|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________

FORM 10-K

_________

(Mark One) |

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the Fiscal Year Ended January 31, 2015 |

|

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from _______________ to ________________ |

|

Commission File Number 000-52055 |

|

RED METAL RESOURCES LTD. |

(Exact name of registrant as specified in its charter) |

Nevada |

| 20-2138504 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

1158 Russell Street, Unit D, Thunder Bay, ON P7B 5N2

(Address of principal executive offices)

Registrant's telephone number, including area code: (807) 345-7384

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Name of each exchange on which each is registered |

N/A |

| N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer [ ] |

| Accelerated filer [ ] |

Non-accelerated filer [ ] |

| Smaller reporting company [X] |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. As of July 31, 2014, the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and ask price of the common equity was $901,919.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date. The number of shares of the registrant's common stock, $0.001 par value per share, outstanding as of April 30, 2015 was 33,456,969.

TABLE OF CONTENTS

GLOSSARY OF SELECTED MINING AND TECHNICAL TERMS | 1 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS | 2 |

ITEM 1: BUSINESS | 3 |

ITEM 1A: RISK FACTORS | 24 |

ITEM 1B: UNRESOLVED STAFF COMMENTS | 30 |

ITEM 2: PROPERTIES | 30 |

ITEM 3: LEGAL PROCEEDINGS | 30 |

ITEM 4: MINE SAFETY DISCLOSURES | 30 |

ITEM 5: MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 30 |

ITEM 6: SELECTED FINANCIAL DATA | 31 |

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 32 |

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 40 |

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 40 |

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 41 |

ITEM 9A: CONTROLS AND PROCEDURES | 41 |

ITEM 9B: OTHER INFORMATION | 42 |

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 42 |

ITEM 11: EXECUTIVE COMPENSATION | 46 |

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 47 |

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 49 |

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES | 50 |

ITEM 15: EXHIBITS | 51 |

i

GLOSSARY OF SELECTED MINING AND TECHNICAL TERMS

The following is a glossary of selected mining terms used in the United States and Canada and referenced in this Annual Report on Form 10-K:

Table 1. Glossary

Term | Definition |

Ag | Silver |

Assay | A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained. |

Au | Gold |

Bulk sample | A large sample of mineralized rock, frequently hundreds of tonnes, selected in such a manner as to be representative of the potential mineral deposit (orebody) being sampled and used to determine metallurgical characteristics. |

Core | The long cylindrical piece of rock, about an inch in diameter, brought to surface by diamond drilling |

Core sample | One or several pieces of whole or split parts of core selected as a sample for analysis or assay. |

Cross-cut | A horizontal opening driven from a shaft and (or near) right angles to the strike of a vein or other orebody. The term is also used to signify that a drill hole is crossing the mineralization at or near right angles to it. |

Cu | Copper |

Cut-off grade | The lowest grade of mineralized rock that qualifies as ore grade in a given deposit, and is also used as the lowest grade below which the mineralized rock currently cannot be profitably exploited. Cut-off grades vary between deposits depending upon the amenability of ore to gold extraction and upon costs of production. |

Diorite | An intrusive igneous rock composed chiefly of sodic plagioclase, hornblende, biotite or pyroxene. |

Drift | A horizontal or nearly horizontal underground opening driven along a vein to gain access to the deposit. |

Exploration | Prospecting, sampling, mapping, diamond drilling and other work involved in searching for or defining a mineral deposit. |

Fault | A break in the earth's crust caused by tectonic forces which have moved the rock on one side with respect to the other. |

Grade | Term used to indicate the concentration of an economically desirable mineral or element in its host rock as a function of its relative mass. With gold or silver, this term may be expressed as grams per tonne (g/t) or ounces per tonne (opt or oz/t). |

Gram | 0.0321507 troy ounces |

g/t | Grams per metric tonne |

Hydrothermal | Processes associated with heated or superheated water, especially mineralization or alteration. |

Km | Kilometre(s). Equal to 0.62 miles. |

M | Metre(s). Equal to 3.28 feet. |

Metamorphic | Affected by physical, chemical, and structural processes imposed by depth in the earth's crust. |

Mine | An excavation on or beneath the surface of the ground from which mineral matter of value is extracted. |

Net Smelter Return ("NSR") | A payment made by a producer of metals based on the value of the gross metal production from the property, less deduction of certain limited costs including smelting, refining, transportation and insurance costs. |

Orebody | A term used to denote the mineralization contained within an economic mineral deposit. |

1

Term | Definition |

Ag | Silver |

Outcrop | An exposure of rock or mineral deposit that can be seen on the surface, that is, not covered by soil or water. |

Oxidation | A chemical reaction caused by exposure to oxygen that results in a change in the chemical composition of a mineral. |

Oz | Ounce. A measure of weight in gold and other precious metals, correctly troy ounces, which weigh 31.1 grams as distinct from an imperial ounce which weigh 28.4 grams. |

