UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013 | Commission File Number: 001-14965 |

The Goldman Sachs Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-4019460 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

200 West Street New York, N.Y. | 10282 | |

| (Address of principal executive offices) | (Zip Code) | |

(212) 902-1000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

Common stock, par value $.01 per share | New York Stock Exchange | |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series A | New York Stock Exchange | |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of 6.20% Non-Cumulative Preferred Stock, Series B | New York Stock Exchange | |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series C | New York Stock Exchange | |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series D | New York Stock Exchange | |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series I | New York Stock Exchange | |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of 5.50% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series J | New York Stock Exchange | |

| See Exhibit 99.2 for debt and trust securities registered under Section 12(b) of the Act |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Annual Report on Form 10-K or any amendment to the Annual Report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2013, the aggregate market value of the common stock of the registrant held by non-affiliates of the registrant was approximately $66.8 billion.

As of February 14, 2014, there were 452,752,440 shares of the registrant's common stock outstanding.

Documents incorporated by reference : Portions of The Goldman Sachs Group, Inc.'s Proxy Statement for its 2014 Annual Meeting of Shareholders are incorporated by reference in the Annual Report on Form 10-K in response to Part III, Items 10, 11, 12, 13 and 14.

THE GOLDMAN SACHS GROUP, INC.

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

INDEX

Form 10-K Item Number | Page No. | |||

PART I | 1 | |||

Item 1 | Business | 1 | ||

Introduction | 1 | |||

Our Business Segments and Segment Operating Results | 1 | |||

Investment Banking | 2 | |||

Institutional Client Services | 3 | |||

Investing & Lending | 4 | |||

Investment Management | 5 | |||

Business Continuity and Information Security | 6 | |||

Employees | 6 | |||

Competition | 6 | |||

Regulation | 7 | |||

Available Information | 22 | |||

Cautionary Statement Pursuant to the U.S. Private Securities Litigation Reform Act of 1995 | 23 | |||

Item 1A | Risk Factors | 24 | ||

Item 1B | Unresolved Staff Comments | 40 | ||

Item 2 | Properties | 40 | ||

Item 3 | Legal Proceedings | 40 | ||

Item 4 | Mine Safety Disclosures | 40 | ||

Executive Officers of The Goldman Sachs Group, Inc. | 41 | |||

PART II | 42 | |||

Item 5 | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 42 | ||

Item 6 | Selected Financial Data | 42 | ||

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operations | 43 | ||

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 119 | ||

Item 8 | Financial Statements and Supplementary Data | 120 | ||

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 239 | ||

Item 9A | Controls and Procedures | 239 | ||

Item 9B | Other Information | 239 | ||

PART III | 239 | |||

Item 10 | Directors, Executive Officers and Corporate Governance | 239 | ||

Item 11 | Executive Compensation | 239 | ||

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 240 | ||

Item 13 | Certain Relationships and Related Transactions, and Director Independence | 240 | ||

Item 14 | Principal Accountant Fees and Services | 240 | ||

PART IV | 241 | |||

Item 15 | Exhibits and Financial Statement Schedules | 241 | ||

SIGNATURES | II-1 | |||

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

PART I

Item 1. Business

Introduction

Goldman Sachs is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals.

When we use the terms "Goldman Sachs," "the firm," "we," "us" and "our," we mean The Goldman Sachs Group, Inc. (Group Inc.), a Delaware corporation, and its consolidated subsidiaries.

References to "the 2013 Form 10-K" are to our Annual Report on Form 10-K for the year ended December 31, 2013. All references to 2013, 2012 and 2011 refer to our years ended, or the dates, as the context requires, December 31, 2013, December 31, 2012 and December 31, 2011, respectively.

Group Inc. is a bank holding company and a financial holding company regulated by the Board of Governors of the Federal Reserve System (Federal Reserve Board). Our U.S. depository institution subsidiary, Goldman Sachs Bank USA (GS Bank USA), is a New York State-chartered bank.

As of December 2013, we had offices in over 30 countries and 50% of our total staff was based outside the Americas (which includes the countries in North and South America). Our clients are located worldwide, and we are an active participant in financial markets around the world. In 2013, we generated 42% of our net revenues outside the Americas. For more information on our geographic results, see Note 25 to the consolidated financial statements in Part II, Item 8 of the 2013 Form 10-K.

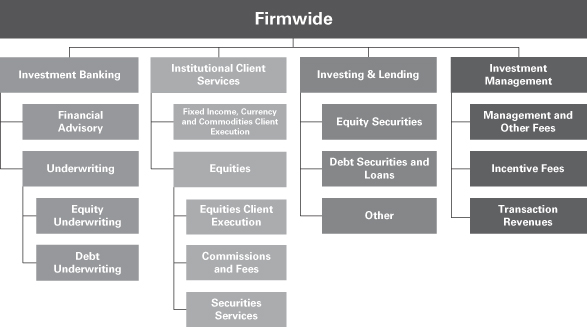

Our Business Segments and Segment Operating Results

We report our activities in four business segments: Investment Banking, Institutional Client Services, Investing & Lending and Investment Management. The chart below presents our four business segments.

| Goldman Sachs 2013 Form 10-K | 1 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

The table below presents our segment operating results.

| Year Ended December 1 | % of 2013 | |||||||||||||||||

| in millions | 2013 | 2012 | 2011 | | Net Revenues | | ||||||||||||

Investment Banking | Net revenues | $ 6,004 | $ 4,926 | $ 4,355 | 18 | % | ||||||||||||

Operating expenses | 3,475 | 3,330 | 2,995 | |||||||||||||||

Pre-tax earnings | $ 2,529 | $ 1,596 | $ 1,360 | |||||||||||||||

Institutional Client Services | Net revenues | $15,721 | $18,124 | $17,280 | 46 | % | ||||||||||||

Operating expenses | 11,782 | 12,480 | 12,837 | |||||||||||||||

Pre-tax earnings | $ 3,939 | $ 5,644 | $ 4,443 | |||||||||||||||

Investing & Lending | Net revenues | $ 7,018 | $ 5,891 | $ 2,142 | 20 | % | ||||||||||||

Operating expenses | 2,684 | 2,666 | 2,673 | |||||||||||||||

Pre-tax earnings/(loss) | $ 4,334 | $ 3,225 | $ (531 | ) | ||||||||||||||

Investment Management | Net revenues | $ 5,463 | $ 5,222 | $ 5,034 | 16 | % | ||||||||||||

Operating expenses | 4,354 | 4,294 | 4,020 | |||||||||||||||

Pre-tax earnings | $ 1,109 | $ 928 | $ 1,014 | |||||||||||||||

Total | Net revenues | $34,206 | $34,163 | $28,811 | ||||||||||||||

Operating expenses 2 | 22,469 | 22,956 | 22,642 | |||||||||||||||

Pre-tax earnings | $11,737 | $11,207 | $ 6,169 | |||||||||||||||

| 1. | Financial information concerning our business segments for 2013, 2012 and 2011 is included in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the "Financial Statements and Supplementary Data," which are in Part II, Items 7 and 8, respectively, of the 2013 Form 10-K. See Note 25 to the consolidated financial statements in Part II, Item 8 of the 2013 Form 10-K for a summary of our total net revenues, pre-tax earnings and net earnings by geographic region. |

| 2. | Includes the following expenses that have not been allocated to our segments: (i) charitable contributions of $155 million for 2013, $169 million for 2012 and $103 million for 2011; and (ii) real estate-related exit costs of $19 million for 2013, $17 million for 2012 and $14 million for 2011. |

Investment Banking

Investment Banking serves corporate and government clients around the world. We provide financial advisory services and help companies raise capital to strengthen and grow their businesses. We seek to develop and maintain long-term relationships with a diverse global group of institutional clients, including governments, states and municipalities. Our goal is to deliver to our clients the entire resources of the firm in a seamless fashion, with investment banking serving as the main initial point of contact with Goldman Sachs.

