UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2013

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-17272

TECHNE CORPORATION

(Exact name of Registrant as specified in its charter)

| Minnesota | 41-1427402 | |

(State of Incorporation) | (IRS Employer Identification No.) | |

| 614 McKinley Place N.E., Minneapolis, MN | 55413-2610 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number: (612) 379-8854

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.01 par value

Name of each exchange on which registered: The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrants has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Small reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the Registrant, based upon the closing sale price on December 31, 2012 as reported on The Nasdaq Stock Market ($68.34 per share) was approximately $2.2 billion. Shares of Common Stock held by each officer and director and by each person who owns 5% or more of the outstanding Common Stock have been excluded.

Shares of $0.01 par value Common Stock outstanding at August 23, 2013: 36,844,944

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's Proxy Statement for its 2013 Annual Meeting of Shareholders are incorporated by reference into Part III.

TABLE OF CONTENTS

| Page | ||||

PART I | ||||

Item 1. Business | 1 | |||

Item 1A. Risk Factors | 8 | |||

Item 1B. Unresolved Staff Comments | 12 | |||

Item 2. Properties | 12 | |||

Item 3. Legal Proceedings | 13 | |||

Item 4. Mine Safety Disclosures | 13 | |||

PART II | ||||

Item 5. Market for the Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | 13 | |||

Item 6. Selected Financial Data | 15 | |||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations | 16 | |||

Item 7A. Quantitative and Qualitative Disclosures about Market Risk | 26 | |||

Item 8. Financial Statements and Supplementary Data | 28 | |||

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 45 | |||

Item 9A. Controls and Procedures | 45 | |||

Item 9B. Other Information | 46 | |||

PART III | ||||

Item 10. Directors, Executive Officers and Corporate Governance | 46 | |||

Item 11. Executive Compensation | 46 | |||

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 47 | |||

Item 13. Certain Relationships and Related Transactions, and Director Independence | 47 | |||

Item 14. Principal Accounting Fees and Services | 47 | |||

PART IV | ||||

Item 15. Exhibits, Financial Statement Schedules | 48 | |||

SIGNATURES | 49 | |||

i

PART I

ITEM 1. BUSINESS

OVERVIEW

Techne Corporation and subsidiaries (the Company) are engaged in the development, manufacture and sale of biotechnology products and clinical diagnostic controls. These activities are conducted domestically through its wholly-owned subsidiaries, R&D Systems, Inc. (R&D Systems), Boston Biochem, Inc. (Boston Biochem), and BiosPacific, Inc. (BiosPacific). The Company's European biotechnology operations are conducted through its wholly-owned U.K. subsidiaries, R&D Systems Europe Ltd. (R&D Europe) and Tocris Holdings Limited (Tocris). R&D Europe has a sales subsidiary, R&D Systems GmbH, in Germany and a sales office in France. The Company distributes its biotechnology products in China through its wholly-owned subsidiary, R&D Systems China Co., Ltd. (R&D China). R&D China has a sales subsidiary, R&D Systems Hong Kong Ltd., in Hong Kong.

The Company has two reportable segments based on the nature of its products (biotechnology and clinical controls). R&D Systems' Biotechnology Division, R&D Europe, Tocris, R&D China, BiosPacific and Boston Biochem are included in the biotechnology reporting segment. The Company's biotechnology reporting segment develops, manufactures and sells biotechnology research and diagnostic products world-wide. The Company's clinical controls reporting segment (formerly hematology), which consists of R&D Systems' Clinical Controls Division, develops and manufactures controls and calibrators for sale world-wide.

On July 22, 2013, the Company acquired Bionostics Holdings Limited (Bionostics) and its U.S. operating subsidiary, Bionostics, Inc. Bionostics is a global leader in the development, manufacture and distribution of clinical control solutions that verify the proper operation of in-vitro diagnostic devices primarily utilized in point of care blood glucose and blood gas testing. All of the shares of Bionostics were acquired for approximately $104 million in cash, subject to adjustment following closing based on the final level of working capital of Bionostics. Bionostics will become part of the Company's clinical controls segment.

THE MARKET

The Company manufactures and sells products for the biotechnology research market and the clinical diagnostics market. In fiscal 2013, 2012 and 2011, net sales from the Company's biotechnology segment were 93% of consolidated net sales in each year. The Company's clinical controls segment net sales were 7% of consolidated net sales for each of fiscal 2013, 2012 and 2011. Financial information relating to the Company's segments is incorporated herein by reference to Note L to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Biotechnology Segment

The Company, through its biotechnology segment, is one of the world's leading suppliers of specialized proteins, such as cytokines and related reagents, to the biotechnology research community. These valuable proteins are produced in minute amounts by different types of cells and can be isolated from these cells or synthesized through recombinant DNA technology. Currently, nearly all of the Company's proteins are produced by recombinant DNA technology.

The growing interest by academic and commercial researchers in cytokines is largely due to the profound effect that a tiny amount of a cytokine can have on cells and tissues. Cytokines are intercellular messengers. They act as signaling agents by interacting with specific receptors on the affected cells and trigger events that can lead to significant changes in a cell, tissue or organ. For example, cytokines can induce cells to acquire more specialized functions and features. Another example of the beneficial action of cytokines is their key role played in attracting cells at the site of injury, inducing them to grow and divide and initiate the healing process. Unregulated cytokine production and action can have non-beneficial effects and lead to various pathologies.

1

The Company also produces and markets enzymes and intracellular signaling reagents. Enzymes are proteins which act as biological catalysts that accelerate a variety of chemical reactions in cells. Most enzymes, including proteases, kinases and phosphatases, are proteins that modify the structure and function of other proteins. Additionally, both enzymes and cytokines have the potential to serve as predictive biomarkers and therapeutic targets for a variety of diseases and conditions including cancer, Alzheimer's, arthritis, autoimmunity, diabetes, hypertension, obesity, inflammation, AIDS and influenza.

The Company markets a variety of immunoassays on different testing platforms, including a microtiter plated based kit sold under the trade name Quantikine ® , immunoassays based on encoded beads technology and immunoassays based on spotted surfaces. All of these immunoassay products are used by researchers to quantify the level of a specific protein in biological fluids, such as serum, plasma, or urine. Protein quantification is an integral component of basic research and as a valuable indicator of the effects of new therapeutic compounds in the pharmaceutical drug discovery and development process.

With the acquisition of Tocris in April 2011, the Company added chemically-based products to its biotechnology segment. Tocris products are small compounds, sold in highly purified forms typically with agonistic or antagonistic properties in a variety of biological processes. The addition of Tocris products to the Company's product lines allows customers to have access to the broadest range of compounds and biological reagents to meet their life science research needs. The Company's combined chemical and biological reagents portfolio provide new tools which customers can use in solving the complexity of important biological pathways and glean knowledge which may lead to a fuller understanding of biological processes and ultimately to the development of novel strategies to address different pathologies.

The Company currently manufactures and sells approximately 24,000 biotechnology products.

Biotechnology Products

Proteins. Cytokines and enzymes, extracted from natural sources or produced using recombinant DNA technology, are manufactured to the highest possible purity. Proteins, including enzyme substrates and inhibitors, are highly purified and characterized to ensure the highest biological activity.

Antibodies. Antibodies are specialized proteins produced by the immune system of an animal that recognize and bind to target molecules. The Company's polyclonal antibodies are produced in animals (primarily goats, sheep and rabbits) and purified from the animals' blood. Monoclonal antibodies are derived from immortalized rodent cell lines and are isolated from cell culture medium.

Immunoassays. The immunoassay product line includes Quantikine kits for the detection of human and animal proteins using 96-well plates, along with immunoassays on other testing platforms, which allow researchers to quantify the amount of a specific analyte (typically a cytokine, adhesion molecule or an enzyme) in a sample derived from any biological fluid.

