UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended June 30, 2018 | ||||||

| or | ||||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from | to | |||||

Commission File Number: 001-14965

The Goldman Sachs Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-4019460 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 200 West Street, New York, N.Y. | 10282 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 902-1000

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ Accelerated filer ☐ | ||

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) Smaller reporting company ☐ | ||

| Emerging growth company ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

APPLICABLE ONLY TO CORPORATE ISSUERS

As of July 20, 2018, there were 377,556,226 shares of the registrant's common stock outstanding.

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

QUARTERLY REPORT ON FORM 10-Q FOR THE QUARTER ENDED JUNE 30, 2018

INDEX

| Form 10-Q Item Number | Page No. | |||

PART I | ||||

FINANCIAL INFORMATION | 1 | |||

Item 1 | ||||

Financial Statements (Unaudited) | 1 | |||

Consolidated Statements of Earnings | 1 | |||

Consolidated Statements of Comprehensive Income | 2 | |||

Consolidated Statements of Financial Condition | 3 | |||

Consolidated Statements of Changes in Shareholders' Equity | 4 | |||

Consolidated Statements of Cash Flows | 5 | |||

Notes to Consolidated Financial Statements | 6 | |||

Note 1. Description of Business | 6 | |||

Note 2. Basis of Presentation | 6 | |||

Note 3. Significant Accounting Policies | 7 | |||

Note 4. Financial Instruments Owned and Financial Instruments Sold, But Not Yet Purchased | 15 | |||

Note 5. Fair Value Measurements | 16 | |||

Note 6. Cash Instruments | 17 | |||

Note 7. Derivatives and Hedging Activities | 24 | |||

Note 8. Fair Value Option | 36 | |||

Note 9. Loans Receivable | 43 | |||

Note 10. Collateralized Agreements and Financings | 47 | |||

Note 11. Securitization Activities | 51 | |||

Note 12. Variable Interest Entities | 53 | |||

Note 13. Other Assets | 55 | |||

Note 14. Deposits | 58 | |||

Note 15. Short-Term Borrowings | 59 | |||

Note 16. Long-Term Borrowings | 59 | |||

Note 17. Other Liabilities | 61 | |||

Note 18. Commitments, Contingencies and Guarantees | 62 | |||

Note 19. Shareholders' Equity | 67 | |||

Note 20. Regulation and Capital Adequacy | 69 | |||

Note 21. Earnings Per Common Share | 77 | |||

Note 22. Transactions with Affiliated Funds | 77 | |||

Note 23. Interest Income and Interest Expense | 78 | |||

Note 24. Income Taxes | 78 | |||

Note 25. Business Segments | 79 | |||

Note 26. Credit Concentrations | 81 | |||

Note 27. Legal Proceedings | 82 | |||

| Page No. | ||||

Report of Independent Registered Public Accounting Firm | 89 | |||

Statistical Disclosures | 90 | |||

Item 2 | ||||

Management's Discussion and Analysis of Financial Condition and Results of Operations | 92 | |||

Introduction | 92 | |||

Executive Overview | 92 | |||

Business Environment | 93 | |||

Critical Accounting Policies | 94 | |||

Recent Accounting Developments | 96 | |||

Use of Estimates | 96 | |||

Results of Operations | 97 | |||

Balance Sheet and Funding Sources | 110 | |||

Equity Capital Management and Regulatory Capital | 115 | |||

Regulatory Matters and Developments | 119 | |||

Off-Balance-Sheet Arrangements and Contractual Obligations | 120 | |||

Risk Management | 122 | |||

Overview and Structure of Risk Management | 122 | |||

Liquidity Risk Management | 127 | |||

Market Risk Management | 134 | |||

Credit Risk Management | 139 | |||

Operational Risk Management | 145 | |||

Model Risk Management | 147 | |||

Available Information | 148 | |||

Cautionary Statement Pursuant to the U.S. Private Securities Litigation Reform Act of 1995 | 149 | |||

Item 3 | ||||

Quantitative and Qualitative Disclosures About Market Risk | 150 | |||

Item 4 | ||||

Controls and Procedures | 150 | |||

PART II | ||||

OTHER INFORMATION | 150 | |||

Item 1 | ||||

Legal Proceedings | 150 | |||

Item 2 | ||||

Unregistered Sales of Equity Securities and Use of Proceeds | 150 | |||

Item 6 | ||||

Exhibits | 151 | |||

SIGNATURES | 151 | |||

| Goldman Sachs June 2018 Form 10-Q | ||

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Consolidated Statements of Earnings

(Unaudited)

| Three Months Ended June | Six Months Ended June | |||||||||||||||||

| in millions, except per share amounts | 2018 | 2017 | 2018 | 2017 | ||||||||||||||

Revenues | ||||||||||||||||||

Investment banking | $2,045 | $1,730 | $ 3,838 | $ 3,433 | ||||||||||||||

Investment management | 1,728 | 1,433 | 3,367 | 2,830 | ||||||||||||||

Commissions and fees | 795 | 794 | 1,657 | 1,565 | ||||||||||||||

Market making | 2,546 | 1,915 | 5,750 | 4,333 | ||||||||||||||

Other principal transactions | 1,286 | 1,227 | 2,906 | 2,448 | ||||||||||||||

Total non-interest revenues | 8,400 | 7,099 | 17,518 | 14,609 | ||||||||||||||

Interest income | 4,920 | 3,220 | 9,150 | 5,966 | ||||||||||||||

Interest expense | 3,918 | 2,432 | 7,230 | 4,662 | ||||||||||||||

Net interest income | 1,002 | 788 | 1,920 | 1,304 | ||||||||||||||

Net revenues, including net interest income | 9,402 | 7,887 | 19,438 | 15,913 | ||||||||||||||

Operating expenses | ||||||||||||||||||

Compensation and benefits | 3,466 | 3,233 | 7,581 | 6,524 | ||||||||||||||

Brokerage, clearing, exchange and distribution fees | 812 | 741 | 1,656 | 1,433 | ||||||||||||||

Market development | 183 | 141 | 365 | 275 | ||||||||||||||

Communications and technology | 260 | 224 | 511 | 447 | ||||||||||||||

Depreciation and amortization | 335 | 265 | 634 | 522 | ||||||||||||||

Occupancy | 197 | 190 | 391 | 366 | ||||||||||||||

Professional fees | 223 | 229 | 458 | 434 | ||||||||||||||

Other expenses | 650 | 355 | 1,147 | 864 | ||||||||||||||

Total non-compensation expenses | 2,660 | 2,145 | 5,162 | 4,341 | ||||||||||||||

Total operating expenses | 6,126 | 5,378 | 12,743 | 10,865 | ||||||||||||||

Pre-tax earnings | 3,276 | 2,509 | 6,695 | 5,048 | ||||||||||||||

Provision for taxes | 711 | 678 | 1,298 | 962 | ||||||||||||||

Net earnings | 2,565 | 1,831 | 5,397 | 4,086 | ||||||||||||||

Preferred stock dividends | 217 | 200 | 312 | 293 | ||||||||||||||

Net earnings applicable to common shareholders | $2,348 | $1,631 | $ 5,085 | $ 3,793 | ||||||||||||||

Earnings per common share | ||||||||||||||||||

Basic | $ 6.04 | $ 4.00 | $ 13.07 | $ 9.24 | ||||||||||||||

Diluted | $ 5.98 | $ 3.95 | $ 12.93 | $ 9.10 | ||||||||||||||

Dividends declared per common share | $ 0.80 | $ 0.75 | $ 1.55 | $ 1.40 | ||||||||||||||

Average common shares | ||||||||||||||||||

Basic | 387.8 | 406.1 | 388.4 | 409.3 | ||||||||||||||

Diluted | 392.6 | 413.3 | 393.2 | 416.7 | ||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 1 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income