Financial Advisory. Financial Advisory includes strategic advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense activities, risk management, restructurings and spin-offs. In particular, we help clients execute large, complex transactions for which we provide multiple services, including acquisition financing and cross-border structuring expertise. Financial Advisory also includes revenues from derivative transactions directly related to these client advisory assignments.

We also assist our clients in managing their asset and liability exposures and their capital. In addition, we may provide lending commitments and bank loan and bridge loan facilities in connection with our advisory assignments.

Underwriting. The other core activity of Investment Banking is helping companies raise capital to fund their businesses. As a financial intermediary, our job is to match the capital of our investing clients - who aim to grow the savings of millions of people - with the needs of our corporate and government clients - who need financing to generate growth, create jobs and deliver products and services. Our underwriting activities include public offerings and private placements, including domestic and cross-border transactions, of a wide range of securities and other financial instruments. Underwriting also includes revenues from derivative transactions entered into with corporate and government clients in connection with our underwriting activities.

| 2 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Equity Underwriting. We underwrite common and preferred stock and convertible and exchangeable securities. We regularly receive mandates for large, complex transactions and have held a leading position in worldwide public common stock offerings and worldwide initial public offerings for many years.

Debt Underwriting. We underwrite and originate various types of debt instruments, including investment-grade and high-yield debt, bank loans and bridge loans, and emerging- and growth-market debt, which may be issued by, among others, corporate, sovereign, municipal and agency issuers. In addition, we underwrite and originate structured securities, which include mortgage-related securities and other asset-backed securities.

Institutional Client Services

Institutional Client Services serves our clients who come to the firm to buy and sell financial products, raise funding and manage risk. We do this by acting as a market maker and offering market expertise on a global basis. Institutional Client Services makes markets and facilitates client transactions in fixed income, equity, currency and commodity products. In addition, we make markets in and clear client transactions on major stock, options and futures exchanges worldwide. Market makers provide liquidity and play a critical role in price discovery, which contributes to the overall efficiency of the capital markets. Our willingness to make markets, commit capital and take risk in a broad range of products is crucial to our client relationships.

Our clients are primarily institutions that are professional market participants, including investment entities whose ultimate customers include individual investors investing for their retirement, buying insurance or putting aside surplus cash in a deposit account.

Through our global sales force, we maintain relationships with our clients, receiving orders and distributing investment research, trading ideas, market information and analysis. As a market maker, we provide prices to clients globally across thousands of products in all major asset classes and markets. At times we take the other side of transactions ourselves if a buyer or seller is not readily available and at other times we connect our clients to other parties who want to transact. Much of this connectivity between the firm and its clients is maintained on technology platforms and operates globally wherever and whenever markets are open for trading.

Institutional Client Services and our other businesses are supported by our Global Investment Research division, which, as of December 2013, provided fundamental research on more than 3,700 companies worldwide and more than 40 national economies, as well as on industries, currencies and commodities.

Institutional Client Services generates revenues in four ways:

| Ÿ | In large, highly liquid markets (such as markets for U.S. Treasury bills, large capitalization S&P 500 stocks or certain mortgage pass-through securities), we execute a high volume of transactions for our clients for modest spreads and fees. |

| Ÿ | In less liquid markets (such as mid-cap corporate bonds, growth market currencies or certain non-agency mortgage-backed securities), we execute transactions for our clients for spreads and fees that are generally somewhat larger. |

| Ÿ | We also structure and execute transactions involving customized or tailor-made products that address our clients' risk exposures, investment objectives or other complex needs (such as a jet fuel hedge for an airline). |

| Ÿ | We provide financing to our clients for their securities trading activities, as well as securities lending and other prime brokerage services. |

Institutional Client Services activities are organized by asset class and include both "cash" and "derivative" instruments. "Cash" refers to trading the underlying instrument (such as a stock, bond or barrel of oil). "Derivative" refers to instruments that derive their value from underlying asset prices, indices, reference rates and other inputs, or a combination of these factors (such as an option, which is the right or obligation to buy or sell a certain bond or stock index on a specified date in the future at a certain price, or an interest rate swap, which is the agreement to convert a fixed rate of interest into a floating rate or vice versa).

| Goldman Sachs 2013 Form 10-K | 3 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Fixed Income, Currency and Commodities Client Execution. Includes interest rate products, credit products, mortgages, currencies and commodities.

| Ÿ | Interest Rate Products. Government bonds, money market instruments such as commercial paper, treasury bills, repurchase agreements and other highly liquid securities and instruments, as well as interest rate swaps, options and other derivatives. |

| Ÿ | Credit Products. Investment-grade corporate securities, high-yield securities, credit derivatives, bank and bridge loans, municipal securities, emerging market and distressed debt, and trade claims. |

| Ÿ | Mortgages. Commercial mortgage-related securities, loans and derivatives, residential mortgage-related securities, loans and derivatives (including U.S. government agency-issued collateralized mortgage obligations, other prime, subprime and Alt-A securities and loans), and other asset-backed securities, loans and derivatives. |

| Ÿ | Currencies. Most currencies, including growth-market currencies. |

| Ÿ | Commodities. Crude oil and petroleum products, natural gas, base, precious and other metals, electricity, coal, agricultural and other commodity products. |

Equities. Includes equities client execution, commissions and fees, and securities services.

Equities Client Execution . We make markets in equity securities and equity-related products, including convertible securities, options, futures and over-the-counter (OTC) derivative instruments, on a global basis. As a principal, we facilitate client transactions by providing liquidity to our clients with large blocks of stocks or derivatives, requiring the commitment of our capital.

We also structure and make markets in derivatives on indices, industry groups, financial measures and individual company stocks. We develop strategies and provide information about portfolio hedging and restructuring and asset allocation transactions for our clients. We also work with our clients to create specially tailored instruments to enable sophisticated investors to establish or liquidate investment positions or undertake hedging strategies. We are one of the leading participants in the trading and development of equity derivative instruments.

Our exchange-based market-making activities include making markets in stocks and exchange-traded funds, futures and options on major exchanges worldwide.

Commissions and Fees . We generate commissions and fees from executing and clearing institutional client transactions on major stock, options and futures exchanges worldwide. We provide our clients with access to a broad spectrum of equity execution services, including electronic "low-touch" access and more traditional "high-touch" execution. While the majority of our equity trading activity is "low-touch," the majority of our net revenues continue to be derived from our "high-touch" activity. We expect both types of activity to remain important.

