UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

R Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | £ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||

For the fiscal year ended December 31, 2010 | For the transition period from to |

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization | Delaware | ||

I.R.S. Employer Identification No. | 95-4035997 | ||

Address of principal executive offices | 10889 Wilshire Blvd., Los Angeles, CA | ||

Zip Code | 90024 | ||

Registrant's telephone number, including area code | (310) 208-8800 |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | ||

9 1/4% Senior Debentures due 2019 | New York Stock Exchange | ||

Common Stock | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. R YES £ NO Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: (Note: Checking the box will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections). £ YES R NO Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. R YES £ NO Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period as the registrant was required to submit and post files). R YES £ NO | Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act). Large Accelerated Filer R Accelerated Filer £ Non-Accelerated Filer £ Smaller Reporting Company £ Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). £ YES R NO The aggregate market value of the voting common stock held by nonaffiliates of the registrant was approximately $61.85 billion, computed by reference to the closing price on the New York Stock Exchange composite tape of $77.15 per share of Common Stock on June 30, 2010. Shares of Common Stock held by each executive officer and director have been excluded from this computation in that such persons may be deemed to be affiliates. This determination of potential affiliate status is not a conclusive determination for other purposes. |

At January 31, 2011, there were 812,849,169 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement, filed in connection with its May 6, 2011, Annual Meeting of Stockholders, are incorporated by reference into Part III.

TABLE OF CONTENTS | ||

Page | ||

Part I | ||

Items 1 and 2 | Business and Properties | 3 |

General | 3 | |

Oil and Gas Operations | 3 | |

Chemical Operations | 4 | |

Midstream, Marketing and Other Operations | 5 | |

Capital Expenditures | 5 | |

Employees | 5 | |

Environmental Regulation | 5 | |

Available Information | 5 | |

Item 1A | Risk Factors | 6 |

Item 1B | Unresolved Staff Comments | 7 |

Item 3 | Legal Proceedings | 7 |

Executive Officers | 8 | |

Part II | ||

Item 5 | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 9 |

Item 6 | Selected Financial Data | 11 |

Item 7 and 7A | Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) | 11 |

Strategy | 11 | |

Oil and Gas Segment | 14 | |

Chemical Segment | 19 | |

Midstream, Marketing and Other Segment | 20 | |

Segment Results of Operations | 21 | |

Significant Items Affecting Earnings | 23 | |

Taxes | 23 | |

Consolidated Results of Operations | 23 | |

Consolidated Analysis of Financial Position | 25 | |

Liquidity and Capital Resources | 25 | |

Off-Balance-Sheet Arrangements | 27 | |

Contractual Obligations | 27 | |

Lawsuits, Claims, Commitments, Contingencies and Related Matters | 28 | |

Environmental Liabilities and Expenditures | 28 | |

Foreign Investments | 29 | |

Critical Accounting Policies and Estimates | 29 | |

Significant Accounting and Disclosure Changes | 33 | |

Derivative Activities and Market Risk | 33 | |

Safe Harbor Discussion Regarding Outlook and Other Forward-Looking Data | 35 | |

Item 8 | Financial Statements and Supplementary Data | 36 |

Management's Annual Assessment of and Report on Internal Control Over Financial Reporting | 36 | |

Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements | 37 | |

Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting | 38 | |

Consolidated Statements of Income | 39 | |

Consolidated Balance Sheets | 40 | |

Consolidated Statements of Stockholders' Equity | 42 | |

Consolidated Statements of Comprehensive Income | 42 | |

Consolidated Statements of Cash Flows | 43 | |

Notes to Consolidated Financial Statements | 44 | |

Quarterly Financial Data (Unaudited) | 71 | |

Supplemental Oil and Gas Information (Unaudited) | 73 | |

Financial Statement Schedule: | ||

Schedule II – Valuation and Qualifying Accounts | 84 | |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 85 |

Item 9A | Controls and Procedures | 85 |

Disclosure Controls and Procedures | 85 | |

Part III | ||

Item 10 | Directors, Executive Officers and Corporate Governance | 85 |

Item 11 | Executive Compensation | 85 |

Item 12 | Security Ownership of Certain Beneficial Owners and Management | 85 |

Item 13 | Certain Relationships and Related Transactions and Director Independence | 85 |

Item 14 | Principal Accountant Fees and Services | 85 |

Part IV | ||

Item 15 | Exhibits and Financial Statement Schedules | 86 |

Part I

Items 1 And 2 Business and Properties

In this report, "Occidental" refers to Occidental Petroleum Corporation, a Delaware corporation (OPC), and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental conducts its operations through various subsidiaries and affiliates. Occidental's executive offices are located at 10889 Wilshire Boulevard, Los Angeles, California 90024; telephone (310) 208-8800.

General

Occidental's principal businesses consist of three segments. The oil and gas segment explores for, develops, produces and markets crude oil, including natural gas liquids (NGLs) and condensate (together with NGLs, "liquids"), as well as natural gas. The chemical segment (OxyChem) manufactures and markets basic chemicals, vinyls and other chemicals. The midstream, marketing and other segment (midstream and marketing) gathers, treats, processes, transports, stores, purchases and markets crude oil, liquids, natural gas, carbon dioxide (CO 2 ) and power. It also trades around its assets, including pipelines and storage capacity, and trades oil and gas, other commodities and commodity-related securities. Unless otherwise indicated hereafter, discussion of oil or oil and liquids refers to crude oil, NGLs and condensate.

For information regarding Occidental's current developments, segments and geographic areas, see the information in the "Management's Discussion and Analysis of Financial Condition and Results of Operations" (MD&A) section of this report and Note 16 to the Consolidated Financial Statements.

Oil and Gas Operations

General

Occidental's domestic oil and gas operations are mainly located in Texas, New Mexico, California, Kansas, Oklahoma, Utah, Colorado, North Dakota and West Virginia. International operations are located in Bahrain, Bolivia, Colombia, Iraq, Libya, Oman, Qatar, the United Arab Emirates (UAE) and Yemen. Occidental has classified its Argentine operations as held for sale on a retrospective application basis.

Proved Reserves and Sales Volumes

The table below shows Occidental's total oil and natural gas proved reserves and sales volumes in 2010, 2009 and 2008. See "MD&A - Oil and Gas Segment," and the information under the caption "Supplemental Oil and Gas Information" for certain details regarding Occidental's oil and gas proved reserves, the reserves estimation process, sales volumes, production costs and other reserves-related data.

Comparative Oil and Gas Proved Reserves and Sales Volumes | |||||||||||||||||||

Oil in millions of barrels; natural gas in billions of cubic feet; barrels of oil equivalent (BOE) in millions of barrels of oil equivalent | |||||||||||||||||||

2010 | 2009 | 2008 | |||||||||||||||||

Proved Reserves | Oil | (a) | Gas | BOE | (b) | Oil | (a) | Gas | BOE | (b) | Oil | (a) | Gas | BOE | (b) | ||||

United States | 1,697 | 3,034 | 2,203 | 1,606 | 2,799 | 2,072 | 1,547 | 3,153 | 2,073 | ||||||||||

International | 613 | (c) | 2,104 | 964 | (c) | 657 | (d) | 2,228 | 1,028 | (d) | 533 | (d) | 1,299 | 749 | (d) | ||||

Continuing Operations | 2,310 | 5,138 | 3,167 | 2,263 | 5,027 | 3,100 | 2,080 | 4,452 | 2,822 | ||||||||||

Held for Sale (e) | 166 | 182 | 196 | 108 | 130 | 130 | 135 | 149 | 160 | ||||||||||

Total | 2,476 | 5,320 | 3,363 | (f) | 2,371 | 5,157 | 3,230 | (f) | 2,215 | 4,601 | 2,982 | (f) | |||||||

Sales Volumes | |||||||||||||||||||

United States | 99 | 247 | 140 | 99 | 232 | 137 | 96 | 215 | 132 | ||||||||||

International | 88 | (d) | 172 | 117 | (d) | 69 | (d) | 95 | 85 | (d) | 63 | (d) | 84 | 77 | (d) | ||||

Continuing Operations | 187 | 419 | 257 | 168 | 327 | 222 | 159 | 299 | 209 | ||||||||||

