UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended December 31, 2010 | Commission file number 1-9700 |

THE CHARLES SCHWAB CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 94-3025021 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

211 Main Street, San Francisco, CA 94105

(Address of principal executive offices and zip code)

Registrant's telephone number, including area code: (415) 667-7000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock - $.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2010, the aggregate market value of the voting stock held by non-affiliates of the registrant was $14.2 billion. For purposes of this information, the outstanding shares of Common Stock owned by directors and executive officers of the registrant, and certain investment companies managed by Charles Schwab Investment Management, Inc. were deemed to be shares of the voting stock held by affiliates.

The number of shares of Common Stock outstanding as of January 31, 2011, was 1,203,314,123.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates certain information contained in the registrant's definitive proxy statement for its annual meeting of stockholders, to be held May 17, 2011, by reference to that document.

THE CHARLES SCHWAB CORPORATION

Annual Report On Form 10-K

For Fiscal Year Ended December 31, 2010

TABLE OF CONTENTS

| Part I | ||||||

| Item 1. | Business | 1 | ||||

General Corporate Overview | 1 | |||||

Acquisitions and Divestiture | 1 | |||||

Business Strategy and Competitive Environment | 1 | |||||

Products and Services | 2 | |||||

Regulation | 5 | |||||

Sources of Net Revenues | 6 | |||||

Available Information | 6 | |||||

Item 1A. | Risk Factors | 6 | ||||

Item 1B. | Unresolved Securities and Exchange Commission Staff Comments | 12 | ||||

Item 2. | Properties | 12 | ||||

Item 3. | Legal Proceedings | 12 | ||||

| Part II | ||||||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 13 | ||||

Item 6. | Selected Financial Data | 15 | ||||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 16 | ||||

Overview | 16 | |||||

Current Market and Regulatory Environment | 18 | |||||

Results of Operations | 19 | |||||

Liquidity and Capital Resources | 29 | |||||

Risk Management | 34 | |||||

Fair Value of Financial Instruments | 39 | |||||

Critical Accounting Estimates | 40 | |||||

Forward-Looking Statements | 41 | |||||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 43 | ||||

Item 8. | Financial Statements and Supplementary Data | 45 | ||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 89 | ||||

Item 9A. | Controls and Procedures | 89 | ||||

Item 9B. | Other Information | 89 | ||||

| Part III | ||||||

| Item 10. | Directors, Executive Officers, and Corporate Governance | 89 | ||||

Item 11. | Executive Compensation | 91 | ||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 91 | ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 91 | ||||

Item 14. | Principal Accountant Fees and Services | 92 | ||||

| Part IV | ||||||

| Item 15. | Exhibits and Financial Statement Schedule | 92 | ||||

Exhibit Index | 92 | |||||

Signatures | 97 | |||||

Index to Financial Statement Schedule | F-1 | |||||

THE CHARLES SCHWAB CORPORATION

PART I

| Item 1. | Business |

General Corporate Overview

The Charles Schwab Corporation (CSC), headquartered in San Francisco, California, was incorporated in 1986 and engages, through its subsidiaries (collectively referred to as the Company, and primarily located in San Francisco except as indicated), in securities brokerage, banking, asset management, and related financial services. At December 31, 2010, the Company had $1.57 trillion in client assets, 8.0 million active brokerage accounts (a) , 1.5 million corporate retirement plan participants, and 690,000 banking accounts.

Significant business subsidiaries of CSC include:

| • | Charles Schwab & Co., Inc. (Schwab), which was incorporated in 1971, is a securities broker-dealer with 302 domestic branch offices in 45 states, as well as a branch in each of the Commonwealth of Puerto Rico and London, U.K., and serves clients in Hong Kong through one of CSC's subsidiaries; |

| • | Charles Schwab Bank (Schwab Bank), which commenced operations in 2003, is a federal savings bank located in Reno, Nevada; and |

| • | Charles Schwab Investment Management, Inc. (CSIM), which is the investment advisor for Schwab's proprietary mutual funds, referred to as the Schwab Funds ® . |

The Company provides financial services to individuals and institutional clients through two segments – Investor Services and Institutional Services. The Investor Services segment includes the Company's retail brokerage and banking operations. The Institutional Services segment provides custodial, trading, and support services to independent investment advisors (IAs), as well as retirement plan, equity compensation plan, and other financial services to corporations and their employees. For financial information by segment for the three years ended December 31, 2010, see "Item 8 – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – 24. Segment Information."

As of December 31, 2010, the Company had full-time, part-time and temporary employees, and persons employed on a contract basis that represented the equivalent of about 12,800 full-time employees.

Acquisitions and Divestiture

On November 9, 2010, the Company completed its acquisition of substantially all of the assets of Windward Investment Management, Inc. (Windward), which was an investment advisory firm that managed diversified investment portfolios comprised primarily of exchange-traded fund securities.

In July 2007, the Company sold all of the outstanding stock of U.S. Trust Corporation (USTC, and with its subsidiaries collectively referred to as U.S. Trust). U.S. Trust was a subsidiary that provided wealth management services.

In March 2007, the Company acquired The 401(k) Company, which offers retirement plan services. The acquisition enhanced the Company's ability to meet the needs of retirement plans of all sizes. The acquisition also provided the opportunity to capture rollover accounts from individuals participating in retirement plans served by The 401(k) Company and to cross-sell the Company's other investment and banking services to plan participants.

Business Strategy and Competitive Environment

The Company's purpose is to help everyone be financially fit. The Company's strategy is to meet the financial services needs of individual investors, both directly and indirectly, through its two segments. To pursue its strategy, the Company focuses on: building client loyalty; innovating in ways that benefit clients; operating in a disciplined manner; and leveraging its strengths through shared core processes and technology platforms. The Company provides clients with a compelling combination of

| (a) | Accounts with balances or activity within the preceding eight months. |

- 1 -

THE CHARLES SCHWAB CORPORATION

personalized relationships, superior service, and great value, delivered through a blend of people and technology. People provide the client focus and personal touch that are essential in serving investors, while technology helps create services that are scalable and consistent. This combination helps the Company address a wide range of client needs – from tools and information for self-directed or active investors, to advice services, to retirement and equity-based incentive plans, to support services for independent IAs – while enabling each client to easily utilize some or all of these capabilities according to their unique circumstances.

The Company's competition in serving individual investors includes a wide range of brokerage, wealth management, and asset management firms, as well as banks and trust companies. In serving these investors and competing for a growing percentage of the investable wealth in the U.S., the Company offers a multi-channel service delivery model, which includes branch, telephonic, and online capabilities. Under this model, the Company can offer personalized service at competitive prices while giving clients the choice of where, when, and how they do business with the Company. Schwab's branches and regional telephone service centers are staffed with trained and experienced financial consultants (FCs) focused on building and sustaining client relationships. The Company offers the ability to meet client investing needs through a single ongoing point of contact, even as those needs change over time. In particular, management believes that the Company's ability to provide those clients seeking help, guidance, or advice with an integrated, individually tailored solution – ranging from occasional consultations to an ongoing relationship with a Schwab FC or an IA – is a competitive strength compared to the more fragmented offerings of other firms.

The Company's online and telephonic channels provide quick and efficient access to an extensive array of information, research, tools, trade execution, and administrative services, which clients can access according to their needs. For example, as clients trade more actively, they can use these channels to access highly competitive pricing, expert tools, and extensive service capabilities – including experienced, knowledgeable teams of trading specialists and integrated product offerings.