(Unaudited)

| Three Months Ended June | Six Months Ended June | |||||||||||||||||||

| $ in millions | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||

Net earnings | $2,565 | $1,831 | $5,397 | $4,086 | ||||||||||||||||

Other comprehensive income/(loss) adjustments, net of tax: | ||||||||||||||||||||

Currency translation | (2 | ) | 29 | – | 13 | |||||||||||||||

Debt valuation adjustment | 878 | (275 | ) | 1,148 | (414 | ) | ||||||||||||||

Pension and postretirement liabilities | (1 | ) | – | (5 | ) | 1 | ||||||||||||||

Available-for-sale securities | (63 | ) | 1 | (221 | ) | 1 | ||||||||||||||

Other comprehensive income/(loss) | 812 | (245 | ) | 922 | (399 | ) | ||||||||||||||

Comprehensive income | $3,377 | $1,586 | $6,319 | $3,687 | ||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| Goldman Sachs June 2018 Form 10-Q | 2 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Consolidated Statements of Financial Condition

(Unaudited)

| As of | ||||||||

| $ in millions | June 2018 | December 2017 | ||||||

Assets | ||||||||

Cash and cash equivalents | $131,417 | $110,051 | ||||||

Collateralized agreements: | ||||||||

Securities purchased under agreements to resell (includes $135,035 and $120,420 at fair value) | 135,180 | 120,822 | ||||||

Securities borrowed (includes $42,198 and $78,189 at fair value) | 162,825 | 190,848 | ||||||

Receivables: | ||||||||

Brokers, dealers and clearing organizations | 28,859 | 24,676 | ||||||

Customers and counterparties (includes $1,967 and $3,526 at fair value) | 59,778 | 60,112 | ||||||

Loans receivable | 74,082 | 65,933 | ||||||

Financial instruments owned (at fair value and includes $71,384 and $50,335 pledged as collateral) | 347,959 | 315,988 | ||||||

Other assets | 28,510 | 28,346 | ||||||

Total assets | $968,610 | $916,776 | ||||||

Liabilities and shareholders' equity | ||||||||

Deposits (includes $25,634 and $22,902 at fair value) | $153,441 | $138,604 | ||||||

Collateralized financings: | ||||||||

Securities sold under agreements to repurchase (at fair value) | 93,219 | 84,718 | ||||||

Securities loaned (includes $6,351 and $5,357 at fair value) | 16,300 | 14,793 | ||||||

Other secured financings (includes $26,260 and $24,345 at fair value) | 26,379 | 24,788 | ||||||

Payables: | ||||||||

Brokers, dealers and clearing organizations | 9,579 | 6,672 | ||||||

Customers and counterparties | 183,038 | 171,497 | ||||||

Financial instruments sold, but not yet purchased (at fair value) | 112,747 | 111,930 | ||||||

Unsecured short-term borrowings (includes $19,598 and $16,904 at fair value) | 44,390 | 46,922 | ||||||

Unsecured long-term borrowings (includes $41,944 and $38,638 at fair value) | 227,354 | 217,687 | ||||||

Other liabilities (includes $108 and $268 at fair value) | 15,564 | 16,922 | ||||||

Total liabilities | 882,011 | 834,533 | ||||||

Commitments, contingencies and guarantees | ||||||||

Shareholders' equity | ||||||||

Preferred stock; aggregate liquidation preference of $11,203 and $11,853 | 11,203 | 11,853 | ||||||

Common stock; 890,582,030 and 884,592,863 shares issued, and 377,879,137 and 374,808,805 shares outstanding | 9 | 9 | ||||||

Share-based awards | 2,581 | 2,777 | ||||||

Nonvoting common stock; no shares issued and outstanding | – | – | ||||||

Additional paid-in capital | 54,000 | 53,357 | ||||||

Retained earnings | 95,941 | 91,519 | ||||||

Accumulated other comprehensive loss | (958 | ) | (1,880 | ) | ||||

Stock held in treasury, at cost; 512,702,895 and 509,784,060 shares | (76,177 | ) | (75,392 | ) | ||||

Total shareholders' equity | 86,599 | 82,243 | ||||||

Total liabilities and shareholders' equity | $968,610 | $916,776 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 3 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Consolidated Statements of Changes in Shareholders' Equity

(Unaudited)

| $ in millions | Six Months Ended June 2018 | Year Ended December 2017 | ||||||

Preferred stock | ||||||||

Beginning balance | $ 11,853 | $ 11,203 | ||||||

Issued | – | 1,500 | ||||||

Redeemed | (650 | ) | (850 | ) | ||||

Ending balance | 11,203 | 11,853 | ||||||

Common stock | ||||||||

Beginning balance | 9 | 9 | ||||||

Issued | – | – | ||||||

Ending balance | 9 | 9 | ||||||

Share-based awards | ||||||||

Beginning balance, as previously reported | 2,777 | 3,914 | ||||||

Cumulative effect of the change in accounting principle related to forfeiture of share-based awards | – | 35 | ||||||

Beginning balance, adjusted | 2,777 | 3,949 | ||||||

Issuance and amortization of share-based awards | 991 | 1,810 | ||||||

Delivery of common stock underlying share-based awards | (1,148 | ) | (2,704 | ) | ||||

Forfeiture of share-based awards | (29 | ) | (89 | ) | ||||

Exercise of share-based awards | (10 | ) | (189 | ) | ||||

Ending balance | 2,581 | 2,777 | ||||||

Additional paid-in capital | ||||||||

Beginning balance | 53,357 | 52,638 | ||||||

Delivery of common stock underlying share-based awards | 1,677 | 2,934 | ||||||

Cancellation of share-based awards in satisfaction of withholding tax requirements | (1,049 | ) | (2,220 | ) | ||||

Preferred stock issuance costs, net of reversals upon redemption | 15 | 8 | ||||||

Cash settlement of share-based awards | – | (3 | ) | |||||

Ending balance | 54,000 | 53,357 | ||||||

Retained earnings | ||||||||

Beginning balance, as previously reported | 91,519 | 89,039 | ||||||

Cumulative effect of the change in accounting principle related to: | ||||||||

Revenue recognition from contracts with clients, net of tax | (53 | ) | – | |||||

Forfeiture of share-based awards, net of tax | – | (24 | ) | |||||

Beginning balance, adjusted | 91,466 | 89,015 | ||||||

Net earnings | 5,397 | 4,286 | ||||||

Dividends and dividend equivalents declared on common stock and share-based awards | (610 | ) | (1,181 | ) | ||||

Dividends declared on preferred stock | (297 | ) | (587 | ) | ||||

Preferred stock redemption premium | (15 | ) | (14 | ) | ||||

Ending balance | 95,941 | 91,519 | ||||||

Accumulated other comprehensive loss | ||||||||

Beginning balance | (1,880 | ) | (1,216 | ) | ||||

Other comprehensive income/(loss) | 922 | (664 | ) | |||||

Ending balance | (958 | ) | (1,880 | ) | ||||

Stock held in treasury, at cost | ||||||||

Beginning balance | (75,392 | ) | (68,694 | ) | ||||

Repurchased | (800 | ) | (6,721 | ) | ||||

Reissued | 16 | 34 | ||||||

Other | (1 | ) | (11 | ) | ||||

Ending balance | (76,177 | ) | (75,392 | ) | ||||

Total shareholders' equity | $ 86,599 | $ 82,243 |

The accompanying notes are an integral part of these consolidated financial statements.

| Goldman Sachs June 2018 Form 10-Q | 4 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

Six Months Ended June | ||||||||

| $ in millions | 2018 | 2017 | ||||||

Cash flows from operating activities | ||||||||

Net earnings | $ 5,397 | $ 4,086 | ||||||

Adjustments to reconcile net earnings to net cash provided by/(used for) operating activities: | ||||||||

