UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended January 31, 2011

o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to ________________

Commission File Number 000-52055

RED METAL RESOURCES LTD.

(Exact name of registrant as specified in its charter)

Nevada | 20-2138504 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

195 Park Avenue Thunder Bay, Ontario P7B 1B9

(Address of principal executive offices)

Registrant's telephone number, including area code: (807) 345-7384

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which each is registered | |

N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes [ x ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ] The registrant is not yet subject to this requirement.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer [ ] | Accelerated filer [ ] | |

Non-accelerated filer [ ] | Smaller reporting company [X] | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. As of July 30, 2010, the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of the common equity was $1,439,473.

TABLE OF CONTENTS

NOTE ABOUT FORWARD-LOOKING STATEMENTS | 1 |

ITEM 1: BUSINESS | 1 |

GENERAL | 1 |

UNPROVED MINERAL PROPERTIES | 3 |

COMPETITION | 15 |

RAW MATERIALS | 15 |

DEPENDENCE ON MAJOR CUSTOMERS | 15 |

PATENTS/TRADEMARKS/LICENSES/FRANCHISES/CONCESSIONS/ROYALTY AGREEMENTS/LABOR CONTRACTS | 15 |

COSTS AND EFFECTS OF COMPLIANCE WITH ENVIRONMENTAL LAWS | 16 |

EXPENDITURES ON RESEARCH AND DEVELOPMENT | 16 |

NUMBER OF TOTAL EMPLOYEES AND NUMBER OF FULL-TIME EMPLOYEES | 16 |

ITEM 1A: RISK FACTORS | 16 |

ITEM 1B: UNRESOLVED STAFF COMMENTS | 21 |

ITEM 2: PROPERTIES | 21 |

ITEM 3: LEGAL PROCEEDINGS | 21 |

ITEM 4: REMOVED AND RESERVED | 21 |

ITEM 5: MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 21 |

ITEM 6: SELECTED FINANCIAL DATA. | 22 |

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 23 |

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 31 |

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 31 |

INDEX TO FINANCIAL STATEMENTS | 31 |

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 34 |

NOT APPLICABLE. | 34 |

ITEM 9A(T): CONTROLS AND PROCEDURES | 34 |

ITEM 9B: OTHER INFORMATION | 35 |

ITEM 10: DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 35 |

ITEM 11: EXECUTIVE COMPENSATION | 37 |

ITEM 12: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 37 |

ITEM 13: CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 38 |

DIRECTOR INDEPENDENCE | 38 |

TRANSACTIONS WITH RELATED PERSONS | 38 |

ITEM 14: PRINCIPAL ACCOUNTING FEES AND SERVICES | 41 |

ITEM 15: EXHIBITS | 42 |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains "forward-looking statements". These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our business and our industry. Words such as "believe," "anticipate," "expect," "intend," "plan," "may," and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the sections of this annual report titled "Risk Factors", "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations", as well as the following:

| • | general economic conditions, because they may affect our ability to raise money |

| • | our ability to raise enough money to continue our operations |

| • | changes in regulatory requirements that adversely affect our business |

| • | changes in the prices for minerals that adversely affect our business |

| • | political changes in Chile, which could affect our interests there |

| • | other uncertainties, all of which are difficult to predict and many of which are beyond our control |

You are cautioned not to place undue reliance on these forward-looking statements, which relate only to events as of the date on which the statements are made. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date of this annual report. You should refer to and carefully review the information in future documents we file with the Securities and Exchange Commission.

ITEM 1: BUSINESS

General

Red Metal Resources Ltd. was incorporated in Nevada on January 10, 2005 as Red Lake Exploration, Inc. We changed our name to Red Metal Resources Ltd. on August 27, 2008.

On August 21, 2007, we formed Minera Polymet Limitada, a limited liability company, under the laws of the Republic of Chile. We own 99% of Polymet, which holds our Chilean mineral property interests. Under Chilean law, a resident of Chile must be a shareholder in a limitada. To meet this requirement, 1% of Polymet is owned by a Chilean resident, an experienced manager who has organized an office and other resources for us to use and is Polymet's legal representative in Chile. Polymet's office is located in Vallenar, III Region of Atacama, Chile.

Our resident agent's office is at 711 S. Carson Street, Suite 4, Carson City, Nevada, 89701. Our business office is at 195 Park Avenue, Thunder Bay, Ontario, Canada, P7B 1B9. Our telephone number is (807) 345-7384; our email address is info@redmetalresources.com ; and our web address is www.redmetalresources.com . Information on our web site is not a part of this annual report.

We are a start-up exploration stage company without operations. We are in the business of acquiring and exploring mineral claims. All of our claims are located in the III Region of Atacama, Chile. We have not determined whether our claims contain mineral reserves that are economically recoverable. We have not produced revenues from our principal business and are considered an exploration stage company as defined by "Accounting and Reporting by Development Stage Enterprises."

Our ability to realize a return on our investment in mineral claims depends upon whether we maintain the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. To the best of our knowledge, and after consultation with an attorney knowledgeable in the practice of mining, we believe that we have taken the steps necessary to ensure that we have good title to our mineral claims. We have had our contracts and deeds notarized, recorded in the registry of mines and published in the mining bulletin and we review the mining bulletin regularly to determine whether other parties have staked claims over our ground. We have discovered no such claims.

1

Chile's mining and land tenure policies were established to secure the property rights of both domestic and foreign investors to stimulate development of mining in Chile. The government of Chile owns all mineral resources, but exploration and exploitation of these resources are permitted through exploration and mining concessions. A mineral concession must pass through three stages to become a permanent mining concession, namely, pedimento, manifestacion and mensura.

A pedimento is an initial exploration claim. It can be placed on any area, whereas the survey to establish a permanent mensura claim can only be completed on free areas where no other mensuras exist. A pedimento is valid for a maximum of two years. At the end of this period it may either be reduced in size by at least 50% and renewed for an additional two years or entered into the manifestacion process to establish a permanent mensura claim. New pedimentos can overlap existing pedimentos, but the pedimento with the earliest filing date takes precedence providing the claim holder maintains the pedimento in accordance with the mining code and the applicable regulations.

Manifestacion is the process by which a pedimento is converted to a permanent mining claim. At any stage during its two-year life, the holder of a pedimento can submit a manifestacion application, which is valid for 220 days. To begin the manifestacion process, the owner must request a survey (mensura) within 220 days. After the survey request is accepted, the owner has approximately 12 months to have the claim surveyed by a government-licensed surveyor, inspected and approved by the national mining service, and affirmed as a mensura (equivalent to a patented claim) by a judge. Thereafter, an abstract describing the claim is published in Chile's official mining bulletin (published weekly) and 30 days later the claim is inscribed in the appropriate mining registry.

A mensura is a permanent property right that does not expire so long as the annual fees (patentes) are paid in a timely manner. Failure to pay the patentes for an extended period can result in the claim being listed for sale at auction, where a third party can acquire a claim for the payment of the back taxes owed and a penalty.

In Chile, we have both pedimento and mensura claims. We cannot guarantee that any of our pedimento claims will convert to mensura claims. Some of our pedimentos are still in the registration process and some are in the manifestacion stage. We may decide, for geologic, economic or other reasons, not to complete a registration or manifestacion or to abandon a claim after it is registered. Some of our pedimentos may have been staked over other owners' claims as permitted by the Chilean mining code. Our pedimento rights in these claims will not crystallize unless the owners of the underlying claims fail to pay their taxes or otherwise forfeit their interests in their claims. Our purpose in over-staking is to claim free ground around others' claims and to have the first right to forfeited claims if we want them. Over-staking is easier and less costly than staking available ground around claims and ensures that all available ground is covered that might otherwise be missed.

We have a close working relationship with Minera Farellon Limitada, a Chilean company owned equally by Kevin Mitchell, Polymet's legal representative in Chile, and Richard Jeffs, the father of our president, who holds more than 5% of our shares of common stock (see Table 16 below). Minera Farellon investigates potential claims and often ties them up, by staking new claims, optioning or buying others' claims, all at its own cost. This gives us an opportunity to review the claims to decide whether they are of interest to us. If we are interested, then we either proceed to acquire an interest in the property directly from the owner, or, if Minera Farellon has already obtained an interest, we take an option to acquire its interest. Minera Farellon, which is located in the city of Vallenar, also provides all of our logistical support in Vallenar under a month-to-month contract, which enables us to limit our operating expenses to those needed from time to time.