Individuals investing for retirement through 401(k) plans can take advantage of the Company's bundled offering of multiple investment choices, education, and third-party advice. Management also believes the Company is able to compete with the wide variety of financial services firms striving to attract individual client relationships by complementing these capabilities with the extensive array of investment, banking, and lending products and services described in the following section.

In the IA arena, the Company competes with institutional custodians, traditional and discount brokers, banks, and trust companies. Management believes that its Institutional Services segment can maintain its market leadership position primarily through the efforts of its expanded sales and support teams, which are dedicated to helping IAs grow, compete, and succeed in serving their clients. In addition to focusing on superior service, Institutional Services competes by utilizing technology to provide IAs with a highly-developed, scalable platform for administering their clients' assets easily and efficiently. Institutional Services sponsors a variety of national, regional, and local events designed to help IAs identify and implement better ways to grow and manage their practices efficiently.

Another important aspect of the Company's ability to compete is its ongoing focus on efficiency and productivity, as lower costs give the Company greater flexibility in its approach to pricing and investing for growth. Management believes that this flexibility remains important in light of the current competitive environment, in which a number of competitors offer reduced online trading commission rates and lower expense ratios on certain classes of mutual funds. Additionally, the Company's nationwide marketing effort is an important competitive tool because it reinforces the attributes of the Schwab ® brand.

Products and Services

The Company offers a broad range of products to address individuals' varying investment and financial needs. Examples of these product offerings include:

| • | Brokerage – an array of brokerage accounts including some with check-writing features, debit card, and billpay; individual retirement accounts; retirement plans for small to large businesses; 529 college savings accounts; designated brokerage accounts; equity incentive plan accounts; and margin loans, as well as access to fixed income securities, and equity and debt offerings; |

| • | Banking – checking accounts linked to brokerage accounts, savings accounts, certificates of deposit, demand deposit accounts, first mortgages, home equity lines of credit (HELOCs), and pledged asset loans; |

| • | Trust – trust custody services, personal trust reporting services, and administrative trustee services; |

- 2 -

THE CHARLES SCHWAB CORPORATION

| • | Advice – separately managed accounts, customized personal advice for tailored portfolios, and specialized planning and full-time portfolio management; |

| • | Mutual funds – third-party mutual funds through Mutual Fund Marketplace ® , including no-load mutual funds through the Mutual Fund OneSource ® service, proprietary mutual funds from two fund families – Schwab Funds ® and Laudus Funds ® , other third-party mutual funds, and mutual fund trading and clearing services to broker-dealers; and |

| • | Exchange-traded funds (ETFs) – third-party and proprietary ETFs, as well as separately managed portfolios of ETFs. |

These products, and the Company's full array of investing services, are made available through its two segments – Investor Services and Institutional Services.

Investor Services

Through the Investor Services segment, the Company provides retail brokerage and banking services to individual investors.

The Company offers research, analytic tools, performance reports, market analysis, and educational material to all clients. Clients looking for more guidance have access to online portfolio planning tools, professional advice from Schwab's portfolio consultants who can help develop an investment strategy and carry out investment and portfolio management decisions, as well as a range of fully delegated managed solutions that provide ongoing portfolio management.

Schwab strives to demystify investing by educating and assisting clients in the development of investment plans. Educational tools include workshops, interactive courses, and online information about investing. Additionally, Schwab provides various internet-based research and analysis tools that are designed to help clients achieve better investment outcomes. As an example of such tools, Schwab Equity Ratings ® is a quantitative model-based stock rating system that provides all clients with ratings on approximately 3,000 stocks, assigning each equity a single grade: A, B, C, D, or F. Stocks are rated based on specific factors relating to fundamentals, valuation, momentum, and risk and ranked so that the number of ‘buy consideration' ratings – As and Bs – equals the number of ‘sell consideration' ratings – Ds and Fs.

Clients may need specific investment recommendations, either from time to time or on an ongoing basis. The Company provides clients seeking advice with customized solutions. The Company's approach to advice is based on long-term investment strategies and guidance on portfolio diversification and asset allocation. This approach is designed to be offered consistently across all of Schwab's delivery channels.

Schwab Private Client TM features a personal advice relationship with a designated portfolio consultant, supported by a team of investment professionals who provide individualized service, a customized investment strategy developed in collaboration with the client, and ongoing guidance and execution.

For clients seeking a relationship in which investment decisions are fully delegated to a financial professional, the Company offers several alternatives. The Company provides investors access to professional investment management in a diversified account that is invested exclusively in either mutual funds or ETFs through the Schwab Managed Portfolio TM program. The Company also refers investors who want to utilize a specific third-party money manager to direct a portion of their investment assets to the Schwab Managed Account program. In addition, clients who want the assistance of an independent professional in managing their financial affairs may be referred to IAs in the Schwab Advisor Network ® . These IAs provide personalized portfolio management, financial planning, and wealth management solutions.

The Company strives to deliver information, education, technology, service, and pricing that meet the specific needs of clients who trade actively. Schwab offers integrated Web- and software-based trading platforms, which incorporate intelligent order routing technology, real-time market data, options trading, premium stock research, and multi-channel access, as well as sophisticated account and trade management features, risk management tools, decision support tools, and dedicated personal support.

The Company serves both foreign investors and non-English-speaking U.S. clients who wish to trade or invest in U.S. dollar-based securities. The Company has a physical presence in the United Kingdom and Hong Kong. In the U.S., the Company serves Chinese-, Portuguese-, Spanish-, and Vietnamese-speaking clients through a combination of its branch offices and Web-based and telephonic services.

- 3 -

THE CHARLES SCHWAB CORPORATION

Institutional Services

Through the Institutional Services segment, Schwab provides custodial, trading, technology, practice management, trust asset, and other support services to IAs. To attract and serve IAs, Institutional Services has a dedicated sales force and service teams assigned to meet their needs.

IAs who custody client accounts at Schwab may use proprietary software that provides them with up-to-date client account information, as well as trading capabilities. The Institutional Services website is the core platform for IAs to conduct daily business activities online with Schwab, including submitting client account information and retrieving news and market information. This platform provides IAs with a comprehensive suite of electronic and paper-based reporting capabilities. Institutional Services offers online cashiering services, as well as internet-based eDocuments sites for both IAs and their clients that provide multi-year archiving of online statements, trade confirms and tax reports, along with document search capabilities.

To help IAs grow and manage their practices, Institutional Services offers a variety of services, including marketing and business development, business strategy and planning, and transition support. Regulatory compliance consulting and support services are available, as well as website design and development capabilities. Institutional Services maintains a website that provides interactive tools, educational content, and research reports to assist advisors thinking about establishing their own independent practices.

Institutional Services offers an array of services to help advisors establish their own independent practices through the Business Start-up Solutions package. This includes access to dedicated service teams and outsourcing of back-office operations, as well as third-party firms who provide assistance with real estate, errors and omissions insurance, and company benefits.

The Company offers a variety of educational materials and events to IAs seeking to expand their knowledge of industry issues and trends, as well as sharpen their individual expertise and practice management skills. Institutional Services updates and shares market research on an ongoing basis, and it holds a series of events and conferences every year to discuss topics of interest to IAs, including business strategies and best practices. The Company sponsors the annual IMPACT ® conference, which provides a national forum for the Company, IAs, and other industry participants to gather and share information and insights.

IAs and their clients have access to a broad range of the Company's products and services, including managed accounts and cash products.

