UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018

or

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to __________

Commission file number: 001-15543

________________________

PALATIN TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

Delaware |

| 95-4078884 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

4B Cedar Brook DriveCranbury, New Jersey |

| 08512 |

(Address of principal executive offices) |

| (Zip Code) |

(609) 495-2200

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) for the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 11, 2018, 198,677,039 shares of the registrant's common stock, par value $0.01 per share, were outstanding.

PALATIN TECHNOLOGIES, INC .

Table of Contents

| Page |

PART I – FINANCIAL INFORMATION | |

Item 1. Financial Statements (Unaudited) |

|

Consolidated Balance Sheets as of March 31, 2018 and June 30, 2017 | 3 |

Consolidated Statements of Operations for the Three and Nine Months Ended March 31, 2018 and 2017 | 4 |

Consolidated Statements of Comprehensive (Loss) Income for the Three and Nine Months Ended March 31, 2018 and 2017 | 5 |

Consolidated Statements of Cash Flows for the Three and Nine Months Ended March 31, 2018 and 2017 | 6 |

Notes to Consolidated Financial Statements | 7 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | 19 |

Item 3. Quantitative and Qualitative Disclosures About Market Risk | 22 |

Item 4. Controls and Procedures | 22 |

PART II – OTHER INFORMATION | |

|

|

Item 1. Legal Proceedings | 23 |

Item 1A. Risk Factors | 23 |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 42 |

Item 3. Defaults Upon Senior Securities | 42 |

Item 4. Mine Safety Disclosures | 42 |

Item 5. Other Information | 42 |

Item 6. Exhibits | 43 |

Signatures | 44 |

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In this Quarterly Report on Form 10-Q, references to "we", "our", "us" or "Palatin" means Palatin Technologies, Inc. and its subsidiary.

Statements in this Quarterly Report on Form 10-Q, as well as oral statements that may be made by us or by our officers, directors, or employees acting on our behalf, that are not historical facts constitute "forward-looking statements", which are made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The forward-looking statements in this Quarterly Report on Form 10-Q do not constitute guarantees of future performance. Investors are cautioned that statements that are not strictly historical statements contained in this Quarterly Report on Form 10-Q, including, without limitation, the following are forward looking statements:

●

estimates of our expenses, future revenue and capital requirements;

●

our ability to obtain additional financing on terms acceptable to us, or at all;

●

our ability to advance product candidates into, and successfully complete, clinical trials;

●

the initiation, timing, progress and results of future preclinical studies and clinical trials, and our research and development programs;

●

the timing or likelihood of regulatory filings and approvals;

●

our expectations regarding completion of required clinical trials and studies and validation of methods and controls used to manufacture bremelanotide for the treatment of premenopausal women with hypoactive sexual desire disorder ("HSDD"), which is a type of female sexual dysfunction ("FSD");

●

our expectation regarding the timing of our regulatory submissions for approval of bremelanotide for HSDD in the United States and in certain other jurisdictions outside the United States;

●

our expectation regarding performance of our exclusive licensees of bremelanotide, including;

o

AMAG Pharmaceuticals, Inc. ("AMAG") for North America,

o

Shanghai Fosun Pharmaceutical Industrial Development Co. Ltd. ("Fosun"), a subsidiary of Shanghai Fosun Pharmaceutical (Group) Co., Ltd., for the territories of the People's Republic of China, Taiwan, Hong Kong S.A.R. and Macau S.A.R. (collectively, "China"), and

o

Kwangdong Pharmaceutical Co., Ltd. ("Kwangdong") for the Republic of Korea ("Korea");

●

the potential for commercialization of bremelanotide for HSDD in North America by AMAG and other product candidates, if approved, by us;

●

our expectations regarding the potential market size and market acceptance for bremelanotide for HSDD and our other product candidates, if approved for commercial use;

●

our ability to compete with other products and technologies similar to our product candidates;

●

the ability of our third-party collaborators to timely carry out their duties under their agreements with us;

●

the ability of our contract manufacturers to perform their manufacturing activities for us in compliance with applicable regulations;

●

our ability to recognize the potential value of our licensing arrangements with third parties;

●

the potential to achieve revenues from the sale of our product candidates;

●

our ability to obtain adequate reimbursement from Medicare, Medicaid, private insurers and other healthcare payers;

●

our ability to maintain product liability insurance at a reasonable cost or in sufficient amounts, if at all;

●

the retention of key management, employees and third-party contractors;

●

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology;

●

our compliance with federal and state laws and regulations;

●

the timing and costs associated with obtaining regulatory approval for our product candidates;

●

the impact of fluctuations in foreign exchange rates;

●

the impact of legislative or regulatory healthcare reforms in the United States;

●

our ability to adapt to changes in global economic conditions; and

●

our ability to remain listed on the NYSE American stock exchange.

Such forward-looking statements involve risks, uncertainties and other factors that could cause our actual results to be materially different from historical results or from any results expressed or implied by such forward-looking statements. Our future operating results are subject to risks and uncertainties and are dependent upon many factors, including, without limitation, the risks identified in this report, in our Annual Report on Form 10-K for the year ended June 30, 2017, and in our other Securities and Exchange Commission ("SEC") filings.

We expect to incur losses in the future as a result of spending on our planned development programs and results may fluctuate significantly from quarter to quarter.

Palatin Technologies® is a registered trademark of Palatin Technologies, Inc.

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

PALATIN TECHNOLOGIES, INC . | ||

and Subsidiary | ||

Consolidated Balance Sheets | ||

(unaudited) | ||

|

|

|

|

March 31, 2018 |

June 30, 2017 |

ASSETS |

|

|

Current assets: |

|

|

Cash and cash equivalents | $ 25,736,158 | $ 40,200,324 |

Available-for-sale investments | - | 249,837 |

Accounts receivable | - | 15,116,822 |

Prepaid expenses and other current assets | 701,456 | 1,011,221 |

Total current assets | 26,437,614 | 56,578,204 |

|

|

|

Property and equipment, net | 165,080 | 198,153 |

Other assets | 556,915 | 56,916 |

Total assets | $ 27,159,609 | $ 56,833,273 |

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) |

|

|

Current liabilities: |

|

|

Accounts payable | $ 793,642 | $ 1,551,367 |

Accrued expenses | 5,894,877 | 10,521,098 |

Notes payable, net of discount and debt issuance costs | 6,921,032 | 7,824,935 |

Capital lease obligations | - | 14,324 |

Deferred revenue | 585,519 | 35,050,572 |

Total current liabilities | 14,195,070 | 54,962,296 |

|

|

|

Notes payable, net of discount and debt issuance costs | 1,328,973 | 6,281,660 |

Deferred revenue | 500,000 | - |

Other non-current liabilities | 909,179 | 753,961 |

Total liabilities | 16,933,222 | 61,997,917 |

|

|

|

Stockholders' equity (deficiency): |

|

|

Preferred stock of $0.01 par value – authorized 10,000,000 shares: |

|

|

Series A Convertible: issued and outstanding 4,030 shares as of March 31, 2018 and June 30, 2017 | 40 | 40 |

Common stock of $0.01 par value – authorized 300,000,000 shares: |

|

|

issued and outstanding 195,477,332 shares as of March 31, 2018 and 160,515,361 shares as of June 30, 2017, respectively | 1,954,773 | 1,605,153 |

