UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

March 31, 2018

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-14287

Centrus Energy Corp.

Delaware | 52-2107911 |

(State of incorporation) | (I.R.S. Employer Identification No.) |

6901 Rockledge Drive, Suite 800, Bethesda, Maryland 20817

(301) 564-3200

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o |

| Smaller reporting company | ý |

Accelerated filer | o |

| Emerging growth company | o |

Non-accelerated filer | o |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ý No o

As of May 1, 2018, there were 7,632,669 shares of the registrant's Class A Common Stock, par value $0.10 per share, and 1,406,082 shares of the registrant's Class B Common Stock, par value $0.10 per share, outstanding.

TABLE OF CONTENTS

|

| Page |

| PART I – FINANCIAL INFORMATION |

|

|

| |

Item 1. | Financial Statements (Unaudited): |

|

| Condensed Consolidated Balance Sheets at March 31, 2018 and December 31, 2017 | 4 |

| Condensed Consolidated Statements of Operations for the Three Months Ended March 31, 2018 and 2017 | 5 |

| Condensed Consolidated Statements of Comprehensive Income (Loss) for the Three Months Ended March 31, 2018 and 2017 | 6 |

| Condensed Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2018 and 2017 | 7 |

| Condensed Consolidated Statements of Stockholders' Deficit for the Three Months Ended March 31, 2018 and 2017 | 8 |

| Notes to Condensed Consolidated Financial Statements | 9 |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 28 |

Item 4. | Controls and Procedures | 40 |

|

|

|

| PART II – OTHER INFORMATION |

|

Item 1. | Legal Proceedings | 41 |

Item 1A. | Risk Factors | 41 |

Item 6. | Exhibits | 41 |

Signatures | 42 | |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, including Management's Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2, contains "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") - that is, statements related to future events. In this context, forward-looking statements may address our expected future business and financial performance, and often contain words such as "expects", "anticipates", "intends", "plans", "believes", "will", "should", "could", "would" or "may" and other words of similar meaning. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For Centrus Energy Corp., particular risks and uncertainties that could cause our actual future results to differ materially from those expressed in our forward-looking statements include risks: related to our significant long-term liabilities, including material unfunded defined benefit pension plan obligations and postretirement health and life benefit obligations; risks relating to our outstanding 8.0% paid-in-kind ("PIK") toggle notes (the "8% PIK Toggle Notes") maturing in September 2019, our 8.25% notes (the "8.25% Notes") maturing in February 2027 and our Series B Senior Preferred Stock, including the potential termination of the guarantee by United States Enrichment Corporation of the 8% PIK Toggle Notes; risks related to the use of our net operating losses ("NOLs") and net unrealized built-in losses ("NUBILs") to offset future taxable income and the use of the Rights Agreement (as defined herein) to prevent an "ownership change" as defined in Section 382 of the Internal Revenue Code of 1986, as amended (the "Code") and our ability to generate taxable income to utilize all or a portion of the NOLs and NUBILs prior to the expiration thereof; risks related to the limited trading markets in our securities; risks related to our ability to maintain the listing of our Class A Common Stock on the NYSE American LLC (the "NYSE American"); risks related to decisions made by our Class B stockholders regarding their investment in the Company based upon factors that are unrelated to the Company's performance; the continued impact of the March 2011 earthquake and tsunami in Japan on the nuclear industry and on our business, results of operations and prospects; the impact and potential extended duration of the current supply/demand imbalance in the market for low-enriched uranium ("LEU"); our dependence on others for deliveries of LEU including deliveries from the Russian government entity Joint Stock Company "TENEX" ("TENEX") under a commercial supply agreement with TENEX (the "Russian Supply Agreement"); risks related to our ability to sell the LEU we procure

2

pursuant to our purchase obligations under our supply agreements, including the Russian Supply Agreement; risks relating to our sales order book, including uncertainty concerning customer actions under current contracts and in future contracting due to market conditions and lack of current production capability; risks related to financial difficulties experienced by customers, including possible bankruptcies, insolvencies or any other inability to pay for our products or services; pricing trends and demand in the uranium and enrichment markets and their impact on our profitability; movement and timing of customer orders; risks related to the value of our intangible assets related to the sales order book and customer relationships; risks associated with our reliance on third-party suppliers to provide essential services to us; risks related to existing or new trade barriers and contract terms that limit our ability to deliver LEU to customers; risks related to actions that may be taken by the U.S. government, the Russian government or other governments that could affect our ability or the ability of our sources of supply to perform under their contract obligations to us, including the imposition of sanctions, restrictions or other requirements; the impact of government regulation including by the U.S. Department of Energy and the United States Nuclear Regulatory Commission; uncertainty regarding our ability to commercially deploy competitive enrichment technology; risks and uncertainties regarding funding for the American Centrifuge project and our ability to perform under our agreement with UT-Battelle, LLC ("UT-Battelle"), the management and operating contractor for Oak Ridge National Laboratory ("ORNL"), for continued research and development of the American Centrifuge technology; the potential for further demobilization or termination of the American Centrifuge project; risks related to the current demobilization of portions of the American Centrifuge project, including risks that the schedule could be delayed and costs could be higher than expected; failures or security breaches of our information technology systems; potential strategic transactions, which could be difficult to implement, disrupt our business or change our business profile significantly; the outcome of legal proceedings and other contingencies (including lawsuits and government investigations or audits); the competitive environment for our products and services; changes in the nuclear energy industry; the impact of financial market conditions on our business, liquidity, prospects, pension assets and insurance facilities; revenue and operating results can fluctuate significantly from quarter to quarter, and in some cases, year to year; and other risks and uncertainties discussed in this and our other filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2017.

Readers are urged to carefully review and consider the various disclosures made in this report and in our other filings with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances that may arise after the date of this Quarterly Report on Form 10-Q, except as required by law.

3

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, |

| December 31, | ||||

ASSETS |

|

|

| ||||

Current assets |

|

|

| ||||

Cash and cash equivalents | $ | 153.3 | |

| $ | 208.8 | |

Accounts receivable | 15.0 | |

| 60.2 | | ||

Inventories | 164.0 | |

| 153.1 | | ||

Deferred costs associated with deferred revenue | 119.6 | |

| 122.3 | | ||

Other current assets | 22.4 | |

| 22.5 | | ||

Total current assets | 474.3 | |

| 566.9 | | ||

Property, plant and equipment, net of accumulated depreciation of $2.3 as of March 31, 2018 and $1.9 as of December 31, 2017 | 4.6 | |

| 4.9 | | ||

Deposits for financial assurance | 19.8 | |

| 19.7 | | ||

Intangible assets, net | 81.3 | |

| 82.7 | | ||

Other long-term assets | 0.9 | |

| 1.1 | | ||

Total assets | $ | 580.9 | |

| $ | 675.3 | |

|

|

|

| ||||

LIABILITIES AND STOCKHOLDERS' DEFICIT |

| |

|

| | ||

Current liabilities |

| |

|

| | ||

Accounts payable and accrued liabilities | $ | 57.2 | |

| $ | 54.3 | |

Payables under SWU purchase agreements | 23.5 | |

| 79.4 | | ||

Inventories owed to customers and suppliers | 93.8 | |

| 77.9 | | ||

Deferred revenue and advances from customers | 170.2 | |

| 191.8 | | ||

Total current liabilities | 344.7 | |

| 403.4 | | ||

Long-term debt | 155.3 | |

| 157.5 | | ||

Postretirement health and life benefit obligations | 153.1 | |

| 154.2 | | ||

Pension benefit liabilities | 159.2 | |

| 161.6 | | ||

Other long-term liabilities | 12.3 | |

| 17.5 | | ||

Total liabilities | 824.6 | |

| 894.2 | | ||

Commitments and contingencies (Note 11) | | |

| | | ||

Stockholders' deficit |

|

|

| ||||

Preferred stock, par value $1.00 per share, 20,000,000 shares authorized |

|

|

| ||||

Series A Participating Cumulative Preferred Stock, none issued | - | |

| - | | ||

Series B Senior Preferred Stock, 7.5% cumulative, 104,574 shares issued and outstanding and an aggregate liquidation preference of $113.5 as of March 31, 2018 and $111.5 as of December 31, 2017 | 4.6 | |

| 4.6 | | ||

Class A Common Stock, par value $0.10 per share, 70,000,000 shares authorized, 7,632,669 shares issued and outstanding as of March 31, 2018 and December 31, 2017 | 0.8 | |

| 0.8 | | ||

Class B Common Stock, par value $0.10 per share, 30,000,000 shares authorized, 1,406,082 shares issued and outstanding as of March 31, 2018 and December 31, 2017 | 0.1 | |

| 0.1 | | ||

Excess of capital over par value | 60.1 | |

| 60.0 | | ||

Accumulated deficit | (309.4 | ) |

| (284.5 | ) | ||

Accumulated other comprehensive income, net of tax | 0.1 | |

| 0.1 | | ||

Total stockholders' deficit | (243.7 | ) |

| (218.9 | ) | ||

Total liabilities and stockholders' deficit | $ | 580.9 | |

| $ | 675.3 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

( Unaudited; in millions, except share and per share data)