The Institutional Services segment also provides retirement plan recordkeeping and related services, retirement plan trust and custody services, stock plan services, and mutual fund clearing services, and supports the availability of Schwab proprietary investment funds on third-party platforms. The Company serves a range of employer sponsored plans: equity compensation plans, defined contribution plans, defined benefit plans, nonqualified deferred compensation plans and other employee benefit plans.

The Company's bundled 401(k) retirement plan product offers plan sponsors a wide array of investment options, trustee or custodial services, and participant-level recordkeeping. Plan design features, which increase plan efficiency and achieve employer goals, are also offered, such as automatic enrollment, automatic fund mapping at conversion, and automatic contribution increases. Services also include support for Roth 401(k) accounts and profit sharing and defined benefit plans. The Company provides a robust suite of tools to plan sponsors to manage their plans, including plan-specific reports, studies and research, access to legislative updates and benchmarking reports that provide perspective on their plan's features compared with overall industry and segment-specific plans. Participants in bundled plans serviced by the Company receive targeted education materials, have access to electronic tools and resources, may attend onsite and virtual seminars, and can receive third-party advice delivered by Schwab. This third-party advice service is delivered online, by phone, or in person, including recommendations based on the core investment fund choices in their retirement plan and specific recommended savings rates.

- 4 -

THE CHARLES SCHWAB CORPORATION

Through the Retirement Business Services unit, the Company and independent retirement plan providers work together to serve plan sponsors, combining the consulting and administrative expertise of the administrator with the Company's investment, technology, trust, and custodial services. Retirement Business Services also offers the Schwab Personal Choice Retirement Account ® , a self-directed brokerage offering for retirement plans.

The Company's Corporate Brokerage Services unit provides specialty brokerage-related services to corporate clients through its Stock Plan Services and Designated Brokerage Services businesses. Stock Plan Services offers equity compensation plan sponsors full-service recordkeeping for stock plans: stock options, restricted stock, performance shares and stock appreciation rights. Specialized services for executive transactions and reporting, grant acceptance tracking and other services are offered to employers to meet the needs of administering the reporting and compliance aspects of an equity compensation plan. Designated Brokerage Services provides solutions for compliance departments of regulated companies and firms with special requirements to monitor employee personal trading. The Corporate Brokerage Services unit also provides mutual fund clearing services to banks, brokerage firms and trust companies and offers Schwab-generated Investment Solutions outside the Company to institutional channels.

Regulation

CSC is a savings and loan holding company and Schwab Bank, CSC's depository institution subsidiary, is a federal savings bank. CSC and Schwab Bank are both currently subject to supervision and regulation by the Office of Thrift Supervision. However, the Dodd-Frank Wall Street Reform and Consumer Protection Act legislation eliminates the Office of Thrift Supervision and transfers its functions to other federal banking agencies effective July 21, 2011, unless extended or delayed for up to an additional six months. As a result, the Federal Reserve will become CSC's primary regulator and the Office of the Comptroller of the Currency will become the primary regulator of Schwab Bank. As a savings and loan holding company, CSC is not subject to specific statutory capital requirements. However, CSC is required to maintain capital that is sufficient to support the holding company and its subsidiaries' business activities, and the risks inherent in those activities.

Schwab Bank is subject to regulation and supervision and to various requirements and restrictions under federal and state laws, including regulatory capital guidelines. Among other things, these requirements govern transactions with CSC and its non-depository institution subsidiaries, including loans and other extensions of credit, investments or asset purchases, dividends, and investments. The federal banking agencies have broad powers to enforce these regulations, including the power to terminate deposit insurance, impose substantial fines and other civil and criminal penalties, and appoint a conservator or receiver. Schwab Bank is required to maintain minimum capital levels as specified in federal banking laws and regulations. Failure to meet the minimum levels will result in certain mandatory, and possibly additional discretionary, actions by the regulators that, if undertaken, could have a direct material effect on Schwab Bank.

The securities industry in the United States is subject to extensive regulation under both federal and state laws. Schwab is registered as a broker-dealer with the United States Securities and Exchange Commission (SEC), the fifty states, and the District of Columbia and Puerto Rico. Schwab and CSIM are registered as investment advisors with the SEC. Additionally, Schwab is regulated by the Commodities Futures Trading Commission (CFTC) with respect to the futures and commodities trading activities it conducts as an introducing broker.

Much of the regulation of broker-dealers has been delegated to self-regulatory organizations (SROs), which in Schwab's case includes the Financial Industry Regulatory Authority, Inc. (FINRA), the Municipal Securities Rulemaking Board (MSRB), NYSE Arca, and the Chicago Board Options Exchange. The primary regulators of Schwab are FINRA and, for municipal securities, the MSRB. The CFTC has designated the National Futures Association (NFA) as Schwab's primary regulator for futures and commodities trading activities. The Company's business is also subject to oversight by regulatory bodies in other countries in which the Company operates.

The principal purpose of regulating broker-dealers and investment advisors is the protection of clients and the securities markets. The regulations to which broker-dealers and investment advisors are subject cover all aspects of the securities business, including, among other things, sales and trading practices, publication of research, margin lending, uses and safekeeping of clients' funds and securities, capital adequacy, recordkeeping and reporting, fee arrangements, disclosure to clients, fiduciary duties owed to advisory clients, and the conduct of directors, officers and employees.

- 5 -

THE CHARLES SCHWAB CORPORATION

As a registered broker-dealer, Schwab is subject to Rule 15c3-1 under the Securities Exchange Act of 1934 (the Uniform Net Capital Rule) and related SRO requirements. The CFTC and NFA also impose net capital requirements. The Uniform Net Capital Rule specifies minimum capital requirements that are intended to ensure the general financial soundness and liquidity of broker-dealers. Because CSC itself is not a registered broker-dealer, it is not subject to the Uniform Net Capital Rule. However, if Schwab failed to maintain specified levels of net capital, such failure would constitute a default by CSC under certain debt covenants.

The Uniform Net Capital Rule limits broker-dealers' ability to transfer capital to parent companies and other affiliates. Compliance with the Uniform Net Capital Rule could limit Schwab's operations and its ability to repay subordinated debt to CSC, which in turn could limit CSC's ability to repay debt, pay cash dividends, and purchase shares of its outstanding stock.

Sources of Net Revenues

The Company's major sources of net revenues are asset management and administration fees, net interest revenue, and trading revenue. The Company generates asset management and administration fees through its proprietary and third-party mutual fund offerings, as well as fee-based investment management and advisory services. Net interest revenue is the difference between interest earned on interest-earning assets (such as cash, short- and long-term investments, and mortgage and margin loans) and interest paid on funding sources (including banking deposits and client cash in brokerage accounts, short-term borrowings, and long-term debt). The Company generates trading revenue through commissions earned for executing trades for clients and principal transaction revenue from trading activity in fixed income securities.

For revenue information by source for the three years ended December 31, 2010, see "Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Net Revenues."

Available Information

The Company files annual, quarterly, and current reports, proxy statements, and other information with the SEC. The Company's SEC filings are available to the public over the Internet on the SEC's website at http://www.sec.gov . You may read and copy any document that the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

On the Company's Internet website, http://www.aboutschwab.com , the Company posts the following recent filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: the Company's annual reports on Form 10-K, the Company's quarterly reports on Form 10-Q, the Company's current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. All such filings are available free of charge either on the Company's website or by request via email ( [email protected] ), telephone (415-667-1959), or mail (Charles Schwab Investor Relations at 211 Main Street, San Francisco, CA 94105).

| Item 1A. | Risk Factors |

The Company faces a variety of risks that may affect its operations or financial results, and many of those risks are driven by factors that the Company cannot control or predict. The following discussion addresses those risks that management believes are the most significant, although there may be other risks that could arise, or may prove to be more significant than expected, that may affect the Company's operations or financial results.

