Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 28, 2009. | ||

OR | ||

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | ||

Commission File No. 001-07832

PIER 1 IMPORTS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE (State or other jurisdiction of incorporation or organization) | 75-1729843 (I.R.S. Employer Identification No.) | |

100 Pier 1 Place Fort Worth, Texas (Address of principal executive offices) | | 76102 (Zip Code) |

Company's telephone number, including area code: (817) 252-8000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $1.00 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of August 29, 2008, the approximate aggregate market value of the registrant's common stock held by non-affiliates of the registrant was $391,319,000 based on the closing sales price on that day of $4.42 as reported by the New York Stock Exchange.

As of April 29, 2009, 90,546,034 shares of the registrant's common stock, $1.00 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents have been incorporated herein by reference:

1) Registrant's Proxy Statement for the 2009 Annual Meeting in Part III hereof.

Table of Contents

PIER 1 IMPORTS, INC.

FORM 10-K ANNUAL REPORT

Fiscal Year Ended February 28, 2009

TABLE OF CONTENTS

| | | PAGE | ||

|---|---|---|---|---|

| PART I | |||

Item 1. | Business. | 3 | ||

Item 1A. | Risk Factors. | 7 | ||

Item 1B. | Unresolved Staff Comments. | 14 | ||

Item 2. | Properties. | 15 | ||

Item 3. | Legal Proceedings. | 16 | ||

Item 4. | Submission of Matters to a Vote of Security Holders. | 16 | ||

| PART II | |||

Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 16 | ||

Item 6. | Selected Financial Data. | 18 | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 20 | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 36 | ||

Item 8. | Financial Statements and Supplementary Data. | 38 | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 78 | ||

Item 9A. | Controls and Procedures. | 78 | ||

Item 9B. | Other Information. | 79 | ||

| PART III | |||

Item 10. | Directors, Executive Officers and Corporate Governance. | 80 | ||

Item 11. | Executive Compensation. | 80 | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 80 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 80 | ||

Item 14. | Principal Accounting Fees and Services. | 80 | ||

| PART IV | |||

Item 15. | Exhibits, Financial Statement Schedules. | 81 |

Table of Contents

PART I

Item 1. Business.

(a) General Development of Business.

Pier 1 Imports, Inc. was incorporated as a Delaware corporation in 1986. Throughout this report, references to the "Company" include Pier 1 Imports, Inc. and its consolidated subsidiaries. References to "Pier 1 Imports" relate to the Company's retail locations operating under the name Pier 1 Imports®. References to "Pier 1 Kids" relate to the Company's retail locations that operated under the name Pier 1 Kids®.

On March 20, 2006, the Company announced the sale of its subsidiary based in the United Kingdom, The Pier Retail Group Limited ("The Pier"). The Pier has been included in discontinued operations in the Company's financial statements for fiscal 2007 and prior years. All discussions in this report relate to continuing operations, unless stated otherwise.

In fiscal 2009, the Company closed 26 stores and opened one new Pier 1 Imports store, a relocation of an existing store in Flushing, New York. During the fourth quarter of fiscal 2009, the Company began negotiating with landlords to achieve rental reductions across its store portfolio. Unsuccessful rental reduction negotiations may lead to the execution of early termination agreements for underperforming store locations. The Company expects these negotiations to be on-going throughout the upcoming fiscal year.

As of the end of fiscal 2009, the Company maintained regional distribution center facilities in or near Baltimore, Maryland; Chicago, Illinois; Columbus, Ohio; Fort Worth, Texas; Ontario, California; Savannah, Georgia; and Tacoma, Washington. The Company plans to cease operations at its Company-owned 514,000 square foot distribution center near Chicago, Illinois, by the end of the first quarter of fiscal 2010.

The Company has an arrangement to supply Grupo Sanborns, S.A. de C.V. ("Grupo Sanborns") with merchandise to be sold primarily in a "store within a store" format in certain stores operated by Grupo Sanborns' subsidiaries, Sears Roebuck de Mexico, S.A. de C.V. ("Sears Mexico") and Dorian's Tijuana, S.A. de C.V. ("Dorian's"). The agreement with Grupo Sanborns will expire January 1, 2012. The agreement is structured in a manner which substantially insulates the Company from currency fluctuations in the value of the Mexican peso. In fiscal 2009, Grupo Sanborns opened three new "store within a store" locations and one free-standing location offering Pier 1 Imports merchandise. As of February 28, 2009, Pier 1 Imports merchandise was offered in 34 Sears Mexico stores and one Dorian's store. Grupo Sanborns has no plans for new "store within a store" or "free-standing" locations in Mexico during fiscal 2010. Since Sears Mexico operates these locations, the Company has no employee or real estate obligations in Mexico.

The Company has a product distribution agreement with Sears Roebuck de Puerto Rico, Inc. ("Sears Puerto Rico"), which allows Sears Puerto Rico to market and sell Pier 1 Imports merchandise in a "store within a store" format in certain Sears Puerto Rico stores. The Company has no employee or real estate obligations in Puerto Rico because Sears Puerto Rico operates these locations. As of February 28, 2009, Pier 1 Imports merchandise was offered in seven Sears Puerto Rico stores. Sears Puerto Rico has no plans for new "store within a store" locations in Puerto Rico during fiscal 2010.

During fiscal 2007, the Company sold its credit card operations, which included its credit card bank located in Omaha, Nebraska, that operated under the name Pier 1 National Bank, N.A. (the "Bank") to Chase Bank USA, N.A. ("Chase"). The sale was comprised of the Company's proprietary credit card receivables, certain charged-off accounts and the common stock of the Bank. The Company and Chase have entered into a long-term program agreement. Under this agreement, the Company

3

Table of Contents

continues to support the card through marketing programs and receives payments over the life of the agreement for transaction level incentives, marketing support and other program terms.

In August 2007, the Company discontinued its e-commerce business. The Company continues to use its web site, www.pier1.com , for marketing and product information, plus investor relations purposes.

(b) Financial Information about Industry Segments.

In fiscal 2009, the Company conducted business as one operating segment consisting of the retail sale of decorative home furnishings, gifts and related items.

Financial information with respect to the Company's business is found in the Company's Consolidated Financial Statements, which are set forth in Item 8 herein.

(c) Narrative Description of Business.

The specialty retail operations of the Company consist of retail stores operating under the name "Pier 1 Imports", selling a wide variety of furniture, decorative home furnishings, dining and kitchen goods, epicurean products, bath and bedding accessories, candles and other specialty items for the home.

On February 28, 2009, the Company operated 1,011 Pier 1 Imports stores in the United States and 81 Pier 1 Imports stores in Canada. During fiscal 2009, the Company supplied merchandise and licensed the Pier 1 Imports name to Grupo Sanborns and Sears Puerto Rico, which sold Pier 1 Imports merchandise primarily in a "store within a store" format in 34 Sears Mexico stores, one Dorian's store and in seven Sears Puerto Rico stores. Pier 1 Imports stores in the United States and Canada average approximately 9,900 gross square feet, which includes an average of approximately 7,900 square feet of retail selling space. The stores consist of freestanding units located near shopping centers or malls and in-line positions in major shopping centers. Pier 1 Imports operates in all major U.S. metropolitan areas and many of the primary smaller markets. Pier 1 Imports stores generally have their highest sales volumes during November and December as a result of the holiday selling season. In fiscal 2009, net sales of the Company totaled $1.3 billion.

