U NITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended April 30, 2014

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From _____ to _____

Commission File Number 000-52711

STAR GOLD CORP.

(Exact name of small business issuer as specified in its charter)

NEVADA | 27-0348508 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

611 E. Sherman Avenue Coeur d'Alene, Idaho (Address of principal executive office) | 83814 (Postal Code) | |

(208) 664-5066 (Issuer's telephone number) | ||

SECURITIES REGISTERED UNDER SECTION 12(b) OF THE ACT:

None

SECURITIES REGISTERED UNDER SECTION 12(g) OF THE ACT:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issued, as defined in Rule 405 of the Securities Act: Yes[ ] No [ x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes[ ] No [ x]

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post filed). Yes [x ] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of III of this Form 10-K or any amendment to the Form 10-K. [x]

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "Accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer [ ]

Accelerated Filer [ ]

Non-Accelerated Filer [ ]

Smaller Reporting Company [x]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [x]

The Company had $Nil in revenue during the year.

The aggregate market value of the Common Stock held by non-affiliates (as affiliates are defined in Rule 12b-2 of the Exchange Act) of the registrant, computed by reference to the average of the high and low sale price on October 31, 2013 was $ 9,276,994

As of July 15, 2014 there were 34,981,326 shares of issuer's common stock outstanding.

Page 1 of 65

STAR GOLD CORP.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED APRIL 30, 2014

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD LOOKING FINANCIAL STATEMENTS

PART I

ITEM 1.- BUSINESS

ITEM 1A. - RISK FACTORS

ITEM 1B. - UNRESOLVED STAFF COMMENTS

ITEM 2. - PROPERTIES

ITEM 3. - LEGAL PROCEEDINGS

ITEM 4. – MINE SAFETY DISCLOSURES

PART II

ITEM 5. - MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

ITEM 6.

- SELECTED FINANCIAL DATA

ITEM 7.

- MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

ITEM 7A. - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

ITEM 8.

- FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

ITEM 9.

- CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

ITEM 9A. - CONTROLS AND PROCEDURES

ITEM 9B. - OTHER INFORMATION

PART III

ITEM 10. - DIRECTORS, EXECUTIVE OFFICERS AND

CORPORATE GOVERNANCE

ITEM 11. - EXECUTIVE COMPENSATION

ITEM 12. - SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

ITEM 13. - CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE .

ITEM 14. - PRINCIPAL ACCOUNTANT FEES AND SERVICES

PART IV

ITEM 15. - EXHIBITS

SIGNATURES

Page 2 of 65

C AUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statement that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always using words or phrases such as "believes", "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates", or "intends", or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

·

Risks related to the Company's properties being in the exploration stage;

·

Risks related to the mineral operations being subject to government regulation;

·

Risks related to the Company's ability to obtain additional capital to develop the Company's resources, if any;

·

Risks related to mineral exploration and development activities;

·

Risks related to mineral estimates;

·

Risks related to the Company's insurance coverage for operating risks;

·

Risks related to the fluctuation of prices for precious and base metals, such as gold, silver and copper;

·

Risks related to the competitive industry of mineral exploration;

·

Risks related to the title and rights in the Company's mineral properties;

·

Risks related to the possible dilution of the Company's common stock from additional financing activities;

·

Risks related to potential conflicts of interest with the Company's management;

·

Risks related to the Company's shares of common stock;

This list is not exhaustive of the factors that may affect the Company's forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled "Risk Factors and Uncertainties", "Description of Business" and "Management's Discussion and Analysis" of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Star Gold Corp. disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law. The Company advises readers to carefully review the reports and documents filed from time to time with the Securities and Exchange Commission (the "SEC"), particularly the Company's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

As used in this Annual Report, the terms "we," "us," "our," "Star Gold," and the "Company", mean Star Gold Corp., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

Management's Discussion and Analysis is intended to be read in conjunction with the Company's financial statements and the integral notes ("Notes") thereto for the fiscal year ending April 30, 2014. The following statements may be forward-looking in nature and actual results may differ materially.

Page 3 of 65

PART I

ITEM 1.

BUSINESS

Corporate Background

The Company was originally incorporated on December 8, 2006, under the laws of the State of Nevada as Elan Development, Inc. On April 25, 2008, the name of the company was changed to Star Gold Corp. Star Gold Corp. is an exploration stage company engaged in the acquisition and exploration of precious metal deposit properties and advancing them toward production. The Company is engaged in the business of exploring, evaluating and acquiring mineral prospects with the potential for economic deposits of precious and base metals.

Star Gold Corp. currently leases with an option to acquire unpatented mining claims located in the State of Nevada and known as the Longstreet Property. The Longstreet Property comprises 125 mineral claims (75 original optioned claims, of which 70 are unpatented staked claims and five claims acquired from local ranchers (Roy Clifford et al)), as well as 50 recently staked claims by Star Gold, covering a total area of approximately 2,500 acres (1,012 ha). The Longstreet property is at an intermediate stage of exploration.

The Company currently owns the rights to acquire up to a 100% mining interest (covering a total of 50 unpatented claims) in a mineral property located in the State of Nevada known as the Excalibur Property.

The Company has completed an initial exploration program on the Excalibur Property, which included Geological Mapping, Rock Sampling and Assaying. Based on this analysis the Company has decided to move forward with the permitting of this property and associated drilling program. The permitting was completed in June 2010 and the initial drilling program commenced immediately therafter.

