|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-00368

Chevron Corporation

(Exact name of registrant as specified in its charter)

Delaware |

| 94-0890210 |

| 6001 Bollinger Canyon Road, |

(State or other jurisdiction of |

| (I.R.S. Employer |

| (Address of principal executive offices) (Zip Code) |

Registrant's telephone number, including area code (925) 842-1000

Securities registered pursuant to Section 12 (b) of the Act:

Title of Each Class |

| Name of Each Exchange |

Common stock, par value $.75 per share |

| New York Stock Exchange, Inc. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☑ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ |

| Accelerated filer o |

| Non-accelerated filer o |

| Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ☑

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter - $228,635,687,380 (As of June 28, 2013 )

Number of Shares of Common Stock outstanding as of February 10, 2014 - 1,909,130,328

DOCUMENTS INCORPORATED BY REFERENCE

(To The Extent Indicated Herein)

Notice of the 2014 Annual Meeting and 2014 Proxy Statement, to be filed pursuant to Rule 14a-6(b) under the Securities Exchange Act of 1934, in connection with the company's 2014 Annual Meeting of Stockholders (in Part III)

|

1

TABLE OF CONTENTS

ITEM |

|

| PAGE NO. |

PART I | |||

1. |

| Business | 3 |

|

| General Development of Business | 3 |

|

| Description of Business and Properties | 4 |

|

| Capital and Exploratory Expenditures | 4 |

|

| Upstream | 4 |

|

| Downstream | 24 |

|

| Other Businesses | 26 |

|

| Website Access to SEC Reports | 27 |

1A. |

| Risk Factors | 27 |

1B. |

| Unresolved Staff Comments | 29 |

2. |

| Properties | 29 |

3. |

| Legal Proceedings | 29 |

4. |

| Mine Safety Disclosures | 31 |

PART II | |||

5. |

| Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 31 |

6. |

| Selected Financial Data | 31 |

7. |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 31 |

7A. |

| Quantitative and Qualitative Disclosures About Market Risk | 31 |

8. |

| Financial Statements and Supplementary Data | 32 |

9. |

| Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 32 |

9A. |

| Controls and Procedures | 32 |

9B. |

| Other Information | 32 |

PART III | |||

10. |

| Directors, Executive Officers and Corporate Governance | 33 |

11. |

| Executive Compensation | 34 |

12. |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 34 |

13. |

| Certain Relationships and Related Transactions, and Director Independence | 34 |

14. |

| Principal Accounting Fees and Services | 34 |

PART IV | |||

15. |

| Exhibits, Financial Statement Schedules | 35 |

|

| Schedule II - Valuation and Qualifying Accounts | 36 |

|

| Signatures | 37 |

|

|

|

|

EX-10.8 | EX-24.10 |

EX-10.9 | EX-31.1 |

EX-12.1 | EX-31.2 |

EX-21.1 | EX-32.1 |

EX-23.1 | EX-32.2 |

EX-24.1 | EX-95 |

EX-24.2 | EX-99.1 |

EX-24.3 | EX-101 INSTANCE DOCUMENT |

EX-24.4 | EX-101 SCHEMA DOCUMENT |

EX-24.5 | EX-101 CALCULATION LINKBASE DOCUMENT |

EX-24.6 | EX-101 LABELS LINKBASE DOCUMENT |

EX-24.7 | EX-101 PRESENTATION LINKBASE DOCUMENT |

EX-24.8 | EX-101 DEFINITION LINKBASE DOCUMENT |

EX-24.9 |

|

|

|

1

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION

FOR THE PURPOSE OF "SAFE HARBOR" PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This Annual Report on Form 10-K of Chevron Corporation contains forward-looking statements relating to Chevron's operations that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words such as "anticipates," "expects," "intends," "plans," "targets," "forecasts," "projects," "believes," "seeks," "schedules," "estimates," "budgets," "outlook" and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company's control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices; changing refining, marketing and chemicals margins; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of equity affiliates; the inability or failure of the company's joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company's production or manufacturing facilities or delivery/transportation networks due to war, accidents, political events, civil unrest, severe weather or crude oil production quotas that might be imposed by the Organization of Petroleum Exporting Countries; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant investment or product changes required by existing or future environmental statutes, regulations and litigation; the potential liability resulting from other pending or future litigation; the company's future acquisition or disposition of assets and gains and losses from asset dispositions or impairments; government-mandated sales, divestitures, recapitalizations, industry-specific taxes, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; and the factors set forth under the heading "Risk Factors" on pages 27 through 29 in this report. In addition, such results could be affected by general domestic and international economic and political conditions. Other unpredictable or unknown factors not discussed in this report could also have material adverse effects on forward-looking statements.

2

PART I

Item 1. Business

General Development of Business

Summary Description of Chevron

Chevron Corporation, * a Delaware corporation, manages its investments in subsidiaries and affiliates and provides administrative, financial, management and technology support to U.S. and international subsidiaries that engage in fully integrated petroleum operations, chemicals operations, mining operations, and power and energy services. Upstream operations consist primarily of exploring for, developing and producing crude oil and natural gas; processing, liquefaction, transportation and regasification associated with liquefied natural gas; transporting crude oil by major international oil export pipelines; transporting, storage and marketing of natural gas; and a gas-to-liquids project. Downstream operations consist primarily of refining crude oil into petroleum products; marketing of crude oil and refined products; transporting crude oil and refined products by pipeline, marine vessel, motor equipment and rail car; and manufacturing and marketing of commodity petrochemicals, plastics for industrial uses and fuel and lubricant additives.

A list of the company's major subsidiaries is presented on page E-4. As of December 31, 2013 , Chevron had approximately 64,600 employees (including about 3,200 service station employees). Approximately 32,000 employees (including about 3,000 service station employees), or 50 percent, were employed in U.S. operations.

Overview of Petroleum Industry

Petroleum industry operations and profitability are influenced by many factors. Prices for crude oil, natural gas, petroleum products and petrochemicals are generally determined by supply and demand. The members of the Organization of Petroleum Exporting Countries (OPEC) are typically the world's swing producers of crude oil and their production levels are a major factor in determining worldwide supply. Demand for crude oil and its products and for natural gas is largely driven by the conditions of local, national and global economies, although weather patterns and taxation relative to

other energy sources also play a significant part. Laws and governmental policies, particularly in the areas of taxation, energy and the environment affect where and how companies conduct their operations and formulate their products and, in some cases, limit their profits directly.

Strong competition exists in all sectors of the petroleum and petrochemical industries in supplying the energy, fuel and chemical needs of industry and individual consumers. Chevron competes with fully integrated, major global petroleum companies, as well as independent and national petroleum companies, for the acquisition of crude oil and natural gas leases and other properties and for the equipment and labor required to develop and operate those properties. In its downstream business, Chevron competes with fully integrated, major petroleum companies and other independent refining, marketing, transportation and chemicals entities and national petroleum companies in the sale or acquisition of various goods or services in many national and international markets.

Operating Environment

Refer to pages FS-2 through FS-8 of this Form 10-K in Management's Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the company's current business environment and outlook.

Chevron's Strategic Direction

Chevron's primary objective is to create shareholder value and achieve sustained financial returns from its operations that will enable it to outperform its competitors. In the upstream, the company's strategies are to grow profitably in core areas and build new legacy positions. In the downstream, the strategies are to deliver competitive returns and grow earnings across the value chain. The company also continues to apply commercial excellence to enable the success of the upstream and downstream strategies, to utilize technology across all its businesses to differentiate performance, and to invest in profitable renewable energy and energy efficiency solutions.

___________________________________

* | Incorporated in Delaware in 1926 as Standard Oil Company of California, the company adopted the name Chevron Corporation in 1984 and ChevronTexaco Corporation in 2001. In 2005, ChevronTexaco Corporation changed its name to Chevron Corporation. As used in this report, the term "Chevron" and such terms as "the company," "the corporation," "our," "we" and "us" may refer to Chevron Corporation, one or more of its consolidated subsidiaries, or all of them taken as a whole, but unless stated otherwise they do not include "affiliates" of Chevron - i.e., those companies accounted for by the equity method (generally owned 50 percent or less) or investments accounted for by the cost method. All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs. |

3

Description of Business and Properties

The upstream and downstream activities of the company and its equity affiliates are widely dispersed geographically, with operations and projects* in North America, South America, Europe, Africa, Asia and Australia. Tabulations of segment sales and other operating revenues, earnings and income taxes for the three years ending December 31, 2013 , and assets as of the end of 2013 and 2012 - for the United States and the company's international geographic areas - are in Note 11 to the Consolidated Financial Statements beginning on page FS-35. Similar comparative data for the company's investments in and income from equity affiliates and property, plant and equipment are in Notes 12 and 13 on pages FS-37 through FS-39.