Pier 1 Imports offers a unique selection of merchandise consisting of more than 4,000 items imported from over 50 countries around the world. While the broad categories of Pier 1 Imports' merchandise remain fairly constant, individual items within these merchandise categories change frequently in order to meet the changing demands and preferences of customers. The principal categories of merchandise include the following:

DECORATIVE ACCESSORIES -This merchandise group constitutes the broadest category of merchandise in Pier 1 Imports' sales mix and contributed approximately 60% to Pier 1 Imports' total U.S. and Canadian retail sales in fiscal year 2009, 59% in fiscal year 2008 and 57% in fiscal year 2007. These items are imported primarily from Asian and European countries, as well as some domestic sources. This category includes decorative wood accessories, lamps, vases, dried and artificial flowers, baskets, ceramics, dinnerware, bath and fragrance products, candles, bedding, epicurean products, and seasonal and gift items.

FURNITURE -This merchandise group consists of furniture and furniture cushions to be used in living, dining, office, kitchen and bedroom areas, sunrooms, and on patios. Also included in this group are wall decorations and mirrors. This product group constituted approximately 40% of Pier 1 Imports' total U.S. and Canadian retail sales in fiscal year 2009, 41% in fiscal year 2008 and 43% in fiscal year 2007. These goods are imported from a variety of countries such as Vietnam, Malaysia, Brazil, Thailand, China, the Philippines, India and Indonesia, and are also obtained from domestic sources.

4

Table of Contents

This merchandise is made of metal or handcrafted natural materials, including rattan, pine, beech, rubberwood and selected hardwoods with either natural, stained, painted or upholstered finishes.

Pier 1 Imports merchandise largely consists of items that feature a significant degree of handcraftsmanship and are mostly imported directly from foreign suppliers. For the most part, the imported merchandise is handcrafted in cottage industries and small factories. Pier 1 Imports has enjoyed long-standing relationships with many vendors and agents and is not dependent on any particular supplier. The Company believes alternative sources of merchandise could be procured over a relatively short period of time, if necessary. In selecting the source of merchandise, Pier 1 Imports considers quality, dependability of delivery, and cost. During fiscal 2009, Pier 1 Imports sold merchandise imported from over 50 different countries with over 40% of its sales derived from merchandise produced in China. The remainder of its merchandise is sourced from India, Indonesia and other countries around the world.

Imported merchandise and a portion of domestic purchases are delivered to the Company's distribution centers, unpacked and made available for shipment to the various stores in each distribution center's region.

The Company, through one of its wholly owned subsidiaries, owns a number of federally registered trademarks and service marks under which Pier 1 Imports stores do business. Additionally, certain subsidiaries of the Company have registered and have applications pending for the registration of certain other Pier 1 Imports trademarks and service marks in the United States and in numerous foreign countries. The Company believes that its marks have significant value and are important in its marketing efforts. The Company maintains a policy of pursuing registration of its marks and opposing any infringement of its marks.

The Company operates in the highly competitive specialty retail business and competes primarily with specialty sections of large department stores, furniture and decorative home furnishings retailers, small specialty stores, and mass merchandising discounters.

The Company allows customers to return merchandise within a reasonable time after the date of purchase without limitation as to reason. Most returns occur within 30 days of the date of purchase. The Company monitors the level of returns and maintains a reserve for future returns based on historical experience and other known factors.

On February 28, 2009, the Company employed approximately 16,700 associates in the United States and Canada, of which approximately 3,500 were full-time employees and 13,200 were part-time employees.

(d) Financial Information about Geographic Areas.

Information required by this Item is found in Note 1 of the Notes to the Consolidated Financial Statements .

(e) Available Information.

The Company makes available free of charge through its Internet web site address ( www.pier1.com ) its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed with the Securities and Exchange Commission (the "SEC") pursuant to Section 13(a) of the Securities Exchange Act of 1934 as soon as reasonably practicable after it electronically files such material with, or furnishes such material to, the SEC.

Certain statements contained in Item 1, Item 1A, Item 7, Item 7A, Item 8 and elsewhere in this report may constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934. The Company may also make forward-looking statements in other reports filed

5

Table of Contents

with the SEC and in material delivered to the Company's shareholders. Forward-looking statements provide current expectations of future events based on certain assumptions. These statements encompass information that does not directly relate to any historical or current fact and often may be identified with words such as "anticipates," "believes," "expects," "estimates," "intends," "plans," "projects" and other similar expressions. Management's expectations and assumptions regarding planned store openings and closings, financing of Company obligations from operations, success of its marketing, merchandising and store operations strategies, and other future results are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements. Risks and uncertainties that may affect Company operations and performance include, among others, the effects of terrorist attacks or other acts of war, conflicts or war involving the United States or its allies or trading partners, labor strikes, weather conditions or natural disasters, volatility of fuel and utility costs, the on-going recession and related financial crisis and the actions taken by the United States and other countries to stimulate the economy or to prevent the worsening of the financial crisis, the general strength of the economy and levels of consumer spending, consumer confidence, the availability of suitable sites for locating stores and distribution centers, the availability of a qualified labor force and management, the availability and proper functioning of technology and communications systems supporting the Company's key business processes, the ability of the Company to import merchandise from foreign countries without significantly restrictive tariffs, duties or quotas, and the ability of the Company to source, ship and deliver items of acceptable quality to its U.S. distribution centers at reasonable prices and rates and in a timely fashion. The foregoing risks and uncertainties are in addition to others discussed elsewhere in this report which may also affect Company operations and performance. The Company assumes no obligation to update or otherwise revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied will not be realized.

Executive Officers of the Company

ALEXANDER W. SMITH, age 56, has been a director of Pier 1 Imports, has served as President and Chief Executive Officer and has been a member of Pier 1 Imports' Executive Committee since February 19, 2007. From March 2004 to February 18, 2007, Mr. Smith served as the Senior Executive Vice President, Group President of The TJX Companies, Inc. From 2001 to March 2004, Mr. Smith served as Executive Vice President, Group Executive, International of The TJX Companies, Inc.

CHARLES H. TURNER, age 52, has served as Executive Vice President of the Company since April 2002 and has served as Chief Financial Officer of the Company since August 1999. He served as Senior Vice President of Finance of the Company from August 1999 to April 2002. He served as Senior Vice President of Stores of the Company from August 1994 to August 1999, and served as Controller and Principal Accounting Officer of the Company from January 1992 to August 1994.

GREGORY S. HUMENESKY, age 57, has served as Executive Vice President of Human Resources of the Company since February 2005. Prior to joining the Company, he served as Senior Vice President of Human Resources at Zale Corporation from April 1996 to February 2005.

JAY R. JACOBS, age 54, served as Executive Vice President of Merchandising of the Company from April 2002 to March 2009. He served as Senior Vice President of Merchandising of the Company from May 1995 to April 2002. He served as Vice President of Divisional Merchandising of Pier 1 Imports (U.S.), Inc. from May 1993 to May 1995, and served as Director of Divisional Merchandising of Pier 1 Imports (U.S.), Inc. from July 1991 to May 1993. On March 4, 2009 Mr. Jacobs announced his retirement from the Company. As of that date he will no longer serve as Executive Vice President of Merchandising for the Company. He will, however, continue his employment through March 1, 2010 to ensure continuity throughout the transition of his duties.

6

Table of Contents

SHARON M. LEITE, age 46, has served as Executive Vice President of Stores of the Company since September 2007. Prior to joining the Company, she served as Vice President of Store Operations at Bath & Body Works from April 2001 to August 2007.

MICHAEL A. CARTER, age 50, has served as Senior Vice President and General Counsel, Secretary of the Company since December 2005. He served as Vice President-Legal Affairs of Pier 1 Imports, (U.S.), Inc. from April 1999 to December 2005. He served as Corporate Counsel of Pier 1 Imports (U.S.), Inc. from March 1990 until April 1999. He served as Assistant Secretary of the Company from April 1991 until December 2005.