Held for Sale (e) | 14 | 12 | 16 | 13 | 11 | 15 | 12 | 8 | 13 | ||||||||||

Total | 201 | 431 | 273 | 181 | 338 | 237 | 171 | 307 | 222 | ||||||||||

(a) | Includes NGLs and condensate. | |

(b) | Natural gas volumes have been converted to BOE based on energy content of six thousand cubic feet (Mcf) of gas to one barrel of oil. | |

(c) | Excludes the former noncontrolling interest in a Colombian subsidiary because on December 31, 2010, Occidental restructured its Colombian operations to take a direct working interest in the related assets. | |

(d) | Includes the noncontrolling interest in a Colombian subsidiary. | |

(e) | Occidental has classified its Argentine operations as held for sale. | |

(f) | Stated on a net basis after applicable royalties. Includes proved reserves related to production-sharing contracts (PSCs) and other similar economic arrangements of 1.1 billion BOE in 2010, 1.1 billion BOE in 2009 and 825 million BOE in 2008. |

3

Competition and Sales and Marketing

As a producer of oil and natural gas, Occidental competes with numerous other domestic and foreign private and government producers. Oil and natural gas are commodities that are sensitive to prevailing global and, in certain cases local, current and anticipated market conditions. They are sold at current market prices or on a forward basis to refiners and other market participants. Occidental competes by developing and producing its worldwide oil and gas reserves cost-effectively and acquiring rights to explore, develop and produce in areas with known oil and gas deposits. Occidental also competes by increasing production through enhanced oil recovery projects in mature and underdeveloped fields and making strategic acquisitions.

Chemical Operations

OxyChem owns and operates manufacturing plants at 22 domestic sites in Alabama, Georgia, Illinois, Kansas, Louisiana, Michigan, New Jersey, New York, Ohio, Pennsylvania and Texas and at two international sites in Canada and Chile and has interests in a Brazilian joint venture. OxyChem produces the following products:

Principal Products | Major Uses | Annual Capacity | ||

Basic Chemicals | ||||

Chlorine | Chlorovinyl chain and water treatment | 4.0 million tons (a) | ||

Caustic Soda | Pulp, paper and aluminum production | 4.2 million tons (a) | ||

Chlorinated organics | Silicones, paint stripping, pharmaceuticals and refrigerants | 0.9 billion pounds | ||

Potassium chemicals | Glass, fertilizers, cleaning products and rubber | 0.4 million tons | ||

Ethylene dichloride (EDC) | Raw material for vinyl chloride monomer (VCM) | 2.4 billion pounds (a) | ||

Vinyls | ||||

VCM | Precursor for polyvinyl chloride (PVC) | 6.2 billion pounds | ||

PVC | Piping, medical, building materials and automotive products | 3.7 billion pounds | ||

Other Chemicals | ||||

Chlorinated isocyanurates | Swimming pool sanitation and disinfecting products | 131 million pounds | ||

Resorcinol | Tire manufacture, wood adhesives and flame retardant synergist | 50 million pounds | ||

Sodium silicates | Soaps, detergents and paint pigments | 0.6 million tons | ||

Calcium chloride | Ice melting, dust control, road stabilization and oil field services | 0.7 million tons | ||

(a) | Includes gross capacity of a joint venture in Brazil, owned 50 percent by Occidental. |

4

Midstream, Marketing and Other Operations

The midstream and marketing operations are conducted in the locations described below:

Location | Description | Capacity | ||

Gas Plants | ||||

California, Colorado and Permian Basin | Occidental-operated and third-party-operated gas gathering, treating, compression and processing systems, and CO 2 processing | 2.5 billion cubic feet per day | ||

Pipelines | ||||

Permian Basin and Oklahoma | Common carrier oil pipeline and storage system | 365,000 barrels of oil per day 5.8 million barrels of oil storage 2,700 miles of pipeline | ||

Colorado, New Mexico and Texas - CO 2 fields and pipelines | CO 2 fields and pipeline systems transporting CO 2 to oil and gas producing locations | 1.625 billion cubic feet per day | ||

Dolphin Pipeline - Qatar and United Arab Emirates | 24.5% equity investment in a natural gas pipeline | 3.2 billion cubic feet of natural gas per day (a) | ||

Western and Southern United States and Canada | Minority investment in entity involved in pipeline transportation, storage, terminalling and marketing of oil, gas and related petroleum products | 16,000 miles of pipeline and gathering systems (b) 92 million barrels of oil and other petroleum products and 50 billion cubic feet of natural gas storage (b) | ||

Marketing and Trading | ||||

Texas, Connecticut, United Kingdom, Singapore and other | Trades around its assets and purchases, markets and trades oil, gas, power, other commodities and commodity-related securities | Not applicable | ||

Power Generation | ||||

California, Texas and Louisiana | Occidental-operated power and steam generation facilities | 1,800 megawatts per hour and 1.6 million pounds of steam per hour |

(a) | Capacity requires additional gas compression and customer contracts. |

(b) | Amounts are gross, including interests held by third parties. |

Capital Expenditures

For information on capital expenditures, see the information under the heading "Liquidity and Capital Resources - Capital Expenditures" in the MD&A section of this report.

Employees

Occidental employed approximately 11,000 people at December 31, 2010, 7,100 of whom were located in the United States. Occidental employed approximately 6,900 people in the oil and gas and midstream and marketing segments and 3,000 people in the chemical segment. An additional 1,100 people were employed in administrative and headquarters functions. Approximately 900 U.S.-based employees and 300 foreign-based employees are represented by labor unions.

Occidental has a long-standing strict policy to provide fair and equal employment opportunities to all applicants and employees.

Environmental Regulation

For environmental regulation information, including associated costs, see the information under the heading "Environmental Liabilities and Expenditures" in the MD&A section of this report and "Risk Factors."

Available Information

Occidental makes the following information available free of charge through its web site at www.oxy.com:

Ø | Forms 10-K, 10-Q, 8-K and amendments to these forms as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC); |

Ø | Other SEC filings, including Forms 3, 4 and 5; and |

Ø | Corporate governance information, including its corporate governance guidelines, board-committee charters and Code of Business Conduct. (See Part III Item 10 of this report for further information.) |

Information contained on Occidental's web site is not part of this report.

5

Item 1A | Risk Factors |

Volatile global and local commodity pricing strongly affects Occidental's results of operations.

Occidental's financial results typically correlate closely to the prices it obtains for its products.

Changes in consumption patterns, global and local economic conditions, inventory levels, production disruptions, the actions of OPEC, currency exchange rates, market speculation, worldwide drilling and exploration activities, weather, geophysical and technical limitations and other matters may affect the supply and demand dynamics of oil and gas, contributing to price volatility.

Demand and, consequently, the price obtained for Occidental's chemical products correlate strongly to the health of the United States and global economy, as well as chemical industry expansion and contraction cycles. Occidental also depends on feedstocks and energy to produce chemicals, which are commodities subject to significant price fluctuations.

Occidental's oil and gas business operates in highly competitive environments, which affect, among other things, its results of operations and its ability to grow production and replace reserves.

Growth in Occidental's oil and gas production and results of operations depends, in part, on its ability to profitably acquire, develop or find additional reserves. Occidental replaces significant amounts of its reserves through acquisitions, exploration and large development projects. Occidental has many competitors (including national oil companies), some of which are: (i) larger and better funded, (ii) may be willing to accept greater risks or (iii) have special competencies. Competition for reserves may make it more difficult to find attractive investment opportunities or require delay of expected reserve replacement efforts. During periods of low product prices, any cash conservation efforts may delay production growth and reserve replacement efforts.

Occidental faces risks associated with its mergers, acquisitions and divestitures.

Occidental's merger, acquisition and divestiture activities carry risks that it may: (i) not fully realize anticipated benefits due to less than expected reserves or production or changed circumstances, such as product prices; (ii) bear unexpected integration costs or experience other integration difficulties; (iii) experience share price declines based on the market's evaluation of the activity; or (iv) assume or retain liabilities that are greater than anticipated.

Governmental actions, political instability and labor unrest may affect Occidental's results of operations.