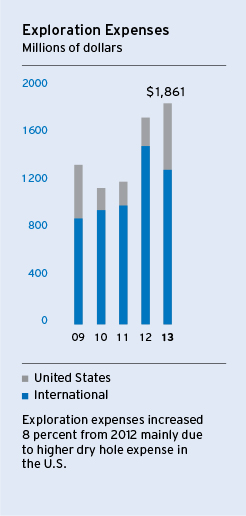

Capital and Exploratory Expenditures

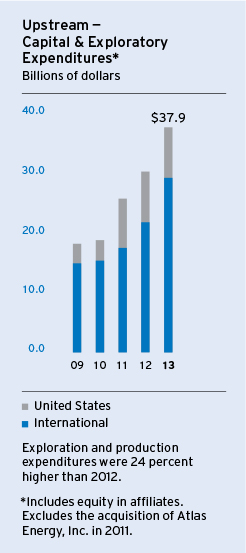

Total expenditures for 2013 were $41.9 billion , including $2.7 billion for the company's share of equity-affiliate expenditures. In 2012 and 2011 , expenditures were $34.2 billion and $29.1 billion , respectively, including the company's share of affiliates' expenditures of $2.1 billion in 2012 and $1.7 billion in 2011 .

Of the $41.9 billion in expenditures for 2013 , 90 percent , or $37.9 billion , was related to upstream activities. Approximately 89 percent was expended for upstream operations in both 2012 and 2011 . International upstream accounted for about 78 percent of the worldwide upstream investment in 2013 , about 72 percent in 2012 and about 68 percent in 2011 . These amounts exclude the acquisition of Atlas Energy, Inc. in 2011.

In 2014 , the company estimates capital and exploratory expenditures will be $39.8 billion, including $4.8 billion of spending by affiliates. Approximately 90 percent of the total, or $35.8 billion, is budgeted for exploration and production activities, with $27.9 billion, or about 78 percent, of this amount for projects outside the United States.

Refer also to a discussion of the company's capital and exploratory expenditures on page FS- 12.

Upstream

The table on the following page summarizes the net production of liquids and natural gas for 2013 and 2012 by the company and its affiliates. Worldwide oil-equivalent production of 2.597 million barrels per day in 2013 was essentially unchanged from 2012 . The benefits of lower maintenance-related downtime and higher reliability at the Tengizchevroil facilities in Kazakhstan, and ramp-ups at the Usan Project in Nigeria, in the Marcellus Shale in western Pennsylvania and in the Delaware Basin in New Mexico were offset by normal field declines. Refer to the "Results of Operations" section beginning on page FS-6 for a detailed discussion of the factors explaining the 2011 through 2013 changes in production for crude oil and natural gas liquids, and natural gas.

The company estimates its average worldwide oil-equivalent production in 2014 will be approximately 2.610 million barrels per day based on an average Brent price of $109 per barrel in 2013 . This estimate is subject to many factors and uncertainties, including quotas that may be imposed by OPEC, price effects on entitlement volumes, changes in fiscal terms or restrictions on the scope of company operations, delays in project start-ups and ramp-ups, fluctuations in demand for natural gas in various markets, weather conditions that may shut in production, civil unrest, changing geopolitics, delays in completion of maintenance turnarounds, greater-than-expected declines in production from mature fields, or other disruptions to operations. The longer-term outlook for production levels is also affected by the size and number of economic investment opportunities and, for new, large-scale projects, the time lag between initial exploration and the beginning of production. Refer to the "Review of Ongoing Exploration and Production Activities in Key Areas," beginning on page 9, for a discussion of the company's major crude oil and natural gas development projects.

___________________________________

* | As used in this report, the term "project" may describe new upstream development activity, individual phases in a multiphase development, maintenance activities, certain existing assets, new investments in downstream and chemicals capacity, investments in emerging and sustainable energy activities, and certain other activities. All of these terms are used for convenience only and are not intended as a precise description of the term "project" as it relates to any specific governmental law or regulation. |

4

Net Production of Crude Oil and Natural Gas Liquids and Natural Gas 1

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

| Components of Oil-Equivalent |

| |||||||||||||

|

|

|

|

| Crude Oil & Natural Gas |

|

|

|

| ||||||||||

|

| Oil-Equivalent (Thousands |

| Liquids (Thousands of |

| Natural Gas (Millions |

| ||||||||||||

|

| of Barrels per Day) |

| Barrels per Day) |

| of Cubic Feet per Day) |

| ||||||||||||

|

| 2013 |

| 2012 |

| 2013 |

| 2012 |

| 2013 |

| 2012 |

| ||||||

United States |

| 657 | |

| 655 | |

| 449 | |

| 455 | |

| 1,246 | |

| 1,203 | |

|

Other Americas |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Argentina |

| 19 | |

| 22 | |

| 18 | |

| 21 | |

| 6 | |

| 4 | |

|

Brazil |

| 6 | |

| 6 | |

| 5 | |

| 6 | |

| 2 | |

| 2 | |

|

Canada |

| 71 | |

| 69 | |

| 70 | |

| 68 | |

| 9 | |

| 4 | |

|

Colombia |

| 36 | |

| 36 | |

| - | |

| - | |

| 216 | |

| 216 | |

|

Trinidad and Tobago |

| 29 | |

| 29 | |

| - | |

| - | |

| 173 | |

| 173 | |

|

Total Other Americas |

| 161 | |

| 162 | |

| 93 | |

| 95 | |

| 406 | |

| 399 | |

|

Africa |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Angola |

| 127 | |

| 137 | |

| 118 | |

| 128 | |

| 52 | |

| 53 | |

|

Chad |

| 19 | |

| 23 | |

| 18 | |

| 22 | |

| 4 | |

| 6 | |

|

Democratic Republic of the Congo |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

|

Nigeria |

| 268 | |

| 269 | |

| 238 | |

| 242 | |

| 182 | |

| 165 | |

|

Republic of the Congo |

| 14 | |

| 19 | |

| 13 | |

| 17 | |

| 10 | |

| 13 | |

|

Total Africa |

| 431 | |

| 451 | |

| 389 | |

| 411 | |

| 249 | |

| 238 | |

|

Asia |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Azerbaijan |

| 28 | |

| 28 | |

| 26 | |

| 26 | |

| 10 | |

| 10 | |

|

Bangladesh |

| 113 | |

| 94 | |

| 2 | |

| 2 | |

| 663 | |

| 550 | |

|

China |

| 20 | |

| 21 | |

| 19 | |

| 20 | |

| 6 | |

| 9 | |

|

Indonesia |

| 193 | |

| 198 | |

| 156 | |

| 158 | |

| 225 | |

| 236 | |

|

Kazakhstan |

| 57 | |

| 61 | |

| 34 | |

| 37 | |

| 135 | |

| 139 | |

|

Myanmar |

| 16 | |

| 16 | |

| - | |

| - | |

| 96 | |

| 94 | |

|

Partitioned Zone 2 |

| 87 | |

| 90 | |

| 84 | |

| 86 | |

| 19 | |

| 21 | |

|

Philippines |

| 23 | |

| 24 | |

| 3 | |

| 4 | |

| 119 | |

| 120 | |

|

Thailand |

| 229 | |

| 243 | |

| 62 | |

| 67 | |

| 1,003 | |

| 1,060 | |

|

Total Asia |

| 766 | |

| 775 | |

| 386 | |

| 400 | |

| 2,276 | |

| 2,239 | |

|

Australia |

| 96 | |

| 99 | |

| 26 | |

| 28 | |

| 421 | |

| 428 | |

|

Europe |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Denmark |

| 28 | |

| 36 | |

| 19 | |

| 24 | |

| 55 | |

| 74 | |

|

Netherlands |

| 9 | |

| 9 | |

| 2 | |

| 2 | |

| 41 | |

| 42 | |

|

Norway |

| 2 | |

| 3 | |

| 2 | |

| 3 | |

| 1 | |

| 1 | |

|

United Kingdom |

| 55 | |

| 66 | |

| 40 | |

| 46 | |

| 94 | |

| 122 | |

|

Total Europe |

| 94 | |

| 114 | |

| 63 | |

| 75 | |

| 191 | |

| 239 | |

|

Total Consolidated Companies |

| 2,205 | |

| 2,256 | |

| 1,406 | |

| 1,464 | |

| 4,789 | |

| 4,746 | |

|

Affiliates3 |

| 392 | |

| 354 | |

| 325 | |

| 300 | |

| 403 | |

| 328 | |

|

Total Including Affiliates 4 |

| 2,597 | |

| 2,610 | |

| 1,731 | |

| 1,764 | |

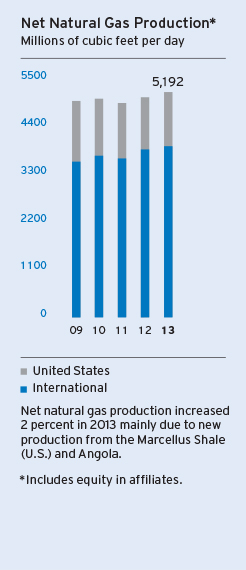

| 5,192 | |

| 5,074 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

1 Includes synthetic oil: Canada, net |

| 43 | |

| 43 | |

| 43 | |

| 43 | |

| - | |

| - | |

|

Venezuelan affiliate, net | 25 | |

| 17 | |

| 25 | |

| 17 | |

| - | |

| - | |

| |

2 Located between Saudi Arabia and Kuwait. |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

3 Volumes represent Chevron's share of production by affiliates, including Tengizchevroil in Kazakhstan; Petroboscan, Petroindependiente and Petropiar in Venezuela; and Angola LNG in Angola. | |||||||||||||||||||