The officers of the Company are appointed by the Board of Directors, hold office until their successors are elected and qualified and/or until their earlier death, resignation or removal. None of the above executive officers has any family relationship with any other of such officers or with any director of the Company. None of such officers was selected pursuant to any arrangement or understanding between him and any other person.

Item 1A. Risk Factors.

The following information describes certain significant risks and uncertainties inherent in the Company's business that should be carefully considered, along with other information contained elsewhere in this report and in other filings, when making an investment decision with respect to the Company. If one or more of these risks actually occurs, the impact on the Company's operations, financial position, or liquidity could be material and the business could be harmed substantially. Additional risks and uncertainties not presently known to the Company or that it currently believes are immaterial may also adversely affect the Company's business, financial condition, future results of operations and cash flow. In addition to the risks discussed below, the Company is also subject to certain market risks as described in Item 7A to this report.

Strategic Risks and Strategy Execution Risks

The deterioration of the United States economy and its impact on consumer confidence and spending could continue for an unspecified period of time, and could further adversely impact the Company's results of operations.

The United States economy remains in a deep recession and is suffering from a near collapse of the credit and financial markets. The market value of domestic and foreign companies has declined significantly since August 2008, which has adversely affected the savings and investments of United States consumers. Consumer confidence and spending have deteriorated significantly as a result of this current market turmoil. The difficult economic situation faced in the United States and other countries may not end in the near future and consumer confidence and spending could remain depressed and possibly deteriorate even further. During times of economic uncertainty, consumers tend to sacrifice purchases of discretionary items, including the Company's merchandise, which could continue to adversely impact the Company's financial results and turnaround plan.

The success of the business is dependent on factors affecting consumer spending that are not controllable by the Company.

Consumer spending, including spending for the home and home-related furnishings, are further dependent upon factors besides general economic conditions and include, but are not limited to, levels of employment, disposable consumer income, prevailing interest rates, consumer debt, costs of fuel, inflation, recession and fears of recession, war and fears of war, inclement weather, tax rates and rate increases, consumer confidence in future economic conditions and political conditions, and consumer perceptions of personal well-being and security. Unfavorable changes in factors affecting discretionary

7

Table of Contents

spending could reduce demand for the Company's products and therefore lower sales and negatively impact the business and its operating results.

The Company's turnaround strategy may cause a disruption in operations and may not be successful.

The Company began implementing a strategy during fiscal 2008 for returning the Company to profitability. The turnaround strategy may negatively impact the Company's operations, which could include disruptions from the realignment of operational functions within the home office and distribution centers, changes in the store administration reporting structure, and changes in the Company's product assortments or marketing strategies. These changes could adversely affect the Company's business operations and financial results. While the Company believes any disruptions would be short-term, it is unknown whether the impact would be material. In addition, if the Company's turnaround strategy is not successful, takes longer than initially projected, or is not executed effectively, the Company's business operations and financial results could be adversely affected.

The Company must be able to anticipate, identify and respond to changing trends and customer preferences for home furnishings.

The success of the Company's specialty retail business depends largely upon its ability to predict trends in home furnishings consistently and to provide merchandise that satisfies consumer demand in a timely manner. Consumer preferences often change and may not be reasonably predicted. A majority of the Company's merchandise is manufactured, purchased and imported from countries around the world and may be ordered well in advance of the applicable selling season. Extended lead times may make it difficult to respond rapidly to changes in consumer demand and as a result, the Company may be unable to react quickly and source needed merchandise. In addition, the Company's vendors may not have the ability to handle its increased demand for product. The seasonal nature of the business leads the Company to purchase and requires it to carry a significant amount of inventory prior to its peak selling season. As a result, the Company may be vulnerable to evolving home furnishing trends, changes in customer preferences, and pricing shifts, and may misjudge the timing and selection of merchandise purchases. The Company's failure to anticipate, predict and respond in a timely manner to changing home furnishing trends could lead to lower sales and additional discounts and markdowns in an effort to clear merchandise, which could have a negative impact on merchandise margins and in turn the results of operations.

Failure to control merchandise returns could negatively impact the business.

The Company has established a provision for estimated merchandise returns based upon historical experience and other known factors. If actual returns are greater than those projected by management, additional reductions of revenue could be recorded in the future. Also, to the extent that returned merchandise is damaged, the Company may not receive full retail value from the resale of the returned merchandise. Introductions of new merchandise, changes in merchandise mix, merchandise quality issues, changes in consumer confidence, or other competitive and general economic conditions may cause actual returns to exceed the provision for estimated merchandise returns. An increase in merchandise returns that exceeds the Company's current provisions could negatively impact the business and operating results.

A disruption in the operation of the domestic portion of the Company's supply chain could impact its ability to deliver merchandise to its stores and customers, which could impact its sales and results of operations.

The Company maintains regional distribution centers in Maryland, Illinois, Ohio, Texas, California, Georgia and Washington. At these distribution centers, merchandise is received, allocated, and shipped to the Company's stores. Major catastrophic events such as fire or flooding, malfunction or disruption

8

Table of Contents

of the information systems, or shipping problems could result in distribution delays of merchandise to the Company's stores and customers. Such disruptions could have a negative impact on the Company's sales and results of operations.

Factors that may or may not be controllable by the Company may adversely affect the Company's financial performance.

Increases in the Company's expenses that are beyond the Company's control including items such as increases in fuel and transportation costs, higher interest rates, increases in losses from damaged merchandise, inflation, fluctuations in foreign currency rates, higher costs of labor, insurance and healthcare, increases in postage and media costs, higher tax rates and changes in laws and regulations, including accounting standards, may negatively impact the Company's operating results.

Failure to successfully manage and execute the Company's marketing initiatives could have a negative impact on the business.

The success and growth of the Company is partially dependent on generating customer traffic in order to gain sales momentum in its stores. Successful marketing efforts require the ability to reach customers through their desired mode of communication utilizing various media outlets. Media placement decisions are generally made months in advance of the scheduled release date. The Company's inability to accurately predict its consumers' preferences or to utilize the desired mode of communication may negatively impact the business and operating results.

Changes to estimates related to the Company's property and equipment, or operating results that are lower than its current estimates at certain store locations, may cause the Company to incur impairment charges on certain long-lived assets.

The Company makes certain estimates and projections with regards to individual store operations as well as overall Company performance in connection with its impairment analyses for long-lived assets in accordance with Statement of Financial Accounting Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets." An impairment charge is required when the carrying value of the asset exceeds the estimated fair value or undiscounted future cash flows of the asset. The projection of future cash flows used in this analysis requires the use of judgment and a number of estimates and projections of future operating results. If actual results differ from the Company's estimates, additional charges for asset impairments may be required in the future. If impairment charges are significant, the Company's results of operations could be adversely affected.

Risks Related to Store Profitability

The Company's success depends, in part, on its ability to operate in desirable locations at reasonable rental rates and to close underperforming stores at or before the conclusion of their lease terms.

The profitability of the business is dependent on operating the current store base at a reasonable profit, opening and operating new stores at a reasonable profit, and identifying and closing underperforming stores. For a majority of the Company's current store base, a large portion of a stores' operating expense is the cost associated with leasing the location. Management actively monitors individual store performance and attempts to negotiate rent reductions to ensure stores can remain profitable or have the ability to rebound to a profitable state. Current locations may not continue to be desirable as demographics change, and the Company may choose to close an underperforming store before its lease expires and incur lease termination costs associated with that closing. The Company cannot give assurance that opening new stores or an increase in closings will result in greater profits.

