2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2014

Commission file number 1-16811

(Exact name of registrant as specified in its charter)

Delaware |

| 25-1897152 |

(State of Incorporation) |

| (I.R.S. Employer Identification No.) |

600 Grant Street, Pittsburgh, PA 15219-2800

(Address of principal executive offices)

Tel. No. (412) 433-1121

Securities registered pursuant to Section 12 (b) of the Act:

Title of Each Class |

| Name of Exchange on which Registered |

United States Steel Corporation Common Stock, par value $1.00 |

| New York Stock Exchange, Chicago Stock Exchange |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☑ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for at least the past 90 days. Yes ☑ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☑ |

| Accelerated filer |

Non-accelerated filer (Do not check if a smaller reporting company) |

| Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No ☑

Aggregate market value of Common Stock held by non-affiliates as of June 30, 2014 (the last business day of the registrant's most recently completed second fiscal quarter): $3.8 billion. The amount shown is based on the closing price of the registrant's Common Stock on the New York Stock Exchange composite tape on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. However, the registrant has made no determination that such individuals are "affiliates" within the meaning of Rule 405 under the Securities Act of 1933.

There were 145,660,794 shares of United States Steel Corporation Common Stock outstanding as of February 19, 2015 .

Documents Incorporated By Reference:

Portions of the Proxy Statement for the 2015 Annual Meeting of Stockholders are incorporated into Part III.

INDEX

| FORWARD-LOOKING STATEMENTS | 3 | |

|

| ||

PART I |

| ||

Item 1. | BUSINESS | 4 | |

Item 1A | RISK FACTORS | 31 | |

Item 1B | UNRESOLVED STAFF COMMENTS | 41 | |

Item 2. | PROPERTIES | 42 | |

Item 3. | LEGAL PROCEEDINGS | 44 | |

Item 4. | MINE SAFETY DISCLOSURE | 51 | |

|

| ||

PART II |

| ||

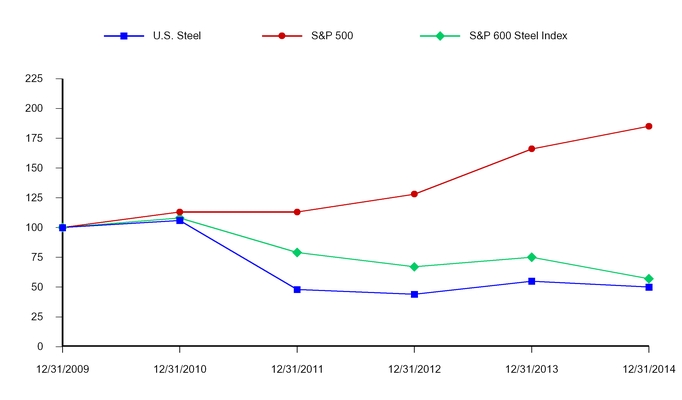

Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 53 | |

Item 6. | SELECTED FINANCIAL DATA | 55 | |

Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 56 | |

Item 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 85 | |

Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | F-1 | |

Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 88 | |

Item 9A | CONTROLS AND PROCEDURES | 88 | |

Item 9B | OTHER INFORMATION | 88 | |

|

| ||

PART III |

| ||

Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 89 | |

Item 11. | EXECUTIVE COMPENSATION | 89 | |

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 90 | |

Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 90 | |

Item 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 90 | |

|

| ||

PART IV |

| ||

Item 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULE | 91 | |

|

| ||

SIGNATURES | 99 | | |

|

| ||

GLOSSARY OF CERTAIN DEFINED TERMS | 100 | | |

|

| ||

SUPPLEMENTARY DATA | 102 | | |

|

| ||

TOTAL NUMBER OF PAGES | 105 | | |

Table of Contents

FORWARD-LOOKING STATEMENTS

Certain sections of the Annual Report of United States Steel Corporation (U. S. Steel) on Form 10-K, particularly Item 1. Business, Item 1A. Risk Factors, Item 3. Legal Proceedings, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and Item 7A. Quantitative and Qualitative Disclosures About Market Risk, include forward-looking statements concerning trends or events potentially affecting U. S. Steel. These statements typically contain words such as "anticipates," "believes," "estimates," "expects" or similar words indicating that future outcomes are uncertain. In accordance with "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, these statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in forward-looking statements. For additional factors affecting the businesses of U. S. Steel, see "Item 1A. Risk Factors" and "Supplementary Data – Disclosures About Forward-Looking Statements." References in this Annual Report on Form 10-K to "U. S. Steel," "the Company," "we," "us" and "our" refer to U. S. Steel and its consolidated subsidiaries, unless otherwise indicated by the context.

3

Table of Contents

PART I

Item 1. BUSINESS

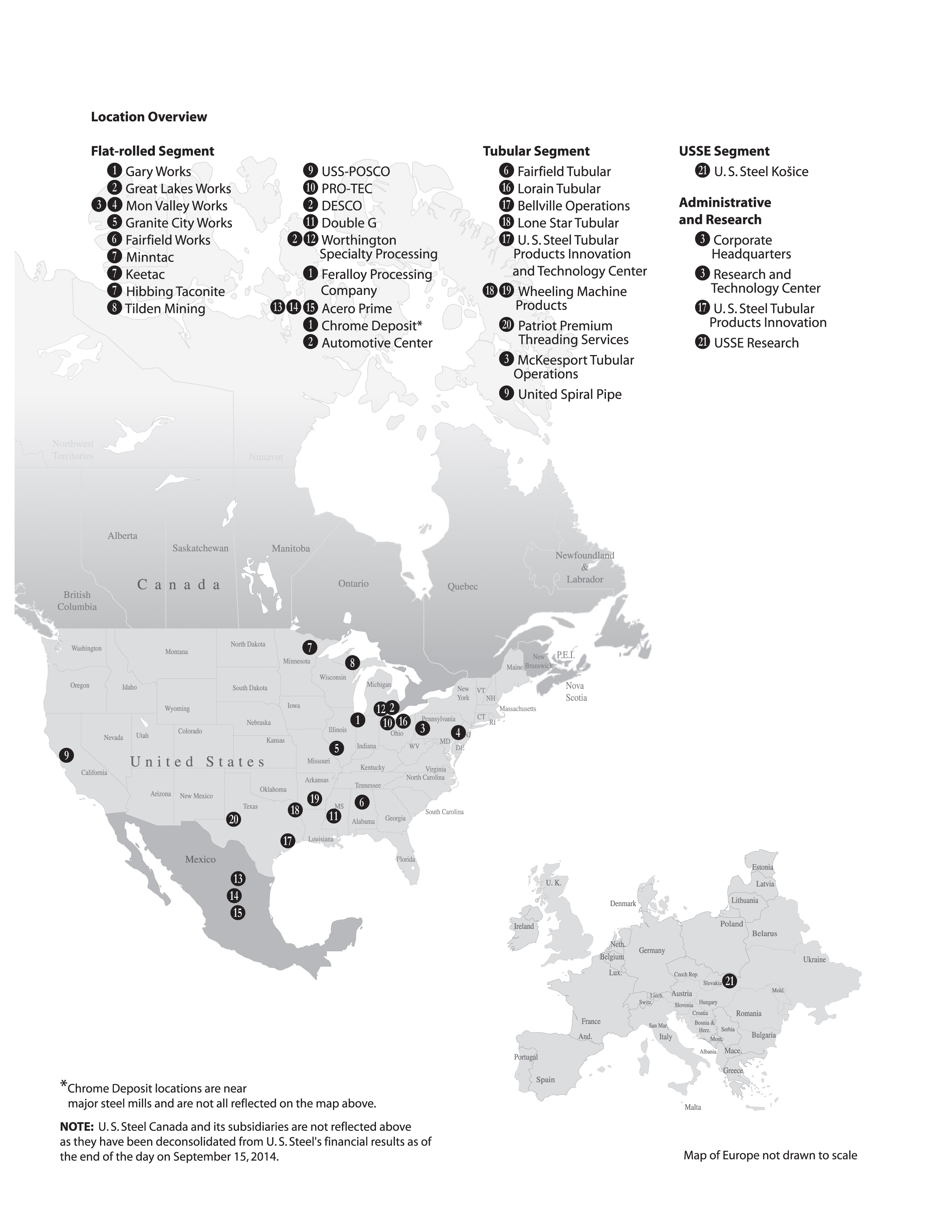

United States Steel Corporation (U. S. Steel) is an integrated steel producer of flat-rolled and tubular products with major production operations in North America and Europe. An integrated steel producer uses iron ore and coke as primary raw materials for steel production. U. S. Steel has annual raw steel production capability of 24.4 million net tons (19.4 million tons in the United States and 5 million tons in Europe), which reflects a reduction of 4.9 million tons as a result of the deconsolidation of U. S. Steel Canada Inc.(USSC) on September 16, 2014 as noted below and the permanent shut down of the iron and steelmaking facilities at USSC's Hamilton Works on December 31, 2013. According to worldsteel Association's latest published statistics, U. S. Steel was the thirteenth largest steel producer in the world in 2013. U. S. Steel is also engaged in other business activities consisting primarily of railroad services and real estate operations.

During 2014, we have progressed along our transformation journey at U. S. Steel to execute on our stockholder value creation strategy: earn the right to grow, and drive and sustain profitable growth. Through a disciplined approach we refer to as "The Carnegie Way," we continue working toward strengthening our balance sheet, with a strong focus on cash flow, and have launched a series of initiatives that we believe will enable us to add value, right-size the Company, and improve our performance across our core business processes, including commercial, supply chain, manufacturing, procurement, innovation, and operational and functional support. We are on a mission to become an iconic industry leader, as we define and create a sustainable competitive advantage with a relentless focus on economic profit, our customers, our cost structure and innovation with talented teams of motivated employees.