Clinical Diagnostic Immunoassay Kits. The Company has received Food and Drug Administration (FDA) marketing clearance for its erythropoietin (EPO), transferrin receptor (TfR) and Beta2-microglobulin (ß2M) immunoassays for use as in vitro diagnostic devices.

Flow Cytometry Products. This product line includes fluorochrome labeled antibodies and kits, which are used to determine the immuno-phenotypic properties of cells from different tissues.

Intracellular Signaling Products. This diverse product line provides reagents to elucidate signal transduction pathways within cells. Products include antibodies, phospho-specific antibodies, antibody arrays, active caspases, kinases, phosphatases, and enzyme-linked immunosorbant assay (ELISA) assays to measure the activity of apoptotic and signaling molecules.

Small Molecule Chemically-based Products. These products include small natural or synthetic chemical compounds used by investigators as agonists, antagonists and/or inhibitors of various biological functions. Used in concert with other Company products, they provide additional tools to elucidate key pathways of cellular functions and can provide insight into the drug discovery process.

2

The Company sells its biotechnology products directly to customers in North America, most of Western Europe and to certain customers in China. Third party distributors are used in the remainder of China and Europe and in the rest of the world.

Clinical Controls Segment (formerly the Hematology Segment)

Proper diagnosis of many illnesses requires a thorough and accurate analysis of a patient's blood cells, which is usually done with automated or semi-automated hematology instruments. One of the most frequently performed laboratory tests on a blood sample is a complete blood count (CBC). Doctors use this test in disease screening and diagnosis.

Hematology controls and calibrators are products derived from various cellular components of blood which have been stabilized. Control and calibrator products can be utilized to ensure that hematology instruments are performing accurately and reliably. Ordinarily, a hematology control is used once to several times a day to make sure the instrument is reading accurately. In addition, most instruments need to be calibrated periodically. Hematology calibrators are similar to controls, but undergo additional testing to ensure that the calibration values assigned are within tight specifications and can be used to calibrate the instrument.

The Company offers a wide range of hematology controls and calibrators for both impedance and laser type cell counters. The Company believes its products have improved stability and versatility and a longer shelf life than most of those of its competitors. Hematology control products are also supplied for use as proficiency testing tools by laboratory certifying authorities in a number of states and countries.

Original Equipment Manufacturer (OEM) agreements represent the largest market for clinical controls made by the Company. In fiscal 2013, 2012 and 2011, OEM agreements accounted for $10.8 million, $9.7 million and $8.7 million, respectively, or 3% of total consolidated net sales in each fiscal year. The Company sells its clinical control products directly to customers in the United States and through distributors in the rest of the world.

PRODUCTS UNDER DEVELOPMENT

The Company is engaged in ongoing research and development in all of its major product lines: controls and calibrators and cytokines, antibodies, assays, small bioactive molecules and related biotechnology products. The Company believes that its future success depends, to a large extent, on its ability to keep pace with changing technologies and markets. At the same time, the Company continues to examine its production processes to ensure high quality and maximum efficiency.

In fiscal 2013, the Company introduced 2,100 new biotechnology products. The Company is planning to release new proteins, antibodies, immunoassay products and chemically-based research reagents in the coming year. All of these products will be for research use only and therefore do not require FDA clearance. The Company also developed several new clinical diagnostic products in fiscal 2013 and is continuously working to expand these product lines along with ongoing product improvements and enhancements. However, there is no assurance that any of the products in the research and development phase can be successfully completed or, if completed, can be successfully introduced into the marketplace.

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Research expense (in thousands): | ||||||||||||

Biotechnology | $ | 28,441 | $ | 27,112 | $ | 25,176 | ||||||

Clinical Controls | 816 | 800 | 809 | |||||||||

|

|

|

|

|

| |||||||

| $ | 29,257 | $ | 27,912 | $ | 25,985 | |||||||

|

|

|

|

|

| |||||||

Percent of net sales | 9.4 | % | 8.9 | % | 9.0 | % | ||||||

3

INVESTMENTS

The Company has an approximately 15.0% equity investment in ChemoCentryx, Inc. (CCXI). CCXI is a technology and drug development company working in the area of chemokines. Chemokines are cytokines which regulate the trafficking patterns of leukocytes, the effector cells of the human immune system. At June 30, 2011, the Company had a $14.3 million investment in the preferred stock of CCXI and accounted for the investment on a cost basis. The investment was included in "Investments in unconsolidated entities" at June 30, 2011. In September 2011, the Company entered into a $10.0 million loan agreement with CCXI. The loan agreement contained a number of conversion features contingent upon CCXI obtaining future debt or equity financing. The agreement also included a $5.0 million commitment by the Company to participate in a private placement in the event of a successful public offering of CCXI shares. On February 8, 2012, CCXI completed its initial public offering (IPO) at $10 per share. Upon the close of the IPO, the Company's investment in CCXI's preferred shares and the loan, plus accrued interest, converted into CCXI common stock. The Company invested an additional $5.0 million in the private placement, as discussed above, and received ten year warrants to purchase 150,000 shares of CCXI common stock at $20 per share. The Company's investment in CCXI is included in "Short-term available-for-sale investments" at June 30, 2013 and 2012 at fair values of $89.6 million and $94.7 million, respectively.

The Company has a 6.5% ownership percentage in H2Equity, LLC (formerly Hemerus Medical, LLC). The Company accounts for its investment in H2Equity under the equity method of accounting as H2Equity is a limited liability company. During fiscal 2012, H2Equity entered into an agreement to sell substantially all of its assets. The sale closed in April 2013. The Company received a $1.1 million distribution at closing and recorded a gain of $708,000. The Company's net investment in H2Equity was $26,000 and $551,000 at June 30, 2013 and 2012, respectively.

The Company has a 16.8% ownership interest in Nephromics LLC (Nephromics). The Company accounts for its investment in Nephromics under the equity method of accounting as Nephromics is a limited liability company. During fiscal 2012, Nephromics signed an agreement to sell substantially all of its assets. The sale price included a payment at closing, future payment contingent upon the issuance of certain patents, and royalties on future sublicense income. As a result of the agreement, the Company determined that a portion of its investment in Nephromics was other-than-temporarily impaired and wrote off $2.4 million of this investment in fiscal 2012. The Company's net investment in Nephromics was $505,000 at both June 30, 2013 and 2012.

The Company held an ownership interest in ACTGen, Inc. (ACTGen), a development stage biotechnology company located in Japan through October 2012. During fiscal 2012, the Company determined that the Company's investment in ACTGen was other-than-temporarily impaired and wrote off its remaining investment of $854,000.

GOVERNMENT REGULATION

All manufacturers of clinical diagnostic controls are regulated under the Federal Food, Drug and Cosmetic Act, as amended. All of the Company's clinical control products are classified as " in vitro diagnostic products" by the FDA. The entire control manufacturing process, from receipt of raw materials to the monitoring of control products through their expiration date, is strictly regulated and documented. FDA inspectors make periodic site inspections of the Company's clinical control operations and facilities. Clinical control manufacturing must comply with Quality System Regulations (QSR) as set forth in the FDA's regulations governing medical devices.

Three of the Company's immunoassay kits, EPO, TfR and ß2M, have FDA clearance to be sold for clinical diagnostic use. The Company must comply with QSR for the manufacture of these kits. Biotechnology products manufactured in the United States and sold for use in the research market do not require FDA clearance. Tocris products are used as research tools and require no regulatory approval for commercialization. Some of Tocris' products are considered controlled substances and require government permits to stock such products and to ship them to end-users. The Company has no reason to believe that these annual permits will not be re-issued.

