UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended October 31, 2015

Commission File Number 1-6049

|

TARGET CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota |

| 41-0215170 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

1000 Nicollet Mall, Minneapolis, Minnesota |

| 55403 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code: 612/304-6073

Former name, former address and former fiscal year, if changed since last report: N/A

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Act).

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller Reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Indicate the number of shares outstanding of each of registrant's classes of common stock, as of the latest practicable date. Total shares of common stock, par value $0.0833, outstanding at November 19, 2015 were 616,051,610.

TARGET CORPORATION

TABLE OF CONTENTS

PART I | FINANCIAL INFORMATION |

|

Item 1. | Financial Statements |

|

| Consolidated Statements of Operations | 1 |

| Consolidated Statements of Comprehensive Income | 2 |

| Consolidated Statements of Financial Position | 3 |

| Consolidated Statements of Cash Flows | 4 |

| Consolidated Statements of Shareholders' Investment | 5 |

| Notes to Consolidated Financial Statements | 6 |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 15 |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 25 |

Item 4. | Controls and Procedures | 25 |

|

|

|

PART II | OTHER INFORMATION |

|

Item 1. | Legal Proceedings | 26 |

Item 1A. | Risk Factors | 26 |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 26 |

Item 3. | Defaults Upon Senior Securities | 26 |

Item 4. | Mine Safety Disclosures | 26 |

Item 5. | Other Information | 26 |

Item 6. | Exhibits | 27 |

|

|

|

Signature |

| 28 |

Exhibit Index |

| 29 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Consolidated Statements of Operations |

|

|

|

|

| ||||||||

| Three Months Ended | Nine Months Ended | |||||||||||

(millions, except per share data) (unaudited) | October 31, | |

| November 1, | | October 31, | | November 1, | | ||||

Sales | $ | 17,613 | |

| $ | 17,254 | | $ | 52,159 | | $ | 50,868 | |

Cost of sales | 12,440 | |

| 12,171 | | 36,402 | | 35,716 | | ||||

Selling, general and administrative expenses | 3,736 | |

| 3,644 | | 10,745 | | 10,619 | | ||||

Depreciation and amortization | 561 | |

| 535 | | 1,651 | | 1,584 | | ||||

Earnings from continuing operations before interest expense and income taxes | 876 | |

| 904 | | 3,361 | | 2,949 | | ||||

Net interest expense | 151 | |

| 146 | | 455 | | 730 | | ||||

Earnings from continuing operations before income taxes | 725 | |

| 758 | | 2,906 | | 2,219 | | ||||

Provision for income taxes | 249 | |

| 232 | | 1,006 | | 730 | | ||||

Net earnings from continuing operations | 476 | |

| 526 | | 1,900 | | 1,489 | | ||||

Discontinued operations, net of tax | 73 | |

| (174 | ) | 37 | | (485 | ) | ||||

Net earnings | $ | 549 | |

| $ | 352 | | $ | 1,937 | | $ | 1,004 | |

Basic earnings / (loss) per share |

|

|

|

|

| ||||||||

Continuing operations | $ | 0.76 | |

| $ | 0.83 | | $ | 3.00 | | $ | 2.35 | |

Discontinued operations | 0.12 | |

| (0.28 | ) | 0.06 | | (0.76 | ) | ||||

Net earnings per share | $ | 0.88 | |

| $ | 0.55 | | $ | 3.06 | | $ | 1.58 | |

Diluted earnings / (loss) per share |

|

|

|

|

| ||||||||

Continuing operations | $ | 0.76 | |

| $ | 0.82 | | $ | 2.98 | | $ | 2.33 | |

Discontinued operations | 0.11 | |

| (0.27 | ) | 0.06 | | (0.76 | ) | ||||

Net earnings per share | $ | 0.87 | |

| $ | 0.55 | | $ | 3.03 | | $ | 1.57 | |

Weighted average common shares outstanding |

|

|

|

|

| ||||||||

Basic | 623.7 | |

| 634.0 | | 633.5 | | 633.6 | | ||||

Dilutive impact of share-based awards | 5.1 | |

| 5.6 | | 5.2 | | 5.1 | | ||||

Diluted | 628.8 | |

| 639.6 | | 638.7 | | 638.7 | | ||||

Antidilutive shares | - | |

| 2.3 | | - | | 4.2 | | ||||

Note: Per share amounts may not foot due to rounding.

See accompanying Notes to Consolidated Financial Statements.

1

Consolidated Statements of Comprehensive Income |

|

| ||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||

(millions) (unaudited) | October 31, | |

| November 1, | | October 31, | |

| November 1, | | ||||

Net earnings | $ | 549 | |

| $ | 352 | | $ | 1,937 | |

| $ | 1,004 | |

Other comprehensive income, net of tax |

| |

|

| |

| |

|

| | ||||

Pension and other benefit liabilities, net of taxes of $8, $4, $84 and $12 | 13 | |

| 7 | | 130 | |

| 21 | | ||||

Currency translation adjustment and cash flow hedges, net of taxes of $1, $1, $2 and $2 | (1 | ) |

| (138 | ) | - | |

| (53 | ) | ||||

Other comprehensive income / (loss) | 12 | |

| (131 | ) | 130 | |

| (32 | ) | ||||

Comprehensive income | $ | 561 | |

| $ | 221 | | $ | 2,067 | |

| $ | 972 | |

See accompanying Notes to Consolidated Financial Statements.

2

Consolidated Statements of Financial Position |

| |

|

| |

|

| | |||

(millions) | October 31, | |

| January 31, | |

| November 1, | | |||

Assets | (unaudited) | |

|

| |

| (unaudited) | | |||

Cash and cash equivalents, including short term investments of $1,154, $1,520 and $4 | $ | 1,977 | |

| $ | 2,210 | |

| $ | 718 | |

Inventory | 10,374 | |

| 8,283 | |

| 9,957 | | |||

Assets of discontinued operations | 451 | |

| 1,333 | |

| 808 | | |||

Other current assets | 2,402 | |

| 2,261 | |

| 2,355 | | |||

Total current assets | 15,204 | |

| 14,087 | |

| 13,838 | | |||

Property and equipment |

| |

|

| |

|

| | |||

Land | 6,118 | |

| 6,127 | |

| 6,111 | | |||

Buildings and improvements | 26,912 | |

| 26,613 | |

| 26,439 | | |||

Fixtures and equipment | 5,283 | |

| 5,329 | |

| 5,247 | | |||

Computer hardware and software | 2,652 | |

| 2,552 | |

| 2,437 | | |||

Construction-in-progress | 428 | |

| 424 | |

| 440 | | |||

Accumulated depreciation | (15,921 | ) |

| (15,093 | ) |

| (14,641 | ) | |||

Property and equipment, net | 25,472 | |

| 25,952 | |

| 26,033 | | |||

Noncurrent assets of discontinued operations | 42 | |

| 442 | |

| 5,540 | | |||

Other noncurrent assets | 978 | |

| 923 | |

| 1,050 | | |||

Total assets | $ | 41,696 | |

| $ | 41,404 | |

| $ | 46,461 | |

Liabilities and shareholders' investment |

| |

|

| |

|

| | |||

Accounts payable | $ | 8,904 | |

| $ | 7,759 | |

| $ | 8,839 | |

Accrued and other current liabilities | 3,868 | |

| 3,783 | |

| 3,697 | | |||

Current portion of long-term debt and other borrowings | 825 | |

| 91 | |

| 483 | | |||

Liabilities of discontinued operations | 261 | |

| 103 | |

| 506 | | |||

Total current liabilities | 13,858 | |

| 11,736 | |

| 13,525 | | |||

Long-term debt and other borrowings | 11,951 | |

| 12,705 | |

| 12,623 | | |||

Deferred income taxes | 1,316 | |

| 1,321 | |

| 1,195 | | |||

Noncurrent liabilities of discontinued operations | 36 | |

| 193 | |

| 1,292 | | |||

Other noncurrent liabilities | 1,279 | |

| 1,452 | |

| 1,453 | | |||

Total noncurrent liabilities | 14,582 | |

| 15,671 | |

| 16,563 | | |||

Shareholders' investment |

| |

|

| |

|

| | |||

Common stock | 52 | |

| 53 | |

| 53 | | |||

Additional paid-in capital | 5,314 | |

| 4,899 | |

| 4,612 | | |||

Retained earnings | 8,359 | |

| 9,644 | |

| 12,631 | | |||

Accumulated other comprehensive loss |

| |

|

| |

|

| | |||

Pension and other benefit liabilities | (431 | ) |

| (561 | ) |

| (401 | ) | |||

Currency translation adjustment and cash flow hedges | (38 | ) |

| (38 | ) |

| (522 | ) | |||

Total shareholders' investment | 13,256 | |

| 13,997 | |

| 16,373 | | |||

Total liabilities and shareholders' investment | $ | 41,696 | |

| $ | 41,404 | |

| $ | 46,461 | |

Common Stock Authorized 6,000,000,000 shares, $.0833 par value; 618,604,168 , 640,213,987 and 634,378,337 shares issued and outstanding at October 31, 2015 , January 31, 2015 and November 1, 2014 , respectively.