9

Table of Contents

Failure to attract and retain an effective management team or changes in the costs or availability of a suitable workforce to manage and support the Company's stores and distribution facilities could adversely affect the business.

The Company's success is dependent, in a large part, on being able to successfully attract, motivate and retain a qualified management team and employees. Sourcing qualified candidates to fill important positions within the Company, especially management, in the highly competitive retail environment may prove to be a challenge. The inability to recruit and retain such individuals could result in turnover in the home office, stores and the distribution facilities, which could have an adverse effect on the business. Management will continue to assess the Company's compensation and benefit structure in an effort to attract future qualified candidates or retain current experienced management team members.

Occasionally the Company experiences union organizing activities in its non-unionized distribution facilities. These types of activities may result in work slowdowns or stoppages and higher labor costs. Any increase in costs associated with labor organization at the distribution facilities could result in higher costs to distribute inventory and could negatively impact merchandise margins.

The Company operates in a highly competitive retail environment with companies offering similar merchandise, and if customers are lost to the Company's competitors, sales could decline.

The Company's retail locations operate in the highly competitive specialty retail business competing with specialty sections of large department stores, home furnishing stores, small specialty stores and mass merchandising discounters. Management believes that as it is competing for sales, it does so on the basis of pricing and quality of products, constantly changing merchandise assortment, visual presentation of its merchandise and customer service. The Company could also experience added short-term competition when other retailers are liquidating merchandise for various reasons. If the Company is unable to maintain a competitive position, it could experience negative pressure on retail prices and loss of customers, which in turn could result in reduced merchandise margins and operating results.

The Company's business is subject to seasonal variations, with a significant portion of its sales and earnings occurring during two months of the year.

Approximately 25% of the Company's sales generally occur during the November-December holiday selling season. Failure to predict consumer demand correctly during these months could result in lost sales or gross margin erosion if merchandise must be marked down significantly to clear inventory.

The Company's business may be harmed by adverse weather conditions and natural disasters.

Extreme or undesirable weather can affect customer traffic in retail stores as well as customer shopping behavior. Natural disasters such as earthquakes, weather phenomena, and events causing infrastructure failures could adversely affect any of the Company's retail locations, distribution centers, administrative facilities, ports, or locations of its suppliers domestically and in foreign countries.

Risks Associated with Dependence on Technology

The Company is heavily dependent on various kinds of technology in the operation of its business.

Failure of any critical software applications, technology infrastructure, telecommunications, data communications, or networks could have a material adverse effect on the Company's ability to manage the merchandise supply chain, sell merchandise, accomplish payment functions or report financial data. Although the Company maintains off-site data backups, a concentration of technology related risk does exist in certain locations.

10

Table of Contents

The Company outsources certain business processes to third-party vendors that subject the Company to risks, including disruptions in business and increased costs.

Some business processes that are dependent on technology are outsourced to third parties. Such processes include gift card tracking and authorization, credit card authorization and processing, insurance claims processing, U.S. customs filings and reporting, certain payroll processing and tax filings, and record keeping for retirement plans. The Company makes a diligent effort to ensure that all providers of outsourced services are observing proper internal control practices, such as redundant processing facilities; however, there are no guarantees that failures will not occur. Failure of third parties to provide adequate services could have an adverse effect on the Company's results of operations, financial condition, or ability to accomplish its financial and management reporting.

Failure to protect the integrity and security of individually identifiable data of the Company's customers and employees could expose the Company to litigation and damage the Company's reputation.

The Company receives and maintains certain personal information about its customers and employees. The use of this information by the Company is regulated at the international, federal and state levels, as well as by certain third party contracts. If the Company's security and information systems are compromised or our business associates fail to comply with these laws and regulations and this information is obtained by unauthorized persons or used inappropriately, it could adversely affect the Company's reputation, as well as operations, results of operations and financial condition, and could result in litigation against the Company or the imposition of penalties. As privacy and information security laws and regulations change, the Company may incur additional costs to ensure it remains in compliance.

Regulatory Risks

The Company is subject to laws and regulatory requirements in many jurisdictions. Changes in these laws and requirements may result in additional costs to the Company, including the costs of compliance as well as potential penalties for non-compliance.

The Company operates in many local, state, and federal taxing jurisdictions, including foreign countries. In most of these jurisdictions, the Company is required to collect state and local sales taxes at the point of sale and remit them to the appropriate taxing authority. The Company is also subject to income taxes, excise taxes, franchise taxes, payroll taxes and other special taxes. The Company is also required to maintain various kinds of business and commercial licenses to operate its stores and other facilities. Rates of taxation are beyond the Company's control, and increases in such rates or taxation methods and rules could have a material impact on the Company's profitability. Failure to comply with laws concerning the collection and remittance of taxes and with licensing requirements could also subject the Company to financial penalties or business interruptions.

Local, state, and federal legislation also has a potential material effect on the Company's profitability or ability to operate its business. Compliance with certain legislation carries with it significant costs. The Company is subject to oversight by many governmental agencies in the course of operating its business because of its numerous locations, large number of employees, contact with consumers and importation and exportation of product. Complying with regulations may cause the Company to incur significant expenses, including the costs associated with periodic audits. Failure to comply may also cause additional costs in the form of penalties.

11

Table of Contents

Risks Associated with International Trade

As a retailer of imported merchandise, the Company is subject to certain risks that typically do not affect retailers of domestically produced merchandise.

The Company may order merchandise well in advance of delivery and generally takes title to the merchandise at the time it is loaded for transport to designated U.S. destinations. Global political unrest, war, threats of war, terrorist acts or threats, especially threats to foreign and U.S. ports, could affect the Company's ability to import merchandise from certain countries. Fluctuations in foreign currency exchange rates and the relative value of the U.S. dollar, restrictions on the convertibility of the dollar and other currencies, duties, taxes and other charges on imports, dock strikes, import quota systems and other restrictions sometimes placed on foreign trade can affect the price, delivery and availability of imported merchandise as well as exports to the Company's stores in other countries. The inability to import merchandise from China and other countries, unavailability of adequate shipping capacity at reasonable rates, or the imposition of significant tariffs could have a material adverse effect on the results of operations of the Company. Freight costs contribute a substantial amount to the cost of imported merchandise. Monitoring of foreign vendors' compliance with U.S. laws and Company standards, including quality and safety standards, is more difficult than monitoring of domestic vendors.

The United States government has the authority to enforce trade agreements, resolve trade disputes, and open foreign markets to U.S. goods and services. The United States government may also impose trade sanctions on foreign countries that are deemed to violate trade agreements or maintain laws or practices that are unjustifiable and restrict U.S. commerce. In these situations, the United States government may increase duties on imports into the United States from one or more foreign countries. In this event, the Company could be adversely affected by the imposition of trade sanctions.

In addition, the United States maintains in effect a variety of additional international trade laws under which the Company's ability to import may be affected from time to time, including, but not limited to, the antidumping law, the countervailing duty law, the safeguards law, and laws designed to protect intellectual property rights. Although the Company may not be directly involved in a particular trade dispute under any of these laws, its ability to import, or the terms and conditions under which it can continue to import, may be affected by the outcome of such disputes.

In particular, because the Company imports merchandise from countries around the world, the Company may be affected from time to time by antidumping petitions filed with the United States Commerce Department and International Trade Commission by U.S. producers of competing products alleging that foreign manufacturers are selling their own products at prices in the United States that are less than the prices that they charge in their home country market or in third country markets or at less than their cost of production. Such petitions, if successful, could significantly increase the United States import duties on those products. In that event, the Company might possibly decide to pay the increased duties, thereby possibly increasing the Company's price to consumers. Alternatively, the Company might decide to source the product or a similar product from a different country not subject to increased duties or else discontinue the importation and sale of the product.

