UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2018

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Commission File Number 1-11758

(Exact Name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 1585 Broadway New York, NY 10036 (Address of principal executive offices, including zip code)

| 36-3145972 (I.R.S. Employer Identification No.) | (212) 761-4000 (Registrant's telephone number, including area code) | |||

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ☒ | Accelerated Filer ☐ | |

Non-Accelerated Filer ☐ | Smaller reporting company ☐ | |

(Do not check if a smaller reporting company) | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 31, 2018, there were 1,744,789,709 shares of the Registrant's Common Stock, par value $0.01 per share, outstanding.

QUARTERLY REPORT ON FORM 10-Q

For the quarter ended June 30, 2018

Table of Contents | Part | Item | Page | |||||||||

Financial Information | I | 1 | ||||||||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | I | 2 | 1 | |||||||||

Introduction | 1 | |||||||||||

Executive Summary | 2 | |||||||||||

Business Segments | 7 | |||||||||||

Supplemental Financial Information and Disclosures | 18 | |||||||||||

Accounting Development Updates | 19 | |||||||||||

Critical Accounting Policies | 19 | |||||||||||

Liquidity and Capital Resources | 19 | |||||||||||

Quantitative and Qualitative Disclosures about Market Risk | I | 3 | 32 | |||||||||

Report of Independent Registered Public Accounting Firm | 41 | |||||||||||

Financial Statements | I | 1 | 42 | |||||||||

Consolidated Financial Statements and Notes | 42 | |||||||||||

Consolidated Income Statements (Unaudited) | 42 | |||||||||||

Consolidated Comprehensive Income Statements (Unaudited) | 43 | |||||||||||

Consolidated Balance Sheets (Unaudited at June 30, 2018) | 44 | |||||||||||

Consolidated Statements of Changes in Total Equity (Unaudited) | 45 | |||||||||||

Consolidated Cash Flow Statements (Unaudited) | 46 | |||||||||||

Notes to Consolidated Financial Statements (Unaudited) | 47 | |||||||||||

1. Introduction and Basis of Presentation | 47 | |||||||||||

2. Significant Accounting Policies | 48 | |||||||||||

3. Fair Values | 50 | |||||||||||

4. Derivative Instruments and Hedging Activities | 61 | |||||||||||

5. Investment Securities | 65 | |||||||||||

6. Collateralized Transactions | 68 | |||||||||||

7. Loans, Lending Commitments and Allowance for Credit Losses | 69 | |||||||||||

8. Equity Method Investments | 71 | |||||||||||

9. Deposits | 72 | |||||||||||

10.Borrowings and Other Secured Financings | 72 | |||||||||||

11.Commitments, Guarantees and Contingencies | 72 | |||||||||||

12.Variable Interest Entities and Securitization Activities | 76 | |||||||||||

13.Regulatory Requirements | 79 | |||||||||||

14.Total Equity | 81 | |||||||||||

15.Earnings per Common Share | 83 | |||||||||||

16.Interest Income and Interest Expense | 84 | |||||||||||

17.Employee Benefit Plans | 84 | |||||||||||

18.Income Taxes | 84 | |||||||||||

19.Segment, Geographic and Revenue Information | 85 | |||||||||||

20.Subsequent Events | 87 | |||||||||||

| Financial Data Supplement (Unaudited) | 88 | |||||||||||

| Glossary of Common Acronyms | 91 | |||||||||||

| Other Information | II | 93 | ||||||||||

| Legal Proceedings | II | 1 | 93 | |||||||||

| Unregistered Sales of Equity Securities and Use of Proceeds | II | 2 | 94 | |||||||||

| Controls and Procedures | I | 4 | 95 | |||||||||

| Exhibits | II | 6 | 95 | |||||||||

| Exhibit Index | E-1 | |||||||||||

| Signatures | S-1 |

| i |

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file with the SEC at the SEC's public reference room at 100 F Street, NE, Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for information on the public reference room. The SEC maintains an internet site, www.sec.gov , that contains annual, quarterly and current reports, proxy and information statements and other information that issuers file electronically with the SEC. Our electronic SEC filings are available to the public at the SEC's internet site.

Our internet site is www.morganstanley.com . You can access our Investor Relations webpage at www.morganstanley.com/about-us-ir . We make available free of charge, on or through our Investor Relations webpage, our Proxy Statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended ("Exchange Act"), as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We also make available, through our Investor Relations webpage, via a link to the SEC's internet site, statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

You can access information about our corporate governance at www.morganstanley.com/about-us-governance. Our Corporate Governance webpage includes:

| • | Amended and Restated Certificate of Incorporation; |

| • | Amended and Restated Bylaws; |

| • | Charters for our Audit Committee, Compensation, Management Development and Succession Committee, Nominating and Governance Committee, Operations and Technology Committee, and Risk Committee; |

| • | Corporate Governance Policies; |

| • | Policy Regarding Corporate Political Activities; |

| • | Policy Regarding Shareholder Rights Plan; |

| • | Equity Ownership Commitment; |

| • | Code of Ethics and Business Conduct; |

| • | Code of Conduct; |

| • | Integrity Hotline Information; and |

| • | Environmental and Social Policies. |

Our Code of Ethics and Business Conduct applies to all directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer and Deputy Chief Financial Officer. We will post any amendments to the Code of Ethics and Business Conduct and any waivers that are required to be disclosed by the rules of either the SEC or the New York Stock Exchange LLC ("NYSE") on our internet site. You can request a copy of these documents, excluding exhibits, at no cost, by contacting Investor Relations, 1585 Broadway, New York, NY 10036 (212-761-4000). The information on our internet site is not incorporated by reference into this report.

| ii |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

Introduction

Morgan Stanley is a global financial services firm that maintains significant market positions in each of its business segments-Institutional Securities, Wealth Management and Investment Management. Morgan Stanley, through its subsidiaries and affiliates, provides a wide variety of products and services to a large and diversified group of clients and customers, including corporations, governments, financial institutions and individuals. Unless the context otherwise requires, the terms "Morgan Stanley," "Firm," "us," "we" or "our" mean Morgan Stanley (the "Parent Company") together with its consolidated subsidiaries. We define the following as part of our consolidated financial statements ("financial statements"): consolidated income statements ("income statements"), consolidated balance sheets ("balance sheets"), and consolidated cash flow statements ("cash flow statements"). See the "Glossary of Common Acronyms" for definitions of certain acronyms used throughout this Form 10-Q.

A description of the clients and principal products and services of each of our business segments is as follows:

Institutional Securities provides investment banking, sales and trading, lending and other services to corporations, governments, financial institutions, and high to ultra-high net worth clients. Investment banking services consist of capital raising and financial advisory services, including services relating to the underwriting of debt, equity and other securities, as well as advice on mergers and acquisitions, restructurings, real estate and project finance. Sales and trading services include sales, financing, prime brokerage and market-making activities in equity and fixed income products, including foreign exchange and commodities. Lending services include originating and/or purchasing corporate loans, commercial and residential mortgage lending, asset-backed lending and financing extended to equities and commodities customers and municipalities. Other activities include investments and research.

Wealth Management provides a comprehensive array of financial services and solutions to individual investors and small to medium-sized businesses and institutions covering brokerage and investment advisory services, financial and wealth planning services, annuity and insurance products, credit and other lending products, banking and retirement plan services.

Investment Management provides a broad range of investment strategies and products that span geographies, asset classes, and public and private markets to a diverse group of clients across institutional and intermediary channels. Strategies and products include equity, fixed income, liquidity and alternative/other products. Institutional clients include defined benefit/defined contribution plans, foundations, endowments, government entities, sovereign wealth funds, insurance companies, third-party fund sponsors and corporations. Individual clients are serviced through intermediaries, including affiliated and non-affiliated distributors.

