|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended

October 31, 2015

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-33913

_______________________________

QUANEX BUILDING PRODUCTS CORPORATION

Delaware |

| 26-1561397 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

1800 West Loop South, Suite 1500, Houston, Texas |

| 77027 |

(Address of principal executive offices) |

| (Zip code) |

Registrant's telephone number, including area code: (713) 961-4600

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Name of each exchange on which registered |

Common Stock, $0.01 par value |

| New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: NONE

_______________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x |

| Accelerated filer | o |

Non-accelerated filer | o |

| Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of April 30, 2015, computed by reference to the closing price for the Common Stock on the New York Stock Exchange, Inc. on that date, was $647,082,082 . Such calculation assumes only the registrant's officers and directors at such date were affiliates of the registrant.

At December 11, 2015 there were outstanding 33,971,483 shares of the registrant's Common Stock, $0.01 par value.

_______________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive Proxy Statement for its 2016 Annual Meeting of Stockholders to be filed with the Commission within 120 days of October 31, 2015 are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

|

TABLE OF CONTENTS

|

| Page |

PART I |

| |

|

|

|

Item 1. | Business | 4 |

|

|

|

Item 1A. | Risk Factors | 10 |

|

|

|

Item 1B. | Unresolved Staff Comments | 13 |

|

|

|

Item 2. | Properties | 14 |

|

|

|

Item 3. | Legal Proceedings | 14 |

|

|

|

Item 4. | Mine Safety Disclosures | 15 |

|

| |

PART II |

| |

|

|

|

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 16 |

|

|

|

Item 6. | Selected Financial Data | 18 |

|

|

|

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 20 |

|

|

|

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 39 |

|

|

|

Item 8. | Financial Statements and Supplementary Data | 41 |

|

|

|

Item 9. | Change in and Disagreements with Accountants on Accounting and Financial Disclosure | 88 |

|

|

|

Item 9A. | Controls and Procedures | 89 |

|

| |

Item 9B. | Other Information | 89 |

|

| |

PART III |

| |

|

|

|

Item 10. | Directors, Executive Officers and Corporate Governance | 90 |

|

|

|

Item 11. | Executive Compensation | 90 |

|

|

|

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 90 |

|

|

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 90 |

|

|

|

Item 14. | Principal Accountant Fees and Services | 90 |

|

| |

PART IV |

| |

|

|

|

Item 15. | Exhibits and Financial Statement Schedules | 90 |

Unless the context indicates otherwise, references to "Quanex", the "Company", "we", "us" and "our" refer to the consolidated business operations of Quanex Building Products Corporation and its subsidiaries.

Cautionary Note Regarding Forward-Looking Statements

Certain of the statements contained in this document and in documents incorporated by reference herein, including those made under the caption "Management's Discussion and Analysis of Financial Condition and Results of Operations" are "forward-looking" statements as defined under the Private Securities Litigation Reform Act of 1995. Generally, the words "expect," "believe," "intend," "estimate," "anticipate," "project," "will" and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward looking statements are (1) all statements which address future operating performance, (2)events or developments that we expect or anticipate will occur in the future, including statements relating to volume, sales, operating income and earnings per share, and (3) statements expressing general outlook about future operating results. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our current projections or expectations. As and when made, we believe that these forward-looking statements are reasonable. However, caution should be taken not to place undue reliance on any such forward-looking statements since such statements speak only as of the date when made and there can be no assurance that such forward-looking statements will occur. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to the following:

• | changes in market conditions, particularly in the new home construction, and residential remodeling and replacement (R&R) activity markets in the United States, United Kingdom and Germany; |

• | changes in non-pass-through raw material costs; |

• | changes in domestic and international economic conditions; |

• | changes in purchases by our principal customers; |

• | fluctuations in foreign currency exchange rates; |

• | our ability to maintain an effective system of internal controls; |

• | our ability to successfully implement our internal operating plans and acquisition strategies; |

• | our ability to successfully implement our plans with respect to information technology (IT) systems and processes; |

• | our ability to control costs and increase profitability; |

• | changes in environmental laws and regulations; |

• | changes in warranty obligations; |

• | changes in energy costs; |

• | changes in tax laws, and interpretations thereof; |

• | changes in interest rates; |

• | our ability to service our debt facilities and remain in good standing with our lenders; |

• | our ability to maintain a good relationship with our suppliers, subcontractors, and key customers; and |

• | the resolution of litigation and other legal proceedings. |

Additional factors that could cause actual results to differ materially are discussed under Item 1A, " Risk Factors " included elsewhere in this Annual Report on Form 10-K.

About Third-Party Information

In this report, we rely on and refer to information regarding industry data obtained from market research, publicly available information, industry publications, United States government sources and other third parties. Although we believe this information is reliable, we cannot guarantee the accuracy or completeness of the information and have not independently verified it.

Table of Contents

PART I

Item 1. Business (Continuing Operations).

Our Company

Quanex was incorporated in Delaware on December 12, 2007 as Quanex Building Products Corporation. We manufacture components primarily for the window and door (fenestration) industry, which include (1) energy-efficient flexible insulating glass spacers, (2) extruded vinyl profiles, (3) window and door screens, and (4) precision-formed metal and wood products for original equipment manufacturers (OEMs), as well as certain non-fenestration components and products, which include solar panel sealants, wood flooring, trim moldings, plastic decking, fencing, water retention barriers, hardware, and conservatory roof components. We use low-cost production processes and engineering expertise to provide our customers with specialized products for their specific window and door applications. We believe these capabilities provide us with unique competitive advantages. We serve a primary customer base in North America and the United Kingdom, and also serve customers in international markets through our operating plants in the United Kingdom and Germany, as well as through sales and marketing efforts in other countries.

Our History

Our predecessor company, Quanex Corporation, was organized in Michigan in 1927 as Michigan Seamless Tube Company, and was later reincorporated in Delaware in 1968. In 1977, Michigan Seamless Tube Company changed its name to Quanex Corporation. On December 12, 2007, Quanex Building Products Corporation was incorporated as a wholly-owned subsidiary in the state of Delaware, in order to facilitate the separation of Quanex Corporation's vehicular products and building products businesses. This separation became effective on April 23, 2008, through a spin-off of the building products business to Quanex Corporation's then-existing shareholders. Immediately following the spin-off, our former parent company, consisting principally of the vehicular products business and all non-building products related corporate accounts, merged with a wholly-owned subsidiary of Gerdau S.A.

Since the spin-off in 2008, we have evolved our business by making investments in organic growth initiatives and taking a disciplined approach to new business and strategic acquisition opportunities, and disposing of non-core businesses while seeking to provide superior value to our customers.