4 Volumes include natural gas consumed in operations of 524 million and 522 million cubic feet per day in 2013 and 2012, respectively. Total "as sold" natural gas volumes were 4,668 million and 4,552 million cubic feet per day for 2013 and 2012, respectively. | |||||||||||||||||||

|

| ||||||||||||||||||

5

Average Sales Prices and Production Costs per Unit of Production

Refer to Table IV on page FS-64 for the company's average sales price per barrel of crude oil, condensate and natural gas liquids and per thousand cubic feet of natural gas produced, and the average production cost per oil-equivalent barrel for 2013 , 2012 and 2011 .

Gross and Net Productive Wells

The following table summarizes gross and net productive wells at year-end 2013 for the company and its affiliates:

|

|

|

|

|

|

|

|

|

| ||||

|

| Productive |

| Productive |

| ||||||||

|

| Oil Wells |

| Gas Wells |

| ||||||||

|

| Gross |

| Net |

| Gross |

| Net |

| ||||

|

|

|

|

|

|

|

|

|

| ||||

| United States | 50,533 | |

| 33,068 | |

| 14,217 | |

| 7,740 | |

|

| Other Americas | 1,042 | |

| 690 | |

| 60 | |

| 37 | |

|

| Africa | 2,608 | |

| 870 | |

| 17 | |

| 7 | |

|

| Asia | 13,530 | |

| 11,693 | |

| 3,318 | |

| 1,953 | |

|

| Australia | 808 | |

| 428 | |

| 69 | |

| 12 | |

|

| Europe | 373 | |

| 95 | |

| 173 | |

| 42 | |

|

| Total Consolidated Companies | 68,894 | |

| 46,844 | |

| 17,854 | |

| 9,791 | |

|

| Affiliates | 1,364 | |

| 476 | |

| 7 | |

| 2 | |

|

| Total Including Affiliates | 70,258 | |

| 47,320 | |

| 17,861 | |

| 9,793 | |

|

|

|

|

|

|

|

|

|

|

| ||||

| Multiple completion wells included above | 952 | |

| 677 | |

| 413 | |

| 372 | |

|

|

|

|

|

|

|

|

|

|

| ||||

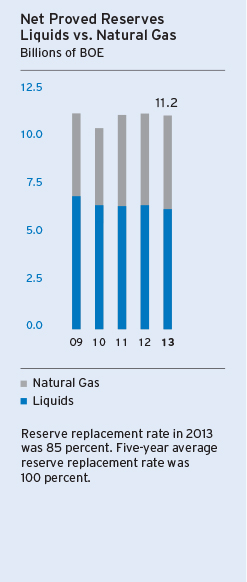

Reserves

Refer to Table V beginning on page FS-64 for a tabulation of the company's proved net crude oil and natural gas reserves by geographic area, at the beginning of 2011 and each year-end from 2011 through 2013 . Reserves governance, technologies used in establishing proved reserves additions, and major changes to proved reserves by geographic area for the three-year period ended December 31, 2013 , are summarized in the discussion for Table V. Discussion is also provided regarding the nature of, status of and planned future activities associated with the development of proved undeveloped reserves. The company recognizes reserves for projects with various development periods, sometimes exceeding five years. The external factors that impact the duration of a project include scope and complexity, remoteness or adverse operating conditions, infrastructure constraints, and contractual limitations.

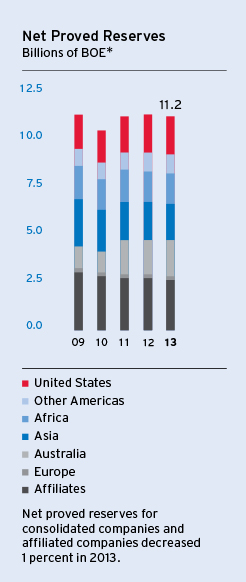

The net proved reserve balances at the end of each of the three years 2011 through 2013 are shown in the following table.

Net Proved Reserves at December 31

| 2013 |

| 2012 |

| 2011 |

| |||

Liquids - Millions of barrels |

| ||||||||

Consolidated Companies | 4,303 | |

| 4,353 | |

| 4,295 | |

|

Affiliated Companies | 2,042 | |

| 2,128 | |

| 2,160 | |

|

Total Liquids | 6,345 | |

| 6,481 | |

| 6,455 | |

|

Natural Gas - Billions of cubic feet |

| ||||||||

Consolidated Companies | 25,670 | |

| 25,654 | |

| 25,229 | |

|

Affiliated Companies | 3,476 | |

| 3,541 | |

| 3,454 | |

|

Total Natural Gas | 29,146 | |

| 29,195 | |

| 28,683 | |

|

Oil-Equivalent - Millions of barrels |

| ||||||||

Consolidated Companies | 8,582 | |

| 8,629 | |

| 8,500 | |

|

Affiliated Companies | 2,621 | |

| 2,718 | |

| 2,736 | |

|

Total Oil-Equivalent | 11,203 | |

| 11,347 | |

| 11,236 | |

|

6

Acreage

At December 31, 2013 , the company owned or had under lease or similar agreements undeveloped and developed crude oil and natural gas properties throughout the world. The geographical distribution of the company's acreage is shown in the following table.

Acreage at December 31, 2013

(Thousands of Acres)

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

| Developed and |

| ||||||||||||

|

| Undeveloped* |

| Developed |

| Undeveloped |

| ||||||||||||

|

| Gross |

| Net |

| Gross |

| Net |

| Gross |

| Net |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| United States | 6,237 | |

| 5,125 | |

| 7,381 | |

| 4,714 | |

| 13,618 | |

| 9,839 | |

|

| Other Americas | 26,898 | |

| 15,397 | |

| 1,389 | |

| 384 | |

| 28,287 | |

| 15,781 | |

|

| Africa | 15,490 | |

| 8,995 | |

| 3,286 | |

| 1,362 | |

| 18,776 | |

| 10,357 | |

|

| Asia | 31,897 | |

| 15,485 | |

| 1,498 | |

| 871 | |

| 33,395 | |

| 16,356 | |

|

| Australia | 19,418 | |

| 13,655 | |

| 912 | |

| 236 | |

| 20,330 | |

| 13,891 | |

|

| Europe | 5,205 | |

| 4,045 | |

| 489 | |

| 73 | |

| 5,694 | |

| 4,118 | |

|

| Total Consolidated Companies | 105,145 | |

| 62,702 | |

| 14,955 | |

| 7,640 | |

| 120,100 | |

| 70,342 | |

|

| Affiliates | 935 | |

| 429 | |

| 262 | |

| 103 | |

| 1,197 | |

| 532 | |

|

| Total Including Affiliates | 106,080 | |

| 63,131 | |

| 15,217 | |

| 7,743 | |

| 121,297 | |

| 70,874 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

* | The gross undeveloped acres that will expire in 2014 , 2015 and 2016 if production is not established by certain required dates are 2,627, 2,430 and 701, respectively. |

Delivery Commitments

The company sells crude oil and natural gas from its producing operations under a variety of contractual obligations. Most contracts generally commit the company to sell quantities based on production from specified properties, but some natural gas sales contracts specify delivery of fixed and determinable quantities, as discussed below.

In the United States, the company is contractually committed to deliver to third parties 285 billion cubic feet of natural gas through 2016 . The company believes it can satisfy these contracts through a combination of equity production from the company's proved developed U.S. reserves and third-party purchases. These commitments include a variety of pricing terms, including both indexed and fixed-price contracts.