Depreciation and amortization | 634 | 522 | ||||||

Share-based compensation | 1,505 | 1,452 | ||||||

Gain related to extinguishment of subordinated borrowings | – | (108 | ) | |||||

Changes in operating assets and liabilities: | ||||||||

Receivables and payables (excluding loans receivable), net | 10,355 | (14,527 | ) | |||||

Collateralized transactions (excluding other secured financings), net | 23,673 | 23,971 | ||||||

Financial instruments owned (excluding available-for-sale securities) | (31,730 | ) | (31,864 | ) | ||||

Financial instruments sold, but not yet purchased | 645 | 472 | ||||||

Other, net | (2,845 | ) | 1,899 | |||||

Net cash provided by/(used for) operating activities | 7,634 | (14,097 | ) | |||||

Cash flows from investing activities | ||||||||

Purchase of property, leasehold improvements and equipment | (3,751 | ) | (1,520 | ) | ||||

Proceeds from sales of property, leasehold improvements and equipment | 1,946 | 202 | ||||||

Net cash used for business acquisitions | (149 | ) | (1,086 | ) | ||||

Purchase of investments | (3,200 | ) | (728 | ) | ||||

Proceeds from sales and paydowns of investments | 303 | 888 | ||||||

Loans receivable, net | (7,952 | ) | (4,462 | ) | ||||

Net cash used for investing activities | (12,803 | ) | (6,706 | ) | ||||

Cash flows from financing activities | ||||||||

Unsecured short-term borrowings, net | 1,954 | (28 | ) | |||||

Other secured financings (short-term), net | 3,623 | (881 | ) | |||||

Proceeds from issuance of other secured financings (long-term) | 2,458 | 4,683 | ||||||

Repayment of other secured financings (long-term), including the current portion | (4,691 | ) | (3,151 | ) | ||||

Purchase of Trust Preferred Securities | (35 | ) | (62 | ) | ||||

Proceeds from issuance of unsecured long-term borrowings | 31,128 | 31,654 | ||||||

Repayment of unsecured long-term borrowings, including the current portion | (20,045 | ) | (19,335 | ) | ||||

Derivative contracts with a financing element, net | 702 | 1,002 | ||||||

Deposits, net | 14,837 | 1,446 | ||||||

Preferred stock redemption | (650 | ) | – | |||||

Common stock repurchased | (800 | ) | (2,969 | ) | ||||

Settlement of share-based awards in satisfaction of withholding tax requirements | (1,049 | ) | (1,507 | ) | ||||

Dividends and dividend equivalents paid on common stock, preferred stock and share-based awards | (907 | ) | (876 | ) | ||||

Proceeds from issuance of common stock, including exercise of share-based awards | 10 | 7 | ||||||

Cash settlement of share-based awards | – | (3 | ) | |||||

Net cash provided by financing activities | 26,535 | 9,980 | ||||||

Net increase/(decrease) in cash and cash equivalents | 21,366 | (10,823 | ) | |||||

Cash and cash equivalents, beginning balance | 110,051 | 121,711 | ||||||

Cash and cash equivalents, ending balance | $131,417 | $110,888 | ||||||

SUPPLEMENTAL DISCLOSURES:

Cash payments for interest, net of capitalized interest, were $7.62 billion and $6.28 billion, and cash payments for income taxes, net of refunds, were $547 million and $464 million during the six months ended June 2018 and June 2017, respectively. Cash flows related to common stock repurchased includes common stock repurchased in the prior period for which settlement occurred during the current period and excludes common stock repurchased during the current period for which settlement occurred in the following period.

Non-cash activities during the six months ended June 2018:

| • | The firm received $419 million of loans receivable and $90 million of held-to-maturity securities in connection with the securitization of financial instruments owned and held for sale loans included in receivables from customers and counterparties. |

| • | The firm exchanged $35 million of Trust Preferred Securities and common beneficial interests for $35 million of certain of the firm's junior subordinated debt. |

Non-cash activities during the six months ended June 2017:

| • | The firm received $226 million of loans receivable in connection with the securitization of financial instruments owned. |

| • | The firm exchanged $62 million of Trust Preferred Securities and common beneficial interests for $67 million of the firm's junior subordinated debt. |

The accompanying notes are an integral part of these consolidated financial statements.

| 5 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Note 1.

Description of Business

The Goldman Sachs Group, Inc. (Group Inc. or parent company), a Delaware corporation, together with its consolidated subsidiaries (collectively, the firm), is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

The firm reports its activities in the following four business segments:

Investment Banking

The firm provides a broad range of investment banking services to a diverse group of corporations, financial institutions, investment funds and governments. Services include strategic advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense activities, restructurings, spin-offs and risk management, and debt and equity underwriting of public offerings and private placements, including local and cross-border transactions and acquisition financing, as well as derivative transactions directly related to these activities.

Institutional Client Services

The firm facilitates client transactions and makes markets in fixed income, equity, currency and commodity products, primarily with institutional clients such as corporations, financial institutions, investment funds and governments. The firm also makes markets in and clears client transactions on major stock, options and futures exchanges worldwide and provides financing, securities lending and other prime brokerage services to institutional clients.

Investing & Lending

The firm invests in and originates loans to provide financing to clients. These investments and loans are typically longer-term in nature. The firm makes investments, some of which are consolidated, including through its Merchant Banking business and its Special Situations Group, in debt securities and loans, public and private equity securities, infrastructure and real estate entities. Some of these investments are made indirectly through funds that the firm manages. The firm also makes unsecured and secured loans to retail clients through its digital platforms, Marcus: by Goldman Sachs (Marcus) and Goldman Sachs Private Bank Select (GS Select), respectively.

Investment Management

The firm provides investment management services and offers investment products (primarily through separately managed accounts and commingled vehicles, such as mutual funds and private investment funds) across all major asset classes to a diverse set of institutional and individual clients. The firm also offers wealth advisory services provided by the firm's subsidiary, The Ayco Company, L.P., including portfolio management and financial planning and counseling, and brokerage and other transaction services to high-net-worth individuals and families.

Note 2.

Basis of Presentation

These consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP) and include the accounts of Group Inc. and all other entities in which the firm has a controlling financial interest. Intercompany transactions and balances have been eliminated.

These consolidated financial statements are unaudited and should be read in conjunction with the audited consolidated financial statements included in the firm's Annual Report on Form 10-K for the year ended December 31, 2017. References to "the 2017 Form 10-K" are to the firm's Annual Report on Form 10-K for the year ended December 31, 2017. Certain disclosures included in the annual financial statements have been condensed or omitted from these financial statements as they are not required for interim financial statements under U.S. GAAP and the rules of the Securities and Exchange Commission.

These unaudited consolidated financial statements reflect all adjustments that are, in the opinion of management, necessary for a fair statement of the results for the interim periods presented. These adjustments are of a normal, recurring nature. Interim period operating results may not be indicative of the operating results for a full year.

All references to June 2018, March 2018 and June 2017 refer to the firm's periods ended, or the dates, as the context requires, June 30, 2018, March 31, 2018 and June 30, 2017, respectively. All references to December 2017 refer to the date December 31, 2017. Any reference to a future year refers to a year ending on December 31 of that year. Certain reclassifications have been made to previously reported amounts to conform to the current presentation.

| Goldman Sachs June 2018 Form 10-Q | 6 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Note 3.