RC drilling | Reverse Circulation drilling, is one of the drilling methods, where drill cuttings are returned to surface inside the rods. |

Shaft | A vertical passageway to an underground mine for moving personnel, equipment, supplies and material including ore and waste rock. |

Strike | The direction, or bearing from true north, of a vein or rock formation measure on a horizontal surface. |

Stringer | A narrow vein or irregular filament of a mineral or minerals traversing a rock mass. |

Sulphides | A group of minerals which contains sulfur and other metallic elements such as copper and zinc. Gold is usually associated with sulphide enrichment in mineral deposits. |

Tailings | Material rejected from a mill after most of the recoverable valuable minerals have been extracted. |

Vein | A fissure, fault or crack in a rock filled by minerals that have travelled upwards from some deep source. |

Zone | An area of distinct mineralization. |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements". These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our business and our industry. Words such as "believe," "anticipate," "expect," "intend," "plan," "may," and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the sections of this Annual Report titled " Risk Factors " , " Business " and " Management ' s Discussion and Analysis of Financial Condition and Results of Operations " , as well as the following:

·

general economic conditions, because they may affect our ability to raise money

·

our ability to raise enough money to continue our operations

·

changes in regulatory requirements that adversely affect our business

·

changes in the prices for minerals that adversely affect our business

·

political changes in Chile, which could affect our interests there

·

other uncertainties, all of which are difficult to predict and many of which are beyond our control

You are cautioned not to place undue reliance on these forward-looking statements, which relate only to events as of the date on which the statements are made. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report. You should refer to and carefully review the information in future documents we file with the Securities and Exchange Commission.

2

ITEM 1: BUSINESS

General

Red Metal Resources Ltd. was incorporated in Nevada on January 10, 2005, as Red Lake Exploration, Inc. We changed our name to Red Metal Resources Ltd. on August 27, 2008.

On August 21, 2007, we formed Minera Polymet Limitada ("Polymet"), a limited liability company, under the laws of the Republic of Chile. We own 99% of Polymet, which holds our Chilean mineral property interests. Under Chilean law, a resident of Chile must be a shareholder in a limited liability company ("Limitada"). To meet this requirement, 1% of Polymet is owned by a Chilean resident, an experienced manager who has organized an office and other resources for us to use and is Polymet's legal representative in Chile. Polymet's office is located in Vallenar, III Region of Atacama, Chile. When we refer to "Red Metal", the "Company", "we", "us" or "our" in this report, we mean Red Metal Resources Ltd. together with Minera Polymet Limitada.

Our resident agent's office is at 711 S. Carson Street, Suite 4, Carson City, Nevada, 89701. Our business office is at 1158 Russell Street, Unit D, Thunder Bay, ON P7B 5N2. Our telephone number is (807) 345-7384; our email address is [email protected] ; and our web address is www.redmetalresources.com . Information on our web site is not a part of this Annual Report.

We are a start-up exploration stage company with no material revenue generating operations. We are in the business of acquiring and exploring mineral claims. All of our claims are located in the III Region of Atacama, Chile. We have not determined whether our claims contain mineral reserves that are economically recoverable. We have not produced revenues from our principal business and are considered an exploration stage company.

Our ability to realize a return on our investment in mineral claims depends upon whether we maintain the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. To the best of our knowledge, and after consultation with an attorney knowledgeable in the practice of mining, we believe that we have taken the steps necessary to ensure that we have good title to our mineral claims. We have had our contracts and deeds notarized, recorded in the registry of mines and published in the mining bulletin and we review the mining bulletin regularly to determine whether other parties have staked claims over our ground. We have discovered no such claims.

Recent corporate developments

Option to acquire Quina Claim

On May 27, 2014, Polymet entered into a Memorandum of Understanding (the "MOU") with David Mitchell to acquire an option to earn 100% interest in two mining claims contiguous to the Farellon Property. On December 15, 2014, the MOU was superseded by an option agreement to earn 100% interest in one of the mining claims included in the MOU, Quina 1-56 (the "Quina claim"). For further information about this transaction, see the discussion titled "Option to acquire Quina Claim" included in the " Unproved Mineral Properties" section of this Annual Report. We have a verbal extension of the MOU on the remaining claim and expect to finalize the option agreement in May 2015.

Option with Geoactiva SpA

On April 30, 2013, Polymet granted Geoactiva SpA, a Chilean mining company ("Geoactiva"), an option to purchase 100% of our Perth property. To maintain the option and acquire the property, Geoactiva agreed to pay Minera Polymet $1,000,000 and incur $3,500,000 in exploration expenses over 48 months. In August 2014 Geoactiva notified us of the cancellation of the Option Agreement. For further information about this transaction, see the discussion titled "Option with Geoactiva SpA" included in the " Unproved Mineral Properties" section of this Annual Report.