For a discussion of the Company's risk management, including technology and operating risk, credit risk, concentration risk, market risk, fiduciary risk, and legal and regulatory risk, see "Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Risk Management."

- 6 -

THE CHARLES SCHWAB CORPORATION

Developments in the business, economic, and geopolitical environment could negatively impact the Company's business.

The Company's business can be adversely affected by the general environment – economic, corporate, securities market, regulatory, and geopolitical developments all play a role in client asset valuations, trading activity, interest rates and overall investor engagement, and are outside of the Company's control. Deterioration in the housing and credit markets, reductions in short-term interest rates, and decreases in securities valuations negatively impact the Company's net interest revenue, asset management and administration fees, and capital resources.

A significant decrease in the Company's liquidity could negatively affect the Company's business and financial management as well as reduce client confidence in the Company.

Maintaining adequate liquidity is crucial to the business operations of the Company, including margin lending, mortgage lending, and transaction settlement, among other liquidity needs. The Company meets its liquidity needs primarily through cash generated by client activity and operating earnings, as well as cash provided by external financing. Fluctuations in client cash or deposit balances, as well as changes in market conditions, may affect the Company's ability to meet its liquidity needs. A reduction in the Company's liquidity position could reduce client confidence in the Company, which could result in the loss of client accounts. In addition, if the Company's broker-dealer or depository institution subsidiaries fail to meet regulatory capital guidelines, regulators could limit the subsidiaries' operations or their ability to upstream funds to CSC, which could reduce CSC's liquidity and adversely affect its ability to repay debt and pay cash dividends. In addition, CSC may need to provide additional funding to such subsidiaries.

Factors which may adversely affect the Company's liquidity position include a reduction in cash held in banking or brokerage client accounts, a dramatic increase in the Company's client lending activities (including margin and personal lending), unanticipated outflows of company cash, increased capital requirements, other regulatory changes or a loss of market or customer confidence in the Company. Schwab may also experience temporary liquidity demands due to timing differences between clients' transaction settlements and the availability of segregated cash balances.

When cash generated by client activity and operating earnings is not sufficient for the Company's liquidity needs, the Company must seek external financing. During periods of disruptions in the credit and capital markets, potential sources of external financing could be reduced, and borrowing costs could increase. Although CSC and Schwab maintain committed and uncommitted, unsecured bank credit lines and CSC has a commercial paper issuance program, as well as a universal shelf registration statement filed with the SEC, financing may not be available on acceptable terms or at all due to market conditions and disruptions in the credit markets. In addition, a significant downgrade in the Company's credit ratings could increase its borrowing costs and limit its access to the capital markets.

The Company may suffer significant losses from its credit exposures.

The Company's businesses are subject to the risk that a client, counterparty or issuer will fail to perform its contractual obligations, or that the value of collateral held to secure obligations will prove to be inadequate. While the Company has policies and procedures designed to manage this risk, the policies and procedures may not be fully effective. The Company's exposure mainly results from margin lending activities, securities lending activities, mortgage lending activities, its role as a counterparty in financial contracts and investing activities, and indirectly from the investing activities of certain of the proprietary funds that the Company sponsors.

The Company has exposure to credit risk associated with its securities available for sale and securities held to maturity portfolios, which includes U.S. agency and non-agency residential mortgage-backed securities, consumer loan asset-backed securities, corporate debt securities, and certificates of deposit among other investments. These instruments are also subject to price fluctuations as a result of changes in the financial market's assessment of issuer credit quality, increases in the unemployment rate, delinquency and default rates, housing price declines, changes in prevailing interest rates and other economic factors.

Loss of value of securities available for sale and securities held to maturity can result in charges if management determines that the impairments are other than temporary. The evaluation of whether other-than-temporary impairment exists is a matter

- 7 -

THE CHARLES SCHWAB CORPORATION

of judgment, which includes the assessment of several factors. See "Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates." If management determines that a security is other-than-temporarily impaired, the cost basis of the security may be adjusted and a corresponding loss may be recognized in current earnings. Certain securities available for sale experienced continued deteriorating credit characteristics in 2010, which resulted in impairment charges. Deterioration in the performance of securities available for sale and securities held to maturity could result in the recognition of future impairment charges.

The Company's loans to banking clients primarily consist of first-lien mortgage loans and HELOCs. Increases in delinquency and default rates, housing price declines, increases in the unemployment rate, and other economic factors can result in charges for loan loss reserves and write downs on such loans.

Heightened credit exposures to specific counterparties or instruments (concentration risk) can increase the Company's risk of loss. Examples of the Company's credit concentration risk include:

| • | large positions in financial instruments collateralized by assets with similar economic characteristics or in securities of a single issuer or industry; |

| • | mortgage loans and HELOCs to banking clients which are secured by properties in the same geographic region; and |

| • | margin and securities lending activities collateralized by securities of a single issuer or industry. |

The Company may also be subject to concentration risk when lending to a particular counterparty, borrower or issuer.

The Company sponsors a number of proprietary money market mutual funds and other proprietary funds. Although the Company has no obligation to do so, the Company may decide for competitive reasons to provide credit, liquidity or other support to its funds in the event of significant declines in valuation of fund holdings or significant redemption activity that exceeds available liquidity. Such support could cause the Company to take significant charges and could reduce the Company's liquidity. If the Company chose not to provide credit, liquidity or other support in such a situation, the Company could suffer reputational damage and its business could be adversely affected.

Significant interest rate changes could affect the Company's profitability and financial condition.

The Company is exposed to interest rate risk primarily from changes in the interest rates on its interest-earning assets (such as cash equivalents, short- and long-term investments, and mortgage and margin loans) relative to changes in the costs of its funding sources (including deposits in banking and brokerage accounts, short-term borrowings, and long-term debt). Changes in interest rates generally affect the interest earned on interest-earning assets differently than the interest the Company pays on its interest-bearing liabilities. In addition, certain funding sources do not bear interest and their cost therefore does not vary. Overall, the Company is positioned to benefit from a rising interest rate environment; the Company could be adversely affected by a decline in interest rates if the rates that the Company earns on interest-earning assets decline more than the rates that the Company pays on its funding sources, or if prepayment rates increase on the mortgages and mortgage-backed securities that the Company holds. With the low interest rate environment, the Company's revenue from interest-earning assets has been declining more than the rates that the Company pays on its funding sources. The Company may also be limited in the amount it can reduce interest rates on deposit accounts and still offer a competitive return.

To the extent the overall yield on certain Schwab-sponsored money market mutual funds falls to a level at or below the management fees on those funds, the Company may waive a portion of its fee in order to continue providing some return to clients. As a result of the low interest rate environment, the Company has been waiving and may continue to waive a portion of its management fees for certain Schwab-sponsored money market mutual funds. Such fee waivers negatively impact the Company's asset management and administration fees.

The Company is subject to litigation and regulatory investigations and proceedings and may not always be successful in defending itself against such claims or proceedings.