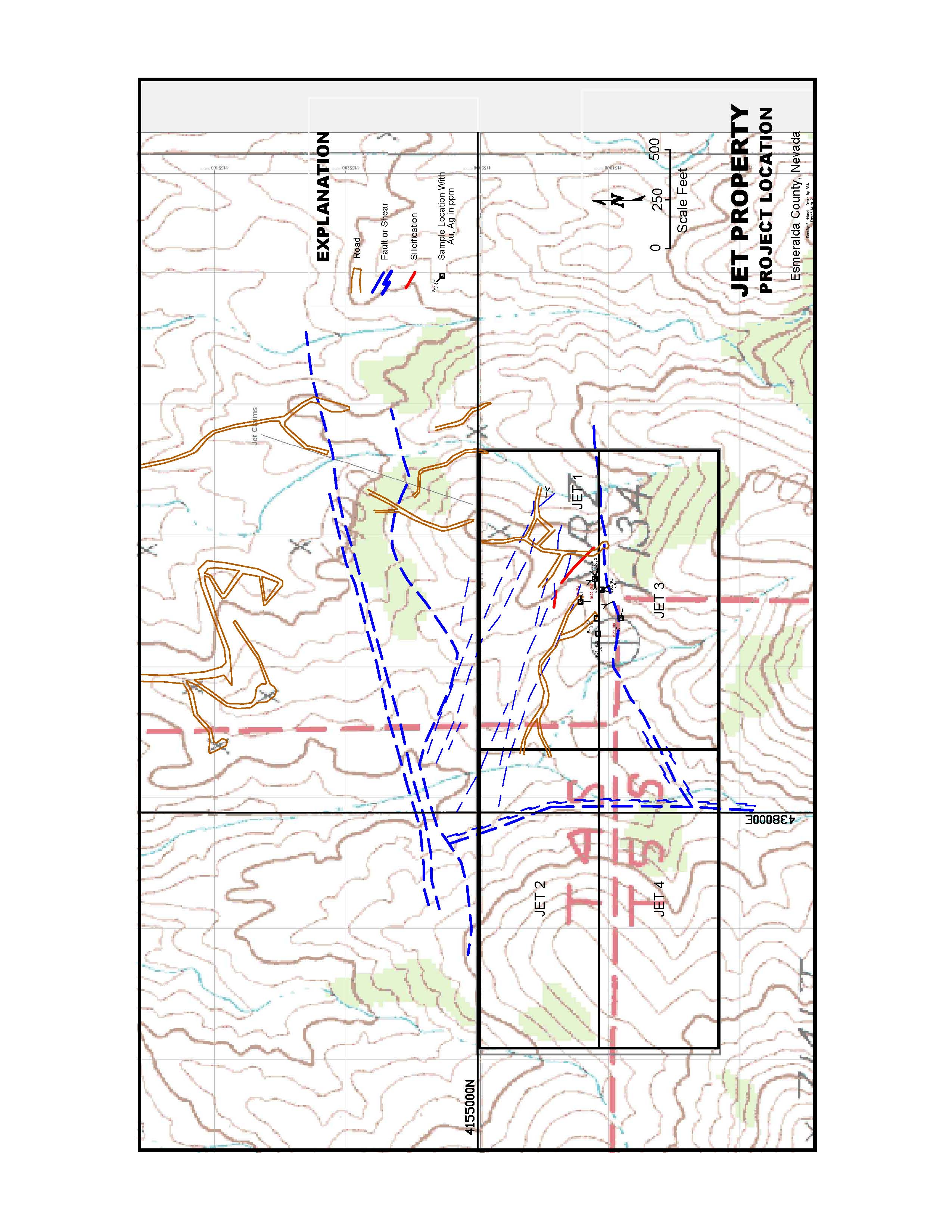

On July 7th, 2010, Star Gold Corp. acquired an option to acquire a 100% mining interest in a property located in the State of Nevada (approximately 300 kilometers northwest of Las Vegas) known as the Jet Property. The Company is currently engaged in preliminary exploration activities and surface testing of the Jet property.

The Company has no patents, licenses, franchises or concessions which are considered by the Company to be of importance. The business is not of a seasonal nature. Since the potential products are traded in the open market, the Company has no control over the competitive conditions in the industry.

Overview of Mineral Exploration and Current Operations

Star Gold Corp. is an exploration stage mineral company with no producing mines. Mineral exploration is essentially a research activity that does not produce a product. As such the Company acquires properties which it believes have potential to host economic concentrations of minerals, particularly gold and silver. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims, or private property owned by others. An unpatented mining claim is an interest that can be acquired to the mineral rights on open lands of the federal owned public domain. Claims are staked in accordance with the Mining Law of 1872, recorded with the federal government pursuant to laws and regulations established by the Bureau of Land Management The Company intends to remain in the business of exploring for mining properties that have the potential to produce gold, silver, base metals and other commodities.

The Company will perform basic geological work to identify specific drill targets on the properties, and then collect subsurface samples by drilling to confirm the presence of mineralization (the presence of economic minerals in a specific area or geological formation). The Company may enter into joint venture agreements with other companies to fund further exploration and/or development work. It is the Company's plan to focus on assembling a high quality group of mid-stage mineral (gold and silver) exploration prospects, using the experience and contacts of the management group. By such prospects, the Company means properties that have been previously identified by third parties, including prior owners such as exploration companies, as mineral prospects with potential for economic mineralization. Often these properties have been sampled, mapped and sometimes drilled, usually with indefinite results. Accordingly, such acquired projects will have either prior exploration history or will have strong similarity to a recognized geologic ore deposit model. Geographic emphasis will be place on the western United States.

The geologic potential and ore deposit models have been defined and specific drill targets identified on the majority of the Company's properties. The Company's property evaluation process involves using basic geologic fieldwork to perform an initial evaluation of a

Page 4 of 65

property. If the evaluation is positive, the Company seeks to acquire, either by staking unpatented mining claims on open public domain, or by leasing the property from the owner of private property or the owner of unpatented claims. Once acquired, the Company then typically makes a more detailed evaluation of the property. This detailed evaluation involves expenditures for exploration work which may include rock and soil sampling, geologic mapping, geophysics, trenching, drilling or other means to determine if economic mineralization is present on the property.

Portions of the Company's mining properties are owned by third parties and leased to Star Gold as outlined in the following table:

| Property Name | Third Party | Number of Claims |

| Acres |

| Agreements/Royalties |

| Longstreet | Minquest | 150 |

| 2,240 |

| 3% Net Smelter Royalty ("NSR") Annual lease payments totaling $270k, annual exploration expenditures totaling $3.55m, and 200k shares due through 2017. |

| Excalibur | Minquest | 50 |

| 1,000 |

| 3% Net Smelter Royalty ("NSR"); Annual lease payments of $20ktotalling $100k and annual exploration expenditures totaling $255k through 2017. |

| Jet | Minquest | 4 |

| 80 |

| 3% Net Smelter Royalty ("NSR"); Annual lease payment of $5,000 totaling $40k and annual exploration expenditures of $10,000 totaling $70k through 2017. |

Compliance With Government Regulations

If the Company decides to continue with the acquisition and exploration of mineral properties in the State of Nevada it will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the State of Nevada and the United States Federal agencies.

United States

Mining in the State of Nevada is subject to federal, state and local law. Three types of laws are of particular importance to the Company's U.S. mineral properties: those affecting land ownership and mining rights; those regulating mining operations; and those dealing with the environment.

Land Ownership and Mining Rights.

On Federal Lands, mining rights are governed by the General Mining Law of 1872 (General Mining Law) as amended, 30 U.S.C. §§ 21-161 (various sections), which allows the location of mining claims on certain Federal Lands upon the discovery of a valuable mineral deposit and proper compliance with claim location requirements. A valid mining claim provides the holder with the right to conduct mining operations for the removal of locatable minerals, subject to compliance with the General Mining Law and Nevada state law governing the staking and registration of mining claims, as well as compliance with various federal, state and local operating and environmental laws, regulations and ordinances. As the owner or lessee of the unpatented mining claims, the Company has the right to conduct mining operations on the lands subject to the prior procurement of required operating permits and approvals, compliance with the terms and conditions of any applicable mining lease, and compliance with applicable federal, state, and local laws, regulations and ordinances.

Mining Operations

The exploration of mining properties and development and operation of mines is governed by both federal and state laws.

The State of Nevada likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to

Page 5 of 65

ensure that proper reclamation takes place, and the bond will not be released until that time. The Nevada Department of Environmental Protection, which is referred to as the NDEP, is the state agency that administers the reclamation permits, mine permits and related closure plans on the Nevada property. Local jurisdictions (such as Eureka County) may also impose permitting requirements (such as conditional use permits or zoning approvals).

Environmental Law

The development, operation, closure, and reclamation of mining projects in the United States requires numerous notifications, permits, authorizations, and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits issued by regulatory agencies, and to file various reports and keep records of the Company's operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to the Company's proposed operations may be encountered. The Company is currently operating under various permits for activities connected to mineral exploration, reclamation, and environmental considerations. Unless and until a mineral resource is proved, it is unlikely Star Gold Corp. operations will move beyond the exploration stage. If in the future the Company decides to proceed beyond exploration, there will be numerous notifications, permit applications, and other decisions to be addressed at that time.

Competition

Star Gold Corp. competes with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties and also for equipment and labor related to exploration and development of mineral properties. Many of the mineral resource exploration and development companies with whom the Company competes have greater financial and technical resources. Accordingly, competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact Star Gold Corp.'s ability to finance further exploration and to achieve the financing necessary for the Company to develop its mineral properties.

The Company provides no assurance it will be able to compete in any of its business areas effectively with current or future competitors or that the competitive pressures faced by the Company will not have a material adverse effect on the business, financial condition and operating results.

Office and Other Facilities

Star Gold Corp. currently maintains its administrative offices at 611 E. Sherman Avenue, Coeur d'Alene, ID 83814. The telephone number is (208) 664-5066. Star Gold Corp. subleases office space from Marlin Property Management, LLC ("Marlin") which is a single member limited liability company owned by the spouse of the Company's Chairman of the Board, Lindsay Gorrill. This office space consists of approximately 250 square feet, and Marlin supplies this office space to the Company at a monthly rental rate of $2,500. Star Gold Corp. does not currently own title to any real property.

Employees

The Company has one employee other than its executive officers as of the date of this Annual Report on Form 10-K. Star Gold Corp. conducts business largely through independent contractor agreements with consultants.

Research and Development Expenditures

The Company has not incurred any research expenditures since incorporation.