The results of operations in the past have been, and in the future may continue to be, materially affected by competition; risk factors; and legislative, legal and regulatory developments; as well as other factors. These factors also may have an adverse impact on our ability to achieve our strategic objectives. Additionally, the discussion of our results of operations herein may contain forward-looking statements. These statements, which reflect management's beliefs and expectations, are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of the risks and uncertainties that may affect our future results, see "Forward-Looking Statements," "Business-Competition," "Business-Supervision and Regulation" and "Risk Factors" in the 2017 Form 10-K, and "Liquidity and Capital Resources" herein.

| 1 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Executive Summary

Overview of Financial Results

Consolidated Results

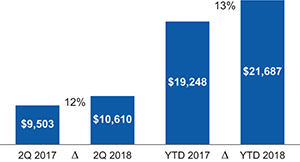

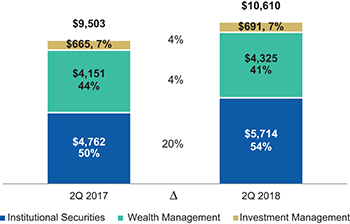

Net Revenues

($ in millions)

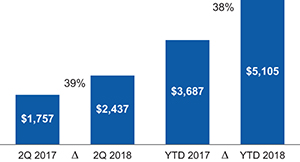

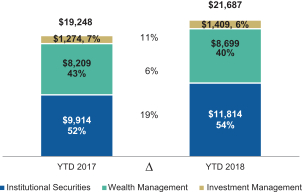

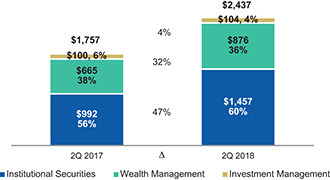

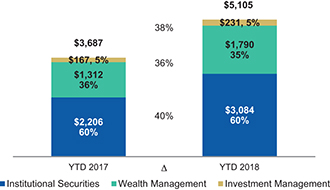

Net Income Applicable to Morgan Stanley

($ in millions)

Earnings per Common Share 1

| 1. | For the calculation of basic and diluted EPS, see Note 15 to the financial statements. |

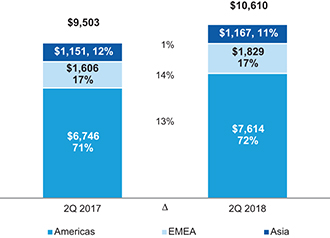

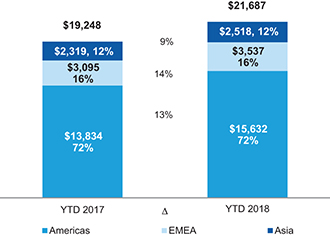

| • | We reported net revenues of $10,610 million in the quarter ended June 30, 2018 ("current quarter," or "2Q 2018"), compared with $9,503 million in the quarter ended June 30, 2017 ("prior year quarter," or "2Q 2017"). For the current quarter, net income applicable to Morgan Stanley was $2,437 million, or $1.30 per diluted common share, compared with $1,757 million, or $0.87 per diluted common share, in the prior year quarter. |

| • | We reported net revenues of $21,687 million in the six months ended June 30, 2018 ("current year period," or "YTD 2018"), compared with $19,248 million in the six months ended June 30, 2017 ("prior year period," or "YTD 2017"). For the current year period, net income applicable to Morgan Stanley was $5,105 million, or $2.75 per diluted common share, compared with $3,687 million, or $1.87 per diluted common share, in the prior year period. |

| June 2018 Form 10-Q | 2 |

| Management's Discussion and Analysis |  |

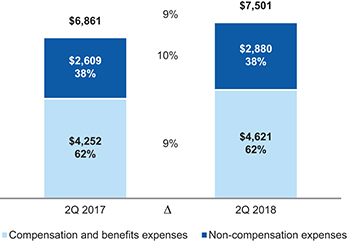

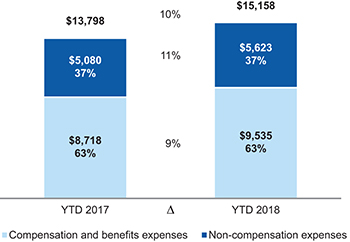

Non-interest Expenses 1

($ in millions)

| 1. | The percentages on the bars in the charts represent the contribution of compensation expense and non-compensation expense to the total. |

| • | Compensation and benefits expenses of $4,621 million in the current quarter and $9,535 million in the current year period each increased 9% from $4,252 million in the prior year quarter and $8,718 million in the prior year period. These results primarily reflected increases in discretionary incentive compensation mainly driven by higher revenues, as well as salaries, across all business segments, the formulaic payout to Wealth Management representatives, and amortization of deferred cash and equity awards. These increases were partially offset by a decrease in the fair value of investments to which certain deferred compensation plans are referenced. |

| • | Non-compensation expenses were $2,880 million in the current quarter and $5,623 million in the current year period compared with $2,609 million in the prior year quarter and $5,080 million in the prior year period, representing a 10% and an 11% increase, respectively. These increases were primarily a result of higher volume-related expenses and the gross presentation of certain expenses due to the adoption of the accounting update Revenue from Contracts with Customers (see Notes 2 and 19 to the financial statements for further information). |

Income Taxes

The current quarter and current year period included intermittent net discrete tax benefits of $88 million primarily associated with new information pertaining to the resolution of multi-jurisdiction tax examinations and other matters. The prior year quarter and prior year period included intermittent tax provisions of $4 million and $18 million, respectively. For further information, see "Supplemental Financial Information and Disclosures-Income Tax Matters" herein.

| 3 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Selected Financial Information and Other Statistical Data

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| $ in millions | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Income from continuing operations applicable to Morgan Stanley | $ | 2,439 | $ | 1,762 | $ | 5,109 | $ | 3,714 | ||||||||

Income (loss) from discontinued operations applicable to Morgan Stanley | (2 | ) | (5 | ) | (4 | ) | (27 | ) | ||||||||

Net income applicable to Morgan Stanley | 2,437 | 1,757 | 5,105 | 3,687 | ||||||||||||

Preferred stock dividends and other | 170 | 170 | 263 | 260 | ||||||||||||

Earnings applicable to Morgan Stanley common shareholders | $ | 2,267 | $ | 1,587 | $ | 4,842 | $ | 3,427 | ||||||||

Expense efficiency ratio 1 | 70.7% | 72.2% | 69.9% | 71.7% | ||||||||||||

ROE 2 | 13.0% | 9.1% | 13.9% | 9.9% | ||||||||||||

ROTCE 2 | 14.9% | 10.4% | 16.0% | 11.4% | ||||||||||||

| in millions, except per share and employee data | At June 30, 2018 | At December 31, 2017 | ||||||

GLR 3 | $ | 226,322 | $ | 192,660 | ||||

Loans 4 | $ | 112,113 | $ | 104,126 | ||||

Total assets | $ | 875,875 | $ | 851,733 | ||||

Deposits | $ | 172,802 | $ | 159,436 | ||||

Borrowings | $ | 192,244 | $ | 192,582 | ||||

Common shareholders' equity | $ | 70,589 | $ | 68,871 | ||||

Common shares outstanding | 1,750 | 1,788 | ||||||

Book value per common share 5 | $ | 40.34 | $ | 38.52 | ||||

Worldwide employees | 58,010 | 57,633 | ||||||

| At June 30, 2018 | At December 31, 2017 | |||||||

Capital ratios 6 | ||||||||

Common Equity Tier 1 capital ratio | 15.8% | 16.5% | ||||||

Tier 1 capital ratio | 18.1% | 18.9% | ||||||

Total capital ratio | 20.6% | 21.7% | ||||||

Tier 1 leverage ratio | 8.2% | 8.3% | ||||||

SLR 7 | 6.4% | 6.5% | ||||||

| 1. | The expense efficiency ratio represents total non-interest expense as a percentage of net revenues. |

| 2. | Represents a non-GAAP measure. See "Selected Non-GAAP Financial Information" herein. |

| 3. | For a discussion of the GLR, see "Liquidity and Capital Resources-Liquidity Risk Management Framework-Global Liquidity Reserve" herein. |

| 4. | Amounts include loans held for investment (net of allowance) and loans held for sale but exclude loans at fair value, which are included in Trading assets in the balance sheets (see Note 7 to the financial statements). |

| 5. | Book value per common share equals common shareholders' equity divided by common shares outstanding. |

| 6. | Beginning in 2018, our risk based capital ratios are based on the Standardized Approach fully phased-in rules. At December 31, 2017, our risk based capital ratios were based on the Standardized Approach transitional rules. For a discussion of our regulatory capital ratios, see "Liquidity and Capital Resources-Regulatory Requirements" herein. |

| 7. | The SLR became effective as a capital standard on January 1, 2018. For a discussion of the SLR, see "Liquidity and Capital Resources-Regulatory Requirements" herein. |

Business Segment Results

Net Revenues by Segment 1, 2

($ in millions)

| June 2018 Form 10-Q | 4 |

| Management's Discussion and Analysis |  |

Net Income Applicable to Morgan Stanley by Segment 1, 3

($ in millions)

| 1. | The percentages in the charts represent the contribution of each business segment to the total. Amounts do not necessarily total to 100% due to intersegment eliminations, where applicable. |

| 2. | The total amount of Net Revenues by Segment also includes intersegment eliminations of $(120) million and $(75) million in the current quarter and prior year quarter, respectively, and $(235) million and $(149) million in the current year period and prior year period, respectively. |

| 3. | The total amount of Net Income Applicable to Morgan Stanley by Segment also includes intersegment eliminations of $2 million in the prior year period. |

| • | Institutional Securities net revenues of $5,714 million in the current quarter and $11,814 million in the current year period increased 20% from the prior year quarter and 19% from the prior year period primarily reflecting higher sales and trading and Investment banking revenues. |

| • | Wealth Management net revenues of $4,325 million in the current quarter and $8,699 million in the current year period increased 4% from the prior year quarter and 6% from the prior year period primarily reflecting growth in Asset management revenues. |

| • | Investment Management net revenues of $691 million in the current quarter and $1,409 million in the current year period increased 4% from the prior year quarter and 11% from the prior year period primarily reflecting higher revenues from Asset management. |

Net Revenues by Region 1, 2

($ in millions)

| 1. | For a discussion of how the geographic breakdown for net revenues is determined, see Note 19 to the financial statements. |

| 2. | The percentages on the bars in the charts represent the contribution of each region to the total. |

| 5 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Selected Non-GAAP Financial Information

We prepare our financial statements using U.S. GAAP. From time to time, we may disclose certain "non-GAAP financial measures" in this document or in the course of our earnings releases, earnings and other conference calls, financial presentations, Definitive Proxy Statement and otherwise. A "non-GAAP financial measure" excludes, or includes, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. We consider the non-GAAP financial measures we disclose to be useful to us, investors and analysts by providing further transparency about, or an alternate means of assessing, our financial condition, operating results, prospective regulatory capital requirements or capital adequacy. These measures are not in accordance with, or a substitute for, U.S. GAAP and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the U.S. GAAP financial measure and the non-GAAP financial measure.

