UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

[ X ] QUARTERLY REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

[ _ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For Quarter Ended November 28, 2015 |

| Commission File No. 001-15141 |

HERMAN MILLER, INC.

A Michigan Corporation |

| ID No. 38-0837640 |

|

|

|

855 East Main Avenue, Zeeland, MI 49464-0302 |

| Phone (616) 654 3000 |

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [_]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ X ] No [_]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ X ] | Accelerated filer [_] | Non-accelerated filer [_] | Smaller reporting company [_] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [_] No [ X ]

Common Stock Outstanding at January 4, 2016 - 59,896,703 shares

Herman Miller, Inc. Form 10-Q

Table of Contents

|

| Page No. |

Part I - Financial Information |

| |

| Item 1 Financial Statements (Unaudited) |

|

| Condensed Consolidated Statements of Comprehensive Income - Three and Six Months Ended November 28, 2015 and November 29, 2014 | 3 |

| Condensed Consolidated Balance Sheets - November 28, 2015 and May 30, 2015 | 4 |

| Condensed Consolidated Statements of Cash Flows - Six Months Ended November 28, 2015 and November 29, 2014 | 5 |

| Condensed Consolidated Statements of Stockholders' Equity - Six Months Ended November 28, 2015 and November 29, 2014 | 6 |

| Notes to Condensed Consolidated Financial Statements |

|

| Note 1 - Basis of Presentation and Correction of Immaterial Error | 7 |

| Note 2 - New Accounting Standards | 7 |

| Note 3 - Fiscal Year | 8 |

| Note 4 - Acquisitions | 8 |

| Note 5 - Inventories, Net | 10 |

| Note 6 - Goodwill and Indefinite-Lived Intangibles | 10 |

| Note 7 - Employee Benefit Plans | 10 |

| Note 8 - Earnings Per Share | 11 |

| Note 9 - Stock-Based Compensation | 11 |

| Note 10 - Income Taxes | 11 |

| Note 11 - Fair Value Measurements | 12 |

| Note 12 - Commitments and Contingencies | 13 |

| Note 13 - Debt | 14 |

| Note 14 - Accumulated Other Comprehensive Loss | 15 |

| Note 15 - Redeemable Noncontrolling Interests | 15 |

| Note 16 - Operating Segments | 15 |

| Item 2 Management's Discussion and Analysis of Financial Condition and Results of Operations | 17 |

| Item 3 Quantitative and Qualitative Disclosures about Market Risk | 29 |

| Item 4 Controls and Procedures | 29 |

Part II - Other Information |

| |

| Item 1 Legal Proceedings | 30 |

| Item 1A Risk Factors | 30 |

| Item 2 Unregistered Sales of Equity Securities and Use of Proceeds | 30 |

| Item 3 Defaults upon Senior Securities | 30 |

| Item 4 Mine Safety Disclosures | 30 |

| Item 5 Other Information | 30 |

| Item 6 Exhibits | 31 |

| Signatures | 32 |

2

Herman Miller, Inc.

Condensed Consolidated Statements of Comprehensive Income

(Dollars in millions, except per share data)

(Unaudited)

| Three Months Ended |

| Six Months Ended | ||||||||||||

| November 28, 2015 |

| November 29, 2014 |

| November 28, 2015 |

| November 29, 2014 | ||||||||

Net sales | $ | 580.4 | |

| $ | 565.4 | |

| $ | 1,145.8 | |

| $ | 1,075.1 | |

Cost of sales | 356.0 | |

| 359.7 | |

| 704.6 | |

| 683.8 | | ||||

Gross margin | 224.4 | |

| 205.7 | |

| 441.2 | |

| 391.3 | | ||||

Operating expenses: |

|

|

|

|

|

|

| ||||||||

Selling, general, and administrative | 149.7 | |

| 141.1 | |

| 292.8 | |

| 267.8 | | ||||

Design and research | 19.2 | |

| 17.9 | |

| 37.8 | |

| 34.6 | | ||||

Total operating expenses | 168.9 | |

| 159.0 | |

| 330.6 | |

| 302.4 | | ||||

Operating earnings | 55.5 | |

| 46.7 | |

| 110.6 | |

| 88.9 | | ||||

Other expenses: |

|

|

|

|

|

|

| ||||||||

Interest expense | 3.9 | |

| 4.6 | |

| 7.8 | |

| 9.3 | | ||||

Other, net | (0.4 | ) |

| 0.1 | |

| 0.1 | |

| 0.1 | | ||||

Earnings before income taxes and equity income | 52.0 | |

| 42.0 | |

| 102.7 | |

| 79.5 | | ||||

Income tax expense | 17.2 | |

| 14.2 | |

| 34.2 | |

| 26.6 | | ||||

Equity earnings from nonconsolidated affiliates, net of tax | 0.1 | |

| - | |

| 0.2 | |

| 0.1 | | ||||

Net earnings | 34.9 | |

| 27.8 | |

| 68.7 | |

| 53.0 | | ||||

Net earnings attributable to noncontrolling interests | 0.2 | |

| - | |

| 0.5 | |

| - | | ||||

Net earnings attributable to Herman Miller, Inc. | $ | 34.7 | |

| $ | 27.8 | |

| $ | 68.2 | |

| $ | 53.0 | |

|

|

|

|

|

|

|

| ||||||||

Earnings per share - basic | $ | 0.58 | |

| $ | 0.47 | |

| $ | 1.14 | |

| $ | 0.89 | |

Earnings per share - diluted | $ | 0.57 | |

| $ | 0.46 | |

| $ | 1.13 | |

| $ | 0.88 | |

Dividends declared, per share | $ | 0.148 | |

| $ | 0.140 | |

| $ | 0.295 | |

| $ | 0.280 | |

|

|

|

|

|

|

|

| ||||||||

Other comprehensive loss, net of tax |

|

|

|

|

|

|

| ||||||||

Foreign currency translation adjustments | $ | (1.0 | ) |

| $ | (5.4 | ) |

| $ | (4.5 | ) |

| $ | (5.9 | ) |

Pension and post-retirement liability adjustments | 0.5 | |

| 0.5 | |

| 1.4 | |

| 0.9 | | ||||

Other comprehensive loss | (0.5 | ) |

| (4.9 | ) |

| (3.1 | ) |

| (5.0 | ) | ||||

Comprehensive income | 34.4 | |

| 22.9 | |

| 65.6 | |

| 48.0 | | ||||

Comprehensive income attributable to noncontrolling interests | 0.2 | |

| - | |

| 0.5 | |

| - | | ||||

Comprehensive income attributable to Herman Miller, Inc. | $ | 34.2 | |

| $ | 22.9 | |

| $ | 65.1 | |

| $ | 48.0 | |

See accompanying notes to condensed consolidated financial statements.

3

Herman Miller, Inc.

Condensed Consolidated Balance Sheets

(Dollars in millions, except per share data)

(Unaudited)

| November 28, 2015 |

| May 30, 2015 | ||||

ASSETS |

|

|

| ||||

Current Assets: |

|

|

| ||||

Cash and cash equivalents | $ | 54.7 | |

| $ | 63.7 | |

Marketable securities | 5.4 | |

| 5.7 | | ||

Accounts and notes receivable, net | 218.1 | |

| 189.6 | | ||

Inventories, net | 131.7 | |

| 129.6 | | ||

Prepaid expenses and other | 45.2 | |

| 74.9 | | ||

Total current assets | 455.1 | |

| 463.5 | | ||

Property and equipment, at cost | 893.4 | |

| 868.6 | | ||

Less - accumulated depreciation | (637.3 | ) |

| (619.1 | ) | ||

Net property and equipment | 256.1 | |

| 249.5 | | ||

Goodwill | 306.1 | |

| 303.1 | | ||

Indefinite-lived intangibles | 85.2 | |

| 85.2 | | ||

Other amortizable intangibles, net | 52.7 | |

| 52.3 | | ||

Other noncurrent assets | 48.8 | |

| 39.1 | | ||

Total Assets | $ | 1,204.0 | |

| $ | 1,192.7 | |

|

|

|

| ||||

LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS & STOCKHOLDERS' EQUITY |

|

|

| ||||

Current Liabilities: |

|

|

| ||||

Accounts payable | $ | 155.2 | |

| $ | 164.7 | |

Accrued compensation and benefits | 73.3 | |

| 66.6 | | ||

Accrued warranty | 40.6 | |

| 39.3 | | ||

Other accrued liabilities | 101.3 | |

| 92.8 | | ||

Total current liabilities | 370.4 | |

| 363.4 | | ||

Long-term debt | 256.8 | |

| 289.8 | | ||

Pension and post-retirement benefits | 25.8 | |

| 27.8 | | ||

Other liabilities | 43.8 | |

| 61.0 | | ||

Total Liabilities | 696.8 | |

| 742.0 | | ||

Redeemable noncontrolling interests | 31.2 | |

| 30.4 | | ||

Stockholders' Equity: |

|

|

| ||||

Preferred stock, no par value (10,000,000 shares authorized, none issued) | - | |

| - | | ||

Common stock, $0.20 par value (240,000,000 shares authorized, 60,005,530 and 59,694,611 shares issued and outstanding in 2016 and 2015, respectively) | 12.0 | |

| 11.9 | | ||

Additional paid-in capital | 143.6 | |

| 135.1 | | ||

Retained earnings | 380.2 | |

| 330.2 | | ||

Accumulated other comprehensive loss | (59.3 | ) |

| (56.2 | ) | ||

Key executive deferred compensation plans | (1.2 | ) |

| (1.2 | ) | ||

Herman Miller, Inc. Stockholders' Equity | 475.3 | |

| 419.8 | | ||

Noncontrolling Interests | 0.7 | |

| 0.5 | | ||

Total Stockholders' Equity | 476.0 | |

| 420.3 | | ||

Total Liabilities, Redeemable Noncontrolling Interests, and Stockholders' Equity | $ | 1,204.0 | |

| $ | 1,192.7 | |

See accompanying notes to condensed consolidated financial statements.

