UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period for ________________________ to __________________________

Commission file number: 0-29963

FINDEX.COM, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 88-0379462 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 1313 South Killian Drive, Lake Park, Florida | 33403 | |

| (Address of principal executive offices) | (Zip Code) |

(561) 328-6488

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company ☒ | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2014, the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average of the closing bid and asked prices on such date was approximately $457,000.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

At April 15, 2015, the registrant had outstanding 457,001,409 shares of common stock, of which there is only a single class.

TABLE OF CONTENTS

| Page Number | |

| PART I | |

| Item 1. Business. | 3 |

| Item 1A. Risk Factors. | 19 |

| Item 1B. Unresolved Staff Comments. | 39 |

| Item 2. Properties. | 39 |

| Item 3. Legal Proceedings. | 40 |

| Item 4. Mine Safety Disclosures. | 40 |

| PART II | |

| Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 41 |

| Item 6. Selected Financial Data. | 42 |

| Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. | 43 |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk. | 51 |

| Item 8. Consolidated Financial Statements and Supplementary Data. | F-1 |

| Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | 52 |

| Item 9A(T). Controls and Procedures. | 52 |

| Item 9B. Other Information. | 52 |

| PART III | |

| Item 10. Directors, Executive Officers and Corporate Governance. | 53 |

| Item 11. Executive Compensation. | 55 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 57 |

| Item 13. Certain Relationships and Related Transactions, and Director Independence. | 58 |

| Item 14. Principal Accounting Fees and Services. | 58 |

| PART IV | |

| Item 15. Exhibits, Financial Statement Schedules. | 59 |

| 2 |

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K, press releases and certain information provided periodically in writing or verbally by our officers or our agents contain statements which constitute forward-looking statements. The words "may", "would", "could", "will", "expect", "estimate", "anticipate", "believe", "intend", "plan", "goal", and similar expressions and variations thereof are intended to specifically identify forward-looking statements. These statements appear in a number of places in this Form 10-K and include all statements that are not statements of historical fact regarding the intent, belief or current expectations of us, our directors or our officers, with respect to, among other things: (i) our liquidity and capital resources, (ii) our financing opportunities and plans, (iii) our ability to attract customers to generate revenues, (iv) competition in our business segment, (v) market and other trends affecting our future financial condition or results of operations, (vi) our growth strategy and operating strategy, and (vii) the declaration and/or payment of dividends.

Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Factors that might cause such differences include, among others, those set forth in Part II, Item 7 of this annual report on Form 10-K, entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations", and including without limitation the "Risk Factors" section contained in Part I, Item 1A. Except as required by law, we undertake no obligation to update any of the forward-looking statements in this annual report on Form 10-K after the date hereof.

Readers of this annual report on Form 10-K should note that, in order to provide materially relevant disclosure regarding certain of Findex's historical, operational expenses not otherwise appropriately accounted for in our consolidated financial statements given the applied accounting treatment described elsewhere in this annual report on Form 10-K, certain disclosure is contained in the text of this report relating to such expenses, including e.g. executive compensation, director compensation, and audit fees, that does not numerically align with the corresponding figures contained in our consolidated financial statements.

ITEM 1. BUSINESS.

OVERVIEW

Findex.com, Inc. ("Findex," the "Company," "we," "us," or "our") headquarters and operations are based in Lake Park, Florida. Our business is comprised of two distinct operating divisions. As a result of a recent merger (the "Merger"), one of these divisions, EcoSmart, centers around the development of a proprietary line of specialty materials coatings that have a broad range of value-adding industrial, commercial, and residential applications. The other division, FormTool, which we acquired in February 2008, is focused upon the production, marketing and distribution of a line of consumer software products that offer quality, professionally designed forms for business, accounting, construction, sales, real estate, human resources and personal organization needs.

For accounting purposes, we recognized the Merger in accordance with ASC 805-40, Reverse Acquisitions . Accordingly, Findex has been recognized as the accounting acquiree in relation to the Merger, with EcoSmart being the accounting acquirer, and our consolidated financial statements for the reporting period from January 1, 2013 through July 23, 2014 being those of EcoSmart, not the enterprise historically recognized as Findex. Our consolidated financial statements for the periods since July 24, 2014, the day after which the Merger was consummated, recognize Findex and EcoSmart as a single operating enterprise and entity for accounting and reporting purposes, albeit with a carryover capital structure inherited from Findex (attributable to the legal structure of the transaction). Readers of this annual report on Form 10-K should note that, in order to provide materially relevant disclosure regarding certain of Findex's historical, operational expenses not otherwise appropriately accounted for in our consolidated financial statements given the applied accounting treatment described herein, certain disclosure is contained in the text of this report relating to such expenses, including e.g. executive compensation, director compensation, and audit fees, that does not numerically align with the corresponding figures contained in our consolidated financial statements.

| 3 |

Prior to the Merger, and since 1999, our business had been developing, publishing, marketing, distributing and direct-selling off-the-shelf consumer and organizational software products for the Windows platform. Following divestitures of two software titles which had consistently accounted for the overwhelming majority of our revenues while owned by us, including our Membership Plus product line, which we sold in late 2007, and our flagship QuickVerse product line, which we sold during 2011, and title acquisitions during the same period that, in the aggregate, have been relatively insignificant in offsetting the loss of revenues associated with those divestitures, our continuing operations, while not nominal, have been very limited and insubstantial in terms of revenue, both relative to what they had been prior thereto and by any appropriate standalone measure. Specifically, our operations immediately prior to the Merger consisted exclusively of those relating to the FormTool line of products which we acquired in February 2008, as well as two language tutorial products, which were retained after the sale of the QuickVerse product line. Due to a continuing lack of capital over a number of years, we were unable to meaningfully grow the FormTool line and develop related products, and our business and financial prospects became increasingly challenged.

As a result of the Merger, and although it is our current intention to continue to operate and further develop our FormTool product line and business, it is expected that our primary focus will shift going forward in the direction of the business of EcoSmart, where we believe the opportunities for our future growth are greater and have significantly more to offer economically.

Corporate Formation, Legacy & Subsidiaries

We were incorporated in the State of Nevada on November 7, 1997 as EJH Entertainment, Inc. On December 4, 1997, a predecessor corporation with the same name as our own but domiciled in Idaho was merged with and into us. Although the predecessor Idaho corporation was without material assets or operations as of the time of the merger, since being organized in 1968, it had historically been involved in mining and entertainment businesses unrelated to our current business.

Beginning in 1997, and although we were not then a reporting company under the Securities Exchange Act, our common stock was quoted on the OTC Bulletin Board (originally under the symbol "TIXX", which was later changed to "TIXXD"). On May 13, 1999, we changed our name to FINdex.com, Inc. On March 7, 2000, in an effort to satisfy a newly imposed NASD Rule eligibility requirement that companies quoted on the OTC Bulletin Board be fully reporting under the Securities Exchange Act (thereby requiring recently audited financial statements) and current in their filing obligations, we acquired, as part of a share exchange in which we issued 150,000 shares of our common stock, all of the outstanding capital stock of Reagan Holdings, Inc., a Delaware corporation. At the time of this transaction, Reagan Holdings was subject to the requirements of having to file reports pursuant to Section 13 of the Securities Exchange Act, had recently audited financial statements and was current in its reporting obligations. Having no operations, employees, revenues or other business plan at the time, however, it was a public shell company. As a result of this transaction, Reagan Holdings, Inc. became our wholly owned subsidiary and we became the successor issuer to Reagan Holdings for reporting purposes pursuant to Rule 12g-3 of the Securities Exchange Act. Shortly thereafter, we changed our stock symbol to "FIND". Though it does not currently have any operations, employees, or revenues, Reagan Holdings remains our wholly owned subsidiary.

