD&A | SEGMENT OPERATIONS | TRANSPORTATION |

OPERATIONAL OVERVIEW

(Dollars in billions)

2014 GEOGRAPHIC REVENUES: $5.7 BILLION | ORDERS | ||

|  |

Equipment

Services | |

2014 SUB-SEGMENT REVENUES | BACKLOG | ||

|  |

Equipment

Services | |

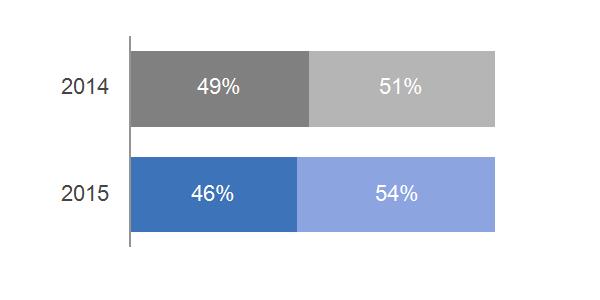

EQUIPMENT/SERVICES REVENUES | UNIT SALES | ||

Services Equipment

|

| ||

SIGNIFICANT TRENDS & DEVELOPMENTS |

| Rail volume, especially in North America, continues to climb and the number of parked locomotives remains low. |

| North American locomotives competition remains strong, but GE is positioned with the only locomotive currently available meeting the U.S. EPA's highest (Tier 4) emission standards. We expect U.S. growth to be driven by early demand for Tier 4 locomotives. |

| Continued global mining softness has resulted in delayed capital expenditures in the mining industry. |

| During the fourth quarter of 2014, we signed an agreement to sell our Signaling business to Alstom for approximately $0.8 billion. |

GE 2014 FORM 10-K 48

MD&A | SEGMENT OPERATIONS | TRANSPORTATION |

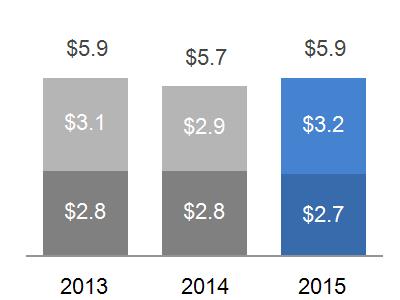

FINANCIAL OVERVIEW

(Dollars in billions)

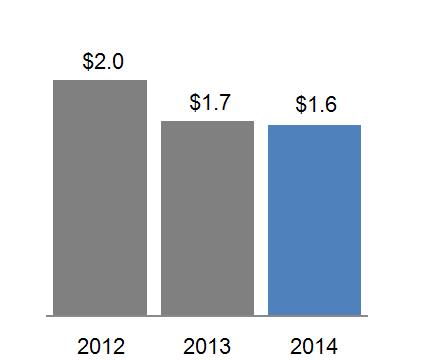

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN | |

- - Revenue - - Profit

|  | |

COMMENTARY: | ||

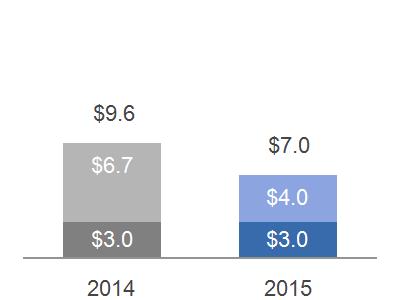

2014 – 2013 | 2013 – 2012 | |

Segment revenues down $0.2 billion (4%) as a result of: Lower volume ($0.2 billion), primarily in Mining reflecting weakness in the industry, partially offset by an increase in volume in the locomotive services business.

Segment profit down 3% as a result of: Lower volume, primarily in Mining as discussed above, was partially offset by deflation and cost productivity.

|

Segment revenues up $0.3 billion (5%) as a result of: Higher volume ($0.3 billion), due to 2012 acquisitions (primarily Industrea).

Segment profit up $0.1 billion (13%) as a result of: Material deflation ($0.1 billion), higher volume and productivity. |

GE 2014 FORM 10-K 49

MD&A | SEGMENT OPERATIONS | APPLIANCES & LIGHTING |

APPLIANCES & LIGHTING

APPLIANCES & LIGHTING BUSINESS OVERVIEW

Leaders: Chip Blankenship & Maryrose Sylvester |

Headquarters & Operations | |||

| President & CEO, Appliances Over 20 years of service with General Electric

President & CEO, Lighting Over 25 years of service with General Electric |  | 5% of segment revenues in 2014 7% of industrial segment revenues 2% of industrial segment profit Appliances HQ: Louisville, KY Lighting HQ: East Cleveland, OH Serving customers in 100+ countries Employees: approximately 24,000 | |

Products & Services | |||

| Appliances & Lighting products, such as major appliances and a subset of lighting products, are primarily directed to consumer applications, while other lighting products are directed towards commercial and industrial applications. We also invest in the development of differentiated, premium products such as energy efficient solutions for both consumers and businesses.

