UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Commission file number 000-52534

PARALLAX HEALTH SCIENCES, INC.

(Exact name of registrant as specified in its charter)

Nevada | 46-4733512 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

One Boston Place, Suite 2600, Boston, MA | 02108 |

(Address of principal executive offices) | (Zip Code) |

|

|

Registrant's telephone number, including area code: | (617) 209-7999 |

Copy of all Communications to:

Lawrence I. Washor

Washor & Associates

21800 Oxnard Street, Suite 790

Woodland Hills, CA 91367

(310) 479-2660

|

| |||||

|

| |||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. | Yes ¨ No ☑ | |||||

|

| |||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes ¨ No ☑ | |||||

|

| |||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. | Yes ☑ No ¨ | |||||

|

| |||||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registration statement was required to submit and post such files). | Yes ☑ No ¨ | |||||

|

| |||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | Yes ¨ No ☑ | |||||

| ||||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. | ||||||

| ||||||

| Large accelerated filer | ¨ |

| Accelerated filer | ¨ |

|

| Non-accelerated filer | ¨ |

| Smaller reporting company | ☑ |

|

| ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ¨ No ☑ | |||||

|

| |||||

|

| |||||

The aggregate market value of Common Stock held by non-affiliates of the Registrant as of June 30, 2013 was $798,197, based on a closing price of $0.01 for the Common Stock on June 30, 2013, the last business day of the Registrant's most recently completed second fiscal quarter. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Indicate the number of shares outstanding of each of the registrant's

classes of common stock as of the latest practicable date.

126,303,018 Common Shares issued and outstanding as of March 15, 2014

TABLE OF CONTENTS | ||

| ||

ITEM 1. | BUSINESS | 3 |

|

|

|

ITEM 1A. | RISK FACTORS | 25 |

|

|

|

ITEM 2. | PROPERTIES | 25 |

|

|

|

ITEM 3. | LEGAL PROCEEDINGS | 25 |

|

|

|

ITEM 4. | MINE SAFETY STANDARDS | 25 |

|

|

|

ITEM 5 . | MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 26 |

|

|

|

ITEM 6. | SELECTED FINANCIAL DATA | 28 |

|

|

|

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 28 |

|

|

|

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS | 33 |

|

|

|

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 34 |

|

|

|

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 35 |

|

|

|

ITEM 9A. | CONTROLS AND PROCEDURES | 35 |

|

|

|

ITEM 9B. | OTHER INFORMATION | 36 |

|

|

|

ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 36 |

|

|

|

ITEM 11. | EXECUTIVE COMPENSATION | 42 |

|

|

|

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 43 |

|

|

|

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 45 |

|

|

|

ITEM 14. | PRINCIPAL ACCOUNTANTS FEES AND SERVICES | 46 |

|

|

|

ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 47 |

2

PART I

ITEM 1. | BUSINESS |

This annual report contains forward-looking statements. These statements relate to future events or the Company's future financial performance, and include statements made by the Company regarding product development and obtaining FDA clearances. In some cases, forward-looking statements can be identified by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors" that may cause the Company's or its industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

The Company's financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars and all references to "common shares" refer to the common shares in the Company's capital stock.

As used in this annual report, the terms "we", "us", "our" and "Parallax" mean Parallax Health Sciences, Inc. (formerly Endeavor Power Corp.), and its wholly-owned subsidiary, Endeavor Sciences, Inc. (formerly Parallax Diagnostics, Inc.), unless otherwise indicated.

Corporate Overview

The Company's principal executive office is located at One Boston Place, Suite 2600, Boston, MA 02108, with operations at 1327 Ocean Avenue, Suite M, Santa Monica, California, 90401. The Company's telephone numbers are (617) 209-7999 (Boston) and (310) 899-4442 (Santa Monica).

The Company's website under construction will be at www.parallaxhealthsciences.com . The Company's subsidiary website is at www.endeavorsciences.com .

The Company is currently a fully reporting Company with its stock traded on the OTC Bulletin Board and the OTCQB under the symbol "PRLX".

On March 8, 2013, the Company was notified that the Securities and Exchange Commission ("SEC") had suspended the trading of the Company's securities for 10 days, until March 21, 2013. This temporary suspension of trading arose out of concerns that the Company had incorrectly stated within its public filings and press releases that certain components related to the Company's Target Antigen Detection System ("Target System") are patented, when these patents have expired.

The Company, after discussions with the SEC and with the Company's counsel, has addressed any questions raised regarding the accuracy of assertions in the Company's public filings. The Company has clarified the status of the patents in question, and the way in which the Company refers to its Target System components. The Company has also clarified that it currently has filed four patent applications with the USPTO, which are deemed "patent pending", and the Company has disclosed that there can be no assurance that the patents will be granted. For additional information on the Company's patent applications, please refer to the section entitled "Intellectual Property" contained within this Annual Report.

On May 10, 2013, the Company filed its new form 15c211 with a FINRA Member Market Maker, in order that the Company's shares can resume trading on the OTCBB and OTCQB markets, pursuant to Rule 15c2-11 under the Exchange Act, which states that at the termination of the trading suspension, no quotation may be entered unless and until the Company has strictly complied with all of the provisions of the rule, including the filing of a new Form 15c2-11 and obtaining FINRA approval to commence trading. On August 19, 2013, FINRA approved the resumption of trading.

Table of Contents

3

Corporate History

Formation and Development

Parallax Health Sciences, Inc. (formerly Endeavor Power Corp.) (the "Company") was incorporated in the State of Nevada on July 6, 2005 under the name VB Biotech Laboratories, Inc. On September 21, 2007, the Company filed a Certificate of Amendment with the State of Nevada to change its operating name to VB Trade, Inc., with principal business operations to develop an online website that allowed web designers to sell their website designs in exchange for a commission on all products that were sold through the website. On September 21, 2007, the Company entered into a Plan of Merger (the "Merger") with Endeavor Uranium, Inc., a mineral exploration company with mineral properties in the northwestern United States. Effectively, the Company changed its name to Endeavor Uranium, Inc. as part of the Merger transaction. On December 23, 2008, the Company entered into a Joint Venture Agreement (the "Agreement") with Federated Energy Corporation, a Tennessee corporation, for working interests in prospective oil and gas wells located in Nowata County, Oklahoma. Effectively on December 23, 2008, the Company changed its operating name to Endeavor Power Corporation.

In November 2010, Management assessed a potential business opportunity and determined that in an effort to create value for its Shareholders, the Company should change its business direction. On November 8, 2010, the Company discontinued its operations in its working interests in oil and gas exploration and changed its operating focus to the development of E-Waste processing services aimed at industrial and government clients. The Company's new direction sought to limit the impact of discarded "E-Waste" on the environment, as discarded computers and electronic equipment pose environmental hazards.

On May 26, 2011, Mr. Alfonso Knoll resigned from all positions with the Company, including but not limited to, that of President, Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary. The resignation did not involve any disagreement with the Company. On June 8, 2011, the Company entered into a Settlement Agreement and General Mutual Release ("Settlement Agreement") to terminate Mr. Knoll's Employment Agreement dated November 8, 2010, and to accept his resignation. Pursuant to the Settlement Agreement, Mr. Knoll immediately ceased all services to the Company and, on June 11, 2011, returned to the Company any and all shares of its common stock currently held by him.

On June 2, 2011, Mr. Matthew Carley was appointed as the Company's President, Chief Executive Officer, Chief Financial Officer, Treasurer, Secretary and Director. Mr. Carley accepted the appointment, but effectively resigned his positions on September 27, 2011. The Company's Board of Directors accepted the resignation of Mr. Carley, as well as the resignation of Mr. Keith Kress as a member of the Board of Directors. Simultaneously, the Board of Directors appointed Tom Mackay as the President/Chief Executive Officer, Secretary, Treasurer/Chief Financial Officer and the sole member of the Board of Directors.