Occidental's businesses are subject to the decisions of many governments and political interests. As a result, Occidental faces risks of:

Ø | new or amended laws and regulations, including those related to labor and employment, taxes, royalty rates, profit repatriation, permitted production rates, drilling, production or manufacturing processes, entitlements, import, export and use of equipment, use of land, water and other natural resources, safety, security and environmental protection, all of which may increase production costs or reduce the demand for Occidental's products; and |

Ø | refusal or delay in the extension or grant of exploration, development or production contracts. |

Occidental may experience adverse consequences, such as risk of loss or production limitations, because certain of its foreign operations are located in countries occasionally affected by political instability, armed conflict, terrorism, insurgency, civil unrest, security problems, labor unrest, OPEC production restrictions, equipment import restrictions and sanctions. Exposure to such risks may increase if a greater percentage of Occidental's future oil and gas production comes from foreign sources.

There has been recent political instability and civil unrest in Bahrain, Libya and Yemen. The effect, if any, of these developments on Occidental's operations is unknown at this time, but is not expected to be material.

Occidental's oil and gas reserves are based on professional judgments and may be subject to revision.

Calculations of oil and gas reserves depend on estimates concerning reservoir characteristics and recoverability, including decline rates, as well as capital and operating costs. If Occidental were required to make unanticipated significant negative reserve revisions, its results of operations and stock price could be adversely affected.

Occidental may experience significant losses in exploration activities or delays in development efforts or cost overruns.

Exploration is inherently risky. Exploration and development activities are subject to delays, misinterpretation of geologic or engineering data, unexpected geologic conditions or finding reserves of disappointing quality or quantity, which may result in significant losses. Occidental bears the risks of project delays and cost overruns due to equipment failures, approval delays, construction delays, escalating costs or competition for services, materials, supplies or labor, border disputes and other associated risks in its development efforts.

Concerns about climate change may affect Occidental's operations.

There is an ongoing effort to assess and quantify the effects of climate change and the potential human influences on climate. Various U.S. and foreign jurisdictions, including the U.S. federal government and the states of California and New Mexico, have adopted legislation, regulations or policies that seek to control or reduce the production, use or emissions of "greenhouse gases" (GHGs), to control or reduce the production or consumption of fossil fuels, and to increase the use of renewable or alternative energy sources, and such measures are pending in other jurisdictions. The uncertain outcome and timing of existing and proposed international, national, and state measures intended to reduce GHGs make it difficult to predict their business

6

impact. However, Occidental could face risks of delays in development projects, increases in costs and taxes and reductions in the demand for and restrictions on the use of its products as a result of ongoing GHG reduction efforts.

Occidental's businesses may experience catastrophic events.

The occurrence of events, such as earthquakes, hurricanes, floods, well blowouts, fires, explosions, chemical releases and industrial accidents, and other events that cause operations to cease or be curtailed, may negatively affect Occidental's businesses and communities in which it operates. Third-party insurance may not provide adequate coverage or Occidental may be self-insured with respect to the related losses.

Other risk factors.

Additional discussion of risks related to oil and gas reserve estimation processes, price and demand, litigation, environmental matters, foreign operations, impairments, derivatives and market risks appears under the headings: "MD&A - Oil & Gas Segment -Proved Reserves" and "- Industry Outlook," "Chemical Segment - Industry Outlook," "Midstream, Marketing and Other Segment - Industry Outlook," "Lawsuits, Claims, Commitments, Contingencies and Related Matters," "Environmental Liabilities and Expenditures," "Foreign Investments," "Critical Accounting Policies and Estimates," and "Derivative Activities and Market Risk."

Item 1B | Unresolved Staff Comments |

None.

Item 3 | Legal Proceedings |

For information regarding legal proceedings, see the information under the caption, "Lawsuits, Claims, Commitments, Contingencies and Related Matters" in the MD&A section of this report and in Note 9 to the Consolidated Financial Statements.

In May 2010, a putative stockholder action, Resnik v. Abraham, was filed in the U.S. District Court (Delaware), naming the present directors, certain executive officers and Occidental, as defendants. The complaint alleges defendants made a false and misleading proxy solicitation in connection with re-approval of the performance goals for certain incentive awards and authorized excessive compensation constituting corporate waste and breach of fiduciary duties. In July and August 2010, second and third purported stockholder complaints, Gusinsky v. Irani and Wein v. Irani , respectively, alleging similar derivative claims for corporate waste and breach of fiduciary duty, were filed in the Los Angeles Superior Court. The parties in the Resnik case reached an agreement in principle, providing for the settlement of that action in October 2010. The plaintiffs in the Gusinsky and Wein matters filed objections to the Resnik settlement in November 2010. In December 2010, Occidental reached an agreement with those plaintiffs to resolve their objections and filed a revised notice of settlement with the court on December 27, 2010. At a fairness hearing on February 8, 2011, the settlement was approved. As a result, the Wein and Gusinsky plaintiffs have agreed to dismiss their cases with prejudice.

In a previously disclosed proceeding, the Colorado Oil and Gas Conservation Commission (COGCC) has proposed a penalty of approximately $370,000 for an alleged release of production fluids from a well site.

7

Executive Officers

The current term of employment of each executive officer of Occidental will expire at the May 6, 2011 organizational meeting of the Board of Directors or when a successor is selected. The following table sets forth the executive officers of Occidental:

Name | Age at February 24, 2011 |

Positions with Occidental and Subsidiaries and Five-Year Employment History | ||

Dr. Ray R. Irani | 76 | Chairman and Chief Executive Officer since 1990; Director since 1984; Member of Executive Committee; 2005-2007, President. | ||

Stephen I. Chazen | 64 | President since 2007; Chief Operating Officer and Director since 2010; 1999-2010, Chief Financial Officer; 2005-2007, Senior Executive Vice President. | ||

Donald P. de Brier | 70 | Executive Vice President, General Counsel and Secretary since 1993. | ||

James M. Lienert | 58 | Executive Vice President and Chief Financial Officer since 2010; 2006-2010, Executive Vice President - Finance and Planning; 2004-2006, Vice President; Occidental Chemical Corporation: 2004-2006, President. | ||

William E. Albrecht | 59 | Vice President since 2008; Occidental Oil and Gas Corporation (OOGC): President - Oxy Oil & Gas, USA since 2008; 2007-2008, Vice President, California Operations; Noble Royalties, Inc.: 2006-2007, President of Acquisitions and Divestitures; EOG Resources, Inc.: 1998-2006, Vice President of Acquisitions and Engineering. | ||

Edward A. "Sandy" Lowe | 59 | Vice President since 2008; OOGC: President - Oxy Oil & Gas, International Production since 2009; 2008-2009, Executive Vice President - Oxy Oil & Gas, International Production and Engineering; 2008, Executive Vice President - Oxy Oil & Gas, Major Projects; Dolphin Energy Ltd.: 2002-2007, Executive Vice President and General Manager. | ||

Roy Pineci | 48 | Vice President, Controller and Principal Accounting Officer since 2008; 2007-2008, Senior Vice President, Finance - Oil and Gas; 2005-2007, Vice President - Internal Audit. | ||

B. Chuck Anderson | 51 | President of Occidental Chemical Corporation since 2006; 2004-2006, Executive Vice President - Chlorovinyls. |

8

Part II

Item 5 | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Trading Price Range and Dividends

This section incorporates by reference the quarterly financial data appearing under the caption "Quarterly Financial Data (Unaudited)" after the Notes to the Consolidated Financial Statements and the information appearing under the caption "Liquidity and Capital Resources" in the MD&A section of this report. Occidental's common stock was held by 35,577 stockholders of record at December 31, 2010, and by approximately 537,000 additional stockholders whose shares were held for them in street name or nominee accounts. The common stock is listed and traded principally on the New York Stock Exchange. The quarterly financial data, which are included in this report after the Notes to the Consolidated Financial Statements, set forth the range of trading prices for the common stock as reported on the composite tape of the New York Stock Exchange and quarterly dividend information.

The quarterly dividends declared on the common stock were $0.33 per share for the first quarter of 2010 and $0.38 for the last three quarters of 2010 ($1.47 for the year). On February 10, 2011, a quarterly dividend of $0.46 per share ($1.84 on an annualized basis) was declared on the common stock, payable on April 15, 2011 to stockholders of record on March 10, 2011. The declaration of future dividends is a business decision made by the Board of Directors from time to time, and will depend on Occidental's financial condition and other factors deemed relevant by the Board.