The financial services industry faces substantial litigation and regulatory risks. The Company is subject to arbitration claims and lawsuits in the ordinary course of its business, as well as class actions and other significant litigation. The Company is also the subject of inquiries, investigations, and proceedings by regulatory and other governmental agencies. Actions brought against the Company may result in settlements, awards, injunctions, fines, penalties or other results adverse to the Company

- 8 -

THE CHARLES SCHWAB CORPORATION

including reputational harm. Even if the Company is successful in defending against these actions, the defense of such matters may result in the Company incurring significant expenses. Predicting the outcome of matters is inherently difficult, particularly where claims are brought on behalf of various classes of claimants, claimants seek substantial or unspecified damages, or when investigations or legal proceedings are at an early stage. A substantial judgment, settlement, fine, or penalty could be material to the Company's operating results or cash flows for a particular future period, depending on the Company's results for that period. In market downturns, the volume of legal claims and amount of damages sought in litigation and regulatory proceedings against financial services companies have historically increased. See "Item 8 – Financial Statements and Supplementary Data – Note to Consolidated Financial Statements – 14. Commitments and Contingent Liabilities."

From time to time, the Company is subject to litigation claims from third parties alleging infringement of their intellectual property rights (e.g., patents). Such litigation can require the expenditure of significant Company resources. If the Company was found to have infringed a third-party patent, or other intellectual property rights, it could incur substantial liability, and in some circumstances could be enjoined from using certain technology, or providing certain products or services.

Extensive regulation of the Company's businesses limits the Company's activities and may subject it to significant penalties.

As a participant in the securities, banking and financial services industries, the Company is subject to extensive regulation under both federal and state laws by governmental agencies, supervisory authorities, and SROs. Such regulation is expected to become more extensive and complex in response to the recent market disruptions. The requirements imposed by the Company's regulators are designed to ensure the integrity of the financial markets, the safety and soundness of financial institutions, and the protection of clients. These regulations often serve to limit the Company's activities by way of capital, customer protection and market conduct requirements, and restrictions on the businesses activities that the Company may conduct. Despite the Company's efforts to comply with applicable regulations, there are a number of risks, particularly in areas where applicable regulations may be unclear or where regulators revise their previous guidance. Any enforcement actions or other proceedings brought by the Company's regulators against the Company or its affiliates, officers or employees could result in fines, penalties, cease and desist orders, enforcement actions, suspension or expulsion, or other disciplinary sanctions, including limitations on the Company's business activities, any of which could harm the Company's reputation and adversely affect the Company's results of operations and financial condition.

Legislation or changes in rules and regulations could negatively impact the Company's business and financial results.

New legislation, rule changes, or changes in the interpretation or enforcement of existing federal, state and SRO rules and regulations may directly affect the operation and profitability of the Company or its specific business lines. The profitability of the Company could also be affected by rules and regulations which impact the business and financial communities generally, including changes to the laws governing taxation, electronic commerce, client privacy and security of client data. In addition, the rules and regulations could result in limitations on the lines of business the Company conducts, modifications to the Company's business practices, increased capital requirements, or additional costs.

Financial reforms and related regulations may affect the Company's business activities, financial position and profitability.

The "Dodd-Frank Wall Street Reform and Consumer Protection Act" was signed into law in July 2010. This legislation makes extensive changes to the laws regulating financial services firms and requires significant rule-making. In addition, the legislation mandates multiple studies, which could result in additional legislative or regulatory action. CSC continues to review the impact that the legislation, studies and related rule-making will have on the Company's business, financial condition, and results of operations.

The legislation charges the Federal Reserve with drafting enhanced regulatory requirements for "systemically important" bank holding companies and certain other non-bank financial institutions designated as "systemically important" by the Financial Stability Oversight Council, which may include CSC. The enhanced requirements include more stringent capital, leverage and liquidity standards. The legislation permits the Federal Reserve to tailor its enhanced requirements to the perceived risk profile of an individual financial institution. Among other things, the legislation authorizes various assessments and fees, requires the

- 9 -

THE CHARLES SCHWAB CORPORATION

establishment of minimum leverage and risk-based capital requirements for insured depository institutions, and requires the SEC to complete studies and develop rules regarding various investor protection issues.

The legislation also establishes a new independent Consumer Financial Protection Bureau, which will have broad rulemaking, supervisory and enforcement authority over consumer products, including mortgages, home-equity loans and credit cards. States will be permitted to adopt stricter consumer protection laws and state attorney generals can enforce consumer protection rules issued by the Bureau.

The legislation gives the SEC discretion to adopt rules regarding standards of conduct for broker-dealers providing investment advice to retail customers. The various studies required by the legislation could result in additional rulemaking or legislative action, which could impact our business and financial results.

The changes resulting from the legislation may impact the profitability of the Company's business activities, require changes to certain of its business practices, impose upon the Company more stringent capital, liquidity and leverage ratio requirements or otherwise adversely affect the Company's business. These changes may also require the Company to invest significant management attention and resources to evaluate and make necessary changes.

The Company's industry is characterized by aggressive price competition.

The Company continually monitors its pricing in relation to competitors and periodically adjusts trade commission rates, interest rates on deposits and loans, fees for advisory services, and other fee structures to enhance its competitive position. Increased price competition from other financial services firms, such as reduced commissions to attract trading volume or higher deposit rates to attract client cash balances, could impact the Company's results of operations and financial condition.

The industry in which the Company competes has undergone a period of consolidation.

The Company faces intense competition for the clients that it serves and the products and services it offers. There has been significant consolidation as financial institutions with which the Company competes have been acquired by or merged into or acquired other firms. This consolidation may continue. Competition is based on many factors, including the range of products and services offered, pricing, customer service, brand recognition, reputation, and perceived financial strength. Consolidations may enable other firms to offer a broader range of products and services than the Company does, or offer such products at more competitive prices.

The Company faces competition in hiring and retaining qualified employees, especially for employees who are key to the Company's ability to build and enhance client relationships.

The market for quality professionals and other personnel in the Company's business is highly competitive. Competition is particularly strong for financial consultants who build and sustain the Company's client relationships. The Company's ability to continue to compete effectively will depend upon its ability to attract new employees and retain existing employees while managing compensation costs.

Technology and operational failures could subject the Company to losses, litigation, and regulatory actions.

The Company faces technology and operating risk which is the potential for loss due to deficiencies in control processes or technology systems of the Company, its vendors or its outsourced service providers that constrain the Company's ability to gather, process, and communicate information and process client transactions efficiently and securely, without interruptions. This risk also includes the risk of human error, employee misconduct, external fraud, computer viruses, distributed denial of service attacks, terrorist attacks, and natural disaster. It could take several hours or more to restore full functionality in the event of an unforeseen event which could affect the Company's ability to process and settle client transactions. Extraordinary trading volumes could cause the Company's computer systems to operate at an unacceptably slow speed or even fail. The Company's business and operations could be negatively impacted by any significant technology and operational failures. Moreover, instances of fraud or other misconduct, including improper use or disclosure of confidential client, employee, or company information, might also negatively impact the Company's reputation and client confidence in the Company, in addition to any direct losses that might result from such instances. Despite the Company's efforts to identify areas of risk,

- 10 -

THE CHARLES SCHWAB CORPORATION

oversee operational areas involving risk, and implement policies and procedures designed to manage risk, there can be no assurance that the Company will not suffer unexpected losses, reputational damage or regulatory action due to technology or other operational failures, including those of its vendors.

The Company also faces risk related to its security guarantee which covers client losses from unauthorized account activity, such as those caused by external fraud involving the compromise of clients' login and password information. Losses reimbursed under the guarantee could have a negative impact on the Company's results of operations.

