UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-368-2

Chevron Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 94-0890210 | 6001 Bollinger Canyon Road, San Ramon, California 94583-2324 | ||

|

|

| ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | (Address of principal executive offices) (Zip Code) |

Registrant's telephone number, including area code (925) 842-1000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common stock, par value $.75 per share | New York Stock Exchange, Inc. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☑ | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ☑

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter - $203,659,751,369 (As of June 30, 2008)

Number of Shares of Common Stock outstanding as of February 20, 2009 - 2,004,559,279

DOCUMENTS INCORPORATED BY REFERENCE

(To The Extent Indicated Herein)

Notice of the 2009 Annual Meeting and 2009 Proxy Statement, to be filed pursuant to Rule 14a-6(b) under the Securities Exchange Act of 1934, in connection with the company's 2009 Annual Meeting of Stockholders (in Part III)

TABLE OF CONTENTS

Item | Page No. | |||||||

PART I | ||||||||

1. | Business | 3 | ||||||

(a) General Development of Business | 3 | |||||||

(b) Description of Business and Properties | 4 | |||||||

Capital and Exploratory Expenditures | 4 | |||||||

Upstream - Exploration and Production | 4 | |||||||

Net Production of Crude Oil and Natural Gas Liquids and Natural Gas | 5 | |||||||

Average Sales Prices and Production Costs per Unit of Production | 6 | |||||||

Gross and Net Productive Wells | 6 | |||||||

Reserves | 6 | |||||||

Acreage | 7 | |||||||

Delivery Commitments | 8 | |||||||

Development Activities | 8 | |||||||

Exploration Activities | 9 | |||||||

Review of Ongoing Exploration and Production Activities in Key Areas | 9 | |||||||

Sales of Natural Gas and Natural Gas Liquids | 23 | |||||||

Downstream - Refining, Marketing and Transportation | 24 | |||||||

Refining Operations | 24 | |||||||

Gas-to-Liquids | 25 | |||||||

Marketing Operations | 25 | |||||||

Transportation Operations | 26 | |||||||

Chemicals | 27 | |||||||

Other Businesses | 28 | |||||||

Mining | 28 | |||||||

Power Generation | 28 | |||||||

Chevron Energy Solutions | 29 | |||||||

Research and Technology | 29 | |||||||

Environmental Protection | 29 | |||||||

Web Site Access to SEC Reports | 29 | |||||||

1A. | Risk Factors | 30 | ||||||

1B. | Unresolved Staff Comments | 31 | ||||||

2. | Properties | 31 | ||||||

3. | Legal Proceedings | 31 | ||||||

4. | Submission of Matters to a Vote of Security Holders | 32 | ||||||

PART II | ||||||||

5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 33 | ||||||

6. | Selected Financial Data | 33 | ||||||

7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||||||

7A. | Quantitative and Qualitative Disclosures About Market Risk | 33 | ||||||

8. | Financial Statements and Supplementary Data | 33 | ||||||

9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 34 | ||||||

9A. | Controls and Procedures | 34 | ||||||

(a) Evaluation of Disclosure Controls and Procedures | 34 | |||||||

(b) Management's Report on Internal Control Over Financial Reporting | 34 | |||||||

(c) Changes in Internal Control Over Financial Reporting | 34 | |||||||

9B. | Other Information | 34 | ||||||

PART III | ||||||||

10. | Directors, Executive Officers and Corporate Governance | 35 | ||||||

11. | Executive Compensation | 36 | ||||||

12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 36 | ||||||

13. | Certain Relationships and Related Transactions, and Director Independence | 36 | ||||||

14. | Principal Accounting Fees and Services | 36 | ||||||

| PART IV | ||||||||

15. | Exhibits, Financial Statement Schedules | 37 | ||||||

Schedule II - Valuation and Qualifying Accounts | 38 | |||||||

Signatures | 39 | |||||||

| EX-4.2 | ||||||||

| EX-10.1 | ||||||||

| EX-10.2 | ||||||||

| EX-10.3 | ||||||||

| EX-10.5 | ||||||||

| EX-10.6 | ||||||||

| EX-10.7 | ||||||||

| EX-10.13 | ||||||||

| EX-10.19 | ||||||||

| EX-12.1 | ||||||||

| EX-21.1 | ||||||||

| EX-23.1 | ||||||||

| EX-24.1 | ||||||||

| EX-24.2 | ||||||||

| EX-24.3 | ||||||||

| EX-24.4 | ||||||||

| EX-24.5 | ||||||||

| EX-24.6 | ||||||||

| EX-24.7 | ||||||||

| EX-24.8 | ||||||||

| EX-24.9 | ||||||||

| EX-24.10 | ||||||||

| EX-24.11 | ||||||||

| EX-24.12 | ||||||||

| EX-24.13 | ||||||||

| EX-31.1 | ||||||||

| EX-31.2 | ||||||||

| EX-32.1 | ||||||||

| EX-32.2 | ||||||||

| EX-99.1 | ||||||||

| INSTANCE DOCUMENT | ||||||||

| SCHEMA DOCUMENT | ||||||||

| CALCULATION LINKBASE DOCUMENT | ||||||||

| LABELS LINKBASE DOCUMENT | ||||||||

| PRESENTATION LINKBASE DOCUMENT | ||||||||

| DEFINITION LINKBASE DOCUMENT | ||||||||

1

CAUTIONARY

STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION

FOR THE PURPOSE OF "SAFE HARBOR" PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This Annual Report on Form 10-K of Chevron Corporation contains forward-looking statements relating to Chevron's operations that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words such as "anticipates," "expects," "intends," "plans," "targets," "projects," "believes," "seeks," "schedules," "estimates," "budgets" and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond the company's control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are crude-oil and natural-gas prices; refining, marketing and chemical margins; actions of competitors or regulators; timing of exploration expenses; timing of crude-oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of equity affiliates; the inability or failure of the company's joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude-oil and natural-gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company's net production or manufacturing facilities or delivery/transportation networks due to war, accidents, political events, civil unrest, severe weather or crude-oil production quotas that might be imposed by OPEC (Organization of Petroleum Exporting Countries); the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant investment or product changes under existing or future environmental statutes, regulations and litigation; the potential liability resulting from pending or future litigation; the company's acquisition or disposition of assets; gains and losses from asset dispositions or impairments; government-mandated sales, divestitures, recapitalizations, industry-specific taxes, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; and the factors set forth under the heading "Risk Factors" on pages 30 and 31 in this report. In addition, such statements could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed in this report could also have material adverse effects on forward-looking statements.

2

PART I

| Item 1. | Business |

| (a) | General Development of Business |

Summary Description of Chevron

Chevron Corporation, 1 a Delaware corporation, manages its investments in subsidiaries and affiliates and provides administrative, financial, management and technology support to U.S. and international subsidiaries that engage in fully integrated petroleum operations, chemicals operations, mining operations, power generation and energy services. Exploration and production (upstream) operations consist of exploring for, developing and producing crude oil and natural gas and also marketing natural gas. Refining, marketing and transportation (downstream) operations relate to refining crude oil into finished petroleum products; marketing crude oil and the many products derived from petroleum; and transporting crude oil, natural gas and petroleum products by pipeline, marine vessel, motor equipment and rail car. Chemical operations include the manufacture and marketing of commodity petrochemicals, plastics for industrial uses, and fuel and lubricant oil additives.

A list of the company's major subsidiaries is presented on pages E-125 and E-126. As of December 31, 2008, Chevron had approximately 67,000 employees (including about 5,000 service station employees). Approximately 32,000 employees (including about 4,000 service station employees), or 48 percent, were employed in U.S. operations.