Securities Services. Includes financing, securities lending and other prime brokerage services.

| Ÿ | Financing Services. We provide financing to our clients for their securities trading activities through margin loans that are collateralized by securities, cash or other acceptable collateral. We earn a spread equal to the difference between the amount we pay for funds and the amount we receive from our client. |

| Ÿ | Securities Lending Services. We provide services that principally involve borrowing and lending securities to cover institutional clients' short sales and borrowing securities to cover our short sales and otherwise to make deliveries into the market. In addition, we are an active participant in broker-to-broker securities lending and third-party agency lending activities. |

| Ÿ | Other Prime Brokerage Services. We earn fees by providing clearing, settlement and custody services globally. In addition, we provide our hedge fund and other clients with a technology platform and reporting which enables them to monitor their security portfolios and manage risk exposures. |

Investing & Lending

Our investing and lending activities, which are typically longer-term, include the firm's investing and relationship lending activities across various asset classes, primarily debt securities and loans, public and private equity securities, and real estate. These activities include investing directly in publicly and privately traded securities and in loans, and also through certain investment funds that we manage. We manage a diversified global portfolio of investments in equity securities and debt and other investments in privately negotiated transactions, leveraged buyouts, acquisitions and investments in funds managed by external parties. We also provide financing to our clients.

| 4 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Equity Securities. We make corporate, real estate and infrastructure equity-related investments.

Debt Securities and Loans. We make corporate, real estate and infrastructure debt investments. In addition, we provide credit to corporate clients through loan facilities and to high-net-worth individuals primarily through secured loans.

Other. Our other investments primarily include consolidated investments, for which we have an exit strategy and which are engaged in activities that are not closely related to our principal businesses. We also invest directly in distressed assets, currencies, commodities and other assets.

Investment Management

Investment Management provides investment and wealth advisory services to help clients preserve and grow their financial assets. Our clients include institutions and high-net-worth individuals, as well as retail investors who access our products through a network of third-party distributors around the world.

We manage client assets across a broad range of asset classes and investment strategies, including equity, fixed income and alternative investments. Alternative investments primarily include hedge funds, credit funds, private equity, real estate, currencies, commodities, and asset allocation strategies. Our investment offerings include those managed on a fiduciary basis by our portfolio managers as well as strategies managed by third-party managers. We offer our investments in a variety of structures, including separately managed accounts, mutual funds, private partnerships, and other commingled vehicles.

We also provide customized investment advisory solutions designed to address our clients' investment needs. These solutions begin with identifying clients' objectives and continue through portfolio construction, ongoing asset allocation and risk management and investment realization. We draw from a variety of third-party managers as well as our proprietary offerings to implement solutions for clients.

We supplement our investment advisory solutions for high-net-worth clients with wealth advisory services that include income and liability management, trust and estate planning, philanthropic giving and tax planning. We also use the firm's global securities and derivatives market-making capabilities to address clients' specific investment needs.

Management and Other Fees. The majority of revenues in management and other fees is comprised of asset-based fees on client assets. The fees that we charge vary by asset class and are affected by investment performance as well as asset inflows and redemptions. Other fees we receive include financial counseling fees generated through our wealth advisory services and fees related to the administration of real estate assets.

Assets under supervision include assets under management and other client assets. Assets under management include client assets where we earn a fee for managing assets on a discretionary basis. This includes net assets in our mutual funds, hedge funds, credit funds and private equity funds (including real estate funds), and separately managed accounts for institutional and individual investors. Other client assets include client assets invested with third-party managers, bank deposits and advisory relationships where we earn a fee for advisory and other services, but do not have investment discretion. Assets under supervision do not include the self-directed brokerage assets of our clients. Long-term assets under supervision represent assets under supervision excluding liquidity products. Liquidity products represent money markets and bank deposit assets.

Incentive Fees. In certain circumstances, we are also entitled to receive incentive fees based on a percentage of a fund's or a separately managed account's return, or when the return exceeds a specified benchmark or other performance targets. Such fees include overrides, which consist of the increased share of the income and gains derived primarily from our private equity funds when the return on a fund's investments over the life of the fund exceeds certain threshold returns. Incentive fees are recognized only when all material contingencies are resolved.

Transaction Revenues. We receive commissions and net spreads for facilitating transactional activity in high-net-worth client accounts. In addition, we earn net interest income primarily associated with client deposits and margin lending activity undertaken by such clients.

| Goldman Sachs 2013 Form 10-K | 5 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Business Continuity and Information Security

Business continuity and information security, including cyber security, are high priorities for Goldman Sachs. Our Business Continuity Program has been developed to provide reasonable assurance of business continuity in the event of disruptions at the firm's critical facilities and to comply with regulatory requirements, including those of FINRA. Because we are a bank holding company, our Business Continuity Program is also subject to review by the Federal Reserve Board. The key elements of the program are crisis planning and management, people recovery, business recovery, systems and data recovery, and process improvement. In the area of information security, we have developed and implemented a framework of principles, policies and technology to protect the information provided to us by our clients and that of the firm from cyber attacks and other misappropriation, corruption or loss. Safeguards are applied to maintain the confidentiality, integrity and availability of information.

Employees

Management believes that a major strength and principal reason for the success of Goldman Sachs is the quality and dedication of our people and the shared sense of being part of a team. We strive to maintain a work environment that fosters professionalism, excellence, diversity, cooperation among our employees worldwide and high standards of business ethics.

Instilling the Goldman Sachs culture in all employees is a continuous process, in which training plays an important part. All employees are offered the opportunity to participate in education and periodic seminars that we sponsor at various locations throughout the world. Another important part of instilling the Goldman Sachs culture is our employee review process. Employees are reviewed by supervisors, co-workers and employees they supervise in a 360-degree review process that is integral to our team approach, and includes an evaluation of an employee's performance with respect to risk management, compliance and diversity. As of December 2013, we had 32,900 total staff.

Competition

The financial services industry - and all of our businesses - are intensely competitive, and we expect them to remain so. Our competitors are other entities that provide investment banking, securities and investment management services, as well as those entities that make investments in securities, commodities, derivatives, real estate, loans and other financial assets. These entities include brokers and dealers, investment banking firms, commercial banks, insurance companies, investment advisers, mutual funds, hedge funds, private equity funds and merchant banks. We compete with some entities globally and with others on a regional, product or niche basis. Our competition is based on a number of factors, including transaction execution, products and services, innovation, reputation and price.

Over time, there has been substantial consolidation and convergence among companies in the financial services industry and, in particular, the credit crisis caused numerous mergers and asset acquisitions among industry participants. Efforts by our competitors to gain market share have resulted in pricing pressure in our investment banking and client execution businesses and could result in pricing pressure in other of our businesses. Moreover, we have faced, and expect to continue to face, pressure to retain market share by committing capital to businesses or transactions on terms that offer returns that may not be commensurate with their risks. In particular, corporate clients seek such commitments (such as agreements to participate in their commercial paper backstop or other loan facilities) from financial services firms in connection with investment banking and other assignments.