3

Grant of options

On February 28, 2014, we granted 1,200,000 options to purchase our common stock under the Red Metal Resources Ltd. 2011 Equity Incentive Plan. The options were granted to certain officers, directors, and consultants; our Chief Executive Officer, Chief Financial Officer, and Vice President of Exploration were each granted options to purchase up to 300,000 shares of our common stock. The options are exercisable at $0.15 for a term of two years and vested upon grant.

Chile's mining and land tenure policies

Chile's mining and land tenure policies were established to secure the property rights of both domestic and foreign investors to stimulate development of mining in Chile. The government of Chile owns all mineral resources, but exploration and exploitation of these resources are permitted through exploration and mining concessions. A mineral concession must pass through three stages to become a permanent mining concession, namely, pedimento, manifestacion and mensura.

A pedimento is an initial exploration claim. It can be placed on any area, whereas the survey to establish a permanent mensura claim can only be completed on free areas where no other mensuras exist. A pedimento is valid for a maximum of two years. At the end of this period it may either be reduced in size by at least 50% and renewed for an additional two years or entered into the manifestacion process to establish a permanent mensura claim. New pedimentos can overlap existing pedimentos, but the pedimento with the earliest filing date takes precedence providing the claim holder maintains the pedimento in accordance with the mining code and the applicable regulations.

Manifestacion, or mensura in process, is the process by which a pedimento is converted to a permanent mining claim. At any stage during its two-year life, the holder of a pedimento can submit a manifestacion application, which is valid for 220 days. To begin the manifestacion process, the owner must request a survey (mensura) within 220 days. After the survey request is accepted, the owner has approximately 12 months to have the claim surveyed by a government-licensed surveyor, inspected and approved by the national mining service, and affirmed as a mensura (equivalent to a patented claim) by a judge. Thereafter, an abstract describing the claim is published in Chile's official mining bulletin (published weekly) and 30 days later the claim is inscribed in the appropriate mining registry.

A mensura is a permanent property right that does not expire so long as the annual fees (patentes) are paid in a timely manner. Failure to pay the patentes for an extended period can result in the claim being listed for sale at auction, where a third party can acquire a claim for the payment of the back taxes owed and a penalty.

As of the date of this report, our Chilean mineral properties are represented mainly by mensura and mensura in process claims.

Strategic relationships

We have a close working relationship with Minera Farellon Limitada ("Minera Farellon"), a Chilean company owned equally by Kevin Mitchell, Polymet's 1% shareholder and our legal representative in Chile, and Richard Jeffs, who holds more than 5% of our shares of common stock (see Table 23). Minera Farellon investigates potential claims and often ties them up, by staking new claims, optioning or buying others' claims, all at its own cost. This gives us an opportunity to review the claims prior to making a decision whether they are of interest to us. If we are interested, then we either proceed to acquire an interest in the property directly from the owner, or, if Minera Farellon has already obtained an interest, we take an option to acquire its interest. Minera Farellon, which is located in the city of Vallenar, also provides some of our logistical support in Vallenar, which enables us to limit our operating expenses to those needed from time to time.

4

Unproved mineral properties

Due to a lack of operating capital, during the fiscal year ended January 31, 2015, we conducted no material exploratory operations on any of our properties. Until we are able to raise operating capital, which we cannot assure that we can do, we will not be able to initiate new exploration efforts or continue the exploration efforts we have begun. In the past we entered into several various agreements, being the joint ventures or the option agreements to acquire an interest in our claims. These agreements give us confidence there are opportunities to raise funds by selling some of our properties or by entering into joint venture agreements to continue developing some of our properties.

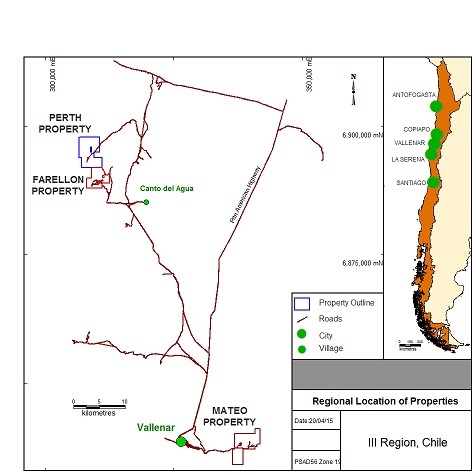

As of the date of this Annual Report on Form 10-K we have three active properties which we have assembled since the beginning of 2007 - the Farellon, Perth, and Mateo. These properties are grouped into two geographical areas - Carrizal Alto area properties and Vallenar area properties.