Outside the United States, the company is contractually committed to deliver a total of 871 billion cubic feet of natural gas to third parties from 2014 through 2016 from operations in Australia, Colombia, Denmark, the Netherlands and the Philippines. These sales contracts contain variable pricing formulas that are generally referenced to the prevailing market price for crude oil, natural gas or other petroleum products at the time of delivery. The company believes it can satisfy these contracts from quantities available from production of the company's proved developed reserves in these countries.

7

Development Activities

Refer to Table I on page FS-59 for details associated with the company's development expenditures and costs of proved property acquisitions for 2013 , 2012 and 2011 .

The following table summarizes the company's net interest in productive and dry development wells completed in each of the past three years, and the status of the company's development wells drilling at December 31, 2013 . A "development well" is a well drilled within the proved area of a crude oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Development Well Activity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

| Wells Drilling |

| Net Wells Completed |

| ||||||||||||||||||||

|

| at 12/31/13 |

| 2013 |

| 2012 |

| 2011 |

| ||||||||||||||||

|

| Gross |

| Net |

| Prod. |

| Dry |

| Prod. |

| Dry |

| Prod. |

| Dry |

| ||||||||

| United States | 134 | |

| 75 | |

| 1,101 | |

| 4 | |

| 941 | |

| 6 | |

| 909 | |

| 9 | |

|

| Other Americas | 60 | |

| 39 | |

| 127 | |

| - | |

| 50 | |

| - | |

| 37 | |

| - | |

|

| Africa | 9 | |

| 3 | |

| 20 | |

| 1 | |

| 23 | |

| - | |

| 29 | |

| - | |

|

| Asia | 77 | |

| 42 | |

| 535 | |

| 5 | |

| 566 | |

| 6 | |

| 549 | |

| 6 | |

|

| Australia | 4 | |

| 2 | |

| - | |

| - | |

| - | |

| - | |

| - | |

| - | |

|

| Europe | 3 | |

| - | |

| 3 | |

| - | |

| 9 | |

| - | |

| 6 | |

| - | |

|

| Total Consolidated Companies | 287 | |

| 161 | |

| 1,786 | |

| 10 | |

| 1,589 | |

| 12 | |

| 1,530 | |

| 15 | |

|

| Affiliates | 30 | |

| 13 | |

| 25 | |

| - | |

| 26 | |

| - | |

| 25 | |

| - | |

|

| Total Including Affiliates | 317 | |

| 174 | |

| 1,811 | |

| 10 | |

| 1,615 | |

| 12 | |

| 1,555 | |

| 15 | |

|

|

|

|

|

|

|

|

|

|

| |

| |

|

|

|

|

| ||||||||

Exploration Activities

Refer to Table I on page FS-59 for detail on the company's exploration expenditures and costs of unproved property acquisitions for 2013 , 2012 and 2011 .

The following table summarizes the company's net interests in productive and dry exploratory wells completed in each of the last three years, and the number of exploratory wells drilling at December 31, 2013 . "Exploratory wells" are wells drilled to find and produce crude oil or natural gas in unproved areas and include delineation and appraisal wells, which are wells drilled to find a new reservoir in a field previously found to be productive of crude oil or natural gas in another reservoir or to extend a known reservoir beyond the proved area.

Exploratory Well Activity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

| Wells Drilling |

| Net Wells Completed |

| ||||||||||||||||||||

|

| at 12/31/13 |

| 2013 |

| 2012 |

| 2011 |

| ||||||||||||||||

|

| Gross |

| Net |

| Prod. |

| Dry |

| Prod. |

| Dry |

| Prod. |

| Dry |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

| United States | 10 | | | 7 | | | 17 | | | 2 | | | 4 | | | - | | | 5 | | | 1 | |

|

| Other Americas | 3 | | | 1 | | | 12 | | | 2 | | | 8 | | | - | | | 1 | | | - | |

|

| Africa | 2 | | | 1 | | | - | | | - | | | 1 | | | 2 | | | 1 | | | - | |

|

| Asia | 4 | | | 3 | | | 13 | | | 4 | | | 12 | | | 3 | | | 10 | | | 1 | |

|

| Australia | 2 | | | 1 | | | 3 | | | - | | | 3 | | | - | | | 4 | | | 1 | |

|

| Europe | 2 | | | - | | | 2 | | | 2 | | | 1 | | | 2 | | | - | | | 1 | |

|

| Total Consolidated Companies | 23 | | | 13 | | | 47 | | | 10 | | | 29 | | | 7 | | | 21 | | | 4 | |

|

| Affiliates | - | | | - | | | - | | | - | | | - | | | - | | | 1 | | | - | |

|

| Total Including Affiliates | 23 | | | 13 | | | 47 | | | 10 | | | 29 | | | 7 | | | 22 | | | 4 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

8

Review of Ongoing Exploration and Production Activities in Key Areas

Chevron's 2013 key upstream activities, some of which are also discussed in Management's Discussion and Analysis of Financial Condition and Results of Operations, beginning on page FS-6, are presented below. The comments include references to "total production" and "net production," which are defined under "Production" in Exhibit 99.1 on page E-10.

The discussion that follows references the status of proved reserves recognition for significant long-lead-time projects not on production and for projects recently placed on production. Reserves are not discussed for exploration activities or recent discoveries that have not advanced to a project stage, or for mature areas of production that do not have individual projects requiring significant levels of capital or exploratory investment. Amounts indicated for project costs represent total project costs, not the company's share of costs for projects that are less than wholly owned.

|

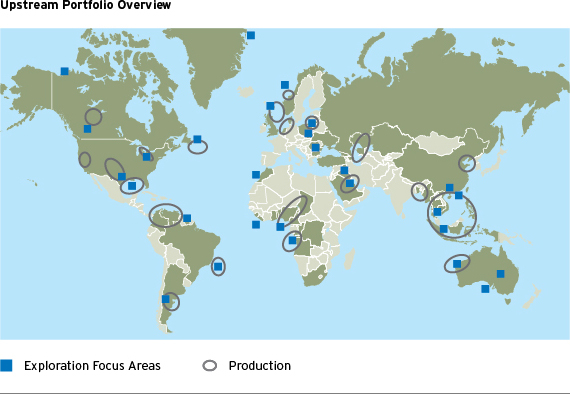

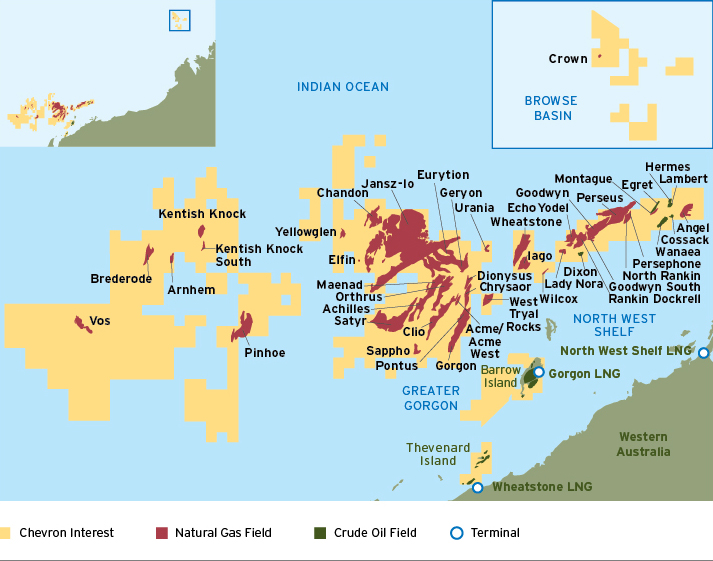

Chevron has exploration and production activities in most of the world's major hydrocarbon basins. The map above indicates Chevron's primary areas for exploration and production.

United States

Upstream activities in the United States are concentrated in California, the Gulf of Mexico, Colorado, Louisiana, Michigan, New Mexico, Ohio, Oklahoma, Pennsylvania, Texas, West Virginia and Wyoming. Average net oil-equivalent production in the United States during 2013 was 657,000 barrels per day.

In California, the company has significant production in the San Joaquin Valley. In 2013, net daily production averaged 162,000 barrels of crude oil, 69 million cubic feet of natural gas and 4,000 barrels of natural gas liquids (NGLs). Approximately 86 percent of the crude oil production is considered heavy oil (typically with API gravity lower than 22 degrees).

|

During 2013, net daily production for the company's combined interests in the Gulf of Mexico averaged 143,000 barrels of crude oil, 347 million cubic feet of natural gas and 15,000 barrels of NGLs.