Additional paid-in capital | 352,125,554 | 349,979,373 |

Accumulated other comprehensive loss | - | (590 ) |

Accumulated deficit | (343,853,980 ) | (356,748,620 ) |

Total stockholders' equity (deficiency) | 10,226,387 | (5,164,644 ) |

Total liabilities and stockholders' equity (deficiency) | $ 27,159,609 | $ 56,833,273 |

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

3

PALATIN TECHNOLOGIES, INC. | ||||

and Subsidiary | ||||

Consolidated Statements of Operations | ||||

(unaudited) | ||||

|

|

|

|

|

|

Three Months Ended March 31, |

Nine Months Ended March 31, | ||

|

2018 |

2017 |

2018 |

2017 |

|

|

|

|

|

REVENUES: |

|

|

|

|

License and contract revenue | $ 8,962,709 | $ 10,823,748 | $ 46,516,370 | $ 10,823,748 |

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

Research and development | 7,068,849 | 9,062,316 | 27,277,830 | 28,422,975 |

General and administrative | 2,411,302 | 4,773,696 | 5,581,066 | 7,289,342 |

Total operating expenses | 9,480,151 | 13,836,012 | 32,858,896 | 35,712,317 |

|

|

|

|

|

(Loss) Income from operations | (517,442 ) | (3,012,264 ) | 13,657,474 | (24,888,569 ) |

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

Interest income | 86,496 | 6,304 | 219,578 | 18,940 |

Interest expense | (326,983 ) | (558,702 ) | (1,175,023 ) | (1,777,222 ) |

Total other expense, net | (240,487 ) | (552,398 ) | (955,445 ) | (1,758,282 ) |

|

|

|

|

|

(Loss) Income before income taxes | (757,929 ) | (3,564,662 ) | 12,702,029 | (26,646,851 ) |

Income tax benefit, net | 18,746 | - | 192,611 | - |

|

|

|

|

|

NET (LOSS) INCOME | $ (739,183 ) | $ (3,564,662 ) | $ 12,894,640 | $ (26,646,851 ) |

|

|

|

|

|

Basic net (loss) income per common share | $ (0.00 ) | $ (0.02 ) | $ 0.07 | $ (0.15 ) |

|

|

|

|

|

Diluted net (loss) income per common share | $ (0.00 ) | $ (0.02 ) | $ 0.06 | $ (0.15 ) |

|

|

|

|

|

Weighted average number of common shares outstanding used in computing basic net (loss) income per common share | 197,485,758 | 196,580,519 | 197,277,286 | 179,841,133 |

|

|

|

|

|

Weighted average number of common shares outstanding used in computing diluted net (loss) income per common share | 197,485,758 | 196,580,519 | 202,712,963 | 179,841,133 |

The accompanying notes are an integral part of these consolidated financial statements.

4

PALATIN TECHNOLOGIES, INC. | ||||

and Subsidiary | ||||

Consolidated Statements of Comprehensive (Loss) Income | ||||

(unaudited) | ||||

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

Nine Months Ended March 31, | ||

|

2018 |

2017 |

2018 |

2017 |

|

|

|

|

|

Net (loss) income | $ (739,183 ) | $ (3,564,662 ) | $ 12,894,640 | $ (26,646,851 ) |

|

|

|

|

|

Other comprehensive (loss) income : |

|

|

|

|

Unrealized gain on available-for-sale investments | - | 587 | 590 | 525 |

|

|

|

|

|

Total comprehensive (loss) income | $ (739,183 ) | $ (3,564,075 ) | $ 12,895,230 | $ (26,646,326 ) |

The accompanying notes are an integral part of these consolidated financial statements.

5

PALATIN TECHNOLOGIES, INC. | ||

and Subsidiary | ||

Consolidated Statements of Cash Flows | ||

(unaudited) | ||

|

|

|

|

Nine Months Ended March 31, | |

|

2018 |

2017 |

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

Net income (loss) | $ 12,894,640 | $ (26,646,851 ) |

Adjustments to reconcile net income (loss) to net cash |

|

|

(used in) provided by operating activities: |

|

|

Depreciation and amortization | 42,573 | 22,891 |

Non-cash interest expense | 143,837 | 234,056 |

Stock-based compensation | 2,370,972 | 1,404,721 |

Deferred income tax benefit | (500,000 ) | - |

Changes in operating assets and liabilities: |

|

|

Accounts receivable | 15,116,822 | (4,657,577 ) |

Prepaid expenses and other assets | 309,766 | 256,026 |

Accounts payable | (757,725 ) | 529,254 |

Accrued expenses | (4,601,842 ) | 546,474 |

Deferred revenue | (33,965,053 ) | 53,833,828 |

Other non-current liabilities | 155,218 | 245,701 |

Net cash (used in) provided by operating activities | (8,790,792 ) | 25,768,523 |

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

Proceeds from matured investments | 250,000 | 450,000 |

Purchases of property and equipment | (9,500 ) | - |

Net cash provided by investing activities | 240,500 | 450,000 |

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

Payments on capital lease obligations | (14,324 ) | (20,418 ) |

Payment of withholding taxes related to restricted |

|

|

stock units | (45,165 ) | (222 ) |

Payment on notes payable obligations | (6,000,000 ) | (3,666,666 ) |

Proceeds from the exercise of options and warrants | 145,615 | 114,358 |

Proceeds from the sale of common stock and |

|

|

warrants, net of costs | - | 23,856,972 |

Net cash (used in) provided by financing activities | (5,913,874 ) | 20,284,024 |

|

|

|

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | (14,464,166 ) | 46,502,547 |

|

|

|

CASH AND CASH EQUIVALENTS, beginning of period | 40,200,324 | 8,002,668 |

|

|

|

CASH AND CASH EQUIVALENTS, end of period | $ 25,736,158 | $ 54,505,215 |

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

Cash paid for interest | $ 876,394 | $ 1,299,731 |

Unrealized gain on available-for-sale investments | 590 | 525 |

The accompanying notes are an integral part of these consolidated financial statements.

6

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

(1)

ORGANIZATION:

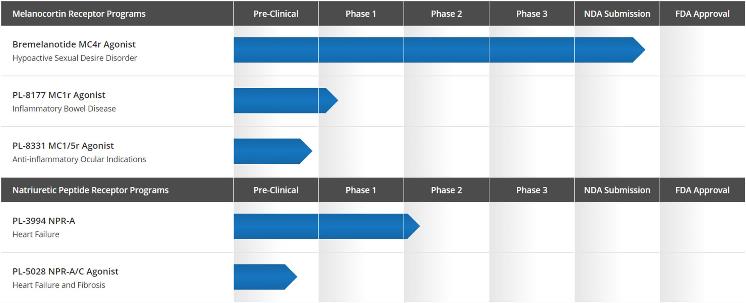

Nature of Business – Palatin Technologies, Inc. ("Palatin" or the "Company") is a biopharmaceutical company developing targeted, receptor-specific peptide therapeutics for the treatment of diseases with significant unmet medical need and commercial potential. Palatin's programs are based on molecules that modulate the activity of the melanocortin and natriuretic peptide receptor systems. The melanocortin system is involved in a large and diverse number of physiologic functions, and therapeutic agents modulating this system may have the potential to treat a variety of conditions and diseases, including sexual dysfunction and inflammation-related diseases. The natriuretic peptide receptor system has numerous cardiovascular functions, and therapeutic agents modulating this system may be useful in treatment of heart failure and other cardiovascular diseases.

