|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

Commission file number 1-9924

Citigroup Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) |

| 52-1568099 (I.R.S. Employer Identification No.) |

388 Greenwich Street, New York, NY (Address of principal executive offices) |

| 10013 (Zip code) |

(212) 559-1000 (Registrant's telephone number, including area code) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Large accelerated filer x |

| Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) |

| Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Number of shares of Citigroup Inc. common stock outstanding on March 31, 2018 : 2,549,933,493

Available on the web at www.citigroup.com

|

CITIGROUP'S FIRST QUARTER

2018

-FORM

10-Q

OVERVIEW | 1 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 3 |

Executive Summary | 3 |

Summary of Selected Financial Data | 6 |

SEGMENT AND BUSINESS-INCOME (LOSS) AND REVENUES | 8 |

SEGMENT BALANCE SHEET | 10 |

Global Consumer Banking (GCB) | 12 |

North America GCB | 14 |

Latin America GCB | 16 |

Asia GCB | 18 |

Institutional Clients Group | 20 |

Corporate/Other | 24 |

OFF-BALANCE SHEET ARRANGEMENTS | 25 |

CAPITAL RESOURCES | 26 |

MANAGING GLOBAL RISK TABLE OF CONTENTS | 40 |

MANAGING GLOBAL RISK | 41 |

INCOME TAXES | 75 |

FUTURE APPLICATION OF ACCOUNTING STANDARDS | 76 |

DISCLOSURE CONTROLS AND PROCEDURES | 77 |

DISCLOSURE PURSUANT TO SECTION 219 OF THE IRAN THREAT REDUCTION AND SYRIA HUMAN RIGHTS ACT | 77 |

FORWARD-LOOKING STATEMENTS | 78 |

FINANCIAL STATEMENTS AND NOTES TABLE OF CONTENTS | 81 |

CONSOLIDATED FINANCIAL STATEMENTS | 82 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | 89 |

UNREGISTERED SALES OF EQUITY SECURITIES, PURCHASES OF EQUITY SECURITIES AND DIVIDENDS | 192 |

OVERVIEW

This Quarterly Report on Form 10-Q should be read in conjunction with Citigroup's Annual Report on Form 10-K for the year ended December 31, 2017 (2017 Annual Report on Form 10-K).

Additional information about Citigroup is available on Citi's website at www.citigroup.com . Citigroup's annual reports on Form 10-K, quarterly reports on Form 10-Q and proxy statements, as well as other filings with the U.S. Securities and Exchange Commission (SEC), are available free of charge through Citi's website by clicking on the "Investors" page and selecting "All SEC Filings." The SEC's website also contains current reports on Form 8-K, and other information regarding Citi at www.sec.gov .

Certain reclassifications, including a realignment of certain businesses, have been made to the prior periods' financial statements and disclosures to conform to the current period's presentation. For additional information on certain recent reclassifications, see Notes 1 and 3 to the Consolidated Financial Statements below and Notes 1 and 3 to the Consolidated Financial Statements in Citi's 2017 Annual Report on Form 10-K.

Throughout this report, "Citigroup," "Citi" and "the Company" refer to Citigroup Inc. and its consolidated subsidiaries.

1

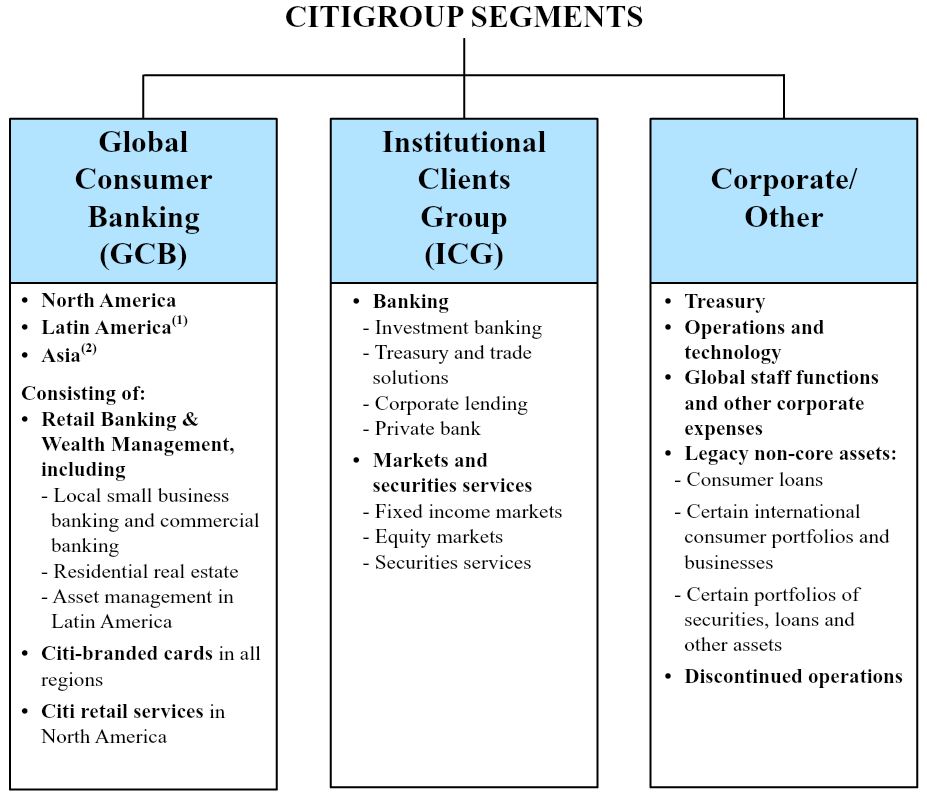

Citigroup is managed pursuant to two business segments: Global Consumer Banking and Institutional Clients Group , with the remaining operations in Corporate/Other .

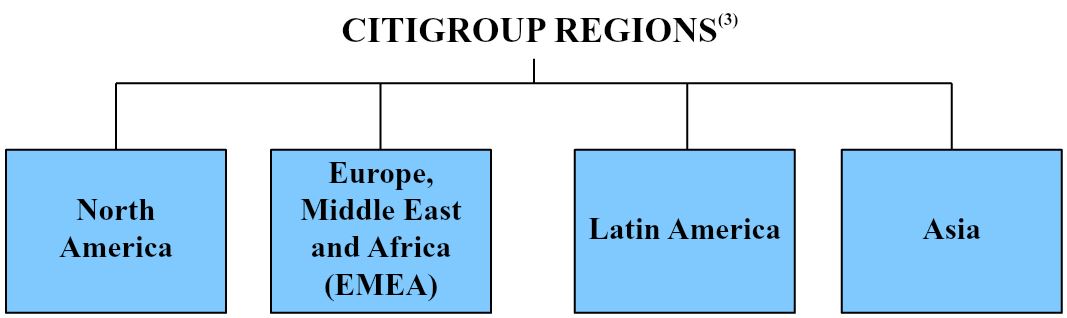

The following are the four regions in which Citigroup operates. The regional results are fully reflected in the segment results above.

(1) | Latin America GCB consists of Citi's consumer banking business in Mexico. |

(2) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

(3) | North America includes the U.S., Canada and Puerto Rico, Latin America includes Mexico and Asia includes Japan. |

2

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

First Quarter of 2018-Balanced Operating Results and Continued Momentum

As described further throughout this Executive Summary, Citi reported balanced operating results in the first quarter of 2018, reflecting continued momentum across businesses and geographies, including many of those areas where Citi has been making investments. During the quarter, Citi had revenue and loan growth in the Institutional Clients Group (ICG) and across products and all three regions in Global Consumer Banking (GCB). Citi also continued to demonstrate expense and credit discipline, resulting in positive operating leverage and an improvement in pre-tax earnings.

In the first quarter of 2018, Citi continued to return capital to shareholders. During the quarter, Citi returned approximately $3.1 billion in the form of common stock repurchases and dividends and repurchased approximately 30 million common shares as outstanding common shares declined 7% from the prior-year period. Despite the continued progress in improving the capital return for shareholders, each of Citi's key regulatory capital metrics remained strong (see "Capital" below).

While global economic growth has continued and the macroeconomic environment remains positive, there continue to be various economic, political and other risks and uncertainties that could impact Citi's businesses and future results. For a discussion of the risks and uncertainties that could impact Citi's businesses, results of operations and financial condition during 2018, see each respective business's results of operations and "Forward-Looking Statements" below, as well as each respective business's results of operations and the "Managing Global Risk" and "Risk Factors" sections in Citi's 2017 Annual Report on Form 10-K.

First Quarter of 2018 Summary Results

Citigroup

Citigroup reported net income of $4.6 billion, or $1.68 per share, compared to net income of $4.1 billion, or $1.35 per share, in the prior-year period. The 13% increase in net income was driven by higher revenues and a significantly lower effective tax rate due to the impact of the Tax Cuts and Jobs Act (Tax Reform), partially offset by higher expenses and cost of credit. Earnings per share increased 24% due to the growth in net income and a 7% reduction in average shares outstanding driven by the capital return to common shareholders.

Citigroup revenues of $18.9 billion in the first quarter of 2018 increased 3%, driven by 7% aggregate growth in GCB and ICG , partially offset by a 51% decrease in Corporate/Other , primarily due to the continued wind-down of legacy assets.

