Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2009

Commission File Number: 1-9852

CHASE CORPORATION

(Exact name of registrant as specified in its charter)

| Massachusetts (State or other jurisdiction of incorporation of organization) | 11-1797126 (I.R.S. Employer Identification No.) |

26 Summer Street, Bridgewater, Massachusetts 02324

(Address of Principal Executive Offices, Including Zip Code)

(508) 279-1789

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to section 12(b) of the Act:

Title of Each Class: | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock ($0.10 Par Value) | NYSE Amex |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES o NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES o NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO ý

The aggregate market value of the common stock held by non-affiliates of the registrant, as of February 28, 2009 (the last business day of the registrant's second quarter of fiscal 2009), was approximately $55,403,681.

As of October 31, 2009, the Company had outstanding 8,795,005 shares of common stock, $.10 par value, which is its only class of common stock.

Documents Incorporated By Reference:

Portions of the registrant's definitive proxy statement for the Annual Meeting of Shareholders, which is expected to be filed within 120 days after the registrant's fiscal year ended August 31, 2009, are incorporated by reference into Part III hereof.

Table of Contents

CHASE CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

For the Year Ended August 31, 2009

| | | Page No. | ||||

|---|---|---|---|---|---|---|

PART I | ||||||

Item 1 | Business | 3 | ||||

Item 1A | Risk Factors | 7 | ||||

Item 1B | Unresolved Staff Comments | 9 | ||||

Item 2 | Properties | 10 | ||||

Item 3 | Legal Proceedings | 11 | ||||

Item 4 | Submission of Matters to a Vote of Security Holders | 11 | ||||

Item 4A | Executive Officers of the Registrant | 11 | ||||

PART II | ||||||

Item 5 | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 12 | ||||

Item 6 | Selected Financial Data | 13 | ||||

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operations | 14 | ||||

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 25 | ||||

Item 8 | Financial Statements and Supplementary Data | 26 | ||||

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 60 | ||||

Item 9A | Controls and Procedures | 60 | ||||

Item 9B | Other Information | 60 | ||||

PART III | ||||||

Item 10 | Directors, Executive Officers and Corporate Governance | 61 | ||||

Item 11 | Executive Compensation | 61 | ||||

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 61 | ||||

Item 13 | Certain Relationships and Related Transactions, and Director Independence | 61 | ||||

Item 14 | Principal Accountant Fees and Services | 61 | ||||

PART IV | ||||||

Item 15 | Exhibits and Financial Statement Schedules | 62 | ||||

SIGNATURES | 65 | |||||

2

Table of Contents

PART I

ITEM 1-BUSINESS

Primary Operating Divisions and Facilities and Industry Segment

Chase Corporation (the "Company," "Chase," "we," or "us") is a global manufacturer of tapes, laminates, sealants, and coatings for high reliability applications, and a provider of contract assembly services for the electronics industry. Our strategy is to maximize the performance of our core businesses and brands while seeking future opportunities through strategic acquisitions. We are organized into two operating segments with multiple facilities. All plant locations are part of our Specialized Manufacturing segment with the exception of Chase EMS, which is part of our Electronic Manufacturing Services segment. A summary of our operating structure as of August 31, 2009 is as follows:

Primary Manufacturing Location | Background/History | Key Products & Services | |||

|---|---|---|---|---|---|

| SPECIALIZED MANUFACTURING SEGMENT | |||||

| | Randolph, MA | | This was one of our first operating facilities and has been producing products for the wire and cable industry for more than fifty years. | | Electrical cable insulation tapes using the brand name Chase & Sons® and related products such as Chase BLH 2 OCK®, a water blocking compound sold to the wire and cable industry. Insulating and conducting materials for the manufacture of electrical and telephone wire and cable, electrical splicing, and terminating and repair tapes, which are marketed to wire and cable manufacturers and public utilities. |

| | Webster, MA | | We began operating this facility, which manufactures tape and related products, in 1992. In December 2003, we acquired the assets of PaperTyger, LLC ("PaperTyger"). The PaperTyger product lines are also manufactured at this facility. | | Specialty tapes and related products for the electronic and telecommunications industries using the brand name Chase & Sons®. PaperTyger® is a trademark for laminated durable papers sold to the envelope converting and commercial printing industries. |

| | Paterson, NJ | | In February 2003, Chase Facile, Inc., our wholly-owned subsidiary, acquired certain assets of Facile, Inc., located in Paterson, New Jersey. | | Flexible composites and laminates for the wire & cable, aerospace and industrial laminate markets including Insulfab®, an insulation material used in the aerospace industry. |

| | Taylorsville, NC | | In January 2004, we purchased certain manufacturing equipment and began operations at this facility. | | Flexible packaging for industrial and retail use. Slit film for the building wire market and for telecommunication cable. |

| | Evanston, IL | | In November 2001, we acquired substantially all of the assets of Tapecoat, a division of T.C. Manufacturing Inc. | | Manufacturer of technologically advanced products, including the brand Tapecoat®, for demanding anti-corrosion applications in the gas, oil and marine pipeline market segments, as well as tapes and membranes for roofing and other construction related applications. |