Active properties

Table 2: Active properties

|

| Hectares | |

Property | Percentage, type of claim | Gross area | Net area a |

Farellon |

|

|

|

Farellon Alto 1 - 8 claim | 100%, mensura | 66 |

|

Cecil 1 - 49 claim | 100%, mensura | 230 |

|

Quina 1 - 56 claim | 100%, mensura | 252 |

|

Teresita claim | 100%, mensura | 1 |

|

Azucar 6 - 25 claim | 100%, mensura | 88 |

|

Stamford 61 - 101 claim | 100%, mensura | 165 |

|

Kahuna 1 - 40 claim | 100%, mensura | 200 |

|

|

| 1,002 | 1,002 |

Perth |

|

|

|

Perth 1 al 36 claim | 100%, mensura | 109 |

|

Lancelot I 1 al 30 claim | 100%, mensura in process | 300 |

|

Lancelot II 1 al 20 claim | 100%, mensura in process | 200 |

|

Rey Arturo 1 al 30 claim | 100%, mensura in process | 300 |

|

Merlin I 1 al 10 claim | 100%, mensura in process | 60 |

|

Merlin I 1 al 24 claim | 100%, mensura in process | 240 |

|

Galahad I 1 al 10 claim | 100%, mensura in process | 50 |

|

Galahad IA 1 al 45 claim | 100%, mensura in process | 230 |

|

Percival III 1 al 30 claim | 100%, mensura in process | 300 |

|

Tristan II 1 al 30 claim | 100%, mensura in process | 300 |

|

Tristan IIA 1 al 5 claim | 100%, mensura in process | 15 |

|

Camelot 1 al 58 claim | 100%, mensura in process | 262 |

|

|

| 2,366 |

|

Overlapped claims a |

| (121) | 2,245 |

Mateo |

|

|

|

Margarita claim | 100%, mensura | 56 |

|

Che 1 & 2 claims | 100%, mensura | 76 |

|

Irene & Irene II claims | 100%, mensura | 60 |

|

Mateo 4 and 5 claims | 100%, mensura | 600 |

|

Mateo 1, 2, 3, 10, 12, 13 claims | 100%, mensura in process | 861 |

|

|

| 1,653 |

|

Overlapped claims a |

| (469) | 1,184 |

|

|

|

|

|

|

| 4,431 |

Our active properties as of the date of this filing are set out in Figure 1. These properties are accessible by road from Vallenar as illustrated in Figure 1 below.

5

Figure 1: Location and access to active properties.

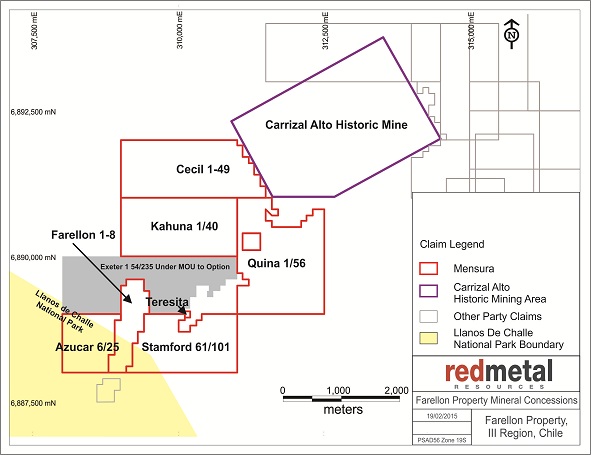

FARELLON PROPERTY

The Farellon property consists of two groups of claims which are not contiguous but lie within the historical Carrizal Alto mining district southwest of the Carrizal Alto mine. Table 3 describes the claims and Figure 2 illustrates them.

Table 3: Farellon property

| |

| Type |

Claim | Mensura (ha) |

Farellon Alto 1 - 8 | 66 |

Cecil 1 - 49 | 230 |

Quina 1 - 56 | 252 |

Teresita | 1 |

Azucar 6 - 25 | 88 |

Stamford 61 - 101 | 165 |

Kahuna 1 - 40 | 200 |

| 1,002 |

6

Figure 2: Farellon Property

FARELLON ALTO 1 - 8 CLAIM

The Farellon Alto 1 - 8 (the "Farellon Claim") is the first mineral claim that we acquired in Chile. It covers 66 hectares and is centered about 309,150 east and 6,888,800 south UTM PSAD56 Zone 19 in Province of Huasco, Commune of Huasco, III Region of Atacama, Chile.

We acquired the claim on April 25, 2008, for $550,000 and owe a royalty equal to 1.5% of the net proceeds that we receive from the processor to a maximum of $600,000 with a monthly minimum of $1,000 when we start exploiting the minerals extracted from the claim. We can pay any unpaid balance of the royalty at any time.

On May 23, 2013, we entered into a rental agreement with Minera Farellon Limitada ("Minera Farellon"), to allow Minera Farellon to conduct certain exploration and mining activities on the Farellon Claim in exchange for a 10% royalty on gross smelter returns. This agreement was amended on June 5, 2014, when Polymet gave the permission to conduct certain exploration and mining activities on Farellon Alto 1 - 6 claims directly to Kevin Mitchell, leaving Minera Farellon the right to work on Farellon Alto 7 - 8 claims.