Preferred Stock Authorized 5,000,000 shares, $.01 par value; no shares were issued or outstanding at October 31, 2015 , January 31, 2015 or November 1, 2014 .

See accompanying Notes to Consolidated Financial Statements.

3

Consolidated Statements of Cash Flows |

|

|

|

| ||||

| Nine Months Ended |

| ||||||

(millions) (unaudited) | October 31, | |

| November 1, | |

| ||

Operating activities |

| |

|

| |

| ||

Net earnings | $ | 1,937 | |

| $ | 1,004 | |

|

Earnings / (losses) from discontinued operations, net of tax | 37 | |

| (485 | ) |

| ||

Net earnings from continuing operations | 1,900 | |

| 1,489 | |

| ||

Adjustments to reconcile net earnings to cash provided by operations: |

| |

|

| |

| ||

Depreciation and amortization | 1,651 | |

| 1,584 | |

| ||

Share-based compensation expense | 84 | |

| 61 | |

| ||

Deferred income taxes | (111 | ) |

| (213 | ) |

| ||

Loss on debt extinguishment | - | |

| 285 | |

| ||

Noncash (gains) / losses and other, net | (25 | ) |

| (33 | ) |

| ||

Changes in operating accounts |

| |

|

|

| |||

Inventory | (2,096 | ) |

| (2,186 | ) |

| ||

Other assets | 95 | |

| 92 | |

| ||

Accounts payable and accrued liabilities | 1,458 | |

| 1,520 | |

| ||

Cash provided by operating activities-continuing operations | 2,956 | |

| 2,599 | |

| ||

Cash provided by / (required for) operating activities-discontinued operations | 804 | |

| (549 | ) |

| ||

Cash provided by operations | 3,760 | |

| 2,050 | |

| ||

Investing activities |

| |

|

| |

| ||

Expenditures for property and equipment | (1,129 | ) |

| (1,362 | ) |

| ||

Proceeds from disposal of property and equipment | 21 | |

| 84 | |

| ||

Proceeds from sale of business | 8 | |

| - | |

| ||

Cash paid for acquisitions, net of cash assumed | - | |

| (18 | ) |

| ||

Other investments | 12 | |

| 88 | |

| ||

Cash required for investing activities-continuing operations | (1,088 | ) |

| (1,208 | ) |

| ||

Cash provided by / (required for) investing activities-discontinued operations | 19 | |

| (208 | ) |

| ||

Cash required for investing activities | (1,069 | ) |

| (1,416 | ) |

| ||

Financing activities |

| |

|

| |

| ||

Change in commercial paper, net | - | |

| 305 | |

| ||

Additions to long-term debt | - | |

| 1,993 | |

| ||

Reductions of long-term debt | (72 | ) |

| (2,062 | ) |

| ||

Dividends paid | (1,017 | ) |

| (874 | ) |

| ||

Repurchase of stock | (2,179 | ) |

| - | |

| ||

Stock option exercises and related tax benefit | 344 | |

| 88 | |

| ||

Cash required for financing activities | (2,924 | ) |

| (550 | ) |

| ||

Effect of exchange rate changes on cash and cash equivalents | - | |

| 1 | |

| ||

Net (decrease) / increase in cash and cash equivalents | (233 | ) |

| 85 | |

| ||

Cash and cash equivalents at beginning of period | 2,210 | |

| 695 | | (a) | ||

Cash and cash equivalents at end of period | $ | 1,977 | |

| $ | 780 | | (b) |

(a) Includes cash of our discontinued operations of $25 million at February 1, 2014.

(b) Includes cash of our discontinued operations of $62 million at November 1, 2014.

See accompanying Notes to Consolidated Financial Statements.

4

Consolidated Statements of Shareholders' Investment | ||||||||||||||||||||||

| Common | |

| Stock | |

| Additional | |

|

| |

| Accumulated Other | |

|

| | |||||

| Stock | |

| Par | |

| Paid-in | |

| Retained | |

| Comprehensive | |

|

| | |||||

(millions, except per share data) | Shares | |

| Value | |

| Capital | |

| Earnings | |

| Income / (Loss) | |

| Total | | |||||

February 1, 2014 | 632.9 | |

| $ | 53 | |

| $ | 4,470 | |

| $ | 12,599 | |

| $ | (891 | ) |

| $ | 16,231 | |

Net earnings | - | |

| - | |

| - | |

| (1,636 | ) |

| - | |

| (1,636 | ) | |||||

Other comprehensive income | - | |

| - | |

| - | |

| - | |

| 292 | |

| 292 | | |||||

Dividends declared | - | |

| - | |

| - | |

| (1,273 | ) |

| - | |

| (1,273 | ) | |||||

Repurchase of stock | (0.8 | ) |

| - | |

| - | |

| (46 | ) |

| - | |

| (46 | ) | |||||

Stock options and awards | 8.1 | |

| - | |

| 429 | |

| - | |

| - | |

| 429 | | |||||

January 31, 2015 | 640.2 | |

| $ | 53 | |

| $ | 4,899 | |

| $ | 9,644 | |

| $ | (599 | ) |

| $ | 13,997 | |

(unaudited) |

| |

|

| |

|

| |

|

| |

|

| |

|

| | |||||

Net earnings | - | |

| - | |

| - | |

| 1,937 | |

| - | |

| 1,937 | | |||||

Other comprehensive income | - | |

| - | |

| - | |

| - | |

| 130 | |

| 130 | | |||||

Dividends declared | - | |

| - | |

| - | |

| (1,039 | ) |

| - | |

| (1,039 | ) | |||||

Repurchase of stock | (27.3 | ) |

| (2 | ) |

| - | |

| (2,183 | ) |

| - | |

| (2,185 | ) | |||||

Stock options and awards | 5.7 | |

| 1 | |

| 415 | |

| - | |

| - | |

| 416 | | |||||

October 31, 2015 | 618.6 | |

| $ | 52 | |

| $ | 5,314 | |

| $ | 8,359 | |

| $ | (469 | ) |

| $ | 13,256 | |

We declared $1.64 and $1.47 per share dividends for the nine months ended October 31, 2015 and November 1, 2014 , respectively, and $1.99 per share for the fiscal year ended January 31, 2015 .

See accompanying Notes to Consolidated Financial Statements.

5

Notes to Consolidated Financial Statements (unaudited)

1. Accounting Policies

These financial statements should be read in conjunction with the financial statement disclosures in our 2014 Form 10-K. We use the same accounting policies in preparing quarterly and annual financial statements. All adjustments necessary for a fair presentation of quarterly operating results are reflected herein and are of a normal, recurring nature. Certain prior-year amounts have been reclassified to conform to the current year presentation. Unless otherwise noted, amounts presented within the Notes to Consolidated Financial Statements refer to our continuing operations.

Due to the seasonal nature of our business, quarterly revenues, expenses, earnings and cash flows are not necessarily indicative of the results that may be expected for the full year.

2. Pharmacies and Clinics Transaction

On June 12, 2015, we entered into an asset purchase agreement with CVS Pharmacy, Inc. (CVS) to sell our pharmacy and clinic businesses for cash consideration of approximately $1.9 billion . The closing of the transaction is subject to regulatory approval and other customary conditions. Either party will be permitted to terminate the agreement if the closing has not occurred on or before March 15, 2016 (or September 15, 2016 solely in the event that, as of March 15, 2016, all conditions other than regulatory approval have been satisfied or waived). Following the closing, CVS will operate the pharmacy and clinic businesses in our stores on a long term basis.

The agreement includes the sale of inventory and other assets. These currently held-for-sale assets have been classified as follows.

(millions) |

| October 31, | |

| January 31, | |

| November 1, | | |||

Inventory included in other current assets |

| $ | 456 | |

| $ | 506 | | (a) | $ | 507 | |

Other current assets |

| 15 | |

| 3 | | (a) | 3 | | |||

Other noncurrent assets |

| - | |

| 12 | | (a) | 12 | | |||

Total |

| $ | 471 | |

| $ | 521 | |

| $ | 522 | |

(a) Amounts have been updated to be comparable with the current period.

6

3. Canada Exit

Background

On January 15, 2015, Target Canada Co. and certain other wholly owned subsidiaries of Target (collectively Canada Subsidiaries), comprising substantially all of our Canadian operations and our historical Canadian Segment, filed for protection (the Filing) under the Companies' Creditors Arrangement Act (CCAA) with the Ontario Superior Court of Justice in Toronto (the Court) and were deconsolidated. The Canada Subsidiaries are executing a liquidation through the CCAA process.

