UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: October 31, 2015

[ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_______to_______

Commission file number 000-52055

RED METAL RESOURCES LTD.

(Exact name of small business issuer as specified in its charter)

Nevada (State or other jurisdiction of incorporation or organization) | 20-2138504 (I.R.S. Employer Identification No.) |

1158 Russell Street, Unit D, Thunder Bay, ON P7B 5N2

(Address of principal executive offices) (Zip Code)

(807) 345-7384

(Issuer's telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filed," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [ ] | Accelerated filer | [ ] |

Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. As of December 14, 2015, the number of shares of the registrant's common stock outstanding was 33,456,969.

Table of Contents

PART I - FINANCIAL INFORMATION | F-1 |

Item 1. Financial Statements. | F-1 |

Consolidated Balance Sheets | F-1 |

Consolidated Statements of Operations | F-2 |

Consolidated Statement of Stockholders' Deficit | F-3 |

Consolidated Statements of Cash Flows | F-4 |

Notes to the Interim Consolidated Financial Statements | F-5 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations. | 1 |

Item 3. Quantitative and Qualitative Disclosures about Market Risk. | 13 |

Item 4. Controls and Procedures. | 13 |

PART II - OTHER INFORMATION | 13 |

Item 1. Legal Proceedings. | 13 |

Item 1a. Risk Factors. | 13 |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds. | 13 |

Item 3. Defaults upon Senior Securities. | 13 |

Item 4. Mine Safety Disclosures. | 13 |

Item 5. Other Information. | 13 |

Item 6. Exhibits. | 14 |

SIGNATURES | 15 |

ii

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

RED METAL RESOURCES LTD.

CONSOLIDATED BALANCE SHEETS

| October 31, 2015 |

| January 31, 2015 | ||

| (unaudited) |

|

| ||

ASSETS |

|

|

| ||

Current assets |

|

|

| ||

|

|

|

| ||

Cash | $ | - |

| $ | 4,440 |

Prepaids and other receivables |

| 3,095 |

|

| 670 |

Total current assets |

| 3,095 |

|

| 5,110 |

|

|

|

|

|

|

Equipment |

| 3,470 |

|

| 4,775 |

Unproved mineral properties |

| 643,989 |

|

| 640,653 |

Total assets | $ | 650,554 |

| $ | 650,538 |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

Bank indebtedness | $ | 540 |

| $ | - |

Accounts payable |

| 350,321 |

|

| 340,037 |

Accrued liabilities |

| 176,029 |

|

| 164,263 |

Due to related parties |

| 934,030 |

|

| 892,495 |

Notes payable |

| 17,086 |

|

| - |

Notes payable to related parties |

| 685,861 |

|

| 489,809 |

Total liabilities |

| 2,163,867 |

|

| 1,886,604 |

|

|

|

|

|

|

Stockholders' deficit |

|

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, authorized 500,000,000 |

|

|

|

|

|

33,456,969 issued and outstanding at October 31, 2015 and January 31, 2015 |

| 33,457 |

|

| 33,457 |

Additional paid in capital |

| 6,730,380 |

|

| 6,730,380 |

Deficit |

| (8,279,799) |

|

| (8,013,633) |

Accumulated other comprehensive income |

| 2,649 |

|

| 13,730 |

Total stockholders' deficit |

| (1,513,313) |

|

| (1,236,066) |

Total liabilities and stockholders' deficit | $ | 650,554 |

| $ | 650,538 |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-1

RED METAL RESOURCES LTD.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

| Three Months Ended |

| Nine Months Ended | ||||||

|

| October 31, |

| October 31, | ||||||

|

| 2015 | 2014 |

| 2015 | 2014 | ||||

|

|

|

|

|

|

| ||||

Operating expenses |

|

|

|

|

|

| ||||

Administration |

| $ | 13,855 | $ | 12,457 |

| $ | 37,450 | $ | 38,103 |

Advertising and promotion |

|

| 416 |

| 2,732 |

|

| 5,941 |

| 15,499 |

Amortization |

|

| 282 |

| 580 |

|

| 975 |

| 1,862 |

Automobile |

|

| 229 |

| 1,003 |

|

| (1,356) |

| 3,448 |

Bank charges |

|

| 1,048 |

| 1,574 |

|

| 4,996 |

| 3,237 |

Consulting fees |

|

| 30,000 |

| 31,862 |

|

| 90,000 |

| 97,379 |

Interest on current debt |

|

| 20,657 |

| 17,503 |

|

| 60,678 |

| 49,028 |

IVA expense |

|

| (262) |

| 69 |

|

| (1,535) |

| (8) |

Mineral exploration costs |

|

| 2,729 |

| 4,501 |

|

| 12,378 |

| 14,635 |

Office |

|

| 2,338 |

| 2,757 |

|

| 7,212 |

| 8,386 |

Professional fees |

|

| 4,004 |

| 4,009 |

|

| 13,670 |

| 13,262 |

Rent |

|

| 2,388 |

| 2,797 |

|

| 7,659 |

| 8,732 |

Regulatory |

|

| 581 |

| 1,174 |

|

| 5,023 |

| 7,794 |

Travel and entertainment |

|

| 442 |

| 172 |

|

| 622 |

| 388 |

Salaries, wages and benefits |

|

| 11,129 |

| 12,078 |

|

| 37,491 |

| 36,864 |

Stock based compensation |

|

| - |

| - |

|

| - |

| 146,901 |

Foreign exchange gain |

|

| (420) |

| (441) |

|

| (1,333) |

| (177) |

Write-down of unproved mineral properties |

|

| - |

| - |

|

| 3,401 |

| 2,265 |

|

|

| (89,416) |

| (94,827) |

|

| (283,272) |

| (447,598) |

|

|

|

|

|

|

|

|

|

|

|

Other items |

|

|

|

|

|

|

|

|

|

|

Gain on mineral property option payment |

|

| - |

| - |

|

| - |

| 27,687 |

Recovery of mineral exploration costs |

|

| 4,140 |

| 3,002 |

|

| 17,106 |

| 9,019 |

Net loss |

|

| (85,276) |

| (91,825) |

|

| (266,166) |

| (410,892) |

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange translation |

|

| (8,720) |

| 35,896 |

|

| (11,081) |

| 26,860 |

Comprehensive loss |

| $ | (93,996) | $ | (55,929) |

| $ | (277,247) | $ | (384,032) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

| $ | (0.00) | $ | (0.00) |

| $ | (0.01) | $ | (0.01) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

outstanding - basic and diluted |

|

| 33,456,969 |

| 32,956,969 |

|

| 33,456,969 |

| 32,956,969 |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-2

RED METAL RESOURCES LTD.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' DEFICIT

(unaudited)

| Common Stock Issued |

| Accumulated |

| |||||||

|

|

| Additional |

| Other |

| |||||

| Number of |

| Paid-in | Accumulated | Comprehensive |

| |||||

| Shares | Amount | Capital | Deficit | Income / (Loss) | Total | |||||

|

|

|

|

|

|

| |||||

Balance at January 31, 2014 | 32,956,969 | $ | 32,957 | $ | 6,563,101 | $ | (7,481,121) | $ | 52,003 | $ | (833,060) |

|

|

|

|

|

|

|

|

|

|

|

|

Stock options | - |

| - |

| 146,901 |

| - |

| - |

| 146,901 |

Net loss for the nine months ended October 31, 2014 | - |

| - |

| - |

| (410,892) |

| - |

| (410,892) |

Foreign exchange translation | - |

| - |

| - |

| - |

| 26,860 |

| 26,860 |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at October 31, 2014 | 32,956,969 |

| 32,957 |

| 6,710,002 |

| (7,892,013) |

| 78,863 |

| (1,070,191) |

|

|

|

|

|

|

|

|

|

|

|

|

Stock options | - |

| - |

| (4,122) |

| - |

| - |

| (4,122) |

Stock issued for property | 500,000 |

| 500 |

| 24,500 |

| - |

| - |

| 25,000 |

Net loss for the three months ended January 31, 2015 | - |

| - |

| - |

| (121,620) |

| - |

| (121,620) |

Foreign exchange translation | - |

| - |

| - |

| - |

| (65,133) |

| (65,133) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 31, 2015 | 33,456,969 |

| 33,457 |

| 6,730,380 |

| (8,013,633) |

| 13,730 |

| (1,236,066) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the nine months ended October 31, 2015 | - |

| - |

| - |

| (266,166) |

| - |

| (266,166) |

Foreign exchange translation | - |

| - |

| - |

| - |

| (11,081) |

| (11,081) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at October, 2015 | 33,456,969 | $ | 33,457 | $ | 6,730,380 | $ | (8,279,799) | $ | 2,649 | $ | (1,513,313) |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-3