Consolidation and convergence have significantly increased the capital base and geographic reach of some of our competitors, and have also hastened the globalization of the securities and other financial services markets. As a result, we have had to commit capital to support our international operations and to execute large global transactions. To take advantage of some of our most significant opportunities, we will have to compete successfully with financial institutions that are larger and have more capital and that may have a stronger local presence and longer operating history outside the United States.

| 6 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

We have experienced intense price competition in some of our businesses in recent years. For example, over the past several years the increasing volume of trades executed electronically, through the internet and through alternative trading systems, has increased the pressure on trading commissions, in that commissions for "low-touch" electronic trading are generally lower than for "high-touch" non-electronic trading. It appears that this trend toward electronic and other "low-touch," low-commission trading will continue. In addition, we believe that we will continue to experience competitive pressures in these and other areas in the future as some of our competitors seek to obtain market share by further reducing prices.

The provisions of the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the requirements promulgated by the Basel Committee on Banking Supervision (Basel Committee) and other financial regulation could affect our competitive position to the extent that limitations on activities, increased fees and compliance costs or other regulatory requirements do not apply, or do not apply equally, to all of our competitors or are not implemented uniformly across different jurisdictions. The impact of the Dodd-Frank Act and other regulatory developments on our competitive position will depend to a large extent on the manner in which the required rulemaking and regulatory guidance evolve, the extent of international convergence, and the development of market practice and structures under the new regulatory regimes as discussed further under "Regulation" below.

We also face intense competition in attracting and retaining qualified employees. Our ability to continue to compete effectively will depend upon our ability to attract new employees, retain and motivate our existing employees and to continue to compensate employees competitively amid intense public and regulatory scrutiny on the compensation practices of large financial institutions. Our pay practices and those of our principal competitors are subject to review by, and the standards of, the Federal Reserve Board and regulators outside the United States, including the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) in the United Kingdom. See "Regulation - Banking Regulation" and "Regulation - Compensation Practices" below and "Risk Factors - Our businesses may be adversely affected if we are unable to hire and retain qualified employees" in Part I, Item 1A of the 2013 Form 10-K for more information on the regulation of our compensation practices.

Regulation

As a participant in the banking, securities, investment management, and derivatives industries, we are subject to extensive regulation worldwide. Regulatory bodies around the world are generally charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of the customers of market participants, including depositors in banking entities and the customers of broker-dealers, investment advisers, swap dealers and security-based swap dealers.

The financial services industry has been the subject of intense regulatory scrutiny in recent years. Our businesses have been subject to increasing regulation and supervision in the United States and other countries, and we expect this trend to continue in the future. In particular, the Dodd-Frank Act, which was enacted in July 2010, significantly altered the financial regulatory regime within which we operate. The implications of the Dodd-Frank Act for our businesses will depend to a large extent on the implementation of the legislation by the Federal Reserve Board, the FDIC, the SEC, the U.S. Commodity Futures Trading Commission (CFTC) and other agencies, as well as the development of market practices and structures under the regime established by the legislation and the implementing rules. Other reforms have been adopted or are being considered by other regulators and policy makers worldwide, as discussed further throughout this section. We will continue to update our business, risk management, and compliance practices to conform to developments in the regulatory environment.

Bank Holding Company Regulation

Group Inc. is a bank holding company under the Bank Holding Company Act of 1956 (BHC Act) and a financial holding company under amendments to the BHC Act effected by the U.S. Gramm-Leach-Bliley Act of 1999 (GLB Act).

| Goldman Sachs 2013 Form 10-K | 7 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Supervision and Regulation

As a bank holding company and a financial holding company under the BHC Act, Group Inc. is subject to supervision and examination by the Federal Reserve Board. Under the system of "functional regulation" established under the BHC Act, the Federal Reserve Board serves as the primary regulator of our consolidated organization, but generally defers to the primary regulators of our U.S. non-bank subsidiaries with respect to the activities of those subsidiaries. Such "functionally regulated" non-bank subsidiaries include broker-dealers registered with the SEC, such as our principal U.S. broker-dealer, Goldman, Sachs & Co. (GS&Co.), entities registered with or regulated by the CFTC with respect to futures-related and swaps-related activities and investment advisers registered with the SEC with respect to their investment advisory activities.

As discussed further below, our subsidiary, GS Bank USA, is supervised and regulated by the Federal Reserve Board, the FDIC, the New York State Department of Financial Services and the Consumer Financial Protection Bureau (CFPB). In addition, Group Inc. has two limited purpose trust company subsidiaries that are not permitted to accept deposits or make loans (other than as incidental to their trust activities) and are not insured by the FDIC. The Goldman Sachs Trust Company, N.A., a national banking association that is limited to fiduciary activities, is regulated by the Office of the Comptroller of the Currency and is a member bank of the Federal Reserve System. The Goldman Sachs Trust Company of Delaware, a Delaware limited purpose trust company, is regulated by the Office of the Delaware State Bank Commissioner.

Activities

The BHC Act generally restricts bank holding companies from engaging in business activities other than the business of banking and certain closely related activities. Financial holding companies, however, generally can engage in a broader range of financial and related activities than are otherwise permissible for bank holding companies as long as they continue to meet the eligibility requirements for financial holding companies. These requirements include that the financial holding company and each of its U.S. depository institution subsidiaries maintain their status as "well-capitalized" and "well-managed." The broader range of permissible activities for financial holding companies includes underwriting, dealing and making markets in securities and making investments in non-financial companies. In addition, financial holding companies are permitted under the GLB Act to engage in certain commodities activities in the United States that may otherwise be impermissible for bank holding companies, so long as the assets held pursuant to these activities do not equal 5% or more of their consolidated assets.

The Federal Reserve Board, however, has the authority to limit our ability to conduct activities that would otherwise be permissible for a financial holding company, and will do so if we do not satisfactorily meet certain requirements of the Federal Reserve Board. In addition, we are required to obtain prior Federal Reserve Board approval before engaging in certain banking and other financial activities both in the United States and abroad.

Volcker Rule

In December 2013, the final rules to implement the provisions of the Dodd-Frank Act referred to as the "Volcker Rule" were adopted. We are required to be in compliance with the rule (including the development of an extensive compliance program) by July 2015 with certain provisions of the rule subject to possible extensions through July 2017.

The Volcker rule prohibits "proprietary trading," but will allow activities such as underwriting, market making and risk-mitigation hedging. In anticipation of the final rule, we evaluated this prohibition and determined that businesses that engage in "bright line" proprietary trading were most likely to be prohibited. In 2010 and 2011, we liquidated substantially all of our Global Macro Proprietary and Principal Strategies trading positions.

In addition to the prohibition on proprietary trading, the Volcker rule limits the sponsorship of, and investment in, "covered funds" (as defined in the rule) by banking entities, including Group Inc. and its subsidiaries. It also limits certain types of transactions between us and our sponsored funds, similar to the limitations on transactions between depository institutions and their affiliates as described below under "- Transactions with Affiliates." Covered funds include our private equity funds, certain of our credit and real estate funds, and our hedge funds. The limitation on investments in covered funds requires us to reduce our investment in each such fund to 3% or less of the fund's net asset value, and to reduce our aggregate investment in all such funds to 3% or less of our Tier 1 capital. In anticipation of the final rule, we limited our initial investment in certain new covered funds to 3% of the fund's net asset value.

We continue to manage our existing funds, taking into account the transition periods under the Volcker Rule. As a result, in March 2012, we began redeeming certain interests in our hedge funds and will continue to do so.

| 8 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

For certain of our covered funds, in order to be compliant with the Volcker Rule by the prescribed compliance date, to the extent that the underlying investments of the particular funds are not sold, the firm may be required to sell its investments in such funds. If that occurs, the firm may receive a value for its investments that is less than the then carrying value, as there could be a limited secondary market for these investments and the firm may be unable to sell them in orderly transactions.

