U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

Mark One

[ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2014

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission File No. 333-181747

MOBETIZE CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

7299 (Primary Standard Industrial Classification Number) | 99-0373704 (IRS Employer Identification Number) |

8150 Birch Bay Square Street, Suite 205, Blaine WA 98230

(Address of principal executive offices)

Issuer's telephone number : (206) 347-4515

Indicate by checkmark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X ] No[ ]

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the most practicable date: As at June 27, 2014, there were 29,488,365 shares of the issuer's $0.001 par value common stock issued and outstanding

TABLE OF CONTENTS

Item 1. | Business | 3 |

Item 1A. | Risk Factors | 13 |

Item 1B. | Unresolved Staff Comments | 21 |

Item 2. | Properties | 21 |

Item 3. | Legal Proceedings | 22 |

Item 4. | Mine Safety Disclosures | 22 |

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 22 |

Item 6. | Selected Financial Data | 23 |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 23 |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 30 |

Item 8. | Financial Statements and Supplementary Data | 30 |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 48 |

Item 9A. | Controls and Procedures | 48 |

Item 9B. | Other Information | 50 |

Item 10. | Directors, Executive Officers and Corporate Governance | 50 |

Item 11. | Executive Compensation | 55 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 58 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 60 |

Item 14. | Principal Accounting Fees and Services | 61 |

Item 15. | Exhibits, Financial Statement Schedules | 61 |

2

Item 1. Business

FORWARD LOOKING STATEMENTS

This annual report contains certain forward-looking statements. All statements other than statements of historical fact are "forward-looking statements" for purposes of these provisions, including any projections of earnings, revenues, or other financial items; any statements of the plans, strategies, and objectives of management for future operation; any statements concerning proposed new products, services, or developments; any statements regarding future economic conditions or performance; statements of belief; and any statement of assumptions underlying any of the foregoing. Such forward-looking statements are subject to inherent risks and uncertainties, and actual results could differ materially from those anticipated by the forward-looking statements.

These forward-looking statements involve significant risks and uncertainties, including, but not limited to, the following: competition, promotional costs and the risk of declining revenues. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of a number of factors. These forward-looking statements are made as of the date of this filing, and we assume no obligation to update such forward-looking statements. The following discusses our financial condition and results of operations based upon our audited financial statements which have been prepared in conformity with accounting principles generally accepted in the United States. It should be read in conjunction with our financial statements and the notes thereto included elsewhere herein.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our consolidated financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (US$) and all references to "common shares" refer to the common shares in our capital stock.

As used in this quarterly report, the terms "we", "us", "our" and "our company" mean Mobetize Corp., unless otherwise indicated.

Corporate Background

We were incorporated in the State of Nevada on February 23, 2012. We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. Our administrative office is located at 8150 Birch Bay Square Street, Suite 205, Blaine WA 98230. Our fiscal year end is March 31.

Our original business was to provide service to international students who want to study in Canada. We have not generated any revenues and our principal business activities to date consist of creating a business plan and entering into a Referral Agreement dated May 7, 2012 with Novy Mir, Ltd., an independent contractor who was to refer international students to us.

Our business plan was to help international students enroll in appropriate universities, institutes, colleges or schools in Canada. We also had planned to help students obtain student visas and find accommodations in the cities of study. Our service was to start from preliminary consultation and will end when the client is enrolled to the program, entered to the destination country and accommodated at desired place.

3

Unfortunately, we were not able to raise sufficient capital to fund our business development and consequently our management began considering alternative strategies, such as business combinations or acquisitions to create value for our shareholders.

On July 9, 2013, we entered into an asset purchase agreement with Mobetize Inc. ("Priveco") (formerly Telupay Inc.), a privately held Nevada corporation. Pursuant to the terms of the agreement, we agreed to acquire substantially all the assets of Priveco in exchange for the issuance by our company of 22,003,000 shares of our common stock to Priveco.

In accordance with board approval, we filed a Certificate of Change dated August 8, 2013 with the Nevada Secretary of State to give effect to a forward split of our authorized, issued and outstanding shares of common stock on a 7 new for 1 old basis, such that our authorized capital will be increased from 75,000,000 to 525,000,000 shares of common stock and, correspondingly, our issued and outstanding shares of common stock was increased from 3,290,000 to 23,030,000 common shares, all with a par value of $0.001.

In connection with the asset purchase and sale agreement, our President, Mr. Fowler agreed to return for cancellation 18,400,000 shares of our common stock on September 4, 2013. Concurrently, we closed the asset purchase and sale by issuing the required 22,003,000 common shares to Priveco.

On September 16, 2013, our company issued 315,000 common shares as compensation for an on-going consulting agreement with our company. Additionally on October 7, 2013 our company issued 1,050,000 shares in a private placement at $0.50 per share for gross funds of $525,000. $52,500 of financing fees were charged on this transaction.

On December 15, 2013 our company issued 15,000 common shares for prepaid marketing services with a fair value of $19,500. As of March 31, 2014 $14,625 of these services have been amortized.

On December 31, 2013 our company issued 1,200 common shares in payment of consultancy services received with a fair market value of $1,500.

On March 14, 2014 our company issued 200,000 common shares at a deemed price of $0.20 a share upon conversion of the outstanding notes payable to equity.