Citigroup's end-of-period loans increased 7% to $673 billion versus the prior-year period. Excluding the impact of foreign currency translation in U.S. dollars for reporting

purposes (FX translation), Citigroup's end-of-period loans grew 6%, as 7% aggregate growth in GCB and ICG was partially offset by the continued wind-down of legacy assets in Corporate/Other (Citi's results of operations excluding the impact of FX translation are non-GAAP financial measures). Citigroup's end-of-period deposits increased 5% to $1.0 trillion versus the prior-year period. Excluding the impact of FX translation, Citigroup's deposits were up 3%, driven by a 5% increase in ICG deposits, while GCB deposits were largely unchanged.

Expenses

Citigroup operating expenses increased 2% to $10.9 billion versus the prior-year period, as the impact of higher volume-related expenses and ongoing investments were offset by efficiency savings and the wind-down of legacy assets. Year-over-year, ICG operating expenses were up 7% and GCB operating expenses increased 5%, while Corporate/Other operating expenses declined 35%, all versus the prior-year period.

Cost of Credit

Citi's total provisions for credit losses and for benefits and claims of $1.9 billion increased 12% from the prior-year period. The increase was mostly driven by a $158 million increase in net credit losses, primarily in North America GCB , and a net loan loss reserve release of $36 million, compared to a net loan loss reserve release of $77 million in the prior-year period. The increase reflected volume growth and seasoning in the North America cards portfolios, as well as a lower net reserve release in ICG .

Net credit losses of $1.9 billion increased 9% versus the prior-year period. Consumer net credit losses increased 6% to

$1.8 billion, mostly reflecting volume growth and seasoning in the North America cards portfolios. The increase in consumer net credit losses was partially offset by the continued wind-down of legacy assets in Corporate/Other . Corporate net credit losses increased $59 million to $96 million.

For additional information on Citi's consumer and corporate credit costs and allowance for loan losses, see each respective business's results of operations and "Credit Risk" below.

Capital

Citigroup's Common Equity Tier 1 Capital and Tier 1 Capital ratios, on a fully implemented basis, were 12.1% and 13.7% as of March 31, 2018 (based on the Basel III Standardized Approach for determining risk-weighted assets), respectively, compared to 12.8% and 14.5% as of March 31, 2017 (based on the Basel III Advanced Approaches for determining risk-weighted assets). The decline in regulatory capital ratios reflected the return of capital to common shareholders and the previously disclosed approximate $6 billion reduction in Common Equity Tier 1 (CET1) Capital in the fourth quarter of 2017 due to the impact of Tax Reform, partially offset by net income. Citigroup's Supplementary Leverage ratio as of

3

March 31, 2018, on a fully implemented basis, was 6.7%, compared to 7.3% as of March 31, 2017. For additional information on Citi's capital ratios and related components, including the impact of Tax Reform on its capital ratios, see "Capital Resources" below.

Global Consumer Banking

GCB net income of $1.4 billion increased 40%, as higher revenues and a lower effective tax rate were partially offset by higher expenses and higher cost of credit. Operating expenses were $4.7 billion, up 5%, as higher volume-related expenses and continued investments were partially offset by efficiency savings across all three regions.

GCB revenues of $8.4 billion increased 7% versus the prior-year period, driven by growth across all regions and the impact of the Hilton portfolio sale in North America Citi-branded cards. The sale resulted in a pre-tax gain of $150 million, partially offset by the loss of operating revenues, for a net year-over-year benefit of approximately $120 million. North America GCB revenues increased 4% to $5.2 billion, driven by higher revenues across all businesses. Citi-branded cards revenues of $2.2 billion were up 6% versus the prior-year period, driven by the sale of the Hilton portfolio. Excluding Hilton, revenues were roughly flat, as growth in interest-earning balances was mostly offset by higher cost of funds and the impact of additional partnership terms. Citi retail services revenues of $1.6 billion increased 2% versus the prior-year period, primarily reflecting continued loan growth. Retail banking revenues increased 4% from the prior-year period to $1.3 billion. Excluding mortgage revenues, retail banking revenues of $1.2 billion were up 8% from the prior-year period, driven by continued growth in deposit margins, growth in investments and loans and increased commercial banking activity.

North America GCB average deposits of $181 billion decreased 2% year-over-year, primarily driven by lower mortgage escrow balances as well as a reduction in money market balances, reflecting transfers to investments. North America GCB average retail loans of $56 billion grew 1% and assets under management of $61 billion grew 10%. Average Citi-branded card loans of $87 billion increased 5%, while Citi-branded card purchase sales of $79 billion increased 8% versus the prior-year period. Average Citi retail services loans of $47 billion increased 4% versus the prior-year period, while Citi retail services purchase sales of $17 billion were up 3%. For additional information on the results of operations of North America GCB for the first quarter of 2018, see " Global Consumer Banking-North America GCB " below.

International GCB revenues (consisting of Latin America GCB and Asia GCB (which includes the results of operations in certain EMEA countries)) increased 13% versus the prior-year period to $3.3 billion. Excluding the impact of FX translation, international GCB revenues increased 8% versus the prior-year period. Latin America GCB revenues increased 8% versus the prior-year period , reflecting growth in cards revenues as well as volume growth across retail loans and deposits and improved deposit spreads. Asia GCB revenues increased 7% (6% excluding a modest one-time gain in the first quarter of 2018) versus the prior-year period, primarily

reflecting an increase in wealth management and cards revenues. For additional information on the results of operations of Latin America GCB and Asia GCB for the first quarter of 2018, including the impact of FX translation, see " Global Consumer Banking-Latin America GCB " and " Global Consumer Banking-Asia GCB " below.

Year-over-year, international GCB average deposits of $128 billion increased 3%, average retail loans of $91 billion increased 4%, assets under management of $103 billion increased 10%, average card loans of $25 billion increased 4% and card purchase sales of $26 billion increased 7%, all excluding the impact of FX translation.

Institutional Clients Group

ICG net income of $3.3 billion increased 11%, driven by higher revenues and a lower effective tax rate, partially offset by higher operating expenses and cost of credit. ICG operating expenses increased 7% to $5.5 billion, driven by the impact of FX translation and a higher level of investment spending.

ICG revenues were $9.8 billion in the first quarter of 2018, up 6% from the prior-year period, primarily driven by a 9% increase in Banking revenues and a 3% increase in Markets and securities services . The increase in Banking revenues included the impact of $23 million of gains on loan hedges within corporate lending, compared to losses of $115 million in the prior-year period.

Banking revenues of $4.8 billion (excluding the impact of gains (losses) on loan hedges within corporate lending) increased 6%, driven by solid growth in treasury and trade solutions, private bank and corporate lending , partially offset by lower revenues in investment banking. Investment banking revenues of $1.1 billion decreased 10% versus the prior-year period, reflecting declines in the overall market wallet and the timing of episodic deal activity. Advisory revenues decreased 14% to $215 million, equity underwriting revenues decreased 14% to $216 million and debt underwriting revenues decreased 8% to $699 million, all versus the prior-year period.

Private bank revenues increased 21% to $904 million, versus the prior-year period, driven by growth in clients, loans, investments and deposits, as well as improved deposit spreads. Corporate lending revenues increased 68% to $544 million. Excluding the impact of gains (losses) on loan hedges, corporate lending revenues increased 19% versus the prior-year period, primarily driven by loan growth and lower hedging costs. Treasury and trade solutions revenues of $2.3 billion increased 8% versus the prior-year period, reflecting volume growth and improved deposit spreads, with growth in both net interest and fee income.

Markets and securities services revenues of $5.0 billion increased 3% from the prior-year period, as strong revenue growth in equity markets and securities services was partially offset by a decline in fixed income markets revenues. Fixed income markets revenues of $3.4 billion decreased 7% from the prior-year period, driven by a less favorable environment and lower investor client activity in G10 rates and spread products, partially offset by strong corporate client activity in G10 foreign exchange and local markets rates and currencies. Equity markets revenues of $1.1 billion increased 38% from the prior-year period, with growth across all products, as

4

volatility increased and momentum with investor clients continued. Securities services revenues of $641 million increased 16%, driven by continued growth in client volumes and higher interest revenue. For additional information on the results of operations of ICG for the first quarter of 2018, see " Institutional Clients Group " below.

Corporate/Other

Corporate/Other net loss was $86 million in the first quarter of 2018, compared to net income of $97 million in the prior-year period, reflecting lower revenues, partially offset by lower operating expenses. Operating expenses of $741 million declined 35% from the prior-year period, largely reflecting the wind-down of legacy assets.

Corporate/Other revenues were $591 million, down 51% from the prior-year period, primarily reflecting the continued wind-down of legacy assets.

For additional information on the results of operations of Corporate/Other for the first quarter of 2018, see " Corporate/Other " below.