RED METAL RESOURCES LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| For the Nine Months Ended | |||

| October 31, | |||

| 2015 | 2014 | ||

Cash flows used in operating activities: |

|

| ||

Net loss | $ | (266,166) | $ | (410,892) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

Amortization |

| 975 |

| 1,862 |

Gain on mineral property option payment |

| - |

| (27,687) |

Stock based compensation |

| - |

| 146,901 |

Write-down of unproved mineral properties |

| 3,401 |

| 2,265 |

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Prepaids and other receivables |

| (2,654) |

| (1,577) |

Accounts payable |

| 15,931 |

| 17,994 |

Accrued liabilities |

| 17,277 |

| 12,110 |

Due to related parties |

| 65,785 |

| 110,562 |

Notes payable to related parties |

| 37,756 |

| 23,586 |

|

|

|

|

|

Net cash used in operating activities |

| (127,695) |

| (124,876) |

|

|

|

|

|

Cash flows provided by (used in) investing activities: |

|

|

|

|

Option payments received on mineral properties |

| - |

| 50,000 |

Acquisition of unproved mineral properties |

| (59,531) |

| (38,137) |

|

|

|

|

|

Net cash provided by (used in) investing activities |

| (59,531) |

| 11,863 |

|

|

|

|

|

Cash flows provided by financing activities: |

|

|

|

|

Cash received on issuance of notes payable to related parties |

| 170,022 |

| 101,002 |

Cash received on issuance of notes payable |

| 16,619 |

| - |

|

|

|

|

|

Net cash provided by financing activities |

| 186,641 |

| 101,002 |

|

|

|

|

|

Effects of foreign currency exchange |

| (4,395) |

| 16,576 |

|

|

|

|

|

Increase (decrease) in cash |

| (4,980) |

| 4,565 |

|

|

|

|

|

Cash, beginning |

| 4,440 |

| 3,508 |

|

|

|

|

|

Cash, ending | $ | (540) | $ | 8,073 |

|

|

|

|

|

Supplemental disclosures: |

|

|

|

|

Cash paid for: |

|

|

|

|

Income tax | $ | - | $ | - |

Interest | $ | - | $ | - |

|

|

|

|

|

Non-cash investing transactions: |

|

|

|

|

Changes in accrued mineral property taxes | $ | 4,682 | $ | - |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

F-4

RED METAL RESOURCES LTD.

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

OCTOBER 31, 2015

(Unaudited)

NOTE 1 - ORGANIZATION AND BASIS OF PRESENTATION

Nature of Operations

Red Metal Resources Ltd. (the "Company") holds a 99% interest in Minera Polymet SpA ("Polymet") incorporated under the laws of the Republic of Chile. The Company is involved in acquiring and exploring mineral properties in Chile. The Company has not determined whether its properties contain mineral reserves that are economically recoverable.

Unaudited Interim Consolidated Financial Statements

The unaudited interim consolidated financial statements of the Company have been prepared in accordance with United States generally accepted accounting principles ("GAAP") for interim financial information and the rules and regulations of the Securities and Exchange Commission ("SEC"). They do not include all information and footnotes required by GAAP for complete financial statements. Except as disclosed herein, there have been no material changes in the information disclosed in the notes to the financial statements for the year ended January 31, 2015, included in the Company's Annual Report on Form 10-K, filed with the SEC. The unaudited interim consolidated financial statements should be read in conjunction with those financial statements included in Form 10-K. In the opinion of management, all adjustments considered necessary for fair presentation, consisting solely of normal recurring adjustments, have been made. Operating results for the three and nine month periods ended October 31, 2015 are not necessarily indicative of the results that may be expected for the year ending January 31, 2016.

NOTE 2 - RELATED-PARTY TRANSACTIONS

The following amounts were due to related parties as at:

|

| October 31, 2015 |

| January 31, 2015 | ||

|

|

|

|

| ||

Due to a company owned by an officer (a) |

| $ | 529,347 |

| $ | 445,601 |

Due to a company controlled by directors (b) |

|

| 318,969 |

|

| 317,089 |

Due to a company controlled by a major shareholder (a) |

|

| 50,988 |

|

| 91,966 |

Due to a major shareholder (a) |

|

| 34,726 |

|

| 37,839 |

Total due to related parties |

| $ | 934,030 |

| $ | 892,495 |

|

|

|

|

|

|

|

Note payable to the Chief Executive Officer ("CEO") (c) |

| $ | 266,821 |

| $ | 248,564 |

Note payable to the Chief Financial Officer ("CFO") (c) |

|

| 11,466 |

|

| 10,802 |

Note payable to a major shareholder (c) |

|

| 284,146 |

|

| 113,241 |

Note payable to a company controlled by directors (c) |

|

| 123,428 |

|

| 117,202 |

Total notes payable to related parties |

| $ | 685,861 |

| $ | 489,809 |

(a) Amounts are unsecured, due on demand and bear no interest.

(b) Amounts are unsecured, due on demand and bear interest at 10%.

(c) Amounts are unsecured, due on demand and bear interest at 8%.

During the nine months ended October 31, 2015, the Company recorded $37,288 (October 31, 2014 - $23,586) in interest expense on the notes payable to related parties. During the same time, the Company accrued $11,066 (October 31, 2014 - $12,195) in interest expense on trade accounts payable with related parties.

F-5

Transactions with Related Parties

During the nine months ended October 31, 2015 and 2014, the Company incurred the following expenses with related parties:

|

| October 31, 2015 |

| October 31, 2014 | ||

|

|

|

|

| ||

Consulting fees paid or accrued to a company owned by the CFO |

| $ | 90,000 |

| $ | 90,000 |

Fees paid or accrued to a company controlled by two directors |

| $ | -- |

| $ | 4,113 |

Rent fees paid or accrued to a company controlled by a major shareholder |

| $ | 7,659 |

| $ | 8,732 |

Royalty revenue earned from a company controlled by a major shareholder |

| $ | -- |

| $ | 9,019 |

NOTE 3 - UNPROVED MINERAL PROPERTIES

Mineral Claims | January 31, 2015 |

| Additions/ Payments |

| Property Taxes Paid/ Accrued |

| Write- down |

| Effect of foreign currency translation |

| October 31, 2015 | ||||||

Farellon Project |

|

|

|

|

|

|

|

|

|

|

| ||||||

Farellon Alto 1-8(1) | $ | 416,430 |

| $ | -- |

| $ | 3,773 |

| $ | -- |

| $ | (34,911) |

| $ | 385,292 |

Cecil |

| 41,729 |

|

| -- |

|

| 1,597 |

|

| -- |

|

| (3,586) |

|

| 39,740 |

Quina |

| 24,409 |

|

| -- |

|

| 1,759 |

|

| -- |

|

| (2,178) |

|

| 23,990 |

Exeter |

| -- |

|

| 27,708 |

|

| 1,628 |

|

| -- |

|

| (2,275) |

|

| 27,061 |

|

| 482,568 |

|

| 27,708 |

|

| 8,757 |

|

| -- |

|

| (42,950) |

|

| 476,083 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Perth Project |

| -- |

|

| -- |

|

| 16,413 |

|

| -- |

|

| (1,584) |

|

| 14,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mateo Project |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Margarita |

| 20,107 |

|

| -- |

|

| 392 |

|

| -- |

|

| (1,691) |

|

| 18,808 |

Che |

| 21,343 |

|

| -- |

|

| 532 |

|

| -- |

|

| (1,807) |

|

| 20,068 |

Irene |

| 36,213 |

|

| -- |

|

| 420 |

|

| -- |

|

| (3,019) |

|

| 33,614 |

Mateo |

| 80,422 |

|

| -- |

|

| 15,005 |

|

| (8,415) |

|

| (6,425) |

|

| 80,587 |

|

| 158,085 |

|

| -- |

|

| 16,349 |

|

| (8,415) |

|

| (12,942) |

|

| 153,077 |

Total Costs | $ | 640,653 |

| $ | 27,708 |

| $ | 41,519 |

| $ | (8,415) |

| $ | (57,476) |

| $ | 643,989 |

(1)