Securities Authorized for Issuance under Equity Compensation Plans

All of Occidental's equity compensation plans for its employees and non-employee directors, pursuant to which options, rights or warrants or other equity awards may be granted, have been approved by the stockholders. Occidental has established several Plans that allow it to issue stock-based awards in the form of options, restricted stock units, stock appreciation rights, performance stock awards, total shareholder return incentives and dividend equivalents. These include the 1995 Incentive Stock Plan (1995 ISP), 2001 Incentive Compensation Plan (2001 ICP), Phantom Share Unit Awards Plan and the 2005 Long-Term Incentive Plan (2005 LTIP). No further awards will be granted under the 1995 ISP and 2001 ICP; however, certain 1995 ISP and 2001 ICP award grants were outstanding at December 31, 2010. An aggregate of 66 million shares of Occidental common stock were authorized for issuance under the 2005 LTIP.

The following is a summary of the shares reserved for issuance as of December 31, 2010, pursuant to outstanding options, rights or warrants or other equity awards granted under Occidental's equity compensation plans:

a) | Number of securities to be issued upon exercise of outstanding options, warrants and rights | b) | Weighted-average exercise price of outstanding options, warrants and rights | c) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities in column (a)) | ||

1,013,615 | $23.62 | 53,088,606 | |||||

* Includes, with respect to:

Ÿ | the 1995 Incentive Stock Plan, 5,602 shares reserved for issuance pursuant to deferred stock unit awards; |

Ÿ | the 2001 Incentive Compensation Plan, 16,564 shares reserved for issuance pursuant to deferred stock unit awards and 1,446 shares reserved for issuance as dividend equivalents on deferred stock unit awards; and |

Ÿ | the 2005 Long-Term Incentive Plan, 285,340 shares at maximum payout level (142,670 at target level) reserved for issuance pursuant to outstanding performance stock awards, 3,561 shares reserved for issuance pursuant to restricted stock unit awards and 3,834,537 shares at maximum payout level (2,041,022 at target or mid-point level) reserved for issuance pursuant to total stockholder return incentive awards. |

Of the 48,941,557 shares that are not reserved for issuance under the 2005 Long-Term Incentive Plan, approximately 9 million to 28 million shares are available for issuance, depending on the type of award, after giving effect to the provision of the plan that each award, other than options and stock appreciation rights, must be counted against the number of shares available for issuance as three shares for every one share covered by the award.

9

Share Repurchase Activities

Occidental's share repurchase activities for the year ended December 31, 2010 were as follows:

Period | Total Number of Shares Purchased (a) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||

First Quarter 2010 | - | - | - | ||||||

Second Quarter 2010 | 129,774 | $86.60 | - | ||||||

Third Quarter 2010 | - | - | - | ||||||

October 1 - 31, 2010 | 124,845 | $82.39 | - | ||||||

November 1 - 30, 2010 | 252,835 | $84.70 | - | ||||||

December 1 - 31, 2010 | 252,232 | $93.38 | - | ||||||

Fourth Quarter 2010 | 629,912 | $87.72 | - | ||||||

Total 2010 | 759,686 | $87.53 | - | 27,155,575 | (b) | ||||

(a) | Purchased from the trustee of Occidental's defined contribution savings plan. |

(b) | Occidental has had a 95 million share authorization in place since 2008 for its share repurchase program; however, the program does not obligate Occidental to acquire any specific number of shares and may be discontinued at any time. |

Performance Graph

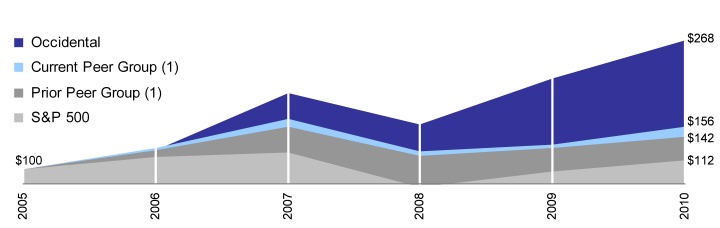

The following graph compares the yearly percentage change in Occidental's cumulative total return on its common stock with the cumulative total return of the Standard & Poor's 500 Stock Index (S&P 500) and with that of Occidental's peer groups over the five-year period ended on December 31, 2010. The graph assumes that $100 was invested in Occidental common stock, in the stock of the companies in the S&P 500 and in separate portfolios of each of the peer group companies' common stock weighted by their relative market values each year and that all dividends were reinvested.

12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | ||||||||||||||

| $100 | $124 | $199 | $158 | $218 | $268 | |||||||||||||

| 100 | 127 | 165 | 123 | 132 | 156 | |||||||||||||

| 100 | 124 | 155 | 117 | 127 | 142 | |||||||||||||

| 100 | 116 | 122 | 77 | 97 | 112 | |||||||||||||

The information provided in this Performance Graph shall not be deemed "soliciting material" or "filed" with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 (Exchange Act), other than as provided in Item 201 to Regulation S-K under the Exchange Act, or subject to the liabilities of Section 18 of the Exchange Act and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act except to the extent Occidental specifically requests that it be treated as soliciting material or specifically incorporates it by reference. | |||||||||||||||||||

(1) | The total cumulative return of each peer group companies' common stock includes the cumulative total return of Occidental's common stock. | ||||||||||||||||||

10

Item 6 Selected Financial Data

Five-Year Summary of Selected Financial Data | ||||||||||||||||

Dollar amounts in millions, except per-share amounts | ||||||||||||||||

As of and for the years ended December 31, | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

results of operations (a) | ||||||||||||||||

Net sales | $ | 19,045 | $ | 14,814 | $ | 23,713 | $ | 18,323 | $ | 16,648 | ||||||

Income from continuing operations (b) | $ | 4,569 | $ | 3,151 | $ | 7,183 | $ | 5,072 | $ | 4,127 | ||||||

Net income attributable to common stock | $ | 4,530 | $ | 2,915 | $ | 6,857 | $ | 5,400 | $ | 4,191 | ||||||

Basic earnings per common share from continuing operations (b) | $ | 5.62 | $ | 3.88 | $ | 8.77 | $ | 6.06 | $ | 4.82 | (c) | |||||

Basic earnings per common share (b) | $ | 5.57 | $ | 3.59 | $ | 8.37 | $ | 6.45 | $ | 4.90 | (c) | |||||

Diluted earnings per common share (b) | $ | 5.56 | $ | 3.58 | $ | 8.34 | $ | 6.42 | $ | 4.86 | (c) | |||||

financial position (a) | ||||||||||||||||

Total assets | $ | 52,432 | $ | 44,229 | $ | 41,537 | $ | 36,519 | $ | 32,431 | ||||||

Long-term debt, net | $ | 5,111 | $ | 2,557 | $ | 2,049 | $ | 1,741 | $ | 2,619 | ||||||

Stockholders' equity | $ | 32,484 | $ | 29,159 | $ | 27,325 | $ | 22,858 | $ | 19,604 | ||||||

market capitalization ( d ) | $ | 79,735 | $ | 66,050 | $ | 48,607 | $ | 63,573 | $ | 41,013 | ||||||

cash flow | ||||||||||||||||

Operating: | ||||||||||||||||

Cash provided by operating activities | $ | 9,349 | $ | 5,807 | $ | 10,654 | $ | 6,798 | $ | 6,351 | ||||||

Investing: | ||||||||||||||||

Capital expenditures | $ | (3,940 | ) | $ | (3,245 | ) | $ | (4,126 | ) | $ | (3,038 | ) | $ | (2,684 | ) | |

Cash used by all other investing activities, net | $ | (5,138 | ) | $ | (2,082 | ) | $ | (5,203 | ) | $ | (37 | ) | $ | (1,606 | ) | |

Financing: | ||||||||||||||||

Cash dividends paid | $ | (1,159 | ) | $ | (1,063 | ) | $ | (940 | ) | $ | (765 | ) | $ | (646 | ) | |

Cash provided (used) by all other financing activities, net | $ | 2,242 | $ | 30 | $ | (570 | ) | $ | (2,333 | ) | $ | (2,266 | ) | |||

dividends per common share | $ | 1.47 | $ | 1.31 | $ | 1.21 | $ | 0.94 | $ | 0.80 | (c) | |||||

weighted average basic shares outstanding (thousands) | 812,472 | 811,305 | 817,635 | 834,932 | 852,550 | (c) | ||||||||||

Note : Argentine operations have been reflected as held for sale for all periods.