On March 26, 2014 our company entered in to a debt for equity settlement agreement with the President of our company. Under the terms of this agreement, our company settled debts of $112,500 owed to the President of the our company in return for the issuance of 150,000 common shares. This transaction was valued at the prevailing market price of $1.35 per share, so our company incurred an interest charge of $90,000 as a result of this transaction.

On April 4, 2014 our company issued 1,334 common shares in settlement of a supplier liability valued at $1,800.

On June 25, 2014 our company closed a private placement under which it sold 1,122,831 investment units for gross proceeds of approximately $842,123. Each investment unit consisted of one common share of our company's stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for two years from issue. $58,500 financing fees are payable in cash associated with this private placement and 113,500 financing warrants will be issued on the same terms as those in the investment units.

4

Business Overview

Our original business was to provide service to international students who want to study in Canada. We did not generate any revenues and our principal business activities consisted of creating a business plan. Our business plan was to help international students enrol in appropriate universities, institutes, colleges or schools in Canada. We also had planned to help students obtain student visas and find accommodations in the cities of study. Our service was to start from preliminary consultation and will end when the client is enrolled to the program, entered to the destination country and accommodated at desired place.

Unfortunately, we were not able to raise sufficient capital to fund our business development and consequently our management began considering alternative strategies, such as business combinations or acquisitions to create value for our shareholders.

As such, we purchased the all or substantially all of the business assets of Mobetize Inc. on September 4, 2013 and our new business offers us to become a leading online and mobile commerce platform provider for telecom operators, payment service providers and banks. Initially, we are focussed on providing solutions to telcos in N America that allow them to quickly and easily offer a full suite of Mobile Financial Services (" MFS ") to their customers. Our unique ‘freemuim' business model removes the cost barriers for telcos to adopt MFS and positions us at the leading edge of this exciting market development. Our integrated platform is an innovative product tailored to implement bill management, payments, airtime recharge, domestic money transfers, international remittances, and various other Mobile Financial Services technologies all on a mobile device.

Telecom Products and Solutions:

Adoption of the smart phone has created an unprecedented increase in the use of the mobile devices for financial transactions. This paradigm is changing the way people receive financial services across the globe. MFS are part of a long-term strategy for telecom operators worldwide to enhance their relationship with their subscribers and increase Average Revenue Per User (" ARPU "). For telcos with predominantly prepaid customer bases, we assist them in significantly increasing their enterprise value, as we effectively convert pre-paid subscribers in to post-paid subscribers. We have commenced operations with our first products designed and ready for sale and/or implementation.

SmartWallet

Our smartWallet enables telecom companies to integrate mobile financial services with their existing custom telecom product offerings, provide customized services to their subscribers, increase ARPU and reduce customer churn. Our secure platform is integrated with the telco's billing system which enhances customer experience, and optimize efficiencies. Our smartWallet is built with bank and carrier grade security in its core architecture.

Our smartWallet is specifically designed for telecom operators, mobile network operators and mobile virtual network operators. As subscribers increasingly adopt smartphones, telcos need to ensure that they are up to speed by providing customers with an efficient and convenient platform to manage their financial transactions. Our solutions empower subscribers of telecoms to make mobile payments, mobile top ups and mobile remittances globally.

The smartWallet is a simple and convenient mobile solution for prepaid and post-paid telecom service subscribers to load money via multiple payment methods such as credit card, debit, PayPal, automated clearing house and even cash. SmartWallet integrates with all methods supported by a telco's current billing platform. Once an account has been loaded, subscribers can dedicate amounts for various services such as money remittances, air-time top-ups, long distance calling and any other telecom services offered by the telco.

5

SmartBill

Our mobile telecom account management solution (" smartBill ") is designed to integrate with a telecom's existing electronic bill presentment and payment (" EBPP ") system, or be a standalone mobile customer self-care application directly connected to the telecom's in-house or third party billing platform – increasing the level of convenience for both telecoms and their subscribers.

SmartBill reduces postage and production expenses, provides automated and instant delivery and access to account information and payment methods which accelerates a telecom's cash-flow and lowers their customer service costs. We understand the critical component of the business of telecoms is to provide their customers with quick and accurate answers to their billing concerns, and that on-the-go mobile access to their accounts lowers customer service calls. The smartBill solution is the quickest, most affordable and user friendly approach to managing telecom bills and services all on one single platform.

SmartRemit

We also offer fully integrated platform (" smartRemit ") that is dedicated to providing the most convenient, efficient globally scalable and inexpensive mobile money remittance solution so telecom subscriber customers can send money to their friends and family worldwide. We are in final stages of negotiations with a partner agent network that is spread across 150 countries on five different continents with over 170,000 agent locations.

SmartRemit makes money transfers simple, removing all the barriers of traditional global remittances. Our state of the art smartRemit solution is a cost effective and easy to integrate platform that does not require telecom companies to have bank licensing requirements. smartRemit will leverage a T1 licensed global leader in money remittances to ensure all compliance and regulatory requirement are met plus provides service in up to 30 countries with over 30,000 agent locations and growing.

Our potential partner is a T1 licensed money transfer company that has ongoing relationships with prestigious banking and non-banking organizations providing presence and complementary services in many parts of the world. They are licensed to provide remittances services in 42 US states plus Mexico and Canada.

With just a tap and a few swipes on a smart phone from telecom subscribers, they can choose their beneficiaries' currency, amount to be transferred and format of delivery such as bank account, agent location or even home delivery.