During the nine month period ended October 31, 2015, the Company received $17,106 in royalty payments from minerals extracted during the small scale mining operations that were carried out by a third-party; these payments were recorded as recovery of mineral exploration costs. During the same period the Company paid $12,055 in royalty payments to the original vendor of the Farellon Alto 1-8, which were recorded as part of mineral exploration costs.

Farellon Project

On June 3, 2015, the subsidiary of the Company entered into an option agreement (the "Option Agreement"), made effective on June 15, 2015, with an unrelated party (the "Vendor"), to earn 100% interest in a mining exploration concession Exeter 1-54 (the "Exeter claim").

F-6

In order to acquire 100% interest in the Exeter claim, the Company is required to pay a total of $150,000 as outlined in the following schedule:

|

| Option Payment | |

Upon execution of the Option Agreement ("Execution date")(paid) |

| $ | 25,000 |

On or before May 12, 2016 |

|

| 25,000 |

On or before May 12, 2017 |

|

| 25,000 |

On or before May 12, 2018 |

|

| 25,000 |

On or before May 12, 2019 |

|

| 50,000 |

Total |

| $ | 150,000 |

All of the above payments shall be made only if the Company wishes to keep the Option Agreement in force and finally to exercise the option to purchase.

In addition to the option payments, the Vendor will retain a 1.5% royalty from net smelter returns ("NSR") on the Exeter claim, which the Company may buy out for a one-time payment of $750,000 any time after acquiring 100% of the Exeter claim. Should the Company choose to mine the Exeter claim prior to acquiring the option, the Company will be obligated to pay a minimum monthly royalty of $2,500 up to 5,000 tonnes, and a further $0.25 for every additional tonne mined.

NOTE 4 - COMMON STOCK

During the nine months ended October 31, 2015, the Company did not have any transactions that resulted in issuance of its common stock.

Warrants

| Number of Warrants |

Balance, January 31, 2015 | 267,335 |

Expired | (267,335) |

Balance, October 31, 2015 | -- |

Options

On February 28, 2014, the Company granted options to purchase up to 1,200,000 shares of its common stock to certain officers, directors, consultants and employees. The Company's CEO, CFO, and Vice President of Exploration were each granted options to purchase up to 300,000 shares of the Company's common stock. The options vested upon grant and are exercisable at $0.15 for a term of two years.

At October 31, 2015, all options remained unexercised. The weighted average life of the options was 0.33 years and the weighted average exercise price was $0.15.

F-7

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

This Quarterly Report on Form 10-Q filed by Red Metal Resources Ltd. contains forward-looking statements. These are statements regarding financial and operating performance and results and other statements that are not historical facts. The words "expect," "project," "estimate," "believe," "anticipate," "intend," "plan," "forecast," and similar expressions are intended to identify forward-looking statements. Certain important risks could cause results to differ materially from those anticipated by some of the forward-looking statements. Some, but not all, of these risks include, among other things:

·

general economic conditions, because they may affect our ability to raise money;

·

our ability to raise enough money to continue our operations;

·

changes in regulatory requirements that adversely affect our business;

·

changes in the prices for minerals that adversely affect our business;

·

political changes in Chile, which could affect our interests there; and / or

·

other uncertainties, all of which are difficult to predict and many of which are beyond our control.

We caution you not to place undue reliance on these forward-looking statements, which reflect our management's view only as of the date of this report. We are not obligated to update these statements or publicly release the results of any revisions to them to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events. You should refer to, and carefully review, the information in future documents we file with the Securities and Exchange Commission.

General

You should read this discussion and analysis in conjunction with our interim unaudited consolidated financial statements and related notes included in this Form 10-Q and the audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended January 31, 2015. The inclusion of supplementary analytical and related information may require us to make estimates and assumptions to enable us to fairly present, in all material respects, our analysis of trends and expectations with respect to our results of operations and financial position taken as a whole. Actual results may vary from the estimates and assumptions we make.

Overview

Red Metal Resources Ltd. ("Red Metal", or the "Company") is a mineral exploration company engaged in locating, and eventually developing, mineral resources in Chile. Our business strategy is to identify, acquire and explore prospective mineral claims with a view to either developing them ourselves or, more likely, finding a joint venture partner with the mining experience and financial means to undertake the development. All of our claims are in the Candelaria IOCG belt in the Chilean Coastal Cordillera.

Consistent with our historical practices, we continue to monitor our costs in Chile by reviewing our mineral claims to determine whether they possess the geological indicators to economically justify the capital to maintain or explore them. Currently, our subsidiary, Minera Polymet SpA, has one employee in Chile and engages independent consultants on as needed basis. Most of our support - such as vehicles, office and equipment - is supplied under short-term contracts. The only long-term commitments that we have are for royalty payments on four of our mineral claims - Farellon Alto 1-8, Quina 1 - 56, Exeter 1 - 54, and Che. These royalties are payable once exploitation begins. We are also required to pay property taxes that are due annually on all the claims that are included in our properties.

The cost and timing of all planned exploration programs are subject to the availability of qualified mining personnel, such as consulting geologists, geo-technicians and drillers, and drilling equipment. Although Chile has a well-trained and qualified mining workforce from which to draw and few early-stage companies such as ours are competing for the available resources, if we are unable to find the personnel and equipment that we need when we need them and at the prices that we have estimated today, we might have to revise or postpone our plans.

1

Results of operations

SUMMARY OF FINANCIAL CONDITION

Table 1 summarizes and compares our financial condition at the nine months ended October 31, 2015, to the year ended January 31, 2015.

Table 1: Comparison of financial condition

| October 31, 2015 |

| January 31, 2015 | ||

Working capital deficit | $ | (2,160,772) |

| $ | (1,881,494) |

Current assets | $ | 3,095 |

| $ | 5,110 |

Unproved mineral properties | $ | 643,989 |

| $ | 640,653 |

Total liabilities | $ | 2,163,867 |

| $ | 1,886,604 |

Common stock and additional paid in capital | $ | 6,763,837 |

| $ | 6,763,837 |

Deficit | $ | (8,279,799) |

| $ | (8,013,633) |

Accumulated other comprehensive income | $ | 2,649 |

| $ | 13,730 |

COMPARISON OF PRIOR QUARTERLY RESULTS

Table 2: Summary of quarterly results (January 31, 2015 - October 31, 2015)

| October 31, 2015 | July 31, 2015 | April 30, 2015 | January 31, 2015 |

Net loss | $(85,276) | $(90,406) | $(90,484) | $(121,620) |

Basic and diluted loss per share | $(0.00) | $(0.00) | $(0.00) | $(0.00) |

Table 3: Summary of quarterly results (January 31, 2014 - October 31, 2014)

| October 31, 2014 | July 31, 2014 | April 30, 2014 | January 31, 2014 |

Net loss | $(91,825) | $(103,803) | $(215,264) | $(140,004) |

Basic and diluted loss per share | $(0.00) | $(0.00) | $(0.01) | $(0.00) |

During the past eight fiscal quarters we maintained our exploration and operating activities at low levels. Following are the most significant events that affected our quarterly financial results:

·

During the quarter ended October 31, 2015, we completed restructuring of our Chilean subsidiary, Minera Polymet, from a Limited Liability Company to a Closed Stock Corporation. During the same period, we continued renting our Farellon Alto 1 - 8 claim to a third-party, who was carrying out a small scale mining operation on the claim, which resulted in recovery of mineral exploration costs totaling $4,140.