Minera Farellon started small scale mining activities on the Farellon Claim in January 2014. The work done on the Farellon Claim by Minera Farellon resulted in $9,865 royalty payments from gross smelter returns during the year ended January 31, 2015. During the same period we received $4,389 in royalty payments from Kevin Mitchell. At the same time, the mining activities triggered our obligation to pay the minimum royalty to the original vendors; during the year ended January 31, 2015, we have paid $14,255 in minimum royalties payable under our option agreement.

7

CECIL 1 - 49 CLAIM

On September 17, 2008, we bought the Cecil 1 - 49, Cecil 1 - 40 and Burghley 1 - 60 claims for $27,676. On December 1, 2009, we initiated the manifestacion process when we applied to convert the Cecil 1 - 40 and Burghley 1 - 60 exploration (pedimento) claims to mining (mensura) claims. In January 2013 we abandoned the manifestacion process for the Cecil 1-40 and Burghley 1-60 claims due to the fact that several mensuras underlying the claims covered the most prospective ground as outlined in our prospecting and mapping program completed in April 2012.

The Cecil 1 - 49 (the "Cecil Claim") covers 230 hectares and is centered at 310,250 east and 6,891,500 south UTM PSAD56 Zone 19 and lies approximately 1.7 kilometers north of the Farellon Claim border. The Cecil Claim covers a 700 metre strike length of a mineralized vein interpreted to be part of the same mineralizing system as the Farellon Alto 1 - 8 vein (the "Farellon Vein"). An investigation completed during the Farellon Claim acquisition uncovered a broad regional reconnaissance sampling program completed in 1996 showing results from the areas covered by the Cecil Claim. Results from the 1996 sampling show copper and gold grades similar to grades returned from the Farellon Vein, indicating that the Cecil Claim could have similar mineralized bodies.

QUINA 1 - 56 CLAIM

On December 15, 2014, we entered into an option agreement with David Marcus Mitchell to earn 100% interest in a Quina 1-56 clam (the "Quina Claim"). The Quina Claim covers 252 hectares and is centered at 310,063 east and 6,890,435 south UTM PSAD56 Zone 19 and is contiguous to the Farellon Property. Acquisition of the Quina Claim added approximately 2 kilometers of strike length of the Farellon Veins.

OTHER CLAIMS

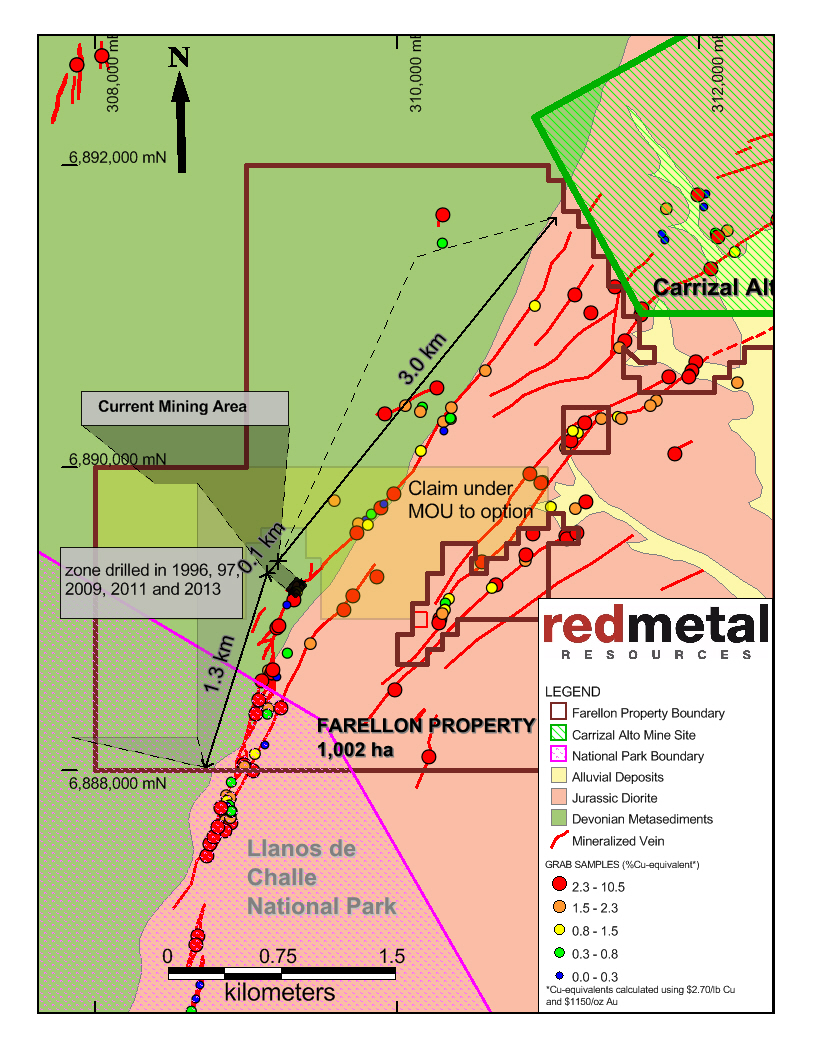

On August 21, 2012, we acquired four mineral claims - Azucar 6-25, Kahuna 1-40, Stamford 61-101, and Teresita - through the government auction for a total price of $19,784. The Azucar claim is the most prospective of these claims as it covers a 1,200 metre strike length of a mineralized vein interpreted to be part of the same mineralizing system as the Farellon Vein. Three parallel veins have also been identified on the Azucar claim during the 2012 mapping and prospecting program and can be seen on Figure 3.