4

Some of the Company's research groups use small amounts of radioactive materials in the form of radioisotopes in their product development activities. Thus, the Company is subject to regulation and inspection by the Minnesota Department of Health and has been granted a license through August 2014. The license is renewable annually. The Company has had no difficulties in renewing this license in prior years and has no reason to believe it will not be renewed in the future. If, however, the license was not renewed, it would have minimal effect on the Company's business since there are other technologies the research groups could use to replace the use of radioisotopes.

Beginning January 1, 2013, the Company was subject to the medical device excise tax which was included as part of the Affordable Care Act. The tax applies to the sale of medical devices by a manufacturer, producer or importer of the device and is 2.3% of the sale price. The tax applies to the Company's in vitro diagnostic products, including its clinical control products and biotechnology clinical diagnostic immunoassay kits. The Company's medical device excise tax for fiscal 2013 was $91,000.

AVAILABILITY OF RAW MATERIALS

The primary raw material for the Company's clinical controls is whole blood. Human blood is purchased from commercial blood banks, while porcine and bovine blood is purchased from nearby meat processing plants. After raw blood is received, it is separated into its components, processed and stabilized. Although the cost of human blood has increased due to the requirement that it be tested for certain diseases and pathogens, the higher cost of these materials has not had a material adverse effect on the Company's business. The Company does not perform its own pathogen testing as the supplier tests all human blood purchased.

R&D Systems' Biotechnology Division develops and manufactures the majority of its cytokines from synthetic genes developed in-house, thus significantly reducing its reliance on outside resources. R&D Systems typically has several outside sources for all critical raw materials necessary for the manufacture of products. Tocris sources its raw material from multiple world-wide sources. Many of the starting components used in the chemical synthesis are widely available products and no single source of raw reagents poses a supply risk to this business.

PATENTS AND TRADEMARKS

The Company owns patent protection for certain clinical controls which extend for various periods depending on the date of the patent application or patent grant. The Company is not substantially dependent on products for which it has obtained patent protection. Sales of such products are not material to the Company's financial results.

The Company may seek patent protection for new or existing products it manufactures. No assurance can be given that any such patent protection will be obtained. No assurance can be given that the Company's products do not infringe upon patents or proprietary rights owned or claimed by others, particularly for genetically engineered products. The Company has not conducted a patent infringement study for each of its products. For more information on patent litigation, see Item 3 "Legal Proceedings" in this Annual Report on Form 10-K.

The Company has a number of licensing agreements with patent holders under which it has the non-exclusive right to use patented technology or the non-exclusive right to manufacture and sell certain patented proteins and related products to the research market. For fiscal 2013, 2012 and 2011, total royalties expensed under these licenses were approximately $3.3 million, $3.2 million and $3.4 million, respectively.

The Company has obtained federal trademark registration for certain of its clinical controls and biotechnology product groups which extend for various periods depending upon the date of the trademark grant. The Company believes it has common law trademark rights to certain marks in addition to those which it has registered.

SEASONALITY OF BUSINESS

Biotechnology segment products marketed by the Company historically experience a slowing of sales or of the rate of sales growth during the summer months. The Company also usually experiences a slowing of sales in both of its reportable segments during the Thanksgiving to New Year holiday period. The Company believes this seasonality is a result of vacation schedules in Europe and Japan and of academic schedules in the United States.

5

SIGNIFICANT CUSTOMERS

No single customer in either reportable segment accounted for more than 10% of the Company's consolidated net sales during fiscal 2013, 2012 or 2011.

BACKLOG

There was no significant backlog of orders for the Company's products as of the date of this Annual Report on Form 10-K or as of a comparable date for fiscal 2012. The majority of the Company's biotechnology products are shipped within one day of receipt of the customers' orders. The majority of the Company's clinical control products are shipped based on a preset, recurring schedule.

COMPETITION

The worldwide market for protein related and chemically-based research reagents is being supplied by a number of companies, including GE Healthcare Life Sciences, BD Biosciences, Merck KGaA/EMD Chemicals, Inc., Life Technologies Corporation, Millipore Corporation, PeproTech, Inc., Santa Cruz Biotechnology, Inc., Abcam plc., Sigma-Aldrich Corporation, Thermo Fisher Scientific, Inc., Cayman Chemical Company and Enzo Biochem, Inc. The Company believes that it is one of the leading world-wide suppliers of cytokine related products in the research marketplace. The Company further believes that the expanding line of its products, their recognized quality, and the growing demand for protein related and chemically-based research reagents will allow the Company to remain competitive in the growing biotechnology research and diagnostic market.

Competition is intense in the clinical control business. The first control products were developed in response to the rapid advances in electronic instrumentation used in hospital and clinical laboratories for blood cell counting. Historically, most of the instrument manufacturing companies made controls for use in their own instruments. With rapid expansion of the instrument market, however, a need for more versatile controls enabled non-instrument manufacturers to gain a foothold. Today the market is composed of manufacturers of laboratory reagents, chemicals and coagulation products and independent control manufacturers in addition to instrument manufacturers. The principal clinical diagnostic control competitors for the Company's retail products are Abbott Diagnostics, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Streck, Inc., Siemens Healthcare Diagnostics Inc. and Sysmex Corporation. The Company believes it is the third largest supplier of hematology controls in the marketplace behind Beckman Coulter, Inc. and Streck, Inc.

EMPLOYEES

Through its subsidiaries, the Company employed 789 full-time and 65 part-time employees as of June 30, 2013, as follows:

| Full-time | Part-time | |||||||

U.S. | 665 | 35 | ||||||

Europe | 105 | 29 | ||||||

Asia | 19 | 1 | ||||||

|

|

|

| |||||

| 789 | 65 | |||||||

|

|

|

| |||||

ENVIRONMENT

Compliance with federal, state and local environmental protection laws in the United States, United Kingdom, Germany, China and Hong Kong had no material effect on the Company in fiscal 2013.

6

GEOGRAPHIC AREA FINANICAL INFORMATION

Following is financial information relating to geographic areas (in thousands):

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

External sales | ||||||||||||

United States | $ | 164,308 | $ | 172,310 | $ | 159,857 | ||||||

Europe | 88,297 | 90,142 | 83,676 | |||||||||

China | 14,106 | 11,378 | 8,299 | |||||||||

Other Asia | 28,608 | 25,988 | 24,715 | |||||||||

Rest of world | 15,256 | 14,742 | 13,415 | |||||||||

|

|

|

|

|

| |||||||

Total external sales | $ | 310,575 | $ | 314,560 | $ | 289,962 | ||||||

|

|

|

|

|

| |||||||

| As of June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Long-lived assets | ||||||||||||

United States | $ | 103,541 | $ | 87,968 | $ | 88,802 | ||||||

Europe | 7,129 | 7,528 | 7,819 | |||||||||

China | 117 | 141 | 96 | |||||||||

|

|

|

|

|

| |||||||

Total long-lived assets | $ | 110,787 | $ | 95,637 | $ | 96,717 | ||||||

|

|

|

|

|

| |||||||

Net sales are attributed to countries based on the location of the customer/distributor. Long-lived assets are comprised of land, buildings and improvements and equipment, net of accumulated depreciation and other assets. See the description of risks associated with the Company's foreign subsidiaries in Item 1A of this Annual Report on Form 10-K.

INVESTOR INFORMATION

The Company is subject to the information requirements of the Securities Exchange Act of 1934 (the Exchange Act). Therefore, the Company files periodic reports, proxy statements, and other information with the Securities and Exchange Commission (SEC). Such reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

Financial and other information about the Company is available on its web site (http://www.techne-corp.com). The Company makes available on its web site copies of its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

EXECUTIVE OFFICERS OF THE REGISTRANT

Currently, the names, ages and positions of each executive officer of the Company are as follows:

Name | Age | Position | Officer Since | |||||||

Charles Kummeth | 52 | President, Chief Executive Officer and Director | 2013 | |||||||

Gregory J. Melsen | 61 | Vice President of Finance, Treasurer and Chief Financial Officer | 2004 | |||||||

Marcel Veronneau | 59 | Senior Vice President, Clinical Controls | 1995 | |||||||

Kevin Reagan | 61 | Senior Vice President, Biotech | 2013 | |||||||

J. Fernando Bazan | 53 | Chief Technical Officer | 2013 | |||||||

7

The term of office of each executive officer is annual or until a successor is elected. There are no arrangements or understandings among any of the executive officers and any other person (not an officer or director acting as such) pursuant to which any of the executive officers was selected as an officer of the Company.