2

Unproved mineral properties

We have three active properties-the Farellon, Mateo, and Perth-consisting of both mining claims and exploration claims that we have assembled since the beginning of 2007.

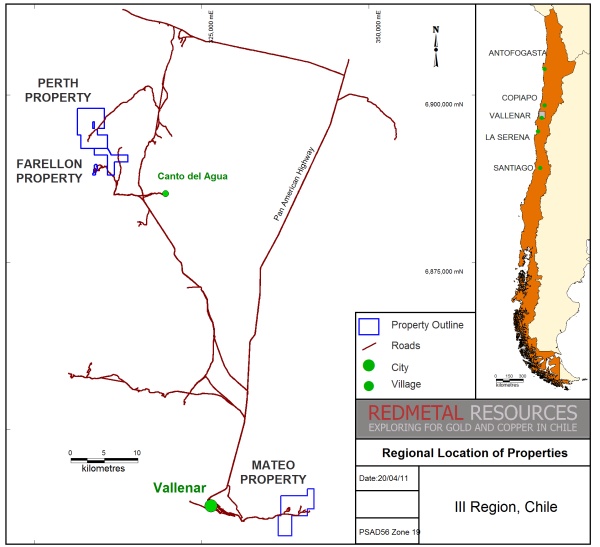

Our active properties as of the date of this filing are set out in Table 1. These properties are accessible by road from Vallenar as illustrated in Figure 1.

Table 1: Active properties

Table 1: Active properties | |||||

Property | Percentage, type of claim | Hectares | |||

Gross area | Net area a | ||||

Farellon | |||||

Farellon 1 – 8 claim | 100%, mensura | 66 | |||

Farellon 3 claim | 100%, pedimento | 300 | |||

Cecil 1 – 49 claim | 100%, mensura | 230 | |||

Cecil 1 – 40 and Burghley 1 – 60 claims | 100%, manifestacion | 500 | |||

1,096 | 1,096 | ||||

Mateo | |||||

Margarita claim | 100%, mensura | 56 | |||

Che 1 & 2 claims | 100%, mensura | 76 | |||

Irene & Irene II claims | 100% b , mensura | 60 | |||

Mateo 1, 2, 3, 12, 13, 14 claims | 100%, manifestacion | 1,500 | |||

Mateo 4 and 5 claims | 100%, pedimento | 600 | |||

2,292 | |||||

Overlapped claims (see Figure 3) | (170) | 2,122 | |||

Perth | |||||

Perth 1 al 36 claim | 100%, mensura | 109 | |||

Lancelot I 1 al 30 claim | 100%, mensura in process | 300 | |||

Lancelot II 1 al 20 claim | 100%, mensura in process | 200 | |||

Rey Arturo 1 al 30 claim | 100%, mensura in process | 300 | |||

Merlin I 1 al 10 claim | 100%, mensura in process | 60 | |||

Merlin I 1 al 24 claim | 100%, mensura in process | 240 | |||

Galahad I 1 al 10 claim | 100%, manifestacion | 50 | |||

Galahad I 1 al 46 claim | 100%, manifestacion | 230 | |||

Percival III 1 al 30 claim | 100%, manifestacion | 300 | |||

Tristan II 1 al 30 claim | 100%, manifestacion | 300 | |||

Tristan IIA 1 al 5 claim | 100%, manifestacion | 15 | |||

Camelot claim | 100%, pedimento | 300 | |||

2,404 | |||||

Overlapped claims (see Figure 4) | (124) | 2,280 | |||

5,498 | |||||

a Some pedimentos and manifestacions overlap other claims. The net area is the total of the hectares we have in each property (i.e. net of our overlapped claims). b We have agreed to complete the purchase of this property in May, 2011. | |||||

3

Figure 1: Location and access to active properties |

Farellon property

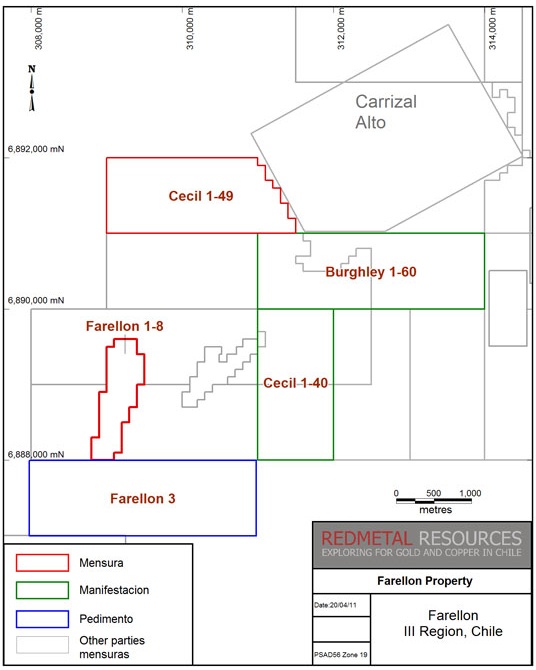

The Farellon property consists of two groups of claims-the Farellon claim and the Cecil and Burghley claims-which are not contiguous but lie within the historical Carrizal Alto mining district southwest of the Carrizal Alto mine. Table 2 describes the claims and Figure 2 illustrates them.

Table 2: Farellon property | |||

Claim | Type | ||

Mensura (ha) | Manifestacion (ha) | Pedimento (ha) | |

Farellon 1 – 8 | 66 | ||

Cecil 1 – 49 | 230 | ||

Cecil 1 – 40 | 200 | ||

Burghley 1 – 60 | 300 | ||

Farellon 3 | 300 | ||

296 | 500 | 300 | |

4

Figure 2: Farellon property |

The Farellon 1 – 8 is the first mineral claim that we acquired in Chile. It covers 66 hectares and is centered about 309,150 east and 6,888,800 south UTM PSAD56 Zone 19 in Province of Huasco, Commune of Huasco, III Region of Atacama, Chile.

We acquired the claim on April 25, 2008 for $550,000. We owe a royalty equal to 1.5% of the net proceeds that we receive from the processor to a maximum of $600,000, payable monthly and subject to a monthly minimum of $1,000 when we start exploiting the minerals we extract from the claim. We can pay any unpaid balance of the royalty at any time. We have not yet exploited the claim.

On September 17, 2008, we bought the Cecil 1 – 49, Cecil 1 – 40 and Burghley 1 – 60 claims for $27,676. The Cecil and Burghley claims cover 730 hectares and are centered at 311,500 east and 6,890,000 south UTM PSAD56 Zone 19 and lie approximately 1.7 kilometers north of the Farellon 1 – 8 border. The claims cover a 1.8-kilometre strike length of a mineralized vein interpreted to be part of the same mineralizing system as the Farellon 1 – 8 vein. An investigation completed during the Farellon 1 – 8 acquisition uncovered a broad regional reconnaissance sampling program completed in 1996 showing results from the areas covered by the Cecil and Burghley claims. Results from the 1996 sampling show copper and gold grades similar to grades returned from the Farellon vein, indicating that the Cecil and Burghley claims could have similar mineralized bodies. On December 1, 2009, we initiated the manifestacion process when we applied to convert the Cecil 1 – 40 and Burghley 1 – 60 exploration (pedimento) claims to mining (mensura) claims.

On July 1, 2010 we registered a pedimento, Farellon 3, at a cost of $305 to cover 300 hectares of ground directly south of our Farellon 1 – 8 claim. The Farellon 3 claim covers a further 1,000 metres of potential strike extent of the known mineralized zone on the Farellon 1 – 8 claim.

5

Location and means of access. The Farellon property is approximately 40 kilometers west of the Pan-American Highway, about 1 hour and 15 minutes by vehicle from the town of Vallenar which has a population of 40,000 and modern facilities. High-tension power lines and a fiber-optic communications line run along the highway and both power and rail are connected to the Cerro Colorado iron ore mine only 20 kilometers from the Farellon property. The area is serviced from Copiapó, a city of 70,000 with daily air and bus services to Santiago and other centers.