In accordance with a change in management effective September 27, 2011, the Company's business operations changed. The Company intended to change its business focus to provide managerial services, and pursue potential funding opportunities for the Company. It also retained consultants to perform due diligence on certain mining properties located in Venezuela, Brazil, Bolivia, Guyana and several other South American countries. Management, however, determined that the outcome of such due diligence did not provide the Company a viable opportunity, nor did it provide sufficient economic benefit for the Company. Management therefore pursued other viable opportunities to increase shareholder market value.

During 2012, the Company's management entered discussions and assessed a potential business opportunity with Parallax Diagnostics, Inc., a Nevada corporation ("Parallax'), whose principal line of business is in the bio-medical sector.

On November 1, 2012, the Company, and its wholly owned subsidiary Endeavor Holdings, Inc. ("Endeavor Holdings") entered into an Agreement and Plan of Merger (the "Parallax Merger") with Parallax and the shareholders of Parallax (the "Parallax Shareholders"), whereby Endeavor Holdings acquired 100% (one hundred percent), or 24,870,000 shares, of Parallax common stock (the "Parallax Stock") from the Parallax Shareholders. In exchange for the Parallax Stock, the Company issued 90,375,750 shares of its common stock to the Parallax Shareholders. The 90,375,750 shares, issued at par value $.001, represent approximately 60% of the Company's total issued and outstanding shares. The Common Stock Purchase Agreement, and subsequent transaction closing, was completed on October 22, 2012. On October 27, 2012, the Common Stock Purchase Agreement was finalized, and a change in control of the Registrant took place.

As a further condition of the Merger Agreement, the then-current officer and director of the Company, Mr. Gardner Williams, resigned from all positions, and Mr. J. Michael Redmond was appointed to serve as Chief Executive Officer and President of the Company, and also as a Director on the Board of Directors. Additionally, Ms. Calli Bucci was appointed to serve as the Company's Treasurer and Chief Financial Officer, Mr. Kyle W. Withrow was appointed to serve as the Company's Corporate Secretary, Dr. Roger Morris was appointed to serve as the Company's Chief Science Officer, and Mr. Mike Contarino was appointed to serve as the Company's Vice President. Mr. Edward W. Withrow III was appointed to serve as Executive Chairman of the Board of Directors, and Mr. Redmond, Dr. Jorn Gorlach, Mr. Anand Kumar, Mr. David Engert and Mr. E. William Withrow Jr. were appointed to serve as Directors.

As a result of the transactions effected by the Merger Agreement, (i) Parallax merged with and into Endeavor Holdings whereupon Endeavor Holdings continued as the surviving entity and the corporate existence of Parallax ceased; (ii) the former business of Parallax is now the Company's primary business, (iii) the Company's existing business activities will continue as ancillary operations, and (iv) there is a change of control whereby the former shareholders of Parallax now own a controlling 60% ownership interest in the Company on a fully diluted basis.

4

On November 26, 2012, Parallax Diagnostics, Inc. changed its name to Endeavor Sciences, Inc. ("ESI"), a wholly owned subsidiary of Parallax Health Sciences, Inc.

On July 22, 2013, the Company entered into a binding Letter of Intent ("LOI") for the acquisition of a privately held California corporation, whose primary operations are in the pharmaceutical industry (the "NewCo"). Since completion of its due diligence, the Company has been working with financial institutions to secure a combined debt-equity financing that will enable the Company to complete the acquisition. There can, however, be no guarantee that satisfactory financing arrangements will be secured to complete the acquisition.

The Company's management and the NewCo management have completed negotiations, the terms of which are confidential and will be disclosed upon completion of the acquisition. On March 28, 2014, the Company's board of directors issued a board resolution authorizing the acquisition.

On January 9, 2014, the Company changed its name from Endeavor Power Corp. (OTCQB.EDVP) to Parallax Health Sciences, Inc. (OTCQB.PRLX).

NOTE : The following sections of this annual report and any further reference made to "the Company", "we", "us", "our" and "Parallax " shall mean Parallax Health Sciences, Inc. (formerly Endeavor Power Corp.) and its wholly-owned subsidiary, Endeavor Sciences, Inc. (formerly Parallax Diagnostics, Inc.), unless otherwise indicated.

Description of Business

The Company is a development stage company whose principal line of business is in the bio-medical sector. More specifically, the Company, through its wholly owned subsidiary, Endeavor Sciences, Inc. ("ESI"), is focused on the exploitation of a diagnostic and monitoring platform and processes.

Product Strategy and Overview

In recent years, there has been a continuing shift from the use of laboratory-based analyzers to point-of-care ("POC") tests that can be performed in a matter of minutes. Unlike the centralized clinical laboratory segment of the diagnostic market, which is mature and highly competitive, the POC market is still in its relatively early stages, According to the recent worldwide research reports, however, such as the 2010 Worldwide IVD Market, by the research firm Kalorama Information, the growth rate of the POC market continues to rise. Although certain simple, single analyte diagnostic tests have been developed, such tests have remained incapable of precise and highly sensitive quantitative measurements. As a result, medical tests that require precise quantization of the target analyte have remained the domain of immunoassay analyzers in the centralized laboratory.

Point-of-care diagnostic kits typically consist of test strips that the health care provider applies a patient's sample to and then reads the strip either visually or with an instrument in order to determine a result. They are simple to use, fast, disposable and reliable within an acceptable range. More sensitive analytes or tests requiring quantitative analysis and definitive antibody screening needed in most situations, must be sent out to a diagnostic lab, and hours or days later results arrive. These tests are comparatively complex, expensive, and time consuming; only centralized diagnostic facilities can manage sample handling and the cost of instruments and reagents. A point-of-care instrument that has the advantage of a test strip device in terms of ease of use and rapid results along with ELISA-like capabilities for major diseases would circumscribe diagnosis routinely within the course of a patient visit. This could disrupt the current model. The Company is developing just such a device that it intends to sell to doctors and health care providers.

The commercial success of the current generation of small, simple to use diagnostic devices which provide rapid results in POC applications has been limited by their inability to provide precise, highly sensitive, quantitative measurement.

Despite these limitations, the rapid increase in discovery of individual markers of disease processes, coupled with the advancements in rapid detection technologies, has made these tools available to medical professionals on a wide scale and POC diagnostics are quickly becoming a high growth industry.

The Company believes that there is market potential for advanced POC diagnostic products that provide quick and accurate diagnosis during a patient visit, shortening the decision time to medical intervention and minimizing the need for additional patient follow-up, thereby reducing overall health care delivery costs.

The Company's Target System (the systems includes the VT-1000 Desktop Analyzer, the Target Antigen Detection Cartridge and associated reagents) technology addresses these limitations by applying sophisticated immunochemical and optical methods to detect and quantify analytes present in various human specimens, including blood, urine, and feces. Data indicates that sensitivity will be comparable to expensive and complicated laboratory-based analyzers.

The Company also believes that there is growth opportunity for the exploitation of its Target System platform in developing nations and regions such as Africa, India, South America, Eastern Europe, Russia and Asia as well as developed markets of North America and Western Europe. One of the first initiatives to be developed for this market will combine the Company's SPARKS Mobile (a portable hand-held diagnostic analyzer based on the VT-1000 Desktop Analyzer technology, but smaller and more portable), currently in development, with a test for the monitoring of AIDS/TB patients through the use of a proprietary rapid point-of-care immunoassay CD4-CD8 test called PROMISE CD4, also in development.

