UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2016 .

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

.

Commission file number: 000-28731

MOBETIZE CORP.

(Exact name of registrant as specified in its charter)

Nevada

99-0373704

(State or other jurisdiction of

(I.R.S. Employer

incorporation or organization)

Identification No.)

8105 Birch Bay Square Street, Suite 205, Blaine, Washington 98230

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (778) 588-5563

Securities registered under Section 12(b) of the Act: none.

Securities registered under Section 12(g) of the Act: none.

DRAFT

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☑ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule

12b-2 of the Exchange Act. Smaller reporting company ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ☑

The aggregate market value of the registrant's common stock, $0.001 par value held by non-affiliates (12,944,506) was

approximately $8,284,484 based on the last price ($0.64) at which its common stock was sold on September 30, 2015.

At July 4, 2016, the number of shares outstanding of the registrant's common stock, $0.001 par value was 23,330,233, the

number of shares outstanding of registrant's Series A preferred stock, $0.001 par value was 4,565,000, and the number of shares

outstanding of registrants Series B preferred stock, $0.001 par value was 5,420,648.

1

TABLE OF CONTENTS

PART I

BUSINESS OVERVIEW AND RISKS

ITEM 1

Business

3

ITEM 1A

Risk Factors

13

ITEM 1B

Unresolved Staff Comments

13

ITEM 2

Properties

13

ITEM 3

Legal Proceedings

13

ITEM 4

Mine Safety Disclosures

13

PART II

FINANCIAL AND MARKET INFORMATION

ITEM 5

Market for Registrant's Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities

14

ITEM 6

Selected Financial Data

20

Management's Discussion and Analysis of Financial Condition and Results of

ITEM 7

Operations

21

ITEM 7A

Quantitative and Qualitative Disclosures About Market Risk

26

ITEM 8

Financial Statements

26

ITEM 9

Changes in and Disagreements With Accountants on Accounting and Financial

Disclosure

52

ITEM 9A

Controls and Procedures

52

ITEM 9B

Other Information

54

PART III

RELATED PARTIES AND GOVERN DRAFT ANCE

ITEM 10

Directors, Executive Officers and Corporate Governance

55

ITEM 11

Executive Compensation

59

Security Ownership of Certain Beneficial Owners and Management and Related

ITEM 12

Stockholder Matters

62

ITEM 13

Certain Relationships and Related Transactions, and Director Independence

63

ITEM 14

Principal Accounting Fees and Services

64

PART IV

EXHIBITS

ITEM 15

Exhibits, Financial Statement Schedules

65

Signatures

66

2

PART I - BUSINESS OVERVIEW

ITEM 1.

Business

As used herein the terms "Mobetize," "we," "our," "us," refer to Mobetize Corp., and our

predecessors, unless the context indicates otherwise.

BACKGROUND

We were incorporated in the State of Nevada on February 23, 2012, as Slavia Corp. in order to assist

international students enroll in accredited universities, institutes, colleges or schools in Canada. Since we

were not able to raise sufficient capital to fund development in this business segment, management

determined to consider alternative strategies to create value for our shareholders.

On July 9, 2013, we entered into an Asset Purchase and Sale Agreement with Mobetize Inc., a Nevada

corporation. The Asset Purchase and Sale Agreement caused us to acquire substantially all of the assets

and none of the liabilities of Mobetize Inc. in exchange for shares of our common stock. The assets

conveyed included a license agreement between Mobetize, Inc., Paysafe Group PLC (formerly Optimal

Payments PLC) and Rentmoola Payment Systems Inc. We changed our name to "Mobetize Corp."

effective August 13, 2013, in connection with this transaction.

We offer services in the United States through our Nevada subsidiary Mobetize USA Inc. and to clients

outside the United States through our Canadian Subsidiary Mobetize Canada Inc.

Mobetize's USA business office is located at 8105 Birch Bay Road, Suite 205, Blaine Washington 98230

and our Canadian operations are located at #1150 – 5 DRA 1 FT 0 Burrard St. Vancouver, BC, V6C 3A8. Our

registered statutory office is located at Nevada Agency and Transfer Company 50 West Liberty Street,

Suite 880, Reno, Nevada 89501.

Mobetize trades on the OTCQB, an electronic trading platform owned by OTC Markets Group, Inc. under

the symbol "MPAY".

OVERVIEW

Fintech - financial technology - is an umbrella term describing disruptive technologies involved in the

provision of financial services. Fintech is transforming the way money is managed and affects almost

every financial activity.

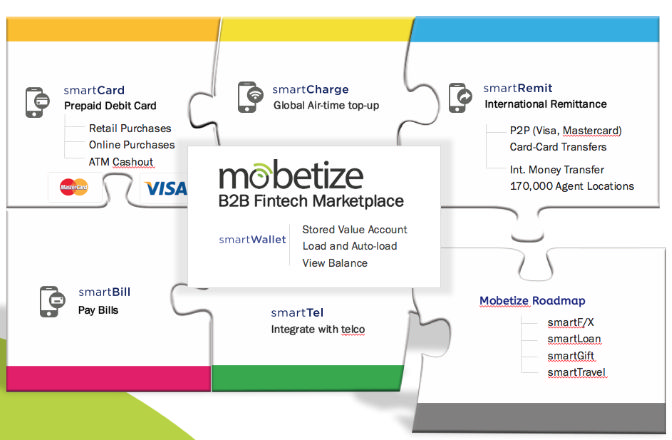

Mobetize is an emerging Fintech company which provides Fintech solutions and services that enable and

support the convergence of global telecom and financial services providers (the "Customers") through our

Global Mobile B2B Fintech and Financial Services Marketplace (the "Hub").

This Hub provides among other things a mobile financial services ("MFS") white label technology

platform, including an individual MFS application program interface ("API") consumption protocol to

enable and support services such as prepaid air-time and data top ups, international money transfers, P2P

transfers, Visa ™ /MasterCard ™ programs and bill payments on personal computers and mobile devices

(the "Services").

The Hub seamlessly integrates with Mobetize Customers; who subsequently offer the Services to their

subscribers and members (the "Users").

3

Users access the Services from the Hub through multiple access points including:

1. Desktop Applications

2. Mobile Web Applications

3. Native Applications for Apple iOS Devices and Android Devices

REVENUE

The Mobetize HUB generates revenue from:

1)

Transactional processing fees based on volume of activity

2)

Revenue share based fees for financial services delivered by the Mobetize Hub

3)

Recurring platform fees for licensing of the Mobetize Hub

4)

Recurring fees for service level agreements

5)

Consulting and professional services fees

6)

Customization, integration, and deployment fees

Existing revenue is influenced by among other things, the growth of the consumption of telecom and

financial services over the Internet globally and the adoption of digitized financial services by Users and

their comfort with mobile as an access point to complete transactions. Future revenue will also be affected

by our ability to innovate new technology processes and systems that our Customers want to offer to their

Users. Our strategy is to drive growth by:

•

Leveraging our existing contracts to increase Customer and User adoption

•

Enhancing business development efforts to expand sales globally

•

Evaluating M&A strategies to grow inorganically

•

Continuing to bring innovative Fintech soluti DRAFT ons and technology first-to-market.