4

Herman Miller, Inc.

Condensed Consolidated Statements of Cash Flows

(Dollars in millions)

(Unaudited)

| Six Months Ended | ||||||

November 28, 2015 | | November 29, 2014 | |||||

Cash Flows from Operating Activities: | | | | ||||

Net earnings | $ | 68.7 | |

| $ | 53.0 | |

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

| ||||

Depreciation and amortization | 27.6 | |

| 25.2 | | ||

Stock-based compensation | 6.5 | |

| 5.7 | | ||

Excess tax benefits from stock-based compensation | (1.0 | ) |

| (0.6 | ) | ||

Pension and post-retirement expenses | 0.8 | |

| 0.6 | | ||

Deferred taxes | (4.2 | ) |

| (5.4 | ) | ||

Gain on sales of property and dealers | - | |

| (0.2 | ) | ||

Other, net | 1.4 | |

| 0.4 | | ||

Increase in current assets | (42.1 | ) |

| (1.7 | ) | ||

Increase in current liabilities | 10.9 | |

| 3.3 | | ||

Increase in non-current liabilities | 4.6 | |

| 0.4 | | ||

Net Cash Provided by Operating Activities | 73.2 | |

| 80.7 | | ||

|

|

|

| ||||

Cash Flows from Investing Activities: |

|

|

| ||||

Proceeds from sales of property | 3.1 | |

| 0.3 | | ||

Marketable securities sales | 0.3 | |

| 4.5 | | ||

Acquisitions, net of cash received | (3.6 | ) |

| (154.0 | ) | ||

Capital expenditures | (35.2 | ) |

| (26.7 | ) | ||

Other, net | 0.7 | |

| (0.6 | ) | ||

Net Cash Used in Investing Activities | (34.7 | ) |

| (176.5 | ) | ||

|

|

|

| ||||

Cash Flows from Financing Activities: |

|

|

| ||||

Dividends paid | (17.2 | ) |

| (16.6 | ) | ||

Proceeds from issuance of long-term debt | 422.1 | |

| 401.5 | | ||

Payments of long-term debt | (455.1 | ) |

| (324.5 | ) | ||

Common stock issued | 5.6 | |

| 5.7 | | ||

Common stock repurchased and retired | (3.7 | ) |

| (3.2 | ) | ||

Excess tax benefits from stock-based compensation | 1.0 | |

| 0.6 | | ||

Purchase of noncontrolling interests | - | |

| (5.8 | ) | ||

Other, net | - | |

| 0.8 | | ||

Net Cash (Used in) Provided by Financing Activities | (47.3 | ) |

| 58.5 | | ||

|

|

|

| ||||

Effect of Exchange Rate Changes on Cash and Cash Equivalents | (0.2 | ) |

| 0.5 | | ||

Net Decrease in Cash and Cash Equivalents | (9.0 | ) |

| (36.8 | ) | ||

|

|

|

| ||||

Cash and Cash Equivalents, Beginning of Period | 63.7 | |

| 101.5 | | ||

Cash and Cash Equivalents, End of Period | $ | 54.7 | |

| $ | 64.7 | |

See accompanying notes to condensed consolidated financial statements.

5

Herman Miller, Inc.

Condensed Consolidated Statements of Stockholders' Equity

(Dollars in millions)

(Unaudited)

| Six Months Ended | ||||||

November 28, 2015 |

| November 29, 2014 | |||||

Preferred Stock |

|

|

| ||||

Balance at beginning of year and end of period | $ | - | |

| $ | - | |

Common Stock |

|

|

| ||||

Balance at beginning of year | 11.9 | |

| 11.9 | | ||

Restricted stock units released | 0.1 | |

| - | | ||

Balance at end of period | 12.0 | |

| 11.9 | | ||

Additional Paid-in Capital |

|

|

| ||||

Balance at beginning of year | 135.1 | |

| 122.4 | | ||

Repurchase and retirement of common stock | (3.7 | ) |

| (3.2 | ) | ||

Exercise of stock options | 4.6 | |

| 4.9 | | ||

Stock-based compensation expense | 4.5 | |

| 5.2 | | ||

Excess tax benefit for stock-based compensation | 0.5 | |

| 0.2 | | ||

Restricted stock units released | 1.7 | |

| 0.1 | | ||

Employee stock purchase plan issuances | 0.9 | |

| 0.8 | | ||

Balance at end of period | 143.6 | |

| 130.4 | | ||

Retained Earnings |

|

|

| ||||

Balance at beginning of year | 330.2 | |

| 269.6 | | ||

Net income attributable to Herman Miller, Inc. | 68.2 | |

| 53.0 | | ||

Dividends declared on common stock (per share - 2016: $0.295; 2015; $0.280) | (17.8 | ) |

| (16.8 | ) | ||

Noncontrolling interests redemption value adjustment | (0.4 | ) |

| - | | ||

Balance at end of period | 380.2 | |

| 305.8 | | ||

Accumulated Other Comprehensive Loss |

|

|

| ||||

Balance at beginning of year | (56.2 | ) |

| (37.9 | ) | ||

Other comprehensive loss | (3.1 | ) |

| (5.0 | ) | ||

Balance at end of period | (59.3 | ) |

| (42.9 | ) | ||

Key Executive Deferred Compensation |

|

|

| ||||

Balance at beginning of year and end of period | (1.2 | ) |

| (1.7 | ) | ||

Herman Miller, Inc. Stockholders' Equity | 475.3 | |

| 403.5 | | ||

Noncontrolling Interests |

|

|

| ||||

Balance at beginning of year | 0.5 | |

| - | | ||

Net income attributable to noncontrolling interests | 0.2 | |

| - | | ||

Noncontrolling interests related to DWR acquisition | - | |

| 5.8 | | ||

Purchase of noncontrolling interests | - | |

| (5.8 | ) | ||

Balance at end of period | 0.7 | |

| - | | ||

Total Stockholders' Equity | $ | 476.0 | |

| $ | 403.5 | |

6

Notes to Condensed Consolidated Financial Statements

Three and

Six

Months Ended

November 28, 2015

(in millions)

1. Basis of Presentation and Correction of Immaterial Error

The condensed consolidated financial statements have been prepared by Herman Miller, Inc. ("the company") in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. Management believes the disclosures made in this document are adequate with respect to interim reporting requirements.

The accompanying unaudited condensed consolidated financial statements, taken as a whole, contain all adjustments that are of a normal recurring nature necessary to present fairly the financial position of the company as of November 28, 2015 . Operating results for the six months ended November 28, 2015 , are not necessarily indicative of the results that may be expected for the year ending May 28, 2016 . It is suggested that these condensed consolidated financial statements be read in conjunction with the financial statements and notes thereto included in the company's Form 10-K filing for the year ended May 30, 2015 .

In the second quarter of fiscal 2016, the company made an adjustment to correct an immaterial error related to the accrual for product warranties. As a result of this correction, the company adjusted Accrued warranty, Other noncurrent assets (to capture the impact of adjusting deferred taxes), and Retained earnings by $12.5 million , $4.7 million , and $7.8 million , respectively. The adjustment impacts the Condensed Consolidated Balance Sheets as of November 28th, 2015 and May 30th, 2015, the Condensed Consolidated Statement of Stockholders' Equity as of November 28th, 2015 and November 29th, 2014, Note 12 - Commitments and Contingencies, and Note 16 - Operating Segments. This correction had no impact on earnings or cash flows.