Overview of Petroleum Industry

Petroleum industry operations and profitability are influenced by many factors, and individual petroleum companies have little control over some of them. Governmental policies, particularly in the areas of taxation, energy and the environment have a significant impact on petroleum activities, regulating how companies are structured and where and how companies conduct their operations and formulate their products and, in some cases, limiting their profits directly. Prices for crude oil and natural gas, petroleum products and petrochemicals are generally determined by supply and demand for these commodities. However, some governments impose price controls on refined products such as gasoline or diesel fuel. The members of the Organization of Petroleum Exporting Countries (OPEC) are typically the world's swing producers of crude oil, and their production levels are a major factor in determining worldwide supply. Demand for crude oil and its products and for natural gas is largely driven by the conditions of local, national and global economies, although weather patterns and taxation relative to other energy sources also play a significant part. Seasonality is not a primary driver to changes in the company's quarterly earnings during the year.

Strong competition exists in all sectors of the petroleum and petrochemical industries in supplying the energy, fuel and chemical needs of industry and individual consumers. Chevron competes with fully integrated major global petroleum companies, as well as independent and national petroleum companies, for the acquisition of crude oil and natural gas leases and other properties and for the equipment and labor required to develop and operate those properties. In its downstream business, Chevron also competes with fully integrated major petroleum companies and other independent refining, marketing and transportation entities in the sale or acquisition of various goods or services in many national and international markets.

Operating Environment

Refer to pages FS-2 through FS-8 of this Form 10-K in Management's Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the company's current business environment and outlook.

1 Incorporated in Delaware in 1926 as Standard Oil Company of California, the company adopted the name Chevron Corporation in 1984 and ChevronTexaco Corporation in 2001. In 2005, ChevronTexaco Corporation changed its name to Chevron Corporation. As used in this report, the term "Chevron" and such terms as "the company," "the corporation," "our," "we" and "us" may refer to Chevron Corporation, one or more of its consolidated subsidiaries, or all of them taken as a whole, but unless stated otherwise, it does not include "affiliates" of Chevron - i.e., those companies accounted for by the equity method (generally owned 50 percent or less) or investments accounted for by the cost method. All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs.

3

Chevron Strategic Direction

Chevron's primary objective is to create stockholder value and achieve sustained financial returns from its operations that will enable it to outperform its competitors. As a foundation for achieving this objective, the company has established the following strategies:

Strategies for Major Businesses

| • | Upstream - grow profitably in core areas, build new legacy positions and commercialize the company's equity natural-gas resource base while growing a high-impact global gas business | |

| • | Downstream - improve returns and selectively grow, with a focus on integrated value creation |

The company also continues to invest in renewable-energy technologies, with an objective of capturing profitable positions.

Enabling Strategies Companywide

| • | Invest in people to achieve the company's strategies | |

| • | Leverage technology to deliver superior performance and growth | |

| • | Build organizational capability to deliver world-class performance in operational excellence, cost management, capital stewardship and profitable growth |

(b) Description of Business and Properties

The upstream, downstream and chemicals activities of the company and its equity affiliates are widely dispersed geographically, with operations in North America, South America, Europe, Africa, the Middle East, Asia and Australia. Tabulations of segment sales and other operating revenues, earnings and income taxes for the three years ending December 31, 2008, and assets as of the end of 2008 and 2007 - for the United States and the company's international geographic areas - are in Note 9 to the Consolidated Financial Statements beginning on page FS-38. Similar comparative data for the company's investments in and income from equity affiliates and property, plant and equipment are in Notes 12 and 13 on pages FS-41 to FS-43.

Capital and Exploratory Expenditures

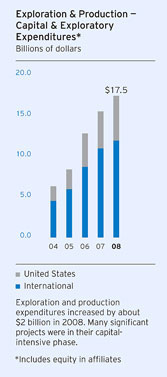

Total expenditures for 2008 were $22.8 billion, including $2.3 billion for Chevron's share of expenditures by affiliated companies, which did not require cash outlays by the company. In 2007 and 2006, expenditures were $20 billion and $16.6 billion, respectively, including the company's share of affiliates' expenditures of $2.3 billion and $1.9 billion in the corresponding periods.

Of the $22.8 billion in expenditures for 2008, about three-fourths, or $17.5 billion, was related to upstream activities. Approximately the same percentage was also expended for upstream operations in 2007 and 2006. International upstream accounted for about 70 percent of the worldwide upstream investment in each of the three years, reflecting the company's continuing focus on opportunities that are available outside the United States.

In 2009, the company estimates capital and exploratory expenditures will be $22.8 billion, including $1.8 billion of spending by affiliates. About three-fourths of the total, or $17.5 billion, is budgeted for exploration and production activities, with $13.9 billion of that amount outside the United States.

Refer also to a discussion of the company's capital and exploratory expenditures on page FS-11 and FS-12.

Upstream - Exploration and Production

The table on the following page summarizes the net production of liquids and natural gas for 2008 and 2007 by the company and its affiliates.

4

Net Production of Crude Oil and Natural Gas Liquids and Natural Gas 1

Components of Oil-Equivalent | ||||||||||||||||||||||||

| Crude Oil & Natural Gas | ||||||||||||||||||||||||

| Oil-Equivalent (Thousands | Liquids (Thousands of | Natural Gas (Millions of | ||||||||||||||||||||||

| of Barrels per Day) | Barrels per Day) | Cubic Feet per Day) | ||||||||||||||||||||||

| 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | |||||||||||||||||||

United States: | ||||||||||||||||||||||||

California | 215 | 221 | 201 | 205 | 88 | 97 | ||||||||||||||||||

Gulf of Mexico | 160 | 214 | 86 | 118 | 439 | 576 | ||||||||||||||||||

Texas (Onshore) | 149 | 153 | 76 | 77 | 441 | 457 | ||||||||||||||||||

Other States | 147 | 155 | 58 | 60 | 533 | 569 | ||||||||||||||||||

Total United States | 671 | 743 | 421 | 460 | 1,501 | 1,699 | ||||||||||||||||||

Africa: | ||||||||||||||||||||||||

Angola | 154 | 179 | 145 | 171 | 52 | 48 | ||||||||||||||||||

Nigeria | 154 | 129 | 142 | 126 | 72 | 15 | ||||||||||||||||||

Chad | 29 | 32 | 28 | 31 | 5 | 4 | ||||||||||||||||||

Republic of the Congo | 13 | 8 | 11 | 7 | 12 | 7 | ||||||||||||||||||

Democratic Republic of the Congo | 2 | 3 | 2 | 3 | 1 | 2 | ||||||||||||||||||

Total Africa | 352 | 351 | 328 | 338 | 142 | 76 | ||||||||||||||||||

Asia-Pacific: | ||||||||||||||||||||||||

Thailand | 217 | 224 | 67 | 71 | 894 | 916 | ||||||||||||||||||

Partitioned Neutral Zone (PNZ) 2 | 106 | 112 | 103 | 109 | 20 | 17 | ||||||||||||||||||

