UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-8974

Honeywell International Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware | 22-2640650 | |

|

|

|

(State or other jurisdiction of | (I.R.S. Employer | |

101 Columbia Road | 07962 | |

|

|

|

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (973) 455-2000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class | Name of Each Exchange | |

|

|

|

Common Stock, par value $1 per share* | New York Stock Exchange | |

| Chicago Stock Exchange | |

9 1 / 2 % Debentures due June 1, 2016 | New York Stock Exchange |

| ||||||||||||||||||||

* |

|

| The common stock is also listed on the London Stock Exchange.

| |||||||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes S No £

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes £ No S

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes S No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "accelerated filer," "large accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

Large accelerated filer S Accelerated filer £ Non-accelerated filer £ Smaller reporting company £

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No S

The aggregate market value of the voting stock held by nonaffiliates of the Registrant was approximately $62.3 billion at June 30, 2013.

There were 784,131,620 shares of Common Stock outstanding at January 24, 2014.

Documents Incorporated by Reference

Part III: Proxy Statement for Annual Meeting of Shareowners to be held April 28, 2014.

TABLE OF CONTENTS

|

|

|

|

|

|

|

| Item |

| Page | |||

Part I | 1. | Business | 1 | |||

| 1A. | Risk Factors | 14 | |||

| 1B. | Unresolved Staff Comments | 21 | |||

| 2. | Properties | 21 | |||

| 3. | Legal Proceedings | 22 | |||

| 4. | Mine Safety Disclosures | 23 | |||

| Executive Officers of the Registrant | 23 | ||||

Part II. | 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 24 | |||

| 6. | Selected Financial Data | 26 | |||

| 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 27 | |||

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | 58 | |||

| 8. | Financial Statements and Supplementary Data | 59 | |||

| 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 122 | |||

| 9A. | Controls and Procedures | 122 | |||

| 9B. | Other Information | 123 | |||

Part III. | 10. | Directors and Executive Officers of the Registrant | 123 | |||

| 11. | Executive Compensation | 123 | |||

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 123 | |||

| 13. | Certain Relationships and Related Transactions | 126 | |||

| 14. | Principal Accounting Fees and Services | 126 | |||

Part IV. | 15. | Exhibits and Financial Statement Schedules | 126 | |||

Signatures | 127 | |||||

PART I.

Item 1. Business

Honeywell International Inc. (Honeywell) is a diversified technology and manufacturing company, serving customers worldwide with aerospace products and services, control, sensing and security technologies for buildings, homes and industry, turbochargers, automotive products, specialty chemicals, electronic and advanced materials, process technology for refining and petrochemicals, and energy efficient products and solutions for homes, business and transportation. Honeywell was incorporated in Delaware in 1985.

We maintain an internet website at http://www.honeywell.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports, are available free of charge on our website under the heading "Investor Relations" (see "SEC Filings & Reports") immediately after they are filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, in this Form 10-K, the Company incorporates by reference certain information from parts of its proxy statement for the 2014 Annual Meeting of Stockholders, which we expect to file with the SEC on or about March 13, 2014, and which will also be available free of charge on our website.

Information relating to corporate governance at Honeywell, including Honeywell's Code of Business Conduct, Corporate Governance Guidelines and Charters of the Committees of the Board of Directors are also available, free of charge, on our website under the heading "Investor Relations" (see "Corporate Governance"), or by writing to Honeywell, 101 Columbia Road, Morris Township, New Jersey 07962, c/o Vice President and Corporate Secretary. Honeywell's Code of Business Conduct applies to all Honeywell directors, officers (including the Chief Executive Officer, Chief Financial Officer and Controller) and employees.

Major Businesses

We globally manage our business operations through four businesses that are reported as operating segments: Aerospace, Automation and Control Solutions, Performance Materials and Technologies, and Transportation Systems. Financial information related to our operating segments is included in Note 24 of Notes to Financial Statements in "Item 8. Financial Statements and Supplementary Data."

The major products/services, customers/uses and key competitors of each of our operating segments follows:

Aerospace

Our Aerospace segment is a leading global provider of integrated avionics, engines, systems and service solutions for aircraft manufacturers, airlines, business and general aviation, military, space and airport operations.

|

|

|

|

|

Turbine propulsion engines | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

TFE731 turbofan | Business, regional, and general | Rolls Royce/Allison | ||

1

|

|

|

|

|

Turbine propulsion engines | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

HTS900 turboshaft |

|

|

|

|

|

|

|

|

|

Auxiliary power units (APUs) | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Airborne auxiliary power units | Commercial, regional, business | United Technologies | ||

|

|

|

|

|

Environmental control systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Air management systems: | Commercial, regional and | Auxilec | ||

|

|

|

|

|

Electric power systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Generators | Commercial, regional, business | General Electric | ||

|

|

|

|

|

Engine systems accessories | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Electronic and hydromechanical | Commercial, regional and | BAE Controls | ||

|

|

|

|

|

Avionics, displays, flight guidance and flight management systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Flight data and cockpit voice | Commercial, business and | BAE | ||

2

|

|

|

|

|

Avionics, displays, flight guidance and flight management systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Flight management systems | Military aircraft | General Electric | ||

|

|

|

|

|

Radios, radar, navigation communication, datalink safety systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Flight safety systems: | Commercial, business and | BAE | ||

|

|

|

|

|

Aircraft lighting | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Interior and exterior aircraft | Commercial, regional, business, | Hella/United Technologies | ||

|

|

|

|

|

Inertial sensor | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Inertial sensor systems for | Military and commercial | Astronautics Kearfott | ||

3

|

|

|

|

|

Control products | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Radar altimeters | Military aircraft | BAE | ||

|

|

|

|

|

Space products and subsystems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Guidance subsystems | Commercial and military spacecraft | BAE | ||

|

|

|

|

|

Management and technical services | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Maintenance/operation and | NASA | Bechtel | ||

|

|

|

|

|

Landing systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Wheels and brakes | Commercial airline, regional, | Meggitt | ||

Automation and Control Solutions

Our Automation and Control Solutions segment is a leading global provider of environmental and combustion controls, sensing controls, security and life safety products and services, scanning and mobility devices and process automation and building solutions and services for homes, buildings and industrial facilities.

|

|

|

|

|

Environmental and combustion controls; sensing controls | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Heating, ventilating and air | Original equipment | Amphenol | ||

4

|

|

|

|

|

Environmental and combustion controls; sensing controls | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Indoor air quality products | Retailers | Eaton | ||

|

|

|

|

|

Security and life safety products and services | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Security products and home | OEMs | Alarm.com | ||

|

|

|

|

|

Scanning and mobility | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Hand held and hands free | OEMs | Bluebird Soft | ||