Notable developments and transactions which occurred since the spin-off include the following:

• | in March 2011, we acquired certain vinyl extrusion assets in Yakima, Washington from a customer of our vinyl extrusion business; |

• | in March 2011, we acquired Edgetech, I.G. Inc. and its German subsidiary, which provided us with three manufacturing facilities, one each in the United States, United Kingdom and Germany, that produce and market a full line of flexible insulating glass spacer systems for window and door customers in North America and abroad. This acquisition complemented our then existing insulating glass products business in the United States and, as a result, we committed to a plan to consolidate these facilities in November 2011. This consolidation plan, in part, resulted in the closure of a plant in Barbourville, Kentucky, and the relocation of equipment that was used to manufacture the single seal, warm-edge spacer system to our facility in Cambridge, Ohio. This consolidation was substantially completed by August 2012, with minor residual cash payments and program costs incurred during fiscal 2013. We sold the facility in Barbourville in May 2014; |

• | in December 2012, we acquired substantially all of the assets of Alumco Inc. and its subsidiaries (Alumco), an aluminum screen manufacturer, which we believe allowed us to expand the scope of our fenestration business to include screens for vinyl window and door manufacturers and to expand our geographic reach throughout the United States; |

• | in April 2014, we sold our interest in a limited liability company which held the net assets of our Nichols Aluminum business (Nichols), the sole operating segment included in our Aluminum Sheet Products reportable segment, to Aleris International, Inc. (Aleris), a privately held company which provides aluminum rolled products and extrusions, aluminum recycling and specification aluminum alloy production; |

• | in June 2015, we acquired the outstanding ownership shares of Flamstead Holdings Limited, an extruder of vinyl lineal products and manufacturer of other plastic products incorporated and registered in England and Wales. Following a pre-sale reorganization and purchase, Flamstead Holdings Limited owned 100% of the ownership shares of the following subsidiaries: HL Plastics Limited, Vintage Windows Limited, Wegoma Machinery Sales Limited, and Liniar Limited (collectively referred to as "HLP"), each registered in England and Wales. We believe that this acquisition expands our vinyl extrusion product offerings and expands our international presence in the global fenestration business; and |

4

Table of Contents

• | in November 2015, we completed the merger of QWMS, Inc., a Delaware corporation which was a newly-formed and wholly-owned Quanex subsidiary, and WII Holding, Inc. (WII), a Delaware corporation. Upon satisfaction or waiver of conditions set forth in the merger agreement, QWMS, Inc. merged with and into WII, and WII became our wholly-owned subsidiary, and, as a result, we acquired all the subsidiaries of WII (referred to collectively as Woodcraft). Woodcraft is a manufacturer of cabinet doors and other components to original equipment manufacturers (OEMs) in the kitchen and bathroom cabinet industry, and operates various plants in the United States and Mexico. See additional discussion of this transaction at Item 7. " Management's Discussion and Analysis of Financial Condition and Results of Operations ." |

As of October 31, 2015, we operated 23 manufacturing facilities located in 13 states in the United States, five facilities in the United Kingdom, and another in Germany. These facilities feature efficient plant design and flexible manufacturing processes, enabling us to produce a wide variety of custom engineered products and components primarily focused on the window and door segment of the residential building products markets. We are able to maintain minimal levels of finished goods inventories at most locations because we typically manufacture products upon order to customer specifications. We believe the primary drivers of our operating results are new home construction and residential remodeling and replacement activity.

Our Industry

Our business is largely North American based and dependent upon the spending and growth activity levels of our customers which include national and regional residential window and door manufacturers. With the HLP acquisition in June 2015, we have expanded our international presence and acquired a platform from which to sell vinyl extruded lineal for house systems to smaller customers primarily in the United Kingdom.

We use data related to United States and United Kingdom housing starts and window shipments, as published by or derived from third-party sources, to evaluate the United States and United Kingdom fenestration market.

The following table presents calendar-year annual and quarterly housing starts information, as published by the United States Census Bureau based on data collected from the National Association of Home Builders (NAHB), (units in thousands):

|

| Single-family Units |

| Multi-family Units |

| Manufactured Units |

|

| ||||||

Period |

| Units |

| % Change |

| Units |

| % Change |

| Units |

| % Change |

| Total Units |

Annual Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 |

| 444 |

| N/A |

| 111 |

| N/A |

| 49 |

| N/A |

| 604 |

2010 |

| 471 |

| 6% |

| 116 |

| 5% |

| 50 |

| 2% |

| 637 |

2011 |

| 434 |

| (8)% |

| 178 |

| 53% |

| 51 |

| 2% |

| 663 |

2012 |

| 537 |

| 24% |

| 247 |

| 39% |

| 55 |

| 8% |

| 839 |

2013 |

| 620 |

| 15% |

| 308 |

| 25% |

| 60 |

| 9% |

| 988 |

2014 |

| 647 |

| 4% |

| 354 |

| 15% |

| 64 |

| 7% |

| 1,065 |

Annual Data - Forecast |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

| 714 |

| 10% |

| 405 |

| 14% |

| 68 |

| 6% |

| 1,187 |

2016 |

| 877 |

| 23% |

| 378 |

| (7)% |

| 69 |

| 1% |

| 1,324 |

2017 |

| 1,148 |

| 31% |

| 372 |

| (2)% |

| 79 |

| 14% |

| 1,599 |

Quarterly Data - Forecast |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 : 1st quarter |

| 140 |

| N/A |

| 75 |

| N/A |

| No Data Available |

| 215 | ||

2nd quarter |

| 205 |

| 46% |

| 115 |

| 53% |

| No Data Available |

| 320 | ||

3rd quarter (1) |

| 203 |

| (1)% |

| 113 |

| (2)% |

| No Data Available |

| 316 | ||

(1) | Derived from IHS Global Insight's forecast report based on United States Census Data. |

5

Table of Contents

The following table presents calendar-year annual and quarterly window shipments information, derived from reports published by Ducker Worldwide LLC, a consulting and research firm, (units in thousands):

|

| New Construction |

| Remodeling & Replacement | ||||||||||||||||||||

Period |

| Wood |

| Aluminum |

| Vinyl |

| Fiberglass |

| Other |

| Total |

| Wood |

| Aluminum |

| Vinyl |

| Fiberglass |

| Other |

| Total |

Annual Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

| 2,778 |

| 1,746 |

| 6,729 |

| 526 |

| 167 |

| 11,946 |

| 6,139 |

| 1,012 |

| 21,079 |

| 840 |

| 573 |

| 29,643 |

2011 |

| 2,601 |

| 1,820 |

| 6,623 |

| 514 |

| 182 |

| 11,740 |

| 5,071 |

| 717 |

| 19,086 |

| 730 |

| 516 |

| 26,120 |

2012 |

| 2,736 |

| 2,516 |

| 8,625 |

| 592 |

| 237 |

| 14,706 |

| 4,566 |

| 696 |

| 18,902 |

| 657 |

| 594 |

| 25,415 |

2013 |

| 2,989 |

| 3,077 |

| 10,585 |

| 668 |

| 264 |

| 17,583 |

| 4,739 |

| 658 |

| 19,588 |

| 685 |

| 658 |

| 26,328 |

2014 |

| 3,108 |

| 3,471 |

| 11,651 |

| 728 |

| 291 |

| 19,249 |

| 4,697 |

| 718 |

| 19,972 |

| 698 |

| 677 |

| 26,762 |

Quarterly Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015: 1st quarter |

| 671 |

| 758 |

| 2,653 |

| 173 |

| 74 |

| 4,329 |

| 1,072 |

| 154 |

| 4,608 |

| 166 |

| 160 |

| 6,160 |

2nd quarter |

| 791 |

| 893 |

| 3,127 |

| 204 |

| 87 |

| 5,102 |

| 1,243 |

| 179 |

| 5,345 |

| 193 |

| 186 |

| 7,146 |

Quarterly Data - Forecast |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

3rd quarter |

| 944 |

| 1,065 |

| 3,731 |

| 243 |

| 103 |

| 6,086 |

| 1,318 |

| 189 |

| 5,666 |

| 205 |

| 197 |

| 7,575 |

4th quarter |

| 852 |

| 962 |

| 3,368 |

| 220 |

| 93 |

| 5,495 |

| 1,173 |

| 170 |

| 5,099 |

| 191 |

| 184 |

| 6,817 |

The following table presents calendar-year annual housing starts information in the United Kingdom, derived from reports published by D&G Consulting, a consulting and research firm, (units in thousands):