The Farellon property can be accessed by driving approximately 20 kilometers north on the Pan-American Highway from Vallenar then turning northwest towards Canto del Agua. From Canto del Agua, the Farellon property is approximately 10 kilometers along a well-maintained gravel road. There are numerous gravel roads in the area, so a guide is necessary to access the property the first time. All of the roads are well maintained and can support large machinery necessary to transport drills, backhoes and bulldozers. Water is readily available in Canto del Agua and could probably be found on the Farellon property where all of the historic drill holes intersected water.

Exploration history . The Farellon property is in the Carrizal Alto mining district and lies 5 kilometers along strike south of the center of the historic Carrizal Alto copper-gold mine. Veins of the Farellon property were exploited as part of the Carrizal Alto mines. We have located no hard data summarizing all of the past mining activity, but tailings, slag dumps and the size of the shafts and some of the shallow surface workings are evidence of extensive historical mining.

Mine workings of various sizes are all along the Farellon property, but only one modern exploration program has been completed. In 1996, the Farellon and two other veins, the Fortuna and the Theresa, were explored by an Australian junior mining company under the name Minera Stamford S.A. Their exploration included a large mapping and surface sampling program followed by a 34-hole RC drilling program. Of these 34 drill holes, 23 were drilled on the Farellon 1 – 8 claim. The RC drilling program on the Farellon claim consistently intersected oxide and sulphide facies mineralization along a 2 kilometer-long zone covering the Farellon claim and strike extents to the south. Mineralization is 2 to 35 meters wide with an average width of 5 meters. The mineralized zone consists of one or more discrete veins and, in places, stockwork veining and mineralization. While drilling covered the length of the property, gaps up to 350 meters are untested and infill drilling is required to confirm an economic ore body. Table 3 presents the significant intersections from the 23 holes drilled on the Farellon claim in the 1996 drilling.

6

Table 3: Farellon historic significant intersections (1996) | ||||||||

Drill hole | Significant intervals (m) | Assay results | ||||||

FAR–96 | From | To | Length | Gold (g/t) | Copper (%) | Cobalt (%) | ||

06 | 49 | 54 | 5 | 0.15 | 0.73 | 0.01 | ||

07 | 25 | 34 | 9 | 0.38 | 1.05 | 0.02 | ||

09 | 57 | 84 | 27 | 0.51 | 0.91 | 0.03 | ||

010 | 31 | 36 | 5 | 1.00 | 0.68 | 0.04 | ||

011 | 20 | 26 | 6 | 0.67 | 0.46 | 0.02 | ||

013 | 86 | 93 | 7 | 0.87 | 1.68 | 0.04 | ||

014 | 77 | 83 | 6 | 0.66 | 0.85 | 0.06 | ||

015 | 59 | 79 | 20 | 0.99 | 0.98 | 0.06 | ||

99 | 109 | 10 | 0.18 | 1.02 | 0.03 | |||

016 | 24 | 26 | 2 | 0.95 | 1.57 | 0.02 | ||

64 | 70 | 6 | 0.73 | 0.81 | 0.07 | |||

020 | 14 | 16 | 2 | 0.46 | 1.85 | 0.05 | ||

39 | 43 | 4 | 0.75 | 0.90 | 0.03 | |||

021 | 22 | 25 | 3 | 4.17 | 5.29 | 0.11 | ||

022 | 29 | 39 | 10 | 1.53 | 1.31 | 0.04 | ||

100 | 108 | 8 | 3.72 | 2.49 | 0.06 | |||

023 | 50 | 53 | 3 | 0.48 | 1.10 | 0.06 | ||

59 | 64 | 5 | 0.28 | 0.78 | 0.03 | |||

132 | 147 | 15 | 0.60 | 1.42 | 0.03 | |||

024 | 33 | 36 | 3 | 0.94 | 2.89 | 0.06 | ||

025 | 65 | 85 | 20 | 0.97 | 1.22 | 0.02 | ||

028 | 55 | 58 | 3 | 0.12 | 0.52 | 0.06 | ||

029 | 30 | 34 | 4 | 0.18 | 1.15 | 0.07 | ||

82 | 87 | 5 | 0.09 | 0.96 | 0.01 | |||

Geology . The Farellon area has two major lithological units: Palaeozoic metamorphic sediments consisting of schists, phyllites and quartzites; and the Franja Central diorites. The metamorphosed sediments outcrop in the western part of the property and have been metamorphosed to lower greenschist facies and then extensively overprinted by hydrothermal alteration. Hydrothermal alteration is directly associated with the shear zone. The diorite underlies the eastern part of the project area and has been extensively intruded by northeasterly trending intermediate mafic dykes. At the Farellon property, a small stock-like felsic body named Pan de Azucar intrudes the diorite. The intrusive relationship between the diorite and metamorphic sediments always appear to be tectonic. Within the property and at the main Carrizal Alto workings to the north, the major mineralization is intimately related to the south-southwest trending mylonitic sheared contact between the metamorphic sediments and the diorite. The shear is considered a splay of the main Atacama Fault Zone and dips 30º to 65º west. This contact parallels the regional geological trend and coincides with a major lineament which extends for hundreds of kilometers. The sheared contact is 50 meters to 200 meters wide over the 1.7-kilometre strike length of the Farellon property. Veins are typically 3 to 15 meters wide, striking south-southwest and dipping approximately 65 degrees to the northwest.

Mineralization . The Farellon property lies within the Candelaria iron oxide-copper-gold (IOCG) belt of Chile. Ore bodies in the belt occur in veins, breccias, stringer bodies and layer parallel replacement bodies and are typically associated with north-south trending faults related to the Atacama Fault Zone. All IOCG deposits have a strong association with iron oxides in the form of hematite or magnetite. In the Candelaria region, larger ore bodies are located where the fault zones intersect a lithological contact with significant rheological contrast such as a sedimentary and volcanic intrusive contact.

Economic IOCG deposits are generally polymetallic and can include iron, copper, gold, zinc, lead, uranium and cobalt among others. The Farellon property historically has been exploited for copper and to a lesser extent, gold. Cobalt mineralization was observed during the 1996–97 exploration work, but we have found no records of cobalt extraction.

7

Drilling . In September 2009, we completed a 725-metre RC drilling program on the Farellon property. Table 4 summarizes the results of our drilling.

The drilling program was designed to confirm historic drilling results and test mineralization down dip of previous drilling. Of the five holes drilled, three holes-FAR–09–A, B and E-tested historic intersections FAR–96–09, 021 and 022 summarized in Table 3; and two-FAR–09–C and D-tested depth extents of the previously known mineralization. Results of the drilling show grades and widths of mineralization consistent with historic exploration results and have given us valuable geological information showing the possibility of a shallow, 30-degree dip of the mineralization.

Table 4: Farellon drilling results (2009) | |||||||

Drill hole FAR – 09 | Assay interval (m) | Assay grade | |||||

From | To | Core length | Gold (ppm) | Copper (%) | |||

A | 31 | 34 | 3.0 | 0.81 | 1.99 | ||

79 | 109 | 30.0 | 0.18 | 0.62 | |||

including | 97 | 106 | 9.0 | 0.44 | 1.63 | ||

B | 56 | 96 | 40.0 | 0.27 | 0.55 | ||

including | 56 | 63 | 7.0 | 0.22 | 0.66 | ||

74 | 96 | 22.0 | 0.42 | 0.79 | |||

including | 75 | 86 | 11.0 | 0.67 | 1.35 | ||

C | 73 | 103 | 30.0 | 0.79 | 0.55 | ||

including | 77 | 82 | 5.0 | 4.16 | 2.57 | ||

D | 95 | 134 | 39.0 | 0.11 | 0.58 | ||

including | 95 | 103 | 8.0 | 0.33 | 2.02 | ||

E | 25 | 30 | 5.0 | 0.54 | 1.35 | ||

65 | 68 | 3.0 | 0.58 | 1.46 | |||

We commissioned Micon International Limited to prepare a technical report that complies with Canadian National Instrument 43-101 summarizing the information obtained from this drilling program. Micon concluded that our drilling confirmed the general location and tenure of the mineralization identified during the 1996 drilling program and noted some minor disparities between historical 1996 gold and copper assays and the recent 2009 gold and copper assays in two of the drill holes-FAR–09–A and E. In FAR–09–E. Micon recommended that we investigate these disparities during the next phase of drilling.

The drilling identified that the copper and gold mineralization exhibited a direct correlation in both location and relative intensity and provided useful information for outlining the relative location and spacing of drill holes in our next exploration programs.