5

RESULTS OF OPERATIONS

SUMMARY OF SELECTED FINANCIAL DATA-PAGE 1

Citigroup Inc. and Consolidated Subsidiaries

| First Quarter |

| ||||||

In millions of dollars, except per-share amounts and ratios | 2018 | 2017 | % Change | |||||

Net interest revenue | $ | 11,172 | | $ | 10,955 | | 2 | % |

Non-interest revenue | 7,700 | | 7,411 | | 4 | | ||

Revenues, net of interest expense | $ | 18,872 | | $ | 18,366 | | 3 | % |

Operating expenses | 10,925 | | 10,723 | | 2 | | ||

Provisions for credit losses and for benefits and claims | 1,857 | | 1,662 | | 12 | | ||

Income from continuing operations before income taxes | $ | 6,090 | | $ | 5,981 | | 2 | % |

Income taxes (1) | 1,441 | | 1,863 | | (23 | ) | ||

Income from continuing operations | $ | 4,649 | | $ | 4,118 | | 13 | % |

Income (loss) from discontinued operations, net of taxes (2) | (7 | ) | (18 | ) | 61 | | ||

Net income before attribution of noncontrolling interests | $ | 4,642 | | $ | 4,100 | | 13 | % |

Net income attributable to noncontrolling interests | 22 | | 10 | | NM | | ||

Citigroup's net income | $ | 4,620 | | $ | 4,090 | | 13 | % |

Less: |

|

| | | ||||

Preferred dividends-Basic | $ | 272 | | $ | 301 | | (10 | )% |

Dividends and undistributed earnings allocated to employee restricted and deferred shares that contain nonforfeitable rights to dividends, applicable to basic EPS | 51 | | 55 | | (7 | ) | ||

Income allocated to unrestricted common shareholders for basic and diluted EPS | $ | 4,297 | | $ | 3,734 | | 15 | % |

Earnings per share |

|

| | | ||||

Basic |

|

| | | ||||

Income from continuing operations | 1.68 | | 1.36 | | 24 | | ||

Net income | 1.68 | | 1.35 | | 24 | | ||

Diluted |

|

| | | ||||

Income from continuing operations | $ | 1.68 | | $ | 1.36 | | 24 | % |

Net income | 1.68 | | 1.35 | | 24 | | ||

Dividends declared per common share | 0.32 | | 0.16 | | 100 | | ||

Table continues on the next page, including footnotes.

6

SUMMARY OF SELECTED FINANCIAL DATA-PAGE 2

Citigroup Inc. and Consolidated Subsidiaries |

| |||||||

| First Quarter |

| ||||||

In millions of dollars, except per-share amounts, ratios and direct staff | 2018 | 2017 | % Change | |||||

At March 31: |

|

|

| |||||

Total assets | $ | 1,922,104 | | $ | 1,821,479 | | 6 | % |

Total deposits | 1,001,219 | | 949,990 | | 5 | | ||

Long-term debt | 237,938 | | 208,530 | | 14 | | ||

Citigroup common stockholders' equity (1) | 182,759 | | 208,723 | | (12 | ) | ||

Total Citigroup stockholders' equity (1) | 201,915 | | 227,976 | | (11 | ) | ||

Direct staff (in thousands) | 209 | | 215 | | (3 | ) | ||

Performance metrics |

|

| | | ||||

Return on average assets | 0.98 | % | 0.91 | % | | | ||

Return on average common stockholders' equity (1)(3) | 9.7 | | 7.4 | | | | ||

Return on average total stockholders' equity (1)(3) | 9.3 | | 7.3 | | | | ||

Efficiency ratio (total operating expenses/total revenues) | 58 | | 58 | | | | ||

Basel III ratios-full implementation (1) |

|

|

| |||||

Common Equity Tier 1 Capital (4)(5) | 12.05 | % | 12.81 | % |

| |||

Tier 1 Capital (4)(5) | 13.67 | | 14.48 | |

| |||

Total Capital (4)(5) | 16.01 | | 16.52 | |

| |||

Supplementary Leverage ratio (5) | 6.71 | | 7.27 | |

| |||

Citigroup common stockholders' equity to assets (1) | 9.51 | % | 11.46 | % |

| |||

Total Citigroup stockholders' equity to assets (1) | 10.50 | | 12.52 | |

| |||

Dividend payout ratio (6) | 19.0 | | 11.9 | |

| |||

Total payout ratio (7) | 71 | | 59 | |

| |||

Book value per common share (1) | $ | 71.67 | | $ | 75.81 | | (5 | )% |

Tangible book value (TBV) per share (8)(1) | 61.02 | | 65.88 | | (7 | ) | ||

Ratio of earnings to fixed charges and preferred stock dividends | 2.10x | | 2.51x | |

| |||

(1) | The first quarter of 2018 reflects the impact of Tax Reform. For additional information on Tax Reform, including the impact on Citi's fourth quarter and full-year 2017 results, see Citi's 2017 Annual Report on Form 10-K. |

(2) | See Note 2 to the Consolidated Financial Statements for additional information on Citi's discontinued operations. |

(3) | The return on average common stockholders' equity is calculated using net income less preferred stock dividends divided by average common stockholders' equity. The return on average total Citigroup stockholders' equity is calculated using net income divided by average Citigroup stockholders' equity. |

(4) | Citi's reportable Common Equity Tier 1 (CET1) Capital and Tier 1 Capital ratios were the lower derived under the U.S. Basel III Standardized Approach at March 31, 2018, and U.S. Basel III Advanced Approaches at March 31, 2017. Citi's reportable Total Capital ratios were derived under the U.S. Basel III Advanced Approaches for both periods presented. This reflects the U.S. Basel III requirement to report the lower of risk-based capital ratios under both the Standardized Approach and Advanced Approaches in accordance with the Collins Amendment of the Dodd-Frank Act. |

(5) | Citi's risk-based capital and leverage ratios as of March 31, 2017 are non-GAAP financial measures, which reflect full implementation of regulatory capital adjustments and deductions prior to the effective date of January 1, 2018. |

(6) | Dividends declared per common share as a percentage of net income per diluted share. |

(7) | Total common dividends declared plus common stock repurchases as a percentage of net income available to common shareholders. See "Consolidated Statement of Changes in Stockholders' Equity," Note 9 to the Consolidated Financial Statements and "Equity Security Repurchases" below for the component details. |

(8) | For information on TBV, see "Capital Resources-Tangible Common Equity, Book Value Per Share, Tangible Book Value Per Share and Returns on Equity" below. |

NM Not meaningful

7

SEGMENT AND BUSINESS-INCOME (LOSS) AND REVENUES

CITIGROUP INCOME

| First Quarter |

| ||||||

In millions of dollars | 2018 | 2017 | % Change | |||||

Income from continuing operations |

|

|

| |||||

Global Consumer Banking |

|

|

| |||||

North America | $ | 838 | | $ | 614 | | 36 | % |

Latin America | 183 | | 135 | | 36 | | ||

Asia (1) | 373 | | 249 | | 50 | | ||

Total | $ | 1,394 | | $ | 998 | | 40 | % |

Institutional Clients Group | | |

| | | |||

North America | $ | 857 | | $ | 1,077 | | (20 | )% |

EMEA | 1,113 | | 862 | | 29 | | ||

Latin America | 491 | | 482 | | 2 | | ||

Asia | 868 | | 590 | | 47 | | ||

Total | $ | 3,329 | | $ | 3,011 | | 11 | % |

Corporate/Other | (74 | ) | 109 | | NM | | ||

Income from continuing operations | $ | 4,649 | | $ | 4,118 | | 13 | % |

Discontinued operations | $ | (7 | ) | $ | (18 | ) | 61 | % |

Net income attributable to noncontrolling interests | 22 | | 10 | | NM | | ||

Citigroup's net income | $ | 4,620 | | $ | 4,090 | | 13 | % |

(1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

NM Not meaningful

8

| First Quarter |

| ||||||

In millions of dollars | 2018 | 2017 | % Change | |||||

Global Consumer Banking |

|

|

| |||||

North America | $ | 5,157 | | $ | 4,945 | | 4 | % |

Latin America | 1,347 | | 1,167 | | 15 | | ||

Asia (1) | 1,929 | | 1,734 | | 11 | | ||

Total | $ | 8,433 | | $ | 7,846 | | 7 | % |

Institutional Clients Group | | |

| | | |||

North America | $ | 3,265 | | $ | 3,522 | | (7 | )% |

EMEA | 3,167 | | 2,854 | | 11 | | ||

Latin America | 1,210 | | 1,169 | | 4 | | ||

Asia | 2,206 | | 1,774 | | 24 | | ||

Total | $ | 9,848 | | $ | 9,319 | | 6 | % |

Corporate/Other | 591 | | 1,201 | | (51 | ) | ||

Total Citigroup net revenues | $ | 18,872 | | $ | 18,366 | | 3 | % |

(1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

9

SEGMENT BALANCE SHEET

(1)In millions of dollars | Global Consumer Banking | Institutional Clients Group | Corporate/Other and consolidating eliminations (2) | Citigroup parent company- issued long-term debt and stockholders' equity (3) | Total Citigroup consolidated | ||||||||||

Assets |

|

|

|

|

| ||||||||||

Cash and deposits with banks | $ | 7,493 | | $ | 65,194 | | $ | 130,017 | | $ | - | | $ | 202,704 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | 291 | | 257,288 | | 308 | | - | | 257,887 | | |||||

Trading account assets | 662 | | 260,226 | | 7,920 | | - | | 268,808 | | |||||

Investments | 1,475 | | 111,464 | | 239,032 | | - | | 351,971 | | |||||

Loans, net of unearned income and allowance for loan losses | 294,808 | | 345,478 | | 20,298 | | - | | 660,584 | | |||||

Other assets | 37,341 | | 107,949 | | 34,860 | | - | | 180,150 | | |||||

Net inter-segment liquid assets (4) | 80,816 | | 259,120 | | (339,936 | ) | - | | - | | |||||

Total assets | $ | 422,886 | | $ | 1,406,719 | | $ | 92,499 | | $ | - | | $ | 1,922,104 | |

Liabilities and equity |

|

|

|

|

| ||||||||||

Total deposits | $ | 314,355 | | $ | 665,987 | | $ | 20,877 | | $ | - | | $ | 1,001,219 | |

Federal funds purchased and securities loaned or sold under agreements to repurchase | 4,359 | | 167,391 | | 9 | | - | | 171,759 | | |||||