3

Table of Contents

Primary Manufacturing Location | Background/History | Key Products & Services | |||

|---|---|---|---|---|---|

| Pittsburgh, PA | The HumiSeal business and product lines were acquired in the early 1970's. The Royston business was acquired in the early 1970's. In April 2005, we acquired certain assets of E-Poxy Engineered Materials. Additionally, in September 2006, we acquired all of the capital stock of Capital Services Joint Systems. Both of these acquisitions were combined to form the Expansion Joints product line which is now manufactured in Pittsburgh. | Protective conformal coatings under the brand name HumiSeal®, moisture protective electronic coatings sold to the electronics industry. Protective pipe coating tapes and other protectants for valves, regulators, casings, joints, metals, concrete, and wood which are sold under the brand name Royston®, to oil companies, gas utilities, and pipeline companies. Rosphalt50® is a polymer additive that provides long term cost effective solutions in many applications such as waterproofing of approaches and bridges, ramps, race tracks, airports and specialty road applications. Waterproofing sealants, expansion joints and accessories for the transportation, industrial and architectural markets. | |||

| | Camberley, Surrey, England | | In October 2005, we acquired all of the capital stock of Concoat Holdings Ltd. and its subsidiaries. In 2006 Concoat was renamed HumiSeal Europe. In March 2007, we expanded our international presence with the formation of HumiSeal Europe SARL in France. In conjunction with establishing the new company, certain assets were acquired from Metronelec SARL, a former distributor of HumiSeal products. | | Protective conformal coatings under the brand name HumiSeal®, moisture protective electronic coatings sold to the electronics industry. HumiSeal Europe SARL operates a sales/technical service office and warehouse near Paris. This business works closely with the HumiSeal operation in Camberley, Surrey, England allowing direct sales and service to the French market. |

| | Rye, East Sussex, England | | On September 1, 2007, we purchased certain product lines and a related manufacturing facility in Rye, East Sussex, England through our wholly owned subsidiary, Chase Protective Coatings Ltd. | | Manufacturer of waterproofing and corrosion protection systems for oil, gas and water pipelines and a supplier to Europe, the Middle East and Southeast Asia. This facility joins Chase's North American based Tapecoat® and Royston® brands to broaden the protective coatings product line and better address increasing global demand. |

| | ELECTRONIC MANUFACTURING SERVICES SEGMENT | ||||

| | Winchester, MA | | In May 1999, we acquired RWA, Inc. ("RWA"). In fiscal 2005, this division moved to Winchester, MA from Melrose, MA and is doing business as Chase EMS. | | Assembly and turnkey contract manufacturing services including printed circuit board and electromechanical assembly services to the electronics industry operating principally in the United States. |

4

Table of Contents

Other Business Developments

C.I.M. Industries Inc.

On September 4, 2009, we acquired all of the outstanding capital stock of C.I.M. Industries Inc. ("C.I.M."), which is based in Peterborough, NH and has a manufacturing facility in Texas. C.I.M. is a specialized manufacturer of high performance coating and lining systems used worldwide in the liquid storage and containment industry. With a primary focus on the water and wastewater industry, C.I.M. has the preferred products that complement our product line of high performance tapes and coatings. In its most recently completed twelve month period ending August 31, 2009, C.I.M. revenues were approximately $9,790,000.

The total purchase price, net of cash received, was $18,894,000, subject to certain adjustments relating to the closing date working capital. The purchase was funded through a combination of available cash on hand, a term loan in the amount of $10,000,000 from Bank of America, and a $3,000,000 note payable to C.I.M. shareholders. The net assets acquired by us include cash, inventories, trade receivables, property, plant & equipment, trade payables and certain other current assets and liabilities. The effective date for this acquisition was September 4, 2009. The results of this acquisition have been included in our financial statements since that date, and consequently are not reflected in our results of operations for the fiscal year ended August 31, 2009 or any prior period.

Closing of Paterson, NJ Manufacturing Facility

In August 2009, we announced our intention to close our Paterson, NJ manufacturing facility effective December 31, 2009. Since its acquisition, this operation has been part of our Specialized Manufacturing segment and its key product offerings include flexible composites and laminates for the wire & cable, aerospace and industrial laminate markets. We will be transitioning production to other Chase manufacturing sites with similar capabilities.

Sale of Northeast Quality Products ("NEQP") Business

In August 2009, we sold our NEQP specialty custom label printing business to Label Tech, Inc. of Somersworth, NH for $185,000. This business was originally acquired by Chase in 1999 and was part of our Specialized Manufacturing segment. With the challenges of the current economy and increased competition, we determined it was the right time for us to divest the label printing business while remaining focused on our core product offerings.