Reports to Security Holders

The Registrant does not issue annual or quarterly reports to security holders other than the annual Form 10-K and quarterly Forms 10-Q as electronically filed with the SEC. Electronically filed reports may be accessed at www.sec.gov . Interested parties also may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 450 Fifth Street NW, Washington, DC 20549. Information may be obtained on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330.

Page 6 of 65

ITEM 1A.

RISK FACTORS

The following factors, among others, could cause the actual operating results to differ materially from those indicated or suggested by forward-looking statements made in this Form 10-K or presented elsewhere from time to time.

Estimates of mineralized material are forward-looking statements inherently subject to error. Although resource estimates require a high degree of assurance in the underlying data when the estimates are made, unforeseen events and uncontrollable factors can have significant adverse or positive impacts on the estimates. Actual results may inherently differ from estimates. The unforeseen and uncontrollable factors include but are not limited to: geologic uncertainties including inherent sample variability, metal price fluctuations, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be accurately predicted.

Failure to successfully address the risks and uncertainties described below would have a material adverse effect on the Company's business, financial condition and/or results of operations, and the trading price of the Company's common stock may decline and investors may lose all or part of their investment. Star Gold Corp. cannot assure readers that the Company will successfully address these risks or other unknown risks that may affect its business.

Risks Related to the Company

The Company has a limited operating history on which to base an evaluation of the business and prospects

The Company has not derived any revenue from exploration of its properties. The Company's operating history has been limited to the acquisition and exploration of its mineral properties. Such history does not provide a meaningful basis for an evaluation of its prospects for success if future determinations are made that mineral reserves exist and to commence construction and operation of a mine. Other than through conventional and typical exploration methods and procedures, the Company has no addition means to evaluate the likelihood of whether its mineral properties contain any mineral reserve or, if they do, that they will be operated successfully. The Company anticipates that it will continue to incur operating costs without realizing any operating revenues during the period it explores the properties.

During the fiscal year ended April 30, 2014, the Company had losses of $1,541,678 in connection with the maintenance and exploration of its mineral properties and the operation of the exploration business. The Company therefore expects to continue to incur significant losses into the foreseeable future. The Company recognizes that if it is unable to generate significant revenues from mining operations and dispositions of its properties, the Company will not be able to earn profits or continue operations. At this early stage of operations, the Company expects to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the development stage of their business. The Company cannot ensure it will be successful in addressing these risks and uncertainties and the failure to do so could have a materially adverse effect on its financial condition. There is no history upon which to base any assumption as to the likelihood that the Company will prove successful and the Company can provide investors no assurance that we will generate any operating revenue or ever achieve profitable operations.

Investors' interests in the Company will be diluted and investors may suffer dilution in their net book value per share if the Company issues additional employee/director/consultant options or if the Company sells additional shares to finance its operation.

The Company has not generated any operational revenues from the exploration of its properties. In order to further expand the Company's business and meet its objectives, including but not limited to, obtaining funds to further explore the Company's existing properties or to finance any acquisition activity, growth and/or additional exploration programs, should those opportunities present themselves, and depending on the outcome of its exploration programs, additional capital funding may need to be obtained through the sale and issuance of additional debt and/or equity securities. The Company may also, in the future, grant to some or all of its directors, officers, insiders and key employee/consultants options, or other rights to acquire common or preferred shares in the Company as non-cash incentives. The issuance of any additional equity securities could cause then-existing stockholders to experience dilution of their ownership interests.

Should the Company issue additional shares in order to finance its business activities, investors' interests in the Company may be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. As of the date of the filing of this report there are outstanding 3,056,214 common share purchase warrants exercisable into 3,056,214 shares of common stock, and 3,572,000 options granted that are exercisable into 3,572,000 shares of common stock. If all of these are exercised or converted, these would represent approximately 15.9% of the Company's issued and outstanding shares. If all of the

Page 7 of 65

warrants and options are exercised and the underlying shares issued, such issuance would cause a reduction in the proportionate ownership and voting power of all other stockholders. The dilution may result in a decline in the market price of the Company's shares.

Conflicts of interest

Certain of the Company's officers and directors may be or become associated with other businesses, including natural resource companies that acquire interests in properties. Such associations may give rise to conflicts of interests from time to time. The Company's directors are required by law to act honestly and in good faith with a view to the Company's best interests and to disclose any interest, which they may have in any of the Company's projects or opportunities. In general, if a conflict of interest arises at a meeting of the board of directors, any director in a conflict will disclose his interest and abstain from voting on such matter or, if he does vote, his vote will not be counted.

Dependence on Key Management Personnel

The Company's ability to continue exploration and development activities and to develop a competitive edge in the marketplace depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there can be no assurance that the Company will be able to attract and retain such personnel. The Company's development now and in the future will depend on the effort of key management figures such as Lindsay Gorrill, Kelly Stopher, David Segelov and Scott Jenkins. The loss of any of these key people could have a material adverse effect on the Company's business. In addition, the Company has expanded the provisions of its stock option plan so the Company can provide incentive for the key personnel.

Failure to obtain additional financing

Unless and until the Company is able to generate revenues from operations, the Company's main potential continuing source of funds will be additional debt and/or equity financings which may not be sufficient to sustain operations. There is no guarantee that the Company, if needed, will be able to raise additional funds through debt and/or equity financing or that any such financing will be able to be obtained on terms beneficial to the Company. If Star Gold Corp. is unsuccessful in raising additional funds, the Company will not be able to develop its properties and may be unable to continue as a going concern.

Company Directors and Officers own 36.8% of the Company's outstanding common stock which may cause corporate decisions influenced by the Directors and Officers to appear to be inconsistent with the interests of other stockholders.

Company directors and/or officers as a group control a combined 36.8% of the issued and outstanding shares of the Company's common stock. Accordingly, while none of the current directors and/or officers (individually or collectively) can control, as shareholders, who is elected to the board of directors, since these individuals are not simply passive investors but are also active members of Company management, their interests as directors and/or officers and shareholders may, at times, be adverse to those of merely passive investors. Where those conflicts exist, stockholders will be dependent upon management exercising their fiduciary duties as members of the Board of Directors and/or as an officer. Also, due to their stock ownership position, members of the Company's management team will have: (i) the ability to substantially influence the outcome of many (if not most) corporate actions requiring stockholder approval, including amendments to the Company's Articles of Incorporation; and (ii) the ability to substantially influence corporate combinations or similar transactions that might benefit minority stockholders which may not be supported by management to the detriment of smaller and/or passive investors.

There is substantial risk that no commercially viable mineral deposits will be found due to speculative nature of mineral exploration,

Exploration for commercially viable mineral deposits is a speculative venture involving substantial risk. Star Gold cannot provide investors with assurance that its mining claim contains commercially viable mineral deposits. The exploration program that the Company will conduct on its claim may not result in the discovery of commercial viable mineral deposits. Problems such as unusual and unexpected rock formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, the Company may be unable to complete its business plan and investors could lose their entire investment.

Page 8 of 65

Due to the inherent dangers involved in mineral exploration, there is a risk that the Company may incur liability or damages as it conducts its business.

The search for minerals involves numerous hazards. As a result, Star Gold Corp. may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which the Company cannot insure or against which we may elect not to insure. Star Gold Corp. currently has no such insurance nor does the Company expect to acquire such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed the Company's asset value and cause management to liquidate all of the Company's assets resulting in the loss of a stockholder's entire investment.

Exploration efforts may be adversely affected by metals price volatility causing the Company to cease exploration efforts.

The company has no earnings. However, the success of any exploration effort is derived from the price of metal prices that are affected by numerous factors including: 1) expectations for inflation; 2) investor speculative activities: 3) relative exchange rate of the U.S. dollar to other currencies; 4) global and regional demand and production; 5) global and regional political and economic conditions; and 6) production costs in major producing regions. These factors are beyond the Company's control and are impossible for the Company to accurately predict.

There is no guarantee that current favorable prices for metals and other commodities will be sustained. If the market prices for these commodities fall the Company may temporarily suspend or cease exploration efforts.