SmartCharge

SmartCharge is a fast, convenient and reliable solution enabling the transfer of small amounts of value in the form of prepaid mobile credits – the ideal low cost, high value complement to cash remittances. SmartCharge is a global remittance platform that connects mobile operators' systems to deliver international top-up or recharge services.

With a global reach over the five continents, smartCharge is involved with in international prepaid airtime top ups. Through our account with Fixed & Mobile Private Limited, operating as Transfer-To, a telecommunications company incorporated under the laws of Singapore, we can enable real time prepaid recharge transfers to over 250 partner mobile network operators in 90 countries, reaching 3.6 billion prepaid users.

Our account with Transfer-To allows us to purchase mobile minutes at wholesale prices from Transfer-To and to re-sell these minutes to our telecom-clients at retail prices. Our account with Transfer-To is subject to none specific terms of use.

We support multiple payment channels enabling phone to phone, point of sale to phone and web to phone top-up transfers. Through smartCharge telecom customer subscribers can easily send airtime minutes to their relatives and friends anywhere in the world.

6

SmartPay

smartPay is a further services provided out of the smartWallet, that allows users to pay bills from merchants including utility bills, mobile phone bills, credit card bills etc. across the United States. We will partner with a provider that will be able to provide bill payments to over 14,000 merchants within the United States.

smartPay allows users a quick and easy way to pay their bills direct from their mobile, without the need for mailing checks or visiting banks.

Payment Products and Solutions:

Additionally we offer accessible, convenient and powerful for both merchants and consumers. Our business has a global leading mobile commerce platform that enables merchant customers to offer secure and convenient non-near field communication payment solutions. With our revolutionary mobile commerce technologies, merchants are able to provide enhanced purchasing experiences to their consumers. We have commenced operations with our first products designed and ready for sale and/or implementation.

We have implemented revolutionary mobile commerce solutions that cater to the needs of merchants and consumers alike both online and in-store. Our mobile services platform makes it easier for consumers to perform mobile transactions through a secure, bank grade mobile interface anytime, anyplace. Our attention to detailed user experience makes payments simple, convenient and safe. Our carefully chosen features provide unparalleled quality to our customers, partners and business associates across the world.

Our mobile commerce solution is has the advantages of;

| · | a custom branded wallet; |

| · | deepening customer relationships and loyalty; |

| · | launching new products and services via mobile; |

| · | attracting new customers and increase sales; |

| · | reducing customer payment-processing costs; |

| · | interoperability; and |

| · | reducing fraud and increase customers' security. |

With our mWallet, mPay and mPos solutions we address the needs of merchants worldwide.

mPOS

With our mobile point of sale product (" mPOS ") we allow merchant customers to shift their cashiers out from behind a register and into the storefront. Our mPOS leverages the merchant's most valuable assets – their employees. Cashiers are empowered to act as in-store sales associates with a mobile device to connect with shoppers and provide them with detailed product information, real-time pricing and inventory data and provide a higher level of customer service.

The interactive and fully integrated solution offers powerful selling tools, including cross-sells, up-sells and individual shopper history to increase average cart size. mPOS ensures a more personalized and interactive in-store experience to drive higher conversion rates while decreasing both the number of registers needed and the time shoppers spend in line.

7

mPay

mPay is designed to transform the in-store customer experience using the most convenient device for payment- their mobile device. mPay accelerates a merchant's customer's shopping process by turning their smartphones into a self check out device. The customer's mobile device is the ubiquitous point of access to converge data and metrics of online and retail shopping from both ecommerce and in-store technologies. The mPay solution allows consumers to engage and transact with merchants in-store and complete a self-checkout process. mPay is designed to transform the in-store customer experience using the most convenient device for payment- their mobile device.

mWallet

With mWallet, merchant customers can securely store credit cards, offers, and loyalty points on their phones specific to merchant brands ensuring a safe, secure and scalable platform for merchants to implement their mobile payment strategy.

The mWallet solution can be implemented by merchants to enable mobile shopping and ordering for their customers. As more and more retail shopping is shifting to mobile, the mWallet solution ensures a safe, secure and scalable platform for merchants to implement their mobile payment strategy.

Mobile Banking Products and Solutions:

On March 26, 2012, Telupay PLC entered into a five-year License Agreement with Baccarat Overseas, Ltd. (" Baccarat ") for the latter's use and distribution of the mobile banking and payment software owned by Telupay PLC. A License Assignment Agreement between Priveco and Baccarat Overseas Ltd. dated August 21, 2012 assigned the license from the License Agreement to Priveco, which made up part of the asset purchase by us.

Our mobile banking services (" MBS ") technology is a secure, robust method of delivering bank-grade transactions via an intuitive interface on mobile devices. Our MBS technology is not tied to proprietary bank or operator technologies, which gives it the ability to provide its service to all of the major banks, mobile operators, and agent networks worldwide. Highlights of our MBS business development include strong progress in Philippine business where three top ten banks and one of two interbank networks are now using our MBS platform, including Metrobank, Union Bank, United Coconut Planters Bank, and MegaLink, an interbank network servicing 17 national banks in the Philippines.

Markets and Market Penetration

Market Size

According to the World Bank, the total money transfer market was $965 billion in 2012. Worldwide mobile payment transaction value is forecast to surpass $235 billion in 2013. With 215 million people living outside their country of origin, migrants would form the 5th largest country. Additionally, the mobile bill payment value is to grow by 44% by 2014. The global mobile transaction market is expected to be $617 billion with 448 million users by 2016.