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

Revenue: |

|

|

| ||||

Separative work units | $ | 17.7 | |

| $ | 0.8 | |

Uranium | 3.6 | |

| - | | ||

Contract services | 14.4 | |

| 6.4 | | ||

Total revenue | 35.7 | |

| 7.2 | | ||

Cost of Sales: |

|

|

| ||||

Separative work units and uranium | 34.8 | |

| 2.7 | | ||

Contract services | 6.5 | |

| 7.4 | | ||

Total cost of sales | 41.3 | |

| 10.1 | | ||

Gross loss | (5.6 | ) |

| (2.9 | ) | ||

Advanced technology license and decommissioning costs | 7.7 | |

| 6.1 | | ||

Selling, general and administrative | 11.2 | |

| 12.4 | | ||

Amortization of intangible assets | 1.3 | |

| 1.2 | | ||

Special charges for workforce reductions and advisory costs | 0.6 | |

| 2.4 | | ||

Gains on sales of assets | (0.1 | ) |

| (1.0 | ) | ||

Operating loss | (26.3 | ) |

| (24.0 | ) | ||

Gain on early extinguishment of debt | - | |

| (33.6 | ) | ||

Nonoperating components of net periodic benefit expense (income) | (1.6 | ) |

| (0.4 | ) | ||

Interest expense | 1.0 | |

| 2.9 | | ||

Investment income | (0.6 | ) |

| (0.3 | ) | ||

Income (loss) before income taxes | (25.1 | ) |

| 7.4 | | ||

Income tax benefit | (0.1 | ) |

| (0.2 | ) | ||

Net income (loss) | (25.0 | ) |

| 7.6 | | ||

Preferred stock dividends - undeclared and cumulative | 2.0 | |

| 1.0 | | ||

Net income (loss) allocable to common stockholders | $ | (27.0 | ) |

| $ | 6.6 | |

|

|

|

| ||||

Net income (loss) per common share: |

|

|

| ||||

– Basic | $ | (2.97 | ) |

| $ | 0.73 | |

– Diluted | $ | (2.97 | ) |

| $ | 0.72 | |

Average number of common shares outstanding (in thousands): | | |

| | | ||

– Basic | 9,103 | |

| 9,063 | | ||

– Diluted | 9,103 | |

| 9,174 | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

( Unaudited; in millions)

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

Net income (loss) | $ | (25.0 | ) |

| $ | 7.6 | |

Other comprehensive loss, before tax (Note 12): |

|

|

| ||||

Amortization of prior service credits, net | - | |

| (0.1 | ) | ||

Other comprehensive loss, before tax | - | |

| (0.1 | ) | ||

Income tax benefit related to items of other comprehensive income | - | |

| - | | ||

Other comprehensive loss, net of tax benefit | - | |

| (0.1 | ) | ||

Comprehensive income (loss) | $ | (25.0 | ) |

| $ | 7.5 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

( Unaudited; in millions)

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

Operating Activities |

|

|

| ||||

Net income (loss) | $ | (25.0 | ) |

| $ | 7.6 | |

Adjustments to reconcile net income (loss) to cash used in operating activities: |

|

|

| ||||

Depreciation and amortization | 1.6 | |

| 1.4 | | ||

PIK interest on paid-in-kind toggle notes | 0.4 | |

| 0.8 | | ||

Gain on early extinguishment of debt | - | |

| (33.6 | ) | ||

Gain on sales of assets | (0.1 | ) |

| (1.0 | ) | ||

Changes in operating assets and liabilities: |

|

|

| ||||

Accounts receivable | 45.2 | |

| 23.0 | | ||

Inventories, net | 5.0 | |

| (0.9 | ) | ||

Payables under SWU purchase agreements | (55.9 | ) |

| (59.5 | ) | ||

Deferred revenue, net of deferred costs | (18.9 | ) |

| - | | ||

Accounts payable and other liabilities | (5.4 | ) |

| (9.4 | ) | ||

Other, net | 0.8 | |

| (1.4 | ) | ||

Cash used in operating activities | (52.3 | ) |

| (73.0 | ) | ||

|

|

|

| ||||

Investing Activities |

|

|

| ||||

Capital expenditures | (0.1 | ) |

| - | | ||

Proceeds from sales of assets | 0.1 | |

| 0.6 | | ||

Cash provided by investing activities | - | |

| 0.6 | | ||

|

|

|

| ||||

Financing Activities |

|

|

| ||||

Payment of interest classified as debt | (3.0 | ) |

| - | | ||

Repurchase of debt | - | |

| (27.6 | ) | ||

Payment of securities transaction costs | - | |

| (9.0 | ) | ||

Cash used in financing activities | (3.0 | ) |

| (36.6 | ) | ||

|

|

|

| ||||

Decrease in cash, cash equivalents and restricted cash | (55.3 | ) |

| (109.0 | ) | ||

Cash, cash equivalents and restricted cash at beginning of period (1) | 244.8 | |

| 296.7 | | ||

Cash, cash equivalents and restricted cash at end of period (1) | $ | 189.5 | |

| $ | 187.7 | |

|

|

|

| ||||

Supplemental cash flow information: |

|

|

| ||||

Interest paid in cash | $ | 0.4 | |

| $ | 0.4 | |

Non-cash activities: |

|

|

| ||||

Conversion of interest payable-in-kind to long-term debt | $ | 0.9 | |

| $ | 0.8 | |

Exchange of debt for Series B preferred stock | $ | - | |

| $ | 4.6 | |

_______________

(1) Refer to Note 4 regarding cash, cash equivalents and restricted cash.

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

CENTRUS ENERGY CORP.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' DEFICIT