2. New Accounting Standards

Recently Adopted Accounting Standards | ||||||

Standard |

| Description |

| Date of Adoption |

| Effect on the Financial Statements or Other Significant Matters |

Interest-Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs |

| The standard requires debt issuance costs related to a recognized debt liability to be presented in the balance sheet as a direct deduction from the debt liability, rather than as an asset. For debt issuance costs related to line-of-credit arrangements, the SEC would not object to an entity deferring and presenting debt issuance costs as an asset and subsequently amortizing the issuance costs over the term of the line-of-credit arrangement. The standard was applied on a retrospective basis. |

| November 28, 2015 |

| For each period presented the company reclassified debt issuance costs related to senior notes from Other non-current assets to Long-term debt. Debt issuance costs related to our revolving line of credit continue to be presented as an asset within Other non-current assets. |

|

|

|

|

|

|

|

Balance Sheet Classification of Deferred Taxes |

| The standard requires that deferred tax liabilities and assets, as well as any related valuation allowance, be classified as non-current in a classified statement of financial position. |

| November 28, 2015 |

| The company adopted the accounting standard prospectively. As such, the prior period was not retrospectively adjusted. As of November 28, 2015 deferred tax liabilities and assets are presented as non-current. |

Recently Issued Accounting Standards Not Yet Adopted | ||||||

Standard |

| Description |

| Effective Date |

| Effect on the Financial Statements or Other Significant Matters |

Simplifying the Measurement of Inventory |

| Under the updated standard, an entity should measure inventory that is measured using either the first-in, first-out ("FIFO") or average cost methods at the lower of cost and net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. The updated standard should be applied prospectively. |

| June 4, 2017 |

| The company is currently evaluating the impact of adopting this guidance. |

7

Recently Issued Accounting Standards Not Yet Adopted (Continued) | ||||||

Standard |

| Description |

| Effective Date |

| Effect on the Financial Statements or Other Significant Matters |

Revenue from Contracts with Customers |

| The standard outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue model is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard is designed to create greater comparability for financial statement users across industries and jurisdictions and also requires enhanced disclosures. The standard allows for two adoption methods, a full retrospective or modified retrospective approach. |

| June 3, 2018 |

| The company is currently evaluating the possible adoption methodologies and the implications of adoption on our consolidated financial statements. |

|

|

|

|

|

|

|

Intangibles - Goodwill and Other - Internal-Use Software Customer's Accounting for Fees Paid in a Cloud Computing Arrangement |

| The standard provides guidance regarding whether a cloud computing arrangement includes a software license. The customer should account for the software license element of the arrangement consistent with the acquisition of other software licenses. If the cloud computing arrangement does not include a software license, the customer should account for the arrangement as a service contract. The updated standard can be applied either prospectively or retrospectively. |

| May 29, 2016 |

| The company is currently evaluating the impact of adopting this guidance. |

3. Fiscal Year

The company's fiscal year ends on the Saturday closest to May 31. Fiscal 2016, the year ending May 28, 2016 , and fiscal 2015, the year ended May 30, 2015 , each contain 52 weeks. The second quarters of fiscal 2016 and fiscal 2015 each contained 13 weeks.

4. Acquisitions

George Nelson Bubble Lamp Product Line Acquisition

On September 17, 2015, the company acquired certain assets associated with the George Nelson Bubble Lamp product line which together constituted the acquisition of a business. Consideration transferred to acquire the assets consisted of $3.6 million in cash transferred during the second quarter of fiscal 2016 and an additional component of performance-based contingent consideration with a fair value of $2.7 million as of the acquisition date.

The assets acquired included an exclusive manufacturing agreement and customer relationships with fair values of $2.5 million and and $0.6 million , respectively, each having a useful life of 10 years. The excess of the purchase consideration over the fair value of the net assets acquired was $3.2 million and recognized as goodwill within the Consumer reportable segment. The company has finalized the purchase accounting for the acquisition of the George Nelson Bubble Lamp product line.

Design Within Reach Acquisition

On July 28, 2014, the company acquired the majority of the outstanding equity of Design Within Reach, Inc. ("DWR"), a Stamford, Connecticut based, leading North American marketer and seller of modern furniture, lighting, and accessories primarily serving consumers and design trade professionals. The acquisition of DWR advances the company's strategy of being both an industry brand and a consumer brand by expanding the company's reach into the consumer sector.

The company purchased an ownership interest in DWR equal to approximately 81 percent for $155.2 million in cash. Subsequent to the initial transaction, the company acquired an additional 4 percent of DWR stock from the remaining public shareholders for approximately $5.8 million in cash, all of which was paid during the first and second quarters of fiscal 2015. The remaining 15 percent of DWR stock was contributed by DWR executives into a newly formed consumer facing subsidiary and the company contributed the assets of the existing Herman Miller Consumer business. After these transactions, the redeemable noncontrolling interests in the newly formed subsidiary, known as Herman Miller Consumer Holdings, Inc. ("HMCH"), were approximately 7 percent . The remaining HMCH shareholders have a put option to require the company to purchase their remaining interest over a five-year period from the date of issuance of such shares. As a result, these noncontrolling interests are not included within Stockholders' Equity within the Condensed Consolidated Balance Sheets, but rather are included within Redeemable noncontrolling interests.

DWR acquisition-related expenses were $2.2 million during fiscal 2015. These expenses included legal and professional services fees. The following table summarizes the fair values of the assets acquired and the liabilities assumed from the acquisition.

8

Assets Acquired and Liabilities Assumed on July 28, 2014 |

| ||

(In millions) | Fair Value | ||

Purchase price | $ | 155.2 | |

Fair value of the assets acquired: |

| ||

Cash | 1.2 | | |

Accounts receivable | 2.2 | | |

Inventory | 47.4 | | |

Current deferred tax asset | 1.5 | | |

Other current assets | 5.5 | | |

Goodwill | 75.6 | | |

Other intangible assets | 68.5 | | |

Property | 32.0 | | |

Other long term assets | 2.4 | | |

Total assets acquired | 236.3 | | |

Fair value of liabilities assumed: |

| ||

Accounts payable | 20.8 | | |

Accrued compensation and benefits | 1.6 | | |

Other accrued liabilities | 12.3 | | |

Long term deferred tax liability | 14.5 | | |

Other long term liabilities | 0.4 | | |

Total liabilities assumed | 49.6 | | |

Redeemable noncontrolling interests | 25.7 | | |

Noncontrolling interests | 5.8 | | |

Net assets acquired | $ | 155.2 | |

The goodwill stemming from the transaction in the amount of $75.6 million was recorded as "Goodwill" in the Condensed Consolidated Balance Sheet and allocated to the Consumer reportable segment. The goodwill recognized was attributable primarily to the assembled workforce and expected synergies from DWR and the total amount of this goodwill is not deductible for tax purposes.

Other intangible assets acquired as a result of the acquisition of DWR were valued at $68.5 million . These amounts are reflected in the values presented in the following table:

Intangible Assets Acquired from the DWR Acquisition |

| |||

(In millions) | Fair Value | Useful Life | ||

Trade Names and Trademarks | $ | 55.1 | | Indefinite |

Exclusive Distribution Agreements | 0.2 | | 1.5 years | |

Customer Relationships | 12.0 | | 10 - 16 years | |

Product Development Designs | 1.2 | | 7 years | |

Total Intangible Assets Acquired | $ | 68.5 | |

|

9

5. Inventories, net

(In millions) | November 28, 2015 |

| May 30, 2015 | ||||

Finished goods | $ | 106.3 | |

| $ | 106.5 | |

Raw materials | 25.4 | |

| 23.1 | | ||

Total | $ | 131.7 | |

| $ | 129.6 | |

Inventories are valued at the lower of cost or market and include material, labor, and overhead. The inventories of the majority of domestic manufacturing subsidiaries are valued using the last-in, first-out method ("LIFO"). The inventories of all other subsidiaries are valued using the first-in, first-out method ("FIFO").

6. Goodwill and Indefinite-lived Intangibles

Goodwill and other indefinite-lived intangible assets included in the Condensed Consolidated Balance Sheets consisted of the following as of November 28, 2015 and May 30, 2015 :