Housing Construction | ||||||||

|

| Private Housing |

| Public Housing | ||||

Period |

| Annual |

| % Change |

| Actual |

| % Change |

Actual Data |

|

|

|

|

|

|

|

|

2010 |

| 100 |

| -% |

| 30 |

| -% |

2011 |

| 100 |

| -% |

| 34 |

| 13% |

2012 |

| 104 |

| 4% |

| 32 |

| (6)% |

2013 |

| 102 |

| (2)% |

| 32 |

| -% |

2014 |

| 111 |

| 9% |

| 28 |

| (13)% |

Forecast Data |

|

|

|

|

|

|

|

|

2015 |

| 122 |

| 10% |

| 35 |

| 25% |

2016 |

| 141 |

| 16% |

| 30 |

| (14)% |

2017 |

| 155 |

| 10% |

| 28 |

| (7)% |

2018 |

| 165 |

| 6% |

| 28 |

| -% |

We have noted the following trends which we believe affect our industry:

• | the number of housing starts and window shipments in the United States has increased in recent years following a dramatic decline from 2007 through 2011. The NAHB expects this trend to continue for the next several years, which should result in higher demand for our fenestration products; |

• | the recent growth in the housing market has been predominately in new construction which has outpaced the growth in the residential remodeling and replacement sector; the recent recovery in new home construction in the United States has been led by multi-family homes compared to mid- and higher priced homes; the current growth in single-family homes has seen the share of the large tract builders increase and the smaller custom builders decrease; and multi-family and tract homes typically employ lower cost, less energy efficient windows; |

• | programs in the United States such as Energy Star have improved customer awareness of the technological advances in window and door energy-efficiency, but the government has been reluctant to enforce stricter energy standards; |

• | higher energy efficiency standards in Europe should favorably impact sales of our insulating glass spacer products in the short- to mid-term; and |

• | commodity prices have fluctuated in recent years, including the cost of critical materials used in our manufacturing processes such as resin, which impacts margins related to our vinyl extrusion products, oil products such as butyl, which impacts our insulating glass products, and aluminum and wood products used by our other businesses. |

6

Table of Contents

Strategy

Our vision is to be the preferred supplier to our customers in each market we serve. Our strategy to achieve this vision includes the following:

• | focus on organic growth with our current customer base and expand our market share with national and regional customers by providing: (1) a quality product; (2) a high level of customer service; (3) product choices at different price points; and (4) new products or enhancements to existing product offerings. These enhancements may include higher thermal efficiency, enhanced functionality, improved weatherability, better appearance and best-in-class quality for our fenestration products; |

• | realize improved profitability in our manufacturing processes through: (1) ongoing preventive maintenance programs; (2) better utilization of our capacity by focusing on operational efficiencies and reducing scrap; (3) marketing our value added products; and (4) focusing on employee safety; |

• | offer logistic solutions that provide our customers with just-in-time service which can reduce their processing costs; and |

• | pursue targeted business acquisitions which may include vertically integrated vinyl extrusion businesses or screen or wood product manufacturers, that allow us to expand our existing fenestration footprint, enhance our existing product offerings, acquire complementary technology, enhance our leadership position within the markets we serve, and expand into adjacent markets or service lines. |

Business Segments

We have two reportable business segments: (1) Engineered Products, comprised of our four operating segments focused primarily on North American fenestration, and (2) International Extrusion, comprised solely of HLP acquired on June 15, 2015. In addition, we recorded LIFO inventory adjustments, corporate office charges and inter-segment eliminations as Corporate & Other. Prior to April 1, 2014, we presented two reportable segments: (1) Engineered Products, and (2) Aluminum Sheet Products as well as corporate and other. On April 1, 2014, we sold Nichols, the sole operating segment included in our Aluminum Sheet Products reportable segment. To account for Nichols as a discontinued operation, we reclassified certain costs from Corporate & Other to Nichols, including a portion of the LIFO reserve, as well as insurance accruals related to workers compensation claims, to properly reflect these direct expenses as a component of the disposal group. The accounting policies of our operating segments are the same as those used to prepare our accompanying consolidated financial statements. Financial information specific to each segment is located in note 18 of the accompanying financial statements.

We produce window and door components for original equipment manufacturers that primarily serve the residential new construction, and residential remodeling and replacement markets. We manufacture insulating glass (IG) spacer systems, window and door profiles, window and patio door screens, aluminum cladding and other roll formed metal window components, door components such as thresholds and astragals, patio screen doors and custom window grilles, trim and architectural moldings in a variety of woods, thin film solar panel sealants, and engineered wood flooring. We operate five flexible IG spacer facilities, five polyvinyl chloride (PVC) extrusion facilities, nine facilities producing window and door screens, two facilities producing wood fenestration (door and window) components, one facility producing engineered wood flooring, four facilities producing other fenestration products, and two facilities producing PVC, plastic decking, fencing, hardware, conservatory roof component, and water retention barriers. The insulating glass facilities use compound-extrusion and laminating technology to produce highly engineered insulating glass spacer products from butyl, ethylene propylene dieneterpolymer (EPDM), composite and silicone-based raw materials. These spacer products separate two or three panes of glass in an IG unit to improve its thermal performance. Our vinyl extrusion facilities use automated production processes to manufacture vinyl and composite profiles which constitute the framing material used in the assembly of vinyl windows and patio doors.

We believe our strengths include design expertise, new technology development capability, customer service, just-in-time delivery systems, high quality manufacturing, the ability to generate unique patented products and participation in industry and governmental advocacy.

7

Table of Contents

Raw Materials and Supplies

We purchase a diverse range of raw materials, which include PVC, epoxy resin, butyl, titanium dioxide (TiO 2 ) desiccant powder, silicone and EPDM rubber compounds, coated and uncoated aluminum sheet and wood (both hardwood and softwood). These raw materials are generally available from several suppliers at market prices. We may enter into sole sourcing arrangements with our suppliers from time to time if we believe we can realize beneficial savings, but only after we have determined that the vendor can reliably supply our raw material requirements. These sole sourcing arrangements, generally have termination clauses to protect us if a sole sourced vendor could not provide raw materials timely and on economically feasible terms. We believe there are other qualified suppliers from which we could purchase raw materials and supplies.

Competition

Our products are sold under highly competitive conditions. We compete with a number of companies, some of which have greater financial resources than us. We believe the primary competitive factors in the markets we serve include price, product quality, delivery and the ability to manufacture to customer specifications. The volume of engineered building products that we manufacture represents a small percentage of annual domestic consumption. Similarly, our subsidiaries in the United Kingdom compete against some larger vinyl producers and many smaller window manufacturers.

We compete against a range of small and mid-size metal, vinyl and wood products suppliers, wood molding companies, and the in-house operations of customers who have vertically integrated fenestration operations. We also compete against IG spacer manufacturing firms. IG systems are used in numerous end markets including residential housing, commercial construction, appliances and transportation vehicles, but we primarily serve the residential housing market. Competition is largely based on regional presence, custom engineering, product development, quality, service and price. Primary competitors include, but are not limited to, Veka, Deceuninck, Axiall, Vision Extrusions, GED Integrated Solutions, Technoform, Swiss Spacer, Thermix, Rite Screen, Allmetal and Endura.

Sales, Marketing, and Distribution

We sell our products to customers in various countries. Therefore, we have sales representatives whose territories essentially cover the United States, Canada, Europe, and to a lesser extent, the Middle East, Latin and South America, Australia and Asia. Our sales force is tasked with selling and marketing our complete range of components, products and systems to national and regional OEMs through a direct sales force in North America and the United Kingdom, supplemented with the limited use of distributors and independent sales agents.