In recent years, dispute resolution processes have been utilized to resolve disputes regarding market access between the European Union, China, the United States and other countries. In some instances, these trade disputes can lead to threats by countries of sanctions against each other, which can include import prohibitions and increased duty rates on imported items. The Company considers any agreement that reduces tariff and non-tariff barriers in international trade to be beneficial to its business. Any type of sanction on imports is likely to increase the Company's import costs or limit the availability of merchandise purchased from sanctioned countries. In that case, the Company may be required to seek similar merchandise from other countries.

12

Table of Contents

Risks Relating to Liquidity

The disruption in the global credit and equity markets could adversely impact the Company's ability to obtain financing on acceptable terms or could increase the cost of obtaining credit.

From fiscal 2006 through fiscal 2009, the Company has incurred net losses and had negative cash flows from operations. In the future, the Company may become dependent on the availability of adequate capital to fund its operations, carry out its turnaround strategy, or refinance existing indebtedness if necessary. Disruption in the global credit and equity markets and future disruptions in the financial markets could adversely affect the Company's ability to enter into new financing agreements, refinance the Company's current indebtedness if necessary, or obtain funding through the issuance of the Company's securities. A continued decline in economic conditions could also result in continued difficulties for financial institutions and other parties that the Company does business with, which could potentially affect the Company's ability to access financing under existing arrangements or to otherwise recover amounts as they become due under the Company's contractual agreements. The inability of the Company to obtain financing as needed, on acceptable terms in order to finance its operations may have a material adverse impact on the Company's business, financial condition and results of operations.

Insufficient cash flows from operations could result in the substantial utilization of the Company's secured credit facility, which may impose certain financial covenants.

The Company maintains a secured credit facility to enable it to issue merchandise and special purpose standby letters of credit as well as to occasionally fund working capital requirements. Borrowings under the credit facility are subject to a borrowing base calculation consisting of a percentage of certain eligible assets of the Company and is subject to advance rates and commercially reasonable reserves. Substantial utilization of the availability under the borrowing base will result in various restrictions on the Company including: restricted ability of the Company to repurchase its common stock or pay dividends, dominion over the Company's cash accounts, and compliance with a minimum fixed charge coverage ratio. The minimum fixed charge coverage ratio, assuming availability below the required minimum, would not have been met during fiscal 2009. See Note 5 to the Notes to Consolidated Financial Statements for additional discussion regarding the Company's secured credit facility. Significant decreases in cash flow from operations and investing could result in the Company's borrowing increased amounts under the credit facility to fund operational needs. Increases in utilization of letters of credit and/or increased cash borrowings could result in the Company being subject to these limitations.

Risks Relating to Common Stock

The Company must remain in compliance with the New York Stock Exchange's requirements for the continued listing of its common stock on the exchange.

The Company's common stock is traded on the New York Stock Exchange ("NYSE"). Continued listing on the NYSE is contingent upon the Company's ability to meet certain listing criteria including, among others, an average closing share price over a consecutive 30 trading-day period of at least $1.00. On May 4, 2009, the Company received notice from NYSE Regulation, Inc. ("NYSE Regulation") that the Company was in compliance with this requirement. Previously on December 15, 2008, the Company had received notice from NYSE Regulation that the Company was not in compliance with this requirement. The Company notified NYSE Regulation within the required ten business days that it intended to cure the deficiency and that its Board of Directors had met and was considering all strategic measures to cure the non-compliance with the listing standard.

Another criteria for continued listing on the NYSE is an average global market capitalization over a consecutive 30 trading-day period of at least $25 million. The NYSE will promptly initiate suspension

13

Table of Contents

and delisting procedures with respect to a company if it is not in compliance with this standard. As of May 1, 2009, the Company's average global market capitalization over a consecutive 30 trading-day period was greater than $25 million.

On February 26, 2009, the Company received notice from the NYSE that it had suspended its $1.00 minimum price requirement on a temporary basis, initially through June 30, 2009. On January 23, 2009, the NYSE temporarily changed to $15 million from $25 million the consecutive 30 trading-day average global market capitalization required of listed issues. On February 26, 2009, this temporary change was extended by the NYSE until June 30, 2009.

Failure to maintain the NYSE listing could negatively impact the Company by reducing the number of investors willing to hold or acquire the Company's stock, which could limit the ability to raise capital by issuing additional shares in the future. It could also negatively impact the perception of the Company's financial situation which may cause some vendors, creditors and other business partners to impose less favorable terms on the Company or cease to conduct business with the Company. In addition, the perceived value of equity incentive awards granted to employees could deteriorate significantly, thereby negating the goal of retaining key employees with equity incentive awards.

Item 1B. Unresolved Staff Comments.

None.

14

Table of Contents

Item 2. Properties.

The Company is headquartered in Fort Worth, Texas. In August 2004, the Company completed construction of a corporate headquarters facility, which contains approximately 460,000 square feet of office space. On June 9, 2008, the Company sold its headquarters building and accompanying land. As part of the transaction, the Company entered into a lease agreement to rent approximately 250,000 square feet of office space in the building for a primary term of seven years beginning on the closing date, with one three-year renewal option, and a right to terminate the lease at the end of the fifth lease year.

The Company leases the majority of its retail stores, its warehouses and regional space. At February 28, 2009, the present value of the Company's minimum future operating lease commitments discounted at 10% totaled approximately $736.4 million. The following table sets forth the distribution of Pier 1 Imports' U.S. and Canadian stores by state and province as of February 28, 2009:

United States | ||||||||||

Alabama | 15 | Louisiana | 15 | Ohio | 31 | |||||

Alaska | 1 | Maine | 1 | Oklahoma | 9 | |||||

Arizona | 25 | Maryland | 24 | Oregon | 14 | |||||

Arkansas | 8 | Massachusetts | 24 | Pennsylvania | 39 | |||||

California | 114 | Michigan | 33 | Rhode Island | 3 | |||||

Colorado | 19 | Minnesota | 20 | South Carolina | 17 | |||||

Connecticut | 21 | Mississippi | 6 | South Dakota | 2 | |||||

Delaware | 4 | Missouri | 18 | Tennessee | 18 | |||||

Florida | 78 | Montana | 6 | Texas | 83 | |||||

Georgia | 30 | Nebraska | 3 | Utah | 9 | |||||

Hawaii | 4 | Nevada | 8 | Virginia | 35 | |||||

Idaho | 6 | New Hampshire | 6 | Washington | 28 | |||||

Illinois | 42 | New Jersey | 35 | West Virginia | 5 | |||||

Indiana | 18 | New Mexico | 5 | Wisconsin | 19 | |||||

Iowa | 8 | New York | 45 | Wyoming | 1 | |||||

Kansas | 8 | North Carolina | 34 | |||||||

Kentucky | 11 | North Dakota | 3 | |||||||

Canada | ||||||||||

Alberta | 11 | New Brunswick | 2 | Ontario | 34 | |||||

British Columbia | 14 | Newfoundland | 1 | Quebec | 14 | |||||

Manitoba | 2 | Nova Scotia | 1 | Saskatchewan | 2 |

The Company currently owns or leases distribution center space of approximately 4.5 million square feet. The Company also acquires temporary distribution center space from time to time through short-term leases. During fiscal 2009, the Company vacated approximately 350,000 square feet of leased distribution center space near Baltimore. The lease on this space expires in July 2009. In February 2009, the Company announced plans to vacate a Company-owned distribution center near Chicago,

15

Table of Contents

Illinois during the first quarter of fiscal 2010. As of February 28, 2009, the Company owned or leased under operating leases the following warehouse properties in or near the following cities:

Location | Approx. Sq. Ft. | Owned/Leased Facility | ||

|---|---|---|---|---|

Baltimore, Maryland | 981,000 sq. ft. | Leased | ||

Chicago, Illinois | 514,000 sq. ft. | Owned | ||

Columbus, Ohio | 527,000 sq. ft. | Leased | ||

Fort Worth, Texas | 460,000 sq. ft. | Owned | ||

Ontario, California | 747,000 sq. ft. | Leased | ||

Savannah, Georgia | 784,000 sq. ft. | Leased | ||

Tacoma, Washington | 451,000 sq. ft. | Leased |

Item 3. Legal Proceedings.