Governmental regulation and environmental risks

The Company's business is subject to extensive federal, state and local laws and regulations governing mining exploration, development, production, labor standards, occupational health, waste disposal, use of toxic substances, environmental regulations, mine safety and other matters. New legislation and regulations may be adopted at any time that results in additional operating expense, capital expenditures or restrictions and delays in the exploration, mining, production or development of its properties F urther drilling at both Longstreet and Excalibur is dependent on a successful Plan of Operation, which may not be forthcoming but which has been applied for as the existing Plan of Operation had expired.

Internal control, fraud detection and financial reporting

Should the Company fail to maintain an effective system of internal controls, it may not be able to detect fraud or report financial results accurately, which could harm the business and could be subject to regulatory scrutiny.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 ("Section 404"), the Company is required to perform an evaluation of its internal controls over financial reporting. The Company is required to have an independent registered public accounting firm test and evaluate the design and operating effectiveness of such internal controls and publicly attest to such evaluation. Continuing compliance with the requirements of Section 404 is expected to be expensive and time-consuming. If the independent registered public accounting firm cannot attest to management's evaluation, the Company could be subject to regulatory scrutiny and a loss of public confidence in the Company's internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm the Company's operating results or cause the Company to fail to meet its reporting obligations.

Risks Associated with the Company's Common Stock

Star Gold Corp. stock is a penny stock; stockholders will be more limited in their ability to sell their stock.

The shares of Star Gold Corp. common stock constitute "penny stocks" under the Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. The classification as a penny stock makes it more difficult for a broker/dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker/dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to rules 15g-1 through 15g-10 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock.

Page 9 of 65

The "penny stock" rules adopted by the SEC under the Exchange Act subjects the sale of the shares of the Company's common stock to certain regulations which impose sales practice requirements on broker/dealers. For example, brokers/dealers selling such securities must, prior to effecting the transaction, provide their customers with a document that discloses the risks of investing in such securities.

Legal remedies, which may be available to an investor in "penny stocks," are as follows:

(a) | if "penny stock" is sold to an investor in violation of his or her rights listed above, or other federal or states securities laws, the investor may be able to cancel his or her purchase and get his or her money back. |

|

|

(b) | if the stocks are sold in a fraudulent manner, the investor may be able to sue the persons and firms that caused the fraud for damages. |

|

|

(c) | if the investor has signed an arbitration agreement, however, he or she may have to pursue his or her claim through arbitration. |

If the person purchasing the securities is someone other than an accredited investor or an established customer of the broker/dealer, the broker/dealer must also approve the potential customer's account by obtaining information concerning the customer's financial situation, investment experience and investment objectives. The broker/dealer must also make a determination whether the transaction is suitable for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of evaluating the risk of transactions in such securities. Accordingly, the SEC's rules may limit the number of potential purchasers of the shares of Star Gold Corp. common stock.

The Company's stock price has been volatile and stockholder investment in the Company's common stock could suffer a decline in value.

The Company's common stock is quoted via the OTC Markets. The market price of the Company's common stock may fluctuate significantly in response to a number of factors, some of which are beyond the Company's control. These factors include price fluctuations of precious metals, government regulations, disputes regarding mining claims, broad stock market fluctuations and economic conditions in the United States.

Although the Company's common stock is currently quoted via the OTC Markets, there are no assurances any public market for the Company's common stock will continue. There are also no assurances as to the depth or liquidity of any such market or the prices at which holders may be able to sell the shares. An investment in these shares may be totally illiquid and investors may not be able to liquidate their investment readily or at all when they need or desire to sell.

The Company does not intend to pay any dividends on shares of common stock in the near future.

The Company does not currently anticipate declaring and paying dividends to its stockholders in the near future, and any future decision as to the payment of dividends will be at the discretion of the board of directors and will depend upon the Company's earnings, financial position, capital requirements, plans for expansion and such other factors as the board of directors deems relevant. It is the Company's intention to apply net earnings, if any, in the foreseeable future to finance the growth and development of the business.

ITEM 1B.

UNRESOLVED STAFF COMMENTS

None

ITEM 2.

PROPERTIES.

The Company subleases office space at 611 E. Sherman Avenue, Coeur d'Alene, Idaho, 83814 for $2500 per month from Marlin Property Management, LLC, an entity owned by the spouse of the Company's Chairman of the Board, Lindsay Gorrill. The Company believes this office space and facilities are sufficient to meet the Company's present needs, and do not anticipate any difficulty securing alternative or additional space, as needed, on terms acceptable to the Company.

Page 10 of 65

The Company currently does not own any real property. The Company owns a vehicle for business use in Nevada and other personal property used in the conduct of the Company's business at its headquarters and at its various holdings in Nevada.

The Company is an 'exploration state' company with no proven or measured mineral reserves. There is no assurance that a commercially viable mineral deposit exists in any of the Excalibur, Longstreet, of Jet properties. Further exploration and will be required before any final determination as to the economic or legal feasibility may be made as to any of the Company's properties.

THE EXCALIBUR PROPERTY

On April 11, 2008, Star Gold Corp. executed a property purchase agreement (the "Excalibur Agreement") with MinQuest, Inc. ("MinQuest") granting the Company the right to acquire up to 100% of the mining interests within the Excalibur Property, a mineral exploration property. The property is located in Mineral County Nevada and the Excalibur Agreement originally covered 8 unpatented mining claims. On June 18, 2009, the Company and MinQuest entered into an amending agreement to add an additional 42 claims and expanding the total to 50 claims, all of which are unpatented. A list of claims, ownership and Bureau of Land Management (BLM) serial numbers is shown below:

CLAIM NAME

CLAIMANT'S NAME

NMC NUMBER

MM1

MinQuest Inc.

887042

MM2

MinQuest Inc.

887043

MM3

MinQuest Inc.

887044

MM4

MinQuest Inc.

887045

MM5

MinQuest Inc.

887046

MM6

MinQuest Inc.

887047

MM7

MinQuest Inc.

887048

MM8

MinQuest Inc.

887049

MM9

MinQuest Inc

1003596

MM10

MinQuest Inc

1003597

MM11

MinQuest Inc

1003598

MM12

MinQuest Inc

1003599

MM13

MinQuest Inc

1003600

MM14

MinQuest Inc

1003601

MM15

MinQuest Inc

1003602

MM16

MinQuest Inc

1003603

MM17

MinQuest Inc

1003604

MM18

MinQuest Inc

1003605

MM19

MinQuest Inc

1003606

MM20

MinQuest Inc

1003607

MM21

MinQuest Inc

1003608

MM22

MinQuest Inc

1003609

MM23

MinQuest Inc

1003610

MM24

MinQuest Inc

1003611

MM25

MinQuest Inc

1003612

MM26

MinQuest Inc

1003613

MM27

MinQuest Inc

1003614

MM28

MinQuest Inc

1003615

MM29

MinQuest Inc

1003616

MM30

MinQuest Inc

1003617

MM31

MinQuest Inc

1003618

MM32

MinQuest Inc

1003619

MM33

MinQuest Inc

1003620

MM34

MinQuest Inc

1003621

MM35

MinQuest Inc

1003622

MM36

MinQuest Inc

1003623

MM37

MinQuest Inc

1003624

MM38

MinQuest Inc

1003625

MM39

MinQuest Inc

1003626

MM40

MinQuest Inc

1003627

MM41

MinQuest Inc

1003628

Page 11 of 65

MM42

MinQuest Inc

1003629

MM43

MinQuest Inc

1003630

MM44

MinQuest Inc

1003631

MM45

MinQuest Inc

1003632

MM51

MinQuest Inc

1003633

MM52

MinQuest Inc

1003634

MM53

MinQuest Inc

1003635

MM54

MinQuest Inc

1003636

MM55

MinQuest Inc

1003637

The annual claim fees due to federal and state governments total $7,529 per year and are due before September 1 st of each year.

The Company has completed an initial exploration program on the Excalibur Property, which included Geological Mapping, Rock Sampling and Assaying. Based on this analysis we decided to move forward with the permitting of this property and associated drilling program. The permitting was completed in June 2010 and the drilling program commenced immediately thereafter.