The Company relies on outsourced service providers to perform key functions.

The Company relies on external service providers to perform certain key technology, processing, servicing, and support functions. These service providers also face technology and operating risk and any significant failures by them, including the improper use or disclosure of the Company's confidential client, employee, or company information, could cause the Company to incur losses and could harm the Company's reputation. An interruption in or the cessation of service by any external service provider as a result of systems failures, capacity constraints, financial difficulties or for any other reason, and the Company's inability to make alternative arrangements in a timely manner could disrupt the Company's operations. Switching to an alternative service provider may require a transition period and result in less efficient operations.

Potential strategic transactions could have a negative impact on the Company's financial position.

The Company evaluates potential strategic transactions, including business combinations, acquisitions, and dispositions. Any such transaction could have a material impact on the Company's financial position, results of operations, or cash flows. The process of evaluating, negotiating, and effecting any such strategic transaction may divert management's attention from other business concerns, and might cause the loss of key clients, employees, and business partners. Moreover, integrating businesses and systems may result in unforeseen expenditures as well as numerous risks and uncertainties, including the need to integrate operational, financial, and management information systems and management controls, integrate relationships with clients and business partners, and manage facilities and employees in different geographic areas. In addition, an acquisition may cause the Company to assume liabilities or become subject to litigation. Further, the Company may not realize the anticipated benefits from an acquisition, and any future acquisition could be dilutive to the Company's current stockholders' percentage ownership or to earnings per share (EPS).

The Company's acquisitions and dispositions are typically subject to closing conditions, including regulatory approvals and the absence of material adverse changes in the business, operations or financial condition of the entity being acquired or sold. To the extent the Company enters into an agreement to buy or sell an entity, there can be no guarantee that the transaction will close when expected, or at all. If a material transaction does not close, the Company's stock price could decline.

The Company's stock price has fluctuated historically, and may continue to fluctuate.

The Company's stock price can be volatile. Among the factors that may affect the volatility of the Company's stock price are the following:

| • | speculation in the investment community or the press about, or actual changes in, the Company's competitive position, organizational structure, executive team, operations, financial condition, financial reporting and results, effectiveness of cost reduction initiatives, or strategic transactions; |

| • | the announcement of new products, services, acquisitions, or dispositions by the Company or its competitors; |

| • | increases or decreases in revenue or earnings, changes in earnings estimates by the investment community, and variations between estimated financial results and actual financial results. |

Changes in the stock market generally or as it concerns the Company's industry, as well as geopolitical, economic, and business factors unrelated to the Company, may also affect the Company's stock price.

- 11 -

THE CHARLES SCHWAB CORPORATION

Future sales of CSC's equity securities may adversely affect the market price of CSC's common stock and result in dilution.

CSC's certificate of incorporation authorizes CSC's Board of Directors to, among other things, issue additional shares of common or preferred stock or securities convertible or exchangeable into equity securities, without stockholder approval. CSC may issue additional equity or convertible securities to raise additional capital or for other purposes. The issuance of any additional equity or convertible securities could be substantially dilutive to holders of CSC's common stock and may adversely affect the market price of CSC's common stock.

| Item 1B. | Unresolved Securities and Exchange Commission Staff Comments |

None.

| Item 2. | Properties |

A summary of the Company's significant locations at December 31, 2010, is presented in the following table. Locations are leased or owned as noted below. The square footage amounts are presented net of space that has been subleased to third parties.

| Square Footage | ||||||||

| (amounts in thousands) | Leased | Owned | ||||||

Location | ||||||||

Corporate office space: | ||||||||

San Francisco, CA (1) | 778 | - | ||||||

Service centers: | ||||||||

Phoenix, AZ (2) | 47 | 709 | ||||||

Denver, CO | 383 | - | ||||||

Indianapolis, IN | - | 274 | ||||||

Austin, TX | 190 | - | ||||||

Orlando, FL | 168 | - | ||||||

Richfield, OH | - | 117 | ||||||

| (1) | Includes the Company's headquarters. |

| (2 ) | Includes two data centers. |

Substantially all of the Company's branch offices are located in leased premises. The corporate headquarters, data centers, offices, and service centers generally support all of the Company's segments.

| Item 3. | Legal Proceedings |

For a discussion of legal proceedings, see "Item 8 – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – 14. Commitments and Contingent Liabilities."

- 12 -

THE CHARLES SCHWAB CORPORATION

PART II

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

CSC's common stock is listed on The New York Stock Exchange under the ticker symbol SCHW. The number of common stockholders of record as of January 31, 2011, was 8,276. The closing market price per share on that date was $18.05.

The quarterly high and low sales prices for CSC's common stock and the other information required to be furnished pursuant to this item are included in "Item 8 – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – 27. Quarterly Financial Information (Unaudited) and 19. Employee Incentive, Deferred Compensation, and Retirement Plans."

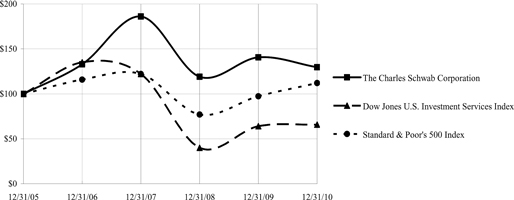

The following graph shows a five-year comparison of cumulative total returns for CSC's common stock, the Dow Jones U.S. Investment Services Index, and the Standard & Poor's 500 Index, each of which assumes an initial investment of $100 and reinvestment of dividends.

December 31, | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||||

The Charles Schwab Corporation | $ | 100 | $ | 133 | $ | 186 | $ | 119 | $ | 141 | $ | 130 | ||||||||||||

Dow Jones U.S. Investment Services Index | $ | 100 | $ | 135 | $ | 122 | $ | 40 | $ | 64 | $ | 66 | ||||||||||||

Standard & Poor's 500 Index | $ | 100 | $ | 116 | $ | 122 | $ | 77 | $ | 97 | $ | 112 | ||||||||||||

- 13 -

THE CHARLES SCHWAB CORPORATION

Issuer Purchases of Equity Securities

The following table summarizes purchases made by or on behalf of CSC of its common stock for each calendar month in the fourth quarter of 2010:

Month | Total Number of Shares Purchased (in thousands) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program (1) (in thousands) | Approximate Dollar Value of Shares that May Yet be Purchased under the Program (in millions) | ||||||||||||

October: | ||||||||||||||||

Share Repurchase Program (1) | - | $ | - | - | $ | 596 | ||||||||||

Employee transactions (2) | 4 | $ | 14.12 | N/A | N/A | |||||||||||

November: | ||||||||||||||||

Share Repurchase Program (1) | - | $ | - | - | $ | 596 | ||||||||||

Employee transactions (2) | 490 | $ | 15.42 | N/A | N/A | |||||||||||

December: | ||||||||||||||||

Share Repurchase Program (1) | - | $ | - | - | $ | 596 | ||||||||||

Employee transactions (2) | 3 | $ | 16.20 | N/A | N/A | |||||||||||

Total: | ||||||||||||||||

Share Repurchase Program (1) | - | $ | - | - | $ | 596 | ||||||||||

Employee transactions (2) | 497 | $ | 15.41 | N/A | N/A | |||||||||||

N/A Not applicable.

| (1) | There were no share repurchases under the Share Repurchase Program during the fourth quarter. Repurchases under this program are under authorizations by CSC's Board of Directors covering up to $500 million and $500 million of common stock publicly announced by the Company on April 25, 2007, and March 13, 2008, respectively. The remaining authorizations do not have an expiration date. |

| (2) | Includes restricted shares withheld (under the terms of grants under employee stock incentive plans) to offset tax withholding obligations that occur upon vesting and release of restricted shares. The Company may receive shares to pay the exercise price and/or to satisfy tax withholding obligations by employees who exercise stock options (granted under employee stock incentive plans), which are commonly referred to as stock swap exercises. |

Recent Sales of Unregistered Securities

In connection with the acquisition of substantially all of the assets of Windward on November 9, 2010, CSC issued 4,789,875 and 2,052,803 shares of its common stock to Windward and the Stephen J. Cucchiaro 2001 Revocable Trust, respectively. The issuance of the shares was exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(2) as a transaction not involving any public offering.

