UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

Commission file number 1-9924

Citigroup Inc.

(Exact name of registrant as specified in its

charter)

| Delaware | 52-1568099 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 399 Park Avenue, New York, NY | 10022 |

| (Address of principal executive offices) | (Zip code) |

Registrant's telephone number, including area code: (212) 559-1000

Securities registered pursuant to Section 12(b) of the Act: See Exhibit 99.01

Securities registered pursuant to Section 12(g) of the Act: none

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes X No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. X Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). X Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| X Large accelerated filer | ¨ Accelerated filer | ¨ Non-accelerated filer | ¨ Smaller reporting company |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes X No

The aggregate market value of Citigroup Inc. common stock held by non-affiliates of Citigroup Inc. on June 30, 2012 was approximately $80.4 billion.

Number of shares of Citigroup, Inc. common stock outstanding on January 31, 2013: 3,038,758,550

Documents Incorporated by Reference: Portions of the registrant's proxy statement for the annual meeting of stockholders scheduled to be held on April 24, 2013, are incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III.

FORM 10-K CROSS-REFERENCE INDEX

| Item Number | Page | |||

| Part I | ||||

| 1. | Business | 4–36, 40, 126–132, | ||

| 135–136, 163, | ||||

| 290–293 | ||||

| 1A. | Risk Factors | 60–71 | ||

| 1B. | Unresolved Staff Comments | Not Applicable | ||

| 2. | Properties | 293 | ||

| 3. | Legal Proceedings | 280–287 | ||

| 4. | Mine Safety Disclosures | Not Applicable | ||

| Part II | ||||

| 5. | Market for Registrant's Common | |||

| Equity, Related Stockholder Matters, | ||||

| and Issuer Purchases of Equity | ||||

| Securities | 44, 169, 288, | |||

| 294–295, 297 | ||||

| 6. | Selected Financial Data | 10–11 | ||

| 7. | Management's Discussion and | |||

| Analysis of Financial Condition and | ||||

| Results of Operations | 6–59, 72–125 | |||

| 7A. | Quantitative and Qualitative | |||

| Disclosures About Market Risk | 72–125, 164–165, | |||

| 187–218, 223–273 | ||||

| 8. | Financial Statements and | |||

| Supplementary Data | 140–289 | |||

| 9. | Changes in and Disagreements with | |||

| Accountants on Accounting and | ||||

| Financial Disclosure | Not Applicable | |||

| 9A. | Controls and Procedures | 133–134 | ||

| 9B. | Other Information | Not Applicable | ||

| Part III | ||||

| 10. | Directors, Executive Officers and | |||

| Corporate Governance | 296–297, 299* | |||

| 11. | Executive Compensation | ** | ||

| 12. | Security Ownership of Certain | |||

| Beneficial Owners and Management | ||||

| and Related Stockholder Matters | *** | |||

| 13. | Certain Relationships and Related | |||

| Transactions and Director | ||||

| Independence | **** | |||

| 14. | Principal Accountant Fees and | |||

| Services | ***** | |||

| Part IV | ||||

| 15. | Exhibits and Financial Statement | |||

| Schedules | ||||

| * | For additional information regarding Citigroup's Directors, see "Corporate Governance," "Proposal 1: Election of Directors" and "Section 16(a) Beneficial Ownership Reporting Compliance" in the definitive Proxy Statement for Citigroup's Annual Meeting of Stockholders scheduled to be held on April 24, 2013, to be filed with the SEC (the Proxy Statement), incorporated herein by reference. | |

| ** | See "Executive Compensation-The Personnel and Compensation Committee Report," "-Compensation Discussion and Analysis" and "-2012 Summary Compensation Table" in the Proxy Statement, incorporated herein by reference. | |

| *** | See "About the Annual Meeting", "Stock Ownership" and "Proposal 4, Approval of Amendment to the Citigroup 2009 Stock Incentive Plan" in the Proxy Statement, incorporated herein by reference. | |

| **** | See "Corporate Governance-Director Independence," "-Certain Transactions and Relationships, Compensation Committee Interlocks and Insider Participation," and "-Indebtedness" in the Proxy Statement, incorporated herein by reference. | |

| ***** | See "Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm" in the Proxy Statement, incorporated herein by reference. | |

2

CITIGROUP'S 2012 ANNUAL REPORT ON FORM 10-K

| OVERVIEW | 4 | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | ||

| OF FINANCIAL CONDITION AND RESULTS | ||

| OF OPERATIONS | 6 | |

| Executive Summary | 6 | |

| Five-Year Summary of Selected Financial Data | 10 | |

| SEGMENT AND BUSINESS-INCOME (LOSS) | ||

| AND REVENUES | 12 | |

| CITICORP | 14 | |

| Global Consumer Banking | 15 | |

| North America Regional Consumer Banking | 16 | |

| EMEA Regional Consumer Banking | 18 | |

| Latin America Regional Consumer Banking | 20 | |

| Asia Regional Consumer Banking | 22 | |

| Institutional Clients Group | 24 | |

| Securities and Banking | 25 | |

| Transaction Services | 28 | |

| Corporate/Other | 30 | |

| CITI HOLDINGS | 31 | |

| Brokerage and Asset Management | 32 | |

| Local Consumer Lending | 33 | |

| Special Asset Pool | 36 | |

| BALANCE SHEET REVIEW | 37 | |

| CAPITAL RESOURCES AND LIQUIDITY | 41 | |

| Capital Resources | 41 | |

| Funding and Liquidity | 50 | |

| OFF-BALANCE-SHEET ARRANGEMENTS | 58 | |

| CONTRACTUAL OBLIGATIONS | 59 | |

| RISK FACTORS | 60 | |

| MANAGING GLOBAL RISK | 72 | |

| CREDIT RISK | 74 | |

| Loans Outstanding | 75 | |

| Details of Credit Loss Experience | 76 | |

| Non-Accrual Loans and Assets and | ||

| Renegotiated Loans | 78 | |

| North America Consumer Mortgage Lending | 83 | |

| North America Cards | 97 | |

| Consumer Loan Details | 98 | |

| Corporate Loan Details | 100 | |

| MARKET RISK | 102 | |

| OPERATIONAL RISK | 112 | |

| COUNTRY AND CROSS-BORDER RISK | 113 | |

| Country Risk | 113 | |

| Cross-Border Risk | 120 |

| FAIR VALUE ADJUSTMENTS FOR | ||

| DERIVATIVES AND STRUCTURED DEBT | 123 | |

| CREDIT DERIVATIVES | 124 | |

| SIGNIFICANT ACCOUNTING POLICIES AND | ||

| SIGNIFICANT ESTIMATES | 126 | |

| DISCLOSURE CONTROLS AND PROCEDURES | 133 | |

| MANAGEMENT'S ANNUAL REPORT ON | ||

| INTERNAL CONTROL OVER FINANCIAL | ||

| REPORTING | 134 | |

| FORWARD-LOOKING STATEMENTS | 135 | |

| REPORT OF INDEPENDENT REGISTERED | ||

| PUBLIC ACCOUNTING FIRM-INTERNAL | ||

| CONTROL OVER FINANCIAL REPORTING | 137 | |

| REPORT OF INDEPENDENT REGISTERED | ||

| PUBLIC ACCOUNTING FIRM- | ||

| CONSOLIDATED FINANCIAL STATEMENTS | 138 | |

| FINANCIAL STATEMENTS AND NOTES | ||

| TABLE OF CONTENTS | 139 | |

| CONSOLIDATED FINANCIAL STATEMENTS | 140 | |

| NOTES TO CONSOLIDATED FINANCIAL | ||

| STATEMENTS | 146 | |

| FINANCIAL DATA SUPPLEMENT (Unaudited) | 289 | |

| SUPERVISION, REGULATION AND OTHER | 290 | |

| Disclosure Pursuant to Section 219 of the | ||

| Iran Threat Reduction and Syria Human Rights Act | 291 | |

| Customers | 292 | |

| Competition | 292 | |

| Properties | 293 | |

| LEGAL PROCEEDINGS | 293 | |

| UNREGISTERED SALES OF EQUITY, | ||

| PURCHASES OF EQUITY SECURITIES, DIVIDENDS | 294 | |

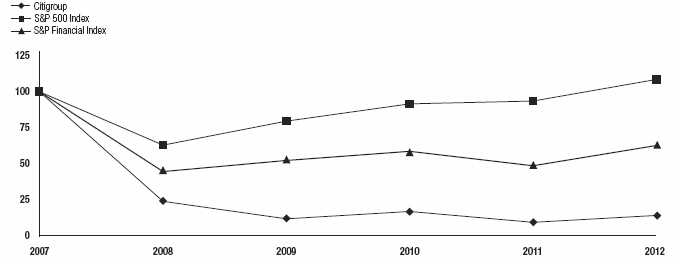

| PERFORMANCE GRAPH | 295 | |

| CORPORATE INFORMATION | 296 | |

| Citigroup Executive Officers | 296 | |

| CITIGROUP BOARD OF DIRECTORS | 299 |

3

OVERVIEW

Citigroup's history dates back to the

founding of Citibank in 1812. Citigroup's original corporate predecessor was

incorporated in 1988 under the laws of the State of Delaware. Following a series

of transactions over a number of years, Citigroup Inc. was formed in 1998 upon

the merger of Citicorp and Travelers Group

Inc.

Citigroup is a

global diversified financial services holding company whose businesses provide

consumers, corporations, governments and institutions with a broad range of

financial products and services, including consumer banking and credit,

corporate and investment banking, securities brokerage, transaction services and

wealth management. Citi has approximately 200 million customer accounts and does

business in more than 160 countries and jurisdictions.