Customers

Certain of our businesses or product lines are largely dependent on a relatively few large customers. See page 51 of this Annual Report on form 10-K for related disclosure.

Sales Backlog

Given the short lead times involved in our business, we have a relatively low backlog, approximately $21 million as of October 31, 2015.The criteria for revenue recognition has not been met, and therefore, we have not recorded revenue or deferred revenue with regard to these sales orders. If these sales orders result in a sale, we will record as revenue during Fiscal 2016.

Seasonal Nature of Business

Our business is impacted by seasonality. We have historically experienced lower sales for our products during the first half of our fiscal year as winter weather reduces homebuilding and home improvement activity. Our operating income tends to decline during this period of lower sales because a high percentage of our operating expenses are fixed overhead. We typically experience more favorable results in the third and fourth quarters of the fiscal year. Expenses for labor and other costs are generally semi-variable throughout the year.

Working Capital

We fund operations through a combination of available cash and cash equivalents, short-term investments, and cash flow generated from our operations. In addition, our revolving credit facility is available for working capital needs. We extend credit to our domestic customers in the ordinary course of business generally for a term of 30 days, while the terms for our international customers vary from cash advances to 90 days. Inventory of raw materials are carried in quantities deemed necessary to ensure a smooth production process, some of which are governed by consignment agreements with suppliers. We strive to maintain minimal finished goods inventories, while ensuring an adequate supply on hand to service customer needs.

8

Table of Contents

Service Marks, Trademarks, Trade Names, and Patents

Our federally registered trademarks or service marks include QUANEX, QUANEX and design, "Q" design, TRUSEAL TECHNOLOGIES, DURASEAL, DURALITE, SOLARGAIN EDGE TAPE, ENVIROSEALED WINDOWS, EDGETHERM, COLONIAL CRAFT, EDGETECH, ECOBLEND, SUPER SPACER, TSS, TRUE WARM, E & Design, QUIET EDGE, HEALTH SMART WINDOWS, ENERGY WISE WINDOWS, DESI-ROPE, 360 and design, INTELLICLIP, SUSTAINAVIEW, MIKRON, MIKRONWOOD, MIKRONBLEND, MIKRON BLEND and design, ENERGYCORE, FUSION INSULATED SYSTEM, AIRCELL, SUPERCOAT, SUPERCAP, STYLELOCK, STYLELOCK and design, K2 MIKRON and design, HOMESHIELD, HOMESHIELD and design, and STORM SEAL. We consider the following marks, design marks and associated trade names to be valuable in the conduct of our business: HOMESHIELD, COLONIAL CRAFT, TRUSEAL TECHNOLOGIES, EDGETECH, MIKRON and QUANEX. With the acquisition of HLP in June 2015, we acquired a number of registered designs, patents and trademarks registered in the United Kingdom, which include: MODLOK, LINIAR, SUPERCUT, and various other trade marks and patents which are pending approval. Generally, our business does not depend on patent protection, but patents obtained with regard to our vinyl extrusion products and processes, fabricated metal components and IG spacer products business remain a valuable competitive advantage over other building products manufacturers. We obtain patent protection for various dyes and other tooling created in connection with the production of customer-specific vinyl profile designs and vinyl extrusions. Our fabricated metal components business obtains patent protection for its thresholds. Our window sealant business unit relies on patents to protect the design of several of its window spacer products. Although we hold numerous patents, the proprietary process technology that has been developed is also considered a source of competitive advantage.

Research and Development

In general, we expense research and development costs as incurred. We devote time, effort and expense to: (1) custom- engineer products for specific customer applications; (2) develop superior, proprietary process technology; and (3) partner with customers to develop new products. In addition, we may acquire businesses with patented technology in order to expand our product offerings.

Environmental and Employee Safety Matters

We are subject to extensive laws and regulations concerning worker safety, the discharge of materials into the environment and the remediation of chemical contamination. To satisfy such requirements, we must make capital and other expenditures on an on-going basis. The cost of worker safety and environmental matters has not had a material adverse effect on our operations or financial condition in the past, and we are not currently aware of any existing conditions that we believe are likely to have a material adverse effect on our operations, financial condition, or cash flows.

Safety and Environmental Policies

For many years, we have maintained compliance policies that are designed to help protect our workforce, to identify and reduce the potential for job-related accidents, and to minimize liabilities and other financial impacts related to worker safety and environmental issues. These policies include extensive employee training and education, as well as internal policies embodied in our Code of Business Conduct and Ethics. We have a Director of Environmental, Health and Safety and maintain a company-wide Safety Council, comprised of leaders from across the organization, which meets regularly to discuss safety issues and drive safety improvements. We plan to continue to focus on safety in particular as a core strategy to improve our operational efficiency and financial performance.

Remediation

Under applicable state and federal laws, we may be responsible for, among other things, all or part of the costs required to remove or remediate wastes or hazardous substances at locations we, or our predecessors, have owned or operated. From time to time, we also have been alleged to be liable for all or part of the costs incurred to clean up third-party sites where there might have been an alleged improper disposal of hazardous substances. At present, we are not involved in any such matters.

9

Table of Contents

Environmental Compliance Costs

We have incurred expenses to comply with existing environmental regulations which total approximately $0.2 million, $0.4 million and $0.3 million for the years ended October 31, 2015, 2014 and 2013, respectively. We have not incurred capital expenditures related to environmental matters during these years and we do not expect to incur such costs for fiscal 2016. However, future expenditures relating to environmental matters may result from the identification of new environmental issues, changes in regulations or environmental laws, or governmental actions with regards to existing sites. We will continue to have expenditures beyond fiscal 2015 in connection with environmental matters, including control of air emissions, control of water discharges and plant decommissioning costs. It is not possible at this time to reasonably estimate the amount of those expenditures, except as discussed above, due to uncertainties about emission levels, control technologies, the positions of governmental authorities and the application of requirements to us. Based upon our experience to date, we do not believe that our compliance with environmental requirements will have a material adverse effect on our operations, financial condition or cash flows.

Employees

As of October 31, 2015, we had 2,693 employees. Of these employees, 2,140 were domiciled in the United States, 490 in the United Kingdom, and 63 in Germany.

Geographic Information

Our manufacturing facilities and all long-lived assets are located in the United States, United Kingdom and Germany. Financial information specific to each geographic area is located in note 18 of the accompanying financial statements.

For Investors

We periodically file or furnish documents to the Securities and Exchange Commission (SEC), including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports as required. These reports are also available free of charge from the Investor Relations Section of our website at http://www.quanex.com , as soon as reasonably practicable after we file such material, or furnish it to the SEC. As permitted by the SEC rules, we post relevant information on our website. However, the information contained on our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this report.

Item 1A. Risk Factors.

The following risk factors, along with other information contained elsewhere in this Annual Report on Form 10-K and our other public filings with the SEC, should be carefully considered before deciding to invest in our securities. Additional risks and uncertainties that are not currently known to us or that we may view as immaterial could impair our business if such risks were to develop into actual events. Therefore, any of these risks could have a material adverse effect on our financial condition, results of operations and cash flows. This listing of risk factors is not all-inclusive and is not necessarily presented in order of importance.

Industry Risks

Any sustained decline in residential remodeling, replacement activities, or housing starts could have a material adverse effect on our business, financial condition and results of operations.