5

|

|

|

|

|

Scanning and mobility | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Satellite tracking hardware, | Security, logistics, maritime |

|

| |

Search & Rescue ground | National organizations that |

|

| |

|

|

|

|

|

Process automation products and solutions | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Advanced control software and | Refining and petrochemical | ABB | ||

|

|

|

|

|

Building solutions and services | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

HVAC and building control | Building managers and owners | Ameresco | ||

6

Performance Materials and Technologies

Our Performance Materials and Technologies segment is a global leader in providing customers with leading technologies and high-performance materials, including hydrocarbon processing technologies, catalysts, adsorbents, equipment and services, fluorine products, specialty films and additives, advanced fibers and composites, intermediates, specialty chemicals, electronic materials and chemicals.

|

|

|

|

|

Resins & chemicals | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Nylon 6 polymer | Nylon for carpet fibers, | BASF | ||

|

|

|

|

|

Hydrofluoric acid (HF) | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Anhydrous and aqueous | Fluorochemicals | Mexichem Fluor | ||

|

|

|

|

|

Fluorochemicals | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Refrigerants, aerosol and | Refrigeration | Asahi | ||

|

|

|

|

|

Nuclear services | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

UF6 conversion services | Nuclear fuel | Cameco | ||

|

|

|

|

|

Research and fine chemicals | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Oxime-based fine chemicals | Agrichemicals | Avecia | ||

7

|

|

|

|

|

Performance chemicals, Imaging chemicals, Chemical processing sealants | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

HF derivatives | Diverse by product type | Atotech | ||

|

|

|

|

|

Advanced fibers & composites | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

High modulus polyethylene | Bullet resistant vests, helmets | DuPont | ||

|

|

|

|

|

Healthcare and packaging | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Cast nylon film | Food and pharmaceutical packaging | American Biaxis | ||

|

|

|

|

|

Specialty additives | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Polyethylene waxes | Coatings and inks | BASF | ||

|

|

|

|

|

Electronic chemicals | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Ultra high-purity HF | Semiconductors | BASF | ||

|

|

|

|

|

Semiconductor materials and services | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Interconnect-dielectrics | Semiconductors | BASF | ||

8

|

|

|

|

|

Catalysts, adsorbents and specialties | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Catalysts | Petroleum, refining, | Axens | ||

|

|

|

|

|

Process technology and equipment | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Technology licensing and | Petroleum refining, | Axens | ||

|

|

|

|

|

Renewable fuels and chemicals | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Technology licensing of | Military, refining, fuel oil, power | Dynamotive | ||

|

|

|

|

|

Gas processing and hydrogen | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Design, engineer, manufacture | Gas processing and hydrogen | Cameron | ||

9

Transportation Systems

Our Transportation Systems segment is one of the leading manufacturers of engine boosting systems for passenger cars and commercial vehicles, as well as a leading provider of braking products.

|

|

|

|

|

Charge-air systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Turbochargers for gasoline, | Passenger car, truck and | Borg-Warner | ||

|

|

|

|

|

Thermal systems | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Exhaust gas coolers | Passenger car, truck and | Behr | ||

|

|

|

|

|

Brake hard parts and other friction materials | ||||

| ||||

Major Products/Services | Major Customers/Uses | Key Competitors | ||

Disc brake pads and shoes | Automotive and heavy vehicle | Akebono | ||

Aerospace Sales

Our sales to aerospace customers were 31, 32, and 31 percent of our total sales in 2013, 2012 and 2011, respectively. Our sales to commercial aerospace original equipment manufacturers were 7, 7, and 6 percent of our total sales in 2013, 2012 and 2011, respectively. In addition, our sales to commercial aftermarket customers of aerospace products and services were 11, 12, and 11 percent of our total sales in 2013, 2012 and 2011. Our Aerospace results of operations can be impacted by various industry and economic conditions. See "Item 1A. Risk Factors."

U.S. Government Sales

Sales to the U.S. Government (principally by our Aerospace segment), acting through its various departments and agencies and through prime contractors, amounted to $3,856, $4,109 and $4,276 million in 2013, 2012 and 2011, respectively, which included sales to the U.S. Department of Defense, as a prime contractor and subcontractor, of $3,066, $3,273 and $3,374 million in 2013, 2012 and 2011, respectively. U.S. defense spending decreased in 2013 compared to 2012. Due to anticipated lower U.S. Government spending levels mandated by the Budget Control Act (sequestration), we expect a slight decline in our defense and space revenue in 2014. We do not expect our overall operating results to be significantly affected by any proposed changes in 2014 federal defense spending due principally to the varied mix of the government programs which impact us (OEM production, engineering development programs, aftermarket spares and repairs and overhaul programs), increases in direct foreign defense and space market sales, as well as our diversified commercial businesses.

10

Our contracts with the U.S. Government are subject to audits, investigations, and termination by the government. See "Item 1A. Risk Factors."

Backlog

Our total backlog at December 31, 2013 and 2012 was $16,523 and $16,307 million, respectively. We anticipate that approximately $12,262 million of the 2013 backlog will be filled in 2014. We believe that backlog is not necessarily a reliable indicator of our future sales because a substantial portion of the orders constituting this backlog may be canceled at the customer's option.

Competition

We are subject to active competition in substantially all product and service areas. Competition is expected to continue in all geographic regions. Competitive conditions vary widely among the thousands of products and services provided by us, and vary by country. Our businesses compete on a variety of factors, such as price, quality, reliability, delivery, customer service, performance, applied technology, product innovation and product recognition. Brand identity, service to customers and quality are important competitive factors for our products and services, and there is considerable price competition. Other competitive factors include breadth of product line, research and development efforts and technical and managerial capability. While our competitive position varies among our products and services, we believe we are a significant competitor in each of our major product and service classes. A number of our products and services are sold in competition with those of a large number of other companies, some of which have substantial financial resources and significant technological capabilities. In addition, some of our products compete with the captive component divisions of original equipment manufacturers. See Item 1A "Risk Factors" for further discussion.

International Operations

We are engaged in manufacturing, sales, service and research and development globally. U.S. exports and foreign manufactured products are significant to our operations. U.S. exports comprised 14, 14 and 12 percent of our total sales in 2013, 2012 and 2011, respectively. Foreign manufactured products and services, mainly in Europe and Asia, were 41, 41 and 43 percent of our total sales in 2013, 2012 and 2011, respectively.

Approximately 23 percent of total 2013 sales of Aerospace-related products and services were exports of U.S. manufactured products and systems and performance of services such as aircraft repair and overhaul. Exports were principally made to Europe, Asia, Canada, and Latin America. Foreign manufactured products and systems and performance of services comprised approximately 16 percent of total 2013 Aerospace sales. The principal manufacturing facilities outside the U.S. are in Europe, with less significant operations in Canada and Asia.