Although our net revenues from investments in our private equity, credit, real estate and hedge funds may vary from period to period, our aggregate net revenues from these investments were not material to our aggregate total net revenues over the period from 1999 through 2013.

Leveraged Lending

In March 2013, the U.S. federal bank regulatory agencies (Agencies) issued updated guidance on leveraged lending. The guidance focuses on transaction structures and risk management frameworks and outlines high-level principles for safe-and-sound leveraged lending, including underwriting standards, valuation and stress testing. Although the full impact of the guidance remains uncertain, implementation of this guidance and any related changes in the leveraged lending market could adversely affect our leveraged lending business.

Capital and Liquidity Requirements

As a bank holding company, we are subject to consolidated regulatory capital requirements administered by the Federal Reserve Board, and GS Bank USA is subject to broadly similar capital requirements.

Under the Federal Reserve Board's capital adequacy requirements and, in the case of GS Bank USA, the regulatory framework for prompt corrective action, both Group Inc. and GS Bank USA must meet specific regulatory capital requirements that involve quantitative measures of assets, liabilities and certain off-balance-sheet items. The sufficiency of our capital levels and those of GS Bank USA, as well as GS Bank USA's prompt corrective action classification, are also subject to qualitative judgments by regulators.

Other regulated subsidiaries, including GS&Co. and Goldman Sachs International (GSI), are also subject to capital requirements. We expect Group Inc., GS Bank USA, GS&Co., GSI and other regulated subsidiaries to become subject to increased capital requirements over time.

Capital Ratios. See "Management's Discussion and Analysis of Financial Condition and Results of Operations - Equity Capital - Consolidated Regulatory Capital Ratios" in Part II, Item 7 of the 2013 Form 10-K and Note 20 to the consolidated financial statements in Part II, Item 8 of the 2013 Form 10-K for information on our Tier 1 capital ratio, Tier 1 capital, Total capital ratio, total capital, risk-weighted assets (RWAs) including the market risk capital rules, Tier 1 leverage ratio, Common Equity Tier 1 (defined below), Common Equity Tier 1 ratio and Tier 1 supplementary leverage ratio (supplementary leverage ratio), and for a discussion of minimum required ratios.

Revised market risk capital rules of the Federal Reserve Board became effective on January 1, 2013. These rules required the addition of several new model-based capital requirements, as well as an increase in capital requirements for securitization positions, and were designed to implement the new market risk framework of the Basel Committee, as well as a prohibition on the use of external credit ratings, as required by the Dodd-Frank Act.

Changes in Capital Requirements. The Agencies have approved revised risk-based capital and leverage ratio regulations establishing a new comprehensive capital framework for U.S. banking organizations (Revised Capital Framework). These regulations are largely based on the Basel Committee's December 2010 final capital framework for strengthening international capital standards (Basel III), and significantly revise the risk-based capital and leverage ratio requirements applicable to bank holding companies as compared to the previous U.S. risk-based capital and leverage ratio rules, and thereby, implement certain provisions of the Dodd-Frank Act.

Under the Revised Capital Framework, Group Inc. is an "Advanced approach" banking organization. Below are the aspects of the rules that are most relevant to us as an Advanced approach banking organization.

| Goldman Sachs 2013 Form 10-K | 9 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Definition of Capital and Capital Ratios. The Revised Capital Framework introduced changes to the definition of regulatory capital, which, subject to transitional provisions, became effective across our regulatory capital and leverage ratios on January 1, 2014. These changes include the introduction of a new capital measure called Common Equity Tier 1 (CET1), and the related regulatory capital ratio of CET1 to RWAs (CET1 ratio). In addition, the definition of Tier 1 capital has been narrowed to include only CET1 and instruments such as perpetual non-cumulative preferred stock that meet certain criteria.

Certain aspects of the revised requirements phase in over time. These include increases in the minimum capital ratio requirements and the introduction of new capital buffers and certain deductions from regulatory capital (such as investments in nonconsolidated financial institutions). In addition, junior subordinated debt issued to trusts is being phased out of regulatory capital. It is first phased out of Tier 1 capital but is eligible as Tier 2 capital for an interim period through December 31, 2015, after which it will also be phased out of Tier 2 capital through December 31, 2021.

The minimum CET1 ratio is 4.0% as of January 1, 2014 and will increase to 4.5% on January 1, 2015. The minimum Tier 1 capital ratio increased from 4.0% to 5.5% on January 1, 2014 and will increase to 6.0% beginning January 1, 2015. The minimum Total capital ratio remains unchanged at 8.0%. These minimum ratios will be supplemented by a new capital conservation buffer that phases in, beginning on January 1, 2016, in increments of 0.625% per year until it reaches 2.5% on January 1, 2019. The Revised Capital Framework also introduces a new counter-cyclical capital buffer, to be imposed in the event that national supervisors deem it necessary in order to counteract excessive credit growth.

Certain adjustments to calculate CET1 are subject to transition provisions. Most items that were previously deducted from Tier 1 capital become deductions from CET1, many of which transition into CET1 deductions at a rate of 20% per year, beginning in January 2014. The Revised Capital Framework also introduced new deductions from CET1 (such as investments in nonconsolidated financial institutions), which are also phased in as CET1 deductions at a rate of 20% per year with residual amounts subject to risk weighting.

Risk-Weighted Assets. In February 2014, the Federal Reserve Board informed us that we have completed a satisfactory "parallel run," as required of Advanced approach banking organizations under the Revised Capital Framework, and therefore changes to RWAs will take effect beginning with the second quarter of 2014. Accordingly, the calculation of RWAs in future quarters will be based on the following methodologies:

| Ÿ | During the first quarter of 2014 - the Basel I risk-based capital framework adjusted for certain items related to existing capital deductions and the phase-in of new capital deductions (Basel I Adjusted); |

| Ÿ | During the remaining quarters of 2014 - the higher of RWAs computed under the Basel III Advanced approach or the Basel I Adjusted calculation; and |

| Ÿ | Beginning in the first quarter of 2015 - the higher of RWAs computed under the Basel III Advanced or Standardized approach. |

The primary difference between the Standardized approach and the Basel III Advanced approach is that the Standardized approach utilizes prescribed risk-weightings and does not contemplate the use of internal models to compute exposure for credit risk on derivatives and securities financing transactions, whereas the Basel III Advanced approach permits the use of such models, subject to supervisory approval. In addition, RWAs under the Standardized approach depend largely on the type of counterparty (e.g., whether the counterparty is a sovereign, bank, broker-dealer or other entity), rather than on assessments of each counterparty's creditworthiness. Furthermore, the Standardized approach does not include a capital requirement for operational risk. RWAs for market risk under both the Standardized and Basel III Advanced approaches are based on the Federal Reserve Board's revised market risk regulatory capital requirements described above.

For information on our RWAs, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Equity Capital - Risk-Weighted Assets" in Part II, Item 7 of the 2013 Form 10-K.

| 10 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Regulatory Leverage Ratios. The Revised Capital Framework increased the minimum Tier 1 leverage ratio applicable to us from 3% to 4% effective January 1, 2014.