The Company's primary product in development is bremelanotide for the treatment of hypoactive sexual desire disorder ("HSDD"), which is a type of female sexual dysfunction ("FSD"). The Company also has drug candidates or development programs for cardiovascular diseases, including heart failure and fibrosis, and inflammatory diseases, including inflammatory bowel disease and ocular indications.

Key elements of the Company's business strategy include using its technology and expertise to develop and commercialize therapeutic products; entering into alliances and partnerships with pharmaceutical companies to facilitate the development, manufacture, marketing, sale and distribution of product candidates that the Company is developing; and partially funding its product candidate development programs with the cash flow generated from its relationships with third parties.

Business Risk and Liquidity – Since inception, the Company has incurred negative cash flows from operations, and has expended, and expects to continue to expend, substantial funds to complete its planned product development efforts. As shown in the accompanying consolidated financial statements, the Company had an accumulated deficit as of March 31, 2018 of $343,853,980 and had net losses and income for the three and nine months ended March 31, 2018 of $739,183 and $12,894,640, respectively. The Company anticipates incurring losses in the future as a result of spending on its development programs and will require substantial additional financing to continue to fund its planned developmental activities. To achieve sustained profitability, if ever, the Company, alone or with others, must successfully develop and commercialize its technologies and proposed products, conduct successful preclinical studies and clinical trials, obtain required regulatory approvals and successfully manufacture and market such technologies and proposed products. The time required to reach sustained profitability is highly uncertain, and the Company may never be able to achieve profitability on a sustained basis, if at all.

As of March 31, 2018, the Company's cash and cash equivalents were $25,736,158 and current liabilities were $13,609,551, net of deferred revenue of $585,519. The Company intends to utilize existing capital resources for general corporate purposes and working capital, and preclinical and clinical development of the Company's other product candidates and programs, including natriuretic peptide receptor and melanocortin receptor programs.

Management believes that the Company's existing capital resources, together with proceeds received from sales of common stock in the Company's "at-the-market" program (if any) (Note 14), will be adequate to fund the Company's planned operations through at least June 30, 2019. The Company will need additional funding to complete required clinical trials for its other product candidates and, assuming those clinical trials are successful, as to which there can be no assurance, to complete submission of required applications to the U.S. Food and Drug Administration ("FDA"). If the Company is unable to obtain approval or otherwise advance in the FDA approval process, the Company's ability to sustain its operations would be materially adversely affected.

The Company may seek the additional capital necessary to fund its operations through public or private equity offerings, collaboration agreements, debt financings or licensing arrangements. Additional capital that is required by the Company may not be available on reasonable terms, or at all.

Concentrations – Concentrations in the Company's assets and operations subject it to certain related risks. Financial instruments that subject the Company to concentrations of credit risk primarily consist of cash and cash equivalents, accounts receivable and investments. The Company's cash and cash equivalents are primarily invested in one money market account sponsored by a large financial institution. For the three and nine months ended March 31, 2018, the Company reported $8,962,709 and $41,516,370, respectively, in license and contract revenue related to a license agreement with AMAG for bremelanotide for North America ("License Agreement with AMAG") (Note 5). In addition, for the nine months ended March 31, 2018, the Company reported $5,000,000 in license revenue related to a license agreement with Fosun for bremelanotide for China and certain other Asian territories ("License Agreement with Fosun") (Note 6). For the three and nine months ended March 31, 2017, the Company reported $10,823,748 in contract revenue related to the License Agreement with AMAG.

7

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

(2)

BASIS OF PRESENTATION:

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnote disclosures required to be presented for complete financial statements. In the opinion of management, these consolidated financial statements contain all adjustments (consisting of normal recurring adjustments) considered necessary for fair presentation. The results of operations for the three and nine months ended March 31, 2018 may not necessarily be indicative of the results of operations expected for the full year.

The accompanying unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended June 30, 2017, filed with the SEC, which includes consolidated financial statements as of June 30, 2017 and 2016 and for each of the fiscal years in the three-year period ended June 30, 2017.

(3)

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

Principles of Consolidation – The consolidated financial statements include the accounts of Palatin and its wholly-owned inactive subsidiary. All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates – The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents – Cash and cash equivalents include cash on hand, cash in banks and all highly liquid investments with a purchased maturity of less than three months. Cash equivalents consist of $25,461,335 and $40,019,336 in a money market account as of March 31,2018 and June 30, 2017, respectively.

Investments – The Company determines the appropriate classification of its investments in debt and equity securities at the time of purchase and reevaluates such determinations at each balance sheet date. Debt securities are classified as held-to-maturity when the Company has the intent and ability to hold the securities to maturity. Debt securities for which the Company does not have the intent or ability to hold to maturity are classified as available-for-sale. Held-to-maturity securities are recorded as either short-term or long-term on the balance sheet, based on the contractual maturity date and are stated at amortized cost. Marketable securities that are bought and held principally for the purpose of selling them in the near term are classified as trading securities and are reported at fair value, with unrealized gains and losses recognized in earnings. Debt and marketable equity securities not classified as held-to-maturity or as trading are classified as available-for-sale and are carried at fair market value, with the unrealized gains and losses, net of tax, included in the determination of other comprehensive (loss) income.

The fair value of substantially all securities is determined by quoted market prices. The estimated fair value of securities for which there are no quoted market prices is based on similar types of securities that are traded in the market.

Fair Value of Financial Instruments – The Company's financial instruments consist primarily of cash equivalents, accounts receivable, accounts payable and notes payable. Management believes that the carrying values of cash equivalents, accounts receivable, available-for-sale investments and accounts payable are representative of their respective fair values based on the short-term nature of these instruments. Management believes that the carrying amount of its notes payable approximates fair value based on the terms of the notes.

Credit Risk – Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents. Total cash and cash equivalent balances have exceeded balances insured by the Federal Depository Insurance Company.

Property and Equipment – Property and equipment consists of office and laboratory equipment, office furniture and leasehold improvements and includes assets acquired under capital leases. Property and equipment are recorded at cost. Depreciation is recognized using the straight-line method over the estimated useful lives of the related assets, generally five years for laboratory and computer equipment, seven years for office furniture and equipment and the lesser of the term of the lease or the useful life for leasehold improvements. Amortization of assets acquired under capital leases is included in depreciation expense. Maintenance and repairs are expensed as incurred while expenditures that extend the useful life of an asset are capitalized. Accumulated depreciation and amortization was $2,324,562 and $2,281,989 as of March 31, 2018 and June 30, 2017, respectively.

8

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

Impairment of Long-Lived Assets – The Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. To determine recoverability of a long-lived asset, management evaluates whether the estimated future undiscounted net cash flows from the asset are less than its carrying amount. If impairment is indicated, the long-lived asset would be written down to fair value. Fair value is determined by an evaluation of available price information at which assets could be bought or sold, including quoted market prices, if available, or the present value of the estimated future cash flows based on reasonable and supportable assumptions.