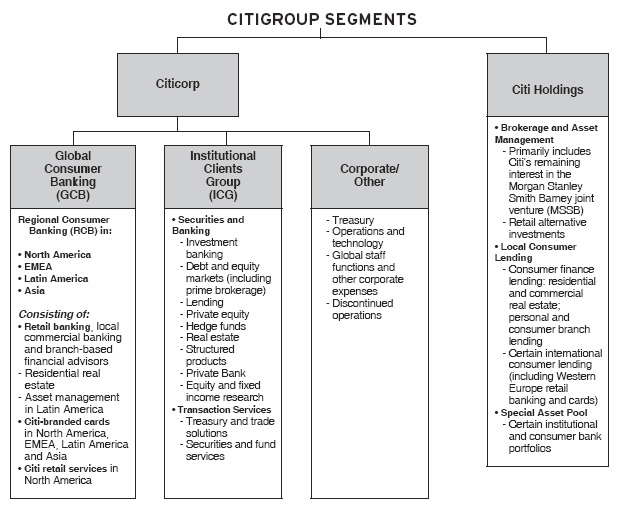

Citigroup

currently operates, for management reporting purposes, via two primary business

segments: Citicorp, consisting of Citi's Global Consumer Banking businesses and Institutional Clients Group ; and Citi Holdings, consisting of Brokerage and Asset Management, Local Consumer Lending and Special Asset

Pool . For a further description of the

business segments and the products and services they provide, see "Citigroup

Segments" below, "Management's Discussion and Analysis of Financial Condition

and Results of Operations" and Note 4 to the Consolidated Financial

Statements.

Throughout this report, "Citigroup," "Citi" and "the Company"

refer to Citigroup Inc. and its consolidated subsidiaries.

Additional

information about Citigroup is available on Citi's website at www.citigroup.com . Citigroup's recent annual reports on Form 10-K,

quarterly reports on Form 10-Q, proxy statements, as well as other filings with

the SEC, are available free of charge through Citi's website by clicking on the

"Investors" page and selecting "All SEC Filings." The SEC's website also

contains current reports, information statements, and other information

regarding Citi at www.sec.gov .

Within this Form 10-K, please refer to the

tables of contents on pages 3 and 139 for page references to Management's

Discussion and Analysis of Financial Condition and Results of Operations and

Notes to Consolidated Financial Statements, respectively.

Certain

reclassifications have been made to the prior periods' financial statements to

conform to the current period's presentation. For information on certain recent

such reclassifications, including the transfer of the substantial majority of

Citi's retail partner cards businesses (which are now referred to as Citi retail

services) from Citi Holdings- Local Consumer

Lending to Citicorp- North America Regional Consumer Banking, which was effective January 1, 2012, see Citi's Form 8-K

furnished to the SEC on March 26, 2012.

At December 31, 2012, Citi had approximately 259,000 full-time

employees compared to approximately 266,000 full-time employees at December 31,

2011.

Please see "Risk Factors" below for a discussion of the most significant risks and uncertainties that could impact Citigroup's businesses, financial condition and results of operations.

4

As described above, Citigroup is managed pursuant to the following segments:

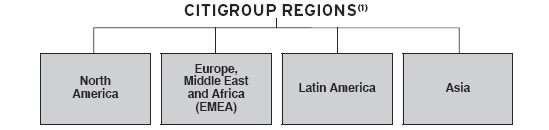

The following are the four regions in which Citigroup operates. The regional results are fully reflected in the segment results above.

(1) North America includes the U.S., Canada and Puerto Rico, Latin America includes Mexico, and Asia includes Japan.

5

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

Overview

2012-Ongoing Transformation of

Citigroup

During 2012, Citigroup

continued to build on the significant transformation of the Company that has

occurred over the last several years. Despite a challenging operating

environment (as discussed below), Citi's 2012 results showed ongoing momentum in

most of its core businesses, as Citi continued to simplify its business model

and focus resources on its core Citicorp franchise while continuing to wind down

Citi Holdings as quickly as practicable in an economically rational manner. Citi

made steady progress toward the successful execution of its strategy, which is

to:

With these goals in mind, on December 5, 2012, Citi announced a number of repositioning efforts to optimize its footprint, re-size and re-align certain businesses and improve efficiencies, while at the same time maintaining its unique competitive advantages. As a result of these repositioning efforts, in the fourth quarter of 2012, Citi recorded pretax repositioning charges of approximately $1 billion, and expects to incur an additional $100 million of charges in the first half of 2013.

Continued Challenges in

2013

Citi continued to face a

challenging operating environment during 2012, many aspects of which it expects

will continue into 2013. While showing some signs of improvement, the overall

economic environment-both in the U.S. and globally-remains largely uncertain,

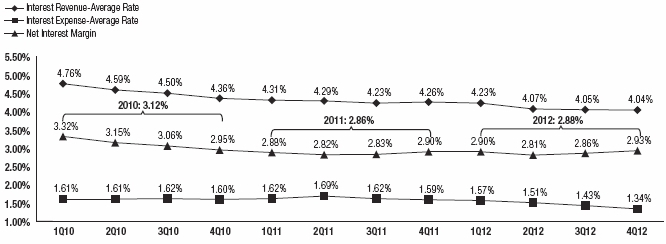

and spread compression 1 continues to negatively impact the results of

operations of several of Citi's businesses, particularly in the U.S. and Asia.

Citi also continues to face a significant number of regulatory changes and

uncertainties, including the timing and implementation of the final U.S.

regulatory capital standards. Further, Citi's legal and related costs remain

elevated and likely volatile as it continues to work through "legacy" issues,

such as mortgage-related expenses, and operates in a heightened litigious and

regulatory environment. Finally, while Citi reduced the size of Citi Holdings by

approximately 31% during 2012, the remaining assets within Citi Holdings will

continue to have a negative impact on Citi's overall results of operations in

2013, although this negative impact should continue to abate as the wind-down

continues. For a more detailed discussion of these and other risks that could

impact Citi's businesses, results of operations and financial condition, see

"Risk Factors" below. As a result of these continuing challenges, Citi remains

highly focused on the areas within its control, including operational efficiency

and optimizing its core businesses in order to drive improved

returns.

| 1 | As used throughout this report, spread compression refers to the reduction in net interest revenue as a percentage of loans or deposits, as applicable, as driven by either lower yields on interest-earning assets or higher costs to fund such assets (or a combination thereof). |

6

2012 Summary Results

Citigroup

For 2012, Citigroup reported net income of $7.5 billion and

diluted earnings per share of $2.44, compared to $11.1 billion and $3.63 per

share, respectively, for 2011. 2012 results included several significant

items:

a $582 million tax benefit in the third quarter of 2012 related to the resolution of certain tax audit items.

Excluding CVA/DVA, the impact of minority investments, the repositioning charges in the fourth quarters of 2012 and 2011 and the tax benefit, net income was $11.9 billion, or $3.86 per diluted share, in 2012, an increase of 18% compared to $10.1 billion, or $3.30 per diluted share, reported in 2011, as higher revenues, lower core operating expenses and lower net credit losses were partially offset by higher legal and related costs and a lower net loan loss reserve release. 3

Citi's revenues, net of interest expense, were $70.2 billion in 2012, down 10% versus the prior year. Excluding CVA/DVA and the impact of minority investments, revenues were $77.1 billion, up 1% from 2011, as revenues in Citicorp rose 5%, but were offset by a 40% decline in Citi Holdings revenues compared to the prior year. Net interest revenues of $47.6 billion were 2% lower than the prior year, largely driven by the decline in loan balances in Local Consumer Lending in Citi Holdings as well as spread compression in North America and Asia Regional Consumer Banking (RCB) in Citicorp. Non-interest revenues were $22.6 billion, down 25% from the prior year, driven by CVA/DVA and the loss on MSSB in the third quarter of 2012. Excluding CVA/DVA and the impact of minority investments, non-interest revenues were $29.5 billion, up 6% from the prior year, principally driven by higher revenues in Securities and Banking and higher mortgage revenues in North America RCB , partially offset by lower revenues in the Special Asset Pool within Citi Holdings.

Operating

Expenses

Citigroup expenses decreased

1% versus the prior year to $50.5 billion. In 2012, in addition to the

previously mentioned repositioning charges, Citi incurred elevated legal and

related costs of $2.8 billion compared to $2.2 billion in the prior year.

Excluding legal and related costs, repositioning charges for the fourth quarters

of 2012 and 2011, and the impact of foreign exchange translation into U.S.

dollars for reporting purposes (as used throughout this report, FX translation),

which lowered reported expenses by approximately $0.9 billion in 2012 as

compared to the prior year, operating expenses declined 1% to $46.6 billion

versus $47.3 billion in the prior year.

Citicorp's expenses were $45.3 billion, up 2% from the prior

year, as efficiency savings were more than offset by higher legal and related

costs and repositioning charges. Citi Holdings expenses were down 19%

year-over-year to $5.3 billion, principally due to the continued decline in

assets.

| 2 | As referenced above, in 2012, the sale of minority investments included a pretax loss of $4.7 billion ($2.9 billion after-tax) from the sale of a 14% interest and other-than-temporary impairment of the carrying value of Citi's remaining 35% interest in MSSB recorded in Citi Holdings- Brokerage and Asset Management during the third quarter of 2012. In addition, Citi recorded a net pretax loss of $424 million ($274 million after-tax) from the partial sale of Citi's minority interest in Akbank T.A.S. (Akbank) recorded in Corporate/Other during the second quarter of 2012. In the first quarter of 2012, Citi recorded a net pretax gain on minority investments of $477 million ($308 million after-tax), which included pretax gains of $1.1 billion and $542 million on the sales of Citi's remaining stake in Housing Development Finance Corporation Ltd. (HDFC) and its stake in Shanghai Pudong Development Bank (SPDB), respectively, offset by a pretax impairment charge relating to Akbank of $1.2 billion, all within Corporate/Other . In 2011, Citi recorded a $199 million pretax gain ($128 million after-tax) from the partial sale of Citi's minority interest in HDFC, recorded in Corporate/Other . | |

| 3 | Presentation of Citi's results excluding CVA/DVA, the impact of minority investments, the repositioning charges in the fourth quarters of 2012 and 2011 and the tax benefit, as applicable, represent non- GAAP financial measures. Citigroup believes the presentation of its results of operations excluding these impacts provides a more meaningful depiction of the underlying fundamentals of Citi's businesses and enhances the comparison of results across periods. |

7

Credit Costs

Citi's total provisions for credit losses and for benefits and

claims of $11.7 billion declined 8% from the prior year. Net credit losses of

$14.6 billion were down 27% from 2011, largely reflecting improvements in North America cards and Local Consumer Lending and the Special Asset Pool within Citi

Holdings. Consumer net credit losses declined 22% to $14.4 billion reflecting

improvements in North America Citi-branded cards and Citi retail services in Citicorp and Local Consumer Lending within Citi Holdings. Corporate net credit losses decreased

86% year-over-year to $223 million, driven primarily by continued credit

improvement in both the Special Asset

Pool in Citi Holdings and Securities and Banking in

Citicorp.