The primary drivers of our business are residential remodeling, replacement activities and housing starts. The home building and residential construction industry is cyclical and seasonal, and product demand is based on numerous factors such as interest rates, general economic conditions, consumer confidence and other factors beyond our control. Declines in the number of housing starts and remodeling expenditures resulting from such factors could have a material adverse effect on our business, results of operations and financial condition.

If the availability of critical raw materials were to become scarce or if the price of these items were to increase significantly, we might not be able to timely produce products for our customers or maintain our profit levels.

We purchase from outside sources significant amounts of raw materials, such as butyl, titanium dioxide, vinyl resin, aluminum, steel and wood products for use in our manufacturing facilities. Because we do not have long-term contracts for the supply of many of our raw materials, their availability and price are subject to market fluctuation and may be subject to curtailment or change. Any of these factors could affect our ability to timely and cost-effectively manufacture products for our customers.

10

Table of Contents

Compliance with, or liabilities under, existing or future environmental laws and regulations could significantly increase our costs of doing business.

We are subject to extensive federal, state and local laws and regulations concerning the discharge of materials into the environment and the remediation of chemical contamination. To satisfy such requirements, we must make capital and other expenditures on an on-going basis. Future expenditures relating to environmental matters will necessarily depend upon whether such regulations and future governmental decisions or interpretations of these regulations apply to us and our facilities. It is likely that we will be subject to increasingly stringent environmental standards, and we will incur additional expenditures to comply with such standards. Furthermore, if we fail to comply with applicable environmental regulations, we could be subject to substantial fines or penalties and to civil and criminal liability.

Our goodwill and indefinite-lived intangible assets may become impaired and could result in a charge to income.

We evaluate our goodwill and indefinite-lived intangible assets at least annually to determine whether we must test for impairment. In making this assessment, we must use judgment to make estimates of future operating results and appropriate residual values. Actual future operating results and residual values associated with our operations could differ significantly from these estimates, which may result in an impairment charge in a future period, resulting in a decrease in net income from operations in the year of the impairment, as well as a decline in our recorded net worth.

We may not be able to protect our intellectual property.

We rely on a combination of copyright, patent, trade secrets, confidentiality procedures and contractual commitments to protect our proprietary information. However, these measures can only provide limited protection and unauthorized third parties may try to copy or reverse engineer portions of our products or may otherwise obtain and use our intellectual property. If we cannot protect our proprietary information against unauthorized use, we may not be able to retain a perceived competitive advantage and we may lose sales to the infringing sellers, which may have a material adverse effect on our financial condition, results of operations and cash flows.

We are subject to various existing and contemplated laws, regulations and government initiatives that may materially impact the demand for our products, our profitability or our costs of doing business.

Our business may be materially impacted by various governmental laws, regulations and initiatives that may artificially create, deflate, accelerate, or decelerate consumer demand for our products. For example, when the government issues tax credits designed to encourage increased homebuilding or energy-efficient window purchases, the credits may create a spike in demand that would not otherwise have occurred and our production capabilities may not be able to keep pace, which could materially impact our profitability. Likewise, when such laws, regulations or initiatives expire, our business may experience a material loss in sales volume or an increase in production costs as a result of the decline in consumer demand.

Our operations outside the United States require us to comply with a number of United States and international anti-corruption regulations, violations of which could have a material adverse effect on our consolidated results of operations and consolidated financial condition.

Our international operations require us to comply with a number of United States and international regulations, including the Foreign Corrupt Practices Act (FCPA) and the United Kingdom Bribery Act 2010. While we have implemented appropriate training and compliance programs to prevent violations of these anti-bribery regulations, we cannot ensure that our policies, procedures and programs will always protect us from reckless or criminal acts committed by our employees or agents. Allegations of violations of applicable anti-corruption laws, may result in internal, independent, or government investigations, and violations of anti-corruption laws may result in severe criminal or civil sanctions or other liabilities which could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

Failure to achieve and maintain effective internal controls could have a material adverse effect on our business and on our stock price.

Effective internal controls are necessary for us to effectively monitor our business, prevent fraud or theft, remain in compliance with our credit facility covenants, and provide reliable financial reports, both to the public and to our lenders. If we fail to maintain the adequacy of our internal controls, both in accordance with current standards and as standards are modified over time, we could trigger an event of default under our credit facilities or lose the confidence of the investing community, both of which could result in a material adverse effect on our stock price, limit our ability to borrow funds, or result in the application of unfavorable commercial terms to borrowings then outstanding.

11

Table of Contents

Company Risks

Our business will suffer if we are unable to adequately address potential supplier or customer pricing pressures, particularly with respect to original equipment manufacturers that have significant pricing leverage over suppliers.

Our primary customers are OEMs, who have substantial leverage in setting purchasing and payment terms. We attempt to manage this pricing pressure and to preserve our business relationships with the OEMs by negotiating reasonable price concessions when needed, and by reducing our production costs through various measures, which may include managing our purchase process to control the cost of our raw materials and components, and implementing cost-effective process improvements. However, our efforts may not be successful and our operating margins could be negatively impacted.

Our revenues could decline or we may lose business if our customers vertically integrate their operations, diversify their supplier base, or transfer manufacturing capacity to other regions.

Certain of our businesses or product lines are largely dependent on a relatively few large customers. Although we believe we have an extensive customer base, if we were to lose one of these large customers or if such customer were to materially reduce its purchases as a result of vertical integration, supplier diversification, or a shift in regional focus, our revenue, general financial condition and results of operations could be adversely affected.

Our credit facility contains certain operational restrictions, reporting requirements, and financial covenants that limit the aggregate availability of funds.

Our credit facility is comprised of an asset-based lending (ABL) revolver and a term loan, each of which contains certain financial covenants and other operating and reporting requirements that could present risk to our operating results or limit our ability to access capital for use in the business. For a full discussion of the various covenants and operating requirements imposed by our new credit facility and information related to the potential limitations on our ability to access capital, see Item 7 page 31. Management's Discussion and Analysis of Financial Conditions and Results of Operations-Liquidity and Capital Resources , in this Annual Report on Form 10-K.

We may not be able to successfully identify, manage or integrate future acquisitions, and if we are unable to do so, then our rate of growth and profitability could be adversely affected.

We cannot provide assurance that we will be able to identify appropriate targets for acquisition, or that we will successfully manage or integrate acquisition targets once we have purchased them. If we acquire a business for which we do not fully understand or appreciate the specific business risks, if we overvalue an acquisition or fail to conduct effective due diligence on an acquisition, or if we fail to effectively and efficiently integrate a business that we acquire, then there could be a material adverse effect on our ability to achieve the projected growth and cash flow goals associated with the new business, which could result in an overall material adverse effect on our long-term profitability or revenue generation.

If our information technology systems fail, or if we experience an interruption in our operations due to an aging IT infrastructure, then our results of operations and financial condition could be materially adversely affected.

The failure of our information technology systems, our inability to successfully maintain, enhance and/or replace our information technology systems when necessary, or a significant compromise of the integrity or security of the data that is generated from our information technology systems, could adversely affect our results of operations and could disrupt business and prevent or severely limit our ability to respond to data requests from our customers, suppliers, auditors, shareholders, employees or government authorities.

We may not have the right personnel in place to achieve our operating goals and the rural location of some of our operations may make it difficult to locate or hire highly skilled employees.

We operate in some rural areas and small towns where the competition for labor can be fierce, and where the pool of qualified employees may be very small. If we are unable to obtain skilled workers and adequately trained professionals to conduct our business, we may not be able to manage our business to the necessary high standards. In addition, we may be forced to pay higher wages or offer other benefits that might impact our cost of labor and thereby negatively impact our profitability.