Approximately 3 percent of total 2013 sales of Automation and Control Solutions products and services were exports of U.S. manufactured products. Foreign manufactured products and performance of services accounted for 57 percent of total 2013 Automation and Control Solutions sales. The principal manufacturing facilities outside the U.S. are in Europe and Asia, with less significant operations in Canada and Australia.

Approximately 30 percent of total 2013 sales of Performance Materials and Technologies products and services were exports of U.S. manufactured products. Exports were principally made to Asia and Latin America. Foreign manufactured products and performance of services comprised 23 percent of total 2013 Performance Materials and Technologies sales. The principal manufacturing facilities outside the U.S. are in Europe and Asia.

Approximately 4 percent of total 2013 sales of Transportation Systems products were exports of U.S. manufactured products. Foreign manufactured products accounted for 84 percent of total 2013 sales of Transportation Systems. The principal manufacturing facilities outside the U.S. are in Europe, with less significant operations in Asia.

11

Financial information including net sales and long-lived assets related to geographic areas is included in Note 25 of Notes to Financial Statements in "Item 8. Financial Statements and Supplementary Data". Information regarding the economic, political, regulatory and other risks associated with international operations is included in "Item 1A. Risk Factors."

Raw Materials

The principal raw materials used in our operations are generally readily available. Although we occasionally experience disruption in raw materials supply, we experienced no significant problems in the purchase of key raw materials and commodities in 2013. We are not dependent on any one supplier for a material amount of our raw materials, except related to R240 (a key component in foam blowing agents), a raw material used in our Performance Materials and Technologies segment.

The costs of certain key raw materials, including cumene, fluorspar, R240, natural gas, perchloroethylene, sulfur and ethylene in our Performance Materials and Technologies business, nickel, steel and other metals in our Transportation Systems business, and nickel, titanium and other metals in our Aerospace business, are expected to continue to fluctuate. We will continue to attempt to offset raw material cost increases with formula or long-term supply agreements, price increases and hedging activities where feasible. We do not presently anticipate that a shortage of raw materials will cause any material adverse impacts during 2014. See "Item 1A. Risk Factors" for further discussion.

Patents, Trademarks, Licenses and Distribution Rights

Our segments are not dependent upon any single patent or related group of patents, or any licenses or distribution rights. We own, or are licensed under, a large number of patents, patent applications and trademarks acquired over a period of many years, which relate to many of our products or improvements to those products and which are of importance to our business. From time to time, new patents and trademarks are obtained, and patent and trademark licenses and rights are acquired from others. We also have distribution rights of varying terms for a number of products and services produced by other companies. In our judgment, those rights are adequate for the conduct of our business. We believe that, in the aggregate, the rights under our patents, trademarks and licenses are generally important to our operations, but we do not consider any patent, trademark or related group of patents, or any licensing or distribution rights related to a specific process or product, to be of material importance in relation to our total business. See "Item 1A. Risk Factors" for further discussion.

We have registered trademarks for a number of our products and services, including Honeywell, Aclar, Ademco, Bendix, BW, Callidus, Enovate, Esser, Fire-Lite, Garrett, Genetron, Gent, Howard Leight, Intermec, Jurid, Matrikon, Maxon, MK, North, Notifier, Novar, Oleflex, Parex, RAE Systems, RMG, Silent Knight, Solstice, Spectra, System Sensor, Trend, Tridium and UOP.

Research and Development

Our research activities are directed toward the discovery and development of new products, technologies and processes, and the development of new uses for existing products and software applications. The Company's principal research and development activities are in the U.S., India, Europe and China.

Research and development (R&D) expense totaled $1,804, $1,847 and $1,799 million in 2013, 2012 and 2011, respectively. The decrease in R&D expense of 2 percent in 2013 compared to 2012 was primarily due to lower pension (primarily due to the absence of U.S. pension mark-to-market adjustment in 2013) and other postretirement expenses, partially offset by the increased expenditures for new product development in our Automation and Control Solutions and Performance Materials Technologies segments. The increase in R&D expense of 3 percent in 2012 compared to 2011 was mainly due to increased expenditures on the development of new technologies to support existing and new aircraft platforms in our Aerospace segment and new product development in our Automation and Control Solutions and Performance Materials Technologies segments. R&D as a percentage of sales was 4.6, 4.9 and 4.9 percent in 2013, 2012 and 2011, respectively. Customer-sponsored (principally

12

the U.S. Government) R&D activities amounted to an additional $969, $835 and $867 million in 2013, 2012 and 2011, respectively.

Environment

We are subject to various federal, state, local and foreign government requirements regulating the discharge of materials into the environment or otherwise relating to the protection of the environment. It is our policy to comply with these requirements, and we believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage, and of resulting financial liability, in connection with our business. Some risk of environmental damage is, however, inherent in some of our operations and products, as it is with other companies engaged in similar businesses.

We are and have been engaged in the handling, manufacture, use and disposal of many substances classified as hazardous by one or more regulatory agencies. We believe that, as a general matter, our policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage and personal injury, and that our handling, manufacture, use and disposal of these substances are in accord with environmental and safety laws and regulations. It is possible, however, that future knowledge or other developments, such as improved capability to detect substances in the environment or increasingly strict environmental laws and standards and enforcement policies, could bring into question our current or past handling, manufacture, use or disposal of these substances.

Among other environmental requirements, we are subject to the federal superfund and similar state and foreign laws and regulations, under which we have been designated as a potentially responsible party that may be liable for cleanup costs associated with current and former operating sites and various hazardous waste sites, some of which are on the U.S. Environmental Protection Agency's Superfund priority list. Although, under some court interpretations of these laws, there is a possibility that a responsible party might have to bear more than its proportional share of the cleanup costs if it is unable to obtain appropriate contribution from other responsible parties, to date we have not had to bear significantly more than our proportional share in multi-party situations taken as a whole.

We do not believe that existing or pending climate change legislation, regulation, or international treaties or accords are reasonably likely to have a material effect in the foreseeable future on the Company's business or markets that it serves, nor on its results of operations, capital expenditures or financial position. We will continue to monitor emerging developments in this area.

Further information, including the current status of significant environmental matters and the financial impact incurred for remediation of such environmental matters, if any, is included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," in Note 22 Commitments and Contingencies of Notes to Financial Statements in "Item 8. Financial Statements and Supplementary Data," and in "Item 1A. Risk Factors."

Employees

We have approximately 131,000 employees at December 31, 2013, of which approximately 51,000 were located in the United States.