FINTECH ECOSYSTEM

Globally FinTech "ecosystems" have stimulated technological innovation, made financial markets and

systems more efficient, and improved the overall customer experience. These ecosystems - include

telecom and financial service providers that are faced with heavy competition from enterprises like Apple

and Google who have cemented their positioning to compete in various parts of the Fintech ecosystem.

To remain competitive, telecoms and financial service providers are evaluating and adapting to the digital

age with a broad set of solutions, from pure channel adaptation to radical changes in business models.

Banking Industry

In a report published by the Economist Intelligence Unit titled: ‘The Disruption of Banking ,' over 100

senior bankers and 100 Fintech executives were interviewed to ascertain the likely landscape for the retail

banking industry over the next five years. When bankers were asked how Fintech might disrupt the

banking industry, more than 90% of the bankers believed that Fintech firms will have a significant impact

on the future landscape of banking, with more than a third believing that Fintech will win an equal share

or even dominate the market.

According to Juniper Research (July 2013), 800 million people would use mobile banking services in

2014, which number is expected to increase to 1.75 billion (32 percent of the global adult population) by

2019.

As of February 2015, bank spending on new technologies in North America was projected by Juniper

Research to reach $17 billion dollars in 2015 and increase to $19.9 billion dollars in 2017.

4

The online statistics Internet portal Statista at w ww.statista.com/topics/2404/fintech reported that the

value of investment in financial technology ventures on a global scale amounted to approximately $3

billion dollars in 2013 and was projected to grow to around $8 billion dollars in 2018. In 2013, 29 percent

of Fintech investments were in the banking and corporate finance area. Statista f urther reported that the

United States was the leading Fintech country in 2014, as the value of investment in U.S. financial

technology companies reached approximately $3.97 billion dollars. Silicon Valley, New York, and

London were the leading world Fintech locations that year.

Telecoms

According to The International Telecommunication Union (May 2014), there are nearly seven billion

mobile subscribers worldwide representing about 95.5 percent of the world population. Telcoms are

uniquely positioned to be the leading providers of mobile financial services to their customers by

leveraging their billing platforms. The fact that basic financial services can be done without a banking

relationship further strengthens the opportunity for telecoms.

Money Remittance

The World Bank estimated that in 2014 $131 billion dollars was sent from the United States by residents

and immigrant workers to their family members in their respective countries. The United States is the

largest market for these money transfer services accounting for over 22% of all global money transfers.

TECHNOLOGY SOLUTIONS AND PRODUCTS

DRAFT

The Mobetize Global Mobile B2B Fintech and Financial Services Marketplace/Hub offers the following:

5

smartWallet:

Our smartWallet solution is provided via mobile web and web OS Apple and Android app to the desktop,

iPad, or mobile phone.

The smartWallet is the core of our HUB and allows Users to load funds into their mobile wallet and

access global mobile financial services such as prepaid top-ups for themselves or for gifts for family

members, P2P money transfers, international money transfer remittances, bill payments and bill

management.

Users can load funds into their smartWallet from their bank account (ACH or real time ACH), via credit

or prepaid debit card, and PayPal.

The smartWallet can be integrated with an existing billing system to enable a mobile ‘my account' as part

of a mobile wallet with features including:

•

Registration - sign in and sign up

•

User Account Settings - Allows the User to update their information, edit/add and save different

payment methods while changing password and saving account numbers to favorites for fast

access.

•

View Balance - Users are able to track their balances by viewing their real-time balance.

•

Add and Save Services -Create, save, and edit a list of favorites for easy and fast access to all

transactions.

•

Favorites - Create, save, and edit a list of favorite contacts, remittances, airtime transactions and

more for convenience and accessibility.

DRAFT

•

Stored Payment Methods - Safely store and edit a list of preferred method of payments to load the

smartWallet and increase convenience and accessibility including credit cards, debit cards, and

ACH.

smartRemit:

A fully integrated mobile platform dedicated to providing convenient, efficient, scalable, and inexpensive

global money transfer solutions for Customers and Users.

smartRemit enables Users to send funds cross-border via multiple payout channels such as, direct bank

account deposits, pick-up at agent location, and home delivery. Users can send funds in one currency and

have the beneficiary receive in another. Cash delivery options include:

•

Cash to cash

•

Cash to account

•

Door service

•

Mobile transfers

smartRemit is accessed outside the smartWallet to ensure full Money Transfer Licensing compliance.

smartRemit provides Users with 24/7 mobile money transfer remittance capabilities.

smartCharge:

6

smartCharge enables real time prepaid mobile top-ups to any mobile phone and recharge transfers to over

350 mobile network operators in 90 countries, reaching 3.6 billion prepaid users. Users can send air-time

top-ups to any prepaid mobile phone globally.

smartBill:

smartBill is supported by our MSB licensed billing partner and allows Users to pay bills at approximately

14,000 companies within the United States, including utilities, cable companies, and mobile phone

providers.

smartTel:

smartTel can be integrated by our telecom Customers, electronic bill presentment and payment systems or

directly connect to third-party billing platforms.

smartTel features allow Users the ability to view their telecom service invoices and account activity, pay

their outstanding invoices, and email themselves their records.

smartCard:

smartCard is our white label Visa/MasterCard program that allows users to request (during sign-up or at

any time via the Mobetize app) a prepaid MasterCard or Visa card, which is linked to their smartWallet.

Users are able to move any cleared funds from their smartWallet on to the MasterCard, allowing them to

make purchases both online and in retail locations, plus withdraw cash from ATMs.

Users are able to track the balance and see recent transactions via the Mobetize smartWallet and can

easily move money back to the smartWallet. The sma DRAFT rtCard has the same white-label branding as the

smartWallet for a seamless User experience.

Customer Relationship Management ("CRM") and Reporting Tool:

Mobetize provides Customers an online CRM and data analytics reporting system for all transactions

processed through the Hub.

The reporting system can be configured so that different levels within a customer's team can see and

access different levels of information. The reporting tool provides real time data, at different levels of

detail, allowing Customers to track User metrics as:

•

Transactions $ values

•

Transaction volume-by type of transaction

•

Number of registered users

•

Number of active users

•

Geographic splits

•

Other key performance Indicators

The web based CRM reporting tool also provides Customer's access to User data such as:

•

User information (name, address, etc.)

•

User transaction history

•

User wallet balance

This data is a key driver for User support services.

7

Latest Technology and Product Developments

Technology

In April 2015, we completed the production version of Mobile Web application 1.0. This suite of products

includes smartCard, Paypal, bank ACH, and credit card processing as cash-in options and smartCharge,

smartBill, person-to-person transfers, and smartCard for ATM withdrawals and POS purchases as cash-

out options. The CRM, reporting, and incident management tools are active in addition to a desktop

version and Representation State Transfer ("REST") Application Program Interface ("API") with all of

the above features.

In October 2015, we completed the development of Version 2.0 for rollout to our Customers. Version 2.0

includes the most significant component and key differentiator of our offerings to date by enabling

international money transfer capabilities globally via our international money transfer partners. Version

2.0 also supports multi-language web services, with the Spanish language being the first non-English

language offered. Existing customers equipped with Version 2.0 can initiate international money transfers

from the United States via a network of nearly 200,000 payout agent locations, and instruct bank transfers

to over six hundred banks worldwide.