(In millions) | Goodwill |

| Indefinite-lived Intangible Assets |

| Total Goodwill and Indefinite-lived Intangible Assets | ||||||

May 30, 2015 | $ | 303.1 | |

| $ | 85.2 | |

| $ | 388.3 | |

Foreign currency translation adjustments | (0.2 | ) |

| - | |

| (0.2 | ) | |||

Acquisition | 3.2 | |

| - | |

| 3.2 | | |||

November 28, 2015 | $ | 306.1 | |

| $ | 85.2 | |

| $ | 391.3 | |

7. Employee Benefit Plans

Components of Net Periodic Benefit Costs |

|

|

|

| |||||||||||

| Three Months Ended |

| Six Months Ended | ||||||||||||

| Pension Benefits |

| Pension Benefits | ||||||||||||

(In millions) | November 28, 2015 |

| November 29, 2014 |

| November 28, 2015 |

| November 29, 2014 | ||||||||

International: |

|

|

|

|

|

|

| ||||||||

Interest cost | $ | 1.0 | |

| $ | 1.1 | |

| $ | 2.0 | |

| $ | 2.3 | |

Expected return on plan assets | (1.4 | ) |

| (1.5 | ) |

| (2.8 | ) |

| (3.0 | ) | ||||

Net amortization loss | 0.7 | |

| 0.5 | |

| 1.4 | |

| 1.0 | | ||||

Net periodic benefit cost | $ | 0.3 | |

| $ | 0.1 | |

| $ | 0.6 | |

| $ | 0.3 | |

|

|

|

|

|

|

|

| ||||||||

10

8. Earnings Per Share

| Three Months Ended |

| Six Months Ended | ||||||||||||

| November 28, 2015 |

| November 29, 2014 |

| November 28, 2015 |

| November 29, 2014 | ||||||||

Numerators : |

|

|

|

|

|

|

| ||||||||

Numerator for both basic and diluted EPS, net earnings attributable to Herman Miller, Inc. - in millions | $ | 34.7 | |

| $ | 27.8 | |

| $ | 68.2 | |

| $ | 53.0 | |

|

|

|

|

|

|

|

| ||||||||

Denominators : |

|

|

|

|

|

|

| ||||||||

Denominator for basic EPS, weighted-average common shares outstanding | 59,891,876 | |

| 59,445,577 | |

| 59,812,900 | |

| 59,370,718 | | ||||

Potentially dilutive shares resulting from stock plans | 519,664 | |

| 578,941 | |

| 536,359 | |

| 581,916 | | ||||

Denominator for diluted EPS | 60,411,540 | |

| 60,024,518 | |

| 60,349,259 | |

| 59,952,634 | | ||||

Antidilutive equity awards not included in weighted-average common shares - diluted | 479,912 | |

| 538,380 | |

| 520,722 | |

| 743,060 | | ||||

The company has certain share-based payment awards that meet the definition of participating securities. The company has evaluated the impact on EPS of all participating securities under the two-class method, noting the impact on EPS was immaterial.

9. Stock-Based Compensation

The company's stock-based compensation expense for the three month periods ended November 28, 2015 and November 29, 2014 was $2.6 million and $2.7 million , respectively. The related income tax effect for both the three month periods ended November 28, 2015 and November 29, 2014 was $1.0 million . For the six months ended November 28, 2015 and November 29, 2014 , stock-based compensation expense was $6.5 million and $5.7 million , respectively. The related income tax effect for the respective six month periods was $2.4 million and $2.1 million .

Stock-based compensation expense recognized in the Condensed Consolidated Statements of Comprehensive Income for the three and six month periods ended November 28, 2015 and November 29, 2014 has been reduced for estimated forfeitures, as it is based on awards ultimately expected to vest. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ. Forfeitures are estimated based on historical experience.

For the six month period ended November 28, 2015 , the company issued 185,949 shares of common stock related to the exercise of stock options, 163,430 shares of common stock related to the vesting of restricted stock units, and 55,825 shares of common stock related to the vesting of performance share units.

For the six month period ended November 29, 2014 , the company issued 226,867 shares of common stock related to the exercise of stock options, 121,985 shares of common stock related to the vesting of restricted stock units, and no shares of common stock related to the vesting of performance share units.

10. Income Taxes

The company recognizes interest and penalties related to uncertain tax benefits through income tax expense in its Condensed Consolidated Statement of Comprehensive Income. Interest and penalties recognized in the company's Condensed Consolidated Statement of Comprehensive Income were $0.1 million during the six month periods ended November 28, 2015 and November 29, 2014 and were negligible during the three month periods ended November 28, 2015 and November 29, 2014 . The company's recorded liability for potential interest and penalties related to uncertain tax benefits totaled $0.9 million as of both November 28, 2015 and May 30, 2015 . The company had income tax accruals associated with uncertain tax benefits totaling $1.8 million as of both November 28, 2015 and May 30, 2015 .

The company is subject to periodic audits by domestic and foreign tax authorities. Currently, the company is undergoing routine periodic audits in both domestic and foreign tax jurisdictions. It is reasonably possible that the amounts of unrecognized tax benefits could change in the next twelve months as a result of the audits. Tax payments related to these audits, if any, are not expected to be material to the company's Condensed Consolidated Statements of Comprehensive Income.

For the majority of tax jurisdictions, the company is no longer subject to state, local, or non-United States income tax examinations by tax authorities for fiscal years before 2012.

11

11. Fair Value Measurements

The following describes the methods the company uses to estimate the fair value of financial assets and liabilities, which have not significantly changed in the current period:

Available-for-sale securities - The company's available-for-sale marketable securities primarily include mortgage-backed debt securities, government obligations and corporate debt securities and are recorded at fair value using quoted prices for similar securities.

Deferred compensation plan - The company's deferred compensation plan primarily includes various domestic and international mutual funds that are recorded at fair value using quoted prices for similar securities.

Foreign currency exchange contracts - The company's foreign currency exchange contracts are valued using an approach based on foreign currency exchange rates obtained from active markets. The estimated fair value of forward currency exchange contracts is based on month-end spot rates as adjusted by market-based current activity. These forward contracts are not designated as hedging instruments. Accordingly, we record the fair value of these contracts as of the end of the reporting period in the Condensed Consolidated Balance Sheets with changes in fair value recorded within the Condensed Consolidated Statements of Comprehensive Income.

The following tables set forth financial assets and liabilities measured at fair value in the Condensed Consolidated Balance Sheets and the respective pricing levels to which the fair value measurements are classified within the fair value hierarchy as of November 28, 2015 and May 30, 2015 .

(In millions) | Fair Value Measurements | ||||||

| November 28, 2015 |

| May 30, 2015 | ||||

Financial Assets | Quoted Prices with Other Observable Inputs (Level 2) |

| Quoted Prices with Other Observable Inputs (Level 2) | ||||

Available-for-sale marketable securities: |

|

|

| ||||

Asset-backed securities | $ | 0.1 | |

| $ | 0.2 | |

Corporate securities | 0.4 | |

| 0.6 | | ||

Government obligations | 4.4 | |

| 4.4 | | ||

Mortgage-backed securities | 0.5 | |

| 0.5 | | ||

Foreign currency forward contracts | 0.7 | |

| 0.7 | | ||

Deferred compensation plan | 8.5 | |

| 7.9 | | ||

Total | $ | 14.6 | |

| $ | 14.3 | |

|

|

|

| ||||

Financial Liabilities |

|

|

| ||||

Foreign currency forward contracts | $ | 0.4 | |

| $ | 0.2 | |

Total | $ | 0.4 | |

| $ | 0.2 | |

12

| November 28, 2015 | ||||||||||||||

(In millions) | Cost |

| Unrealized Gain |

| Unrealized Loss |

| Market Value | ||||||||

Asset-backed securities | $ | 0.1 | |

| $ | - | |

| $ | - | |

| $ | 0.1 | |

Corporate securities | 0.4 | |

| - | |

| - | |

| 0.4 | | ||||

Government obligations | 4.4 | |

| - | |

| - | |

| 4.4 | | ||||

Mortgage-backed securities | 0.5 | |

| - | |

| - | |

| 0.5 | | ||||

Total | $ | 5.4 | |

| $ | - | |

| $ | - | |

| $ | 5.4 | |

|

|

|

|

|

|

|

| ||||||||

| May 30, 2015 | ||||||||||||||

(In millions) | Cost |

| Unrealized Gain |

| Unrealized Loss |

| Market Value | ||||||||

Asset-backed securities | $ | 0.2 | |

| $ | - | |

| $ | - | |

| $ | 0.2 | |

Corporate securities | 0.6 | |

| - | |

| - | |

| 0.6 | | ||||

Government obligations | 4.4 | |

| - | |

| - | |

| 4.4 | | ||||

Mortgage-backed securities | 0.5 | |

| - | |

| - | |

| 0.5 | | ||||

Total | $ | 5.7 | |

| $ | - | |

| $ | - | |

| $ | 5.7 | |

Adjustments to the fair value of available-for-sale securities are recorded as increases or decreases, net of income taxes, within accumulated other comprehensive loss in stockholders' equity. The cost of securities sold is based on the specific identification method; realized gains and losses resulting from such sales are included in the Condensed Consolidated Statements of Comprehensive Income within "Other, net".

The company reviews its investment portfolio for any unrealized losses that would be deemed other-than-temporary and require the recognition of an impairment loss in earnings. If the cost of an investment exceeds its fair value, the company evaluates, among other factors, general market conditions, the duration and extent to which the fair value is less than its cost, the company's intent to hold the investment, and whether it is more likely than not that the company will be required to sell the investment before recovery of the cost basis. The company also considers the type of security, related industry and sector performance, and published investment ratings. Once a decline in fair value is determined to be other-than-temporary, an impairment charge is recorded and a new cost basis in the investment is established. If conditions within individual markets, industry segments, or macro-economic environments deteriorate, the company could incur future impairments.

Maturities of debt securities included in marketable securities as of November 28, 2015 , are as follows.