Australia | 96 | 100 | 34 | 39 | 376 | 372 | ||||||||||||||||||

Bangladesh | 71 | 47 | 2 | 2 | 414 | 275 | ||||||||||||||||||

Kazakhstan | 66 | 66 | 41 | 41 | 153 | 149 | ||||||||||||||||||

Azerbaijan | 29 | 61 | 28 | 60 | 7 | 5 | ||||||||||||||||||

Philippines | 26 | 26 | 5 | 5 | 128 | 126 | ||||||||||||||||||

China | 22 | 26 | 19 | 22 | 22 | 22 | ||||||||||||||||||

Myanmar | 15 | 17 | - | - | 89 | 100 | ||||||||||||||||||

Total Asia-Pacific | 648 | 679 | 299 | 349 | 2,103 | 1,982 | ||||||||||||||||||

Indonesia | 235 | 241 | 182 | 195 | 319 | 277 | ||||||||||||||||||

Other International: | ||||||||||||||||||||||||

United Kingdom | 106 | 115 | 71 | 78 | 208 | 220 | ||||||||||||||||||

Denmark | 61 | 63 | 37 | 41 | 142 | 132 | ||||||||||||||||||

Argentina | 44 | 47 | 37 | 39 | 45 | 50 | ||||||||||||||||||

Canada | 37 | 36 | 36 | 35 | 4 | 5 | ||||||||||||||||||

Colombia | 35 | 30 | - | - | 209 | 178 | ||||||||||||||||||

Trinidad and Tobago | 32 | 29 | - | - | 189 | 174 | ||||||||||||||||||

Netherlands | 9 | 4 | 2 | 3 | 40 | 5 | ||||||||||||||||||

Norway | 6 | 6 | 6 | 6 | 1 | 1 | ||||||||||||||||||

Total Other International | 330 | 330 | 189 | 202 | 838 | 765 | ||||||||||||||||||

Total International | 1,565 | 1,601 | 998 | 1,084 | 3,402 | 3,100 | ||||||||||||||||||

Total Consolidated Operations | 2,236 | 2,344 | 1,419 | 1,544 | 4,903 | 4,799 | ||||||||||||||||||

Equity Affiliates 3 | 267 | 248 | 230 | 212 | 222 | 220 | ||||||||||||||||||

Total Including Affiliates 4 | 2,503 | 2,592 | 1,649 | 1,756 | 5,125 | 5,019 | ||||||||||||||||||

1 Excludes

Athabasca oil sands production, net: | 27 | 27 | 27 | 27 | - | - | ||||||||||||||||||

2 Located between Saudi Arabia and Kuwait. | ||||||||||||||||||||||||

3 Volumes represent Chevron's share of production by affiliates, including Tengizchevroil (TCO) in Kazakhstan and Petroboscan, Petroindependiente and Petropiar/Hamaca in Venezuela. | ||||||||||||||||||||||||

4 Volumes include natural gas consumed in operations of 520 million and 498 million cubic feet per day in 2008 and 2007, respectively. | ||||||||||||||||||||||||

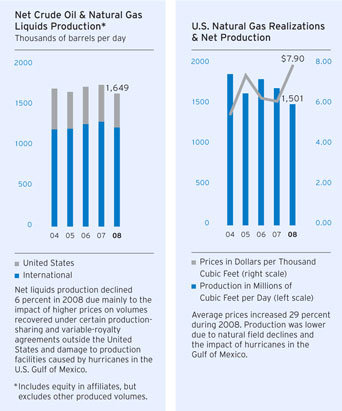

Worldwide oil-equivalent production, including volumes from oil sands (refer to footnote 1 above), was 2.53 million barrels per day, down about 3 percent from 2007. The decline was mostly attributable to damages to facilities caused by September 2008 hurricanes in the U.S. Gulf of Mexico and the impact of higher prices on certain production-sharing and variable-royalty agreements outside the United States. Refer to the "Results of Operations" section beginning on page FS-6 for a detailed discussion of the factors explaining the 2006 - 2008 changes in production for crude oil and natural gas liquids and natural gas.

5

The company estimates that its average worldwide oil-equivalent production in 2009 will be approximately 2.63 million barrels per day. This estimate is subject to many uncertainties, including quotas that may be imposed by OPEC, the price effect on production volumes calculated under cost-recovery and variable-royalty provisions of certain contracts, changes in fiscal terms or restrictions on the scope of company operations, delays in project start-ups, fluctuations in demand for natural gas in various markets, and production that may have to be shut in due to weather conditions, civil unrest, changing geopolitics or other disruptions to operations. Future production levels also are affected by the size and number of economic investment opportunities and, for new large-scale projects, the time lag between initial exploration and the beginning of production. Refer to the "Review of Ongoing Exploration and Production Activities in Key Areas," beginning on page 9, for a discussion of the company's major oil and gas development projects.

Average Sales Prices and Production Costs per Unit of Production

Refer to Table IV on page FS-67 for the company's average sales price per barrel of crude oil and natural gas liquids and per thousand cubic feet of natural gas produced and the average production cost per oil-equivalent barrel for 2008, 2007 and 2006.

Gross and Net Productive Wells

The following table summarizes gross and net productive wells at year-end 2008 for the company and its affiliates:

Productive Oil and Gas Wells 1 at December 31, 2008

| Productive 2 | Productive 2 | |||||||||||||||

| Oil Wells | Gas Wells | |||||||||||||||

| Gross | Net | Gross | Net | |||||||||||||

United States: | ||||||||||||||||

California | 25,726 | 23,921 | 188 | 44 | ||||||||||||

Gulf of Mexico | 1,489 | 1,214 | 922 | 701 | ||||||||||||

Other U.S. | 23,729 | 8,460 | 10,587 | 4,824 | ||||||||||||

Total United States | 50,944 | 33,595 | 11,697 | 5,569 | ||||||||||||

Africa | 2,126 | 723 | 17 | 7 | ||||||||||||

Asia-Pacific | 2,479 | 1,150 | 2,468 | 1,560 | ||||||||||||

Indonesia | 7,879 | 7,737 | 203 | 165 | ||||||||||||

Other International | 1,091 | 680 | 275 | 105 | ||||||||||||

Total International | 13,575 | 10,290 | 2,963 | 1,837 | ||||||||||||

Total Consolidated Companies | 64,519 | 43,885 | 14,660 | 7,406 | ||||||||||||

Equity in Affiliates | 1,174 | 413 | 7 | 2 | ||||||||||||

Total Including Affiliates | 65,693 | 44,298 | 14,667 | 7,408 | ||||||||||||

Multiple completion wells included above: | 881 | 549 | 411 | 318 | ||||||||||||

| 1 | Includes wells producing or capable of producing and injection wells temporarily functioning as producing wells. Wells that produce both oil and gas are classified as oil wells. | |

| 2 | Gross wells include the total number of wells in which the company has an interest. Net wells include wholly owned wells and the sum of the company's fractional interests in gross wells. |

Reserves

Refer to Table V beginning on page FS-67 for a tabulation of the company's proved net oil and gas reserves by geographic area, at the beginning of 2006 and each year-end from 2006 through 2008, and an accompanying discussion of major changes to proved reserves by geographic area for the three-year period ending December 31, 2008. During 2008, the company provided oil and gas reserves estimates for 2007 to the Department of Energy, Energy Information Administration (EIA), that agree with the 2007 reserve volumes in Table V. This reporting fulfilled the requirement that such estimates are to be consistent with, and do not differ more than 5 percent from, the information furnished to the Securities and Exchange Commission in the company's 2007 Annual Report on Form 10-K. During 2009, the company will file estimates of oil and gas reserves with the Department of Energy, EIA, consistent with the 2008 reserve data reported in Table V.