Chevron was engaged in various exploration and development activities in the deepwater Gulf of Mexico during 2013. The Jack and St. Malo fields are being jointly developed with a host floating production unit (FPU) located between the two fields. Chevron has a 50 percent interest in the Jack Field and a 51 percent interest in the St. Malo Field. Both fields are company-operated. Chevron's interest in the production host facility was reduced to 40.6 percent in 2013, after the owners of a third-party oil field acquired an interest in the host. The facility has a design capacity of 170,000 barrels of crude oil and 42 million cubic feet of natural gas per day to accommodate production from the Jack/St. Malo development and third-party tiebacks. Development drilling activities continued during the year, and the FPU was moored at the offshore location in fourth quarter 2013. At the end of 2013, project activities were 74 percent complete and first oil is expected in late 2014. Total project costs for the initial phase of development are estimated at $7.5 billion. Proved reserves have been recognized for this project.

In 2013, work continued on the evaluation of additional development opportunities for the Jack and St. Malo fields. Stage 2, the first phase of future development work, is expected to include four additional development wells, two each at the Jack and the St. Malo fields. Front-end engineering and design (FEED) activities began in mid-2013, and a final investment decision is expected in 2015. At the end of 2013, proved reserves had not been recognized for the Jack/St. Malo Stage 2 Project.

Production from the Jack/St. Malo development is expected to ramp up to a total daily rate of 94,000 barrels of crude oil and 21 million cubic feet of natural gas. The Jack and St. Malo fields have an estimated production life of 30 years.

9

Fabrication continued in 2013 for the 60 percent-owned and operated Big Foot Project. The development plan includes a 15-slot drilling and production platform with water injection facilities and a design capacity of 75,000 barrels of crude oil and 25 million cubic feet of natural gas per day. At the end of 2013, project activities were 84 percent complete, and the platform is expected to be towed to the location in third quarter 2014. Total project costs are estimated at $5.1 billion, and first production is anticipated in 2015. The field has an estimated production life of 20 years. Proved reserves have been recognized for this project.

Tahiti 2 is the second development phase for the 58 percent-owned and operated Tahiti Field, and is designed to increase recovery from the main producing interval by adding

two production wells, three water injection wells and water injection facilities. Start-up of the first production well occurred in fourth quarter 2013. Additional infill drilling is scheduled for the Tahiti Field from 2014 through 2016. The next development phase, the Tahiti Vertical Expansion Project, is being planned, with FEED expected in 2015. At the end of 2013, proved reserves had not been recognized for the infill drilling or the Tahiti Vertical Expansion Project. The Tahiti Field has an estimated production life of 30 years.

The company has a 42.9 percent nonoperated working interest in the Tubular Bells Field. Development drilling continued during 2013, and plans include three producing and two injection wells, with a subsea tieback to a third-party production facility. First oil is planned for third quarter 2014, with total production expected to reach 44,000 barrels of oil-equivalent per day. The field has an estimated production life of 25 years. Proved reserves have been recognized for this project.

The company has a 15.6 percent nonoperated working interest in the Mad Dog Field. The next development phase, the Mad Dog II Project, is planned to develop the southern portion of the Mad Dog Field. The project was recycled in 2013 and is expected to reenter FEED in late 2014. At the end of 2013, proved reserves had not been recognized for this project.

Chevron holds a 20 percent nonoperated working interest in the Stampede Project, which includes the joint development of the Knotty Head and Pony fields. The development plans include a tension leg platform with a planned design capacity of 80,000 barrels of crude oil and 40 million cubic feet of natural gas per day. The project entered FEED in second quarter 2013, and a final investment decision is expected in fourth quarter 2014. At the end of 2013, proved reserves had not been recognized for this project.

Pre-FEED activities continue at the 55 percent-owned and operated Buckskin Project. The project is expected to enter FEED in 2015. The Moccasin discovery, located 12 miles from Buckskin, is a potential tieback opportunity into Buckskin.

Deepwater exploration activities in 2013 included participation in six exploratory wells - three appraisal and three wildcat. Drilling of the first appraisal well at the 43.8 percent-owned and operated Moccasin discovery was

completed in third quarter 2013. Drilling of an appraisal well at the Buckskin discovery is expected to be completed in second quarter 2014. Drilling at the 40 percent-owned and operated Coronado prospect resulted in a crude oil discovery in the Lower Tertiary Wilcox formation in first quarter 2013. Drilling commenced on the first Coronado appraisal well in December 2013. The company also completed drilling a wildcat well at the 30 percent-owned and operated Rio Grande prospect in December 2013 and at the 67.5 percent-owned and operated Oceanographer prospect in January 2014.

Chevron added eight leases to its deepwater portfolio as a result of awards from the central Gulf of Mexico lease sale held in first quarter 2013. In addition, Chevron acquired three deepwater leases from the western Gulf of Mexico lease sale held in third quarter 2013.

|

Company activities in the midcontinental United States include operated and nonoperated interests in properties primarily in Colorado, New Mexico, Oklahoma, Texas and Wyoming. During 2013, the company's net daily production in these areas averaged 96,000 barrels of crude oil, 610 million cubic feet of natural gas and 28,000 barrels of NGLs.

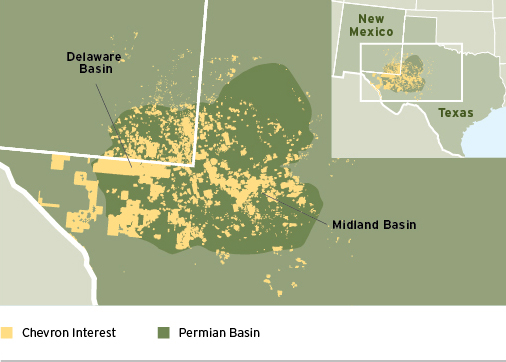

In West Texas, the company continues to pursue development of shale and tight resources in the Midland Basin's Wolfcamp play and several plays in the Delaware Basin through use of advanced drilling and completion technologies. Additional production growth is expected from interests in these formations in future years. In June 2013, the company reached a joint development agreement covering 104,000 total acres in the Delaware Basin. In East Texas, the company continued development, at a managed pace, of multiple stacked reservoirs, including the Travis Peak, Cotton Valley, Bossier and Haynesville zones, during 2013.

10

|

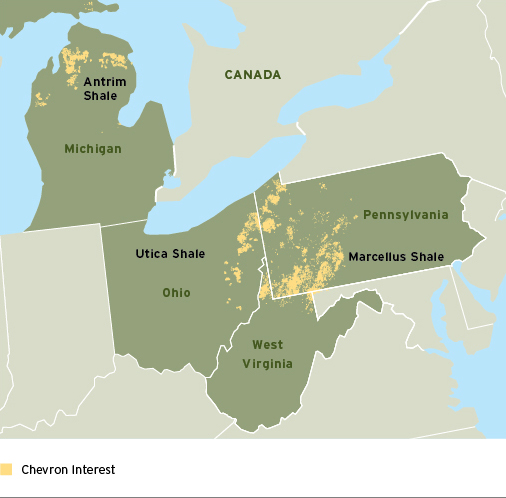

The company holds leases in the Marcellus Shale and the Utica Shale, primarily located in southwestern Pennsylvania, eastern Ohio, and the West Virginia panhandle, and in the Antrim Shale and Collingwood/Utica Shale in Michigan. During 2013, the company's net daily production in these areas averaged 220 million cubic feet of natural gas. In 2013, development of the Marcellus Shale continued at a measured pace, focused on improving execution capability and reservoir understanding. Activities in the Utica Shale during 2013 included drilling seven exploratory wells. This initial activity was focused on acquiring data necessary for potential future development.

Other Americas

"Other Americas" is composed of Argentina, Brazil, Canada, Colombia, Greenland, Suriname, Trinidad and Tobago, and Venezuela. Net oil-equivalent production from these countries averaged 226,000 barrels per day during 2013.

Canada: Chevron has interests in oil sands projects and shale acreage in Alberta; shale acreage and a liquefied natural gas (LNG) project in British Columbia; exploration, development and production projects offshore in the Atlantic region; and exploration and discovered resource interests in the Beaufort Sea region of the Northwest Territories. Average net oil-equivalent production during 2013 was 71,000 barrels per day, composed of 27,000 barrels of crude oil, 9 million cubic feet of natural gas and 43,000 barrels of synthetic oil from oil sands.

The company holds a 20 percent nonoperated working interest in the Athabasca Oil Sands Project (AOSP). Oil sands are mined from both the Muskeg River and the Jackpine mines, and bitumen is extracted from the oil sands and upgraded into

|

synthetic oil. Construction work progressed during 2013 on the Quest Project, a carbon capture and sequestration project that is designed to capture and store more than one million tons of carbon dioxide produced annually by bitumen processing at the AOSP by 2015.