Trading account liabilities | 142 | | 143,018 | | 801 | | - | | 143,961 | | |||||

Short-term borrowings | 588 | | 20,256 | | 15,250 | | - | | 36,094 | | |||||

Long-term debt (3) | 1,977 | | 36,913 | | 45,974 | | 153,074 | | 237,938 | | |||||

Other liabilities | 18,379 | | 95,702 | | 14,186 | | - | | 128,267 | | |||||

Net inter-segment funding (lending) (3) | 83,086 | | 277,452 | | (5,549 | ) | (354,989 | ) | - | | |||||

Total liabilities | $ | 422,886 | | $ | 1,406,719 | | $ | 91,548 | | $ | (201,915 | ) | $ | 1,719,238 | |

Total stockholders' equity (5) | - | | - | | 951 | | 201,915 | | 202,866 | | |||||

Total liabilities and equity | $ | 422,886 | | $ | 1,406,719 | | $ | 92,499 | | $ | - | | $ | 1,922,104 | |

(1) | The supplemental information presented in the table above reflects Citigroup's consolidated GAAP balance sheet by reporting segment as of March 31, 2018 . The respective segment information depicts the assets and liabilities managed by each segment as of such date. |

(2) | Consolidating eliminations for total Citigroup and Citigroup parent company assets and liabilities are recorded within Corporate/Other . |

(3) | The total stockholders' equity and the majority of long-term debt of Citigroup reside in the Citigroup parent company Consolidated Balance Sheet. Citigroup allocates stockholders' equity and long-term debt to its businesses through inter-segment allocations as shown above. |

(4) | Represents the attribution of Citigroup's liquid assets (primarily consisting of cash, marketable equity securities, and available-for-sale debt securities) to the various businesses based on Liquidity Coverage Ratio (LCR) assumptions. |

(5) | Corporate/Other equity represents noncontrolling interests. |

10

This page intentionally left blank.

11

GLOBAL CONSUMER BANKING

Global Consumer Banking (GCB) consists of consumer banking businesses in North America , Latin America (consisting of Citi's consumer banking business in Mexico) and Asia . GCB provides traditional banking services to retail customers through retail banking, including commercial banking, and Citi-branded cards and Citi retail services (for additional information on these businesses, see "Citigroup Segments" above). GCB is focused on its priority markets in the U.S., Mexico and Asia with 2,433 branches in 19 countries and jurisdictions as of March 31, 2018 . At March 31, 2018 , GCB had approximately $423 billion in assets and $314 billion in deposits.

GCB 's overall strategy is to leverage Citi's global footprint and be the pre-eminent bank for the emerging affluent and affluent consumers in large urban centers. In credit cards and in certain retail markets, Citi serves customers in a somewhat broader set of segments and geographies.

| First Quarter |

| ||||||

In millions of dollars except as otherwise noted | 2018 | 2017 | % Change | |||||

Net interest revenue | $ | 6,980 | | $ | 6,579 | | 6 | % |

Non-interest revenue | 1,453 | | 1,267 | | 15 | | ||

Total revenues, net of interest expense | $ | 8,433 | | $ | 7,846 | | 7 | % |

Total operating expenses | $ | 4,681 | | $ | 4,451 | | 5 | % |

Net credit losses | $ | 1,736 | | $ | 1,603 | | 8 | % |

Credit reserve build (release) | 144 | | 177 | | (19 | ) | ||

Provision (release) for unfunded lending commitments | (1 | ) | 6 | | NM | | ||

Provision for benefits and claims | 26 | | 29 | | (10 | ) | ||

Provisions for credit losses and for benefits and claims (LLR & PBC) | $ | 1,905 | | $ | 1,815 | | 5 | % |

Income from continuing operations before taxes | $ | 1,847 | | $ | 1,580 | | 17 | % |

Income taxes | 453 | | 582 | | (22 | ) | ||

Income from continuing operations | $ | 1,394 | | $ | 998 | | 40 | % |

Noncontrolling interests | 2 | | 1 | | 100 | | ||

Net income | $ | 1,392 | | $ | 997 | | 40 | % |

Balance Sheet data (in billions of dollars) | | |

| | | |||

Total EOP assets | $ | 423 | | $ | 411 | | 3 | % |

Average assets | 423 | | 410 | | 3 | | ||

Return on average assets | 1.33 | % | 0.99 | % | | | ||

Efficiency ratio | 56 | | 57 | | | | ||

Average deposits | $ | 309 | | $ | 303 | | 2 | |

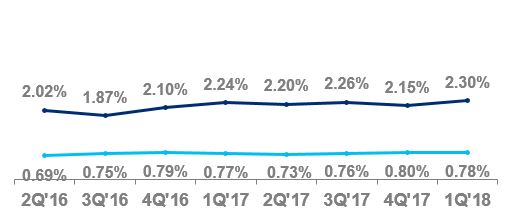

Net credit losses as a percentage of average loans | 2.30 | % | 2.24 | % | | | ||

Revenue by business | | |

| | | |||

Retail banking | $ | 3,471 | | $ | 3,175 | | 9 | % |

Cards (1) | 4,962 | | 4,671 | | 6 | | ||

Total | $ | 8,433 | | $ | 7,846 | | 7 | % |

Income from continuing operations by business | | |

| | | |||

Retail banking | $ | 524 | | $ | 333 | | 57 | % |

Cards (1) | 870 | | 665 | | 31 | | ||

Total | $ | 1,394 | | $ | 998 | | 40 | % |

Table continues on the next page, including footnotes.

12

Foreign currency (FX) translation impact |

|

| | | ||||

Total revenue-as reported | $ | 8,433 | | $ | 7,846 | | 7 | % |

Impact of FX translation (2) | - | | 139 | | | | ||

Total revenues-ex-FX (3) | $ | 8,433 | | $ | 7,985 | | 6 | % |

Total operating expenses-as reported | $ | 4,681 | | $ | 4,451 | | 5 | % |

Impact of FX translation (2) | - | | 87 | | | | ||

Total operating expenses-ex-FX (3) | $ | 4,681 | | $ | 4,538 | | 3 | % |

Total provisions for LLR & PBC-as reported | $ | 1,905 | | $ | 1,815 | | 5 | % |

Impact of FX translation (2) | - | | 27 | | | | ||

Total provisions for LLR & PBC-ex-FX (3) | $ | 1,905 | | $ | 1,842 | | 3 | % |

Net income-as reported | $ | 1,392 | | $ | 997 | | 40 | % |

Impact of FX translation (2) | - | | 18 | | | | ||

Net income-ex-FX (3) | $ | 1,392 | | $ | 1,015 | | 37 | % |

(1) | Includes both Citi-branded cards and Citi retail services. |

(2) | Reflects the impact of FX translation into U.S. dollars at the first quarter of 2018 average exchange rates for all periods presented. |

(3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

NM Not meaningful

13

NORTH AMERICA GCB

North America GCB provides traditional retail banking, including commercial banking, and its Citi-branded cards and Citi retail services card products to retail customers and small to mid-size businesses, as applicable, in the U.S. North America GCB 's U.S. cards product portfolio includes its proprietary portfolio (including the Citi Double Cash, Thank You and Value cards) and co-branded cards (including, among others, American Airlines and Costco) within Citi-branded cards as well as its co-brand and private label relationships (including, among others, Sears, The Home Depot, Best Buy and Macy's) within Citi retail services.

As of March 31, 2018 , North America GCB 's 694 retail bank branches are concentrated in the six key metropolitan areas of New York, Chicago, Miami, Washington, D.C., Los Angeles and San Francisco. Also as of March 31, 2018 , North America GCB had approximately 9.1 million retail banking customer accounts, $55.4 billion in retail banking loans and $184.3 billion in deposits. In addition, North America GCB had approximately 119.3 million Citi-branded and Citi retail services credit card accounts with $131.7 billion in outstanding card loan balances.

| First Quarter |

| ||||||

In millions of dollars, except as otherwise noted | 2018 | 2017 | % Change | |||||

Net interest revenue | $ | 4,750 | | $ | 4,617 | | 3 | % |

Non-interest revenue | 407 | | 328 | | 24 | | ||

Total revenues, net of interest expense | $ | 5,157 | | $ | 4,945 | | 4 | % |

Total operating expenses | $ | 2,645 | | $ | 2,597 | | 2 | % |

Net credit losses | $ | 1,296 | | $ | 1,190 | | 9 | % |

Credit reserve build (release) | 123 | | 152 | | (19 | ) | ||

Provision for unfunded lending commitments | (4 | ) | 7 | | NM | | ||

Provision for benefits and claims | 6 | | 6 | | - | | ||

Provisions for credit losses and for benefits and claims | $ | 1,421 | | $ | 1,355 | | 5 | % |

Income from continuing operations before taxes | $ | 1,091 | | $ | 993 | | 10 | % |

Income taxes | 253 | | 379 | | (33 | ) | ||

Income from continuing operations | $ | 838 | | $ | 614 | | 36 | % |

Noncontrolling interests | - | | - | | NM | | ||

Net income | $ | 838 | | $ | 614 | | 36 | % |

Balance Sheet data (in billions of dollars) | | |

| | | |||

Average assets | $ | 248 | | $ | 245 | | 1 | % |

Return on average assets | 1.37 | % | 1.02 | % | | | ||

Efficiency ratio | 51 | | 53 | | | | ||

Average deposits | $ | 180.9 | | $ | 184.6 | | (2 | ) |

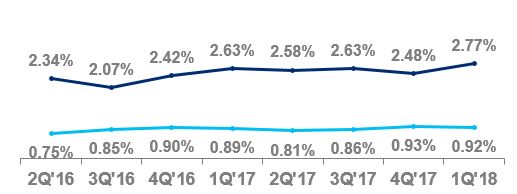

Net credit losses as a percentage of average loans | 2.77 | % | 2.63 | % | | | ||

Revenue by business | | |

| | | |||

Retail banking | $ | 1,307 | | $ | 1,257 | | 4 | % |

Citi-branded cards | 2,232 | | 2,096 | | 6 | | ||

Citi retail services | 1,618 | | 1,592 | | 2 | | ||

Total | $ | 5,157 | | $ | 4,945 | | 4 | % |

Income from continuing operations by business | | |

| | | |||

Retail banking | $ | 140 | | $ | 72 | | 94 | % |

Citi-branded cards | 425 | | 246 | | 73 | | ||

Citi retail services | 273 | | 296 | | (8 | ) | ||

Total | $ | 838 | | $ | 614 | | 36 | % |

NM Not meaningful

14

1Q18 vs. 1Q17

Net income increased 36% due to higher revenues and a lower effective tax rate due to the impact of Tax Reform, partially offset by higher expenses and higher cost of credit.