The net

release of allowance for loan losses and unfunded lending commitments was $3.7

billion in 2012, 55% lower than 2011. Of the $3.7 billion net reserve release,

$2.1 billion was attributable to Citicorp compared to a $4.9 billion release in

the prior year. The decline in the Citicorp reserve release year-over-year

mostly reflected a lower reserve release in North America Citi-branded cards and

Citi retail services and Securities and

Banking . The $1.6 billion net reserve release

in Citi Holdings was down from $3.3 billion in the prior year, due primarily to

lower releases within the Special Asset

Pool , reflecting the decline in assets. Of

the $3.7 billion net reserve release, $3.6 billion related to Consumer, with the

remainder in Corporate.

Capital and Loan Loss Reserve

Positions

Citigroup's Tier 1 Capital

and Tier 1 Common ratios were 14.1% and 12.7% as of December 31, 2012,

respectively, compared to 13.6% and 11.8% in the prior year. Citi's estimated

Tier 1 Common ratio under Basel III was 8.7% at December 31, 2012, up slightly

from an estimated 8.6% at September 30,

2012. 4

Citigroup's total allowance for loan losses was $25.5 billion at year

end, or 3.9% of total loans, compared to $30.1 billion, or 4.7%, at the end of

the prior year. The decline in the total allowance for loan losses reflected the

continued wind-down of Citi Holdings and overall continued improvement in the

credit quality of Citi's loan portfolios.

The Consumer allowance for loan losses was $22.7

billion, or 5.6% of total Consumer loans, at year end, compared to $27.2

billion, or 6.5% of total loans, at December 31, 2011. Total non-accrual assets

increased 3% to $12.0 billion as compared to December 31, 2011. Corporate

non-accrual loans declined 28% to $2.3 billion, reflecting continued credit

improvement. Consumer non-accrual loans increased $1.4 billion, or 17%, to $9.2

billion versus the prior year. The increase in Consumer non-accrual loans

predominantly reflected the Office of the Comptroller of the Currency (OCC)

guidance issued in the third quarter of 2012 regarding the treatment of mortgage

loans where the borrower has gone through Chapter 7 bankruptcy, which added $1.5

billion to Consumer non-accrual loans (of which approximately $1.3 billion were

current).

Citicorp net income decreased 8% from the prior year to $14.1 billion. The decrease largely reflected the impact of CVA/DVA and higher legal and related costs and repositioning charges, partially offset by lower provisions for income taxes. CVA/DVA, recorded in Securities and Banking, was $(2.5) billion in 2012, compared to $1.7 billion in the prior year. Within Citicorp, repositioning charges were $951 million ($604 million after-tax) in the fourth quarter 2012, versus $368 million ($237 million after-tax) in the prior year period. Excluding CVA/DVA, the impact of minority investments, the repositioning charges in the fourth quarters of 2012 and 2011, and the tax benefit in the third quarter of 2012, Citicorp net income increased 9% from the prior year to $15.6 billion, primarily driven by growth in revenues and lower net credit losses partially offset by lower loan loss reserve releases and higher taxes.

Citicorp revenues, net of interest expense, were $71 billion in 2012, down 1% versus the prior year. Excluding CVA/DVA and the impact of minority investments, Citicorp revenues were $73.4 billion in 2012, 5% higher than 2011. Global Consumer Banking ( GCB) revenues of $40.2 billion increased 3% versus the prior year. North America RCB revenues grew 5% to $21.1 billion. International RCB revenues (consisting of Asia RCB , Latin America RCB and EMEA RCB ) increased 1% year-over-year to $19.1 billion. Excluding the impact of FX translation, 6 international RCB revenues increased 5% year-over-year. Securities and Banking revenues were $19.7 billion in 2012, down 8% year-over-year . Securities and Banking revenues, excluding CVA/DVA, were $22.2 billion, or 13%, higher than the prior year. Transaction Services revenues were $10.9 billion, up 3% from the prior year, but up 5% excluding the impact of FX translation. Corporate/Other revenues, excluding the impact of minority investments, declined 80% from the prior year mainly reflecting the absence of hedging gains.

In North America RCB , the revenue growth year-over-year was driven by higher mortgage revenues, partially offset by lower revenues in Citi-branded cards and Citi retail services, mostly driven by lower average card loans. North America RCB average deposits of $154 billion grew 6% year-over-year and average retail loans of $41 billion grew 19%. Average card loans of $109 billion declined 3%, driven by increased payment rates resulting from consumer deleveraging, and card purchase sales of $232 billion were roughly flat. Citi retail services revenues were also negatively impacted by improving credit trends, which increased contractual partner payments.

| 4 | Citi's estimated Basel III Tier 1 Common ratio is a non-GAAP financial measure. For additional information on Citi's estimated Basel III Tier 1 Common Capital and Tier 1 Common ratio, including the calculation of these measures, see "Capital Resources and Liquidity-Capital Resources" below. |

| 5 | Citicorp includes Citi's three operating businesses- Global Consumer Banking, Securities and Banking and Transaction Services -as well as Corporate/Other . See "Citicorp" below for additional information on the results of operations for each of the businesses in Citicorp. | |

| 6 | For the impact of FX translation on 2012 results of operations for each of EMEA RCB, Latin America RCB, Asia RCB and Transaction Services , see the table accompanying the discussion of each respective business' results of operations below. |

8

The international RCB revenue growth

year-over-year, excluding the impact of FX translation, was driven by 9% revenue

growth in Latin America RCB and 2% revenue growth in EMEA RCB . Asia RCB revenues were flat

year-over-year, primarily reflecting spread compression in some countries in the

region and the impact of regulatory actions in certain countries, particularly

Korea. International RCB average deposits grew 2% versus the prior year, average

retail loans increased 11%, investment sales grew 12%, average card loans grew

6%, and international card purchase sales grew 10%, all excluding the impact of

FX translation.

In Securities and Banking, fixed income markets revenues of $14.0

billion, excluding CVA/DVA, 7 increased 28% from the prior year, reflecting higher

revenues in rates and currencies and credit-related and securitized products.

Equity markets revenues of $2.4 billion in 2012, excluding CVA/DVA, increased 1%

driven by improved derivatives performance as well as the absence in the current

year of proprietary trading losses, partially offset by lower cash equity volumes.

Investment banking revenues rose 10% from the prior year to $3.6 billion,

principally driven by higher revenues in debt underwriting and advisory

activities, partially offset by lower equity underwriting revenues. Lending

revenues of $997 million were down 45% from the prior year, reflecting $698

million in losses on hedges related to accrual loans as credit spreads tightened

during 2012 (compared to a $519 million gain in the prior year as spreads

widened). Excluding the mark-to-market impact of loan hedges related to accrual

loans, lending revenues rose 31% year-over-year to $1.7 billion reflecting

growth in the Corporate loan portfolio and improved spreads in most regions.

Private Bank revenues of $2.3 billion increased 8% from the prior year,

excluding CVA/DVA, driven primarily by growth in North America lending and

deposits.

In Transaction Services, the increase in revenues year-over-year, excluding

the impact of FX translation, was driven by growth in Treasury and Trade Solutions, which

was partially offset by a decline in Securities and Fund Services .

Excluding the impact of FX translation, Treasury and Trade Solutions revenues

were up 8%, driven by growth in trade as end-of-period trade loans grew 23%,

partially offset by ongoing spread compression given the low interest rate

environment. Securities and Fund

Services revenues were down 2%, excluding the

impact of FX translation, mostly reflecting lower market volumes as well as

spread compression on deposits.

Citicorp end-of-period loans increased 7% year-over-year to

$540 billion, with 3% growth in Consumer loans, primarily in Latin America, and 11%

growth in Corporate loans.

Citi

Holdings 8

Citi Holdings net

loss was $6.6 billion compared to a net loss of $4.2 billion in 2011. The

increase in the net loss was driven by the $4.7 billion pretax ($2.9 billion

after-tax) loss on MSSB described above. In addition, Citi Holdings results

included $77 million in repositioning charges in the fourth quarter of 2012,

compared to $60 million in the fourth quarter of 2011. Excluding the loss on

MSSB, CVA/DVA 9 and the repositioning charges in the fourth quarters

of 2012 and 2011, Citi Holdings net loss decreased to $3.7 billion compared to a

net loss of $4.2 billion in the prior year, as revenue declines and lower loan

loss reserve releases were more than offset by lower operating expenses and

lower net credit losses. These improved results in 2012 reflected the continued

decline in Citi Holdings assets.

Citi Holdings revenues decreased to $(833) million from $6.3

billion in the prior year. Excluding CVA/DVA and the loss on MSSB, Citi Holdings

revenues were $3.7 billion in 2012 compared to $6.2 billion in the prior year. Special Asset Pool revenues, excluding CVA/DVA, were $(657) million in 2012, compared to

$473 million in the prior year, largely due to lower non-interest revenue

resulting from lower gains on asset sales. Local Consumer Lending revenues of

$4.4 billion declined 20% from the prior year primarily due to the 24% decline

in average assets. Brokerage and Asset

Management revenues, excluding the loss on

MSSB, were $(15) million, compared to $282 million in the prior year, mostly

reflecting higher funding costs. Net interest revenues declined 30%

year-over-year to $2.6 billion, largely driven by continued declining loan

balances in Local Consumer

Lending . Non-interest revenues, excluding the

loss on MSSB and CVA/DVA, were $1.1 billion versus $2.5 billion in the prior

year, principally reflecting lower gains on asset sales within the Special Asset Pool .