On September 16, 2014, USSC, a wholly owned subsidiary of U. S. Steel, applied for relief from its creditors pursuant to Canada's Companies' Creditors Arrangement Act (CCAA). As a result of USSC filing for CCAA protection (CCAA filing), U. S. Steel determined that USSC and its subsidiaries would be deconsolidated from U. S. Steel's financial statements on a prospective basis effective as of the date of the CCAA filing. We recorded a total non-cash charge of $416 million in 2014 related to the deconsolidation of USSC and other charges.

4

Table of Contents

5

Table of Contents

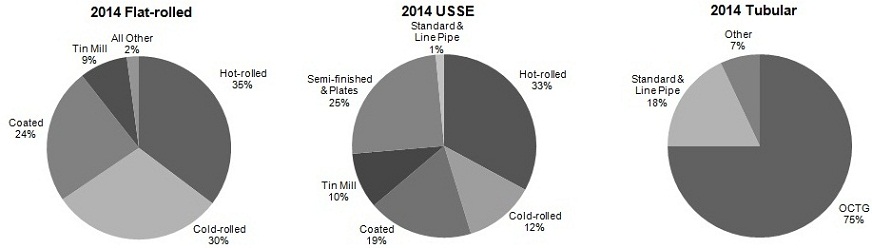

Segments

U. S. Steel has three reportable operating segments: Flat-rolled Products (Flat-rolled), U. S. Steel Europe (USSE) and Tubular Products (Tubular). The results of our railroad and real estate businesses that do not constitute reportable segments are combined and disclosed in the Other Businesses category.

The Flat-rolled segment includes the operating results of U. S. Steel's integrated steel plants and equity investees in the United States and Canada (prior to the deconsolidation of USSC as a result of the CCAA filing) involved in the production of slabs, rounds, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States and Canada (prior to the deconsolidation of USSC). These operations primarily serve North American customers in the service center, conversion, transportation (including automotive), construction, container, and appliance and electrical markets. Flat-rolled also supplies steel rounds and hot-rolled bands to Tubular.

Subsequent to USSC's CCAA filing on September 16, 2014, the Flat-rolled segment information does not include USSC. After the deconsolidation of USSC, transactions between U. S. Steel and USSC are considered related party transactions.

Effective January 1, 2015, the Flat-rolled segment has been realigned to better service customer needs through the creation of commercial entities to specifically address customers in the automotive, consumer, industrial, service center and mining market sectors. This realignment will not affect the Company's reportable segments as they currently exist. For further information, see Item 1. Business Strategy.

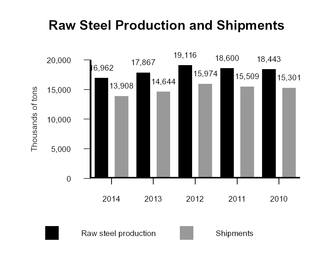

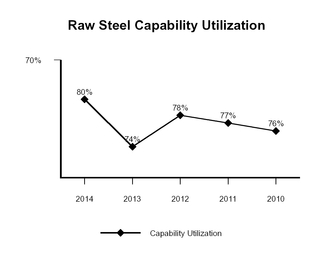

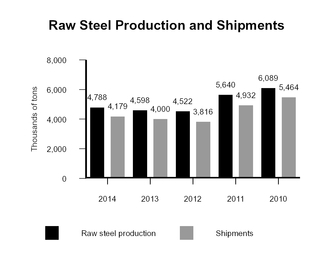

Flat-rolled has annual raw steel production capability of 19.4 million tons. Prior to the CCAA filing and deconsolidation of U.S. Steel Canada in September 2014 and the permanent shut down of the iron and steelmaking facilities at Hamilton Works in December 2013, annual raw steel production capability for Flat-rolled was 22.0 million tons and 24.3 million tons, respectively. Raw steel production was 17.0 million tons in 2014, 17.9 million tons in 2013, and 19.1 million tons in 2012. Raw steel production averaged 80 percent of capability in 2014, 74 percent of capability in 2013 and 78 percent of capability in 2012.

The USSE segment includes the operating results of U. S. Steel Košice (USSK), U. S. Steel's integrated steel plant and coke production facilities in Slovakia. Prior to January 31, 2012, the USSE segment also included the operating results of U. S. Steel Serbia d.o.o. (USSS), which was sold on January 31, 2012. USSE primarily serves customers in the European construction, service center, conversion, container, transportation (including automotive), appliance and electrical, and oil, gas and petrochemical markets. USSE produces and sells slabs, sheet, strip mill plate, tin mill products and spiral welded pipe, as well as heating radiators and refractory ceramic materials.

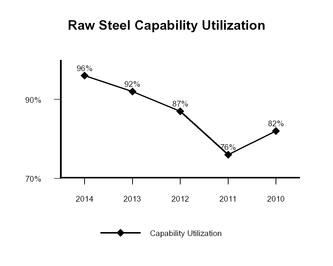

USSE has annual raw steel production capability of 5.0 million tons. USSE's raw steel production was 4.8 million tons in 2014, 4.6 million tons in 2013, and 4.5 million tons in 2012. USSE's raw steel production averaged 96 percent of capability in 2014, 92 percent of capability in 2013 and 87 percent of capability in 2012.

The Tubular segment includes the operating results of U. S. Steel's tubular production facilities, primarily in the United States, and equity investees in the United States and Brazil. These operations produce and sell seamless and electric resistance welded (ERW) steel casing and tubing (commonly known as oil country tubular goods or OCTG), standard and line pipe and mechanical tubing and primarily serve customers in the oil, gas and petrochemical markets. Tubular's annual production capability is 2.8 million tons and U. S. Steel is the largest supplier of OCTG to the combined U.S. and Canadian market. U. S. Steel Tubular Products, Inc. (USSTP) is designing and developing a range of premium and semi-premium connections to address the growing needs for technical solutions to our end users' well site production challenges. USSTP also offers rig site services, which provides the technical expertise for proper installation of our tubular products and proprietary connections at the well site.

For further information, see Note 3 to the Consolidated Financial Statements.

6

Table of Contents

Financial and Operational Highlights

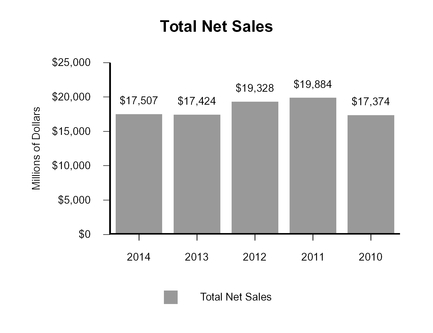

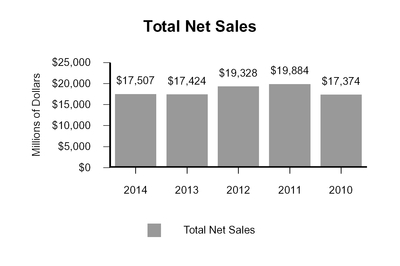

Net Sales

Net Sales by Segment

(Dollars in millions, excluding intersegment sales) |

| 2014 |

| 2013 |

| 2012 | ||||||

Flat-rolled |

| $ | 11,708 | |

| $ | 11,572 | |

| $ | 12,908 | |

USSE |

| 2,891 | |

| 2,941 | |

| 2,949 | | |||

Tubular |

| 2,772 | |

| 2,772 | |

| 3,283 | | |||

Total sales from reportable segments |

| 17,371 | |

| 17,285 | |

| 19,140 | | |||

Other Businesses |

| 136 | |

| 139 | |

| 188 | | |||

Net sales |

| $ | 17,507 | |

| $ | 17,424 | |

| $ | 19,328 | |

7

Table of Contents

Income (Loss) from Operations by Segment (a)

|

| Year Ended December 31, |

| ||||||||||

(Dollars in Millions) |

| 2014 |

| 2013 |

| 2012 |

| ||||||

Flat-rolled (b) |

| $ | 709 | |

| $ | 105 | |

| $ | 400 | |

|

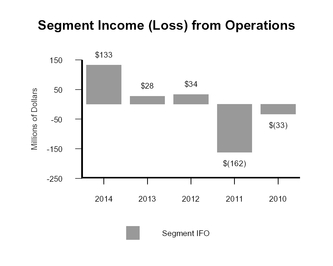

USSE |

| 133 | |

| 28 | |

| 34 | | (c) | |||

Tubular |

| 261 | |

| 190 | |

| 366 | |

| |||

Total income from reportable segments |

| 1,103 | |

| 323 | |

| 800 | |

| |||

Other Businesses |

| 82 | |

| 77 | |

| 55 | |

| |||

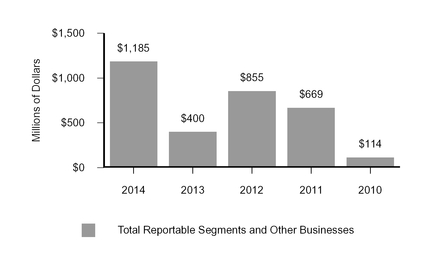

Reportable segments and Other Businesses income from operations |

| 1,185 | |

| 400 | |

| 855 | |

| |||

Postretirement benefit expenses (b), (d) |

| (114 | ) |

| (221 | ) |

| (297 | ) |

| |||

Other items not allocated to segments: |

|

|

|

|

|

|

| ||||||

Loss on deconsolidation of U. S. Steel Canada and other charges |

| (416 | ) |

| - | |

| - | |

| |||

Impairment of carbon alloy facilities (e) |

| (195 | ) |

| - | |

| - | |

| |||

Litigation reserves |

| (70 | ) |

| - | |

| - | |

| |||

Write-off of pre-engineering costs (e) |

| (37 | ) |

| - | |

| - | |

| |||

Loss on assets held for sale (e) |

| (14 | ) |

| - | |

| - | |

| |||

Gain on sale of real estate assets |

| 55 | |

| - | |

| - | |

| |||

Curtailment gain |

| 19 | |

| - | |

| - | |

| |||

Impairment of goodwill |

| - | |

| (1,806 | ) |

| - | |

| |||

Restructuring and other charges |

| - | |

| (248 | ) |

| - | |

| |||

Environmental remediation charge |

| - | |

| (32 | ) |

| - | |

| |||

Write-off of equity investment |

| - | |

| (16 | ) |

| - | |

| |||

Supplier contract dispute settlement |

| - | |

| 23 | |

| 15 | |

| |||

Net loss on the sale of assets |

| - | |

| - | |

| (310 | ) |

| |||

Labor agreement lump sum payments |

| - | |

| - | |

| (35 | ) |

| |||

Property tax settlements |

| - | |

| - | |

| 19 | |

| |||

Total income (loss) from operations |

| $ | 413 | |

| $ | (1,900 | ) |

| $ | 247 | |

|

(a) | See Note 3 to the Consolidated Financial Statements for reconciliations and other disclosures required by Accounting Standards Codification Topic 280. |