The principal non-GAAP financial measures presented in this document are set forth below.

Reconciliations from U.S. GAAP to Non-GAAP Consolidated Financial Measures

| $ in millions, except | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| per share data | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Net income applicable to Morgan Stanley | $ | 2,437 | $ | 1,757 | $ | 5,105 | $ | 3,687 | ||||||||

Impact of adjustments | (88 | ) | 4 | (88 | ) | 18 | ||||||||||

Adjusted net income applicable to Morgan Stanley-non-GAAP 1 | $ | 2,349 | 1,761 | $ | 5,017 | 3,705 | ||||||||||

Earnings per diluted common share | $ | 1.30 | $ | 0.87 | $ | 2.75 | $ | 1.87 | ||||||||

Impact of adjustments | (0.05 | ) | - | (0.05 | ) | 0.01 | ||||||||||

Adjusted earnings per diluted common share -non-GAAP 1 | $ | 1.25 | $ | 0.87 | $ | 2.70 | $ | 1.88 | ||||||||

Effective income tax rate | 20.6% | 32.0% | 20.7% | 30.5% | ||||||||||||

Impact of adjustments | 2.8% | (0.1)% | 1.4% | (0.4)% | ||||||||||||

Adjusted effective income tax rate-non-GAAP 1 | 23.4% | 31.9% | 22.1% | 30.1% | ||||||||||||

| Average Monthly Balance | ||||||||||||||||||||||||

At 2018 | At December 31, 2017 | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||

| $ in millions | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||

Tangible Equity | ||||||||||||||||||||||||

U.S. GAAP | ||||||||||||||||||||||||

Morgan Stanley shareholders' equity | $ | 79,109 | $ | 77,391 | $ | 78,432 | $ | 78,436 | $ | 77,960 | $ | 77,836 | ||||||||||||

Less: Goodwill and net intangible assets | (9,022 | ) | (9,042 | ) | (9,076 | ) | (9,194 | ) | (9,049 | ) | (9,227 | ) | ||||||||||||

Morgan Stanley tangible shareholders' equity-non-GAAP | $ | 70,087 | $ | 68,349 | $ | 69,356 | $ | 69,242 | $ | 68,911 | $ | 68,609 | ||||||||||||

U.S. GAAP | ||||||||||||||||||||||||

Common equity | $ | 70,589 | $ | 68,871 | $ | 69,912 | $ | 69,916 | $ | 69,440 | $ | 69,459 | ||||||||||||

Less: Goodwill and net intangible assets | (9,022 | ) | (9,042 | ) | (9,076 | ) | (9,194 | ) | (9,049 | ) | (9,227 | ) | ||||||||||||

Tangible common equity-non-GAAP | $ | 61,567 | $ | 59,829 | $ | 60,836 | $ | 60,722 | $ | 60,391 | $ | 60,232 | ||||||||||||

Consolidated Non-GAAP Financial Measures

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| $ in billions | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Average common equity |

| |||||||||||||||

Unadjusted | $ | 69.9 | $ | 69.9 | $ | 69.4 | $ | 69.5 | ||||||||

Adjusted 1 | 69.9 | 69.9 | 69.4 | 69.5 | ||||||||||||

ROE 2 |

| |||||||||||||||

Unadjusted | 13.0% | 9.1% | 13.9% | 9.9% | ||||||||||||

Adjusted 1, 3 | 12.5% | 9.1% | 13.7% | 9.9% | ||||||||||||

Average tangible common equity |

| |||||||||||||||

Unadjusted | $ | 60.8 | $ | 60.7 | $ | 60.4 | $ | 60.2 | ||||||||

Adjusted 1 | 60.8 | 60.7 | 60.4 | 60.2 | ||||||||||||

ROTCE 2 |

| |||||||||||||||

Unadjusted | 14.9% | 10.4% | 16.0% | 11.4% | ||||||||||||

Adjusted 1, 3 | 14.3% | 10.5% | 15.7% | 11.4% | ||||||||||||

At June 30, 2018 | At December 31, 2017 | |||||||

Tangible book value per common share 4 | $ | 35.19 | $ | 33.46 | ||||

| June 2018 Form 10-Q | 6 |

| Management's Discussion and Analysis |  |

Non-GAAP Financial Measures by Business Segment

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| $ in billions | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Pre-tax profit margin 5 | ||||||||||||||||

Institutional Securities | 32% | 30% | 33% | 32% | ||||||||||||

Wealth Management | 27% | 25% | 27% | 25% | ||||||||||||

Investment Management | 20% | 21% | 20% | 19% | ||||||||||||

Consolidated | 29% | 28% | 30% | 28% | ||||||||||||

Average common equity 6 |

| |||||||||||||||

Institutional Securities | $ | 40.8 | $ | 40.2 | $ | 40.8 | $ | 40.2 | ||||||||

Wealth Management | 16.8 | 17.2 | 16.8 | 17.2 | ||||||||||||

Investment Management | 2.6 | 2.4 | 2.6 | 2.4 | ||||||||||||

Parent Company | 9.7 | 10.1 | 9.2 | 9.7 | ||||||||||||

Consolidated average common equity | $ | 69.9 | $ | 69.9 | $ | 69.4 | $ | 69.5 | ||||||||

Average tangible common equity 6 |

| |||||||||||||||

Institutional Securities | $ | 40.1 | $ | 39.6 | $ | 40.1 | $ | 39.6 | ||||||||

Wealth Management | 9.2 | 9.3 | 9.2 | 9.3 | ||||||||||||

Investment Management | 1.7 | 1.6 | 1.7 | 1.6 | ||||||||||||

Parent Company | 9.8 | 10.2 | 9.4 | 9.7 | ||||||||||||

Consolidated average tangible common equity | $ | 60.8 | $ | 60.7 | $ | 60.4 | $ | 60.2 | ||||||||

ROE 2, 7 |

| |||||||||||||||

Institutional Securities | 13.0% | 8.5% | 14.1% | 9.9% | ||||||||||||

Wealth Management | 20.0% | 14.6% | 20.7% | 14.6% | ||||||||||||

Investment Management | 15.7% | 16.3% | 17.5% | 13.7% | ||||||||||||

Consolidated | 13.0% | 9.1% | 13.9% | 9.9% | ||||||||||||

ROTCE 2, 7 |

| |||||||||||||||

Institutional Securities | 13.2% | 8.7% | 14.3% | 10.1% | ||||||||||||

Wealth Management | 36.6% | 27.0% | 37.8% | 27.0% | ||||||||||||

Investment Management | 24.5% | 24.1% | 27.4% | 20.2% | ||||||||||||

Consolidated | 14.9% | 10.4% | 16.0% | 11.4% | ||||||||||||

| 1. | Adjusted amounts exclude intermittent net discrete tax provisions (benefits). Income tax consequences associated with employee share-based awards are recognized in Provision for income taxes in the income statements but are excluded from the intermittent net discrete tax provisions (benefits) adjustment as we anticipate conversion activity each quarter. For further information on the net discrete tax provisions (benefits), see "Supplemental Financial Information and Disclosures-Income Tax Matters" herein. |

| 2. | ROE and ROTCE equal annualized net income applicable to Morgan Stanley less preferred dividends as a percentage of average common equity and average tangible common equity, on a consolidated basis as indicated. When excluding intermittent net discrete tax provisions (benefits), both the numerator and denominator are adjusted. |

| 3. | The calculations used in determining the Firm's "ROE and ROTCE Targets" referred to below are the Adjusted ROE and Adjusted ROTCE amounts shown in this table. |

| 4. | Tangible book value per common share equals tangible common equity divided by common shares outstanding. |

| 5. | Pre-tax profit margin represents income from continuing operations before income taxes as a percentage of net revenues. |

| 6. | Average common equity and average tangible common equity for each business segment are determined using our Required Capital framework (see "Liquidity and Capital Resources-Regulatory Requirements-Attribution of Average Common Equity According to the Required Capital Framework" herein). |

| 7. | The calculation of the ROE and ROTCE by segment uses the annualized net income applicable to Morgan Stanley by segment less preferred dividends allocated to each segment as a percentage of average common equity and average tangible common equity, respectively, allocated to each segment. |

Return on Equity and Tangible Common Equity Targets

In January 2018, we established an ROE Target of 10% to 13% for the medium term, which is equivalent to an ROTCE Target of 11.5% to 14.5%.