6

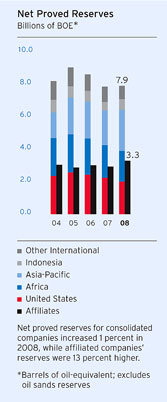

The net proved-reserve balances at the end of each of the three years 2006 through 2008 are shown in the table below:

Net Proved Reserves at December 31

| 2008 | 2007 | 2006 | ||||||||||

Liquids* - Millions of barrels | ||||||||||||

Consolidated Companies | 4,735 | 4,665 | 5,294 | |||||||||

Affiliated Companies | 2,615 | 2,422 | 2,512 | |||||||||

Natural Gas - Billions of cubic feet | ||||||||||||

Consolidated Companies | 19,022 | 19,137 | 19,910 | |||||||||

Affiliated Companies | 4,053 | 3,003 | 2,974 | |||||||||

Total Oil-Equivalent - Millions of barrels | ||||||||||||

Consolidated Companies | 7,905 | 7,855 | 8,612 | |||||||||

Affiliated Companies | 3,291 | 2,922 | 3,008 | |||||||||

| * | Crude oil, condensate and natural gas liquids |

Acreage

At December 31, 2008, the company owned or had under lease or similar agreements undeveloped and developed oil and gas properties located throughout the world. The geographical distribution of the company's acreage is shown in the following table.

Acreage 1 at December 31, 2008

(Thousands of Acres)

| Developed and | ||||||||||||||||||||||||

| Undeveloped 2 | Developed 2 | Undeveloped | ||||||||||||||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||||||||||||||

United States: | ||||||||||||||||||||||||

California | 138 | 122 | 183 | 176 | 321 | 298 | ||||||||||||||||||

Gulf of Mexico | 2,108 | 1,500 | 1,568 | 1,141 | 3,676 | 2,641 | ||||||||||||||||||

Other U.S. | 3,441 | 2,784 | 4,461 | 2,497 | 7,902 | 5,281 | ||||||||||||||||||

Total United States | 5,687 | 4,406 | 6,212 | 3,814 | 11,899 | 8,220 | ||||||||||||||||||

Africa | 17,686 | 7,710 | 2,487 | 921 | 20,173 | 8,631 | ||||||||||||||||||

Asia-Pacific | 45,429 | 22,447 | 5,937 | 2,649 | 51,366 | 25,096 | ||||||||||||||||||

Indonesia | 8,031 | 5,348 | 383 | 341 | 8,414 | 5,689 | ||||||||||||||||||

Other International | 35,236 | 19,957 | 1,924 | 613 | 37,160 | 20,570 | ||||||||||||||||||

Total International | 106,382 | 55,462 | 10,731 | 4,524 | 117,113 | 59,986 | ||||||||||||||||||

Total Consolidated Companies | 112,069 | 59,868 | 16,943 | 8,338 | 129,012 | 68,206 | ||||||||||||||||||

Equity in Affiliates | 640 | 300 | 259 | 104 | 899 | 404 | ||||||||||||||||||

Total Including Affiliates | 112,709 | 60,168 | 17,202 | 8,442 | 129,911 | 68,610 | ||||||||||||||||||

| 1 | Gross acreage includes the total number of acres in all tracts in which the company has an interest. Net acreage includes wholly owned interests and the sum of the company's fractional interests in gross acreage. | |

| 2 | Developed acreage is spaced or assignable to productive wells. Undeveloped acreage is acreage on which wells have not been drilled or completed to permit commercial production and that may contain undeveloped proved reserves. The gross undeveloped acres that will expire in 2009, 2010 and 2011 if production is not established by certain required dates are 5,707, 8,290 and 4,720, respectively. |

7

Delivery Commitments

The company sells crude oil and natural gas from its producing operations under a variety of contractual obligations. Most contracts generally commit the company to sell quantities based on production from specified properties, but some natural gas sales contracts specify delivery of fixed and determinable quantities, as discussed below.

In the United States, the company is contractually committed to deliver to third parties and affiliates 414 billion cubic feet of natural gas through 2011. The company believes it can satisfy these contracts from quantities available from production of the company's proved developed U.S. reserves. These contracts include a variety of pricing terms, including both index and fixed-price contracts.

Outside the United States, the company is contractually committed to deliver to third parties a total of 865 billion cubic feet of natural gas from 2009 through 2011 from Argentina, Australia, Canada, Colombia, Denmark and the Philippines. The sales contracts contain variable pricing formulas that are generally referenced to the prevailing market price for crude oil, natural gas or other petroleum products at the time of delivery. The company believes it can satisfy these contracts from quantities available from production of the company's proved developed reserves in Argentina, Australia, Colombia, Denmark and the Philippines. The company plans to meet its Canadian contractual delivery commitments of 28 billion cubic feet through third-party purchases.

Development Activities

Refer to Table I on page FS-62 for details associated with the company's development expenditures and costs of proved property acquisitions for 2008, 2007 and 2006.

The table below summarizes the company's net interest in productive and dry development wells completed in each of the past three years and the status of the company's development wells drilling at December 31, 2008. A "development well" is a well drilled within the proved area of a crude oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Development Well Activity

| Wells Drilling | Net Wells Completed 1 | |||||||||||||||||||||||||||||||

| at 12/31/08 2 | 2008 | 2007 | 2006 | |||||||||||||||||||||||||||||

| Gross | Net | Prod. | Dry | Prod. | Dry | Prod. | Dry | |||||||||||||||||||||||||

United States: | ||||||||||||||||||||||||||||||||

California | 8 | 1 | 533 | - | 620 | - | 600 | - | ||||||||||||||||||||||||

Gulf of Mexico | 44 | 25 | 26 | 3 | 30 | 1 | 34 | 5 | ||||||||||||||||||||||||

Other U.S. | 9 | 8 | 287 | 1 | 225 | 4 | 317 | 6 | ||||||||||||||||||||||||

Total United States | 61 | 34 | 846 | 4 | 875 | 5 | 951 | 11 | ||||||||||||||||||||||||

Africa | 13 | 8 | 33 | - | 43 | - | 45 | 2 | ||||||||||||||||||||||||

Asia-Pacific | 13 | 4 | 203 | 1 | 223 | - | 235 | 1 | ||||||||||||||||||||||||

Indonesia | 2 | 2 | 462 | - | 374 | - | 258 | - | ||||||||||||||||||||||||

Other International | 7 | 2 | 41 | - | 52 | - | 43 | - | ||||||||||||||||||||||||

Total International | 35 | 16 | 739 | 1 | 692 | - | 581 | 3 | ||||||||||||||||||||||||

Total Consolidated Companies | 96 | 50 | 1,585 | 5 | 1,567 | 5 | 1,532 | 14 | ||||||||||||||||||||||||

Equity in Affiliates | 2 | 1 | 16 | - | 3 | - | 13 | - | ||||||||||||||||||||||||

Total Including Affiliates | 98 | 51 | 1,601 | 5 | 1,570 | 5 | 1,545 | 14 | ||||||||||||||||||||||||

| 1 | Indicates the fractional number of wells completed during the year, regardless of when drilling was initiated. Completion refers to the installation of permanent equipment for the production of crude oil or natural gas or, in the case of a dry well, the reporting of abandonment to the appropriate agency. | |

| 2 | Represents wells in the process of drilling, including wells for which drilling was not completed and which were temporarily suspended at the end of 2008. Gross wells include the total number of wells in which the company has an interest. Net wells include wholly owned wells and the sum of the company's fractional interests in gross wells. |

8

Exploration Activities

The following table summarizes the company's net interests in productive and dry exploratory wells completed in each of the last three years and the number of exploratory wells drilling at December 31, 2008. "Exploratory wells" are wells drilled to find and produce crude oil or natural gas in unproved areas and include delineation wells, which are wells drilled to find a new reservoir in a field previously found to be productive of crude oil or natural gas in another reservoir or to extend a known reservoir beyond the proved area.