As noted

above, Citi Holdings assets declined 31% year-over-year to $156 billion as of

the end of 2012. Also at the end of 2012, Citi Holdings assets comprised

approximately 8% of total Citigroup GAAP assets and 15% of risk-weighted assets

(as defined under current regulatory guidelines). Local Consumer Lending continued to

represent the largest segment within Citi Holdings, with $126 billion of assets

as of the end of 2012, of which approximately 73% consisted of mortgages in North America real estate lending.

| 7 | For the summary of CVA/DVA by business within Securities and Banking for 2012 and comparable periods, see "Citicorp- Institutional Clients Group. " |

| 8 | Citi Holdings includes Local Consumer Lending, Special Asset Pool and Brokerage and Asset Management. See "Citi Holdings" below for additional information on the results of operations for each of the businesses in Citi Holdings. | |

| 9 | CVA/DVA in Citi Holdings, recorded in the Special Asset Pool , was $157 million in 2012, compared to $74 million in the prior year. |

9

| FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA-PAGE 1 | Citigroup Inc. and Consolidated Subsidiaries |

| In millions of dollars, except per-share amounts and ratios | 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||

| Net interest revenue | $ | 47,603 | $ | 48,447 | $ | 54,186 | $ | 48,496 | $ | 53,366 | |||||

| Non-interest revenue | 22,570 | 29,906 | 32,415 | 31,789 | (1,767 | ) | |||||||||

| Revenues, net of interest expense | $ | 70,173 | $ | 78,353 | $ | 86,601 | $ | 80,285 | $ | 51,599 | |||||

| Operating expenses | 50,518 | 50,933 | 47,375 | 47,822 | 69,240 | ||||||||||

| Provisions for credit losses and for benefits and claims | 11,719 | 12,796 | 26,042 | 40,262 | 34,714 | ||||||||||

| Income (loss) from continuing operations before income taxes | $ | 7,936 | $ | 14,624 | $ | 13,184 | $ | (7,799 | ) | $ | (52,355 | ) | |||

| Income taxes (benefits) | 27 | 3,521 | 2,233 | (6,733 | ) | (20,326 | ) | ||||||||

| Income (loss) from continuing operations | $ | 7,909 | $ | 11,103 | $ | 10,951 | $ | (1,066 | ) | $ | (32,029 | ) | |||

| Income (loss) from discontinued operations, net of taxes (1) | (149 | ) | 112 | (68 | ) | (445 | ) | 4,002 | |||||||

| Net income (loss) before attribution of noncontrolling interests | $ | 7,760 | $ | 11,215 | $ | 10,883 | $ | (1,511 | ) | $ | (28,027 | ) | |||

| Net income (loss) attributable to noncontrolling interests | 219 | 148 | 281 | 95 | (343 | ) | |||||||||

| Citigroup's net income (loss) | $ | 7,541 | $ | 11,067 | $ | 10,602 | $ | (1,606 | ) | $ | (27,684 | ) | |||

| Less: | |||||||||||||||

| Preferred dividends-Basic | $ | 26 | $ | 26 | $ | 9 | $ | 2,988 | $ | 1,695 | |||||

| Impact of the conversion price reset related to the $12.5 | |||||||||||||||

| billion convertible preferred stock private issuance-Basic | - | - | - | 1,285 | - | ||||||||||

| Preferred stock Series H discount accretion-Basic | - | - | - | 123 | 37 | ||||||||||

| Impact of the public and private preferred stock exchange offers | - | - | - | 3,242 | - | ||||||||||

| Dividends and undistributed earnings allocated to employee restricted | |||||||||||||||

| and deferred shares that contain nonforfeitable rights to dividends, | |||||||||||||||

| applicable to Basic EPS | 166 | 186 | 90 | 2 | 221 | ||||||||||

| Income (loss) allocated to unrestricted common shareholders for Basic EPS | $ | 7,349 | $ | 10,855 | $ | 10,503 | $ | (9,246 | ) | $ | (29,637 | ) | |||

| Less: Convertible preferred stock dividends | - | - | - | (540 | ) | (877 | ) | ||||||||

| Add: Interest expense, net of tax, on convertible securities and | |||||||||||||||

| adjustment of undistributed earnings allocated to employee | |||||||||||||||

| restricted and deferred shares that contain nonforfeitable rights to | |||||||||||||||

| dividends, applicable to diluted EPS | 11 | 17 | 2 | - | - | ||||||||||

| Income (loss) allocated to unrestricted common shareholders for diluted EPS (2) | $ | 7,360 | $ | 10,872 | $ | 10,505 | $ | (8,706 | ) | $ | (28,760 | ) | |||

| Earnings per share (3) | |||||||||||||||

| Basic (3) | |||||||||||||||

| Income (loss) from continuing operations | 2.56 | 3.69 | 3.66 | (7.61 | ) | (63.89 | ) | ||||||||

| Net income (loss) | 2.51 | 3.73 | 3.65 | (7.99 | ) | (56.29 | ) | ||||||||

| Diluted (2)(3) | |||||||||||||||

| Income (loss) from continuing operations | $ | 2.49 | $ | 3.59 | $ | 3.55 | $ | (7.61 | ) | $ | (63.89 | ) | |||

| Net income (loss) | 2.44 | 3.63 | 3.54 | (7.99 | ) | (56.29 | ) | ||||||||

| Dividends declared per common share (3)(4) | 0.04 | 0.03 | 0.00 | 0.10 | 11.20 | ||||||||||

Statement continues on the next page, including notes to the table.

10

| FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA-PAGE 2 | Citigroup Inc. and Consolidated Subsidiaries | |||||||||||||||

| In millions of dollars, except per-share amounts, ratios and direct staff | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||

| At December 31: | ||||||||||||||||

| Total assets | $ | 1,864,660 | $ | 1,873,878 | $ | 1,913,902 | $ | 1,856,646 | $ | 1,938,470 | ||||||

| Total deposits | 930,560 | 865,936 | 844,968 | 835,903 | 774,185 | |||||||||||

| Long-term debt | 239,463 | 323,505 | 381,183 | 364,019 | 359,593 | |||||||||||

| Trust preferred securities (included in long-term debt) | 10,110 | 16,057 | 18,131 | 19,345 | 24,060 | |||||||||||

| Citigroup common stockholders' equity | 186,487 | 177,494 | 163,156 | 152,388 | 70,966 | |||||||||||

| Total Citigroup stockholders' equity | 189,049 | 177,806 | 163,468 | 152,700 | 141,630 | |||||||||||

| Direct staff (in thousands) | 259 | 266 | 260 | 265 | 323 | |||||||||||

| Ratios | ||||||||||||||||

| Return on average assets | 0.4 | % | 0.6 | % | 0.5 | % | (0.08 | )% | (1.28 | )% | ||||||

| Return on average common stockholders' equity (5) | 4.1 | 6.3 | 6.8 | (9.4 | ) | (28.8 | ) | |||||||||

| Return on average total stockholders' equity (5) | 4.1 | 6.3 | 6.8 | (1.1 | ) | (20.9 | ) | |||||||||

| Efficiency ratio | 72 | 65 | 55 | 60 | 134 | |||||||||||

| Tier 1 Common (6) | 12.67 | % | 11.80 | % | 10.75 | % | 9.60 | % | 2.30 | % | ||||||

| Tier 1 Capital | 14.06 | 13.55 | 12.91 | 11.67 | 11.92 | |||||||||||

| Total Capital | 17.26 | 16.99 | 16.59 | 15.25 | 15.70 | |||||||||||

| Leverage (7) | 7.48 | 7.19 | 6.60 | 6.87 | 6.08 | |||||||||||

| Citigroup common stockholders' equity to assets | 10.00 | % | 9.47 | % | 8.52 | % | 8.21 | % | 3.66 | % | ||||||

| Total Citigroup stockholders' equity to assets | 10.14 | 9.49 | 8.54 | 8.22 | 7.31 | |||||||||||

| Dividend payout ratio (4) | 1.6 | 0.8 | NM | NM | NM | |||||||||||

| Book value per common share (3) | $ | 61.57 | $ | 60.70 | $ | 56.15 | $ | 53.50 | $ | 130.21 | ||||||

| Ratio of earnings to fixed charges and preferred stock dividends | 1.38 | x | 1.59 | x | 1.51 | x | NM | NM | ||||||||

| (1) | Discontinued operations in 2012 includes a carve-out of Citi's liquid strategies business within Citi Capital Advisors, the sale of which is expected to close in the first half of 2013. Discontinued operations in 2012 and 2011 reflect the sale of the Egg Banking PLC credit card business. Discontinued operations for 2008 to 2009 reflect the sale of Nikko Cordial Securities to Sumitomo Mitsui Banking Corporation, the sale of Citigroup's German retail banking operations to Crédit Mutuel, and the sale of CitiCapital's equipment finance unit to General Electric. Discontinued operations for 2008 to 2010 also include the operations and associated gain on sale of Citigroup's Travelers Life & Annuity, substantially all of Citigroup's international insurance business, and Citigroup's Argentine pension business sold to MetLife Inc. Discontinued operations for the second half of 2010 also reflect the sale of The Student Loan Corporation. See Note 3 to the Consolidated Financial Statements for additional information on Citi's discontinued operations. | |

| (2) | The diluted EPS calculation for 2009 and 2008 utilizes basic shares and income allocated to unrestricted common stockholders (Basic) due to the negative income allocated to unrestricted common stockholders. Using diluted shares and income allocated to unrestricted common stockholders (Diluted) would result in anti-dilution. As of December 31, 2012, primarily all stock options were out of the money and did not impact diluted EPS. The year-end share price was $39.56. See Note 11 to the Consolidated Financial Statements. | |

| (3) | All per share amounts and Citigroup shares outstanding for all periods reflect Citigroup's 1-for-10 reverse stock split, which was effective May 6, 2011. | |

| (4) | Dividends declared per common share as a percentage of net income per diluted share. | |

| (5) | The return on average common stockholders' equity is calculated using net income less preferred stock dividends divided by average common stockholders' equity. The return on average total Citigroup stockholders' equity is calculated using net income divided by average Citigroup stockholders' equity. | |

| (6) | As currently defined by the U.S. banking regulators, the Tier 1 Common ratio represents Tier 1 Capital less non-common elements, including qualifying perpetual preferred stock, qualifying noncontrolling interests in subsidiaries and qualifying trust preferred securities divided by risk-weighted assets. | |

| (7) | The leverage ratio represents Tier 1 Capital divided by quarterly adjusted average total assets. |