13

Item 1A. Risk Factors

Cautionary Statement about Forward-Looking Statements

We have described many of the trends and other factors that drive our business and future results in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations", including the overview of the Company and each of our segments and the discussion of their respective economic and other factors and areas of focus for 2014. These sections and other parts of this report (including this Item 1A) contain "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are those that address activities, events or developments that management intends, expects, projects, believes or anticipates will or may occur in the future. They are based on management's assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments and other relevant factors. They are not guarantees of future performance, and actual results, developments and business decisions may differ significantly from those envisaged by our forward-looking statements. We do not undertake to update or revise any of our forward-looking statements. Our forward-looking statements are also subject to risks and uncertainties that can affect our performance in both the near-and long-term. These forward-looking statements should be considered in light of the information included in this Form 10-K, including, in particular, the factors discussed below.

Risk Factors

Our business, operating results, cash flows and financial condition are subject to the risks and uncertainties set forth below, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results.

Industry and economic conditions may adversely affect the markets and operating conditions of our customers, which in turn can affect demand for our products and services and our results of operations.

The operating results of our segments are impacted by general global industry and economic conditions that can cause changes in spending and capital investment patterns, demand for our products and services and the level of our manufacturing and shipping costs. The operating results of our Aerospace segment, which generated 31 percent of our consolidated revenues in 2013, are directly tied to cyclical industry and economic conditions, including global demand for air travel as reflected in new aircraft production, the deferral or cancellation of orders for new aircraft, delays in launch schedules for new aircraft platforms, the retirement of aircraft, global flying hours, and business and general aviation aircraft utilization rates, as well as changes in customer buying patterns with respect to aftermarket parts, supplier consolidation, factory transitions, capacity constraints, and the level and mix of U.S. and foreign government appropriations for defense and space programs (as further discussed in other risk factors below). The challenging operating environment faced by the commercial airline industry may be influenced by a wide variety of factors including global flying hours, aircraft fuel prices, labor issues, airline consolidation, airline insolvencies, terrorism and safety concerns as well as changes in regulations. Future terrorist actions or pandemic health issues could dramatically reduce both the demand for air travel and our Aerospace aftermarket sales and margins. The operating results of our Automation and Control Solutions (ACS) segment, which generated 42 percent of our consolidated revenues in 2013, are impacted by the level of global residential and commercial construction (including retrofits and upgrades), capital spending and operating expenditures on building and process automation, industrial plant capacity utilization and expansion, inventory levels in distribution channels, and global economic growth rates. Performance Materials and Technologies' operating results, which generated 17 percent of our consolidated revenues in 2013, are impacted by global economic growth rates, capacity utilization for chemical, industrial, refining, petrochemical and semiconductor plants, our customers' availability of capital for refinery construction and expansion, and raw material demand and supply volatility. Transportation Systems' operating results, which generated 10 percent of our consolidated revenues in 2013, are impacted by global production and demand for

14

automobiles and trucks equipped with turbochargers, and regulatory changes regarding automobile and truck emissions and fuel economy, delays in launch schedules for new automotive platforms, and consumer demand and spending for automotive aftermarket products. Demand of global automotive and truck manufacturers will continue to be influenced by a wide variety of factors, including ability of consumers to obtain financing, ability to reduce operating costs and overall consumer and business confidence. Each of the segments is impacted by volatility in raw material prices (as further described below) and non- material inflation.

Raw material price fluctuations, the ability of key suppliers to meet quality and delivery requirements, or catastrophic events can increase the cost of our products and services, impact our ability to meet commitments to customers and cause us to incur significant liabilities.

The cost of raw materials is a key element in the cost of our products, particularly in our Performance Materials and Technologies (cumene, fluorspar, R240, natural gas, perchloroethylene, sulfur and ethylene), Transportation Systems (nickel, steel and other metals) and Aerospace (nickel, titanium and other metals) segments. Our inability to offset material price inflation through increased prices to customers, formula or long-term fixed price contracts with suppliers, productivity actions or through commodity hedges could adversely affect our results of operations.

Our manufacturing operations are also highly dependent upon the delivery of materials (including raw materials) by outside suppliers and their assembly of major components, and subsystems used in our products in a timely manner and in full compliance with purchase order terms and conditions, quality standards, and applicable laws and regulations. In addition, many major components, product equipment items and raw materials are procured or subcontracted on a single-source basis with a number of domestic and foreign companies; in some circumstances these suppliers are the sole source of the component or equipment. Although we maintain a qualification and performance surveillance process to control risk associated with such reliance on third parties and we believe that sources of supply for raw materials and components are generally adequate, it is difficult to predict what effects shortages or price increases may have in the future. Our ability to manage inventory and meet delivery requirements may be constrained by our suppliers' inability to scale production and adjust delivery of long-lead time products during times of volatile demand. Our suppliers may fail to perform according to specifications as and when required and we may be unable to identify alternate suppliers or to otherwise mitigate the consequences of their non-performance. The supply chains for our businesses could also be disrupted by suppliers' decisions to exit certain businesses, bankruptcy and by external events such as natural disasters, extreme weather events, pandemic health issues, terrorist actions, labor disputes, governmental actions and legislative or regulatory changes (e.g., product certification or stewardship requirements, sourcing restrictions, product authenticity, climate change or greenhouse gas emission standards, etc.). Our inability to fill our supply needs would jeopardize our ability to fulfill obligations under commercial and government contracts, which could, in turn, result in reduced sales and profits, contract penalties or terminations, and damage to customer relationships. Transitions to new suppliers may result in significant costs and delays, including those related to the required recertification of parts obtained from new suppliers with our customers and/or regulatory agencies. In addition, because our businesses cannot always immediately adapt their cost structure to changing market conditions, our manufacturing capacity for certain products may at times exceed or fall short of our production requirements, which could adversely impact our operating costs, profitability and customer and supplier relationships.

Our facilities, distribution systems and information technology systems are subject to catastrophic loss due to, among other things, fire, flood, terrorism or other natural or man-made disasters. If any of these facilities or systems were to experience a catastrophic loss, it could disrupt our operations, result in personal injury or property damage, damage relationships with our customers and result in large expenses to repair or replace the facilities or systems, as well as result in other liabilities and adverse impacts. The same risk could also arise from the failure of critical systems supplied by Honeywell to large industrial, refining and petrochemical customers.

15

Failure to increase productivity through sustainable operational improvements, as well as an inability to successfully execute repositioning projects, may reduce our profitability or adversely impact our businesses

Our profitability and margin growth are dependent upon our ability to drive sustainable improvements through the Honeywell Enablers. In addition, we seek productivity and cost savings benefits through repositioning actions and projects, such as consolidation of manufacturing facilities, transitions to cost- competitive regions and product line rationalizations. Risks associated with these actions include delays in execution of the planned initiatives, additional unexpected costs, adverse effects on employee morale and the failure to meet operational targets due to employee attrition. Many of the restructuring actions are complex and difficult to implement. Hence, we may not realize the full operational or financial benefits we expected, the recognition of these benefits may be delayed and these actions may potentially disrupt our operations. See Note 3 Repositioning and Other Charges of Notes to the Financial Statements in "Item 8. Financial Statements and Supplementary Data" for a summary of our repositioning actions.