In February 2013, Chevron acquired a 50 percent-owned and operated interest in the Kitimat LNG and Pacific Trail Pipeline projects, and a 50 percent nonoperated working interest in 644,000 total acres in the Horn River and Liard shale gas basins in British Colombia. The Kitimat LNG Project is planned to include a two-train, 10.0 million-metric-ton-per-year LNG facility. The total production capacity for the project is expected to be 1.6 billion cubic feet of natural gas per day. Activities during 2013 included FEED, early site preparation and LNG marketing activities.

Chevron holds a 26.9 percent nonoperated working interest in the Hibernia Field and a 23.6 nonoperated working interest in the unitized Hibernia Southern Extension (HSE) areas offshore Atlantic Canada. The HSE development is expected to increase the economic life of the Hibernia Field. During 2013, two subsea water injection wells began drilling, and installation of subsea equipment was initiated. Full production start-up is expected in 2015. Proved reserves have been recognized for this project.

The company holds a 26.6 percent nonoperated working interest in the heavy oil Hebron Field, also offshore Atlantic Canada. The development plan includes a concrete, gravity-based platform with a design capacity of 150,000 barrels of crude oil per day. Procurement and construction activities progressed in 2013. Project costs are estimated at $14 billion. The project has an expected economic life of 30 years, and first oil is expected in 2017. Proved reserves have been recognized for this project.

In 2013, the company acquired 86,000 total additional acres in the Duvernay shale formation in Alberta. Drilling for these tight resources continued in 2013, with completion of a

11

multiwell program. Nine wells were completed and tied into production facilities by early 2014.

The company also holds a 40 percent nonoperated working interest in exploration rights for two blocks in the Flemish Pass Basin offshore Newfoundland. During 2013, the company relinquished its license in the Orphan Basin located offshore Newfoundland and Exploration License 1109 located offshore Labrador. The company also holds two exploration licenses in the Beaufort Sea region of the Northwest Territories and a 40 percent nonoperated working interest in the Amauligak discovery.

In addition, Chevron holds interests in the Aitken Creek and Alberta Hub natural gas storage facilities, which have aggregate total capacity of approximately 100 billion cubic feet. These facilities are located in western Canada near the Duvernay, Horn River, Liard and Montney shale gas plays.

Greenland: In December 2013, Chevron acquired a 29.2 percent interest in and operatorship of two blocks located in the Kanumas Area, offshore the northeast cost of Greenland. Blocks 9 and 14 cover 1.2 million acres. The acquisition of seismic data is planned for 2014.

Argentina: Chevron holds operated interests in four concessions in the Neuquen Basin, with working interests ranging from 18.8 percent to 100 percent, and a 50 percent nonoperated working interest in one concession. Net oil-equivalent production in 2013 averaged 19,000 barrels per day, composed of 18,000 barrels of crude oil and 6 million cubic feet of natural gas. During 2013, the company completed four exploratory wells in El Trapial concession, targeting oil and gas in the Vaca Muerta Shale. Chevron plans to continue production testing the wells during 2014. El Trapial concession expires in 2032.

In addition, Chevron signed agreements during 2013 to advance the Loma Campana Project to develop the Vaca Muerta Shale . In 2013, 109 wells were drilled, and the drilling plan includes more than 140 wells in 2014.

Brazil: Chevron holds working interests in three deepwater fields in the Campos Basin: Frade (51.7 percent-owned and operated), Papa-Terra and Maromba (37.5 percent and 30 percent nonoperated working interests, respectively). Net oil-equivalent production in 2013 averaged 6,000 barrels per day, composed of 5,000 barrels of crude oil and 2 million cubic feet of natural gas.

In second quarter 2013, the company received regulatory approval to partially resume production at the Frade Field. A plan to resume production from additional existing wells has been submitted for regulatory approval. The concession that includes the Frade Field expires in 2025.

|

First production from the initial well occurred in fourth quarter 2013 for the Papa-Terra Project. The project includes a floating production, storage and offloading vessel (FPSO) and a tension leg wellhead platform, with a design capacity of 140,000 barrels of crude oil and 35 million cubic feet of natural gas per day. The concession that contains the Papa-Terra Field expires in 2032. Additional development drilling is planned for 2014.

Evaluation of the field development concept for Maromba continues. At the end of 2013, proved reserves had not been recognized for this project . The concession containing the Maromba Field expires in 2032.

In May 2013, Chevron was awarded a 50 percent interest in and operatorship of Block CE-M715. The deepwater block covers 81,000 total acres and is located in the Ceará Basin offshore equatorial Brazil. Acquisition of seismic data is planned for 2014.

12

Colombia: The company operates the offshore Chuchupa and the onshore Ballena and Riohacha natural gas fields and receives 43 percent of the production for the remaining life of each field and a variable production volume based on prior Chuchupa capital contributions. Daily net production averaged 216 million cubic feet of natural gas in 2013.

Suriname: Chevron holds a 50 percent nonoperated working interest in Blocks 42 and 45 offshore Suriname. In 2013, seismic data was acquired for Block 45. The data is being processed in 2014 to plan for the drilling of an exploration well in 2015.

|

Trinidad and Tobago: The company has a 50 percent nonoperated working interest in three blocks in the East Coast Marine Area offshore Trinidad, which includes the Dolphin and Dolphin Deep producing natural gas fields and the Starfish development. Net production in 2013 averaged 173 million cubic feet of natural gas per day. Development of the Starfish Field continued during 2013, and first gas is expected in 2015. Natural gas from the project is planned to supply existing contractual commitments. Proved reserves have been recognized for this project. Chevron also holds a 50 percent-owned and operated interest in the Manatee Area of Block 6(d), where the Manatee discovery comprises a single cross-border field with Venezuela's Loran Field in Block 2. In 2013, cross-border agreements were signed between the governments of Trinidad and Tobago and Venezuela, and work continued on maturing commercial development concepts.

Venezuela: Chevron's production activities are performed by two affiliates in western Venezuela and one affiliate in the Orinoco Belt. Chevron has a 30 percent interest in the Petropiar affiliate that operates the Hamaca heavy oil production and upgrading project located in Venezuela's Orinoco Belt, a 39.2 percent interest in the Petroboscan affiliate that operates the Boscan Field in western Venezuela, and a 25.2 percent interest in the Petroindependiente affiliate that operates the LL-652 Field in Lake Maracaibo. The company's share of net oil-equivalent production during 2013 from these operations averaged 65,000 barrels per day, composed of 61,000 barrels of liquids and 26 million cubic feet of natural gas.

Chevron holds a 34 percent interest in the Petroindependencia affiliate that is working toward commercialization of Carabobo 3, a heavy oil project located within the Carabobo Area of the Orinoco Belt. Project activities in 2013 focused on assessing development alternatives.

The company operates and holds a 60 percent interest in Block 2 and a 100 percent interest in Block 3 in the Plataforma Deltana area offshore eastern Venezuela. The Loran Field in Block 2 and the Manatee Field in Trinidad and Tobago form a single, cross-border field that lies along the maritime border of Venezuela and Trinidad and Tobago. During 2013, cross-border agreements were signed between the governments of Venezuela and Trinidad and Tobago, and work continued on maturing commercial development concepts.

Africa

|

Angola: Chevron holds company-operated working interests in offshore Blocks 0 and 14 and nonoperated working interests in offshore Block 2 and the onshore Fina Sonangol Texaco (FST) concession area. In addition, Chevron has a 36.4 percent interest in Angola LNG Limited. Net production from these operations in 2013 averaged 133,000 barrels of oil-equivalent per day.

13

The company operates the 39.2 percent-owned Block 0, which averaged 90,000 barrels per day of net liquids production in 2013. The Block 0 concession extends through 2030.

Construction activities on Mafumeira Sul, the second development stage for the Mafumeira Field in Block 0, progressed in 2013. Development plans include a central processing facility, two wellhead platforms, subsea pipelines, and 34 producing and 16 water injection wells. The facility has a design capacity of 150,000 barrels of liquids and 350 million cubic feet of natural gas per day. First production is planned for 2015, and ramp-up to full production is expected to continue until 2017. The project is estimated to cost $5.6 billion. Proved reserves have been recognized for this project.

A project to develop the Greater Longui Area of Block 0 is expected to enter FEED in first-half 2014. FEED activities progressed during 2013 on the south extension of the N'Dola Field development and work continues toward a final investment decision. The facility is planned to have a design capacity of 28,000 barrels of crude oil and 50 million cubic feet of natural gas per day. At the end of 2013, proved reserves had not been recognized for these projects.

Work continued in 2013 on the Nemba Enhanced Secondary Recovery Stage 1 & 2 Project in Block 0. Installation of the platform was completed in early 2014, and project start-up is expected in 2015. Total daily production is expected to be 12,000 barrels of crude oil . Proved reserves have been recognized for this project.