(a) | See the MD&A section of this report and the Notes to Consolidated Financial Statements for information regarding acquisitions and dispositions, discontinued operations and other items affecting comparability. | |

(b) | Represent amounts attributable to common stock after deducting noncontrolling interest amounts of $72 million in 2010, $51 million in 2009, $116 million in 2008, $75 million in 2007 and $111 million in 2006. | |

(c) | Amounts have been adjusted to reflect a two-for-one stock split in the form of a stock dividend to stockholders on August 1, 2006. | |

(d) | Market capitalization is calculated by multiplying the year-end total shares of common stock outstanding, net of shares held as treasury stock, by the year-end closing stock price. |

Item 7 and 7A

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A)

Strategy

General

In this report, "Occidental" refers to Occidental Petroleum Corporation (OPC), and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental's principal businesses consist of three industry segments operated by OPC's subsidiaries and affiliates. The oil and gas segment explores for, develops, produces and markets crude oil, including natural gas liquids (NGLs) and condensate (together with NGLs, "liquids"), as well as natural gas. The chemical segment (OxyChem) manufactures and markets basic chemicals, vinyls and other chemicals. The midstream, marketing and other segment (midstream and marketing) gathers, treats, processes, transports, stores, purchases and markets crude oil, liquids, natural gas, carbon dioxide (CO 2 ) and power. It also trades around its assets, including pipelines and storage capacity, and trades oil and gas, other commodities and commodity-related securities. Unless otherwise indicated hereafter, discussion of oil or oil and liquids refers to crude oil, NGLs and condensate. In addition, discussions of oil and gas production or volumes, in general, refer to sales volumes unless the context requires or it is indicated otherwise.

Occidental aims to generate superior total returns to stockholders using the following strategies:

Ø | Focus on large, long -lived oil and gas assets with long-term growth potential; |

Ø | Maintain financial discipline and a strong balance sheet; |

11

Ø | Manage the chemical segment to provide cash in excess of normal capital expenditures; and |

Ø | Manage the midstream and marketing segment to generate returns in excess of Occidental's cost of capital. |

Occidental prefers to own large, long-lived "legacy" oil and gas assets, like those in California and the Permian Basin, that tend to have enhanced secondary and tertiary recovery opportunities and economies of scale that lead to cost-effective production in a safe and environmentally sound manner. Management expects such assets to contribute substantially to earnings and cash flow after invested capital.

At Occidental, maintaining financial discipline means investing capital in projects that management expects will generate above-cost-of-capital returns through their life cycle. Occidental expects to use most of any excess cash flow after capital expenditures to enhance stockholders' returns through dividend increases and acquisition opportunities.

The chemical business is not managed with a growth strategy but to generate cash flow exceeding its normal capital expenditure requirements. Capital is employed to operate the chemical business in a safe and environmentally sound way, to sustain production capacity and to focus on projects designed to improve the competitiveness of these assets. Acquisitions may be pursued when they are expected to enhance the existing core chlor-alkali and polyvinyl chloride (PVC) businesses or take advantage of other specific opportunities.

The midstream and marketing segment is managed to generate returns on capital invested in excess of Occidental's cost of capital. In marketing its own production and third party purchases, Occidental attempts to maximize realized prices and margins and limit credit risk exposure. In commodities and commodity-related securities trading, Occidental seeks to generate gains using net long positions. Capital is employed to operate segment assets in a safe and environmentally sound way, to sustain or, where appropriate, increase operational capacity and to improve the competitiveness of Occidental's assets.

Oil and Gas

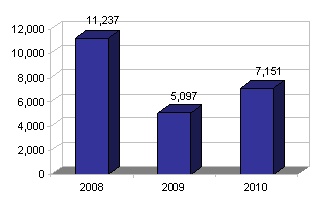

Segment Earnings

($ millions)

The oil and gas business seeks to increase its oil and gas production profitably and add new reserves at a pace ahead of production while minimizing costs incurred for finding and development. The oil and gas business implements this strategy within the limits of the overall corporate strategy primarily by:

Ø | Deploying capital to fully develop areas where proved reserves exist and increase production from mature fields; |

Ø | Adding commercial reserves through a combination of focused exploration and development programs conducted in Occidental's core areas, which are the United States, the Middle East/North Africa and Latin America; |

Ø | Pursuing commercial opportunities in core areas to enhance the development of mature fields with large volumes of remaining oil by applying appropriate technology and advanced reservoir-management practices; and |

Ø | Maintaining a disciplined approach to acquisitions and divestitures with an emphasis on transactions at attractive prices. |

Over the past several years, Occidental has strengthened its asset base within its core areas. Occidental has invested in, and disposed of, assets with the goal of raising the average performance and potential of its assets.

In December 2010, Occidental executed an agreement with a subsidiary of China Petrochemical Corporation (Sinopec) to sell its Argentine oil and gas operations for after-tax proceeds of approximately $2.6 billion. The sale closed in February 2011.

In January 2011, Occidental completed the acquisition of gas producing properties in South Texas for approximately $1.8 billion. In December 2010, Occidental acquired approximately 174,000 net contiguous acres of oil producing and prospective properties in North Dakota, which also offer significant further development opportunity, for approximately $1.4 billion.

In 2010, Occidental also acquired various domestic oil and gas interests that complement its existing portfolio of assets for approximately $2.8 billion. These assets are in operated, producing and non-producing properties in the Permian Basin, mid-continent region and California.

The acquisitions mentioned above collectively are expected to offset the Argentine production.

In addition, Occidental continues to deploy significant capital to its core operations in the Permian Basin, California and mid-continent region to increase production from these assets.

Internationally, Occidental announced in January 2011 that it had reached an agreement-in-principle for a 40-percent participating interest in the Shah Field development project in Abu Dhabi, partnering with the Abu Dhabi National Oil Company. In January of 2010, Occidental and its partners signed a technical service contract with the South Oil Company of Iraq to develop the Zubair Field in Iraq. In April 2009, Occidental and its partners signed a Development and Production Sharing

12

Agreement (DPSA) with the National Oil and Gas Authority of Bahrain for further development of the Bahrain Field. The DPSA became effective in December 2009. In addition, Occidental has continued to make capital expenditures and investments in existing projects in the Middle East/North Africa and expects continued production growth in the Mukhaizna project in Oman.

Chemical

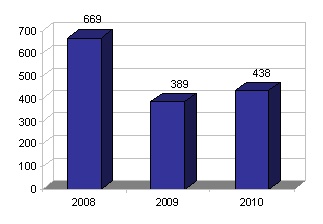

Segment Earnings

($ millions)

OxyChem's strategy is to be a low-cost producer in order to maximize its cash flow generation. OxyChem concentrates on the chlorovinyls chain beginning with chlorine, which is co-produced with caustic soda, both of which are marketed to third parties. In addition, chlorine, together with ethylene, is converted through a series of intermediate products into polyvinyl chloride (PVC). OxyChem's focus on chlorovinyls permits it to maximize the benefits of integration and allows it to take advantage of economies of scale.

Midstream, Marketing and Other

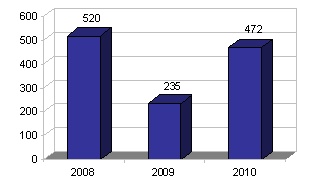

Segment Earnings

($ millions)

The midstream and marketing segment is managed to generate returns on capital invested in excess of Occidental's cost of capital. In order to generate these returns, the segment provides low cost services to other segments as well as to third parties and operates gas plants, oil, gas and CO 2 pipeline systems and storage facilities. In addition, the marketing and trading group markets Occidental's and third-party oil and gas, trades around the midstream and marketing segment assets and engages in commodities and commodity-related securities trading.

In December 2010, Occidental purchased additional interests in the General Partner of Plains All-American Pipeline, L.P. (Plains Pipeline), and now owns approximately 35 percent of the General Partner. In December 2010, Occidental also completed its acquisition of the remaining 50-percent joint venture interest in Elk Hills Power, LLC (EHP), a limited liability company that operates a gas-fired power-generation plant in California, bringing Occidental's total ownership to 100 percent.

