UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(X ) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2011 |

( ) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934 |

For the transition period form to | |

Commission File number 333-151339 |

| SWEETWATER RESOURCES, INC. |

(Exact name of registrant as specified in its charter)

Nevada | 71-1050559 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

Madappilly House, Elenjipra, P.O. Chalakudy Via, Kerala, India |

(Address of principal executive offices) |

011-91-480-320-8192 |

(Issuer's telephone number) |

N/A |

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. [ ] Yes [ ] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definition of "large accelerated filer", "accelerated filer" and "small reporting company" Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] (Do not check if a small reporting company) Small reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recent completed second fiscal quarter.

-1-

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PROCEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes □ No □

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date:

May 20, 2011: 113,525,000 common shares

-2-

TABLE OF CONTENTS

PART 1 | Page | |

ITEM 1. | Business. | 4 |

ITEM 1A. | Risk Factors. | 5 |

ITEM 1B. | Unresolved Staff Comments. | 8 |

ITEM 2. | Properties. | 9 |

ITEM 3. | Legal Proceedings. | 13 |

ITEM 4. | Submission of Matters to Vote of Securities Holders | 13 |

PART II | ||

ITEM 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities. | 13 |

ITEM 6 | Selected Financial Information. | 14 |

ITEM 7. | Management's Discussion and Analysis of Financial Conditions and Results of Operations. | 15 |

ITEM 7A. | Quantitative and Qualitative Disclosure about Market Risk. | 20 |

ITEM 8. | Financial Statement and Supplementary Data. | 21 |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 21 |

ITEM 9A | Controls and Procedures. | 21 |

ITEM 9A(T) | Controls and Procedures | 23 |

ITEM 9B | Other information | 23 |

PART III | ||

ITEM 10. | Directors, Executive Officers and Corporate Governance. | 23 |

ITEM 11. | Executive Compensation. | 27 |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 28 |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence. | 30 |

ITEM 14 | Principal Accounting Fees and Services. | 31 |

PART IV | ||

ITEM 13. | Exhibits, Financial Statement Schedules | 32 |

SIGNATURES | 33 |

-3-

PART 1

ITEM 1. BUSINESS

History and Organization

Sweetwater Resources, Inc. was incorporated on the 24 th day of July, 2007, under the laws of the State of Nevada for the purpose of acquiring, exploring and developing mineral properties. Our principal offices are located at Madappilly House, Elenjipra, P.O. Chalakudey, Via 680271, Kerala, India. Our telephone number is 011-91-480-320-8192.

The following is merely a summary of the information, including financial statements and the commentary included herein. You should read the entire Form 10-K carefully, including "Risk Factors" and our financial statements and the notes appended thereto prior to your making any investment in the shares of our Company.

Currently we are in the pre-exploration stage. To date, we have had no revenues, no operating history beyond the initial set up of our Company. Our sole asset is a mining claim called the Bhavnagar Gold Claim (the "Bhavnagar") located in the Republic of India which is more fully described elsewhere in this Form 10-K. We have incurred losses since inception and to remain as a going concern we must raise additional capital, through the sale of securities, in order to fund our operations. There is no assurance we will be able to raise this capital and if we do not our Company may no longer be a going concern.

We own no other mineral property other than the Bhavnagar and are not engaged in the exploration of any other mineral properties. There can be no assurance that a commercially viable mineral deposit, an ore reserve, exits on the Bhavnagar or can be shown to exist unless and until sufficient and appropriate exploration work is carried out and a comprehensive evaluation of such work concludes economic and legal feasibility. Such work may take many years and there is no assurance that we will have available the working capital to bring an ore deposit into production.

Our shares are currently listed on the OTC Bulletin Board ("OTCBB") but our shareholders might find it difficult to sell their shares due to low volume and therefore they might not receive the price they originally acquired their shares at.

We have no fulltime employees and the management of the Company, all of whom are in the Republic of India, devote a very little percentage of their working day to the affairs of our Company. Presently our directors and officers are not directors and officers of other public companies but this might not be the case in the future. If this happens there might be a conflict of interest on their part.

Planned Business

The following discussion should be read in conjunction with the information contained in the financial statements of the Company and the notes, which form an integral part of the financial statements, which are attached hereto.

The financial statements mentioned above have been prepared in conformity with accounting principles generally accepted in the United States of America and are stated in United States dollars.

Cautionary Statement Concerning Forward-Looking Statements

This Form 10-K contains written statements regarding our business and prospects, such as projections of future performance, statements of management's plans and objectives, forecasts of market trends, and other matters that are forward-looking statements. Statements containing the words or phases such as "is anticipated", "estimates", "believes", "expects", "anticipates", "plans", "objective", "should" or similar expressions identify forward-looking statements, which may appear in this Form 10-K.

-4-

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communication and other information from government agencies and other sources that may be subject to revision. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement, or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are several important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or results that are reflected from time to time in any forward-looking statement. Some of these important factors, but not necessarily all important factors, include the following Risk Factors.

ITEM 1A. RISK FACTORS

RISK FACTORS

An investment in our securities involves an exceptionally high degree of risk and is extremely speculative. In addition to the other information regarding Sweetwater Resources Inc., contained in this Form 10-K, you should consider many important factors in considering whether you should purchase the shares in our Company. The following risk factors reflect the potential and substantial material risks which could be involved if you consider purchasing shares in our Company.

Risks Associated With Our Company

Even though we recently raised capital through the sale of our common shares our financial position is not favorable.

Presently we have accumulated losses of $127,131 since our inception on July 24, 2007 and our working capital deficiency is $38,331. This will mean we will either have to raise funds through a sale of our common shares, ask our directors and officers to offer personally guarantees for debt financing from a lending institution or else the officers and directors will have to advance money to us so that we can continue in operations. In short, our current cash position will not last us for more than a few more months; if that.

The probability of any given property having any provable reserves is very remote. In all likelihood our property does not contain any reserves, and any funds spent on exploration will be lost.

As the probability of finding provable reserves on any given property is extremely unlikely, the same applies to prospects on our only property, the Bhavnagar Gold Claim, with the result being that funds spent on exploration will be lost. Following upon that, if we are unable to raise further funds for our operations, we may have to suspend or cease our operations resulting in loss of your investment.

We lack an operating history and have losses which we expect will continue into the future. As a result we may have to suspend or cease exploration and cease operations.

We are a pre-exploration stage company which is undertaking limited exploration, at this time, on the Bhavnagar. Accordingly, we anticipate incurring operating losses into the foreseeable future.

-5-

Our Company was incorporated in 2007, and has undertaken limited exploration work, nor has it generated any revenues. We do not have an exploration history against which one can assess the future prospects of our Company. To March 31, 2011, we have incurred a loss of $127,131. Whether we will generate income or a positive cash flow will be dependent upon our capacity to find economically viable reserves on the Bhavnagar and control of our operating costs.