In March 2016, we completed the development of Version 2.1, which incorporates a new registration

system. The system includes text message verification and allows faster password recovery as well as

faster completion of the registration process on a mobile device.

DRAFT

We are now in the final stages of completing Version 2.2, which will enable instantaneous bank account

verification functionalities that will permit Mobetize to scrutinize User financial credentials. We expect

to launch Version 2.2 in the third quarter of 2016.

The Mobetize Hub will continue to be developed as a Fintech marketplace that offers stand alone

Services, REST API services for our financial technology products, and solutions that allow clients with

existing technologies, such as virtual wallets, to be able to include Mobetize Services in their systems.

Native applications for iOS and Android are also expected to be completed in the third quarter of 2016.

BUSINESS

On September 3, 2014, Mobetize was selected by DCR Strategies Inc. ("DCR"), an alternative financial

services company ("AFSC"), that specializes in designing, hosting and sustaining prepaid card programs;

to support its "TruCash" brand as a mobile financial services provider. We have since fully integrated our

smartWallet into TruCash prepaid card mobile applications. Millions of existing DCR prepaid card users

can access DCR services through our smartWallet in the United States and Canada. DCR is planning to

launch their Mobetize supported services in the third quarter of 2016.

The successful testing and integration of our Hub with DCR proves that our model for account to account

interoperability and API consumption with existing AFSCs is viable. This validation represents a

significant milestone for Mobetize as we are now able to market our Hub to major alternative AFSCs like

Apple, Inc. and its Apple Pay brand. Our relationship with DCR has resulted in processing revenues.

8

On September 8, 2014, we entered into an agreement with Impact Telecom ("Impact"), a global provider

of voice, messaging, and data services, to offer the Mobetize smartWallet for the delivery of international

money transfers, mobile airtime top-up, and bill payments to Impact's extensive customer base in the

United States and Canada. To date our agreement with Impact has not generated any revenue, however,

Impact was instrumental in the successful negotiation of an agreement with CostMaster Communications

Inc.

During the year ended March 31, 2016, Mobetize realized processing revenues from CostMaster

Communications Inc. ("CMC") a worldwide communication carrier based in Vancouver, Canada. As a

pioneer in long distance VoIP, CMC is now a major carrier in several markets around the globe. CMC

implemented Mobetize's smartCard for delivery of its foreign payroll. To date we have processed and

distributed over $1 million dollars in payroll for CMC. The Services provided to CMC proved our

metrics and Mobetize's ability to handle payroll services via our smartRemit product that utilizes

international person to person (P2P) mobile money transfers on the MasterCard ™ network.

Mobetize was selected from over 100 technology companies to speak and present at the 2015 Innovation

Showcase Event on May 29, 2015, held by the Telecom Council of Silicon Valley in Sunnyvale,

California. Mobetize showcased its Hub to decision level executives and had more than ten individual

meetings and demos with some of largest telecom companies in the world. The meetings resulted in

numerous NDA's and ongoing discussions with several large global telecoms.

On August 10, 2015, Mobetize showcased Version 2.0 at the Prepaid Expo in Las Vegas, Nevada, a

product suite that incorporates the full mobile money product solution that can be white-labeled by any

telecom operator. The suite consists of a mobile wall D e RAFT t with key financial services offerings that include

global money transfer capabilities, US bill payments, global gifting of prepaid air-time top ups and paid

Visa ™ /MasterCard ™ programs for telecom operators. Mobetize allows its telecom operators to pick and

choose the financial services they want to deliver branded for their respective customers, which can be

launched through APIs, or as a stand-alone system.

On October 7, 2015, Mobetize announced that it had formed a strategic partnership to deliver mobile

wallet and financial services to customers of Pure Minutes, Ltd. ("PML"). PML is a leading provider of

prepaid international calling services and mobile phone payment services for domestic and international

mobile carriers with an addressable customer base of over 1.1 million in the United States. In June 2016,

PML completed a white label application of the Mobetize smartWallet under the brand Digibux. The

online portal www.mydigibux.com has also been completed and PML expects to be launching the

services to their customers in the third quarter of 2016.

On October 15, 2015, Mobetize signed a consulting services agreement with Tata Communications

(America) Inc., ("TATA"), a global provider of communications services and infrastructure, to license

Mobetize solution as their core mobile money platform. Mobetize and Tata are working closely to create

a global business to business (B2B) channel strategy to deliver a financial technology services hub for

telecom companies, enterprise and alternative financial service providers that Tata supports globally in its

telecom network. We are also discussing opportunities in India and other global markets where Tata has

significant brand and product presence.

9

On November 3, 2015, Mobetize announced that it had formed a strategic partnership with Global Service

Solutions, Inc. ("Global Service") to deliver a mobile money and financial services platform under its

new brand Gotawallet ™ . Global Service, through its' Got Prepaid ™ brand, provides distribution,

through a nation-wide channel of large distributors and retailers, to over one million end-users in the

United States covering over fifty different prepaid cellular products. The products include a combination

of hard card, real time replenishments, and e-pin formats. The Got Prepaid ™ brand is highly regarded

within the prepaid segment of the market for its ability to provide quality customer service and technical

support. Got Prepaid ™ provides recharge capabilities for wireless AT&T, Verizon, T Mobile, H20, Red

Pocket and many other telecom providers. The project to deliver a mobile financial services platform was

completed in the second quarter of 2016. We are now actively working with Global Service to discuss

various market launch strategies.

During the second quarter of 2016 Mobetize entered into a development agreement with a financial

institution in Canada to explore the potential expansion of Mobetize Hub to deliver digitized/mobile

lending capabilities in compliance with and supported by the bank regulatory framework. The successful

development of such a platform could significantly disrupt the traditional lending model for financial

institutions. Work is presently underway to advance this project.

During the second quarter of 2016, Mobetize also signed a letter of intent with another financial

institution in Canada, which maintains an ATM Network comprised of more than one hundred and fifty

banks that could potentially integrate our Mobetize Hub into their bank client ecosystem. The purpose of

these discussions is the next step in our vision to become a leading technology company resolute on the

convergence of telecom and financial services. For example, imagine for a moment, a mobile lending

service delivered by a bank integrated to our MFS Hub. Banks could offer their mobile lending services

directly to telecom customers. Mobetize Hub could b DRA e FT the central platform connecting the respective

parties and clearing the related transactions. The eventual transformation of a mobile lending service

could extend to include consumer products, insurance, mortgages, and much more. A technology

transformation of this magnitude would represent a huge disruption to traditional retail banking. Should

we proceed to an agreement in this instance, the successful integration of our Hub with the bank's ATM

Network would be an industry first move that would impact millions of bank customers.

COMPETITION

The global Fintech industry is highly competitive. We compete against businesses in varied industries,

many of which are larger than we are, have a dominant and secure position in other industries, or offer

other goods and services to consumers and merchants which we do not offer. We compete against all

forms of Fintech service providers, including credit and debit cards providers, automated clearing house

and bank transfers providers, other online payment services providers, mobile payments providers, and

offline payment methods, including cash and check.