Revenue Recognition – The Company has generated revenue solely through license and collaboration agreements. The Company recognizes revenue in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 605-25, Revenue Recognition for Arrangements with Multiple Elements , which addresses the determination of whether an arrangement involving multiple deliverables contains more than one unit of accounting. A delivered item within an arrangement is considered a separate unit of accounting only if both of the following criteria are met:

●

the delivered item has value to the customer on a stand-alone basis; and

●

if the arrangement includes a general right of return relative to the delivered item, delivery or performance of the undelivered item is considered probable and substantially in control of the vendor.

Under FASB ASC Topic 605-25, if both of the criteria above are not met, then separate accounting for the individual deliverables is not appropriate.

The Company has determined that it is appropriate to recognize the consideration received under its License Agreement with AMAG as revenue using the input-based proportional method during the period of the Palatin Development Obligation as defined in the License Agreement with AMAG. Refer to Note 5 for additional information on this topic.

Under its License Agreement with Fosun (Note 6), the Company received consideration in the form of an upfront license fee payment and determined that it was appropriate to recognize such consideration as revenue in the first quarter of 2018, which was the quarter in which the license was granted, since the license has stand-alone value and the upfront payment received by the Company is non-refundable.

Under its License Agreement with Kwangdong (Note 7), the Company received consideration in the form of an upfront license fee payment and has currently determined that it is appropriate to record such consideration as non-current deferred revenue because the upfront payment received by the Company is subject to certain refund provisions.

Revenue resulting from the achievement of development milestones is recorded in accordance with the accounting guidance for the milestone method of revenue recognition.

Amounts received prior to satisfying the revenue recognition criteria are recorded as deferred revenue on the Company's consolidated balance sheet. Amounts expected to be recognized as revenue in the next 12 months following the balance sheet date are classified as current liabilities.

Research and Development Costs – The costs of research and development activities are charged to expense as incurred, including the cost of equipment for which there is no alternative future use.

Accrued Expenses – Third parties perform a significant portion of the Company's development activities. The Company reviews the activities performed under all contracts each quarter and accrues expenses and the amount of any reimbursement to be received from collaborators based upon the estimated amount of work completed. Estimating the value or stage of completion of certain services requires judgment based on available information. If the Company does not identify services performed but not billed by the service-provider, or if the Company underestimates or overestimates the value of services performed as of a given date, reported expenses will be understated or overstated.

Stock-Based Compensation – The Company charges to expense the fair value of stock options and other equity awards granted. The Company determines the value of stock options utilizing the Black-Scholes option pricing model. Compensation costs for share-based awards with pro-rata vesting are determined using the quoted market price of the Company's common stock on the date of grant and allocated to periods on a straight-line basis, while awards containing a market condition and performance conditions are valued using multifactor Monte Carlo simulations.

9

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

Income Taxes – The Company and its subsidiary file consolidated federal and separate-company state income tax returns. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences or operating loss and tax credit carryforwards are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period that includes the enactment date. The Company has recorded a valuation allowance against its deferred tax assets based on the history of losses incurred.

Pursuant to the License Agreement with Fosun (Note 6) and the License Agreement with Kwangdong (Note 7), $500,000 and $82,500, respectively, was withheld in accordance with tax withholding requirements in China and the Republic of Korea, respectively, and will be recorded as an expense during the fiscal year ending June 30, 2018. For the three and nine months ended March 31, 2018, the Company recorded an income tax benefit of $18,746 and an income tax expense of $307,389, respectively, related to these transactions and the remaining balance of $275,111 was included in prepaid expenses and other current assets at March 31, 2018. Any potential credit to be received by the Company on its United States tax returns is currently offset by the Company's valuation allowance.

On December 22, 2017, the U.S. government enacted wide-ranging tax legislation, the Tax Cuts and Jobs Act (the "2017 Tax Act"). The 2017 Tax Act significantly revises U.S. tax law by, among other provisions, (a) lowering the applicable U.S. federal statutory corporate income tax rate from 35% to 21%, (b) eliminating or reducing certain income tax deductions, such as deductions for interest expense, executive compensation expenses and certain employee expenses, and (c) repealing the federal alternative minimum tax ("AMT") and providing for the refund of existing AMT credits.

As a result of the 2017 Tax Act, during the quarter ended December 31, 2017, the Company recorded a tax benefit of $500,000 related to the release of a valuation allowance against an AMT credit; accordingly, $500,000 is included in Other long-term assets at March 31, 2018. In addition, as a result of the enactment of the new corporate income tax rate, the Company remeasured certain deferred tax assets and liabilities based on the rates at which they are expected to reverse and with the exception of the AMT credit, the Company continues to maintain a full valuation allowance against its net deferred tax assets.

The June 30,

2017 tax return was filed during the quarter ended March 31, 2018.

As a result, the Company did not incur AMT liability. The Company

has an income tax receivable of $500,000 from previously paying tax

that can be refunded in the future.

Net (Loss) Income per Common Share – Basic and diluted earnings per common share ("EPS") are calculated in accordance with the provisions of FASB ASC Topic 260, " Earnings per Share ," which includes guidance pertaining to the warrants issued in connection with the July 3, 2012, December 23, 2014, and July 2, 2015 private placement offerings and the August 4, 2016 underwritten offering, that were exercisable for nominal consideration and, therefore, to the extent not yet exercised are considered in the computation of basic and diluted net loss per common share. As of March 31, 2018, all warrants exercisable for nominal value have been converted into common stock.

The following table is a reconciliation of net (loss) income and the shares used in calculating basic and diluted net (loss) income per common share for the three and nine months ended March 31, 2018 and 2017:

|

Three Months Ended March 31, |

Nine Months Ended March 31, | ||

|

2018 |

2017 |

2018 |

2017 |

|

|

|

|

|

Net (loss) income | $ (739,183 ) | $ (3,564,662 ) | $ 12,894,640 | $ (26,646,851 ) |

|

|

|

|

|

Denominator: |

|

|

|

|

Weighted average common shares outstanding - Basic | 197,485,758 | 196,580,519 | 197,277,286 | 179,841,133 |

|

|

|

|

|

Effect of dilutive shares: |

|

|

|

|

Common stock equivalents arising from stock options, |

|

|

|

|

warrants and conversion of preferred stock | - | - | 3,610,611 | - |

Restricted stock units | - | - | 1,825,066 | - |

Weighted average common shares outstanding - Diluted | 197,485,758 | 196,580,519 | 202,712,963 | 179,841,133 |

|

|

|

|

|

Net (loss) income per common share: |

|

|

|

|

Basic | $ (0.00 ) | $ (0.02 ) | $ 0.07 | $ (0.15 ) |

Diluted | $ (0.00 ) | $ (0.02 ) | $ 0.06 | $ (0.15 ) |

10

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

As of March 31, 2018 and 2017, common shares issuable upon conversion of Series A Convertible Preferred Stock, the exercise of outstanding options and warrants (excluding the Series A 2012, Series B 2012, Series C 2014, Series E 2015 and Series I 2016 warrants issued in connection with the July 3, 2012, December 23, 2014, and July 2, 2015 private placement offerings and the August 4, 2016 underwritten offering as such warrants, to the extent not yet exercised, are already included in the weighted average number of common shares outstanding used in computing basic net (loss) income per common share since they are exercisable for nominal consideration), and the vesting of restricted stock units amounted to an aggregate of 46,773,540 and 36,222,569 shares, respectively, and are excluded from the weighted average number of common shares outstanding used in computing basic net (loss) income per common share. For the nine months ended March 31, 2018, an additional 5,435,677 common shares are included in the computation of diluted EPS using the treasury stock and if-converted methods. However, for the three months ended March 31, 2018 and the three and nine months ended March 31, 2017, no additional common shares were added in the computation of diluted EPS because to do so would have been anti-dilutive.