Charles Kummeth has been President and Chief Executive Officer of the Company since April 1, 2013. Prior to joining the Company, he served as President of Mass Spectrometry and Chromatography at Thermo Fisher Scientific Inc. from September 2011. He was President of that company's Laboratory Consumables Division from 2009 to September 2011. Prior to joining Thermo Fisher, Mr. Kummeth served in various roles at 3M Corporation, most recently as the Vice President of the company's Medical Division from 2006 to 2008.

Gregory J. Melsen joined the Company in December 2004 as Vice President of Finance and Chief Financial Officer. In October 2010, he also assumed the role of Treasurer. Prior to 2004, he held various vice president and chief financial officer positions at several publicly traded companies and was employed by a public accounting firm for 19 years, including nine years as an audit partner.

Marcel Veronneau was appointed as Vice President, Clinical Controls (formerly Hematology) for the Company in March 1995. Prior thereto, he served as Director of Operations for R&D Systems' Clinical Controls Division since joining the Company in 1993.

Dr. Kevin Reagan was appointed Senior Vice President, Biotech on August 1, 2013. Dr. Reagan joined the Company in January 2012 as R&D Systems' Vice President of Immunology. Prior to joining the Company, Dr. Reagan served as Managing Director of Calbiotech Veterinary Diagnostics from 2010 through 2011 and Senior Vice President of Calbiotech, Inc from 2009 through 2011. From 2005 through 2009, he served as Vice President, R&D, Immunological Systems at Invitrogen, Corp,, a division of Life Technologies Corporation.

Dr. J. Fernando Bazan was appointed Chief Technical Officer when he joined the Company on August 1, 2013. Dr. Bazan is an adjunct profession at the University of Minnesota School of Medicine and served as Chief Scientific Officer at Neuroscience, Inc., a neuroimmunology startup from 2010 to 2012. From 2003 through 2010, Dr. Bazan served as Senior Scientist at Genentech, Inc. (Roche).

ITEM 1A. RISK FACTORS

Statements in this Annual Report on Form 10-K, and elsewhere, that are forward-looking involve risks and uncertainties which may affect the Company's actual results of operations. Certain of these risks and uncertainties which have affected and, in the future, could affect the Company's actual results are discussed below. The Company undertakes no obligation to update or revise any forward-looking statements made due to new information or future events. Investors are cautioned not to place undue emphasis on these statements.

The following risk factors should be read carefully in connection with evaluation of the Company's business and any forward-looking statements made in this Annual Report on Form 10-K and elsewhere. Any of the following risks or others discussed in this Annual Report on Form 10-K or the Company's other SEC filings, could materially adversely affect the Company's business, operating results and financial condition.

The Company's future growth is dependent on the development of new products in a rapidly changing technological environment.

A major element of the Company's growth strategy is to increase revenues through new product releases. As a result, the Company must anticipate industry trends and develop products in advance of customer needs. New product development requires planning, designing and testing at both technological and manufacturing-process levels and may require significant research and development expenditures. There can be no assurance that any products now in development, or that the Company may seek to develop in the future, will achieve feasibility or gain market acceptance. There can also be no assurance that the Company's competitors will not succeed in developing technologies and products that are more effective than any which have been or are being developed by the Company or that would render the Company's technologies and products obsolete or noncompetitive.

8

Changes in economic conditions could negatively impact the Company's revenues and earnings.

The Company's biotechnology products are sold primarily to research scientists at pharmaceutical and biotechnology companies and at university and government research institutions. Research and development spending by the Company's customers and the availability of government research funding can fluctuate based on spending priorities and general economic conditions. An economic downturn or a reduction or delay in governmental funding could cause customers to delay or forego purchases of the Company's products. The Company carries essentially no backlog of orders and changes in the level of orders received and filled daily can cause fluctuations in quarterly revenues and earnings.

The biotechnology and clinical control industries are very competitive.

The Company faces significant competition across all of its product lines and in each market in which it operates. Competitors include companies ranging from start-up companies, who may be able to more quickly respond to customers' needs, to large multinational companies, which may have greater financial and marketing resources than the Company. In addition consolidation trends in the pharmaceutical and biotechnology industries have served to create fewer customer accounts and/or to concentrate purchasing decisions for some customers, resulting in increased pricing pressure on the Company. The entry into the market of manufacturers in China and other low-cost manufacturing locations is also creating increased pricing pressures, particularly in developing markets. Failure to anticipate and respond to competitors' actions may impact the Company's future sales and earnings.

The Company relies heavily on internal manufacturing and related operations to produce, package and distribute its products.

The Company manufactures the majority of the products it sells at its Minneapolis, Minnesota facility. Quality control, packaging and distribution operations support all of the Company's sales. Since the Company creates value for its customers through the development of high-quality products, any significant decline in quality or disruption of operations for any reason could adversely affect sales and customer relationships, and therefore adversely affect the business. While the Company has taken certain steps to manage these operational risks, and while insurance coverage may reimburse, in whole or in part, for losses related to such disruptions, the Company's ability to provide products in the longer term could adversely affect future sales growth and earnings.

The design and manufacture of products involves certain inherent risks. Manufacturing or design defects could lead to recalls, litigation or alerts relating to the Company's products. A recall could result in significant costs and damage to the Company's reputation which could reduce demand for its products.

The Company is significantly dependent on sales made through foreign subsidiaries which are subject to changes in exchange rates.

Approximately 31% of the Company's sales are made through its foreign subsidiaries, which transact their sales in foreign currencies. The Company's revenues and earnings are, therefore, affected by fluctuations in currency exchange rates. Any adverse movement in foreign currency exchange rates could negatively affect the Company's revenues and earnings.

The Company conducts and plans to grow its business in developing markets.

The Company's efforts to grow its businesses depends, to a degree, on its success in developing market share in additional geographic markets including, but not limited to, China. In some cases, these countries have greater political and economic volatility and greater vulnerability to infrastructure and labor disruptions than the Company's other markets. Operating and seeking to expand business in a number of different regions and countries exposes the Company to multiple and potentially conflicting cultural practices, business practices and legal and regulatory requirements.

9

The Company faces risk resulting from the economic instability in the Eurozone countries.

Sales in Europe made up approximately 28% of the Company's net sales in fiscal 2013. As a result of several Eurozone countries facing fiscal crises and uncertainty about the continued viability of the Euro as a single currency, the Company's European sales may be adversely affected by reduced spending on health care and research by Eurozone governments and general economic instability in the region. Such reduced sales would adversely affect the Company's revenues, financial condition and results of operations.

The Company's success will be dependent on recruiting and retaining highly qualified personnel.

Recruiting and retaining qualified scientific, production and management personnel are critical to the Company's success. The Company's anticipated growth and its expected expansion into areas and activities requiring additional expertise will require the addition of new personnel and the development of additional expertise by existing personnel. The failure to attract and retain such personnel could adversely affect the Company's business.

The Company's business is subject to governmental laws and regulations.