In addition, the Revised Capital Framework will introduce a new supplementary leverage ratio for Advanced approach banking organizations, which compares Tier 1 capital (as defined under the Revised Capital Framework) to a measure of leverage exposure (defined as the sum of our assets less certain CET1 deductions plus certain off-balance-sheet exposures).

The Revised Capital Framework requires a minimum supplementary leverage ratio of 3%, effective January 1, 2018, but with disclosure required beginning in the first quarter of 2015.

Liquidity Ratios under Basel III. Historically, regulation and monitoring of bank and bank holding company liquidity has been addressed as a supervisory matter, both in the United States and internationally, without required formulaic measures. Basel III will require banks and bank holding companies to measure their liquidity against two specific liquidity tests that, although similar in some respects to liquidity measures historically applied by banks and regulators for management and supervisory purposes, will be mandated by regulation. One test, referred to as the liquidity coverage ratio, is designed to ensure that the entity maintains an adequate level of unencumbered high-quality liquid assets under an acute liquidity stress scenario. The other, referred to as the net stable funding ratio, is designed to promote more medium- and long-term funding of the assets and activities of these entities over a one-year time horizon. These requirements may incentivize banking entities to increase their holdings of securities that qualify as high-quality liquid assets and increase the use of long-term debt as a funding source. Under the Basel Committee's framework, the liquidity coverage ratio would be introduced on January 1, 2015; however there would be a phase-in period whereby firms would have a 60% minimum in 2015, which would be raised 10% per year until it reaches 100% in 2019. The net stable funding ratio is not expected to be introduced as a requirement until January 1, 2018.

In October 2013, the Agencies issued a proposal on minimum liquidity standards that is generally consistent with the Basel Committee's framework as described above, but with certain modifications to the high-quality liquid asset definition and expected cash outflow assumptions, and accelerated transition provisions. In addition, under the proposed accelerated transition timeline, the liquidity coverage ratio would be introduced on January 1, 2015; however, there would be an accelerated U.S. phase-in period whereby firms would have an 80% minimum in 2015 which would be raised 10% per year until it reaches 100% in 2017.

While the principles behind the new frameworks proposed by the Basel Committee and the Agencies are broadly consistent with our current liquidity management framework, it is possible that the refinement and implementation of these standards could impact our liquidity and funding requirements and practices.

Stress Tests. In October 2012, the Federal Reserve Board issued final rules implementing the requirements of the Dodd-Frank Act concerning the Dodd-Frank Act supervisory stress tests to be conducted by the Federal Reserve Board and semi-annual company-run stress tests for bank holding companies with total consolidated assets of $50 billion or more. The stress test rules require increased involvement by boards of directors in stress testing and, since March 2013, public disclosure of the results of both the Federal Reserve Board's annual stress tests and a bank holding company's annual supervisory stress tests, and semi-annual internal stress tests. Certain stress test requirements are also applicable to GS Bank USA, as discussed below.

We published a summary of our annual Dodd-Frank Act stress test results under the Federal Reserve Board's severely adverse scenario in March 2013. We submitted the results of our mid-cycle Dodd-Frank Act stress test to the Federal Reserve Board in July 2013 and we published a summary of our mid-cycle Dodd-Frank Act stress test results under our internally developed severely adverse scenario in September 2013. Our internally developed severely adverse scenario is designed to stress the firm's risks and idiosyncratic vulnerabilities and assess the firm's pro-forma capital position and ratios under the hypothetical stressed environment. We provide additional information on our annual and mid-cycle Dodd-Frank Act stress test results on our web site as described under "Available Information" below. Our annual Dodd-Frank Act stress test submission is incorporated into the annual capital plans that we are required to submit to the Federal Reserve Board as part of the Comprehensive Capital Analysis and Review (CCAR).

| Goldman Sachs 2013 Form 10-K | 11 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Payment of Dividends and Stock Repurchases. Dividend payments by Group Inc. to its shareholders and stock repurchases by Group Inc. are subject to the oversight of the Federal Reserve Board. The dividend and share repurchase policies of large bank holding companies, such as Group Inc., are reviewed by the Federal Reserve Board based on capital plans and stress tests submitted by the bank holding company, and will be assessed against, among other things, the bank holding company's ability to meet and exceed minimum regulatory capital ratios under stressed scenarios, its expected sources and uses of capital over the planning horizon (generally a period of two years) under baseline and stressed scenarios, and any potential impact of changes to its business plan and activities on its capital adequacy and liquidity. The purpose of the capital plan review is to ensure that these institutions have robust, forward-looking capital planning processes that account for each institution's unique risks and that permit continued operations during times of economic and financial stress. As part of the capital plan review, the Federal Reserve Board will evaluate an institution's plan to make capital distributions, such as repurchasing or redeeming stock or increasing dividend payments, across a range of macro-economic and firm-specific assumptions.

As part of our initial 2013 CCAR submission, the Federal Reserve Board informed us that it did not object to our proposed capital actions through the first quarter of 2014, including the repurchase of outstanding common stock, an increase in our quarterly common stock dividend, and the possible issuance, redemption and modification of other capital securities. As required by the Federal Reserve Board, we resubmitted our 2013 capital plan in September 2013, incorporating certain enhancements to our stress testing process. In December 2013, the Federal Reserve Board informed us that it did not object to our resubmitted capital plan. We submitted our 2014 CCAR to the Federal Reserve in January 2014 and expect to publish a summary of our annual Dodd-Frank Act stress test results in March 2014.

Enhanced Prudential Standards. In February 2014, the Federal Reserve Board adopted rules to implement certain of the enhanced prudential standards contemplated by the Dodd-Frank Act. Beginning January 1, 2015, the rules require bank holding companies with $50 billion or more in total consolidated assets to comply with enhanced liquidity and overall risk management standards, including a buffer of highly liquid assets based on projected funding needs for 30 days, and increased involvement by boards of directors in liquidity and overall risk management. The liquidity buffer is in addition to the Agencies' proposal on minimum liquidity standards discussed above. Although the rules are broadly consistent with our current liquidity and overall risk management frameworks, it is possible that the implementation of the rules could impact our liquidity, funding and risk management practices.

Regulatory Proposals

In addition to the regulatory rule changes that have already been adopted (as discussed above), both the Federal Reserve Board and the Basel Committee have proposed other changes, which are discussed below. The full impact of these proposals on the firm will not be known with certainty until after any resulting rules are finalized and market practices develop under the final rules. Furthermore, these proposals, the Dodd-Frank Act, other reform initiatives proposed and announced by the Agencies, the Basel Committee, and other governmental entities and regulators (including the European Union (EU), the PRA and the FCA) are not in all cases consistent with one another, which adds further uncertainty to our future capital, leverage and liquidity requirements, and those of our subsidiaries.

| 12 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Federal Reserve Board Proposals. In December 2011, the Federal Reserve Board proposed rules to implement the enhanced prudential standards and early remediation requirements contemplated by the Dodd-Frank Act. Although many of these proposals have now been addressed in final rules that are described above, the single-counterparty credit limits and early remediation requirements are still under consideration. The proposed single-counterparty credit limits impose more stringent requirements for credit exposure among major financial institutions, which (together with other provisions incorporated into the Basel III capital rules) may affect our ability to transact or hedge with other financial institutions. The proposed early remediation rules are modeled on the prompt corrective action regime, described below, but are designed to require action to begin in earlier stages of a company's financial distress, based on a range of triggers, including capital and leverage, stress test results, liquidity and risk management.