12

Table of Contents

Equipment failures or catastrophic loss at any of our manufacturing facilities could prevent us from manufacturing our products.

An interruption in production capabilities at any of our facilities due to equipment failure, catastrophic loss, or other reasons could result in our inability to manufacture products, which could severely affect delivery times, return or cancellation rates, and future sales, any of which could result in lower sales and earnings or the loss of customers. Although we have a disaster recovery plan in place, we currently have one plant which is the sole source for our insulating spacer business in the United States. If that plant were to experience a catastrophic loss and our disaster recovery plan were to fail, it could have a material adverse effect on our results of operations or financial condition.

Product liability claims and product replacements could harm our reputation, revenue generation and financial condition, or could result in costs related to litigation, warranty claims, or customer accommodations.

We have, on occasion, found flaws and deficiencies in the manufacturing, design, testing or installation of our products, which may result from a product defect, a defect in a component part provided by our suppliers, or as a result of the product being installed incorrectly by our customer or an end user. The failure of products before or after installation could result in litigation or claims by our customers or other users of the products, which may result in the need for us to expend legal fees or other related warranty coverage, settlement, or customer accommodation costs related to the replacement of products or the retrofitting of affected structures.

Risks Associated with Investment in Quanex Securities

Our corporate governance documents or the provisions of Delaware law may delay or preclude a business acquisition or divestiture that stockholders may consider to be favorable, which might result in a decrease in the value of our common shares.

Our certificate of incorporation and bylaws and Delaware law contain provisions that could make it more difficult for a third party to acquire us without the consent of our Board of Directors. These provisions include restrictions on the ability of our stockholders to remove directors and supermajority voting requirements for stockholders to amend our organizational documents, a classified Board of Directors, and limitations on action by our stockholders by written consent. Our Board has recently approved amendments to our Certificate of Incorporation that are designed to declassify director elections and lower our supermajority voting thresholds, and plans to present those amendments for stockholder approval at our 2016 annual meeting. However, those proposed changes might not be approved by our stockholders and, as such, the current classified Board structure and supermajority voting requirements may continue to apply in the future. In addition, our Board of Directors has the right to issue preferred stock without stockholder approval, which could be used to dilute the stock ownership of a potential hostile acquirer. Although we believe these provisions protect our stockholders from coercive or otherwise unfair takeover tactics, and thereby provide for an opportunity for us to receive a higher bid by requiring potential acquirers to negotiate with our Board of Directors, these provisions apply even if the offer may be considered beneficial by some stockholders.

We have the ability to issue additional equity securities, which would lead to dilution of our issued and outstanding common stock.

We are authorized to issue, without stockholder approval, 1,000,000 shares of preferred stock, no par value, in one or more series, which may give other stockholders dividend, conversion, voting, and liquidation rights, among other rights, which may be superior to the rights of holders of our common stock. The issuance of additional equity securities or securities convertible into equity securities would result in dilution of existing stockholders' equity interests. Our Board of Directors has no present intention to issue any such preferred shares, but has the right to do so in the future. In addition, we were authorized, by prior stockholder approval, to issue up to 125,000,000 shares of our common stock, $0.01 par value per share. These authorized shares can be issued, without stockholder approval, as securities convertible into either common stock or preferred stock.

Item 1B. Unresolved Staff Comments.

None.

13

Item 2. Properties.

The following table lists our principal properties by location, general character and use as of October 31, 2015. These properties are owned by us, unless indicated otherwise.

Location |

| Character & Use of Property |

Executive Offices |

|

|

Houston, Texas (Lease expires 2023) |

| Executive corporate office |

Engineered Products Segment |

|

|

Rice Lake, Wisconsin |

| Fenestration products |

Chatsworth, Illinois |

| Fenestration products |

Richmond, Indiana |

| Fenestration products |

Solon, Ohio (Lease expires 2017) |

| Flexible spacer, and adhesive research and sales |

Luck, Wisconsin |

| Wood products |

Richmond, Kentucky |

| Vinyl and composite extrusions |

Winnebago, Illinois |

| Vinyl extrusions |

Mounds View, Minnesota (Lease expires 2016) |

| Fenestration products |

Kent, Washington (Lease expires 2020) |

| Vinyl and composite extrusions |

Yakima, Washington (Lease expires 2016) |

| Vinyl extrusions |

Dubuque, Iowa (Leased expires 2017) |

| Fenestration products |

Shawano, Wisconsin (Lease expires 2020) |

| Wood flooring |

Cambridge, Ohio, (Lease expires 2021) |

| Flexible spacer and solar adhesives |

Coventry, United Kingdom |

| Flexible spacer |

Heinsberg, Germany (Lease expires 2025) |

| Flexible spacer |

Sacramento, California (Lease expires 2016) |

| Screens for vinyl windows and doors |

Des Moines, Iowa (Lease expires 2019) |

| Screens for vinyl windows and doors |

Phoenix, Arizona (Lease expires 2015 & 2018) |

| Screens for vinyl windows and doors |

Denver, Colorado (Lease expires 2020) |

| Screens for vinyl windows and doors |

Paris, Illinois (Lease expires 2017) |

| Screens for vinyl windows and doors |

Parkersburg, West Virginia (Lease expires 2017) |

| Screens for vinyl windows and doors |

Fontana, California (Lease expires 2019) |

| Screens for vinyl windows and doors |

Perrysburg, Ohio (Lease expires 2019) |

| Screens for vinyl windows and doors |

Chehalis, Washington (Leases expire 2015 & 2019) |

| Screens for vinyl windows and doors |

Greenville, Texas (Lease expires 2020) |

| Vinyl extrusions |

Burnley, United Kingdom (Lease expires 2020) |

| Flexible/ rigid spacer |

International Extrusion Segment |

|

|

Denby, United Kingdom (Lease expires 2027) |

| Vinyl and composite extrusions |

Riddings, United Kingdom (Lease expires 2017) |

| Machinery Sales |

Alfreton, United Kingdom (Lease expires 2017) |

| Vinyl and composite extrusions |

We believe our operating properties are in good condition and well maintained, and are generally suitable and adequate to carry on our business. In fiscal 2015, our facilities operated at approximately 60% of capacity.

Item 3. Legal Proceedings.

From time to time, we, along with our subsidiaries, are party to various legal proceedings arising in the ordinary course of business. We reserve for litigation loss contingencies that are both probable and reasonably estimable. We do not expect that losses resulting from any current legal proceedings will have a material adverse effect on our consolidated financial statements if or when such losses are incurred.

14

For discussion of environmental issues, see Item 1 , "Business - Environmental and Employee Safety Matters" discussed elsewhere in this Annual Report on Form 10-K.

Item 4. Mine Safety Disclosures.

Not Applicable.

15

Table of Contents

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock, $0.01 par value, has been listed on the New York Stock Exchange under the ticker symbol NX since April 24, 2008. The following table sets forth, for the periods indicated, the high and low sales price per share of our common stock as reported, and the quarterly cash dividend declared per share on our common stock.

| NX Stock Price |

| Cash Dividends | ||||||||

Period | High |

| Low |

| Declared | ||||||

Quarter ended October 31, 2015 | $ | 20.91 | |

| $ | 17.03 | |

| $ | 0.04 | |

Quarter ended July 31, 2015 | 21.93 | |

| 17.34 | |

| 0.04 | | |||

Quarter ended April 30, 2015 | 21.79 | |

| 18.64 | |

| 0.04 | | |||

Quarter ended January 31, 2015 | 20.72 | |

| 17.65 | |

| 0.04 | | |||

Quarter ended October 31, 2014 | 20.26 | |

| 16.96 | |

| 0.04 | | |||

Quarter ended July 31, 2014 | 19.16 | |

| 16.50 | |

| 0.04 | | |||

Quarter ended April 30, 2014 | 21.42 | |

| 17.78 | |

| 0.04 | | |||

Quarter ended January 31, 2014 | $ | 20.54 | |

| $ | 16.98 | |

| $ | 0.04 | |

The terms of our revolving credit agreement as of October 31, 2015 do not specifically limit the total amount of dividends or other distributions to our shareholders. Dividends and other distributions are permitted so long as after giving effect to such dividend or stock repurchase, there is no event of default.