The Company's operations are subject to regulation by various U.S. federal, state and international agencies. Laws and regulations enacted and enforced by these agencies impact all aspects of the Company's operations including design, development, manufacturing, labeling, selling and the importing and exporting of products across international borders. Any changes to laws and regulations governing such activities could have an effect on the Company's operations. If the Company fails to comply with any of these regulations, it may become subject to fines, penalties or actions that could impact development, manufacturing and distribution and/or increase costs or reduce sales. The approval process applicable to clinical control products of the type that may be developed by the Company may take a year or more. Delays in obtaining approvals could adversely affect the marketing of new products developed by the Company, and negatively affect the Company's revenues.

As a multinational corporation, the Company is subject to the tax laws and regulations of the U.S. federal, state and local governments and of several international jurisdictions. From time to time, new tax legislation may be implemented which could adversely affect current or future tax filings or negatively impact the Company's effective tax rate and thus increase future tax payments.

The Company is dependent on maintaining its intellectual property rights.

The Company's success will depend, in part, on its ability to obtain licenses and patents, maintain trade secret protection and operate without infringing the proprietary rights of others. The Company has obtained and continues to negotiate licenses to produce a number of products claimed to be owned by others. Since the Company has not conducted a patent infringement study for each of its products, it is possible that products of the Company may unintentionally infringe patents of third parties or that the Company may have to alter its products or processes, pay licensing fees or cease certain activities because of patent rights of third parties, thereby causing additional unexpected costs and delays which may have a material adverse effect on the Company.

The Company is exposed to credit risk and fluctuations in the market values of its investment portfolio.

The Company has investments in marketable securities that are classified and accounted for as available-for-sale. These securities may include U.S. government and agency securities, state and municipal securities, foreign government securities, U.S. and foreign corporate debt and equity securities and certificates of deposit. These investments may experience reduced liquidity due to changes in market conditions and investor demand. Although the Company has not recognized any significant losses to date on its available-for-sale securities, any significant future declines in their market values could materially adversely affect the Company's financial condition and operating results. Given the global nature of its business, the Company has investments both domestically and internationally. Credit ratings and pricing of these investments can be negatively impacted by liquidity, credit deterioration or losses, financial results, or other factors. As a result, the value or liquidity of the Company's available-for-sale investments could decline and result in a material impairment, which could materially adversely affect the Company's financial condition and operating results.

10

The Company may incur losses as a result of its investments in ChemoCentryx, Inc. and other companies, the success of which is largely out of the Company's control.

The Company's expansion strategies include collaborations, investments in joint ventures and companies developing new products related to the Company's business, and the acquisition of businesses for new products, technologies and additional customer base. These strategies carry risks that objectives will not be achieved and future earnings will be adversely affected.

The Company has an approximate 15.0% equity investment in ChemoCentryx, Inc. (CCXI) that is valued at $89.6 million on the Company's June 30, 2013 Balance Sheet. CCXI is a biopharmaceutical company focused on discovering, developing and commercializing orally-administered therapeutics to treat autoimmune diseases, inflammatory diseases and cancers. The development of new drugs is a highly risky undertaking. CCXI is dependent on a limited number of products, must achieve favorable clinical trial results, obtain regulatory and marketing approval for these products and is reliant on a strategic alliance with GlaxoSmithKline. CCXI has also incurred significant losses and has yet to achieve profitability.

The ownership of CCXI shares is very concentrated, the share price is highly volatile and there is limited trading of the shares. These factors make it possible that the Company could experience future dilution or a substantial decline in the $60.2 million unrealized gain it has on its CCXI investment and/or its $29.5 million investment in CCXI. At August 26, 2013, the market value of the Company's investment in CCXI was $51.2 million and its unrealized gain declined to $21.8 million.

We have identified a material weakness in our internal controls that, if not properly corrected, could adversely affect our operations and result in material misstatements in our financial statements.

As described in "Item 9A. Controls and Procedures", we have identified a material weakness in our system of internal control over financial reporting as of June 30, 2013. A material weakness is a deficiency, or combination of deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

The Company has identified a material weakness in the design, implementation and operating effectiveness of general IT controls (GITCs) intended to ensure that access to financial applications and data was adequately restricted to appropriate personnel, and that program changes to particular financial applications are documented, tested, and moved into the production environment only by individuals separate from the development function. As a result, certain classes of transactions subject to controls that rely upon information generated by the Company's IT systems that are subject to the operation of the GITCs, including the completeness, existence, and accuracy of revenue and accounts receivable, allow for a reasonable possibility that a misstatement is not adequately prevented or detected through the operation of management's system of internal control over financial reporting.

In response to the material weakness we have developed a plan to enhance our internal testing approach, including related procedures, documentation, and possible expansion of human resources, for select controls to ensure that we have adequately addressed the completeness and accuracy of system-generated information used to support the operation of the controls and to improve segregation of duties.

Although there can be no assurances, we believe these enhancements and improvements, when repeated in future periods, will remediate the material weakness described above. However, if we are not able to remedy the material weakness in a timely manner, we may be unable to provide holders of our securities with the required financial information in a timely and reliable manner and we may incorrectly report financial information. Either of these events could subject us to regulatory enforcement and other actions, and could have a material adverse effect on our operations, investor, supplier and customer confidence in our reported financial information and the trading price of our common stock.

11

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved staff comments as of the date of this report.

ITEM 2. PROPERTIES

The Company owns the facilities that its headquarters and R&D Systems subsidiary occupy in Minneapolis, Minnesota. The Minneapolis facilities are utilized by both the Company's clinical controls and biotechnology segments.

The Minneapolis complex includes approximately 800,000 square feet of space in several adjoining buildings. R&D Systems uses approximately 600,000 square feet of the complex for administrative, research, manufacturing, shipping and warehousing activities. The Company is currently leasing or plans to lease the remaining space in the complex as retail and office space.

The Company owns approximately 649 acres of farmland, including buildings, in southeast Minnesota. A portion of the land and buildings are being leased to third parties as cropland and for a dairy operation. The remaining property is used by the Company to house goats and sheep for polyclonal antibody production for its biotechnology segment.

Rental income from the above properties was $830,000, $693,000 and $549,000 in fiscal 2013, 2012 and 2011, respectively.

The Company owns the 17,000 square foot facility that its R&D Europe subsidiary occupies in Abingdon, England. This facility is utilized by the Company's biotechnology segment.

The Company leases the following facilities, all of which are utilized by the Company's biotechnology segment:

Subsidiary | Location | Type | Square Feet | |||

| R&D GmbH | Wiesbaden-Nordenstadt, Germany | Office space | 4,200 | |||

| BiosPacific | Emeryville, California | Office space | 3,000 | |||

| R&D China | Shanghai, China | Office/warehouse | 5,600 | |||

| R&D Hong Kong | Hong Kong | Office space | 1,200 | |||

| Boston Biochem | Cambridge, Massachusetts | Office/lab | 7,400 | |||

| Tocris | Bristol, United Kingdom | Office/manufacturing/lab/warehouse | 11,000 |

The Company is currently analyzing options related to upgrading the Tocris facility. The Company is also pursuing a lease for warehouse space near Heathrow airport in London to simplify logistics for the European marketplace.

The Company believes the owned and leased properties, other than the Tocris facility, are adequate to meet its occupancy needs in the foreseeable future.

12

ITEM 3. LEGAL PROCEEDINGS

As of August 23, 2013, the Company is not a party to any legal proceedings that, individually or in the aggregate, are reasonably expected to have a material adverse effect on the Company's business, results of operations, financial condition or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company's common stock trades on the NASDAQ Global Select Market under the symbol "TECH." The following table sets forth for the periods indicated the high and low sales price per share for the Company's common stock as reported by the NASDAQ Global Select Market.

| Fiscal 2013 Price | Fiscal 2012 Price | |||||||||||||||

| High | Low | High | Low | |||||||||||||

1st Quarter | $ | 76.02 | $ | 66.26 | $ | 86.43 | $ | 66.34 | ||||||||

2nd Quarter | 74.17 | 65.37 | 73.55 | 62.04 | ||||||||||||

3rd Quarter | 72.20 | 65.67 | 72.20 | 65.25 | ||||||||||||

4th Quarter | 70.00 | 62.55 | 74.79 | 63.08 | ||||||||||||

As of August 23, 2013, there were over 29,000 beneficial shareholders of the Company's common stock and over 150 shareholders of record. The Company paid quarterly cash dividends totaling $43.5 million, $41.0 million and $39.7 million in fiscal 2013, 2012 and 2011, respectively. Its Board of Directors periodically considers the payment of cash dividends, and there is no guarantee that the Company will pay cash dividends in the future.