( Unaudited; in millions, except per share data)

| Preferred Stock, Series B |

| Common Stock, Class A, Par Value $.10 per Share |

| Common Stock, Class B, Par Value $.10 per Share |

| Excess of Capital Over Par Value |

| Accumulated Deficit |

| Accumulated Other Comprehensive Income |

| Total | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

Balance at December 31, 2016 | $ | - | |

| $ | 0.8 | |

| $ | 0.1 | |

| $ | 59.5 | |

| $ | (296.7 | ) |

| $ | 0.2 | |

| $ | (236.1 | ) |

Net income | - | |

| - | |

| - | |

| - | |

| 7.6 | |

| - | |

| 7.6 | | |||||||

Issuance of preferred stock | 4.6 | |

| - | |

| - | |

| - | |

| - | |

| - | |

| 4.6 | | |||||||

Other comprehensive loss, net of tax benefit (Note 12) | - | |

| - | |

| - | |

| - | |

| - | |

| (0.1 | ) |

| (0.1 | ) | |||||||

Restricted stock units and stock options issued, net of amortization | - | |

| - | |

| - | |

| 0.1 | |

| - | |

| - | |

| 0.1 | | |||||||

Balance at March 31, 2017 | $ | 4.6 | |

| $ | 0.8 | |

| $ | 0.1 | |

| $ | 59.6 | |

| $ | (289.1 | ) |

| $ | 0.1 | |

| $ | (223.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

Balance at December 31, 2017 | $ | 4.6 | |

| $ | 0.8 | |

| $ | 0.1 | |

| $ | 60.0 | |

| $ | (284.5 | ) |

| $ | 0.1 | |

| $ | (218.9 | ) |

Adoption of ASC 606 as of January 1, 2018 (Note 1) | - | |

| - | |

| - | |

| - | |

| 0.1 | |

| - | |

| 0.1 | | |||||||

Net loss | - | |

| - | |

| - | |

| - | |

| (25.0 | ) |

| - | |

| (25.0 | ) | |||||||

Other comprehensive loss, net of tax benefit (Note 12) | - | |

| - | |

| - | |

| - | |

| - | |

| - | |

| - | | |||||||

Restricted stock units and stock options issued, net of amortization | - | |

| - | |

| - | |

| 0.1 | |

| - | |

| - | |

| 0.1 | | |||||||

Balance at March 31, 2018 | $ | 4.6 | |

| $ | 0.8 | |

| $ | 0.1 | |

| $ | 60.1 | |

| $ | (309.4 | ) |

| $ | 0.1 | |

| $ | (243.7 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

CENTRUS ENERGY CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

1. BASIS OF PRESENTATION

The unaudited condensed consolidated financial statements of Centrus Energy Corp. ("Centrus" or the "Company"), which include the accounts of the Company, its principal subsidiary United States Enrichment Corporation ("Enrichment Corp.") and its other subsidiaries, as of March 31, 2018, and for the three months ended March 31, 2018 and 2017, have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC"). The condensed consolidated balance sheet as of December 31, 2017, was derived from audited consolidated financial statements, but does not include all disclosures required by generally accepted accounting principles in the United States ("GAAP"). In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments, including normal recurring adjustments, necessary for a fair statement of the financial results for the interim period. Certain prior year amounts have been reclassified for consistency with the current year presentation. Certain information and notes normally included in financial statements prepared in accordance with GAAP have been omitted pursuant to such rules and regulations. All material intercompany transactions have been eliminated.

Operating results for the three months ended March 31, 2018, are not necessarily indicative of the results that may be expected for the year ending December 31, 2018. The unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes and Management's Discussion and Analysis of Financial Condition and Results of Operations included in the Annual Report on Form 10-K for the year ended December 31, 2017.

New Accounting Standards

Recently Adopted Accounting Standards

In 2014, the Financial Accounting Standards Board (the "FASB") issued Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers, which requires revenue to be recognized when a customer obtains control of promised goods and services at an amount that reflects the consideration the Company expects to receive in exchange for those goods and services. In addition, ASU 2014-09 and subsequent amendments, collectively known as Accounting Standards Codification ("ASC") 606 ("ASC 606") require certain additional disclosures regarding the nature, amount, timing, and uncertainty of revenues and cash flows arising from contracts with customers.

The Company adopted ASC 606 on January 1, 2018, using the modified retrospective method. The new standard was applied to contracts that were not completed as of the adoption date. The Company recognized the cumulative effect of initially applying ASC 606 of $0.1 million as an adjustment to the opening balance of accumulated deficit. The comparative information has not been restated and continues to be presented according to accounting standards in effect for those periods. Refer to Note 2, Revenue Recognition and Contracts with Customers, for additional information.

The following table summarizes the cumulative effect of the changes to the Company's condensed consolidated balance sheet as of January 1, 2018, from the adoption of ASC 606 (in millions):

| Balance at December 31, 2017 |

| Adjustment for ASC 606 |

| Balance at January 1, 2018 | ||||||

Assets: |

|

|

|

|

| ||||||

Unbilled contract revenue | $ | - | |

| $ | 0.1 | |

| $ | 0.1 | |

Stockholders' Deficit: |

|

|

|

|

| ||||||

Accumulated Deficit | (284.5 | ) |

| 0.1 | |

| (284.4 | ) | |||

9

The following table summarizes the impact of adopting ASC 606 on revenue for the three months ended March 31, 2018 (in millions):

| Three Months Ended March 31, 2018 | ||||||||||

| As Reported |

| Under Previous Accounting |

| Effect of Adoption Higher (Lower) | ||||||

Revenue - Contract services | $ | 14.4 | |

| $ | 14.8 | |

| $ | (0.4 | ) |

Net income (loss) | $ | (25.0 | ) |

| $ | (24.6 | ) |

| $ | (0.4 | ) |

The effect of adoption includes the opening balance adjustment of $0.1 million and $0.3 million of amounts billed as of March 31, 2018, that are included in Deferred Revenue and Advances with Customers pending transfer of control of contractual services to the customer.

In March 2017, the FASB issued ASU 2017-07, Compensation-Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost . ASU 2017-07 requires changes to the presentation of the components of net periodic benefit cost on the statement of operations by requiring service cost to be presented with other employee compensation costs and other components of net periodic benefit cost to be presented outside of any subtotal of operating income. The Company adopted this standard on January 1, 2018, on a retrospective basis for all periods presented, and certain prior period amounts have been recast to conform with the current presentation as follows (in millions):

| Three Months Ended March 31, 2017 | ||||||||||

| As Previously Reported |

| Adjustments |

| Current Presentation | ||||||

Cost of sales - separative work units and uranium | $ | 2.3 | |

| $ | 0.4 | |

| $ | 2.7 | |

Nonoperating components of net periodic benefit expense (income) | - | |

| (0.4 | ) |

| (0.4 | ) | |||

Refer to Note 9, Pension and Postretirement Benefits for additional information.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments . ASU 2016-15 addresses the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. It is intended to reduce diversity in practice by providing guidance on eight specific cash flow issues. ASU 2016-15 became effective for the Company on January 1, 2018. Upon adoption, the Company reclassified $9.0 million of transaction costs incurred in the first quarter of 2017 related to the note exchange (see Note 7, Debt ) in the statement of cash flows as follows (in millions):

| Three Months Ended March 31, 2017 | ||||||||||

| As Previously Reported |

| Adjustments |

| Current Presentation | ||||||

Cash used in operating activities | $ | (82.0 | ) |

| $ | 9.0 | |

| $ | (73.0 | ) |

Cash used in financing activities | (27.6 | ) |

| (9.0 | ) |

| (36.6 | ) | |||

10

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash . ASU 2016-18 requires that the statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. ASU 2016-18 is to be applied retrospectively for each period presented. The Company adopted the new standard on January 1, 2018. Upon adoption, the Company added its restricted cash balances to the consolidated statement of cash flows, and the prior period amounts have been recast to conform with the current presentation.

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory, requiring an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. Consequently, an entity is required to recognize the current and deferred income taxes resulting from an intra-entity transfer of assets other than inventory when the transfer occurs. ASU 2016-16 is effective for the Company beginning in 2018, including interim reporting periods. In applying the new standard on a modified retrospective basis, there is no material cumulative-effect adjustment to retained earnings or net assets in its consolidated balance sheet as of January 1, 2018 due to the Company's full valuation allowance against net deferred assets. In addition, the adoption did not have an impact to the Company's net income (loss) for the quarter ended March 31, 2018.

Accounting Standards Effective in Future Periods

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which requires lessees to recognize a right-of-use asset and lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting expense recognition in the statement of operations. ASU 2016-02 will become effective for the Company beginning in the first quarter of 2019, with early adoption permitted, and is to be applied using a modified retrospective approach. The Company is evaluating the effect that the provisions of ASU 2016-02 will have on its condensed consolidated financial statements.

Significant Accounting Policies

The accounting policies of the Company are set forth in Note 1 to the Consolidated Financial Statements contained in the Company's 2017 Annual Report on Form 10-K. Updates to those policies as a result of the adoption of ASC 606 have been included in Note 2, Revenue Recognition and Contracts with Customers .