Significant Accounting Policies

The firm's significant accounting policies include when and how to measure the fair value of assets and liabilities, accounting for goodwill and identifiable intangible assets, and when to consolidate an entity. See Notes 5 through 8 for policies on fair value measurements, Note 13 for policies on goodwill and identifiable intangible assets, and below and Note 12 for policies on consolidation accounting. All other significant accounting policies are either described below or included in the following footnotes:

Financial Instruments Owned and Financial Instruments Sold, But Not Yet Purchased | Note 4 | |||

Fair Value Measurements | Note 5 | |||

Cash Instruments | Note 6 | |||

Derivatives and Hedging Activities | Note 7 | |||

Fair Value Option | Note 8 | |||

Loans Receivable | Note 9 | |||

Collateralized Agreements and Financings | Note 10 | |||

Securitization Activities | Note 11 | |||

Variable Interest Entities | Note 12 | |||

Other Assets | Note 13 | |||

Deposits | Note 14 | |||

Short-Term Borrowings | Note 15 | |||

Long-Term Borrowings | Note 16 | |||

Other Liabilities | Note 17 | |||

Commitments, Contingencies and Guarantees | Note 18 | |||

Shareholders' Equity | Note 19 | |||

Regulation and Capital Adequacy | Note 20 | |||

Earnings Per Common Share | Note 21 | |||

Transactions with Affiliated Funds | Note 22 | |||

Interest Income and Interest Expense | Note 23 | |||

Income Taxes | Note 24 | |||

Business Segments | Note 25 | |||

Credit Concentrations | Note 26 | |||

Legal Proceedings | Note 27 | |||

Consolidation

The firm consolidates entities in which the firm has a controlling financial interest. The firm determines whether it has a controlling financial interest in an entity by first evaluating whether the entity is a voting interest entity or a variable interest entity (VIE).

Voting Interest Entities. Voting interest entities are entities in which (i) the total equity investment at risk is sufficient to enable the entity to finance its activities independently and (ii) the equity holders have the power to direct the activities of the entity that most significantly impact its economic performance, the obligation to absorb the losses of the entity and the right to receive the residual returns of the entity. The usual condition for a controlling financial interest in a voting interest entity is ownership of a majority voting interest. If the firm has a controlling majority voting interest in a voting interest entity, the entity is consolidated.

Variable Interest Entities. A VIE is an entity that lacks one or more of the characteristics of a voting interest entity. The firm has a controlling financial interest in a VIE when the firm has a variable interest or interests that provide it with (i) the power to direct the activities of the VIE that most significantly impact the VIE's economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE. See Note 12 for further information about VIEs.

Equity-Method Investments. When the firm does not have a controlling financial interest in an entity but can exert significant influence over the entity's operating and financial policies, the investment is accounted for either (i) under the equity method of accounting or (ii) at fair value by electing the fair value option available under U.S. GAAP. Significant influence generally exists when the firm owns 20% to 50% of the entity's common stock or in-substance common stock.

In general, the firm accounts for investments acquired after the fair value option became available, at fair value. In certain cases, the firm applies the equity method of accounting to new investments that are strategic in nature or closely related to the firm's principal business activities, when the firm has a significant degree of involvement in the cash flows or operations of the investee or when cost-benefit considerations are less significant. See Note 13 for further information about equity-method investments.

| 7 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Investment Funds. The firm has formed numerous investment funds with third-party investors. These funds are typically organized as limited partnerships or limited liability companies for which the firm acts as general partner or manager. Generally, the firm does not hold a majority of the economic interests in these funds. These funds are usually voting interest entities and generally are not consolidated because third-party investors typically have rights to terminate the funds or to remove the firm as general partner or manager. Investments in these funds are generally measured at net asset value (NAV) and are included in financial instruments owned. See Notes 6, 18 and 22 for further information about investments in funds.

Use of Estimates

Preparation of these consolidated financial statements requires management to make certain estimates and assumptions, the most important of which relate to fair value measurements, accounting for goodwill and identifiable intangible assets, discretionary compensation accruals, income tax expense related to the Tax Cuts and Jobs Act (Tax Legislation), provisions for losses that may arise from litigation and regulatory proceedings (including governmental investigations), the allowance for losses on loans receivable and lending commitments held for investment, and provisions for losses that may arise from tax audits. These estimates and assumptions are based on the best available information but actual results could be materially different.

Revenue Recognition

Financial Assets and Financial Liabilities at Fair Value. Financial instruments owned and financial instruments sold, but not yet purchased are recorded at fair value either under the fair value option or in accordance with other U.S. GAAP. In addition, the firm has elected to account for certain of its other financial assets and financial liabilities at fair value by electing the fair value option. The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Financial assets are marked to bid prices and financial liabilities are marked to offer prices. Fair value measurements do not include transaction costs. Fair value gains or losses are generally included in market making for positions in Institutional Client Services and other principal transactions for positions in Investing & Lending. See Notes 5 through 8 for further information about fair value measurements.

Revenue from Contracts with Clients. Beginning in January 2018, the firm accounts for revenue earned from contracts with clients for services such as investment banking, investment management, and execution and clearing (contracts with clients) under ASU No. 2014-09, "Revenue from Contracts with Customers (Topic 606)." As such, revenues for these services are recognized when the performance obligations related to the underlying transaction are completed. See "Recent Accounting Developments - Revenue from Contracts with Customers (ASC 606)" for further information.

The firm's net revenues from contracts with clients subject to this ASU represent approximately 50% and 45% of the firm's total net revenues for the three and six months ended June 2018, respectively. This includes approximately 80% of the firm's investment banking revenues, substantially all of the investment management revenues, and commissions and fees for both the three and six months ended June 2018. See Note 25 for information about the firm's net revenues by business segment.

Investment Banking

Advisory. Fees from financial advisory assignments are recognized in revenues when the services related to the underlying transaction are completed under the terms of the assignment. Beginning in January 2018, non-refundable deposits and milestone payments in connection with financial advisory assignments are recognized in revenues upon completion of the underlying transaction or when the assignment is otherwise concluded. Prior to January 2018, non-refundable deposits and milestone payments were recognized in revenues in accordance with the terms of the contract.

Beginning in January 2018, non-compensation expenses associated with financial advisory assignments are recognized when incurred. Client reimbursements for such expenses are included in financial advisory revenues. Prior to January 2018, such expenses were deferred until the related revenue was recognized or the assignment was otherwise concluded and were presented net of client reimbursements.

| Goldman Sachs June 2018 Form 10-Q | 8 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Underwriting. Fees from underwriting assignments are recognized in revenues upon completion of the underlying transaction based on the terms of the assignment.

Non-compensation expenses associated with underwriting assignments are deferred until the related revenue is recognized or the assignment is otherwise concluded. Beginning in January 2018, such expenses are presented as non-compensation expenses. Prior to January 2018, such expenses were presented net within underwriting revenues.

Investment Management

The firm earns management fees and incentive fees for investment management services, which are included in investment management revenues. The firm makes payments to brokers and advisors related to the placement of the firm's investment funds (distribution fees), which are included in brokerage, clearing, exchange and distribution fees.

Management Fees. Management fees for mutual funds are calculated as a percentage of daily net asset value and are received monthly. Management fees for hedge funds and separately managed accounts are calculated as a percentage of month-end net asset value and are generally received quarterly. Management fees for private equity funds are calculated as a percentage of monthly invested capital or committed capital and are received quarterly, semi-annually or annually, depending on the fund. Management fees are recognized over time in the period the investment management services are provided.

Distribution fees paid by the firm are calculated based on either a percentage of the management fee, the investment fund's net asset value or the committed capital. Beginning in January 2018, the firm presents such fees in brokerage, clearing, exchange and distribution fees. Prior to January 2018, where the firm was considered an agent to the arrangement, such fees were presented on a net basis in investment management revenues.

Incentive Fees. Incentive fees are calculated as a percentage of a fund's or separately managed account's return, or excess return above a specified benchmark or other performance target. Incentive fees are generally based on investment performance over a twelve-month period or over the life of a fund. Fees that are based on performance over a twelve-month period are subject to adjustment prior to the end of the measurement period. For fees that are based on investment performance over the life of the fund, future investment underperformance may require fees previously distributed to the firm to be returned to the fund.