We compete primarily on the basis of the following:

•

ability to attract, retain, and engage customers and their users

•

ability to show that customers will achieve incremental sales by using our Mobetize Hub

•

security of transactions and the ability for customers to integrate our Mobetize Hub products and

services

•

fee structure

•

ability to develop services across multiple customer channels, including telecom and Fintech

service providers

•

customer service

10

•

brand recognition

•

website, mobile platform and application onboarding, ease-of-use, and accessibility

•

system reliability and data security

•

ease and quality of integration into third-party mobile applications and operating systems

•

quality of developer tools such as our Mobetize Hub programming interfaces

Mobetize seeks to differentiate itself from other industry participants. The vision of the Mobetize Hub is

to create an open marketplace of Fintech services and partnerships. Our open Fintech architecture for

telecoms and financial institutions uniquely positions us to potentially disrupt the current money services

infrastructure.

COMPETITIVE ADVANTAGES

Mobetize has developed a unique business and partnership model to simplify and orchestrate mobile

financial services. There are two key business relationships which give us a competitive advantage:

Telecoms and Financial Institutions – These are revenue share business partnerships that are our

channels to acquire customers and maximize transactional volumes. These partnerships can white

label the Mobetize Hub or integrate via the API consumption model to market the various MFS

products to end users.

Financial Partners – These are our strategic financial services partners who traditionally have

bricks and mortar style financial services and products. We digitize their regulatory compliance

and service fulfillment.

Advantages

DRAFT

1.

Customer Acquisition : Mobetize is scalable and is attractive to significant numbers of customers

cost-effectively.

2.

Lower Customer Costs : Mobetize provides economic advantages of digital distribution over

physical distribution.

3.

Advanced Analytics : Mobetize generates data for advanced analytics which provides customers

with several significant advantages, including the ability to redesign products to developing contextual

offers based on better understanding of customer needs.

4.

Leveraging Existing Infrastructure : Mobetize engages with the existing ecosystem of telcom

and financial service providers. Successful Fintech companies leverage what currently exists.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements, and Labor

Contracts

Mobetize has no patents, registered trademarks, licenses, franchises, concessions, royalty agreements or

labor contracts other than as detailed in this report. However, we do assert common law trademark rights

for the following names in the field of mobile commerce:

smartWallet

smartRemit

smartCharge

smartTel

smartcard

11

Common law trademark rights are enforceable in provincial courts in Canada, and may be asserted

against those who appropriate, dilute, or damage the goodwill of our business by using the same or

similar trade names or trademarks. Unlike statutory trademark rights, which are acquired by registration

and provide nation-wide protection, common law trademark rights are acquired automatically and provide

protection only in the jurisdiction where a business uses a name or logo in commerce. We intend to rely

on common law trademark protection until such time as we deem it economical for our business to

register our trade names or trademarks.

We have not registered for the protection of any rights under trademark, patent, or copyright in any

jurisdiction.

GOVERNMENT REGULATION

Government regulation impacts key aspects of our business. We are subject to regulations that affect the

payments industry in the markets we operate.

Payments Regulation . Various laws and regulations govern the payments industry in the United States

and globally. In the United States, our partners hold licenses to operate as a money transmitter (or its

equivalent), which, among other things, relieve us from reporting requirements, bonding requirements,

limitations on the investment of customer funds and inspection by state regulatory agencies.

Outside the United States, the laws and regulations applicable to the payments industry in any given

jurisdiction are subject to interpretation and change.

Banking Agency Supervision . Based on our relationships with financial institutions in the United States,

we are subject to indirect regulation and examination DRAFT by these financial institutions' regulators.

Consumer Financial Protection Bureau . The Consumer Financial Protection Bureau (the "CFPB") has

significant authority to regulate consumer financial products in the United States, including consumer

credit, deposit, payment, and similar products. The CFPB and other similar regulatory agencies in other

jurisdictions may have broad consumer protection mandates that could result in the promulgation and

interpretation of rules and regulations that may affect our business.

Anti-Money Laundering and Counter Terrorist Financing . Mobetize is not subject to anti-money

laundering ("AML") laws and regulations in the United States and other jurisdictions outside of the

United States, as well as laws designed to prevent the use of the financial systems to facilitate terrorist

activities. Regardless of the nature of our business, we do intend to implement a comprehensive AML

program designed to prevent our Hub from being used to facilitate money laundering, terrorist financing,

and other illicit activities.

The mobile commerce industry is also subject to requirements, codes and standards imposed by various

insurance, approval, listing, and standards organizations. Depending upon the type of commerce product

and requirements of the applicable local governmental jurisdiction, adherence to requirements, codes and

standards of such organizations is mandatory in some instances and voluntary in others.

RESEARCH AND DEVELOPMENT

We have spent $541,801 and $320,777 on research and development activities during the years ended

March 31, 2016 and 2015 respectively. This work has focused on building and enhancing the Mobetize

Hub.

12

EMPLOYEES

Mobetize had eight employees at March 31, 2016. Management uses consultants, attorneys, and

accountants to assist in the conduct of our business as deemed necessary.

ITEM 1A.

Risk Factors

Not required of smaller reporting companies.

ITEM 1B.

Unresolved Staff Comments

Not required of smaller reporting companies.

ITEM 2.

Properties

Our principal executive office is located at 8150 Birch Bay Square Street, Suite 205, Blaine Washington

98230. Our telephone number is (778) 588-5563. We pay rent of approximately $30 per month for the use

of this space.

Our principal operating office is located at 1150-510 Burrard Street, Vancouver, British Columbia V6C

3A8. Our telephone number is (778) 588-5563. We pay rent of $4,900 per month for the use of this space.

We believe that we have sufficient office space for the foreseeable future.

ITEM 3.

Legal Proceedings

DRAFT

None.

ITEM 4.

Mine Safety Disclosures

Not applicable.

13

PART II – FINANCIAL AND MARKET INFORMATION

ITEM 5.

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

Mobetize common stock is quoted on the OTCQB, a service maintained by OTC Link under the symbol

"MPAY." Trading in the common stock over-the-counter market has been limited and sporadic and the

quotations set forth below are not necessarily indicative of actual market conditions. These prices reflect

inter-dealer prices without retail mark-up, mark-down, or commission, and may not necessarily reflect

actual transactions. The high and low bid prices for the common stock for each quarter of the years ended

March 31, 2016 and 2015 are as follows:

Year

Quarter Ended

High

Low

2016

March 31

$0.29

$0.29

December 31

$0.30

$0.30

September 30

$0.65

$0.64

June 30

$0.73

$0.70

2015

March 31

$0.98

$0.51

December 31

$1.30

$0.83

September 30

$1.34

$1.05

June 30

$1.35

$1.05

The following is a summary of the material terms of our capital stock outstanding securities. This

summary is subject to and qualified by our articles of incorporation and bylaws.

DRAFT

Common Stock

As of March 31, 2016, there were 60 shareholders of record holding 28,750,881 shares of fully paid and

non-assessable common stock of the 525,000,000 shares of common stock, par value $0.001, authorized.

The Board of Directors believes that the number of beneficial owners is greater than the number of record

holders because a portion of our outstanding common stock is held in broker "street names" for the

benefit of individual investors. The holders of the common stock are entitled to one vote for each share

held of record on all matters submitted to a vote of stockholders. Holders of the common stock have no

preemptive rights and no right to convert their common stock into any other securities. There are no

redemption or sinking fund provisions applicable to the common stock.