With smartCharge, we can potentially reach the 3.6 billion prepaid mobile phone users of the 250 partner mobile network operators in 90 countries, which would include 70-100% coverage in emerging countries, 50 billion air-time top ups transacted annually, and $20 billion in commission fees (estimated total market $100b). Marketing and engagement integrate sms messaging alerts and create mobile campaigns and promotions to increase revenues and conversions.

Our potential smartRemit partner network is spread across 150 countries with over 170,000 agent locations. We are in final negotiations for an official agreement for the integration of our products with this network.

8

Within the USA, according to the 2011 FDIC National Survey, 20.1% of households were deemed underserved or not served by the current banking infrastructure and we believe that these individuals would be an ideal target market for the Mobetize smartWallet.

Further, Priveco entered into a partnership agreement with Alligato and Optimal Payments PLC ("Optimal") on August 11, 2011. Pursuant to this partnership agreement, Optimal has been provided with a license of Priveco's online and mobile commerce platform provider for payment service providers and banks. As part of the asset and purchase agreement that closed on September 4, 2013, all title, interests and rights of Priveco under the partnership agreement were assigned to us.

Optimal Payments is a global provider of online and mobile payment processing services to thousands of merchants and millions of consumers, who move billions of US dollars per year securely in and through over 200 countries and territories with over 100 types of payment and multi-currency options. Optimal is publicly traded company (LSE: OPAY) with approximately 350 employees and maintains offices and data centres in both North America and the UK. Optimal's payments solution was chosen by Espacejeux.com to provide online payments processing, fraud and risk management services for its online gaming activities. Espacejeux.com is run by Société d'exploitation des loteries et courses du Québec ("Loto-Québec").

In early 2012 and in connection with the partnership agreement that was assigned to us, Optimal introduced our mobile-enabled payments solution to enable Loto Québec's customers to play – and pay – while on the move. Our mobile-enabled payment solution allows Loto Québec's users to top up their accounts via a mobile device.

There is a large market for our remittance product and the market has only grown. Remittances are playing an increasingly large role in the economies of many countries, and we plan to focus our activities in the markets which present the largest opportunities.

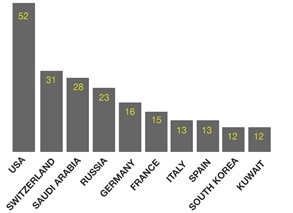

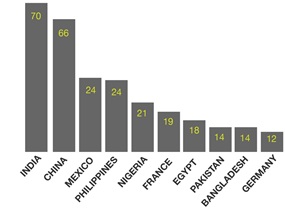

Statistics on the global remittance market by country:

Top 10 Send Countries US Billion Dollars:

| Top 10 Receiving Countries US Billion Dollars:

|

Market Segments and Competitive Landscape

We are subject to all the typical global remittance market barriers to entry which include:

| • | Infrastructure; |

| • | Regulations; |

| • | Licenses; |

| • | Security; |

| • | Liquidity of the agents; |

| • | Multi currency settlement; and |

| • | Cash in & cash out networks. |

9

Security and compliance are first and foremost. The customers are ensured the safe handling of cardholder information at every step of the way. What makes our technology a highly reliable and secure platform is that it is supported by the PCI Data Security Standard. The PCI Security Standards Council offers this comprehensive standard to ensure the highest security during card data process. The context includes prevention, detection and appropriate reaction to security incidents.

We also fully support OWASP, an international open community dedicated to maintaining the safety and security of software and applications. Our systems are "bank-grade" utilizing recent industry encryption technologies.

Material Contracts

On July 15, 2013, our company entered into a consulting agreement with Stephen Fowler. Pursuant to the agreement, Mr. Fowler will provide us with advice regarding matters of our strategic plans, operations and finances. In exchange for the service Mr. Fowler is providing us, we will compensate him $8,750 per month and an office allowance of $250 per month until the end of the term of the agreement on April 1, 2015.

Pursuant to the asset purchase and sale agreement, we were assigned the rights to two management services agreements entered into by Priveco. One management services contract was entered into with Alligato Inc. ("Alligato") whereby Alligato would provide the following services until May 31, 2014 and which has been further extended with one months rolling notice:

• VP, Engineering;

• Solutions Architecture;

• VP, Operations;

• Senior Java Engineer;

• Senior HTML 5 Web Developer

• Network Infrastructure and System Administration;

• Senior Project Management; and

• Financial/Business forecasting analysis.

In exchange for these services, Priveco agreed to compensate Alligato at a rate of $44.25 per hour of work.

The second management services agreement that was assigned to us was entered into with 0853574 BC Ltd. This agreement provided that 0853574 BC Ltd. would provide management services in a capacity of Principal Executive Officer until May 31, 2014. For these services, 0853574 BC Ltd. is compensated $6,000 per month. Ajay Hans serves as our Principal Executive Officer under this agreement.

On March 26, 2012, Telupay PLC entered into a five-year license agreement with Baccarat Overseas, Ltd. (" Baccarat ") whereby Baccarat could use and distribute of the mobile banking and payment software developed and owned by Telupay PLC.

All title, interests and rights of Baccarat under the License Assignment Agreement with Telupay PLC were assigned to Priveco under an assignment agreement on August 21, 2012.

As part of the asset and purchase agreement entered into on July 9, 2013, all title, interests and rights of Priveco under the assignment agreement (assigning the License Assignment Agreement between Baccarat and Telupay PLC to Priveco) were assigned to us.