Note: The following accounting changes were adopted by Citi during the respective years:

On January 1, 2010, Citigroup adopted SFAS 166/167. Prior periods have not been restated as the standards were adopted prospectively. See Note 1 to the Consolidated Financial Statements. On January 1, 2009, Citigroup adopted SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements (now ASC 810-10-45-15, Consolidation: Noncontrolling Interest in a Subsidiary ), and FSP EITF 03-6-1, "Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities" (now ASC 260-10-45-59A, Earnings Per Share: Participating Securities and the Two-Class Method ). All prior periods have been restated to conform to the current period's presentation.11

SEGMENT AND BUSINESS-INCOME (LOSS) AND REVENUES

The following tables show the income (loss) and revenues for Citigroup on a segment and business view:

CITIGROUP INCOME

| % Change | % Change | |||||||||||||

| In millions of dollars | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| Income (loss) from continuing operations | ||||||||||||||

| CITICORP | ||||||||||||||

| Global Consumer Banking | ||||||||||||||

| North America | $ | 4,815 | $ | 4,095 | $ | 974 | 18 | % | NM | |||||

| EMEA | (18 | ) | 95 | 97 | NM | (2 | )% | |||||||

| Latin America | 1,510 | 1,578 | 1,788 | (4 | ) | (12 | ) | |||||||

| Asia | 1,797 | 1,904 | 2,110 | (6 | ) | (10 | ) | |||||||

| Total | $ | 8,104 | $ | 7,672 | $ | 4,969 | 6 | % | 54 | % | ||||

| Securities and Banking | ||||||||||||||

| North America | $ | 1,011 | $ | 1,044 | $ | 2,495 | (3 | )% | (58 | )% | ||||

| EMEA | 1,354 | 2,000 | 1,811 | (32 | ) | 10 | ||||||||

| Latin America | 1,308 | 974 | 1,093 | 34 | (11 | ) | ||||||||

| Asia | 822 | 895 | 1,152 | (8 | ) | (22 | ) | |||||||

| Total | $ | 4,495 | $ | 4,913 | $ | 6,551 | (9 | )% | (25 | )% | ||||

| Transaction Services | ||||||||||||||

| North America | $ | 470 | $ | 415 | $ | 490 | 13 | % | (15 | )% | ||||

| EMEA | 1,244 | 1,130 | 1,218 | 10 | (7 | ) | ||||||||

| Latin America | 654 | 639 | 663 | 2 | (4 | ) | ||||||||

| Asia | 1,127 | 1,165 | 1,251 | (3 | ) | (7 | ) | |||||||

| Total | $ | 3,495 | $ | 3,349 | $ | 3,622 | 4 | % | (8 | )% | ||||

| Institutional Clients Group | $ | 7,990 | $ | 8,262 | $ | 10,173 | (3 | )% | (19 | )% | ||||

| Corporate/Other | $ | (1,625 | ) | $ | (728 | ) | $ | 242 | NM | NM | ||||

| Total Citicorp | $ | 14,469 | $ | 15,206 | $ | 15,384 | (5 | )% | (1 | )% | ||||

| CITI HOLDINGS | ||||||||||||||

| Brokerage and Asset Management | $ | (3,190 | ) | $ | (286 | ) | $ | (226 | ) | NM | (27 | )% | ||

| Local Consumer Lending | (3,193 | ) | (4,413 | ) | (5,365 | ) | 28 | % | 18 | |||||

| Special Asset Pool | (177 | ) | 596 | 1,158 | NM | (49 | ) | |||||||

| Total Citi Holdings | $ | (6,560 | ) | $ | (4,103 | ) | $ | (4,433 | ) | (60 | )% | 7 | % | |

| Income from continuing operations | $ | 7,909 | $ | 11,103 | $ | 10,951 | (29 | )% | 1 | % | ||||

| Discontinued operations | $ | (149 | ) | $ | 112 | $ | (68 | ) | NM | NM | ||||

| Net income attributable to noncontrolling interests | 219 | 148 | 281 | 48 | % | (47 | )% | |||||||

| Citigroup's net income | $ | 7,541 | $ | 11,067 | $ | 10,602 | (32 | )% | 4 | % | ||||

NM Not meaningful

12

CITIGROUP REVENUES

| % Change | % Change | |||||||||||||

| In millions of dollars | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| CITICORP | ||||||||||||||

| Global Consumer Banking | ||||||||||||||

| North America | $ | 21,081 | $ | 20,159 | $ | 21,747 | 5 | % | (7 | )% | ||||

| EMEA | 1,516 | 1,558 | 1,559 | (3 | ) | - | ||||||||

| Latin America | 9,702 | 9,469 | 8,667 | 2 | 9 | |||||||||

| Asia | 7,915 | 8,009 | 7,396 | (1 | ) | 8 | ||||||||

| Total | $ | 40,214 | $ | 39,195 | $ | 39,369 | 3 | % | - | % | ||||

| Securities and Banking | ||||||||||||||

| North America | $ | 6,104 | $ | 7,558 | $ | 9,393 | (19 | )% | (20 | )% | ||||

| EMEA | 6,417 | 7,221 | 6,849 | (11 | ) | 5 | ||||||||

| Latin America | 3,019 | 2,370 | 2,554 | 27 | (7 | ) | ||||||||

| Asia | 4,203 | 4,274 | 4,326 | (2 | ) | (1 | ) | |||||||

| Total | $ | 19,743 | $ | 21,423 | $ | 23,122 | (8 | )% | (7 | )% | ||||

| Transaction Services | ||||||||||||||

| North America | $ | 2,564 | $ | 2,444 | $ | 2,485 | 5 | % | (2 | )% | ||||

| EMEA | 3,576 | 3,486 | 3,356 | 3 | 4 | |||||||||

| Latin America | 1,797 | 1,713 | 1,530 | 5 | 12 | |||||||||

| Asia | 2,920 | 2,936 | 2,714 | (1 | ) | 8 | ||||||||

| Total | $ | 10,857 | $ | 10,579 | $ | 10,085 | 3 | % | 5 | % | ||||

| Institutional Clients Group | $ | 30,600 | $ | 32,002 | $ | 33,207 | (4 | )% | (4 | )% | ||||

| Corporate/Other | $ | 192 | $ | 885 | $ | 1,754 | (78 | )% | (50 | )% | ||||

| Total Citicorp | $ | 71,006 | $ | 72,082 | $ | 74,330 | (1 | )% | (3 | )% | ||||

| CITI HOLDINGS | ||||||||||||||

| Brokerage and Asset Management | $ | (4,699 | ) | $ | 282 | $ | 609 | NM | (54 | )% | ||||

| Local Consumer Lending | 4,366 | 5,442 | 8,810 | (20 | )% | (38 | ) | |||||||

| Special Asset Pool | (500 | ) | 547 | 2,852 | NM | (81 | ) | |||||||

| Total Citi Holdings | $ | (833 | ) | $ | 6,271 | $ | 12,271 | NM | (49 | )% | ||||

| Total Citigroup net revenues | $ | 70,173 | $ | 78,353 | $ | 86,601 | (10 | )% | (10 | )% | ||||

NM Not meaningful

13

CITICORP

Citicorp is Citigroup's global

bank for consumers and businesses and represents Citi's core franchises.

Citicorp is focused on providing best-in-class products and services to

customers and leveraging Citigroup's unparalleled global network, including many

of the world's emerging economies. Citicorp is physically present in

approximately 100 countries, many for over 100 years, and offers services in

over 160 countries and jurisdictions. Citi believes this global network provides

a strong foundation for servicing the broad financial services needs of its

large multinational clients and for meeting the needs of retail, private

banking, commercial, public sector and institutional clients around the world.

At December 31, 2012, Citicorp had $1.7 trillion of assets and $863 billion of

deposits, representing 92% of Citi's total assets and 93% of its

deposits.