Beginning in January 2018, incentive fees earned from a fund or separately managed account are recognized when it is probable that a significant reversal of such fees will not occur, which is generally when such fees are no longer subject to fluctuations in the market value of investments held by the fund or separately managed account. Therefore, incentive fees recognized during the period may relate to performance obligations satisfied in previous periods. Prior to January 2018, incentive fees were recognized only when all material contingencies were resolved.

Commissions and Fees

The firm earns commissions and fees from executing and clearing client transactions on stock, options and futures markets, as well as over-the-counter (OTC) transactions. Commissions and fees are recognized on the day the trade is executed. The firm also provides third-party research services to clients in connection with certain soft-dollar arrangements.

Beginning in January 2018, costs incurred by the firm for research are presented net within commissions and fees. Prior to January 2018, costs incurred by the firm for research for certain soft-dollar arrangements were presented in brokerage, clearing, exchange and distribution fees.

Remaining Performance Obligations

Remaining performance obligations are services that the firm has committed to perform in the future in connection with its contracts with clients. The firm's remaining performance obligations are generally related to its financial advisory assignments and certain investment management activities. Revenues associated with remaining performance obligations relating to financial advisory assignments cannot be determined until the outcome of the transaction. For the firm's investment management activities, where fees are calculated based on the net asset value of the fund or separately managed account, future revenues associated with remaining performance obligations cannot be determined as such fees are subject to fluctuations in the market value of investments held by the fund or separately managed account.

The firm is able to determine the future revenues associated with management fees calculated based on committed capital. As of June 2018, substantially all of the firm's future net revenues associated with remaining performance obligations will be recognized through 2023. Annual revenues associated with such performance obligations average less than $250 million through 2023.

| 9 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Transfers of Financial Assets

Transfers of financial assets are accounted for as sales when the firm has relinquished control over the assets transferred. For transfers of financial assets accounted for as sales, any gains or losses are recognized in net revenues. Assets or liabilities that arise from the firm's continuing involvement with transferred financial assets are initially recognized at fair value. For transfers of financial assets that are not accounted for as sales, the assets are generally included in financial instruments owned and the transfer is accounted for as a collateralized financing, with the related interest expense recognized over the life of the transaction. See Note 10 for further information about transfers of financial assets accounted for as collateralized financings and Note 11 for further information about transfers of financial assets accounted for as sales.

Cash and Cash Equivalents

The firm defines cash equivalents as highly liquid overnight deposits held in the ordinary course of business. As of June 2018 and December 2017, cash and cash equivalents included $13.17 billion and $10.79 billion, respectively, of cash and due from banks, and $118.25 billion and $99.26 billion, respectively, of interest-bearing deposits with banks. The firm segregates cash for regulatory and other purposes related to client activity. As of June 2018 and December 2017, $22.62 billion and $18.44 billion, respectively, of cash and cash equivalents were segregated for regulatory and other purposes. In addition, the firm segregates securities for regulatory and other purposes related to client activity. See Note 10 for further information about segregated securities.

Receivables from and Payables to Brokers, Dealers and Clearing Organizations

Receivables from and payables to brokers, dealers and clearing organizations are accounted for at cost plus accrued interest, which generally approximates fair value. While these receivables and payables are carried at amounts that approximate fair value, they are not accounted for at fair value under the fair value option or at fair value in accordance with other U.S. GAAP and therefore are not included in the firm's fair value hierarchy in Notes 6 through 8. Had these receivables and payables been included in the firm's fair value hierarchy, substantially all would have been classified in level 2 as of both June 2018 and December 2017.

Receivables from Customers and Counterparties

Receivables from customers and counterparties generally relate to collateralized transactions. Such receivables primarily consist of customer margin loans, certain transfers of assets accounted for as secured loans rather than purchases at fair value and collateral posted in connection with certain derivative transactions. Substantially all of these receivables are accounted for at amortized cost net of estimated uncollectible amounts. Certain of the firm's receivables from customers and counterparties are accounted for at fair value under the fair value option, with changes in fair value generally included in market making revenues. See Note 8 for further information about receivables from customers and counterparties accounted for at fair value under the fair value option. In addition, as of June 2018 and December 2017, the firm's receivables from customers and counterparties included $6.25 billion and $4.63 billion, respectively, of loans held for sale, accounted for at the lower of cost or fair value. See Note 5 for an overview of the firm's fair value measurement policies.

As of both June 2018 and December 2017, the carrying value of receivables not accounted for at fair value generally approximated fair value. While these receivables are carried at amounts that approximate fair value, they are not accounted for at fair value under the fair value option or at fair value in accordance with other U.S. GAAP and therefore are not included in the firm's fair value hierarchy in Notes 6 through 8. Had these receivables been included in the firm's fair value hierarchy, substantially all would have been classified in level 2 as of both June 2018 and December 2017. Interest on receivables from customers and counterparties is recognized over the life of the transaction and included in interest income.

Receivables from customers and counterparties includes receivables from contracts with clients and, beginning in January 2018, also includes contract assets. Contract assets represent the firm's right to receive consideration for services provided in connection with its contracts with clients for which collection is conditional and not merely subject to the passage of time. As of June 2018, the firm's receivables from contracts with clients were $1.93 billion and contract assets were not material.

| Goldman Sachs June 2018 Form 10-Q | 10 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Payables to Customers and Counterparties

Payables to customers and counterparties primarily consist of customer credit balances related to the firm's prime brokerage activities. Payables to customers and counterparties are accounted for at cost plus accrued interest, which generally approximates fair value. While these payables are carried at amounts that approximate fair value, they are not accounted for at fair value under the fair value option or at fair value in accordance with other U.S. GAAP and therefore are not included in the firm's fair value hierarchy in Notes 6 through 8. Had these payables been included in the firm's fair value hierarchy, substantially all would have been classified in level 2 as of both June 2018 and December 2017. Interest on payables to customers and counterparties is recognized over the life of the transaction and included in interest expense.

Offsetting Assets and Liabilities

To reduce credit exposures on derivatives and securities financing transactions, the firm may enter into master netting agreements or similar arrangements (collectively, netting agreements) with counterparties that permit it to offset receivables and payables with such counterparties. A netting agreement is a contract with a counterparty that permits net settlement of multiple transactions with that counterparty, including upon the exercise of termination rights by a non-defaulting party. Upon exercise of such termination rights, all transactions governed by the netting agreement are terminated and a net settlement amount is calculated. In addition, the firm receives and posts cash and securities collateral with respect to its derivatives and securities financing transactions, subject to the terms of the related credit support agreements or similar arrangements (collectively, credit support agreements). An enforceable credit support agreement grants the non-defaulting party exercising termination rights the right to liquidate the collateral and apply the proceeds to any amounts owed. In order to assess enforceability of the firm's right of setoff under netting and credit support agreements, the firm evaluates various factors including applicable bankruptcy laws, local statutes and regulatory provisions in the jurisdiction of the parties to the agreement.

Derivatives are reported on a net-by-counterparty basis (i.e., the net payable or receivable for derivative assets and liabilities for a given counterparty) in the consolidated statements of financial condition when a legal right of setoff exists under an enforceable netting agreement. Resale and repurchase agreements and securities borrowed and loaned transactions with the same term and currency are presented on a net-by-counterparty basis in the consolidated statements of financial condition when such transactions meet certain settlement criteria and are subject to netting agreements.

In the consolidated statements of financial condition, derivatives are reported net of cash collateral received and posted under enforceable credit support agreements, when transacted under an enforceable netting agreement. In the consolidated statements of financial condition, resale and repurchase agreements, and securities borrowed and loaned, are not reported net of the related cash and securities received or posted as collateral. See Note 10 for further information about collateral received and pledged, including rights to deliver or repledge collateral. See Notes 7 and 10 for further information about offsetting.