In addition to Reagan Holdings, we also have one other wholly owned subsidiary, Findex.com, Inc. ( i.e. the same name as our own), a Delaware corporation. Like Reagan Holdings, this entity, too, does not currently have any operations, employees, or revenues. This subsidiary resulted from an acquisition on April 30, 1999 pursuant to which we acquired all of the issued and outstanding capital stock of FINdex Acquisition Corp., a Delaware corporation, from its then stockholders in exchange for 4,700,000 shares of our common stock, which, immediately following the transaction, represented 55% of our total outstanding common stock. Our purpose for this acquisition was to broaden our then-existing stockholder base, an important factor in our effort to develop a strong market for our common stock. On May 12, 1999, in exchange for the issuance of 457,625 shares of FINdex Acquisition Corp. common stock, FINdex.com, Inc., another Delaware corporation (originally incorporated in December 1995 as FinSource, Ltd.), was merged with and into FINdex Acquisition Corp., with FINdex Acquisition Corp. remaining as the surviving entity. Our purpose for this merger was to acquire a proprietary financial information search engine for the Internet which was to serve as the cornerstone for a Web-based development-stage business, but which has since been abandoned. As part of the certificate of merger relating to this transaction, FINdex Acquisition Corp. changed its name to FINdex.com, Inc. We currently own 4,700,000 shares of FINdex.com, Inc. (the Delaware corporation), representing 100% of its total outstanding common stock.

| 4 |

In its most recent corporate form, EcoSmart was organized in 2012. The patents and other intellectual property forming the foundation of the EcoSmart business were originally developed during a preceding period dating back to 2003 in which it was operated by the developers of the Company's technologies as Surface Modification Technologies, Inc. ("SMT"), a Florida corporation, and EcoSmart, LLC, a Florida limited liability company, which were sold together to TRC in 2012. On January 20, 2012, EcoSmart Coating Technologies, Inc., a Florida corporation, was organized as a wholly-owned subsidiary of TRC. Simultaneously, EcoSmart Surface Technologies, Inc., also a Florida corporation, was formed as a wholly-owned subsidiary of TRC. With common ownership by TRC, the assets of each of SMT and EcoSmart, LLC were thereafter transferred in part to EcoSmart Coating Technologies, Inc. with the remainder to EcoSmart Surface Technologies, Inc. On September 18, 2012, EcoSmart Surface Technologies, Inc. changed its name to EcoSmart Surface & Coating Technologies, Inc. On October 19, 2012, EcoSmart Coating Technologies, Inc. was merged with and into EcoSmart Surface & Coating Technologies, Inc., leaving EcoSmart Surface & Coating Technologies, Inc. ("EcoSmart") as the surviving corporation.

E COSMART

EcoSmart is divided into two basic product areas. One product area is currently centered around a line of specialty industrial glass-based "smart surface" coatings that have a wide range of uses across each of the industrial, commercial, and household market segments and that are centered around a U.S. patented technology that, either on its own or when coupled with any of an array of available proprietary formula additives, offers a unique combination of beneficial surface properties that allow for a broad array of multi-surface and end-product applications. The other product area involves a proprietary surfacing process – for which a U.S. patent is currently pending – to treat and cover existing floors, walls, counter-tops and table-tops, that offers property owners and occupants of all types a cost-effective means of enjoying a virtually limitless array of very lightweight, aesthetically desirable and high-demand decorative options, coupled with a variety of meaningfully beneficial surface-layer properties, without the necessity for having to remove and dispose of the floors, walls, counter-tops and table-tops already in place, and which process affords a uniquely attractive solution to those property owners and occupants otherwise facing the very costly, time-consuming and administratively burdensome challenges of having to remove and dispose of existing legacy-laden, chemically contaminated and/or vinyl asbestos tile (so-called "VAT").

Over time, we intend to progress in the strategic direction of becoming a leading research-oriented high-tech specialty "smart-surface" materials development and licensing company centered around a highly qualified research team and state-of-the-art research lab and applying a combination of organic and inorganic chemistries, materials science engineering, and nanotechnology. We currently have expertise and capabilities in each of these areas.

Organic chemistry is a chemistry sub-discipline involving the scientific study of the structure, properties, and reactions of organic compounds and organic materials (i.e., matter in its various forms that contain carbon atoms). Inorganic chemistry, by contrast, refers to the chemistry sub-discipline aimed at understanding the synthesis and behavior of inorganic and organometallic compounds, generally focused on the silicon atom. Nanotechnology is the creation of functional materials, devices and systems through control of matter (atoms and molecules) on the nanometer length scale (1-100 nanometers), and exploitation of novel phenomena and properties (physical, chemical, biological, mechanical, electrical) at that length scale. Materials science engineering has as its focus the development of new products based on materials whose properties and behavior are controlled at the micrometer and nanometer scales, and through microfabrication technologies.

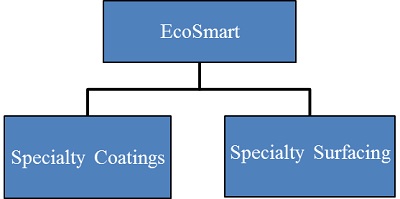

Currently, and as is expected to remain true in the near term, the Company consists solely of the specialty coatings business and the specialty surfacing businesses, which, while possessing certain overlap in terms of underlying technology and product development, are operated by us as separate divisions, chiefly because of certain differences in their respective business models and marketing strategies.

| 5 |

During the year ended December 31, 2014, our revenues were approximately 88% attributable to sales within the specialty coatings division and approximately 12% attributable to sales within the specialty surfacing division. For the year ended December 31, 2013, these revenue percentages were approximately 70% and 30% respectively. For the year ended December 31, 2013, these revenue figures were derived from EcoSmart Surface Coatings and Technologies, Inc., a subsidiary of TRC at the time.

SURFACE AND COATING TECHNOLOGIES

Specialty Coatings Division

The surface is an integral aspect of virtually every physical object and often plays a fundamental role in many of the processes, beyond mere connectivity and structural support, that govern chemical and biological interactions involving the product. In some instances, the surface serves to protect the internal elements of the object that it surrounds; in others, it provides an entry point into those chemical or biological systems. In most, combinations of these attributes are present, and the potential variations are both vast in number and complex in structure.