Exploratory Well Activity

| Wells Drilling | Net Wells Completed 1,2 | |||||||||||||||||||||||||||||||

| at 12/31/08 3 | 2008 | 2007 | 2006 | |||||||||||||||||||||||||||||

| Gross | Net | Prod. | Dry | Prod. | Dry | Prod. | Dry | |||||||||||||||||||||||||

United States: | ||||||||||||||||||||||||||||||||

California | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

Gulf of Mexico | 9 | 3 | 8 | 1 | 4 | 7 | 9 | 8 | ||||||||||||||||||||||||

Other U.S. | - | - | - | 1 | - | 1 | 7 | - | ||||||||||||||||||||||||

Total United States | 9 | 3 | 8 | 2 | 4 | 8 | 16 | 8 | ||||||||||||||||||||||||

Africa | 8 | 3 | 2 | 1 | 6 | 2 | 1 | - | ||||||||||||||||||||||||

Asia-Pacific | 4 | 2 | 10 | 1 | 14 | 9 | 18 | 7 | ||||||||||||||||||||||||

Indonesia | - | - | 4 | 1 | 1 | - | 2 | - | ||||||||||||||||||||||||

Other International | 2 | - | 39 | 2 | 41 | 6 | 6 | 3 | ||||||||||||||||||||||||

Total International | 14 | 5 | 55 | 5 | 62 | 17 | 27 | 10 | ||||||||||||||||||||||||

Total Consolidated Companies | 23 | 8 | 63 | 7 | 66 | 25 | 43 | 18 | ||||||||||||||||||||||||

Equity in Affiliates | - | - | - | - | - | - | 1 | - | ||||||||||||||||||||||||

Total Including Affiliates | 23 | 8 | 63 | 7 | 66 | 25 | 44 | 18 | ||||||||||||||||||||||||

| 1 | 2007 conformed to 2008 presentation. | |

| 2 | Indicates the fractional number of wells completed during the year, regardless of when drilling was initiated. Completion refers to the installation of permanent equipment for the production of crude oil or natural gas or, in the case of a dry well, the reporting of abandonment to the appropriate agency. Some exploratory wells are not drilled with the intention of producing from the well bore. In such cases, "completion" refers to the completion of drilling. Further categorization of productive or dry is based on the determination as to whether hydrocarbons in a sufficient quantity were found to justify completion as a producing well, whether or not the well is actually going to be completed as a producer. | |

| 3 | Represents wells that are in the process of drilling but have been neither abandoned nor completed as of the last day of the year, including wells for which drilling was not completed and which were temporarily suspended at the end of 2008. Does not include wells for which drilling was completed at year-end 2008 and that were reported as suspended wells in Note 20 beginning on page FS-48. Gross wells include the total number of wells in which the company has an interest. Net wells include wholly owned wells and the sum of the company's fractional interests in gross wells. |

Refer to Table I on page FS-62 for detail of the company's exploration expenditures and costs of unproved property acquisitions for 2008, 2007 and 2006.

Review of Ongoing Exploration and Production Activities in Key Areas

Chevron's 2008 key upstream activities, some of which are also discussed in Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page FS-2, are presented below. The comments include references to "total production" and "net production," which are defined under "Production" in Exhibit 99.1 on page E-146.

The discussion that follows references the status of proved reserves recognition for significant long-lead-time projects not yet on production and for projects recently placed on production. Reserves are not discussed for recent discoveries that have yet to advance to a project stage or for mature areas of production that do not have individual projects requiring significant levels of capital or exploratory investment. Amounts indicated for project costs represent total project costs, not the company's share of costs for projects that are less than wholly owned.

9

Consolidated Operations

| Chevron has production and exploration activities in most of the world's major hydrocarbon basins. The company's upstream strategy is to grow profitably in core areas, build new legacy positions and commercialize the company's equity natural-gas resource base while growing a high-impact global gas business. The map at left indicates Chevron's primary areas of production and exploration. |

| a) | United States |

Upstream activities in the United States are concentrated in California, the Gulf of Mexico, Louisiana, Texas, New Mexico, the Rocky Mountains and Alaska. Average net oil-equivalent production in the United States during 2008 was 671,000 barrels per day, composed of 421,000 barrels of crude oil and natural gas liquids and 1.5 billion cubic feet of natural gas. Refer to Table V beginning on page FS-67 for a discussion of the net proved reserves and different hydrocarbon characteristics for the company's major U.S. producing areas.

| California: The company has significant production in the San Joaquin Valley. In 2008, average net oil-equivalent production was 215,000 barrels per day, composed of 196,000 barrels of crude oil, 88 million cubic feet of natural gas and 5,000 barrels of natural gas liquids. Approximately 84 percent of the crude-oil production is considered heavy oil (typically with API gravity lower than 22 degrees). |

| Gulf of Mexico: Average net oil-equivalent

production during 2008 for the company's combined interests

in the Gulf of Mexico shelf and deepwater areas, and the onshore

fields in the region was 160,000 barrels per day. The daily

oil-equivalent production comprised 76,000 barrels of crude

oil, 439 million cubic feet of natural gas and

10,000 barrels of natural gas liquids. Production levels in 2008 were adversely affected by damage to facilities caused by hurricanes Gustav and Ike in September. At the end of 2008, approximately 50,000 barrels per day of oil-equivalent production remained offline, with restoration of the volumes to occur as repairs to third-party pipelines and producing facilities are completed. |

10

During 2008, Chevron was engaged in various development and exploration activities in the deepwater Gulf of Mexico. Production start-up occurred in fourth quarter 2008 at the 75 percent-owned and operated Blind Faith project. The project was designed for daily production capacity of 65,000 barrels of crude oil and 55 million cubic feet of natural gas from subsea wells tied back to a semisubmersible hull. Proved undeveloped reserves were initially recorded in 2005, and a portion was transferred to the proved-developed category in 2008 coincident with project start-up. The production life of the field is estimated to be approximately 20 years.

At Caesar/Tonga, the company participated in a successful appraisal well in 2008. The Tonga and Caesar partnerships have formed a unit agreement for the area, with Chevron having a 20 percent nonoperated working interest. First oil is expected by 2011. Development plans include a subsea tie-back to a nearby third-party production facility.

The company is also participating in the ultra-deep Perdido Regional Development. The project encompasses the installation of a producing host facility to service multiple fields, including Chevron's 33 percent-owned Great White, 60 percent-owned Silvertip and 58 percent-owned Tobago. Chevron has a 38 percent interest in the Perdido Regional Host. All of these fields and the production facility are partner-operated. Activities during 2008 included facility construction, development drilling and spar installation. First oil is expected in early 2010, with the facility capable of handling 130,000 barrels of oil-equivalent per day. The project has an expected life of approximately 25 years. Proved undeveloped reserves related to the project were first recorded in 2006, and the phased reclassification of these reserves to the proved-developed category is anticipated near the time of production start-up.

At the 58 percent-owned and operated Tahiti Field, development work continued following a delay in 2007 due to metallurgical problems with the facility's mooring shackles, which problems have been resolved. The project is designed as a subsea development, with the wells tied back to a truss-spar floating production facility. Production start-up is expected in mid-2009. Initial booking of proved undeveloped reserves occurred in 2003 for the project, with the transfer of a portion of these reserves into the proved-developed category anticipated near the time of production start-up. With an estimated production life of 30 years, Tahiti is designed to have a maximum total daily production of 125,000 barrels of crude oil and 70 million cubic feet of natural gas. In early 2009, a possible second phase of field development was under evaluation.