(4)

NEW AND RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS:

In May 2017, the FASB issued ASU No. 2017-09, Compensation-Stock Compensation (Topic 718): Scope of Modification Accounting , which clarifies when to account for a change to the terms or conditions of a share-based payment award as a modification. Under the new guidance, modification accounting is required only if the fair value, the vesting conditions, or the classification of the award (as equity or liability) changes as a result of the change in terms or conditions. It is effective prospectively for the annual period ending June 30, 2019 and interim periods within that annual period. Early adoption is permitted. The Company is currently evaluating the effect that ASU No. 2017-09 will have on its consolidated financial statements and related disclosures.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments Credit Losses: Measurement of Credit Losses on Financial Instruments, which requires measurement and recognition of expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. This is different from the current guidance as this will require immediate recognition of estimated credit losses expected to occur over the remaining life of many financial assets. The new guidance will be effective for the Company on July 1, 2020. Early adoption will be available on July 1, 2019. The Company is currently evaluating the effect that ASU No. 2016-13 will have on its consolidated financial statements and related disclosures.

In March 2016, the FASB issued ASU No. 2016-09, Compensation – Improvements to Employee Share-Based Payment Accounting , which amends the current guidance related to stock compensation. The updated guidance changes how companies account for certain aspects of share-based payment awards to employees, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. Under this guidance, on a prospective basis, companies will no longer be able to record excess tax benefits and certain tax deficiencies as additional paid-in capital. Instead, companies will record all excess tax benefits and tax deficiencies as income tax expense or benefit in the income statement. In addition, the guidance eliminates the requirement that excess tax benefits be realized before companies can recognize them. The ASU requires a cumulative-effect adjustment for previously unrecognized excess tax benefits in opening retained earnings in the period of adoption. Effective July 1, 2017, the Company adopted this updated guidance and elected to recognize forfeitures when they occur using a modified retrospective approach. The adoption of ASU No. 2016-09 did not have a material impact on the Company's consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, Leases , related to the recognition of lease assets and lease liabilities. The new guidance requires lessees to recognize almost all leases on their balance sheet as a right-of-use asset and a lease liability, other than leases that meet the definition of a short-term lease and requires expanded disclosures about leasing arrangements. The recognition, measurement, and presentation of expenses and cash flows arising from a lease have not significantly changed from the current guidance. Lessor accounting is similar to the current guidance but updated to align with certain changes to the lessee model and the new revenue recognition standard. The new guidance is effective for the Company on July 1, 2019, with early adoption permitted. The Company is evaluating the impact that ASU No. 2016-02 will have on its consolidated financial statements and related disclosures.

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments: Recognition and Measurement of Financial Assets and Financial Liabilities . The new guidance relates to the recognition and measurement of financial assets and liabilities. The new guidance makes targeted improvements to U.S. GAAP impacting equity investments (other than those accounted for under the equity method or consolidated), financial liabilities accounted for under the fair value election, and presentation and disclosure requirements for financial instruments, among other changes. The new guidance is effective for the Company on July 1, 2018, with early adoption prohibited other than for certain provisions. The Company is evaluating the impact that ASU No. 2016-01 will have on its consolidated financial statements and related disclosures.

11

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

In November 2015, the FASB issued ASU No. 2015-17, Income Taxes: Balance Sheet Classification of Deferred Taxes, which simplifies the balance sheet classification of deferred taxes. The new guidance requires that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. The current requirement that deferred tax liabilities and assets of a tax-paying component of an entity be offset and presented as a single amount is not affected by the new guidance. Effective July 1, 2017, the Company adopted this updated guidance, which did not have a material impact on the Company's financial position or results of operations because its net deferred tax assets were fully offset by a valuation allowance based on the history of losses incurred.

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers , which requires an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. The ASU will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective. In July 2015, the FASB voted to defer the effective date of the new standard until fiscal years beginning after December 15, 2017 with early application permitted for fiscal years beginning after December 15, 2016. With the deferral, the new standard is effective for the Company on July 1, 2018. In addition, in April 2016 the FASB issued ASU No. 2016-10, Identifying Performance Obligations and Licensing , which addresses various issues associated with identifying performance obligations, licensing of intellectual property, royalty considerations, and other matters. ASU No. 2016-10 is effective in connection with ASU No. 2014-09. The two permitted transition methods under ASU 2014-09 are the full retrospective method, in which case the new standard would be applied to each prior period presented and the cumulative effect of applying the standard would be recognized as of the earliest period reported, or the modified retrospective method, in which case the cumulative effect of applying the new standard would be recognized as of the date of initial application. The Company is engaged in an ongoing review to assess the impact to its financial statements, including an assessment of the Company's three key contracts, and is evaluating the effect that these standards will have on its consolidated financial statements and related disclosures.

(5)

AGREEMENT WITH AMAG:

On January 8, 2017, the Company entered into the License Agreement with AMAG. Under the terms of the License Agreement with AMAG, the Company granted to AMAG (i) an exclusive license in all countries of North America (the "Territory"), with the right to grant sub-licenses, to research, develop and commercialize products containing bremelanotide (each a "Product," and collectively, "Products"), (ii) a non-exclusive license in the Territory, with the right to grant sub-licenses, to manufacture Products, and (iii) a non-exclusive license in all countries outside the Territory, with the right to grant sub-licenses, to research, develop and manufacture (but not commercialize) the Products.

Following the satisfaction of certain conditions to closing, the License Agreement with AMAG became effective on February 2, 2017. On that date, AMAG paid the Company $60,000,000 as a one-time initial payment. Pursuant to the terms of and subject to the conditions in the License Agreement with AMAG, AMAG is required to reimburse the Company up to an aggregate amount of $25,000,000 for reasonable, documented, direct out-of-pocket expenses incurred by the Company following February 2, 2017, in connection with the development and regulatory activities necessary to file an NDA for bremelanotide for HSDD in the United States related to Palatin's development obligations.

The Company has determined there is no stand-alone value for the license, and that the license and the reimbursable direct out-of-pocket expenses, pursuant to the terms of the License Agreement with AMAG, represent a combined unit of accounting which totals $85,000,000. The Company is recognizing revenue of the combined unit of accounting over the arrangement using the input-based proportional method as the Company completes its development obligations. For the three and nine months ended March 31, 2018, the Company recognized $8,962,709 and $41,516,370, respectively, as license and contract revenue related to this transaction. As of March 31, 2018, and June 30, 2017, there was $585,519 and $35,050,572, respectively, of current deferred revenue on the consolidated balance sheet related to this transaction.