Discontinued Operations | Three Months Ended |

| Nine Months Ended | ||||||||||

(millions) | October 31, | | November 1, | |

| October 31, | | November 1, | | ||||

Sales | $ | - | | $ | 479 | |

| $ | - | | $ | 1,321 | |

Cost of sales | - | | 386 | |

| - | | 1,072 | | ||||

SG&A expenses | - | | 250 | |

| - | | 685 | | ||||

Depreciation and amortization | - | | 70 | |

| - | | 207 | | ||||

Interest expense | - | | 19 | |

| - | | 57 | | ||||

Pretax loss from operations | - | | (246 | ) |

| - | | (700 | ) | ||||

Pretax exit costs (a) | (2 | ) | - | |

| (115 | ) | - | | ||||

Income taxes | 75 | | 72 | |

| 152 | | 215 | | ||||

Earnings / (losses) from discontinued operations | $ | 73 | | $ | (174 | ) |

| $ | 37 | | $ | (485 | ) |

(a) For the three and nine months ended October 31, 2015, pretax exit costs related to our ongoing support of the liquidation process and other professional fees. For the nine months ended October 31, 2015, pretax exits costs also included an increase to our accrual for the estimated probable losses related to claims that may be asserted against us, primarily under guarantees of certain leases.

Recorded Assets and Liabilities

Assets and Liabilities of Discontinued Operations | |||||||||||

(millions) | October 31, | | January 31, | |

|

| November 1, | | |||

Income tax benefit | $ | 181 | | $ | 1,430 | |

| Inventory | $ | 603 | |

Receivables from Canada Subsidiaries | 312 | | 326 | |

| Property and equipment, net | 4,846 | | |||

Receivables under the debtor-in-possession credit facility | - | | 19 | |

| Other | 899 | | |||

Total assets | $ | 493 | | $ | 1,775 | |

| Total assets | $ | 6,348 | |

|

|

|

| Capital lease obligations | $ | 1,198 | | ||||

Accrued liabilities | $ | 297 | | $ | 296 | |

| Accounts payable and other liabilities | 600 | | |

Total liabilities | $ | 297 | | $ | 296 | |

| Total liabilities | $ | 1,798 | |

Accrued liabilities include estimated probable losses related to claims that may be asserted against us, primarily under guarantees of certain leases. The beneficiaries of those guarantees may seek damages or other related relief as a result of our exit from Canada. Our probable loss estimate is based on the expectation that claims will be asserted against us and negotiated settlements will be reached, and not on any determination that it is probable we would be found liable were these claims to be litigated. Our estimates involve significant judgment and are based on currently available information, an assessment of the validity of certain claims and estimated payments by the Canada Subsidiaries. We are not able to reasonably estimate a range of possible losses in excess of the accrual because there are significant factual and legal issues to be resolved. We believe that it is reasonably possible that future changes to our estimates of loss and the ultimate amount paid on these claims could be material to our results of operations in future periods. Any such losses would be reported in discontinued operations.

Receivables from the Canada Subsidiaries primarily relate to loans made to fund the operations of the Canada Subsidiaries and receivables generated in the ordinary course of business prior to deconsolidation. To assess recoverability, we estimated the fair value of the underlying net assets of the Canada Subsidiaries available for distribution to their creditors in relation to the estimated creditor claims and the priority of these claims. Our estimates involve significant judgment and are based on currently available

7

information, an assessment of the validity of certain claims and estimated payments by the Canada Subsidiaries. Our ultimate recovery is subject to the final liquidation value of the Canada Subsidiaries.

On November 23, 2015, we reached a settlement with an entity that controls guaranteed leases representing approximately 30 percent of the recorded accrual. Under the settlement terms, this entity has subrogated to us their claims against the Canada Subsidiaries. The settlement amount is materially consistent with our previously recorded accrual.

Income Taxes

During the three and nine months ended October 31, 2015, we recognized net tax benefits of $75 million and $152 million , respectively, in discontinued operations, which primarily relate to our pretax exit costs and change in the estimated tax benefit from our investment losses in Canada. During the fourth quarter of 2014, we recognized a tax benefit of $1,627 million in discontinued operations. The majority of the tax benefit was received in the first quarter of 2015, and we expect to use substantially all of the remainder to reduce our 2015 estimated tax payments.

4. Restructuring Initiatives

In 2015, we initiated a series of headquarters workforce reductions intended to increase organizational effectiveness and provide cost savings that can be reinvested in our growth initiatives. As a result, we recorded $21 million and $135 million of severance and other benefits-related charges within selling, general and administrative expenses (SG&A) during the three and nine months ended October 31, 2015, respectively. The vast majority of these expenses require cash expenditures. These costs were not included in our segment results.

Restructuring Costs | October 31, 2015 | ||||||

(millions) | Three Months Ended | |

| Nine Months Ended | | ||

Severance | $ | 19 | |

| $ | 127 | |

Pension and other | 2 | |

| 8 | | ||

Total | $ | 21 | |

| $ | 135 | |

Accruals for restructuring costs are included in other current liabilities.

Restructuring-Related Liabilities (millions) | Severance | |

| Pension and Other | |

| Total | | |||

Restructuring liability as of January 31, 2015 | $ | - | |

| $ | - | |

| $ | - | |

Charges during period | 127 | |

| 8 | |

| 135 | | |||

Paid or otherwise settled | (113 | ) |

| (8 | ) |

| (121 | ) | |||

Restructuring liability as of October 31, 2015 | $ | 14 | |

| $ | - | |

| $ | 14 | |

8

5. Fair Value Measurements

Fair value measurements are reported in one of three levels based on the lowest level of significant input used: Level 1 (unadjusted quoted prices in active markets); Level 2 (observable market inputs, other than quoted prices included in Level 1); and Level 3 (unobservable inputs that cannot be corroborated by observable market data).

Fair Value Measurements - Recurring Basis |

| Fair Value at | ||||||||||

(millions) | Pricing Category | October 31, | |

| January 31, | |

| November 1, | | |||

Assets |

|

| |

|

| |

|

| | |||

Cash and cash equivalents |

|

| |

|

| |

|

| | |||

Short-term investments | Level 1 | $ | 1,154 | |

| $ | 1,520 | |

| $ | 4 | |

Other current assets |

|

| |

|

| |

|

| | |||

Interest rate swaps (a) | Level 2 | 19 | |

| - | |

| - | | |||

Prepaid forward contracts | Level 1 | 34 | |

| 38 | |

| 42 | | |||

Beneficial interest asset | Level 3 | 23 | |

| 43 | |

| 50 | | |||

Other noncurrent assets |

|

| |

|

| |

|

| | |||

Interest rate swaps (a) | Level 2 | 22 | |

| 65 | |

| 51 | | |||

Company-owned life insurance investments (b) | Level 2 | 325 | |

| 322 | |

| 322 | | |||

Beneficial interest asset | Level 3 | 15 | |

| 31 | |

| 37 | | |||

Liabilities |

|

| |

|

| |

|

| | |||

Other current liabilities |

|

| |

|

| |

|

| | |||

Interest rate swaps (a) | Level 2 | 12 | |

| - | |

| - | | |||

Other noncurrent liabilities |

|

| |

|

| |

|

| | |||

Interest rate swaps (a) | Level 2 | - | |

| 24 | |

| 28 | | |||

(a) See Note 10 for additional information on interest rate swaps.

(b) Company-owned life insurance investments consist of equity index funds and fixed income assets. Amounts are presented net of nonrecourse loans that are secured by some of these policies. These loan amounts totaled $789 million at October 31, 2015 , $773 million at January 31, 2015 and $780 million at November 1, 2014 .

Significant Financial Instruments not Measured at Fair Value (a) (millions) | October 31, 2015 |

| January 31, 2015 |

| November 1, 2014 | |||||||||||||||

Carrying Amount | | Fair Value | |

| Carrying Amount | | Fair Value | |

| Carrying Amount | | Fair Value | | |||||||

Debt (b) | $ | 11,921 | | $ | 13,322 | |

| $ | 11,946 | | $ | 14,089 | |

| $ | 12,332 | | $ | 13,779 | |

(a) The carrying amounts of certain other current assets, accounts payable, and certain accrued and other current liabilities approximate fair value due to their short-term nature.

(b) The carrying amount and estimated fair value of debt exclude unamortized swap valuation adjustments and capital lease obligations.

6. Notes Payable and Long-Term Debt

We obtain short-term financing from time to time under our commercial paper program, a form of notes payable.