·

During the quarter ended July 31, 2015, we increased royalties payable to us on the minerals extracted during the small scale mining operations that were carried out by the third-party on our Farellon Property, which resulted in $10,007 we recorded as recovery of mineral exploration costs.

·

During the quarter ended April 30, 2014, our net loss was affected by $146,901 we recorded on stock based compensation when we issued options to purchase up to 1,200,000 shares of our common stock to our executives, consultants and employees. This increase was partially offset by the gain we recorded on the option payment we received from Geoactiva pursuant to our Option Agreement with the company. In August 2014 Geoactiva cancelled the Option Agreement, which ended any future revenue streams from this source.

2

Selected Financial Results

NINE MONTHS ENDED OCTOBER 31, 2015 AND 2014

Our operating results for the three and nine month periods ended October 31, 2015 and 2014, and the changes in the operating results between those periods are summarized in Table 4.

Table 4: Summary of operating results

| Three months ended October 31, | Changes between | Nine months ended October 31, | Changes between | ||||||||

| 2015 | 2014 | the periods | 2015 | 2014 | the periods | ||||||

|

|

|

|

|

|

| ||||||

Operating expenses | $ | (89,416) | $ | (94,827) | $ | (5,411) | $ | (283,272) | $ | (447,598) | $ | (164,326) |

Other items: |

|

|

|

|

|

|

|

|

|

|

|

|

Gain on mineral property option payment received |

| - |

| - |

| - |

| - |

| 27,687 |

| (27,687) |

Recovery of mineral exploration costs |

| 4,140 |

| 3,002 |

| 1,138 |

| 17,106 |

| 9,019 |

| 8,087 |

Net loss |

| (85,276) |

| (91,825) |

| (6,549) |

| (266,166) |

| (410,892) |

| (144,726) |

Foreign exchange translation |

| (8,720) |

| 35,896 |

| (44,616) |

| (11,081) |

| 26,860 |

| (37,941) |

Comprehensive loss | $ | (93,996) | $ | (55,929) | $ | 38,067 | $ | (277,247) | $ | (384,032) | $ | (106,785) |

Revenue . We did not generate any revenue during the three and nine month periods ended October 31, 2015 and 2014. Due to the exploration rather than the production nature of our business, we do not expect to have significant operating revenue in the foreseeable future.

Operating expenses . Our operating expenses decreased by $5,411, or 6%, from $94,827 for the three month period ended October 31, 2014 to $89,416 for the three month period ended October 31, 2015. Since we kept our operating activities on the low level the change in the operating expenses during the period ended October 31, 2015 was associated mainly with increase in interest expense on notes payable to related parties, and, to a minor extent, with increase in administrative fees following restructure of our Subsidiary. These costs were offset by decreases in consulting, advertising and promotion fees, as well as continued reduction in regulatory and automobile expenses.

On a year-to-date basis, our operating expenses decreased by $164,326 or 37%, from $447,598 for the nine months ended October 31, 2014, to $283,272 for the nine months ended October 31, 2015.

Our operating expenses for the three and nine month periods ended October 31, 2015 and 2014, and the changes between those periods are summarized in Table 5.

3

Table 5: Detailed changes in operating expenses

| Three months ended October 31, | Changes between | Nine months ended October 31, | Changes between | ||||||||

| 2015 | 2014 | the periods | 2015 | 2014 | the periods | ||||||

Operating expenses |

|

|

|

|

|

| ||||||

Administration | $ | 13,855 | $ | 12,457 | $ | 1,398 | $ | 37,450 | $ | 38,103 | $ | (653) |

Advertising and promotion |

| 416 |

| 2,732 |

| (2,316) |

| 5,941 |

| 15,499 |

| (9,558) |

Amortization |

| 282 |

| 580 |

| (298) |

| 975 |

| 1,862 |

| (887) |

Automobile |

| 229 |

| 1,003 |

| (774) |

| (1,356) |

| 3,448 |

| (4,804) |

Bank charges |

| 1,048 |

| 1,574 |

| (526) |

| 4,996 |

| 3,237 |

| 1,759 |

Consulting fees |

| 30,000 |

| 31,862 |

| (1,862) |

| 90,000 |

| 97,379 |

| (7,379) |

Interest on current debt |

| 20,657 |

| 17,503 |

| 3,154 |

| 60,678 |

| 49,028 |

| 11,650 |

IVA expense |

| (262) |

| 69 |

| (331) |

| (1,535) |

| (8) |

| (1,527) |

Mineral exploration costs |

| 2,729 |

| 4,501 |

| (1,772) |

| 12,378 |

| 14,635 |

| (2,257) |

Office |

| 2,338 |

| 2,757 |

| (419) |

| 7,212 |

| 8,386 |

| (1,174) |

Professional fees |

| 4,004 |

| 4,009 |

| (5) |

| 13,670 |

| 13,262 |

| 408 |

Rent |

| 2,388 |

| 2,797 |

| (409) |

| 7,659 |

| 8,732 |

| (1,073) |

Regulatory |

| 581 |

| 1,174 |

| (593) |

| 5,023 |

| 7,794 |

| (2,771) |

Travel and entertainment |

| 442 |

| 172 |

| 270 |

| 622 |

| 388 |

| 234 |

Salaries and wages |

| 11,129 |

| 12,078 |

| (949) |

| 37,491 |

| 36,864 |

| 627 |

Stock based compensation |

| - |

| - |

| - |

| - |

| 146,901 |

| (146,901) |

Foreign exchange gain |

| (420) |

| (441) |

| 21 |

| (1,333) |

| (177) |

| (1,156) |

Write-down of unproved mineral properties |

| - |

| - |

| - |

| 3,401 |

| 2,265 |

| 1,136 |

Total operating expenses | $ | 89,416 | $ | 94,827 | $ | (5,411) | $ | 283,272 | $ | 447,598 | $ | (164,326) |

The most significant year-to-date changes included the following:

·

During the nine months ended October 31, 2014 we granted options to purchase up to 1,200,000 shares of our common stock to certain officers, directors, consultants and employees, which resulted in stock-based compensation expense of $146,901. We did not have similar transactions during the nine months ended October 31, 2015.

·

Our advertising and promotion expenses decreased by $9,558 or 62% from $ 15,499 we incurred during the nine months ended October 31, 2014 to $ 5,941 we incurred during the nine months ended October 31, 2015; and our regulatory fees decreased by $2,771, or 36% from $7,794 we incurred during the nine months ended October 31, 2014 to $5,023 we incurred during the nine months ended October 31, 2015, respectively. These decreases were associated with our continued efforts to control our overhead costs.

·

During the nine months ended October 31, 2015 we wrote down a claim within our Mateo property, which resulted in the write off of the cash acquisition fees totaling $3,401.

·

During the second quarter of the Fiscal 2016 Mr. Mitchell, who was carrying out small scale mining operations on our Farellon Alto 1 - 8 claim, was renting our automobile equipment, which resulted in a decrease to our automobile expense of $4,804, from $3,448 we incurred during the nine months ended October 31, 2014 to a recovery of $1,356 we recorded during the nine months ended October 31, 2015.