Our present prospects are that we anticipate incurring further operating losses in future operating quarters, given that we will be facing research and exploration costs in exploring the Bhavnagar. There is no certainty that we will be able to produce income in which case our business will cease or be suspended indefinitely. Our prospects for success must be weighed in light of the problems, expenses, complications, difficulties and delays commonly associated with exploring a mineral property. There is a high rate of failure in ventures such as ours.

We have never had profitable operations since our inception.

Even though we have been incorporated for only a short period of time, we have never had profitable operations and if the situation continues as it is today we might never have profitable operations. This would mean that our shareholders would never be able to realize any dividends and/or increase in the value of their initial investment.

We have no known reserves. Without ore reserves we cannot generate income and if we cannot generate income we will have to cease exploration activity, which will result in the loss of your investment. Reserve estimates are very speculative and unreliable as indicators of success. Regardless of how much money is spent on the Bhavnagar, there is risk that we may never identify a commercially viable ore reserve. Even with positive results during exploration, the Bhavnagar may never be put into commercial production due to inadequate tonnage, low metal prices or high extraction costs.

Currently we have no known reserves. Without actual ore reserves we will be unable to generate income, in which case exploration operations will cease resulting in a loss of your investment. Typically reserves in regard to mining claims are referred to as "proven reserves" or "probable reserves". At present, we have neither proven nor probable reserves. Ore reserve figures are merely estimates and are not guarantees that the amounts so estimated would be recovered. The Company would engage private, independent contractors to conduct sampling and testing of the mining claim and from the results of such sampling and testing estimates of potential reserves are made. Such estimates are inherently imprecise in that they are based upon statistical analysis of geological data requiring the interpretation of the professionals involved. As such they are likely to be unreliable as indicators of the extent of reserves.

As production proceeds, existing reserves are diminished. Reserves may be reduced as a result of the grade and volume being recovered being lower than anticipated.

As reserve estimates are calculated using assumptions about metal prices, they are subject to a great degree of uncertainty in that metal prices can fluctuate considerably. Falling metal prices, rising production costs, capital costs, declining recovery rates, can render reserve estimates commercially unviable. Material declines in our reserves may result in reduced cash flow, net losses, asset write downs, and other such adverse financial consequences to our operation and the financial wherewithal of our Company. Reserves are not assurances of future revenues or the profitability of the mining operation, nor can they be utilized to predict the life of a particular mining venture. Reserves are no assurance of the amount of metal, if any that might be produced, nor that any given level of production will be achieved.

If we do not have enough funds for exploration, we will have to delay exploration or go out of business which will result in our shareholders losing their entire investment.

If we are unable to raise funds for exploration, our proposed exploration plan will be delayed. This may result in cessation or suspension of operations. If we cease operations or if operations are suspended for indefinitely, we will go out of business and our shareholders will lose their entire investment in our Company.

-6-

Because we are small and do not have much capital, we must delay conduct of any exploration and as a result may not find an ore body. Without an ore body, we cannot generate revenues and our shareholders might lose their entire investment in our Company.

As our Company is small with little capital, there will be delays in the conduct of exploration and we may not find an ore body. If we do not find an ore body, we cannot generate revenues and our shareholders might lose their entire investment in our Company.

We may not have access to all the materials and supplies we need to begin exploration which could cause us to delay or suspend exploration activity.

Due to our own financial condition or due to extraneous factors relating to costs and market forces, we may not be able to have access to the materials and supplies required to commence exploration. Without such basics of exploration, we would be forced to delay, suspend or even cancel exploration activity in which case our shareholders might lose their entire investment in our Company.

Because mineral exploration and development activities are inherently risky, we may be subject to various hazards including environmental liabilities, adverse weather conditions, floods, cave-ins, and the like. If such an event were to occur it may result in our shareholder losing their investment in our shares.

Mining operations are subject to a myriad of risks inherent to its nature. These include the presentation of unusual geological formations, environmental pollution issues, mine collapses, injury to personnel, flooding, changing and adverse weather conditions, and other such uncontrollable events. In some cases, the risk might be ameliorated by way of insurance, however, all such risks are not necessarily covered by insurance and the cost of insurance may in any event become prohibitive. Any one or a combination of such events could render the operation subject to delay, suspension or cancellation having become either too difficult or impossible to continue or uneconomical to carry on.

Because we have not put a mineral deposit into production before, we will have to acquire outside expertise. If we are unable to acquire such expertise we may be unable to put Bhavnagar into production and our shareholders might lose their entire investment. Management has no technical experience mineral exploration or production.

Our directors do not have technical training or proficiency in geology or engineering, specifically as such relates to exploration, development and operation of a mine. Consequently, they may not exploit opportunities in acquisition and exploration of claims without hired professionals. Management may not appreciate the usual and common approaches necessary in the industry to commercially exploit or investigate a claim. Such a deficiency may severely, permanently and adversely affect the financial viability of our business.

Risks Associated With Owning our Shares:

Even though we are quoted on the OTCBB our shares might be thinly traded at any given time resulting in our shareholders not having the opportunity to easily liquidate their investment in our shares.

Even though our shares are quoted on the OTCBB, we might experience a lack of buying or selling which will not allow our shareholders to sell their shares when they want and at prices they desire. Reasons for the lack of buying or selling could be the result of investors not desiring to purchase our shares, the stock markets overall are unfavorable to purchasing or selling shares or our Company cannot identify an ore body on the Bhavnagar. On the other hand, our share prices might be volatile with wide fluctuations in response to the previous mentioned circumstances. This also might restrict our shareholders from selling their investment in our shares at the price they wish.

-7-

We might in the future have to sell shares by way of private placements or through a public offering which will have the effect of diluting our shareholders' current percentage ownership in our Company.

If, in the future, we decide to sell shares to raise additional capital for operations, our shareholders current percentage ownership in our Company will be diluted unless they participate in the purchase of shares equivalent to their present ownership in our Company. If they do not participate in either a future private placement or public offering their percentage interest in our Company will be diluted.

Because our officers and directors have other outside business activities and may not be in a position to devote a majority of their time to our planned exploration activity, our exploration activity may be sporadic which may result in periodic interruptions or suspensions of exploration

Our directors and officers have other business interests which take a large percentage of their time. Our president spends approximately 10 hours a month attending to the affairs of our Company whereas our Secretary Treasurer spends only 5 hours per month. If our business and exploration activities expand in the near future our directors and officers will have to devote more time to the affairs of our Company or they will have to hire professional personnel to undertake these duties. This will result in an increase in costs to the Company.

Ratio of Earnings to Fixed Charges

We have no registered debt securities or any fixed charges in the way of interest expense or preference security dividends.

The Conversion of Indian Rupees to United States Dollars and Vise Versa.