Commercial Paper | Three Months Ended |

| Nine Months Ended | ||||||||||||

(dollars in millions) | October 31, | |

| November 1, | |

| October 31, | |

| November 1, | | ||||

Maximum daily amount outstanding during the period | $ | - | |

| $ | 386 | |

| $ | - | |

| $ | 590 | |

Average daily amount outstanding during the period | - | |

| 51 | |

| - | |

| 160 | | ||||

Amount outstanding at period-end | - | |

| 386 | |

| - | |

| 386 | | ||||

Weighted average interest rate | - | % |

| 0.12 | % |

| - | % |

| 0.11 | % | ||||

9

7. Goodwill and Intangible Assets

We review long-lived assets for impairment when events or changes in circumstances, such as a decision to discontinue a business, indicate that the asset's carrying value may not be recoverable. We also review goodwill for impairment when events or circumstances indicate it is more likely than not the fair value of a reporting unit is below its carrying value. During the third quarter 2015, we announced our decision to wind down certain noncore operations. As a result, we recorded a $35 million pretax impairment loss, which included approximately $23 million of intangible assets and $12 million of goodwill. These costs were included in SG&A on our Consolidated Statements of Operations, but were not included in our segment results.

8. Property and Equipment

We review long-lived assets for impairment when events or changes in circumstances, such as a decision to relocate or close a store, make significant software changes or discontinue projects, indicate that the asset's carrying value may not be recoverable. We recognized impairment losses during each of the periods presented, primarily resulting from discontinued projects, store closures, and completed or planned land sales.

Impairments (a) | Three Months Ended |

| Nine Months Ended | ||||||||||||

(millions) | October 31, | |

| November 1, | |

| October 31, | |

| November 1, | | ||||

Total segment impairments | $ | 4 | |

| $ | 18 | |

| $ | 44 | |

| $ | 77 | |

Unallocated impairments (b) | 4 | |

| - | |

| 4 | |

| 16 | | ||||

Total impairments | $ | 8 | |

| $ | 18 | |

| $ | 48 | |

| $ | 93 | |

(a) Substantially all of the impairments are recorded in selling, general and administrative expense on the Consolidated Statements of Operations.

(b) For the three and nine months ended October 31, 2015, represents long-lived asset impairments from our decision to wind down certain noncore operations. For the nine months ended November 1, 2014, represents impairments of undeveloped land. These costs were not included in our segment results.

9. Data Breach

In the fourth quarter of 2013, we experienced a data breach in which an intruder stole certain payment card and other guest information from our network (the Data Breach). Based on our investigation, we believe that the intruder installed malware on our point-of-sale system in our U.S. stores and stole payment card data from up to approximately 40 million credit and debit card accounts of guests who shopped at our U.S. stores between November 27 and December 17, 2013. In addition, the intruder stole certain guest information, including names, mailing addresses, phone numbers or email addresses, for up to 70 million individuals.

Data Breach Related Accruals

Each of the four major payment card networks made a written claim against us regarding the Data Breach, either directly or through our acquiring banks. During the third quarter we entered into settlement agreements with two of the four payment card networks. We have resolved a claim from a third network and expect to resolve the remaining claim in the fourth quarter, both on terms consistent with our accrual.

As previously reported, we entered into a Settlement Agreement to resolve and dismiss the claims asserted on behalf of a class of guests whose information was compromised in the Data Breach. Pursuant to the Settlement Agreement, Target has agreed to pay $10 million to class member guests, certain administrative costs associated with the settlement, and attorneys' fees and expenses to class counsel as the Court may award. That settlement received Court approval on November 17, 2015.

Actions related to the Data Breach that remain pending are: (1) a class action brought on behalf of financial institutions; (2)

one action previously filed in Canada; (3) several putative class action suits brought on behalf of shareholders; and (4) ongoing investigations by State Attorneys General and the Federal Trade Commission.

Our accrual for estimated probable losses is based on actual settlements reached to date, discussions with the remaining two payment card networks and the expectation of negotiated settlements in the pending actions.We have not based our accrual on any determination that it is probable we would be found liable for the losses we have accrued were these claims to be litigated. While our estimates may change as new information becomes available, we do not believe any adjustments will be material.

10

Expenses Incurred and Amounts Accrued

Data Breach Balance Sheet Rollforward (millions) | Liabilities | |

| Insurance Receivable | | ||

Balance at February 1, 2014 | $ | 61 | |

| $ | 44 | |

Expenses incurred / insurance receivable recorded (a) | 186 | |

| 46 | | ||

Payments made / received | (69 | ) |

| (28 | ) | ||

Balance at November 1, 2014 | $ | 178 | |

| $ | 62 | |

Balance at January 31, 2015 | $ | 171 | |

| $ | 60 | |

Expenses incurred / insurance receivable recorded (a) | 38 | |

| - | | ||

Payments made / received | (95 | ) |

| (5 | ) | ||

Balance at October 31, 2015 | $ | 114 | |

| $ | 55 | |

(a) Includes expenditures and accruals for Data Breach-related costs and expected insurance recoveries as described below.

We recorded $26 million and $38 million of pretax Data Breach-related expenses during the three and nine months ended October 31, 2015 , respectively. Along with legal and other professional services, expenses include an adjustment to the accrual in the third quarter of 2015 based on refined estimates of our probable exposure. We recorded $12 million of pretax Data Breach-related expenses during the three months ended November 1, 2014 . We recorded $186 million of pretax Data Breach-related expenses, partially offset by expected insurance proceeds of $46 million , for net expenses of $140 million during the nine months ended November 1, 2014. These expenses were included in our Consolidated Statements of Operations as SG&A, but were not part of our segment results.

Since the Data Breach, we have incurred $290 million of cumulative expenses, partially offset by expected insurance recoveries of $90 million , for net cumulative expenses of $200 million .

Insurance Coverage

To limit our exposure to losses relating to Data Breach and other claims, we maintained $100 million of network-security insurance coverage during the period that the Data Breach occurred, above a $10 million deductible and with a $50 million sublimit for settlements with the payment card networks. This coverage, and certain other customary business-insurance coverage, has reduced our exposure related to the Data Breach. We will pursue recoveries to the maximum extent available under the policies. Since the Data Breach, we have received $35 million from our network-security insurance carriers of the $90 million accrued.

10. Derivative Financial Instruments

Our derivative instruments primarily consist of interest rate swaps, which are used to mitigate interest rate risk. As a result of our use of derivative instruments, we have counterparty credit exposure to large global financial institutions. We monitor this concentration of counterparty credit risk on an ongoing basis. See Note 5 for a description of the fair value measurement of our derivative instruments and their classification on the Consolidated Statements of Financial Position.

As of October 31, 2015 and November 1, 2014, three interest rate swaps with notional amounts totaling $1,250 million were designated as fair value hedges. No ineffectiveness was recognized during the three and nine months ended October 31, 2015 or November 1, 2014 .

Periodic payments, valuation adjustments and amortization of gains or losses on our derivative contracts had the following effect on our Consolidated Statements of Operations:

Derivative Contracts - Effect on Results of Operations (millions) | Three Months Ended |

| Nine Months Ended | ||||||||||||||

Type of Contract |

| Classification of (Income)/Expense | October 31, | |

| November 1, | |

| October 31, | |

| November 1, | | ||||

Interest rate swaps |

| Net interest expense | $ | (9 | ) |

| $ | (9 | ) |

| $ | (28 | ) |

| $ | (23 | ) |

11

The amount remaining on unamortized hedged debt valuation gains from terminated or de-designated interest rate swaps that will be amortized into earnings over the remaining lives of the underlying debt totaled $20 million , $34 million and $38 million , at October 31, 2015 , January 31, 2015 and November 1, 2014 , respectively.

11. Share Repurchase

In June 2015, our Board of Directors authorized a $5 billion expansion of our existing share repurchase program to $10 billion . Under this program, we have repurchased 77.2 million shares of common stock through October 31, 2015 , at an average price of $68.86 , for a total investment of $5.3 billion .

Share Repurchases | Nine Months Ended | ||||||

(millions, except per share data) | October 31, 2015 (a) | |

| November 1, 2014 (b) | | ||

Total number of shares purchased | 27.3 | |

| 0.6 | | ||

Average price paid per share | $ | 79.84 | |

| $ | 55.36 | |

Total investment | $ | 2,182 | |

| $ | 34 | |

(a) Includes 0.1 million shares delivered upon the noncash settlement of prepaid contracts, which had an original cash investment of $3 million and an aggregate market value at their settlement dates of $7 million . These contracts are among the investment vehicles used to reduce our economic exposure related to our nonqualified deferred compensation plans. Note 12 provides the details of our positions in prepaid forward contracts.

(b) All of the shares reacquired were delivered upon the noncash settlement of prepaid forward contracts which had an original cash investment of $34 million and an aggregate market value at their settlement dates of $35 million .

12. Pension, Postretirement Health Care and Other Benefits

Pension and Postretirement Health Care Benefits

We provide qualified defined benefit pension plans, unfunded nonqualified pension plans and certain postretirement health care benefits to eligible team members.