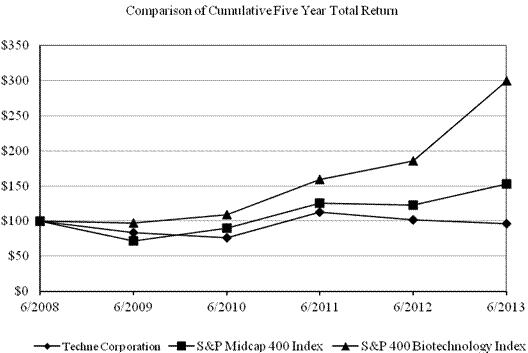

The following chart compares the cumulative total shareholder return on the Company's common stock with the S&P Midcap 400 Index and the S&P 400 Biotechnology Index. The comparison assumes $100 was invested on the last trading day before July 1, 2008 in the Company's common stock and in each of the foregoing indices and assumes reinvestment of dividends.

13

The following table sets forth the repurchases of Company common stock for the quarter ended June 30, 2013.

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||||

4/1/13 - 4/30/13 | 24,000 | 64.29 | 24,000 | $ | 125.5 million | |||||||||||

5/1/13 - 5/31/13 | 4,300 | 64.85 | 4,300 | $ | 125.2 million | |||||||||||

6/1/13 - 6/30/13 | 0 | 0 | 0 | $ | 125.2 million | |||||||||||

In April 2009, the Company authorized a plan for the repurchase and retirement of $60 million of its common stock. The plan does not have an expiration date. In October 2012, the Company increased the amount authorized under the plan by $100 million.

14

ITEM 6. SELECTED FINANCIAL DATA

(dollars in thousands, except per share data)

Income and Share Data: | 2013 | 2012 | 2011 (1) | 2010 | 2009 | |||||||||||||||

Net sales | $ | 310,575 | $ | 314,560 | $ | 289,962 | $ | 269,047 | $ | 263,956 | ||||||||||

Gross margin (2) | 74.4 | % | 75.0 | % | 77.6 | % | 79.6 | % | 78.8 | % | ||||||||||

Selling, general and administrative expenses (2) | 14.0 | % | 13.3 | % | 12.4 | % | 12.2 | % | 12.8 | % | ||||||||||

Research and development expenses (2) | 9.4 | % | 8.9 | % | 9.0 | % | 9.3 | % | 8.9 | % | ||||||||||

Operating income (2) | 51.0 | % | 52.8 | % | 56.2 | % | 58.1 | % | 57.1 | % | ||||||||||

Earnings before income taxes (2) | 51.7 | % | 51.6 | % | 56.9 | % | 58.1 | % | 58.9 | % | ||||||||||

Net earnings (2) | 36.2 | % | 35.7 | % | 38.7 | % | 40.8 | % | 39.9 | % | ||||||||||

Net earnings | $ | 112,561 | $ | 112,331 | $ | 112,302 | $ | 109,776 | $ | 105,242 | ||||||||||

Diluted earnings per share | $ | 3.05 | $ | 3.04 | $ | 3.02 | $ | 2.94 | $ | 2.78 | ||||||||||

Average common and common equivalent shares-diluted (in thousands) | 36,900 | 37,006 | 37,172 | 37,347 | 37,900 | |||||||||||||||

Closing price per share: | ||||||||||||||||||||

High | $ | 76.02 | $ | 85.13 | $ | 83.37 | $ | 69.65 | $ | 81.90 | ||||||||||

Low | $ | 63.42 | $ | 62.37 | $ | 56.14 | $ | 57.10 | $ | 45.64 | ||||||||||

Balance Sheet Data as of June 30: | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

Cash, cash equivalents and short-term available-for-sale investments | $ | 332,937 | $ | 268,986 | $ | 140,813 | $ | 138,811 | $ | 202,887 | ||||||||||

Receivables | 40,175 | 37,741 | 37,860 | 34,137 | 31,153 | |||||||||||||||

Inventories | 34,877 | 38,277 | 44,906 | 13,737 | 11,269 | |||||||||||||||

Working capital | 377,432 | 310,757 | 212,229 | 184,016 | 239,944 | |||||||||||||||

Total assets | 778,098 | 719,324 | 617,670 | 518,816 | 472,005 | |||||||||||||||

Cash Flow Data: | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

Net cash provided by operating activities | $ | 123,562 | $ | 126,746 | $ | 127,194 | $ | 111,260 | $ | 111,321 | ||||||||||

Capital expenditures | 22,454 | 6,017 | 3,630 | 4,644 | 6,556 | |||||||||||||||

Cash dividends paid per common share (3) | 1.18 | 1.11 | 1.07 | 1.03 | 0.75 | |||||||||||||||

Financial Ratios: | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

Return on average equity | 15.9 | % | 17.8 | % | 20.6 | % | 22.9 | % | 22.3 | % | ||||||||||

Return on average assets | 15.0 | % | 16.8 | % | 19.8 | % | 22.2 | % | 21.5 | % | ||||||||||

Current ratio | 12.8 | 9.7 | 12.7 | 11.8 | 16.5 | |||||||||||||||

Price to earnings ratio (4) | 23 | 24 | 28 | 20 | 23 | |||||||||||||||

Employee Data as of June 30: | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

Full-time employees | 789 | 783 | 763 | 684 | 687 | |||||||||||||||

| (1) | The Company acquired Boston Biochem, Inc. on April 1, 2011 and Tocris Holdings Limited and subsidiaries on April 28, 2011. |

| (2) | As a percent of net sales. |

| (3) | The Company's Board of Directors periodically considers the payment of cash dividends. |

| (4) | Common share price at end of fiscal year (June 30) divided by the diluted earnings per share for the respective fiscal year. |

15

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING INFORMATION

This report contains forward-looking statements, which are based on the Company's current assumptions and expectations. The principal forward-looking statements in this report include: the Company's expectations regarding product releases, governmental license renewals, future income tax rates, capital expenditures, the performance of the Company's investments, future dividend declarations, the construction and lease of certain facilities, the adequacy of owned and leased property for future operations, fluctuations in the Company's financial results and sufficiency of capital resources to meet the Company's foreseeable future cash and working capital requirements.

All such forward-looking statements are intended to enjoy the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Although the Company believes there is a reasonable basis for the forward-looking statements, the Company's actual results could be materially different. The most important factors which could cause the Company's actual results to differ from forward-looking statements are set forth in the Company's description of risk factors in Item 1A to this Annual Report on Form 10-K.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update any forward-looking statements.