Our specialty coatings division produces, markets, and distributes a line of effectively invisible glass-based specialty coatings – "smart surfaces" – that have a wide range of industrial, commercial, and household applications that add a competitive advantage to a given product or surface through a variety of protective and other features. Conventional coatings, which are bonded by mechanical means to whatever surface they are applied to, tend to fail, ultimately, in the bonding to the substrate, typically due to poor surface preparation or variation of temperature exposures. Uniquely, EcoSmart's products consist of inorganic and organic combinatorial chemistry that causes them to bond chemically with the substrate, whether metal, cement-based, or organic ( e.g. plastics). By utilizing covalent bonding that penetrates into the substrate and reacts directly with the free ion within, the otherwise resulting disbondment is avoided. The result is a much longer lasting and stronger coating, and of course, a longer life for the substrate that has been treated.

With an addition of only 50 millionths to 2 thousandths of an inch in surface thickness (depending on which product is used), no loss of either hardness, on the one hand, or pliability, on the other, and no reduction in photon (light) penetration, the patented platform technology, either on its own or when coupled with any of an array of available proprietary formula additives, offers the following unique combination of beneficial protective, maintenance-reducing, performance-enhancing and cosmetically-enhancing properties to most surfaces, including metals, plastics, paints, fabrics, vinyl, wood, masonry, or concrete, in each case without regard to temperature, climate or most other environmental conditions, without hazard to either human, animal or plant health/life, and for a period of up to as many as approximately 15-20 years:

| Protective Benefits | |||||

| Against Physical Surface Damage | Against Surface Appearance / Cosmetic Degradation | ||||

| ● | Resistant to Abrasion / Scratching | ● | Resistant to Dust / Dirt / Grime | ||

| ● | Resistance to Corrosion | ● | Resistant to Staining | ||

| ● | Resistant to Oxidation | ● | Resistant to Color Fading | ||

| ● | Resistant to (Effects of) Weather / Elements | ● | Resistant to Fingerprints | ||

| 6 |

| ● | Resistant to (Effects of) UV | ● | Resistant to Marking / Graffiti | ||

| ● | Resistant to (Effects of) All But Most Extreme Alkaline or Acidic Chemicals | ● | Oleophobic (Oil-Repellent) | ||

| ● | Resistance to (Effects of) Acid Rain | ||||

| ● | Resistance to (Effects of) Guano (excrement of birds, bats, seals, etc.) | ||||

| ● | Resistance to Termite Infestation | ||||

| Against Human Health Risks / Contagion | Against Human Physical / Safety Risks | ||||

| ● | Resistant to Bacterial Growth / Germs (sometimes referred to as "Self-Sterilizing") | ● | Slip-Resistant When Wet | ||

| ● | Resistant to Mold / Fungal Spore Growth | ||||

| ● | Resistant to Small and Large Viruses | ||||

Maintenance-Reducing Benefits (sometimes referred to as "Self-Cleaning" attributes)

| ● | Hydrophobic (Water-Repellent) | |

| ● | Oleophobic (Oil-Repellent) | |

| ● | Resistant to Dust / Dirt / Grime | |

| ● | Rinses Cleans with Only Water and/or Mild Detergent |

Performance-Enhancing Benefits

| ● | Improved Hydrodynamics / Drag Reduction / Fuel Efficiency | |

| ● | Improved Aerodynamics / Drag Reduction / Fuel Efficiency | |

| ● | Energy Efficiency |

Cosmetically-Enhancing Benefits

| ● | Enhanced Color Clarity | |

| ● | Enhanced Gloss / Sheen | |

| ● | Enhanced Reflection |

With the extraordinary array of beneficial properties identified above, certain but not all of which have been independently lab-tested and verified, the range of potential applications of our specialty coatings is notably far-reaching, spanning across numerous industrial, commercial, and household segments. While we are currently focusing our pursuit on only several of these potential applications, and there can be no assurance that it will ever pursue any one or more of the others, we have identified the following as potential markets, among others, to be explored and possibly pursued over time:

| ● | residential, commercial, and industrial building / construction | ● | automotive / auto body | ||

| ● | interior and exterior flooring and tiling / pavers | ● | motorcycles and ATVs | ||

| ● | sewage infrastructure, highways, bridges | ● | boats, jet-skis and snowmobiles | ||

| ● | oil & gas drilling / production equipment | ● | windshields | ||

| ● | solar panels, reflectors and heliostats | ● | bathroom fixtures | ||

| ● | wind turbines | ● | kitchen countertops and cabinetry | ||

| ● | HVAC / commercial refrigeration systems | ● | swimming pools and hot-tubs / jacuzzis | ||

| ● | desalination and potable water systems | ● | outdoor home decking | ||

| ● | aircraft / drones | ● | patio furnishings | ||

| ● | military equipment and weapons systems | ● | outdoor cooking hardware | ||

| ● | spacecraft / satellites / space-stations | ● | outdoor lighting systems | ||

| ● | passenger cruise ships | ● | kitchen and other household appliances | ||

| ● | railroad / monorail | ● | telescopic equipment | ||

| ● | medical equipment, operating environments and implant devices | ● | sunglasses | ||

| ● | biometric and other security devices | ● | water/snow skis, surf boards, and other sporting goods | ||

| ● | industrial machinery and robotics | ● | protective helmets and sporting gear | ||

| ● | telecommunications hardware | ● | playground equipment / apparatus | ||

| ● | textiles | ● | camping equipment | ||

| ● | smart-phones and tablets | ● | home furnishings, picture frames and decorative items |

| 7 |

To date, we have not commissioned or otherwise undertaken or obtained any comprehensive market study in respect of any one or more of the above-listed potential product applications. The immediate-term focus of the Company is on the following five, unrelated applications, each of which has been selected based on management's combined assessment of (i) the relative size, age and projected growth trend of the subject market, (ii) experience, observational/anecdotal intelligence, and testing results previously obtained in relation to the application, (iii) the relative strength of the value proposition to prospective customers, (iv) the comparative time-to-market, (v) the comparative cost-to-market coupled with existing industry relationships and available resources, (vi) the relative geographic accessibility of the market, (vii) the seasonality of the market, if any, (viii) the relative barriers-to-entry within the market, (ix) the relative, projected length of the particular sales cycle, (x) the projected gross profit margins, (xi) both the presence within the subject market, together with the relative quality, of competitive products, and (xii) the relative size and strength of the individual competitors:

| ● | Hardscape . This is the market segment defined by us to include applications involving surfaces consisting of pavers, poured and stamped concrete, natural stone, brick, and ceramic tile. It has been targeted based on a combination of all of the factors identified above, with a particular emphasis on (i) geographic accessibility to the regional market of South Florida, in which the Company maintains its executive offices and principal operations, and (ii) relative ease of installation. At a competitive price point, the Company's products offer this market a high-grade, functional alternative to comparatively under-performing water-based hardscape sealants, and one with numerous unique, secondary benefits. The marketing and sales strategy being applied by us is a dual-pronged approach aimed at manufacturers of primary materials, on the one hand, and contractor-installers, on the other. Able to rely for showcasing purposes on a recent major installation involving 310,000 square feet of pavers at the newly-opened Palm Beach Outlet Mall in West Palm Beach, Fl., the Company believes it is poised for an aggressive roll-out in the hardscape arena. | |