Preferred Stock – Series A

On February 4, 2016, we authorized 250,000,000 preferred shares and designated 10,000,000 of the

preferred shares as Series A preferred stock. The par value of the preferred stock is $0.001 per share. As

of March 31, 2016, there was one shareholder of record holding 4,565,000 shares of fully paid and non-

assessable Series A preferred stock.

Preferred Stock – Series B

On May 23, 2016, we designated 25,000,000 of the authorized preferred shares as Series B preferred

stock. The par value of the preferred stock is $0.001 per share. As of the date of this report there were

three shareholders of record holding 5,420,648 shares of fully paid and non-assessable Series B preferred

stock .

14

Convertible Debentures

As of March 31, 2016, we had five convertible debt securities convertible into the shares of our common

stock for an aggregate principal amount of $275,000 including accrued interest. The convertible

debentures have a 12 month term at 12% annual interest that paid the respective holders 12 months of

prepaid interest on issuance, with a conversion feature exercisable at the option of the holder. The

conversion feature enables the holder to convert any portion of their outstanding convertible debenture

principal balance into common shares at a variable and discounted conversion price 180 days from the

issue date, but no later than the maturity date. The conversion price is calculated as a 50% discount to the

average of the three lowest closing market prices over any ten day trading period, ending one day prior to

a notice of conversion provided by the holder.

Stock Options

On August 7, 2015, our directors approved the adoption of our 2015 Stock Option Plan, which permits

Mobetize to grant up to 3,000,000 options to acquire shares of common stock, to its directors, officers,

employees, and consultants.

As of March 31, 2016, we have granted 2,630,000 stock options of which 2,381,262 remain outstanding,

each with five year terms, to directors, employees, advisors, and consultants, pursuant to the 2015 Stock

Option Plan, to purchase shares of our common stock at an exercise price of $0.60 that vested on grant or

will vest over time based on tenure with Mobetize.

We do not have in effect any other compensation plans under which our equity securities are authorized

for issuance.

DRAFT

Warrants

As of March 31, 2016, we have 2,636,406 share purchase warrants outstanding. We issued 694,414 share

purchase warrants on June 25, 2014, with an exercise price of $1.00 per share that expire on June 24,

2018; 305,000 share purchase warrants on December 11, 2014 with an exercise price of $1.25 that expire

on December 10, 2018; 81,670 share purchase warrants on March 17, 2015, with an exercise price of

$1.25 that expire on December 10, 2018; 94,750 share purchase warrants on July 15, 2015, with an

exercise price of $1.00 that expire on August 30, 2018; and 1,460,572 share purchase warrants on August

31, 2015, with an exercise price of $1.00 that expire on August 30, 2018.

Dividends

We have not declared any cash dividends since inception and do not anticipate paying any dividends in

the near future. The payment of dividends on our common stock is within the discretion of the Board of

Directors subject to earnings, capital requirements, financial condition, and other relevant factors

including those contractual restrictions related to certain debt obligations and those limitations generally

imposed by applicable state law.

Transfer Agent and Registrar

Our transfer agent is VStock Transfer, LLC located at 18 Lafayette Place, Woodmere, New York, 11598

having a telephone number at (212) 818-8436 and a facsimile number at (646) 536-3179.

15

Recent Sales of Unregistered Securities; Use of Proceeds From Registered Securities

On March 31, 2016, our board of directors authorized the issuance of five convertible debentures

convertible into shares of our common stock for an aggregate amount of $275,000, net of $30,000 in pre

paid interest valued at 12% over a one year term convertible at the option of holder at a 50% discount to

the average of the three lowest closing market prices over any ten day trading period. The offering was

conducted pursuant to the exemptions from registration provided by Section 4(2) and Regulation D of the

Securities Act of 1933, as amended ("Securities Act") to the following persons:

Name

Issue Date

Consideration

Exemption

Charles M. Zatzkin

03/16/2016

$50,000

Section 4(2)/Reg D

Jonathan Kalikow

03/21/2016

$100,000

Section 4(2)/Reg D

Donald Duberstein

03/22/2016

$50,000

Section 4(2)/Reg D

Wendy Klein

03/30/2016

$50,000

Section 4(2)/Reg D

Alan Rothschild

03/31/2016

$25,000

Section 4(2)/Reg D

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuances were isolated private transactions by Mobetize which did not involve

a public offering; (2) the offerees had access to the kind of information which registration would disclose;

and (3) the offerees are financially sophisticated.

Mobetize complied with the requirements of Regulation D of the Securities Act by: (i) foregoing any

general solicitation or advertising to market the securities; (ii) offering only to accredited offerees; (iii)

having not violated antifraud prohibitions with the information provided to the offerees; (iv) being

available to answer questions by the offerees; and (v) providing restricted securities to each offeree.

DRAFT

No commissions or financing fees were paid in connection with this offering.

On September 1, 2015, our board of directors authorized the issuance of 2,724,668 investment units for

aggregate proceeds of $681,167. Each investment unit consisted of one common share and one half-

warrant, two of which half warrants entitling the holder to purchase an additional share of our common

stock for $1.00 for three years from the date of issue. The offering was conducted pursuant to the

exemptions from registration provided by Section 4(2), and Regulation D of the Securities Act to the

following persons:

16

Name

Consideration

Shares

Exemption

James A. Weil

$100,000.00

400,000

Section 4(2)/Reg D

Alan H Rothschild as Trustee of the Joshua

Caspi 2011 Gift Trust

$33,333.00

133,333

Section 4(2)/Reg D

Alan H Rothschild as Trustee of the Laura

Caspi 2011 Gift Trust

$33,334.00

133,336

Section 4(2)/Reg D

Alan H Rothschild as Trustee of the Andrew

Caspi 2011 Gift Trust

$33,333.00

133,333

Section 4(2)/Reg D

Donald Duberstein

$125,000.00

500,000

Section 4(2)/Reg D

Jason Feingold

$8,333.25

33,333

Section 4(2)/Reg D

Charles M. Zatzkin

$12,500

50,000

Section 4(2)/Reg D

Lambert Wayne LeRoux

$20,000

80,000

Section 4(2)/Reg D

Alan H. Rothschild

$25,000

100,000

Section 4(2)/Reg D

Frank Weil

$2,000

8,000

Section 4(2)/Reg D

David Duberstein

$10,000

40,000

Section 4(2)/Reg D

William Duberstein

$10,000

40,000

Section 4(2)/Reg D

Avenue T Fund, L.P.

$25,000

100,000

Section 4(2)/Reg D

Carol Fowler

$135,000

540,000

Section 4(2)/Reg D

Carol Fowler as Trustee of Ellis A Jackson

$15,000

60,000

Section 4(2)/Reg D

Carol Fowler as Trustee of Anya Jackson

$12,500

50,000

Section 4(2)/Reg D

Carol Fowler as Trustee of Lucy Jackson

$12,500

50,000

Section 4(2)/Reg D

Scott Gurfein

$10,000

40,000

Section 4(2)/Reg D

NBCN Inc. IFT Ron Gesser

$27,500

110,000

Section 4(2)/Reg D

NBCN Inc. IFT Nator Holdings Ltd.