USE OF ADJUSTED FINANCIAL MEASURES:

The adjusted financial measures used in this Annual Report on Form 10-K quantify the impact the following events had on reported net sales, gross margin percentages and net earnings for fiscal 2013 as compared to fiscal 2012 and 2011:

| • | fluctuations in exchange rates used to convert transactions in foreign currencies (primarily the Euro, British pound sterling and Chinese yuan) to U.S. dollars; |

| • | the acquisitions of Boston Biochem, Inc. on April 1, 2011 and Tocris Holdings Limited on April 28, 2011, including the impact of amortizing intangible assets and the recognition of costs upon the sale of inventory written-up to fair value; |

| • | professional fees and other costs incurred as part of the acquisitions of Boston Biochem, Inc. and Tocris Holdings Limited in fiscal 2011 and the acquisition of Bionostics Holdings Limited in July 2013; |

| • | impairment losses related to the Company's investments in unconsolidated entities; and |

| • | income tax adjustments related to the reversal of valuation allowances on deferred tax assets and the reinstatement of the U.S. credit for research and development expenditures. |

These adjusted financial measures are not prepared in accordance with generally accepted accounting principles (GAAP) and may be different from adjusted financial measures used by other companies. Adjusted financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. The Company views these adjusted financial measures to be helpful in assessing the Company's ongoing operating results. In addition, these adjusted financial measures facilitate our internal comparisons to historical operating results and comparisons to competitors' operating results. These adjusted financial measures are included in this Annual Report on Form 10-K because the Company believes they are useful to investors in allowing for greater transparency related to supplemental information used in the Company's financial and operational analysis. Investors are encouraged to review the reconciliations of adjusted financial measures used in this Annual Report on Form 10-K to their most directly comparable GAAP financial measures.

16

OVERVIEW

Techne Corporation and subsidiaries (the Company) are engaged in the development, manufacture and sale of biotechnology products and clinical diagnostic controls. These activities are conducted domestically through its wholly-owned subsidiaries, R&D Systems, Inc. (R&D Systems), Boston Biochem, Inc. (Boston Biochem) and BiosPacific, Inc. (BiosPacific). The Company's European biotechnology operations are conducted through its wholly-owned U.K. subsidiaries, R&D Systems Europe Ltd. (R&D Europe) and Tocris Holdings Limited (Tocris). R&D Europe has a sales subsidiary, R&D Systems GmbH, in Germany and a sales office in France. The Company distributes its biotechnology products in China through its wholly-owned subsidiary, R&D Systems China Co., Ltd. (R&D China). R&D China has a sales subsidiary, R&D Systems Hong Kong Ltd., in Hong Kong.

The Company has two reportable segments based on the nature of its products (biotechnology and clinical controls). R&D Systems' Biotechnology Division, R&D Europe, Tocris, R&D China, BiosPacific and Boston Biochem are included in the biotechnology reporting segment. The Company's biotechnology reporting segment develops, manufactures and sells biotechnology research and diagnostic products world-wide. The Company's clinical controls reporting segment, which consists of R&D Systems' Clinical Controls Division, develops and manufactures controls and calibrators for sale world-wide.

OVERALL RESULTS

Consolidated net sales decreased 1.3% and consolidated net earnings were flat for fiscal 2013 as compared to fiscal 2012. Consolidated net earnings for fiscal 2013 included $4.5 million of costs recognized upon the sale of inventory acquired in fiscal 2011 that was written-up to fair value compared to $7.6 million in fiscal 2012. Consolidated net earnings in fiscal 2012 included impairment losses of $3.3 million recorded on two of the Company's investments in unconsolidated entities and a $3.0 million tax benefit from the reversal of deferred tax valuation allowances.

Consolidated net sales increased 8.5% and consolidated net earnings were flat for fiscal 2012 as compared to fiscal 2011. Consolidated net sales in fiscal 2012 were impacted by the acquisitions of Boston Biochem and Tocris during the fourth quarter of fiscal 2011. Included in fiscal 2012 and fiscal 2011 consolidated net sales were $19.4 million and $4.7 million, respectively, of acquisition-related net sales. Consolidated net earnings for fiscal 2012 included $7.6 million of costs recognized upon the sale of inventory that was written-up to fair value at the time of the acquisitions and $5.1 million amortization of intangible assets compared to $1.8 million and $1.5 million, respectively, in fiscal 2011.

RESULTS OF OPERATIONS

Net Sales

Consolidated organic net sales, excluding the impact of the acquisitions in fiscal 2011 and the effect of the change from the prior year in exchange rates used to convert sales in foreign currencies (primarily British pound sterling, euros and Chinese yuan) into U.S. dollars, were as follows (in thousands):

| Year Ended June 30, | ||||||||

| 2013 | 2012 | |||||||

Consolidated net sales | $ | 310,575 | $ | 314,560 | ||||

Organic sales adjustments: | ||||||||

Impact of foreign currency fluctuations | 2,637 | 0 | ||||||

|

|

|

| |||||

Consolidated organic net sales | $ | 313,212 | $ | 314,560 | ||||

|

|

|

| |||||

Organic sales growth | (0.4 | %) | ||||||

17

| Year Ended June 30, | ||||||||

| 2012 | 2011 | |||||||

Consolidated net sales | $ | 314,560 | $ | 289,962 | ||||

Organic sales adjustments: | ||||||||

Acquisitions | (19,385 | ) | 0 | |||||

Impact of foreign currency fluctuations | 27 | 0 | ||||||

|

|

|

| |||||

Consolidated organic net sales | $ | 295,202 | $ | 289,962 | ||||

|

|

|

| |||||

Organic sales growth | 1.8 | % | ||||||

Net sales by reportable segment were as follows (in thousands):

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Biotechnology | $ | 288,156 | $ | 293,274 | $ | 270,287 | ||||||

Clinical Controls | 22,419 | 21,286 | 19,675 | |||||||||

|

|

|

|

|

| |||||||

| $ | 310,575 | $ | 314,560 | $ | 289,962 | |||||||

|

|

|

|

|

| |||||||

Biotechnology segment net sales decreased $5.1 million (1.8%) and increased $23.0 million (8.5%), respectively, in fiscal 2013 and fiscal 2012 from each of the prior fiscal years. Biotechnology segment organic net sales decreased $2.5 million (0.8%) in fiscal 2013 primarily as a result of decreased sales volume in the U.S. Biotechnology segment organic net sales increased $3.6 million (1.3%) in fiscal 2012, primarily as a result of increased sales volume. Included in fiscal 2013 and 2012 net sales were $2.8 million and $2.7 million, respectively, of sales of new biotechnology products which had their first sale in each of the fiscal years.

Biotechnology segment organic sales growth from the same prior-year periods was as follows:

| Year Ended June 30, | ||||||||

| 2013 | 2012 | |||||||

U.S. industrial, pharmaceutical and biotechnology | (2.6 | %) | 3.2 | % | ||||

U.S. academic | (5.9 | %) | (5.1 | %) | ||||

Europe | 0.1 | % | (1.5 | %) | ||||

China | 18.9 | % | 21.6 | % | ||||

Pacific rim distributors, excluding China | 3.5 | % | 7.0 | % | ||||

Biotechnology segment net sales consisted of the following:

| Year Ended June 30, | ||||

| 2013 | ||||

United States | ||||

Industrial, pharmaceutical and biotechnology | 29 | % | ||

Academic | 13 | % | ||

Other | 13 | % | ||

|

| |||

| 55 | % | |||

Europe | 28 | % | ||

China | 5 | % | ||

Pacific rim distributors, excluding China | 9 | % | ||

Rest of world | 3 | % | ||

|

| |||

| 100 | % | |||

|

| |||

Clinical controls segment net sales increased $1.1 million (5.3%) and $1.6 million (8.2%), respectively, in fiscal 2013 and 2012 from each of the prior fiscal years, primarily as a result of increased sales volume.

18

Gross Margins

Fluctuations in gross margins, as a percentage of net sales, are typically the result of changes in foreign currency exchange rates and changes in product mix. Such fluctuations are normal and expected to continue in future periods. Gross margins have also been affected by acquisitions completed in prior years.

Consolidated gross margins for fiscal 2013 and 2012 were negatively impacted as a result of purchase accounting related to inventory and intangible assets acquired during the fourth quarter of fiscal 2011. Under purchase accounting, inventory is valued at fair value less expected selling and marketing costs, resulting in reduced margins in future periods as the inventory is sold.