Also in Block 0, drilling of an exploration well in Area A was completed in early 2013 and resulted in a discovery in the post-salt Vermelha interval. Plans for future development are under evaluation. Drilling of an appraisal well in the Minzu Pinda reservoir commenced in late 2013 and is planned to be completed in second quarter 2014 . A pre-salt exploration well in Area A is planned for first-half 2014.

The company operates and holds a 31 percent interest in a production-sharing contract (PSC) for deepwater Block 14. Net production in 2013 averaged 27,000 barrels of liquids per day. Development and production rights for the various producing fields in Block 14 expire between 2023 and 2028.

Planning continues on the multireservoir, deepwater Lucapa Field in Block 14, located on the north rim of the Congo River Canyon. The project was recycled in 2013 to conduct additional subsurface studies over a 12-month period. During the year, development alternatives were evaluated for the Malange Field, and the project is expected to enter FEED in early 2014. At the end of 2013, proved reserves had not been recognized for these projects.

In addition to the exploration and production activities in Angola, Chevron has a 36.4 percent interest in Angola LNG Limited, which operates an onshore natural gas liquefaction plant in Soyo, Angola. The plant has a capacity to process 1.1 billion cubic feet of natural gas per day, with expected average total daily sales of 670 million cubic feet of natural gas and up to 63,000 barrels of NGLs. This is the world's first LNG

plant supplied with associated gas, where the natural gas is a by-product of crude oil production. Feedstock for the plant originates from multiple fields and operators. The first LNG shipment from the plant occurred in second quarter 2013. Commissioning and testing of the plant continued through the end of 2013. Due to the variability in the associated gas that supplies Angola LNG, the plant is expected to operate at approximately 50 percent of capacity until permanent plant modifications are completed in 2015, allowing Angola LNG to consistently produce at full capacity. Total daily production in 2013 averaged 83 million cubic feet of natural gas (30 million net) and 2,000 barrels of NGLs (1,000 net). The anticipated economic life of the project is in excess of 20 years.

The company also holds a 38.1 percent interest in the Congo River Canyon Crossing Pipeline project that is designed to transport up to 250 million cubic feet of natural gas per day from Block 0 and Block 14 to the Angola LNG plant. Construction on the project continued in 2013, with project completion targeted for 2015.

Angola-Republic of the Congo Joint Development Area: Chevron operates and holds a 31.3 percent interest in the Lianzi Unitization Zone, located in an area shared equally by Angola and the Republic of the Congo. The project scope includes four producing wells and three water injection wells with a subsea tieback to an existing platform in Block 14. The project has a design capacity of 46,000 barrels of crude oil per day. First production is planned for 2015. Proved reserves have been recognized for this project.

Democratic Republic of the Congo: Chevron has a 17.7 percent nonoperated working interest in an offshore concession. Daily net production in 2013 averaged 2,000 barrels of crude oil.

Republic of the Congo: Chevron has a 31.5 percent nonoperated working interest in the offshore Haute Mer permit areas (Nkossa, Nsoko and Moho-Bilondo). The licenses for Nsoko, Nkossa and Moho-Bilondo expire in 2018, 2027 and 2030, respectively. In September 2013, the company sold its nonoperated interest in the Kitina permit area. Net production averaged 13,000 barrels of liquids per day in 2013.

A final investment decision was reached in first quarter 2013 for the Moho Nord Project, located in the Moho-Bilondo development area. The $10 billion project includes a new facilities hub and a subsea tieback to the existing Moho-Bilondo FPU. First production is expected in 2015, and total daily production of 140,000 barrels of crude oil is expected in 2017. The initial recognition of proved reserves occurred in 2013 .

14

Chad/Cameroon: Chevron has a 25 percent nonoperated working interest in crude oil producing operations in southern Chad and an approximate 21 percent interest in two affiliates that own an export pipeline that transports crude oil to the coast of Cameroon. Average daily net crude oil production from the Chad fields in 2013 was 18,000 barrels. The Chad producing operations are conducted under a concession that expires in 2030.

|

Nigeria: Chevron holds a 40 percent interest in 13 operated concessions, predominantly in the onshore and near-offshore regions of the Niger Delta. The company also owns varying interests in three operated and six nonoperated deepwater blocks. In 2013, the company's net oil-equivalent production in Nigeria averaged 268,000 barrels per day, composed of 233,000 barrels of crude oil, 182 million cubic feet of natural gas and 5,000 barrels of liquefied petroleum gas (LPG).

Chevron operates and holds a 67.3 percent interest in the Agbami Field, located in deepwater Oil Mining Lease (OML) 127 and OML 128. During 2013, drilling continued on a 10-well, Phase 2 development program, Agbami 2, that is expected to offset field decline and maintain plateau production. Drilling is expected to continue through 2015. The third development phase, Agbami 3, is a five-well drilling program expected to offset field decline. The project entered FEED in early 2014, and a final investment decision is expected in second-half 2014. Drilling is scheduled to continue through 2017. The leases that contain the Agbami Field expire in 2023 and 2024.

Chevron holds a 30 percent nonoperated interest in the deepwater Usan Field in OML 138. Ramp-up continued during 2013, and additional development drilling is planned for 2014 through 2017.

Also in the deepwater area, the Aparo Field in OML 132 and OML 140 and the third-party-owned Bonga SW Field in OML 118 share a common geologic structure and are planned to be jointly developed. The proposed development plan involves subsea wells tied back to an FPSO with a planned design

capacity of 225,000 barrels of crude oil per day. The project achieved FEED in second quarter 2013, and a final investment decision is expected in late 2014. At the end of 2013, no proved reserves were recognized for this project.

In the Niger Delta region, the company reached a final investment decision in 2013 on the Dibi Long-Term Project that is designed to rebuild the Dibi facilities and replace the Early Production System facility. The facilities have a design capacity of 70,000 barrels of crude oil per day, and start-up is expected in 2016.

Also in the Niger Delta region, ramp-up activity continued at the Escravos Gas Plant (EGP). During 2013, construction continued on Phase 3B of the EGP project, which is designed to gather 120 million cubic feet of natural gas per day from eight near-shore fields and to compress and transport the natural gas to onshore facilities. The Phase 3B project is expected to be completed in 2016. Proved reserves associated with this project have been recognized.

Construction activities progressed during 2013 on the 40 percent-owned and operated Sonam Field Development Project, which is designed to process natural gas through EGP, deliver 215 million cubic feet of natural gas per day to the domestic market and produce a total of 30,000 barrels of liquids per day. First production is expected in 2016. Proved reserves have been recognized for the project.

Chevron is the operator of and has a 75 percent interest in this 33,000-barrel-per-day gas-to-liquids facility at Escravos. The facility is designed to process 325 million cubic feet per day of natural gas. Production is scheduled to commence in first-half 2014, and the first product shipment is expected to occur in second-half 2014. The estimated cost of the project is $10 billion.

In deepwater exploration, Chevron operates and holds a 100 percent interest in OML 132, where an exploration well at Aparo North is planned for 2014. In addition, Chevron operates and holds a 95 percent interest in the deepwater Nsiko discovery in OML 140, where additional exploration activities are planned for 2014.

Shallow-water exploration activities to identify and evaluate potential deep hydrocarbon targets are ongoing. Reprocessing of 3-D seismic data over OML 49 and regional mapping activities over OML 86 and OML 88 continued in 2013.

With a 36.7 percent interest, Chevron is the largest shareholder in the West African Gas Pipeline Company Limited affiliate, which owns and operates the 421-mile West African Gas Pipeline. The pipeline supplies Nigerian natural gas to customers in Benin, Ghana and Togo for industrial applications and power generation and has the capacity to transport 170 million cubic feet per day.

Liberia: Chevron holds a 45 percent interest in and operates three deepwater blocks off the coast of Liberia. In 2014, the company plans additional drilling based on the evaluation of 3-D seismic data and 2012 drilling results.

15

Morocco: In early 2013, the company acquired a 75 percent-owned and operated interest in three deepwater areas offshore Morocco. The areas, Cap Rhir Deep, Cap Cantin Deep and Cap Walidia Deep, encompass approximately 7.2 million acres. The acquisition of seismic data is planned for 2014.

Sierra Leone: The company holds a 55 percent interest in and operates a concession off the coast of Sierra Leone. The concession contains two deepwater blocks, with a combined area of approximately 1.4 million acres. Interpretation of 2-D seismic data is planned for 2014.

South Africa: In 2013, the company continued seeking shale gas exploration opportunities in the Karoo Basin in South Africa under an agreement that allows Chevron and its partner to work together to obtain exploration permits in the 151 million-acre basin.