Key Performance Indicators

General

Occidental seeks to ensure that it meets its strategic goals by continuously measuring its success in maintaining below-average debt levels, delivering returns in excess of its cost of capital and achieving top-quartile performance compared to its peers in:

Ø | Total return to stockholders; |

Ø | Return on equity (ROE); |

Ø | Return on capital employed (ROCE); and |

Ø | Other segment-specific measures such as per-unit profit, production cost, cash flow, finding and development cost, reserves replacement percentage and others. |

Over the years, Occidental has delivered high levels of return. Occidental increased stockholder's equity by 11 percent for 2010 and 42 percent for the three-year period from 2008 to 2010 while continuing to deliver above cost of capital returns. During the three-year period from 2008 to 2010, Occidental increased its dividend rate by 52 percent while its stock price increased by 27 percent.

Annual 2010 (a) | Three-Year Annual Average 2008 - 2010 (b) | |||

ROE | 14.7% | 17.1% | ||

ROCE | 13.2% | 15.5% |

(a) | The ROE and ROCE for 2010 were calculated by dividing Occidental's 2010 net income attributable to common stock (taking into account cost of capital for ROCE) by its average equity and capital employed, respectively, during 2010. |

(b) | The three-year average ROE and ROCE were calculated by dividing Occidental's average net income attributable to common stock (taking into account cost of capital for ROCE) over the three-year period 2008-2010 by its average equity and capital employed, respectively, over the same period. |

Debt Structure

Occidental's year-end 2010 total debt-to-capitalization ratio was 14 percent. Occidental issued $2.6 billion of senior unsecured notes in the fourth quarter of 2010.

Occidental's long-term senior unsecured debt was rated A by Fitch Ratings, Standard and Poor's Ratings and DBRS. Occidental's long-term unsecured debt was rated A2 by Moody's Investors Service. A security rating is not a recommendation to buy, sell or hold securities, may be subject to revision or withdrawal at any time by the assigning rating organization and should be evaluated independently of any other rating.

13

Oil and Gas Segment

Business Environment

Oil and gas prices are the major variables that drive the industry's short and intermediate term financial performance. Average oil prices were higher in 2010 than 2009. West Texas Intermediate (WTI) was $91.38 and $79.36 per barrel as of December 31, 2010 and 2009, respectively. The average daily WTI market price for 2010 was $79.53 per barrel compared with $61.80 per barrel in 2009. Occidental's realized price for crude oil for its continuing operations as a percentage of average WTI prices was approximately 95 percent and 93 percent for 2010 and 2009, respectively.

The average daily New York Mercantile Exchange (NYMEX) domestic natural gas price in 2010 increased approximately 7 percent from 2009. For 2010, the price averaged $4.49 per thousand cubic feet (Mcf) compared with $4.20 per Mcf for 2009, and was $4.41 per Mcf as of December 31, 2010.

Prices and differentials can vary significantly, even on a short-term basis, making it impossible to predict realized prices with a reliable degree of certainty.

Business Review

All sales, production and reserves volumes are net to Occidental and include amounts attributable to noncontrolling interests, where applicable, unless otherwise specified.

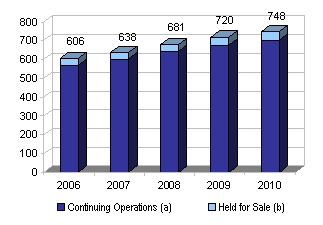

Worldwide Sales Volumes

(thousands BOE/day)

(a) | Includes average sales volumes per day of 4 thousand barrels (mbbl), 6 mbbl, 6 mbbl, 5 mbbl and 5 mbbl for 2010, 2009, 2008, 2007 and 2006, respectively, related to the noncontrolling interest in a Colombian subsidiary. | |

(b) | Represents average sales volumes per day of 43 thousand barrels of oil equivalent (MBOE), 42 MBOE, 36 MBOE, 36 MBOE and 36 MBOE for 2010, 2009, 2008, 2007 and 2006, respectively, related to the Argentine operations. |

Production-Sharing Contracts (PSC)

Occidental conducts its operations in Bahrain, Iraq, Libya, Oman, Yemen and Qatar, including Dolphin, under PSCs or similar contracts. Under such contracts, Occidental receives a share of production and reserves to recover its costs and an additional share for profit. In addition, Occidental's share of production and reserves from operations in Long Beach, California and certain contracts in Colombia are subject to contractual arrangements similar to a PSC. These contracts do not transfer any right of ownership to Occidental and reserves reported from these arrangements are based on Occidental's economic interest as defined in the contracts. Occidental's share of production and reserves from these contracts decreases when product prices rise and increases when prices decline. Overall, Occidental's net economic benefit from these contracts is greater when product prices are higher.

United States

| |||

United States 1. Permian 2. Elk Hills and other interests 3. Other California interests 4. Midcontinent and Other Interests | |||

Permian

Occidental's Permian production is diversified across a large number of producing areas in the Permian Basin. The Permian Basin extends throughout southwest Texas and southeast New Mexico and is one of the largest and most active oil basins in the United States, with the entire basin accounting for approximately 18 percent of the total United States crude oil production. Occidental is the largest producer of crude oil in the Permian Basin with an approximate 16-percent net share of the total production. Occidental also produces and processes natural gas and NGLs in the Permian Basin.

Starting in 2010, Permian Basin non-associated gas assets were included as part of the Midcontinent Gas operations. As a result of this change, the Permian business unit's production shifted from 84 percent liquids and 16 percent gas, to 89 percent liquids and 11 percent, mostly associated, gas.

In the past several years, including 2010, Occidental increased its Permian interests through various acquisitions.

Occidental's interests in Permian offer additional development and exploitation potential. During 2010, Occidental drilled approximately 190 wells on its operated properties and participated in additional wells drilled on third-party-operated properties. Occidental conducted development activity on 11 CO 2 projects during 2010. Occidental also focused on improving the performance of existing wells. Occidental had an average of 80 well service units working in Permian during 2010 performing well maintenance and workovers.

Approximately 66 percent of Occidental's Permian oil production is from fields that actively employ the application of CO 2 flood technology, an enhanced oil recovery (EOR) technique. This technique involves injecting CO 2 into oil reservoirs where it causes the oil to flow more freely into producing wells. These CO 2 flood operations make Occidental a world leader in the application of this technology.

Occidental's policy regarding tertiary recovery is to capitalize costs when they support development of proved reserves and otherwise generally expense these costs. In 2009, Occidental capitalized approximately 50 percent of the costs of CO 2 injected in Permian. Over the years, as the CO 2 program matured, a smaller portion of the injected CO 2 resulted in the development of proved reserves. Beginning in 2010, Occidental expensed 100 percent of the CO 2 injected, in order to better reflect the current nature of the CO 2 program.

Occidental's total share of Permian Basin oil and gas production was approximately 197,000 BOE per day in 2010, which included approximately 183,000 BOE per day from the Permian business unit. At the end of 2010, Occidental's Permian properties had approximately 1.2 billion BOE in proved reserves.

California

Occidental's California operations consist of holdings in the Elk Hills area, the Wilmington Field in the Los Angeles basin and other interests in the Ventura, San Joaquin, Los Angeles and Sacramento basins.

Occidental's interests in the Elk Hills area include the Elk Hills oil and gas field in the southern portion of California's San Joaquin Valley, which it operates with an approximate 78-percent interest, along with other adjacent properties. The Elk Hills Field is the largest producer of gas and NGLs in California. During 2010, Occidental continued to perform infill drilling, field extensions and recompletions identified by advanced reservoir characterization techniques, resulting in approximately 240 new wells being drilled and approximately 190 wells being worked over.

During 2010, Occidental continued to produce from the Kern County discovery area announced last year and continued to develop the multi-pay zones. Based on currently available data, Occidental believes that its estimates of gross reserves ranges for the area remain reasonable for the combined conventional and unconventional pay zones.

Occidental began construction of a new gas processing plant in the Elk Hills area in 2010, and plans to commence building a second such plant in the next two years.

Occidental also owns interests in California properties in the Ventura, San Joaquin and Sacramento basins, other than Elk Hills. The combined properties produce oil and gas from more than 50 fields.

Occidental holds approximately 1.6 million acres in California, the vast majority of which are net fee mineral interests. A large portion of such interests has been acquired in the last few years. As a result, Occidental has a large inventory of properties available for future development.