Citicorp consists of the following operating businesses: Global Consumer Banking (which consists of Regional Consumer

Banking in North America, EMEA, Latin America and Asia ) and Institutional Clients

Group (which includes Securities and Banking and Transaction Services ). Citicorp also includes Corporate/Other .

| % Change | % Change | |||||||||||||

| In millions of dollars except as otherwise noted | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| Net interest revenue | $ | 45,026 | $ | 44,764 | $ | 46,101 | 1 | % | (3 | )% | ||||

| Non-interest revenue | 25,980 | 27,318 | 28,229 | (5 | ) | (3 | ) | |||||||

| Total revenues, net of interest expense | $ | 71,006 | $ | 72,082 | $ | 74,330 | (1 | )% | (3 | )% | ||||

| Provisions for credit losses and for benefits and claims | ||||||||||||||

| Net credit losses | $ | 8,734 | $ | 11,462 | $ | 16,901 | (24 | )% | (32 | )% | ||||

| Credit reserve build (release) | (2,177 | ) | (4,988 | ) | (3,171 | ) | 56 | (57 | ) | |||||

| Provision for loan losses | $ | 6,557 | $ | 6,474 | $ | 13,730 | 1 | % | (53 | )% | ||||

| Provision for benefits and claims | 236 | 193 | 184 | 22 | 5 | |||||||||

| Provision for unfunded lending commitments | 40 | 92 | (35 | ) | (57 | ) | NM | |||||||

| Total provisions for credit losses and for benefits and claims | $ | 6,833 | $ | 6,759 | $ | 13,879 | 1 | % | (51 | )% | ||||

| Total operating expenses | $ | 45,265 | $ | 44,469 | $ | 40,019 | 2 | % | 11 | % | ||||

| Income from continuing operations before taxes | $ | 18,908 | $ | 20,854 | $ | 20,432 | (9 | )% | 2 | % | ||||

| Provisions for income taxes | 4,439 | 5,648 | 5,048 | (21 | ) | 12 | ||||||||

| Income from continuing operations | $ | 14,469 | $ | 15,206 | $ | 15,384 | (5 | )% | (1 | )% | ||||

| Income (loss) from discontinued operations, net of taxes | (149 | ) | 112 | (68 | ) | NM | NM | |||||||

| Noncontrolling interests | 216 | 29 | 74 | NM | (61 | ) | ||||||||

| Net income | $ | 14,104 | $ | 15,289 | $ | 15,242 | (8 | )% | - | % | ||||

| Balance sheet data (in billions of dollars) | ||||||||||||||

| Total end-of-period (EOP) assets | $ | 1,709 | $ | 1,649 | $ | 1,601 | 4 | % | 3 | % | ||||

| Average assets | 1,717 | 1,684 | 1,578 | 2 | 7 | |||||||||

| Return on average assets | 0.82 | % | 0.91 | % | 0.97 | % | ||||||||

| Efficiency ratio (Operating expenses/Total revenues) | 64 | % | 62 | % | 54 | % | ||||||||

| Total EOP loans | $ | 540 | $ | 507 | $ | 450 | 7 | 13 | ||||||

| Total EOP deposits | 863 | 804 | 769 | 7 | 5 | |||||||||

NM Not meaningful

14

GLOBAL CONSUMER BANKING

Global Consumer Banking (GCB) consists of Citigroup's four geographical Regional Consumer Banking (RCB) businesses that provide traditional banking services to retail customers through retail banking, commercial banking, Citi-branded cards and Citi retail services. GCB is a globally diversified business with 4,008 branches in 39 countries around the world. For the year ended December 31, 2012, GCB had $387 billion of average assets and $322 billion of average deposits. Citi's strategy is to focus on the top 150 cities globally that it believes have the highest growth potential in consumer banking. Consistent with this strategy, as announced in the fourth quarter of 2012 as part of its repositioning efforts, Citi intends to optimize its branch footprint and further concentrate its presence in major metropolitan areas. As of December 31, 2012, Citi had consumer banking operations in approximately 120, or 80%, of these cities.

| % Change | % Change | |||||||||||||

| In millions of dollars except as otherwise noted | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| Net interest revenue | $ | 29,468 | $ | 29,683 | $ | 29,858 | (1 | )% | (1 | )% | ||||

| Non-interest revenue | 10,746 | 9,512 | 9,511 | 13 | - | |||||||||

| Total revenues, net of interest expense | $ | 40,214 | $ | 39,195 | $ | 39,369 | 3 | % | - | % | ||||

| Total operating expenses | $ | 21,819 | $ | 21,408 | $ | 18,887 | 2 | % | 13 | % | ||||

| Net credit losses | $ | 8,452 | $ | 10,840 | $ | 16,328 | (22 | )% | (34 | )% | ||||

| Credit reserve build (release) | (2,131 | ) | (4,429 | ) | (2,547 | ) | 52 | (74 | ) | |||||

| Provisions for unfunded lending commitments | - | 3 | (3 | ) | (100 | ) | NM | |||||||

| Provision for benefits and claims | 237 | 192 | 184 | 23 | 4 | |||||||||

| Provisions for credit losses and for benefits and claims | $ | 6,558 | $ | 6,606 | $ | 13,962 | (1 | )% | (53 | )% | ||||

| Income from continuing operations before taxes | $ | 11,837 | $ | 11,181 | $ | 6,520 | 6 | % | 71 | % | ||||

| Income taxes | 3,733 | 3,509 | 1,551 | 6 | NM | |||||||||

| Income from continuing operations | $ | 8,104 | $ | 7,672 | $ | 4,969 | 6 | % | 54 | % | ||||

| Noncontrolling interests | 3 | - | (9 | ) | - | 100 | ||||||||

| Net income | $ | 8,101 | $ | 7,672 | $ | 4,978 | 6 | % | 54 | % | ||||

| Balance Sheet data (in billions of dollars) | ||||||||||||||

| Average assets | $ | 387 | $ | 376 | $ | 353 | 3 | % | 7 | % | ||||

| Return on assets | 2.09 | % | 2.04 | % | 1.41 | % | ||||||||

| Efficiency ratio | 54 | % | 55 | % | 48 | % | ||||||||

| Total EOP assets | $ | 402 | $ | 385 | $ | 374 | 4 | 3 | ||||||

| Average deposits | 322 | 314 | 299 | 3 | 5 | |||||||||

| Net credit losses as a percentage of average loans | 2.95 | % | 3.93 | % | 6.22 | % | ||||||||

| Revenue by business | ||||||||||||||

| Retail banking | $ | 18,059 | $ | 16,398 | $ | 15,874 | 10 | % | 3 | % | ||||

| Cards (1) | 22,155 | 22,797 | 23,495 | (3 | ) | (3 | ) | |||||||

| Total | $ | 40,214 | $ | 39,195 | $ | 39,369 | 3 | % | - | % | ||||

| Income from continuing operations by business | ||||||||||||||

| Retail banking | $ | 2,986 | $ | 2,523 | $ | 3,052 | 18 | % | (17 | )% | ||||

| Cards (1) | 5,118 | 5,149 | 1,917 | (1 | ) | NM | ||||||||

| Total | $ | 8,104 | $ | 7,672 | $ | 4,969 | 6 | % | 54 | % | ||||

| Foreign Currency (FX) Translation Impact | ||||||||||||||

| Total revenue-as reported | $ | 40,214 | $ | 39,195 | $ | 39,369 | 3 | % | - | % | ||||

| Impact of FX translation (2) | - | (742 | ) | (153 | ) | |||||||||

| Total revenues-ex-FX | $ | 40,214 | $ | 38,453 | $ | 39,216 | 5 | % | (2 | )% | ||||

| Total operating expenses-as reported | $ | 21,819 | $ | 21,408 | $ | 18,887 | 2 | % | 13 | % | ||||

| Impact of FX translation (2) | - | (494 | ) | (134 | ) | |||||||||

| Total operating expenses-ex-FX | $ | 21,819 | $ | 20,914 | $ | 18,753 | 4 | % | 12 | % | ||||

| Total provisions for LLR & PBC-as reported | $ | 6,558 | $ | 6,606 | $ | 13,962 | (1 | )% | (53 | )% | ||||

| Impact of FX translation (2) | - | (167 | ) | (19 | ) | |||||||||

| Total provisions for LLR & PBC-ex-FX | $ | 6,558 | $ | 6,439 | $ | 13,943 | 2 | % | (54 | )% | ||||

| Net income-as reported | $ | 8,101 | $ | 7,672 | $ | 4,978 | 6 | % | 54 | % | ||||

| Impact of FX translation (2) | - | (102 | ) | (17 | ) | |||||||||

| Net income-ex-FX | $ | 8,101 | $ | 7,570 | $ | 4,961 | 7 | % | 53 | % | ||||

| (1) | Includes both Citi-branded cards and Citi retail services. |

| (2) | Reflects the impact of foreign exchange (FX) translation into U.S. dollars at the current exchange rate for all periods presented. |

| NM | Not meaningful |

15

NORTH AMERICA REGIONAL CONSUMER BANKING

North America Regional Consumer Banking (NA RCB) provides traditional banking and Citi-branded cards and Citi retail services to retail customers and small to mid-size businesses in the U.S. NA RCB 's approximate 1,000 retail bank branches as of December 31, 2012 are largely concentrated in the greater metropolitan areas of New York, Los Angeles, San Francisco, Chicago, Miami, Washington, D.C., Boston, Philadelphia, Dallas, Houston, San Antonio and Austin. As announced in the fourth quarter of 2012, as part of its repositioning efforts, Citi expects to optimize its branch network in North America and further concentrate its presence in major metropolitan areas. At December 31, 2012, NA RCB had approximately 12.4 million customer accounts, $42.7 billion of retail banking loans and $165.2 billion of deposits. In addition, NA RCB had approximately 102.1 million Citi-branded and Citi retail services credit card accounts, with $111.5 billion in outstanding card loan balances.