The Bhavnagar is located in the Republic of India, and costs expressed in the geological report prepared by Raman Mistry, Professional Geologist, are expressed in Indian Rupees. For purposes of consistency and to express United States Dollars throughout this registration statement, Indian Rupee have been converted into United States currency at the rate of US $1.00 being approximately equal to Indian Rupee 52.1743 or 1 Indian Rupee being approximately equal US $0.01917 which is the approximate average exchange rate during recent months and which is consistent with the incorporated financial statements.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved staff comments at the date of this Form 10-K.

ITEM 2. PROPERTIES

Our Company has made no revenue since its inception on July 24, 2007. During 2011 we will be conducting research in the form of exploration on our Bhavnagar claim located in the Republic of India. We have a 100% interest in the mineral rights on the Bhavnagar claim which we acquired from Bhindi Mines LLC, an unrelated limited liability company having its registered office at Bhopal, India for $5,000, on November 1, 2007.

In order to determine a work program on the Bhavnagar claim, we commissioned Raman Mistry, Professional Geologist, to prepare a report on it.

The professional background of Mr. Mistry is that he graduated from the University of New Delhi, India with a Bachelor of Science degree in Geology in 1974 and a Masters of Science degree in 1979 from the same university. He worked as a consulting geologist for 25 years for such companies as Pradesh Mining, Gusain Ventures and Porbqander Explorations where he was commissioned to write reports on their geological structures. He is currently a member in good standing of the Geological Society of India.

-8-

In order to write his report, Mr. Mistry reviewed historical and current geological reports of the area and of the Bhavnagar claim and visited to the area between November 17 and 19, 2007 for the purpose of evaluating the exploration potential of the Bhavnagar. The reports by previous qualified persons as presented from a literature search of the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of India in its annual reports, papers, Geological Survey maps and assessment reports provide most of the technical basis for his report. His report, dated November 22, 2007, is summarized below:

-9-

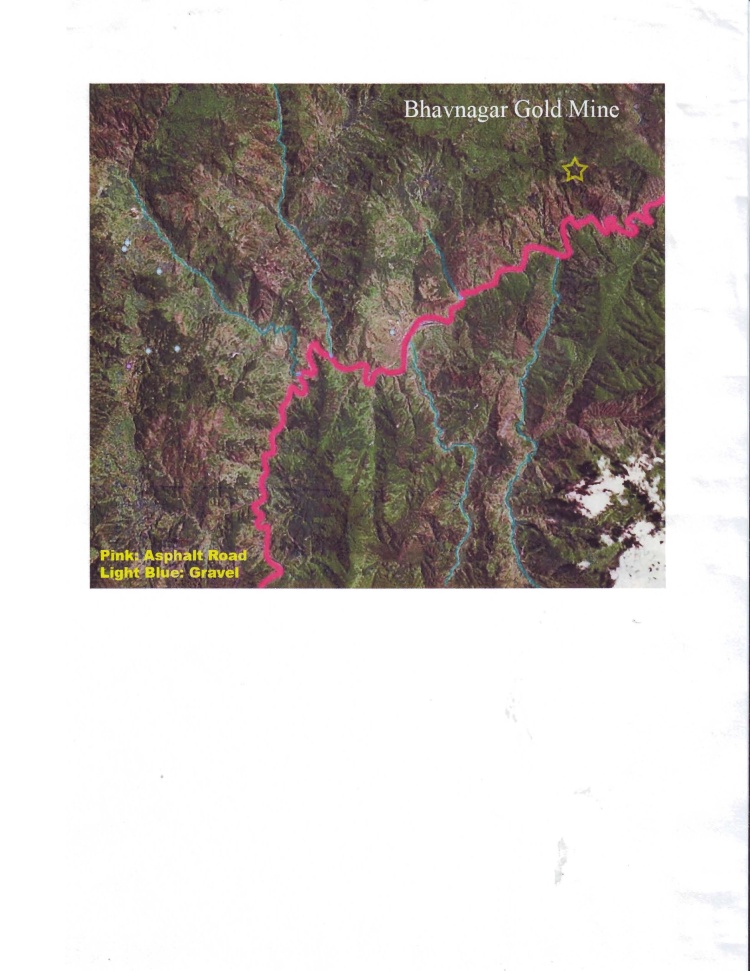

Description of the Bhavnagar and its location

Bhavnagar claim consists of 1 unpatented mineral claim, located 42 km East of Surat, and 79 km Northwest of Amreli at UTM co-ordinates Latitude 21 ° 46'00"North and Longitude 072 ° 14'00"East. A 100% of the Bhavnagar claim was assigned to our Company by Bhindi Mines LLC. and the assignment was filed with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of India.

There are no known environmental concerns or parks designated for any area contained within the Bhavnagar claim. The property has no encumbrances. As advanced exploration proceeds there may be

bonding requirements for reclamation.

Accessibility, climate, local resources, infrastructure and topography

The Bhavnagar claim is accessible from Gujarat. It is connected to Mumbai by air and railway. Daily flights operated by Jet Airways and Air Deccan. It was one of the first cities in Gujarat to have an airport. The city is well connected to other major cities of Gujarat such as Valadara, Ahmedabad, Rajkot, Jamnagar, Surat and more by road, with bus services operating by private and state-owned transport corporations. The city is also connected to Ahmedabad and some major cities of Saurashtra by rail road. Intercity bus service is operated by VITCOs. Private auto-rikshaw is other mode of transport. The city of Bhavnagar has an experienced work force and will provide all the necessary services needed for an exploration and development operation, including police, hospitals, groceries, fuel, transportation services, hardware and other necessary items. Drilling companies and assay facilities are present in Gujurat.

Natural resources play an important role in industrial development. Gujarat is endowed with important resources like minerals, marine, agriculture; besides animal wealth and human resources. The state government has taken several measures to explore and exploit these resources for industrial development.

Tropical mountain forests grow at lower elevations in the northeast corner of the claim and good rock exposure is found along the peaks and ridges in the western portion of the claim. The area has a tropical and humid climate, with an oppressive summer and plentiful seasonal rainfall. The summer season, from March to May, is followed by the south west monsoon from June to September. The north east monsoon lasts from October to November.

History

Gold is available in acid and basic volcanic rocks of Archaean age, the oldest known rocks in India ranging in age from more than 3000 million years to 2000 million years.

India has a large number of economically useful minerals and they constitute one-quarter of the world's known mineral resources. India is a country rich in mineral resources. A major portion of the country is composed of Precambrian rocks which have hosted major gold discoveries worldwide. There were over a hundred gold mining centers in the early part of last century. Today India's annual primary gold mine output is only between 2 and 3 tones. India is the land of the world famous Kolar Gold Fields and the largest consumer of gold.

Numerous showings of mineralization have been discovered in the area and six prospects have achieved significant production, with the nearby Dayal Gold Mine (36 kilometers away) producing 175,000 ounces of gold annually.