On September 23, 2013 we signed a consulting agreements with Tanuki Business Consulting Inc. under which Tanuki Business Consulting Inc. will provide consulting and management services and will be compensated at the rate of $80 per hour. Chris Convey serves as our Chief Financial Officer under this agreement.

10

On October 1, 2013 we entered into an agreement with Hugo Cuevas-Mohr. Pursuant to this agreement, Mr. Cuevas-Mohr agreed to serve as a consultant as an expert in the field of money remittance and payment processing. The agreement is for six months. As compensation, we agreed to pay Mr. Cuevas-Mohr a fee of $150 per hour with a minimum of 20 hours of work to be performed per quarter. Additionally, the compensation to Mr. Cuevas-Mohr will be paid 50% in cash and 50% in unregistered common shares of our company. The shares issued to Mr. Cuevas-Mohr will have a deemed value of the then market price of our shares on the date of share issuance.

On November 13, 2013 we entered into an agreement with Institutional Marketing Services, Inc. ("IMS"). Pursuant to this agreement, IMS will provide our company with investor relations services. The term of the agreement is until March 31, 2014 and will then continue on a month to month basis. As compensation for such services, we agreed to pay IMS a monthly retainer fee of $6,000 per month. In connection with the agreement, we agreed to issue Mr. John G. Nesbett an aggregate of 60,000 unregistered common shares of our company (to be issued in four equal installments of 15,000 common shares on December 15, 2013, November 15, 2014, May 15, 2015 and November 15, 2015).

Intellectual Property

We assert common law trademark rights for the following names in the field of mobile commerce:

| · | smartBill; |

| · | smartRemit; |

| · | smartCharge; |

| · | smartWallet; |

| · | mPOS; |

| · | mPay; and |

| · | mWallet. |

Common law trademark rights are enforceable in provincial courts in Canada, and may be asserted against those who appropriate, dilute or damage the goodwill of our business by using the same or similar trade-names or trademarks. Unlike statutory trademark rights, which are acquired by registration and provide nation-wide protection, common law trademark rights are acquired automatically and provide protection only in the jurisdiction where a business uses a name or logo in commerce. We intend to rely on common law trademark protection until such time as we deem it economical for our business to register our trade-names or trademarks.

We have not registered for the protection of any rights under trademark, patent, or copyright in any jurisdiction.

Our logo:

Our internet site is located at www.mobetize.com .

11

Government Regulation

Our operations are subject to numerous federal, state and local laws and regulations in the United States and Canada in areas such as consumer protection, government contracts, trade, environmental protection, labor and employment, tax, licensing and others. For example, in the U.S., most states have consumer protection laws and regulations directed specifically toward our industry. In certain jurisdictions, we may have to obtain licenses or permits in order to comply with standards governing consumer protection.

The mobile commerce industry is also subject to requirements, codes and standards imposed by various insurance, approval and listing and standards organizations. Depending upon the type of commerce product and requirements of the applicable local governmental jurisdiction, adherence to the requirements, codes and standards of such organizations is mandatory in some instances and voluntary in others.

Amount Spent on Research and Development the Last Two Fiscal Years

Our company has spent $267,209 and $9,895 on research and development activities during the years ended March 31, 2014 and 2013 respectively. This work has been to build and enhance the Mobetize core platform which will allow us to offer smartWallet services to telcos as well as other services as previously outlined.

Employees and Employment Agreements

Other than our independent contractors, directors and officer who we have or have been assigned independent consulting agreements (details of which are given above), we have no full time employees.

Enforceability of Civil Liabilities Against Foreign Persons

It may be difficult to bring and enforce suits against our management in the United States, as they are citizens of Canada. Our company, however, is incorporated in the State of Nevada. Cash and our material contracts are our only assets.

12

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled "Special Note Regarding Forward Looking Statements" above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

The statements contained in or incorporated into this annual report on Form 10-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations and, as of March 31, 2014 we have an accumulated deficit of $1,246,468. We have not yet generated significant recurring revenues and may not do so in the near future. Our profitability will require the successful commercialization and sales of our products and planned products. We may not be able to successfully achieve any of these requirements or ever become profitable.

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the year ended March 31, 2014 with respect to their doubt about our ability to continue as a going concern. As discussed in Note 1 to the financial statements attached in section 8, we have generated operating losses since inception, and our cash resources may be insufficient to meet planned business objectives, which together raises doubt about our ability to continue as a going concern.

Our inability to complete our future research and development and engineering projects in a timely manner could have a material adverse effect of our results of operations, financial condition and cash flows.

If our research and development projects are not completed in a timely fashion we could experience:

| · | substantial additional cost to obtain a marketable product; |

| · | additional competition resulting from competitors in the surveillance and facial recognition market; and |

| · | delay in obtaining future inflow of cash from financing or partnership activities. |

13

We could face intense competition, which could result in lower revenues and higher research and development expenditures and could adversely affect our results of operations.

Unless we keep pace with changing technologies, we could lose existing customers and fail to win new customers. In order to compete effectively in providing mobile commerce solutions for telecom operators and payment service providers, we must continually design, develop and market new and enhanced technologies. Our future success will depend, in part, upon our ability to address the changing and sophisticated needs of the marketplace. Mobile commerce solution technologies have not achieved widespread commercial acceptance and our strategy of expanding our mobile commerce solution business could adversely affect our business operations and financial condition.