Location and means of access. The Farellon property is approximately 40 kilometers west of the Pan-American Highway, about 1 hour and 15 minutes by vehicle from the town of Vallenar which has a population of 40,000 and modern facilities. High-tension power lines and a fiber-optic communications line run along the highway and both power and rail are connected to the Cerro Colorado iron ore mine only 20 kilometers from the Farellon property. The area is serviced from Copiapó, a city of 70,000 with daily air and bus services to Santiago and other centers.

The Farellon property can be accessed by driving approximately 20 kilometers north on the Pan-American Highway from Vallenar then turning northwest towards Canto del Agua. From Canto del Agua, the Farellon property is approximately 10 kilometers along a well-maintained gravel road. There are numerous gravel roads in the area, so a guide is necessary to access the property the first time. All of the roads are well maintained and can support large machinery necessary to transport drills, backhoes and bulldozers. Water is readily available in Canto del Agua and could probably be found on the Farellon property where all of the historic drill holes intersected water.

Exploration history. The Farellon property is in the Carrizal Alto mining district and lies 5 kilometers along strike south of the center of the historic Carrizal Alto copper-gold mine. Veins of the Farellon property were exploited as part of the Carrizal Alto mines. We have located no hard data summarizing all of the past mining activity, but tailings, slag dumps and the size of the shafts and some of the shallow surface workings are evidence of extensive historical mining.

8

Mine workings of various sizes are all along the Farellon property, but only one modern exploration program has been completed. In 1996, the Farellon and two other veins, the Fortuna and the Theresa, were explored by an Australian junior mining company Minera Stamford S.A. Their exploration included a large mapping and surface sampling program followed by a 34-hole RC drilling program. Of these 34 drill holes, 23 were drilled on the Farellon Alto 1 - 8 claim. The RC drilling program on the Farellon claim consistently intersected oxide and sulphide facies mineralization along a 2 kilometer-long zone covering the Farellon claim and strike extents to the south. Mineralization is 2 to 35 meters wide with an average width of 5 meters. The mineralized zone consists of one or more discrete veins and, in places, stockwork veining and mineralization. While drilling covered the length of the property, gaps up to 350 meters are untested and infill drilling is required to confirm an economic ore body. Table 4 presents the significant intersections from the 23 holes drilled on the Farellon claim in the 1996 drilling.

Table 4: Farellon historic significant intersections (1996)