Deepwater exploration activities in 2008 and early 2009 included participation in 12 exploratory wells - four wildcat and eight appraisal. Exploratory work included the following:

| • | Big Foot - 60 percent-owned and operated. A successful appraisal well was completed in first quarter 2008. A final appraisal well began drilling in November 2008, and was completed in January 2009. As of late February 2009, evaluation of the drilling results was under way. | |

| • | Buckskin - 55 percent-owned and operated. A successful wildcat well was completed in early 2009. | |

| • | Jack & St. Malo - 50 percent- and 41 percent-owned and operated interests, respectively. The prospects are being evaluated together due to their relative proximity. Successful appraisal wells were drilled during 2008 at both Jack and St. Malo, bringing the total wells drilled to three at Jack and four at St. Malo. | |

| • | Knotty Head - 25 percent-owned and nonoperated working interest. Subsurface studies continued during 2008 at this 2005 discovery, with an appraisal well planned for third quarter 2009. | |

| • | Puma - 22 percent-owned and nonoperated working interest. An appraisal well began drilling in late 2008 and was scheduled for completion in second quarter 2009. | |

| • | Tubular Bells - 30 percent-owned and nonoperated working interest. An appraisal well was completed in 2008. |

At the end of 2008, the company had not yet recognized proved reserves for any of the exploration projects discussed above.

Besides the activities connected with the development and exploration projects in the Gulf of Mexico, the company also has access to liquefied natural gas (LNG) for the North America natural gas market through the Sabine Pass LNG terminal in Louisiana. The terminal was completed in mid-2008, and Chevron has contracted for 1 billion cubic feet per day of regasification capacity at the facility beginning in July 2009. The company also has completed the permitting process to develop the Casotte Landing regasification facility adjacent to the company's Pascagoula refinery in Mississippi. Casotte Landing remains a development option for Chevron to bring LNG into the United States.

Also in the Sabine Pass area of Louisiana, the company has a binding agreement to be one of the anchor shippers in a 3.2 billion-cubic-feet-per-day third-party-owned natural gas pipeline. Chevron has contracted to have 1.6 billion cubic

11

feet per day of capacity in the pipeline, of which 1 billion cubic feet per day is in a new pipeline and 600 million cubic feet per day is interconnecting capacity to an existing pipeline. The new pipeline system, expected to be completed in second quarter 2009, will provide access to Chevron's Sabine and Bridgeline pipelines, which connect to the Henry Hub. The Henry Hub interconnects to nine interstate and four intrastate pipelines and is the pricing point for natural gas futures contracts traded on the NYMEX (New York Mercantile Exchange).

Other U.S. Areas: Outside California and the Gulf of Mexico, the company manages operations across the mid-continental United States and Alaska. During 2008, the company's U.S. production outside California and the Gulf of Mexico averaged 296,000 net oil-equivalent barrels per day, composed of 101,000 barrels of crude oil, 974 million cubic feet of natural gas and 33,000 barrels of natural gas liquids.

In the Piceance Basin in northwestern Colorado, the company is continuing a natural-gas development in which it holds a 100 percent operated working interest. A pipeline to transport the gas to a gathering system was completed in 2008 and facilities to produce 60 million cubic feet of natural gas per day are expected to be completed in mid-2009. Development drilling began in 2007, and reserves will be recognized over the life of the project based upon drilling results.

b) Africa

In Africa, the company is engaged in exploration and production activities in Angola, Chad, Democratic Republic of the Congo, Libya, Nigeria and Republic of the Congo.

| Angola: Chevron holds company-operated working interests in offshore Blocks 0 and 14 and nonoperated working interests in offshore Block 2 and the onshore Fina Sonangol Texaco (FST) area. Net production from these operations in 2008 averaged 154,000 barrels of oil-equivalent per day. The company operates in areas A and B of the 39 percent-owned Block 0, which averaged 109,000 barrels per day of net liquids production in 2008. The Block 0 concession extends through 2030. Start-up of the Mafumeira Field in Area A of Block 0 is expected in third quarter 2009, with crude-oil production ramping up to the expected maximum total of 35,000 barrels per day in 2011. Two delineation wells were drilled in Area A. One well found commercial quantities of hydrocarbons and was placed into production during the year. The acquisition of seismic data started in late 2008 and is expected to be finalized in 2010. Also in Area A are three gas management projects that are expected to eliminate routine flaring of natural gas by injecting excess natural gas into various reservoirs. |

The Takula gas-processing platform started production in December 2008. The Cabinda Gas Plant is scheduled for start-up in the second half of 2009. The Takula and Malongo Flare and Relief project is scheduled for start-up in stages beginning in the second half of 2009 and continuing into 2011. In Area B, development drilling occurred during 2008 at the Nemba and Kokongo fields. Front-end engineering and development (FEED) continued on the South N'Dola field development.

In 31 percent-owned Block 14, net production in 2008 averaged 33,000 barrels of liquids per day. Activities in 2008 included development drilling at the Benguela Belize-Lobito Tomboco (BBLT) project and the ongoing evaluation of the Negage project. Development and production rights for the various fields in Block 14 expire between 2027 and 2029.

Also in Block 14, development of the Tombua and Landana fields continued. Installation of producing facilities was completed in late 2008, with expected start-up in the second half of 2009. Production from the Landana North reservoir is expected to continue to utilize the BBLT infrastructure after start-up. The maximum total production from Tombua and Landana of 100,000 barrels of crude oil per day is expected to occur in 2011. Proved undeveloped reserves were recognized for Tombua and Landana in 2001 and 2002, respectively. Reclassification from proved undeveloped to proved developed for Landana occurred in 2006 and 2007. Further reclassification is expected between 2009 and 2012 as the Tombua-Landana facilities and the drilling program are completed.

12

During 2008, in the Lucapa provisional development area of Block 14, exploratory drilling included an appraisal well that was the second successful appraisal of the 2006 Lucapa discovery. Studies to evaluate development alternatives at Lucapa began in second quarter 2008. At the end of 2008, proved reserves had not been recognized. At the 20 percent-owned Block 2 and the 16 percent-owned FST area, combined production during 2008 averaged 3,000 barrels of net liquids per day.

Refer also to page 22 for a discussion of affiliate operations in Angola.

Angola-Republic of the Congo Joint Development Area: Chevron operates and holds a 31 percent interest in the Lianzi Development Area located between Angola and Republic of the Congo. In 2006, the development of the Lianzi area was approved by a committee of representatives from the two countries, and a conceptual field development plan was also submitted to this committee. In late 2008, the project entered FEED, and further development planning is scheduled in 2009.

Republic of the Congo: Chevron has a 32 percent nonoperated working interest in the Nkossa, Nsoko and Moho-Bilondo exploitation permits and a 29 percent nonoperated working interest in the Kitina exploitation permit, all of which are offshore. Net production from the Republic of the Congo fields averaged 13,000 barrels of oil-equivalent per day in 2008.

Production at the Moho-Bilondo subsea development project started in April 2008. Maximum total production of 90,000 barrels of crude oil per day is expected in 2010. Proved undeveloped reserves were initially recognized in 2001. Transfer to the proved-developed category occurred in 2008. Chevron's development and production rights for Moho-Bilondo expire in 2030. One appraisal well was drilled in the Moho-Bilondo permit area during 2008. Drilling began on an exploration well in early 2009.