DRAFT $22,500

90,000

Section 4(2)/Reg D

James R. Connolly

$8,333.25

33,333

Section 4(2)/Reg D

Alligato, Inc.

$40,740.50

81,481

Section 4(2)/Reg D

NBCN Inc. IFT Estate of Halina Weinreb

$25,000

50,000

Section 4(2)/Reg D

Helston Capital Corp L.P.

$15,000

30,000

Section 4(2)/Reg D

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuances were isolated private transactions by Mobetize which did not involve

a public offering; (2) the offerees had access to the kind of information which registration would disclose;

and (3) the offerees are financially sophisticated.

Mobetize complied with the requirements of Regulation D of the Securities Act by: (i) foregoing any

general solicitation or advertising to market the securities; (ii) offering only to accredited offerees; (iii)

having not violated antifraud prohibitions with the information provided to the offerees; (iv) being

available to answer questions by the offerees; and (v) providing restricted securities to each offeree.

We paid $8,750 in financing fees and 17,500 financing warrants worth an estimated $3,372 and issued on

the same terms as those in the investment units authorized in connection with this offering.

17

On September 1, 2015, our board of directors authorized the issuance of 161,481 investment units for

aggregate proceeds of $80,739 each investment unit consisted of one common share and one half-warrant,

two of which half warrants entitling the holder to purchase an additional share of our common stock for

$1.00 for three years from the date of issue. The offering was conducted pursuant to the exemptions from

registration provided by Section 4(2), Regulation D and Regulation S of the Securities Act to the

following persons:

Name

Consideration

Shares

Exemption

Alligato, Inc.

$40,740.50

81,481

Section 4(2)/Reg S

NBCN Inc. ITF Estate of

Halina Weinreb

$25,000

50,000

Section 4(2)/Reg D

Helston Capital Corp L.P.

$15,000

30,000

Section 4(2)/Reg D

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuances were isolated private transactions by Mobetize which did not involve

a public offering; (2) the offerees had access to the kind of information which registration would disclose;

and (3) the offerees are financially sophisticated.

Mobetize complied with the requirements of Regulation D of the Securities Act by: (i) foregoing any

general solicitation or advertising to market the securities; (ii) offering only to accredited offerees; (iii)

having not violated antifraud prohibitions with the information provided to the offerees; (iv) being

available to answer questions by the offerees; and (v) providing restricted securities to each offeree.

Mobetize complied with the exemption requirements of Regulation S by having directed no offering

efforts in the United States, by offering common shares only to offerees who was outside the United

States at the time of the offering, and ensuring that th DRA e FT offerees to whom the securities were offered were

non-U.S. offerees with addresses in foreign countries.

No commissions or financing fees were paid in connection with this offering.

On August 15, 2015, our board of directors authorized the issuance of 5,000 shares of common stock at a

price of $0.50 per share for proceeds of $2,500 upon the exercise of 5,000 warrants, issued in September

2013, to Kynaston Costa Correia pursuant to the exemptions from registration provided by Section 4(2)

and Regulation D of the Securities Act.

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuance was an isolated private transaction by Mobetize which did not involve

a public offering; (2) the offeree had access to the kind of information which registration would disclose;

and (3) the offeree is financially sophisticated.

Mobetize complied with the requirements of Regulation D of the Securities Act by: (i) foregoing any

general solicitation or advertising to market the securities; (ii) offering only to an accredited offeree; (iii)

having not violated antifraud prohibitions with the information provided to the offeree; (iv) being

available to answer questions by the offeree; and (v) providing restricted securities to the offerree.

No commissions or financing fees were paid in connection with this offering.

On June 10, 2015, our board of directors authorized the issuance of 184,500 shares at a price of $0.50 per

share for proceeds of $92,250 upon the exercise of 184,500 warrants pursuant to the exemptions from

registration provided by Section 4(2) and Regulation S of the Securities Act to the following persons.

18

Name

Consideration

Shares

Exemption

Forte Finance LLC

$12,500

25,000

4(2)/Reg S

Helston Capital Corp.

$5,250

10,500

4(2)/Reg S

Nator Holdings, Ltd.

$12,500

25,000

4(2)/Reg S

Christopher Hlady

$3,000

6,000

4(2)/Reg S

Kynaston Costa Correia

$4,000

8,000

4(2)/Reg S

Wayne LeRoux

$10,000

20,000

4(2)/Reg S

Ron Gesser

$45,000

90,000

4(2)/Reg S

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuances were isolated private transaction by Mobetize which did not involve a

public offering; (2) the offerees had access to the kind of information which registration would disclose;

and (3) the offerees are financially sophisticated.

Mobetize complied with the exemption requirements of Regulation S by having directed no offering

efforts in the United States, by offering common shares only to offerees who were outside the United

States at the time of the offering, and ensuring that the offerees to whom the securities were offered were

non-U.S. offerees with addresses in foreign countries.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On September 1, 2015, our board of directors authorized the issuance of 81,481 shares at a price of $0.50

per share for proceeds of $40,741 to Alligato, Inc., a company controlled by our chief executive officer,

pursuant to the exemptions from registration provided by Section 4(2) and Regulation S of the Securities

Act.

DRAFT

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuance was an isolated private transaction by Mobetize which did not involve

a public offering; (2) the offeree had access to the kind of information which registration would disclose;

and (3) the offeree is financially sophisticated.

Mobetize complied with the exemption requirements of Regulation S by having directed no offering

efforts in the United States, by offering common shares only to an offeree who was outside the United

States at the time of the offering, and ensuring that the offeree to whom the securities were offered was a

non-U.S. offeree with an address in a foreign country.

On September 1, 2015, our board of directors authorized the issuance of 700,000 shares at a price of

$0.25 per share for proceeds of $175,000 and permitted the exercise of 25,000 warrants in exchange for

25,000 common shares at a price of $0.50 share for gross proceeds of $12,500 to certain entities and

persons affiliated with our former chief financial officer, pursuant to the exemptions from registration

provided by Section 4(2), Regulation D and Regulation S of the Securities Act as follows:

19

Name

Consideration

Shares

Exemption

Carol Fowler

$135,000

540,000

Section 4(2)/Reg D

Carol Fowler as Trustee

of Ellis A. Jackson

$15,000

60,000

Section 4(2)/Reg D

Carol Fowler as Trustee

of Anya Jackson

$12,500

50,000

Section 4(2)/Reg D

Carol Fowler as Trustee

of Lucy Jackson

$12,500

50,000

Section 4(2)/Reg D

Forte Finance LLC

$12,500

25,000

Section 4(2)/Reg D

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuances were isolated private transactions by Mobetize which did not involve

a public offering; (2) the offerees had access to the kind of information which registration would disclose;

and (3) the offerees are financially sophisticated.

On _September 1, 2015, our board of directors authorized the issuance of 500,000 shares at a price of

$0.25 per share for proceeds of $125,000 to Donald Duberstein, one of our directors, pursuant to the

exemptions from registration provided by Section 4(2) and Regulation D of the Securities Act.

Mobetize complied with the exemption requirements of Section 4(2) of the Securities Act based on the

following factors: (1) the issuance was an isolated private transaction by Mobetize which did not involve

a public offering; (2) the offeree had access to the kind of information which registration would disclose;

and (3) the offeree is financially sophisticated.