All of our 2009 drill holes intersected oxide facies mineralization with only minor amounts of sulphides observed in drill hole FAR–09–D. When we have established the general trend of the mineralization we can conduct some drilling to identify the oxide-sulphide interface.

Micon recommended that we conduct a two-phase drilling program. The first phase would consist of approximately 1,200 meters of diamond drilling to assist in defining the structural controls on the mineralization, which could have been misinterpreted in the past due to the limited geological information obtained from the historic RC drilling, and the depth and nature of the sulphide mineralization. The estimated cost of this phase is $220,000.

If this phase is successful, Micon recommended that we conduct a much larger phase of exploration consisting of 5,000 meters of diamond drilling and 10,000 meters of RC drilling, and geophysical surveys and geological mapping. A geophysics survey using both magnetics and induced polarization will help to identify further mineralized structures on the property that may not have been noticed in the historic mapping. A phase two drill program would be at defined spacing to outline the continuity of mineralization leading to a 3D model and initial resource estimation. The depth of the drilling would be dependent on the results of the phase one drilling program. The estimated cost of this phase is $1.9 million.

8

QA/QC, sampling procedures and analytical methods. We conducted sampling on one-meter intervals, which is generally the industry-standard sampling practice for RC drilling. Sampling started at the collar of the hole and proceeded to the toe or bottom of the drill hole on one-meter increments. Generally, the sample recovery was good to excellent for the 2009 drilling program. Table 4 summarizes significant assay results. They are reported as drill lengths as we have not established the width of the mineralized zone.

Our quality assurance, quality control (QA/QC) protocol consists of the addition of standards, blanks and laboratory duplicates to the sample stream. We inserted these into the sample series using the same number sequence as the samples themselves. One of the QA/QC check samples is inserted every 25 samples and it alternates between standards, blanks and laboratory duplicates.

mateo property

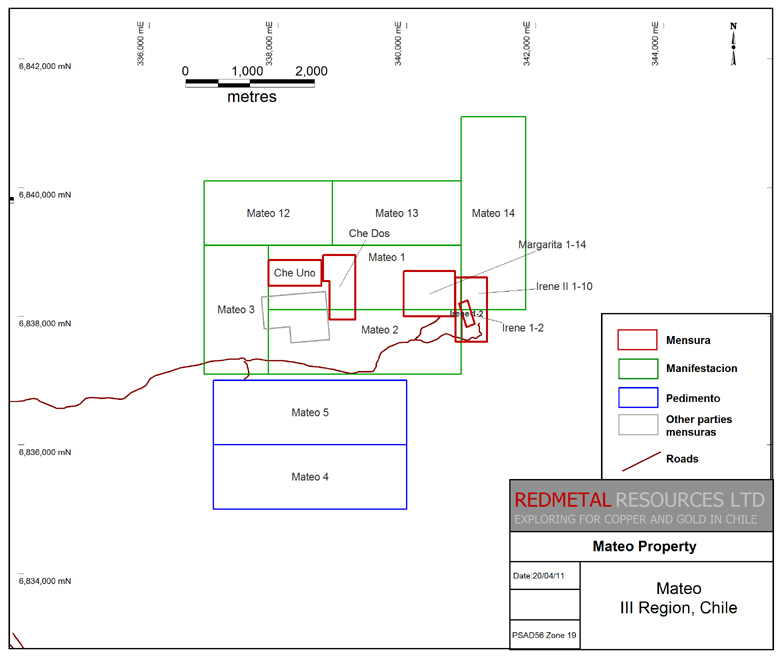

We have assembled a group of claims: the Che Uno and Che Dos, the Margarita, and the Irene Uno and Irene Dos mining claims, and the Mateo exploration claims as described in Table 5 and illustrated in Figure 3. The Mateo exploration claims overlap the Che, Margarita and Irene claims to secure the areas around the claims. Some of them may overlap others' prior claims. We will acquire rights to these overlapped prior claims only if the owners forfeit their rights, and we will exercise our rights only if we want the property. We acquired all of these claims for the same geological reasons and consider them one property, which we call the Mateo property.

Table 5: Mateo property | |||

Claim | Type | ||

Mensura (ha) | Manifestacion a (ha) | Pedimento a (ha) | |

Che Uno 1 – 8 | 32 | ||

Che Dos 1 – 10 | 44 | ||

Margarita 1 – 14 | 56 | ||

Irene Uno 1 – 2 | 10 | ||

Irene Dos 1 – 10 | 50 | ||

Mateo 1 | 300 | ||

Mateo 2 | 300 | ||

Mateo 3 | 200 | ||

Mateo 4 | 300 | ||

Mateo 5 | 300 | ||

Mateo 12 | 200 | ||

Mateo 13 | 200 | ||

Mateo 14 | 300 | ||

192 | 1,500 | 600 | |

a Some of the claims are staked over the mensuras to claim the ground surrounding them. See Figure 3. | |||

9

Figure 3: Mateo property |

che uno and che dos claims

On October 10, 2008 Minera Farellon granted us the option to purchase the Che Uno and Dos claims. The Che claims cover 76 hectares centered about 339,002 east and 6,838,450 south UTM PSAD56 Zone 19. They are in the northwest corner of the Mateo property. On April 12, 2011 we completed the acquisition of the Che claims by paying approximately $20,000 to Minera Farellon.

We continue to owe a royalty equal to 1% of the net proceeds that we receive from the processor to a maximum of $100,000 with no monthly minimum when we start exploiting the minerals we extract from the claim. We have not yet exploited the claim.

margarita claim

We bought the Margarita mining claim on November 27, 2008 through a public auction and at January 31, 2011 had spent a total of $17,078 (including legal and registration costs) for this claim and owe the outstanding property taxes of approximately $667. The Margarita claim covers 56 hectares centered around 340,353 east and 6,838,347 south UTM PSAD56 Zone 19 located within the northeast corner of the Mateo claim.

irene 1-2 and irene II 1-10 claims

On September 7, 2010, we entered into a purchase agreement with Minera Farellon to buy the Irene 1-2 and Irene II 1-10 mining claims. Under the terms of the agreement, as amended, we agreed to pay 21 million Chilean pesos (approximately $43,500 US), the owner's legal, transfer, holding and other costs by May 15, 2011 to exercise the option and purchase the Irene claims. We do not anticipate that the legal transfer and other costs will exceed $5,000.The Irene claims cover 60 hectares centered about 341,002 east and 6,838,101 south UTM PSAD56 Zone 19, are located within the northeast corner of the Mateo property, and share their western border with the Margarita claim.

10

mateo claims

The Mateo claims consist of six manifestaciones - Mateo 1 –3 and 12 – 14, and two pedimentos -Mateo 4 and 5, covering 2,100 hectares, which we staked between November, 2008 and March 2011. The claims are centered about 337,675 east and 6,837,600 south UTM PSAD56 Zone 19 and cover a five-kilometer strike length of intensely altered volcanics with significant massive sulphide mineralization.

Location and means of access. The Mateo property is centered about 337,675 east and 6,837,600 south UTM PSAD56 Zone 19 approximately 10 kilometers east of Vallenar with the highest point at approximately 1,050 meters above sea level. A well-used road leads from the city of Vallenar and crosses through the middle of the west half of the properties and along the southern border of the east half of the properties. Many unmarked dirt roads in the area provide reliable access to most areas of Mateo.

Description. The Mateo property is a copper-gold-silver project that lies in the Candelaria IOCG belt in the Chilean Coastal Cordillera. The Mateo property has undergone limited modern exploration including surface and underground RC drilling and artisanal mining on three separate mine sites, the Irene, Margarita and Santa Theresa mines. We have reviewed all available records of work completed to date, including some records of the mining activity. Our interpretation of the work completed to date indicates the potential for an economic ore body in mineralized mantos and skarn-style mineralization associated with IOCG deposits.

Exploration history. Historical work includes several drill programs completed by different Chilean private and public companies. Records exist from eight drillholes completed in 1994 on the Irene mine and include two full reports written by ENAMI (the Chilean national mining company) with interpretation of mineralization and recommendations for further exploration and mining work.