History : The Moho vein, located within the Excalibur Property, was discovered in 1903 and mined intermittently until the 1930's. According to the US Bureau of Mines IC 6941 written in 1937, the property produced over $100,000 of ore at an average grade of 1 opt gold, 6.5 opt silver and 1.4% lead. This equates to about 5000 tons of hand sorted ore. US Bureau of Mines IC 6941 further reports than additional mineralized material remained, which could potentially be converted into resource or reserve. After 1937 additional work was completed along the northern portion of the property. However, no additional production information is available for the property. The property went into foreclosure around 1984 and was held by the lender until 2006 when Tesoro Resources purchased the property. Although there is significant underground work and numerous trenches along strike of the mineralized zones, no apparent drilling was found within Tesoro's property during this investigation. In 1991 Dennis Flagle discovered the Excalibur area. He leased the project to Alta Gold in 1996. The project is located approximately 3000 feet northeast of the Moho mine.

Alta staked an additional 120 claims south and east of Flagle's original Excalibur claims. Alta reportedly conducted minimal geology, a soil sampling program and completed eleven RC drill holes from 1997 to 1998. Although this data is not currently available, it has been offered for sale by Mr. Flagle. Mr. Flagle reports that some "highly" anomalous gold was encountered in two or more of the drill holes. Alta Gold went into receivership in 1998 and the property reverted to the lessor. The claims were abandoned shortly thereafter. MinQuest acquired the ground through staking of eight unpatented mining claims in 2004 and leased the project to Star Gold (then known as Elan Development, Inc.) in 2007. Since that time an additional 46 claims have been added , 175 rock chip samples have been collected throughout the property and a geologic map with structure, alteration and cultural features has been completed.

Geology : Outcrops within the project boundary have been mapped as Permian Mina Formation to recent alluvial fill. The oldest apparent unit outcropping in the area is at least partially of Permian age known as the Mina Formation. It has been age dated by K-Ar dates of detrital hornblende and by fossil fusulinids. The Formation is composed of silty to sandy shale and greywacke. Graded bedding and turbidity structures were noted in the field and were useful in identifying the upside of steeply dipping beds. This unit is green to gray grading from sands to feldspathic mudstone. Massive units are green in color and probably derived from a basic volcanic component. This unit is at least 600 feet thick based on mapping within the project area. The middle unit is composed of tuff with a pumice-rich basal layer. This unit is distinctive and can be used as a top-set indicator since bedding and sag structures in shale are generally destroyed by alteration. This unit is rather thin from a few feet to 20 feet thick. The upper unit is composed of massive to laminated gray to red-brown chert. It may be up to 200 feet thick in some places. However, this unit may be thickened by folding and faulting where mapped. The Mina Formation has been intruded by a Cretaceous quartz-eye granite porphyry stock on the south end of the project. This porphyry ranges from 89 to 93 Ma. The sediment contact is metamorphosed to slate and bleached quartzite. Feldspathic diorite plugs intrude the north and central portion of the property. The diorite has distinctive feldspar laths, often encased in another feldspar. These plugs may be lower Miocene in age correlating with other feldspathic diorite bodies elsewhere in the range. The age dates for similar plugs in the area range from 15 to 22 Ma. Fractionated mafic dikes or sills are probably related to the feldspathic diorite plugs. The dikes or sills utilize fault planes for emplacement. Most of the mineralization occurs during this phase and strongly affects adjacent slate, meta-tuff. Mild alteration effects are also noted within the quartz porphyry. The dikes are generally bleached and altered to clay suggesting mineralizing fluids are related to this event or at least provided plumbing for later hydrothermal fluids. A late stage leucocratic dike swarm parallels the main northwesterly trending valley bisecting the project. This dike swarm cuts all rock types and appears to be the youngest rock formation within the project boundary. No age dates are known for this unit.

Mineralization : Mineralization appears to be related to the mafic dikes and portions of the feldspathic diorite contacts. These intrusive events appear to have acted as conduits for hydrothermal fluids to migrate upwards and deposit minerals. Prospecting

Page 12 of 65

preferentially occurs along the diorite contact near the south-central portion of the claims, along the Moho "Vein", and along altered mafic dikes and plugs identified elsewhere on the property. There are three distinct types of breccias related to historic prospecting activities. The first breccia type occurs along fault zones that contain zones of rubble up to 10 feet thick flanked by bright orange to red iron oxide staining. A second breccia type is represented by chert fragments cemented by chalcedonic silica. The third type of breccia is related to narrow calcite-filled fault zones and associated weak hematite staining resulting in pink calcite and breccia float trails which are poorly exposed. The bulk of the historic prospecting occurs along multiple, continuous, en echelon zones from 0.5 to 10 feet thick composed of hematite and sparcemented pebble breccias. These breccias wind through the faults zones and can be discontinuous and in discordant orientations. The zones are sometimes 'slaggy' specifically near diorite and mafic dike contacts. The Moho mine and parallel zones are 6 strongly associated with the diorite contact and along mafic dikes. The Moho "Veins" have been prospected to depths of 200 feet or more by multiple shafts and adits. The entire Moho "Vein" zone can be traced for over 7500 feet in length, 600 feet in width and over 1000 feet in elevation. The Central Target is represented by the extension of the Moho that lies within the current claim position can be traced for over 1800 feet before it is lost under alluvial debris. Samples along this extension commonly return highly anomalous values of gold and silver. The workings are less extensive on Star Gold's claim position. However, the low angle deposition of the mineralization coupled with multiple stacked veins indicates potential for either open pit or underground mining. Recent sampling and mapping have identified alteration consisting of silicified and brecciated zones with associated anomalous gold and silver concentrations. These alteration zones are located within the southern and northeastern portions of the property.

The Southern target is defined by an area roughly 1200 by 1500 feet composed of chert fragments cemented with chalcedonic silica. In places, later fault zones cut this material. The later faults contain clay gouge probably related to the aforementioned dikes and iron oxides. Gold and silver values from this zone are anomalous to highly anomalous (several times background values up to hundreds of times background values). The Northeastern target is hosted within brecciated chert and silicified diorite. Barite veins have been noted locally. Gold and Silver values here are highly anomalous. This area was soil sampled by Alta Gold in 1997 and reportedly contained anomalous gold in soils and in select rock chips. In 1998 Alta drilled five holes to test this target. The hole collars were poorly selected and proved to be too far from the target. Three holes failed to intersect any alteration while two holes were lost as they entered the mineralized zone. The area of anomalous gold is roughly 2500 feet by 900 feet. A target was also identified in the northwestern corner of the property. Samples collected from pits and shafts in this area again are highly anomalous for both gold and silver. To date, this area appears to represent narrow, discontinuous structures hosted by a diorite plug. The target is currently considered too small and will need more work to bring it to a potential drill target. The anomalous gold and silver values noted above are indicators of mineralized systems which will be further evaluated with drilling or follow-up sampling.

Environmental, plan of operation and reclamation: To the Company's knowledge, there is no known surface disturbance or groundwater contamination from previous mining activities. Remediation activities are performed immediately after completion of exploratory drilling. With respect to historical mining activities, those activities were on adjacent claims and, therefore, the Company has no plans to remediate at this time.