(b) | Excludes the results of USSC beginning September 16, 2014 as a result of the CCAA filing. See Note 4 to the Consolidated Financial Statements. |

(c) | Includes the results of USSS through the disposition date of January 31, 2012. See Note 5 to the Consolidated Financial Statements for further details. |

(d) | Consists of the net periodic benefit cost elements, other than service cost and amortization of prior service cost for active employees, associated with our pension, retiree health care and life insurance benefit plans. |

(e) | Included in restructuring and other charges on the Consolidated Statement of Operations. See Note 5 to the Consolidated Financial Statements for further details. |

8

Table of Contents

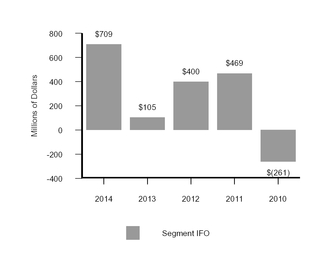

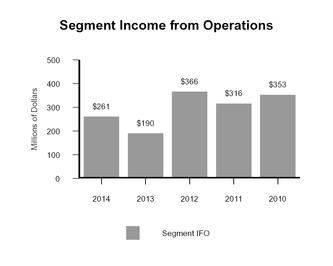

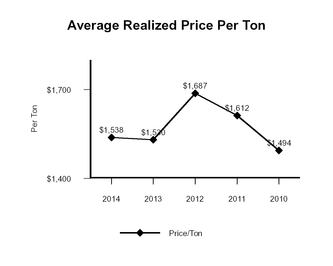

Reportable Segments and Other Businesses – Income from Operations (IFO)

Total Reportable Segments and Other Businesses

Income from Operations

(a)

(a) Amounts prior to 2011 have been restated to reflect a change in our segment allocation methodology for postretirement benefit expenses.

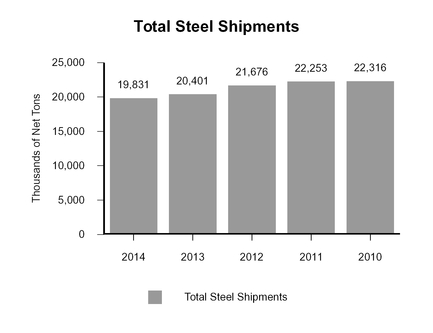

Steel Shipments

9

Table of Contents

Steel Shipments by Product and Segment (Excluding the Results of USSC Beginning on September 16, 2014)

(Thousands of Tons) |

| Flat-rolled |

| USSE |

| Tubular |

| Total | ||||

Product-2014 |

|

|

|

|

|

|

|

| ||||

Hot-rolled Sheets |

| 4,909 | |

| 1,374 | |

| - | |

| 6,283 | |

Cold-rolled Sheets |

| 4,207 | |

| 518 | |

| - | |

| 4,725 | |

Coated Sheets |

| 3,316 | |

| 775 | |

| - | |

| 4,091 | |

Tin Mill Products |

| 1,180 | |

| 411 | |

| - | |

| 1,591 | |

Oil country tubular goods (OCTG) |

| - | |

| - | |

| 1,308 | |

| 1,308 | |

Standard and line pipe |

| - | |

| 62 | |

| 314 | |

| 376 | |

Semi-finished and Plates |

| 165 | |

| 1,039 | |

| - | |

| 1,204 | |

Other |

| 131 | |

| - | |

| 122 | |

| 253 | |

TOTAL |

| 13,908 | |

| 4,179 | |

| 1,744 | |

| 19,831 | |

Memo: Intersegment Shipments from Flat-rolled to Tubular |

|

|

|

|

|

|

|

| ||||

Hot-rolled sheets |

| 863 | |

|

|

|

|

|

| |||

Rounds |

| 849 | |

|

|

|

|

|

| |||

Product-2013 |

|

|

|

|

|

|

|

| ||||

Hot-rolled Sheets |

| 5,028 | |

| 1,426 | |

| - | |

| 6,454 | |

Cold-rolled Sheets |

| 4,347 | |

| 553 | |

| - | |

| 4,900 | |

Coated Sheets |

| 3,599 | |

| 762 | |

| - | |

| 4,361 | |

Tin Mill Products |

| 1,204 | |

| 385 | |

| - | |

| 1,589 | |

Oil country tubular goods (OCTG) |

| - | |

| - | |

| 1,370 | |

| 1,370 | |

Standard and line pipe |

| - | |

| 69 | |

| 264 | |

| 333 | |

Semi-finished and Plates |

| 466 | |

| 805 | |

| - | |

| 1,271 | |

Other |

| - | |

| - | |

| 123 | |

| 123 | |

TOTAL |

| 14,644 | |

| 4,000 | |

| 1,757 | |

| 20,401 | |

Memo: Intersegment Shipments from Flat-rolled to Tubular |

|

|

|

|

|

|

|

| ||||

Hot-rolled sheets |

| 923 | |

|

|

|

|

|

| |||

Rounds |

| 776 | |

|

|

|

|

|

| |||

Product-2012 |

|

|

|

|

|

|

|

| ||||

Hot-rolled Sheets |

| 5,733 | |

| 1,197 | |

| - | |

| 6,930 | |

Cold-rolled Sheets |

| 4,476 | |

| 558 | |

| - | |

| 5,034 | |

Coated Sheets |

| 3,490 | |

| 772 | |

| - | |

| 4,262 | |

Tin Mill Products |

| 1,220 | |

| 388 | |

| - | |

| 1,608 | |

Oil country tubular goods (OCTG) |

| - | |

| - | |

| 1,339 | |

| 1,339 | |

Standard and line pipe |

| - | |

| 82 | |

| 396 | |

| 478 | |

Semi-finished and Plates |

| 1,055 | |

| 819 | |

| - | |

| 1,874 | |

Other |

| - | |

| - | |

| 151 | |

| 151 | |

TOTAL |

| 15,974 | |

| 3,816 | |

| 1,886 | |

| 21,676 | |

Memo: Intersegment Shipments from Flat-rolled to Tubular |

|

|

|

|

|

|

|

| ||||

Hot-rolled sheets |

| 938 | |

|

|

|

|

|

| |||

Rounds |

| 865 | |

|

|

|

|

|

| |||

Memo: Intersegment Shipments from USSE to Flat-rolled |

|

|

|

|

|

|

|

| ||||

Slabs |

| 249 | |

|

|

|

|

|

| |||

10

Table of Contents

Steel Shipments by Market and Segment (Excluding the Results of USSC Beginning on September 16, 2014)