Our ROE and ROTCE Targets are forward-looking statements that may be materially affected by many factors, including, among other things: macroeconomic and market conditions; legislative and regulatory developments; industry trading and investment banking volumes; equity market levels; interest rate environment; outsize legal expenses or penalties and the ability to maintain a reduced level of expenses; and capital levels. For further information on our ROE and ROTCE Targets and related assumptions, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Executive Summary-Return on Equity and Tangible Common Equity Targets" in the 2017 Form 10-K.

Business Segments

Substantially all of our operating revenues and operating expenses are directly attributable to the business segments. Certain revenues and expenses have been allocated to each business segment, generally in proportion to its respective net revenues, non-interest expenses or other relevant measures.

As a result of treating certain intersegment transactions as transactions with external parties, we include an Intersegment Eliminations category to reconcile the business segment results to our consolidated results.

Net Revenues, Compensation Expense and Income Taxes

For an overview of the components of our net revenues, compensation expense and income taxes, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments" in the 2017 Form 10-K.

| 7 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Institutional Securities

Income Statement Information

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Revenues | ||||||||||||

Investment banking | $ | 1,699 | $ | 1,413 | 20% | |||||||

Trading | 3,128 | 2,725 | 15% | |||||||||

Investments | 89 | 37 | 141% | |||||||||

Commissions and fees | 674 | 630 | 7% | |||||||||

Asset management | 102 | 89 | 15% | |||||||||

Other | 168 | 126 | 33% | |||||||||

Total non-interest revenues | 5,860 | 5,020 | 17% | |||||||||

Interest income | 2,195 | 1,243 | 77% | |||||||||

Interest expense | 2,341 | 1,501 | 56% | |||||||||

Net interest | (146 | ) | (258 | ) | 43% | |||||||

Net revenues | 5,714 | 4,762 | 20% | |||||||||

Compensation and benefits | 1,993 | 1,667 | 20% | |||||||||

Non-compensation expenses | 1,909 | 1,652 | 16% | |||||||||

Total non-interest expenses | 3,902 | 3,319 | 18% | |||||||||

Income from continuing operations before income taxes | 1,812 | 1,443 | 26% | |||||||||

Provision for income taxes | 323 | 413 | (22)% | |||||||||

Income from continuing operations | 1,489 | 1,030 | 45% | |||||||||

Income (loss) from discontinued operations, net of income taxes | (2 | ) | (5 | ) | 60% | |||||||

Net income | 1,487 | 1,025 | 45% | |||||||||

Net income applicable to noncontrolling interests | 30 | 33 | (9)% | |||||||||

Net income applicable to Morgan Stanley | $ | 1,457 | $ | 992 | 47% | |||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Revenues | ||||||||||||

Investment banking | $ | 3,212 | $ | 2,830 | 13% | |||||||

Trading | 6,771 | 5,737 | 18% | |||||||||

Investments | 138 | 103 | 34% | |||||||||

Commissions and fees | 1,418 | 1,250 | 13% | |||||||||

Asset management | 212 | 180 | 18% | |||||||||

Other | 304 | 299 | 2% | |||||||||

Total non-interest revenues | 12,055 | 10,399 | 16% | |||||||||

Interest income | 3,999 | 2,367 | 69% | |||||||||

Interest expense | 4,240 | 2,852 | 49% | |||||||||

Net interest | (241 | ) | (485 | ) | 50% | |||||||

Net revenues | 11,814 | 9,914 | 19% | |||||||||

Compensation and benefits | 4,153 | 3,537 | 17% | |||||||||

Non-compensation expenses | 3,737 | 3,204 | 17% | |||||||||

Total non-interest expenses | 7,890 | 6,741 | 17% | |||||||||

Income from continuing operations before income taxes | 3,924 | 3,173 | 24% | |||||||||

Provision for income taxes | 772 | 872 | (11)% | |||||||||

Income from continuing operations | 3,152 | 2,301 | 37% | |||||||||

Income (loss) from discontinued operations, net of income taxes | (4 | ) | (27 | ) | 85% | |||||||

Net income | 3,148 | 2,274 | 38% | |||||||||

Net income applicable to noncontrolling interests | 64 | 68 | (6)% | |||||||||

Net income applicable to Morgan Stanley | $ | 3,084 | $ | 2,206 | 40% | |||||||

| June 2018 Form 10-Q | 8 |

| Management's Discussion and Analysis |  |

Investment Banking

Investment Banking Revenues

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Advisory | $ | 618 | $ | 504 | 23% | |||||||

Underwriting: | ||||||||||||

Equity | 541 | 405 | 34% | |||||||||

Fixed income | 540 | 504 | 7% | |||||||||

Total underwriting | 1,081 | 909 | 19% | |||||||||

Total investment banking | $ | 1,699 | $ | 1,413 | 20% | |||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Advisory | $ | 1,192 | $ | 1,000 | 19% | |||||||

Underwriting: | ||||||||||||

Equity | 962 | 795 | 21% | |||||||||

Fixed income | 1,058 | 1,035 | 2% | |||||||||

Total underwriting | 2,020 | 1,830 | 10% | |||||||||

Total investment banking | $ | 3,212 | $ | 2,830 | 13% | |||||||

Investment Banking Volumes

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| $ in billions | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Completed mergers and acquisitions 1 | $ | 325 | $ | 212 | $ | 488 | $ | 375 | ||||||||

Equity and equity-related offerings 2, 3 | 16 | 20 | 37 | 30 | ||||||||||||

Fixed income offerings 2, 4 | 61 | 70 | 116 | 145 | ||||||||||||

Source: Thomson Reuters, data as of July 2, 2018. Transaction volumes may not be indicative of net revenues in a given period. In addition, transaction volumes for prior periods may vary from amounts previously reported due to the subsequent withdrawal or change in the value of a transaction.

| 1. | Amounts include transactions of $100 million or more. Completed mergers and acquisitions volumes are based on full credit to each of the advisors in a transaction. |

| 2. | Equity and equity-related offerings and fixed income offerings are based on full credit for single book managers and equal credit for joint book managers. |

| 3. | Amounts include Rule 144A issuances and registered public offerings of common stock and convertible securities and rights offerings. |

| 4. | Amounts include non-convertible preferred stock, mortgage-backed and asset-backed securities, and taxable municipal debt. Amounts include publicly registered and Rule 144A issuances. Amounts exclude leveraged loans and self-led issuances. |

Investment banking revenues are composed of fees from advisory services and revenues from the underwriting of securities offerings and syndication of loans, net of syndication expenses.

Investment banking revenues of $1,699 million in the current quarter and $3,212 million in the current year period increased 20% and 13% from the comparable prior year periods. The adoption of the accounting update Revenue from Contracts with Customers had the effect of increasing the revenues reported in investment banking by approximately $101 million in the current quarter and $161 million in the current year period compared with the prior year periods (see Notes 2 and 19 to the financial statements for further information). The drivers of the increase in our Investment banking revenues, other than the effect of the above accounting update, were:

| • | Advisory revenues increased in the current quarter and current year period primarily reflecting higher volumes of completed M&A activity (see Investment Banking Volumes table), partially offset by lower fee realizations. |

| • | Equity underwriting revenues increased in the current quarter primarily as a result of higher fee realizations in initial public offerings and convertibles. In the current year period, equity underwriting revenues increased due to higher equity market volumes (see Investment Banking Volumes table). |

| • | Fixed income underwriting revenues increased in the current quarter primarily due to higher non-investment grade loan fees. Fixed income underwriting revenues in the current year period were relatively unchanged from the prior year period. |

Sales and Trading Net Revenues

By Income Statement Line Item

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Trading | $ | 3,128 | $ | 2,725 | 15% | |||||||

Commissions and fees | 674 | 630 | 7% | |||||||||

Asset management | 102 | 89 | 15% | |||||||||

Net interest | (146 | ) | (258 | ) | 43% | |||||||

Total | $ | 3,758 | $ | 3,186 | 18% | |||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Trading | $ | 6,771 | $ | 5,737 | 18% | |||||||

Commissions and fees | 1,418 | 1,250 | 13% | |||||||||

Asset management | 212 | 180 | 18% | |||||||||

Net interest | (241 | ) | (485 | ) | 50% | |||||||

Total | $ | 8,160 | $ | 6,682 | 22% | |||||||

| 9 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

By Business

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Equity | $ | 2,470 | $ | 2,155 | 15% | |||||||

Fixed income | 1,389 | 1,239 | 12% | |||||||||

Other | (101 | ) | (208 | ) | 51% | |||||||

Total | $ | 3,758 | $ | 3,186 | 18% | |||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Equity | $ | 5,028 | $ | 4,171 | 21% | |||||||