During the 1990's several properties east of Bhavnagar claim were drilled by junior mineral exploration companies.

Our Company is preparing to conduct preliminary exploration work on the Bhavnagar since we have advanced part of the money required to start Phase I of the Mistry report.

-10-

Geological Setting

Regional Geology of the Area

The hilly terrains and the middle level plain contain crystalline hard rocks such as charnockites, granite gneiss, khondalites, leptynites, metamorphic gneisses with detached occurrences of crystalline limestone, iron ore, quartzo-feldspathic veins and basic intrusive such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in most of the districts except the coastal area.

Stratigraphy

The principal bedded rocks for the area of Bhavnagar claim (and for most of India for that matter) are Precambrian rocks which are exposed along a wide axial zone of a broad complex.

Gold at the Dayal Gold Mine (which is in close proximity to the Bhavnagar claim) is generally concentrated within extrusive Precambrian rocks in the walls of large volcanic caldera.

Intrusive

In general the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulphides.

These hydrothermal solutions intrude into the older rocks as quartz veins. These rocks may be broken due to mechanical and chemical weathering into sand size particles and carried by streams and channels. Gold occurs also in these sands as placers.

Recent exploration result for gold occurrence in Gujarat is highly encouraging. Gold belt in sheared gneissic rocks is found in three sub parallel auriferous load zones where some blocks having 250 to 500 meter length and 1.5 to 2 meter width could be identified as most promising ones.

Structure

Capsule Description: Graphite veins currently mined are from few centimeters to a meter thick. Typically they cut amphibolite to granulite grade metamorphic rocks and/or associated intrusive rocks.

Tectonic Setting(s): Katazone (relatively deep, high-grade metamorphic environments associated with igneous activity; conditions that are common in the shield areas).

Depositional Environment / geological setting: Veins form in high-grade, dynamothermal metamorphic environment where met sedimentary belts are invaded by igneous rocks.

Age of Mineralization: Any age; most commonly Precambrian.

Host / Associated Rock Type: Hosted by paragneisses, quartzites, clinopyroxenites, wollastonite-rich rocks, pegmatites. Other associated rocks are charnockites, granitic and intermediate intrusive rocks, quartz-mica schists, granulites, aplites, marbles, amphibolites, magnetite-graphite iron formations and anorthosites.

Deposit Types

Deposits are from a few millimeters to over a meter thick in places, although usually less than 0.3 meter thick. Individual veins display a variety of forms, including saddle-, pod- or lens-shaped, tabular or irregular bodies; frequently forming anatomizing or stock work patterns.

-11-

Mineralization is located within a large fractured block created where prominent northwest-striking shears intersect the north striking caldera fault zone. The major lodes cover an area of 2 km and are mostly within 400m of the surface. Lodes occur in three main structural settings:

(i) steeply dipping northweststriking shears;

(ii) flatdipping (1040) fractures (flatmakes); and

(iii) shatter blocks between shears.

Most of the gold occurs in tellurides and there are also significant quantities of gold in pyrite.

Mineralization

No mineralization has been reported for the area of the Bhavnagar claim but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

Exploration

Previous exploration work has not to Mr. Mistry's knowledge included any attempt to drill the structure on Bhavnagar claim. Records indicate that no detailed exploration has been completed on the property.

Property Geology

To the east of Bhavnagar claim is intrusive consisting of rocks such as tonalite, monzonite, and gabbro while the property itself is underlain by sediments and volcanic. The intrusive also consist of a large mass of granodiorite towards the western most point of the property.

Drilling Summary

No drilling is reported on Bhavnagar claim.

Sampling Method; Sample Preparation; Data Verification

All the exploration conducted to date has been conducted according to generally accepted exploration procedures with methods and preparation that are consistent with generally accepted exploration practices. No opinion as to the quality of the samples to be taken can be presented.

Adjacent Properties

The adjacent properties are cited as examples of the type of deposit that has been discovered in the area and are not major facets to Mr. Mistry's report.

Interpretations and Conclusions

The area is well known for numerous productive mineral occurrences including the Dayal Gold Claim.

The locale of the Bhavnagar claim is underlain by the units of the Precambrian rocks that are found at those mineral occurrence sites. These rocks consisting of cherts and argillites (sediments) and andesitic to basaltic volcanic have been intruded by granodiorite. Structures and mineralization probably related to this intrusion are found throughout the region and occur on the claim. They are associated with all the major mineral occurrences and deposits in the area.

Mineralization found on the Bhavnagar claim is consistent with that found associated with zones of extensive mineralization. Past work however has been limited and sporadic and has not tested the potential of the property.

Mr. Mistry concludes that potential for significant amounts of mineralization to be found exists on the Bhavnagar claim and it merits intensive exploration.

-12-

Recommendations

A two phased exploration program to further delineate the mineralized system currently recognized on Bhavnagar claim is recommended. The program would consist of air photo interpretation of the structures, geological mapping, both regionally and detailed on the area of the main showings, geophysical survey using both magnetic and electromagnetic instrumentation in detail over the area of the showings and in a regional reconnaissance survey and geochemical soil sample surveying regionally to identify other areas on the claim that are mineralized and in detail on the known areas of mineralization. The effort of this exploration work is to define and enable interpretation of a follow-up diamond drill program, so that the known mineralization and the whole property can be thoroughly evaluated with the most up to date exploration techniques.

Budget

The proposed budget for the recommended work in US dollars is $37,345 (INR 1,948,118) is as follows:

Phase I

U.S Dollars | Indian Rupee | |

Geological mapping | $ 6,344 | 330,930 |

Geophysical surveying | 7,182 | 374,638 |

Total Phase I | 13,526 | 705,568 |

Phase II

Geochemical surveying and surface sampling (including sample collection and assaying) | 23,819 | 1,242,550 |

Total of Phases I and II | $ 37,345 | 1,948,118 |

Exploration work undertaken in 2008

Sweetwater engaged the services of Bharat Geologist and Assayers, 23 Kamta Pratap Road, New Delhi, India to assay samples and perform metallurgical test on the Bhavnagar claim. The geologists concluded that all tests taken were favourable since they concluded gold type mineralization and structurally controlled mineralization appears to be possible in the area. This would be similar to that of the Dayal Gold Mine located 20 miles west of the Bhavnagar claim.

ITEM 3. LEGAL PROCEEDINGS

There are no legal proceedings to which the Company is a party or to which the Bhavagar Claim is subject, nor to the best of management's knowledge are any material legal proceedings contemplated.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITIES HOLDERS

Sweetwater has not yet held an annual general meeting of its stockholders since its inception but is planning to do so during the early part of 2011.

-13-

PART l l

ITEM 5. MARKET REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SHARES

The Company is quoted on the OTCBB under the symbol of SWTR. There have been no trades in the shares of the Company since it was quoted.