The Irene mine was investigated by ENAMI in 1994. Work completed during this time included surface RC drilling, including 490 meters in four RC drillholes, and underground diamond drilling, including 220 meters in four drillholes. We obtained ENAMI's reports of mining activities from 1994 through 1997. Approximately 11,875 tonnes of rock were mined in that time averaging 4.3% copper, 61.9 grams per tonne silver, and 1.01 grams per tonne gold. During the period June 2009 to December 2010 the vendor of the Irene, Minera Farellon, conducted small scale mining activities on a different area of the Irene claims and mined 1705 tonnes grading 1.39% Cu, 1.39g/t Ag, 0.29g.t Au in sulphides and 1477 tonnes grading 1.98% Cu in oxides. The difference in grade between the historic work and the recent work is not an indication that further high grade material will not be found on the Mateo property and further modeling and exploration work needs to be completed to determine the best place to drill.

A private Chilean company, Minera Taurus, drilled 16 RC holes on the east end of the Irene claim, but we have no record from this drilling. An unknown company built a portal 250 meters long and approximately three meters wide by three meters high. The portal leads to three mined-out chimneys connected to the surface providing ventilation channels. On a recent property visit with ENAMI's geologists, we found an extension of the mineralized zone at the base of the tunnel below showing the potential for mineral resources.

Geology . Geologically, the Mateo property is located within the brittle-ductile north-south-trending Atacama Fault System that is known to host many of the major deposits in the Candelaria IOCG belt. Known mineralization is hosted in an andesitic volcaniclastic sequence assigned to the Bandurrias Formation. Widespread iron oxide and potassic alteration indicates an IOCG mineralizing system further supported by significant amounts of economic grade mineralization.

11

perth property

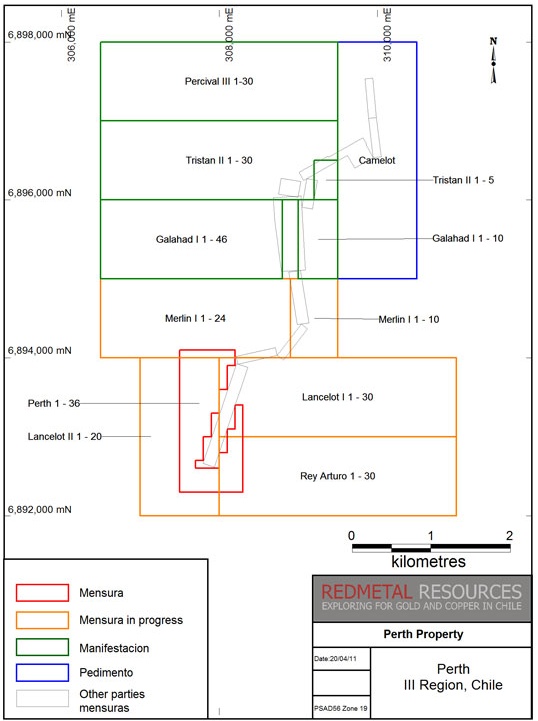

On March 10, 2011, we purchased for $35,000 a group of 12 claims (the Perth) as described in table 6 and illustrated in Figure 4.

Table 6: Perth property

Claim | Type | |||||

Mensura (ha) | Manifestacion (ha) | Pedimento (ha) | ||||

Perth 1 al 36 | 109 | |||||

Lancelot I 1 al 30 (in process) | 300 | |||||

Lancelot II 1 al 20 (in process) | 200 | |||||

Rey Arturo 1 al 30 (in process) | 300 | |||||

Galahad I 1 al 10 | 50 | |||||

Merlin I 1 al 10 (in process) | 60 | |||||

Galahad I 1 al 46 | 230 | |||||

Merlin I 1 al 24 (in process) | 240 | |||||

Percival III 1 al 30 | 300 | |||||

Tristan II 1 al 30 | 300 | |||||

Tristan IIA 1 al 5 | 15 | |||||

Camelot | 300 | |||||

1,209 a | 895 a | 300 a | ||||

a Some claims overlap others, reducing our net area to 2,280 hectares . See Figure 4. | ||||||

12

Figure 4. The Perth property

The Perth property is adjacent to the west side of the historic Carrizal Alto mine and lies approximately 3.5 kilometers north of our Farellon project. It is a 45 minute drive from Vallenar city, with major road access, power and water supply close by. The project lies on a similar geologic contact as the Farellon and Carrizal Alto properties.

Location and means of access. The Perth property is centered about 308,750 east and 6,895,000 south UTM PSAD56 Zone 19 approximately 75 km northwest of the city of Vallenar with the highest point at approximately 925 meters above sea level. The property is accessible by road from Vallenar. The Perth Property is accessed by taking the Pan American Highway north from Vallenar for 20 kilometres, then turning west onto the road to Canto del Agua a distance of 35 kilometres. Then take the Cardones Canyon road for 15 kilometres, turn southwest towards Cerro Cachina Grande along a secondary gravel road for 14 kilometres to the property.

Exploration history. Exploration programs on the Perth property have historically been limited to surface sampling and mapping programs completed in 2007 and 2008. Mapping identified 12 individual veins on surface, significant results from channel samples across the veins are show in Table 7 Numerous artisanal mine workings on the property have previously been exploited for both copper and gold however, no records of grade or tonnage can be located.

13

Table 7: Perth historic significant intersections | ||||

SAMPLE | Au g/t | Cu % | Co% | Length of Sample (m) |

521617 | 2.5 | 0.39 | 0.03 | 1.0 |

521796 | 2.5 | 0.21 | 0.00 | 1.0 |

521629 | 2.8 | 0.76 | 0.19 | 3.5 |

56905 | 3.1 | 1.00 | 0.19 | 1.0 |

521610 | 3.5 | 0.30 | 0.02 | 0.5 |

521622 | 4.5 | 1.72 | 0.02 | 1.0 |

521788 | 4.5 | 0.19 | 0.00 | 2.0 |

56858 | 5.0 | 0.42 | 0.16 | 1.0 |

521789 | 5.5 | 0.29 | 0.00 | 2.0 |

521628 | 6.2 | 0.59 | 0.14 | 1.3 |

521609 | 10.7 | 0.35 | 0.07 | 1.0 |

Geology The Perth property overlies the contact between Paleozoic metamorphic sediments and a Cretaceous tonalitic batholith. A swarm of north northeast trending fault related copper gold bearing quartz veins crosscuts the property. Surface mapping and sampling records show twelve veins identified so far on the south end of the property. The veins average two metres wide but have been measured up to six metres wide.

Perth property joint venture earn-in agreement

On March 14, 2011, we entered into an agreement on the Perth property with Revonergy Inc. Revonergy Inc. paid $35,000 on signing the agreement and can earn a 35% interest in the Perth property if it spends a minimum $1,450,000 on the three phase exploration program, as follows:

| · | Successful completion of a Phase I exploration program costing at least $115,000 one year from signing |

| · | Successful completion of a Phase II exploration program costing at least $300,000 two years from signing |

| · | Successful completion of a Phase III exploration program costing at least $1,000,000 and that can justify completing a preliminary feasibility study three years from signing |

Phase I, II and III exploration programs will be 100% paid for by Revonergy and will be managed by Polymet Limitada. Revonergy will also pay us a 10% management fee on all work programs.

Revonergy Inc. can earn a further 15% interest in the Perth property if it completes a preliminary feasibility study within four years from the signing of the agreement.

Generative claims

As an exploration company, from time to time we will stake, purchase or option claims to allow ourselves the time and access to fully consider the geological potential of the claims. This allows us to generate new properties in areas that have not been explored. We have conducted groundwork on numerous generative claims of interest to us in the areas of our active properties. We have acquired several of these claims, have options to acquire others, and have staked claims in the same areas. We continue to compile data on and review other claims and discuss terms with various owners.

14

Abandoned claims

We wrote off $187,000 in acquisition costs on abandoned generative claims during the year ended January 31, 2009, and $29,685 during the year ended January 31, 2010 either because payments due exceeded our assessment of their fair market value, we hadn't the capital to continue to maintain them or they didn't have sufficient geological potential. We did not write off any acquisition costs during the year ended January 31, 2011.

Competition

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are one of the smallest exploration companies and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other similar companies for financing and joint venture partners, and for resources such as professional geologists, camp staff, helicopters and mineral exploration contractors and supplies.

Raw materials

The raw materials for our exploration programs include camp equipment, hand exploration tools, sample bags, first aid supplies, groceries and propane. All of these types of materials are readily available from a variety of local suppliers.