| ||

| Appliances – sells and services major home appliances including refrigerators, freezers, electric and gas ranges, cooktops, dishwashers, clothes washers and dryers, microwave ovens, room air conditioners, residential water systems for filtration, softening and heating and hybrid water heaters. Our brands include GE Monogram®, GE Café™, GE Profile™, GE®, GE Artistry™, and Hotpoint®. We also manufacture certain products and source finished product and component parts from third-party global manufacturers. A large portion of appliances sales are through a variety of retail outlets for replacement of installed units. Residential building contractors installing units in new construction is the second major U.S. channel. We offer one of the largest original equipment manufacturer (OEM) service organizations in the appliances industry, providing in-home repair and aftermarket parts. |

| Lighting – manufactures, sources and sells a variety of energy-efficient solutions for commercial, industrial, municipal and consumer applications across the globe, utilizing light-emitting diode (LED), fluorescent, halogen and high-intensity discharge (HID) technologies. In addition to growing our LED breadth, the business is focused on building lighting connected by state-of-the-art software that will unleash a whole new potential for how we light our world. The business sells products under the reveal® and Energy Smart® consumer brands, and Evolve™, GTx™, Immersion™, Infusion™, Lumination™, Albeo™, TriGain™, and Tetra® commercial brands. GE Lighting offers a full range of solutions and services to outfit entire properties with lighting, from ceilings, parking lots, signage, displays, roadways, sports arenas and other areas. |

Competition & Regulation |

Cost control, including productivity, is key in the highly competitive marketplace in which Appliances & Lighting competes. GE Lighting operates in a complex, global marketplace. Energy regulations impacting traditional lighting technologies are moving demand to energy-saving products that last longer and cost less to operate over time. Evolving these technologies, as well as cost control, is key in the global arena in which the business operates.

GE 2014 FORM 10-K 50

MD&A | SEGMENT OPERATIONS | APPLIANCES & LIGHTING |

OPERATIONAL OVERVIEW

(Dollar in billions)

2014 GEOGRAPHIC REVENUES: $8.4 BILLION | 2014 SUB-SEGMENT REVENUES | ||

|  | ||

SIGNIFICANT TRENDS & DEVELOPMENTS | |||

During the third quarter of 2014, GE signed an agreement to sell its Appliances business to Electrolux for $3.3 billion. The transaction has been approved by the boards of directors of GE and Electrolux and remains subject to customary closing conditions and regulatory approvals, and is targeted to close in mid-2015. While the demand in the professional non-LED market segment is slowing, there is a strong global shift to energy efficient lighting including continued growth in LED products.

FINANCIAL OVERVIEW

| |||

SEGMENT REVENUES & PROFIT | SEGMENT PROFIT MARGIN | ||

- - Revenue - - Profit

|  | ||

COMMENTARY: 2014 – 2013 |

2013 – 2012 | ||

Segment revenues up $0.1 billion (1% ) as a result of: Higher volume ($0.1 billion) driven by higher sales at Appliances.

Segment profit up $0.1 billion (13%) as a result of : Improved productivity ($0.1 billion) including the effects of classifying Appliances as a business held for sale in the third quarter of 2014. |

Segment revenues up $0.4 billion (5%) as a result of: Higher volume ($0.4 billion) driven by higher sales at Appliances.

Segment profit up $0.1 billion (23%) as a result of : Improved productivity ($0.1 billion) and higher prices. | ||

GE 2014 FORM 10-K 51

MD&A | SEGMENT OPERATIONS | GE CAPITAL |

GE CAPITAL

GE CAPITAL BUSINESS OVERVIEW

Leader: Keith Sherin | Headquarters & Operations | ||||

| Vice Chairman GE, and Chairman & CEO, GE Capital Over 30 years of service with General Electric |  | 28% of segment revenues in 2014 Headquarters: Norwalk, CT Serving customers in 70+ countries Employees: approximately 47,000 | ||

Products & Services | |||||

GE Capital businesses offer a broad range of financial services and products worldwide for businesses of all sizes. Services include commercial loans and leases, fleet management, financial programs, credit cards, personal loans and other financial services. GE Capital also develops strategic partnerships and joint ventures that utilize GE's industry-specific expertise in aviation, energy, infrastructure and healthcare to capitalize on market-specific opportunities. Products and services are offered through the following businesses: | |||||

| Commercial Lending and Leasing ( CLL) – has particular mid-market expertise, and primarily offers secured commercial loans, equipment financing and other financial services to companies across a wide range of industries including construction, retail, manufacturing, transportation, media, communications, technology and healthcare. Equipment financing activities include industrial, medical, fleet vehicles, construction, office imaging and many other equipment types. |

| Consumer – offers a full range of financial products including private-label credit cards; personal loans; bank cards; auto loans and leases; mortgages; debt consolidation; home equity loans; deposit and other savings products; and small and medium enterprise lending on a global basis. |

| Real Estate – offers a range of capital and investment solutions, including fixed and floating rate mortgages for new acquisitions or re-capitalizations of commercial real estate worldwide. Our business finances with loan structures; the acquisition, refinancing and renovation of office buildings, apartment buildings, retail facilities, hotels, warehouses and industrial properties. |

| Energy Financial Services – invests in long-lived, capital intensive energy projects and companies by providing structured equity, debt, leasing, partnership financing, project finance and broad-based commercial finance. |

| GE Capital Aviation Services (GECAS) – our commercial aircraft financing and leasing business, offers a wide range of aircraft types and financing options, including operating leases and secured debt financing, and also provides productivity solutions including spare engine leasing, airport and airline consulting services, and spare parts financing and management. |

Competition & Regulation |