Fixed income | 3,262 | 2,953 | 10% | |||||||||

Other | (130 | ) | (442 | ) | 71% | |||||||

Total | $ | 8,160 | $ | 6,682 | 22% | |||||||

Sales and Trading Revenues-Equity and Fixed Income

| Three Months Ended June 30, 2018 | ||||||||||||||||

| $ in millions | Trading | Fees 1 | Net Interest 2 | Total | ||||||||||||

Financing | $ | 1,373 | $ | 89 | $ | (192 | ) | $ | 1,270 | |||||||

Execution services | 661 | 605 | (66 | ) | 1,200 | |||||||||||

Total Equity | $ | 2,034 | $ | 694 | $ | (258 | ) | $ | 2,470 | |||||||

Total Fixed Income | $ | 1,299 | $ | 83 | $ | 7 | $ | 1,389 | ||||||||

| Three Months Ended June 30, 2017 | ||||||||||||||||

| $ in millions | Trading | Fees 1 | Net Interest 2 | Total | ||||||||||||

Financing | $ | 1,166 | $ | 88 | $ | (227 | ) | $ | 1,027 | |||||||

Execution services | 601 | 580 | (53 | ) | 1,128 | |||||||||||

Total Equity | $ | 1,767 | $ | 668 | $ | (280 | ) | $ | 2,155 | |||||||

Total Fixed income | $ | 1,114 | $ | 48 | $ | 77 | $ | 1,239 | ||||||||

| Six Months Ended June 30, 2018 | ||||||||||||||||

| $ in millions | Trading | Fees 1 | Net Interest 2 | Total | ||||||||||||

Financing | $ | 2,607 | $ | 196 | $ | (338 | ) | $ | 2,465 | |||||||

Execution services | 1,452 | 1,269 | (158 | ) | 2,563 | |||||||||||

Total Equity | $ | 4,059 | $ | 1,465 | $ | (496 | ) | $ | 5,028 | |||||||

Total Fixed Income | $ | 3,014 | $ | 166 | $ | 82 | $ | 3,262 | ||||||||

| Six Months Ended June 30, 2017 | ||||||||||||||||

| $ in millions | Trading | Fees 1 | Net Interest 2 | Total | ||||||||||||

Financing | $ | 2,097 | $ | 177 | $ | (415 | ) | $ | 1,859 | |||||||

Execution services | 1,265 | 1,148 | (101 | ) | 2,312 | |||||||||||

Total Equity | $ | 3,362 | $ | 1,325 | $ | (516 | ) | $ | 4,171 | |||||||

Total Fixed income | $ | 2,712 | $ | 102 | $ | 139 | $ | 2,953 | ||||||||

| 1. | Includes Commissions and fees and Asset management revenues. |

| 2. | Funding costs are allocated to the businesses based on funding usage and are included in Net interest. |

As discussed in "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Net Revenues by Segment" in the 2017 Form 10-K, we manage each of the sales and trading businesses based on its aggregate net revenues. We provide qualitative commentary in the discussion of results that follow on the key drivers of period over period variances, as the quantitative impact of the various market dynamics typically cannot be disaggregated.

For additional information on total Trading revenues, see the table "Trading Revenues by Product Type" in Note 4 to the financial statements.

Sales and Trading Net Revenues during the Current Quarter

Equity

Equity sales and trading net revenues of $2,470 million in the current quarter increased 15% from the prior year quarter, reflecting higher results in both our financing businesses and execution services.

| • | Financing revenues increased from the prior year quarter, primarily due to higher average client balances and changes in funding mix which resulted in increased Trading and Net interest revenues. |

| • | Execution services increased from the prior year quarter, primarily reflecting higher Trading revenues driven by effective inventory management in derivative products. In addition, Commissions and fees increased from higher client activity in cash equities products. |

Fixed Income

Fixed income net revenues of $1,389 million in the current quarter were 12% higher than the prior year quarter, driven by higher results in commodities products and other and credit products, partially offset by lower results in global macro products.

| • | Global macro products revenues decreased as higher client activity was more than offset by unfavorable inventory management results in foreign exchange and emerging markets products. |

| • | Credit products Trading and Net interest revenues increased primarily as a result of increased client activity in lending products, partially offset by the impact of credit spread widening on inventory. |

| • | Commodities products and Other increased primarily due to increased client trading activity across commodities products and higher Trading revenues principally from a reduction in counterparty credit risk. |

| June 2018 Form 10-Q | 10 |

| Management's Discussion and Analysis |  |

Other

Other sales and trading net losses of $101 million in the current quarter decreased from the prior year quarter, primarily reflecting higher revenues on economic hedges related to our long-term debt and corporate loan activity.

Sales and Trading Net Revenues during the Current Year Period

Equity

Equity sales and trading net revenues of $5,028 million in the current year period increased 21% from the prior year period, reflecting higher results in both our financing businesses and execution services.

| • | Financing revenues increased from the prior year period, primarily due to higher average client balances and changes in funding mix which resulted in increased Trading and Net interest revenues. |

| • | Execution services increased from the prior year period, primarily reflecting higher Trading revenues driven by effective inventory management and higher client activity in derivative products. In addition, Commissions and fees increased from higher client activity in cash equities products. |

Fixed Income

Fixed income net revenues of $3,262 million in the current year period were 10% higher than the prior year period, primarily driven by higher results in commodities products and other.

| • | Global macro and Credit products revenues remained relatively unchanged from the prior year period. |

| • | Commodities products and Other increased primarily due to increased Commodities structured transactions and client flow and higher Trading revenues principally from a reduction in counterparty credit risk. |

Other

Other sales and trading net losses of $130 million in the current year period decreased from the prior year period, primarily reflecting higher revenues on economic hedges related to our long-term debt and lower losses associated with corporate loan hedging activity.

Investments, Other Revenues, Non-interest Expenses and Income Tax Items

Investments

| • | Net investment gains of $89 million in the current quarter and $138 million in the current year period increased from the prior year periods, primarily as a result of higher gains on business-related investments, partially offset by lower results from real estate limited partnership investments. |

Other Revenues

| • | Other revenues of $168 million in the current quarter and $304 million in the current year period increased from the prior year periods, reflecting the recovery of a previously charged off energy industry related loan and improved results from other equity method investments. These results were partially offset by losses associated with held-for-sale corporate loans compared with gains in the respective prior year periods. |

Non-interest Expenses

Non-interest expenses of $3,902 million in the current quarter increased from the prior year quarter, reflecting a 20% increase in Compensation and benefits expenses and a 16% increase in Non-compensation expenses. Non-interest expenses of $7,890 million in the current year period increased from the prior year period reflecting a 17% increase in both Compensation and benefits expenses and Non-compensation expenses.

| • | Compensation and benefits expenses increased in the current quarter and current year period, primarily due to increases in discretionary incentive compensation driven by higher revenues, as well as amortization of deferred cash and equity awards and salaries, partially offset by a decrease in the fair value of investments to which certain deferred compensation plans are referenced. |

| • | Non-compensation expenses increased in the current quarter and current year period, primarily due to higher volume-related expenses and the gross presentation of certain expenses due to the adoption of the accounting update Revenue from Contracts with Customers (see Notes 2 and 19 to the financial statements for further information). In addition, in the current year period, the results were partially offset by the reversal of a portion of previously recorded provisions related to U.K. VAT matters. |

| 11 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Income Tax Items

The effective tax rate in the current quarter and current year period is lower compared with the prior year periods primarily as a result of the enactment of the U.S. Tax Cuts and Jobs Act ("Tax Act"). For a discussion of the Tax Act, see "Supplemental Financial Information and Disclosures-Income Tax Matters" herein.

In both the current quarter and current year period, we recognized in Provision for income taxes an intermittent net discrete tax benefit of $97 million, primarily associated with new information pertaining to the resolution of multi-jurisdiction tax examinations and other matters.

| June 2018 Form 10-Q | 12 |

| Management's Discussion and Analysis |  |

Wealth Management

Income Statement Information

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Revenues | ||||||||||||

Investment banking | $ | 114 | $ | 135 | (16)% | |||||||

Trading | 135 | 207 | (35)% | |||||||||

Investments | 3 | 1 | 200% | |||||||||

Commissions and fees | 442 | 424 | 4% | |||||||||

Asset management | 2,514 | 2,302 | 9% | |||||||||

Other | 74 | 73 | 1% | |||||||||

Total non-interest revenues | 3,282 | 3,142 | 4% | |||||||||

Interest income | 1,320 | 1,114 | 18% | |||||||||

Interest expense | 277 | 105 | 164% | |||||||||

Net interest | 1,043 | 1,009 | 3% | |||||||||

Net revenues | 4,325 | 4,151 | 4% | |||||||||

Compensation and benefits | 2,356 | 2,297 | 3% | |||||||||

Non-compensation expenses | 812 | 797 | 2% | |||||||||

Total non-interest expenses | 3,168 | 3,094 | 2% | |||||||||

Income from continuing operations before income taxes | 1,157 | 1,057 | 9% | |||||||||

Provision for income taxes | 281 | 392 | (28)% | |||||||||

Net income applicable to Morgan Stanley | $ | 876 | $ | 665 | 32% | |||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Revenues | ||||||||||||