The market for our solutions is still developing and if the industry adopts test criteria that are different from our internal test criteria our competitive position would be negatively affected. Our plan to pursue sales in international markets may be limited by risks related to conditions in such markets.

Significant parts of our company's business plan are dependent on business relationships with various parties

We rely on several key suppliers to provide the underlying transactional completion and compliance infrastructure necessary for us to offer our products for sale in the market. If these suppliers were to cease providing services to us, we would be forced to seek alternative options which could delay or prohibit our execution of our current business plan.

We also expect to rely in part upon distribution partners to sell and install our products, and we may be adversely affected if those parties do not actively promote their products or pursue installations that use our software. Further, if our software is not timely delivered or does not perform as promised, we could experience increased costs, lower margins, liquidated damage payment obligations and reputational harm.

We are governed by only two people, Stephen Fowler and Ajay Hans, which may lead to faulty corporate governance.

We have only two people, Stephen Fowler and Ajay Hans, serving as directors who make all the decisions regarding corporate governance and they also have full control over matters that require Board of Directors approval. This includes their respective (executive) compensations, accounting overview, related party transactions and so on. This may introduce conflicts of interest and prevent the segregation of executive duties from those that require Board of Directors approval. This may lead to ineffective disclosure and accounting controls. Noncompliance with laws and regulations may result in fines and penalties. They will have the ability to take any action as they review themselves and approve them. They will exercise control over all matters requiring shareholder approval including significant corporate transactions. We have not implemented various corporate governance measures nor have we adopted any independent committees, as we presently do not have any independent directors.

Stephen Fowler and Ajay Hans are also executive officers of our company along with Chris Convey and as such, between themselves they also control the executive functions of our company.

We must attract and maintain key personnel or our business will fail.

Success depends on the acquisition of key personnel. We will have to compete with other companies both within and outside the mobile commerce solutions industry to recruit and retain competent employees. If we cannot maintain qualified employees to meet the needs of our anticipated growth, this could have a material adverse effect on our business and financial condition.

14

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate requiring significant capital to fulfill our contractual obligations (as noted in the audited financial statements), continue development of our planned products to meet market evolution, and execute our business plan, generally. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favourable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled professionals and adequate funds in a timely manner.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have not achieved revenues and have limited significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. We have a limited operating history and must be considered in the development stage. Our success is in part dependent on the successful research and development of our planned products, which cannot be guaranteed. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to complete the research and development of our products and operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

We are affected by certain law and governmental regulations which could affect international distribution of our products.

The digital contents and services that are the actual object of in mobile commerce are regulated by regionally valid legislation, including electronic commerce legislation, privacy protection, and regulations concerning harmful and criminal contents. All these are factors that make the mobile commerce market fragmented.

In the United States, some electronic commerce activities are regulated by the Federal Trade Commission (the " FTC "). These activities include the use of commercial e-mails, online advertising and consumer privacy . Using its authority under Section 5 of the Federal Trade Commission Act , which prohibits unfair or deceptive practices, the FTC has brought a number of cases to enforce the promises in corporate privacy statements, including promises about the security of consumers' personal information. As result, any corporate privacy policy related to e-commerce activity may be subject to enforcement by the FTC.

15

Internationally there is the International Consumer Protection and Enforcement Network (" ICPEN "), which was formed in 1991 from an informal network of government customer fair trade organisations. The purpose was stated as being to find ways of co-operating on tackling consumer problems connected with cross-border transactions in both goods and services, and to help ensure exchanges of information among the participants for mutual benefit and understanding. From this came E-consumer, as an initiative of ICPEN since April 2001. www.econsumer.gov is a portal to report complaints about online and related transactions with foreign companies.

There is also Asia Pacific Economic Cooperation (" APEC ") was established in 1989 with the vision of achieving stability, security and prosperity for the region through free and open trade and investment. APEC has an Electronic Commerce Steering Group as well as working on common privacy regulations throughout the APEC region.

In addition, future government regulations concerning mobile commerce solutions and payment service issues could have an adverse effect on market acceptance or cause time delays or additional costs to meet requirements.

If we are not able to adequately protect our intellectual property, then we may not be able to compete effectively and we may not be profitable.

Our commercial success may depend, in part, on obtaining and maintaining patent protection, trade secret protection and regulatory protection of our technologies and product candidates as well as successfully defending third-party challenges to such technologies and candidates. We will be able to protect our technologies and product candidates from use by third parties only to the extent that valid and enforceable patents, trade secrets or regulatory protection cover them and we have exclusive rights to use them. The ability of our licensors, collaborators and suppliers to maintain their patent rights against third-party challenges to their validity, scope or enforceability will also play an important role in determining our future.

The copyright and patent positions of software and technology related companies can be highly uncertain and involve complex legal and factual questions that include unresolved principles and issues. No consistent policy regarding the breadth of claims allowed regarding such companies' patents has emerged to date in the United States, and the patent situation outside the United States is even more uncertain. Changes in either the patent laws or in interpretations of patent laws in the United States or other countries may diminish the value of our intellectual property. Accordingly, we cannot predict with any certainty the range of claims that may be allowed or enforced concerning our patents.