Sale of West Bridgewater, MA Property

In June 2009, we sold real property (land and building) to ChaseBay Real Estate Holdings, Inc. for $1,370,000. The building and land are located in West Bridgewater, MA and are currently being occupied by Sunburst Electronics Manufacturing Solutions, Inc. The sale of the property resulted in an accounting charge of approximately $262,000 which was recorded in our third quarter ending May 31, 2009 and represents the write down of the book value of the land and building sold to its market value at the time of the sale, as required by generally accepted accounting principles. This transaction was completed with a related party, see notes to financial statements for additional details.

Products and Markets

Our principal products are specialty tapes, laminates, sealants and coatings that are sold by our salespeople, manufacturers' representatives and distributors. In our Specialized Manufacturing segment, these products consist of:

(i) insulating and conducting materials for the manufacture of electrical and telephone wire and cable, electrical splicing, and terminating and repair tapes, which are marketed to wire and cable manufacturers;(ii) protective pipe coating tapes and other protectants for valves, regulators, casings, joints, metals, concrete and wood, which are sold to oil companies, gas utilities and pipeline companies;

(iii) protectants for highway bridge deck metal supported surfaces, which are sold to municipal transportation authorities;

5

Table of Contents

(iv) moisture protective coatings, which are sold to the electronics industry including circuitry used in automobiles and home appliances;(v) laminated durable papers, including laminated paper with an inner security barrier used in personal and mail-stream privacy protection, which are sold primarily to the envelope converting and commercial printing industries;

(vi) flexible composites and laminates for the wire & cable, aerospace, packaging and industrial laminate markets, and

(vii) expansion and control joint systems designed for roads, bridges, stadiums and airport runways.

In addition, our Electronic Manufacturing Services segment provides circuit board assembly and contract manufacturing services to electronic goods manufacturers.

There is some seasonality with our product offerings sold into the construction market as increased demand is often experienced when temperatures are warmer (April through October) with less demand occurring when temperatures are colder (typically our second fiscal quarter). We did not introduce any new products or segments requiring an investment of a material amount of our assets during fiscal year 2009.

Employees

As of October 31, 2009, we employed approximately 365 people (including union employees). We consider our employee relations to be good. In the U.S., we offer our employees a wide array of company-paid benefits, which we believe are competitive relative to others in our industry. In our operations outside the U.S., we offer benefits that may vary from those offered to our U.S. employees due to customary local practices and statutory requirements.

Backlog, Customers and Competition

As of October 31, 2009, the backlog of orders believed to be firm was approximately $12,756,000 of which $7,980,000 was related to our Electronic Manufacturing Services segment. This compared with a total of $16,369,000 as of October 31, 2008 of which $7,476,000 was associated with our Electronic Manufacturing Services segment. The backlog of orders in the Specialized Manufacturing segment has some seasonality due to the construction season. During fiscal 2009, 2008 and 2007, no customer accounted for more than 10% of sales. No material portion of our business is subject to renegotiation or termination of profits or contracts at the election of the United States Federal Government.

There are other companies that manufacture or sell products and services similar to those made and sold by Chase. Many of those companies are larger and have greater financial resources than we have. We compete principally on the basis of technical performance, service reliability, quality and price.

Raw Materials

We obtain raw materials from a wide variety of suppliers with alternative sources of most essential materials available within reasonable lead times.

Patents, Trademarks, Licenses, Franchises and Concessions

We own the following trademarks that we believe are of material importance to our business: Chase Corporation®, C-Spray (Logo), a trademark used in conjunction with most of the company's business segment and product line marketing material and communications; HumiSeal®, a trademark for moisture protective coatings sold to the electronics industry; Chase & Sons® and Chase Facile®, trademarks for barrier and insulating tapes sold to the wire and cable industry; Chase BLH 2 OCK®, a trademark for a water blocking compound sold to the wire and cable industry; Rosphalt50®, a trademark for an asphalt additive used predominantly on bridge decks for waterproofing protection; Insulfab®, a trademark for insulation material used in the aerospace industry; PaperTyger®, a trademark for laminated durable papers sold to the envelope converting and commercial printing industries, Tapecoat®, a trademark for corrosion preventative surface coatings and primers; Royston®, a trademark for corrosion inhibiting coating composition for use on pipes; and Eva-Pox® and Ceva®, trademarks for epoxy pastes/gels/mortars and elastomeric concrete used in the construction industry. We do not have any other material trademarks, licenses,

6

Table of Contents

franchises, or concessions. While we do hold various patents, at this time, we do not believe that they are material to the success of our business.

Working Capital

We fund our business operations through a combination of available cash and cash equivalents, short-term investments and cash flows generated from operations. In addition, our revolving credit facility is available for additional working capital needs or investment opportunities.