A reconciliation of the reported consolidated gross margin percentages, adjusted for acquired inventory sold and intangible amortization included in cost of sales, is as follows:

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Consolidated gross margin percentage | 74.4 | % | 75.0 | % | 77.6 | % | ||||||

Identified adjustments: | ||||||||||||

Costs recognized upon sale of acquired inventory | 1.4 | % | 2.4 | % | 0.6 | % | ||||||

Amortization of intangibles | 1.0 | % | 1.0 | % | 0.3 | % | ||||||

|

|

|

|

|

| |||||||

Adjusted gross margin percentage | 76.8 | % | 78.4 | % | 78.5 | % | ||||||

|

|

|

|

|

| |||||||

Segment gross margins, as a percentage of net sales, were as follows:

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Biotechnology | 76.4 | % | 76.9 | % | 79.8 | % | ||||||

Clinical Controls | 49.0 | % | 48.6 | % | 47.0 | % | ||||||

Consolidated | 74.4 | % | 75.0 | % | 77.6 | % | ||||||

The Biotechnology segment gross margin percentages for fiscal 2013 and 2012 were negatively impacted by purchase accounting and intangible asset amortization as discussed above. The clinical controls segment gross margin percentages changed from the comparable prior-year periods as a result of changes in product mix.

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased $1.7 million (4.1%) and $5.8 million (16.1%) in fiscal 2013 and 2012, respectively. The increase in fiscal 2013 was the results of $607,000 of professional fees related to the acquisition of Bionostics Holdings Limited, which was completed in early fiscal 2014 and $500,000 of professional fees related to the design and engineering for a new facility in the U.K. A decision was made in late fiscal 2013 to pursue other options related to the facilities in the U.K. These increases in fiscal 2013 were offset by a decrease of $1.1 million in profit sharing and bonuses as compared to fiscal 2012. The remaining increase in fiscal 2013 was the result of increased executive compensation and marketing wages and consulting related to upgrading the Company's website. The increase in fiscal 2012 resulted primarily from $3.3 million of additional expenses of the companies acquired in late fiscal 2011 and an increase in customer relationships and trade name amortization of $1.5 million as a result of the acquisitions. The remainder of the change in selling, general and administrative expenses for fiscal 2012 was mainly the result of annual wage, salary and benefit increases.

19

Consolidated selling, general and administrative expenses were composed of the following (in thousands):

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Biotechnology | $ | 37,421 | $ | 36,453 | $ | 30,058 | ||||||

Clinical Controls | 1,561 | 1,697 | 1,451 | |||||||||

Unallocated corporate expenses | 4,402 | 3,533 | 4,388 | |||||||||

|

|

|

|

|

| |||||||

| $ | 43,384 | $ | 41,683 | $ | 35,897 | |||||||

|

|

|

|

|

| |||||||

Research and Development Expenses

Research and development expenses increased $1.3 million (4.8%) and $1.9 million (7.4%) in fiscal 2013 and 2012, respectively, as compared to prior-year periods. The increases were primarily the result of the development of new proteins, antibodies and assay kits by R&D Systems' Biotechnology Division and product development by Boston Biochem and Tocris. The Company introduced approximately 2,100 and 1,800 new biotechnology products in fiscal 2013 and 2012, respectively. Research and development expenses are composed of the following (in thousands):

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Biotechnology | $ | 28,441 | $ | 27,112 | $ | 25,176 | ||||||

Clinical Controls | 816 | 800 | 809 | |||||||||

|

|

|

|

|

| |||||||

| $ | 29,257 | $ | 27,912 | $ | 25,985 | |||||||

|

|

|

|

|

| |||||||

Interest Income

Interest income for fiscal 2013, 2012 and 2011 was $2.6 million, $2.6 million and $3.8 million, respectively. Interest income in fiscal 2013 remained flat from fiscal 2012 as a result of increased cash balances offset by lower interest rates. The decrease in fiscal 2012 from the prior fiscal year was primarily the result of lower cash and available-for-sale debt securities as a result of the acquisitions in late fiscal 2011.

Impairment Loss on Investments in Unconsolidated Entities

The Company has a 16.8% ownership interest in Nephromics LLC (Nephromics). The Company accounts for its investment in Nephromics under the equity method of accounting as Nephromics is a limited liability company. During fiscal 2012, Nephromics signed an agreement to sell substantially all of its assets. The sale price included a payment at closing, future payment contingent upon the issuance of certain patents, and royalties on future sublicense income. As a result of the agreement, the Company determined that a portion of its investment in Nephromics was other-than-temporarily impaired and wrote off $2.4 million of this investment in fiscal 2012. The Company's net investment in Nephromics was $505,000 at both June 30, 2013 and 2012, respectively.

The Company held an ownership interest in ACTGen, Inc. (ACTGen), a development stage biotechnology company located in Japan through October 2012. During fiscal 2012, the Company determined that the Company's investment in ACTGen was other-than-temporarily impaired and wrote off its remaining investment of $854,000.

20

Other Non-operating Expense, Net

Other non-operating expense, net, consists of foreign currency transaction gains and losses, rental income, building expenses related to rental property and the Company's share of gains and losses from equity method investees as follows (in thousands):

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Foreign currency gains (losses) | $ | 339 | $ | (1,362 | ) | $ | 844 | |||||

Rental income | 830 | 693 | 549 | |||||||||

Real estate taxes, depreciation and utilities | (2,192 | ) | (2,127 | ) | (2,293 | ) | ||||||

Net gain (loss) from equity method investees | 570 | (603 | ) | (926 | ) | |||||||

|

|

|

|

|

| |||||||

| $ | (453 | ) | $ | (3,399 | ) | $ | (1,826 | ) | ||||

|

|

|

|

|

| |||||||

The Company has a 6.5% ownership percentage in H2Equity (formerly Hemerus Medical, LLC). The Company accounts for its investment in H2Equity under the equity method of accounting as H2Equity is a limited liability company. During fiscal 2012, H2Equity entered into an agreement to sell substantially all of its assets. The sale closed in April 2013. The Company received a $1.1 million distribution at closing and recorded a gain of $708,000 which is included in "Net gain (loss) from equity investments" above.

Income Taxes

Income taxes for fiscal 2013, 2012 and 2011 were provided at rates of 29.9%, 30.7% and 31.9%, respectively, of consolidated earnings before income taxes. In January 2013, the U.S. federal credit for research and development was reinstated for the period of January 2012 through December 2013. As a result, a credit of $431,000 for January 2012 to June 2012 was included in fiscal 2013 income taxes.

Included in income taxes in fiscal 2012 was a $3.0 million benefit due to the reversal of a deferred tax valuation allowance on the excess tax basis in the Company's investments in unconsolidated entities. The Company determined such valuation allowance was no longer necessary and included the benefit in fiscal 2012 income taxes. Excluding this benefit, the effective tax rate for fiscal 2012 would have been 32.6%. In addition, the fiscal 2012 consolidated tax rate was negatively impacted by the expiration of the U.S. research and development credit on December 31, 2011.

The fiscal 2011 consolidated tax rate was positively impacted by the renewal of the U.S. research and development credit for the January to December 2011 period. Fiscal 2011 included $431,000 of credit for research and development for the January to June 2010 period.

U.S. federal taxes have been reduced by the manufacturer's deduction provided for under the American Jobs Creation Act of 2004 and the U.S. federal credit for research and development. Foreign income taxes have been provided at rates which approximate the tax rates in the countries in which R&D Europe, Tocris and R&D China operate. The Company expects income tax rates for fiscal 2014 to range from 30% to 32%.

21

Net Earnings

Adjusted consolidated net earnings are as follows (in thousands):

| Year Ended June 30, | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Net earnings | $ | 112,561 | $ | 112,331 | $ | 112,302 | ||||||

Identified adjustments: | ||||||||||||