In addition, pursuant to the terms of and subject to the conditions in the License Agreement with AMAG, the Company is eligible to receive from AMAG: (i) up to $80,000,000 in specified regulatory payments upon achievement of certain regulatory milestones, and (ii) up to $300,000,000 in sales milestone payments based on achievement of annual net sales amounts for all Products in the Territory.

12

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

AMAG is also obligated to pay the Company tiered royalties on annual net sales of Products, on a product-by-product basis, in the Territory ranging from the high single-digits to the low double-digits. The royalties will expire on a product-by-product and country-by-country basis until the latest to occur of (i) the earliest date on which there are no valid claims of the Company's patent rights covering such Product in such country, (ii) the expiration of the regulatory exclusivity period for such Product in such country and (iii) ten years following the first commercial sale of such Product in such country. Such royalties are subject to reductions in the event that: (a) AMAG must license additional third party intellectual property in order to develop, manufacture or commercialize a Product, or (b) generic competition occurs with respect to a Product in a given country, subject to an aggregate cap on such deductions of royalties otherwise payable to the Company. After the expiration of the applicable royalties for any Product in a given country, the license for such Product in such country will become a fully paid-up, royalty-free, perpetual and irrevocable license.

The Company engaged Greenhill & Co. LLC ("Greenhill") as the Company's sole financial advisor in connection with a potential transaction with respect to bremelanotide. Under the engagement agreement with Greenhill, the Company was obligated to pay Greenhill a fee equal to 2% of all proceeds and consideration paid to the Company by AMAG in connection with the License Agreement with AMAG, subject to a minimum fee of $2,500,000. The minimum fee of $2,500,000, less credit of $50,000 for an advisory fee previously paid by the Company, was paid to Greenhill upon the closing of the licensing transaction. This amount will be credited toward amounts that become due to Greenhill in the future, provided that the aggregate fee payable to Greenhill will not be less than 2% of all proceeds and consideration paid to the Company by AMAG in connection with the License Agreement with AMAG. The Company will pay Greenhill an aggregate total of 2% of all proceeds and consideration paid to the Company by AMAG in connection with the License Agreement with AMAG, including future milestone and royalty payments, after crediting the $2,500,000 that was paid to Greenhill upon entering into the License Agreement with AMAG. The Company also reimbursed Greenhill $7,263 for certain expenses incurred in connection with its advisory services.

Pursuant to the License Agreement with AMAG, the Company has assigned to AMAG the Company's manufacturing and supply agreements with Catalent Belgium S.A. to perform fill, finish and packaging of bremelanotide.

(6)

AGREEMENT WITH FOSUN:

On September 6, 2017, the Company entered into the License Agreement with Fosun for exclusive rights to commercialize bremelanotide in the territories of the People's Republic of China, Taiwan, Hong Kong S.A.R. and Macau S.A.R.

Under the terms of the agreement, the Company received $4,500,000 in October 2017, which consisted of an upfront payment of $5,000,000 less $500,000 that was withheld in accordance with tax withholding requirements in China and will be recorded as an expense during the fiscal year ending June 30, 2018. For the three and nine months ended March 31, 2018, the Company recorded an income tax benefit of $15,765 and an income tax expense of $264,202, respectively, utilizing an estimated effective annual income tax rate applied to (loss) income for the three and nine months ended March 31, 2018 and the remaining balance of $235,798 was included in prepaid expenses and other current assets at March 31, 2018. The Company will receive a $7,500,000 milestone payment when regulatory approval in China is obtained, provided that a commercial supply agreement for bremelanotide has been entered into. Palatin has the potential to receive up to $92,500,000 in additional sales related milestone payments and high single-digit to low double-digit royalties on net sales in the licensed territory. All development, regulatory, sales, marketing, and commercial activities and associated costs in the licensed territory will be the sole responsibility of Fosun.

(7)

AGREEMENT WITH KWANGDONG:

On November 21, 2017, the Company entered into the License Agreement with Kwangdong for exclusive rights to commercialize bremelanotide in the Republic of Korea.

Under the terms of the agreement, the Company received $417,500 in December 2017, consisting of an upfront payment of $500,000, less $82,500, which was withheld in accordance with tax withholding requirements in Korea and will be recorded as an expense during the fiscal year ending June 30, 2018. Based upon certain refund provisions, the upfront payment has been recorded as non-current deferred revenue at March 31, 2018. For the three and nine months ended March 31, 2018, the Company recorded an income tax benefit of $2,981 and an income tax expense of $43,187, respectively, utilizing an estimated effective annual income tax rate applied to (loss) income for the three and nine months ended March 31, 2018 and the remaining balance of $39,313 was included in prepaid expenses and other current assets at March 31, 2018. The Company will receive a $3,000,000 milestone payment based on the first commercial sale in Korea. Palatin has the potential to receive up to $37,500,000 in additional sales related milestone payments and mid-single-digit to low double-digit royalties on net sales in the licensed territory. All development, regulatory, sales, marketing, and commercial activities and associated costs in the licensed territory will be the sole responsibility of Kwangdong.

13

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

(8)

PREPAID EXPENSES AND OTHER CURRENT ASSETS:

Prepaid expenses and other current assets consist of the following:

|

March 31, 2018 |

June 30, 2017 |

Clinical study costs | $ 232,508 | $ 657,069 |

Insurance premiums | 5,426 | 182,966 |

Foreign withholding tax (Notes 6 & 7) | 275,111 | - |

Other | 188,411 | 171,186 |

| $ 701,456 | $ 1,011,221 |

(9)

INVESTMENTS:

The following summarizes the carrying value of the Company's available-for-sale investments, which consist of corporate debt securities:

|

March 31, 2018 |

June 30, 2017 |

Cost | $ - | $ 262,023 |

Amortization of premium | - | (11,596 ) |

Gross unrealized loss | - | (590 ) |

Fair value | $ - | $ 249,837 |

(10)

FAIR VALUE MEASUREMENTS:

The fair value of cash equivalents and investments is classified using a hierarchy prioritized based on inputs. Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs are quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument. Level 3 inputs are unobservable inputs based on management's own assumptions used to measure assets and liabilities at fair value. A financial asset or liability's classification within the hierarchy is determined based on the lowest level input that is significant to the fair value measurement.