(Thousands of Tons) |

| Flat-rolled |

| USSE |

| Tubular |

| Total | ||||

Major Market – 2014 |

|

|

|

|

|

|

|

| ||||

Steel Service Centers |

| 2,578 | |

| 682 | |

| - | |

| 3,260 | |

Further Conversion – Trade Customers |

| 4,013 | |

| 299 | |

| - | |

| 4,312 | |

– Joint Ventures |

| 1,519 | |

| - | |

| - | |

| 1,519 | |

Transportation (Including Automotive) |

| 2,445 | |

| 674 | |

| - | |

| 3,119 | |

Construction and Construction Products |

| 775 | |

| 1,584 | |

| 122 | |

| 2,481 | |

Containers |

| 1,287 | |

| 403 | |

| - | |

| 1,690 | |

Appliances and Electrical Equipment |

| 616 | |

| 267 | |

| - | |

| 883 | |

Oil, Gas and Petrochemicals |

| - | |

| 3 | |

| 1,545 | |

| 1,548 | |

Exports from the United States |

| 263 | |

| - | |

| 77 | |

| 340 | |

All Other |

| 412 | |

| 267 | |

| - | |

| 679 | |

TOTAL |

| 13,908 | |

| 4,179 | |

| 1,744 | |

| 19,831 | |

Major Market – 2013 |

|

|

|

|

|

|

|

| ||||

Steel Service Centers |

| 2,721 | |

| 560 | |

| - | |

| 3,281 | |

Further Conversion – Trade Customers |

| 4,409 | |

| 286 | |

| - | |

| 4,695 | |

– Joint Ventures |

| 1,664 | |

| - | |

| - | |

| 1,664 | |

Transportation (Including Automotive) |

| 2,480 | |

| 709 | |

| - | |

| 3,189 | |

Construction and Construction Products |

| 773 | |

| 1,501 | |

| 132 | |

| 2,406 | |

Containers |

| 1,259 | |

| 393 | |

| - | |

| 1,652 | |

Appliances and Electrical Equipment |

| 666 | |

| 275 | |

| - | |

| 941 | |

Oil, Gas and Petrochemicals |

| - | |

| 15 | |

| 1,540 | |

| 1,555 | |

Exports from the United States |

| 365 | |

| - | |

| 85 | |

| 450 | |

All Other |

| 307 | |

| 261 | |

| - | |

| 568 | |

TOTAL |

| 14,644 | |

| 4,000 | |

| 1,757 | |

| 20,401 | |

Major Market – 2012 |

|

|

|

|

|

|

|

| ||||

Steel Service Centers |

| 2,882 | |

| 567 | |

| - | |

| 3,449 | |

Further Conversion – Trade Customers |

| 5,119 | |

| 310 | |

| - | |

| 5,429 | |

– Joint Ventures |

| 1,823 | |

| - | |

| - | |

| 1,823 | |

Transportation (Including Automotive) |

| 2,511 | |

| 650 | |

| - | |

| 3,161 | |

Construction and Construction Products |

| 869 | |

| 1,350 | |

| 144 | |

| 2,363 | |

Containers |

| 1,290 | |

| 387 | |

| - | |

| 1,677 | |

Appliances and Electrical Equipment |

| 727 | |

| 272 | |

| - | |

| 999 | |

Oil, Gas and Petrochemicals |

| - | |

| 20 | |

| 1,601 | |

| 1,621 | |

Exports from the United States |

| 409 | |

| - | |

| 141 | |

| 550 | |

All Other |

| 344 | |

| 260 | |

| - | |

| 604 | |

TOTAL |

| 15,974 | |

| 3,816 | |

| 1,886 | |

| 21,676 | |

11

Table of Contents

Business Strategy

During 2014, we have progressed along our transformation journey at U. S. Steel to execute on our stockholder value creation strategy: earn the right to grow, and drive and sustain profitable growth. Through a disciplined approach we refer to as "The Carnegie Way," we continue working toward strengthening our balance sheet, with a strong focus on cash flow, and have launched a series of initiatives that we believe will enable us to add value, right-size the Company, and improve our performance across our core business processes, including commercial, supply chain, manufacturing, procurement, innovation, and operational and functional support. We are on a mission to become an iconic industry leader, as we define and create a sustainable competitive advantage with a relentless focus on economic profit, our customers, our cost structure and innovation while remaining committed to being a world leader in safety and environmental stewardship and attracting, developing and retaining a diverse workforce with the talent and skills needed for our long-term success.

As part of the Carnegie Way transformation process, beginning January 1, 2015, the Company's Flat-rolled, USSE and Tubular reportable segments will be realigned to target achieving the following strategic goals:

• | collaborate better with customers to create and deliver smarter, more innovative relationships in order to be a more customer-centric global solutions provider; |

• | provide focus to Carnegie Way projects within the operating units including reliability centered maintenance and quality, with a continued commitment to safety; and |

• | continue earning the right to grow by creating clearer and more focused and effective accountability. |

This realignment will not affect the Company's reportable segments as they currently exist.

The Flat-rolled realignment will drive a focus on the following markets: automotive, consumer, industrial, service centers and mining.

Automotive Solutions will be based at the Company's Automotive Center in Troy, Michigan, where the company works jointly with customers to develop solutions utilizing the next generation of advanced high-strength steel to address challenges facing the automotive industry, including increased fuel economy standards and enhanced safety requirements.

Consumer Solutions will closely align with customers in the appliance, packaging, container and construction markets. Consumer Solutions will have a robust presence with our tin customers, who represent more than one quarter of this market category. Additional product lines within the market category include the Company's COR-TEN AZP®, ACRYLUME®, GALVALUME® and Weathered Metals.

Industrial Solutions will focus on the Company's customers in the pipe and tube manufacturing market, as well as the agricultural and industrial equipment markets.

Service Center Solutions will align closely with service center and distributor customers. These customers provide a critical bridge to a variety of different enterprises for the Company.

Mining Solutions will include all operations relating to the Company's Minnesota Ore Operations facilities - Minntac in Mt. Iron, MN, and Keetac in Keewatin, MN, as well as the Company's iron ore equity joint ventures. U. S. Steel's integrated steel plants will be the primary customers of Mining Solutions.

In addition to the new commercial focus, the Company will also increase its attention to Flat-rolled manufacturing operations. The emphasis will be on implementing strategic projects, including reliability centered maintenance, quality and a continued commitment to safety.

USSE will further align with the Carnegie Way transformation to accelerate USSE's focus on their customers.

The Tubular segment's commercial and manufacturing operations will also be aligned to include customer solutions for the oil and gas industry, focusing on the go-to-market tubular goods business strategy from the Company's production facilities to rig well sites.

We believe this enhanced commercial concentration will put U. S. Steel in a stronger position to be best-in-class in product innovation, customer service and solutions, as well as steel manufacturing.

12

Table of Contents

Safety

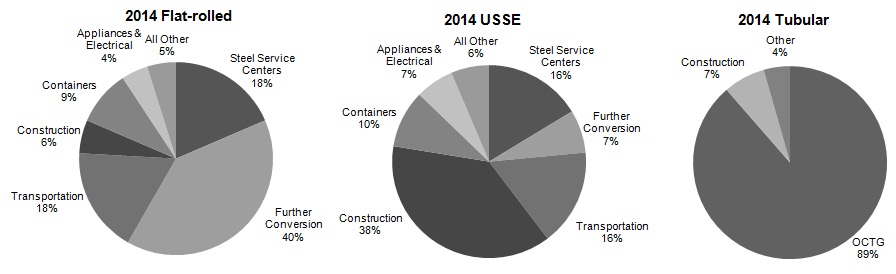

We believe improving safety performance is consistent with the Company's other strategic objectives such as improving quality, cost competiveness and customer service. Through 2014, the ten year trends for our global key safety measurements: recordable injuries, days away from work rate and severity rate showed improvement of 44 percent, 69 percent and 87 percent respectively, as shown in the following graphs.

13

Table of Contents

Environmental Stewardship

U. S. Steel maintains a comprehensive environmental program. The Executive Environmental Committee, which is comprised of U. S. Steel officers and other key leaders, meets regularly to review environmental issues and compliance. The Board of Directors and the Corporate Governance and Public Policy Committee receive regular updates on environmental matters. Also, U. S. Steel, largely through the American Iron and Steel Institute (AISI), the Canadian Steel Producers Association, the worldsteel Association and the European Confederation of Iron and Steel Industries (Eurofer), is involved in the promotion of cost effective environmental strategies through the development of appropriate air, water, waste and climate change laws and regulations at the local, state, national and international levels.

We are committed to reducing emissions as well as our carbon footprint. We have an established program to investigate, share and create innovative, best practice solutions throughout U. S. Steel to manage and reduce energy consumption and greenhouse gas (GHG) emissions. We are also committed to investing in technologies to further improve the environmental performance of our steelmaking process. In addition, we continue to focus on implementing energy reduction strategies, use of efficient energy sources, waste reduction management and the utilization of by-product fuels.

Through the AISI, U. S. Steel has been a proponent of using Life Cycle Analysis (LCA) as a resource for our policymakers in Washington, D.C., to develop regulations that address not only energy efficiency improvement but also consider the impact material selection has on overall sustainability. LCA is a means of measuring the carbon footprint of materials and products. See our carbon strategy section below for further details.

Over the past several years, we have achieved air opacity performance improvements at our domestic coke plants. Continuous process improvements have allowed us to make environmental progress through the utilization of enhanced refractory repair programs and strategically timed maintenance on the structural integrity of our coke batteries. We have also implemented data analysis to track our coke oven performance allowing us to proactively prioritize maintenance activities. At Clairton and Granite City, we installed new low emission quench towers for both new and existing batteries. This innovative quench system employs technology that reduces particulate emissions.

All of our major production facilities have Environmental Management Systems that are certified to the ISO 14001 Standard. This standard, published by the International Organization for Standardization, provides the framework for the measurement and improvement of environmental impacts of the certified facility.

We have submitted an application seeking approval for an innovative approach to environmental compliance at our Minntac facility. This approach will ensure compliance with air and water regulations and will provide reductions in particulate matter, mercury, sulfur dioxide, and sulfate. Once approved, this will be the first multi-media compliance solution of its type for iron ore operations in the United States.

We are certified by the Wildlife Habitat Council (WHC) for our Corporate Lands for Learning (CLL) program at our South Taylor Environmental Park (STEP) facility near Pittsburgh, Pennsylvania, which incorporates interaction with elementary school programs in Western Pennsylvania. Gary Works and Clairton Works are also CLL-certified. In addition, the STEP, the Clairton Plant, the Irvin Plant, Gary Works, Great Lakes Works and the Keetac and Minntac facilities have certifications under the WHC Wildlife at Work Program.

Commercial Strategy

Our commercial strategy is focused on providing customer focused solutions with value-added steel products, including advanced high strength steel and coated sheets for the automotive and appliance industries, electrical steel sheets for the manufacture of motors and electrical equipment, galvanized and Galvalume ® sheets for construction, tin mill products for the container industry and OCTG and premium connections for the oil and gas industry, including steel for the developing North American shale oil and gas markets. Please refer to Item I. Business Strategy for further details of our commercial entities and related strategies.

We are committed to meeting our customers' requirements by developing new steel products and uses for steel. In connection with this commitment, we have research centers in Pittsburgh, Pennsylvania, and Košice, Slovakia. We also have an automotive center in Troy, Michigan and an innovation and technology center for Tubular products in Houston, Texas. The focus of these centers is to develop new products and work with our customers to better serve their needs. Examples of our customer focused product innovation include the development of advanced high strength steels, including Dual-Ten ® and Transformation Induced Plasticity (TRIP) steels, that provide high strength to meet automobile passenger safety requirements while significantly reducing weight to meet vehicle fuel efficiency

14

Table of Contents

requirements; and a line of premium and semi-premium tubular connections to meet our customers' increasingly complex needs for offshore and horizontal drilling.