Company has not paid any dividends on its common stock, and it does not anticipate that it will pay dividends in the foreseeable future.

As at March 31, 2011, the Company had 42 shareholders; two of these shareholders are officers and director of the Company.

There are no warrants or rights outstanding as of the date of this Form 10-K and none have been declared since the date of inception.

No stock options have been granted since the Company's inception.

There are no outstanding conversion privileges for our Company's shares.

ITEM 6. SELECTED FINANCIAL INFORMATION

The above amount does not include advances made by our directors for payments of certain invoices and for accrual set up at the year end.

The following financial information summarizes the more complete historical financial information found in our audited financial statements contained elsewhere in this Form 10-K:

Since inception to March 31, 2011 | |

Statement of Operations Information | |

Revenue | $ - |

Net loss | (127,131) |

Exploration costs | 7,642 |

Impairment loss on mineral claim | 5,000 |

General and administrative | 114,489 |

As at March 31, 2011 | |

Balance Sheet Information | |

Cash | $ 1,948 |

Total assets | 1,948 |

Total liabilities | 40,279 |

Stockholders' deficiency | (38,331) |

We anticipate that any additional funding that we require will be in the form of equity financing from the sale of our common stock. There is no assurance, however, that we will be able to raise sufficient funding from the sale of our common stock. The risky nature of this enterprise and lack of tangible assets places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as an economically viable mine can be demonstrated. We do not have any arrangements in place for any future equity financing. If we are unable to secure additional funding, we will cease or suspend operations. We have no plans, arrangements or contingencies in place in the event that we cease operations.

-14-

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

We presently have minimal day-to-day operations; mainly comprising filing on an annual basis the Annual Report of Directors and Officers with the Secretary of State of Nevada and preparing the various reports required to be filed with the United States Securities and Exchange Commission (the "SEC"); being Forms 10-K and 10-Qs.

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the Bhavnagar claim contains reserves. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we do not find mineralized material or we cannot remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and our shareholders will loss their entire investment.

In addition, we may not have enough money to complete our exploration of the Bhavnagar claim. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and cannot raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our claim and if any minerals which are found can be economically extracted and profitably processed.

The Bhavnagar is undeveloped raw land. We are in the process of exploring the Bhavnagar but have not had any results there to date. If we encounter satisfactory results from our current exploration program we will extend our test to determine if a mineral body exists. The chances of ever identifying a mineral body which can be commercially put into production is extremely remote.

Before minerals retrieval can begin, it is imperative that we explore thoroughly the Bhavnagar and find mineralized material. After that has occurred we have to determine if it is economically feasible to

remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We cannot predict what that will be until we find mineralized material.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that whatever is located on adjoining property may or may not be located on the Bhavnagar.

We do not claim to have any minerals or reserves whatsoever at this time on any part of the Bhavnagar claim.

We intend to implement an exploration program which consists of geochemical soil and rock sampling along with prospecting, geological mapping and geophysical surveys. Work will focus on prospecting the numerous new roads and clear cuts which may have exposed previously covered bedrock. Areas of alteration, fault zones and especially quartz veining (float or in situ) will be explored by establishing grids along which soil sampling will be conducted. Streams should be sampled by collecting silt and heavy mineral concentrates. The soil samples will be analyzed to determine if elevated amounts of minerals are present. The results will be plotted on a map to determine where the elevated areas of mineralization occur. Rock samples and geological mapping and prospecting will be done by competent professionals. Preliminary geophysical surveying will also be done to try and locate anomalies which may be caused by mineralization which is not evident on the surface. Based upon the results of the exploration we will determine, in consultation with our consultants, if the Bhavnagar is to be dropped or further exploration work is warranted and is to be done.

-15-

We estimate the cost of the Phase I work program to be $13,526 (INR 705,568). This is composed of $6,344 (INR 330,930) for geological mapping, $7,182 (INR 374,638) geophysical surveying, which work we have already commenced with an advancement of $5,000. Refer to "Exploration work undertaken in 2008"

If we receive some results from Phase I, we will consider raising money to do Phase II as recommended by Raman Minsty, which will comprise geochemical surveying and surface sampling including sample collection and assaying at an estimated cost of $23,819 (INR 1,242,550). We do not have sufficient funds to undertake this portion of the work and will have to raise additional capital by subsequent issuance of our securities, attracting a joint venture partner to undertake work on our claim (presumably in exchange for an interest in the Bhavnagar) or through advances from our directors. If we are unable to complete any element of Phase I exploration because we do not have enough money, we will cease operations until we raise more money. If we cannot or do not raise more money, we will cease operations. If we cease operations, we do not have any plans to do anything else.

We do not intend to hire any employees at this time. All of the work on the property will be conducted by unaffiliated independent contactors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility or removing any mineralized material we may find.

There is no historical financial information about us upon which to base an evaluation of our performance. We are a pre-exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our claim, and possible cost overruns due to price and cost increases in services. To become profitable and competitive, we will conduct the research and exploration of our claim before we start production of any minerals we may find.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in an additional dilution to existing shareholders.

Liquidity and Capital Resources

We have not raised any funds to date other than our initial two offerings but we will have to consider doing so in the future if we are to remain as a going concern. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans.

We have discussed the lack of funds in the future with our directors and officers and they have agreed to advance funds as needed until such time as they decide what type of funding would be suitable for our Company; whether a public issue of shares, continued advances from our directors and officers or seeking some form of debt financing from an institutional lender or lenders. If we need additional cash and cannot raise it we will either have to suspend operations until we do raise the cash, or cease operations entirely.

We issued 93,750,000 shares (post dividend) of our common stock on October 31, 2007 for an aggregate purchase consideration of $3,750 (being at $0.001 per share). These shares were issued pursuant to the exemption from registration set forth in section 4(2) of the Securities Act of 1933. Our directors have provided us with various loans totalling $24,506. The amounts owed to our directors are non-interest bearing, unsecured and due on demand. Accordingly, the loans are classified as current liabilities.

-16-

As of March 31, 2011, our total assets were $1,948 consisting sole of cash and our total liabilities to third party creditors was $15,773 and amounts owed to our directors were $24,506.