The Company is a party to various legal proceedings and claims in the ordinary course of its business. The Company believes that the outcome of these matters will not have a material adverse effect on its consolidated financial position, results of operations or liquidity.

Item 4. Submission of Matters to a Vote of Security Holders.

There were no matters submitted to a vote of the Company's security holders during the fourth quarter of the Company's 2009 fiscal year.

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Prices of Common Stock

The following table shows the high and low closing sale prices of the Company's common stock on the New York Stock Exchange (the "NYSE"), as reported in the consolidated transaction reporting system for each quarter of fiscal 2009 and 2008.

| | Market Price | ||||||

|---|---|---|---|---|---|---|---|

Fiscal 2009 | High | Low | |||||

First quarter | $ | 8.18 | $ | 4.91 | |||

Second quarter | 7.10 | 3.14 | |||||

Third quarter | 4.75 | 0.38 | |||||

Fourth quarter | 0.69 | 0.21 | |||||

Fiscal 2008 | High | Low | |||||

|---|---|---|---|---|---|---|---|

First quarter | $ | 8.00 | $ | 6.48 | |||

Second quarter | 8.93 | 5.84 | |||||

Third quarter | 6.52 | 3.67 | |||||

Fourth quarter | 6.93 | 3.28 | |||||

Number of Holders of Record

The Company's common stock is traded on the NYSE. As of April 30, 2009, there were approximately 10,000 shareholders of record of the Company's common stock. Please see Item 1A for discussion regarding the risks surrounding the Company's common stock.

16

Table of Contents

Dividends

In fiscal 2007, the Company announced that its Board of Directors discontinued the Company's quarterly cash dividend. The Company believed that discontinuing the cash dividend would provide financial flexibility as it executed its turnaround strategy. The Company did not pay any cash dividends in fiscal years 2009 or 2008 and does not currently anticipate paying cash dividends in fiscal 2010. The Company's dividend policy in the near term will depend upon the earnings, financial condition and capital needs of the Company and other factors deemed relevant by the Company's Board of Directors.

As of February 28, 2009, the Company was restricted under its secured credit facility from paying certain dividends. Dividend payments are not restricted by the Company's secured credit facility unless the availability under the Company's credit facility over a specified period of time is projected to be less than $97.5 million. See Note 5 to the Notes to Consolidated Financial Statements for further discussion of the Company's secured credit facility.

Performance Graph

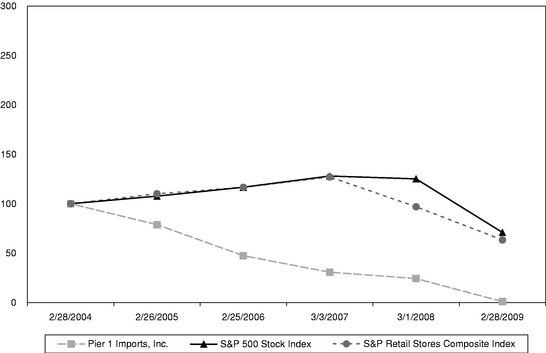

The following graph compares the five-year cumulative total shareholder return for the Company's common stock against the Standard & Poor's 500 Stock Index and the Standard & Poor's Retail Stores Composite Index. The annual changes for the five-year period shown on the graph are based on the assumption, as required by the SEC's rules, that $100 had been invested in the Company's stock and in each index on February 28, 2004, and that all quarterly dividends were reinvested at the average of the closing stock prices at the beginning and end of the quarter. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on February 28, 2009.

PIER 1 IMPORTS, INC. STOCK PERFORMANCE GRAPH

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

There were no purchases of common stock of the Company made during the three months ended February 28, 2009, by Pier 1 Imports, Inc. or any "affiliated purchaser" of Pier 1 Imports, Inc. as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934.

17

Table of Contents

Item 6. Selected Financial Data.

FINANCIAL SUMMARY

| | Year Ended | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 (1) | 2006 | 2005 | |||||||||||

| | ($ in millions except per share amounts) | |||||||||||||||

SUMMARY OF OPERATIONS (2) : | ||||||||||||||||

Net sales | $ | 1,320.7 | 1,511.8 | 1,623.2 | 1,776.7 | 1,825.3 | ||||||||||

Gross profit (3) | $ | 363.5 | 439.6 | 474.0 | 601.7 | 703.6 | ||||||||||

Selling, general and administrative expenses (4) | $ | 453.5 | 487.9 | 649.0 | 588.3 | 549.6 | ||||||||||

Depreciation and amortization | $ | 30.6 | 39.8 | 51.2 | 56.2 | 55.8 | ||||||||||

Operating income (loss) | $ | (120.6 | ) | (88.1 | ) | (226.2 | ) | (42.8 | ) | 98.2 | ||||||

Nonoperating (income) and expenses, net | $ | 8.1 | 5.3 | 1.9 | (0.9 | ) | (0.9 | ) | ||||||||

Income (loss) from continuing operations before income taxes | $ | (128.6 | ) | (93.4 | ) | (228.1 | ) | (41.9 | ) | 99.1 | ||||||

Income (loss) from continuing operations, net of tax | $ | (129.3 | ) | (96.0 | ) | (227.2 | ) | (27.5 | ) | 62.8 | ||||||

Income (loss) from discontinued operations, net of tax | $ | - | - | (0.4 | ) | (12.3 | ) | (2.3 | ) | |||||||

Net income (loss) | $ | (129.3 | ) | (96.0 | ) | (227.6 | ) | (39.8 | ) | 60.5 | ||||||

PER SHARE AMOUNTS: | ||||||||||||||||

Basic earnings (loss) from continuing operations | $ | (1.45 | ) | (1.09 | ) | (2.59 | ) | (.32 | ) | .72 | ||||||

Diluted earnings (loss) from continuing operations | $ | (1.45 | ) | (1.09 | ) | (2.59 | ) | (.32 | ) | .71 | ||||||

Basic earnings (loss) from discontinued operations | $ | - | - | (.01 | ) | (.14 | ) | (.03 | ) | |||||||

Diluted earnings (loss) from discontinued operations | $ | - | - | (.01 | ) | (.14 | ) | (.03 | ) | |||||||

Basic earnings (loss) | $ | (1.45 | ) | (1.09 | ) | (2.60 | ) | (.46 | ) | .69 | ||||||

Diluted earnings (loss) | $ | (1.45 | ) | (1.09 | ) | (2.60 | ) | (.46 | ) | .68 | ||||||

Cash dividends declared | $ | - | - | .20 | .40 | .40 | ||||||||||

Shareholders' equity | $ | 1.62 | 3.04 | 4.13 | 6.81 | 7.63 | ||||||||||

OTHER FINANCIAL DATA: | ||||||||||||||||

Working capital | $ | 299.9 | 307.3 | 349.4 | 486.1 | 387.4 | ||||||||||

Current ratio | 2.3 | 2.1 | 2.2 | 2.7 | 2.3 | |||||||||||

Total assets | $ | 655.5 | 821.9 | 916.5 | 1,169.9 | 1,075.7 | ||||||||||

Long-term debt (5) | $ | 184.0 | 184.0 | 184.0 | 184.0 | 19.0 | ||||||||||

Shareholders' equity | $ | 144.3 | 267.7 | 361.1 | 590.0 | 664.4 | ||||||||||

Weighted average diluted shares outstanding (millions) | 88.9 | 88.1 | 87.4 | 86.6 | 88.8 | |||||||||||

Effective tax rate (%) (6) | (0.5 | ) | (2.8 | ) | 0.4 | 34.5 | 36.7 | |||||||||

(2) Amounts are from continuing operations unless otherwise specified.