Table of Contents

5

The Products

Overview

The Company's product line will include a previously FDA-cleared VT-1000 Desktop Analyzer and more than a dozen FDA 510(k) cleared diagnostic tests.

The Company's previously FDA-cleared VT-1000 Desktop Analyzer and immunoassay system incorporates a flow-through rapid antigen test platform configuration that has the ability to produce high-performance quantitative blood test results with the ease of rapid qualitative diagnostic strips. The Company has patent applications related to its current and future products, as well as methods for future test development. The Target VT-1000 Desktop Analyzer is ideally suited for rapid development and commercialization of all new tests that may be introduced.

VT-1000 Desktop Analyzer: Quantitative and Qualitative Immunoassay

The Company's VT-1000 Desktop Analyzer was FDA 510(k) cleared and is capable of rapidly detecting qualitative and quantitative data for the Company's FDA-cleared Target Platform tests. The VT-1000 Desktop Analyzer is used for all Target Platform Tests, allowing for clinical personnel to be trained once and also gives consistent results for either qualitative or quantitative testing.

Target Antigen Detection System ("TADS")

The Target Antigen Detection System consists of a unique disposable cartridge with preloaded reagents capable of testing multiple test markers, combined with the VT-1000 Desktop Analyzer. The TADS requires a small amount of sample and provides results in minutes. The simplicity of the fully loaded disposable test cartridge and subsequent ease-of-use of the instrument helps to alleviate the technical burden on medical staff and makes patient diagnosis more efficient.

The Company's Target Antigen Detection System is a departure from the standard devices typical to the rapid testing markets. The device is part of the manufacturer's qualitative and quantitative "Target System Diagnostics Platform," which offers an array of improved modifications and features to the traditional qualitative and semi-quantitative flow-through immunoassay test. With its platform uniformity, vacuum pump, absorption layer for sample overflow, and complete compatibility with single and multi-light source reflectometer technology, the TADS cartridge is a unique collection of tests for qualitative and quantitative detection diseases and of conditions.

The Company is currently developing the SPARKS Mobile, a hand-held analyzer unit, similar in size to a mobile phone/PDA, which will be based on the VT-1000 Desktop Analyzer (see Products in Development).

TADS Vacuum Control Flow Device

The TADS cartridge utilizes a vacuum technology to deposit specimen samples uniformly on test membranes. The Vacuum Control Flow Device provides a vacuum pump action, which reduces test time and ensures maximum contact with the membrane antibodies. This collection device allows for numerous tests to be incorporated. The vacuum specimen filtration and excess specimen absorption is built right in.

Target System Patent Status: The Target System and certain of its related components were previously issued patents by the United States Patent and Trademark Office ("USPTO"). The following previously-issued patents have expired:

USPTO Patent # | Description | Date Filed in US | Date Expired |

US4,748,042 | Target Ringing & Spotting Machine (method and Apparatus for Imprinting membrane with pattern of antibody) | May 31, 1988 | May 31, 2008 |

US4,797,260 | Target Cassette (Antibody testing system) | January 10, 1989 | January 1, 2009 |

US5,137,691 | Target Cassette with Removable Air Gap (Antibody testing system with removable air gap) | August 11, 1992 | August 11, 2012 |

The Company's Current Technology

The Company currently holds the rights to certain technology related to the VT-1000 Desktop Analyzer and the Target System, for which four patent applications have been filed and are pending with the USPTO.

The Company also retained the services of Marathon Patent Group to perform an analysis of the Company's intellectual property ("Patent Report"). The Patent Report, included in this filing as Exhibit 99.2, was issued on April 1, 2013, and was intended to inform the Company and its shareholders of the accurate and current state of the commercial patent pending coverage and, where possible, to identify the existence of novel and patentable inventions present in the current innovation initiative. The Patent Report concluded that the Company has a strong patent portfolio protecting its business, and recommended that the Company aggressively proceed with additional patent applications to protect the Company's inventions and innovations. As a result, the Company has initiated the drafting of a minimum of one (potentially two) additional USPTO and International patent applications.

6

There can be no assurance that the Company will be granted patents for any of the patent applications it has filed with the USPTO.

For more information on the Company's patent applications, please see the section entitled "Intellectual Property" contained within this Annual Report.

The Company's previously FDA-Cleared Tests in the area of Infectious Diseases

Rubella

Rubella, German measles, is a highly contagious disease, which is generally transmitted by direct contact with infected persons. Rubella is generally a mild disease. However, when a pregnant woman becomes infected with rubella, the virus may infect the placenta, multiply and induce serious damage to the fetus. Rubella and congenital rubella syndrome became nationally notifiable diseases in 1966. The largest annual total of cases of rubella in the United States was in 1969, when 57,686 cases were reported (58 cases per 100,000 populations). Following vaccine licensure in 1969, rubella incidence fell rapidly. By 1983, fewer than 1,000 cases per year were reported (<0.5 cases per 100,000 population). A moderate resurgence of rubella occurred in 1990-1991, primarily due to outbreaks in California (1990) and among the Amish in Pennsylvania (1991). In 2002 a record low annual total of 18 cases were reported.

Rotavirus

Human rotavirus is recognized as a major cause of gastroenteritis in infants, young children, and the elderly. During the winter months a portion of gastroenteritis in children is due to rotavirus infection. The disease manifests with the symptoms of vomiting, diarrhea, and fever. Rapid and accurate diagnosis is important to avoid inappropriate antibiotic therapy, provide proper treatment early, and to prevent spread of nosocomial infection.

Globally, rotavirus accounts for an estimated 125 million cases of diarrhea each year and represents 30% - 40% of hospitalizations for diarrhea in children less than five years. In developing countries, between 600,000 and 800,000 children die from rotavirus each year (or approximately 2,000 children each day.) This accounts for about one quarter of the deaths from diarrhea and about 5% of all deaths among children less than five years of age.

CMV- Herpes

Cytomegalovirus (CMV) is a human viral pathogen belonging to the Herpes family. Infection in humans is widespread and usually results in asymptomatic disease. However, severe symptomatic infections are a very significant risk in infants and Immuno-compromised individuals. An important primary source of such infection is via blood transfusion and allograft transfer. The serological status of donor and recipient is, therefore, important in patient management.

The United States is not unique in its high rates of CMV seroprevalence. Virtually every country in the world presents similar numbers. Since recurrences are often mild and few patients are aware that they are infected, the infection is likely to continue to rise at double-digit rates without an intervention.

Group A Streptococci: Strep A, Strep Throat, Necrotizing Fasciitis, impetigo

Strep throat is an infection of the pharynx (the part of the throat between the tonsils and the larynx) caused by streptococcus bacteria. The infection is spread by person-to-person contact with nasal secretions or saliva, often among family or household members. Even though the sore throat usually gets better on its own, people who have strep throat should take antibiotics to prevent some of the more serious complications of this infection, particularly acute rheumatic fever.

Approximately 15% of children who have a sore throat and fever are infected by Group A streptococci. CDC estimates that approximately 9,100 cases of invasive GAS disease (rate: 3.2/100,000) and 1,350 deaths occurred nationally during 2002. Disease incidence was highest among children aged <1 year (6.9/100,000) and adults aged >65 years.