Occidental's share of production and reserves from its operations in the Wilmington Field is subject to contractual arrangements similar to a PSC.

Occidental's total share of oil and gas production in California was approximately 139,000 BOE per day in 2010. At the end of 2010, Occidental's properties in California had approximately 768 million BOE in proved reserves.

Midcontinent and Other Interests

In 2010, Occidental combined most of its gas production in the mid-continent region of the United States into a single business unit called Midcontinent Gas, in order to take advantage of common development methods and production optimization opportunities. This business unit includes the Hugoton Field, the Piceance Basin and the bulk of the Permian Basin non-associated gas assets, which were included as part of the Permian business unit in 2009. As a result, Midcontinent Gas' production is approximately 70 percent gas and 30 percent liquids.

The Midcontinent Gas properties are principally located in Texas, New Mexico, Colorado, Utah, Kansas and Oklahoma. Occidental owns over 2.8 million net acres in the mid-continent region, which includes 1.4 million acres in a large concentration of gas reserves and production and royalty interests in the Hugoton area located in Kansas and Oklahoma and approximately 1.4 million acres, mainly in Texas, New Mexico, Colorado and Utah.

In January 2011, Occidental completed the acquisition of gas producing properties in South Texas. Occidental also owns approximately 200,000 net acres of oil producing and prospective properties in North Dakota's Williston Basin, including acreage in the Bakken and Three Forks formations. A substantial portion of this acreage was purchased in 2010.

Beginning in 2011, the new properties acquired during 2010 and 2011 located in South Texas and North Dakota will be grouped as part of Midcontinent and Other Interests.

In 2010, Midcontinent and Other Interests produced approximately 62,000 BOE per day, which included non-associated gas from the Permian Basin. As of December 31, 2010, proved reserves for these operations totaled approximately 266 million BOE.

Other Developments

The recent acquisitions provide Occidental with a large inventory of development projects. Management conducted a review of Occidental's portfolio of oil and gas assets in the fourth quarter of 2010 and concluded that certain projects had become uneconomical considering the natural gas price environment and that it would not pursue them. As a result, Occidental recorded a pre-tax impairment charge of $275 million, predominately of gas properties in the Rocky Mountain region in 2010.

15

Middle East/North Africa

| |||

Middle East/North Africa 1. Bahrain 2. Iraq 3. Libya 4. Oman 5. Qatar 6. United Arab Emirates 7. Yemen | |||

Bahrain

In December 2009, Occidental and its partners began operating the Bahrain Field. Occidental has a 48-percent interest in the joint venture. Occidental expects gross gas production capacity to grow more than 35 percent from a current level of 1.6 billion cubic feet per day to over 2.1 billion cubic feet per day within five years. Gross oil production from the Bahrain Field is expected to more than double to approximately 75,000 barrels per day within five years and grow to a peak level of more than 100,000 barrels per day thereafter. Occidental's share of production from Bahrain during 2010 was approximately 169 million cubic feet (MMcf) of gas and 3,000 barrels of oil per day.

Iraq

In January 2010, Occidental and its partners signed a technical service contract (TSC) with the South Oil Company of Iraq to develop the Zubair Field. Occidental has a 23.44-percent interest in the TSC. Under this TSC, Occidental is entitled to receive oil for cost recovery and remuneration fee, subject to achieving an initial gross production threshold. Occidental and its partners plan to increase production from the initial gross oil production level of approximately 180,000 BOE per day to a contractually targeted production level of 1.2 million BOE per day by 2016 or earlier and maintain this level of production for seven years. During 2010, Occidental and its partners achieved the initial gross production threshold. As of year-end 2010, Occidental's share of production was approximately 12,000 BOE per day.

Libya

Occidental, under agreements with the Libyan National Oil Corporation (NOC), participates in exploration and production operations in the Sirte Basin. In June 2008, Occidental and its partner signed new agreements with NOC to upgrade its existing contracts for up to 30 years. Occidental's share of production from the Libya properties was approximately 13,000 BOE per day in 2010.

Oman

In Oman, Occidental is the operator of Block 9 and Block 27, with a 65-percent working interest in each, Block 53, with a 45-percent working interest, and Block 62, with a 48-percent working interest.

Occidental and its partners signed a 30-year PSC for the Mukhaizna Field (Block 53) with the Government of Oman in 2005. In September 2005, Occidental assumed operations of the Mukhaizna Field. By the end of 2010, Occidental had drilled over 1,020 new wells and continued implementation of a major pattern steam flood project. As of year-end 2010, the exit rate of gross daily production was over 15 times higher than the production rate in September 2005, reaching nearly 120,000 BOE per day. Occidental plans to steadily increase production through continued expansion of the steam flood project.

The term for Block 9 is through December 2015, with a potential 10-year extension. The term for Block 27 is through September 2035.

Occidental has operations in Block 62 where it is pursuing development and exploration opportunities targeting gas and condensate resources.

Occidental's share of production from the Oman properties was approximately 69,000 BOE per day in 2010.

Qatar

Occidental operates three offshore projects in Qatar: Idd El Shargi North Dome (ISND) and Idd El Shargi South Dome (ISSD), with a 100-percent working interest in each, and Al Rayyan (Block 12), with a 92.5-percent working interest.

In 2008, Occidental received approval from the Government of Qatar for the third phase of field development of the ISND Field focusing on continued development of mature reservoirs, while further delineating and developing less mature reservoirs. Drilling under this phase was completed during 2010. Occidental has proposed a fourth phase of development in ISND and field development plans for ISSD and Al Rayyan, which would include additional drilling through 2012.

Occidental also has an investment in Dolphin, which was acquired in 2002, consisting of two separate economic interests through which Occidental owns: (i) a 24.5-percent undivided interest in the assets and liabilities associated with a DPSA with the Government of Qatar to develop and produce natural gas and NGLs in Qatar's North Field through mid-2032, with a provision to request a 5-year extension; and (ii) a 24.5-percent interest in the stock of Dolphin Energy Limited (Dolphin Energy), which is discussed further in "Midstream, Marketing and Other Segment – Pipeline Transportation."

Occidental's share of production from all of its operations in Qatar was approximately 139,000 BOE per day in 2010.

16

United Arab Emirates

Occidental announced in January 2011 that it had reached an agreement-in-principle for a 40-percent interest in the Shah Field high sulfur content gas development project in Abu Dhabi, partnering with the Abu Dhabi National Oil Company. The project is anticipated to produce approximately 500 MMcf per day of natural gas, of which Occidental's net share will be approximately 200 MMcf per day. In addition, the project is expected to produce approximately 50,000 barrels per day of liquids, of which Occidental's net share will be approximately 20,000 barrels per day. Production from this field is expected to begin no earlier than 2014. Capital expenditures are estimated to be in the range of $10 billion for the project with Oxy's share proportional to its ownership.

Occidental conducts a majority of its Middle East business development activities through its office in the United Arab Emirates, which also provides various support functions for Occidental's Middle East/North Africa oil and gas operations.

Yemen

Occidental owns contractual interests in three producing blocks in Yemen, including a 38-percent working interest in the Masila Field, which expires in December 2011, a 40.4-percent interest, including an 11.8-percent interest held in an unconsolidated entity, in the East Shabwa Field, and a 75-percent working interest in Block S-1, which Occidental operates.

Occidental's share of production from the Yemen properties was approximately 30,000 BOE per day in 2010, which included nearly 14,000 BOE per day from the Masila Field.

Latin America

| Latin America 1. Argentina 2. Bolivia 3. Colombia |

Argentina

In December 2010, Occidental executed an agreement to sell its Argentine operations. The sale closed in February 2011.

The Argentine operations consist of 23 concessions located in the San Jorge Basin in southern Argentina and the Cuyo and Neuquén Basins in western Argentina. Occidental operated 19 of the concessions with a 100-percent working interest. In 2010, Occidental obtained a ten-year extension for its hydrocarbon concessions in the Santa Cruz province of Argentina, which extended the concessions through a range of dates from 2025 to 2027. During 2010, Occidental drilled approximately 120 new development wells and performed a number of recompletions and well repairs. Occidental's share of production from the Argentine properties was approximately 43,000 BOE per day in 2010.