Net Pension and Postretirement Health Care Benefits Expense | Pension Benefits |

| Postretirement Health Care Benefits | ||||||||||||||||||||||||||||

| Three Months Ended |

| Nine Months Ended |

| Three Months Ended |

| Nine Months Ended | ||||||||||||||||||||||||

(millions) | Oct 31, | |

| Nov 1, | |

| Oct 31, | |

| Nov 1, | |

| Oct 31, | |

| Nov 1, | |

| Oct 31, | |

| Nov 1, | | ||||||||

Service cost | $ | 27 | |

| $ | 28 | |

| $ | 82 | |

| $ | 84 | |

| $ | - | |

| $ | 2 | |

| $ | 2 | |

| $ | 4 | |

Interest cost | 38 | |

| 37 | |

| 115 | |

| 112 | |

| - | |

| - | |

| 1 | |

| 1 | | ||||||||

Expected return on assets | (65 | ) |

| (58 | ) |

| (195 | ) |

| (175 | ) |

| - | |

| - | |

| - | |

| - | | ||||||||

Amortization of losses | 20 | |

| 16 | |

| 62 | |

| 49 | |

| 9 | |

| 1 | |

| 11 | |

| 4 | | ||||||||

Amortization of prior service cost | (3 | ) |

| (2 | ) |

| (9 | ) |

| (8 | ) |

| (19 | ) |

| (4 | ) |

| (28 | ) |

| (12 | ) | ||||||||

Curtailment gain | - | | | - | | | - | | | - | | | (43 | ) | | - | | | (43 | ) | | - | | ||||||||

Settlement charges | 1 | |

| - | |

| 3 | |

| - | |

| - | |

| - | |

| - | |

| - | | ||||||||

Total | $ | 18 | |

| $ | 21 | |

| $ | 58 | |

| $ | 62 | |

| $ | (53 | ) |

| $ | (1 | ) |

| $ | (57 | ) |

| $ | (3 | ) |

Effective April 1, 2016, we will discontinue the postretirement health care benefits that were offered to team members upon early retirement and prior to Medicare eligibility. This decision resulted in a $58 million reduction in the projected postretirement health care benefit obligation and a $43 million curtailment gain recorded in SG&A during the three months ended October 31, 2015.

As a result of the restructuring initiatives discussed in Note 4, we remeasured the assets and liabilities of our largest pension plan as of March 9, 2015. The remeasurement resulted in a $208 million reduction to the projected benefit obligation, primarily resulting from a 41 basis point increase in the discount rate used, and a $47 million reduction of plan assets. Subsequent to the remeasurement, the pension plan was overfunded, with plan assets of $3,725 million exceeding the projected benefit obligation of $3,604 million .

12

We expect this remeasurement will reduce 2015 pension expense by $26 million , $8 million and $19 million of which was recognized during the three and nine months ended October 31, 2015, respectively.

Other Benefits

We offer unfunded nonqualified deferred compensation plans to certain team members. We mitigate some of our risk of these plans through investing in vehicles, including company-owned life insurance and prepaid forward contracts in our own common stock, that offset a substantial portion of our economic exposure to the returns of these plans. These investment vehicles are general corporate assets and are marked to market with the related gains and losses recognized in the Consolidated Statements of Operations in the period they occur.

The total change in fair value for contracts indexed to our own common stock recognized in earnings was pretax loss of $2 million and pretax income of $2 million for the three and nine months ended October 31, 2015 , respectively, and pretax income of $1 million and $3 million for the three and nine months ended November 1, 2014 , respectively. During the nine months ended October 31, 2015 and November 1, 2014 , we made no investments in prepaid forward contracts in our own common stock. Adjusting our position in these investment vehicles may involve repurchasing shares of Target common stock when settling the forward contracts as described in Note 11. The settlement dates of these instruments are regularly renegotiated with the counterparty.

Prepaid Forward Contracts on Target Common Stock (millions, except per share data) | Number of Shares | |

| Contractual Price Paid per Share | |

| Contractual Fair Value | |

| Total Cash Investment | | |||

October 31, 2015 | 0.4 | |

| $ | 41.13 | |

| $ | 34 | |

| $ | 18 | |

January 31, 2015 | 0.5 | |

| $ | 41.11 | |

| $ | 38 | |

| $ | 21 | |

November 1, 2014 | 0.7 | |

| $ | 42.88 | |

| $ | 42 | |

| $ | 29 | |

13. Accumulated Other Comprehensive Income

(millions) | Cash Flow Hedges | |

| Currency Translation Adjustment | |

| Pension and Other Benefits | |

| Total | | ||||

January 31, 2015 | $ | (22 | ) |

| $ | (16 | ) |

| $ | (561 | ) |

| $ | (599 | ) |

Other comprehensive income before reclassifications | - | |

| (3 | ) |

| 134 | |

| 131 | | ||||

Amounts reclassified from AOCI | 3 | | (a) | - | |

| (4 | ) | (b) | (1 | ) | ||||

October 31, 2015 | $ | (19 | ) |

| $ | (19 | ) |

| $ | (431 | ) |

| $ | (469 | ) |

(a) Represents gains and losses on cash flow hedges, net of $2 million of taxes.

(b) Represents amortization of pension and other benefit liabilities, net of $2 million of taxes.

13

14. Segment Reporting

Our segment measure of profit is used by management to evaluate performance and make operating decisions. We operate as a single segment that includes all of our continuing operations, which are designed to enable guests to purchase products seamlessly in stores, online or through mobile devices.

Business Segment Results | Three Months Ended |

| Nine Months Ended | ||||||||||||

(millions) | October 31, | |

| November 1, | |

| October 31, | |

| November 1, | | ||||

Sales | $ | 17,613 | |

| $ | 17,254 | |

| $ | 52,159 | |

| $ | 50,868 | |

Cost of sales | 12,440 | |

| 12,171 | |

| 36,402 | |

| 35,716 | | ||||

Gross margin | 5,173 | |

| 5,083 | |

| 15,757 | |

| 15,152 | | ||||

Selling, general and administrative expenses (a)(f) | 3,650 | |

| 3,632 | |

| 10,533 | |

| 10,450 | | ||||

Depreciation and amortization | 561 | |

| 535 | |

| 1,651 | |

| 1,584 | | ||||

Segment profit | $ | 962 | |

| $ | 916 | |

| $ | 3,573 | |

| $ | 3,118 | |

Restructuring costs (b)(f) | (21 | ) |

| - | |

| (135 | ) |

| - | | ||||

Data Breach related costs (c)(f) | (26 | ) |

| (12 | ) |

| (38 | ) |

| (140 | ) | ||||

Impairments (d)(f) | (39 | ) |

| - | |

| (39 | ) |

| (16 | ) | ||||

Card brand conversion costs (e)(f) | - | |

| - | |

| - | |

| (13 | ) | ||||

Earnings from continuing operations before interest expense and income taxes | 876 | |

| 904 | |

| 3,361 | |

| 2,949 | | ||||

Net interest expense | 151 | |

| 146 | |

| 455 | |

| 730 | | ||||

Earnings from continuing operations before income taxes | $ | 725 | |

| $ | 758 | |

| $ | 2,906 | |

| $ | 2,219 | |

Note: Amounts may not foot due to rounding.

(a) Beginning with the first quarter of 2015, segment EBIT includes the impact of the reduction of the the beneficial interest asset. For comparison purposes, prior year segment EBIT has been revised.

(b) Refer to Note 4 for more information on restructuring costs.

(c) Refer to Note 9 for more information on Data Breach related costs.

(d) Refer to Note 7 and Note 8 for more information on impairments.

(e) Expense related to converting co-branded card program to MasterCard.

(f) The sum of segment SG&A expenses, restructuring costs, Data Breach related costs, impairments and card brand conversion costs equal consolidated SG&A expenses.

Reconciliation of Segment Assets to Total Assets (millions) | October 31, | |

| January 31, | |

| November 1, | | |||

Segment assets | $ | 41,148 | |

| $ | 39,569 | |

| $ | 40,051 | |

Assets of discontinued operations | 493 | |

| 1,775 | |

| 6,348 | | |||

Unallocated assets (a) | 55 | |

| 60 | |

| 62 | | |||

Total assets | $ | 41,696 | |

| $ | 41,404 | |

| $ | 46,461 | |

(a) Represents the insurance receivable related to the Data Breach.