- 14 -

THE CHARLES SCHWAB CORPORATION

| Item 6. | Selected Financial Data |

Selected Financial and Operating Data

(In Millions, Except Per Share Amounts, Ratios, or as Noted)

| Growth Rates | ||||||||||||||||||||||||||||

| Compounded | Annual | |||||||||||||||||||||||||||

| 4-Year 2006-2010 | 1-Year 2009-2010 | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||

Results of Operations | ||||||||||||||||||||||||||||

Net revenues | - | 1 | % | $ | 4,248 | $ | 4,193 | $ | 5,150 | $ | 4,994 | $ | 4,309 | |||||||||||||||

Expenses excluding interest | 5 | % | 19 | % | $ | 3,469 | $ | 2,917 | $ | 3,122 | $ | 3,141 | $ | 2,833 | ||||||||||||||

Income from continuing operations | (16 | %) | (42 | %) | $ | 454 | $ | 787 | $ | 1,230 | $ | 1,120 | $ | 891 | ||||||||||||||

Net income (1) | (22 | %) | (42 | %) | $ | 454 | $ | 787 | $ | 1,212 | $ | 2,407 | $ | 1,227 | ||||||||||||||

Income from continuing operations per share - basic | (14 | %) | (44 | %) | $ | .38 | $ | .68 | $ | 1.07 | $ | .93 | $ | .70 | ||||||||||||||

Income from continuing operations per share - diluted | (14 | %) | (44 | %) | $ | .38 | $ | .68 | $ | 1.06 | $ | .92 | $ | .69 | ||||||||||||||

Basic earnings per share (1, 2) | (21 | %) | (44 | %) | $ | .38 | $ | .68 | $ | 1.06 | $ | 1.98 | $ | .96 | ||||||||||||||

Diluted earnings per share (1, 2) | (20 | %) | (44 | %) | $ | .38 | $ | .68 | $ | 1.05 | $ | 1.96 | $ | .95 | ||||||||||||||

Dividends declared per common share | 15 | % | - | $ | .240 | $ | .240 | $ | .220 | $ | .200 | $ | .135 | |||||||||||||||

Special dividend declared per common share | N/M | - | $ | - | $ | - | $ | - | $ | 1.00 | $ | - | ||||||||||||||||

Weighted-average common shares outstanding - diluted | (2 | %) | 3 | % | 1,194 | 1,160 | 1,157 | 1,222 | 1,286 | |||||||||||||||||||

Asset management and administration fees as a percentage of net revenues | 43 | % | 45 | % | 46 | % | 47 | % | 45 | % | ||||||||||||||||||

Net interest revenue as a percentage of net revenues | 36 | % | 30 | % | 33 | % | 33 | % | 33 | % | ||||||||||||||||||

Trading revenue as a percentage of net revenues (3) | 20 | % | 24 | % | 21 | % | 17 | % | 18 | % | ||||||||||||||||||

Effective income tax rate on income from continuing operations | 41.7 | % | 38.3 | % | 39.3 | % | 39.6 | % | 39.6 | % | ||||||||||||||||||

Capital expenditures - purchases of equipment, office facilities, and property, net (4) | 21 | % | (9 | %) | $ | 127 | $ | 139 | $ | 194 | $ | 168 | $ | 59 | ||||||||||||||

Capital expenditures, net, as a percentage of net revenues | 3 | % | 3 | % | 4 | % | 3 | % | 1 | % | ||||||||||||||||||

Performance Measures | ||||||||||||||||||||||||||||

Net revenue growth (decline) | 1 | % | (19 | %) | 3 | % | 16 | % | 19 | % | ||||||||||||||||||

Pre-tax profit margin from continuing operations | 18.3 | % | 30.4 | % | 39.4 | % | 37.1 | % | 34.3 | % | ||||||||||||||||||

Return on stockholders' equity | 8 | % | 17 | % | 31 | % | 55 | % | 26 | % | ||||||||||||||||||

Financial Condition (at year end) | ||||||||||||||||||||||||||||

Total assets | 17 | % | 23 | % | $ | 92,568 | $ | 75,431 | $ | 51,675 | $ | 42,286 | $ | 48,992 | ||||||||||||||

Long-term debt | 51 | % | 33 | % | $ | 2,006 | $ | 1,512 | $ | 883 | $ | 899 | $ | 388 | ||||||||||||||

Stockholders' equity | 6 | % | 23 | % | $ | 6,226 | $ | 5,073 | $ | 4,061 | $ | 3,732 | $ | 5,008 | ||||||||||||||

Assets to stockholders' equity ratio | 15 | 15 | 13 | 11 | 10 | |||||||||||||||||||||||

Long-term debt to total financial capital (long-term debt plus stockholders' equity) | 24 | % | 23 | % | 18 | % | 19 | % | 7 | % | ||||||||||||||||||

Employee Information | ||||||||||||||||||||||||||||

Full-time equivalent employees (at year end, in thousands) | 1 | % | 3 | % | 12.8 | 12.4 | 13.4 | 13.3 | 12.4 | |||||||||||||||||||

Net revenues per average full-time equivalent employee (in thousands) | (2 | %) | - | $ | 337 | $ | 338 | $ | 383 | $ | 387 | $ | 362 | |||||||||||||||

Note: All information contained in this Annual Report on Form 10-K is presented on a continuing operations basis unless otherwise noted.

| (1) | Net income in 2007 includes a gain of $1.2 billion, after tax, on the sale of U.S. Trust. |

| (2) | Both basic and diluted earnings per share in 2008, 2007, and 2006 include discontinued operations. |

| (3) | Trading revenue includes commission and principal transaction revenues. |

| (4) | Capital expenditures in 2006 are presented net of proceeds of $63 million primarily from the sale of a data center. |

N/M Not meaningful.