·

To continue our operations we were required to incur additional debt with our related parties, which resulted in $11,650 increase to the interest on current debt.

Other items . During the nine months ended October 31, 2015, we continued renting our Farellon Alto 1-8 claim to Mr. Mitchell, who was carrying out a small scale mining operation on the claim. Pursuant to our rental agreement, Mr. Mitchell was obligated to pay us 5% royalty on the amounts generated from the net smelter returns, which we recorded as the recovery of mineral exploration costs. In June 2015 we reached a verbal agreement with Mr. Mitchell to increase the royalty payable to us from net smelter returns from the Farellon Alto 1-8 claim from 5% to 10%. As such, our recovery of mineral exploration costs increased by $8,087, or 90% from $9,019 we received during the nine months ended October 31, 2014 to $17,106 we received during the same period in Fiscal 2016. For additional information, refer to the "Unproved mineral properties" section of this Quarterly Report on Form 10-Q.

4

During the nine month period ended October 31, 2014, we recorded a gain on mineral property option payments in the amount of $27,687 when we received a third option payment from Geoactiva SpA, a Chilean mining company ("Geoactiva"). The gain represented the excess over the carrying value of the Perth property at the date of the payment. Since Geoactiva terminated the Option agreement during the third quarter of our Fiscal 2015, we did not have similar transactions during the period ended October 31, 2015.

Comprehensive loss . Our comprehensive loss for the three month period ended October 31, 2015 was $93,996 as compared to the comprehensive loss of $55,929 we recorded for the three month period ended October 31, 2014. The $38,067 increase in comprehensive loss was mainly associated with the foreign exchange translation associated with revaluation of the transactions denominated in other than our functional currencies, which was in part offset by overall decrease in our net loss from the current operations.

Our comprehensive loss for the nine month period ended October 31, 2015 was $277,247 as compared to the comprehensive loss of $384,032 we recorded for the nine month period ended October 31, 2014. The $106,785 decrease in comprehensive loss was mainly associated with the decrease in our current operations, which was offset by changes in the foreign exchange translation associated with revaluation of the transactions denominated in other than our functional currencies.

Liquidity and Capital Resources

Table 6: Working Capital

| Nine months ended October 31, | Changes between | ||||

| 2015 | 2014 | the periods | |||

Current assets | $ | 3,095 | $ | 5,110 | $ | (2,015) |

Current liabilities |

| 2,163,867 |

| 1,886,604 |

| 277,263 |

Working capital deficit | $ | (2,160,772) | $ | (1,881,494) | $ | 279,278 |

As of October 31, 2015, we were indebted to our bank in the amount of $540, our working capital was represented by a deficit of $2,160,772 and cash flows used in operations totaled $127,695 for the period then ended. During the nine month period ended October 31, 2015, we funded our operations with $170,022 in loans we received from our related parties and $16,619 loan from Mr. Mitchell. See "Net Cash Provided By Financing Activities."

We did not generate sufficient cash flows from our operating activities to satisfy our cash requirements for the nine month period ended October 31, 2015. The amount of cash that we have generated from our operations to date is significantly less than our current debt obligations, including our debt obligations under our notes and advances payable. There is no assurance that we will be able to generate sufficient cash from our operations to repay the amounts owing under these notes and advances payable, or to service our other debt obligations. If we are unable to generate sufficient cash flow from our operations to repay the amounts owing when due, we may be required to raise additional financing from other sources.

Cash flow

Table 7 summarizes our sources and uses of cash for the nine months ended October 31, 2015 and 2014.

Table 7: Summary of sources and uses of cash

| October 31, | |||

| 2015 | 2014 | ||

Net cash used in operating activities | $ | (127,695) | $ | (124,876) |

Net cash provided by (used in) investing activities |

| (59,531) |

| 11,863 |

Net cash provided by financing activities |

| 186,641 |

| 101,002 |

Effect of foreign currency exchange |

| (4,395) |

| 16,576 |

Net increase (decrease) in cash | $ | (4,980) | $ | 4,565 |

5

Net cash used in operating activities. During the nine months ended October 31, 2015, we used net cash of $127,695 in operating activities. We used $261,790 to cover our cash operating costs and to increase our prepaid expenses by $2,654. These uses of cash were offset by increases in our amounts payable to related parties of $65,785, trade accounts payable and accrued liabilities mainly associated with property taxes payable on our mineral claims of $15,931 and $17,277, respectively. In addition, we recorded $37,756 in accrued interest on outstanding notes payable.

During the nine months ended October 31, 2014, we used net cash of $124,876 in operating activities. We used $287,551 to cover our cash operating costs and increase our prepaid expenses by $1,577. These uses of cash were offset by increases in our accounts payable of $17,994. Our accrued liabilities increased by $12,110; this increase was associated with property taxes that became payable on our mineral claims. We also increased our accounts payable to related parties by $110,562 and recorded $23,586 in accrued interest on notes payable to related parties.

Certain non-cash changes in operating assets and liabilities. During the nine months ended October 31, 2015, we wrote off $3,401 in mineral property acquisition costs.

During the nine months ended October 31, 2014, we recorded $146,901 as stock based compensation on the grant of options to purchase up to 1,200,000 shares of our common stock to certain officers, directors, consultants and employees. We also recorded a $27,687 gain on the mineral property option payment we received from Geoactiva pursuant to the Property Option Agreement with the company, and wrote off $2,265 in mineral property acquisition costs.

Net cash used in investing activities. During the nine months ended October 31, 2015, we spent $59,531 acquiring mineral claims, of which $27,708 was used to acquire Exeter claim and $31,823 to pay 2015 - 2016 mineral property taxes on our claims.

During the nine months ended October 31, 2014, we spent $38,137 acquiring mineral claims. During the same period we received $50,000 from Geoactiva pursuant to the Property Option Agreement, of which $27,687 represented gain on mineral property options in excess over the carrying value of the Perth property.

Certain non-cash investing activities. During the nine month period ended October 31, 2015, we accrued $9,696 in mineral property taxes payable on our active properties. This amount was offset by $5,014 decrease in accrued mineral taxes payable when we wrote off a claim within our Mateo property.

Net cash provided by financing activities. During the nine months ended October 31, 2015, we borrowed $146,000 and $12,391 (CAD$15,000) from our significant shareholder, and $1,040 and $8,145 (CAD$10,300) from our CEO. In addition, we borrowed $2,446 (CAD$3,211) from Fladgate Exploration Consulting Corporation, a company controlled by our CEO and VP of Exploration, and $16,619 (10,500,000 Chilean Pesos) from Mr. Kevin Mitchell. The loans are unsecured, payable on demand and bear interest at 8% per annum, compounded monthly.

During the nine months ended October 31, 2014, we borrowed $53,500 and $13,622 (CAD$15,000) from a significant shareholder and $1,550 and $32,330 (CAD$35,350) from our CEO.

Going Concern

The unaudited interim consolidated financial statements included in this Quarterly Report have been prepared on a going concern basis, which implies that we will continue to realize our assets and discharge our liabilities in the normal course of business. We have not generated any significant revenues from mineral sales since inception, have never paid any dividends and are unlikely to pay dividends or generate significant earnings in the immediate or foreseeable future. Our continuation as a going concern depends upon the continued financial support of our shareholders, our ability to obtain necessary debt or equity financing to continue operations, and the attainment of profitable operations. Our ability to achieve and maintain profitability and positive cash flow depends upon our ability to locate profitable mineral claims, generate revenue from mineral production and control our production costs.

6

Based upon our current plans, we expect to incur operating losses in future periods, which we plan to mitigate by controlling our operating costs and by sharing mineral exploration expenses through joint venture agreements, if possible. At October 31, 2015, we had a working capital deficit of $2,160,772 and accumulated losses of $8,279,799 since inception. These factors raise substantial doubt about our ability to continue as a going concern. We cannot assure you that we will be able to generate significant revenues in the future. Our consolidated interim financial statements do not give effect to any adjustments that would be necessary should we be unable to continue as a going concern and therefore be required to realize our assets and discharge our liabilities in other than the normal course of business and at amounts different from those reflected in our financial statements.