Investment banking | $ | 254 | $ | 280 | (9)% | |||||||

Trading | 244 | 445 | (45)% | |||||||||

Investments | 3 | 2 | 50% | |||||||||

Commissions and fees | 940 | 864 | 9% | |||||||||

Asset management | 5,009 | 4,486 | 12% | |||||||||

Other | 137 | 129 | 6% | |||||||||

Total non-interest revenues | 6,587 | 6,206 | 6% | |||||||||

Interest income | 2,600 | 2,193 | 19% | |||||||||

Interest expense | 488 | 190 | 157% | |||||||||

Net interest | 2,112 | 2,003 | 5% | |||||||||

Net revenues | 8,699 | 8,209 | 6% | |||||||||

Compensation and benefits | 4,806 | 4,614 | 4% | |||||||||

Non-compensation expenses | 1,576 | 1,565 | 1% | |||||||||

Total non-interest expenses | 6,382 | 6,179 | 3% | |||||||||

Income from continuing operations before income taxes | 2,317 | 2,030 | 14% | |||||||||

Provision for income taxes | 527 | 718 | (27)% | |||||||||

Net income applicable to Morgan Stanley | $ | 1,790 | $ | 1,312 | 36% | |||||||

Financial Information and Statistical Data

| $ in billions | At June 30, | At December 31, 2017 | ||||||

Client assets | $ | 2,411 | $ | 2,373 | ||||

Fee-based client assets 1 | $ | 1,084 | $ | 1,045 | ||||

Fee-based client assets as a percentage of total client assets | 45% | 44% | ||||||

Client liabilities 2 | $ | 82 | $ | 80 | ||||

Investment securities portfolio | $ | 59.7 | $ | 59.2 | ||||

Loans and lending commitments | $ | 80.7 | $ | 77.3 | ||||

Wealth Management representatives | 15,632 | 15,712 | ||||||

| Three Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

Per representative: | ||||||||

Annualized revenues ($ in thousands) 3 | $ | 1,105 | $ | 1,052 | ||||

Client assets ($ in millions) 4 | $ | 154 | $ | 142 | ||||

Fee-based asset flows ($ in billions) 5 | $ | 15.3 | $ | 19.9 | ||||

| Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

Per representative: | ||||||||

Annualized revenues ($ in thousands) 3 | $ | 1,110 | $ | 1,041 | ||||

Client assets ($ in millions) 4 | $ | 154 | $ | 142 | ||||

Fee-based asset flows ($ in billions) 5 | $ | 33.5 | $ | 38.7 | ||||

| 1. | Fee-based client assets represent the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets. |

| 2. | Client liabilities include securities-based and tailored lending, residential real estate loans and margin lending. |

| 3. | Annualized revenues per representative equal Wealth Management's annualized revenues divided by the average representative headcount. |

| 4. | Client assets per representative equal total period-end client assets divided by period-end representative headcount. |

| 5. | Fee-based asset flows include net new fee-based assets, net account transfers, dividends, interest and client fees and exclude institutional cash management-related activity. |

| 13 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Transactional Revenues

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Investment banking | $ | 114 | $ | 135 | (16)% | |||||||

Trading | 135 | 207 | (35)% | |||||||||

Commissions and fees | 442 | 424 | 4% | |||||||||

Total | $ | 691 | $ | 766 | (10)% | |||||||

Transactional revenues as a % of Net revenues | 16% | 18% | ||||||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Investment banking | $ | 254 | $ | 280 | (9)% | |||||||

Trading | 244 | 445 | (45)% | |||||||||

Commissions and fees | 940 | 864 | 9% | |||||||||

Total | $ | 1,438 | $ | 1,589 | (10)% | |||||||

Transactional revenues as a % of Net revenues | 17% | 19% | ||||||||||

Net Revenues

Transactional Revenues

Transactional revenues of $691 million in the current quarter and $1,438 million in the current year period decreased 10% from the respective prior year periods primarily as a result of lower Trading and Investment banking revenues, partially offset by higher Commissions and fees.

| • | Investment banking revenues decreased in the current quarter and current year period primarily due to lower revenues from equity and structured products issuances. |

| • | Trading revenues decreased in the current quarter and current year period primarily as a result of lower gains related to investments associated with certain employee deferred compensation plans and lower fixed income revenue driven by product mix. |

| • | Commissions and fees increased in the current quarter and current year period primarily as a result of increased client transactions in alternative products, and options and futures. |

Asset Management

Asset management revenues of $2,514 million in the current quarter and $5,009 million in the current year period increased 9% and 12%, respectively, primarily due to the effect of market appreciation and net positive flows on the respective beginning of period fee-based client assets balances on which billings are generally based.

See "Fee-Based Client Assets Rollforwards" herein.

Net Interest

Net interest of $1,043 million in the current quarter and $2,112 million in the current year period increased 3% and 5%, respectively, primarily as a result of higher Loan balances. In the current quarter and current year period, the effect of higher interest rates on Loans and Investment securities was essentially offset by higher average interest rates on Deposits, due to changes in our deposit mix.

Non-interest Expenses

Non-interest expenses of $3,168 million in the current quarter and $6,382 million in the current year period increased 2% and 3%, respectively, primarily as a result of higher Compensation and benefits expenses.

| • | Compensation and benefits expenses increased in the current quarter and current year period primarily due to the formulaic payout to Wealth Management representatives linked to higher revenues and increases in salaries, partially offset by decreases in the fair value of investments to which certain deferred compensation plans are referenced. |

| • | Non-compensation expenses were relatively unchanged in both the current quarter and current year period. |

Income Tax Items

The effective tax rate in the current quarter and current year period is lower compared with the prior year periods primarily as a result of the enactment of the Tax Act. For a discussion of the Tax Act, see "Supplemental Financial Information and Disclosures-Income Tax Matters" herein.

| June 2018 Form 10-Q | 14 |

| Management's Discussion and Analysis |  |

Fee-Based Client Assets

For a description of fee-based client assets, including descriptions of the fee based client asset types and rollforward items in the following tables, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Wealth Management-Fee-Based Client Assets" in the 2017 Form 10-K.

Fee-Based Client Assets Rollforwards

| $ in billions | At March 31, 2018 | Inflows | Outflows | Market Impact | At June 30, 2018 | |||||||||||||||

Separately managed 1 | $ | 260 | $ | 9 | $ | (5) | $ | 3 | $ | 267 | ||||||||||

Unified managed | 254 | 12 | (8) | 1 | 259 | |||||||||||||||

Mutual fund advisory | 20 | - | (1) | 1 | 20 | |||||||||||||||

Advisor | 147 | 8 | (8) | 2 | 149 | |||||||||||||||

Portfolio manager | 356 | 20 | (12) | 3 | 367 | |||||||||||||||

Subtotal | $ | 1,037 | $ | 49 | $ | (34) | $ | 10 | $ | 1,062 | ||||||||||

Cash management | 21 | 6 | (5) | - | 22 | |||||||||||||||

Total fee-based client assets | $ | 1,058 | $ | 55 | $ | (39) | $ | 10 | $ | 1,084 | ||||||||||

| $ in billions | At March 31, 2017 | Inflows | Outflows | Market Impact | At June 30, 2017 | |||||||||||||||

Separately managed 1 | $ | 230 | $ | 8 | $ | (7) | $ | 6 | $ | 237 | ||||||||||

Unified managed | 217 | 13 | (7) | 5 | 228 | |||||||||||||||

Mutual fund advisory | 21 | - | (1) | 1 | 21 | |||||||||||||||

Advisor | 133 | 10 | (8) | 3 | 138 | |||||||||||||||

Portfolio manager | 305 | 23 | (11) | 4 | 321 | |||||||||||||||

Subtotal | $ | 906 | $ | 54 | $ | (34) | $ | 19 | $ | 945 | ||||||||||

Cash management | 21 | 2 | (6) | - | 17 | |||||||||||||||

Total fee-based client assets | $ | 927 | $ | 56 | $ | (40) | $ | 19 | $ | 962 | ||||||||||

| $ in billions | At December 31, 2017 | Inflows | Outflows | Market Impact | At June 30, 2018 | |||||||||||||||

Separately managed 1 | $ | 252 | $ | 18 | $ | (10) | $ | 7 | $ | 267 | ||||||||||

Unified managed | 250 | 25 | (16) | - | 259 | |||||||||||||||

Mutual fund advisory | 21 | 1 | (2) | - | 20 | |||||||||||||||

Advisor | 149 | 16 | (16) | - | 149 | |||||||||||||||

Portfolio manager | 353 | 39 | (22) | (3) | 367 | |||||||||||||||

Subtotal | $ | 1,025 | $ | 99 | $ | (66) | $ | 4 | $ | 1,062 | ||||||||||

Cash management | 20 | 11 | (9) | - | 22 | |||||||||||||||

Total fee-based client assets | $ | 1,045 | $ | 110 | $ | (75) | $ | 4 | $ | 1,084 | ||||||||||

| $ in billions | At December 31, 2016 | Inflows | Outflows | Market Impact | At June 30, 2017 | |||||||||||||||