The following table provides the assets carried at fair value measured on a recurring basis:

| Carrying Value | Quoted prices in active markets (Level 1) | Other quoted/observable inputs (Level 2) | Significant unobservable inputs (Level 3) |

March 31, 2018: |

|

|

|

|

Money market account | $ 25,461,335 | $ 25,461,335 | $ - | $ - |

June 30, 2017: |

|

|

|

|

Money market account | $ 40,019,336 | $ 40,019,336 | $ - | $ - |

Corporate debt securities | 249,837 | 249,837 | - | - |

TOTAL | $ 40,269,173 | $ 40,269,173 | $ - | $ - |

|

|

|

|

|

14

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

(11)

ACCRUED EXPENSES:

Accrued expenses consist of the following:

|

March 31, 2018 |

June 30, 2017 |

Clinical study costs | $ 4,428,593 | $ 9,138,827 |

Other research related expenses | 393,411 | 217,307 |

Professional services | 45,269 | 434,768 |

Other | 1,027,604 | 730,196 |

| $ 5,894,877 | $ 10,521,098 |

(12)

NOTES PAYABLE:

Notes payable consist of the following:

|

March 31, 2018 |

June 30, 2017 |

Notes payable under venture loan | $ 8,333,333 | $ 14,333,334 |

Unamortized related debt discount | (53,558 ) | (143,524 ) |

Unamortized debt issuance costs | (29,770 ) | (83,215 ) |

Notes payable | 8,250,005 | 14,106,595 |

|

|

|

Less: current portion | 6,921,032 | 7,824,935 |

|

|

|

Long-term portion | $ 1,328,973 | $ 6,281,660 |

On December 23, 2014, the Company closed on a $10,000,000 venture loan which was led by Horizon Technology Finance Corporation ("Horizon"). The debt facility is a four year senior secured term loan that bears interest at a floating coupon rate of one-month LIBOR (floor of 0.50%) plus 8.50%, and provides for interest-only payments for the first eighteen months followed by monthly payments of principal of $333,333 plus accrued interest through January 1, 2019. The lenders also received five-year immediately exercisable Series D 2014 warrants to purchase 666,666 shares of common stock exercisable at an exercise price of $0.75 per share. The Company recorded a debt discount of $267,820 equal to the fair value of these warrants at issuance, which is being amortized to interest expense over the term of the related debt. This debt discount is offset against the note payable balance and included in additional paid-in capital on the Company's balance sheet at March 31,2018 and June 30, 2017. In addition, a final incremental payment of $500,000 is due on January 1, 2019, or upon early repayment of the loan. This final incremental payment is being accreted to interest expense over the term of the related debt. The Company incurred $209,367 of costs in connection with the loan. These costs were capitalized as deferred financing costs and are offset against the note payable balance. These debt issuance costs are being amortized to interest expense over the term of the related debt.

On July 2, 2015, the Company closed on a $10,000,000 venture loan led by Horizon. The debt facility is a four-year senior secured term loan that bears interest at a floating coupon rate of one-month LIBOR (floor of 0.50%) plus 8.50% and provides for interest-only payments for the first eighteen months followed by monthly payments of principal of $333,333 plus accrued interest through August 1, 2019. The lenders also received five-year immediately exercisable Series G warrants to purchase 549,450 shares of the Company's common stock exercisable at an exercise price of $0.91 per share. The Company has recorded a debt discount of $305,196 equal to the fair value of these warrants at issuance, which is being amortized to interest expense over the term of the related debt. This debt discount is offset against the note payable balance and is included in additional paid-in capital on the Company's balance sheet at March 31, 2018 and June 30, 2017. In addition, a final incremental payment of $500,000 is due on August 1, 2019, or upon early repayment of the loan. This final incremental payment is being accreted to interest expense over the term of the related debt. The Company incurred $146,115 of costs in connection with the loan agreement. These costs were capitalized as deferred financing costs and are offset against the note payable balance. These debt issuance costs are being amortized to interest expense over the term of the related debt.

15

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

The Company's obligations under the 2015 amended and restated loan agreement, which includes both the 2014 venture loan and the 2015 venture loan, are secured by a first priority security interest in substantially all of its assets other than its intellectual property. The Company also has agreed to specified limitations on pledging or otherwise encumbering its intellectual property assets. The 2015 amended and restated loan agreement include customary affirmative and restrictive covenants, but does not include any covenants to attain or maintain specified financial metrics. The loan agreement includes customary events of default, including payment defaults, breaches of covenants, change of control and a material adverse change default. Upon the occurrence of an event of default and following any applicable cure periods, a default interest rate of an additional 5% may be applied to the outstanding loan balances, and the lenders may declare all outstanding obligations immediately due and payable and take such other actions as set forth in the loan agreement. As of March 31, 2018, the Company was in compliance with all of its loan covenants.

(13)

STOCKHOLDERS' EQUITY (DEFICIENCY):

Financing Transactions – On December 6, 2016, the Company closed on an underwritten public offering of units, with each unit consisting of a share of common stock and a Series J warrant to purchase 0.50 of a share of common stock. Gross proceeds were $16,500,000, with net proceeds to the Company, after deducting underwriting discounts and commissions and offering expenses, of $15,386,075. The Company issued 25,384,616 shares of common stock and Series J warrants to purchase 12,692,310 shares of common stock at an initial exercise price of $0.80 per share, which warrants are exercisable immediately upon issuance and expire on the fifth anniversary of the date of issuance. The Series J warrants are subject to limitation on exercise if the holder and its affiliates would beneficially own more than 9.99%, or 4.99% for certain holders, of the total number of the Company's shares of common stock outstanding following such exercise.

On August 4, 2016, the Company closed on an underwritten offering of units, with each unit consisting of a share of common stock and a Series H warrant to purchase 0.75 of a share of common stock. Investors whose purchase of units in the offering would result in them beneficially owning more than 9.99% of the Company's outstanding common stock following the completion of the offering had the option to acquire units with Series I prefunded warrants substituted for any common stock they would have otherwise acquired. Gross proceeds were $9,225,000, with net proceeds to the Company, after deducting offering expenses, of $8,470,897. The Company issued 11,481,481 shares of common stock and ten-year prefunded Series I warrants to purchase 2,218,045 shares of common stock at an exercise price of $0.01, together with Series H warrants to purchase 10,274,646 shares of common stock at an exercise price of $0.70 per share.

The Series I warrants were exercised during the fiscal year ended June 30, 2017. The Series H warrants are exercisable at an initial exercise price of $0.70 per share, are exercisable commencing six months following the date of issuance and expire on the fifth anniversary of the date of issuance. The Series H warrants are subject to a limitation on their exercise if the holder and its affiliates would beneficially own more than 9.99% of the total number of the Company's shares of common stock outstanding following such exercise.

On July 2, 2015, the Company closed on a private placement of Series E warrants to purchase 21,917,808 shares of Palatin common stock and Series F warrants to purchase 2,191,781 shares of the Company's common stock. Certain funds managed by QVT Financial LP ("QVT") invested $5,000,000 and another accredited investment fund invested $15,000,000. The funds paid $0.90 for each Series E warrant and $0.125 for each Series F warrant, resulting in gross proceeds to the Company of $20,000,000, with net proceeds, after deducting offering expenses, of $19,834,278.

The Series E warrants were exercisable immediately upon issuance at an initial exercise price of $0.01 per share. As of December 31, 2017, all of the Series E warrants were exercised. The Series F warrants are exercisable at an initial exercise price of $0.91 per share, are exercisable immediately upon issuance and expire on the fifth anniversary of the date of issuance. The Series F warrants are subject to limitation on exercise if QVT and its affiliates would beneficially own more than 9.99% (4.99% for the other accredited investment fund holder) of the total number of the Company's shares of common stock outstanding following such exercise.

During the nine months ended March 31, 2018 and 2017, the Company issued 23,344,451 and 27,989,685 shares, respectively of common stock pursuant to the cashless exercise provisions of warrants at an exercise price of $0.01 per share, and during the nine months ended March 31, 2018, the Company received $114,384 and issued 11,438,356 shares of common stock pursuant to the exercise of warrants at an exercise price of $0.01 per share. As of March 31, 2018, all warrants with an exercise price of $0.01 per share had been exercised.