Revenues increased 4%, reflecting higher revenues across retail banking, Citi retail services and Citi-branded cards, which included the impact of the Hilton portfolio sale (see below).

Retail banking revenues increased 4%. Excluding mortgage revenues ( decline of 18%), retail banking revenues were up 8%, driven by continued growth in deposit margins, growth in both assets under management (up 10%) and average loans (up 1%), as well as increased commercial banking activity. The decline in mortgage revenues was driven by lower origination activity and higher cost of funds reflecting the higher interest rate environment.

Cards revenues increased 4%. In Citi-branded cards, revenues increased 6%, driven by the impact of the Hilton portfolio sale, which resulted in a gain of approximately $150 million in the first quarter of 2018, partially offset by the loss of operating revenues, for a net year-over-year benefit of approximately $120 million. Excluding Hilton, revenues were largely unchanged, as growth in interest-earning balances was offset by higher cost of funds and the impact of additional partnership terms. Average loans increased 5% and purchase sales increased 8%.

Citi retail services revenues increased 2%, reflecting continued loan growth. Average loans increased 4% and purchase sales increased 3%.

Expenses increased 2%, as higher volume-related expenses and continued investments were partially offset by efficiency savings.

Provisions increased 5% from the prior-year period, driven by higher net credit losses, partially offset by a lower net loan loss reserve build.

Net credit losses increased 9% to $1.3 billion, largely driven by higher net credit losses in Citi-branded cards (up 3% to $651 million) and Citi retail services (up 16% to $602 million). The increase in net credit losses primarily reflected volume growth and seasoning in both cards portfolios as well as an increase in net flow rates in later delinquency buckets versus the prior-year period, primarily in Citi retail services.

The net loan loss reserve build in the first quarter of 2018 was $119 million (compared to a build of $159 million in the prior-year period), as volume growth and seasoning in both cards portfolios were partially offset by a loan loss reserve release in the commercial portfolio.

For additional information on North America GCB 's retail banking, including commercial banking, and its Citi-branded cards and Citi retail services portfolios, see "Credit Risk-Consumer Credit" below.

15

LATIN AMERICA GCB

Latin America GCB provides traditional retail banking, including commercial banking, and its Citi-branded card products to retail customers and small to mid-size businesses in Mexico through Citibanamex, one of Mexico's largest banks.

At March 31, 2018 , Latin America GCB had 1,462 retail branches in Mexico, with approximately 28.2 million retail banking customer accounts, $21.2 billion in retail banking loans and $29.6 billion in deposits. In addition, the business had approximately 5.7 million Citi-branded card accounts with $5.7 billion in outstanding loan balances.

| First Quarter |

| ||||||

In millions of dollars, except as otherwise noted | 2018 | 2017 | % Change | |||||

Net interest revenue | $ | 997 | | $ | 848 | | 18 | % |

Non-interest revenue | 350 | | 319 | | 10 | | ||

Total revenues, net of interest expense | $ | 1,347 | | $ | 1,167 | | 15 | % |

Total operating expenses | $ | 759 | | $ | 667 | | 14 | % |

Net credit losses | $ | 278 | | $ | 253 | | 10 | % |

Credit reserve build (release) | 42 | | 12 | | NM | | ||

Provision (release) for unfunded lending commitments | 1 | | - | | NM | | ||

Provision for benefits and claims | 20 | | 23 | | (13 | ) | ||

Provisions for credit losses and for benefits and claims (LLR & PBC) | $ | 341 | | $ | 288 | | 18 | % |

Income from continuing operations before taxes | $ | 247 | | $ | 212 | | 17 | % |

Income taxes | 64 | | 77 | | (17 | ) | ||

Income from continuing operations | $ | 183 | | $ | 135 | | 36 | % |

Noncontrolling interests | - | | 1 | | (100 | ) | ||

Net income | $ | 183 | | $ | 134 | | 37 | % |

Balance Sheet data (in billions of dollars) | | |

| | | |||

Average assets | $ | 44 | | $ | 42 | | 5 | % |

Return on average assets | 1.69 | | 1.29 | | | | ||

Efficiency ratio | 56 | % | 57 | % | | | ||

Average deposits | $ | 28.9 | | $ | 25.3 | | 14 | |

Net credit losses as a percentage of average loans | 4.29 | % | 4.44 | % | | | ||

Revenue by business | | |

| | | |||

Retail banking | $ | 966 | | $ | 850 | | 14 | % |

Citi-branded cards | 381 | | 317 | | 20 | | ||

Total | $ | 1,347 | | $ | 1,167 | | 15 | % |

Income from continuing operations by business | | |

| | | |||

Retail banking | $ | 138 | | $ | 90 | | 53 | % |

Citi-branded cards | 45 | | 45 | | - | | ||

Total | $ | 183 | | $ | 135 | | 36 | % |

16

FX translation impact | | |

| | | |||

Total revenues-as reported | $ | 1,347 | | $ | 1,167 | | 15 | % |

Impact of FX translation (1) | - | | 75 | | | | ||

Total revenues-ex-FX (2) | $ | 1,347 | | $ | 1,242 | | 8 | % |

Total operating expenses-as reported | $ | 759 | | $ | 667 | | 14 | % |

Impact of FX translation (1) | - | | 37 | | | | ||

Total operating expenses-ex-FX (2) | $ | 759 | | $ | 704 | | 8 | % |

Provisions for LLR & PBC-as reported | $ | 341 | | $ | 288 | | 18 | % |

Impact of FX translation (1) | - | | 20 | | | | ||

Provisions for LLR & PBC-ex-FX (2) | $ | 341 | | $ | 308 | | 11 | % |

Net income-as reported | $ | 183 | | $ | 134 | | 37 | % |

Impact of FX translation (1) | - | | 13 | | | | ||

Net income-ex-FX (2) | $ | 183 | | $ | 147 | | 24 | % |

(1) | Reflects the impact of FX translation into U.S. dollars at the first quarter of 2018 average exchange rates for all periods presented. |

(2) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

NM Not meaningful

The discussion of the results of operations for Latin America GCB below excludes the impact of FX translation for all periods presented. Presentations of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. For a reconciliation of certain of these metrics to the reported results, see the table above.

1Q18 vs. 1Q17

Net income increased 24%, reflecting higher revenues and a lower effective tax rate as a result of Tax Reform, partially offset by higher expenses and cost of credit.

Revenues increased 8%, driven by higher revenues in

both retail banking and cards.

Retail banking revenues increased 7%, reflecting continued growth in volumes (average loans up 5% and average deposits up 6%), largely driven by the commercial banking business and mortgages, as well as improved deposit spreads, driven by higher interest rates. Cards revenues increased 13%, reflecting continued growth in purchase sales (up 10%) and full-rate revolving loans, as well as favorable comparisons to the first quarter of 2017. Average card loans grew 8%.

Expenses increased 8%, as ongoing investment spending and business growth were partially offset by efficiency savings.

Provisions increased 11%, primarily driven by a higher net loan loss reserve build ($43 million), largely reflecting volume growth and seasoning.

For additional information on Latin America GCB 's retail banking, including commercial banking, and its Citi-branded cards portfolios, see "Credit Risk-Consumer Credit" below.

17

ASIA GCB

Asia GCB provides traditional retail banking, including commercial banking, and its Citi-branded card products to retail customers and small to mid-size businesses, as applicable. During the first quarter of 2018, Citi's most significant revenues in the region were from Singapore, Hong Kong, Korea, India, Australia, Taiwan, Philippines, Thailand, Indonesia and Malaysia. Included within Asia GCB , traditional retail banking and Citi-branded card products are also provided to retail customers in certain EMEA countries, primarily Poland, Russia and the United Arab Emirates.