Research and Development

Approximately $1,632,000, $1,698,000 and $1,965,000 was spent for Company-sponsored research and development during fiscal 2009, 2008 and 2007, respectively. Research and development was relatively flat in 2009 compared to 2008 but decreased by $267,000 in fiscal 2008 compared to 2007 primarily due to diligent cost management practices and continued efficiency improvements that led to cost savings during fiscal 2008.

Available Information

Chase maintains a website at www.chasecorp.com . We make available, free of charge on our website, our Annual Report on Form 10-K, as soon as reasonably practicable after such report is electronically filed with the SEC. Additionally, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge at the SEC's website at www.sec.gov . Information contained on our website is not part of, or incorporated by reference into, this Annual Report on Form 10-K.

Financial Information About Segments and Geographic Areas

Please see Notes 11 and 12 to the Company's Consolidated Financial Statements for financial information about the Company's industry segments and domestic and foreign operations for each of the last three fiscal years.

ITEM 1A-RISK FACTORS

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. We feel that any of the following risks could materially adversely affect our business, operations, industry, financial position or our future financial performance. While we believe that we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, operations, industry, financial position and financial performance in the future.

We currently operate in mature markets where increases or decreases in market share could be significant.

Our sales and net income are largely dependent on recurring sales from a consistent and established customer base. Organic growth opportunities are minimal; however, we have and will continue to use strategic acquisitions as a means to build and grow the business. In this business environment, increases or decreases in market share could have a material effect on our business condition or results of operation. We face intense competition from a diverse range of competitors, including operating divisions of companies much larger and with far greater resources than we have. If we are unable to maintain our market share, our business could suffer.

Our business strategy includes the pursuit of strategic acquisitions, which may not be successful if they happen at all.

From time to time, we engage in discussions with potential target companies concerning potential acquisitions. In executing our acquisition strategy, we may be unable to identify suitable acquisition candidates. In addition, we may face competition from other companies for acquisition candidates, making it more difficult to acquire suitable companies on favorable terms.

Even if we do identify a suitable acquisition target and are able to negotiate and close a transaction, the integration of an acquired business into our operations involves numerous risks, including potential difficulties in

7

Table of Contents

integrating an acquired company's product line with ours; the diversion of our resources and management's attention from other business concerns; the potential loss of key employees; limitations imposed by antitrust or merger control laws in the United States or other jurisdictions; risks associated with entering a new geographical or product market; and the day-to-day management of a larger and more diverse combined company.

We may not realize the synergies, operating efficiencies, market position or revenue growth we anticipate from acquisitions and our failure to effectively manage the above risks and other problems associated with acquisitions could have a material adverse effect on our business, growth prospects and financial performance.

General economic factors, domestically and internationally, may adversely affect our financial performance through increased raw material costs or other expenses and by making access to capital more difficult.

The cumulative effect of higher interest rates, energy costs, inflation, levels of unemployment, healthcare costs, unsettled financial markets, and other economic factors could adversely affect our financial condition by increasing our manufacturing costs and other expenses at the same time that our customers may be scaling back demand for our products. Prices of certain commodity products, including oil and petroleum-based products are historically volatile and are subject to fluctuations arising from changes in domestic and international supply and demand, labor costs, competition, weather events, market speculation, government regulations and periodic delays in delivery. Rapid and significant changes in commodity prices may affect our sales and profit margins. These factors can also increase our merchandise costs and/or selling, general and administrative expenses, and otherwise adversely affect our operations and results. Recent turmoil in the credit markets may limit our ability to access debt capital for use in acquisitions or other purposes on advantageous terms or at all. If we are unable to manage our expenses in response to general economic conditions and margin pressures, or if we are unable to obtain capital for strategic acquisitions or other needs, then our results of operations would be negatively affected.

Fluctuations in the supply and prices of raw materials may negatively impact our financial results.

We obtain raw materials needed to manufacture our products from a number of suppliers. Many of these raw materials are petroleum-based derivatives. Under normal market conditions, these materials are generally available on the open market and from a variety of producers. From time to time, however, the prices and availability of these raw materials fluctuate, which could impair our ability to procure necessary materials, or increase the cost of manufacturing our products. If the prices of raw materials increase, and we are unable to pass these increases on to our customers, we could experience reduced profit margins.

We are dependent on key personnel.

We depend significantly on our executive officers including Chairman and Chief Executive Officer, Peter R. Chase, and on other key employees. The loss of the services of any of these key employees could have a material impact on our business and results of operations. In addition, our acquisition strategy will require that we attract, motivate and retain additional skilled and experienced personnel. The inability to satisfy such requirements could have a negative impact on our ability to remain competitive in the future.

If we cannot successfully manage the unique challenges presented by international markets, we may not be successful in expanding our international operations.