Bolivia

Occidental holds working interests in four blocks located in the Tarija, Chuquisaca and Santa Cruz regions of Bolivia.

Colombia

Occidental is the operator under four contracts within the Llanos Norte Basin: the Cravo Norte, Rondón, Cosecha, and Chipirón Association Contracts. Occidental's working interests under these four contracts are 39 percent, 44 percent, 53 percent and 61 percent, respectively. Occidental also holds a 48-percent working interest in the La Cira-Infantas Field, which is located in the Middle-Magdalena Basin. Occidental's share of 2010 production from its Colombia operations was approximately 32,000 BOE per day.

Proved Reserves

For further information regarding Occidental's proved reserves, see "Supplemental Oil and Gas Information" following the "Financial Statements."

Occidental had proved reserves at year-end 2010 of 3,363 million BOE, as compared with the year-end 2009 amount of 3,230 million BOE. Proved reserves at year-end 2010 consisted of 74 percent oil and liquids and 26 percent natural gas. Proved developed reserves represented approximately 75 percent of Occidental's total proved reserves at year-end 2010 compared to 77 percent at year-end 2009.

Proved Reserve Additions

Occidental's total proved reserve additions from all sources were 409 million BOE in 2010. The total additions were as follows:

In millions of BOE | ||||

Revisions of previous estimates | (1 | ) | ||

Improved recovery | 259 | |||

Extensions and discoveries | 7 | |||

Purchases | 144 | |||

Total additions | 409 | |||

Occidental's ability to add reserves, other than purchases, depends on the success of improved recovery, extension and discovery projects, each of which depend on reservoir characteristics, technology improvements, oil and natural gas prices, as well as capital and operating costs. Many of these factors are outside of management's control, and will affect whether or not these historical sources of proved reserve additions continue at similar levels.

17

Revisions of Previous Estimates

In 2010, revisions of previous estimates provided a net 1 million BOE reduction to reserves. Revisions included a net positive price-related increase for domestic oil and gas reserves, offset by a negative effect from PSCs mostly in the Middle East/North Africa as well as technical revisions, which were not material.

Oil price changes affect proved reserves recorded by Occidental. For example, when oil prices increase, less oil volume is required to recover costs under PSCs, which results in a reduction of Occidental's share of proved reserves. Conversely, when oil prices drop, Occidental's share of proved reserves increases for these PSCs. Oil and natural gas price changes also tend to affect the economic lives of proved reserves, primarily in domestic properties, in a manner offsetting the PSC reserve volume changes. Apart from the effects of product prices, Occidental believes its approach to interpreting technical data regarding proved oil and gas reserves makes it more likely that future proved reserve revisions will be positive rather than negative.

Improved Recovery

In 2010, Occidental added proved reserves of 259 million BOE from improved recovery through its EOR activities. Generally, the improved recovery additions in 2010 were associated with the continued development of mature properties in California, Permian, Argentina and Oman. These properties are generally characterized by the deployment of secondary and tertiary development projects, largely employing application of waterflood (secondary), steamflood (tertiary) or CO 2 (secondary or tertiary) injection. These development projects are often applied through existing wells, though additional drilling may be required to fully optimize the development configuration. Waterflooding is the technique of injecting water into the formation to displace the oil to the offsetting oil production wells. Steamflooding is the technique of injecting steam into the formation to lower oil viscosity so that it flows more freely into producing wells. This process is applied in areas where the oil is too viscous to be effectively moved with water. CO 2 flooding involves injecting CO 2 into oil reservoirs where it causes the oil to flow more freely into producing wells.

Extensions and Discoveries

Occidental also obtained reserve additions from extensions and discoveries, which are dependent on successful exploration and exploitation programs. In 2010, extensions and discoveries added 7 million BOE.

Purchases and Divestitures of Proved Reserves

Occidental continues to add reserves through acquisitions when properties are available at prices it deems reasonable. As market conditions change, the available supply of properties may increase or decrease accordingly. In 2010, Occidental added 144 million BOE through purchases of proved reserves largely consisting of several domestic acquisitions in the Permian and Williston Basins and the Zubair Field in Iraq.

Proved Undeveloped Reserves

In 2010, Occidental had proved undeveloped reserves additions of 287 million BOE from improved recovery, extensions and discoveries and purchases. Of the total additions, 202 million BOE represented additions from improved recovery, primarily in California, Permian, Argentina, Oman, Bahrain and Qatar. Occidental added 81 million BOE through purchases of proved undeveloped reserves domestically in the Permian and Williston Basins and the Zubair Field in Iraq. These proved undeveloped reserve additions were offset by reserves transfers of 135 million BOE to the proved developed category as a result of the 2010 development programs. Occidental incurred approximately $1.4 billion in 2010 to convert proved undeveloped reserves to proved developed reserves. California, Permian, Argentina, Bahrain, Oman and Qatar accounted for approximately 86 percent of the reserves transfers from proved undeveloped to proved developed in 2010. Proved undeveloped reserve additions will require incurrence of additional future development costs.

Reserves Evaluation and Review Process

Occidental's estimates of proved reserves and associated future net cash flows as of December 31, 2010 were made by Occidental's technical personnel and are the responsibility of management. The current Senior Director of Worldwide Reserves and Reservoir Engineering is responsible for overseeing the preparation of reserve estimates, including the internal audit and review of Occidental's oil and gas reserves data. The Senior Director has over 29 years of experience in the upstream sector of the exploration and production business, and has held various assignments in North America, Asia and Europe. He is a three-time past Chair of the Society of Petroleum Engineers Oil and Gas Reserves Committee. He is an American Association of Petroleum Geologists (AAPG) Certified Petroleum Geologist and the current Chair of the AAPG Committee on Resource Evaluation. He is a member of the Society of Petroleum Evaluation Engineers, the Colorado School of Mines Potential Gas Committee and the UNECE Expert Group on Resource Classification. He is also an active member of the Joint Committee on Reserves Evaluator Training (JCORET). The Senior Director has Bachelor of Science and Master of Science degrees in geology from Emory University in Atlanta.

Occidental has a Corporate Reserves Review Committee (Reserves Committee) consisting of senior corporate officers, to monitor, review and approve Occidental's oil and gas reserves. The Reserves Committee reports to the Audit Committee of Occidental's Board of Directors during the year. Since 2003, Occidental has retained Ryder Scott Company, L.P. (Ryder Scott), independent petroleum engineering consultants, to review its annual oil and gas reserve estimation processes.

18

In 2010, Ryder Scott conducted a process review of Occidental's methods and analytical procedures utilized by Occidental's engineering and geological staff for estimating the proved reserves volumes, preparing the economic evaluations and determining the reserves classifications as of December 31, 2010, in accordance with the U.S. Securities and Exchange Commission (SEC) regulatory standards. Ryder Scott reviewed the specific application of such methods and procedures for selected oil and gas properties considered to be a valid representation of Occidental's total proved reserves portfolio. In 2010, Ryder Scott reviewed approximately 20 percent of Occidental's proved oil and gas reserves. Since being engaged in 2003, Ryder Scott has reviewed the specific application of Occidental's reserve estimation methods and procedures for approximately 74 percent of Occidental's proved oil and gas reserves. Management retains Ryder Scott to provide objective third-party input on its methods and procedures and to gather industry information applicable to Occidental's reserve estimation and reporting process. Ryder Scott has not been engaged to render an opinion as to the reasonableness of reserves quantities reported by Occidental. Occidental has filed Ryder Scott's independent report as an exhibit to this Form 10-K.

Based on its reviews, including the data, technical processes and interpretations presented by Occidental, Ryder Scott has concluded that the overall procedures and methodologies Occidental utilized in estimating the proved reserves volumes for the reviewed properties are appropriate for the purpose thereof, and comply with current SEC regulations.

Industry Outlook

The petroleum industry is highly competitive and subject to significant volatility due to numerous current and anticipated market conditions. WTI generally increased throughout 2010, settling at $91.38 per barrel as of December 31, 2010.

Oil prices will continue to be affected by global demand, which is generally a function of global economic conditions, as well as the actions of OPEC, other significant producers and governments. These factors make it impossible to predict the future direction of oil prices reliably. Occidental continues to adjust to economic conditions by adjusting capital expenditures in line with current economic conditions with the goal of keeping returns well above its cost of capital.