Infectious Mononucleosis: EB, Epstein-Barr Viral Syndrome, Mono

Infectious mononucleosis (IM) is a viral infection causing high temperature, sore throat, and swollen lymph glands, especially in the neck. The Epstein-Barr virus typically causes it. Infectious mononucleosis may begin slowly with fatigue, malaise, headache, and sore throat. The sore throat becomes progressively worse, often with enlarged tonsils covered with a whitish-yellow fibrinous exudate. The lymph nodes in the neck are frequently enlarged and painful. Symptoms of mononucleosis gradually subside over a period of weeks to a month. The disease is generally self-limited.

Tests Currently in Development for the Target System Diagnostic Platform

The Company is in the process of developing and obtaining FDA clearance for the following products. There can be no assurance that the Company will be successful in developing such tests or in obtaining the required FDA clearance.

Table of Contents

7

HIV 1 & 2 TADS Rapid Test

Today, 42 million people are estimated to be living with HIV/AIDS. Of these, 38.6 million are adults. 19.2 million are women, and 3.2 million are children under 15. During 2002, AIDS caused the deaths of an estimated 3.1 million people, including 1.2 million women and 610,000 children under 15. With the recent advent of Rapid HIV testing, HIV detection and prevention programs around the world have become increasingly effective by reducing their time and costs of detecting the virus, thus allowing for a far greater number of individuals to be screened. The FDA has approved several rapid Immunoassay tests for the detection of HIV, but none of these tests are designed for HIV 1 and 2. The current "rate" of these "rapid" tests is from 15 minutes to hours and only a few can produce results less than 15 minutes.

The Company has an HIV 1 & 2 qualitative rapid test in development. The Company realizes that there are numerous competing HIV 1 & 2 tests but has decided to develop the test so that health care providers utilizing the Target VT-1000 Desktop Analyzer and Platform would have the opportunity to incorporate the Company's HIV 1 & 2 test into their use of the Company's platform. The Company has prepared a Clinical Trial Protocol to test the accuracy of the test and the efficacy and specificity of the results. The Company will need to secure additional capital to conduct the FDA-required trials and to prepare the test for commercialization if the FDA approves it for commercialization.

Additional Products in Development

The Company also believes that there is growth opportunity for the exploitation of the Target System platform in developing nations and regions such as Africa, India, South America, Eastern Europe, Russia and Asia as well as developed markets of North America and Western Europe.

One of the first initiatives for the development of this specific market will be to combine the SPARKS Mobile, the Company's hand-held analyzer (the portable version of its VT-1000 Desktop Analyzer), currently in development, with a test for the monitoring of HIV/AIDS patients and Tuberculosis patients, through the use of the Company's proprietary rapid POC immunoassay PROMISE CD4 quantitative test, also in development.

The Target System Hand-Held Analyzer: SPARKS Mobile

The Company's next generation Target System Analyzer, the SPARKS Mobile, a hand-held analyzer currently under development, will include a small, rapid testing format, in conjunction with a hand-held data acquisition and test reading device. The SPARKS Mobile will be a re-engineered version of the Company's previously FDA-approved VT-1000 Desktop Analyzer.

Whether searching for markers in the blood stream, or diagnosing a pathogen in urine, the Company's SPARKS Mobile will be a portable tool for rapid diagnostics. The SPARKS Mobile will also provide an improvement in POC diagnostics and applications in countries with limited health care infrastructures and geographic limitations, both of which are of paramount importance in the combat against infectious diseases and in the fight against proliferation of endemic and pandemic diseases.

This innovative SPARKS Mobile will allow for a fast (minutes instead of hours or days) performance of tests at the point-of-care, and will only require a test cartridge and a small number of ready-to-use solutions in preformatted quantities. Moreover, the SPARKS Mobile will include the ability to store patient information, test data, and QC data, and transmit data through wireless connections.

The SPARKS Mobile is being developed to:

a)

achieve a portable monitoring system, which is compatible with proven and reliable ELISA-based target system technology.

b)

expand readout capabilities to provide a mobile testing and monitoring platform.

c)

increase the economy of scale and scope of the diagnostics and monitoring platform by the development of additional utility of the device without redundant infrastructure investments (additional data acquisition of patients, additional tests for other, predominant diseases).

The basic design of the Company's SPARKS Mobile is based on the same 510(k) cleared technology employed in its VT-1000 Desktop Analyzer and is compatible with existing Test Cartridges. However, a number of innovative features will be integrated into the design to meet customer and patient needs:

1.

High Infrared Light Spectrum : Multiple light source system providing variable light wave analysis into the infra-red spectrum. This diversity in light source and detection will allow for the simultaneous identification and diagnosis of a broader spectrum of different targets within the same sample and assay. It will also allow for very specific test development, without having to develop a new analyzer to read the results.

2.

Easy Field Upgrades : Field software upgrades made through memory chip (SIMM) or Flash memory stick.

8

3.

No Change of Equipment : The same Analyzer will be used for all Target System Tests (example: Cardiac Panel., infectious disease), and will be able to be used on all future tests, allowing for training personnel only once, and displaying consistent test results on an easy to read LCD screen.

4.

Printer Hook-up Capability : When hooked to a printer, the SPARKS Mobile will be able to provide printed results for any Target System Test, both Qualitative (when written results must be stored with original test for HIPPA and other compliance issues), or Quantitative (measured amount analysis must be printed and maintained in the patient chart folder).

5.

Low Entry Cost for New Test Development and Analysis : Due to the technologies' broad capability, a new analyzer will not have to be developed for different samples types (blood, serum, plasma, urine, soil or human skin).

6.

Safety, Security and Accuracy by design: For all tests, the SPARKS Mobile bar code activation system will identify the test to be analyzed.

7.

Desk to Docking Station : The SPARKS Mobile will be able to be configured with or without a desk-to-docking station. The docking station will provide a stationary platform when in use in an office or non-mobile application. It will also provide the user to set up multiple tests samples while the analyzer is processing tests.

8.

Smart Phone Capability: The SPARKS Mobile will have many Smart Phone Capabilities including, but not limited to, Bluetooth, WiFi, MMS messaging, SMS, Memory Cards, internal memory expandable to 8GB, data transfer, and more.

The SPARKS Mobile is being specifically designed to work with the Company's Target System Diagnostics Platform to provide reliable quantitative results within minutes, right at the point-of-care or site of testing. The continuity of the Company's Platform upgrades and the continuous development of new tests based on an increasing point-of-care market paradigm, points to the VT-1000 Desktop Analyzer and the SPARKS Mobile as low cost alternatives to large laboratory analyzers and specialized training of personnel on multiple machinery. The ultimate value to the clinician or the attending physician is the ease of use, reproducibility and the history of accuracy of this type of rapid immunoassay principle in the area of quantitative analysis.

PROMISE CD4: CD4-CD8 Rapid Monitoring Test

The Company has initiated the development of the CD4-CD8 monitoring rapid test using an immunoassay test the Company has named PROMISE CD4, which the Company believes has the potential to enhance the testing, monitoring and treatment of AIDS patients in developing economies such as South Africa, Sub-Saharan countries, India and other nations struggling to deal with the treatment of AIDS. The PROMISE CD4 monitoring test is being developed in conjunction with some of the leaders of research in the HIV testing community.

AIDS Diagnostics and Immune Status

The Company's aim is to use markers for a disease progression instead of using the cell count method that is associated with and based on those markers. The PROMISE CD4 will include quantification of CD4-CD8 protein in either total blood or CD3 + pre-selected cell populations. This quantification can directly be used to assess an individual's immune status.

AIDS Immune Status: Value Proposition

The treatment of AIDS patients represents a challenge in the developed world and much more so in developing countries. The current methodology to determine the status of an HIV-positive individual involves elaborate technologies to determine the immune status of an individual as well as the presence of the HIV virus in the individual's blood (called the "viral load").