Our capital commitments for the next twelve months consist of administrative expenses together with expenses associated with the completion of our planned exploration program are estimated as follows:

Expenses | Amount | Description |

Accounting | $ 5,040 | Fees to the independent accountant for preparing the working papers for the quarters ended for June, 30, September 30 and December 31, 2011 and annual financial statements as at March 31, 2012 for submission to our auditors. |

Audit | 5,700 | Review of the quarterly financial statements for June 30, September 30 and December 31, 2011 and audit of the annual financial statements for the year ended March 31, 2012. |

Exploration | 884 | Balance of Phase I as per the Raman Mistry's report. |

Filing fees | 375 | Annual fee to the Secretary of State for Nevada and business license. |

Miscellaneous | 1,000 | Accrual for expenses not known at this time. |

Office | 500 | Photocopying, delivery and fax expenses |

Transfer agent's fees | 1,200 | Annual fee of $500 and estimated miscellaneous charges of $700 |

Estimated expenses | $ 14,699 |

Since our initial share issuances, the Company has been unable to raise cash from any source other than loan advances from our President who is one of our controlling shareholders. Our total requirement for cash over the next twelve months is summarized below:

Cash requirements over the next twelve months as determined above | $ 14,699 |

Add: Accounts payable to third parties | 15,773 |

30,472 | |

Deduct: Cash on hand as at March 31, 2011 | (1,948) |

Estimated cash requirements for the next twelve months | $ 28,524 |

A comparison of current year's expenses compared to prior year's expenses is a follows:

March 31, 2011 | March 31, 2010 | Reason for Differences | |

Accounting and audit | $ 5,220 | $ 8,975 | In prior year's an accrual was made for accounting and audit but in the current year these fees were recognized only when the work was completed. |

Exploration cost | - | 1,321 | No cost during current year |

Legal | 2,659 | - | Legal fees to forward split the shares |

Management fees | 6,000 | 12,000 | The Company discontinued the practice of accruing management fees with a credit to Capital in Excess of Par Value. |

Office | 335 | 293 | General increase in cost of office supplies. |

-17-

Rent | 1,200 | 2,400 | The Company discontinued the practice of accruing rent with an offsetting credit to Capital in Excess of Par Value. |

Telephone | 600 | 1,200 | The Company discontinued the practice of accruing telephone with an offsetting credit to Capital in Excess of Par Value. |

Transfer agent's fees | 2,009 | 364 | Cost of issuance of share certificates for forward split of shares |

NET LOSS | $ (18,023) | $ (26,553) |

We have no plant or significant equipment to sell, nor are we going to buy any plant or significant equipment during the next twelve months. We will not buy any equipment until we have located a body of ore and we have determined it is economical to extract the ore from the land.

We may attempt to interest other companies to undertake exploration work on the Bhavnagar Gold Claim through joint venture arrangement or even the sale of part of the Bhavnagar claim. Neither of these avenues has been pursued as of the date of this Form 10-K.

Raman Mistry has recommended an exploration program for the Bhavnagar. However, even if the results of this work suggest further exploration work is warranted, we do not presently have the requisite funds and so will be unable to complete anything beyond the initial exploration work recommended in Raman Mistry's report dated November 22, 2007 until we raise more money or find a joint venture partner to complete the exploration work. If we cannot find a joint venture partner and do not raise more money, we will be unable to complete any work beyond part of Phase I we are currently doing. If we are unable to finance additional exploration activities, we do not know what we will do and we do not have any plans to do anything else.

We do not intend to hire any employees at this time. All of the work on the Bhavnagan will be conducted by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for supervision, surveying, exploration, and excavation. If Raman Mistry is not available when we need him, we may engage a geologist to assist in evaluating the information derived from the exploration and excavation including advising us on the economic feasibility of removing any mineralized material we may discover.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance as an exploration corporation. We are a pre-exploration stage company and have not generated any revenues from our exploration activities. Further, we have not generated any revenues since our formation on July 24, 2007. We cannot guarantee we will be successful in our exploration activities.

Results of Operations for the Period ended March 31, 2011.

For the period from July 24, 2007 (date of inception) to March 31, 2011, we had a net loss of $127,131. We have not generated any revenue from operations since inception. Our loss to date represents various expenses incurred with organizing our Company, undertaking audits, general office expenses, accruing management fees, rent and telephone which can be broken down as follows:

-18-

Expense | Inception to March 31,2011 | Description | |

Accounting and audit | $ 27,887 | Preparation of working papers for submission to our independent accountants for examination and/or of the financial statements. | |

Consulting | 5,000 | Assisting in organizing the company and seeking out the Bhavnagar. | |

Exploration Expenses | 7,642 | < | |

Impairment loss on mineral claim | 5,000 | Impairment of Bhavnagar mineral claim. | |

Filing fees | 153 | Obtaining the CUSIP number | |

Incorporation costs | 870 | Incorporation costs paid to the State of Nevada. | |

Legal | 25,171 | Legal expenses relating to the preparation of this prospectus, administering the Company's trust account and various other legal services as required. | |

Management Fees | 35,000 | The Company does not pay management fees to its directors and officers but realizes there is a cost associated with their services to the Company and therefore accrues $1,000 a month in recognition of this service. The credit is allocated to Capital in Excess of Par Value. These expenses will never be paid out in cash or shares to any of the directors or officers. | |

Office and general | 3,947 | General office expenses. | |

Rent | 7,000

| The Company as its office the private residence of its President but does not pay him any money. Nevertheless it gives recognition to rent expense by accruing $200 per month with an offsetting credit to Capital in Excess of Par Value. | |

Telephone | 3,500 | Similar to management fees and rent the Company accrues $100 per month for telephone with the credit being applied to Capital in Excess of Par Value. | |

Transfer agent's fees | 5,961 | Issuance of share certificates and termination fee in changing of transfer agents during the year. | |

Total expenses | $ 127,131 |

When deducing the non-cash expense, being management fees, rent and telephone, the Company has paid and has payable expenses of $81,631.

Balance Sheet

As at March 31, 2011 our total cash was $1,948. Our working capital deficiency as at March 31, 2011 was $38,331.

-19-

Our accounts payable to third parties as at March 31, 2011 was as follows:

Auditors | Examination of March 31, 2011 financial statements | $ NIL |

Internal accountant | Preparation of working papers for quarterly reports, tax returns and other documents required by management | 15,137 |

Office expense | Photocopying, fax, courier and general office supplies | 636 |

Total | $ 15,773 |

Total stockholders' deficiency as at March 31, 2011 is $38,331. Total shares outstanding, as at March 31, 2011, was 113,525,000.

Trends

We are in the pre-explorations stage, have not generated any revenue and have no prospects of generating any revenue in the foreseeable future. We are unaware of any known trends, events or uncertainties that have had, or are reasonably likely to have, a material impact on our business or income, either in the long term or short term, other than as described in the Risk Factors section of this Form 10-K.

Critical Accounting Policies

Our discussion and analysis of its financial condition and results of operations, including the discussion on liquidity and capital resources, are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, management re-evaluates its estimates and judgments.

The going concern basis of presentation assumes we will continue in operation throughout the next fiscal year and into the foreseeable future and will be able to realize our assets and discharge our liabilities and commitments in the normal course of business.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Market Information

There are no common shares subject to outstanding options, warrants or securities convertible into common equity of our Company.

The number of shares subject to Rule 144 is 84,375,000

There are no shares being offered to the public other than indicated in our effective registration statement and no shares have been offered pursuant to an employee benefit plan or dividend reinvestment plan.