There were approximately 2,415 holders of our common stock (excluding individual participants in securities positions listings) on record as of December 11, 2015.

Equity Compensation Plan Information

The following table summarizes certain information regarding equity compensation to our employees, officers and directors under equity compensation plans as of October 31, 2015:

| (a) |

| (b) |

| (c) | ||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

| Weighted-average exercise price of outstanding options, warrants and rights |

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

Equity compensation plans approved by security holders | 2,352,188 | |

| $ | 16.46 | |

| 1,080,907 | |

Issuer Purchases of Equity Securities

On September 5, 2014, our Board of Directors approved a stock repurchase program authorizing us to use up to $75.0 million to repurchase shares of our common stock. During the year ended October 31, 2014, we purchased 1,316,326 shares at a cost of $24.2 million under this program. During the year ended October 31, 2015, we purchased an additional 2,675,903 shares at a cost of $50.8 million. From inception of the program, we purchased 3,992,229 shares at a cost of $75.0 million, an average price of $18.77 per share. This program is now closed and no additional purchases are being made thereunder.

16

Table of Contents

Stock Performance Graph

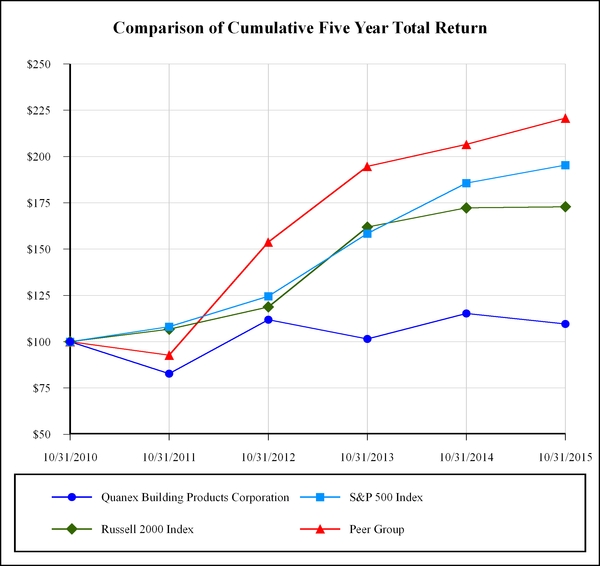

The following chart represents a comparison of the five year total return of our common stock to the Standard & Poor's 500 Index (S&P 500), the Russell 2000 Index, and a peer group index selected by us, which includes companies offering similar products and services as ours. The companies included in the peer group are American Woodmark Corp, Apogee Enterprises Inc, Builders FirstSource Inc., Drew Industries Inc., Eagle Materials Inc., Gibraltar Industries Inc., Griffon Corp., Louisiana-Pacific Corp., Simpson Manufacturing Company Inc., Trex Company Inc., NCI Building Systems Inc., Nortek Inc., Ply Gem Holding Inc., and Universal Forest Products Inc.

INDEXED RETURNS |

| For the Years Ended | ||||||||||||||||||||

Company Name / Index |

| 10/31/2010 |

| 10/31/2011 | |

| 10/31/2012 | |

| 10/31/2013 | |

| 10/31/2014 | |

| 10/31/2015 | | |||||

Quanex Building Products Corporation |

| $100 |

| $ | 82.69 | |

| $ | 111.87 | |

| $ | 101.51 | |

| $ | 115.27 | |

| $ | 109.54 | |

S&P 500 Index |

| 100 |

| 108.09 | |

| 124.52 | |

| 158.36 | |

| 185.71 | |

| 195.37 | | |||||

Russell 2000 Index |

| 100 |

| 106.71 | |

| 118.78 | |

| 161.87 | |

| 172.28 | |

| 172.86 | | |||||

Peer Group |

| $100 |

| $ | 92.71 | |

| $ | 153.76 | |

| $ | 194.67 | |

| $ | 206.51 | |

| $ | 220.72 | |

17

Table of Contents

Item 6. Selected Financial Data.

The following table presents selected historical consolidated financial and operating data for the periods shown. The selected consolidated financial data as of October 31, 2015, 2014, 2013, 2012 and 2011 and for each of the fiscal years then ended was derived from our audited consolidated financial statements for those dates and periods, adjusted for discontinued operations, as indicated. The following information should be read in conjunction with " Management's Discussion and Analysis of Financial Condition and Results of Operations " and our financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