At March 31, 2018 , on a combined basis, the businesses had 277 retail branches, approximately 15.9 million retail banking customer accounts, $70.8 billion in retail banking loans and $100.5 billion in deposits. In addition, the businesses had approximately 16.2 million Citi-branded card accounts with $19.2 billion in outstanding loan balances.

| First Quarter |

| ||||||

In millions of dollars, except as otherwise noted (1) | 2018 | 2017 | % Change | |||||

Net interest revenue | $ | 1,233 | | $ | 1,114 | | 11 | % |

Non-interest revenue | 696 | | 620 | | 12 | | ||

Total revenues, net of interest expense | $ | 1,929 | | $ | 1,734 | | 11 | % |

Total operating expenses | $ | 1,277 | | $ | 1,187 | | 8 | % |

Net credit losses | $ | 162 | | $ | 160 | | 1 | % |

Credit reserve build (release) | (21 | ) | 13 | | NM | | ||

Provision (release) for unfunded lending commitments | 2 | | (1 | ) | NM | | ||

Provisions for credit losses | $ | 143 | | $ | 172 | | (17 | )% |

Income from continuing operations before taxes | $ | 509 | | $ | 375 | | 36 | % |

Income taxes | 136 | | 126 | | 8 | | ||

Income from continuing operations | $ | 373 | | $ | 249 | | 50 | % |

Noncontrolling interests | 2 | | - | | NM | | ||

Net income | $ | 371 | | $ | 249 | | 49 | % |

Balance Sheet data (in billions of dollars) | | | | | | | ||

Average assets | $ | 131 | | $ | 123 | | 7 | % |

Return on average assets | 1.15 | % | 0.82 | % | | | ||

Efficiency ratio | 66 | | 68 | |

| |||

Average deposits | $ | 99.1 | | $ | 92.7 | | 7 | |

Net credit losses as a percentage of average loans | 0.73 | % | 0.78 | % | | | ||

Revenue by business |

|

|

| |||||

Retail banking | $ | 1,198 | | $ | 1,068 | | 12 | % |

Citi-branded cards | 731 | | 666 | | 10 | | ||

Total | $ | 1,929 | | $ | 1,734 | | 11 | % |

Income from continuing operations by business | | | | | | | ||

Retail banking | $ | 246 | | $ | 171 | | 44 | % |

Citi-branded cards | 127 | | 78 | | 63 | | ||

Total | $ | 373 | | $ | 249 | | 50 | % |

18

FX translation impact | | | | |||||

Total revenues-as reported | $ | 1,929 | | $ | 1,734 | | 11 | % |

Impact of FX translation (2) | - | | 64 | | | | ||

Total revenues-ex-FX (3) | $ | 1,929 | | $ | 1,798 | | 7 | % |

Total operating expenses-as reported | $ | 1,277 | | $ | 1,187 | | 8 | % |

Impact of FX translation (2) | - | | 50 | | | | ||

Total operating expenses-ex-FX (3) | $ | 1,277 | | $ | 1,237 | | 3 | % |

Provisions for loan losses-as reported | $ | 143 | | $ | 172 | | (17 | )% |

Impact of FX translation (2) | - | | 7 | | | | ||

Provisions for loan losses-ex-FX (3) | $ | 143 | | $ | 179 | | (20 | )% |

Net income-as reported | $ | 371 | | $ | 249 | | 49 | % |

Impact of FX translation (2) | - | | 5 | | | | ||

Net income-ex-FX (3) | $ | 371 | | $ | 254 | | 46 | % |

(1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

(2) | Reflects the impact of FX translation into U.S. dollars at the first quarter of 2018 average exchange rates for all periods presented. |

(3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

NM Not meaningful

The discussion of the results of operations for Asia GCB below excludes the impact of FX translation for all periods presented. Presentations of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. For a reconciliation of certain of these metrics to the reported results, see the table above.

1Q18 vs. 1Q17

Net income increased 46%, reflecting higher revenues, a lower effective tax rate as a result of Tax Reform and lower cost of credit, partially offset by higher expenses.

Revenues increased 7%, driven by solid growth in both retail banking and cards.

Retail banking revenues increased 8%, reflecting strong growth in wealth management and a modest one-time gain. Excluding the gain, retail banking revenues grew 6%. Wealth management revenues increased due to continued improvement in investor sentiment, stronger equity markets and increases in assets under management (14%) and investment sales (32%). Average deposits increased 2%. Retail lending revenues modestly improved (up 1%), as an increase in volumes (average loans up 3%) was largely offset by spread compression.

Cards revenues increased 5%, reflecting 3% growth in average loans and 7% growth in purchase sales, both of which benefited from the previously disclosed portfolio acquisition in Australia in the first quarter of 2017.

Expenses increased 3%, resulting from volume growth and ongoing investment spending, partially offset by efficiency savings.

Provisions decreased 20%, primarily driven by a net loan loss reserve release compared to a net loan loss reserve build in the prior-year period. Overall credit quality continued to remain stable in the region.

For additional information on Asia GCB 's retail banking, including commercial banking, and its Citi-branded cards portfolios, see "Credit Risk-Consumer Credit" below.

19

INSTITUTIONAL CLIENTS GROUP

Institutional Clients Group (ICG) includes Banking and Markets and securities services (for additional information on these businesses, see "Citigroup Segments" above). ICG provides corporate, institutional, public sector and high-net-worth clients around the world with a full range of wholesale banking products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, derivative services, equity and fixed income research, corporate lending, investment banking and advisory services, private banking, cash management, trade finance and securities services. ICG transacts with clients in both cash instruments and derivatives, including fixed income, foreign currency, equity and commodity products.

ICG revenue is generated primarily from fees and spreads associated with these activities. ICG earns fee income for assisting clients with transactional services and clearing, providing brokerage and investment banking services and other such activities. Such fees are recognized at the point in time when Citigroup's performance under the terms of a contractual arrangement is completed, which is typically at the trade/execution date or closing of a transaction. Revenue generated from these activities is recorded in Commissions and fees and Investment banking . Revenue is also generated from assets under custody and administration which is recognized as/when the associated promised service is satisfied, which normally occurs at the point in time the service is requested by the customer and provided by Citi. Revenue generated from these activities is primarily recorded in Administration and other fiduciary fees . For additional information on these various types of revenues, see Note 5 to the Consolidated Financial Statements.

In addition, as a market maker, ICG facilitates transactions, including holding product inventory to meet client demand, and earns the differential between the price at which it buys and sells the products. These price differentials and the unrealized gains and losses on the inventory are recorded in Principal transactions (for additional information on Principal transactions revenue, see Note 6 to the Consolidated Financial Statements). Other primarily includes mark-to-market gains and losses on certain credit derivatives, gains and losses on available-for-sale (AFS) debt securities, gains and losses on equity securities not held in trading accounts, and other non-recurring gains and losses. Interest income earned on assets held, less interest paid to customers on deposits and long- and short-term debt, is recorded as Net interest revenue .

The amount and types of Markets revenues are impacted by a variety of interrelated factors, including market liquidity; changes in market variables such as interest rates, foreign exchange rates, equity prices, commodity prices and credit spreads, as well as their implied volatilities; investor confidence; and other macroeconomic conditions. Assuming all other market conditions do not change, increases in client activity levels or bid/offer spreads generally result in increases in revenues. However, changes in market conditions can significantly impact client activity levels, bid/offer spreads and the fair value of product inventory. For example, a decrease in market liquidity may increase bid/offer spreads, decrease client activity levels and widen credit spreads on product inventory positions.

ICG 's management of the Markets businesses involves daily monitoring and evaluating of the above factors at the trading desk as well as the country level. ICG does not separately track the impact on total Markets revenues of the volume of transactions, bid/offer spreads, fair value changes of product inventory positions and economic hedges because, as noted above, these components are interrelated and are not deemed useful or necessary individually to manage the Markets businesses at an aggregate level.

In the Markets businesses, client revenues are those revenues directly attributable to client transactions at the time of inception, including commissions, interest or fees earned. Client revenues do not include the results of client facilitation activities (for example, holding product inventory in anticipation of client demand) or the results of certain economic hedging activities.

ICG 's international presence is supported by trading floors in approximately 80 countries and a proprietary network in 98 countries and jurisdictions. At March 31, 2018 , ICG had approximately $1.4 trillion of assets and $666 billion of deposits, while two of its businesses-securities services and issuer services-managed approximately $17.7 trillion of assets under custody compared to $15.9 trillion at the end of the prior-year period.

20

| First Quarter |

| ||||||

In millions of dollars, except as otherwise noted | 2018 | 2017 | % Change | |||||

Commissions and fees | $ | 1,213 | | $ | 1,024 | | 18 | % |

Administration and other fiduciary fees | 694 | | 635 | | 9 | | ||

Investment banking | 985 | | 1,110 | | (11 | ) | ||

Principal transactions | 2,884 | | 2,731 | | 6 | | ||

Other | 418 | | 1 | | NM | | ||

Total non-interest revenue | $ | 6,194 | | $ | 5,501 | | 13 | % |

Net interest revenue (including dividends) | 3,654 | | 3,818 | | (4 | ) | ||

Total revenues, net of interest expense | $ | 9,848 | | $ | 9,319 | | 6 | % |

Total operating expenses | $ | 5,503 | | $ | 5,138 | | 7 | % |

Net credit losses | $ | 105 | | $ | 25 | | NM | |

Credit reserve build (release) | (175 | ) | (176 | ) | 1 | | ||

Provision (release) for unfunded lending commitments | 29 | | (54 | ) | NM | | ||

Provisions for credit losses | $ | (41 | ) | $ | (205 | ) | 80 | % |

Income from continuing operations before taxes | $ | 4,386 | | $ | 4,386 | | - | % |