11

2. REVENUE RECOGNITION AND CONTRACTS WITH CUSTOMERS

On January 1, 2018, the Company adopted ASC 606 using the modified retrospective method as applied to customer contracts that were not completed as of the adoption date. As a result, financial information for reporting periods beginning on or after January 1, 2018, are presented under ASC 606, while comparative financial information has not been adjusted and continues to be reported in accordance with the Company's historical accounting policy for revenue recognition prior to the adoption of ASC 606. There was no material impact of adopting ASC 606 for sales under the LEU Segment. For sales under the Contract Services Segment, revenue is now recognized using a cost-to-cost method to measure the transfer of control of contract services to the customer.

Revenue Recognition

Revenue for product and service sales is recognized when or as the Company transfers control of the promised products or services to the customer. Revenue is measured at the transaction price which is based on the amount of consideration that the Company expects to receive in exchange for transferring the promised goods or services to the customer. The transaction price will include estimates of variable consideration to the extent it is probable that a significant reversal of revenue recognized will not occur.

Revenue for the Company's LEU Segment is derived from sales of the separative work units ("SWU") component of low enriched uranium ("LEU"), from sales of both the SWU and uranium components of LEU, and from sales of uranium. Contracts with customers are primarily long-term, fixed-commitment contracts under which its customers are obligated to purchase a specified quantity of the SWU component of LEU or the SWU and uranium components of LEU. The Company's contracts for natural uranium are generally shorter-term, fixed- commitment contracts.

Revenue is recognized at the time the customer obtains control of the LEU or uranium. Customers generally obtain control of LEU at fuel fabricators. Centrus ships LEU to nuclear fuel fabricators for scheduled or anticipated orders from utility customers. Based on customer orders, Centrus arranges for the transfer of title of LEU from Centrus to the customer for the specified quantity of LEU at the fuel fabricator. Revenue is recognized when control of LEU is transferred to the customer at the fuel fabricator. Each such delivery to a customer is accounted for as a distinct performance obligation under a contract, and a contract may call for multiple deliveries over a number of periods. The contract's transaction price is allocated to each performance obligation based on the observable standalone selling price of each distinct delivery of SWU or uranium.

Utility customers in general have the option to defer physical receipt of LEU or uranium purchased from the Company beyond the contractual sale period. In such cases, title to LEU or uranium is transferred to the customer and a performance obligation for Centrus is created and a receivable is recorded. Cash is collected for the receivable under normal credit terms. The performance obligation is represented as Deferred Revenue on the balance sheet and the customer-titled product is classified as Deferred Costs Associated with Deferred Revenue . Risk of loss remains with Centrus until physical delivery occurs. The recognition of revenue and related cost of sales occurs at the time physical delivery occurs and control and risk of loss of the product transfer to the customer, which may occur beyond one year. The timing of physical delivery, subject to notice period requirements, is at the option of the customer. As such, deferred costs and deferred revenue are classified within current assets and current liabilities, respectively.

On occasion, Centrus will accept payment in the form of uranium. Revenue from the sale of SWU under such contracts is recognized at the time control of the LEU is transferred to the customer and is based on the fair value of the uranium transferred.

Amounts billed to customers for handling costs are included in sales. Handling costs are accounted for as a fulfillment cost and are included in cost of sales. The Company does not have shipping costs associated with outbound freight after control over a product has transferred to a customer. The Company's contracts with customers do not provide for significant payment terms or financing components.

12

Revenue for the Contract Services Segment, principally representing engineering and testing activities performed by the Company, is recognized over the contractual period as services are rendered. The contract services segment consists primarily of revenue and cost of sales for engineering and testing work Centrus performs under an agreement with UT-Battelle, LLC ("UT-Battelle"), the management and operating contractor for Oak Ridge National Laboratory ("ORNL"). The contract services segment also includes limited services provided by Centrus to the U.S. Department of Energy ("DOE") and its contractors at the Portsmouth site related to facilities the Company leases from DOE. In the three months ended March 31, 2018, revenue for the contract services segment included $9.5 million under a settlement agreement with DOE and the United States government. Refer below to Contract Balances for additional details.

The Company recognizes revenue over time as it performs on these contracts because of the continuous transfer of control to the customer. With control transferring over time, revenue is recognized based on the extent of progress towards completion of the performance obligation. A contract may contain one or more performance obligations. Two or more promises to transfer goods or services to a customer may be considered a single performance obligation if the goods or services are highly interdependent or highly interrelated such that utility of the promised goods or services to the customer includes integration services provided by the Company.

The Company principally uses the cost-to-cost input method of progress for its contracts because it best depicts the transfer of control to the customer that occurs as the Company incurs costs. Under the cost-to-cost method, the extent of progress towards completion is measured based on the proportion of direct costs incurred to date to the total estimated direct costs at completion of the performance obligation. Revenues are recorded proportionally as costs are incurred. If transaction prices are not stated in the contract for each performance obligation, contractual prices are allocated to performance obligations based on estimated relative standalone selling prices of the promised services.

The Company has applied the practical expedient in paragraph ASC 606 and does not provide t he value of r emaining performance obligations under service contracts having original expected terms of one year or less.

The timing of revenue recognition may differ from the timing of invoicing to customers. Progress on satisfying performance obligations under contracts with customers and the related billings and cash collections are recorded on the consolidated balance sheet as contract assets or contract liabilities. Contract balances are classified as assets or liabilities on a contract-by-contract basis at the end of each reporting period.

Unbilled receivables (contract assets) are included in Accounts Receivable and arise when the timing of cash collected from customers differs from the timing of revenue recognition, such as when contract provisions require specific milestones to be met before a customer can be billed. Those assets are recognized when the revenue associated with the contract is recognized prior to billing and derecognized when billed in accordance with the terms of the contract. To the extent billings to the customer precede the recognition of contract services revenue, the Company recognizes a liability included in Deferred Revenue and Advances from Customers on the consolidated balance sheet.

Disaggregation of Revenue

The following table presents revenue from SWU and uranium sales disaggregated by geographical region based on the billing addresses of customers (in millions):

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

United States | $ | 21.1 | |

| $ | 0.2 | |

Asia | 0.1 | |

| 0.6 | | ||

Other | 0.1 | |

| - | | ||

Revenue - SWU and uranium | $ | 21.3 | |

| $ | 0.8 | |

13

Refer to Note 13, Segment Information , for disaggregation of revenue by segment. Disaggregation by end-market is provided in Note 13 and the condensed consolidated statement of operations. SWU and uranium sales are made to electric utility customers. Contract services revenue results primarily from the UT-Battelle contract and, in the three months ended March 31, 2018, the settlement with DOE and the United States government. SWU and uranium revenue is recognized at point of sale and contract services revenue is generally recognized over time.

Contract Balances

The following table represents changes in our contract assets and contract liabilities balances (in millions):

|

| March 31, 2018 |

| January 1, 2018 |

| Year-To-Date Change | ||||||

Contract assets |

|

|

|

|

|

| ||||||

Accounts receivable: |

|

|

|

|

|

| ||||||

Billed |

| $ | 15.0 | |

| $ | 60.2 | |

| $ | (45.2 | ) |

Unbilled contract revenue |

| - | |

| 0.1 | |

| (0.1 | ) | |||

Accounts receivable |

| $ | 15.0 | |

| $ | 60.3 | |

| $ | (45.3 | ) |

|

|

|

|

|

|

| ||||||

Deferred costs associated with deferred revenue |

| $ | 119.6 | |

| $ | 122.3 | |

| $ | (2.7 | ) |

|

|

|

|

|

|

| ||||||

Contract liabilities |

|

|

|

|

|

| ||||||

Deferred revenue and advances from customers: |

|

|

|

|

|

| ||||||

Deferred revenue |

| $ | 169.9 | |

| $ | 172.5 | |

| $ | (2.6 | ) |

Advances from customers |

| 0.3 | |

| 19.3 | |

| (19.0 | ) | |||

Deferred revenue and advances from customers |

| $ | 170.2 | |

| $ | 191.8 | |

| $ | (21.6 | ) |

During the three months ended March 31, 2018 and 2017, the Company recognized revenue of $2.7 million and $0.2 million , respectively, that was included in deferred revenue at the beginning of the periods.