Subsequent to the approval of the Revised Capital Framework, the Agencies issued a proposal to increase the minimum supplementary leverage ratio requirement for the largest U.S. banks (those deemed to be global systemically important banking institutions (G-SIBs) under the Basel G-SIB framework). These proposals would require us and other G-SIBs to meet a 5% supplementary leverage ratio (comprised of the current minimum requirement of 3% plus a 2% buffer). In addition, the Basel Committee recently finalized revisions that would increase the size of the leverage exposure for purposes of the supplementary leverage ratio, but would retain a minimum supplementary leverage ratio requirement of 3%. It is not known with certainty at this point whether the U.S. regulators will adopt this revised definition of leverage into their rules and proposals for the supplementary leverage ratio.

Basel Committee Proposals. The Basel Committee has updated its methodology for assessing the global systemic importance of banking institutions and determining the range of additional CET1 that should be maintained by those deemed to be G-SIBs. The required amount of additional CET1 for these institutions will initially range from 1% to 2.5% and could be higher in the future for a banking institution that increases its systemic footprint (e.g., by increasing total assets). In November 2013, the Financial Stability Board (established at the direction of the leaders of the Group of 20) indicated that we would be required to hold an additional 1.5% of CET1 as a G-SIB,

based on our 2012 financial data. The final determination of the amount of additional CET1 that we will be required to hold will initially be based on our 2013 financial data and the manner and timing of the U.S. banking regulators' implementation of the Basel Committee's methodology. The Basel Committee indicated that G-SIBs will be required to meet the capital surcharges on a phased-in basis beginning in 2016 through 2019.

The Basel Committee has also published its final guidelines for calculating incremental capital requirements for domestic systemically important banking institutions (D-SIBs). These guidelines are complementary to the framework outlined above for G-SIBs, but are more principles-based in order to provide an appropriate degree of national discretion. The impact of these guidelines on the regulatory capital requirements of GS Bank USA, GSI and other of our subsidiaries will depend on how they are implemented by the banking and non-banking regulators in the United States and other jurisdictions.

The Basel Committee has released other consultation papers that may result in further changes to regulatory capital requirements, including a "Fundamental Review of the Trading Book" and "Revisions to the Basel Securitization Framework."

Resolution and Recovery Plans

As required by the Dodd-Frank Act, the Federal Reserve Board and FDIC have jointly issued a rule requiring each bank holding company with over $50 billion in assets and each designated systemically important financial institution to provide to regulators an annual plan for its rapid and orderly resolution in the event of material financial distress or failure (resolution plan). Our resolution plan must, among other things, demonstrate that GS Bank USA is adequately protected from risks arising from our other entities. The regulators' joint rule sets specific standards for the resolution plans, including requiring a detailed resolution strategy and analyses of the company's material entities, organizational structure, interconnections and interdependencies, and management information systems, among other elements. In April 2013, the Federal Reserve Board and the FDIC provided additional guidance to us relating to our 2013 resolution plan. Group Inc. submitted its 2013 resolution plan to its regulators in September 2013. Group Inc. is also required to submit, on an annual basis, a global recovery plan to regulators that outlines the steps that management could take over time to reduce risk, raise liquidity, and conserve capital in times of prolonged stress. We have been submitting yearly plans since 2010.

| Goldman Sachs 2013 Form 10-K | 13 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Source of Strength

Federal Reserve Board policy historically has required bank holding companies to act as a source of strength to their bank subsidiaries and to commit capital and financial resources to support those subsidiaries. The Dodd-Frank Act codifies this policy as a statutory requirement. This support may be required by the Federal Reserve Board at times when we might otherwise determine not to provide it. Capital loans by a bank holding company to a subsidiary bank are subordinate in right of payment to deposits and to certain other indebtedness of the subsidiary bank. In addition, if a bank holding company commits to a federal bank regulator that it will maintain the capital of its bank subsidiary, whether in response to the Federal Reserve Board's invoking its source-of-strength authority or in response to other regulatory measures, that commitment will be assumed by the bankruptcy trustee and the bank will be entitled to priority payment in respect of that commitment, ahead of other creditors of the bank holding company.

The BHC Act provides for regulation of bank holding company activities by various functional regulators and prohibits the Federal Reserve Board from requiring a payment by a holding company subsidiary to a depository institution if the functional regulator of that subsidiary objects to such payment. In such a case, the Federal Reserve Board could instead require the divestiture of the depository institution and impose operating restrictions pending the divestiture.

Compensation Practices

Our compensation practices are subject to oversight by the Federal Reserve Board and, with respect to some of our subsidiaries and employees, by other financial regulatory bodies worldwide. The scope and content of compensation regulation in the financial industry are continuing to develop, and we expect that these regulations and resulting market practices will evolve over a number of years.

In June 2010, the Agencies jointly issued guidance designed to ensure that incentive compensation arrangements at banking organizations take into account risk and are consistent with safe and sound practices. The guidance sets forth the following three key principles with respect to incentive compensation arrangements: the arrangements should provide employees with incentives that appropriately balance risk and financial results in a manner that does not encourage employees to expose their organizations to imprudent risk; the arrangements should be compatible with effective controls and risk management; and the arrangements should be supported by strong corporate governance. In addition, the Federal Reserve

Board has conducted a review of the incentive compensation policies and practices of a number of large, complex banking organizations, including us. The June 2010 guidance provides that supervisory findings with respect to incentive compensation will be incorporated, as appropriate, into the organization's supervisory ratings, which can affect its ability to make acquisitions or perform other actions. The guidance also provides that enforcement actions may be taken against a banking organization if its incentive compensation arrangements or related risk management, control or governance processes pose a risk to the organization's safety and soundness.

The Financial Stability Board has released standards for implementing certain compensation principles for banks and other financial companies designed to encourage sound compensation practices. These standards are to be implemented by local regulators. In Europe, the Fourth Capital Requirements Directive (CRD4) includes compensation provisions designed to implement the Financial Stability Board's compensation standards within the EU. These rules are being implemented by EU member states and, among other things, limit the ratio of variable to fixed compensation of certain employees identified as having a material impact on the risk profile of EU-regulated entities, including GSI and certain other affiliates. These requirements are in addition to the guidance issued by U.S. financial regulators discussed above and the Dodd-Frank Act provision discussed below.