- 15 -

THE CHARLES SCHWAB CORPORATION

Management's Discussion and Analysis of Financial Condition and Results of Operations

(Tabular Amounts in Millions, Except Ratios, or as Noted)

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

OVERVIEW

Management of the Company focuses on several key financial and non-financial metrics in evaluating the Company's financial position and operating performance. All information contained in this Annual Report on Form 10-K is presented on a continuing operations basis unless otherwise noted. Summarized results for the years ended December 31, 2010, 2009, and 2008 are shown in the following table:

Year Ended December 31, | Growth

Rate 1-Year 2009-2010 | 2010 | 2009 | 2008 | ||||||||||||

Client Activity Metrics: | ||||||||||||||||

Net new client assets (1) (in billions) | (70 | %) | $ | 26.6 | $ | 87.3 | $ | 113.4 | ||||||||

Client assets (in billions, at year end) | 11 | % | $ | 1,574.5 | $ | 1,422.6 | $ | 1,137.0 | ||||||||

Clients' daily average trades (2) (in thousands) | (4 | %) | 399.7 | 414.8 | 432.1 | |||||||||||

Company Financial Metrics: | ||||||||||||||||

Net revenues | 1 | % | $ | 4,248 | $ | 4,193 | $ | 5,150 | ||||||||

Expenses excluding interest | 19 | % | 3,469 | 2,917 | 3,122 | |||||||||||

Income from continuing operations before taxes on income | (39 | %) | 779 | 1,276 | 2,028 | |||||||||||

Taxes on income | (34 | %) | (325 | ) | (489 | ) | (798 | ) | ||||||||

Income from continuing operations | (42 | %) | 454 | 787 | 1,230 | |||||||||||

Loss from discontinued operations, net of tax | - | - | - | (18 | ) | |||||||||||

Net income | (42 | %) | $ | 454 | $ | 787 | $ | 1,212 | ||||||||

Earnings per share from continuing operations – diluted | (44 | %) | $ | .38 | $ | .68 | $ | 1.06 | ||||||||

Earnings per share – diluted | (44 | %) | $ | .38 | $ | .68 | $ | 1.05 | ||||||||

Net revenue growth (decline) from prior year | 1 | % | (19 | %) | 3 | % | ||||||||||

Pre-tax profit margin from continuing operations | 18.3 | % | 30.4 | % | 39.4 | % | ||||||||||

Return on stockholders' equity | 8 | % | 17 | % | 31 | % | ||||||||||

Net revenue per average full-time equivalent employee (in thousands) | - | $ | 337 | $ | 338 | $ | 383 | |||||||||

| (1) | Includes net outflows of $51.5 billion in 2010 related to the planned deconversion of a mutual fund clearing services client. |

| (2) | Beginning in 2010, amounts include all commission-free trades, including the Company's Mutual Fund OneSource ® funds and ETFs, and other proprietary products. Prior period amounts have been recast to reflect this change. |

| • | Net new client assets is defined as the total inflows of client cash and securities to the firm less client outflows. Management believes that this metric depicts how well the Company's products and services appeal to new and existing clients in a given operating environment. |

| • | Client assets is the market value of all client assets housed at the Company. Management considers client assets to be indicative of the Company's appeal in the marketplace. Additionally, fluctuations in certain components of client assets (e.g., Mutual Fund OneSource funds) directly impact asset management and administration fees. |

| • | Clients' daily average trades is an indicator of client engagement with securities markets and the most prominent driver of trading revenue. |

| • | Management believes that earnings per share, net revenue growth, pre-tax profit margin from continuing operations, and return on stockholders' equity provide broad indicators of the Company's overall financial health, operating efficiency, and ability to generate acceptable returns within the context of a given operating environment. |

| • | Net revenue per average full-time equivalent employee is considered by management to be the Company's broadest measure of productivity. |

- 16 -

THE CHARLES SCHWAB CORPORATION

Management's Discussion and Analysis of Financial Condition and Results of Operations

(Tabular Amounts in Millions, Except Ratios, or as Noted)

The Company's major sources of net revenues are asset management and administration fees, net interest revenue, and trading revenue. The Company generates asset management and administration fees through its proprietary and third-party mutual fund offerings, as well as fee-based investment management and advisory services. Net interest revenue is the difference between interest earned on interest-earning assets and interest paid on funding sources. Asset management and administration fees and net interest revenue are impacted by securities valuations, interest rates, the Company's ability to attract new clients, and client activity levels. The Company generates trading revenue through commissions earned for executing trades for clients and principal transaction revenue from trading activity in fixed income securities. Trading revenue is impacted by trading volumes, the volatility of prices in the equity and fixed income markets, and commission rates.

2010 Compared to 2009

The equity markets improved during 2010 and remained well above their prior year lows. The Nasdaq Composite Index, the Standard & Poor's 500 Index, and the Dow Jones Industrial Average increased 17%, 13%, and 11%, respectively. The three-month LIBOR increased by 5 basis points to .30% in 2010, however the low interest rate environment continued throughout the year as the federal funds target rate remained unchanged during the year at a range of zero to 0.25%.

The Company's sustained investment in expanding and improving product and service capabilities for its clients was reflected in the strength of its key client activity metrics in 2010 – net new client assets totaled $78.1 billion, excluding outflows related to a single Mutual Fund Clearing client who completed a planned transfer to an internal platform during the year, and total client assets ended 2010 at a record $1.57 trillion, up 11% from 2009. Client trading activity slowed during the year as clients' daily average trades decreased 4% from 2009 to 399,700.

Net revenues were relatively flat in 2010 from 2009. However, the Company experienced a change in the mix of its revenue sources as the increase in net interest revenue was offset by decreases in trading revenue, asset management and administration fees, and other revenue. Net interest revenue increased due to higher average balances of interest-earning assets, partially offset by a decrease in the average yield earned. Trading revenue decreased due to lower average revenue per revenue trade resulting from improved online trade pricing for clients, which was implemented in January 2010, and slightly lower daily average revenue trades in 2010. While the low interest rate environment caused over $200 million of additional money market mutual fund fee waivers from the prior year, the decrease in asset management and administration fees was limited to 3% due to higher average asset valuations and continued asset inflows. Other revenue was lower in comparison to 2009 due to a gain of $31 million on the repurchase of a portion of the Company's long-term debt in 2009.

Expenses excluding interest increased by 19% in 2010 from 2009 primarily due to the recognition of certain significant charges in 2010. The Company recognized class action litigation and regulatory reserves and other costs totaling $320 million relating to the Schwab YieldPlus Fund ® . Additionally, the Company decided to cover the net remaining losses recognized by Schwab money market mutual funds as a result of their investments in a single structured investment vehicle that defaulted in 2008 and recorded a charge of $132 million in 2010. Also, as a result of challenging credit card industry economics, the Company ended its sponsorship in its Invest First ® and WorldPoints (a) Visa (b) credit cards and recorded a charge of $30 million. The Company's ongoing expense discipline helped limit the growth in all other expense categories in the aggregate to 3% over the prior year.

2009 Compared to 2008

Economic and market conditions were challenging throughout 2009, marked by unprecedented market dynamics including declines in short-term interest rates and home valuations, increases in home foreclosures and delinquencies, and tight credit markets. While the federal funds target rate was unchanged at a range of zero to 0.25%, the three-month LIBOR decreased by 158 basis points to 0.25%. At the same time, although the equity markets showed sustained improvement from their March

| (a) | WorldPoints is a registered trademark of FIA Card Services, N.A. |

| (b) | Visa is a registered trademark of Visa International Service Association. |

- 17 -

THE CHARLES SCHWAB CORPORATION

Management's Discussion and Analysis of Financial Condition and Results of Operations

(Tabular Amounts in Millions, Except Ratios, or as Noted)

2009 lows – the Nasdaq Composite Index, the Standard & Poor's 500 Index, and the Dow Jones Industrial Average increased during the year by 44%, 24%, and 19%, respectively – average equity market valuations declined from 2008.

The Company attracted $87.3 billion in net new client assets during 2009 and total client assets were $1.42 trillion at December 31, 2009, up 25% from the prior year, reflecting the Company's success in attracting and retaining clients. Client trading activity slowed modestly during 2009 as clients' daily average trades decreased 4% to 414,800 from 2008.