On January 11, 2018, the Company entered into a settlement agreement with DOE and the United States government regarding breach of contract claims relating to work performed by the Company under contracts with DOE and subcontracts with DOE contractors. DOE agreed to settle all claims raised as part of and subsequent to the litigation for a total of $24.0 million and provide a complete close out of all such contracts and subcontracts settled under the settlement agreement without any further audit or review of the Company's costs or incurred cost submissions, except with respect to certain claims for pension and postretirement benefits. Prior to the settlement, the Company had a receivables balance related to the claims being settled of $14.5 million . In the three months ended March 31, 2018, the Company (a) received $4.7 million from the United States government, (b) applied approximately $19.3 million of advances from the United States government received in prior years against the receivables balance, and (c) recorded additional revenue of $9.5 million .

Centrus and DOE have yet to fully settle the Company's claims for reimbursements for certain pension and postretirement benefits costs related to past contract work performed for DOE. There is the potential for additional revenue to be recognized for this work pending the outcome of legal proceedings related to the Company's claims for payment and the potential release of previously established valuation allowances on receivables. As a result of the application of fresh start accounting following the Company's emergence from Chapter 11 bankruptcy on September 30, 2014, the receivables related to the Company's claims for payment are carried at fair value as of September 30, 2014, which is net of the valuation allowances.

14

LEU Segment Order Book

The SWU component of LEU is typically bought and sold under long-term contracts with deliveries over several years. The Company's order book of sales under contract ("order book") extends for more than a decade. As of March 31, 2018, and December 31, 2017, the order book was $1.3 billion . As previously disclosed, s ome long-term contracts in the Company's order book were established with milestones related to the deployment of the American Centrifuge Plant ("ACP") in Piketon, Ohio, that permit termination with respect to portions of the contract under limited circumstances. Further, some of the Company's customers are facing financial difficulties and may seek modifications to their contracts or seek bankruptcy protection. One of the Company's customers, as a result of financial difficulties, has filed for bankruptcy court protection. The Company estimates that as of March 31, 2018, approximately 14% of the order book remains at risk due to milestones related to ACP deployment or due to customer financial conditions. Any cancellation or modification of one or more contracts or orders could negatively impact the Company's future results of operations.

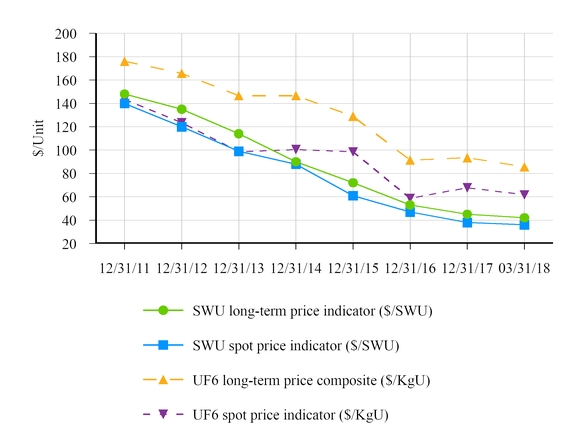

Most of the Company's contracts provide for fixed purchases of SWU during a given year. T he Company's estimate of the aggregate dollar amount of future SWU and uranium sales is partially based on customers' estimates of the timing and size of their fuel requirements and other assumptions that are subject to change. For example, depending on the terms of specific contracts, the customer may be able to increase or decrease the quantity delivered within an agreed range. T he Company's order book estimate is also based on the Company's estimates of selling prices, which are subject to change. For example, depending on the terms of specific contracts, prices may be adjusted based on escalation using a general inflation index, published SWU price indicators prevailing at the time of delivery, and other factors, all of which are variable. T he Company uses external composite forecasts of future market prices and inflation rates in its pricing estimates. Refer to Item 1A, Risk Factors , of the Company's 2017 Annual Report on Form 10-K for a discussion of risks related to the Company's order book.

15

3. SPECIAL CHARGES

Evolving Business Needs

Evolving business needs have resulted in workforce reductions since 2013. In the three months ended March 31, 2018 and 2017, special charges included estimated employee termination benefits of $0.7 million and $0.8 million , respectively. Centrus expects to make payments primarily in the second quarter of 2018 related to the $1.1 million balance payable at March 31, 2018. In the three months ended March 31, 2018 and 2017, the Company incurred advisory costs of $0.1 million and $1.6 million , respectively, related to updating its information technology systems.

Piketon Demonstration Facility

In February 2016, Centrus completed a successful three-year demonstration of American Centrifuge technology at its facility in Piketon, Ohio. The demonstration effort was primarily funded by the U.S. government. As a result of reduced program funding effective October 2015, Centrus incurred a special charge in 2015 for estimated employee termination benefits. Based on current expectations of required employee levels, $0.4 million of the remaining $3.8 million balance as of March 31, 2018, is classified as a current liability in the condensed consolidated balance sheet and the remaining $3.4 million is classified as a long-term liability and is expected to be paid in 2019.

A summary of termination benefit activity and related liabilities follows (in millions):

|

| Liability December 31, 2017 |

| Three Months Ended |

| Liability | ||||||||||

|

|

| Charges for Termination Benefits |

| Paid/Settled |

| ||||||||||

Workforce reductions: |

|

|

|

|

|

|

|

| ||||||||

Evolving business needs |

| $ | 0.8 | |

| $ | 0.7 | |

| $ | (0.4 | ) |

| $ | 1.1 | |

Piketon demonstration facility |

| 5.7 | |

| - | |

| (1.9 | ) |

| 3.8 | | ||||

|

| $ | 6.5 | |

| $ | 0.7 | |

| $ | (2.3 | ) |

| $ | 4.9 | |

4. CASH, CASH EQUIVALENTS AND RESTRICTED CASH

The following table summarizes the Company's cash, cash equivalents and restricted cash as presented on the unaudited condensed consolidated balance sheet to amounts on the condensed consolidated statement of cash flows (in millions):

| March 31, 2018 |

| December 31, 2017 | ||||

|

|

|

| ||||

Cash and cash equivalents | $ | 153.3 | |

| $ | 208.8 | |

Restricted cash included in other current assets | 16.4 | |

| 16.3 | | ||

Restricted cash included in other long-term assets | 19.8 | |

| 19.7 | | ||

Total cash, cash equivalents and restricted cash | $ | 189.5 | |

| $ | 244.8 | |

16

The following provides additional detail regarding the Company's restricted cash (in millions):

| March 31, 2018 |

| December 31, 2017 | ||||

Current assets |

|

|

| ||||

Deposits for surety bonds - NRC | $ | 16.2 | |

| $ | 16.1 | |

Deposits for financial assurance - other | 0.2 | |

| 0.2 | | ||

Included in other current assets | $ | 16.4 | |

| $ | 16.3 | |

|

|

|

| ||||

Long-term assets |

|

|

| ||||

Deposits for surety bonds - DOE | $ | 13.6 | |

| $ | 13.5 | |

Deposits for financial assurance - workers compensation | 5.9 | |

| 5.9 | | ||

Deposits for financial assurance - other | 0.3 | |

| 0.3 | | ||

Deposits for financial assurance | $ | 19.8 | |

| $ | 19.7 | |

Piketon Facility Obligations and Surety Bonds

American Centrifuge expenses that are outside of the Company's contract with UT-Battelle are included in Advanced Technology License and Decommissioning Costs, including ongoing costs for work related to the termination of the license from the U.S. Nuclear Regulatory Commission ("NRC") and the lease with DOE for the Piketon facility. Centrus commenced with the decontamination and decommissioning ("D&D") of the Piketon facility in accordance with NRC requirements in 2016. Most of the D&D work has been completed as of March 31, 2018. The estimated fair value of the remaining costs to complete the D&D work, included in Accounts Payable and Accrued Liabilities on the condensed consolidated balance sheet, is $1.0 million as of March 31, 2018, and December 31, 2017.