14

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Third quarter 2015 includes the following notable items:

• | GAAP earnings per share were $0.87 , including $0.11 related to discontinued operations. |

• | Adjusted earnings per share from continuing operations were $0.86 . |

• | Third quarter comparable sales grew 1.9 percent, driven by traffic growth of 1.4 percent. |

• | Digital channel sales increased by 20 percent, contributing 0.4 percentage points to comparable sales growth. |

• | We returned $1.3 billion to shareholders in the third quarter through dividends and share repurchase. |

Sales were $17,613 million for the three months ended October 31, 2015 , an increase of $359 million or 2.1 percent from the same period in the prior year. Operating cash flow provided by continuing operations was $2,956 million and $2,599 million for the nine months ended October 31, 2015 and November 1, 2014 , respectively.

Earnings Per Share from Continuing Operations | Three Months Ended |

|

| |

| Nine Months Ended |

|

| | ||||||||||||

October 31, | |

| November 1, | |

| Change | |

| October 31, | |

| November 1, | |

| Change | | |||||

GAAP diluted earnings per share | $ | 0.76 | |

| $ | 0.82 | |

| (7.9 | )% |

| $ | 2.98 | |

| $ | 2.33 | |

| 27.7 | % |

Adjustments | 0.10 | |

| (0.04 | ) |

|

|

| 0.21 | |

| 0.39 | |

|

| | |||||

Adjusted diluted earnings per share | $ | 0.86 | |

| $ | 0.79 | |

| 8.6 | % |

| $ | 3.18 | |

| $ | 2.72 | |

| 16.9 | % |

Note: Amounts may not foot due to rounding. Adjusted diluted earnings per share from continuing operations (Adjusted EPS), a non-GAAP metric, excludes the impact of certain matters not related to our routine retail operations and the impact of our discontinued Canadian operations. Management believes that Adjusted EPS is meaningful to provide period-to-period comparisons of our operating results. A reconciliation of non-GAAP financial measures to GAAP measures is provided on page 21.

We are reporting after-tax return on invested capital (ROIC) for continuing operations as we believe ROIC provides a meaningful measure of the effectiveness of our capital allocation over time. For the trailing twelve months ended October 31, 2015 , ROIC was 13.0 percent, compared with 11.2 percent for the trailing twelve months ended November 1, 2014 . A reconciliation of ROIC is provided on page 22.

Pharmacies and Clinics Transaction

On June 12, 2015, we entered into an asset purchase agreement with CVS Pharmacy, Inc. (CVS) to sell our pharmacy and clinic businesses for cash consideration of approximately $1.9 billion. The closing of the transaction is subject to regulatory approval and other customary conditions. Either party will be permitted to terminate the agreement if the closing has not occurred on or before March 15, 2016 (or September 15, 2016 solely in the event that, as of March 15, 2016, all conditions other than regulatory approval have been satisfied or waived). Following the closing, CVS will operate the pharmacy and clinic businesses in our stores under a long term operating agreement. No profit-sharing arrangement exists. CVS will make an ongoing annual, inflation-adjusted occupancy-related payment to us, starting at approximately $20 million to $25 million in the first year of the agreement. We also entered a development agreement with CVS through which we may jointly develop small-format stores.

Based on current estimates, we expect to record a pretax gain of approximately $500 million to $550 million at closing, which will be recorded outside of segment results and excluded from Adjusted EPS. We also expect to record deferred income of approximately $800 million, which we will recognize into income evenly over the 23 year weighted average remaining accounting useful life of our stores.

We expect to use the $1.3 billion to $1.4 billion of after-tax proceeds to settle the approximately $200 million of retained pharmacy and clinic net liabilities (primarily accounts payable, net of accounts receivable) and return capital to shareholders.

15

Had this transaction closed prior to this year, our reported sales, cost of goods sold, and SG&A expense for the nine months ended October 31, 2015 would have been lower by approximately $3.3 billion, $2.6 billion and $0.7 billion, respectively, with no notable effect on EBITDA and EBIT. This transaction is expected to be accretive to EPS in every period following the closing, and should add 50 basis points or more to ROIC over time. In addition, due to the lower sales base, we expect the transaction to have a favorable impact on our EBITDA and EBIT margin rates.

Refer to Note 2 of the Financial Statements for additional information about the transaction.

Analysis of Results of Operations

Segment Results

| Three Months Ended |

|

| |

| Nine Months Ended |

|

| | ||||||||||||

(dollars in millions) | October 31, | |

| November 1, | |

| Percent Change | |

| October 31, | |

| November 1, | |

| Percent Change | | ||||

Sales | $ | 17,613 | |

| $ | 17,254 | |

| 2.1 | % |

| $ | 52,159 | |

| $ | 50,868 | |

| 2.5 | % |

Cost of sales | 12,440 | |

| 12,171 | |

| 2.2 | |

| 36,402 | |

| 35,716 | |

| 1.9 | | ||||

Gross margin | 5,173 | |

| 5,083 | |

| 1.8 | |

| 15,757 | |

| 15,152 | |

| 4.0 | | ||||

SG&A expenses (a) | 3,650 | |

| 3,632 | |

| 0.5 | |

| 10,533 | |

| 10,450 | |

| 0.8 | | ||||

EBITDA | 1,523 | |

| 1,451 | |

| 4.9 | |

| 5,224 | |

| 4,702 | |

| 11.1 | | ||||

Depreciation and amortization | 561 | |

| 535 | |

| 4.8 | |

| 1,651 | |

| 1,584 | |

| 4.3 | | ||||

EBIT | $ | 962 | |

| $ | 916 | |

| 5.0 | % |

| $ | 3,573 | |

| $ | 3,118 | |

| 14.6 | % |

Note: We operate as a single segment which includes all of our continuing operations, excluding net interest expense, Data Breach related costs and certain other expenses that are discretely managed. Our segment operations are designed to enable guests to purchase products seamlessly in stores, online or through mobile devices. Beginning with the first quarter of 2015, segment EBIT includes the impact of the reduction of the beneficial interest asset. For comparison purposes, prior year segment EBIT has been revised. See Note 14 of our Financial Statements for a reconciliation of our segment results to earnings before income taxes.

(a) SG&A includes $166 million and $477 million of net profit-sharing income under our credit card program agreement for the three and nine months ended October 31, 2015 , respectively, and $161 million and $466 million for the three and nine months ended November 1, 2014 , respectively.

Rate Analysis | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Gross margin rate | 29.4 | % |

| 29.5 | % |

| 30.2 | % |

| 29.8 | % |

SG&A expense rate | 20.7 | |

| 21.1 | |

| 20.2 | |

| 20.5 | |

EBITDA margin rate | 8.6 | |

| 8.4 | |

| 10.0 | |

| 9.2 | |

Depreciation and amortization expense rate | 3.2 | |

| 3.1 | |

| 3.2 | |

| 3.1 | |

EBIT margin rate | 5.5 | |

| 5.3 | |

| 6.8 | |

| 6.1 | |

Note: Rate analysis metrics are computed by dividing the applicable amount by sales.

16

Sales

Sales include merchandise sales, net of expected returns, from our stores and digital channels, and gift card breakage. Digital channel sales include all sales initiated through mobile applications and our conventional websites. Digital channel sales may be fulfilled through our distribution centers or our stores.

Sales by Channel | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Stores | 97.3 | % |

| 97.7 | % |

| 97.2 | % |

| 97.8 | % |

Digital | 2.7 | |

| 2.3 | |

| 2.8 | |

| 2.2 | |

Total | 100 | % |

| 100 | % |

| 100 | % |

| 100 | % |

Sales by Product Category | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Household essentials | 28 | % |

| 27 | % |

| 28 | % |

| 27 | % |

Hardlines | 13 | |

| 15 | |

| 14 | |

| 15 | |

Apparel and accessories | 19 | |

| 19 | |

| 20 | |

| 19 | |

Food and pet supplies | 22 | |

| 21 | |

| 21 | |

| 22 | |

Home furnishings and décor | 18 | |

| 18 | |

| 17 | |

| 17 | |

Total | 100 | % |

| 100 | % |

| 100 | % |

| 100 | % |

Comparable sales is a measure that highlights the performance of our existing stores and digital channel sales by measuring the change in sales for a period over the comparable, prior-year period of equivalent length. Comparable sales include all sales, except sales from stores open less than 13 months, digital acquisitions operating less than one year, stores that have been closed and digital acquisitions that we no longer operate. Comparable sales measures vary across the retail industry. As a result, our comparable sales calculation is not necessarily comparable to similarly titled measures reported by other companies.

Comparable Sales | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Comparable sales change | 1.9 | % |

| 1.2 | % |

| 2.2 | % |

| 0.3 | % |

Drivers of change in comparable sales |

| |

|

| |

|

| |

|

| |

Number of transactions | 1.4 | |

| (0.4 | ) |

| 1.3 | |

| (1.5 | ) |

Average transaction amount | 0.4 | |

| 1.6 | |

| 0.9 | |

| 1.8 | |

Selling price per unit | 2.5 | |

| 3.1 | |

| 3.8 | |

| 2.6 | |

Units per transaction | (2.1 | ) |

| (1.5 | ) |

| (2.8 | ) |

| (0.8 | ) |

Note: Amounts may not foot due to rounding.