Unproved mineral properties

Table 8: Active properties |

| ||

Property | Percentage, type of claim | Hectares | |

Gross area | Net area a | ||

Farellon |

|

|

|

Farellon Alto 1 - 8 claim | 100%, mensura | 66 |

|

Cecil 1 - 49 claim | 100%, mensura | 230 |

|

Teresita claim | 100%, mensura | 1 |

|

Azucar 6 - 25 claim | 100%, mensura | 88 |

|

Stamford 61 - 101 claim | 100%, mensura | 165 |

|

Kahuna 1 - 40 claim | 100%, mensura | 200 |

|

Quina 1 - 56 claim | Option to acquire 100% interest, mensura | 252 |

|

Exeter 1 - 54 claim | Option to acquire 100% interest, mensura | 235 |

|

|

| 1,237 | 1,237 |

Perth |

|

|

|

Perth 1 al 36 claim | 100%, mensura | 109 |

|

Lancelot I 1 al 30 claim | 100%, mensura in process | 300 |

|

Lancelot II 1 al 20 claim | 100%, mensura in process | 200 |

|

Rey Arturo 1 al 30 claim | 100%, mensura in process | 300 |

|

Merlin I 1 al 10 claim | 100%, mensura in process | 60 |

|

Merlin I 1 al 24 claim | 100%, mensura in process | 240 |

|

Galahad I 1 al 10 claim | 100%, mensura in process | 50 |

|

Galahad IA 1 al 45 claim | 100%, mensura in process | 230 |

|

Percival III 1 al 30 claim | 100%, mensura in process | 300 |

|

Tristan II 1 al 30 claim | 100%, mensura in process | 300 |

|

Tristan IIA 1 al 5 claim | 100%, mensura in process | 15 |

|

Camelot 1 al 58 claim | 100%, mensura in process | 262 |

|

|

| 2,366 |

|

Overlapped claims a |

| (121) | 2,245 |

|

|

|

|

Mateo |

|

|

|

Margarita claim | 100%, mensura | 56 |

|

Che 1 & 2 claims | 100%, mensura | 76 |

|

Irene & Irene II claims | 100%, mensura | 60 |

|

Mateo 4 and 5 claims | 100%, mensura | 600 |

|

Mateo 1, 2, 3, 10, 12, 13 claims | 100%, mensura in process | 861 |

|

|

| 1,653 |

|

Overlapped claims a |

| (469) | 1,184 |

|

|

|

|

|

|

| 4,666 |

a Certain mensura in process claims overlap other claims. The net area is the total of the hectares we have in each property (i.e. net of our overlapped claims).

7

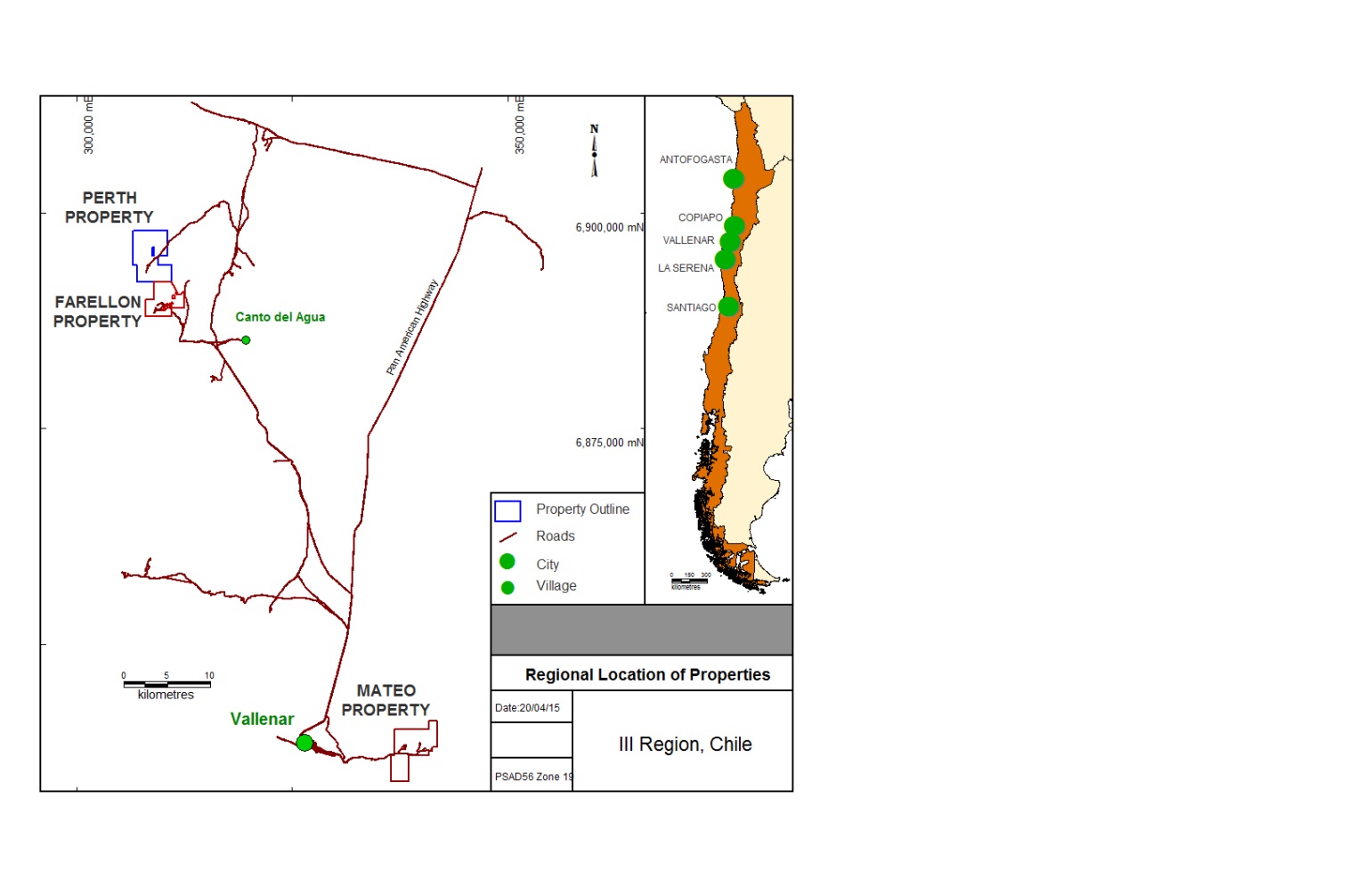

Figure 1: Location and access to active properties.

Farellon Property.

On May 23, 2013, we entered into a rental agreement with Minera Farellon Limitada ("Minera Farellon"), to allow Minera Farellon to conduct certain exploration and mining activities on the Farellon Alto 1-8 claims in exchange for a 10% royalty on gross smelter returns. This agreement was amended on June 5, 2014, when Polymet gave the permission to conduct certain exploration and mining activities on Farellon Alto 1 - 6 claims directly to Kevin Mitchell, leaving Minera Farellon the right to work on Farellon Alto 7 - 8 claims. And on October 21, 2014, the agreement was further amended to transfer the right to mine Farellon Alto 7 - 8 claims from Minera Farellon to Kevin Mitchell. In addition, the Company decreased the royalty on gross smelter returns payable by Mr. Mitchell from initial 10% to 5%. The 10% royalty was reinstated as of June 2015.

Since January 2015 Mr. Mitchell increased the development of the mine to 400 meters reaching a level of approximately 55 metres vertical depth from surface working on six different levels. As of the date of this report on Form 10-Q, the production is in the sulphide zone of the mine and copper, silver and gold are being sold to ENAMI (the Chilean national mining company). Since January 2015 approximately 4,754 tonnes of sulphide ore have been sold, of which 2,254 tonnes sold from August to October 2015 yielded an average grades of 1.45% copper, 5.56 g/t silver, and 0.39 g/t gold.