Our future growth is largely dependent upon our ability to develop new technologies that achieve market acceptance with acceptable margins.

Our businesses operate in global markets that are characterized by rapidly changing technologies and evolving industry standards. Accordingly, our future growth rate depends upon a number of factors, including our ability to (i) identify emerging technological trends in our target end-markets, (ii) develop and maintain competitive products, (iii) enhance our products by adding innovative features that differentiate our products from those of our competitors and prevent commoditization of our products, (iv) develop, manufacture and bring products to market quickly and cost-effectively, and (v) develop and retain individuals with the requisite expertise.

Our ability to develop new products based on technological innovation can affect our competitive position and requires the investment of significant resources. These development efforts divert resources from other potential investments in our businesses, and they may not lead to the development of new technologies or products on a timely basis or that meet the needs of our customers as fully as competitive offerings. In addition, the markets for our products may not develop or grow as we currently anticipate. The failure of our technologies or products to gain market acceptance due to more attractive offerings by our competitors could significantly reduce our revenues and adversely affect our competitive standing and prospects.

Protecting our intellectual property is critical to our innovation efforts.

We own or are licensed under a large number of U.S. and non-U.S. patents and patent applications, trademarks and copyrights. Our intellectual property rights may expire or be challenged, invalidated or infringed upon by third parties or we may be unable to maintain, renew or enter into new licenses of third party proprietary intellectual property on commercially reasonable terms. In some non-U.S. countries, laws affecting intellectual property are uncertain in their application, which can affect the scope or enforceability of our patents and other intellectual property rights. Any of these events or factors could diminish or cause us to lose the competitive advantages associated with our intellectual property, subject us to judgments, penalties and significant litigation costs, and/or temporarily or permanently disrupt our sales and marketing of the affected products or services.

Cybersecurity incidents could disrupt business operations, result in the loss of critical and confidential information, and adversely impact our reputation and results of operations.

Global cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to information technology (IT) systems to sophisticated and targeted measures known as advanced persistent threats, directed at the Company and/or its third party service providers. While we have experienced, and expect to continue to experience, these types of threats and incidents, none of them to date have been material to the Company. Although we employ comprehensive measures to prevent, detect, address and mitigate these threats (including access

16

controls, data encryption, vulnerability assessments, continuous monitoring of our IT networks and systems and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption or unavailability of critical data and confidential or proprietary information (our own or that of third parties) and the disruption of business operations. The potential consequences of a material cybersecurity incident include reputational damage, litigation with third parties, diminution in the value of our investment in research, development and engineering, and increased cybersecurity protection and remediation costs, which in turn could adversely affect our competitiveness and results of operations.

An increasing percentage of our sales and operations is in non-U.S. jurisdictions and is subject to the economic, political, regulatory and other risks of international operations.

Our international operations, including U.S. exports, comprise a growing proportion of our operating results. Our strategy calls for increasing sales to and operations in overseas markets, including developing markets such as China, India, the Middle East and other high growth regions.

In 2013, approximately 55 percent of our total sales (including products manufactured in the U.S. and sold outside the U.S. as well as products manufactured in international locations) were outside of the U.S. including approximately 29 percent in Europe and approximately 13 percent in Asia. Risks related to international operations include exchange control regulations, wage and price controls, employment regulations, foreign investment laws, import, export and other trade restrictions (such as embargoes), changes in regulations regarding transactions with state-owned enterprises, nationalization of private enterprises, government instability, acts of terrorism, and our ability to hire and maintain qualified staff and maintain the safety of our employees in these regions. We are also subject to U.S. laws prohibiting companies from doing business in certain countries, or restricting the type of business that may be conducted in these countries. The cost of compliance with increasingly complex and often conflicting regulations worldwide can also impair our flexibility in modifying product, marketing, pricing or other strategies for growing our businesses, as well as our ability to improve productivity and maintain acceptable operating margins.

With more than half of the Company's sales generated internationally, global economic conditions can have a significant impact on our total sales. Uncertain global economic conditions arising from a tepid recovery in the Euro zone and varying rates of growth in emerging regions could reduce customer confidence that results in decreased demand for our products and services, disruption in payment patterns and higher default rates, a tightening of credit markets (see risk factor below regarding volatility of credit markets for further discussion) and increased risk regarding supplier performance. Volatility in exchange rates of emerging market currencies present uncertainties that complicate planning and could unexpectedly impact our profitability, presenting increased counterparty risk with respect to the financial institutions with whom we do business. While we employ comprehensive controls regarding global cash management to guard against cash or investment loss and to ensure our ability to fund our operations and commitments, a material disruption to the financial institutions with whom we transact business could expose Honeywell to financial loss.

Sales and purchases in currencies other than the US dollar expose us to fluctuations in foreign currencies relative to the US dollar and may adversely affect our results of operations. Currency fluctuations may affect product demand and prices we pay for materials, as a result, our operating margins may be negatively impacted. Fluctuations in exchange rates may give rise to translation gains or losses when financial statements of our non-U.S. businesses are translated into U.S. dollars. While we monitor our exchange rate exposures and seek to reduce the risk of volatility through hedging activities, such activities bear a financial cost and may not always be available to us or successful in significantly mitigating such volatility.

Volatility of credit markets or macro-economic factors could adversely affect our business.

Changes in U.S. and global financial and equity markets, including market disruptions, limited liquidity, and interest rate volatility, may increase the cost of financing as well as the risks of refinancing maturing debt. In addition, our borrowing costs can be affected by short and long-term ratings assigned by independent rating agencies. A decrease in these ratings could increase our cost of borrowing.

17

Delays in our customers' ability to obtain financing, or the unavailability of financing to our customers, could adversely affect our results of operations and cash flow. The inability of our suppliers to obtain financing could result in the need to transition to alternate suppliers, which could result in significant incremental cost and delay, as discussed above. Lastly, disruptions in the U.S. and global financial markets could impact the financial institutions with which we do business.

We may be required to recognize impairment charges for our long-lived assets or available for sale investments.