Centrus has previously provided financial assurance to the NRC for the D&D work in the form of surety bonds that are fully cash collateralized by Centrus for $16.2 million . Centrus expects to receive cash when surety bonds are reduced and/or cancelled as the Company fulfills its D&D obligations and the NRC license for the test facility is terminated.

Centrus leases the Piketon facility from DOE. At the conclusion of the lease on June 30, 2019, without mutual agreement between Centrus and DOE regarding other possible uses for the facility, Centrus is obligated to return the facility to DOE in a condition that meets NRC requirements and in the same condition as the facility was in when it was leased to Centrus (other than due to normal wear and tear). Centrus must remove all Company-owned capital improvements at the Piketon facility, unless otherwise consented to by DOE, by the conclusion of the lease term. The estimated cost for these lease termination obligations, included in Accounts Payable and Accrued Liabilities on the condensed consolidated balance sheet, is $0.8 million as of March 31, 2018 and December 31, 2017.

Centrus has previously provided financial assurance to DOE for the lease obligations in the form of surety bonds that are fully cash collateralized by Centrus for $13.6 million . Centrus expects to receive cash when surety bonds are reduced and/or cancelled as the Company fulfills its lease termination obligations.

Financial Assurance for Workers' Compensatio n

The Company has provided financial assurance to states in which it was previously self-insured for workers' compensation in accordance with the state requirements in the form of a surety bond and a letter of credit that are fully cash collateralized by Centrus for $5.9 million . The surety bond and letter of credit will be cancelled and the Company expects to receive cash when each state determines the Company has no further workers' compensation obligations.

17

5. INVENTORIES

Centrus holds uranium at licensed locations in the form of natural uranium and as the uranium component of LEU. Centrus also holds SWU as the SWU component of LEU at licensed locations (e.g., fabricators) to meet book transfer requests by customers. Fabricators process LEU into fuel for use in nuclear reactors. Components of inventories follow (in millions):

| March 31, 2018 |

| December 31, 2017 | ||||||||||||||||||||

| Current Assets |

| Current Liabilities (a) |

| Inventories, Net |

| Current Assets |

| Current Liabilities (a) |

| Inventories, Net | ||||||||||||

Separative work units | $ | 53.9 | |

| $ | 23.3 | |

| $ | 30.6 | |

| $ | 47.2 | |

| $ | 15.0 | |

| $ | 32.2 | |

Uranium | 110.1 | |

| 70.5 | |

| 39.6 | |

| 105.9 | |

| 62.9 | |

| 43.0 | | ||||||

| $ | 164.0 | |

| $ | 93.8 | |

| $ | 70.2 | |

| $ | 153.1 | |

| $ | 77.9 | |

| $ | 75.2 | |

(a) | Inventories owed to customers and suppliers, included in current liabilities, include SWU and uranium inventories owed to fabricators. |

18

6. INTANGIBLE ASSETS

Intangible assets originated from the Company's reorganization and application of fresh start accounting as of the date the Company emerged from bankruptcy, September 30, 2014, and reflect the conditions at that time. The intangible asset related to the sales order book is amortized as the order book existing at emergence is reduced, principally as a result of deliveries to customers. The intangible asset related to customer relationships is amortized using the straight-line method over the estimated average useful life of 15 years. Amortization expense is presented below gross profit on the condensed consolidated statements of operations.

| March 31, 2018 |

| December 31, 2017 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

|

|

|

|

| (in millions) |

|

|

|

| ||||||||||||||

| Gross Carrying Amount |

| Accumulated Amortization |

| Net Amount |

| Gross Carrying Amount |

| Accumulated Amortization |

| Net Amount | ||||||||||||

Sales order book | $ | 54.6 | |

| $ | 26.1 | |

| $ | 28.5 | |

| $ | 54.6 | |

| $ | 25.9 | |

| $ | 28.7 | |

Customer relationships | 68.9 | |

| 16.1 | |

| 52.8 | |

| 68.9 | |

| 14.9 | |

| 54.0 | | ||||||

Total | $ | 123.5 | |

| $ | 42.2 | |

| $ | 81.3 | |

| $ | 123.5 | |

| $ | 40.8 | |

| $ | 82.7 | |

7. DEBT

A summary of long-term debt follows (in millions):

| Maturity |

| March 31, 2018 |

| December 31, 2017 | ||||

8.25% Notes: | Feb. 2027 |

|

|

|

| ||||

Principal |

|

| $ | 74.3 | |

| $ | 74.3 | |

Interest |

|

| 55.1 | |

| 58.1 | | ||

8.25% Notes |

|

| 129.4 | |

| 132.4 | | ||

8% PIK Toggle Notes | Sep. 2019 (a) |

| 32.1 | |

| 31.3 | | ||

Subtotal |

|

| 161.5 | |

| 163.7 | | ||

Less deferred issuance costs |

|

| 0.1 | |

| 0.1 | | ||

Total debt |

|

| 161.4 | |

| 163.6 | | ||

Less current portion |

|

| 6.1 | |

| 6.1 | | ||

Long-term debt |

|

| $ | 155.3 | |

| $ | 157.5 | |

(a) Maturity can be extended to September 2024 upon the satisfaction of certain funding conditions described in the Indenture.

Note Exchange

On February 14, 2017, pursuant to an exchange offer and consent solicitation, Centrus exchanged $204.9 million principal amount of the Company's 8% paid-in-kind ("PIK") toggle notes (the "8% PIK Toggle Notes") for $74.3 million principal amount of 8.25% notes due February 2027 (the "8.25% Notes"), 104,574 shares of Series B Preferred Stock with a liquidation preference of $1,000 per share, and $27.6 million of cash. The exchange is accounted for as a troubled debt restructuring under ASC Subtopic 470-60, Debt-Troubled Debt Restructurings by Debtors . The Company recognized the 8.25% Notes on the condensed consolidated balance sheet as the sum of the principal balance and all future interest payments and recognized a gain of $33.6 million related to the note exchange for the quarter ended March 31, 2017, which is net of transaction costs of $9.0 million and previously deferred issuance costs related to the 8% PIK Toggle Notes of $0.4 million . Refer to Note 12, Stockholders' Equity for details related to the preferred stock.

19

8.25% Notes

Interest on the 8.25% Notes is payable semi-annually in arrears as of February 28 and August 31 based on a 360-day year consisting of twelve 30-day months. The 8.25% Notes mature on February 28, 2027. As described above, all future interest payment obligations on the 8.25% Notes are included in the carrying value of the 8.25% Notes. As a result, the Company's reported interest expense will be less than its contractual interest payments throughout the term of the 8.25% Notes. As of March 31, 2018, and December 31, 2017, $6.1 million of interest is recorded as current and classified as Accounts Payable and Accrued Liabilities in the condensed consolidated balance sheet.

8% PIK Toggle Notes

Interest on the 8% PIK Toggle Notes is payable semi-annually in arrears on March 31 and September 30 based on a 360-day year consisting of twelve 30-day months. The principal amount is increased by any payment of interest in the form of PIK payments. The Company has the option to pay up to 5.5% per annum of interest due on the 8% PIK Toggle Notes in the form of PIK payments. For the semi-annual interest periods ended March 31, 2018, the Company elected to pay interest in the form of PIK payments at 5.5% per annum. Financing costs for the issuance of the 8% PIK Toggle Notes were deferred and are being amortized on a straight-line basis, which approximates the effective interest method, over the life of the 8% PIK Toggle Notes. The 8% PIK Toggle Notes mature on September 20, 2019. However, the maturity date may be extended to September 30, 2024, upon the satisfaction of certain funding conditions.

Additional terms and conditions of the 8.25% Notes and the 8% PIK Toggle Notes are described in Note 9, Debt , of the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2017.