Dependence on major customers

We have no customers. Our first customer likely will be ENAMI, which refines and smelts copper from the ore that it buys from Chile's small- and medium-scale miners. ENAMI is located in Vallenar. We could also deliver our ore to the Dos Amigos heap leach facility located approximately fifty kilometers south of Vallenar in Domeyko.

Patents/Trademarks/Licenses/Franchises/Concessions/Royalty agreements/Labor Contracts

We have no intellectual property such as patents or trademarks, and, other than the royalties that we must pay if we begin to exploit our Chilean properties, no royalty agreements or labor contracts.

Government controls and regulations

We are not required to obtain permits or submit operational plans in order to conduct exploration on our properties. The mining business, however, is subject to various levels of government controls and regulations, which are supplemented and revised from time to time. We cannot predict what additional legislation or revisions might be proposed that could affect our business or when any proposals, if enacted, might become effective. Such changes, however, could require more operating capital and expenditures and could prevent or delay some of our operations.

The various levels of government controls and regulations address, among other things, the environmental impact of mining and mineral processing operations. For mining and processing, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission standards and other design or operational requirements for various components of operations, including health and safety standards. Legislation and regulations also establish requirements for decommissioning, reclaiming and rehabilitating mining properties following the cessation of operations, and may require that some former mining properties be managed for long periods of time. As we are not mining or processing, and are unlikely to for some years, we have not investigated these regulations.

15

None of the exploration work that we have completed to date requires an environmental permit. We must repair any damage done to the land during exploration. Some of our claims are within the boundaries of a national park. According to the Mining Code of Chile, we will have to get written authorization from the government to mine or complete any exploration work within the park boundaries. We have requested advice on this issue from our Chilean mining lawyer, but have no plans to explore within the boundaries of the park.

If our operations in Chile become profitable, any earnings that we remit abroad will be subject to Chilean withholding tax.

We believe that we are in substantial compliance with all material government controls and regulations at each of our mineral claims.

Costs and effects of compliance with environmental laws

We have incurred no costs to date for compliance with environmental laws for our exploration programs on any of our claims.

Expenditures on research and development

We have incurred no research or development costs since our inception on January 10, 2005.

Number of total employees and number of full-time employees

Red Metal does not have any employees. Caitlin Jeffs and Michael Thompson, both of whom are directors and officers, John daCosta, who is an officer, and Kevin Mitchell, who is Polymet's legal representative and manager in Chile, all provide their services to the company as independent consultants. Polymet retains one full-time employee who provides administration work to our office in Chile and contracts geo-technical services as needed. We intend to contract for the services of geologists, prospectors and other consultants as we require them to conduct our exploration programs.

ITEM 1A: RISK FACTORS

In addition to the factors discussed elsewhere in this annual report, the following risks and uncertainties could materially adversely affect our business, financial condition and results of operations. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and financial condition.

During the fiscal years ended January 31, 2010 and 2011 we earned no royalty revenue while our operating expenses totalled $710,745 and $672,618, respectively. If we do not find sources of financing as and when we need them, we may be required to cease our operations.

Mineral exploration and development are very expensive. During the fiscal year that ended on January 31, 2010, we earned no royalty revenue while our operating expenses totalled $710,745. During the fiscal year that ended on January 31, 2011 we earned no royalty revenue while our operating expenses totalled $672,618. This resulted in a total accumulated loss of $3,056,819 since inception. As of January 31, 2011 we had cash of $8,655. Since our inception we have sold our securities and borrowed money to fund our operations. Our ability to continue our operations, including exploring and developing our properties, will depend on our ability to generate operating revenue, obtain additional financing, or enter into joint venture agreements. We raised $2,017,000 in gross proceeds through a PIPE financing in April 2011. We anticipate that these funds will allow us to continue the current development of our Farellon and Mateo projects for the next 12 months. We have signed a joint venture earn-in agreement with Revonergy Inc. on our Perth property that requires Revonergy Inc. to pay for exploration programs on the Perth property for the next three years. We are continually reviewing potential properties to add to our portfolio. Suitable acquisitions and project development will require additional financing. Until we earn enough revenue to support our operations, which may never happen, we will continue to be dependent on loans and sales of our equity or debt securities to continue our development and exploration activities. If we do not find sources of financing as and when we need them, we may be required to severely curtail, or even to cease, our operations.

16

Our auditors have expressed substantial doubt about our ability to continue as a going concern; as a result we could have difficulty finding additional financing.

Our financial statements have been prepared assuming that we will continue as a going concern. Except for approximately $16,000 of royalty income that we received during the 2009 fiscal year from Minera Farellón, we have not generated any revenue since inception and have accumulated losses. As a result, our auditors have expressed substantial doubt about our ability to continue as a going concern. Our ability to continue our operations depends on our ability to complete equity or debt financings as we need capital or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that could result from the outcome of this uncertainty.

Unfavorable economic conditions may have a material adverse effect on us since raising capital to continue our operations could be more difficult.

The recent credit crisis and related turmoil in the global financial system had an impact on our business and financial position, and a similar financial crisis in the future may also impact us. Depending upon the ultimate severity and duration of any economic downturn, the resulting effects on Red Metal could be materially adverse if it is unable to raise the working capital required to carry out its business plan. While we were able to complete a financing in April 2011, we anticipate that we will continue to need to raise funds in the future in order to develop our properties in accordance with our business plan.

Our business was formed in January 2005 and our operations, to date, have earned only minimal revenues. Due to the high costs of acquiring and exploring claims, we may never be profitable. We expect to continue to incur operating losses during the next 12 months.

We were incorporated on January 10, 2005 and to date have been involved primarily in organizational activities, acquiring and exploring mineral claims and obtaining financing. We have earned minimal revenues and we are not profitable. Whether we will be successful as a mining company must be considered in light of the costs, difficulties, complications and delays associated with our proposed exploration programs. These potential problems include, but are not limited to, finding claims with mineral deposits that can be cost-effectively mined, the costs associated with acquiring the properties and the unavailability of human or equipment resources. We have a very short history and had no more than minimal operations until April 25, 2008 when we acquired the mining claims known as Farellon Alto 1 – 8 in Chile. We cannot assure you that we will ever generate significant revenue from our operations or realize a profit. We expect to continue to incur operating losses during the next 12 months.

Our joint development and operating arrangements may not be successful.

We have in the past, and may in the future, enter into joint venture arrangements in order to share the risks and costs of developing and operating properties. In a typical joint venture arrangement, the partners own a proportionate share of the assets, are entitled to indemnification from each other and are only responsible for any future liabilities in proportion to their interest in the joint venture. If a party fails to perform its obligations under a joint venture agreement, we could incur liabilities and losses in excess of our pro-rata share of the joint venture. We make investments in exploration and development projects that may have to be written off in the event we do not proceed to a commercially viable mining operation.

17

On March 14, 2011, our subsidiary, Minera Polymet, granted the right to earn a 50% joint venture interest in the Perth Property to Revonergy Inc. For more information on the terms of the agreement, see Perth property joint venture earn-in agreement in the discussion above titled "Business".

In some instances members of the board of directors or an officer may be liable for losses incurred by holders of our common stock. If a shareholder were to prevail in such an action in the U.S., it may be difficult for the shareholder to enforce the judgment against any of our directors or officers, who are not U.S. residents.

In certain instances, such as trading securities based on material non-public information, a director may incur liability to shareholders for losses sustained by the shareholders as a result of the director's or officer's illegal or negligent activity. However, all of our directors and officers live and maintain a substantial portion of their assets outside the U.S. As a result it may be difficult or impossible to effect service of process within the U.S. upon these directors and officers or to enforce in the courts any judgment obtained here against them predicated upon any civil liability provisions of the U.S. federal securities laws.

Foreign courts may not entertain original actions predicated solely upon U.S. federal securities laws against these directors; and judgments predicated upon any civil liability provisions of the U.S. federal securities laws may not be directly enforceable in foreign countries.

As a result of the foregoing, it may be difficult or impossible for a shareholder to recover from any of these directors or officers if, in fact, the shareholder is damaged as a result of the negligent or illegal activity of an officer or director.

Mineral exploration is highly speculative and risky: we might not find mineral deposits that can be extracted cost effectively on our claims.