Income taxes | 1,057 | | 1,375 | | (23 | ) | ||

Income from continuing operations | $ | 3,329 | | $ | 3,011 | | 11 | % |

Noncontrolling interests | 15 | | 15 | | - | | ||

Net income | $ | 3,314 | | $ | 2,996 | | 11 | % |

EOP assets (in billions of dollars) | $ | 1,407 | | $ | 1,314 | | 7 | % |

Average assets (in billions of dollars) | 1,388 | | 1,318 | | 5 | | ||

Return on average assets | 0.97 | % | 0.92 | % | | | ||

Efficiency ratio | 56 | | 55 | | | | ||

Revenues by region |

|

| | | ||||

North America | $ | 3,265 | | $ | 3,522 | | (7 | )% |

EMEA | 3,167 | | 2,854 | | 11 | | ||

Latin America | 1,210 | | 1,169 | | 4 | | ||

Asia | 2,206 | | 1,774 | | 24 | | ||

Total | $ | 9,848 | | $ | 9,319 | | 6 | % |

Income from continuing operations by region |

|

| | | ||||

North America | $ | 857 | | $ | 1,077 | | (20 | )% |

EMEA | 1,113 | | 862 | | 29 | | ||

Latin America | 491 | | 482 | | 2 | | ||

Asia | 868 | | 590 | | 47 | | ||

Total | $ | 3,329 | | $ | 3,011 | | 11 | % |

Average loans by region (in billions of dollars) |

|

| | | ||||

North America | $ | 160 | | $ | 146 | | 10 | % |

EMEA | 78 | | 65 | | 20 | | ||

Latin America | 34 | | 34 | | - | | ||

Asia | 67 | | 57 | | 18 | | ||

Total | $ | 339 | | $ | 302 | | 12 | % |

EOP deposits by business (in billions of dollars) |

|

|

| |||||

Treasury and trade solutions | $ | 449 | | $ | 417 | | 8 | % |

All other ICG businesses | 217 | | 203 | | 7 | | ||

Total | $ | 666 | | $ | 620 | | 8 | % |

NM Not meaningful

21

ICG Revenue Details-Excluding Gains (Losses) on Loan Hedges

| First Quarter |

| ||||||

In millions of dollars | 2018 | 2017 | % Change | |||||

Investment banking revenue details |

|

|

| |||||

Advisory | $ | 215 | | $ | 249 | | (14 | )% |

Equity underwriting | 216 | | 250 | | (14 | ) | ||

Debt underwriting | 699 | | 763 | | (8 | ) | ||

Total investment banking | $ | 1,130 | | $ | 1,262 | | (10 | )% |

Treasury and trade solutions | 2,268 | | 2,108 | | 8 | | ||

Corporate lending-excluding gains (losses) on loan hedges (1) | 521 | | 438 | | 19 | | ||

Private bank | 904 | | 749 | | 21 | | ||

Total banking revenues (ex-gains (losses) on loan hedges) | $ | 4,823 | | $ | 4,557 | | 6 | % |

Corporate lending-gains (losses) on loan hedges (1) | $ | 23 | | $ | (115 | ) | NM | |

Total banking revenues (including gains (losses) on loan hedges) | $ | 4,846 | | $ | 4,442 | | 9 | % |

Fixed income markets | $ | 3,418 | | $ | 3,678 | | (7 | )% |

Equity markets | 1,103 | | 802 | | 38 | | ||

Securities services | 641 | | 552 | | 16 | | ||

Other | (160 | ) | (155 | ) | (3 | ) | ||

Total markets and securities services revenues | $ | 5,002 | | $ | 4,877 | | 3 | % |

Total revenues, net of interest expense | $ | 9,848 | | $ | 9,319 | | 6 | % |

Commissions and fees | $ | 176 | | $ | 142 | | 24 | % |

Principal transactions (2) | 2,184 | | 2,360 | | (7 | ) | ||

Other | 276 | | 151 | | 83 | | ||

Total non-interest revenue | $ | 2,636 | | $ | 2,653 | | (1 | )% |

Net interest revenue | 782 | | 1,025 | | (24 | ) | ||

Total fixed income markets | $ | 3,418 | | $ | 3,678 | | (7 | )% |

Rates and currencies | $ | 2,470 | | $ | 2,530 | | (2 | )% |

Spread products/other fixed income | 948 | | 1,148 | | (17 | ) | ||

Total fixed income markets | $ | 3,418 | | $ | 3,678 | | (7 | )% |

Commissions and fees | $ | 361 | | $ | 326 | | 11 | % |

Principal transactions (2) | 537 | | 189 | | NM | | ||

Other | 80 | | 9 | | NM | | ||

Total non-interest revenue | $ | 978 | | $ | 524 | | 87 | % |

Net interest revenue | 125 | | 278 | | (55 | ) | ||

Total equity markets | $ | 1,103 | | $ | 802 | | 38 | % |

(1) | Credit derivatives are used to economically hedge a portion of the corporate loan portfolio that includes both accrual loans and loans at fair value. Gains (losses) on loan hedges include the mark-to-market on the credit derivatives and the mark-to-market on the loans in the portfolio that are at fair value. The fixed premium costs of these hedges are netted against the corporate lending revenues to reflect the cost of credit protection. Citigroup's results of operations excluding the impact of gains (losses) on loan hedges are non-GAAP financial measures. |

(2) Excludes principal transactions revenues of ICG businesses other than Markets , primarily treasury and trade solutions and the private bank.

NM Not meaningful

1Q18 vs. 1Q17

Net income increased 11%, driven by higher revenues and a lower effective tax rate due to the impact of Tax Reform, partially offset by higher expenses and cost of credit.

• | Revenues increased 6%, driven by higher revenues in Banking (increase of 9%; increase of 6% excluding gains (losses) on loan hedges) and higher revenues in Markets |

and securities services (increase of 3%). The increase in Banking revenues was driven by continued strong momentum and performance in treasury and trade solutions, private bank and corporate lending, partially offset by investment banking. Markets and securities services revenues reflected solid growth in equity markets and securities services, partially offset by a decline in fixed income markets. Citi expects Markets and securities services revenues will likely continue to reflect the overall

22

market environment during the remainder of 2018, including a normal seasonal decline sequentially in the second quarter of 2018.

Within Banking :

• | Investment banking revenues declined 10%, driven by a decline in overall market wallet from the prior-year period, particularly in North America . Advisory and equity underwriting revenues both declined 14% versus the prior-year period, reflecting the decline in market wallet as well as timing of episodic deal activity. Debt underwriting revenues decreased 8% due to a decline in market wallet and wallet share. |

• | Treasury and trade solutions revenues increased 8%, reflecting strong growth across both net interest and fee income. Excluding the impact of FX translation, revenues increased 6%, primarily reflecting strength in EMEA and Asia . Revenue growth in the cash business was primarily driven by higher transaction volumes from both new and existing clients, continued growth in deposit balances and improved deposit spreads across most regions. Growth in the trade business was driven by episodic fees and continued focus on high-quality loan growth, but was partially offset by industry-wide tightening of loan spreads. Average deposit balances increased 6% (3% excluding the impact of FX translation). Average loans increased 10% (7% excluding the impact of FX translation), driven by strong loan growth in Asia and EMEA . |

• | Corporate lending revenues increased from $323 million to $544 million. Excluding the impact of gains/losses on loan hedges, revenues increased 19% versus the prior-year period. The increase in revenues was driven by lower hedging costs and higher loan volumes. Average loans increased 11% versus the prior-year period. |

• | Private bank revenues increased 21%, driven by strong momentum in client activity across all products and regions. Revenue growth reflected higher loan and deposit volumes, higher deposit spreads, higher managed investments revenues and increased capital markets activity. |

Within Markets and securities services :

• | Fixed income markets revenues decreased 7%, primarily due to lower revenues in North America . The decline in revenues was largely driven by lower net interest revenue (decrease of 24%) in both rates and currencies and spread products, mainly due to a change in the mix of trading positions in support of client activity as well as higher funding costs, given the higher interest rate environment. The decline in revenues was also due to lower principal transactions revenues (decrease of 7%), reflecting lower investor client activity in a less favorable and more volatile market environment than the prior-year period, particularly in G10 rates and spread products in March. |

Rates and currencies revenues decreased 2%, driven by lower G10 rates revenues due to the lower investor client activity and a less favorable trading environment in

North America , and the comparison to a strong prior-year period in EMEA . The decline in G10 rates was largely offset by an increase in G10 foreign exchange revenues that benefited from the return of volatility in the currency markets as well as strong corporate client activity in both G10 foreign exchange and local markets rates and currencies.

Spread products and other fixed income revenues decreased 17%, primarily driven by lower revenues in credit markets in North America and EMEA due to lower investor client activity and the comparison to a strong prior-year period. The year-over-year revenue decline was also driven by lower municipal products revenues in North America , largely due to the comparison to a strong prior-year period, where municipals markets recovered post U.S. elections.

• | Equity markets revenues increased 38%, with growth across all products, reflecting strength in Asia, North America and EMEA, given the favorable operating environment with higher volatility and increased client activity, particularly with investor clients. Equity derivatives revenues increased across all regions, benefiting from both improved overall market conditions and continued client momentum, in line with the business' investment strategy. The increase in equity markets revenues was also driven by growth in cash equities and higher balances in prime finance. Principal transactions revenues increased, reflecting client facilitation gains in the favorable trading environment. |

• | Securities services revenues increased 16%, reflecting particular strength in EMEA and Asia . The increase in revenues was driven by growth in fee revenues from higher assets under custody and increased client activity, as well as higher net interest revenue driven by higher deposit volume and higher interest rates. |

Expenses increased 7%, largely driven by the impact of FX translation and a higher level of investment spending.