We may also rely on trade secrets to protect our technologies, especially where we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. While we seek to protect confidential information, in part, through confidentiality agreements with our consultants and scientific and other advisors, they may unintentionally or wilfully disclose our information to competitors. Enforcing a claim against a third party related to the illegal acquisition and use of trade secrets can be expensive and time consuming, and the outcome is often unpredictable. If we are not able to maintain patent or trade secret protection on our technologies and product candidates, then we may not be able to exclude competitors from developing or marketing competing products, and we may not be able to operate profitability.

16

If we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could cause us to go out of business.

There has been, and we believe that there will continue to be, significant litigation and demands for licenses in our industry regarding patent and other intellectual property rights. Although we anticipate having a valid defense to any allegation that our current products, production methods and other activities infringe the valid and enforceable intellectual property rights of any third parties, we cannot be certain that a third party will not challenge our position in the future. Other parties may own patent rights that we might infringe with our products or other activities, and our competitors or other patent holders may assert that our products and the methods we employ are covered by their patents. These parties could bring claims against us that would cause us to incur substantial litigation expenses and, if successful, may require us to pay substantial damages. Some of our potential competitors may be better able to sustain the costs of complex patent litigation, and depending on the circumstances, we could be forced to stop or delay our research, development, manufacturing or sales activities. Any of these costs could cause us to go out of business.

We could lose our competitive advantages if we are not able to protect any proprietary technology and intellectual property rights against infringement, and any related litigation could be time-consuming and costly.

Our success and ability to compete depends to a significant degree on our proprietary technology and processes incorporated in our products. We have not taken any legally enforceable action to protect our proprietary technology and processes and are treating our algorithms, crucial to the development of our business, as trade secrets. If any of our competitor's copies or otherwise gains access to our proprietary technology or develops similar technologies independently, we would not be able to compete as effectively.

We also consider our trademarks invaluable to our ability to continue to develop and maintain the goodwill and recognition associated with our brand. We have not registered various trademarks in the United States. Any other measures that we may take to protect our intellectual property rights, which presently are based upon a combination of copyright, trade secret and trademark laws, may not be adequate to prevent their unauthorized use.

Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding any rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights, including claims based upon the content we license from third parties or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate, divert our attention and resources, result in the loss of goodwill associated with our service marks or require us to make changes to our website or other of our technologies.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the commercialization of our products and software technology, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

17

Our services may become obsolete and unmarketable if we are unable to respond adequately to rapidly changing technology and customer demands.

Our industry is characterized by rapid changes in technology and customer demands. As a result, our products and software may quickly become obsolete and unmarketable. Our future success will depend on our ability to adapt to technological advances, anticipate customer demands, develop new products and enhance our current products on a timely and cost-effective basis. Further, our products and software must remain competitive with those of other companies with substantially greater resources. We may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products and software or enhanced versions of existing products. Also, we may not be able to adapt new or enhanced services to emerging industry standards, and our new products and software may not be favourably received.

Risks Relating to Ownership of Our Securities

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the Over-the-counter Bulletin Board quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

| · | variations in our operating results; |

| · | changes in expectations of our future financial performance, including financial estimates by securities analysts and investors; |

| · | changes in operating and stock price performance of other companies in our industry; |

| · | additions or departures of key personnel; and |

| · | future sales of our common stock. |

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

Our common stock has only recently been approved for trading on the OTCQB. As such, we cannot predict the extent to which an active public market for trading our common stock will be sustained. Although the trading volume of our common shares increased significantly recently, it has historically been sporadically or "thinly-traded," meaning that the number of persons interested in purchasing our common shares at or near bid prices at certain given time may be relatively small or non-existent. Only very recently, beginning on October 8, 2013 have there been any trades in our common stock on the OTCQB.

18

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stockbrokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and mark-ups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behaviour of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

If we are listed on the Over-the-Counter Market QB quotation system, our common stock is subject to "penny stock" rules which could negatively impact our liquidity and our shareholders' ability to sell their shares.

Our common stock is currently quoted on the Over-the-counter Markets QB marketplace. We must comply with numerous NASDAQ Marketplace rules in order to maintain the listing of our common stock on the OTCQB. There can be no assurance that we can continue to meet the requirements to maintain the quotation on the OTCQB listing of our common stock. If we are unable to maintain our listing on the OTCQB, the market liquidity of our common stock may be severely limited.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources.

19

An elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains a specific provision that indemnifies the liability of our directors and officers for monetary damages to our company and shareholders .We are prepared to give such indemnification to our directors and officers to the fullest extent provided for by Nevada law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

Our business will incur increased costs and compliance risks as a result of becoming a public company.

As a public company, we will incur significant legal, accounting and other expenses that Priveco did not incur as a private company prior to the private placement financing and asset purchase and sale.

We will incur costs associated with our public company reporting requirements. We also anticipate that we will incur costs associated with recently adopted corporate governance requirements, including certain requirements under the Sarbanes-Oxley Act of 2002, as well as new rules implemented by the SEC and FINRA. We expect these rules and regulations, in particular Section 404 of the Sarbanes-Oxley Act of 2002, to significantly increase our legal and financial compliance costs and to make some activities more time-consuming and costly. Like many smaller public companies, we face a significant impact from required compliance with Section 404 of the Sarbanes-Oxley Act of 2002. Section 404 requires management of public companies to evaluate the effectiveness of internal control over financial reporting. The SEC has adopted rules implementing Section 404 for public companies as well as disclosure requirements. We are currently preparing for compliance with Section 404; however, there can be no assurance that we will be able to effectively meet all of the requirements of Section 404 as currently known to us in the currently mandated timeframe. Any failure to implement effectively new or improved internal controls, or to resolve difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet reporting obligations or result in management being required to give a qualified assessment of our internal controls over financial reporting. Any such result could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

20

We also expect these new rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our Board of Directors or as executive officers. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

We are an "emerging growth company" under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. We will remain an "emerging growth company" for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30.