Determination of the immune status is usually performed through so-called cell counts of T-cells, in particular the determination of CD4 + cell count or the relationship of CD4 and CD3 positive cells. This diagnostic procedure requires high-tech machinery (e.g. cell counters), and well-educated laboratory personnel in a stationary laboratory setting. In addition, the cell counting method presently employed and defined by the Western medical community as the "Gold Standard" has shortcomings, which limit its reproducibility and reliability. These factors might cause changes in diagnostic procedures even within those communities in the future. The determination of the amount of virus populating the blood of a person infected with HIV is currently performed through quantitative PCR, again a method requiring stationary settings, as well as highly educated personnel and sophisticated machinery. These setting are usually not available in developing economies. While, in the Western economic environment, the medical care of HIV positive individuals and AIDS patients involves a combination of the above mentioned medical diagnostics in combination with additional, patient dependent procedures, the situation in developing countries looks to the contrary.

Table of Contents

9

In South Africa, the country with one of the highest infection rates with HIV in the world, treatment is only available to a small number of infected people. Even under those medication-limited circumstances, treatment is usually administered without any diagnostic procedures concerning the immune status or the viral load of an individual in question, leading to unnecessary treatment of otherwise non-immuno-compromised individuals and the lack of treatment for others with AIDS at later progression. Countries like China have only recently begun to diagnose for HIV positive individuals, and have not moved into the AIDS diagnostic either. The same can be said for many other countries in Africa and Asia.

Requirements for "appropriate" AIDS diagnostics have been defined by many national and international, organizations, amongst them the World Health Organization ("WHO"), under strong influence of scientists mainly from the US and the EU. These requirements have led to the above described situation in developing counties: No appropriate diagnosis of AIDS patients caused by requirements that cannot be achieved under the given circumstances and a strong increase of HIV infection in most of these countries over the last years.

Furthermore, the lack of financial resources are limiting to the expansion of suitable points of diagnostics. Cell counts require elaborate machinery (like FACS or alike) and there are no low-cost or highly portable testing systems available to date. There is an overwhelming demand and urgent need to reduce the costs for cell counting or other methods to determine the immune status, and to increase their usefulness in non-laboratory settings.

In addition, the geographic and social structures of many countries require a more POC oriented approach, as opposed to the dominating centralized care found in highly populated countries in North America and Europe. Therefore, it would by highly desirable to reduce the measurements used as a guide for disease progression or treatment to more simple technologies, like an ELISA performed on a handheld device or similar.

For the Company and its efforts to design a handheld diagnostics device for optimal market use, this means:

·

development of a testing system which is compatible with proven and reliable ELISA based target system technology.

·

expansion of the capabilities of handheld device to provide a mobile testing platform.

·

increase the economy of the diagnostics platform by the development of additional utility of the device without redundant infrastructure investments (additional data acquisition of patients, additional tests for other, predominant diseases).

·

acceptance of the Company's testing system as well as the platform within the medical community of African, Asian, and other countries with mounting problems in the field of HIV and other infectious diseases.

Tests for Other Diseases

The Company's testing system is not limited to HIV or AIDS diagnostics. The test format has been applied in the past to viral and bacterial infections (e.g., Rubella, Rotavirus, Strep. A), and can easily be adopted toward other epidemics. Diseases like malaria, cholera, hepatitis, yellow fever, or West Nile virus and other viral diseases present increasing health threats to large populations in the world, with major existing problems at the stage of proper diagnosis. The Company believes that it can adapt its VT-1000 Desktop Analyzer and SPARKS Mobile to the rapid, simple, point-of-care diagnosis of almost all of these diseases without the requirement of additional equipment. Further, the Company believes that the combination of a mobile, hand-held testing device with a large number of different tests provided by a family of cartridges will improve the ability of current health care and disease diagnostics in a fast majority of today's underserved regions. In addition, the Target System Platform also allows for the monitoring of environmental components influencing the health of populations, including the presence of toxins in soil and drinking water as well as contamination of food supply.

The Company's innovative process for the development of new antibodies, which is patent pending, will also be used in the identification of test markers for its Target System Platform, adding a dimension that further distinguishes the Company from its competition. The Company believes that the innovative antibody development process will allow it to create new barriers to entry on certain antigens that it identifies by subsequent patent application filings for use in conjunction the Company's VT-1000 Desktop Analyzer and SPARKS Mobile.

.

Ease of Use

The Company's platform provides tremendous flexibility in sample requirements, clinician training and result interpretation. The Company's "train once" system means the clinician can now perform a number of single use tests on a wide variety of conditions with the interpretation of results consistent through the platform paradigm. The "while you watch" speed of the test development, results in a significant cost saving in time and training.

Application and Economy of Scale

The Company's unique vacuum pump action reduces test time and ensures maximum contact with the membrane antibodies. This collection device is versatile in the number of different tests that can be incorporated. The economy of scale is provided to health care provider or any other customer group by being able to utilize a single test system for multiple tests with varies little variance in training needed. A clinician can move from one test to the next in a matter of minutes.

Furthermore, the capability of acquiring and transmitting patient related data in addition to the tests performed at the point-of-care will enable the Company's SPARKS Mobile Analyzer to become the central diagnostic device in a decentralized, patient oriented, and cost-conscious environment to provide or maintain a high level of health care in the face of threatening epidemics.

10

Safety and Accuracy by Design

For all tests, the Company's bar code activation system will identify the test to be analyzed, allowing only those medical personal that possess that test will be aware that it is available. Without the Company's specific Target System Test Cartridge, read by the bar code reader, the analyzer will not calibrate to that test. This precludes mistakes by the user or erroneous results by the device.

Each Test Cartridge bar code must be read to initialize the analyzer, and load the appropriate algorithm from the software table. This provides a level of security for patient related tests and eliminates errors based on operator's mistakes.

The Company will provide a combination of innovative, fast, and inexpensive diagnostic testing products with a highly mobile data collection and transfer test reader. In this regard, the Company's Target System is suitable for rapid, point-of-care testing in almost every environment, which includes emergency situations, remote locations within the US as well as other parts of the world, immediate response teams, personal testing in a home setting, and many more.

Advantageously, many different tests can be performed using the same reader, e.g., either the Company's VT-1000 Desktop Analyzer or its SPARKS Mobile, currently in development, at any location.

Mobility

The Company's mobile testing, data acquisition, and data transmission system being developed is intended to meet the needs for diagnostics in particular in areas where either no structured health care systems exist or where, due to geographic nature and population density and distribution, a more decentralized approach is necessary. The highly mobile test reader can be used in basically all environments, and will be suited to use power sources independent of an electric network (rechargeable batteries, solar panel, running on motor vehicle voltage and power supply). Furthermore, the tests can be performed within short time periods, and do not require the performing medical personnel, the physician, or the patient to return for test results or potential initiation of treatment.

New Product Screening Criteria

The Target System Platform is broken down into three categories and their associated sub-groups. The categories are:

1. | Qualitative |

2. | Quantitative |

3. | Specialized |

The following list represents a general representation of targeted test to be developed in the area of infectious or highly contagious diseases:

· | Trichomoniasis |

· | Chlamydia |

· | Gonorrhea |

· | Genital herpes (herpes simplex virus of JSV) |

· | Genital warts (human papilloma virus or HPV) |

· | Hepatitis B |

· | H. pylori |

· | Human immunodeficiency virus (HIV) |

· | Lyme Disease |

· | Rocky Mountain Spotted Fever |

· | West Nile |

· | Asian Bird Flu |

Raw substances as well as fully developed and commercially available disease markers and antibodies for the diseases listed above as well as many others can be purchased by the Company from a variety of sources and incorporated into the Target System Platform.