At December 31, 2013, the net carrying value of long-lived assets (property, plant and equipment, goodwill and other intangible assets) and available for sale securities totaled approximately $20.8 billion and $0.8 billion, respectively. In accordance with generally accepted accounting principles, we periodically assess these assets to determine if they are impaired. Significant negative industry or economic trends, disruptions to our business, unexpected significant changes or planned changes in use of the assets, divestitures and market capitalization declines may result in impairments to goodwill and other long-lived assets. An other than temporary decline in the market value of our available for sale securities may also result in an impairment charge. Future impairment charges could significantly affect our results of operations in the periods recognized. Impairment charges would also reduce our consolidated shareowners' equity and increase our debt-to-total-capitalization ratio, which could negatively impact our credit rating and access to the public debt and equity markets.

A change in the level of U.S. Government defense and space funding or the mix of programs to which such funding is allocated could adversely impact Aerospace's defense and space sales and results of operations.

Sales of our defense and space-related products and services are largely dependent upon government budgets, particularly the U.S. defense budget. Sales as a prime contractor and subcontractor to the U.S. Department of Defense comprised approximately 25 percent and 8 percent of Aerospace and total sales, respectively, for the year ended December 31, 2013. We cannot predict the extent to which total funding and/or funding for individual programs will be included, increased or reduced as part of the 2014 and subsequent budgets ultimately approved by Congress, or be included in the scope of separate supplemental appropriations. We also cannot predict the impact of potential changes in priorities due to military transformation and planning and/or the nature of war-related activity on existing, follow-on or replacement programs. A shift in defense or space spending to programs in which we do not participate and/or reductions in funding for or termination of existing programs could adversely impact our results of operations.

As a supplier of military and other equipment to the U.S. Government, we are subject to unusual risks, such as the right of the U.S. Government to terminate contracts for convenience and to conduct audits and investigations of our operations and performance.

In addition to normal business risks, companies like Honeywell that supply military and other equipment to the U.S. Government are subject to unusual risks, including dependence on Congressional appropriations and administrative allotment of funds, changes in governmental procurement legislation and regulations and other policies that reflect military and political developments, significant changes in contract requirements, complexity of designs and the rapidity with which they become obsolete, necessity for frequent design improvements, intense competition for U.S. Government business necessitating increases in time and investment for design and development, difficulty of forecasting costs and schedules when bidding on developmental and highly sophisticated technical work, and other factors characteristic of the industry, such as contract award protests and delays in the timing of contract approvals. Changes are customary over the life of U.S. Government contracts, particularly development contracts, and generally result in adjustments to contract prices and schedules.

Our contracts with the U.S. Government are also subject to various government audits. Like many other government contractors, we have received audit reports that recommend downward price adjustments to certain contracts or changes to certain accounting systems or controls to comply with

18

various government regulations. When appropriate and prudent, we have made adjustments and paid voluntary refunds in the past and may do so in the future.

U.S. Government contracts are subject to termination by the government, either for the convenience of the government or for our failure to perform consistent with the terms of the applicable contract. In the case of a termination for convenience, we are typically entitled to reimbursement for our allowable costs incurred, plus termination costs and a reasonable profit. If a contract is terminated by the government for our failure to perform we could be liable for reprocurement costs incurred by the government in acquiring undelivered goods or services from another source and for other damages suffered by the government as permitted under the contract.

We are also subject to government investigations of business practices and compliance with government procurement regulations. If, as a result of any such investigation or other government investigations (including violations of certain environmental or export laws), Honeywell or one of its businesses were found to have violated applicable law, it could be suspended from bidding on or receiving awards of new government contracts, suspended from contract performance pending the completion of legal proceedings and/or have its export privileges suspended. The U.S. Government also reserves the right to debar a contractor from receiving new government contracts for fraudulent, criminal or other egregious misconduct. Debarment generally does not exceed three years.

Our reputation and ability to do business may be impacted by the improper conduct of employees, vendors, agents or business partners.

We cannot ensure that our extensive compliance controls, policies and procedures will, in all instances, protect us from reckless, unethical or criminal acts committed by our employees, vendors, agents or business partners that would violate the laws of the jurisdictions in which the Company operates, including laws governing payments to government officials, competition, data privacy and rights of employees. Any improper actions could subject us to civil or criminal investigations, monetary and non-monetary penalties and could adversely impact our ability to conduct business, results of operations and reputation.

Changes in legislation or government regulations or policies can have a significant impact on our results of operations.

The sales and margins of each of our segments are directly impacted by government regulations. Safety and performance regulations (including mandates of the Federal Aviation Administration and other similar international regulatory bodies requiring the installation of equipment on aircraft), product certification requirements and government procurement practices can impact Aerospace sales, research and development expenditures, operating costs and profitability. The demand for and cost of providing Automation and Control Solutions products, services and solutions can be impacted by fire, security, safety, health care, environmental and energy efficiency standards and regulations. Performance Materials and Technologies' results of operations can be affected by environmental (e.g. government regulation of fluorocarbons), safety and energy efficiency standards and regulations, while emissions, fuel economy and energy efficiency standards and regulations can impact the demand for turbochargers in our Transportation Systems segment. Honeywell sells products that address safety and environmental regulation and a substantial portion of our portfolio is dedicated to energy efficient products and services. Legislation or regulations regarding areas such as labor and employment, employee benefit plans, tax, health, safety and environmental matters, import, export and trade, intellectual property, product certification, and product liability may impact the results of each of our operating segments and our consolidated results.

Completed acquisitions may not perform as anticipated or be integrated as planned, and divestitures may not occur as planned.

We regularly review our portfolio of businesses and pursue growth through acquisitions and seek to divest non-core businesses. We may not be able to complete transactions on favorable terms, on a timely basis or at all. In addition, our results of operations and cash flows may be adversely impacted

19

by (i) the failure of acquired businesses to meet or exceed expected returns, (ii) the discovery of unanticipated issues or liabilities, (iii) the failure to integrate acquired businesses into Honeywell on schedule and/or to achieve synergies in the planned amount or within the expected timeframe, (iv) the inability to dispose of non-core assets and businesses on satisfactory terms and conditions and within the expected timeframe, and (v) the degree of protection provided by indemnities from sellers of acquired companies and the obligations under indemnities provided to purchasers of our divested businesses.

We cannot predict with certainty the outcome of litigation matters, government proceedings and other contingencies and uncertainties.

We are subject to a number of lawsuits, investigations and disputes (some of which involve substantial amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product liability (including asbestos), prior acquisitions and divestitures, employment, employee benefits plans, intellectual property, antitrust, import and export matters and environmental, health and safety matters. Resolution of these matters can be prolonged and costly, and the ultimate results or judgments are uncertain due to the inherent uncertainty in litigation and other proceedings. Moreover, our potential liabilities are subject to change over time due to new developments, changes in settlement strategy or the impact of evidentiary requirements, and we may become subject to or be required to pay damage awards or settlements that could have a material adverse effect on our results of operations, cash flows and financial condition. While we maintain insurance for certain risks, the amount of our insurance coverage may not be adequate to cover the total amount of all insured claims and liabilities. It also is not possible to obtain insurance to protect against all our operational risks and liabilities. The incurrence of significant liabilities for which there is no or insufficient insurance coverage could adversely affect our results of operations, cash flows, liquidity and financial condition.