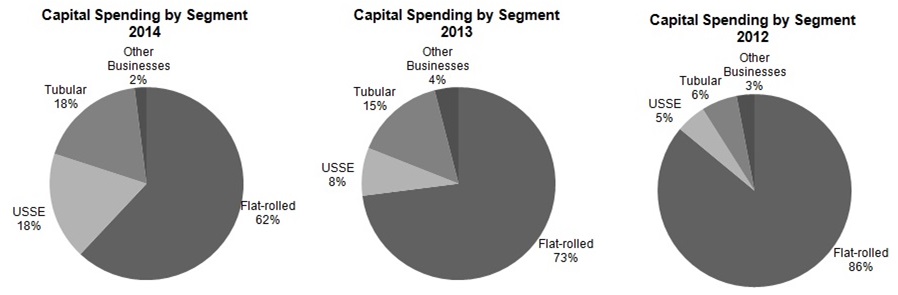

Capital Projects and Other Investments

We are currently developing projects within our Flat-rolled, USSE and Tubular segments, such as facility enhancements, for advanced high strength steels and additional premium connections that will further improve our ability to support our customers' evolving needs and increase our value added product capabilities. We are continuing our efforts to implement an Enterprise Resource Planning (ERP) system, which we anticipate will be completed in 2016, to replace our existing information technology systems, which will enable us to operate more efficiently. The ERP system is expected to provide further opportunities to streamline, standardize and centralize business processes in order to maximize cost effectiveness, efficiency and control across our domestic operations.

During 2014, management determined the Company would no longer pursue the development of its carbon alloy facilities at Gary Works or the expansion planned at its Keetac mining facility.

With reduced pricing for iron-ore, management is considering its options with respect to the Company's iron-ore position in the United States. The Company continues to explore opportunities related to the availability of reasonably priced natural gas as an alternative to coke in the iron reduction process to improve our cost competitiveness, while reducing our dependence on coal and coke. We are examining alternative iron and steelmaking technologies such as gas-based, direct-reduced iron (DRI) and electric arc furnace (EAF) steelmaking. We are currently in the permitting process for the installation of an EAF at our Fairfield Works in Alabama. We submitted air and water permit applications to the Jefferson County Department of Health and the Alabama Department of Environmental Management (ADEM), respectively, in February 2014. We are currently awaiting final determination on the applications from Jefferson County and ADEM.

The DRI process requires iron ore pellets with a lower silica content than blast furnace pellets. We have verified that our iron ore reserves are suitable for direct reduced (DR) grade pellet production and are examining the capital and engineering design requirements to produce DR grade pellets at our Minntac operations for use internally by the Company if we were to construct a DRI facility or for sale to external third parties with DRI facilities.

The foregoing statements regarding expected capital expenditures, capital projects, and expected benefits from the implementation of the ERP project are forward-looking statements. Factors that may affect our capital spending and the associated projects include: (i) levels of cash flow from operations; (ii) changes in tax laws; (iii) general economic conditions; (iv) steel industry conditions; (v) cost and availability of capital; (vi) receipt of necessary permits; (vii) unforeseen hazards such as contractor performance, material shortages, weather conditions, explosions or fires; (viii) our ability to implement these projects; and (ix) the requirements of applicable laws and regulations. There is also a risk that the projects will not be completed in a cost effective and timely manner or produce at the expected levels and within the costs currently projected. Predictions regarding benefits resulting from the implementation of the ERP project are subject to uncertainties. Actual results could differ materially from those expressed in these forward-looking statements.

Workforce

At U. S. Steel, we are committed to attracting, developing, and retaining a workforce of talented, diverse people - all working together in an environment where our employees contribute and excel as they deliver results for our Company, stockholders, customers and communities. We regularly review our human capital needs and focus on the selection, development and retention of employees in order to sustain and enhance our competitive position in the markets we serve.

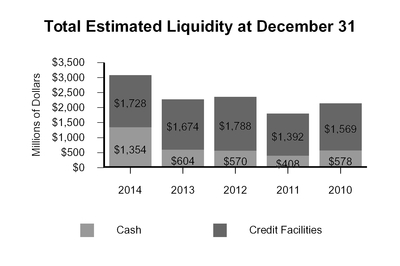

Capital Structure and Liquidity

Our financial goals are to enhance our capital structure and liquidity by deploying cash strategically as we earn the right to grow, and ultimately position ourselves to meet investment grade credit rating criteria. Our cash deployment strategy includes maintaining a healthy pension plan; delivering operational excellence with a focus on safety, quality and reliability; and improving the outcomes of capital investments. In 2015, we will implement a program called "Quick Wins," to focus on low complexity, low dollar, high return capital projects while at the same time putting more focus and discipline around the business outcomes of larger, strategic projects.

15

Table of Contents

During 2014, U. S. Steel paid cash to redeem the remaining $322 million principal amount of our 4% Senior Convertible Notes due May 15, 2014. We also made a voluntary contribution of $140 million to our main defined benefit pension plan. We ended 2014 with $1.4 billion of cash and cash equivalents on hand and total liquidity of $3.1 billion.

Steel Industry Background and Competition

The global steel industry is cyclical, highly competitive and has historically been characterized by overcapacity.

According to worldsteel Association's latest published statistics, U. S. Steel was the thirteenth largest steel producer in the world in 2013. We believe we are currently the second largest integrated steel producer headquartered in North America, one of the largest integrated flat-rolled producers in Central Europe and the largest tubular producer in North America. U. S. Steel competes with many North American and international steel producers. Competitors include integrated producers, which, like U. S. Steel, use iron ore and coke as the primary raw materials for steel production, and EAF producers, which primarily use steel scrap and other iron-bearing feedstocks as raw materials. Global steel capacity has continued to increase, with some published sources estimating that steel capacity in China alone is at or is nearing one billion metric tons per year. In addition, other products, such as aluminum, plastics and composites, compete with steel in some applications.

EAF producers typically require lower capital expenditures for construction of facilities and may have lower total employment costs; however, these competitive advantages may be minimized or eliminated by the cost of scrap when scrap prices are high. Some mini-mills utilize thin slab casting technology to produce flat-rolled products and are increasingly able to compete directly with integrated producers in a number of flat-rolled product applications previously produced only by integrated steelmaking.

U. S. Steel provides defined benefit pension and/or other postretirement benefits to approximately 110,000 current employees, retirees and their beneficiaries. Most of our other competitors do not have comparable retiree obligations.

Demand for flat-rolled products is influenced by a wide variety of factors, including but not limited to macro-economic drivers, the supply-demand balance, inventories, imports and exports, currency fluctuations, and the demand from flat-rolled consuming markets. The largest drivers of North American consumption have historically been the automotive and construction markets, which make up at least 50 percent of total sheet consumption. Other sheet consuming industries include appliance, converter, container, tin, energy, electrical equipment, agricultural, domestic and commercial equipment and industrial machinery.

Demand for energy related tubular products depends on several factors, most notably energy prices, which tend to affect the number of oil and natural gas wells being drilled, completed and re-worked, the depth and drilling conditions of these wells and the drilling techniques utilized. The level of these activities depends primarily on the demand for natural gas and oil and expectations about future prices for these commodities. Demand for our tubular products is also affected by the continuing development of shale oil and gas reserves, the level of production by domestic manufacturers, inventories maintained by manufacturers, distributors, and end users and by the level of new capacity and imports in the markets we serve.

USSE conducts business primarily in Europe. Like our domestic operations, USSE is affected by the cyclical nature of demand for steel products and the sensitivity of that demand to worldwide general economic conditions, as well as currency fluctuations. The sovereign debt issues in the European Union (EU), and the resulting economic uncertainties, can adversely affect markets. We are subject to market conditions in those areas, which are influenced by many of the same factors that affect U.S. markets, as well as matters specific to international markets such as quotas, tariffs and other protectionist measures. In addition, geopolitical tension in the region between Russia and the Ukraine may adversely affect markets in the EU and the broader region.

International competitors may have lower labor costs than U.S. producers and some are owned, controlled or subsidized by their governments, artificially reducing their costs and allowing production and pricing decisions to be influenced by political, social and economic policy considerations, as well as prevailing market conditions.

U. S. Steel remains active in its efforts to ensure that competitors are not engaging in unfair trade practices. In recent years, a significant number of steel imports have been found to violate United States or Canadian trade laws. Under these laws, antidumping duties (AD) have been imposed against dumped products, which are products sold at a price that is less than fair value. Countervailing duties (CVD) have been imposed against products that have benefited from foreign government assistance for the production, manufacture, or exportation of the product. For many years,

16

Table of Contents

U. S. Steel, other producers, customers and the United Steelworkers have sought the imposition of duties and in many cases have been successful.

As in the past, U. S. Steel continues to monitor unfairly traded imports and is prepared to seek appropriate remedies against such importing countries. On July 2, 2013, U. S. Steel and eight other domestic producers filed AD and CVD petitions against imports of OCTG from India and Turkey, along with AD petitions against imports of OCTG from the Philippines, Saudi Arabia, South Korea, Taiwan, Thailand, Ukraine, and Vietnam. These petitions allege that unfairly-traded imports from the subject countries are both a cause and a threat of material injury to United States producers of OCTG.

On July 11, 2014, the U.S. Department of Commerce (DOC) announced its final determinations in both the CVD investigations of OCTG from India and Turkey and the AD investigations of India, South Korea, Philippines, Saudi Arabia, Taiwan, Thailand, Turkey, Ukraine and Vietnam. The DOC made an affirmative determination that exporters and producers in all nine countries were importing OCTG into the United States at less than fair value. The DOC calculated AD margins for all nine countries and CVD margins against India and Turkey.