Separately managed 1 | $ | 222 | $ | 16 | $ | (11) | $ | 10 | $ | 237 | ||||||||||

Unified managed | 204 | 25 | (15) | 14 | 228 | |||||||||||||||

Mutual fund advisory | 21 | 1 | (3) | 2 | 21 | |||||||||||||||

Advisor | 125 | 19 | (14) | 8 | 138 | |||||||||||||||

Portfolio manager | 285 | 42 | (21) | 15 | 321 | |||||||||||||||

Subtotal | $ | 857 | $ | 103 | $ | (64) | $ | 49 | $ | 945 | ||||||||||

Cash management | 20 | 5 | (8) | - | 17 | |||||||||||||||

Total fee-based client assets | $ | 877 | $ | 108 | $ | (72) | $ | 49 | $ | 962 | ||||||||||

Average Fee Rates

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| Fee rate in bps | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Separately managed | 16 | 17 | 16 | 16 | ||||||||||||

Unified managed | 97 | 98 | 98 | 98 | ||||||||||||

Mutual fund advisory | 120 | 118 | 120 | 118 | ||||||||||||

Advisor | 84 | 84 | 85 | 85 | ||||||||||||

Portfolio manager | 96 | 96 | 96 | 97 | ||||||||||||

Subtotal | 77 | 77 | 76 | 76 | ||||||||||||

Cash management | 6 | 6 | 6 | 6 | ||||||||||||

Total fee-based client assets | 75 | 75 | 75 | 75 | ||||||||||||

| 1. | Includes non-custody account values reflecting prior quarter-end balances due to a lag in the reporting of asset values by third-party custodians. |

| 15 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Investment Management

Income Statement Information

| Three Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Revenues | ||||||||||||

Trading | $ | 16 | $ | (3 | ) | N/M | ||||||

Investments | 55 | 125 | (56)% | |||||||||

Asset management | 610 | 539 | 13% | |||||||||

Other | 3 | 4 | (25)% | |||||||||

Total non-interest revenues | 684 | 665 | 3% | |||||||||

Interest income | 17 | 1 | N/M | |||||||||

Interest expense | 10 | 1 | N/M | |||||||||

Net interest | 7 | - | N/M | |||||||||

Net revenues | 691 | 665 | 4% | |||||||||

Compensation and benefits | 272 | 288 | (6)% | |||||||||

Non-compensation expenses | 279 | 235 | 19% | |||||||||

Total non-interest expenses | 551 | 523 | 5% | |||||||||

Income from continuing operations before income taxes | 140 | 142 | (1)% | |||||||||

Provision for income taxes | 36 | 41 | (12)% | |||||||||

Net income | 104 | 101 | 3% | |||||||||

Net income (loss) applicable to noncontrolling interests | - | 1 | N/M | |||||||||

Net income applicable to Morgan Stanley | $ | 104 | $ | 100 | 4% | |||||||

| Six Months Ended June 30, | ||||||||||||

| $ in millions | 2018 | 2017 | % Change | |||||||||

Revenues | ||||||||||||

Trading | $ | 21 | $ | (14 | ) | N/M | ||||||

Investments | 132 | 223 | (41)% | |||||||||

Asset management | 1,236 | 1,056 | 17% | |||||||||

Other | 13 | 8 | 63% | |||||||||

Total non-interest revenues | 1,402 | 1,273 | 10% | |||||||||

Interest income | 18 | 2 | N/M | |||||||||

Interest expense | 11 | 1 | N/M | |||||||||

Net interest | 7 | 1 | N/M | |||||||||

Net revenues | 1,409 | 1,274 | 11% | |||||||||

Compensation and benefits | 576 | 567 | 2% | |||||||||

Non-compensation expenses | 545 | 462 | 18% | |||||||||

Total non-interest expenses | 1,121 | 1,029 | 9% | |||||||||

Income from continuing operations before income taxes | 288 | 245 | 18% | |||||||||

Provision for income taxes | 55 | 71 | (23)% | |||||||||

Net income | 233 | 174 | 34% | |||||||||

Net income (loss) applicable to noncontrolling interests | 2 | 7 | (71)% | |||||||||

Net income applicable to Morgan Stanley | $ | 231 | $ | 167 | 38% | |||||||

Net Revenues

Investments

Investments gains of $55 million in the current quarter and $132 million in the current year period compared with $125 million in the prior year quarter and $223 million in the prior year period, respectively. These decreases reflect the absence of realized investment gains in an infrastructure fund, as well as the reversal of previously accrued carried interest in certain Asia private equity funds, primarily due to losses associated with weakening Asia-Pacific currencies.

Asset Management

Asset management revenues of $610 million in the current quarter and $1,236 million in the current year period increased 13% and 17%, respectively, primarily as a result of higher average AUM across all asset classes. See "AUM Rollforwards" herein.

The adoption of the accounting update Revenue from Contracts with Customers had the effect of increasing Asset management revenues due to the gross presentation of distribution fees. This increase (approximately $44 million in the current year period) was partially offset by the delayed recognition of certain performance fees not in the form of carried interest until they are no longer probable of reversing. For 2018, the recognition of a greater portion of these revenues is expected to occur in the fourth quarter based on current fee arrangements. See Notes 2 and 19 to the financial statements for further details.

Non-interest Expenses

Non-interest expenses of $551 million in the current quarter and $1,121 million in the current year period increased 5% and 9%, respectively, primarily due to higher Non-compensation expenses.

| • | Compensation and benefits expenses decreased in the current quarter due to decreases in deferred compensation associated with carried interest and the fair value of investments to which certain deferred compensation plans are referenced. Compensation and benefits expenses were relatively unchanged in the current year period. |

| • | Non-compensation expenses increased in the current quarter and current year period primarily as a result of the gross presentation of distribution fees due to the adoption of the accounting update Revenue from Contracts with Customers along with higher fee sharing on increased AUM balances. See "Asset Management" above. |

| June 2018 Form 10-Q | 16 |

| Management's Discussion and Analysis |  |

Income Tax Items

The effective tax rate in the current quarter and current year period is lower compared with the prior year periods primarily as a result of the enactment of the Tax Act. For a discussion of the Tax Act, see "Supplemental Financial Information and Disclosures-Income Tax Matters" herein.

Assets Under Management or Supervision

For a description of the asset classes and rollforward items in the following tables, see "Management's Discussion and Analysis of Financial Condition and Results of Operations-Business Segments-Investment Management-Assets Under Management or Supervision" in the 2017 Form 10-K.

AUM Rollforwards

| $ in billions | At March 31, 2018 | Inflows | Outflows | Market Impact | Other 1 | At June 30, 2018 | ||||||||||||||||||

Equity | $ | 109 | $ | 10 | $ | (7 | ) | $ | 3 | $ | (1 | ) | $ | 114 | ||||||||||

Fixed income | 72 | 7 | (7 | ) | (1 | ) | (2 | ) | 69 | |||||||||||||||

Alternative/Other | 131 | 6 | (4 | ) | 1 | (2 | ) | 132 | ||||||||||||||||

Long-term AUM subtotal | 312 | 23 | (18 | ) | 3 | (5 | ) | 315 | ||||||||||||||||

Liquidity | 157 | 375 | (373 | ) | 1 | (1 | ) | 159 | ||||||||||||||||

Total AUM | $ | 469 | $ | 398 | $ | (391 | ) | $ | 4 | $ | (6 | ) | $ | 474 | ||||||||||

Shares of minority stake assets | 7 | 7 | ||||||||||||||||||||||

| $ in billions | At March 31, 2017 | Inflows | Outflows | Market Impact | Other 1 | At June 30, 2017 | ||||||||||||||||||

Equity | $ | 87 | $ | 6 | $ | (5 | ) | $ | 5 | $ | 1 | $ | 94 | |||||||||||

Fixed income | 62 | 8 | (6 | ) | 1 | 1 | 66 | |||||||||||||||||

Alternative/Other | 119 | 6 | (6 | ) | 3 | (1 | ) | 121 | ||||||||||||||||

Long-term AUM subtotal | 268 | 20 | (17 | ) | 9 | 1 | 281 | |||||||||||||||||

Liquidity | 153 | 308 | (308 | ) | - | 1 | 154 | |||||||||||||||||

Total AUM | $ | 421 | $ | 328 | $ | (325 | ) | $ | 9 | $ | 2 | $ | 435 | |||||||||||

Shares of minority stake assets | 7 | 8 | ||||||||||||||||||||||

| $ in billions | At December 31, 2017 | Inflows | Outflows | Market Impact | Other 1 | At June 30, 2018 | ||||||||||||||||||