(In millions) | Cost |

| Fair Value | ||||

Due within one year | $ | 4.3 | |

| $ | 4.3 | |

Due after one year through five years | 1.1 | |

| 1.1 | | ||

Due after five years through ten years | - | |

| - | | ||

Due after more than ten years | - | |

| - | | ||

Total | $ | 5.4 | |

| $ | 5.4 | |

The company views its available-for-sale portfolio as available for use in its current operations. Accordingly, the investments are recorded within Current Assets within the Condensed Consolidated Balance Sheets.

12. Commitments and Contingencies

Product Warranties

The company provides coverage to the end-user for parts and labor on products sold under its warranty policy and for other product-related matters. The standard length of warranty is twelve years for the majority of products sold; however, this varies depending on the product classification. The company does not sell or otherwise issue warranties or warranty extensions as stand-alone products. Reserves have been established for the various costs associated with the company's warranty program and are included in the Condensed Consolidated Balance Sheets under "Accrued warranty." General warranty reserves are based on historical claims experience and other currently available information. These reserves are adjusted once an issue is identified and the actual cost of correction becomes known or can be estimated.

13

(In millions) | Three Months Ended |

| Six Months Ended | ||||||||||||

| November 28, 2015 |

| November 29, 2014 |

| November 28, 2015 |

| November 29, 2014 | ||||||||

Accrual Balance - beginning | $ | 39.5 | |

| $ | 38.2 | |

| $ | 39.3 | |

| $ | 37.7 | |

Accrual for product-related matters | 6.6 | |

| 6.2 | |

| 12.2 | |

| 12.7 | | ||||

Settlements and adjustments | (5.5 | ) |

| (5.9 | ) |

| (10.9 | ) |

| (11.9 | ) | ||||

Accrual Balance - ending | $ | 40.6 | |

| $ | 38.5 | |

| $ | 40.6 | |

| $ | 38.5 | |

Guarantees

The company is periodically required to provide performance bonds in order to do business with certain customers. These arrangements are common and generally have terms ranging between one and three years. The bonds are required to provide assurance to customers that the products and services they have purchased will be installed and/or provided properly and without damage to their facilities. The bonds are provided by various bonding agencies; however, the company is ultimately liable for claims that may occur against them. As of November 28, 2015 , the company had a maximum financial exposure related to performance bonds totaling approximately $6.7 million . The company has no history of claims, nor is it aware of circumstances that would require it to pay, under any of these arrangements. The company also believes that the resolution of any claims that might arise in the future, either individually or in the aggregate, would not materially affect the company's financial statements. Accordingly, no liability has been recorded in respect to these bonds as of November 28, 2015 and May 30, 2015 .

The company has entered into standby letter of credit arrangements for purposes of protecting various insurance companies and lessors against default on insurance premium and lease payments. As of November 28, 2015 , the company had a maximum financial exposure from these standby letters of credit totaling approximately $8.6 million , all of which is considered usage against the company's revolving credit facility. The company has no history of claims, nor is it aware of circumstances that would require it to perform under any of these arrangements, and believes that the resolution of any claims that might arise in the future, either individually or in the aggregate, would not materially affect the company's financial statements. Accordingly, no liability has been recorded in respect of these arrangements as of November 28, 2015 and May 30, 2015 .

Contingencies

The company leases a facility in the United Kingdom under an agreement that expired in June 2011 and the company was leasing the facility on a month-to-month basis. Under the terms of the lease, the company is required to perform the maintenance and repairs necessary to address the general dilapidation of the facility. As of November 28, 2015, the company has exited the lease and determined the cost of these maintenance and repairs to be $ 1.2 million . Accordingly this amount is recorded under the caption "Other accrued liabilities" in the Condensed Consolidated Balance Sheets as of both November 28, 2015 and May 30, 2015 .

The company is also involved in legal proceedings and litigation arising in the ordinary course of business. In the opinion of management, the outcome of such proceedings and litigation currently pending will not materially affect the company's consolidated financial statements.

13. Debt

Long-term debt as of November 28, 2015 and May 30, 2015 consisted of the following obligations:

(In millions) | November 28, 2015 |

| May 30, 2015 | ||||

Series B senior notes, due January 3, 2018 | $ | 149.8 | |

| $ | 149.8 | |

Debt securities, due March 1, 2021 | 50.0 | |

| 50.0 | | ||

Syndicated revolving line of credit, due July 2019 | 57.0 | |

| 90.0 | | ||

Total | $ | 256.8 | |

| $ | 289.8 | |

On July 21, 2014, the company entered into a third amendment and restatement of its syndicated revolving line of credit, which provides the company with up to $250 million in revolving variable interest borrowing capacity and includes an "accordion feature" allowing the company to increase, at its option and subject to the approval of the participating banks, the aggregate borrowing capacity of the facility by $125 million . The facility expires in July 2019 and outstanding borrowings bear interest at rates based on the prime rate, federal funds rate, LIBOR, or negotiated rates as outlined in the agreement. Interest is payable periodically throughout the period if borrowings are outstanding. As of November 28, 2015 , the total debt outstanding related to borrowings against this facility was $57.0 million . These borrowings are included within Long-term debt in the Condensed Consolidated Balance Sheet. As of November 28, 2015 , the total usage against the facility was $65.6 million , of which $8.6 million related to outstanding letters of credit. As of May 30, 2015 , total usage against this facility was $98.3 million , $8.3 million of which related to outstanding letters of credit.

14

14. Accumulated Other Comprehensive Loss

| | Six Months Ended | ||||||

(In millions) | | November 28, 2015 | | November 29, 2014 | ||||

Cumulative translation adjustments at beginning of period | | $ | (20.8 | ) | | $ | (11.1 | ) |

Translation adjustments | | (4.5 | ) | | (5.9 | ) | ||

Balance at end of period | | (25.3 | ) | | (17.0 | ) | ||

Pension and other post-retirement benefit plans at beginning of period | | (35.4 | ) | | (26.8 | ) | ||

Reclassification to earnings - operating expenses (net of tax $(0.5), $(0.2)) | | 1.4 | | | 0.9 | | ||

Balance at end of period | | (34.0 | ) | | (25.9 | ) | ||

Total accumulated other comprehensive loss | | $ | (59.3 | ) | | $ | (42.9 | ) |

15. Redeemable Noncontrolling Interests

Redeemable noncontrolling interests are reported on the Consolidated Balance Sheets in mezzanine equity in "Redeemable noncontrolling interests." The company recognizes changes to the redemption value of redeemable noncontrolling interests as they occur and adjusts the carrying value to equal the redemption value at the end of each reporting period accordingly. The redemption amounts have been estimated based on the fair value of the subsidiary, determined based on a weighting of the discounted cash flow and market methods. This represents a level 3 fair value measurement.

Changes in the company's Redeemable noncontrolling interests for the six months ended November 28, 2015 and November 29, 2014 are as follows:

|

| Six Months Ended | ||||||

(In millions) |

| November 28, 2015 |

| November 29, 2014 | ||||

Beginning Balance |

| $ | 30.4 | |

| $ | - | |

Increase due to business combination |

| - | |

| 25.7 | | ||

Net income attributable to redeemable noncontrolling interests |

| 0.3 | |

| - | | ||

Exercised options |

| - | |

| 0.7 | | ||

Redemption value adjustment |

| 0.4 | |

| - | | ||

Other adjustments |

| 0.1 | |

| 0.6 | | ||

Ending Balance |

| $ | 31.2 | |

| $ | 27.0 | |

16. Operating Segments

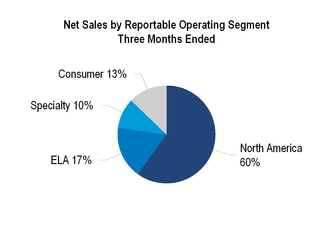

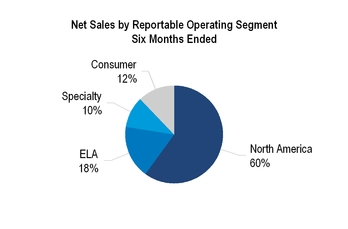

The company's reportable segments consist of North American Furniture Solutions, ELA ("EMEA, Latin America, and Asia Pacific") Furniture Solutions, Specialty, and Consumer. The North American Furniture Solutions reportable segment includes the operations associated with the design, manufacture, and sale of furniture products for work-related settings, including office, education, and healthcare environments, throughout the United States and Canada. ELA Furniture Solutions includes the operations associated with the design, manufacture, and sale of furniture products, primarily for work-related settings, in the EMEA, Latin America, and Asia-Pacific geographic regions. Specialty includes the operations associated with the design, manufacture, and sale of high-craft furniture products and textiles including Geiger wood products, Maharam textiles, and Herman Miller Collection products. The Consumer segment includes the operations associated with the sale of modern design furnishings and accessories to third party retail distributors, as well as direct-to-consumer sales through eCommerce and DWR studios.

The company also reports a "Corporate" category consisting primarily of unallocated corporate expenses including restructuring, impairment, acquisition-related costs, and other unallocated corporate costs.