Chad/Cameroon: Chevron participates in a project to develop crude-oil fields in southern Chad and transport the produced volumes by pipeline to the coast of Cameroon for export. Chevron has a 25 percent nonoperated working interest in the producing operations and a 21 percent interest in two affiliates that own the pipeline.

Average daily net production in 2008 was 29,000 barrels of oil-equivalent. In late 2008, the development application for the Timbre Field in the Doba area was approved. The Chad producing operations are conducted under a concession that expires in 2030. Partners relinquished rights to exploration acreage not covered by field-development rights in February 2009.

Libya: Chevron is the operator and holds a 100 percent interest in the onshore Block 177 exploration license. A two-well exploration program is scheduled for 2009.

| Nigeria: Chevron holds a 40 percent interest in 13 concessions predominantly in the onshore and near-offshore region of the Niger Delta. The company operates under a joint-venture arrangement in this region with the Nigerian National Petroleum Corporation (NNPC), which owns a 60 percent interest. The company also owns varying interests in deepwater offshore blocks. In 2008, the company's net oil-equivalent production in Nigeria averaged 154,000 barrels per day, composed of 142,000 barrels of liquids and 72 million cubic feet of natural gas. In deepwater offshore, initial production occurred in July 2008 at the 68 percent-owned and operated Agbami Field in OML 127 and OML 128. The project is a subsea design, with wells tied back to a floating production, storage and offloading (FPSO) vessel. By year-end 2008, total crude-oil production was averaging approximately 130,000 barrels per day. Maximum total production of crude oil and natural gas liquids of 250,000 barrels per day is expected to be achieved by year-end 2009. The company initially recognized proved undeveloped reserves for Agbami in 2002. A portion of the proved undeveloped reserves was reclassified to proved developed in 2008 at production start-up. The total cost for the first phase of |

13

this project was $7 billion. Additional development drilling is being evaluated. The leases that contain the Agbami Field expire in 2023 and 2024.

Also in the deepwater area, the Aparo Field in OML 132 and OML 140 and the Bonga SW Field in offshore OML 118 share a common geologic structure and are planned to be jointly developed under a proposed unitization agreement. Work continued in early 2009 on agreements between Chevron and partners in OML 118. At the end of 2008, the company had not recognized proved reserves for this project.

Chevron operates and holds a 95 percent interest in the deepwater Nsiko discovery on OML 140. Development activities continued in 2008, with FEED expected to commence after commercial terms are resolved. At the end of 2008, the company had not recognized proved reserves for this project.

The company also holds a 30 percent nonoperated working interest in the deepwater Usan project in OML 138. The development plans involve subsea wells producing to an FPSO vessel. Major construction contracts were awarded in 2008, and development drilling is scheduled to begin in the second half of 2009. Production start-up is scheduled for 2012. Maximum total production of 180,000 barrels of crude oil per day is expected to be achieved within one year of start-up. The company recognized proved undeveloped reserves for the project in 2004, and a portion is expected to be reclassified to the proved-developed category near production start-up.

Chevron participated in three successful deepwater exploration wells during 2008. Hydrocarbons were confirmed in two wells in OPL 214 and one well in OML 113. Additional reservoir studies are scheduled for 2009, and one exploration well is planned later in the year. The company has 20 percent and 18 percent nonoperated working interests in the two leases, respectively. At the end of 2008, proved reserves had not been recognized for these activities.

In the Niger Delta, construction is under way on the Phase 3A expansion of the Escravos Gas Plant (EGP), which is expected to be installed in late 2009 and start up production in 2010. Phase 3A scope includes offshore natural-gas gathering and compression infrastructure and a second gas processing facility, which potentially would increase processing capacity from 285 million to 680 million cubic feet of natural gas per day and increase LPG and condensate export capacity from 15,000 to 58,000 barrels per day. EGP Phase 3A is designed to process natural gas from the Meji, Delta South, Okan and Mefa fields. Proved undeveloped reserves associated with EGP Phase 3A were recognized in 2002. These reserves are expected to be reclassified to proved developed as various project milestones are reached and related projects are completed. The anticipated life of EGP Phase 3A is 25 years. Phase 3B of the EGP project is designed to gather natural gas from eight offshore fields and to compress and transport natural gas to onshore facilities beginning in 2013.

Engineering and procurement activities continued during 2008 for certain onshore fields that had been shut in since 2003 due to civil unrest. The 40 percent-owned and operated Onshore Asset Gas Management project is designed to restore approximately 125 million cubic feet of natural gas per day to the Nigerian domestic gas market. A major construction contract is expected to be awarded in 2010.

Refer to page 23 for a discussion of affiliate operations in Nigeria and to page 25 for a discussion of the planned gas-to-liquids facility at Escravos. Refer also to "Pipelines" under "Transportation Operations" beginning on page 26 for a discussion of the West African Gas Pipeline operations.

14

c) Asia-Pacific

Major producing countries in the Asia-Pacific region include Australia, Azerbaijan, Bangladesh, Kazakhstan, the Partitioned Neutral Zone located between Saudi Arabia and Kuwait, and Thailand.

| Australia: During 2008, the average net oil-equivalent production from Chevron's interests in Australia was 96,000 barrels per day, composed of 34,000 barrels of liquids and 376 million cubic feet of natural gas. Chevron has a 17 percent nonoperated working interest in the North West Shelf (NWS) Venture offshore Western Australia. Daily net production from the project during 2008 averaged 25,000 barrels of crude oil and condensate, 374 million cubic feet of natural gas, and 4,000 barrels of LPG. Approximately 70 percent of the natural gas was sold in the form of LNG to major utilities in Japan, South Korea and China, primarily under long-term contracts. The remaining natural gas was sold to the Western Australia domestic market. In September 2008, a fifth LNG train increased processing and export capacity from approximately 12 million metric tons per year to more than 16 million. Part of the natural gas for these expanded facilities is being supplied from the Angel natural-gas field, which started production in October 2008. Additional supply will be provided by the North Rankin 2 project, for which an investment decision was made in March 2008. The project is scheduled to start production in 2013.Proved undeveloped reserves were booked in prior years and will be reclassified to proved developed upon completion of the project. |

The NWS Venture is also advancing plans to extend the period of crude-oil production. The NWS Oil Redevelopment Project is designed to replace an FPSO and a portion of existing subsea infrastructure that services production from the Cossack, Hermes, Lambert and Wanaea offshore fields. A final investment decision was made in November 2008 and start-up is expected early 2011. The project is expected to extend production past 2020. The concession for the NWS Venture expires in 2034.

On Barrow and Thevenard islands off the northwest coast of Australia, Chevron operates crude-oil producing facilities that had combined net production of 5,000 barrels per day in 2008. Chevron's interests in these operations are 57 percent for Barrow and 51 percent for Thevenard.

Also off the northwest coast of Australia, Chevron is the operator of the Gorgon development and has a 50 percent ownership interest across most of the Greater Gorgon Area. Chevron and two joint-venture participants are planning for the combined development of Gorgon and nearby natural-gas fields as one large-scale project. Environmental approvals were in process and a final investment decision is expected to be made in the second half of 2009 for a three-train, 15 million-metric-ton-per-year LNG facility. Natural gas for the project is expected to be supplied from the Gorgon and Io/Jansz fields. The Gorgon project has an expected economic life of at least 40 years.