(3) Gross profit for fiscal 2007 included a pre-tax charge of $32.5 million for inventory write-down related to a strategic decision made in the fourth quarter to liquidate certain inventory by the end of the first quarter of fiscal 2008.

(4) The decrease in selling, general and adminstrative expense for fiscal years 2009 and 2008 relate primarily to initiatives to reduce costs Company-wide. See detailed description of these expenses in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Selling, general and administrative expense in fiscal 2007 included a pre-tax charge of $32.3 million related to impairment charges on long-lived store level assets.

18

Table of Contents

(5) Subsequent to year end, the Company's consolidated long-term debt was reduced to $105.1 million as a result of a repurchase of a portion of the Company's outstanding convertible debt. See detailed discussion in Note 13 of the Notes to the Consolidated Financial Statements contained in Item 8 of this report .(6) In fiscal years 2009 and 2008, the Company recorded minimal state and foreign tax provisions and provided a valuation allowance on the deferred tax asset arising from the tax benefit of fiscal 2009 and 2008 losses. The decrease in the Company's effective tax rate for fiscal 2007 was the result of recording a valuation allowance on its deferred tax assets during the second quarter and only recording a tax benefit on the losses for the year that could be carried back.

19

Table of Contents

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

MANAGEMENT OVERVIEW

Introduction

Pier 1 Imports, Inc. (together with its consolidated subsidiaries, the "Company") is a global importer and is one of North America's largest specialty retailers of imported decorative home furnishings and gifts. The Company directly imports merchandise from over 50 countries, and sells a wide variety of decorative accessories, furniture collections, bed and bath products, candles, housewares and other seasonal assortments in its stores. The Company conducts business as one operating segment. The Company operates stores in the United States and Canada under the name "Pier 1 Imports" and, for a portion of fiscal 2008 and in prior years, "Pier 1 Kids." As of February 28, 2009, the Company operated 1,092 stores in the United States and Canada.

Since April 2007, the Company has been executing a turnaround strategy that is built on key business priorities. Over the first year, fiscal 2008, the Company was able to execute its strategy successfully, revitalizing its merchandise offering, significantly cutting costs, and ultimately reporting its first quarterly profit in two years in the fourth quarter of fiscal 2008. Management anticipated that the Company would continue to see improvements throughout fiscal 2009. As a result of the dramatic changes in the economic environment, fiscal year 2009 did not turn out the way the Company had anticipated.

During the second half of fiscal 2009, the U.S. economy significantly deteriorated as a result of the disruption in the credit and financial markets which created an environment of uncertainty for consumers. During this time of economic turmoil, consumers sacrificed purchases of discretionary items, including the Company's merchandise, which adversely affected the Company's sales and financial performance. Management believes that the current economic recession has delayed the Company's return to profitability and now expects that its turnaround plan will take approximately two years longer than originally anticipated.

For the year, comparable store sales declined 9.2%. The decline in sales was primarily the result of a reduction in traffic and average ticket, offset slightly by increases in conversion rate and units per transaction. Merchandise margins for the year improved slightly to 49.0% of sales. Improvements in the margin over last year were primarily the result of less aggressive liquidation of inventory as compared to fiscal 2008, especially when comparing the first quarter of each year. Despite the slowdown in the economy, the Company anticipates that it will be able to maintain or improve merchandise margins during fiscal 2010 as it began the year with significantly reduced and clean inventory. Changes in the Company's merchandise assortments have allowed the Company to maintain lower inventory levels without significantly jeopardizing sales.

One of the key components of the Company's turnaround plan was improving its merchandise offering. To accomplish this, the Company doubled the size of its buying staff during fiscal 2008. As these buyers became more familiar with the Pier 1 Imports customer and traveled to meet with the vast network of vendors and agents during fiscal 2009, the Company's merchandise offering improved, began to resonate with customers and once again reflected the quirky and unique style that is synonymous with the Company's brand. This was evident throughout the year as the conversion rate levels consistently improved. Management expects that it will continuously evolve and finesse the Company's merchandise offering and continue to test new products to ensure that the "treasure hunt" feel of its stores is maintained.

The Company believes that it can continue to reduce costs in the supply chain as a result of declining fuel costs and lower ocean freight rates. Additionally, costs in the supply chain will be reduced as the Company ceases operations in its Chicago distribution facility in the first quarter of fiscal 2010.

20

Table of Contents

Another opportunity for the Company to reduce expenses is in its real estate costs. The Company closed 26 stores in fiscal 2009 and ended the year with 1,092 Pier 1 Imports stores in North America. An outside firm has been hired to assist the Company in negotiating with landlords to achieve reductions in rental rates across its store portfolio. In certain cases, if appropriate rental reductions cannot be reached, the Company may elect to close those locations. Currently, the Company expects to close no more than 80 locations in connection with these negotiation efforts.

Selling, general and administrative expenses in fiscal 2009 were lower in dollars than the prior year, primarily as a result of the significant cost savings efforts throughout the year. The Company also made significant changes to its marketing strategy during fiscal 2009. The timing of marketing expenditures was shifted in order to utilize more of the budget in the all important holiday selling period. Most notably, the Company resumed national television advertising on national cable networks during the holiday selling period. The Company will continue to seek out ways to efficiently use its marketing budget through multiple media outlets including television, the Internet, direct mail, and print media.

The Company ended the year with total cash of $155.8 million and net availability under its credit line of $84.9 million, for a total liquidity position of $240.7 million. During fiscal 2009, the Company was able to accomplish two feats in particular which strengthened its liquidity position. In June 2008, the Company sold its corporate headquarters to Chesapeake Energy Company for net proceeds of approximately $102.4 million. The sale had a positive impact on both the balance sheet and the income statement as the cost of leasing space was lower than the carrying costs of the building. In addition, the Company was able to preserve working capital through the significant reduction of its inventory. The Company reduced its inventory position from $411.7 million at the beginning of the year to $316.3 million by year end. The Company accomplished this by reacting quickly to the slowdown in sales, reducing purchases and clearing out excess inventory, especially in the distribution centers. The Company also made changes to its procurement process. The changes included buying inventory much closer to the needed in-store date, and buying smaller initial quantities. This reduction in inventory has the added benefit of allowing the reduction of distribution center space requirements.

Further improvements to the Company's balance sheet were accomplished subsequent to fiscal 2009 year end. On March 20, 2009, a foreign subsidiary of the Company entered into private agreements purchasing $78.9 million of the Company's outstanding 6.375% convertible senior notes due 2036. The notes were acquired at a purchase price of $27.4 million, including accrued interest. As a result of this transaction, the Company reduced its outstanding convertible debt to $86.1 million on a consolidated basis. The foreign subsidiary presently intends to hold the convertible notes until maturity. In connection with this transaction, the Company expects to recognize a gain of approximately $49.0 million during the first quarter of fiscal 2010.