| ● | Solar Panels, Reflectors and Heliostats . This is the alternative energy production and related hardware application market segment consisting of photovoltaic (PV) solar panel modules, reflectors, and heliostats (computer-controlled, curved mirrors which concentrate the sun's rays and keep them reflected on a target as the sun moves across the sky) in relation to which the value-proposition associated with our product offerings arise out of the "self-cleaning" attributes they afford. Because of the economic importance in maximizing the capture of incoming photons for energy conversion output, insuring the consistent cleanliness of solar panels has become an increasingly high priority and a continuing challenge throughout the industry, and the worldwide demand for coatings with efficiently "self-cleaning" properties – such as those produced by us, which do not come at the expense of the optical properties of high transmission (in the PV modules) or high reflectance (in the heliostats) – is growing rapidly. In its earliest stages of market entrance, but driving the forefront, we are currently targeting both domestic and foreign PV panel manufacturers as well as operators of distributed solar energy farms. In respect of both groups, and though there can be no assurance, the Company seeks to build its business through the securing of long-term, ongoing supply contracts. We are aggressively targeting this application based on a combination of all of the factors identified above, including most notably the relative newness and projected growth rate of the developing market. Recently conducted initial field tests utilizing our product, moreover, have been promising, showing in excess of a 30% increase in efficiency over uncoated PV array panels due primarily to increased cleanliness. |

| 8 |

| ● | Oil, Gas, and Mining. This is the market segment application surrounding a vast array of opportunities to sell certain of our coatings to prevent rust, oxidation, corrosion and abrasion breakdown in the oil, gas and mining industries. We believe our coatings could result in unimaginable savings in maintenance costs as well as extending the life of equipment, tools and infrastructure used in these highly corrosive environments. For instance, our coatings could be used as protective pipe linings, protective coating on micro-turbines, hydraulic systems, fleet vehicles, rail cars, shipping containers, storage tanks, cargo vessels as well as general infrastructure. According to recent industry reports, and with industrial coatings generally comprising more than approximately a third of the worldwide aggregate coatings market, the oil and gas segment is one seen as holding the greatest growth potential. Based on the preliminary results of early-stage field and lab tests being conducted by prospective customers, and though there can be no assurance, management believes the effectiveness of its products for this purpose is already higher than many competing products, and that the market and demand for these products is potentially very significant. We are aggressively targeting this application based on a combination of all of the factors identified above, and, to date, we have been pursuing potential distribution opportunities through select industry operators. | |

| ● | HVAC / Commercial Refrigeration Systems . This is the market segment application consisting of coatings for HVAC and commercial refrigeration systems intended to serve as protection from corrosion, including in salt water, acid, alkaline and chemical environments, and from clogging by particles of mold, pollen, dust, and soot. Testing in this area has shown that there is a significant efficiency loss factor on HVAC units due to natural oxidation and the restricted airflow caused by dirt that collects on the condenser coils. With a product that repels moisture and contaminants, offers increased operating/energy efficiency of 12-15% over the life of a subject condensing unit, and substantially reduced cleaning requirements generally, management believes a significant opportunity exists for the Company within this market. Accordingly, we have targeted this application based on a combination of all of the factors identified above and are currently in the process of developing a strategic marketing plan aimed at this segment. | |

| ● | Marine Industry . This is the market segment defined by us to include applications involving surfaces both above and below the water line existing on boats, yachts, ships, commercial vessels, sailing vessels, floating and fixed docks and ocean based platforms. The environmental conditions for all of the above items are extremely harsh whether it is the salt air or salt water. We believe our coatings in this market segment can prohibit the growth of barnacles and algae as well provide a decrease in hydrodynamic friction resulting in an increase of flow through the water by as much as 35%. Based on the preliminary results of prospective customer field and lab tests, and though there can be no assurance, management believes the quality and price of its products for this purpose is better than many alternatives already widely available, and that the market and demand for these products is potentially material. We are aggressively targeting this application based on a combination of all of the factors identified above, and, to date, we have been pursuing potential distribution opportunities through select industry operators. |

In general, though not necessarily across all segments, the Company intends to pursue a strategic approach to identify market opportunities that rely on master distribution arrangements within individual product/application industry verticals. An emphasis is being made in the immediate-term on the establishment of such master distribution relationships holding what management believes to be an industrial customer-base with the greatest potential likelihood of benefitting without a significant lag-time by incorporating the specialty smart coatings as a product upgrade to their respective current offerings.

| 9 |

For purposes of development, competitive analysis, and prioritizing sales initiatives and resource deployment, the Company views its specialty coatings business in terms of numerous individual markets identified in each case by reference to the particular combination of the Company product, on the one hand, and targeted surface and application, on the other. While the Company's complete line of individual specialty coatings products includes more than fifteen separate formulations, the following list identifies the Company's principal five products, by name, together with their respective primary targeted surfaces and application categories, as well certain information in each case relating to their unique benefits in relation to the target application:

| Product Name: | ECT-1 General Purpose Surface Treatment | |

| Primary Targeted Surfaces: | tile, masonry, paint, cement, stucco, metals, plastics, fabric, flame-exposed, cryogenic | |

| Primary Target Application Categories: | interior and exterior flooring and tiling / pavers | |

| Featured Properties For Target Application: | hydrophobic (water-repellent) and oleophobic (oil-repellent); slip-resistant when wet; protective barrier at all temperatures resistant to abrasion/scratching, corrosion, oxidation, microbials, (effects of) weather/elements, UV, guano, acid rain, staining, color fading, mold/fungal spore growth |

* * *

| Product Name: | ECT-2 General Purpose Polyurethane Coating | |

| Primary Targeted Surfaces: | ceramic floor tile, terrazzo, granite | |

| Primary Target Application Categories: | interior and exterior flooring and tiling / pavers | |

| Featured Properties For Target Application: | water-based low VOC (volatile organic compound); extreme chemical-resistance; available with anti-slip additives; single coat potentially equivalent to three coats of competitive product in terms of physical performance. |

* * *

| Product Name: | ECT-5 HVAC Corrosion Energy Coating | |

| Primary Targeted Surfaces: | all surfaces of condensing unit, including coils, copper lines, compressor and cabinet | |

| Primary Target Application Categories: | HVAC and refrigeration condensing units, micro turbines and other equipment on oil rigs | |

| Featured Properties For Target Application: | "glassifying surface treatment"; condensing unit protection from corrosion, including in salt water, acid, alkaline and chemical environments; protection from clogging by particles of mold, pollen, dust, and soot; increased operating/energy efficiency of 12-15% over life of condensing unit; reduced cleaning requirements generally, and condensing units easily cleaned with only water and/or mild soap eliminating need for caustic coil cleaners; reduced maintenance for cooling towers and chiller barrels |

* * *

| Product Name: | ECT-10 Universal Micro-Coating | |

| Primary Targeted Surfaces: | glass, mirrors, fiberglass, paints, plastics, metals, fabrics, granites | |

| Primary Target Application Categories: | automotive/motorcycle/marine interior and exteriors, countertops, sunglasses, surfboards, water and snow skis | |

| Featured Properties For Target Application: | ultra-thin (50 millionths of an inch) gasified glass layer version of ECT-1 that be easily applied directly by consumers and last for 6-8 months; hydrophobic (water-repellent) and oleophobic (oil-repellent); repels dirt and dust, including brake dust; exceptional clarity on glass and mirrors by filling in microscopic voids in the surface (tests conducted by the Ford Motor Company showed improvement in the "Distinction of Image" measurement (clarity of a glossy surface) of 10% on new, and 20% on old, automotive paint); protective barrier at all temperatures resistant to abrasion/scratching, corrosion, oxidation, microbials, (effects of) weather/elements, UV, guano, acid rain, acid damage from insects, staining, color fading, mold/fungal spore growth |