Our strategy includes expansion of our operations in existing and new international markets by selective acquisitions and strategic alliances. Our ability to successfully execute our strategy in international markets is affected by many of the same operational risks we face in expanding our U.S. operations. In addition, our international expansion may be adversely affected by our ability to identify and gain access to local suppliers as well as by local laws and customs, legal and regulatory constraints, political and economic conditions and currency regulations of the countries or regions in which we currently operate or intend to operate in the future. Risks inherent in our international operations also include, among others, the costs and difficulties of managing international operations, adverse tax consequences and greater difficulty in enforcing intellectual property rights. Additionally, foreign currency exchange rates and fluctuations may have an impact our future costs or on future cash flows from our international operations.

8

Table of Contents

Our results of operations could be adversely affected by uncertain economic and political conditions and the effects of these conditions on our customers' businesses and levels of business activity.

Global economic and political conditions can affect the businesses of our customers and the markets they serve. A severe or prolonged economic downturn or a negative or uncertain political climate could adversely affect the levels of business activity of our customers and the industries they serve, including the automotive, housing, construction, transportation infrastructure and electronics manufacturing industries. This may reduce demand for our products or depress pricing of those products, either of which may have a material adverse effect on our results of operations. Changes in global economic conditions could also shift demand to products for which we do not have competitive advantages, and this could negatively affect the amount of business that we are able to obtain. In addition, if we are unable to successfully anticipate changing economic and political conditions, we may be unable to effectively plan for and respond to those changes and our business could be negatively affected.

Financial market performance may have a material adverse effect on our pension plan assets and require additional funding requirements.

Significant and sustained declines in the financial markets may have a material adverse effect on the fair market value of our pension plan assets. While these pension plan assets are considered non-financial assets since they are not carried on our balance sheet, the fair market valuation of these assets could impact our funding requirements, funded status or net periodic pension cost. Any significant and sustained declines in the fair market value of these pension assets could require us to increase our funding requirements which would have an impact on our cash flow, and could also lead to additional pension expense.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

Generally accepted accounting principles and related accounting pronouncements, implementation guidelines and interpretations with regard to a wide range of matters that are relevant to our business, such as revenue recognition, asset impairment, inventories, pensions valuation and tax matters, are highly complex and involve many subjective assumptions, estimates and judgments. Changes in these rules or their interpretation or changes in underlying assumptions, estimates, or judgments could significantly change our reported or expected financial performance or financial condition. In addition, the Financial Accounting Standards Board issued SFAS No. 141R, "Business Combinations", which will have an impact on our accounting for future business combinations. The effect will be dependent upon acquisitions completed by us after August 31, 2009.

ITEM 1B-UNRESOLVED STAFF COMMENTS

None

9

Table of Contents

ITEM 2-PROPERTIES

We own and lease office and manufacturing properties as outlined in the table below.

Location | Square Feet | Operating Segment | Owned/ Leased | Principal Use | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Bridgewater, MA | 5,200 | Corporate | Owned | Corporate headquarters and executive office | ||||||

Randolph, MA | 77,500 | Specialized Manufacturing | Owned | Manufacture of electrical protective coatings and tape products | ||||||

Webster, MA | 25,000 | Specialized Manufacturing | Owned | Manufacture of tape and related products for the electronic and telecommunications industries, as well as laminated durable papers | ||||||

Oxford, MA(a) | 73,600 | Specialized Manufacturing | Owned | Under renovation to provide capacity for storage needs and future growth | ||||||

Paterson, NJ(b) | 40,000 | Specialized Manufacturing | Leased | Manufacture of tape and related products for the electronic and telecommunications industries | ||||||

Taylorsville, NC | 50,000 | Specialized Manufacturing | Leased | Manufacture of flexible packaging for industrial and retail use | ||||||

Taylorsville, NC | 2,500 | Specialized Manufacturing | Leased | Storage warehouse | ||||||

Cranston, RI | 500 | Specialized Manufacturing | Leased | Sales office | ||||||

Taunton, MA | 5,200 | Specialized Manufacturing | Leased | Research and development, and technical center | ||||||

Pittsburgh, PA | 44,000 | Specialized Manufacturing | Owned | Manufacture and sale of protective coatings and tape products | ||||||

O'Hara Township, PA | 109,000 | Specialized Manufacturing | Owned | Manufacture and sale of protective coatings, expansion joints and accessories | ||||||

Evanston, IL(c) | 100,000 | Specialized Manufacturing | Leased | Manufacture and sale of protective coatings and tape products | ||||||

Albany, NY | 2,250 | Specialized Manufacturing | Leased | Sales office | ||||||

Camberley, Surrey, England | 6,700 | Specialized Manufacturing | Leased | Manufacture and sales of protective electronic coatings | ||||||

Rye, East Sussex, England | 36,600 | Specialized Manufacturing | Owned | Manufacture and sales of protective coatings and tape products | ||||||

Paris, France | 1,350 | Specialized Manufacturing | Leased | Sales/technical service office and warehouse allowing direct sales and service to the French market. | ||||||

Winchester, MA | 25,000 | Electronic Manufacturing | Leased | Manufacturing and sales for the Electronic Manufacturing Services segment | ||||||

(a) In

December 2008, we purchased real property (land and building) in Oxford, MA. We began initial renovations to this property during fiscal 2009 and plan to

use it for storage in order to reduce off-site storage expenses as well as provide capacity for future growth. In FY2010, we will continue to evaluate this property in order to determine

the best long term future use for this land and building.