Our operations and the prior operations of predecessor companies expose us to the risk of material environmental liabilities.

Mainly because of past operations and operations of predecessor companies, we are subject to potentially material liabilities related to the remediation of environmental hazards and to claims of personal injuries or property damages that may be caused by hazardous substance releases and exposures. We have incurred remedial response and voluntary clean-up costs for site contamination and are a party to lawsuits and claims associated with environmental and safety matters, including past production of products containing hazardous substances. Additional lawsuits, claims and costs involving environmental matters are likely to continue to arise in the future. We are subject to various federal, state, local and foreign government requirements regulating the discharge of materials into the environment or otherwise relating to the protection of the environment. These laws and regulations can impose substantial fines and criminal sanctions for violations, and require installation of costly equipment or operational changes to limit emissions and/or decrease the likelihood of accidental hazardous substance releases. We incur, and expect to continue to incur, capital and operating costs to comply with these laws and regulations. In addition, changes in laws, regulations and enforcement of policies, the discovery of previously unknown contamination or new technology or information related to individual sites, the establishment of stricter state or federal toxicity standards with respect to certain contaminants, or the imposition of new clean-up requirements or remedial techniques could require us to incur costs in the future that would have a negative effect on our financial condition or results of operations.

Our expenses include significant costs related to employee and retiree health benefits.

With approximately 131,000 employees, including approximately 51,000 in the U.S., our expenses relating to employee health and retiree health benefits are significant. In recent years, we have experienced significant increases in certain of these costs, largely as a result of economic factors beyond our control, in particular, ongoing increases in health care costs well in excess of the rate of inflation. Continued increasing health-care costs, legislative or regulatory changes, and volatility in

20

discount rates, as well as changes in other assumptions used to calculate retiree health benefit expenses, may adversely affect our financial position and results of operations.

Risks related to our defined benefit pension plans may adversely impact our results of operations and cash flow.

Significant changes in actual investment return on pension assets, discount rates, and other factors could adversely affect our results of operations and pension contributions in future periods. U.S. generally accepted accounting principles require that we calculate income or expense for the plans using actuarial valuations. These valuations reflect assumptions about financial markets and interest rates, which may change based on economic conditions. Funding requirements for our U.S. pension plans may become more significant. However, the ultimate amounts to be contributed are dependent upon, among other things, interest rates, underlying asset returns and the impact of legislative or regulatory changes related to pension funding obligations. For a discussion regarding the significant assumptions used to estimate pension expense, including discount rate and the expected long-term rate of return on plan assets, and how our financial statements can be affected by pension plan accounting policies, see "Critical Accounting Policies" included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

Additional tax expense or additional tax exposures could affect our future profitability.

We are subject to income taxes in both the United States and various non-U.S. jurisdictions. Our domestic and international tax liabilities are dependent, in part, upon the distribution of income among these different jurisdictions. In 2013, our tax expense represented 26.8 percent of our income before tax. Our tax expense includes estimates of tax reserves and reflects other estimates and assumptions, including assessments of future earnings of the Company which could impact the valuation of our deferred tax assets. Our future results of operations could be adversely affected by changes in the effective tax rate as a result of a change in the mix of earnings in countries with differing statutory tax rates, changes in the overall profitability of the Company, changes in tax legislation and rates, changes in generally accepted accounting principles, changes in the valuation of deferred tax assets and liabilities, changes in the amount of earnings permanently reinvested offshore, the results of audits and examinations of previously filed tax returns and continuing assessments of our tax exposures.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

We have approximately 1,300 locations consisting of plants, research laboratories, sales offices and other facilities. Our headquarters and administrative complex is located in Morris Township, New Jersey. Our plants are generally located to serve large marketing areas and to provide accessibility to raw materials and labor pools. Our properties are generally maintained in good operating condition. Utilization of these plants may vary with sales to customers and other business conditions; however, no major operating facility is significantly idle. We own or lease warehouses, railroad cars, barges, automobiles, trucks, airplanes and materials handling and data processing equipment. We also lease space for administrative and sales staffs. Our properties and equipment are in good operating condition and are adequate for our present needs. We do not anticipate difficulty in renewing existing leases as they expire or in finding alternative facilities.

21

Our principal plants, which are owned in fee unless otherwise indicated, are as follows:

|

|

|

|

|

| Aerospace |

|

| |

Anniston, AL (leased) | Olathe, KS | Toronto, Canada | ||

| Automation and Control Solutions |

|

| |

San Diego, CA (leased) | Pleasant Prairie, WI (leased) | Schonaich, Germany (leased) | ||

| Performance Materials and Technologies |

|

| |

Mobile, AL (partially leased) | Shreveport, LA | Colonial Heights, VA | ||

| Transportation Systems |

|

| |

Shanghai, China | Atessa, Italy | Mexicali, Mexico (partially leased) |

Item 3. Legal Proceedings

We are subject to a number of lawsuits, investigations and claims (some of which involve substantial amounts) arising out of the conduct of our business. See a discussion of environmental, asbestos and other litigation matters in Note 22 Commitments and Contingencies of Notes to Financial Statements.

Environmental Matters Involving Potential Monetary Sanctions in Excess of $100,000

The U.S. Environmental Protection Agency ("EPA") has alleged that PreCon, Inc., a Honeywell service provider, failed to comply with certain environmental regulations at a Virginia facility. EPA has initially calculated the relevant penalty at approximately $180,000, although negotiations are ongoing. Honeywell includes this allegation because of its contractual relationship with PreCon, Inc. The EPA has made no allegations against Honeywell.

Although the outcome of the matter discussed above cannot be predicted with certainty, we do not believe that it will have a material adverse effect on our consolidated financial position, consolidated results of operations or operating cash flows.