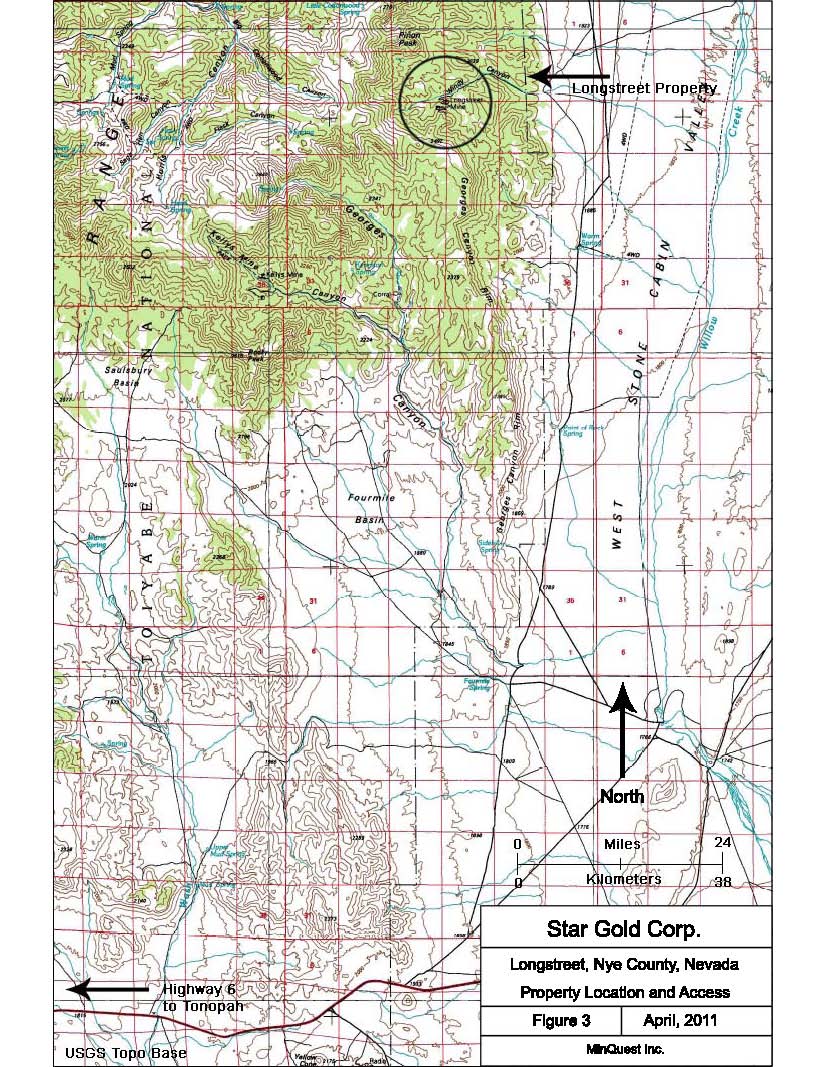

THE LONGSTREET PROPERTY

In January of 2010 Star Gold signed an option agreement to lease with an option to acquire from MinQuest, 60 unpatented mining claims (the "Longstreet Property") totaling approximately 490 hectares (the "Longstreet Agreement"). The Company completed its first phase of drilling in 2011. On July 9, 2010, the Company and MinQuest entered into an amended agreement to add an additional 10 claims and expanded the total to 70 claims, all of which are unpatented. In addition, Star Gold reimburses MinQuest for 5 claims leased from a third party, Roy Clifford. The property comprises 125 mineral claims (75 original optioned claims, of which 70 are unpatented staked claims and five claims acquired from local ranchers (Roy Clifford et al)), as well as 50 recently staked claims by Star Gold, covering a total area of approximately 2,500 acres (1,012 ha) (Figure 6-1). The claims are located within Sections 9-17, 20, and 21 of T6N, R47E, MDB&M (Mount Diablo Base Line & Meridian), Nye County.

Star Gold has staked 38 of these claims (Leach Pad Claims) adjacent to the eastern boundary of the property, with the objective of providing a site for leach pads planned for future development of the Main Zone. In addition, Star Gold has staked 12 of the above claims along a corridor leading from the main Longstreet property to the Leach Pad Claims.

A list of claims, ownership and Bureau of Land Management (BLM) serial numbers is shown below:

Claim Name | Registered Owner | NMC Number | Area (Acres) | Date Located | Good Until Date |

Original Longstreet Property Claims | |||||

Longstreet 1A | MinQuest Inc. | 799562 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 2A | MinQuest Inc. | 799563 | 20 | 22-Jan-1999 | September 1, 2014 |

Page 13 of 65

Longstreet 3A | MinQuest Inc. | 799564 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 6A | MinQuest Inc. | 799565 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 7A | MinQuest Inc. | 799566 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 8A | MinQuest Inc. | 799567 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 9A | MinQuest Inc. | 799568 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 16A | MinQuest Inc. | 799569 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 13 | MinQuest Inc. | 799570 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 32 | MinQuest Inc. | 799571 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 34 | MinQuest Inc. | 799572 | 20 | 22-Jan-1999 | September 1, 2014 |

Longstreet 4A | MinQuest Inc. | 836168 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 5A | MinQuest Inc. | 836169 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 8 | MinQuest Inc. | 836170 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 10 | MinQuest Inc. | 836171 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 10A | MinQuest Inc. | 836172 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 28 | MinQuest Inc. | 836173 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 30 | MinQuest Inc. | 836174 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 36 | MinQuest Inc. | 836175 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 37 | MinQuest Inc. | 836176 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 39 | MinQuest Inc. | 836177 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 41 | MinQuest Inc. | 836178 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 43 | MinQuest Inc. | 836179 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 45 | MinQuest Inc. | 836180 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 47 | MinQuest Inc. | 836181 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 49 | MinQuest Inc. | 836182 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 101 | MinQuest Inc. | 836183 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 102 | MinQuest Inc. | 836184 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 103 | MinQuest Inc. | 836185 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 104 | MinQuest Inc. | 836186 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 105 | MinQuest Inc. | 836187 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 106 | MinQuest Inc. | 836188 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 107 | MinQuest Inc. | 836189 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 108 | MinQuest Inc. | 836190 | 20 | 2-Feb-2002 | September 1, 2014 |

Longstreet 12 | MinQuest Inc. | 843867 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 14 | MinQuest Inc. | 843868 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 16 | MinQuest Inc. | 843869 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 18 | MinQuest Inc. | 843870 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 20 | MinQuest Inc. | 843871 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 26 | MinQuest Inc. | 843872 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 42 | MinQuest Inc. | 843873 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 44 | MinQuest Inc. | 843874 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 46 | MinQuest Inc. | 843875 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 48 | MinQuest Inc. | 843876 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 50 | MinQuest Inc. | 843877 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 40 | MinQuest Inc. | 851568 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 118 | MinQuest Inc. | 851569 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 119 | MinQuest Inc. | 851570 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 120 | MinQuest Inc. | 851571 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 121 | MinQuest Inc. | 851572 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 122 | MinQuest Inc. | 851573 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 123 | MinQuest Inc. | 851574 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 124 | MinQuest Inc. | 851575 | 20 | 29-Sep-2003 | September 1, 2014 |

Longstreet 109 | MinQuest Inc. | 855021 | 20 | 25-Feb-2003 | September 1, 2014 |

Page 14 of 65

Longstreet 110 | MinQuest Inc. | 855022 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 111 | MinQuest Inc. | 855023 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 112 | MinQuest Inc. | 855024 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 113 | MinQuest Inc. | 855025 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 114 | MinQuest Inc. | 855026 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 115 | MinQuest Inc. | 855027 | 20 | 25-Feb-2003 | September 1, 2014 |

Longstreet 56 | MinQuest Inc. | 1025831 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 57 | MinQuest Inc. | 1025832 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 58 | MinQuest Inc. | 1025833 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 59 | MinQuest Inc. | 1025834 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 60 | MinQuest Inc. | 1025835 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 61 | MinQuest Inc. | 1025836 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 62 | MinQuest Inc. | 1025837 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 63 | MinQuest Inc. | 1025838 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 64 | MinQuest Inc. | 1025839 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 65 | MinQuest Inc. | 1025840 | 20 | 9-Jul-2010 | September 1, 2014 |

Longstreet 11 | Roy Clifford et al | 164002 | 20 | 14-Jun-1980 | September 1, 2014 |

Longstreet 12 | Roy Clifford et al | 164003 | 20 | 14-Jun-1980 | September 1, 2014 |

Longstreet 14 | Roy Clifford et al | 164005 | 20 | 14-Jun-1980 | September 1, 2014 |

Longstreet 15 | Roy Clifford et al | 164006 | 20 | 14-Jun-1980 | September 1, 2014 |

Morning Star | Roy Clifford et al | 96719 | 20 | 1-Jul-1957 | September 1, 2014 |