Provisions increased $164 million to a benefit of $41 million, primarily due to lower releases in the current period and higher net credit losses ($105 million in 2018, compared to $25 million in 2017). Net credit losses in 2018 were largely offset by previously established loan loss reserves, due to the continued stability in commodities prices and net ratings upgrades.

23

CORPORATE/OTHER

Corporate/Other includes certain unallocated costs of global staff functions (including finance, risk, human resources, legal and compliance), other corporate expenses and unallocated global operations and technology expenses, Corporate Treasury, certain North America and international legacy consumer loan portfolios, other legacy assets and discontinued operations (for additional information on Corporate/Other , see "Citigroup Segments" above). At March 31, 2018, Corporate/Other had $92 billion in assets, a decrease of 4% year-over-year.

| First Quarter |

| ||||||

In millions of dollars | 2018 | 2017 | % Change | |||||

Net interest revenue | $ | 538 | | $ | 558 | | (4 | )% |

Non-interest revenue | 53 | | 643 | | (92 | ) | ||

Total revenues, net of interest expense | $ | 591 | | $ | 1,201 | | (51 | )% |

Total operating expenses | $ | 741 | | $ | 1,134 | | (35 | )% |

Net credit losses | $ | 26 | | $ | 81 | | (68 | )% |

Credit reserve build (release) | (33 | ) | (35 | ) | 6 | | ||

Provision (release) for unfunded lending commitments | - | | 1 | | (100 | ) | ||

Provision for benefits and claims | - | | 5 | | (100 | ) | ||

Provisions for credit losses and for benefits and claims | $ | (7 | ) | $ | 52 | | NM | |

Income (loss) from continuing operations before taxes | $ | (143 | ) | $ | 15 | | NM | |

Income taxes (benefits) | (69 | ) | (94 | ) | 27 | | ||

Income (loss) from continuing operations | $ | (74 | ) | $ | 109 | | NM | |

Income (loss) from discontinued operations, net of taxes | (7 | ) | (18 | ) | 61 | | ||

Net income (loss) before attribution of noncontrolling interests | $ | (81 | ) | $ | 91 | | NM | |

Noncontrolling interests | 5 | | (6 | ) | NM | | ||

Net income (loss) | $ | (86 | ) | $ | 97 | | NM | |

1Q18 vs. 1Q17

The net loss was $86 million, compared to net income of $97 million in the prior-year period, due to lower revenues, partially offset by lower expenses.

Revenues decreased 51%, driven by the continued wind-down of legacy assets.

Expenses decreased 35%, primarily driven by the wind-down of legacy assets and lower legal and related expenses.

Citi expects that revenues and expenses in Corporate/Other should continue to decline with the ongoing wind-down of legacy assets during the remainder of 2018.

Provisions decreased $59 million to a net benefit of $7 million, primarily due to lower net credit losses. Net credit losses declined 68% to $26 million, primarily reflecting the impact of ongoing divestiture activity.

24

OFF-BALANCE SHEET ARRANGEMENTS

The table below shows where a discussion of Citi's various off-balance sheet arrangements in this Form 10-Q may be found. For additional information, see "Off-Balance Sheet Arrangements" and Notes 1, 21 and 26 to the Consolidated Financial Statements in Citigroup's 2017 Annual Report on Form 10-K.

Types of Off-Balance Sheet Arrangements Disclosures in this Form 10-Q

Variable interests and other obligations, including contingent obligations, arising from variable interests in nonconsolidated VIEs | See Note 18 to the Consolidated Financial Statements. |

Letters of credit, and lending and other commitments | See Note 22 to the Consolidated Financial Statements. |

Guarantees | See Note 22 to the Consolidated Financial Statements. |

25

CAPITAL RESOURCES

Overview

Capital is used principally to support assets in Citi's businesses and to absorb credit, market and operational losses. Citi primarily generates capital through earnings from its operating businesses. Citi may augment its capital through issuances of common stock, noncumulative perpetual preferred stock and equity issued through awards under employee benefit plans, among other issuances.

Further, Citi's capital levels may also be affected by changes in accounting and regulatory standards, as well as U.S. corporate tax laws and the impact of future events on Citi's business results, such as changes in interest and foreign exchange rates, as well as business and asset dispositions.

During the first quarter of 2018 , Citi returned a total of $3.1 billion of capital to common shareholders in the form of share repurchases (approximately 30 million common shares) and dividends.

Capital Management

Citi's capital management framework is designed to ensure that Citigroup and its principal subsidiaries maintain sufficient capital consistent with each entity's respective risk profile, management targets and all applicable regulatory standards and guidelines. Based on Citigroup's current regulatory capital requirements, as well as consideration of potential future changes to the U.S. Basel III rules, management currently believes that a targeted Common Equity Tier 1 Capital ratio of approximately 11.5% represents the amount necessary to prudently operate and invest in Citi's franchise, including when considering future growth plans, capital return projections and other factors that may impact Citi's businesses. However, management may revise Citigroup's targeted Common Equity Tier 1 Capital ratio in response to changing regulatory capital requirements as well as other relevant factors. For additional information regarding Citi's capital management, see "Capital Resources-Capital Management" in Citigroup's 2017 Annual Report on Form 10-K.

Stress Testing Component of Capital Planning

Citi is subject to an annual assessment by the Federal Reserve Board as to whether Citigroup has effective capital planning processes as well as sufficient regulatory capital to absorb losses during stressful economic and financial conditions, while also meeting obligations to creditors and counterparties and continuing to serve as a credit intermediary. This annual assessment includes two related programs: the Comprehensive Capital Analysis and Review (CCAR) and Dodd-Frank Act Stress Testing (DFAST). For additional information regarding the stress testing component of capital planning, including a recent proposed rulemaking and other potential changes in Citi's regulatory capital requirements and future CCAR processes, see "Regulatory Capital Standards Developments" and

"Forward-Looking Statements" below and "Capital Resources-Current Regulatory Capital Standards-Stress Testing Component of Capital Planning" and "Risk Factors-Strategic Risks" in Citigroup's 2017 Annual Report on Form 10-K.

Current Regulatory Capital Standards

Citi is subject to regulatory capital standards issued by the Federal Reserve Board, which constitute the U.S. Basel III rules. These rules establish an integrated capital adequacy framework, encompassing both risk-based capital ratios and leverage ratios. For additional information regarding the risk-based capital ratios, Tier 1 Leverage ratio and Supplementary Leverage ratio, see "Capital Resources-Current Regulatory Capital Standards" in Citigroup's 2017 Annual Report on Form 10-K. For additional information regarding a recent proposed rulemaking that would modify the enhanced Supplementary Leverage ratio standards applicable to U.S. bank holding companies that are identified as global systemically important bank holding companies (GSIBs) and certain of their insured depository institution subsidiaries, see "Regulatory Capital Standards Developments" below.

GSIB Surcharge

The Federal Reserve Board also adopted a rule that imposes a risk-based capital surcharge upon U.S. GSIBs, including Citi. Citi's GSIB surcharge effective for 2018 remains unchanged from 2017 at 3.0%. For additional information regarding the identification of a GSIB and the methodology for annually determining the GSIB surcharge, see "Capital Resources-Current Regulatory Capital Standards-GSIB Surcharge" in Citigroup's 2017 Annual Report on Form 10-K.

Transition Provisions

The U.S. Basel III rules contain several differing, largely multi-year transition provisions (i.e., "phase-ins" and "phase-outs"). Moreover, the GSIB surcharge, Capital Conservation Buffer, and any Countercyclical Capital Buffer (currently 0%), commenced phase-in on January 1, 2016, becoming fully effective on January 1, 2019. With the exception of the non-grandfathered trust preferred securities, which do not fully phase-out until January 1, 2022, and the capital buffers and GSIB surcharge, which do not fully phase-in until January 1, 2019, all other transition provisions are entirely reflected in Citi's regulatory capital ratios beginning January 1, 2018. Accordingly, commencing with the first quarter of 2018, Citi is presenting a single set of regulatory capital components and ratios, reflecting current regulatory capital standards in effect throughout 2018. Citi previously disclosed its Basel III risk-based capital and leverage ratios and related components reflecting Basel III Transition Arrangements with respect to regulatory capital adjustments and deductions, as well as Full Implementation, in Citi's 2017

26

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; however, beginning January 1, 2018, that distinction is no longer relevant.

For additional information regarding the transition provisions under the U.S. Basel III rules, including with respect to the GSIB surcharge, see "Capital Resources-Current Regulatory Capital Standards-Transition Provisions" in Citigroup's 2017 Annual Report on Form 10-K. For information regarding Citigroup's capital resources reflecting Basel III Transition Arrangements as of December 31, 2017, see "Capital Resources-Current Regulatory Capital Standards-Citigroup's Capital Resources Under Current Regulatory Standards" in Citigroup's 2017 Annual Report on Form 10-K.

Citigroup's Capital Resources

Citi is required to maintain stated minimum Common Equity Tier 1 Capital, Tier 1 Capital and Total Capital ratios of 4.5%, 6.0% and 8.0%, respectively.

Citi's effective minimum Common Equity Tier 1 Capital, Tier 1 Capital and Total Capital ratios during 2018, inclusive of the 75% phase-in of both the 2.5% Capital Conservation Buffer and the 3.0% GSIB surcharge (all of which is to be composed of Common Equity Tier 1 Capital), are 8.625%, 10.125% and 12.125%, respectively. Citi's effective minimum Common Equity Tier 1 Capital, Tier 1 Capital and Total Capital ratios during 2017,