(b) In

August 2009, we announced our intention to close our Paterson, NJ manufacturing facility effective December 31, 2009, and to transition production

to other Chase manufacturing sites with similar capabilities.

(c) In

June 2009, we entered into a sale leaseback transaction whereby we sold our real property (land and building) located in Evanston, IL. We have agreed to

provide financing to the purchaser, and the purchaser has agreed to lease the property back to us for a term of 49 months. The term coincides with the period over which the financing will be

repaid to us.

The above facilities range in age from new to about 100 years, are generally in good condition and, in the opinion of management, adequate and suitable for present operations. We also own equipment and machinery that is in good repair and, in the opinion of management, adequate and suitable for present operations. We could significantly add to our capacity by increasing shift operations. Availability of machine hours through additional shifts would provide expansion of current product volume without significant additional capital investment.

10

Table of Contents

ITEM 3-LEGAL PROCEEDINGS

We are one of over 100 defendants in a personal injury lawsuit, pending in Ohio, which alleges personal injury from exposure to asbestos contained in certain Chase products. The case is captioned Marie Lou Scott, Executrix of the Estate of James T. Scott v. A-Best Products, et al., No. 312901 in the Court of Common Pleas for Cuyahoga County, Ohio. The plaintiff in the case issued discovery requests to us in August 2005, to which we timely responded in September 2005. The trial had initially been scheduled to begin on April 30, 2007. However, that date had been postponed and no new trial date has been set. As of October 2009, there have been no new developments as this Ohio lawsuit has been inactive with respect to us.

We were named as one of the defendants in a complaint filed on June 25, 2009, in a lawsuit captioned Lois Jansen, Individually and as Special Administrator of the Estate of Thomas Jansen v. Beazer East, Inc., et al., No: 09-CV-6248 in the Milwaukee County (Wisconsin) Circuit Court. The plaintiff alleges that her husband suffered and died from malignant mesothelioma resulting from exposure to asbestos in his workplace. The plaintiff has sued seven alleged manufacturers or distributors of asbestos-containing products, including Royston Laboratories (formerly an independent company and now a division of Chase Corporation). We have filed an answer to the claim denying the material allegations in the complaint. The parties are currently engaged in discovery.

In addition to the matters described above, we are involved from time to time in litigation incidental to the conduct of our business. Although we do not expect that the outcome in any of these matters, individually or collectively, will have a material adverse effect on our financial condition or results of operations, litigation is inherently unpredictable. Therefore, judgments could be rendered or settlements entered, that could adversely affect our operating results or cash flows in a particular period. We routinely assess all of our litigation and threatened litigation as to the probability of ultimately incurring a liability, and record our best estimate of the ultimate loss in situations where we assess the likelihood of loss as probable.

ITEM 4-SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no matters submitted to a vote of our security holders during the fourth quarter of our fiscal year ended August 31, 2009.

ITEM 4A-EXECUTIVE OFFICERS OF THE REGISTRANT

The following table sets forth information concerning our Executive Officers as of August 31, 2009. Each of our Executive Officers is selected by our Board of Directors and holds office until his successor is elected and qualified.

Name | Age | Offices Held and Business Experience during the Past Five Years | |||

|---|---|---|---|---|---|

| Peter R. Chase | 61 | Chairman of the Board of the Company since February 2007, and Chief Executive Officer of the Company since September 1993. | |||

Adam P. Chase | | | 37 | | President of the Company since January 2008, Chief Operating Officer of the Company since February 2007, Vice President Operations February 2006 through February 2007, and Vice President Chase Coating & Laminating Division March 2003 through February 2007. |

Kenneth L. Dumas | | | 38 | | Chief Financial Officer and Treasurer of the Company since February 2007, Director of Finance February 2006 through January 2007, and Corporate Controller January 2004 through January 2007. |

Terry M. Jones | | | 48 | | Vice President Corporate Development since December 2008, Chief Marketing Officer February 2007 through December 2008, Vice President Marketing and Business Development February 2006 through February 2007, and Vice President Specialty Coatings Division August 2002 through February 2007. |

Gregory A. Pelagio | | | 65 | | Vice President Engineering since September 2008, and Vice President and General Manager of Pittsburgh operations since January 1993. |

11

Table of Contents

PART II

ITEM 5-MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the NYSE Amex under the symbol CCF. As of October 31, 2009, there were 450 shareholders of record of our Common Stock and approximately 3,158 beneficial shareholders who held shares in nominee name. On that date, the closing price of our common stock was $12.00 per share as reported by the NYSE Amex.