Because we have elected to use the extended transition period for complying with new or revised accounting standards for an "emerging growth company" our financial statements may not be comparable to companies that comply with public company effective dates.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates. Consequently, our financial statements may not be comparable to companies that comply with public company effective dates. Because our financial statements may not be comparable to companies that comply with public company effective dates, investors may have difficulty evaluating or comparing our business, performance or prospects in comparison to other public companies, which may have a negative impact on the value and liquidity of our common stock.

Item 1B. Unresolved Staff Comments

As a "smaller reporting company", we are not required to provide the information required by this Item.

Item 2. Properties

Our principal executive offices are located at 8150 Birch Bay Square Street, Suite 205, Blaine WA 98230. Our telephone number is (206) 347-4515. We pay rent of approximately $ 30 per month for the use of this space.

21

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock is not traded on any exchange. Our common stock is quoted on the OTCQB under the trading symbol MPAY". OTC Markets securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Markets securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a national or regional stock exchange.

The following quotations, obtained from Yahoo Finance, reflect the high and low bids for our common shares based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. The first trade of our shares was on October 8, 2013.

OTC MARKETS QB 1) | ||

Quarter Ended | High | Low |

March 31, 2014 | $1.50 | $1.15 |

December 31, 2013 | $1.85 | $1.00 |

September 30, 2013 | n/a | n/a |

(1) | Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, markdown or commission, and may not represent actual transactions. |

As March 31, 2014, we have 53 shareholders of record. As of such date, 28,364,200 shares of our common stock were issued and outstanding.

Our transfer agent is Island Stock Transfer, 15500 Roosevelt Boulevard, Suite 301, Clearwater, Florida 33760; telephone number 727-289-0010; facsimile number 727-289-0069

Dividends

We have never declared or paid any cash dividends on our common stock. For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock.

22

Recent Sales of Unregistered Securities; Use of Proceeds From Registered Securities

On June 25, 2014 our company closed a private placement under which it sold 1,122,831 investment units for gross proceeds of approximately $842,123. Each investment unit consisted of one common share of our company's stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for two years from issue. $58,500 financing fees are payable in cash associated with this private placement and 113,500 financing warrants will be issued on the same terms as those in the investment units. US resident subscribers in this placement fall under category 2, 3 and 8 exemptions. Canadian resident subscribers to this placement fall under category 1 (j) and (k) exemptions.

Equity Compensation Plans

On January 27, 2014, our directors approved the adoption of our 2014 Stock Option Plan which permits our company to grant up to 3,000,000 options to acquire shares of common stock, to directors, officers, employees and consultants of our company. We do not have in effect any other compensation plans under which our equity securities are authorized for issuance.

Awards under our 2014 Stock Option Plan will vest as determined by our board of directors and as established in stock option agreements to be entered into between our company and each participant receiving an award.

Convertible Securities

As of March 31, 2014, we have 5,500 stock options outstanding. These stock options have an exercise price of $1.00 per share and expire on November 26, 2014.

As of March 31, 2014 we have 500,000 share purchase warrants outstanding. These share purchase warrants have an exercise price of $0.50 per share and expire on September 3, 2015.

Compliance with Section 16(A) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of our shares of common stock and other equity securities, on Forms 3, 4 and 5, respectively. Executive officers, directors and greater than 10% shareholders are required by the SEC regulations to furnish us with copies of all Section 16(a) reports they file.

Based solely on our review of the copies of such forms received by us, or written representations from certain reporting persons, we believe that during fiscal year ended March 31, 2014, all filing requirements applicable to our officers, directors and greater than 10% percent beneficial owners were complied with.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

There were no shares of common stock or other securities issued to or purchased by our company or affiliated purchasers during the year ended March 31, 2014.

Item 6. Selected Financial Data

As a smaller reporting company we are not required to provide this information.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

23

PRELIMINARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The following discussion should be read in conjunction with our financial statements, which are included elsewhere in this Form 10-K (the "Report"). This Report contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In evaluating these statements, you should consider various factors which may cause our actual results to differ materially from any forward-looking statements. Although we believe that the predictions reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

We are considered a development stage company. Our auditors have issued a going concern opinion on the financial statements for the year ended March 31, 2014.

24

RESULTS OF OPERATION

Operating Revenues, Operating Expenses and Net Loss

US$ | ||||||||

Year Ended | ||||||||

March 31, | ||||||||

2014 | 2013 | |||||||

Revenues | $ | 196,567 | $ | - | ||||

Operating Expenses | 2,403,656 | 191,239 | ||||||

Net Loss from Operations | (2,207,089 | ) | (191,239 | ) | ||||

Net Income/(Loss) | (1,049,869 | ) | (182,891 | ) | ||||

Our company generated $196,567 of revenue in the year ended March 31, 2014 compared to revenues of $nil during the same period in 2013. All revenues are currently generated through m-commerce services provided in line with the contracts acquired by Mobetize from Alligato Inc. Our company expects to generate further revenue in the next 12 months as Mobile Money services are deployed.