The accounting policies of the reportable operating segments are the same as those of the company. Additionally, the company employs a methodology for allocating corporate costs and assets with the underlying objective of this methodology being to allocate corporate costs according to the relative usage of the underlying resources and to allocate corporate assets according to the relative expected benefit.

15

The company has determined that allocation based on relative net sales is appropriate. The majority of corporate costs are allocated to the operating segments; however, certain costs generally considered the result of isolated business decisions are not subject to allocation and are evaluated separately from the rest of the regular ongoing business operations. For example, restructuring charges that are reflected in operating earnings are allocated to the "Corporate" category.

The performance of the operating segments is evaluated by the company's management using various financial measures. The following is a summary of certain key financial measures for the respective fiscal periods indicated.

| Three Months Ended |

| Six Months Ended | ||||||||||||

(In millions) | November 28, 2015 |

| November 29, 2014 |

| November 28, 2015 |

| November 29, 2014 | ||||||||

Net Sales: |

|

|

|

|

|

|

| ||||||||

North American Furniture Solutions | $ | 348.1 | |

| $ | 315.3 | |

| $ | 686.2 | |

| $ | 636.4 | |

ELA Furniture Solutions | 100.7 | |

| 114.3 | |

| 203.2 | |

| 209.7 | | ||||

Specialty | 57.7 | |

| 55.4 | |

| 115.5 | |

| 110.0 | | ||||

Consumer | 73.9 | |

| 80.4 | |

| 140.9 | |

| 119.0 | | ||||

Corporate | - | |

| - | |

| - | |

| - | | ||||

Total | $ | 580.4 | |

| $ | 565.4 | |

| $ | 1,145.8 | |

| $ | 1,075.1 | |

|

|

|

|

|

|

|

| ||||||||

Operating Earnings: |

|

|

|

|

|

|

| ||||||||

North American Furniture Solutions | $ | 41.4 | |

| $ | 32.3 | |

| $ | 82.2 | |

| $ | 68.5 | |

ELA Furniture Solutions | 7.3 | |

| 10.4 | |

| 13.9 | |

| 13.5 | | ||||

Specialty | 4.2 | |

| 2.8 | |

| 8.5 | |

| 5.7 | | ||||

Consumer | 2.7 | |

| 1.5 | |

| 6.5 | |

| 3.8 | | ||||

Corporate | (0.1 | ) |

| (0.3 | ) |

| (0.5 | ) |

| (2.6 | ) | ||||

Total | $ | 55.5 | |

| $ | 46.7 | |

| $ | 110.6 | |

| $ | 88.9 | |

|

|

|

|

|

|

|

| ||||||||

(In millions) | November 28, 2015 |

| May 30, 2015 | ||||

Total Assets: |

|

|

| ||||

North American Furniture Solutions | $ | 509.1 | |

| $ | 504.5 | |

ELA Furniture Solutions | 239.9 | |

| 235.4 | | ||

Specialty | 150.2 | |

| 151.6 | | ||

Consumer | 244.7 | |

| 231.8 | | ||

Corporate | 60.1 | |

| 69.4 | | ||

Total | $ | 1,204.0 | |

| $ | 1,192.7 | |

|

|

|

| ||||

16

Item 2: Management's Discussion and Analysis of Financial Condition and Results of Operations

Three and

Six

Months Ended

November 28, 2015

(in millions)

The following is management's discussion and analysis of certain significant factors that affected the company's financial condition, earnings and cash flows during the periods included in the accompanying condensed consolidated financial statements and should be read in conjunction with the company's Annual Report on Form 10-K for the fiscal year ended May 30, 2015 . References to "Notes" are to the footnotes included in the accompanying condensed consolidated financial statements.

Discussion of Current Business Conditions

During the second quarter of fiscal 2016, we demonstrated further progress on our strategic and operational initiatives, which was evidenced by growth in orders and sales. Orders of $601.4 million represented an increase of 5 percent as compared to the prior year. Sales increased to $580.4 million , a 3 percent increase as compared to the prior year. The growth in sales brought with it earnings growth as operating earnings increased 19 percent and diluted earnings per share expanded from $0.46 to $0.57 as compared to the same period last year.

We believe our focus and commitment toward delivering innovative designs to solve problems for people wherever they work, live, learn and heal has helped us create widely respected brands. In Contract Magazine's most recent industry survey, Herman Miller earned the #1 ranking in the category of "Brands that Inspire". Additionally, in the same survey, we earned #1 rankings for ergonomic seating, healthcare furniture ( Nemschoff ), and fabric and textiles ( Maharam ).

The North American segment contributed significantly to our growth in sales and orders this quarter. Sales for the segment grew at a rate of over 10 percent and orders grew by more than 9 percent. Excluding the impact of foreign currency translation, net sales growth in the quarter was approximately 12 percent and orders increased by more than 10 percent. This improvement was driven by the continuation of efforts over the past year to improve selling capacity, launch innovative products, and refresh showrooms.

Foreign currency translation continued to have a negative impact on the ELA segment, which reported a 12 percent decrease in net sales as compared to the prior year. New orders for this segment were essentially flat with the second quarter of last year. On a constant currency basis, sales for ELA declined 5 percent and orders increased 8 percent relative to the same quarter a year ago. The divergent growth rates in sales and orders this quarter is attributed to year-on-year timing differences in project invoicing and bid activity. During the second half of the fiscal year, the ELA segment plans to have a number of new product launches under both the Herman Miller and the POSH brand names.

Our Specialty segment continued to gain momentum in the current quarter as it reported growth in orders, sales, and operating earnings as compared to the same period of the prior year. The Specialty segment reported an increase in sales and new orders of 4 percent and more than 15 percent, respectively.

Our Consumer segment posted year-over-year decreases in both orders (10 percent) and net sales (8 percent) as compared to the prior year. These changes were driven by several factors, including:

• | Continued impact from a deliberate reduction in the number of independent retail distributors within our legacy consumer wholesale business. While we remain confident that the sales volume lost during this cross-over period will migrate over time to our online, catalog, and DWR studio channels, the process has been slower than we expected. |

• | A reduction in the number of DWR studios as part of the closure of small legacy locations and a transition to larger format studios. |

• | Interruptions in selling capacity associated with the implementation of a new Enterprise Resource Planning (ERP) system at Design Within Reach. The ERP implementation was largely completed by the close of the quarter. |

While these results did not meet our expectations, we believe the value drivers for the Consumer segment remain intact to drive future growth. These include the transition of DWR studios to larger, more efficient formats and an increase in the mix of exclusive products. Additionally, we are taking action to enhance brand awareness and implement promotional initiatives aimed at increasing sales volume in the second half of fiscal 2016.

Capital expenditures totaled $35.2 million for the six months ended November 28, 2015 , an increase of $8.5 million compared to the same six month period of fiscal 2015 . The increase was mostly attributable to the construction of our new consolidated manufacturing and distribution facility in the United Kingdom. We anticipate our full year capital spending to be between $70.0 million and $80.0 million.

17

The economic backdrop of our business remains mixed globally. North America continues to benefit from strong employment, encouraging construction and architectural billings data, as well as low commodity costs. Outside of North America, areas of economic uncertainty that we are monitoring closely include China, Latin America, Europe and the Middle East.

The remaining sections within Item 2 include additional analysis of our six months ended November 28, 2015 , including discussion of significant variances compared to the prior year periods.

Reconciliation of Non-GAAP Financial Measures

This report contains references to Organic sales, Adjusted operating earnings, Adjusted EBITDA, and Adjusted earnings per share – diluted, all of which are non-GAAP financial measures (referred to collectively as the "Adjusted financial measures"). The adjusted financial measures are calculated by excluding from Operating earnings, and Earnings per share – diluted items that we believe are not indicative of our ongoing operating performance. Such items consist of the following:

• | Expenses associated with acquisition-related inventory adjustments |

• | Transaction expenses associated with recent acquisitions |

Adjusted EBITDA is calculated by excluding depreciation, amortization and other net income or expense from Adjusted Operating Earnings. Organic sales represents the change in Net sales, excluding currency translation effects and the impact of acquisitions. We present the adjusted financial measures because we consider them to be important supplemental measures of our performance and believe them to be useful in analyzing ongoing results from operations.

The adjusted financial measures are not measurements of our financial performance under GAAP and should not be considered an alternative to Net sales, Operating earnings and Earnings per share – diluted under GAAP. The adjusted financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Our presentation of the adjusted financial measures should not be construed as an indication that our future results will be unaffected by unusual or infrequent items. We compensate for these limitations by providing prominence of our GAAP results and using the adjusted financial measures only as a supplement.

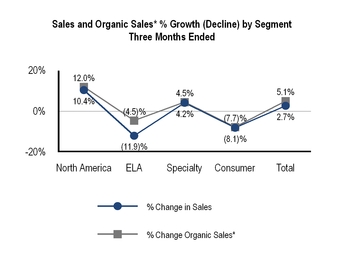

The following table reconciles Net sales to Organic sales for the periods and reportable operating segments indicated.