The following table sets forth the high and low daily sales prices for our common stock as reported by the NYSE Amex for each quarter in the fiscal years ended August 31, 2009 and 2008:

| | Fiscal 2009 | Fiscal 2008 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | High | Low | High | Low | |||||||||

First Quarter | $ | 17.62 | $ | 9.45 | $ | 22.00 | $ | 16.75 | |||||

Second Quarter | 14.81 | 9.00 | 29.04 | 19.00 | |||||||||

Third Quarter | 13.50 | 7.00 | 24.95 | 16.05 | |||||||||

Fourth Quarter | 12.79 | 10.07 | 19.77 | 14.79 | |||||||||

Single annual cash dividend payments were declared and paid subsequent to year end in the amounts of $0.20, $0.35, and $0.25 per common share, for the years ended August 31, 2009, 2008 and 2007, respectively. Certain borrowing facilities of ours contain financial covenants which may have the effect of limiting the amount of dividends that we can pay.

Comparative Stock Performance

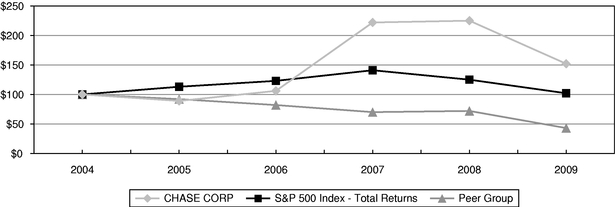

The following line graph compares the yearly percentage change in our cumulative total shareholder return on the Common Stock for the last five fiscal years with the cumulative total return on the Standard & Poor's 500 Stock Index (the "S&P 500 Index"), and a composite peer index that is weighted by market equity capitalization (the "Peer Group Index"). The companies included in the Peer Group Index are American Biltrite Inc., Material Sciences Corporation, Intertape Polymer Group Inc., Quaker Chemical Corporation and Flamemaster Corp. Cumulative total returns are calculated assuming that $100 was invested on August 31, 2004 in each of the Common Stock, the S&P 500 Index and the Peer Group Index, and that all dividends were reinvested.

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100 on August 31, 2004

| | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Chase Corp | $ | 100 | $ | 89 | $ | 106 | $ | 222 | $ | 225 | $ | 152 | |||||||

S&P 500 Index | $ | 100 | $ | 113 | $ | 123 | $ | 141 | $ | 125 | $ | 102 | |||||||

Peer Group Index | $ | 100 | $ | 92 | $ | 82 | $ | 70 | $ | 72 | $ | 43 | |||||||

12

Table of Contents

ITEM 6-SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with "Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Item 8-Financial Statements and Supplementary Data".

| | Fiscal Years Ended August 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||

| | (In thousands, except per share amounts) | ||||||||||||||||

Statement of Operations Data | |||||||||||||||||

Revenues | $ | 107,606 | $ | 132,478 | $ | 127,460 | $ | 108,442 | $ | 91,389 | |||||||

Net income | 6,385 | 12,374 | 10,193 | 6,114 | 4,788 | ||||||||||||

Net income per common share-basic | $ | 0.76 | $ | 1.50 | $ | 1.26 | $ | 0.79 | $ | 0.63 | |||||||

Net income per common share-diluted | $ | 0.73 | $ | 1.43 | $ | 1.22 | $ | 0.77 | $ | 0.61 | |||||||

Balance Sheet Data | |||||||||||||||||

Total assets | $ | 91,066 | $ | 90,297 | $ | 83,965 | $ | 78,837 | $ | 63,927 | |||||||

Long-term debt and capital leases | - | - | 3,823 | 10,288 | 9,569 | ||||||||||||

Total stockholders' equity | 70,213 | 66,186 | 56,212 | 46,074 | 38,840 | ||||||||||||

Cash dividends per common share(a) | $ | 0.20 | $ | 0.35 | $ | 0.25 | $ | 0.20 | $ | 0.175 | |||||||

Note: Information related to our acquisitions and dispositions can be found in the Recent Developments and Overview sections of "Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations".

13

Table of Contents

ITEM 7-MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion provides an analysis of our financial condition and results of operations and should be read in conjunction with the Consolidated Financial Statements and notes thereto included in Item 8 of this Annual Report on Form 10-K.