| % Change | % Change | |||||||||||||

| In millions of dollars, except as otherwise noted | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| Net interest revenue | $ | 16,591 | $ | 16,915 | $ | 17,892 | (2 | )% | (5 | )% | ||||

| Non-interest revenue | 4,490 | 3,244 | 3,855 | 38 | (16 | ) | ||||||||

| Total revenues, net of interest expense | $ | 21,081 | $ | 20,159 | $ | 21,747 | 5 | % | (7 | )% | ||||

| Total operating expenses | $ | 9,933 | $ | 9,690 | $ | 8,445 | 3 | % | 15 | % | ||||

| Net credit losses | $ | 5,756 | $ | 8,101 | $ | 13,132 | (29 | )% | (38 | )% | ||||

| Credit reserve build (release) | (2,389 | ) | (4,181 | ) | (1,319 | ) | 43 | NM | ||||||

| Provisions for benefits and claims | 1 | (1 | ) | - | NM | - | ||||||||

| Provision for unfunded lending commitments | 70 | 62 | 57 | 13 | 9 | |||||||||

| Provisions for credit losses and for benefits and claims | $ | 3,438 | $ | 3,981 | $ | 11,870 | (14 | )% | (66 | )% | ||||

| Income from continuing operations before taxes | $ | 7,710 | $ | 6,488 | $ | 1,432 | 19 | % | NM | |||||

| Income taxes | 2,895 | 2,393 | 458 | 21 | NM | |||||||||

| Income from continuing operations | $ | 4,815 | $ | 4,095 | $ | 974 | 18 | % | NM | |||||

| Noncontrolling interests | 1 | - | - | - | - | |||||||||

| Net income | $ | 4,814 | $ | 4,095 | $ | 974 | 18 | % | NM | |||||

| Balance Sheet data (in billions of dollars) | ||||||||||||||

| Average assets | $ | 172 | $ | 165 | $ | 163 | 4 | % | 1 | % | ||||

| Return on average assets | 2.80 | % | 2.48 | % | 0.60 | % | ||||||||

| Efficiency ratio | 47 | % | 48 | % | 39 | % | ||||||||

| Average deposits | $ | 154 | $ | 145 | $ | 145 | 6 | - | ||||||

| Net credit losses as a percentage of average loans | 3.83 | % | 5.50 | % | 8.71 | % | ||||||||

| Revenue by business | ||||||||||||||

| Retail banking | $ | 6,677 | $ | 5,113 | $ | 5,323 | 31 | % | (4 | )% | ||||

| Citi-branded cards | 8,323 | 8,730 | 9,695 | (5 | ) | (10 | ) | |||||||

| Citi retail services | 6,081 | 6,316 | 6,729 | (4 | ) | (6 | ) | |||||||

| Total | $ | 21,081 | $ | 20,159 | $ | 21,747 | 5 | % | (7 | )% | ||||

| Income from continuing operations by business | ||||||||||||||

| Retail banking | $ | 1,237 | $ | 463 | $ | 744 | NM | (38 | )% | |||||

| Citi-branded cards | 2,080 | 2,151 | (24 | ) | (3 | )% | NM | |||||||

| Citi retail services | 1,498 | 1,481 | 254 | 1 | NM | |||||||||

| Total | $ | 4,815 | $ | 4,095 | $ | 974 | 18 | % | NM | |||||

NM Not meaningful

16

2012 vs. 2011

Net income increased 18%, mainly driven by higher mortgage revenues and a $2.3

billion decrease in net credit losses, partially offset by a $1.8 billion

reduction in loan loss reserve

releases.

Revenues increased 5%, driven by a

38% increase in non-interest revenues from higher gains on sale of mortgages,

partly offset by a 2% decline in net interest revenues. The higher gains on sale

of mortgages were driven by high volumes of mortgage refinancing activity, due

largely to the U.S. government's Home Affordable Refinance Program (HARP), as

well as higher margins resulting from the shift to retail as compared to

third-party origination channels. Assuming the continued low interest rate

environment, Citi believes the higher mortgage refinancing volumes could

continue into the first half of 2013. Excluding mortgages, revenue from the

retail banking business was essentially flat, as volume growth and improved mix

in the deposit and lending portfolios was offset by significant spread

compression. Citi expects spread compression to continue to negatively impact

revenues during 2013.

Cards

revenues declined 4%. In Citi-branded cards, both average loans and net interest

revenue declined year-over-year, reflecting continued increased payment rates

resulting from consumer deleveraging and the impact of the look-back provisions

of The Credit Card Accountability Responsibility and Disclosure Act (CARD

Act). 10 Citi expects the look-back provisions of the CARD Act will

likely have a diminishing impact on the results of operations of its cards

businesses during 2013. In Citi retail services, net interest revenues improved

slightly but were offset by declining non-interest revenues, driven by improving

credit and the resulting impact on contractual partner payments. Citi expects

cards revenues could continue to be negatively impacted by higher payment rates

for consumers, reflecting ongoing economic uncertainty and deleveraging as well

as Citi's shift to higher credit quality borrowers.

As

part of its U.S. Citi-branded cards business, Citibank, N.A. issues a co-branded

credit card product with American Airlines, the Citi/AAdvantage card. AMR

Corporation and certain of its subsidiaries, including American Airlines, Inc.,

filed voluntary petitions for reorganization under Chapter 11 of the U.S.

Bankruptcy Code in November 2011. On February 14, 2013, AMR Corporation and US

Airways Group, Inc. announced that the boards of directors of both companies had

approved a merger agreement under which the companies would be combined. For

additional information, see "Risk Factors-Business and Operational Risks"

below.

Expenses increased 3%, primarily due to increased mortgage origination

costs resulting from the higher retail channel mortgage volumes and $100 million

of repositioning charges in the fourth quarter of 2012, partially offset by

lower expenses in cards. Expenses continued to be impacted by elevated legal and

related costs.

Provisions decreased 14%, due to lower

net credit losses in the cards portfolio partly offset by continued lower loan

loss reserve releases ($2.4 billion in 2012 compared to $4.2 billion in 2011).

Assuming no downturn in the U.S. economic environment, Citi believes credit

trends have largely stabilized in the cards portfolios.

2011 vs.

2010

Net income increased $3.1 billion, driven by higher loan loss reserve

releases and an improvement in net credit losses, partly offset by lower

revenues and higher expenses.

Revenues decreased 7% due to a

decrease in net interest and non-interest revenues. Net interest revenue

decreased 5%, driven primarily by lower cards net interest revenue, which was

negatively impacted by the look-back provision of the CARD Act. In addition, net

interest revenue for cards was negatively impacted by higher promotional

balances and lower total average loans. Non-interest revenue decreased 16%,

primarily due to lower gains from the sale of mortgage loans, as margins

declined and Citi held more loans on-balance sheet, and declining revenues

driven by improving credit and the resulting impact on contractual partner

payments in Citi retail services. In addition, the decline in non-interest

revenue reflected lower retail banking fee income.

Expenses increased 15%, primarily

driven by higher investment spending in the business during the second half of

2011, particularly in cards marketing and technology, and increases in

litigation accruals related to the interchange fees litigation (see Note 28 to

the Consolidated Financial Statements).

Provisions decreased 66%, primarily

due to a loan loss reserve release of $4.2 billion in 2011, compared to a loan

loss reserve release of $1.3 billion in 2010, and lower net credit losses in the

cards portfolios (cards net credit losses declined $5.0 billion, or 38%, from

2010).

| ____________________ | ||

| 10 | The CARD Act requires a review once every six months for card accounts where the annual percentage rate (APR) has been increased since January 1, 2009 to assess whether changes in credit risk, market conditions or other factors merit a future decline in the APR. | |

17

EMEA REGIONAL CONSUMER BANKING

EMEA Regional Consumer Banking (EMEA RCB) provides traditional banking and Citi-branded card services to retail customers and small to mid-size businesses, primarily in Central and Eastern Europe, the Middle East and Africa. The countries in which EMEA RCB has the largest presence are Poland, Turkey, Russia and the United Arab Emirates. As announced in the fourth quarter of 2012, as part of its repositioning efforts, Citi expects to either sell or significantly scale back its consumer operations in Turkey, Romania and Pakistan, and expects to further optimize its branch network in Hungary. At December 31, 2012, EMEA RCB had 228 retail bank branches with 3.9 million customer accounts, $5.1 billion in retail banking loans and $13.2 billion in deposits. In addition, the business had 2.8 million Citi-branded card accounts with $2.9 billion in outstanding card loan balances.

| % Change | % Change | |||||||||||||

| In millions of dollars, except as otherwise noted | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| Net interest revenue | $ | 1,040 | $ | 947 | $ | 936 | 10 | % | 1 | % | ||||

| Non-interest revenue | 476 | 611 | 623 | (22 | ) | (2 | ) | |||||||

| Total revenues, net of interest expense | $ | 1,516 | $ | 1,558 | $ | 1,559 | (3 | )% | - | % | ||||

| Total operating expenses | $ | 1,434 | $ | 1,343 | $ | 1,225 | 7 | % | 10 | % | ||||

| Net credit losses | $ | 105 | $ | 172 | $ | 315 | (39 | )% | (45 | )% | ||||

| Credit reserve build (release) | (5 | ) | (118 | ) | (118 | ) | 96 | - | ||||||

| Provision for unfunded lending commitments | (1 | ) | 4 | (3 | ) | NM | NM | |||||||

| Provisions for credit losses | $ | 99 | $ | 58 | $ | 194 | 71 | % | (70 | )% | ||||

| Income from continuing operations before taxes | $ | (17 | ) | $ | 157 | $ | 140 | NM | 12 | % | ||||

| Income taxes | 1 | 62 | 43 | (98 | ) | 44 | ||||||||

| Income from continuing operations | $ | (18 | ) | $ | 95 | $ | 97 | NM | (2 | )% | ||||

| Noncontrolling interests | 4 | - | (1 | ) | - | 100 | ||||||||

| Net income | $ | (22 | ) | $ | 95 | $ | 98 | NM | (3 | )% | ||||

| Balance Sheet data (in billions of dollars) | ||||||||||||||

| Average assets | $ | 9 | $ | 10 | 10 | (10 | )% | - | % | |||||

| Return on average assets | (0.24 | )% | 0.95 | % | 0.98 | % | ||||||||

| Efficiency ratio | 95 | % | 86 | % | 79 | % | ||||||||

| Average deposits | $ | 12.6 | $ | 12.5 | $ | 13.7 | 1 | (9 | ) | |||||

| Net credit losses as a percentage of average loans | 1.40 | % | 2.37 | % | 4.42 | % | ||||||||