However, on August 11, 2014, the DOC entered an amended final determination in the Saudi Arabia investigation and revised the margin for Saudi Arabia to be less than 2% ad valorem. As a result of the final and amended final determinations, the DOC will "suspend liquidation" and require cash deposits of AD and/or CVD duties for imports of OCTG from those producers and exporters with dumping margins and/or subsidy rates equal to or greater than 2% ad valorem.

On August 22, 2014, the U.S. International Trade Commission (ITC) voted that imports from India, South Korea, Taiwan, Turkey, Ukraine, and Vietnam caused injury to the domestic industry, but did not find injury with regards to imports from the Philippines or Thailand.

On September 10, 2014, the DOC issued AD orders against India, South Korea, Taiwan, Turkey, Ukraine, and Vietnam and CVD orders against India and Turkey. While the duties mentioned above cover 90% of the unfairly traded imports entering the U.S. markets in 2013, U. S. Steel will continue its efforts to ensure that all OCTG imports are fairly traded. As such, U. S. Steel filed an appeal to the Court of International Trade (CIT) regarding the DOC's de minimis determination on Saudi Arabian OCTG imports, as well as appeals to the ITC's negligibility finding for Thailand and the Philippines. Additionally, the respondents have filed appeals to the CIT in the OCTG case. At present, there are 26 separate appeals filed at the CIT from the OCTG determinations. At the end of 2014, South Korea filed a separate action with the World Trade Organization challenging the OCTG ruling. While U. S. Steel strongly believes that all of the imports in question were traded unfairly, and that relief is fully justified under United States law, the outcome of the appeals remains uncertain.

AD and CVD orders are generally subject to "sunset" reviews every five years and U. S. Steel actively participates in such review proceedings. In May 2014, the United States government completed the five-year sunset review of the AD and CVD orders on welded line pipe from China. The United States government decided to maintain AD and CVD orders on the welded line pipe from China. In January 2014, the United States government completed five-year sunset reviews of: (i) AD orders on hot-rolled steel from China, Taiwan, and Ukraine; and (ii) AD and CVD orders on hot-rolled steel from India, Indonesia and Thailand. In each of those reviews, the AD and CVD orders were kept in place.

In 1999, the United States entered into an agreement with Russia suspending 1998 AD orders covering hot-rolled steel. In 2014, a surge of over 900,000 tons of Russian hot-rolled steel was imported into the U. S. market at average unit values significantly below steel produced in the United States. U. S. Steel and other domestic steel producers supported the termination of the Russian Suspension Agreement. On October 17, 2014, the DOC notified the Russian Economy Ministry that the United States would terminate the 1999 Hot-rolled Steel Suspension Agreement in 60 days. On December 16, 2014, duties of 73.59% for Severstal and 184.56% for all other Russian producers and exporters went into effect. Although this may have a positive impact to U. S. Steel in North America, it may adversely affect USSE as Russia is now trying to move more into the European market, and we may potentially see an increase in imports into the EU and surrounding countries.

Steel sheet imports to the United States accounted for an estimated 22 percent of the steel sheet market in the United States in 2014, 15 percent in 2013 and 14 percent in 2012. Increases in future levels of imported steel could reduce future market prices and demand levels for steel produced in our North American facilities.

Imports of flat-rolled steel to Canada accounted for an estimated 36 percent of the Canadian market for flat-rolled steel products in 2014, 35 percent in 2013 and 34 percent in 2012.

17

Table of Contents

Total imports of flat-rolled carbon steel products (excluding quarto plates and wide flats) to the 28 countries currently comprising the EU were 16 percent of the EU market in 2014, 14 percent in 2013 and 13 percent in 2012. Increases in future levels of imported steel could reduce market prices and demand levels for steel produced by USSE.

Energy related tubular products imported into the United States accounted for an estimated 52 percent of the U.S. domestic market in 2014, 49 percent in 2013 and 52 percent in 2012.

Competition from imports will continue to influence the market. U. S. Steel will continue to closely monitor imports of products in which U. S. Steel has an interest. Additional complaints are likely as unfairly-traded imports adversely impact, or threaten to adversely impact, U. S. Steel's financial results.

Facilities and Locations

Flat-rolled

Except for the Fairfield pipe facility, the operating results of all facilities within U. S. Steel's integrated steel plants in the U.S. are included in Flat-rolled. These facilities include Gary Works, Great Lakes Works, Mon Valley Works, Granite City Works and Fairfield Works. During the third quarter 2014, USSC, an indirect wholly owned subsidiary of U. S. Steel, with unanimous approval from its Board of Directors, applied for relief from its creditors pursuant to CCAA. The Flat-rolled segment information subsequent to September 16, 2014 does not include USSC. The operating results of U. S. Steel's coke and iron ore pellet operations and many equity investees in the United States are also included in Flat-rolled.

During 2015, U. S. Steel anticipates adjusting operating levels at several of its Flat-rolled operations as a result of unfavorable market conditions, primarily driven by dramatically lower oil prices, lower steel prices, and the impact of the stronger U.S. dollar and global overcapacity on imports and our operations. Customer order rates will determine the size and duration of any adjustments that we make at our Flat-rolled operations.

Gary Works, located in Gary, Indiana, has annual raw steel production capability of 7.5 million tons. Gary Works has one coke battery, four blast furnaces, six steelmaking vessels, a vacuum degassing unit and four slab casters. Gary Works generally consumes all the coke it produces and sells coke by-products to the chemical and raw material industries. Finishing facilities include a hot strip mill, two pickling lines, two cold reduction mills, three temper mills, a double cold reduction line, four annealing facilities and two tin coating lines. Principal products include hot-rolled, cold-rolled and coated sheets and tin mill products. Gary Works also produces strip mill plate in coil. The Midwest Plant and East Chicago Tin are operated as part of Gary Works.

The Midwest Plant, located in Portage, Indiana, processes hot-rolled and cold rolled bands and produces tin mill products, hot dip galvanized, cold-rolled and electrical lamination sheets. Midwest facilities include a pickling line, two cold reduction mills, two temper mills, a double cold reduction mill, two annealing facilities, two hot dip galvanizing lines, a tin coating line and a tin-free steel line.

East Chicago Tin is located in East Chicago, Indiana and produces tin mill products. Facilities include a pickling line, a cold reduction mill, two annealing facilities, a temper mill, a tin coating line and a tin-free steel line.

Great Lakes Works, located in Ecorse and River Rouge, Michigan, has annual raw steel production capability of 3.8 million tons. Great Lakes facilities include three blast furnaces, two steelmaking vessels, a vacuum degassing unit, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, three annealing facilities, a temper mill, a recoil and inspection line, an electrolytic galvanizing line and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets.

Mon Valley Works consists of the Edgar Thomson Plant, located in Braddock, Pennsylvania; the Irvin Plant, located in West Mifflin, Pennsylvania; the Fairless Plant, located in Fairless Hills, Pennsylvania; and the Clairton Plant, located in Clairton, Pennsylvania. Mon Valley Works has annual raw steel production capability of 2.9 million tons. Facilities at the Edgar Thomson Plant include two blast furnaces, two steelmaking vessels, a vacuum degassing unit and a slab caster. Irvin Plant facilities include a hot strip mill, two pickling lines, a cold reduction mill, three annealing facilities, a temper mill and two hot dip galvanizing lines. The Fairless Plant operates a hot dip galvanizing line. Principal products from Mon Valley Works include hot-rolled, cold-rolled and coated sheets, as well as coke and coke by-products produced at the Clairton Plant.

18

Table of Contents

The Clairton Plant is comprised of ten coke batteries. Almost all of the coke we produce is consumed by U. S. Steel facilities, or swapped with other domestic steel producers. Coke by-products are sold to the chemicals and raw materials industries. In the fourth quarter of 2012, we completed the construction of a technologically and environmentally advanced coke battery with capacity of 960,000 tons at the Clairton Plant.

Granite City Works, located in Granite City, Illinois, has annual raw steel production capability of 2.8 million tons. Granite City's facilities include two coke batteries, two blast furnaces, two steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume ® line. Granite City Works generally consumes all the coke it produces and sells coke by-products to the chemical and raw material industries. Principal products include hot-rolled and coated sheets. In February 2015, U. S. Steel made a decision to permanently close the coke making operations at Granite City Works. See Note 25 to the Consolidated Financial Statements for further details. Gateway Energy and Coke Company LLC (Gateway) constructed a coke plant, which began operating in October 2009 to supply Granite City Works under a 15 year agreement. U. S. Steel owns and operates a cogeneration facility that utilizes by-products from the Gateway coke plant to generate heat and power.

Fairfield Works, located in Fairfield, Alabama, has annual raw steel production capability of 2.4 million tons. Fairfield Works facilities included in Flat-rolled are a blast furnace, three steelmaking vessels, a vacuum degassing unit, a slab caster, a rounds caster, a hot strip mill, a pickling line, a cold reduction mill, two temper/skin pass mills, a hot dip galvanizing line and a hot dip galvanizing/Galvalume ® line. Principal products include hot-rolled, cold-rolled and coated sheets, and steel rounds for Tubular.

U. S. Steel owns a Research and Technology Center located in Munhall, Pennsylvania (near Pittsburgh) where we carry out a wide range of applied research, development and technical support functions.

U. S. Steel also owns an automotive technical center in Troy, Michigan. This facility brings automotive sales, service, distribution and logistics services, product technology and applications research into one location. Much of U. S. Steel's work in developing new grades of steel to meet the demands of automakers for high-strength, light-weight and formable materials is carried out at this location.

U. S. Steel has iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), Minnesota with annual iron ore pellet production capability of 22.4 million tons. During 2014, 2013 and 2012, these operations produced 22.2 million, 21.7 million and 21.4 million tons of iron ore pellets, respectively.

U. S. Steel has a 14.7 percent ownership interest in Hibbing Taconite Company (Hibbing), which is based in Hibbing, Minnesota. Hibbing's rated annual production capability is 9.1 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. Our share of 2014, 2013, and 2012 production was 1.3 million, 1.3 million and 1.4 million tons, respectively.