Selected Relationships within the Consolidated Statements of Operations

| | Years Ended August 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 | |||||||||

| | (Dollars in thousands) | |||||||||||

Revenues | $ | 107,606 | $ | 132,478 | $ | 127,460 | ||||||

Net income | $ | 6,385 | $ | 12,374 | $ | 10,193 | ||||||

Increase/(Decrease) in revenue from prior year | ||||||||||||

Amount | $ | (24,872 | ) | $ | 5,018 | $ | 19,018 | |||||

Percentage | (19 | )% | 4 | % | 18 | % | ||||||

Increase/(Decrease) in net income from prior year | ||||||||||||

Amount | $ | (5,989 | ) | $ | 2,181 | $ | 4,079 | |||||

Percentage | (48 | )% | 21 | % | 67 | % | ||||||

Percentage of revenue: | ||||||||||||

Revenues | 100 | % | 100 | % | 100 | % | ||||||

Expenses: | ||||||||||||

Cost of products and services sold | 70 | % | 68 | % | 69 | % | ||||||

Selling, general and administrative expenses | 20 | 18 | 17 | |||||||||

Loss on impairment of assets | 1 | 0 | 1 | |||||||||

Income before income taxes | 9 | 14 | 13 | |||||||||

Income taxes | 3 | 5 | 5 | |||||||||

Net income | 6 | % | 9 | % | 8 | % | ||||||

Recent Developments

On September 4, 2009, we acquired all of the outstanding capital stock of C.I.M. Industries Inc. ("C.I.M."), which is based in Peterborough, NH and has a manufacturing facility in Texas. C.I.M. is a specialized manufacturer of high performance coating and lining systems used worldwide in the liquid storage and containment industry. With a primary focus on the water and wastewater industry, C.I.M. has the preferred products that complement our product line of high performance tapes and coatings. In its most recently completed twelve month period ending August 31, 2009, C.I.M. revenues were approximately $9,790,000.

The total purchase price, net of cash received, was $18,894,000, subject to certain adjustments relating to the closing date working capital. The purchase was funded through a combination of available cash on hand, a term loan in the amount of $10,000,000 from Bank of America, and a $3,000,000 note payable to C.I.M. shareholders. The net assets acquired by us include cash, inventories, trade receivables, property, plant & equipment, trade payables and certain other current assets and liabilities. The effective date for this acquisition was September 4, 2009. The results of this acquisition have been included in our financial statements since that date, and consequently are not reflected in our results of operations for the fiscal year ended August 31, 2009 or any prior period.

Overview

Following a record year in 2008 for both sales and profits, we were faced with numerous challenges during the 2009 fiscal year as the global recession negatively impacted most of our core product offerings and led to sales and profits in the current fiscal year well below the levels observed in the prior year. The continued declines in two of the larger industries we service, the housing market and worldwide automotive sector, have caused us to reset our expectations and refocus our priorities. We emphasized our efforts to review and consolidate costs where possible, achieved production efficiencies via continuous improvement plans, and identify new business opportunities through sales, marketing and product development teams. Additionally, we are focused on continuing

14

Table of Contents

to support our long term consolidation plans, facility and process improvements and R&D for new and improved product offerings.

Revenues from our Specialized Manufacturing segment were below those of the prior year primarily due to lower demand for pipeline and wire and cable products. Additionally, as previously mentioned, the downturn in the automotive and housing market has negatively impacted sales of our HumiSeal conformal coatings which is used to protect electronic circuitry in automobiles and home appliances. The financial results of our European operations were negatively impacted in fiscal 2009 by the weakened pound sterling whose value against the dollar decreased 11% from August 2008 to August 2009. While fiscal 2009 results were disappointing for this segment, some new business opportunities have been achieved to offset some of the automotive and housing loss, and we experienced increased activity in some sectors during the later stages of the fiscal year.

The Chase Electronic Manufacturing Services segment also faced softness in some key market segments which led to decreased customer demand during fiscal 2009. Lower sales and profits in fiscal 2009 compared to the prior year period reflect the reduced order backlog experienced by this segment as many of our key customers continue to assess their inventory levels and their own customer demand. We continue to have strong relationships with our customers in this segment, even though overall volume is down from what was experienced in fiscal 2008.

In the upcoming fiscal year, our key strategies will include continuous improvement, long term consolidation, product and market development and a targeted acquisition effort. We maintained strong positive cash flows throughout fiscal 2009 and ended the fiscal year with our healthiest balance sheet ever. Despite the uncertainty of the current economic climate, we will continue to focus on our long terms strategic goals. This was evidenced by our acquisition of C.I.M. in the first quarter of fiscal 2010. Additionally, we have recently announced the planned December 2009 closing of the Paterson, NJ plant whose manufacturing will be redistributed to other Chase facilities, and we will be starting up a new coatings plant in Pittsburgh during the same timeframe.

The Company has two reportable segments summarized below:

Segment | Product Lines | Manufacturing Focus and Products | |||

|---|---|---|---|---|---|

Specialized Manufacturing | • Wire and Cable • Electronic Coatings • Pipeline & Construction • Specialty Products | Produces protective coatings and tape products including insulating and conducting materials for wire and cable manufacturers, protective coatings for pipeline applications, moisture protective coatings for electronics, high performance polymeric asphalt additives, and expansion and control joint systems for use in the transportation and architectural markets. | |||

Electronic Manufacturing Services | • Contract Electronic Manufacturing Services | Provides assembly and turnkey contract manufacturing services including printed circuit board and electromechanical assembly services to the electronics industry operating principally in the United States. | |||

15

Table of Contents