Subtotal Original | 75 |

| 1,500 |

|

|

Leach Pad Claims | |||||

Longstreet 200 | MinQuest Inc. | 1073640 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 201 | MinQuest Inc. | 1073641 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 202 | MinQuest Inc. | 1073642 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 203 | MinQuest Inc. | 1073643 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 204 | MinQuest Inc. | 1073644 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 205 | MinQuest Inc. | 1073645 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 206 | MinQuest Inc. | 1073646 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 207 | MinQuest Inc. | 1073647 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 208 | MinQuest Inc. | 1073648 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 209 | MinQuest Inc. | 1073649 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 210 | MinQuest Inc. | 1073650 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 211 | MinQuest Inc. | 1073651 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 212 | MinQuest Inc. | 1073652 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 213 | MinQuest Inc. | 1073653 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 214 | MinQuest Inc. | 1073654 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 215 | MinQuest Inc. | 1073655 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 216 | MinQuest Inc. | 1073656 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 217 | MinQuest Inc. | 1073657 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 218 | MinQuest Inc. | 1073658 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 219 | MinQuest Inc. | 1073659 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 220 | MinQuest Inc. | 1073660 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 210 | MinQuest Inc. | 1073661 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 220 | MinQuest Inc. | 1073662 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 223 | MinQuest Inc. | 1073663 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 224 | MinQuest Inc. | 1073664 | 20 | 22-Jun-2012 | September 1, 2014 |

Page 15 of 65

Longstreet 225 | MinQuest Inc. | 1073665 | 20 | 22-Jun-2012 | September 1, 2014 |

|

|

|

|

|

|

| |||||

Longstreet 226 | MinQuest Inc. | 1073666 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 227 | MinQuest Inc. | 1073667 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 228 | MinQuest Inc. | 1073668 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 229 | MinQuest Inc. | 1073669 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 230 | MinQuest Inc. | 1073670 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 231 | MinQuest Inc. | 1073671 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 232 | MinQuest Inc. | 1073672 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 233 | MinQuest Inc. | 1073673 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 234 | MinQuest Inc. | 1073674 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 235 | MinQuest Inc. | 1073675 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 236 | MinQuest Inc. | 1073676 | 20 | 22-Jun-2012 | September 1, 2014 |

Longstreet 237 | MinQuest Inc. | 1073677 | 20 | 22-Jun-2012 | September 1, 2014 |

Subtotal Leach Pad | 38 |

| 760 |

|

|

|

|

|

|

|

|

Corridor Claims | |||||

Longstreet 66 | MinQuest Inc. | 1080730 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 238 | MinQuest Inc. | 1080731 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 239 | MinQuest Inc. | 1080732 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 240 | MinQuest Inc. | 1080733 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 241 | MinQuest Inc. | 1080734 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 242 | MinQuest Inc. | 1080735 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 243 | MinQuest Inc. | 1080736 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 244 | MinQuest Inc. | 1080737 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 245 | MinQuest Inc. | 1080738 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 246 | MinQuest Inc. | 1080739 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 247 | MinQuest Inc. | 1080740 | 20 | 5-Sept-2012 | September 1, 2014 |

Longstreet 248 | MinQuest Inc. | 1080741 | 20 | 5-Sept-2012 | September 1, 2014 |

Subtotal Corridor | 12 |

| 240 |

|

|

Total | 125 |

| 2,500 |

|

|

Star Gold must make annual claim filing fees of $140 ($155 in 2014) per claim with the Bureau of Land Management (BLM), and Nevada/Nye County claim filing fees of $10.50 per claim plus $4.00 for filing with the Nye County office at Tonopah. The 2013 total annual claim payment was $17,011.

The terms of the Longstreet Agreement called for an initial cash payment of $20,000, the issuance of 25,000 shares of Star Gold shares and 25,000 stock options based on "fair market price" to MinQuest. The Longstreet Agreement also requires cash payments totaling $250,000 over seven years and the issuance of 175,000 shares and 175,000 stock options based on "fair market price" over the same seven-year period. The Company has agreed to work commitments of $3,550,000 over seven years. Following the seventh anniversary of the agreement and if commitments have been met Star Gold shall receive a quitclaim deed for a 100% interest in the Longstreet Property in consideration of an ongoing 3% NSR to MinQuest.

The Longstreet project is located 48 kilometers southeast of the Round Mountain Mine in Nevada. Longstreet is a Round Mountain style volcanic-hosted gold deposit. The first vein mapping program ever done at Longstreet was completed in October, 2002. This work disclosed that gold-bearing veins at Main, as well as 6 other targets in the project area are steeply dipping. Most of the previous drilling was vertical. This indicates high potential to increase continuity, tonnage and grade of the resource. Surface geochemical sampling of veins from all the currently defined targets found gold values up to 18.1 g/t. As at Round Mountain the property contains strong potential for both open pit heap-leachable and high-grade millable ore. No party reading this report should conclude the Longstreet property has economic mineralization due to Longstreet's proximity to Round Mountain. Comparison to this and other

Page 16 of 65

historic or producing mines is strictly informational relative to location and similar geologic characteristics.

History: The Longstreet Property was discovered in the early 1900's, but had limited development work until 1929. A 1929 report and maps show development of the "Golden Lion Mine" on two levels spaced 75 meters apart vertically. The report indicates development of 300,000 tons of "vein material" averaging 0.20 oz/ton (6.8 g/t) gold and 8 oz/ton (274 g/t) silver. A mill was constructed, the remnants of which are still on the property. However, the small stopes underground indicate very little mining was done and the operation was abandoned.

The property lay idle until 1980 when Keradamex Inc. and E & B Exploration formed a joint venture to explore the property. The venture conducted soil and rock chip geochemical surveys, limited underground sampling and drilled seven (one was abandoned) angle core holes into the Main mine workings area. This drilling revealed the presence of fracture related gold mineralization up to 36 meters thick extending into the hanging wall of the vein structure. In 1982 Minerva Exploration optioned the property and initiated an underground sampling program. In 1983 a joint venture was formed with Geomex Canada Resources Ltd. Derry, Michener, and Booth were commissioned to assess the property and conducted underground sampling, bulk sampling and metallurgical testing.

Historic Drilling Summary |

|

|

|

|

|

|

| |

Date | Company |

|

|

|

| Number of Holes |

| Total Footage |

1980 | Keradamex |

|

| 7 |

| NA | ||

1982-1983 | Minerva |

| - |

| UG Sampling, no drilling | |||

1984-1997 | Naneco |

|

| Approx 500 |

| NA, RC and air track | ||

1987 | Cyprus |

|

| 7 |

| 3,000 | ||

2002-2005 | R.E.M. |

|

| 30 |

| 11,000 | ||

|

|

|

|

|

| |||

Page 17 of 65

Page 18 of 65

In 1982 Minerva Exploration optioned the property and initiated an underground sampling program. In 1983 a joint venture was formed with Geomex Canada Resources Ltd. Derry, Michener, and Booth were commissioned to assess the property and conducted underground sampling, bulk sampling and metallurgical testing.

In early 1984 Naneco Resources Ltd., an Alberta company, acquired all of the assets of Minerva and an additional 10 percent interest in the property from Geomex. As operator, Naneco immediately initiated drilling. In 1985, with over 200 RC holes drilled the venture announced encouraging results with anomalous grades of gold and silver throughout its drilling samples.

During the next few years Naneco increased its interest from 53 percent to 100 percent, conducted additional metallurgy, economic evaluation and drilling. At least 492 RC holes have been drilled, most within the Main resource area. Unable to raise money because of falling gold prices and strapped with high land payments to the claim owners, Naneco relinquished the property in 1998. MinQuest acquired it shortly thereafter. The Cyprus target, which was evaluated by Cyprus Minerals Company in 1987 was acquired by MinQuest in early 2002.

The property was optioned to Rare Earth Metals Corp. (REM) in May of 2002. REM later changed its name to Harvest Gold. Mapping and geochemical sampling of the 7 targets shown on the attached map was completed in October, 2002. From 2003 through 2005 REM drilled 30 holes into Main totaling 3,350 meters. The drill holes were angled toward the intersection of the two primary sheeted vein sets. Results showed a 20% improvement in average grade over vertical drilling.