Share-based Compensation

The cost of employee services received in exchange for a share-based award is generally measured based on the grant-date fair value of the award. Share-based awards that do not require future service (i.e., vested awards, including awards granted to retirement-eligible employees) are expensed immediately. Share-based awards that require future service are amortized over the relevant service period. Forfeitures are recorded when they occur. See "Recent Accounting Developments - Improvements to Employee Share-Based Payment Accounting (ASC 718)" for further information.

Cash dividend equivalents paid on outstanding restricted stock units (RSUs) are charged to retained earnings. If RSUs that require future service are forfeited, the related dividend equivalents originally charged to retained earnings are reclassified to compensation expense in the period in which forfeiture occurs.

The firm generally issues new shares of common stock upon delivery of share-based awards. In certain cases, primarily related to conflicted employment (as outlined in the applicable award agreements), the firm may cash settle share-based compensation awards accounted for as equity instruments. For these awards, whose terms allow for cash settlement, additional paid-in capital is adjusted to the extent of the difference between the value of the award at the time of cash settlement and the grant-date value of the award.

| 11 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Foreign Currency Translation

Assets and liabilities denominated in non-U.S. currencies are translated at rates of exchange prevailing on the date of the consolidated statements of financial condition and revenues and expenses are translated at average rates of exchange for the period. Foreign currency remeasurement gains or losses on transactions in nonfunctional currencies are recognized in earnings. Gains or losses on translation of the financial statements of a non-U.S. operation, when the functional currency is other than the U.S. dollar, are included, net of hedges and taxes, in the consolidated statements of comprehensive income.

Recent Accounting Developments

Revenue from Contracts with Customers (ASC 606). In May 2014, the FASB issued ASU No. 2014-09. This ASU, as amended, provides comprehensive guidance on the recognition of revenue earned from contracts with customers arising from the transfer of goods and services, guidance on accounting for certain contract costs and new disclosures.

The firm adopted this ASU in January 2018 under a modified retrospective approach. As a result of adopting this ASU, the firm, among other things, delays recognition of non-refundable and milestone payments on financial advisory assignments until the assignments are completed, and recognizes certain investment management fees earlier than under the firm's previous revenue recognition policies.

The firm also prospectively changed the presentation of certain costs from a net presentation within revenues to a gross basis, and vice versa. Beginning in 2018, certain underwriting expenses, which were netted against investment banking revenues and certain distribution fees, which were netted against investment management revenues, are presented gross as non-compensation expenses. Costs incurred in connection with certain soft-dollar arrangements, which were presented gross as non-compensation expenses, are presented net within commissions and fees.

Net revenues and non-compensation expenses both increased by approximately $80 million and $130 million for the three and six months ended June 2018, respectively, due to the changes in the presentation of certain costs from a net presentation within revenues to a gross basis. In addition, net revenues increased by approximately $40 million for both the three and six months ended June 2018, reflecting certain investment management fees which are now recognized earlier than under the firm's previous revenue recognition policies.

Recognition and Measurement of Financial Assets and Financial Liabilities (ASC 825). In January 2016, the FASB issued ASU No. 2016-01, "Financial Instruments (Topic 825) - Recognition and Measurement of Financial Assets and Financial Liabilities." This ASU amends certain aspects of recognition, measurement, presentation and disclosure of financial instruments. It includes a requirement to present separately in other comprehensive income changes in fair value attributable to a firm's own credit spreads (debt valuation adjustment or DVA), net of tax, on financial liabilities for which the fair value option was elected.

In January 2016, the firm early adopted this ASU for the requirements related to DVA and reclassified the cumulative DVA, a gain of $305 million (net of tax), from retained earnings to accumulated other comprehensive loss. The adoption of the remaining provisions of the ASU in January 2018 did not have a material impact on the firm's financial condition, results of operations or cash flows.

Leases (ASC 842). In February 2016, the FASB issued ASU No. 2016-02, "Leases (Topic 842)." This ASU requires that, for leases longer than one year, a lessee recognize in the statements of financial condition a right-of-use asset, representing the right to use the underlying asset for the lease term, and a lease liability, representing the liability to make lease payments. It also requires that for finance leases, a lessee recognize interest expense on the lease liability, separately from the amortization of the right-of-use asset in the statements of earnings, while for operating leases, such amounts should be recognized as a combined expense. It also requires that for qualifying sale-leaseback transactions the seller recognize the gain or loss at the time control of the asset is transferred instead of amortizing it over the lease period. In addition, this ASU requires expanded disclosures about the nature and terms of lease agreements.

The ASU is effective for the firm in January 2019 under a modified retrospective approach. Early adoption is permitted. The firm's implementation efforts include reviewing the terms of existing leases and service contracts, which may include embedded leases. Based on the implementation efforts to date, the firm expects a gross up of approximately $2 billion on its consolidated statements of financial condition upon recognition of the right-of-use assets and lease liabilities.

| Goldman Sachs June 2018 Form 10-Q | 12 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Improvements to Employee Share-Based Payment Accounting (ASC 718). In March 2016, the FASB issued ASU No. 2016-09, "Compensation - Stock Compensation (Topic 718) - Improvements to Employee Share-Based Payment Accounting." This ASU includes a requirement that the tax effect related to the settlement of share-based awards be recorded in income tax benefit or expense in the statements of earnings rather than directly to additional paid-in capital. This change has no impact on total shareholders' equity and is required to be adopted prospectively. The ASU also allows for forfeitures to be recorded when they occur rather than estimated over the vesting period. This change is required to be applied on a modified retrospective basis.

The firm adopted the ASU in January 2017 and subsequent to the adoption, the tax effect related to the settlement of share-based awards is recognized in the statements of earnings rather than directly to additional paid-in capital. The firm also elected to account for forfeitures as they occur, rather than to estimate forfeitures over the vesting period, and the cumulative effect of this election upon adoption was an increase of $35 million to share-based awards and a decrease of $24 million (net of tax of $11 million) to retained earnings.

In addition, the ASU modifies the classification of certain share-based payment activities within the statements of cash flows. Upon adoption, the firm reclassified amounts related to such activities within the consolidated statements of cash flows, on a retrospective basis.

Measurement of Credit Losses on Financial Instruments (ASC 326). In June 2016, the FASB issued ASU No. 2016-13, "Financial Instruments - Credit Losses (Topic 326) - Measurement of Credit Losses on Financial Instruments." This ASU amends several aspects of the measurement of credit losses on financial instruments, including replacing the existing incurred credit loss model and other models with the Current Expected Credit Losses (CECL) model and amending certain aspects of accounting for purchased financial assets with deterioration in credit quality since origination.

Under CECL, the allowance for losses for financial assets that are measured at amortized cost reflects management's estimate of credit losses over the remaining expected life of the financial assets. Expected credit losses for newly recognized financial assets, as well as changes to expected credit losses during the period, would be recognized in earnings. For certain purchased financial assets with deterioration in credit quality since origination, an initial allowance would be recorded for expected credit losses and recognized as an increase to the purchase price rather than as an expense. Expected credit losses, including losses on off-balance-sheet exposures such as lending commitments, will be measured based on historical experience, current conditions and forecasts that affect the collectability of the reported amount.

The ASU is effective for the firm in January 2020 under a modified retrospective approach. Early adoption is permitted in January 2019. Adoption of the ASU will result in earlier recognition of credit losses and an increase in the recorded allowance for certain purchased loans with deterioration in credit quality since origination with a corresponding increase to their gross carrying value. The firm is currently in the process of identifying and developing the changes to the firm's existing allowance models and processes that will be required under CECL. The impact of adoption of this ASU on the firm's financial condition, results of operations and cash flows will depend on, among other things, the economic environment and the type of financial assets held by the firm on the date of adoption.