The work done on the Farellon Alto 1-8 claim by Mr. Mitchell resulted in $17,106 royalty payments from gross smelter returns during the nine month period ended October 31, 2015, which we recorded as the recovery of mineral exploration costs. At the same time we paid the original vendor of the Farellon Alto 1-8 claim $12,055 in royalty payments required under the original option agreement to acquire the claim.

8

Option to Acquire Exeter claim

On June 3, 2015, Minera Polymet, our Chilean subsidiary, entered into an option agreement (the "Option Agreement"), made effective on June 15, 2015, with Minera Stamford S.A., to earn 100% interest in a mining claim Exeter 1-54 (the "Exeter claim").

The Exeter claim totals 235 hectares and is contiguous to our Farellon Property, which is located in the Carrizal Alto mining district located approximately 75 kilometers northwest of the city of Vallenar, 150 kilometers south of Copiapo and 20 kilometers west of the Pan American Highway.

In order to acquire 100% interest in the Exeter claim, we are required to pay a total of $150,000 as detailed in the following schedule:

| Option Payment | |

Upon execution of the Option Agreement (paid) | $ | 25,000 |

On or before May 12, 2016 |

| 25,000 |

On or before May 12, 2017 |

| 25,000 |

On or before May 12, 2018 |

| 25,000 |

On or before May 12, 2019 |

| 50,000 |

Total | $ | 150,000 |

All of the above payments shall be made only if we wish to keep the Option Agreement in force and finally to exercise the option to purchase.

In addition to the option payments, the vendor will retain a 1.5% royalty from net smelter returns ("NSR") on the Exeter claim and we will have the right to buy out the royalty for a one-time payment of $750,000 any time after acquiring 100% of the Exeter claim. Should we decide to mine the Exeter claim prior to acquiring the option, we will be obligated to pay a minimum monthly royalty of $2,500 up to 5,000 tonnes, and a further $0.25 for every additional tonne mined.

Capital resources

Our ability to acquire and explore our Chilean claims is subject to our ability to obtain the necessary funding. We expect to raise funds through loans from private or affiliated persons and through sales of our debt or equity securities. We have no committed sources of capital. If we are unable to raise funds as and when we need them, we may be required to curtail, or even to cease, our operations.

Contingencies and commitments

We had no contingencies at October 31, 2015.

As of the date of the filing this Quarterly Report we have the following long-term contractual obligations and commitments:

·

Farellon royalty. We are committed to paying the vendor a royalty equal to 1.5% on the net sales of minerals extracted from the Farellon Alto 1 - 8 claim up to a total of $600,000. The royalty payments are due monthly and are subject to minimum payments of $1,000 per month.

·

Quina royalty. We are committed to paying a royalty equal to 1.5% on the net sales of minerals extracted from the Quina claim. The royalty payments are due semi-annually once commercial production begins, and are not subject to minimum payments.

·

Exeter royalty. We are committed to paying a royalty equal to 1.5% on the net sales of minerals extracted from the Exeter claim. The royalty payments are due semi-annually once commercial production begins, and are not subject to minimum payments. Should we decide to mine the Exeter claim prior to acquiring the option, we will be obligated to pay a minimum monthly royalty of $2,500 up to 5,000 tonnes, and a further $0.25 for every additional tonne mined.

9

·

Che royalty. We are committed to paying a royalty equal to 1% of the net sales of minerals extracted from the claims to a maximum of $100,000 to the former owner. The royalty payments are due monthly once exploitation begins, and are not subject to minimum payments.

·

Mineral property taxes. To keep our mineral claims in good standing we are required to pay mineral property taxes of approximately $35,000 per annum.

Equity financing

During the period covered by this Quarterly Report on Form 10-Q we did not engage in financing of our operations through issuance of our equity securities and relied solely on the debt financing.

Based on our operating plan, we anticipate incurring operating losses in the foreseeable future and will require additional equity capital to support our operations and develop our business plan. If we succeed in completing future equity financings, the issuance of additional shares will result in dilution to our existing shareholders.

Debt financing

During the period covered by this Quarterly Report on Form 10-Q we borrowed a total of $170,022 from related parties and $16,619 from an unrelated party.

Challenges and risks

Over the next twelve months we anticipate generating cash through royalty payments pursuant to our rental agreement with Mr. Mitchell. This cash will not be adequate to support our current operations. We plan to continue funding our operations through any combination of equity or debt financing from the sale of our securities, private loans, joint ventures or through the sale of part interest in our mineral properties. Although we have succeeded in raising funds as we needed them, we cannot assure you that this will continue in the future. Many things, such as the continued general worldwide downturn of the economy or a significant decrease in the price of minerals, could affect the willingness of potential investors to invest in risky ventures such as ours. We may consider entering into joint venture partnerships with other resource companies to complete a mineral exploration programs on our properties in Chile. If we enter into a joint venture arrangement, we would likely have to assign a percentage of our interest in our mineral claims to our joint venture partner in exchange for the funding.

As at October 31, 2015, we owed approximately $1.62 million to related parties for loans and services that have been provided to us. We do not have the funds to pay this debt therefore we may decide to partially pay this debt with shares of our common stock. Because of the low price of our common stock, the issuance of the shares to pay the debt will likely result in substantial dilution to the percentage of outstanding shares of our common stock held by our existing shareholders.

Investments in and expenditures on mineral interests

Realization of our investments in mineral properties depends upon our maintaining legal ownership, producing from the properties or gainfully disposing of them.

Title to mineral claims involves risks inherent in the difficulties of determining the validity of claims as well as the potential for problems arising from the ambiguous conveyancing history characteristic of many mineral claims. Our contracts and deeds have been notarized, recorded in the registry of mines and published in the mining bulletin. We review the mining bulletin regularly to discover whether other parties have staked claims over our ground. We have discovered no such claims. To the best of our knowledge, we have taken the steps necessary to ensure that we have good title to our mineral claims.

10

Foreign exchange

We are subject to foreign exchange risk associated with transactions denominated in foreign currencies. Foreign currency risk arises from the fluctuation of foreign exchange rates and the degree of volatility of these rates relative to the United States dollar. We do not believe that we have any material risk due to foreign currency exchange.

Trends, events or uncertainties that may impact results of operations or liquidity

The economic crisis in the United States and the resulting economic uncertainty and market instability may make it harder for us to raise capital as and when we need it and have made it difficult for us to assess the impact of the crisis on our operations or liquidity and to determine if the prices we will receive on the sale of minerals will exceed the cost of mineral exploitation. If we are unable to raise cash, we may be required to cease our operations. Other than as discussed in this report, we know of no other trends, events or uncertainties that have or are reasonably likely to have a material impact on our short-term or long-term liquidity.

Off-balance sheet arrangements

We have no off-balance sheet arrangements and no non-consolidated, special-purpose entities.

Related-party transactions

During the nine month period ended October 31, 2015, and up to the date of the filing of this Quarterly Report on Form 10-Q we have entered into the following transactions with the directors, executive officers, or holders of more than 5% of our common stock, or members of their immediate families:

Loans from Richard N. Jeffs

During the nine month period ended October 31, 2015 we borrowed from Richard N. Jeffs, our major shareholder, $146,000 and $12,391 (CAD$15,000). The loans are subject to 8% interest compounded monthly, are unsecured and due on demand. As of October 31, 2015, we were indebted to Mr. Jeffs in the amount of $284,146 (January 31, 2015 - $113,241), consisting of the full principal of all advances made by Mr. Jeffs to that date plus accrued interest of $27,216 (January 31, 2015 - $13,446).