While the recession has slowed the Company's turnaround speed and increased its timeline, the Company's overall strategy remains the same. Until management sees signs of an upturn, however, it will buy conservatively, manage inventories, and continue to make the Company's merchandise offering more compelling and improve the in-store experience. In addition, the Company will continue to focus on its ongoing mission to maximize its revenues, while continuing to seek out ways to reduce its cost base and preserve its liquidity.

The following discussion and analysis of financial condition, results of operations, liquidity and capital resources relates to continuing operations, unless otherwise stated, and should be read in conjunction with the accompanying audited Consolidated Financial Statements and notes thereto which can be found in Item 8 of this report. Fiscal 2009 and fiscal 2008 were 52-week years while fiscal 2007 was a 53-week year.

21

Table of Contents

Overview of Business

The Company's key financial and operational indicators used by management to evaluate the performance of the business include the following (trends for these indicators are explained in the comparative discussions of this section):

Key Performance Indicators | 2009 | 2008 | 2007 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Continuing operations: | ||||||||||

Total sales decline | (12.6)% | (6.9)% | (8.6)% | |||||||

Comparable stores sales decline | (9.2)% | (1.7)% | (11.3)% | |||||||

Sales per average retail square foot | $ | 149 | $ | 164 | $ | 168 | ||||

Merchandise margins as a % of sales | 49.0% | 48.5% | 47.9% | |||||||

Gross profit as a % of sales | 27.5% | 29.1% | 29.2% | |||||||

Selling, general and administrative expenses as a % of sales | 34.3% | 32.3% | 40.0% | |||||||

Operating loss from continuing operations as a % of sales | (9.1)% | (5.8)% | (13.9)% | |||||||

Loss from continuing operations as a % of sales | (9.8)% | (6.4)% | (14.0)% | |||||||

Inventory per retail square foot | $ | 37 | $ | 47 | $ | 39 | ||||

Total retail square footage (in thousands) | 8,586 | 8,782 | 9,230 | |||||||

Total retail square footage growth (decline) | (2.2)% | (4.9)% | (1.9)% | |||||||

Stores included in the comparable store sales calculation are those stores that were opened prior to the beginning of the preceding fiscal year and are still open. Also included are stores that were relocated during the year within a specified distance serving the same market, where there is not a significant change in store size and where there is not a significant overlap or gap in timing between the opening of the new store and the closing of the existing store. Stores that are expanded or renovated are excluded from the comparable store sales calculation during the period they are closed for such remodeling. When these stores re-open for business, they are included in the comparable store sales calculation in the first full month after the re-opening if there is no significant change in store size. If there is a significant change in store size, the store continues to be excluded from the calculation until it meets the Company's established definition of a comparable store. Comparable store sales in fiscal 2010 are anticipated to include all stores, however, stores closed during the year will be excluded after they are closed.

FISCAL YEARS ENDED FEBRUARY 28, 2009 AND MARCH 1, 2008

Net Sales

Net sales consisted almost entirely of sales to retail customers, net of discounts and returns, but also included delivery revenues and wholesale sales and royalties. Sales by retail concept during fiscal years 2009, 2008 and 2007 were as follows (in thousands):

| | 2009 | 2008 | 2007 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Stores | $ | 1,308,331 | $ | 1,486,147 | $ | 1,590,854 | |||||

Direct to consumer | - | 8,366 | 18,943 | ||||||||

Other (1) | 12,346 | 17,319 | 13,419 | ||||||||

Net sales | $ | 1,320,677 | $ | 1,511,832 | $ | 1,623,216 | |||||

22

Table of Contents

Net sales during fiscal 2009 were $1,320.7 million, a decrease of $191.1 million or 12.6%, from $1,511.8 million for the prior fiscal year. The decrease in sales for the fiscal year was comprised of the following components (in thousands):

| | 2009 | |||

|---|---|---|---|---|

Stores opened during fiscal 2008 | $ | 1,231 | ||

Comparable stores | (129,901 | ) | ||

Closed stores and other (1) | (62,485 | ) | ||

Net decrease in sales | $ | (191,155 | ) | |

The total sales decline for fiscal 2009 was attributable to current macro-environmental conditions which have caused a slowdown in consumer spending, a net decrease of 25 stores for the fiscal year and a comparable store sales decline of 9.2%. The Company's net sales from Canadian stores were subject to fluctuation in currency conversion rates. These fluctuations had an unfavorable impact of approximately 50 basis points on both net sales and comparable store calculations in fiscal 2009 compared to fiscal 2008.

During fiscal 2009, the Company opened one new store and closed 26 store locations. As of February 28, 2009, the Company operated 1,092 stores in the United States and Canada. The Company continues to evaluate every lease in its current real estate portfolio and will attempt to negotiate more favorable occupancy costs in an effort to lower overall costs of leased properties. The Company engaged a third-party real estate consulting firm to assist with these rent reduction efforts for existing leases. If rental reductions cannot be negotiated on stores that have negative operating results, the Company will attempt to negotiate a buyout or exercise any early termination rights and close these stores. As a result of its efforts thus far, the Company now estimates that it will close no more than 80 stores in fiscal 2010.

A summary reconciliation of the Company's stores open at the beginning of fiscal 2009, 2008 and 2007 to the number open at the end of each period follows (openings and closings include relocated stores):

| | United States | Canada | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Open at February 25, 2006 | 1,143 | 83 | 1,226 | ||||||||

Openings | 32 | 2 | 34 | ||||||||

Closings | (63 | ) | (1 | ) | (64 | ) | |||||

Open at March 3, 2007 | 1,112 | 84 | 1,196 | ||||||||

Openings | 4 | - | 4 | ||||||||

Closings | (82 | ) | (1 | ) | (83 | ) | |||||

Open at March 1, 2008 | 1,034 | 83 | 1,117 | ||||||||

Openings | 1 | - | 1 | ||||||||

Closings | (24 | ) | (2 | ) | (26 | ) | |||||

Open at February 28, 2009 (1) | 1,011 | 81 | 1,092 | ||||||||

23

Table of Contents

Gross Profit

Gross profit after related buying and store occupancy costs, expressed as a percentage of sales, was 27.5% in fiscal 2009 compared to 29.1% a year ago. Merchandise margins were 49.0% as a percentage of sales, an increase of 50 basis points over 48.5% in fiscal 2008. Improvements in merchandise margin over last year were primarily the result of less aggressive inventory liquidation activity that occurred during the first quarter of fiscal 2009 as compared to the first quarter of fiscal 2008. Store occupancy costs during fiscal 2009 were $284.1 million or 21.5% of sales, a decrease of $9.1 million and an increase of 210 basis points over store occupancy costs of $293.2 million or 19.4% of sales during fiscal 2008. The decrease of $9.1 million was primarily due to store closures, while the increase as a percentage of sales was the result of the deleveraging of relatively fixed rental costs over a slightly lower sales base in the remaining open stores. As discussed above, the Company is actively evaluating every lease renewal and working to negotiate more favorable occupancy costs in an effort to lower the overall costs of its leased properties.

Operating Expenses, Depreciation and Income Taxes

Selling, general and administrative expenses, including marketing, were $453.5 million or 34.3% of sales in fiscal 2009, a decrease of $34.4 million and an increase 200 basis points from last year's $487.9 million or 32.3% of sales. Selling, general and administrative expenses for fiscal years 2009 and 2008 included charges summarized in the table below (in thousands):

| | February 28, 2009 | March 1, 2008 | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Increase / (Decrease) | ||||||||||||||||

| | Expense | % Sales | Expense | % Sales | |||||||||||||

Store payroll | $ | 217,774 | 16.5 | % | $ | 229,573 | 15.2 | % | $ | (11,799 | ) | ||||||