Drill hole FAR-96 | Significant intervals (m) |

| Assay results | ||||

From | To | Length |

| Gold (g/t) | Copper (%) | Cobalt (%) | |

06 | 49 | 54 | 5 |

| 0.15 | 0.73 | 0.01 |

07 | 25 | 34 | 9 |

| 0.38 | 1.05 | 0.02 |

09 | 57 | 84 | 27 |

| 0.51 | 0.91 | 0.03 |

010 | 31 | 36 | 5 |

| 1.00 | 0.68 | 0.04 |

011 | 20 | 26 | 6 |

| 0.67 | 0.46 | 0.02 |

013 | 86 | 93 | 7 |

| 0.87 | 1.68 | 0.04 |

014 | 77 | 83 | 6 |

| 0.66 | 0.85 | 0.06 |

015 | 59 | 79 | 20 |

| 0.99 | 0.98 | 0.06 |

99 | 109 | 10 |

| 0.18 | 1.02 | 0.03 | |

016 | 24 | 26 | 2 |

| 0.95 | 1.57 | 0.02 |

64 | 70 | 6 |

| 0.73 | 0.81 | 0.07 | |

020 | 14 | 16 | 2 |

| 0.46 | 1.85 | 0.05 |

39 | 43 | 4 |

| 0.75 | 0.90 | 0.03 | |

021 | 22 | 25 | 3 |

| 4.17 | 5.29 | 0.11 |

022 | 29 | 39 | 10 |

| 1.53 | 1.31 | 0.04 |

100 | 108 | 8 |

| 3.72 | 2.49 | 0.06 | |

023 | 50 | 53 | 3 |

| 0.48 | 1.10 | 0.06 |

59 | 64 | 5 |

| 0.28 | 0.78 | 0.03 | |

132 | 147 | 15 |

| 0.60 | 1.42 | 0.03 | |

024 | 33 | 36 | 3 |

| 0.94 | 2.89 | 0.06 |

025 | 65 | 85 | 20 |

| 0.97 | 1.22 | 0.02 |

028 | 55 | 58 | 3 |

| 0.12 | 0.52 | 0.06 |

029 | 30 | 34 | 4 |

| 0.18 | 1.15 | 0.07 |

82 | 87 | 5 |

| 0.09 | 0.96 | 0.01 | |

Geology. The Farellon area has two major lithological units: Paleozoic metamorphic sediments consisting of schists, phyllites and quartzites; and the Franja Central diorites. The metamorphosed sediments outcrop in the western part of the property and have been metamorphosed to lower greenschist facies and then extensively overprinted by hydrothermal alteration. Hydrothermal alteration is directly associated with the shear zone. The diorite underlies the eastern part of the project area and has been extensively intruded by northeasterly trending intermediate mafic dykes. At the Farellon property, a small stock-like felsic body named Pan de Azucar intrudes the diorite. The intrusive relationship between the diorite and metamorphic sediments always appear to be tectonic. Within the property and at the main Carrizal Alto workings to the north, the major mineralization is intimately related to the south-southwest trending mylonitic sheared contact between the metamorphic sediments and the diorite. The shear is considered a splay of the main Atacama Fault Zone and dips 30º to 65º west. This contact parallels the regional geological trend and coincides with a major lineament which extends for hundreds of kilometers. The sheared contact is 50 meters to 200 meters wide over the 1.7-kilometre strike length of the Farellon property. Veins are typically 3 to 15 meters wide, striking south-southwest and dipping approximately 65 degrees to the northwest.

9

Mineralization. The Farellon property lies within the Candelaria iron oxide-copper-gold (IOCG) belt of Chile. Ore bodies in the belt occur in veins, breccias, stringer bodies and layer parallel replacement bodies and are typically associated with north-south trending faults related to the Atacama Fault Zone. All IOCG deposits have a strong association with iron oxides in the form of hematite or magnetite. In the Candelaria region, larger ore bodies are located where the fault zones intersect a lithological contact with significant rheological contrast such as a sedimentary and volcanic intrusive contact.

Economic IOCG deposits are generally polymetallic and can include iron, copper, gold, zinc, lead, uranium and cobalt among others. The Farellon property historically has been exploited for copper and to a lesser extent, gold. Cobalt mineralization was observed during the 1996-97 exploration work, but we have found no records of cobalt extraction.

Drilling (Summer 2011) . During June through September 2011 we conducted a combined RC/diamond drill program on the Farellon property. The program was designed to continue to expand on the results of the 2009 drill program, as well as to continue confirming historical results along the strike. During this program we completed 11 drillholes for a total of 2,233m with the goal not only of better defining structural controls on mineralization but to examine the continuity of mineralization along strike and at depth. The target of the program was to outline a 700m mineralized strike length down to 200m vertical depth with approximate 75m intercept spacing, and to infill gaps 300m further to the north to increase intercepts to 150m spacing.

Many of the existing intercepts in this area were from the 1996/97 drill program, but no geological information can be located for these drill holes. By infilling the area with drilling at 75 meter pierce points the aim was to increase confidence in the continuity and increase knowledge of the nature and structural controls on mineralization to aid further exploration planning. 2011 drill results confirmed that mineralization is still present downdip of past drilling intercepts and still open at depth. Infill drilling continued to confirm the continuity of the mineralization and aided in the development of a 3D model that will be used for any future drill planning.

2011 drilling confirmed the overall regional shear structural controls on mineralization occurring within the oblique fault contact between overlying Paleozoic Metasediments and underlying Jurassic intermediate intrusives. Supergene mineralization seems to occur within local faults not immediately within the lithological fault contact - possibly fault splays emanating off the main regional structure. In the 2011 drillholes, supergene copper-gold mineralization was intersected 50-150m downhole with abundant carbonate and iron oxide precipitation.

Hypogene mineralization occurred below 150m hosted in quartz and carbonate veins which appear closer to the main shear fault zone contact. Approximately within 20m downhole of intersected hypogene mineralized veins the lithological contact was encountered, passing through to the underlying intrusive package. The 2011 drill program was generally positive in better defining structural controls on mineralization and proving continuity of mineralization along strike and at depth. However, more drilling is needed to continue to expand on the mineralized zone along strike and at depth, and prove up infill targets for an initial resource estimation.

In spring of 2012 we commissioned Micon to complete a second 43-101 technical report. Micon now recommends that we conduct a much larger phase of exploration consisting of 5,000 meters of diamond drilling and 10,000 meters of RC drilling, and geophysical surveys and geological mapping. A geophysics survey using both magnetics and induced polarization will help to identify further mineralized structures on the property that may not have been noticed in the historic mapping. A phase two drill program would be at defined spacing to outline the continuity of mineralization leading to an initial resource estimation. The depth of the drilling would be dependent on the results of the phase one drilling program. The estimated cost of this phase is $1.9 million.

10

Significant results of assays from the 2011 drill program are presented in Table 5 below.