8. FAIR VALUE

Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value of assets and liabilities, the following hierarchy is used in selecting inputs, with the highest priority given to Level 1, as these are the most transparent or reliable:

• | Level 1 – quoted prices for identical instruments in active markets. |

• | Level 2 – quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets. |

• | Level 3 – valuations derived using one or more significant inputs that are not observable. |

Financial Instruments Recorded at Fair Value (in millions)

| March 31, 2018 |

| December 31, 2017 | ||||||||||||||||||||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Total |

| Level 1 |

| Level 2 |

| Level 3 |

| Total | ||||||||||||||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Cash and cash equivalents | $ | 153.3 | |

| $ | - | |

| $ | - | |

| $ | 153.3 | |

| $ | 208.8 | |

| $ | - | |

| $ | - | |

| $ | 208.8 | |

Deferred compensation asset (a) | 1.4 | |

| - | |

| - | |

| 1.4 | |

| 1.4 | |

| - | |

| - | |

| 1.4 | | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Liabilities: |

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| | ||||||||||||

Deferred compensation obligation (a) | 1.4 | |

| - | |

| - | |

| 1.4 | |

| 1.4 | |

| - | |

| - | |

| 1.4 | | ||||||||

(a) | The deferred compensation obligation represents the balance of deferred compensation plus net investment earnings. The deferred compensation plan is funded through a rabbi trust. Trust funds are invested in mutual funds for which unit prices are quoted in active markets and are classified within Level 1 of the valuation hierarchy. |

20

There were no transfers between Level 1, 2 or 3 during the periods presented.

Other Financial Instruments

As of March 31, 2018 , and December 31, 2017, the balance sheet carrying amounts for Accounts Receivable , Accounts Payable and Accrued Liabilities (excluding the deferred compensation obligation described above), and Payables under SWU Purchase Agreements approximate fair value because of their short-term nature.

The carrying value and estimated fair value of long-term debt follow (in millions):

| March 31, 2018 |

| December 31, 2017 | ||||||||||||

| Carrying Value |

| Estimated Fair Value (a) |

| Carrying Value |

| Estimated Fair Value (a) | ||||||||

8.25% Notes | $ | 129.4 | | (b) | $ | 60.5 | |

| $ | 132.4 | | (b) | $ | 61.7 | |

8% PIK Toggle Notes | 32.1 | |

| 25.2 | |

| 31.3 | |

| 25.1 | | ||||

(a) Based on the most recent trading price as of the balance sheet date, which is considered a Level 2 input based on the frequency of trading.

(b) | The carrying value of the 8.25% Notes consists of the principal balance of $74.3 million and the sum of current and noncurrent interest payment obligations until maturity. Refer to Note 7, Debt . |

9. PENSION AND POSTRETIREMENT HEALTH AND LIFE BENEFITS

The components of net periodic benefit expense (income) for the defined benefit pension plans were as follows (in millions):

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

Service costs | $ | 0.8 | |

| $ | 0.9 | |

Interest costs | 7.2 | |

| 8.1 | | ||

Expected gains on plan assets | (10.2 | ) |

| (10.2 | ) | ||

Net periodic benefit income | $ | (2.2 | ) |

| $ | (1.2 | ) |

The components of net periodic benefit expense for the postretirement health and life benefit plans were as follows (in millions):

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

Interest costs | $ | 1.4 | |

| $ | 1.8 | |

Amortization of prior service credits | - | |

| (0.1 | ) | ||

Net periodic benefit expense | $ | 1.4 | |

| $ | 1.7 | |

The Company reports service costs for its defined benefit pension plans and its postretirement health and life benefit plans in Cost of Sales and Selling, General and Administrative Expenses . The remaining components of net periodic benefit expense (income) are reported as Nonoperating Components of Net Periodic Benefit Expense (Income).

21

10. NET INCOME (LOSS) PER COMMON SHARE

Basic net income (loss) per common share is calculated by dividing income (loss) allocable to common stockholders by the weighted average number of shares of common stock outstanding during the period. In calculating diluted net income (loss) per common share, the number of shares is increased by the weighted average number of potential shares related to stock compensation awards. No dilutive effect is recognized in a period in which a net loss has occurred.

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

Net income (loss) allocable to common stockholders (in millions) | $ | (27.0 | ) |

| $ | 6.6 | |

|

|

|

| ||||

Shares in thousands: |

|

|

| ||||

Average common shares outstanding - basic | 9,103 | |

| 9,063 | | ||

Potentially dilutive shares related to stock options (a) | - | |

| 111 | | ||

Average common shares outstanding - diluted | 9,103 | |

| 9,174 | | ||

|

|

|

| ||||

Net income (loss) per common share (in dollars): |

|

|

| ||||

Basic | $ | (2.97 | ) |

| $ | 0.73 | |

Diluted | $ | (2.97 | ) |

| $ | 0.72 | |

(a) | For the three months ended March 31, 2018, common stock equivalents of less than 0.1 million shares are excluded from the diluted calculation as a result of the net loss. Common stock equivalents related to stock options were less than 0.1 million shares for the three months ended March 31, 2017. |

Options outstanding and considered anti-dilutive as their exercise price exceeded the average share market price totaled 0.4 million shares and 0 shares for the three months ended March 31, 2018 and 2017, respectively.

22

11. COMMITMENTS AND CONTINGENCIES

Commitments under SWU Purchase Agreement

TENEX

A major supplier of SWU to the Company is the Russian government entity Joint Stock Company "TENEX" ("TENEX"). Under a 2011 agreement with TENEX, as amended, (the "Russian Supply Agreement"), the Company purchases SWU contained in LEU received from TENEX, and the Company delivers natural uranium to TENEX for the LEU's uranium component. The LEU that Centrus obtains from TENEX under the agreement is subject to quotas and other restrictions applicable to commercial Russian LEU. The Company may reschedule SWU quantities scheduled for purchase through 2022 into the period 2023–2026, in return for the purchase of additional SWU in those years. Depending on the total purchase obligations rescheduled to 2023–2026, the Company may defer certain limited quantities beyond 2026.

The Russian Supply Agreement provides that the Company must pay for all SWU in its minimum purchase obligation each year, even if it fails to submit orders for such SWU. The Company would then have the right to take the unordered SWU in the following year. Pricing terms for SWU under the Russian Supply Agreement are based on a mix of market-related price points and other factors.

Orano

On April 27, 2018, the Company's operating subsidiary, Enrichment Corp., entered into a long-term agreement (the "Orano Supply Agreement") with Orano Cycle (formerly, AREVA NC) ("Orano") for the long-term supply to the Company of SWU contained in LEU, commencing as early as 2021. See Note 14, Subsequent Event .

Milestones Under the 2002 DOE-USEC Agreement

The Company and DOE signed an agreement dated June 17, 2002, as amended (the "2002 DOE-USEC Agreement"), pursuant to which the parties made long-term commitments directed at resolving issues related to the stability and security of the domestic uranium enrichment industry. DOE consented to the assumption by Centrus of the 2002 DOE-USEC Agreement and other agreements between the Company and DOE subject to an express reservation of all rights, remedies and defenses by DOE and Centrus under those agreements as part of the Company's Chapter 11 bankruptcy process. The 2002 DOE-USEC Agreement requires Centrus to develop, demonstrate and deploy advanced enrichment technology in accordance with milestones and provides for remedies in the event of a failure to meet a milestone under certain circumstances.

DOE has specific remedies under the 2002 DOE-USEC Agreement if Centrus fails to meet a milestone that would adversely impact its ability to begin commercial operations of the American Centrifuge Plant on schedule, and such delay was within Centrus' control or was due to its fault or negligence or if Centrus abandons or constructively abandons the commercial deployment of an advanced enrichment technology. These remedies include terminating the 2002 DOE-USEC Agreement, revoking Centrus' access to DOE's centrifuge technology that is required for the success of the American Centrifuge project, requiring Centrus to transfer certain rights in the American Centrifuge technology and facilities to DOE, and requiring Centrus to reimburse DOE for certain costs associated with the American Centrifuge project.