Contribution to Comparable Sales Change | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Stores channel comparable sales change | 1.4 | % |

| 0.6 | % |

| 1.6 | % |

| (0.2 | )% |

Digital channel contribution to comparable sales change | 0.4 | |

| 0.6 | |

| 0.6 | |

| 0.5 | |

Total comparable sales change | 1.9 | % |

| 1.2 | % |

| 2.2 | % |

| 0.3 | % |

Note: Amounts may not foot due to rounding.

The collective interaction of a broad array of macroeconomic, competitive and consumer behavioral factors, as well as sales mix, and transfer of sales to new stores makes further analysis of sales metrics infeasible.

17

We monitor the percentage of sales that are paid for using REDcards (REDcard Penetration) because our internal analysis has indicated that a meaningful portion of the incremental purchases on REDcards are also incremental sales for Target, with the remainder representing a shift in tender type. Guests receive a 5 percent discount on virtually all purchases when they use a REDcard at Target.

REDcard Penetration | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Target Debit Card | 12.1 | % |

| 11.2 | % |

| 12.0 | % |

| 11.2 | % |

Target Credit Cards | 10.2 | |

| 9.8 | |

| 9.9 | |

| 9.5 | |

Total REDcard Penetration | 22.3 | % |

| 21.0 | % |

| 22.0 | % |

| 20.7 | % |

Note: Amounts may not foot due to rounding.

Gross Margin Rate

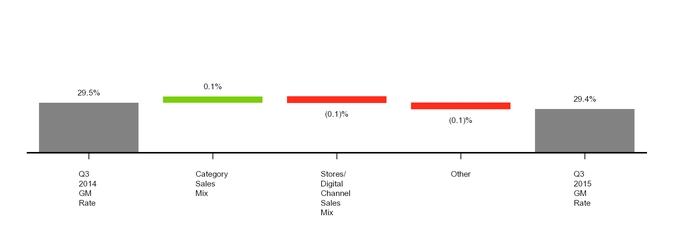

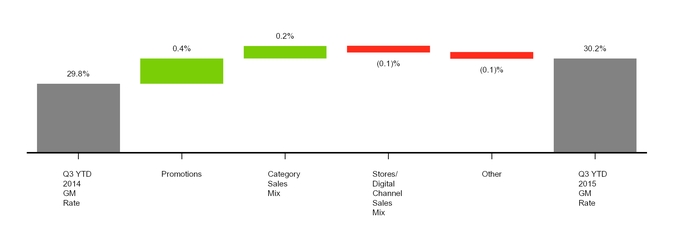

For the three and nine months ended October 31, 2015 , our gross margin rate was 29.4 percent and 30.2 percent compared with 29.5 percent and 29.8 percent in the comparable period last year. For the quarter, the decrease was primarily due to higher digital channel sales and other items, including pharmacy reimbursement pressure, partially offset by a favorable category sales mix. Year-to-date, the increase was primarily due to lower promotional activity relative to the highly promotional period in 2014 following the Data Breach and favorable category sales mix, partially offset by the impact of increased digital channel sales.

18

Selling, General and Administrative Expense Rate

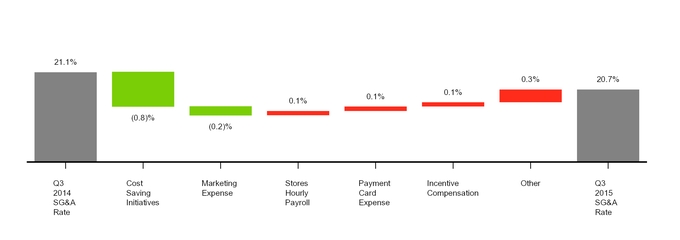

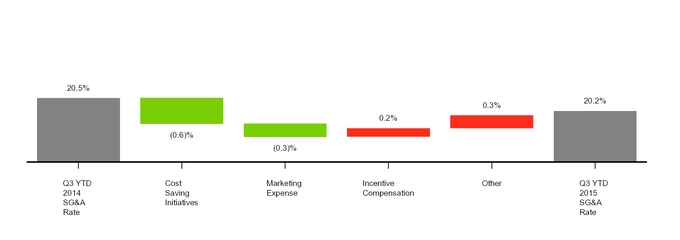

For the three and nine months ended October 31, 2015 , our SG&A expense rate was 20.7 percent and 20.2 percent, respectively, decreasing from 21.1 percent and 20.5 percent in the comparable period last year. The quarter and year-to-date decrease primarily resulted from cost saving initiatives and reduced marketing expense, partially offset by increased incentive compensation. For the quarter, the decrease was also partially offset by higher stores hourly payroll and payment card-related expenses due to the roll-out of chip-enabled REDcards.

Store Data

Change in Number of Stores | Three Months Ended |

| Nine Months Ended | ||||||||

| October 31, | |

| November 1, | |

| October 31, | |

| November 1, | |

Beginning store count | 1,799 | |

| 1,795 | |

| 1,790 | |

| 1,793 | |

Opened | 6 | |

| 6 | |

| 15 | |

| 16 | |

Closed | - | |

| - | |

| - | |

| (8 | ) |

Ending store count | 1,805 | |

| 1,801 | |

| 1,805 | |

| 1,801 | |

Number of stores remodeled during the period | 8 | |

| 13 | |

| 9 | |

| 39 | |

19

Number of Stores and Retail Square Feet | Number of Stores |

| Retail Square Feet (a) | ||||||||||||||

October 31, | |

| January 31, | |

| November 1, | |

| October 31, | |

| January 31, | |

| November 1, | | |

Expanded food assortment stores | 1,306 | |

| 1,292 | |

| 1,294 | |

| 168,745 | |

| 167,026 | |

| 167,291 | |

SuperTarget stores | 249 | |

| 249 | |

| 249 | |

| 44,150 | |

| 44,151 | |

| 44,151 | |

General merchandise stores | 232 | |

| 240 | |

| 249 | |

| 27,028 | |

| 27,945 | |

| 28,861 | |

CityTarget stores | 9 | |

| 8 | |

| 8 | |

| 987 | |

| 820 | |

| 820 | |

TargetExpress stores | 9 | |

| 1 | |

| 1 | |

| 173 | |

| 21 | |

| 21 | |

Total | 1,805 | |

| 1,790 | |

| 1,801 | |

| 241,083 | |

| 239,963 | |

| 241,144 | |

(a) In thousands; reflects total square feet, less office, distribution center and vacant space.

Other Performance Factors

Consolidated Selling, General and Administrative Expenses

We recorded certain selling, general and administrative expenses outside of the segment. For the three and nine months ended October 31, 2015 , these expenses included $39 million of impairments, $21 million and $135 million , respectively, of restructuring costs, and $26 million and $38 million , respectively, of Data Breach-related costs. For the three months ended November 1, 2014 , these expenses included $12 million of Data Breach-related costs. For the nine months ended November 1, 2014, these expenses included $140 million of Data Breach-related costs (net of expected insurance proceeds), $16 million of impairments, and $13 million of costs related to plans to convert existing co-branded REDcards to MasterCard co-branded chip-and-PIN cards in 2015 to support the accelerated transition to chip-and-PIN-enabled REDcards. Additional information about these items is provided within the Reconciliation of Non-GAAP Financial Measures to GAAP Measures on page 21.

Net Interest Expense

Net interest expense from continuing operations was $151 million and $455 million for the three and nine months ended October 31, 2015 , respectively, compared to $146 million and $730 million for the three and nine months ended November 1, 2014 , respectively. Net interest expense for the nine months ended November 1, 2014 included a loss on early retirement of debt of $285 million.

Provision for Income Taxes

Our effective income tax rate from continuing operations for the three and nine months ended October 31, 2015 was 34.3 percent and 34.6 percent, respectively, compared with 30.6 percent and 32.9 percent for the three and nine months ended November 1, 2014 . The increase was primarily due to the favorable resolution of various tax matters during the three and nine months ended November 1, 2014. The resolution of income tax matters reduced tax expense by $0 million and $8 million for the three and nine months ended October 31, 2015, respectively, compared with $30 million and $31 million for the same periods in the prior year.

Discontinued Operations

Income from discontinued operations, net of tax, was $73 million and $37 million for the three and nine months ended October 31, 2015. During the three and nine months ended October 31, 2015, we changed the estimated tax benefit from our investment losses in Canada. In addition, we incurred costs related to our ongoing support of the liquidation process and other professional fees, and for the nine months ended October 31, 2015, we increased our accrual for the estimated probable losses related to claims that may be asserted against us, primarily under guarantees of certain leases.