Equity | $ | 105 | $ | 20 | $ | (14 | ) | $ | 3 | $ | - | $ | 114 | |||||||||||

Fixed income | 73 | 14 | (16 | ) | (1 | ) | (1 | ) | 69 | |||||||||||||||

Alternative/Other | 128 | 11 | (9 | ) | 1 | 1 | 132 | |||||||||||||||||

Long-term AUM subtotal | 306 | 45 | (39 | ) | 3 | - | 315 | |||||||||||||||||

Liquidity | 176 | 700 | (717 | ) | 1 | (1 | ) | 159 | ||||||||||||||||

Total AUM | $ | 482 | $ | 745 | $ | (756 | ) | $ | 4 | $ | (1 | ) | $ | 474 | ||||||||||

Shares of minority stake assets | 7 | 7 | ||||||||||||||||||||||

| $ in billions | At December 31, 2016 | Inflows | Outflows | Market Impact | Other 1 | At June 30, 2017 | ||||||||||||||||||

Equity | $ | 79 | $ | 11 | $ | (10 | ) | $ | 13 | $ | 1 | $ | 94 | |||||||||||

Fixed income | 60 | 13 | (11 | ) | 2 | 2 | 66 | |||||||||||||||||

Alternative/Other | 115 | 13 | (10 | ) | 4 | (1 | ) | 121 | ||||||||||||||||

Long-term AUM subtotal | 254 | 37 | (31 | ) | 19 | 2 | 281 | |||||||||||||||||

Liquidity | 163 | 636 | (646 | ) | - | 1 | 154 | |||||||||||||||||

Total AUM | $ | 417 | $ | 673 | $ | (677 | ) | $ | 19 | $ | 3 | $ | 435 | |||||||||||

Shares of minority stake assets | 8 | 8 | ||||||||||||||||||||||

| 1. | Includes distributions and foreign currency impact for all periods and the impact of the Mesa West Capital, LLC acquisition in the current year period. |

Average AUM

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| $ in billions | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Equity | $ | 111 | $ | 91 | $ | 110 | $ | 87 | ||||||||

Fixed income | 71 | 64 | 72 | 63 | ||||||||||||

Alternative/Other | 131 | 120 | 130 | 119 | ||||||||||||

Long-term AUM subtotal | 313 | 275 | 312 | 269 | ||||||||||||

Liquidity | 161 | 153 | 163 | 155 | ||||||||||||

Total AUM | $ | 474 | $ | 428 | $ | 475 | $ | 424 | ||||||||

Shares of minority stake assets | 7 | 8 | 7 | 8 | ||||||||||||

Average Fee Rate

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| Fee rate in bps | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Equity | 77 | 73 | 76 | 74 | ||||||||||||

Fixed income | 33 | 33 | 34 | 33 | ||||||||||||

Alternative/Other | 67 | 70 | 67 | 70 | ||||||||||||

Long-term AUM | 63 | 62 | 63 | 63 | ||||||||||||

Liquidity | 18 | 17 | 18 | 18 | ||||||||||||

Total AUM | 47 | 46 | 47 | 46 | ||||||||||||

| 17 | June 2018 Form 10-Q |

| Management's Discussion and Analysis |  |

Supplemental Financial Information and Disclosures

Income Tax Matters

Effective Tax Rate from Continuing Operations

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

U.S. GAAP | 20.6% | 32.0% | 20.7% | 30.5% | ||||||||||||

Adjusted effective income tax rate-non-GAAP 1 | 23.4% | 31.9% | 22.1% | 30.1% | ||||||||||||

| 1. | Adjusted amounts exclude intermittent net discrete tax provisions (benefits). Income tax consequences associated with employee share-based awards are recognized in Provision for income taxes in the income statements but are excluded from the intermittent net discrete tax provisions (benefits) adjustment as we anticipate conversion activity each quarter. For further information on non-GAAP measures, see "Selected Non-GAAP Financial Information" herein. |

Adjusted amounts exclude an intermittent net discrete tax benefit of $88 million in the current quarter and current year period, primarily associated with new information pertaining to the resolution of multi-jurisdiction tax examinations and other matters. Intermittent net discrete tax provisions were $4 million and $18 million in the prior year quarter and prior year period, respectively.

The effective tax rates include recurring-type discrete tax benefits associated with employee share-based payments of $17 million and $16 million in the current quarter and prior year quarter, respectively. The effective tax rates include recurring-type discrete tax benefits associated with employee share-based payments of $164 million and $128 million in the current year period and prior year period, respectively.

The effective tax rate reflects our current assumptions, estimates and interpretations related to the Tax Act and other factors. The Tax Act, enacted on December 22, 2017, significantly revised U.S. corporate income tax law by, among other things, reducing the corporate income tax rate to 21%, and implementing a modified territorial tax system that includes a one-time transition tax on deemed repatriated earnings of non-U.S. subsidiaries; imposes a minimum tax on global intangible low-taxed income ("GILTI") and an alternative base erosion and anti-abuse tax ("BEAT") on U.S. corporations that make deductible payments to non-U.S. related persons in excess of specified amounts; and broadens the tax base by partially or wholly eliminating tax deductions for certain historically deductible expenses.

Our income tax estimates may change as additional clarification and implementation guidance continue to be received from the U.S. Treasury Department and as the interpretation of the Tax Act evolves over time. Taking into account continuing developments related to provisions of the Tax Act

such as the modified territorial tax system and GILTI, we expect our effective tax rate from continuing operations for 2018 to be approximately 22% to 25% (see "Forward-Looking Statements" in the 2017 Form 10-K).

U.S. Bank Subsidiaries

Our U.S. bank subsidiaries, Morgan Stanley Bank N.A. ("MSBNA") and Morgan Stanley Private Bank, National Association ("MSPBNA") (collectively, "U.S. Bank Subsidiaries") accept deposit accounts, provide loans to a variety of customers, from large corporate and institutional clients to high net worth individuals, and invest in securities. The lending activities in the Institutional Securities business segment primarily include loans and lending commitments to corporate clients. The lending activities in the Wealth Management business segment primarily include: securities-based lending, which allows clients to borrow money against the value of qualifying securities; and residential real estate loans.

We expect our lending activities to continue to grow through further market penetration of the client base. For a further discussion of our credit risks, see "Quantitative and Qualitative Disclosures about Market Risk-Risk Management-Credit Risk." For further discussion about loans and lending commitments, see Notes 7 and 11 to the financial statements.

U.S. Bank Subsidiaries' Supplemental Financial Information 1

| $ in billions | At 2018 | At December 31, 2017 | ||||||

Assets | $ | 200.5 | $ | 185.3 | ||||

Investment securities portfolio: | ||||||||

Investment securities-AFS | 41.3 | 42.0 | ||||||

Investment securities-HTM | 18.8 | 17.5 | ||||||

Total investment securities | $ | 60.1 | $ | 59.5 | ||||

Deposits 2 | $ | 172.6 | $ | 159.1 | ||||

Wealth Management |

| |||||||

Securities-based lending and other loans 3 | $ | 43.6 | $ | 41.2 | ||||

Residential real estate loans | 26.4 | 26.7 | ||||||

Total | $ | 70.0 | $ | 67.9 | ||||

Institutional Securities |

| |||||||

Corporate loans | $ | 26.7 | $ | 24.2 | ||||

Wholesale real estate loans | 14.5 | 12.2 | ||||||

Total | $ | 41.2 | $ | 36.4 | ||||

| 1. | Amounts exclude transactions with the Parent Company and between the bank subsidiaries. |

| 2. | For further information on deposits, see "Liquidity and Capital Resources-Funding Management-Unsecured Financing" herein. |

| 3. | Other loans primarily include tailored lending. |

| June 2018 Form 10-Q | 18 |

| Management's Discussion and Analysis |  |

Accounting Development Updates

The Financial Accounting Standards Board has issued certain accounting updates that apply to us. Accounting updates not listed below were assessed and determined to be either not applicable or are not expected to have a significant impact on our financial statements.

The following accounting updates are currently being evaluated to determine the potential impact of adoption:

| • | Leases. This accounting update requires lessees to recognize in the balance sheet all leases with terms exceeding one year, which results in the recognition of a right of use asset and corresponding lease liability, including for those leases that we currently classify as operating leases. The accounting for leases where we are the lessor is largely unchanged. |

The right of use asset and lease liability will initially be measured using the present value of the remaining rental payments. This change to the accounting for leases where we are lessee requires modifications to our lease accounting systems and determining the present value of the remaining rental payments. Key aspects of the latter include concluding upon the discount rate and determining whether to include non-lease components in rental payments. Currently, we plan to adopt this accounting update as of the effective date, January 1, 2019. Based upon our current population of leases, we expect the right of use asset and corresponding lease liability to be less than 1% of our total assets. |

| • | Financial Instruments–Credit Losses. This accounting update impacts the impairment model for certain financial assets measured at amortized cost by requiring a CECL methodology to estimate expected credit losses over the entire life of the financial asset, recorded at inception or purchase. CECL will replace the loss model currently applicable to loans held for investment, HTM securities and other receivables carried at amortized cost. |

The update also eliminates the concept of other-than-temporary impairment for AFS securities. Impairments on AFS securities will be required to be recognized in earnings through an allowance, when the fair value is less than amortized cost and a credit loss exists or the securities are expected to be sold before recovery of amortized cost. |