Asia

In Asia, the company is engaged in upstream activities in Azerbaijan, Bangladesh, Cambodia, China, Indonesia, Kazakhstan, the Kurdistan Region of Iraq, Myanmar, the Partitioned Zone located between Saudi Arabia and Kuwait, the Philippines, Russia, Thailand, and Vietnam. During 2013, net oil-equivalent production averaged 1,087,000 barrels per day.

|

Azerbaijan: Chevron holds an 11.3 percent nonoperated working interest in the Azerbaijan International Operating Company (AIOC), which produces crude oil from the Azeri-

Chirag-Gunashli (ACG) fields. The company's daily net production averaged 28,000 barrels of oil-equivalent in 2013. AIOC operations are conducted under a PSC that expires in 2024.

In January 2014, production commenced on the next development phase of the ACG project, which further develops the Chirag and Deepwater Gunashli fields. The project has an incremental design capacity of 183,000 barrels of crude oil and 285 million cubic feet of natural gas per day.

Chevron also has an 8.9 percent interest in the Baku-Tbilisi-Ceyhan (BTC) affiliate, which owns and operates a crude oil export pipeline from Baku, Azerbaijan, through Georgia to Mediterranean deepwater port facilities at Ceyhan, Turkey. The BTC pipeline has a capacity of 1 million barrels per day and transports the majority of ACG production. Another production export route for crude oil is the Western Route Export Pipeline, which is operated by AIOC, with capacity to transport 100,000 barrels per day from Baku, Azerbaijan, to a marine terminal at Supsa, Georgia.

Kazakhstan: Chevron participates in two major upstream developments in western Kazakhstan. The company holds a 50 percent interest in the Tengizchevroil (TCO) affiliate, which is operating and developing the Tengiz and Korolev crude oil fields under a concession that expires in 2033. Chevron's net oil-equivalent production in 2013 from these fields averaged 321,000 barrels per day, composed of 243,000 barrels of crude oil, 347 million cubic feet of natural gas and 20,000 barrels of NGLs. During 2013, the majority of TCO's crude oil production was exported through the Caspian Pipeline Consortium (CPC) pipeline that runs from Tengiz in Kazakhstan to tanker-loading facilities at Novorossiysk on the Russian coast of the Black Sea. The balance of production was exported by rail to Black Sea ports and via the BTC pipeline to the Mediterranean.

In 2013, FEED continued for three projects. The Wellhead Pressure Management Project (WPMP) is designed to maintain production capacity and extend the production plateau from existing assets. The Capacity and Reliability (CAR) Project is designed to reduce facility bottlenecks and increase plant efficiency and reliability. The Future Growth Project (FGP) is designed to increase total daily production by 250,000 to 300,000 barrels of oil-equivalent and to increase ultimate recovery from the reservoir. The project plans to expand the utilization of sour gas injection technology proven in existing operations. During 2013, the company and the government of Kazakhstan signed a memorandum of understanding that establishes the framework and mutual commitments to progress the FGP and the WPMP. The final investment decision on the CAR Project was made in February 2014. The final investment decisions on the WPMP and the FGP are planned for second-half 2014. At the end of 2013, proved reserves have been recognized for the WPMP and the CAR Project .

16

The company holds an 18 percent nonoperated working interest in the Karachaganak Field under a PSC that expires in 2038. During 2013, Karachaganak net oil-equivalent production averaged 57,000 barrels per day, composed of 34,000 barrels of liquids and 135 million cubic feet of natural gas. Access to the CPC and Atyrau-Samara (Russia) pipelines enabled 32,000 net barrels per day of Karachaganak liquids to be exported and sold at world-market prices during 2013. The remaining liquids were sold into local and Russian markets. In 2013, work continued on identifying the optimal scope for future expansion of the field. At the end of 2013, proved reserves had not been recognized for a future expansion.

Kazakhstan/Russia: Chevron has a 15 percent interest in the CPC affiliate. During 2013, CPC transported an average of 706,000 barrels of crude oil per day, including 635,000 barrels per day from Kazakhstan and 71,000 barrels per day from Russia. In 2013, work continued on the 670,000-barrel-per-day expansion of the pipeline capacity with completion of the offshore loading system. The project is being implemented in phases, with capacity increasing progressively until reaching maximum capacity of 1.4 million barrels per day in 2016. The incremental capacity is expected to reach 400,000 barrels per day by year-end 2014, with the first increase expected to be realized by March 2014. The expansion is expected to provide additional transportation capacity that accommodates a portion of the future growth in TCO production.

Bangladesh: Chevron holds a 99 percent interest in two operated PSCs covering Block 12 (Bibiyana Field) and Blocks 13 and 14 (Jalalabad and Moulavi Bazar fields). The rights to produce from Jalalabad expire in 2024, from Moulavi Bazar in 2028 and from Bibiyana in 2034. Net oil-equivalent production from these operations in 2013 averaged 113,000 barrels per day, composed of 663 million cubic feet of natural gas and 2,000 barrels of condensate.

The Bibiyana Expansion Project includes installation of two gas processing trains, additional development wells and an enhanced liquids recovery facility, and has an incremental design capacity of 300 million cubic feet of natural gas and 4,000 barrels of condensate per day. First production is expected in late 2014. Proved reserves have been recognized for this project.

Cambodia: Chevron owns a 30 percent interest in and operates the 1.2 million-acre Block A, located in the Gulf of Thailand. In 2013, the company continued discussions on the production permit and commercial terms for development of Block A. The planned development consists of a wellhead platform and a floating storage and offloading vessel (FSO). A final investment decision is pending resolution of commercial terms. At the end of 2013, proved reserves had not been recognized for the project.

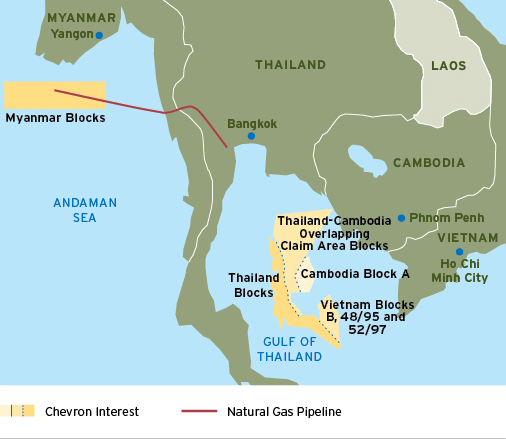

|

Myanmar: Chevron has a 28.3 percent nonoperated working interest in a PSC for the production of natural gas from the Yadana and Sein fields, within Blocks M5 and M6, in the Andaman Sea. The PSC expires in 2028. The company also has a 28.3 percent nonoperated interest in a pipeline company that transports most of the natural gas to the Myanmar-Thailand border for delivery to power plants in Thailand. The company's average net natural gas production in 2013 was 96 million cubic feet per day.

Thailand: Chevron has operated and nonoperated working interests in multiple offshore blocks in the Gulf of Thailand. The company's net oil-equivalent production in 2013 averaged 229,000 barrels per day, composed of 62,000 barrels of crude oil and condensate and 1 billion cubic feet of natural gas. The company's natural gas production is sold to the domestic market under long-term sales agreements.

The company holds operated interests in the Pattani Basin with ownership interests ranging from 35 percent to 80 percent. Concessions for producing areas within this basin expire between 2020 and 2035. Chevron also has a 16 percent nonoperated working interest in the Arthit Field located in the Malay Basin. Concessions for the producing areas within this basin expire between 2036 and 2040.

In the Pattani Basin, the Ubon Project entered FEED in second quarter 2013, and a final investment decision is expected in 2015. The facilities have a planned design capacity of 35,000 barrels of liquids and 115 million cubic feet of natural gas per day. At the end of 2013, proved reserves had not been recognized for this project.

During 2013, the company drilled five exploration wells in the Pattani Basin, and three were successful. The company also holds exploration interests in the Thailand-Cambodia overlapping claim area that are inactive, pending resolution of border issues between Thailand and Cambodia.

17

Vietnam: Chevron is the operator of two PSCs in the Malay Basin off the southwest coast of Vietnam. The company has a 42.4 percent interest in a PSC that includes Blocks B and 48/95, and a 43.4 percent interest in a PSC for Block 52/97.

The Block B Gas Development Project includes installation of wellhead and hub platforms, an FSO, a central processing platform and a pipeline to shore. The facilities have a design capacity of 640 million cubic feet of natural gas and 21,000 barrels of liquids per day. A final investment decision for the development is pending resolution of commercial terms. Concurrent with the commercial negotiations, the company is also evaluating these assets for possible divestment. At the end of 2013, proved reserves had not been recognized for the development project.

|