This in no way represents the complete segment of Qualitative or Semi-Quantitative tests available for rapid development on the Target System Platform.

New Product Identification

·

Track all CDC, FDA, WHO, relevant reports of medical diagnostic requirements. Provide analysis of whether the test should be Specialized, Quantitative or Qualitative.

·

Determine human capital requirements: project management, outsourcing needed political needs (if any) and social needs (affiliations with association or non-profit groups).

·

Determine the market size and utilization of device needed to address identified diagnostic needs.

·

Determine from source venders what antibodies and antigens are available to use in the Company's device with minimal regulatory and manufacturing hurdles.

Table of Contents

11

·

Perform cost analysis of device manufacture, to include: regulatory application time estimates, clinical requirements, third party and vendor involvement for regulatory support.

·

Identify and prepare pre-market distributor (government or commercial) analysis for market penetration timetable and/or government contract fulfillment.

·

Identify new partnership resources if necessary for specialty devices.

·

On all Quantitative Devices the Company will determine the Biohazard level at which it is to perform its algorithm development. For highly contagious diseases, the Company will outsource its complete process to a certified lab.

·

In the development of standard quantitative test the Company will determine through the protocol process: how many tests must be performed for an I.R.B. for both the algorithm development (quantitative controls for each test process) and the accuracy of the variable light analysis.

·

All new quantitative tests will be videotaped during algorithm development (light source verification and reflectivity of known sample), and equivalency testing (where the Company compares its device to another like kind device).

·

All software developed for the Company's tests, that are not modifications of existing source code, will be previewed via written outline to the FDA.

Market Opportunities

In recent years, there has been a continuing shift from the use of laboratory-based analyzers to more technologically advanced point-of-care tests that can be performed in a matter of minutes. Unlike the centralized clinical laboratory segment, which is mature and highly competitive, the point-of-care market is still a relatively early stage market. Although certain simple single analyte diagnostic tests have been developed, such tests have remained incapable of precise and highly sensitive quantitative measurements. As a result, medical tests that require precise quantization of the target analyte have remained the domain of immunoassay analyzers.

Global Statistics

The global In Vitro Diagnostics ("IVD") market was valued at $44 billion in the year 2011, growing at a CAGR of 7.8% from 2011 to 2016. The U.S. represented the biggest market for the IVD equipment's accounting for a share of 47% of the total IVD market in the year 2011. The European region accounted for 31% of the global IVD market, with Germany accounting for the largest share of 23.24%, followed by France (16.89%) and Italy (16.41%) of the total IVD market. Asia is the fastest growing region of the global market and accounts to be 22.88% of the global market and is estimated to reach the market of $17.20 billion with a CAGR 11.3% from 2011 to 2016. China is the fastest growing market within Asia and is growing at a CAGR of 18.8% to reach the market of $1.24 billion by 2016. The Asian region is expected to be ruled by the emerging economies such as China and India, showing the highest CAGR by the year 2016. The Chinese IVD market is taking frog leap amongst the emerging nations, followed by India, Russia, and Brazil.

Budget constraints causing and unfavorable reimbursement scenario for tests especially for severe conditions like cancer are prime reasons for slow growth in the U.S. and Canadian markets. However, the condition is reverse in the Latin American countries like Brazil and Mexico. There has been huge funding from the Brazilian government and the public sector, with increased efforts being taken to prevent infectious diseases in the country by conducting all the preventive tests.

Molecular diagnostics is the largest growing segment of the global IVD market with a highest CAGR for year 2011 to 2016. The major players in the IVD market are Roche Diagnostics (Germany), Abbott Diagnostics (U.S.), Beckman Coulter (U.S.), BD Diagnostics (U.S.), and Siemens Diagnostics (Germany).

The major driving factor for the IVD industry to boom in the emerging countries is the government funding and improved healthcare facilities. However, the condition is completely reverse in the developed countries such as North America and Eu-5 as these countries are facing major financial, thus hampering the growth of the IVD industry. The major factors driving the growth of the IVD market are:

· | increased patient awareness, patient self testing, and increasing baby booming population across the globe. |

· | advancement in the technology bringing more of automated tests is also one of the major drivers for the growth of IVD market. |

Other major drivers for the growth of the IVD industry is rise in the number of diseases, like respiratory infections, hospital acquired infections, and sexually transmitted diseases. Similarly, rises in the chronic diseases such as diabetes, hypertension, cardiovascular diseases, and cancer are driving the overall IVD market.

12

Point-of-Care Diagnostics

The trend is moving toward POC diagnostics using systems and procedures, which do not require extensive laboratory equipment. Here, direct read-out technology will provide a suitable tool, which can be used in basically every environment. The global point-of-care (POC) diagnostics market reached $13.4 billion in 2010 and is expected to reach $13.8 billion in 2011. It will further grow to $16.5 billion in 2016 for a compound annual growth rate (CAGR) of 3.7% between 2011 and 2016. The growth in the POC market is expected to continue through the end of the decade.

The point-of-care market includes hospitals, clinicians, laboratories, assisted living facilities, retirement communities and geriatric facilities and the international market. The Company's system provides the platform for the development of a series of quantitative tests for important diagnostic applications that can provide results at a patient's bedside, in a doctor's office, in the emergency room, in a clinic or in an ambulance.

The two factors that are significant to the rapid growth of POC testing are technology advancements and health care economics. The development of new and improved technologies has resulted in the ability to make evidence-based medical decisions that improve patient outcomes and reduce patient acuity, criticality, morbidity and mortality. Quicker diagnosis of infectious agents can also permit the earlier prescription of appropriate medications, thereby potentially shortening the duration of illness.

Additionally, the economic climate is driving significant changes in the manner in which patients will be tested and how results are delivered. Recent revisions to government regulations, together with growing patient and insurer pressures on hospitals and physicians have increased incentives to reduce overall patient healthcare costs while providing a higher level of care to a greater number of patients. One cost-cutting measure is to reduce the high cost of diagnostic testing carried out in central laboratory sites.

The Target System provides the platform for the development of a series of quantitative tests for important diagnostic applications that can provide results at a patient's bedside, in a doctor's office, in the emergency room, in a clinic, in an ambulance, on the battlefield, on site agri-business locations, rural and economically disadvantaged areas.

The Target System expects to meet the POC diagnostic market criteria as follows:

·

Rapid turnaround time

·

Direct application of a non-critical volume or placement of sample directly into instrument

·

Disposable device or minimal maintenance required

·

Minimal technical expertise required

·

Positive identification and specimen tracking strategy that eliminates specimen identification errors

·

Simple strategy for calibration and QC

·

Transferability of data to the LIS or HIS

·

Agreement of result with accepted "Gold Standard" tests

·

Affordable cost

Immunoassays: Defined

Immunoassays are chemical tests used to detect or quantify a specific substance, the analyte, in a blood or body fluid sample, using an immunological reaction. Immunoassays are highly sensitive and specific. Their high specificity results from the use of antibodies and purified antigens as reagents. An antibody is a protein (immunoglobulin) produced by B-lymphocytes (immune cells) in response to stimulation by an antigen. Immunoassays measure the formation of antibody-antigen complexes and detect them via an indicator reaction. High sensitivity is achieved by using an indicator system (e.g., enzyme label) that results in amplification of the measured product. Immunoassays may be qualitative (positive or negative) or quantitative (amount measured). An example of a qualitative assay is an immunoassay test for pregnancy. Pregnancy tests detect the presence of human chorionic gonadotropin (hCG) in urine or serum. Highly purified antibodies can detect pregnancy within two days of fertilization. Measuring the signal produced by the indicator reaction performs quantitative immunoassays. This same test for pregnancy can be made into a quantitative assay of hCG by measuring the concentration of product formed.