| Fiscal Years Ended October 31, | ||||||||||||||||||

| 2015 (1) |

| 2014 (2)(7) |

| 2013 (2)(3) |

| 2012 (2)(4)(5)(7) |

| 2011 (2)(6)(7) | ||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||

Consolidated Statements of Income |

|

|

|

|

|

|

|

|

| ||||||||||

Net sales | $ | 645,528 | |

| $ | 595,384 | |

| $ | 554,867 | |

| $ | 478,578 | |

| $ | 420,258 | |

Cost and expenses: |

|

|

|

|

|

|

|

|

| ||||||||||

Cost of sales | 499,097 | |

| 464,584 | |

| 419,733 | |

| 355,669 | |

| 315,765 | | |||||

Selling, general and administrative | 86,536 | |

| 82,150 | |

| 98,969 | |

| 100,884 | |

| 75,918 | | |||||

Depreciation and amortization | 35,220 | |

| 33,869 | |

| 53,521 | |

| 29,975 | |

| 25,390 | | |||||

Asset impairment charges | - | |

| 505 | |

| 1,465 | |

| 912 | |

| 1,799 | | |||||

Operating income (loss) | 24,675 | |

| 14,276 | |

| (18,821 | ) |

| (8,862 | ) |

| 1,386 | | |||||

Non-operating income (expense): |

|

|

|

|

|

|

|

|

| ||||||||||

Interest expense | (991 | ) |

| (562 | ) |

| (621 | ) |

| (431 | ) |

| (430 | ) | |||||

Other, net | (531 | ) |

| 92 | |

| 170 | |

| 225 | |

| (510 | ) | |||||

Income (loss) from continuing operations before income taxes | 23,153 | |

| 13,806 | |

| (19,272 | ) |

| (9,068 | ) |

| 446 | | |||||

Income tax benefit (expense) | (7,539 | ) |

| (5,468 | ) |

| 6,888 | |

| 2,507 | |

| (857 | ) | |||||

Income (loss) from continuing operations | 15,614 | |

| 8,338 | |

| (12,384 | ) |

| (6,561 | ) |

| (411 | ) | |||||

Income (loss) from discontinued operations, net of taxes | 479 | |

| 20,896 | |

| 681 | |

| (9,973 | ) |

| 9,477 | | |||||

Net income (loss) | $ | 16,093 | |

| $ | 29,234 | |

| $ | (11,703 | ) |

| $ | (16,534 | ) |

| $ | 9,066 | |

Basic earnings per common share: |

|

|

|

|

|

|

|

|

| ||||||||||

Basic earnings (loss) from continuing operations | $ | 0.46 | |

| $ | 0.22 | |

| $ | (0.34 | ) |

| $ | (0.18 | ) |

| $ | (0.01 | ) |

Basic earnings (loss) from discontinued operations | 0.01 | |

| 0.57 | |

| 0.02 | |

| (0.27 | ) |

| 0.25 | | |||||

Basic earnings (loss) per share | $ | 0.47 | |

| $ | 0.79 | |

| $ | (0.32 | ) |

| $ | (0.45 | ) |

| $ | 0.24 | |

Diluted earnings per common share: |

|

|

|

|

|

|

|

|

| ||||||||||

Diluted earnings (loss) from continuing operations | $ | 0.46 | |

| $ | 0.22 | |

| $ | (0.34 | ) |

| $ | (0.18 | ) |

| $ | (0.01 | ) |

Diluted earnings (loss) from discontinued operations | 0.01 | |

| 0.56 | |

| 0.02 | |

| (0.27 | ) |

| 0.25 | | |||||

Diluted earnings (loss) per share | $ | 0.47 | |

| $ | 0.78 | |

| $ | (0.32 | ) |

| $ | (0.45 | ) |

| $ | 0.24 | |

Cash dividends declared per share | $ | 0.16 | |

| $ | 0.16 | |

| $ | 0.16 | |

| $ | 0.16 | |

| $ | 0.16 | |

Other Financial & Operating Data |

|

|

|

|

|

|

|

|

| ||||||||||

Income (loss) from continuing operations, percent of net sales | 2.4% |

| 1.4% |

| (2.2)% |

| (1.4)% |

| -% | ||||||||||

Cash provided by operating activities | $ | 67,087 | |

| $ | 20,778 | |

| $ | 43,519 | |

| $ | 26,478 | |

| $ | 52,944 | |

Cash (used for) provided by investing activities | (160,144 | ) |

| 74,124 | |

| (59,687 | ) |

| (41,704 | ) |

| (135,367 | ) | |||||

Cash used for financing activities | (4,581 | ) |

| (24,459 | ) |

| (4,869 | ) |

| (3,928 | ) |

| (14,914 | ) | |||||

Acquisitions, net of cash acquired | 131,689 | |

| 5,161 | |

| 22,096 | |

| - | |

| 110,845 | | |||||

Capital expenditures | $ | 29,982 | |

| $ | 33,779 | |

| $ | 37,931 | |

| $ | 42,871 | |

| $ | 25,312 | |

Selected Consolidated Balance Sheet Data at Year End |

|

|

|

|

|

|

|

|

| ||||||||||

Cash and cash equivalents | $ | 23,125 | |

| $ | 120,384 | |

| $ | 49,734 | |

| $ | 71,252 | |

| $ | 89,616 | |

Total assets | 572,031 | |

| 517,113 | |

| 571,815 | |

| 589,538 | |

| 584,929 | | |||||

Long-term debt, excluding current portion | 55,041 | |

| 586 | |

| 701 | |

| 789 | |

| 860 | | |||||

Total liabilities | $ | 176,736 | |

| $ | 96,193 | |

| $ | 155,621 | |

| $ | 167,711 | |

| $ | 147,703 | |

18

Table of Contents

(1) | In June 2015, we acquired all of the outstanding share capital of Flamstead Holdings Limited, a vinyl profile extruder with operations located in the United Kingdom, following a pre-acquisition reorganization. The results of operations of this acquired business have been included in our consolidated operating results since the date of acquisition, June 15, 2015, contributing net income of $1.5 million. |

(2) In April 2014, we sold Nichols to Aleris. Accordingly, the assets and liabilities of Nichols were reported as discontinued operations in the consolidated balance sheets for the applicable periods presented, and the related operating results are reported as discontinued operations in the consolidated statements of income (loss) presented, as applicable.

(3) In December 2012, we acquired substantially all the assets of Alumco, Inc. and its subsidiaries, a manufacturer of window screens, with multiple facilities within the United States. Alumco provided revenues of $49.1 million and a net loss of approximately $0.1 million for the period December 2012 through October 31, 2013.

(4) In November 2011, we announced a consolidation program for two of our insulating glass manufacturing facilities, whereby we closed a facility in Barbourville, Kentucky. This facility consolidation was completed ahead of schedule in August 2012. In fiscal 2012, we recorded expenses totaling $9.0 million ($5.9 million net of tax) related to this consolidation.

(5) In fiscal 2012, we experienced a strike at two of our Nichols facilities in Davenport, Iowa, which had a negative impact on income (loss) from discontinued operations, reducing operating income by approximately $11.1 million ($7.3 million net of tax), including a reduction in sales volume and incremental direct costs.

(6) In March 2011, we acquired Edgetech, I.G. Inc. and its German subsidiary. Headquartered in Cambridge, Ohio, Edgetech has three manufacturing facilities, one each in the United States, United Kingdom and Germany, that produced and marketed a full line of warm edge insulating glass spacer systems for window and door customers in North America and abroad. In addition, in March 2011, we acquired a small vinyl extrusion facility in Yakima, Washington. Accordingly, the estimated fair value of assets acquired in the acquisition and the results of operations were included in our consolidated financial statements as of the effective date of the acquisition.

(7) In fiscal 2011, we recognized an expense of $1.9 million ($1.1 million net of tax) to increase our warranty reserve associated with a discontinued legacy product and claims. In fiscal 2014, we decreased our warranty reserve and reduced expense by $2.8 million ($1.8 million net of tax) related to claims associated with this discontinued legacy product.

19

Table of Contents

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis contains forward-looking statements based on our current assumptions, expectations, estimates and projections about our business and the homebuilding industry, and therefore, it should be read in conjunction with our consolidated financial statements and related notes thereto, as well as "Cautionary Note Regarding Forward-Looking Statements" discussed elsewhere within this Annual Report on Form 10-K. For a listing of potential risks and uncertainties which impact our business and industry, see Item 1A, "Risk Factors." Actual results could differ from our expectations due to several factors which include, but are not limited to: market price and demand for our products, economic and competitive conditions, capital expenditures, new technology, regulatory changes and other uncertainties. Unless otherwise required by law, we undertake no obligation to publicly update any forward-looking statements, even if new information becomes available or other events occur in the future.

Our Business

We manufacture components primarily for the window and door (fenestration) industry, which include (1) energy-efficient flexible insulating glass spacers, (2) extruded vinyl profiles, (3) window and door screens, and (4) precision-formed metal and wood products for original equipment manufacturers (OEMs). In addition, we provide certain non-fenestration components and products, which include solar panel sealants, wood flooring, trim moldings, plastic decking, fencing, water retention barriers, hardware and conservatory roof components. In November 2015, we expanded our product offerings by acquiring a business that manufactures cabinet doors and other components for OEMs in the kitchen and bathroom cabinet industry. We use low-cost production processes and engineering expertise to provide our customers with specialized products for their specific window, door, wood flooring, and cabinet applications. We believe these capabilities provide us with unique competitive advantages. We serve a primary customer base in North America and the United Kingdom, and also serve customers in international markets through our operating plants in the United Kingdom and Germany, as well as through sales and marketing efforts in other countries.

We continue to invest in organic growth initiatives and have completed several targeted business acquisitions. We intend to continue to pursue business acquisitions which may include vertically integrated vinyl extrusion businesses, screen manufacturers, wood product or cabinet door manufacturers or businesses in complementary industries that allow us to expand our existing fenestration and wood product footprint, enhance our product offerings, provide new complementary technology, enhance our leadership position within the markets we serve, and expand into new markets or service lines.