Mobetize complied with the requirements of Regulation D of the Securities Act by: (i) foregoing any

general solicitation or advertising to market the secur DRA i FT ties; (ii) offering only to an accredited offeree; (iii)

having not violated antifraud prohibitions with the information provided to the offeree; (iv) being

available to answer questions by the offeree; and (v) providing restricted securities to the offerree.

ITEM 6.

Selected Financial Data

Not required of smaller reporting companies.

20

ITEM 7.

Management's Discussion and Analysis of Financial Condition and Results of

Operations

PRELIMINARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The following discussion should be read in conjunction with our financial statements, which are included

elsewhere in this Form 10-K (the "Report"). This Report contains forward-looking statements which

relate to future events or our future financial performance. In some cases, you can identify forward-

looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes,"

"estimates," "predicts," "potential" or "continue" or the negative of these terms or other comparable

terminology. These statements are only predictions and involve known and unknown risks, uncertainties,

and other factors that may cause our or our industry's actual results, levels of activity, performance or

achievements to be materially different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking statement

In evaluating these statements, you should consider various factors which may cause our actual results to

differ materially from any forward-looking statements. Although we believe that the predictions reflected

in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Therefore, actual results may differ materially and adversely from those

expressed in any forward-looking statements. We undertake no obligation to revise or update publicly any

forward-looking statements for any reason.

We are considered a development stage company. Our auditors have issued a going concern opinion on

the financial statements for the year ended March 31, 2016. The continuation of Mobetize as a going

concern is dependent upon the continued financial support from its management, and its ability to identify

future investment opportunities and obtain the necess DRAF a T ry debt or equity financing, cutting operating costs,

launching a viable product, and generating profitable operations from our future operations.

Mobetize's plan of operation for the coming year is to finalize Version 2.2 of our Fintech suite, complete

the development and qualification of products in our pipeline, and increase sales of our existing products.

Meanwhile, we will continue internal research and development efforts and collaborate with development

partners to ensure the continuity of our product pipeline focused on the convergence of telecom and

financial services.

RESULTS OF OPERATION

Operating Revenues, Operating Expenses and Net Loss

US $

Year Ended

March 31,

2016

2015

Operating Revenues

$

125,934 $

101,835

Operating Expenses

2,195,479

1,607,330

Net Loss from Operations

(2,069,545)

(1,505,495)

Net Loss

(2,069,545)

(3,009,018)

Mobetize generated $125,934 of revenue in the year ended March 31, 2016, compared to revenues of

$101,835 during the same period in 2015. Revenues are currently generated through licensing, consulting,

and payment processing services provided by Mobetize to our existing Customers. We expect to generate

additional revenues in the next 12 months from all Mobetize Hub revenue sources.

21

Our operating expenses for the year ended March 31, 2016 and 2015 are outlined in the following table:

US $

Year Ended

March 31,

2016

2015

Depreciation

$

3,107 $

1,148

General and administrative

280,709

200,674

General and administrative – related party

2,913

99,695

Stock based compensation expense

711,427

46,097

Investor relations and promotion

31,881

138,142

Listing fees

46,655

30,984

Management salaries and consulting fees

299,916

438,193

Management salaries and consulting fees – related party

120,000

222,382

Professional fees

72,244

74,954

Research and development

467,574

59,170

Research and development – related party

74,227

261,607

Sales and marketing

84,826

31,646

Sales and marketing – related party

-

2,638

Total Operating Expenses

2,195,479

1,607,330

For the year ended March 31, 2016 operating costs were $2,195,479 compared with $1,607,330 for the

year ended March 31, 2015.

DRAFT

This $588,149 increase is primarily attributed to a $221,024 increase in research and development as we

continued to focus on product research and development, and a $665,330 increase in stock based

compensation due to the issuance of stock options to management and employees offset by a $106,261

decrease to investor relations as the result of terminating an investor relations services contract, and a

$240,659 decrease in management salaries and consulting fees as we optimized the management structure

to reduce overhead cost.

During the year ended March 31, 2016, Mobetize recorded a net loss of $2,069,545 compared with a net

loss of $3,009,018 for the year ended March 31, 2015. The decrease in net losses is primarily attributed to

the loss on sale of investment of $1,503,523 in the prior period ended March 31, 2015.

Liquidity and Capital Resources

US $

March 31, 2016

March 31, 2015

Current Assets

318,827

390,544

Current Liabilities

266,185

110,110

Working Capital

52,642

280,434

As at March 31, 2016, Mobetize's cash balance was $210,341 and total assets were $330,655, compared

to a cash balance of $312,899 and total assets of $404,150 as at March 31, 2015.

22

As at March 31, 2016, Mobetize had total liabilities of $588,661 compared with total liabilities of

$163,215 as at March 31, 2015. The increase in total liabilities is attributed to a $104,595 increase in

accounts payable and accrued liabilities, an increase of $50,000 in amounts due to a related party, an

increase of $47,476 due to funds advanced to us in the form of a shareholder loan, and an increase of

$275,000 in convertible debenture.

As at March 31, 2016, Mobetize had working capital deficit of $223,358 compared with working capital

of $280,434 at March 31, 2015. The decrease in working capital can be attributed to the decrease in

current assets, particularly cash used for business purposes, and the increase in current liabilities, mostly

accounts payable and accrued liabilities, promissory note, and convertible debentures.

Cash Flows

US $

Year Ended

March 31,

2016

2015

Cash flows used in Operating Activities

(1,254,120)

(1,164,772)

Cash flows used in Investing Activities

(1,659)

115,867

Cash flows provided by Financing Activities

1,159,802

1,273,623

Effect of exchange rate changes on cash

(6,581)

(2,326)

Net Increase in Cash During Period

(102,558)

222,392

Cash flow used in Operating Activities

During the year ended March 31, 2016, Mobetize used $1,254,120 in net cash for operating activities

compared to $1,164,772 of net cash used in operating DRAFT activities during the year ended March 31, 2015.

The $89,348 increase in net cash used in operating activities in the current period is primarily attributed to

the increase in general and administrative costs for day-to-day activities, as well as the increase in

research and development expenses.

Mobetize expects to continue to use cash flow in operating activities over the next twelve months as it

continues the development of its product suites.

Cash flow used in Investing Activities

During the year ended March 31, 2016, Mobetize used $1,659 in net cash for investing activities

compared to net cash of $115,867 provided by investing activities in 2015. Cash used in investing

activities during the year ended March 31, 2016 was due to the purchase of computer equipment while

cash provided by investing activities during the same period in 2015 was due to $130,526 in proceeds

from the sale of an investment offset by $14,659 cash spent to purchase computer equipment.

Mobetize expects to continue to use cash flow in investing activities over the next twelve months as it

seeks to expand the reach of its business.

23

Cash flow from Financing Activities

During the year ended March 31, 2016, Mobetize received $1,159,802 in proceeds from financing

activities compared to $1,273,623 in proceeds from financing activities during the year ended March 31,

2015. Mobetize realized $619,667 in net proceeds from the issuance of common stock, $245,000 in

proceeds from convertible debentures, $44,000 in proceeds from related party loans, $76,000 in proceeds

from shareholder loans, and $228,240 in related party stock issuances to our chief executive officer and

former chief financial officers, offset by $53,105 in related party loan repayment during the year ended

March 31, 2016. Mobetize realized $1,273,623 in net proceeds from the issuance of common stock.