Following the split of REM into Harvest Gold and VMS Ventures Inc. Harvest performed no further work at Longstreet after late 2005. The property was finally returned to MinQuest in August, 2009. By agreement with Minquest, Star Gold Corp. received an option to acquire the property on January 15, 2010.

Star Gold began drilling in the fall of 2011. A 16 hole program at Main showed new intercepts at depth in the central portion of the deposit. Intercept thicknesses of +0.01 oz/ton gold equivalent values are 65 to 120 feet. Of the 16 holes drilled 8 have +100 feet thicknesses of +0.01 oz/ton gold equivalent and 4 have +200 feet thicknesses of +0.01 oz/ton gold equivalent. Drill hole LS-1101 has 305 feet of +0.01 oz/ton gold equivalent. Gold equivalent values were derived from the following formula: AuEq oz/ton = Au oz/ton + (Ag oz/ton)/60. Drilling results are shown in the table below.

Drill samples were sent through a rotating, wet sample splitter attached to the drill in order to reduce the sample volume and maintain a representative sample. Drill helpers, under the supervision of the project geologist, collected and bagged an 'A' and 'B' sample on 5-foot intervals. Procedurally, an 'A' sample is collected and held by the project geologist for security purposes until it can be delivered to an assay facility. The 'B' sample then remains on site as a duplicate or backup sample if needed at a later date. A blank and two known 'standard' pulps are then submitted randomly spaced with each drill hole. Once assays are available, they are examined for unexpected high or low values. If unexpected high or low values are encountered, the 'B' splits may be collected and submitted, or the lab may be requested to re-assay the pulp or reject in question. The 'check' samples and 'standard' are examined to insure they agree with the original or know within accepted limits, usually +or- 10%.

ALS Chemex of Reno, Nevada did all sample preparation, including crushing, grinding and preparation of the assay pulps. The samples were never left unattended or unsecured by project geologist, drilling or laboratory staff nor are they handled by officers, directors or associates of Star Gold.

Sample preparation involves crushing the entire sample to -10 mesh, splitting, then pulverizing 1,000 grams to 75% passing 75 micron mesh. These pulps are then transferred within the ALS Chemex facility for assay. Both gold and silver assays are done by fire assay with an AA finish. The standard Star-Longstreet submittal to ALS Chemex requests a 30 gram charge for gold fire assay. Assays which exceed 10 g/ton are automatically subjected to a gravimetric finish. Select sample intervals, usually those near intervals assaying significant gold, are chosen by the project geologist for re-assay also.

The Longstreet project is associated with a paleo-hot springs system in a caldera associated volcanic setting very similar to the Round Mountain mine. Round Mountain is an open pit, heap-leach mine that has produced over 10 million ounces of gold over a 30 year period with the average grade currently being mined of 0.018 oz/ton gold. Cut-off grades for Round Mountain and several other oxide ore heap leach operations in Nevada range from 0.003 to 0.005 oz/ton gold. Star Gold hopes to develop an open pit, bulk minable, heap leachable gold/silver mine at Longstreet.

No party reading this report should conclude the Longstreet property has economic mineralization due to Longstreet's proximity to any historic or producing mines and any information regarding any such historic or producing mines is strictly informational relative to location and similar geologic characteristics.

Page 19 of 65

Regional Geology and Mineralization: The Longstreet Property is located in the Nevada portion of the Basin and Range Province. This geological province is characterized by repeated episodes of compressional deformation in Paleozoic and Mesozoic time followed by extensional deformation and extensive magmatism and volcanism in Cenozoic time. Gold deposits are most often described as being associated with ‘mineralization trends', that are a reflection of deep crustal structures and magmatism, such as the ‘Walker Lane' and the ‘Carlin Trend'. The Longstreet Project is located in the Monitor Range, adjacent to the northwest trending Walker Lane volcanic-hosted gold trend that includes such world-class deposits as the Comstock and Goldfields mining camps |

2013 Drill Results Longstreet (≥ 5 feet @ ≥ 0.01 oz/ton gold equivalent) 08/26/13 | ||||||||||

Hole No. | From | To | Interval | True | Gold | Silver | True | Gold | Silver | Au Equiv. |

| (feet) | (feet) | (feet) | Width | (oz/ton) | (oz/ton) | Width (m) | (g/t) | (g/t) | (oz/ton) |

LS-1301 | 45 | 50 | 5.0 | 5.0 | 0.008 | 0.274 | 1.5 | 0.263 | 9.4 | 0.012 |

| 150 | 160 | 10.0 | 10.0 | 0.016 | 0.058 | 3.0 | 0.535 | 2.0 | 0.017 |

| 190 | 215 | 25.0 | 25.0 | 0.009 | 0.141 | 7.6 | 0.300 | 4.8 | 0.011 |

LS-1302 | 0 | 40 | 40.0 | 36.0 | 0.015 | 0.894 | 11.0 | 0.516 | 30.6 | 0.030 |

| 70 | 165 | 95.0 | 85.5 | 0.009 | 0.482 | 26.1 | 0.307 | 16.5 | 0.017 |

| 205 | 270 | 65.0 | 58.5 | 0.012 | 0.444 | 17.8 | 0.396 | 15.2 | 0.019 |

LS-1303 | 85 | 110 | 25.0 | 25.0 | 0.003 | 0.935 | 7.6 | 0.098 | 32.0 | 0.018 |

| 145 | 150 | 5.0 | 5.0 | 0.009 | 0.105 | 1.5 | 0.292 | 3.6 | 0.010 |

| 165 | 170 | 5.0 | 5.0 | 0.007 | 0.201 | 1.5 | 0.238 | 6.9 | 0.010 |

| 185 | 230 | 45.0 | 45.0 | 0.006 | 0.374 | 13.7 | 0.191 | 12.8 | 0.012 |

| 255 | 300 | 45.0 | 45.0 | 0.004 | 0.326 | 13.7 | 0.148 | 11.2 | 0.010 |

LS-1304 | 35 | 50 | 15.0 | 15.0 | 0.004 | 0.388 | 4.6 | 0.130 | 13.3 | 0.010 |

| 60 | 85 | 25.0 | 25.0 | 0.008 | 0.384 | 7.6 | 0.258 | 13.1 | 0.014 |

| 130 | 155 | 25.0 | 25.0 | 0.065 | 0.467 | 7.6 | 2.218 | 16.0 | 0.073 |

LS-1305 | 15 | 30 | 15.0 | 15.0 | 0.007 | 0.184 | 4.6 | 0.226 | 6.3 | 0.010 |

| 45 | 145 | 100.0 | 100.0 | 0.009 | 0.306 | 30.5 | 0.305 | 10.5 | 0.014 |

| 210 | 220 | 10.0 | 10.0 | 0.006 | 0.291 | 3.0 | 0.220 | 10.0 | 0.011 |

LS-1306 | 45 | 50 | 5.0 | 5.0 | 0.004 | 0.523 | 1.5 | 0.120 | 17.9 | 0.012 |

| 205 | 295 | 90.0 | 90.0 | 0.003 | 0.521 | 27.4 | 0.095 | 17.9 | 0.011 |

LS-1307 | 120 | 145 | 25.0 | 25 | 0.007 | 0.783 | 7.6 | 0.236 | 26.8 | 0.020 |

LS-1308 | 85 | 90 | 5.0 | 5 | 0.009 | 0.146 | 1.5 | 0.314 | 5.0 | 0.012 |

| 180 | 190 | 10.0 | 10.0 | 0.003 | 0.444 | 3.0 | 0.101 | 15.2 | 0.010 |

| 280 | 340 | 60.0 | 60.0 | 0.003 | 0.833 | 18.3 | 0.104 | 28.5 | 0.017 |

LS-1309 | 0 | 10 | 10.0 | 10.0 | 0.015 | 0.304 | 3.0 | 0.509 | 10.4 | 0.020 |

| 40 | 265 | 225.0 | 225.0 | 0.022 | 0.678 | 68.6 | 0.750 | 23.2 | 0.033 |

| 330 | 340 | 10.0 | 10.0 | 0.005 | 0.492 | 3.0 | 0.169 | 16.9 | 0.013 |