Loans from Caitlin L. Jeffs

During the nine month period ended October 31, 2015, we borrowed from Caitlin L. Jeffs, our Chief Executive Officer, Secretary and a member of our Board of Directors $1,040 and $8,145 (CAD$10,300). The loans are subject to 8% interest compounded monthly, are unsecured and due on demand. As of October 31, 2015, we were indebted to Ms. Jeffs in the amount of $266,821 (January 31, 2015 - $248,564), consisting of the full principal of all advances made by Ms. Jeffs to that date plus accrued interest of $49,410 (January 31, 2015 - $35,079).

Loans from John da Costa

At October 31, 2015, we were indebted to Joao (John) da Costa, our Chief Financial Officer, Treasurer and a member of our Board of Directors, in the amount of $11,466 (January 31, 2015 - $10,802), consisting of the full principal of the loan we received from Mr. da Costa in Fiscal 2012, plus accrued interest of $2,966 (January 31, 2015 - $2,302). We did not borrow any funds from Mr. da Costa during the nine month period ended October 31, 2015.

11

Transactions with Da Costa Management Corp.

We pay Da Costa Management Corp. for administrative and accounting services. Joao (John) da Costa, our Chief Financial Officer, Treasurer and a member of our Board of Directors is the principal of Da Costa Management Corp. During the nine month period ended October 31, 2015, we paid or accrued $90,000 to Da Costa Management for services provided by them. In addition, during the same period Da Costa Management Corp. paid $3,687 in operating expenses on our behalf. As of October 31, 2015, we were indebted to Da Costa Management Corp. in the amount of $529,347 for unpaid fees (January 31, 2015 - $445,601).

Transactions with Fladgate Exploration Consulting Corporation

We pay Fladgate Exploration Consulting Corporation ("Fladgate") for mineral exploration and corporate communication services. Caitlin Jeffs, our Chief Executive Officer, Secretary and a member of our Board of Directors, and Michael Thompson, our Vice President of Exploration and a member of our Board of Directors are the principals of Fladgate, each owning 33% of the interest in the company. During the nine month period ended October 31, 2015 we borrowed $2,446 (CAD$3,211) from Fladgate. As of October 31, 2015, we were indebted to Fladgate in the amount of $318,969 for unpaid fees (January 31, 2015 - $317,089) and $123,428 (January 31, 2015 - $117,202), consisting of the full principal of all loans we received from Fladgate plus accrued interest of $24,755 (January 31, 2015 - $18,214).

Transactions with Minera Farellon Limitada

We pay Minera Farellon Limitada for rental of our Chilean office used by our Subsidiary, Minera Polymet SpA. During the nine months ended October 31, 2015, we paid or accrued $7,659 in rental fees and repaid approximately $40,500 in advances we received from Minera Farellon in prior years. As of October 31, 2015, we were indebted to Minera Farellon in the amount of $50,988 for unpaid fees (January 31, 2015 - $91,966).

Critical accounting estimates

Preparing financial statements in conformity with U.S. Generally Accepted Accounting Principles requires management to make estimates and assumptions that affect certain of the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. The Company regularly evaluates estimates and assumptions. The Company bases its estimates and assumptions on current facts, historical experience and various other factors it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company's estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. The most significant estimates with regard to these financial statements relate to carrying values of unproved mineral properties, determination of fair values of stock-based transactions, and deferred income tax rates.

Reclassifications

Certain prior-period amounts in the accompanying consolidated interim financial statements have been reclassified to conform to the current period's presentation. These reclassifications had no effect on the consolidated results of operations or financial position for any period presented.

Financial instruments

Our financial instruments include cash, accounts receivable, accounts payable, accrued liabilities, and accrued mineral property costs. The fair value of these financial instruments approximates their carrying values due to their short maturities.

12

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

As a smaller reporting company, we are not required to provide this disclosure.

Item 4. Controls and Procedures.

(a) Disclosure Controls and Procedures

Caitlin Jeffs, our Chief Executive Officer and President, and John da Costa, our Chief Financial Officer, have evaluated the effectiveness of our disclosure controls and procedures (as the term is defined in Rules 13a-15 and 15d-15 under the Securities Exchange Act of 1934) as of the end of the quarter covered by this report (the "evaluation date"). Based on their evaluation, they have concluded that, as of the evaluation date, our disclosure controls and procedures are effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) Changes in Internal Control Over Financial Reporting

During the quarter covered by this report, there were no changes to our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II-OTHER INFORMATION

Item 1. Legal Proceedings.

We are not a party to any pending legal proceedings and, to the best of our knowledge, none of our properties or assets is the subject of any pending legal proceedings.

Item 1a. Risk Factors.

We incorporate by reference the Risk Factors included at Item 1A in the Annual Report on Form 10-K that we filed with the Securities and Exchange Commission on May 1, 2015.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item 3. Defaults upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

None

13

Item 6. Exhibits.

The following table sets forth the exhibits either filed herewith or incorporated by reference.

Exhibit | Description |

3.1.1 | Articles of Incorporation (1) |

3.1.2 | Certificate of Amendment to Articles of Incorporation (2) |

3.2 | By-laws (1) |

10.1 | Memorandum (Minutes) of Understanding between Geoactiva Spa and Minera Polymet Limitada 3 |

10.2 | Extension of Memorandum of Understanding between Geoactiva Spa and Minera Polymet Limitada 4 |

10.3 | Unilateral Purchase Option Contract for Mining Properties: Minera Polymet Limitada to Geoactiva SpA, dated April 30, 2013 (English translation of text) 5 |

10.4 | Memorandum of Understanding between Minera Polymet Limitada and David Marcus Mitchel 6 |

10.5 | Irrevocable Purchase Option Contract for Mining Property Quina 1-56, English translation 7 |

10.6 | Irrevocable Purchase Option Contract for Mining Property Exeter 1-54 in Spanish 9 |

10.7 | Irrevocable Purchase Option Contract for Mining Property Exeter 1-54, English translation 9 |

31.1 | Certification pursuant to Rule 13a-14(a) and 15d-14(a) |

31.2 | Certification pursuant to Rule 13a-14(a) and 15d-14(a) |

32 | Certification pursuant to Section 1350 of Title 18 of the United States Code |

101 | The following financial statements from the registrant's Quarterly Report on Form 10-Q for the fiscal quarter ended October 31, 2015, formatted in XBRL: (i) Consolidated Balance Sheets; (ii) Consolidated Statements of Operations; (iii) Consolidated Statement of Stockholders' Deficit; (iv) Consolidated Statements of Cash Flows; and (v) Notes to the Interim Consolidated Financial Statements. |

(1) Incorporated by reference from the registrant's registration statement on Form SB-2 filed with the Securities and Exchange Commission on May 22, 2006 as file number 333-134363.

(2) Incorporated by reference from the registrant's Quarterly report on Form 10-Q for the period ended October 31, 2010 and filed with the Securities and Exchange Commission on December 13, 2010.

(3) Incorporated by reference from the registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on February 14, 2013.

(4) Incorporated by reference from the registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on April 12, 2013.

(5) Incorporated by reference from the registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on May 6, 2013.

(6) Incorporated by reference from the registrant's Current Report on Form 8-K, filed with the Securities and Exchange Commission on June 4, 2014.

(7) Incorporated by reference from the registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on December 19, 2014.

(8) Incorporated by reference from the registrant's report on Form 10 filed with the Securities and Exchange Commission on February 12, 2010.

(9) Incorporated by reference from the registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on June 18, 2015.

14

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

December 14, 2015

|

| RED METAL RESOURCES LTD. |

| |

|

|

|

|

|

|

| By: | /s/ Caitlin Jeffs |

|

|

|

| Caitlin Jeffs, Chief Executive Officer and President |

|

|

|

|

|

|

|

| By: | / s/ Joao (John) da Costa |

|

|

|

| Joao (John) da Costa, Chief Financial Officer |

|

15