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||||||||

| 11/28/15 | 11/29/14 | ||||||||||||||||||||||||||||

| North America | ELA | Specialty | Consumer | Total | North America | ELA | Specialty | Consumer | Total | ||||||||||||||||||||

Net Sales, as reported | $ | 348.1 | | $ | 100.7 | | $ | 57.7 | | $ | 73.9 | | $ | 580.4 | | $ | 315.3 | | $ | 114.3 | | $ | 55.4 | | $ | 80.4 | | $ | 565.4 | |

% change from PY | 10.4 | % | (11.9 | )% | 4.2 | % | (8.1 | )% | 2.7 | % |

|

|

|

|

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

Currency Translation Effects (1) | 4.9 | | 8.5 | | 0.2 | | 0.3 | | 13.9 | | - | | - | | - | | - | | - | | ||||||||||

Organic net sales | $ | 353.0 | | $ | 109.2 | | $ | 57.9 | | $ | 74.2 | | $ | 594.3 | | $ | 315.3 | | $ | 114.3 | | $ | 55.4 | | $ | 80.4 | | $ | 565.4 | |

% change from PY | 12.0 | % | (4.5 | )% | 4.5 | % | (7.7 | )% | 5.1 | % |

|

|

|

|

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

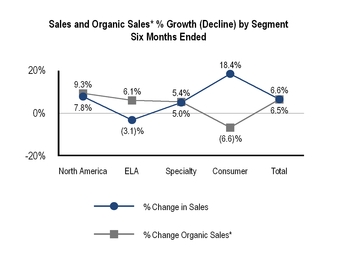

| Six Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| 11/28/15 | 11/29/14 | ||||||||||||||||||||||||||||

| North America | ELA | Specialty | Consumer | Total | North America | ELA | Specialty | Consumer | Total | ||||||||||||||||||||

Net Sales, as reported | $ | 686.2 | | $ | 203.2 | | $ | 115.5 | | $ | 140.9 | | $ | 1,145.8 | | $ | 636.4 | | $ | 209.7 | | $ | 110.0 | | $ | 119.0 | | $ | 1,075.1 | |

% change from PY | 7.8 | % | (3.1 | )% | 5.0 | % | 18.4 | % | 6.6 | % |

|

|

|

|

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

Currency Translation Effects (1) | 9.7 | | 19.2 | | 0.4 | | 0.5 | | 29.8 | | - | | - | | - | | - | | - | | ||||||||||

Acquisition | - | | - | | - | | (30.2 | ) | (30.2 | ) | - | | - | | - | | - | | - | | ||||||||||

Organic net sales | $ | 695.9 | | $ | 222.4 | | $ | 115.9 | | $ | 111.2 | | $ | 1,145.4 | | $ | 636.4 | | $ | 209.7 | | $ | 110.0 | | $ | 119.0 | | $ | 1,075.1 | |

% change from PY | 9.3 | % | 6.1 | % | 5.4 | % | (6.6 | )% | 6.5 | % |

|

|

|

|

| |||||||||||||||

(1) Currency translation effects represent the estimated net impact of translating current period sales and orders using the average exchange rates applicable to the comparable prior year period | ||||||||||||||||||||||||||||||

18

The following table reconciles Operating earnings to Adjusted operating earnings and Adjusted EBITDA for the periods indicated.

| Three Months Ended |

| Six Months Ended | ||||||||||

(Dollars in millions) | November 28, 2015 | November 29, 2014 |

| November 28, 2015 | November 29, 2014 | ||||||||

Operating earnings | $ | 55.5 | | $ | 46.7 | |

| $ | 110.6 | | $ | 88.9 | |

Percentage of net sales | 9.6 | % | 8.3 | % |

| 9.7 | % | 8.3 | % | ||||

Add: Acquisition-related inventory adjustments | - | | 4.8 | |

| - | | 7.8 | | ||||

Add: Acquisition expenses | - | | 0.2 | |

| - | | 2.2 | | ||||

Adjusted operating earnings | $ | 55.5 | | $ | 51.7 | |

| $ | 110.6 | | $ | 98.9 | |

Percentage of net sales | 9.6 | % | 9.1 | % |

| 9.7 | % | 9.2 | % | ||||

Other income (expense), net | 0.4 | | (0.1 | ) |

| (0.1 | ) | (0.1 | ) | ||||

Add: Depreciation and amortization | 13.9 | | 13.2 | |

| 27.6 | | 25.2 | | ||||

Adjusted EBITDA | $ | 69.8 | | $ | 64.8 | |

| $ | 138.1 | | $ | 124.0 | |

Percentage of net sales | 12.0 | % | 11.5 | % |

| 12.1 | % | 11.5 | % | ||||

The following table reconciles Earnings per share – diluted to Adjusted earnings per share – diluted for the periods indicated.

| Three Months Ended |

| Six Months Ended | ||||||||||

| November 28, 2015 | November 29, 2014 |

| November 28, 2015 | November 29, 2014 | ||||||||

Earnings (loss) per share – diluted | $ | 0.57 | | $ | 0.46 | |

| $ | 1.13 | | $ | 0.88 | |

Add: Acquisition-related inventory adjustments | - | | 0.05 | |

| - | | 0.08 | | ||||

Add: Acquisition expenses | - | | - | |

| - | | 0.02 | | ||||

Adjusted earnings per share – diluted | $ | 0.57 | | $ | 0.51 | |

| $ | 1.13 | | $ | 0.98 | |

Analysis of Second Quarter Results

The following table presents certain key highlights from the results of operations for the periods indicated.

(In millions, except per share data) | Three Months Ended |

| Six Months Ended | ||||||||||||||||||

| November 28, 2015 |

| November 29, 2014 |

| Percent Change |

| November 28, 2015 |

| November 29, 2014 |

| Percent | ||||||||||

Net sales | $ | 580.4 | |

| $ | 565.4 | |

| 2.7 | % |

| $ | 1,145.8 | |

| $ | 1,075.1 | |

| 6.6 | % |

Cost of sales | 356.0 | |

| 359.7 | |

| (1.0 | )% |

| 704.6 | |

| 683.8 | |

| 3.0 | % | ||||

Gross margin | 224.4 | |

| 205.7 | |

| 9.1 | % |

| 441.2 | |

| 391.3 | |

| 12.8 | % | ||||

Operating expenses | 168.9 | |

| 159.0 | |

| 6.2 | % |

| 330.6 | |

| 302.4 | |

| 9.3 | % | ||||

Operating earnings | 55.5 | |

| 46.7 | |

| 18.8 | % |

| 110.6 | |

| 88.9 | |

| 24.4 | % | ||||

Other expenses, net | 3.5 | |

| 4.7 | |

| (25.5 | )% |

| 7.9 | |

| 9.4 | |

| (16.0 | )% | ||||

Earnings before income taxes and equity income | 52.0 | |

| 42.0 | |

| 23.8 | % |

| 102.7 | |

| 79.5 | |

| 29.2 | % | ||||

Income tax expense | 17.2 | |

| 14.2 | |

| 21.1 | % |

| 34.2 | |

| 26.6 | |

| 28.6 | % | ||||

Equity earnings from nonconsolidated affiliates, net of tax | 0.1 | |

| - | |

| n/a |

| 0.2 | |

| 0.1 | |

| 100.0 | % | |||||

Net earnings | $ | 34.9 | |

| $ | 27.8 | |

| 25.5 | % |

| $ | 68.7 | |

| $ | 53.0 | |

| 29.6 | % |

Net earnings attributable to noncontrolling interests | 0.2 | |

| - | |

| n/a | |

| 0.5 | |

| - | |

| n/a | | ||||

Net earnings attributable to Herman Miller, Inc. | $ | 34.7 | |

| $ | 27.8 | |

| 24.8 | % |

| $ | 68.2 | |

| $ | 53.0 | |

| 28.7 | % |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

Earnings per share - diluted | $ | 0.57 | |

| $ | 0.46 | |

| 23.9 | % |

| $ | 1.13 | |

| $ | 0.88 | |

| 28.4 | % |

Orders | $ | 601.4 | |

| $ | 572.1 | |

| 5.1 | % |

| $ | 1,164.7 | |

| $ | 1,089.1 | |

| 6.9 | % |

Backlog | $ | 341.1 | |

| $ | 332.5 | |

| 2.6 | % |

|

|

|

|

|

| |||||

The following table presents, for the periods indicated, select components of the company's Condensed Consolidated Statements of Comprehensive Income as a percentage of net sales.