U. S. Steel has a 15 percent ownership interest in Tilden Mining Company (Tilden), which is based in Ishpeming, Michigan. Tilden's rated annual production capability is 8.7 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. Our share of 2014, 2013 and 2012 production was 1.5 million, 1.1 million and 1.5 million tons, respectively.

U. S. Steel participates in a number of additional joint ventures that are included in Flat-rolled, most of which are conducted through subsidiaries or other separate legal entities. All of these joint ventures are accounted for under the equity method. The significant joint ventures and other investments are described below. For information regarding joint ventures and other investments, see Note 10 to the Consolidated Financial Statements.

U. S. Steel and POSCO of South Korea participate in a 50-50 joint venture, USS-POSCO Industries (UPI), located in Pittsburg, California. The joint venture markets sheet and tin mill products, principally in the western United States. UPI produces cold-rolled sheets, galvanized sheets, tin plate and tin-free steel from hot bands principally provided by U. S. Steel and POSCO. UPI's annual production capability is approximately 1.5 million tons.

U. S. Steel and Kobe Steel, Ltd. of Japan participate in a 50-50 joint venture, PRO-TEC Coating Company (PRO-TEC). PRO-TEC owns and operates two hot dip galvanizing lines and a continuous annealing line (CAL) in Leipsic, Ohio, which primarily serve the automotive industry. PRO-TEC's annual production capability is approximately 1.7 million tons. U. S. Steel's domestic production facilities supply PRO-TEC with cold-rolled sheets and U. S. Steel markets all of its products. PRO-TEC constructed and financed the CAL that began operations during the first quarter

19

Table of Contents

of 2013. The CAL produces high strength, lightweight steels that are an integral component in automotive manufacturing as vehicle emission and safety requirements become increasingly stringent.

U. S. Steel has a 50 percent ownership in Double Eagle Steel Coating Company (DESCO) that operates an electrogalvanizing facility located in Dearborn, Michigan. The facility coats sheet steel with free zinc or zinc alloy coatings, primarily for use in the automotive industry. DESCO's annual production capability is approximately 870,000 tons. During the second quarter of 2013, U. S. Steel and its joint venture partner decided to dissolve the partnership with a two year dissolution period running through April 30, 2015. During the first quarter 2015, U. S. Steel entered into negotiations with a party claiming to have acquired a 50 percent ownership as U. S. Steel's partner regarding DESCO ownership and continued operations.

U. S. Steel and ArcelorMittal participate in the Double G Coatings Company, L.P. a 50-50 joint venture (Double G), which operates a hot dip galvanizing and Galvalume ® facility located near Jackson, Mississippi and primarily serves the construction industry. Double G processes steel supplied by each partner and each partner markets the steel it has processed by Double G. Double G's annual production capability is approximately 315,000 tons.

U. S. Steel and Worthington Industries, Inc. participate in Worthington Specialty Processing (Worthington), a joint venture with locations in Jackson, Canton, and Taylor, Michigan in which U. S. Steel has a 49 percent interest. Worthington slits, cuts to length, and presses blanks from steel coils to desired specifications. Worthington's annual production capability is approximately 890,000 tons.

Chrome Deposit Corporation (CDC), a 50-50 joint venture between U. S. Steel and Court Holdings, reconditions finishing work rolls, which require grinding, chrome plating and/or texturing. The rolls are used on rolling mills to provide superior finishes on steel sheets. CDC has seven locations across the United States, with all locations near major steel plants.

Feralloy Processing Company (FPC), a joint venture between U. S. Steel and Feralloy Corporation, converts coiled hot strip mill plate into sheared and flattened plates. U. S. Steel has a 49 percent interest. The plant, located in Portage, Indiana, has annual production capability of approximately 275,000 tons.

U. S. Steel and Feralloy Corporation, participate in a joint venture, Acero Prime, S.R.L. de CV (Acero Prime). U. S. Steel has a 40 percent interest. Acero Prime has facilities in San Luis Potosi, Ramos Arizpe, and Toluca, Mexico. Acero Prime provides slitting, warehousing and logistical services. Acero Prime's annual slitting capability is approximately 385,000 tons.

USSE

USSE consists of USSK and its subsidiaries.

USSK operates an integrated facility in Košice, Slovakia, which has annual raw steel production capability of 5.0 million tons. This facility has two coke batteries, four sintering strands, three blast furnaces, four steelmaking vessels, a vacuum degassing unit, two dual strand casters, a hot strip mill, two pickling lines, two cold reduction mills, three annealing facilities, a temper mill, a temper/double cold reduction mill, three hot dip galvanizing lines, two tin coating lines, three dynamo lines, a color coating line and two spiral welded pipe mills. USSK also has multiple slitting, cutting and other finishing lines for flat products. Principal products include hot-rolled, cold-rolled and coated sheets, tin mill products and spiral welded pipe. USSK also has facilities for manufacturing heating radiators, refractory ceramic materials and has a power plant for internal steam and electricity generation.

In addition, USSK has a research laboratory, which, in conjunction with our Research and Technology Center, supports efforts in cokemaking, electrical steels, design and instrumentation, and ecology.

Tubular

Tubular manufactures seamless and welded OCTG, standard pipe, line pipe and mechanical tubing. During 2015, U. S. Steel anticipates adjusting operating levels at several of its tubular operations as declining oil prices and rig counts have reduced demand for OCTG products. Customer order rates will determine the size and duration of any adjustments that we make at our tubular operations.

Seamless products are produced at a facility located at Fairfield Works in Fairfield, Alabama, and at two facilities located in Lorain, Ohio. The Fairfield plant has annual production capability of 750,000 tons and is supplied with steel rounds from Flat-rolled's Fairfield Works. The Fairfield plant has the capability to produce outer diameter (O.D.) sizes

20

Table of Contents

from 4.5 to 9.875 inches and has quench and temper, hydrotester, threading and coupling and inspection capabilities. The Lorain facilities have combined annual production capability of 780,000 tons and consume steel rounds supplied by Fairfield Works and external sources. Lorain #3 facility has the capability to produce O.D. sizes from 10.125 to 26 inches and has quench and temper, hydrotester, cutoff and inspection capabilities. Lorain #4 facility has the capability to produce O.D. sizes from 1.9 to 4.5 inches and has quench and temper, hydrotester, threading and coupling and inspection capabilities for OCTG 6.0 casing and uses Tubular Processing in Houston for oil field production tubing finishing.

Lone Star Tubular, located in Lone Star, Texas, manufactures welded OCTG, standard pipe, line pipe and mechanical tubing products. Lone Star Tubular #1 facility has the capability to produce O.D. sizes from 7 to 16 inches. Lone Star Tubular #2 facility has the capability to produce O.D. sizes from 1.088 to 7.15 inches. Both facilities have quench and temper, hydrotester, threading and coupling and inspection capabilities. Bellville Tubular Operations, in Bellville, Texas, manufactures welded tubular products primarily for OCTG with the capability to produce O.D. sizes from 2.375 to 4.5 inches and uses Tubular Processing in Houston for oil field production tubing finishing. Lone Star Tubular and Bellville Tubular Operations have combined annual production capability of 1.0 million tons and consume hot-rolled bands from Flat-rolled's facilities. As of August 3, 2014, the Bellville Tubular operations were indefinitely idled.

Welded products are also produced at a facility located in McKeesport, Pennsylvania. McKeesport Tubular Operations has annual production capability of 315,000 tons and consumes hot-rolled bands from Flat-rolled locations. This facility has the capability to produce, hydrotest, cut to length and inspect O.D. sizes from 8.625 to 20 inches. As of August 31, 2014, the McKeesport Tubular operations were indefinitely idled.

Wheeling Machine Products manufactures couplings used to connect individual sections of oilfield casing and tubing. It produces sizes ranging from 2.375 to 20 inches at two locations: Pine Bluff, Arkansas, and Hughes Springs, Texas.

Tubular Processing, located in Houston, Texas, provides quench and temper and end-finishing services for oilfield production tubing. Offshore Operations, also located in Houston, Texas, provides threading, inspection, accessories and storage services to the OCTG market.

In December 2012, U. S. Steel and Butch Gilliam Enterprises LLC formed a new joint venture, Patriot Premium Threading Services located in Midland, Texas, which provides oil country threading, accessory threading , repair services and rig site services to exploration and production companies located principally in the Permian Basin.

U. S. Steel also has a 50 percent ownership interest in Apolo Tubulars S.A. (Apolo), a Brazilian supplier of welded casing, tubing, line pipe and other tubular products. Apolo's annual production capability is approximately 150,000 tons.

U. S. Steel, POSCO and SeAH Steel Corporation, a Korean manufacturer of tubular products, participate in United Spiral Pipe LLC (USP) which owns and operates a spiral weld pipe manufacturing facility in Pittsburg, California with annual production capability of 300,000 tons. Its diameter size range is 24 to 60 inches. U. S. Steel and POSCO each hold a 35-percent ownership interest in the joint venture, with the remaining 30-percent ownership interest held by SeAH. On February 2, 2015, the pipe making assets of USP were sold to a third party. We do not expect any significant financial impact from this sale.

We have an Innovation & Technology Center in Houston, Texas housing exhibits for six areas of interest, an amphitheater, two conference rooms and a lab-themed meeting room. Designed to serve as a training and education center for both internal and external audiences, the facility hosts events such as customer lunch-and-learn sessions, industry association meetings and employee trainings. Research and development for tubular premium connections is performed at this facility.