Our shares are quoted on the OTCBB. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, we must remain current in our filings with the SEC; being as a minimum Forms 10-Q and 10-K. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their filing during that time.

-20-

In the future our common stock trading price might be volatile with wide fluctuations. Things that could cause wide fluctuations in our trading price of our stock could be due to one of the following or a combination of several of them:

● | our variations in our operations results, either quarterly or annually; |

● | trading patterns and share prices in other exploration companies which our shareholders consider similar to ours; |

● | the exploration results on the Bhavnagar Gold Claim, and |

● | other events which we have no control over. |

In addition, the stock market in general, and the market prices for thinly traded companies in particular, have experienced extreme volatility that often has been unrelated to the operating performance of such companies. These wide fluctuations may adversely affect the trading price of our shares regardless of our future performance. In the past, following periods of volatility in the market price of a security, securities class action litigation has often been instituted against such company. Such litigation, if instituted, whether successful or not, could result in substantial costs and a diversion of management's attention and resources, which would have a material adverse effect on our business, results of operations and financial conditions.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements attached to this Form 10-K for the year ended March 31, 2011 have been examined by our independent accountants, Madsen & Associates CPA's Inc. and attached hereto.

\ITEM 9. CHANGES IN AND DISAGREEMENT WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

During the year ended March 31, 2011, to the best of our knowledge, there have been no disagreements with Madsen & Associates CPA's Inc. on any matters of accounting principles or practices, financial statement disclosure, or audit scope procedures, which disagreement if not resolved to the satisfaction of Madsen & Associates CPA's Inc. would have caused them to make a reference in connection with its report on the financial statements for the year.

ITEM 9A – CONTROLS AND PROCEDURES

Risk Management as per the Sarbanes-Oxley Act of 2002

In the ordinary course of business, we employ established risk management policies and procedures, which seek to reduce our exposure to fluctuations in commodity prices, interest rates, foreign currencies and prices of the company's common stock, although there can be no assurance that these policies and procedures will be successful.

Interest Rate Risk

Our objective in managing our exposure to interest rate changes is to minimize the impact of interest rate changes on earnings and cash flows and to lower our overall borrowing costs. Fortunately at this time loans from our directors and officers bear no interest and therefore there are no interest payments Sweetwater has to make.

-21-

Foreign Currency Exchange Rate Risk

Our objective in managing exposure to foreign currency fluctuations is to protect our future foreign cash flows and earnings, if any, from changes associated with foreign currency exchange rate changes through the use of various derivative contracts. Our main concern regarding fluctuations in foreign currency relates to our exploration activities on the Bhavnagar claim. Our foreign currency translation risk results from the Indian Rupee. We face currency exposures in our Indian operations.

Internal Control

Internal control procedures provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company's financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

Internal control is what the Company needs to meet its goal on a on-going basis and if it does so there is the possibility of it achieving success.

Internal controls is about getting things done (performance) but also about ensuring that they are done properly (integrity) and that this can be demonstrated and reviewed (transparency and accountability).

In other words, control activities are the policies and procedures that help ensure the Company's management directives are carried out. They help ensure that necessary actions are taken to address risks to achievement of the Company's objectives. Control activities occur throughout the Company, at all levels and in all functions. They include a range of activities as diverse as approvals, authorizations, verifications, reconciliations, reviews of operating performance, security of assets and segregation of duties.

As of March 31, 2011 ("Evaluation Date"), the management of the Company assessed the effectiveness of the Company's internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") and SEC guidance on conducting such assessments. Management concluded, during the year ended March 31, 2011, internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules. Management realized there are deficiencies in the design or operation of the Company's internal control that adversely affected the Company's internal controls which management considers to be material weaknesses.

In the light of management's review of internal control procedures as they relate to COSO and the SEC the following were identified:

● The Company's Audit Committee does not function as an Audit Committee should since there is a lack of independent directors on the Committee and the Board of Directors has not identified an "expert", one who is knowledgeable about reporting and financial statements requirements, to serve on the Audit Committee.

● The Company has limited segregation of duties which is not consistent with good internal control procedures.

● The Company does not have a written internal control procedurals manual which outlines the duties and reporting requirements of the Directors and any staff to be hired in the future. This lack of a written internal control procedurals manual does not meet the requirements of the SEC or good internal control.

● There are no effective controls instituted over financial disclosure and the reporting processes.

-22-

Management feels the weaknesses identified above, being the latter three, have not had any affect on the financial results of the Company. Management will have to address the lack of independent members on the Audit Committee and identify an "expert" for the Committee to advise other members as to correct accounting and reporting procedures.

The Company and its management will endeavor to correct the above noted weaknesses in internal control once it has adequate funds to do so. By appointing independent members to the Audit Committee and using the services of an expert on the Committee will greatly improve the overall performance of the Audit Committee. With the addition of other Board Members and staff the segregation of duties issue will be addressed and will no longer be a concern to management. By having a written policy manual outlining the duties of each of the officers and staff of the Company it will facilitate better internal control procedures.

Management will continue to monitor and evaluate the effectiveness of the Company's internal controls and procedures and its internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

ITEM 9A (T) – CONTROLS AND PROCEDURES

There were no changes in the Company's internal controls or in other factors that could affect its disclosure controls and procedures subsequent to the Evaluation Date, nor any deficiencies or material weaknesses in such disclosure controls and procedures requiring corrective actions.

ITEM 9 B – OTHER INFORMATION

There are no matters required to be reported upon under this Item.

PART 111

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Each of our Directors serves until his successor is elected and qualified. Each of our officers is elected by the Board of Directors to a term of one (1) year and serves until his successor is duly elected and qualified, or until he is removed from office. The Board of Directors has no nominating or compensation committees.

The name, address, age and position of our officers and directors is set forth below:

Name and Address | Position(s ) | Age |

Jose Madappilly | Chief Executive Officer, President and Director (1) | 41 |

Dr. Jaiju Maliakal | Chief Financial Officer, Chief Accounting Officer, Secretary-Treasurer and Director (2) | 39 |

(1) | Jose Madappilly was appointed a Director, President and Chief Executive Officer on July 25, 2007. |

(2) | Dr. Jaiji Maliakal was appointed a Director, Secretary/Treasurer and Chief Financial Officer on July 25, 2007. |

The percentage of common shares beneficially owned, directly or indirectly, or over which control or direction are exercised by our directors and officers, collectively, is approximately 83% of the total issued and outstanding shares.

-23-

None of our directors or officers has professional or technical accreditation in the mining business.