Classification of Certain Cash Receipts and Cash Payments (ASC 230). In August 2016, the FASB issued ASU No. 2016-15, "Statement of Cash Flows (Topic 230) - Classification of Certain Cash Receipts and Cash Payments." This ASU provides guidance on the disclosure and classification of certain items within the statements of cash flows.

The firm adopted this ASU in January 2018 under a retrospective approach. The impact of adoption was an increase of $244 million to net cash used for operating activities, a decrease of $236 million to net cash used for investing activities and an increase of $8 million to net cash provided by financing activities for the six months ended June 2017.

Clarifying the Definition of a Business (ASC 805). In January 2017, the FASB issued ASU No. 2017-01, "Business Combinations (Topic 805) - Clarifying the Definition of a Business." The ASU amends the definition of a business and provides a threshold which must be considered to determine whether a transaction is an acquisition (or disposal) of an asset or a business.

The firm adopted this ASU in January 2018 under a prospective approach. Adoption of the ASU did not have a material impact on the firm's financial condition, results of operations or cash flows. The firm expects that fewer transactions will be treated as acquisitions (or disposals) of businesses as a result of adopting this ASU.

| 13 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Simplifying the Test for Goodwill Impairment (ASC 350). In January 2017, the FASB issued ASU No. 2017-04, "Intangibles - Goodwill and Other (Topic 350) - Simplifying the Test for Goodwill Impairment." The ASU simplifies the quantitative goodwill impairment test by eliminating the second step of the test. Under this ASU, impairment will be measured by comparing the estimated fair value of the reporting unit with its carrying value.

The ASU is effective for the firm in 2020. The firm early adopted this ASU in the fourth quarter of 2017. Adoption of the ASU did not have a material impact on the results of the firm's goodwill impairment test.

Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets (ASC 610-20). In February 2017, the FASB issued ASU No. 2017-05, "Other Income - Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20) - Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets." The ASU clarifies the scope of guidance applicable to sales of nonfinancial assets and also provides guidance on accounting for partial sales of such assets.

The firm adopted this ASU in January 2018 under a modified retrospective approach. Adoption of the ASU did not have an impact on the firm's financial condition, results of operations or cash flows.

Targeted Improvements to Accounting for Hedging Activities (ASC 815). In August 2017, the FASB issued ASU No. 2017-12, "Derivatives and Hedging (Topic 815) - Targeted Improvements to Accounting for Hedging Activities." The ASU amends certain rules for hedging relationships, expands the types of strategies that are eligible for hedge accounting treatment to more closely align the results of hedge accounting with risk management activities and amends disclosure requirements related to fair value and net investment hedges.

The firm early adopted this ASU in January 2018 under a modified retrospective approach for hedge accounting treatment, and under a prospective approach for the amended disclosure requirements. Adoption of this ASU did not have a material impact on the firm's financial condition, results of operations or cash flows. See Note 7 for further information.

Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (ASC 220). In February 2018, the FASB issued ASU No. 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220) - Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income." This ASU permits a reporting entity to reclassify the income tax effects of Tax Legislation on items within accumulated other comprehensive income to retained earnings.

The ASU is effective for the firm in January 2019 under a retrospective or a modified retrospective approach. Early adoption is permitted. Since this ASU only permits reclassification within shareholders' equity, adoption of this ASU will not have a material impact on the firm's financial condition.

| Goldman Sachs June 2018 Form 10-Q | 14 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Note 4.

Financial Instruments Owned and Financial Instruments Sold, But Not Yet Purchased |

Financial instruments owned and financial instruments sold, but not yet purchased are accounted for at fair value either under the fair value option or in accordance with other U.S. GAAP. See Note 8 for information about other financial assets and financial liabilities at fair value.

The table below presents the firm's financial instruments owned and financial instruments sold, but not yet purchased.

| $ in millions | Financial Instruments Owned | Financial Instruments Sold, But Not Yet Purchased | ||||||

As of June 2018 | ||||||||

Money market instruments | $ 3,274 | $ – | ||||||

Government and agency obligations: | ||||||||

U.S. | 86,660 | 11,207 | ||||||

Non-U.S. | 38,561 | 24,068 | ||||||

Loans and securities backed by: | ||||||||

Commercial real estate | 3,842 | – | ||||||

Residential real estate | 10,386 | 6 | ||||||

Corporate debt instruments | 35,072 | 11,020 | ||||||

State and municipal obligations | 1,653 | – | ||||||

Other debt obligations | 1,933 | 1 | ||||||

Equity securities | 109,961 | 28,903 | ||||||

Commodities | 5,109 | – | ||||||

Investments in funds at NAV | 4,020 | – | ||||||

Subtotal | 300,471 | 75,205 | ||||||

Derivatives | 47,488 | 37,542 | ||||||

Total | $347,959 | $112,747 | ||||||

As of December 2017 | ||||||||

Money market instruments | $ 1,608 | $ – | ||||||

Government and agency obligations: | ||||||||

U.S. | 76,418 | 17,911 | ||||||

Non-U.S. | 33,956 | 23,311 | ||||||

Loans and securities backed by: | ||||||||

Commercial real estate | 3,436 | 1 | ||||||

Residential real estate | 11,993 | – | ||||||

Corporate debt instruments | 33,683 | 7,153 | ||||||

State and municipal obligations | 1,471 | – | ||||||

Other debt obligations | 2,164 | 1 | ||||||

Equity securities | 96,132 | 23,882 | ||||||

Commodities | 3,194 | 40 | ||||||

Investments in funds at NAV | 4,596 | – | ||||||

Subtotal | 268,651 | 72,299 | ||||||

Derivatives | 47,337 | 39,631 | ||||||

Total | $315,988 | $111,930 |

In the table above:

| • | Money market instruments includes commercial paper, certificates of deposit and time deposits, substantially all of which have a maturity of less than one year. |

| • | Corporate debt instruments includes corporate loans and debt securities. |

| • | Equity securities includes public and private equities, exchange-traded funds and convertible debentures. Such amounts include investments accounted for at fair value under the fair value option where the firm would otherwise apply the equity method of accounting of $8.85 billion as of June 2018 and $8.49 billion as of December 2017. |

Gains and Losses from Market Making and Other Principal Transactions

The table below presents market making revenues by major product type, as well as other principal transactions revenues.

Three Months Ended June | Six Months Ended June | |||||||||||||||||||

| $ in millions | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||

Interest rates | $(3,222 | ) | $ 2,625 | $(2,317 | ) | $ 3,989 | ||||||||||||||

Credit | 548 | 382 | 866 | 926 | ||||||||||||||||

Currencies | 3,093 | (2,422 | ) | 3,495 | (2,740 | ) | ||||||||||||||

Equities | 2,025 | 1,293 | 3,161 | 1,871 | ||||||||||||||||

Commodities | 102 | 37 | 545 | 287 | ||||||||||||||||

Market making | 2,546 | 1,915 | 5,750 | 4,333 | ||||||||||||||||

Other principal transactions | 1,286 | 1,227 | 2,906 | 2,448 | ||||||||||||||||

Total | $ 3,832 | $ 3,142 | $ 8,656 | $ 6,781 | ||||||||||||||||

In the table above:

| • | Gains/(losses) include both realized and unrealized gains and losses, and are primarily related to the firm's financial instruments owned and financial instruments sold, but not yet purchased, including both derivative and non-derivative financial instruments. |

| • | Gains/(losses) exclude related interest income and interest expense. See Note 23 for further information about interest income and interest expense. |

| • | Gains/(losses) on other principal transactions are included in the firm's Investing & Lending segment. See Note 25 for net revenues, including net interest income, by product type for Investing & Lending, as well as the amount of net interest income included in Investing & Lending. |

| • | Gains/(losses) are not representative of the manner in which the firm manages its business activities because many of the firm's market-making and client facilitation strategies utilize financial instruments across various product types. Accordingly, gains or losses in one product type frequently offset gains or losses in other product types. For example, most of the firm's longer-term derivatives across product types are sensitive to changes in interest rates and may be economically hedged with interest rate swaps. Similarly, a significant portion of the firm's cash instruments and derivatives across product types has exposure to foreign currencies and may be economically hedged with foreign currency contracts. |

| 15 | Goldman Sachs June 2018 Form 10-Q |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

Note 5.