The purpose of an immunoassay is to measure (or, in a qualitative assay, to detect) an analyte. Immunoassay is the method of choice for measuring analytes normally present at very low concentrations that cannot be determined accurately by other less expensive tests. Common uses include measurement of drugs, hormones, specific proteins, tumor markers, and markers of cardiac injury. Qualitative immunoassays are often used to detect antigens on infectious agents and antibodies that the body produces to fight them. For example, immunoassays are used to detect antigens on Hemophilus, Cryptococcus, and Streptococcus organisms in the cerebrospinal fluid (CSF) of meningitis patients. They are also used to detect antigens associated with organisms that are difficult to culture, such as hepatitis B virus and Chlamydia trichomatis. Immunoassays for antibodies produced in viral hepatitis, HIV, and Lyme disease are commonly used to identify patients with these diseases.

Quantitative Immunoassay Analysis

Immunoassays are powerful techniques for understanding the role of specific components in complex systems. They work on the basis of the recognition of a specific component (target X) by an antibody or equivalent (affibody, RNA aptamer, recombinant antibody, etc.), which results in the production of a detectable signal. In most cases immunoassays are qualitative, providing information in terms of signal intensity. What is really wanted, however, is quantitative assay providing information in absolute chemical terms, namely the concentration of target X.

Table of Contents

13

Quantitative Immunoassays would allow:

·

Detection of the absolute concentration of components

·

Reduce inter-assay variation in data

·

Permit successful statistical analysis of smaller sample sets

·

Permits direct comparison of data generated at independent sites or occasions.

Quantitative Immunoassays are simple to construct. They require the simultaneous analysis of experimental (or test) samples and calibration standards. The signal intensity generated by calibration standards of known concentration permits conversion of the signals generated by the test samples into absolute units of concentration.

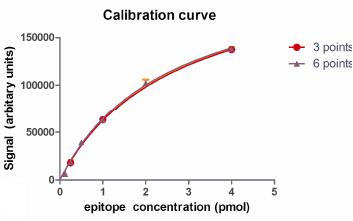

Calibration curve

A calibration curve (or standard curve) establishes the relationship between the amount of material present and the signal intensity measured. In the case of immunoassays, this would represent the relationship between the epitope concentration and the signal intensity obtained. This relationship is often non-linear, and in many applications displays a dynamic range (or response range) of approximately two orders of magnitude in the concentration of target X.

To perform a Quantitative Immunoassay, a set of "calibration standards" containing the epitope in various concentrations, are deployed in the immunoassay alongside experimental "test samples". Densitometry is performed on all data from the assay, and curve fitting used to define the relationship between epitope concentration and signal intensity. This mathematical relationship is then used to convert the signals generated by experimental samples into concentration of target X, which in the Company's experience is highly accurate.

Molecular Identity of Calibration Standards

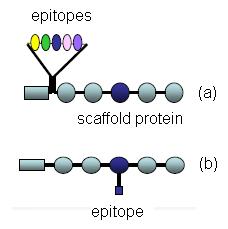

For Western Blot applications, a calibration standard is a molecule which contains the epitope feature of an immunoassay covalently bonded to a protein of known molecular weight. Two configurations of this structure are possible (Figure 1), where the epitope structure is either linked to the amino acid backbone (Fig 1a) in the form of a fusion protein or linked to a side chain of a specific amino acid (Fig 1b).

Figure

Figure 1 : Schematic representation of calibration standard molecules.

A set of calibration standards to common epitope tags (His6, c-myc, HA, FLAG, AU1, AU5, glu-glu,) was analyzed by SDS-PAGE/Western blotting (detected via the His6 tag). A single band of 55kDa was detected, and the intensity of signal decreased with decreasing calibration standard loading as expected (Figure 2).

Figure

Figure 2 : Immunodetection of a serial dilution of His6-calibration standard.

Densitometry of the data was performed and the data plotted to define the relationship between epitope amount and signal intensity (Figure 3). Mathematical fitting of the data was performed, with the best fit achieved by "one site-specific binding" analysis (GraphPad Prism) as shown in Figure 3. An excellent fit of the data was achieved using 6 calibration standard concentrations each analyzed in quadruplicate. Similar excellent fits could also be achieved by analysis of fewer standards, with indistinguishable results obtained from 3 calibration standard samples analyzed in triplicate.

Figure

Figure 3 : Mathematical description of a calibration curve.

14

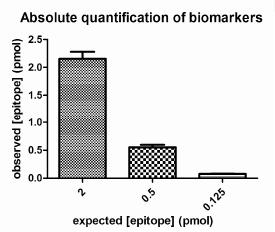

To determine the epitope concentration of an experimental sample, the mathematical description of the calibration curve is rearranged to calculate epitope concentration from raw signal intensity. Figure 4 displays the quantitative measurement of three "test" samples. Test samples of 2pmol and 0.5 pmol were analyzed and the results obtained were 2.153± 0.127 pmol (mean ± standard error, n=4), 0.552± 0.045 pmol (mean ± standard error, n=4), confirming the accuracy of the measure (Figure 4). Samples should only be analyzed which fall within the calibration range, as errors are higher for observations beyond the confines of the calibration curve e.g. 0.125 pmol in this example.

Figure

Figure 4 : Accuracy of Quantitative Immunoassays.

In summary, Quantitative Immunoassays are easy to construct and offer several valuable benefits to the researcher. They permit calculation of the absolute concentration of the component of study with high accuracy (error <10%) and high reproducibility. This enhances the quality of research results and also the productivity of research programs by facilitating the direct comparison of data obtained on separate occasions.

The Immunoassay Market

Overview

Immunoassays have been used since the mid-1960's by hospitals, laboratories and research facilities. With the widespread usage of blood and other biological specimen tests for disease and medical condition diagnoses, there is a growing need for new and better technologies to achieve fast and accurate test results. Though the traditional laboratory testing of blood samples has been an acceptable form of screening for certain conditions for quite some time, it has only been in the last twenty years that rapid POC qualitative (yes/no) and semi quantitative (based on predetermined cutoff levels) testing has become an acknowledged source of accurate information.

Rapid Immunoassay Test

With continuing breakthroughs in detectable markers in the body that can identify the presence of a growing number of diseases and conditions, coupled with the advancements in rapid detection technologies, the tools available to medical professionals is quickly becoming a booming industry.

Rapid immunoassays generally come in two configurations: Lateral Flow and Flow-Through. Examples of the rapid immunoassay test are the home pregnancy test and the on-site drug screening test. While both of these examples are based on urine specimens, many of the new rapid screening devices have been developed to use blood as the specimen. The different types of rapid immunoassay test include:

·

Lateral Flow Test

·

Solid Phase Test

·

Agglutination Assay

·

Flow Through Immunoassay

Lateral Flow Tests

A popular testing method used by both professional and over-the-counter tests, the lateral flow test is quick and efficient. Depending on the specific test kit, a sample of urine, whole blood, blood plasma, and in some cases feces, may be mixed with diluting substances, reactive agents or other solutions that are provided for the conduct of the test. Most of the tests are classified as solid phase enzyme immunoassays.

Most home pregnancy tests utilize lateral-flow technology, whereby urine is absorbed through the exposed sample application pad and is allowed (by natural wicking) to migrate to the analytical membrane and react with an embedded agent designed to change color if hormones associated with pregnancy are present in the urine. This is a direct specimen application and does not require dilution or other agents to be added for results to appear. The typical finished product in general use encases all but the application pad in plastic with view openings for the test line or dot and the control line.