Stock Options – In December 2017, the Company granted 1,200,000 options to its executive officers and 225,000 options to its non-employee directors under the Company's 2011 Stock Incentive Plan. The fair value of these options is $691,171 and $126,130, respectively. The Company is amortizing the fair value of these options over a 48-month vesting period for its executive officers and over a 36-month vesting period for its non-employee directors. The Company recognized $53,709 and $71,613 of stock-based compensation expense related to these options during the three and nine months ended March 31, 2018.

16

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

Also, in December 2017, the Company granted 1,075,000 and 125,000 performance-based options to its executive officers and employees, respectively, which vest during a performance period ending on December 31, 2020, if and upon i) as to 100% of the target number of shares upon achievement of a closing price for the Company's common stock equal to or greater than $1.50 per share for 20 consecutive trading days, which is considered a market condition; ii) as to thirty percent (30%) of the target number of shares, upon the acceptance for filing by the FDA of an NDA for bremelanotide for HSDD in premenopausal women during the performance period, which is considered a performance condition; iii) as to fifty percent (50%) of the target number of shares, upon the approval by the FDA of an NDA for bremelanotide for HSDD in premenopausal women during the performance period, which is also considered a performance condition; iv) as to twenty percent (20%) of the target number of shares, upon entry into a licensing agreement during the performance period for the commercialization of bremelanotide for FSD in at least two of the following geographic areas (a) four or more countries in Europe, (b) Japan, (c) two or more countries in Central and/or South America, (d) two or more countries in Asia, excluding Japan and China, and (e) Australia, which is also considered a performance condition. The fair value of these options, as calculated under a multifactor Monte Carlo simulation, is $602,760. The Company is amortizing the fair value over the derived service period of 1.1 years. The Company recognized $205,743 and $247,777 of stock-based compensation expense related to these options during the three and nine months ended March 31, 2018.

In September 2017, the Company granted 54,000 options to a newly appointed non-employee director under the Company's 2011 Stock Incentive Plan. The Company is amortizing the fair value of these options of $18,176 over a 48-month vesting period. The Company recognized $1,136 and $2,651, respectively, of stock-based compensation expense related to these options during the three and nine months ended March 31, 2018.

In June 2017, the Company granted 1,797,000 options to its executive officers, 780,000 options to its employees and 378,000 options to its non-employee directors under the Company's 2011 Stock Incentive Plan. The Company is amortizing the fair value of these options of $445,533, $194,689 and $89,220, respectively, over the vesting period of the options. The Company recognized $62,096 and $187,109, respectively, of stock-based compensation expense related to these options during the three and nine months ended March 31, 2018.

In September 2016, the Company granted 828,000 options to its executive officers and 336,000 options to its employees under the Company's 2011 Stock Incentive Plan. The Company is amortizing the fair value of the options vesting over a 48-month period, consisting of 595,000 options granted to its executive officers and all options granted to its employees, of $188,245 and $106,303, respectively, over the vesting period. The Company recognized $17,537 and $52,943, respectively, of stock-based compensation expense related to these options during the three and nine months ended March 31, 2018 and $16,426 and $38,210, respectively, during the three and nine months ended March 31, 2017. The remaining 233,000 options granted to the Company's executive officers vested 12 months from the date of grant, and the Company amortized the fair value of these options of $67,160 over this vesting period. The Company recognized $11,193 of stock-based compensation expense related to these options during the nine months ended March 31, 2018 and $16,370 and $36,238, respectively, during the three and nine months ended March 31, 2017.

Unless otherwise stated, stock options granted to the Company's executive officers and employees vest over a 48-month period, while stock options granted to its non-employee directors vest over a 12-month period.

During the three and nine months ended March 31, 2018, the Company received $31,231 and issued 56,400 shares of common stock pursuant to the exercise of options.

Restricted Stock Units – In December 2017, the Company granted 1,200,000 restricted stock units to its executive officers, 225,000 restricted stock units to its non-employee directors and 545,000 restricted stock units to its employees under the Company's 2011 Stock Incentive Plan. The fair value of these restricted stock units is $1,020,000, $191,250 and $463,250, respectively. For executive officers and employees, the restricted stock units vest 25% on the first, second, third and fourth anniversary dates from the date of grant. For non-employee directors, the restricted stock units vest 33 1/3% on the first, second and third anniversary dates from the date of grant. The Company recognized $222,350 and $269,290 of stock-based compensation expense related to these restricted stock units during the three and nine months ended March 31, 2018.

Also, in December 2017, the Company granted 1,075,000 performance-based restricted stock units to its executive officers and 670,000 performance-based restricted stock units to other employees which vest during a performance period, ending on December 31, 2020, if and upon i) as to 100% of the target number of shares upon achievement of a closing price for the Company's common stock equal to or greater than $1.50 per share for 20 consecutive trading days, which is considered a market condition; ii) as to thirty percent (30%) of the target number of shares, upon the acceptance for filing by the FDA of an NDA for bremelanotide for HSDD in premenopausal women during the performance period, which is considered a performance condition; iii) as to fifty percent (50%) of the target number of shares, upon the approval by the FDA of an NDA for bremelanotide for HSDD in premenopausal women during the performance period, which is also considered a performance condition; iv) as to twenty percent (20%) of the target number of shares, upon entry into a licensing agreement during the performance period for the commercialization of bremelanotide for FSD in at least two of the following geographic areas (a) four or more countries in Europe, (b) Japan, (c) two or more countries in Central and/or South America, (d) two or more countries in Asia, excluding Japan and China, and (e) Australia, which is also considered a performance condition. The fair value of these awards, as calculated under a multifactor Monte Carlo simulation, is $913,750 and $569,500, respectively. The Company is amortizing the fair value over the derived service period of 1.1 years. The Company recognized $506,132 and $612,982 of stock-based compensation expense related to these restricted stock units during the three and nine months ended March 31, 2018.

17

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

In September 2017, the Company granted 54,000 restricted stock units to a newly appointed non-employee director under the Company's 2011 Stock Incentive Plan. The Company is amortizing the fair value of these restricted stock units of $27,000 over a 48- month vesting period. The Company recognized $3,516 and $7,930, respectively, of stock-based compensation expense related to these restricted stock units during the three and nine months ended March 31, 2018.

In June 2017, the Company granted 1,140,000 restricted stock units to its executive officers, 780,000 restricted stock units to its employees and 378,000 restricted stock units to its non-employee directors under the Company's 2011 Stock Incentive Plan. The Company is amortizing the fair value of these restricted stock units of $421,800, $288,600, and $139,860, respectively, over the vesting period. The Company recognized $150,364 and $473,568, respectively, of stock-based compensation expense related to these restricted stock units during the three and nine months ended March 31, 2018.

In September 2016, the Company granted 558,000 restricted stock units to its executive officers, 350,500 of which vest over 24 months and 207,500 of which vested over 12 months, and 336,000 restricted stock units to its employees under the Company's 2011 Stock Incentive Plan. The Company is amortizing the fair value of the restricted stock units of $284,580 and $171,360, respectively, over the vesting periods. The Company recognized $13,228 and $104,711, respectively, of stock-based compensation expense related to these restricted stock units during the three and nine months ended March 31, 2018 and $76,822 and $177,554, respectively, during the three and nine months ended March 31, 2017.