* * *

| 10 |

| Product Name: | ECT-775 | |

| Primary Targeted Surfaces: | pavers, concrete, roofing tile, ceramic tile, and other porous surfaces | |

| Primary Target Application Categories: | floors, walls, decorative panels, swimming pools, solar panels, reflectors | |

| Featured Properties For Target Application: | able to be applied in heavy coats; protective against staining, chemicals, UV fading, slipping; "self-cleaning" |

The most unique feature shared by our coatings, and the specific focal point of a patent held by the Company considered by it to be the centerpiece of its smart surface technology, is the positive surface charge they possess once applied. It is this positive surface charge that is responsible for their most unique and valuable properties identified above, including the hydrophobicity, oleophobicity, microbial and fungal resistance, dust-repellance, and the enhanced aerodynamics and hydrodynamics.

Hydrophibicity is a term largely unfamiliar to many outside scientific circles, but that describes a quality with which most everybody has a basic familiarity. Surfaces may be characterized as either hydro philic or hydro phobic depending on whether or not they attract or repel water or other water-based liquids. Hydrophilic and hydrophobic surfaces are abundant in both nature as well as in synthetic materials, and they exist both organically and inorganically in terms of chemical composition. A hydro philic surface can be wet and may adsorb water; a hydrophobic surface cannot and will not – it is compositionally incapable of becoming wet. An example of a hydrophilic surface encountered routinely in daily life are sponges, which, of course, readily soak up whatever water with which they come into contact, at least to the point of saturation. Hydro phobic materials and coatings, by contrast, prevent water from pooling on their surfaces. In scientific terms, hybrophobicity is caused by surfaces that disrupt the hydrogen bonding in water; so as to minimize the disruption in its molecular makeup, the water droplet pushes itself away from the surface to minimize its contact area, thus becoming very tightly bound. Hydrophobic materials are generally easy to identify because water forms into droplets upon contact with them after which they tend to roll around freely, like marbles on a flat Formica countertop, as occurs commonly on the freshly waxed exterior of a car or recently cleaned windshield with new wiper blades. The more hydrophobic the material (all the way up to and including so-called " super hydrophobic" surfaces), the stronger this effect, until the water effectively floats or skims across the surface with what amounts to very low friction. Naturally occurring hydrophobic surfaces include many species of plant leaves and flower petals, as well as many types of bird feathers and the outer body parts of a variety of insects; the lotus leaf is among the most hydrophobic of naturally occurring hydrophobic surfaces. Synthetic hydrophobic surfaces include such household-name brands as Scotchgard ™ treated fabric, Teflon ® coated metal, or Rain-X ® coated glass.

Oleophobicity is a property very comparable to hydrophobicity, but it relates to oil-repellancy, not water-repellancy. There are important technical differences, but, for practical and basic observational purposes, they are very similar.

In terms of chemistry, our platform smart surface, and the coating variations identified above that it serves as a basis for, are inorganic, formed as they are of chemically "grown" glass. The process by which they form upon application can be likened to the process, witnessed by many daily in science classrooms, labs, or at home with popular science kits, whereby quartz crystals are effectively "grown" in a solution. This is important because it results in the establishment of a uniquely firm chemical bond between the coating and the surface, far stronger than would exist through either a mechanical or light bonding (the traditional alternatives), fundamentally setting the coatings apart from most others. When coupled with the unusually thin layer they inhabit – approximately 50 millionths to 1-2 thousandths of an inch – the combination of properties leaves them notably flexible, permitting their use in connection with such items as fabrics, plastics, and pliable floor-boards, yet hard, durable, and resilient, particularly when refined with select additives.

| 11 |

The additives used in our various coating formulations available to customers fall into three basic categories. In the first category are color tints, which, in recent years, have seen major technology advancements in terms of durability, variety and depth of color, reflectivity, and fade-resistance. Through developing strategic relationships, we have available to us a wide range of the most advanced offerings in this regard. In the second category are additives intended to provide increased hardness and wear-resistance. Here, too, we have access to what we believe are some of the most superior materials available. In the third category is a single additive, ConShield™, an EPA approved "on-contact" mechanical microbial germ and virus so-called "quat" (industrial and commercial quaternary ammonium) killer – that works in such a way as to prohibit the mutation of microbials which can otherwise become resistant over time to chemical kill mechanisms, such as antibiotics – capable of fortifying any of our coatings with additional protection against bacteria and relatively large viruses/microbials, including, for example, Methicillin-resistant Staphylococcus Aureus (more commonly known as "MRSA), Clostridium difficile bacterial infection (more commonly known as "C-diff"), and Influenza A virus subtype H1N1 (more commonly known as "H1N1" or "Swine Flu"). By combining our coatings – which, based on their positive surface charge, already powerfully discourage the growth of many of the smaller, more common viruses which can exist between active elements of existing "on-contact" killers (such as the Norovirus, for example, a concern long plaguing the vacation cruise ship industry) – with ConShield™, available to us through an informal, strategic joint-marketing arrangement with its manufacturer, a unique, broader spectrum of microbial protection is afforded, un-matched, in the belief of the Company's management, by any other product in anti-microbial effectiveness.

Specialty Surfacing Division

The EcoSmart specialty surfacing division produces, markets, and installs, directly and through third-party contractors, a proprietary system to treat and cover existing floors, walls, counter-tops and table-tops, providing property owners and occupants of all types with a cost-effective solution that affords a virtually limitless array of very lightweight, aesthetically desirable and high-demand decorative choices, coupled with a variety of meaningfully beneficial surface-layer properties. Through a combination of advancements in applied chemical engineering, enhanced digital imaging and printing technologies, as well as EcoSmart's own specialty coatings, the system, marketed under the brand name EcoSmart Digital Flooring™, is able to generate a safe, rugged, durable, maintenance-friendly, and monolithic flooring alternative containing the sharp, color-rich visual imagery of virtually any desired pattern, design, photo, graphic, logo, or inlaid artwork, on the one hand, or, alternatively, carrying the textured, virtually indistinguishable appearance of natural, solid materials traditionally associated with both classic and contemporary flooring applications, such as hardwood, marbles, and granites, but at a fraction of the weight, on the other.

Developed over recent years in cooperation with Bayer Material Sciences, one of the largest resin suppliers worldwide, EcoSmart Digital Flooring system centers around a unique compound – for which a U.S. patent is currently pending – which chemically activates any unclean surface (including a floor), allowing a clear resin/polymer base floor-coating to be integrally – chemically – bonded to it. The process further encompasses the integral high-definition digital printing component, effected vis-a-vis a porous media embedded in the clear resin base floor-coating, as well as a surface preparatory agent and a topcoat drawn from products belonging to EcoSmart's family of specialty coating formulations, all of which combine to deliver not only a visually appealing, premium quality end-product reasonably expected to meet and exceed the most demanding commercial grade standards for any indoor and/or outdoor application, but one that also features enhanced protection, stability, durability and slip-resistance.