On November 23, 2015, we reached a settlement with an entity that controls guaranteed leases representing approximately 30 percent of the recorded accrual. Under the settlement terms, this entity has subrogated to us their claims against the Canada Subsidiaries. The settlement amount is materially consistent with our previously recorded accrual.

See Note 3 of the Financial Statements for information regarding our Canada exit.

20

Reconciliation of Non-GAAP Financial Measures to GAAP Measures

To provide additional transparency, we have disclosed non-GAAP adjusted diluted earnings per share from continuing operations (Adjusted EPS). This metric excludes restructuring costs, net expenses related to the 2013 data breach and other matters presented below. We believe this information is useful in providing period-to-period comparisons of the results of our continuing operations. This measure is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The most comparable GAAP measure is diluted earnings per share from continuing operations. Adjusted EPS should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Other companies may calculate Adjusted EPS differently than we do, limiting the usefulness of the measure for comparisons with other companies. Prior year amounts have been revised to present Adjusted EPS on a continuing operations basis.

Adjusted EPS |

| Three Months Ended | ||||||||||||||||||||||

|

| October 31, 2015 |

| November 1, 2014 | ||||||||||||||||||||

(millions, except per share data) |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | | ||||||

GAAP diluted earnings per share from continuing operations |

|

|

|

|

| $ | 0.76 | |

|

|

|

|

| $ | 0.82 | | ||||||||

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Restructuring costs (a) |

| $ | 21 | |

| $ | 13 | |

| $ | 0.02 | |

| $ | - | |

| $ | - | |

| $ | - | |

Data Breach-related costs (b) |

| 26 | |

| 20 | |

| 0.03 | |

| 12 | |

| 7 | |

| 0.01 | | ||||||

Impairments (c) |

| 39 | |

| 29 | |

| 0.05 | |

| - | |

| - | |

| - | | ||||||

Resolution of income tax matters |

| - | |

| - | |

| - | |

| - | |

| (30 | ) |

| (0.05 | ) | ||||||

Adjusted diluted earnings per share from continuing operations |

|

|

|

|

| $ | 0.86 | |

|

|

|

|

| $ | 0.79 | | ||||||||

|

| Nine Months Ended | ||||||||||||||||||||||

|

| October 31, 2015 |

| November 1, 2014 | ||||||||||||||||||||

(millions, except per share data) |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | |

| Pretax | |

| Net of Tax | |

| Per Share Amounts | | ||||||

GAAP diluted earnings per share from continuing operations |

|

|

|

|

| $ | 2.98 | |

|

|

|

|

| $ | 2.33 | | ||||||||

Adjustments |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

Restructuring costs (a) |

| $ | 135 | |

| $ | 85 | |

| $ | 0.13 | |

| $ | - | |

| $ | - | |

| $ | - | |

Data Breach-related costs (b) |

| 38 | |

| 27 | |

| 0.04 | |

| 140 | |

| 90 | |

| 0.14 | | ||||||

Loss on early retirement of debt |

| - | |

| - | |

| - | |

| 285 | |

| 174 | |

| 0.27 | | ||||||

Impairments (c) |

| 39 | |

| 29 | |

| 0.05 | |

| 16 | |

| 9 | |

| 0.01 | | ||||||

Card brand conversion costs (d) |

| - | |

| - | |

| - | |

| 13 | |

| 8 | |

| 0.01 | | ||||||

Resolution of income tax matters |

| - | |

| (8 | ) |

| (0.01 | ) |

| - | |

| (31 | ) |

| (0.05 | ) | ||||||

Adjusted diluted earnings per share from continuing operations |

|

|

|

|

| $ | 3.18 | |

|

|

|

|

| $ | 2.72 | | ||||||||

Note: Amounts may not foot due to rounding. Beginning with the first quarter 2015, we no longer exclude the reduction of the beneficial interest asset from Adjusted EPS because it is no longer meaningful. For comparison purposes, prior year Adjusted EPS has been revised.

(a) Refer to Note 4 in the Financial Statements for more information on restructuring costs.

(b) Refer to Note 9 in the Financial Statements for more information on Data Breach-related costs.

(c) Refer to Note 7 and Note 8 in the Financial Statements for more information on impairments.

(d) Expense related to converting the co-branded card program to MasterCard.

21

We have also disclosed after-tax return on invested capital for continuing operations (ROIC), which is a ratio based on GAAP information, with the exception of adjustments made to capitalize operating leases. Operating leases are capitalized as part of the ROIC calculation to control for differences in capital structure between us and our competitors. We believe this metric provides a meaningful measure of the effectiveness of our capital allocation over time. Other companies may calculate ROIC differently than we do, limiting the usefulness of the measure for comparisons with other companies.

After-Tax Return on Invested Capital |

|

| ||||||||||

|

|

|

|

| ||||||||

Numerator |

| Trailing Twelve Months |

|

| ||||||||

(dollars in millions) |

| October 31, | |

| November 1, | |

|

| ||||

Earnings from continuing operations before interest expense and income taxes |

| $ | 4,946 | |

| $ | 4,264 | |

|

| ||

+ Operating lease interest (a)(b) |

| 90 | |

| 98 | |

|

| ||||

Adjusted earnings from continuing operations before interest expense and income taxes |

| 5,036 | |

| 4,362 | |

|

| ||||

- Income taxes (c) |

| 1,717 | |

| 1,444 | |

|

| ||||

Net operating profit after taxes |

| $ | 3,319 | |

| $ | 2,918 | |

|

| ||

Denominator (dollars in millions) |

| October 31, | |

| November 1, | |

| November 2, | | |||

Current portion of long-term debt and other borrowings |

| $ | 825 | |

| $ | 483 | |

| $ | 2,109 | |

+ Noncurrent portion of long-term debt |

| 11,951 | |

| 12,623 | |

| 11,381 | | |||

+ Shareholders' equity |

| 13,256 | |

| 16,373 | |

| 16,155 | | |||

+ Capitalized operating lease obligations (b)(d) |

| 1,503 | |

| 1,639 | |

| 1,546 | | |||

- Cash and cash equivalents |

| 1,977 | |

| 718 | |

| 687 | | |||

- Net assets of discontinued operations |

| 196 | |

| 4,550 | |

| 4,457 | | |||

Invested capital |

| $ | 25,362 | |

| $ | 25,850 | |

| $ | 26,047 | |

Average invested capital (e) |

| $ | 25,606 | |

| $ | 25,949 | |

|

| ||

After-tax return on invested capital |

| 13.0 | % |

| 11.2 | % |

|

|

(a) Represents the add-back to operating income driven by the hypothetical capitalization of our operating leases, using eight times our trailing twelve months rent expense and an estimated interest rate of six percent.

(b) See the following Reconciliation of Capitalized Operating Leases table for the adjustments to our GAAP total rent expense to obtain the hypothetical capitalization of operating leases and related operating lease interest.

(c) Calculated using the effective tax rate for continuing operations, which was 34.1% and 33.1% for the trailing twelve months ended October 31, 2015 and November 1, 2014 .

(d) Calculated as eight times our trailing twelve months rent expense.

(e) Average based on the invested capital at the end of the current period and the invested capital at the end of the prior period.

Capitalized operating lease obligations and operating lease interest are not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The most comparable GAAP measure is total rent expense. Capitalized operating lease obligations and operating lease interest should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP.

Reconciliation of Capitalized Operating Leases |

| Trailing Twelve Months | ||||||||||||

(dollars in millions) |

| October 31, | |

| November 1, | |

| November 2, | | |||||

Total rent expense |

| $ | 188 | |

| $ | 205 | |

| $ | 193 | | ||

Capitalized operating lease obligations (total rent expense x 8) |

| 1,503 | |

| 1,639 | |

| 1,546 | | |||||

Operating lease interest (capitalized operating lease obligations x 6%) |

| 90 | |

| 98 | |

| n/a | | |||||

22

Analysis of Financial Condition

Liquidity and Capital Resources

Our cash and cash equivalents balance was $1,977 million at October 31, 2015 , compared with $718 million for the same period in 2014 . Our investment policy is designed to preserve principal and liquidity of our short-term investments. This policy allows investments in large money market funds or in highly rated direct short-term instruments that mature in 60 days or less. We also place certain dollar limits on our investments in individual funds or instruments.

Cash Flows

Operations during the first nine months of 2015 were funded by internally generated funds. Operating cash flow provided by continuing operations was $2,956 million for the nine months ended October 31, 2015 compared with $2,599 million for the same period in 2014 . These cash flows, combined with our prior year-end cash position, allowed us to invest in the business, pay dividends and repurchase shares under our share repurchase program.

Share Repurchases

In June 2015, our Board of Directors authorized a $5 billion expansion of our existing share repurchase program to $10 billion. Under this program, we have repurchased 77.2 million shares of common stock through October 31, 2015, at an average price of $68.86, for a total investment of $5.3 billion.