Exploration for mineral deposits is a speculative venture involving substantial risk. Problems such as unusual and unexpected rock formations often result in unsuccessful exploration efforts. We cannot assure you that our claims contain mineral deposits that can be extracted cost effectively.

Mineral exploration is hazardous. We could incur liability or damages as we conduct our business due to the dangers inherent in mineral exploration.

The search for minerals is hazardous. We could become liable for hazards such as pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We have no insurance for these kinds of hazards, nor do we expect to get such insurance for the foreseeable future. If we were to suffer from such a hazard, the costs of rectifying it could exceed our asset value and require that we liquidate our assets .

In the future we may be required to comply with government regulations affecting mineral exploration and exploitation, which could adversely affect our business, the results of our operations and our financial condition.

The mining business is subject to various levels of government control and regulation, which are supplemented and revised from time to time. We cannot predict what legislation or revisions might be proposed that could affect our business or when any such proposals, if enacted, might become effective. Our exploration activities are subject to laws and regulations governing worker safety, and, if we explore within the national park that is part of our Farellon property, protection of endangered and other special status species will likely require compliance with additional laws and regulations. The cost of complying with these regulations has not been burdensome to date, but if we mine our properties and process more than 5,000 tonnes of ore monthly, we will be required to submit an environmental impact study for review and approval by the federal environmental agency. We anticipate that the cost of such a study will be significant. If the study were to show too great an adverse impact on the environment, we might be unable to develop the property or we might have to engage in expensive remedial measures during or after developing the property, which could make production unprofitable. This requirement could materially adversely affect our business, the results of our operations and our financial condition if we were to proceed to mine a property or process ore on the property. We have no immediate or intermediate plans to process ore on any of our properties.

18

If we do not comply with applicable environmental and health and safety laws and regulations, we could be fined, enjoined from continuing our operations, and suffer other penalties. Although we make every attempt to comply with these laws and regulations, we cannot assure you that we have fully complied or will always fully comply with them.

We might not be able to market any minerals that we find on our mineral claims due to market factors that are beyond our control.

Even if we discover minerals that can be extracted cost-effectively, we may not be able to find a ready market for our minerals. Many factors beyond our control affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting minerals and environmental protection. We cannot accurately predict the effect of these factors, but any combination of these factors could result in an inadequate return on invested capital.

We are not certain that we can successfully compete in the mineral exploration business. We do not represent a significant presence in this industry.

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are one of the smallest exploration companies and we do not represent a significant presence in the mineral exploration business. Being a junior mineral exploration company, we compete with other similar companies for financing and joint venture partners, and for resources such as professional geologists, camp staff, helicopters and mineral exploration contractors and supplies. We may not have the means to compete successfully for these resources.

We conduct operations in a foreign jurisdiction, and are subject to certain risks that may limit or disrupt our business operations.

Our head office is in Canada; and our mining operations are in Chile. Mining investments are subject to the risks normally associated with the conduct of any business in foreign countries including uncertain political and economic environments; wars, terrorism and civil disturbances; changes in laws or policies, including those relating to imports, exports, duties and currency; cancellation or renegotiation of contracts; royalty and tax increases or other claims by government entities, including retroactive claims; risk of expropriation and nationalization; delays in obtaining or the inability to obtain or maintain necessary governmental permits; currency fluctuations; restrictions on the ability of local operating companies to sell gold, copper or other minerals offshore for U.S. dollars, and on the ability of such companies to hold U.S. dollars or other foreign currencies in offshore bank accounts; import and export regulations, including restrictions on the export of gold, copper or other minerals; limitations on the repatriation of earnings; and increased financing costs.

These risks could limit or disrupt our exploration programs, cause us to lose our interests in our mineral claims, restrict the movement of funds, cause us to spend more than we expected, deprive us of contract rights or result in our operations being nationalized or expropriated without fair compensation, and could materially adversely affect our financial position or the results of our operations. If a dispute arises from our activities in Chile, we could be subject to the exclusive jurisdiction of courts outside North America, which could adversely affect the outcome of the dispute.

19

While we take the steps we believe are necessary to maintain legal ownership of our claims, title to mineral claims may be invalidated for a number of reasons, including errors in the transfer history or our acquisition of a claim we believed, after appropriate due diligence investigation, to be valid, but in fact, wasn't. If ownership of our claims was ultimately determined to be invalid, our business and prospects would likely be materially and adversely affected.

Our ability to realize a return on our investment in mineral claims depends upon whether we maintain the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. We take a number of steps to protect the legal ownership of our claims, including having our contracts and deeds notarized, recording these documents with the registry of mines and publishing them in the mining bulletin. We also review the mining bulletin regularly to determine whether other parties have staked claims over our ground. However, none of these steps guarantees that another party could not challenge our right to a claim. Any such challenge could be costly to defend and, if we lost our claim, our business and prospects would likely be materially and adversely affected.

We cannot guarantee that any of our pedimento claims will convert to mensura claims.

Some of our exploration claims (pedimentos) are still in the registration process. We cannot guarantee that any of our pedimento claims will convert to mining claims (mensuras). Some of our pedimentos may have been staked over other owners' claims, as permitted by the Chilean mining code. The pedimento with the earliest filing date takes precedence providing the claim holder maintains its claim in accordance with the mining code and the applicable regulations. Our pedimento rights in these claims will not crystallize unless the owners of the underlying claims fail to pay their taxes or otherwise forfeit their interests in their claims. We will exercise any right that we acquire through forfeiture only if the ground remains of interest to us.

We sometimes hold a significant portion of our cash in United States dollars, which could weaken our purchasing power in other currencies and limit our ability to conduct our exploration programs.

Currency fluctuations could affect the costs of our operations and affect our operating results and cash flows. Gold and copper are sold throughout the world based principally on the U.S. dollar price, but most of our operating expenses are incurred in local currencies, such as the Canadian dollar and the Chilean peso. The appreciation of other currencies against the U.S. dollar can increase the costs of our operations.

We sometimes hold a significant portion of our cash in U.S. dollars. Currency exchange rate fluctuations can result in conversion gains and losses and diminish the value of our U.S. dollars. If the U.S. dollar declined significantly against the Canadian dollar or the Chilean peso, our U.S.-dollar purchasing power in Canadian dollars and Chilean pesos would also significantly decline and we would not be able to afford to conduct our mineral exploration programs. We have not entered into derivative instruments to offset the impact of foreign exchange fluctuations.

Because our directors are not independent they can make and control corporate decisions that may be disadvantageous to other common shareholders.

Our securities are not listed on a national securities exchange or quoted on an inter-dealer quotation system that requires that directors be independent. Using the definition of "independent" in Section 803 of the Rules of the NYSE Amex, we have determined that none of our directors are independent. Our directors have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations, and the sale of all or substantially all of our assets. They also have the power to prevent or cause a change in control. The interests of our directors may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

20

We do not expect to declare or pay dividends in the foreseeable future.

We have never paid cash dividends on our common stock and have no plans to do so in the foreseeable future. We intend to retain any earnings to develop, carry on, and expand our business.

"Penny stock" rules may make buying or selling our common stock difficult, and severely limit its marketability and liquidity.

Trading in shares of our common stock is subject to regulations adopted by the SEC commonly known as the "penny stock" rules. The additional burdens imposed upon broker-dealers by the penny stock rules could discourage broker-dealers from participating in transactions involving shares of our common stock, which could severely limit its marketability and liquidity. Under the penny stock rules, broker-dealers participating in penny-stock transactions must first deliver to their customer a risk disclosure document describing the risks associated with penny stocks, the broker-dealer's duties in selling the stock, the customer's rights and remedies, and certain market and other information. The broker-dealer must determine the customer's suitability for penny- stock transactions based on the customer's financial situation, investment experience and objectives. Broker-dealers must also disclose these restrictions in writing to the customer, obtain specific written consent from the customer, and provide monthly account statements to the customer. The effect of these restrictions can decrease broker-dealers' willingness to make a market in our shares of common stock, decrease the liquidity of our common stock, and increase transaction costs for sales and purchases of our common stock as compared to other securities.

ITEM 1B: UNRESOLVED STAFF COMMENTS

As a smaller reporting company we are not required to provide this information.