Taken as a whole, and depending in each case on the particular starting surface involved, on the one hand, and desired end-product, on the other, the system involves either a two, three, or five step procedure, with each step corresponding to an additional layer/coating of a particular proprietary EcoSmart formulation:

| Two-Step Procedure: | (1) ECT 110 – Surface Preparatory Agent |

| (2) ECT 210 – Encapsulating Base Coat | |

| Three-Step Procedure: | (1) ECT 110 – Surface Preparatory Agent |

| (2) ECT 210 – Encapsulating Base Coat | |

| (3) ECT 310 – Color Polyaspartic Top Coat | |

| Five-Step Procedure: | (1) ECT 110 – Surface Preparatory Agent |

| (2) ECT 210 – Encapsulating Base Coat | |

| (3) ECT Surfaces Digital Design/Image | |

| (4) ECT 310 – Color Polyaspartic Mid Coat | |

| (5) ECT 775 – Top Coat |

| 12 |

A notably unique aspect of the EcoSmart Digital Flooring system is that, because of the end-result both enabled and facilitated by the underlying chemical technology, the necessity for having to remove and dispose of existing flooring and baseboards, or wall tiling, and, in many cases, to purchase replacement flooring or surfacing, is entirely eliminated. This feature is attributable to the fundamental nature of the final product made possible by the system, which, as applied, resides directly over an existing floor – be it wood, wood laminate, engineered wood flooring, ceramic tile, concrete slabs, and including formerly carpeted areas – with as little as 1/16 th of an inch in additional, even surface thickness, devoid of irregularities. The resultant negation of any need for demolition and clean-up afforded by the system, and the avoidance this leads to in associated dust-up and diminution in air-quality that would otherwise follow, is not insignificant, particularly when occurring in homes or small business; it is not uncommon for such clean-up to otherwise have to include the air-handling system, and for the subject premises to have to be vacated in the meantime. A complete install utilizing the EcoSmart Digital Flooring system, by contrast, requires only minor preparation and typically takes – for a residential floor, for example – approximately two days, during which occupants can remain on the premises because there is neither dust nor other particulates, nor anything more than a minor odor, released into the immediately surrounding environment.

While an attractive option both aesthetically and economically for most any application, EcoSmart Digital Flooring presents EcoSmart with one of its most compelling, immediate-term to long-term market opportunities because it has proven particularly well-suited for those faced – increasingly through federal and state level regulatory mandates coupled with substantial monetary fines for non-compliance – with the unique and daunting challenges of having to work with legacy-laden, chemically contaminated (with, for example, asbestos, fossil fuel residues, or other potentially hazardous substances), and/or, most notably, vinyl asbestos tile (so-called "VAT"), floors and walls. This is because of the heightened importance in such situations of having to undertake the intensely regulated, administratively burdensome, highly dangerous, and very costly processes of specialized demolition, removal, and disposal of the contaminated substrates, which are inherently hazardous to human health in most cases, and often lethally carcinogenic, and the comparatively low-cost avoidance of all that made possible through use of the EcoSmart Digital Flooring system rather than abatement or other officially EPA sanctioned forms of remediation. Applying the technology, old asbestos-based tile, for example, can be chemically bonded and very effectively encapsulated for all purposes – including those arising under applicable EPA guidelines – without the need for any of the machine abrasion and otherwise highly-intensive cleaning processes traditionally associated with the handling of friable, asbestos-fibre-laden materials, and without the need for specialized and expensive hazmat materials treatment and disposal. Consisting of a highly durable coating with resultant flexibility properties such that it can tolerate elongation of up to approximately 100% once installed, the containment provided by this encapsulation is not jeopardized by potential cracking and future instability in the composition of the asbestos materials, thereby effectively eliminating the risk of future liberation and exposure of the hazardous substances.

Although there can be no assurance as to which markets will be targeted by EcoSmart over time, or in what order they may be targeted, the potential markets for the EcoSmart Digital Flooring system include owners or operators of essentially all types of premises:

| ● | residential properties, including all single and multi-family homes, apartments, condominiums, cooperatives | |

| ● | commercial properties, including retail spaces, office complexes and buildings, restaurants, and gas stations | |

| ● | hospitals, medical centers and research laboratories | |

| ● | private and public schools and universities | |

| ● | churches, synagogues, temples and other places of worship | |

| ● | federal, state and local government occupied buildings and properties | |

| ● | factories, storage facilities, and related industrial buildings and complexes |

| 13 |

To date, the EcoSmart Digital Flooring system has been used with favorable results, through installations conducted by EcoSmart, in more than twelve U.S. Veteran's Administration (VA) facilities, six Wal-Mart stores, and four Bed, Bath and Beyond retail outlets, and through installations conducted by approved distributor-contractors, an additional 150 Bed, Bath and Beyond outlets. In each of these cases, the installations principally involved restrooms, kitchens and other tiled areas.

MANUFACTURING AND FULFILLMENT

EcoSmart currently conducts all manufacturing and fulfillment operations on its own at the Company facility in Lake Park, FL. Though output capacity is only approximately 150 gallons per day currently, the Company intends to approximately double that in-house capacity in the near future, subject to having available to it the capital investment requirements. Management is additionally in the process of negotiating a higher volume, ISO-quality toll manufacturing arrangement with a reputable contract manufacturer which, once finalized, is expected to be relied upon by the Company for production of its higher sales volume products. In both cases, the manufacturing process is comprised largely of combining and blending raw materials and chemicals, including additives, in each case consistent with EcoSmart's proprietary formulations, and bottling of final product into labeled, quart and gallon containers. In general, on-hand inventory is kept to a minimum and built up based on forecasted near-term sales.

Backlog

In general, EcoSmart does not manufacture its products against a backlog of orders and does not consider backlog to be a significant indicator of the level of future sales activity. Production and inventory levels are based on the level of incoming orders as well as projections of future demand. Accordingly, management does not believe that backlog information is material to an understanding of its overall business and should not be considered a reliable indicator of the Company's ability to achieve any particular level of revenue or other metric of financial performance.

Product Returns Policies and Warranties

EcoSmart's product returns policies and warranties do not differ materially as between the specialty coatings and specialty surfacing divisions. Within the divisions, however, these policies and warranties do differ materially based on the type of surface to which the product is being applied as well as the anticipated performance life of the particular product.

I n general, EcoSmart maintains a consistent return policy relative to any products in relation to which there is either no associated installation or, if there is an installation involved, it is one that EcoSmart has no participation in or responsibility for (as may be the case in relation to the EcoSmart Digital Flooring system, for example, as well as the Company's paver application specialty coating products). The policy under such circumstances requires that the subject products be returned unopened within no more than 30 days of purchase, and that all shipping charges associated with the return be borne by the customer, together with a re-stocking fee equal to 10% of the corresponding purchase price unless the return is received in the form of purchase credit. For a period of up to 10 years from purchase, a warranty is extended in such cases to customers relative to both the chemical integrity (as represented upon sale) and the performance integrity of the coatings based on the specific characteristics of the subject product and application, and the corresponding representations made by the Company in relation thereto.