Background of officers and directors

Jose Maddappilly was born in Chalakudy, India (the Spice town of India's Southern most state of Kerala). He attended Carmel High School from where he graduated in 1987. He attended Christ College where he did his Senior Secondary and graduated in 1989. As a student, he excelled in Mathematics and Science and represented his State for the junior basketball team. While at school he actively participated in the various student movements; such as Literacy Movement and the Beautiful Kerala movements. In 1991, Jose left Christ College where he had been attending while in the Bachelor of Science Program specializing in Physics and entered one of the best institutes in Bhopal, India to take a course in hotel management, catering technology and applied nutrition program. He graduated in 1994 after excelling in the Food Production and Food and Beverage Service. He was successful in working for the elite Leela Group of Hotels in Mumbai as a management trainee. After several years he was appointed the Assistant Food and Beverage Manager. In 1999 Jose left his employment at the Leela Group of Hotels and returned to Kerala, his home state, where he had some real estate interests. Subsequent to 1999 he worked as a consultant for the hospitality industry, worked as a mediator for the Government for the Tourism Infrastructure and was part of the faculty at various hospitality schools. He assisted in setting up several of Cochin's best restaurants where he had a financial interest in. For the past five years he has been president and chief executive officer of his own private company, Madappilly Ventures Inc., which he has been using to assist in the setting up of an international school for students wishing to enter the tourist industry.

Dr. Jaiju Maliakal was born in Ayyampilly, Kerala. Jaiju attended Carmel High School where he graduated with honor in 1990 and subsequently went to Christ College in Irinjalakuda where he graduated in 1992. After graduation he went to university where he obtained a Bachelor of Science before entering the medical program. In 2002 he obtained his medical degree and is currently registered with the Indian Medical Council as a Doctor in General Medicine Currently he is a practicing doctor at Vincent De Paul's Hospital in his home town of Ayyampilly, Kerala, India. He, with his fellow Physicians and Surgeons, conduct free medical classes to educate the people in the financially backward communities.

None of our officers and directors work full time for our Company. It is expected that Jose Madappilly will spend approximately 10 hours a month on the affairs of our Company. As Secretary Treasurer, Dr. Jaiju Maliakal spends approximately 5 hours per month on affairs of our Company.

Board of Directors

Since inception our Board has held no meetings and our Audit Committee held no meetings. All agreements and directions have been done by way of Directors' Consent Resolutions to date. With both our directors and officers residing in India it is likely that within the next several months they will hold a Directors' Meeting.

Below is a description of the Audit Committee of the Board of Directors.

The Charter of the Audit Committee of the Board of Directors sets forth the responsibilities of the Audit Committee. The primary function of the Audit Committee is to oversee and monitor the Company's accounting and reporting processes and the audits of the Company's financial statements.

On July 31, 2007, our directors appointed Jose Madappilly and Dr. Jaiju Maliakal to the Audit Committee and at the same time adopted the Audit Committee Charter. Neither Jose nor Jaiju can be considered an "audit committee financial expert" as defined in Item 401 of Regulation S-B. We will have to attract an individual with the qualification of an audit committee expert to our Audit Committee. At this time, we have not identified such an individual.

Apart from the Audit Committee, our Company does not have any other Board committees.

-24-

Conflicts of Interest

While none of our officers and directors is a director or officer of any other company involved in the mining industry there can be no assurance such involvement will not occur in the future. Such involvement could create a conflict of interest.

To ensure that potential conflicts of interest are avoided or declared to our Company and its shareholders and to comply with the requirements of the Sarbanes Oxley Act of 2002, the Board of Directors adopted, on July 31, 2007, a Code of Business Conduct and Ethics. Our Company's Code of Business Conduct and Ethics embodies our commitment to such ethical principles and sets forth the responsibilities of our Company and its officers and directors to its shareholders, employees, customers, lenders and other stakeholders. Our Code of Business Conduct and Ethics addresses general business ethical principles, conflicts of interest, special ethical obligations for employees with financial reporting responsibilities, insider trading rules, reporting of any unlawful or unethical conduct, political contributions and other relevant issues.

Significant Employees

We have no paid employees. Our Officers and Directors fulfill many of the functions that would otherwise require our Company to hire employees or outside consultants. Even though our Company does not pay remuneration to our officers and directors, it realizes there is a cost associated with the services performed by them and therefore accrues each month, starting in November 1, 2007, management fees of $1,000 per month. The credit is changed to Capital in Excess of Par Value under the Shareholders Equity section of the Balance Sheet. This amount will never be paid to the directors and officers in either cash or shares.

Since our directors and officers do not have direct experience in exploration or mining we will rely on consultants to assist in the exploration of the Bhavnagar. In particular we will engage a professional geologist on a consulting basis, together with an assistant(s). Such geologist will be responsible for hiring and supervising, to conduct the Phase I exploration work to be undertaken on the Bhavnagar. Being professionals and with knowledge of the exploration business for mineral properties they will be responsible for the completion of our exploration program. They will not be full or part time employees since our exploration program will only last several weeks.

Family Relationships

Jose Madappilly and Jaiju Maliakal are not related.

Directorships

Neither Jose Madappilly nor Dr. Jaiju Maliakal are a director of another company registered under the Securities and Exchange Act of 1934.

Involvement in Certain Legal Proceedings

To the knowledge of the Company, during the past five years, none of our directors or executive officers:

(1) | has filed a petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by the court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filings, or any corporation or business association of which he was an executive officer at or within the last two year before the time of such filing; |

-25-

(2) | was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offences); |

(3) | was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting, the following activities: |

(i) | acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliate person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; |

(ii) engaging in any type of business practice; or

| (iii) | engaging in any activities in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws; |

(4) | was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under paragraph (3) (i) above, or to be associated with persons engaged in any such activities; or |

(5) | was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated. |

(6) | was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated. |

Promoters and Control Persons

The promoters of our Company are our two directors and officers. We have no other promoters. Our two directors and officers jointly control 83% of our issued and outstanding shares.

Executive Compensation

General Philosophy

Our Company's Board of Directors is responsible for establishing and administering the Company's executive and directors' compensation. To date none of our directors and officers have been paid any money or received any other compensation. As mentioned above, the Company gave recognition to the services the Company performs on behalf of the Company by accruing each month as an expense $1,000 as management fees with an offsetting credit to Capital in Excess of Par Value Until September 30, 2010 when this accrual was discontinued.

Directors are not compensated if they attend Directors' Meetings. Any out-of-pocket costs paid by them on behalf of the Company is reimbursed to them including any travel and entertainment charges.

-26-

ITEM 11. EXECUTIVE COMPENSATION

The following table summarizes all compensation earned by or paid to our Chief Executive Officer and other executive officers, during the past five years.

Directors' Compensation

Name and Principal Position |

Year |

Fee earned or paid in cash ($) |

Stock Awards ($) |

Option Awards ($) |

Non-equity Incentive Plan Compensation ($) | Change in Pension value and Nonqualified Compensation Earnings ($) |

All other Compensation ($) |