22

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers of the Registrant

The executive officers of Honeywell, listed as follows, are elected annually by the Board of Directors. There are no family relationships among them.

|

|

|

Name, Age, | Business Experience | |

David M. Cote, 61 | Chairman of the Board and Chief Executive Officer since July 2002. | |

Katherine L. Adams, 49 | Senior Vice President and General Counsel since April 2009. Vice President and General Counsel from September 2008 to April 2009. Vice President and General Counsel for Performance Materials and Technologies from February 2005 to September 2008. | |

David J. Anderson, 64 | Senior Vice President and Chief Financial Officer since June 2003. | |

Roger Fradin, 60 | President and Chief Executive Officer Automation and Control Solutions since January 2004. | |

Alexandre Ismail, 48 | President Energy, Safety and Security since May 2013. President and Chief Executive Officer Transportation Systems from April 2009 to May 2013. President Turbo Technologies from November 2008 to April 2009. President Global Passengers Vehicles from August 2006 to November 2008. | |

Mark R. James, 52 | Senior Vice President Human Resources, Procurement and Communications since November 2007. | |

Terrence S. Hahn, 47 | President and Chief Executive Officer Transportation Systems since May 2013. Vice President and General Manager of Fluorine Products from March 2007 to May 2013. | |

Andreas C. Kramvis, 61 | President and Chief Executive Officer Performance Materials and Technologies since March 2008. President of Environmental and Combustion Controls from September 2002 to February 2008. | |

Timothy O. Mahoney, 57 | President and Chief Executive Officer Aerospace since September 2009. Vice President Aerospace Engineering and Technology and Chief Technology Officer from March 2007 to August 2009. | |

Krishna Mikkilineni, 54 | Senior Vice President Engineering, Operations and Information Technology since April 2013. Senior Vice President Engineering and Operations from April 2010 to April 2013 and President Honeywell Technology Solutions from January 2009 to April 2013. Vice President Honeywell Technology Solutions from July 2002 to January 2009

|

| ||||||||||||||||||||

(a) |

|

| Also a Director.

| |||||||||||||||||

23

Part II.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Honeywell's common stock is listed on the New York Stock Exchange. Market and dividend information for Honeywell's common stock is included in Note 27 Unaudited Quarterly Financial Information of Notes to Financial Statements in "Item 8. Financial Statements and Supplementary Data."

The number of record holders of our common stock at December 31, 2013 was 55,537.

Honeywell purchased 3,500,000 shares of its common stock, par value $1 per share, in the quarter ending December 31, 2013. In December 2013, the Board of Directors authorized the repurchase of up to a total of $5 billion of Honeywell common stock, which replaced the previously approved share repurchase program. $5 billion remained available as of December 31, 2013 for additional share repurchases. Honeywell presently expects to repurchase outstanding shares from time to time to offset the dilutive impact of employee stock based compensation plans, including future option exercises, restricted unit vesting and matching contributions under our savings plans. The amount and timing of future repurchases may vary depending on market conditions and the level of operating, financing and other investing activities.

The following table summarizes Honeywell's purchase of its common stock, par value $1 per share, for the three months ended December 31, 2013:

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

Issuer Purchases of Equity Securities | ||||||||||||||||||||||||||||

Period | (a) | (b) | (c) | (d) | ||||||||||||||||||||||||

Total | Average | Total Number | Approximate Dollar | |||||||||||||||||||||||||

November 2013 |

|

| 3,500,000 |

|

| $ |

| 86.96 |

|

| 3,500,000 |

|

| $ |

| 525 | ||||||||||||

December 2013 |

|

| - |

|

| - |

|

| - |

|

| $ |

| 5,000 | ||||||||||||||

24

Performance Graph

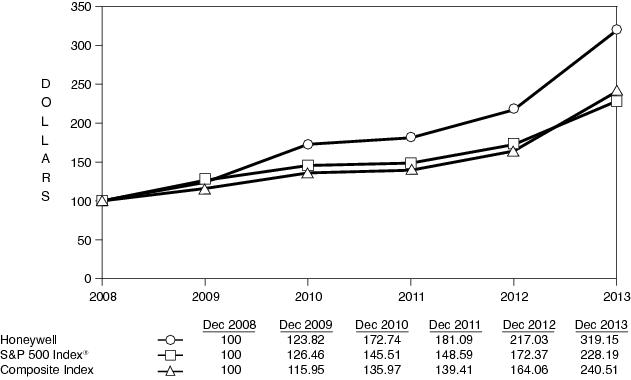

The following graph compares the five-year cumulative total return on our Common Stock to the total returns on the Standard & Poor's 500 Stock Index and a composite of Standard & Poor's Industrial Conglomerates and Aerospace and Defense indices, on a 60%/40% weighted basis, respectively (the "Composite Index"). The weighting of the components of the Composite Index are based on our segments' relative contribution to total segment profit. The selection of the Industrial Conglomerates component of the Composite Index reflects the diverse and distinct range of non-aerospace businesses conducted by Honeywell. The annual changes for the five-year period shown in the graph are based on the assumption that $100 had been invested in Honeywell stock and each index on December 31, 2008 and that all dividends were reinvested.

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

25

HONEYWELL INTERNATIONAL INC.

The Consumer Products Group (CPG) automotive aftermarket business had historically been part of the Transportation Systems reportable segment. In accordance with generally accepted accounting principles, CPG is presented as discontinued operations in all periods presented. See Note 2 Acquisitions and Divestitures for further details. This selected financial data should be read in conjunction with Honeywell's Consolidated Financial Statements and related Notes included elsewhere in this Annual Report as well as the section of this Annual Report titled Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Item 6. Selected Financial Data

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||||||||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||

| (Dollars in millions, except per share amounts) | ||||||||||||||||||||||||||||||||||

Results of Operations |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net sales |

|

| $ |

| 39,055 |

|

| $ |

| 37,665 |

|

| $ |

| 36,529 |

|

| $ |

| 32,350 |

|

| $ |

| 29,951 | ||||||||||

Amounts attributable to Honeywell: |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Income from continuing operations less net income attributable to the noncontrolling interest |

|

| 3,924 |

|

| 2,926 |

|

| 1,858 |

|

| 1,944 |

|

| 1,492 | ||||||||||||||||||||

Income from discontinued operations(1) |

|

| - |

|

| - |

|

| 209 |

|

| 78 |

|

| 56 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net income attributable to Honeywell |

|

| 3,924 |

|

| 2,926 |

|

| 2,067 |

|

| 2,022 |

|

| 1,548 | ||||||||||||||||||||

Earnings Per Common Share |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Basic: |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Income from continuing operations |

|

| 4.99 |

|

| 3.74 |

|

| 2.38 |

|

| 2.51 |

|

| 1.99 | ||||||||||||||||||||

Income from discontinued operations |

|

| - |

|

| - |

|

| 0.27 |

|

| 0.10 |

|

| 0.07 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net income attributable to Honeywell |

|

| 4.99 |

|

| 3.74 |

|

| 2.65 |

|

| 2.61 |

|

| 2.06 | ||||||||||||||||||||

Assuming dilution: |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Income from continuing operations |

|

| 4.92 |

|

| 3.69 |

|

| 2.35 |

|

| 2.49 |

|

| 1.98 | ||||||||||||||||||||

Income from discontinued operations |

|

| - |