I n general, EcoSmart does not maintain a separate return policy in relation to specialty surfacing products sold as part of the EcoSmart Digital Flooring system, distinct from the one maintained in relation to the system taken as a whole, inclusive of the installation, except as it relates to product purchased by contract installers, in relation to which the policy is consistent with the one for EcoSmart specialty coatings . In these cases, the contract installer bears exclusive responsibility for all of the preparatory site work associated with the application (including, e.g. cleaning and insuring that the surface subject to treatment has acceptable PH readings and moisture levels). Where the installation is additionally covered and the warranty extends directly to the property owner, which is only the case when EcoSmart itself, or an EcoSmart approved contract installer, performs the application, the EcoSmart warranty extends for a number of years from the date of installation, determined in each case based on a variety of case-specific situational factors and relates to the performance integrity of the surfacing product based on the characteristics claimed by EcoSmart in relation to the EcoSmart Digital Flooring system generally . The warranty in these cases guarantees coverage of not only the cost for new product but also the associated labor for re-application in the event that that is necessary.

| 14 |

In connection with the sale of specialty coatings products in relation to which EcoSmart is involved in the corresponding installation (e.g. pavers), the product returns policies and warranties are similar to those that apply to sales and installations of the EcoSmart Digital Flooring system.

EcoSmart's returns policies and product warranties relative to both divisions are general policies and warranties and are subject to change in relation to any particular sale. Further, the general policies and warranties themselves are subject to change from time to time and are likely to evolve as EcoSmart's operations and revenues develop.

SIGNIFICANT CUSTOMERS AND SUPPLIERS

During the years ended December 31, 2014 and 2013, we generated a significant portion of our revenues in the coatings and surfacing divisions from certain customers as follows:

| % of Total Revenues | ||||||||||

| Customer | EcoSmart Division | 2014 | 2013 | |||||||

| PCS Phosphate Company Inc. | Coatings | 29.47 | % | --- | ||||||

| Christian Convention Center | Coatings | 16.99 | % | --- | ||||||

| Brite Bay Solutions of North Florida | Coatings | 3.66 | % | 13.2 | % | |||||

| A6 Inc. | Coatings | 3.36 | % | 13.7 | % | |||||

| Casual Creations | Surfacing | --- | 16.5 | % | ||||||

| Promiz, LLC | Coatings | --- | 10.5 | % | ||||||

For the year ended December 31, 2014, our revenues were approximately 88% attributable to sales within the specialty coatings division and approximately 12% attributable to sales within the specialty surfacing division. For the year ended December 31 2013, these revenue percentages were approximately 70% and 30%, respectively. In the future, we would anticipate that the majority of our revenues are derived from the specialty coatings division.

During the years ended December 31, 2014 and 2013, our significant product and chemical raw material purchases were as follows:

| % to Total Products | ||||||||

| 2014 | 2013 | |||||||

| Shin-Etsu Chemical | 29.27 | % | --- | |||||

| VPM A1, LLC | 20.25 | % | --- | |||||

| D.B. Becker Co., Inc. | 18.08 | % | --- | |||||

| Univar | --- | 30.57 | % | |||||

| Bayer Material Science | --- | 12.95 | % | |||||

| Hauthaway | --- | 12.42 | % | |||||

We currently have no long-term written agreements with any of these suppliers. The payment terms are generally net 30 days, and we are not substantially dependent upon any one or more of them; all are easily replaceable with any locally available supplier.

RESEARCH AND DEVELOPMENT

EcoSmart's research and development ("R&D") has been very modest over the past several years, including prior to the Merger, due to a lack of allocable funds. The limited R&D activities that have been pursued over this period have been conducted exclusively in-house.

| 15 |

EcoSmart's R&D objective is to leverage our unique, integrated, emerging science capabilities to drive revenue and margin growth. EcoSmart's R&D initiatives are principally focused on our strategic priority of achieving a leadership position across the relatively higher margin, science-driven segments of the specialized coatings and surfaces markets in which it operates by developing and refining differentiated, advanced industrial and related coatings and surface materials. EcoSmart management believes that its specialized scientific expertise, together with its developing R&D program, combine to provide it with distinctive, competitive advantages that position it to establish broad global reach over time and deep market penetration in its market verticals.

Our EcoSmart R&D team is led by senior research and development personnel.

We continue to protect our R&D investments and assets through application of a comprehensive intellectual property strategy. See discussion under "Intellectual Property."

REGULATION

In connection with each of our EcoSmart specialty coatings business and specialty surfacing business, we are subject to an extensive variety of stringent regulations under numerous U.S. federal, state, local and foreign environmental, health and safety laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other harmful materials. These regulations have potential implications for us in terms of EcoSmart's manufacturing operations, product handling and use by customers and agents, as well as installation processes. In this regard, we will likely have to expend substantial amounts to comply with such laws and regulations as well as establish a policy to minimize our environmental emissions. Nevertheless, legislative, regulatory and economic uncertainties (including existing and potential laws and regulations pertaining to climate change) may make it difficult for us to project future spending for these purposes and, if there is an acceleration in new regulatory requirements, we may be required to expend substantial additional funds to remain in compliance.

COMPETITION

Specialty Coatings Division

Product performance, technology, cost effectiveness, quality and technical and customer service are major competitive factors in the industrial coatings businesses. EcoSmart management is unaware of any one or more products possessing the same combination of physical properties, and that, on the whole, offers the same array of benefits, as its proprietary line of specialty smart surface coatings. There can be no assurance, however, that there not products under development or already in existence and in the early stages of market introduction of which management is not yet aware. The market for industrial and product performance coatings is extremely large, broad in scope, and consists of many different segments and sub-segments, each of which involves a range of product applications. It is also increasingly characterized by rapidly evolving technology. Precisely because of the wide array of beneficial properties they possess, and notwithstanding the U.S. patent held by us on our platform smart surface technology, the specialty coatings produced and distributed by EcoSmart should be viewed as competing with other coatings products across a wide variety of the various existing market segments and sub-segments. Hydrophobic and antimicrobial coatings, for example, are each segments in which numerous companies are aggressively competing with one another worldwide, both in terms of technology and market share, but that, combined, represent only a minor portion of the aggregate competition that EcoSmart should be viewed as meaningfully confronting.