The 2002 DOE-USEC Agreement provides that if a delaying event beyond the control and without the fault or negligence of Centrus occurs that could affect Centrus' ability to meet an American Centrifuge Plant milestone, DOE and Centrus will jointly meet to discuss in good faith possible adjustments to the milestones as appropriate to accommodate the delaying event. The Company notified DOE that it had not met the June 2014 milestone within the time period provided due to events beyond its control and without the fault or negligence of the Company. The assumption of the 2002 DOE-USEC Agreement provided for under the Plan of Reorganization did not affect the ability of either party to assert all rights, remedies and defenses under the agreement and all such rights, remedies

23

and defenses are specifically preserved and all time limits tolled expressly including all rights, remedies and defenses and time limits relating to any missed milestones. DOE and Centrus have agreed that all rights, remedies and defenses of the parties with respect to any missed milestones since March 5, 2014, including the June 2014 and November 2014 milestones, and all other matters under the 2002 DOE-USEC Agreement continue to be preserved, and that the time limits for each party to respond to any missed milestones continue to be tolled.

Legal Matters

Centrus is subject to various legal proceedings and claims, either asserted or unasserted, which arise in the ordinary course of business. While the outcome of these claims cannot be predicted with certainty, Centrus does not believe that the outcome of any of these legal matters will have a material adverse effect on its results of operations or financial condition.

24

12. STOCKHOLDERS' EQUITY

Series B Preferred Stock

On February 14, 2017, Centrus issued 104,574 shares of Series B Preferred Stock as part of the securities exchange described in Note 7, Debt . The issuance of the Series B Preferred Stock was a non-cash financing transaction. The Series B Preferred Stock has a par value of $1.00 per share and a liquidation preference of $1,000 per share (the "Liquidation Preference"). The Series B Preferred Stock is recorded on the condensed consolidated balance sheet at fair value less transaction costs, or $4.6 million , as of March 31, 2018, and December 31, 2017.

Holders of the Series B Preferred Stock are entitled to cumulative dividends of 7.5% per annum of the Liquidation Preference. Centrus is obligated to pay cash dividends on the Series B Preferred Stock in an amount equal to the Liquidation Preference to the extent that dividends are declared by the Board and:

(a) | its pension plans and Enrichment Corp.'s pension plans are at least 90% funded on a variable rate premium calculation in the current plan year; |

(b) | its net income calculated in accordance with GAAP (excluding the effect of pension remeasurement) for the immediately preceding fiscal quarter exceeds $7.5 million ; |

(c) | its free cash flow (defined as the sum of cash provided by (used in) operating activities and cash provided by (used in) investing activities) for the immediately preceding four fiscal quarters exceeds $35 million ; |

(d) | the balance of cash and cash equivalents calculated in accordance with GAAP on the last day of the immediately preceding quarter would exceed $150 million after pro forma application of the dividend payment; and |

(e) | dividends may be legally paid under Delaware law. |

Centrus has not met these criteria for the periods from issuance through March 31, 2018, and has not declared, accrued or paid dividends on the Series B Preferred Stock as of March 31, 2018. Dividends on the Series B Preferred Stock are cumulative to the extent not paid at any quarter-end, whether or not declared and whether or not there are assets of the Company legally available for the payment of such dividends in whole or in part. As of March 31, 2018, the Series B Preferred Stock has an aggregate liquidation preference of $113.5 million , including accumulated dividends of $6.9 million . As of December 31, 2017, the Series B Preferred Stock had an aggregate liquidation preference of $111.5 million , including accumulated dividends of $6.9 million .

Outstanding shares of the Series B Senior Preferred Stock are redeemable at the Company's option, in whole or in part, for an amount of cash equal to the Liquidation Preference, plus an amount equal to the accrued and unpaid dividends, if any, whether or not declared, through date of redemption.

Rights Agreement

On April 6, 2016 (the "Effective Date"), the Company's Board of Directors (the "Board") adopted a Section 382 Rights Agreement (the "Rights Agreement"). The Board adopted the Rights Agreement in an effort to protect shareholder value by, among other things, attempting to protect against a possible limitation on the Company's ability to use its net operating loss carryforwards and other tax benefits, which may be used to reduce potential future income tax obligations. As reported on the Company's Annual Report on Form 10-K for the year ended December 31, 2017, the Company had federal net operating losses of $789.7 million as of December 31, 2017, that currently expire through 2037.

25

In connection with the adoption of the Rights Agreement, the Board declared a dividend of one preferred-share-purchase-right for each share of the Company's Class A Common Stock and Class B Common Stock outstanding as of the Effective Date. The rights initially trade together with the common stock and are not exercisable. In the absence of further action by the Board, the rights would generally become exercisable and allow a holder to acquire shares of a new series of the Company's preferred stock if any person or group acquires 4.99% or more of the outstanding shares of the Company's common stock, or if a person or group that already owns 4.99% or more of the Company's Class A Common Stock acquires additional shares representing 0.5% or more of the outstanding shares of the Company's Class A Common Stock. The rights beneficially owned by the acquirer would become null and void, resulting in significant dilution in the ownership interest of such acquirer.

The Board may exempt any acquisition of the Company's common stock from the provisions of the Rights Agreement if it determines that doing so would not jeopardize or endanger the Company's use of its tax assets or is otherwise in the best interests of the Company. The Board also has the ability to amend or terminate the Rights Agreement prior to a triggering event.

Effective on February 14, 2017, in connection with the settlement and completion of the exchange offer and consent solicitation, the Company amended the Rights Agreement solely to exclude acquisitions of the Series B Preferred Stock issued as part of the exchange offer and consent solicitation from the definition of "Common Shares."

The Company's stockholders approved the Rights Agreement at the 2017 annual meeting of stockholders on May 31, 2017. Unless earlier terminated in accordance with the Rights Agreement, the rights issued under the Rights Agreement expire on April 6, 2019.

Shares Outstanding

Changes in the number of shares outstanding follow:

| Preferred Stock, Series B |

| Common Stock, Class A |

| Common Stock, Class B | |||

|

|

|

|

|

| |||

Balance at December 31, 2016 | - | |

| 7,563,600 | |

| 1,436,400 | |

Issuance of Preferred Stock | 104,574 | |

| - | |

| - | |

Balance at March 31, 2017 | 104,574 | |

| 7,563,600 | |

| 1,436,400 | |

|

|

|

|

|

| |||

Balance at December 31, 2017 and March 31, 2018 | 104,574 | |

| 7,632,669 | |

| 1,406,082 | |

Accumulated Other Comprehensive Income (Loss)

The sole component of accumulated other comprehensive income (loss) ("AOCI") relates to activity in the accounting for pension and postretirement health and life benefit plans. Amortization of prior service credits is reclassified from AOCI and included in the computation of net periodic benefit expense as detailed in Note 9, Pension and Postretirement Health and Life Benefits .

26

13. SEGMENT INFORMATION

Gross profit is Centrus' measure for segment reporting. There were no intersegment sales in the periods presented. Refer to Note 2, Revenue Recognition and Contracts with Customers, for additional details on revenue for each segment.

| Three Months Ended | ||||||

| 2018 |

| 2017 | ||||

| (in millions) | ||||||

Revenue |

|

|

| ||||

LEU Segment: |

|

|

| ||||

Separative work units | $ | 17.7 | |

| $ | 0.8 | |

Uranium | 3.6 | |

| - | | ||

| 21.3 | |

| 0.8 | | ||

Contract Services Segment | 14.4 | |

| 6.4 | | ||

Revenue | $ | 35.7 | |

| $ | 7.2 | |

|

|

|

| ||||

Segment Gross Profit (Loss) |

|

|

| ||||

LEU Segment | $ | (13.5 | ) |

| $ | (1.9 | ) |

Contract Services Segment | 7.9 | |

| (1.0 | ) | ||

Gross loss | $ | (5.6 | ) |

| $ | (2.9 | ) |

14. SUBSEQUENT EVENT