Lateral flow devices have been used for home pregnancy tests, drugs of abuse testing in clinical laboratories and, more recently, for home use. Manufactured in continuous membrane strips cut to the desired length and batch tested for accuracy, the manufacture of test kits is highly automated and inexpensive, making lateral flow tests well suited for mass market applications.

Table of Contents

15

Lateral flow devices, however, can suffer in performance when the sample being tested is not handled within strict conditions. Test samples may be affected by environmental conditions (barometric pressure, temperature and humidity), thereby requiring special care in sample preparation, exact dilution controls and controlled time for the test to develop properly. Test development time, for example, can vary from a few minutes (3 to 5) for urine-based tests and up to 20 minutes for whole blood or plasma.

Solid Phase Tests

Solid phase assays include the so-called "dipstick" or "dipstick comb" tests. As its title suggests, the detection materials are in a solid state affixed to a solid, non-porous base. The dipstick is then incubated with the patient's specimen.

The solid phase tests use urine, saliva, serum, plasma, or whole blood as its specimen and the same patient can be tested for multiple parameters with a single assay. Results are usually provided in an hour or less. The sensitivity and accuracy is generally lower than the flow through and lateral flow tests.

Agglutination Test

The basic principle of an agglutination test is the formation of clumps (agglutination) of small particles coated with antigens when exposed to antibodies specific for the antigen. The test particles and the patient antibodies combine to form a visible precipitate. This usually is observed under a microscope.

Some of the advantages of the agglutination test are that its individual test cost is low, the results are semi-quantitative, and it takes a relatively short time to obtain results. However, results can vary as the test reaction depends upon careful control of the test re-agents and environmental conditions. The sensitivity/accuracy is lower than the flow through or lateral flow tests.

Flow-Through Immunoassay

The flow through test procedure requires a number of steps, and includes a vacuum device that deposits fluid containing the test sample through a porous membrane and into an absorbent pad. A second layer, or sub-membrane, inhibits the immediate back-flow of fluids, which can obscure results.

Positive, uniform deposition of test samples on a membrane containing selected diagnostic reagents provides for a flexible, inexpensive and reproducible platform technology to test for a large number of diseases.

The flow-through platform technology can be used to detect both antibodies and antigens. To perform the test, a sample is applied to the membrane followed by a wash step, the addition of the signal reagent, and a second wash to clear the membrane. The solutions can be added as rapidly as the previous liquids are absorbed into the cassette.

The time it takes for a test to display results is subject to the viscosity of the sample, which can be affected by environmental conditions, such as humidity and barometric pressure, further interfering with the time the test takes is the amount of sample used.

Limitations

Each of the screening devices described above have limitations in their utility and range of application. Many screening devices have been adopted from their use in clinical laboratories and, when applied to POC application, required special handling of the specimen samples (blood, urine, and feces) and decreased sensitivity and/or specificity.

Competition

There are approximately 40 to 50 companies in the point-of care ("POC") diagnostic industry in the U.S. and approximately another 100 outside the U.S. The POC space can be broken down into various sub-sets such as molecular biologist developing reagents, and markers to diagnostic equipment and test development companies, as well as companies who do neither and focus on marketing tests, equipment and assays. Most notably in the POC space are the large pharmaceutical companies such as Bayer, Roche, Abbot Labs and others. The Company's specific competitive landscape is tied to its patent pending process involving its SPARKS Mobile Analyzer and Target System Platform In-Vitro Tests. There are a number of companies developing mobile devices to perform a host of health industry-related services and the Company believes that more companies will enter the mobile diagnostic space in the next few years. The industry has yet to develop a standardized point of care immunoassay platform for any device to be integrated into. The goal of the Company's SPARKS Mobile Analyzer is to deliver a device that adds immediate value to health providers, patients and health insurance companies. The Company's primary goal is to create a mobile platform that could integrate and utilize the flow-through process of the Company's Target System Platform and offer the healthcare provider a system that is fully interoperable and ubiquitous with a potentially large number of in vitro tests. There are other test platforms in the space but the Company has filed a patent on the process of its SPARKS Mobile Analyzer and its TADS Cartridge. There can be no assurance that the Company's POC device will prove to be competitive with the other POC devices under development.

16

Until the Company secures a minimum of two million dollars ($2,000,000) of additional capital to operate for the next eighteen months the Company will remain highly vulnerable from the Company's competition. The Company anticipates the need for a minimum of an additional four million ($4,000,000) dollars of investment capital will be required for it to achieve its goal of developing a commercially viable rapid point of care CD4-8 immune status test and its proposed mobile SPARKS Mobile version of its FDA Approved VT 1000 Desktop Analyzer. There can be no assurance that such amount will prove adequate to develop the Company' products. Furthermore, the Company's competition has significantly greater resources that it can deploy and anytime to head off competition.

In Vitro Diagnostic Sales Leaders

·

Roche Diagnostics, Switzerland www.roche.com

·

Abbott Diagnostics, Abbott Park, IL 60064 www.abbott.com

·

Siemens Medical Solutions Diagnostics, Deerfield, IL www.diagnostics.siemens.com

·

Johnson & Johnson, Ortho Clinical Diagnostics (OCD) division, Raritan, NJ www.jnj.com

·

Beckman Coulter Inc., Fullerton, CA www.beckmancoulter.com

·

Becton, Dickinson & Co., Franklin Lakes, NJ www.bd.com

·

bioMerieux SA, Marcy l'Etoile, France www.biomerieux.com

·

Bio-Rad Laboraties Inc., Hercules, CA www.bio-rad.com

·

Arkray Inc., Kyoto, Japan www.arkray.co.jp

·

Mitsubishi,Japan www.mitsubishi.com

Top Medical Device Manufacturers

Rank | Company | Earnings |

| Rank | Company | Earnings |

1. | Johnson and Johnson | $17.7B |

| 16. | St. Jude Medical | $2.9B |

2. | GE Healthcare | $12.1B |

| 17. | Kodak Health Group | $2.7B |

3. | Medtronic | $10.1B |

| 18. | Hospira | $2.6B |

4. | Baxter International | $9.8B |

| 19. | Fresenius | $2.5B |

4. | Cardinal Health | $9.8B |

| 20. | Smith & Nephew | $2.4B |

6. | Tyco Healthcare | $9.5B |

| 21. | Synthes | $2.1B |

7. | Siemens Medical Solutions | $9.2B |

| 22. | Alcon | $2.0B |

8. | Philips Medical Systems | $7.5B |

| 23. | Biomet | $1.9B |

9. | Boston Scientific | $6.3B |

| 24. | C. R. Bard | $1.8B |

10. | Stryker | $4.9B |

| 24. | Terumo | $1.8B |

11. | B. Braun | $3.9B |

| 26. | Dentsply International | $1.7B |

12. | Guidant Corp. | $3.6B |

| 27. | Invacare | $1.5B |

13. | 3M Healthcare | $3.5B |

| 28. | Gambro | $1.4B |

14. | Zimmer Holdings | $3.3B |

| 29. | Dräger Medical | $1.3B |

15. | Becton, Dickinson & Co. | $3.0B |

| 30. | Varian Medical | $1.2B |

Barriers to Use

The main barriers and constraints to the use of rapid diagnostic tests can be put into three main categories:

·

Acceptability : Rapid tests need to be acceptable to policymakers, clinicians, and patients. Tests need to have sufficient sensitivity and specificity and need to have an adequate predictive value. Ease-of-use is critical for point-of-care use by clinicians. Culturally appropriate specimens and credible results are important if rapid tests are to be accepted by patients.

·