Mobetize expects to continue to use cash during the year ended March 31, 2015.

Mobetize expects to continue to realize net cash flow from financing activities over the next twelve

months as its business will require additional funding to meet forecast capital requirements to develop its

product line and expand its commercial reach.

We expect that working capital requirements will continue to be funded through a combination of existing

funds and further issuances of securities as either debt or equity are expected to increase in line with the

growth of our business.

Existing working capital, further advances and debt or equity instruments that Mobetize plans to issue, in

combination with anticipated cash flow are expected to be adequate to fund our operations over the next

twelve months. We have no lines of credit or other bank financing arrangements. Generally, we have

financed operations to date through the proceeds of the private placement of equity and advances from

directors. In connection with our business plan, management anticipates additional increases in operating

expenses and capital expenditures relating to: (i) acquisition of inventory; (ii) developmental expenses;

and (iii) marketing expenses. We intend to finance th DRA e FT se expenses with further issuances of securities, and

debt issuances. Thereafter, we expect we will need to raise additional capital and generate revenues to

meet long-term operating requirements. We currently have no agreements, arrangements or

understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Since we have no such arrangements or plans currently in effect, our inability to raise funds for the above

purposes will have a severe negative impact on our ability to remain a viable company. Additional

issuances of equity or convertible debt securities will result in dilution to our current shareholders.

Further, such securities might have rights, preferences or privileges senior to our common stock.

Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not

available or are not available on acceptable terms, we may not be able to take advantage of prospective

new business endeavors or opportunities, which could significantly and materially restrict our business

operations.

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this Report, we do not have any off-balance sheet arrangements that have or are

reasonably likely to have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources

that are material to investors.

24

GOING CONCERN

The independent auditors' report accompanying our March 31, 2016, financial statements contained an

explanatory paragraph expressing substantial doubt about our ability to continue as a going concern.

These financial statements included in this Report for March 31, 2016 have been prepared on a going

concern basis, which implies that our company will continue to realize its assets and discharge its

liabilities in the normal course of business. As of March 31, 2016, Mobetize has an accumulated deficit of

$6,325,061 and has accumulated other comprehensive losses of $6,910. The continuation of Mobetize as

a going concern is dependent upon the continued financial support from its management, and its ability to

identify future investment opportunities and obtain the necessary debt or equity financing, and generating

profitable operations from future operations. These factors raise substantial doubt regarding Mobetize's

ability to continue as a going concern. These financial statements do not include any adjustments to the

recoverability and classification of recorded asset amounts and classification of liabilities that might be

necessary should Mobetize be unable to continue as a going conce

CRITITCAL ACCOUNTING POLICIES

Our significant accounting policies are summarized in Note 2 to our financial statements. While the

selection and application of any accounting policy may involve some level of subjective judgments and

estimates, we believe the following accounting policies are the most critical to our financial statements,

potentially involve the most subjective judgments in their selection and application, and are the most

susceptible to uncertainties and changing conditions.

Revenue Recognition

Mobetize recognizes revenue from payment processi D n RAFT g, licensing, and provision of consulting services.

Revenue will be recognized only when the price is fixed and determinable, persuasive evidence of an

arrangement exists, the service has been provided, and collectability is reasonably assured.

Stock-Based Compensation

Mobetize records stock-based compensation in accordance with ASC 718, Compensation – Stock

Compensation, which requires the measurement and recognition of compensation expense based on

estimated fair values for all share-based awards made to employees and directors, including stock options.

ASC 718 requires companies to estimate the fair value of share-based awards on the date of grant using

an option-pricing model. Mobetize uses the Black-Scholes option-pricing model as its method of

determining fair value. This model is affected by Mobetize's stock price as well as assumptions regarding

a number of subjective variables. These subjective variables include, but are not limited to Mobetize's

expected stock price volatility over the term of the awards, and actual and projected employee stock

option exercise behaviors. The value of the portion of the award that is ultimately expected to vest is

recognized as an expense in the statement of consolidated comprehensive loss over the requisite service

period. Options granted to consultants are valued at the fair value of the equity instruments issued, or the

fair value of the services received, whichever is more reliably measureable.

25

Embedded Conversion Features

Mobetize evaluates embedded conversion features within convertible debt under ASC 815 Derivatives

and Hedging to determine whether the embedded conversion feature(s) should be bifurcated from the host

instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings.

If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated

under ASC 470-20, Debt with Conversion and Other Options for consideration of any beneficial

conversion feature.

Derivative Financial Instruments

Mobetize does not use derivative instruments to hedge exposures to cash flow, market, or foreign

currency risks. Mobetize evaluates all of it financial instruments, including stock purchase warrants, to

determine if such instruments are derivatives or contain features that qualify as embedded derivatives.

For derivative financial instruments that are accounted for as liabilities, the derivative instrument is

initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair

value reported as charges or credits to income. For option-based simple derivative financial instruments,

Mobetize uses the Black-Scholes option-pricing model to value the derivative instruments at inception

and subsequent valuation dates. The classification of derivative instruments, including whether such

instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting

period.

Beneficial Conversion Feature

For conventional convertible debt where the rate of c DRAF o T nversion is below market value, Mobetize records a

Beneficial Conversion Feature (the "BCF") and related debt discount.

ITEM 7A.

Quantitative and Qualitative Disclosures about Market Risk

Not required of smaller reporting companies.

ITEM 8.

Financial Statements and Supplementary Data

Our audited financial statements and notes thereto for the years ended March 31, 2016 and 2015 are

attached hereto as F-1 through F-25 .

26

Report of Independent Registered

Public Accounting Firm

Grant Thornton LLP

T (604) 687-2711

Suite 1600, Grant Thornton Place

F (604) 685-6569

333 Seymour Street

www.GrantThornton.ca

Vancouver, BC

V6B 0A4

To the Board of Directors and Stockholders of

Mobetize Corp.

We have audited the accompanying consolidated balance sheets of Mobetize Corp. (a Nevada corporation) and

subsidiaries (collectively, the "Company") as of March 31, 2016 and March 31, 2015, and the related consolidated

statements of operations and comprehensive loss, changes in stockholders' equity, and cash flows for each of the

two years in the period ended March 31, 2016. These financial statements are the responsibility of the Company's

management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board

(United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misst DRAFT atement. We were not engaged to perform an audit of the

Company's internal control over financial reporting. Our audits included consideration of internal control over

financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the

purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting.

Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the

amounts and disclosures in the financial statements, assessing the accounting principles used and significant

estimates made by management, as well as evaluating the overall financial statement presentation. We believe that

our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the

financial position of Mobetize Corp. and subsidiaries as of March 31, 2016 and March 31, 2015, and the results of

their operations and their cash flows for each of the two years in the period ended March 31, 2016, in conformity

with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue

as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has a history of

operating losses. These conditions, along with other matters as set forth in Note 1, raise substantial doubt about the

Company's ability to continue as a going concern. Management's plans in regard to these matters are also described