Fair Value Measurements

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Financial assets are marked to bid prices and financial liabilities are marked to offer prices. Fair value measurements do not include transaction costs. The firm measures certain financial assets and financial liabilities as a portfolio (i.e., based on its net exposure to market and/or credit risks).

The best evidence of fair value is a quoted price in an active market. If quoted prices in active markets are not available, fair value is determined by reference to prices for similar instruments, quoted prices or recent transactions in less active markets, or internally developed models that primarily use market-based or independently sourced inputs including, but not limited to, interest rates, volatilities, equity or debt prices, foreign exchange rates, commodity prices, credit spreads and funding spreads (i.e., the spread or difference between the interest rate at which a borrower could finance a given financial instrument relative to a benchmark interest rate).

U.S. GAAP has a three-level hierarchy for disclosure of fair value measurements. This hierarchy prioritizes inputs to the valuation techniques used to measure fair value, giving the highest priority to level 1 inputs and the lowest priority to level 3 inputs. A financial instrument's level in this hierarchy is based on the lowest level of input that is significant to its fair value measurement. In evaluating the significance of a valuation input, the firm considers, among other factors, a portfolio's net risk exposure to that input. The fair value hierarchy is as follows:

Level 1. Inputs are unadjusted quoted prices in active markets to which the firm had access at the measurement date for identical, unrestricted assets or liabilities.

Level 2. Inputs to valuation techniques are observable, either directly or indirectly.

Level 3. One or more inputs to valuation techniques are significant and unobservable.

The fair values for substantially all of the firm's financial assets and financial liabilities are based on observable prices and inputs and are classified in levels 1 and 2 of the fair value hierarchy. Certain level 2 and level 3 financial assets and financial liabilities may require appropriate valuation adjustments that a market participant would require to arrive at fair value for factors such as counterparty and the firm's credit quality, funding risk, transfer restrictions, liquidity and bid/offer spreads. Valuation adjustments are generally based on market evidence.

See Notes 6 through 8 for further information about fair value measurements of cash instruments, derivatives and other financial assets and financial liabilities at fair value.

The table below presents financial assets and financial liabilities accounted for at fair value under the fair value option or in accordance with other U.S. GAAP.

| As of | ||||||||||||

| $ in millions | June 2018 | March 2018 | December 2017 | |||||||||

Total level 1 financial assets | $180,345 | $169,447 | $155,086 | |||||||||

Total level 2 financial assets | 378,977 | 404,152 | 395,606 | |||||||||

Total level 3 financial assets | 20,516 | 21,057 | 19,201 | |||||||||

Investments in funds at NAV | 4,020 | 4,043 | 4,596 | |||||||||

Counterparty and cash collateral netting | (56,699 | ) | (59,502 | ) | (56,366 | ) | ||||||

Total financial assets at fair value | $527,159 | $539,197 | $518,123 | |||||||||

Total assets | $968,610 | $973,535 | $916,776 | |||||||||

Total level 3 financial assets divided by: | ||||||||||||

Total assets | 2.1% | 2.2% | 2.1% | |||||||||

Total financial assets at fair value | 3.9% | 3.9% | 3.7% | |||||||||

Total level 1 financial liabilities | $ 62,401 | $ 73,176 | $ 63,589 | |||||||||

Total level 2 financial liabilities | 279,805 | 289,362 | 261,719 | |||||||||

Total level 3 financial liabilities | 21,193 | 20,256 | 19,620 | |||||||||

Counterparty and cash collateral netting | (37,538 | ) | (42,652 | ) | (39,866 | ) | ||||||

Total financial liabilities at fair value | $325,861 | $340,142 | $305,062 | |||||||||

Total level 3 financial liabilities divided by total financial liabilities at fair value | 6.5% | 6.0% | 6.4% | |||||||||

In the table above:

| • | Counterparty netting among positions classified in the same level is included in that level. |

| • | Counterparty and cash collateral netting represents the impact on derivatives of netting across levels of the fair value hierarchy. |

| Goldman Sachs June 2018 Form 10-Q | 16 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

The table below presents a summary of level 3 financial assets.

| As of | ||||||||||||

| $ in millions | June 2018 | March 2018 | December 2017 | |||||||||

Cash instruments | $16,216 | $16,942 | $15,395 | |||||||||

Derivatives | 4,293 | 4,114 | 3,802 | |||||||||

Other financial assets | 7 | 1 | 4 | |||||||||

Total | $20,516 | $21,057 | $19,201 | |||||||||

Level 3 financial assets as of June 2018 decreased compared with March 2018, reflecting a decrease in level 3 cash instruments. Level 3 financial assets as of June 2018 increased compared with December 2017, primarily reflecting an increase in level 3 cash instruments. See Notes 6 through 8 for further information about level 3 financial assets (including information about unrealized gains and losses related to level 3 financial assets and financial liabilities, and transfers in and out of level 3).

Note 6.

Cash Instruments

Cash instruments include U.S. government and agency obligations, non-U.S. government and agency obligations, mortgage-backed loans and securities, corporate debt instruments, equity securities, investments in funds at NAV, and other non-derivative financial instruments owned and financial instruments sold, but not yet purchased. See below for the types of cash instruments included in each level of the fair value hierarchy and the valuation techniques and significant inputs used to determine their fair values. See Note 5 for an overview of the firm's fair value measurement policies.

Level 1 Cash Instruments

Level 1 cash instruments include certain money market instruments, U.S. government obligations, most non-U.S. government obligations, certain government agency obligations, certain corporate debt instruments and actively traded listed equities. These instruments are valued using quoted prices for identical unrestricted instruments in active markets.

The firm defines active markets for equity instruments based on the average daily trading volume both in absolute terms and relative to the market capitalization for the instrument. The firm defines active markets for debt instruments based on both the average daily trading volume and the number of days with trading activity.

Level 2 Cash Instruments

Level 2 cash instruments include most money market instruments, most government agency obligations, certain non-U.S. government obligations, most mortgage-backed loans and securities, most corporate debt instruments, most state and municipal obligations, most other debt obligations, restricted or less liquid listed equities, commodities and certain lending commitments.

Valuations of level 2 cash instruments can be verified to quoted prices, recent trading activity for identical or similar instruments, broker or dealer quotations or alternative pricing sources with reasonable levels of price transparency. Consideration is given to the nature of the quotations (e.g., indicative or firm) and the relationship of recent market activity to the prices provided from alternative pricing sources.

Valuation adjustments are typically made to level 2 cash instruments (i) if the cash instrument is subject to transfer restrictions and/or (ii) for other premiums and liquidity discounts that a market participant would require to arrive at fair value. Valuation adjustments are generally based on market evidence.

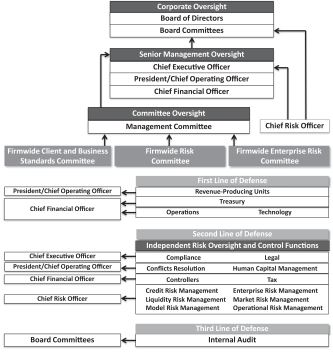

Level 3 Cash Instruments