21

Table of Contents

Other Businesses

U. S. Steel's Other Businesses include railroad services and real estate operations.

U. S. Steel owns the Gary Railway Company in Indiana; Lake Terminal Railroad Company and Lorain Northern Company in Ohio; Union Railroad Company in Pennsylvania; Fairfield Southern Company, Inc. located in Alabama; Delray Connecting Railroad Company in Michigan and Texas & Northern Railroad Company in Texas; all of which comprise U. S. Steel's transportation business. On February 1, 2012, U. S. Steel completed the sale of the majority of operating assets of Birmingham Southern Railroad Company and the Port Birmingham Terminal. See Note 5 to the Consolidated Financial Statements for further information. McKeesport Connecting Railroad Company merged into Union Railroad Company effective January 1, 2013.

U. S. Steel owns, develops and manages various real estate assets, which include approximately 50,000 acres of surface rights primarily in Alabama, Illinois, Maryland, Michigan, Minnesota and Pennsylvania. In addition, U. S. Steel participates in joint ventures that are developing real estate projects in Alabama, Maryland and Illinois. In August 2014, U. S. Steel sold land and mineral rights in Alabama for approximately $55 million.

Raw Materials and Energy

As an integrated producer, U. S. Steel's primary raw materials are iron units in the form of iron ore pellets and sinter ore, carbon units in the form of coal and coke (which is produced from coking coal) and steel scrap. U. S. Steel's raw materials supply strategy consists of acquiring and expanding captive sources of certain primary raw materials and entering into flexible supply contracts for certain other raw materials at competitive market prices which are subject to fluctuations based on market conditions at the time.

The amounts of such raw materials needed to produce a ton of steel will fluctuate based upon the specifications of the final steel products, the quality of raw materials and, to a lesser extent, differences among steel producing equipment. In broad terms, U. S. Steel consumes approximately 1.4 tons of coal to produce one ton of coke and then it consumes approximately 0.4 tons of coke, 0.3 tons of steel scrap (40 percent of which is internally generated) and 1.3 tons of iron ore pellets to produce one ton of raw steel. At normal operating levels, we also consume approximately 6 mmbtu's of natural gas per ton produced. While we believe that these estimated consumption amounts are useful for planning purposes, substantial variations occur. They are presented to give a general sense of raw material and energy consumption related to steel production.

Carbon Strategy

Our carbon strategy in North America is to achieve the lowest cost fuel rate to produce hot metal in our blast furnaces. We have aggressively worked to adjust the coal blends that feed our coke batteries in order to use lower cost coals. We also have increased the natural gas injection capabilities on our blast furnaces to utilize the abundant supply of competitively priced natural gas to reduce costs. This strategy has improved our flexibility to use the lowest cost combination of coke, injection coal, and natural gas in our blast furnaces to achieve low cost fuel rates.

According to the American Iron and Steel Institute, relative to competing materials, steel has approximately one-fifth the carbon footprint of aluminum, one-twelfth the footprint of magnesium, and about one-ninth the footprint of carbon fiber composites. Our Advanced High Strength Steels used in today's car affords significant light-weighting opportunities and when comparing steel to aluminum in terms of sustainability, steel has a better carbon footprint and a lower cost.

22

Table of Contents

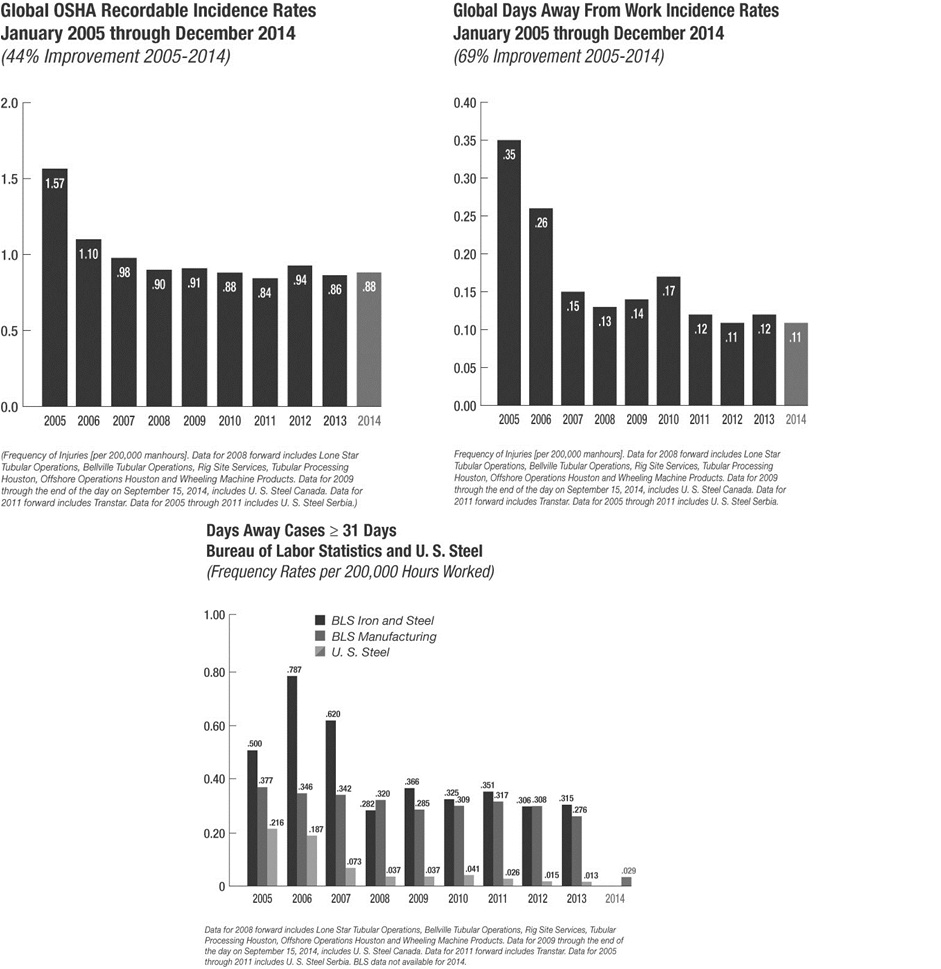

Iron Ore

Iron Ore Production (a)

(a) Includes our share of production from Hibbing and Tilden.

The iron ore facilities at Minntac and Keetac contain an estimated 912 million short tons of recoverable reserves and our share of recoverable reserves at the Hibbing and Tilden joint ventures is 50 million short tons. Recoverable reserves are defined as the tons of product that can be used internally or delivered to a customer after considering mining and beneficiation or preparation losses. Minntac and Keetac's annual capability and our share of annual capability for the Hibbing and Tilden joint ventures total approximately 25 million tons. Through our wholly owned operations and our share of joint ventures, we have adequate iron ore pellet production to cover a significant portion of our North American needs.

We sold iron ore pellets in 2014, 2013 and 2012 to third parties. Depending on our production requirements, inventory levels and other factors we may sell additional pellets in the future. Our one remaining long-term contract for the purchase of iron ore pellets expired in December 2014.

Substantially all of USSE's iron ore requirements are purchased from outside sources, primarily Russian and Ukrainian mining companies. However, in 2014, 2013 and some prior years, USSE also received iron ore from U. S. Steel's iron ore facilities in North America. We believe that supplies of iron ore, adequate to meet USSE's needs, are available at competitive market prices.

Coking Coal

All of U. S. Steel's coal requirements for our cokemaking facilities are purchased from outside sources. U. S. Steel has entered into multi-year contracts for a portion of Flat-rolled's coking coal requirements. Prices for these North American contracts for 2015 are set at what we believe are competitive market prices. Prices in subsequent years will be negotiated in accordance with contractual provisions on an annual basis at prevailing market prices or have fixed prices for a set time frame.

Prices for European contracts are negotiated at defined intervals (usually quarterly).

We believe that supplies of coking coal adequate to meet our needs are available from outside sources at competitive market prices. The main source of coking coal for Flat-rolled is the United States; and sources for USSE include Poland, the Czech Republic, the United States, Russia, and Ukraine.

23

Table of Contents

Coke

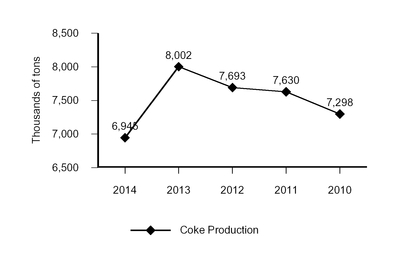

Coke Production (a)

(a) The decrease in 2014 coke production from 2013 is primarily due to the deconsolidation

of USSC and the permanent shut down of two coke batteries at Gary Works.

In North America, the Flat-rolled segment operates cokemaking facilities at the Clairton Plant of Mon Valley Works, Gary Works and Granite City Works. In February 2015, U. S. Steel made a decision to permanently close the coke making operations at Granite City Works. See Note 25 to the Consolidated Financial Statements for further details. At our Granite City Works, we also have a 15 year coke supply agreement with Gateway, which began in 2009. North America coke production also included USSC prior to the CCAA filing on September 16, 2014. Effective December 4, 2014, the Company entered into an arrangement with USSC for the conversion of U. S. Steel's coal into coke at USSC's Hamilton coke battery. The agreement has three one year terms ending on December 31, 2017, with the possibility of early termination. In Europe, the USSE segment operates cokemaking facilities at USSK. Blast furnace injection of coal, natural gas and self-generated coke oven gas is also used to reduce coke usage.

With Flat-rolled's cokemaking facilities and the Gateway long-term supply agreement, it has the capability to be self-sufficient with respect to its annual coke requirements at normal operating levels. Coke is purchased from, sold to, or swapped with suppliers and other end-users to adjust for production needs and reduce transportation costs.

USSE can be self-sufficient for coke at normal operating levels.

Steel Scrap and Other Materials

We believe supplies of steel scrap and other alloy and coating materials required to fulfill the requirements for Flat-rolled and USSE are available from outside sources at competitive market prices. Generally, approximately 40 percent of our steel scrap requirements are internally generated through normal operations.