The competition faced by EcoSmart in relation to its proprietary line of specialty smart surface coatings includes both public and private organizations and collaborations among academic institutions and large companies, both domestic and foreign, most of which have significantly greater experience and financial resources than EcoSmart. Management expects that EcoSmart's most significant competitors in its specialty coatings business will tend to be larger, more established companies, including many major multinational corporations such as Akzo Nobel N.V., PPG Industries, Inc., Axalta Coating Systems, BASF Corporation, and Valspar Corporation. In general, these companies are all developing products that, at some level or in one or more ways, compete with those of EcoSmart and, in addition to many existing issued and pending patents, they have significantly greater capital and other resources available to them for research and development, testing, seeking and obtaining any required regulatory approvals, marketing and distribution. In addition, many smaller coatings and related nanotechnology companies have formed strategic alliances or collaborative arrangements, partnerships, and other types of joint ventures with larger, well-established industry competitors that afford these companies' potential research and development and commercialization advantages, and may be aided in becoming significant competitors through rapid evolution of new technologies. Academic institutions, governmental agencies, and other public and private dedicated research organizations are also financing and conducting research and development activities that could result in the introduction of products directly competitive to those of EcoSmart.

| 16 |

Specialty Surfacing Division

EcoSmart management is unaware of any one or more products possessing the same combination of physical properties, and that, on the whole, offers the same array of benefits, as the EcoSmart Digital Flooring system. There can be no assurance, however, that there not products under development or already in existence and in the early stages of market introduction of which management is not yet aware. The market for comparable floor, wall, tabletop and countertop surfacing products and systems is extremely large, broad in scope, and consists of many different participants. It is also increasingly characterized by rapidly evolving technology. Notwithstanding the unique attributes of the EcoSmart Digital Flooring system, or the U.S. patent-pending on it, it should be viewed as competing with all other products in the market vying for differentiation and customers.

The competition faced by EcoSmart in relation to the EcoSmart Digital Flooring system includes both public and private organizations and collaborations among academic institutions and large companies, both domestic and foreign, most of which have significantly greater experience and financial resources than EcoSmart. Management expects that EcoSmart's most significant competitors in its specialty surfacing business will tend to be larger, more established companies, including many major multinational corporations such as Akzo Nobel N.V., PPG Industries, Inc., Axalta Coating Systems, BASF Corporation, Valspar Corporation, Dupont, and Sherwin-Williams. In general, these companies are all developing products that, at some level or in one or more ways, compete with those of EcoSmart and, in addition to many existing issued and pending patents, they have significantly greater capital and other resources available to them for research and development, testing, seeking and obtaining any required regulatory approvals, marketing and distribution. In addition, many smaller surfacing product/system companies have formed strategic alliances or collaborative arrangements, partnerships, and other types of joint ventures with larger, well-established industry competitors that afford these companies' potential research and development and commercialization advantages, and may be aided in becoming significant competitors through rapid evolution of new technologies. Academic institutions, governmental agencies, and other public and private dedicated research organizations are also financing and conducting research and development activities that could result in the introduction of products and systems directly competitive to those of EcoSmart.

INTELLECTUAL PROPERTY

Patents and Licenses

The competitive environment in which EcoSmart operates is largely driven by technology, proprietary or otherwise. In general, companies in this environment seek to develop competitive advantages – both offensive and defensive –through the obtaining and maintaining of relevant patents relating to their respective technological advancements. As a science and technology based company, EcoSmart believes that securing intellectual property is an important part of protecting its research, and that, in particular, patent, as well as related trade secret – protection, is critical for the new specialty coatings and surfacing technologies it develops, as well as any products and processes derived through them.

By way of assignment, EcoSmart currently holds one United States patent relating to our smart surface specialty coatings technology and one United States patent pending relating to our EcoSmart Digital Flooring system:

| Title | Awarded | Pending | Expiration | |||

| Method of Treating Surfaces For Self-Sterilization and Microbial Growth Resistance | X | 2025 | ||||

| Decorative Monolithic, Functionally Bonded Composite Surface Overlayment System and Application Process | X |

| 17 |

Over time, EcoSmart intends to apply for additional patents relating to advancements it achieves through its research and development initiatives. There can be no assurance however, that any of the patents currently held, or any obtained in the future, will prove adequate to protect its technologies or that it will have sufficient financial and resources to keep others from infringing the exclusive rights it possesses in relation to its technologies. The fields in which EcoSmart operates have been characterized by significant efforts by competitors to establish dominant or blocking patent rights to gain a competitive advantage, and by considerable differences of opinion as to the value and legal legitimacy of competitors' purported patent rights and the technologies they actually utilize in their businesses.

Because we may license our technology and products in foreign markets, we may also seek foreign patent protection for some specific patents. With respect to foreign patents, the patent laws of other countries may differ significantly from those of the United States as to the patentability of our products or technology.

It is possible that competitors in both the United States and foreign countries, many of which have substantially greater resources and have made substantial investments in competing technologies, may have applied for, or may in the future apply for and obtain, patents, which will have an adverse impact on our ability to make and sell our products. There can also be no assurance that competitors will not infringe on our patents or will not claim that we are infringing on their patents. Defense and prosecution of patent infringement suits, even if successful, are both costly and time consuming. An adverse outcome in the defense of a patent infringement suit could subject us to significant liabilities to third parties, require disputed rights to be licensed from third parties or potentially even require us to cease our operations.

Certain aspects of EcoSmart's know-how and technology are not patentable, or, for strategic reasons, are best protected in the determination of management by leaving them unpatented. In this regard, t rade secrets play an important part in the Company's intellectual property strategy, and EcoSmart vigilantly seeks to protect them. To protect our proprietary position in trade secrets, we require all employees, consultants, advisors and collaborators with access to our technology to enter into confidentiality and invention ownership agreements with us. There can be no assurance, however, that these agreements will provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure. Further, in the absence of patent protection, competitors who independently develop substantially equivalent technology, or otherwise acquire it, may adversely impact our business. If and when we discover that any trade secrets have been misappropriated, it is expected that we will, unless we otherwise determine for strategic or similar reasons, report the matter to governmental authorities for investigation and potential criminal action, as appropriate. In addition, and to the extent that we have the available financial resources, we intend to take all reasonably required measures in an effort to mitigate any potential adverse economic impact , which may include civil actions seeking redress, restitution and/or damages based on loss to the Company and/or unjust enrichment.

EcoSmart owns the rights to two unique registered trademarks for its proprietary digital flooring system. One of these is for the name " EcoSmart Digital Flooring" system itself , and the other is for a name the use of which the Company has abandoned and has no present intention of using or otherwise benefitting from in the future. The Company is in the process of evaluating its options in connection with the registering of other trademarks, both for its specialty coatings business and its specialty surfacing business, and this process is expected to be ongoing. Unlike patent rights, ownership rights in trademarks do not expire if the trademarks are continued in use and properly protected.

EMPLOYEES

As of April 15, 2015, we had six full-time and one part-time employees/contractors. One full-time employee/contractor is part of the senior-level executive team, two full-time employees/contractors and one part-time employee/contractor are part of the product research and development and business development team, one full-time employee/contractor is part of the marketing, customer service and sales team, one full-time employee/contractor is part of the manufacturing team, and one full-time employee/contractor is part of the financial management and administration team.

We rely heavily on our current officers and directors in operating the business. We are not subject to any collective bargaining agreements and believe that our relationships with our employees/contractors are good.

| 18 |

ITEM 1A. RISK FACTORS.

Several of the matters discussed in this annual report on Form 10-K for the fiscal year ended December 31, 2014 contain forward-looking statements that involve risks and uncertainties. Factors associated with the forward-looking statements that could cause actual results to differ from those projected or forecast are included in the statements below. In addition to other information contained in this annual report, readers should carefully consider the following cautionary statements and risk factors.

An investment in the Company is highly speculative in nature and involves an extremely high degree of risk.

GENERAL BUSINESS RISKS

We are operating at a substantial working capital deficit and our liquidity and capital resources are very limited.