The Dodd-Frank Act requires the U.S. financial regulators, including the Federal Reserve Board, to establish joint regulations or guidelines prohibiting incentive-based payment arrangements at specified regulated entities having at least $1 billion in total assets (which would include Group Inc. and some of its depository institution, broker-dealer and investment advisor subsidiaries) that encourage inappropriate risks by providing an executive officer, employee, director or principal shareholder with excessive compensation, fees, or benefits or that could lead to material financial loss to the entity. In addition, these regulators must establish regulations or guidelines requiring enhanced disclosure to regulators of incentive-based compensation arrangements. The initial version of these regulations was proposed by the U.S. financial regulators in early 2011 but the regulations have not yet been finalized. The proposed regulations incorporate the three key principles from the June 2010 regulatory guidance discussed above. If the regulations are adopted in the form initially proposed, they may restrict our flexibility with respect to the manner in which we structure compensation.

| 14 | Goldman Sachs 2013 Form 10-K |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Regulation of GS Bank USA

Our subsidiary, GS Bank USA, an FDIC-insured, New York State-chartered bank and a member of the Federal Reserve System, is supervised and regulated by the Federal Reserve Board, the FDIC, the New York State Department of Financial Services and the CFPB, and is subject to minimum capital requirements (described below) that are calculated in a manner similar to those applicable to bank holding companies. A number of our activities are conducted partially or entirely through GS Bank USA and its subsidiaries, including: origination of bank loans; interest rate, credit, currency and other derivatives; leveraged finance; mortgage origination; structured finance; and agency lending.

Under rules adopted by the Agencies in 2012 under the Dodd-Frank Act, GS Bank USA is required to undertake stress tests, to submit the results to the Federal Reserve Board, and to make a summary of those results public. The rules require that the board of directors of GS Bank USA, among other things, consider the results of the stress tests in the normal course of the bank's business including, but not limited to, its capital planning, assessment of capital adequacy and risk management practices.

The Dodd-Frank Act contains "derivative push-out" provisions that will prevent us from conducting certain swaps-related activities through GS Bank USA, subject to exceptions for certain interest rate, currency and cleared credit default swaps and for hedging or risk mitigation activities directly related to the bank's business. In July 2013, the Federal Reserve Board granted GS Bank USA an extension through July 2015 to comply with these derivative push-out provisions. Precluded activities may be conducted elsewhere within the firm, subject to certain requirements and potential registration as a swap or security-based swap dealer.

In addition, New York State banking law imposes lending limits (which take into account credit exposure from derivative transactions) and other requirements that could impact the manner and scope of GS Bank USA's activities.

Transactions with Affiliates. Transactions between GS Bank USA or its subsidiaries, on the one hand, and Group Inc. or its other subsidiaries and affiliates, on the other hand, are regulated by the Federal Reserve Board under the Federal Reserve Act. The statute and the related regulations limit the types and amounts of transactions (including credit extensions from GS Bank USA or its subsidiaries to Group Inc. or its other subsidiaries and affiliates) that may take place and generally require those transactions to be on market terms or better to GS Bank USA. These regulations generally do not apply to transactions between GS Bank USA and its subsidiaries. The Dodd-Frank Act significantly expands the coverage and scope of the regulations that limit affiliate transactions within a banking organization, including by applying these regulations to the credit exposure arising under derivative transactions, repurchase and reverse repurchase agreements, and securities borrowing and lending transactions.

Federal and state laws impose limitations on the payment of dividends by our depository institution subsidiaries to Group Inc. In general, the amount of dividends that may be paid by GS Bank USA or our national bank trust company subsidiary is limited to the lesser of the amounts calculated under a "recent earnings" test and an "undivided profits" test. Under the recent earnings test, a dividend may not be paid if the total of all dividends declared by the entity in any calendar year is in excess of the current year's net income combined with the retained net income of the two preceding years, unless the entity obtains prior regulatory approval. Under the undivided profits test, a dividend may not be paid in excess of the entity's "undivided profits" (generally, accumulated net profits that have not been paid out as dividends or transferred to surplus). The banking regulators have authority to prohibit or limit the payment of dividends if, in the banking regulator's opinion, payment of a dividend would constitute an unsafe or unsound practice in light of the financial condition of the banking organization.

| Goldman Sachs 2013 Form 10-K | 15 |

THE GOLDMAN SACHS GROUP, INC. AND SUBSIDIARIES

Deposit Insurance. GS Bank USA accepts deposits, and those deposits have the benefit of FDIC insurance up to the applicable limits. The FDIC's Deposit Insurance Fund is funded by assessments on insured depository institutions, such as GS Bank USA. The amounts of these assessments for larger depository institutions (generally those that have $10 billion in assets or more), such as GS Bank USA, are currently based on the average total consolidated assets less the average tangible equity of the insured depository institution during the assessment period, the supervisory ratings of the insured depository institution and specified forward-looking financial measures used to calculate the assessment rate. The assessment rate is subject to adjustment by the FDIC.

Prompt Corrective Action and Capital Ratios. The U.S. Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA), among other things, requires the federal banking agencies to take "prompt corrective action" in respect of depository institutions that do not meet specified capital requirements. FDICIA establishes five capital categories for FDIC-insured banks: well-capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized.

A depository institution is generally deemed to be "well-capitalized," the highest category, if it has a Tier 1 capital ratio of at least 6%, a Total capital ratio of at least 10% and a Tier 1 leverage ratio of at least 5%. GS Bank USA has agreed with the Federal Reserve Board to maintain minimum capital ratios in excess of these "well-capitalized" levels. Under the Revised Capital Framework, as of January 1, 2014, GS Bank USA became subject to a new minimum CET1 ratio requirement of 4%, increasing to 4.5% in 2015. In addition, the Revised Capital Framework changes the standards for "well-capitalized" status under prompt corrective action regulations beginning January 1, 2015 by, among other things, introducing a CET1 ratio requirement of 6.5% and increasing the Tier 1 capital ratio requirement from 6% to 8%. In addition, commencing, January 1, 2018, Advanced approach banking organizations, such as GS Bank USA, must have a supplementary leverage ratio of 3% or greater. Shortly after the approval of the Revised Capital Framework, in July 2013, the Agencies issued a proposal that would also require that U.S. insured depository institution subsidiaries of U.S. G-SIBs, such as GS Bank USA, meet a "well-capitalized" supplementary leverage ratio requirement of 6%, which would be effective beginning January 1, 2018 if the proposal is enacted as proposed.

See Note 20 to the consolidated financial statements in Part II, Item 8 of the 2013 Form 10-K for information on GS Bank USA's regulatory capital ratios.

GS Bank USA computes its risk-based capital ratios in accordance with the regulatory capital requirements applicable to state member banks, which are based on the Federal Reserve Board's risk-based capital requirements applicable to bank holding companies. As of December 2013, these capital requirements were based on the Basel I Capital Accord of the Basel Committee, and also reflected the revised market risk regulatory capital requirements as implemented by the Federal Reserve Board, which became effective on January 1, 2013.

The Revised Capital Framework is also applicable to GS Bank USA, which is an Advanced approach banking organization under this framework. GS Bank USA has also been informed by the Federal Reserve Board that it has completed a satisfactory parallel run, as required of Advanced approach banking organizations under the Revised Capital Framework, and therefore changes to its calculations of RWAs will take effect beginning with the second quarter of 2014.

An institution may be downgraded to, or deemed to be in, a capital category that is lower than is indicated by its capital ratios if it is determined to be in an unsafe or unsound condition or if it receives an unsatisfactory examination rating with respect to certain matters. FDICIA imposes progressively more restrictive constraints on operations, management and capital distributions, as the capital category of an institution declines. Failure to meet the capital requirements could also require a depository institution to raise capital. Ultimately, critically undercapitalized institutions are subject to the appointment of a receiver or conservator, as described under "- Insolvency of an Insured Depository Institution or a Bank Holding Company" below.