| Revenue by business | ||||||||||||||

| Retail banking | $ | 889 | $ | 890 | $ | 878 | - | 1 | % | |||||

| Citi-branded cards | 627 | 668 | 681 | (6 | ) | (2 | ) | |||||||

| Total | $ | 1,516 | $ | 1,558 | $ | 1,559 | (3 | )% | - | % | ||||

| Income (loss) from continuing operations by business | ||||||||||||||

| Retail banking | $ | (81 | ) | $ | (37 | ) | $ | (59 | ) | NM | 37 | % | ||

| Citi-branded cards | 63 | 132 | 156 | (52 | ) | (15 | ) | |||||||

| Total | $ | (18 | ) | $ | 95 | $ | 97 | NM | (2 | )% | ||||

| Foreign Currency (FX) Translation Impact | ||||||||||||||

| Total revenue-as reported | $ | 1,516 | $ | 1,558 | $ | 1,559 | (3 | )% | - | % | ||||

| Impact of FX translation (1) | - | (75 | ) | (55 | ) | |||||||||

| Total revenues-ex-FX | $ | 1,516 | $ | 1,483 | $ | 1,504 | 2 | % | (1 | )% | ||||

| Total operating expenses-as reported | $ | 1,434 | $ | 1,343 | $ | 1,225 | 7 | % | 10 | % | ||||

| Impact of FX translation (1) | - | (66 | ) | (34 | ) | |||||||||

| Total operating expenses-ex-FX | $ | 1,434 | $ | 1,277 | $ | 1,191 | 12 | % | 7 | % | ||||

| Provisions for credit losses-as reported | $ | 99 | $ | 58 | $ | 194 | 71 | % | (70 | )% | ||||

| Impact of FX translation (1) | - | (2 | ) | (7 | ) | |||||||||

| Provisions for credit losses-ex-FX | $ | 99 | $ | 56 | $ | 187 | 77 | % | (70 | )% | ||||

| Net income-as reported | $ | (22 | ) | $ | 95 | $ | 98 | NM | (3 | )% | ||||

| Impact of FX translation (1) | - | (11 | ) | (13 | ) | |||||||||

| Net income-ex-FX | $ | (22 | ) | $ | 84 | $ | 85 | NM | (1 | )% | ||||

| (1) | Reflects the impact of foreign exchange (FX) translation into U.S. dollars at the current exchange rate for all periods presented. | |

| NM | Not meaningful |

18

The discussion of the results of operations for EMEA RCB below excludes the impact of FX translation for all periods presented. Presentation of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. Citi believes the presentation of EMEA RCB 's results excluding the impact of FX translation is a more meaningful depiction of the underlying fundamentals of the business. For a reconciliation of certain of these metrics to the reported results, see the table above.

2012 vs. 2011

The net loss of $22 million compared to net income of $84

million in 2011 was mainly due to higher operating expenses and lower loan loss

reserve releases, partially offset by higher

revenues.

Revenues increased 2%, with growth

across the major products, including strong growth in Russia. Year-over-year,

cards purchase sales increased 12%, investment sales increased 15% and retail

loan volume increased 17%. Revenue growth year-over-year was partly offset by

the absence of Akbank, Citi's equity investment in Turkey, which was moved

to Corporate/Other in the first quarter of 2012. Net interest revenue increased 17%, driven

by the absence of Akbank investment funding costs and growth in average deposits

of 5%, average retail loans of 16% and average cards loans of 6%, partially

offset by spread compression. Interest rate caps on credit cards, particularly

in Turkey and Poland, the continued liquidation of a higher yielding

non-strategic retail banking portfolio and the continued low interest rate

environment were the main contributors to the lower spreads. Citi expects spread

compression to continue to negatively impact revenues in this business during

2013. Non-interest revenue decreased 20%, mainly reflecting the absence of

Akbank.

Expenses grew 12%,

primarily due to the $57 million of fourth quarter of 2012 repositioning charges

in Turkey, Romania and Pakistan and the impact of continued investment spending

on new internal operating platforms during the year.

Provisions increased $43 million due

to lower loan loss reserve releases, partially offset by lower net credit losses

across most countries. Net credit losses continued to decline, decreasing 36%

due to the ongoing improvement in credit quality and the move toward lower-risk

customers. Citi believes that net credit losses in EMEA RCB have largely stabilized and

assuming the underlying core portfolio continues to grow in 2013, credit costs

could begin to rise.

2011 vs. 2010

Net

income decreased 1%, as an improvement in credit costs was offset by higher

expenses from increased investment spending and lower revenues.

Revenues decreased 1%, driven by the liquidation of higher yielding non-strategic customer portfolios and a lower contribution from

Akbank. Net interest revenue declined 1% due to the decline in the higher yielding non-strategic retail banking portfolio

and spread compression in the Citi-branded cards portfolio. Interest rate caps on credit cards, particularly in Turkey and

Poland, contributed to the lower spreads in the cards portfolio. Non-interest revenue decreased 2%, mainly reflecting the

lower contribution from Akbank. Despite the negative impacts to revenues described above, underlying businesses showed

growth, with investment sales up 28% from the prior year and cards purchase sales up 15%.

Expenses increased 7% due to the impact of account acquisition, focused investment spending and higher transactional expenses,

partly offset by continued savings initiatives.

Provisions decreased

70%, driven by a reduction in net credit losses. Net credit losses decreased 46%, reflecting the continued credit quality

improvement during the year, stricter underwriting criteria and the move to lower-risk products.

19

LATIN AMERICA REGIONAL CONSUMER BANKING

Latin America Regional Consumer Banking (Latin America RCB) provides traditional banking and Citi-branded card services to retail customers and small to mid-size businesses, with the largest presence in Mexico and Brazil. Latin America RCB includes branch networks throughout Latin America as well as Banco Nacional de Mexico, or Banamex, Mexico's second-largest bank, with over 1,700 branches. As announced in the fourth quarter of 2012, as part of its repositioning efforts, Citi expects to either sell or significantly scale back consumer operations in Paraguay and Uruguay, and expects to further optimize its branch network in Brazil. At December 31, 2012, Latin America RCB had 2,181 retail branches, with approximately 31.8 million customer accounts, $28.3 billion in retail banking loans and $48.6 billion in deposits. In addition, the business had approximately 12.9 million Citi-branded card accounts with $14.8 billion in outstanding loan balances.

| % Change | % Change | |||||||||||||

| In millions of dollars, except as otherwise noted | 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | |||||||||

| Net interest revenue | $ | 6,695 | $ | 6,456 | $ | 5,953 | 4 | % | 8 | % | ||||

| Non-interest revenue | 3,007 | 3,013 | 2,714 | - | 11 | |||||||||

| Total revenues, net of interest expense | $ | 9,702 | $ | 9,469 | $ | 8,667 | 2 | % | 9 | % | ||||

| Total operating expenses | $ | 5,702 | $ | 5,756 | $ | 5,139 | (1 | )% | 12 | % | ||||

| Net credit losses | $ | 1,750 | $ | 1,684 | $ | 1,868 | 4 | % | (10 | )% | ||||

| Credit reserve build (release) | 299 | (67 | ) | (823 | ) | NM | 92 | |||||||

| Provision for benefits and claims | 167 | 130 | 127 | 28 | 2 | |||||||||

| Provisions for loan losses and for benefits and claims (LLR & PBC) | $ | 2,216 | $ | 1,747 | $ | 1,172 | 27 | % | 49 | % | ||||

| Income from continuing operations before taxes | $ | 1,784 | $ | 1,966 | $ | 2,356 | (9 | )% | (17 | )% | ||||

| Income taxes | 274 | 388 | 568 | (29 | ) | (32 | ) | |||||||

| Income from continuing operations | $ | 1,510 | $ | 1,578 | $ | 1,788 | (4 | )% | (12 | )% | ||||

| Noncontrolling interests | (2 | ) | - | (8 | ) | - | 100 | |||||||

| Net income | $ | 1,512 | $ | 1,578 | $ | 1,796 | (4 | )% | (12 | )% | ||||

| Balance Sheet data (in billions of dollars) | ||||||||||||||

| Average assets | $ | 80 | $ | 80 | $ | 72 | - | % | 11 | % | ||||

| Return on average assets | 1.89 | % | 1.97 | % | 2.50 | % | ||||||||

| Efficiency ratio | 59 | % | 61 | % | 59 | % | ||||||||

| Average deposits | $ | 45.0 | $ | 45.8 | $ | 40.3 | (2 | ) | 14 | |||||

| Net credit losses as a percentage of average loans | 4.34 | % | 4.69 | % | 6.14 | % | ||||||||

| Revenue by business | ||||||||||||||

| Retail banking | $ | 5,766 | $ | 5,468 | $ | 5,016 | 5 | % | 9 | % | ||||

| Citi-branded cards | 3,936 | 4,001 | 3,651 | (2 | ) | 10 | ||||||||

| Total | $ | 9,702 | $ | 9,469 | $ | 8,667 | 2 | % | 9 | % | ||||

| Income from continuing operations by business | ||||||||||||||

| Retail banking | $ | 861 | $ | 902 | $ | 927 | (5 | )% | (3 | )% | ||||

| Citi-branded cards | 649 | 676 | 861 | (4 | ) | (21 | ) | |||||||

| Total | $ | 1,510 | $ | 1,578 | $ | 1,788 | (4 | )% | (12 | )% | ||||

| Foreign Currency (FX) Translation Impact | ||||||||||||||

| Total revenue-as reported | $ | 9,702 | $ | 9,469 | $ | 8,667 | 2 | % | 9 | % | ||||

| Impact of FX translation (1) | - | (569 | ) | (335 | ) | |||||||||

| Total revenues-ex-FX | $ | 9,702 | $ | 8,900 | $ | 8,332 | 9 | % | 7 | % | ||||

| Total operating expenses-as reported | $ | 5,702 | $ | 5,756 | $ | 5,139 | (1 | )% | 12 | % | ||||

| Impact of FX translation (1) | - | (367 | ) | (233 | ) | |||||||||

| Total operating expenses-ex-FX | $ | 5,702 | $ | 5,389 | $ | 4,906 | 6 | % | 10 | % | ||||