19

| Three Months Ended |

| Six Months Ended | ||||||||

| November 28, 2015 |

| November 29, 2014 |

| November 28, 2015 |

| November 29, 2014 | ||||

Net sales | 100.0 | % |

| 100.0 | % |

| 100.0 | % |

| 100.0 | % |

Cost of sales | 61.3 | |

| 63.6 | |

| 61.5 | |

| 63.6 | |

Gross margin | 38.7 | |

| 36.4 | |

| 38.5 | |

| 36.4 | |

Operating expenses | 29.1 | |

| 28.1 | |

| 28.9 | |

| 28.1 | |

Operating earnings | 9.6 | |

| 8.3 | |

| 9.7 | |

| 8.3 | |

Other expenses, net | 0.6 | |

| 0.8 | |

| 0.7 | |

| 0.9 | |

Earnings before income taxes and equity income | 9.0 | |

| 7.4 | |

| 9.0 | |

| 7.4 | |

Income tax expense | 3.0 | |

| 2.5 | |

| 3.0 | |

| 2.5 | |

Equity earnings from nonconsolidated affiliates, net of tax | - | |

| - | |

| - | |

| - | |

Net earnings | 6.0 | |

| 4.9 | |

| 6.0 | |

| 4.9 | |

Net earnings attributable to noncontrolling interests | - | |

| - | |

| - | |

| - | |

Net earnings attributable to Herman Miller, Inc. | 6.0 | |

| 4.9 | |

| 6.0 | |

| 4.9 | |

Performance versus the Domestic Contract Furniture Industry

We monitor the trade statistics reported by BIFMA, the trade association for the United States domestic office furniture industry, and consider them an indicator of industry-wide sales and order performance in the U.S. BIFMA publishes statistical data for the contract segment within the United States furniture market. The United States contract segment is primarily composed of large to mid-size corporations serviced by a network of dealers. The office supply segment is primarily made up of smaller customers serviced by wholesalers and retailers. We primarily participate, and believe we are a leader in, the contract segment. While comparisons of our performance to BIFMA statistics are important, we continue to pursue a strategy of revenue diversification intended to make us less reliant on the drivers that impact BIFMA and lessen our dependence on the United States office furniture market.

We also use BIFMA statistical information as a benchmark for the performance of our domestic United States business (as defined by BIFMA), as well as the performance of our competitors. The timing of large project-based business may affect comparisons to this data. We remain cautious about reaching conclusions regarding changes in market share based on analysis of data on a short-term basis. Instead, we believe such conclusions should only be reached by analyzing comparative data over several quarters.

While the sales and order data for our North American reportable segment provide a relative comparison to BIFMA, it is not intended to be an exact comparison. The data we report to BIFMA is consistent with the BIFMA definition of office furniture "consumption." This definition differs slightly from the categorization we have presented in this report. Notwithstanding this difference, we believe our presentation provides the reader with a relevant comparison.

For the three month period ended November 28, 2015 , the company's domestic United States shipments, as defined by BIFMA, increased by 7.9 percent while the company's domestic orders increased 9.7 percent year-over-year. BIFMA reported an estimated year-over-year increase in shipments of 3.5 percent and an increase in orders of 1.2 percent for the comparable period.

Performance versus the Consumer Furnishings Sector

We also monitor trade statistics reported by the U.S. Census Bureau, which reports monthly retail sales growth data across a number of retail categories, including Furniture and Home Furnishing Stores . This information provides a relative comparison to our Consumer reportable segment, but is not intended to be an exact comparison. The average monthly year-over-year growth rate in sales for the Furniture and Home Furnishing Stores category for the three month period ended November 30, 2015 was approximately 6.2 percent. By comparison, net sales declined by approximately 8.1 percent in our Consumer segment for the three months ended November 28, 2015 . Year-over-year comparisons of net sales within the Consumer segment were negatively impacted this quarter by the factors included within the Discussion of Current Business Conditions above.

20

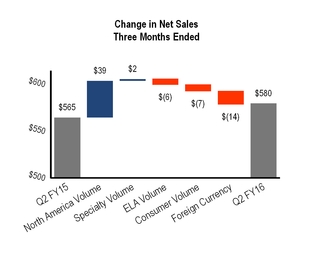

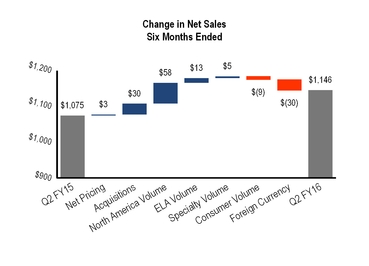

Consolidated Sales

The following charts present graphically the primary drivers of the year-over-year change in net sales for the three and six-months ended November 28, 2015. The amounts presented in the bar graphs are expressed in millions and have been rounded to eliminate decimals.

Consolidated net sales increased $15.0 million or 2.7 percent for the second quarter of fiscal 2016 compared to the second quarter of fiscal 2015. The following items led to the change:

• | Increased sales volume within the North American segment of approximately $39.1 million, which was driven by strategic actions taken to improve selling capacity, launch innovative products and refresh showrooms. |

• | Decreased sales volume within the Consumer segment of $6.6 million, resulting from the factors included within the Discussion of Current Business Conditions above. |

• | Decreased sales volume within the ELA segment of $5.5 million, primarily due to decreases within EMEA and Latin America. |

• | Foreign currency translation had a negative impact on sales of $13.9 million. |

Consolidated net sales increased $70.7 million or 6.6 percent in the first half of fiscal 2016 compared to the first half of fiscal 2015. The following items led to the change:

• | Increased sales volume within the North American segment of approximately $58.1 million, which was driven by strategic actions taken to improve selling capacity, launch innovative products and refresh showrooms. |

• | Incremental sales volume within the Consumer segment related to the acquisition of DWR, which increased sales by $30.2 million. |

• | Increased sales volume within the ELA segment of $12.7 million, driven by increases within Asia and Latin America. |

• | Foreign currency translation had a negative impact on sales of $29.8 million. |

• | Price increases, net of incremental discounting had a positive impact on sales of $3.0 million. |

*Non-GAAP Financial Measure

21

Consolidated Gross Margin

Consolidated gross margin was 38.7 percent and 38.5 percent for the three and six month periods ending November 28, 2015 as compared to 36.4 percent for both the three and six month periods of the prior year. The following factors summarize the major drivers of the year-over-year change in gross margin percentage for the three and six month periods:

• | Inventory-related purchase accounting adjustments related to the acquisition of DWR unfavorably impacted gross margin in the prior year by approximately 80 basis points and 70 basis points for the three and six month periods, respectively. |

• | We estimate that relative changes in foreign currency exchange rates had a negative impact on our consolidated gross margin of approximately 60 basis points in the current year (in both the three and six-month comparative periods). |

• | We have recognized higher incentive compensation expenses through the first half of fiscal 2016 and this has reduced our consolidated gross margin by approximately 40 basis points relative to the three and six-month periods of last fiscal year. |

• | Lower commodity costs within the North American segment in the current fiscal year drove a favorable year-over-year margin impact of approximately 90 basis points in the three month period. For the six month period, we estimate this impact to be closer to 80 basis points. |

• | Other factors providing a favorable impact to gross margin during the three and six month comparative periods of the current year included production volume leverage at the company's West Michigan manufacturing facilities, decreased freight expenses driven mainly by lower fuel costs, and improved operating efficiencies at certain international and domestic subsidiaries. |

Operating Expenses and Operating Earnings

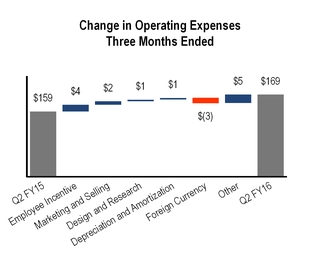

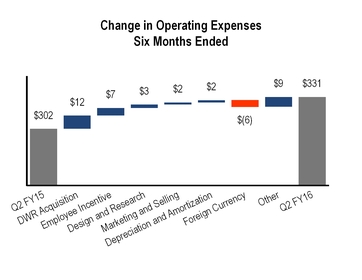

The following charts present graphically the primary drivers of the year-over-year change in operating expenses for the three and six-months ended November 28, 2015. The amounts presented in the bar graphs are expressed in millions and have been rounded to eliminate decimals.

Consolidated operating expenses increased $9.9 million or 6.2% and $28.2 million or 9.3% in the second quarter and first half of fiscal 2016, respectively, compared to the prior year periods. The following factors contributed to the changes:

• | Employee incentive costs increased by $3.7 million and $7.2 million for the three and six month comparative periods. The increases reflect higher incentive compensation that are tied to increased earnings for the comparative periods. |

• | Marketing and selling expenses increased $1.9 million and $2.4 million during the three and six month comparative periods. The increases resulted from new marketing initiatives, increases in selling capacity and sales growth during the comparative periods. |

• | Design and research expenses increased by $1.3 million and $2.9 million during the three and six month comparative periods. The increase resulted from investments in product development initiatives covering a variety of targeted future launch dates. |

• | The impact of foreign currency translation decreased operating expenses by $3.1 million and $6.4 million for the three and six month comparative periods. |

• | The acquisition of DWR increased operating expenses by $11.5 million for the six month comparative period. |

• | The remaining year-over-year operating expense change for both the three and six month periods relates to various contributing factors, including but not limited to higher costs for information technology initiatives, wage and benefit inflation, and general variability with higher net sales. |

22