ITEM 2: PROPERTIES

Our executive offices are located at 195 Park Avenue, Thunder Bay, Ontario, Canada, P7B 1B9. Our president, Caitlin Jeffs, provides this space free of charge although she is under no obligation to do so. We also have a field and administrative office in Vallenar, Chile, which we rent from month to month at the rate of 550,000 Chilean pesos (approximately $1,000) per month. We believe that these properties are suitable and adequate for our business operations.

We have assembled interests in three mineral properties in Chile-the Farellon, Mateo, and Perth-which we have described above in Item 1.

ITEM 3: LEGAL PROCEEDINGS

We are not a party to any pending legal proceedings and, to the best of our knowledge, none of our property or assets are the subject of any pending legal proceedings.

ITEM 4: REMOVED AND RESERVED

ITEM 5: MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

On November 19, 2009 we completed a 1-for-14 reverse split, reducing the number of shares of our common stock outstanding to 5,584,574. All references to the number of issued shares in this report are references to the post–reverse-split numbers of shares; and all references to the prices of our outstanding shares reflect the reverse split.

21

Our common stock was quoted under the symbol RMES on the Pink Sheets from November 19, 2009 to November 21, 2010, and on the OTC Bulletin Board since September 21, 2010. From September 16, 2008 to November 19, 2009 our common stock was quoted on the OTC Bulletin Board under the symbol RMET. From January 16, 2007 to September 16, 2008, our symbol was RLKX. Table 9 presents the range of high and low bid quotes of our common stock for each quarter for the last two fiscal years as reported by the Pink OTC Markets. The bid prices represent inter-dealer quotations, without adjustments for retail mark-ups, markdowns or commissions and may not necessarily represent actual transactions. As indicated above, the information below reflects the 1-for-14 reverse stock split that was effective on November 19, 2009.

Table 8: High and low bids

Fiscal year ended January 31, 2011 | High | Low |

First quarter | $0.50 | $0.20 |

Second quarter | $0.50 | $0.40 |

Third quarter | $0.50 | $0.20 |

Fourth quarter | $0.40 | $0.25 |

Fiscal year ended January 31, 2010 | ||

First quarter | $2.52 | $0.84 |

Second quarter | $0.98 | $0.14 |

Third quarter | $0.98 | $0.14 |

Fourth quarter | $0.10 | $0.02 |

As of April 25, 2011, we had approximately 74 shareholders of record which includes the number of shareholders provided to us by our transfer agent as well as the holders included on the securities position report provided to us by Depositary Trust & Clearing Corporation. This number does not include an indeterminate number of shareholders whose shares are held by brokers in street name. Our transfer agent is Empire Stock Transfer, 1859 Whitney Mesa Dr. Henderson, Nevada, 89014 and their phone number is 702-818-5898.

Dividends

We have not paid any cash dividends on our common stock since our inception and do not anticipate paying any cash dividends in the foreseeable future. We plan to retain our earnings, if any, to provide funds for the expansion of our business.

Securities Authorized for Issuance under Equity Compensation Plans

We have no securities authorized for issuance under equity compensation plans.

Recent Issuances of Unregistered Securities

ITEM 6: SELECTED FINANCIAL DATA.

As a smaller reporting company we are not required to provide this information.

22

ITEM 7: MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Red Metal is a mineral exploration company engaged in locating, and eventually developing, mineral resources in Chile. Our business strategy is to identify, acquire and explore prospective mineral claims with a view to either developing them ourselves or, more likely, finding a joint venture partner with the mining experience and financial means to undertake the development. All of our claims are in the Candelaria IOCG belt in the Chilean Coastal Cordillera.

We have only marginal revenue-generating operations and are dependent upon the equity markets for our working capital. The collapse of the equity markets late in 2008, and the economic uncertainty and market instability that followed, affected our ability to raise equity capital. Market prices of copper and gold overall are presently moving in a positive direction and we are more optimistic that we can raise equity capital under these new market conditions.

In response to the economic environment of 2008, and the fact that we had only nominal revenues, in 2009 we terminated our duty to file reports with the Securities and Exchange Commission to save the legal and auditing costs. We resumed filing reports by filing a registration statement on Form 10 on April 14, 2010.

Consistent with our historical practices, we continue to monitor our costs in Chile by reviewing our mineral claims to determine whether they possess the geological indicators to economically justify the capital to maintain or explore them. We own nothing in Chile except our claims and have no long term commitments except the obligation to pay royalties if we exploit our properties. All of our support there-vehicles, office and equipment, and administrative personnel-is supplied under short-term contracts.

We conducted a drilling program on our Farellon property in September of 2009. We have analyzed the results and believe that further drilling of the property is warranted. Micon International Limited, from whom we commissioned a Canadian National Instrument 43-101 technical report summarizing the drilling results, has recommended that we conduct a two-phase drilling program. The first phase would consist of 1,200 meters of diamond drilling to define the structural controls on the mineralization, which may have been misinterpreted in the past due to the limited geological information available from the historic RC drilling, and assist in defining the depth and nature of the sulphide mineralization. The estimated cost of this phase is $220,000.

If the first phase is successful, we propose to conduct a larger exploration program consisting of 10,000 meters of RC drilling, 5,000 meters of diamond drilling, geophysical surveys and geological mapping to ascertain the extent of the structural controls and the potential size of the mineralization. The estimated cost of this phase is $1.9 million.

We are planning an initial exploration program on the Mateo property including geophysics, surface mapping, sampling and 1000 metre RC drill program for a total cost of approximately $300,000.

The cost and timing of all planned exploration programs are subject to the availability of qualified mining personnel, such as consulting geologists and geo-technicians, and drillers and drilling equipment. When we first started exploring in Chile in late 2007 and early 2008, geologists, geo-technicians, drillers and drilling rigs were in short supply, those that were available were often unreliable and very expensive, and we had to work to their schedules rather than to ours. This changed following the market collapse in 2008, but the increasing prices of copper and gold-the price of copper increased steadily from a low of $1.26 per pound in December 2008 to a high of $4.60 per pound in February, 2011; and the price of gold has increased from a low of $750 per ounce in December 2008 to a high of $1,519 per ounce in April 2011-have caused mining companies to ramp up their operations, reducing the availability of personnel and equipment.

23

Although Chile has a well-trained and qualified mining workforce from which to draw and few early-stage companies such as Red Metal are competing for the available resources, if we are unable to find the personnel and equipment that we need when we need them and at the prices that we have estimated today, we might have to revise or postpone our plans.

At January 31, 2011, we had a working capital deficit of $866,179 and $8,655 cash. On April 7, 2011, we completed a private equity financing for net proceeds after commissions, legal and closing fees of $1,862,462. We intend to use $700,000 on the exploration programs for the Farellon to expand known mineralization along strike and at depth to investigate sulphide mineralization; $300,000 on the phase 1 Mateo mapping and geophysics to identify Candelaria-type targets, and drilling to test the targets; and $700,000 to pay off prior debt and to cover our estimated expenditures for legal, audit and other professional fees, administration, consulting, advertising and promotion, office and vehicle rental that we will incur over the next 12 months.

Results of operations

summary of financial condition

Table 9 summarizes and compares our financial condition at January 31, 2011 to the year-ended January 31, 2010.

Table 9: Comparison of financial condition

January 31, 2011 | January 31, 2010 | |

Working capital deficit | $(866,179) | $(296,575) |

Current assets | $46,227 | $25,126 |

Unproved mineral properties | $662,029 | $643,481 |

Total liabilities | $912,406 | $321,701 |

Common stock and additional paid in capital | $2,923,517 | $2,788,517 |

Deficit | $(3,056,819) | $(2,384,201) |

comparison of prior quarterly results

Tables 10.1 and 10.2 present selected financial information for each of the past eight quarters.

Table 10.1: Summary of quarterly results (2011)

April 30, 2010 | July 31, 2010 | October 31, 2010 | January 31, 2011 | |

Revenue | – | – | – | – |

Net loss | $(196,851) | $(118,279) | $(154,436) | $(203,052) |

Basic and diluted loss per share | $(0.02) | $(0.01) | $(0.02) | $(0.02) |

Table 10.2: Summary of quarterly results (2010)

April 30, 2009 | July 31, 2009 | October 31, 2009 | January 31, 2010 | |

Revenue | – | – | – | – |

Net loss | $(290,188) | $(111,162) | $(105,334) | $(204,061) |

Basic and diluted loss per share | $(0.07) | $(0.03) | $(0.02) | $(0.03) |