Table 5: Farellon drilling results (2011)

Drill Hole ID | Assay interval (m) | Assay grade | |||

From | To | Length | Copper % | Gold g/t | |

FAR-11-001 | 36 | 49 | 13 | 2.51 | 0.35 |

FAR-11-001 | 78 | 85 | 7 | 0.43 | 0.04 |

FAR-11-002 | No Significant Intersections. Zone faulted off | ||||

FAR-11-003 | 150 | 155 | 5 | 0.40 | 0.28 |

FAR-11-003 | 177 | 182 | 5 | 0.44 | 0.15 |

FAR-11-004 | 141 | 145 | 4 | 0.73 | 0.01 |

FAR-11-005 | 124 | 133 | 9 | 0.84 | 0.26 |

FAR-11-006 | 80 | 112 | 32 | 1.35 | 0.99 |

FAR-11-007 | 56 | 74 | 18 | 0.50 | 0.40 |

FAR-11-008 | 98 | 102 | 4 | 0.85 | 0.26 |

FAR-11-009 | 202 | 211.55 | 9.55 | 0.95 | 0.42 |

FAR-11-010 | 179.13 | 183 | 3.87 | 0.50 | 0.39 |

FAR-11-011 | 54 | 56 | 2 | 0.97 | 0.48 |

Figure 3 below illustrates the Farellon geology and the 2006, 2009 and 2011 drillhole collar locations as well as surface traces of mineralized vein systems:

11

Figure 3: Farellon Property Geology

QA/QC, sampling procedures and analytical methods. Samples were taken at intervals between 0.5 and 2 metres. Sampling started at the collar of the hole and proceeded to the top or bottom of the drill hole. Samples were taken at two metre intervals outside the previously identified main zone of interest. Through the main zone of interest samples were taken at one metre intervals. Generally, the sample recovery was good to excellent for the 2011 drilling program. Table 5 above summarizes significant assay results. They are reported as drill lengths as we have not established the width of the mineralized zone.

12

Our quality assurance, quality control (QA/QC) protocol consists of the addition of standards, blanks and laboratory duplicates to the sample stream. We inserted these into the sample series using the same number sequence as the samples themselves. One of the QA/QC check samples is inserted every 25 samples and it alternates between standards, blanks and laboratory duplicates.

Spring 2012 mapping program: In April of 2012 we completed a detailed mapping, prospecting and rock sampling program over the Farellon Property. This program was designed to extend the known mineralized zone to the north and the south and to identify the best potential to expand on the known mineralized zone. As a result of the mapping program, new ground was acquired at public auction in August 2012 to cover the strike extent of the mineralized veins.

2013 Drilling . In 2013 we drilled two RC drillholes on the Farellon Property. The two new drillholes, FAR-13-001 and 002, totaling 116 metres, were drilled 25 metres along strike and are intended to aid in identifying the most prospective area on the site to initiate small scale production. The results from the FAR-13-002 drillhole returned 2.15% Cu over 7m with .28 g/t Au; the FAR-13-001 drillhole returned 0.70% Cu over six meters with 0.20 g/t Au and including 1.25% Cu and 0.34 g/t Au over 2 meters.

2014 Small Scale Mining. In January 2014 Minera Farellon Limitada started small scale mining activities on the Farellon Claim. The main target of the current development is an area intersected in 2011 and 2013 drilling campaigns, more specifically intercepts in drill holes FAR-11-001 of 3.95% Cu and 0.53 g/t Au over 8 meters, FAR-13-002 of 2.15% Cu and 0.28 g/t Au over 7 meters and FAR-13-001 of 0.70% Cu and 0.20 g/t Au over 6 meters including 1.25% Cu and 0.34 g/t Au over 2 meters (see news releases dated Sept. 21, 2011 and Jan. 24, 2014). The target area is at 35 meters vertical depth from surface.

As of the date of this Annual Report on Form 10-K, Minera Farellon has completed aproximately 300 meters of mine development reaching approximately 35 metres in depth and has started production on a vein face averaging 7 metres wide. Our geologist visited site and confirmed the width of the vein and the nature of the mineralization and noted strong oxide supergene mineralization consisting of chalcocite, azurite, malachite and tenorite.

The mining activities resulted in approximately 1,572 tonnes of ore delivered to ENAMI (the Chilean national mining company) at an overall average of 1.40% Cu. We expect Minera Farellon to begin shipping sulphide ore in May 2015 and start to be paid for gold content as well as copper content.

Minera Farellon received $200,000 in a combined grant and low interest loan from ENAMI, which can be used solely for the development of the Farellon Mine. As part of the grant Minera Farellon also received expanded permitting to mine up to 1,000 tonnes per month.

PERTH PROPERTY

On March 10, 2011, we purchased for $35,000 a group of 12 claims (the "Perth property") as described in Table 6 and illustrated in Figure 4.

13

Table 6: Perth property

Claim | Mensura/ Mensura in process (ha) |