At the end of 2008, the company had not recognized proved reserves for any of the Greater Gorgon Area fields. Recognition is contingent on securing sufficient LNG sales agreements and achieving other key project milestones, including receipt of environmental permits. In 2008, negotiations continued to finalize sales agreements with three utility customers in Japan and GS Caltex, a Chevron affiliated company. Purchases by each of these customers are expected to range from 250,000 metric tons per year to 1.5 million metric tons per year over 25 years.

15

In 2008, the company also announced plans for a multi-train LNG plant to process natural gas from its wholly owned Wheatstone discovery located on the northwest cost of mainland Australia. The project is expected to begin FEED during the second half of 2009. During 2008, Chevron conducted appraisal drilling in the Wheatstone and Iago fields. During 2009, the company plans to drill multiple exploration and appraisal wells in its operated acreage. At the end of 2008, the company had not recognized proved reserves for this project.

In the Browse Basin, the company conducted successful appraisal drilling programs in the Calliance and Torosa fields. A commitment well was also drilled to test the northern extension of the Ichthys Field in the eastern Browse Basin. At the end of 2008, proved reserves had not been recognized.

| Azerbaijan: Chevron holds a 10 percent nonoperated working interest in the Azerbaijan International Operating Company (AIOC), which produces crude oil in the Caspian Sea from the Azeri-Chirag-Gunashli (ACG) project. Chevron also has a 9 percent interest in the Baku-Tbilisi-Ceyhan (BTC) affiliate, which transports AIOC production by pipeline from Baku, Azerbaijan, through Georgia to Mediterranean deepwater port facilities in Ceyhan, Turkey. (Refer to "Pipelines" under "Transportation Operations" beginning on page 26 for a discussion of the BTC operations.) In 2008, the company's daily net production from AIOC averaged 29,000 barrels of oil-equivalent. First oil from Phase III of ACG development occurred during the second quarter 2008. Reserves were reclassified to proved developed shortly before start-up. In early 2009, total production was averaging about 670,000 barrels per day. The AIOC operations are conducted under a 30-year production-sharing contract (PSC) that expires in 2024. Kazakhstan: Chevron holds a 20 percent nonoperated working interest in the Karachaganak project, which is being developed in phases. During 2008, Karachaganak net oil-equivalent production averaged 66,000 barrels per day, composed of 41,000 barrels of liquids and 153 million cubic feet of natural gas. In 2008, access to the Caspian Pipeline Consortium (CPC) and Atyrau-Samara (Russia) pipelines enabled Karachaganak sales of |

approximately 163,000 barrels per day (30,000 net barrels) of processed liquids at world-market prices. The remaining liquids were sold into Russian markets. During 2008, work continued on a fourth train that is designed to increase the export of processed liquids by 56,000 barrels per day (11,000 net barrels). The fourth train is expected to start up in 2011.

During 2008, partners continued to evaluate alternatives for a Phase III development of Karachaganak. Timing for the recognition of Phase III proved reserves is uncertain and depends on finalizing a Phase III project design and achievement of project milestones. Karachaganak operations are conducted under a 40-year PSC that expires in 2038.

Refer also to page 23 for a discussion of Tengizchevroil, a 50 percent-owned affiliate with operations in Kazakhstan, and to page 26 in "Pipelines" under "Transportation Operations" for a discussion of CPC operations.

Bangladesh: Chevron operates and has 98 percent interests in three PSCs in onshore Blocks 12, 13 and 14 and an 88 percent interest in Block 7. Net oil-equivalent production from these operations in 2008 averaged 71,000 barrels per day, composed of 414 million cubic feet of natural gas and 2,000 barrels of liquids.

Cambodia: Chevron operates and holds a 55 percent interest in the 1.2 million-acre (4,709 sq-km) Block A, located offshore in the Gulf of Thailand. During 2008 and early 2009, evaluation continued of the exploratory and appraisal drilling programs that occurred in 2007. Proved reserves had not been recognized as of the end of 2008.

16

Myanmar: Chevron has a 28 percent nonoperated working interest in a PSC for the production of natural gas from the Yadana and Sein fields offshore in the Andaman Sea. The company also has a 28 percent interest in a pipeline company that transports the natural gas from Yadana to the Myanmar-Thailand border for delivery to power plants in Thailand. Most of the natural gas is purchased by Thailand's PTT Public Company Limited (PTT). The company's average net natural gas production in 2008 was 89 million cubic feet per day.

| Thailand: Chevron has operated and nonoperated working interests in several different offshore blocks. The company's net oil-equivalent production in 2008 averaged 217,000 barrels per day, composed of 67,000 barrels of crude oil and condensate and 894 million cubic feet of natural gas. All of the company's natural gas production is sold to PTT under long-term sales contracts. Operated interests are in Pattani and other fields with ownership interests ranging from 35 percent to 80 percent in Blocks 10 through 13, B12/27, B8/32, 9A, G4/43 and G4/48. Blocks B8/32 and 9A produce crude oil and natural gas from six operating areas, and Blocks 10 through 13 and B12/27 produce crude oil, condensate and natural gas from 16 operating areas. First production from Block G4/43 occurred in first quarter 2008. |

For Blocks 10 through 13, a final investment decision was made in March 2008 for the construction of a second central natural-gas processing facility in the Platong area. The 70 percent-owned and operated Platong Gas II project is designed to add 420 million cubic feet per day of processing capacity in 2011. The company expects to reclassify proved undeveloped reserves to proved developed throughout the project's life as the wellhead platforms are installed. Concessions for Blocks 10 through 13 expire in 2022.

Chevron has a 16 percent nonoperated working interest in Blocks 14A, 15A, 16A, G9/48 and G8/50, known collectively as the Arthit Field. First production from Arthit occurred in 2008 and averaged 10,000 net oil-equivalent barrels per day through the end of the year.

During 2008, 13 exploration wells were drilled in the Gulf of Thailand, and all were successful. In Block G4/50, an exploratory joint operating agreement was signed in late 2008. A 3-D seismic survey and geological studies are scheduled for 2009. Three exploratory wells are planned for 2010. At the end of 2008, proved reserves had not been recognized for these activities. In addition, Chevron holds exploration interests in a number of blocks that are currently inactive, pending resolution of border issues between Thailand and Cambodia.

Vietnam: The company operates off the southwest coast and has a 42 percent interest in a PSC that includes Blocks B and 48/95, and a 43 percent interest in another PSC for Block 52/97. Chevron also has a third PSC with a 50 percent-owned and operated interest in Block B122 offshore eastern Vietnam. No production occurred in these areas during 2008.

In the blocks off the southwest coast, the Vietnam Gas Project is aimed at developing an area in the Malay Basin to supply natural gas to state-owned PetroVietnam. The project includes installation of wellhead and hub platforms, an FSO vessel, field pipelines and a central processing platform. The timing of first natural-gas production is dependent upon the outcome of commercial negotiations. Maximum total production of approximately 500 million cubic feet of natural gas per day is projected within five years of start-up. At the end of 2008, proved reserves had not been recognized for this project.

During the year, two exploratory wells confirmed hydrocarbons in Block B and Block 52/97. In Block 122, 2-D seismic information was purchased in late 2008, with processing scheduled for 2009. Proved reserves had not been recognized as of the end of 2008. Future activity in Block 122 may be affected by an ongoing territorial dispute between Vietnam and China.

17

| China: Chevron has one operated and three nonoperated working interests in several areas. Net oil-equivalent production from the nonoperated areas in 2008 averaged 22,000 barrels per day, composed of 19,000 barrels of crude oil and condensate and 22 million cubic feet of natural gas. The company holds a 49 percent operated interest in the Chuandongbei area in the onshore Sichuan Basin, where the company entered into a 30-year PSC effective February 2008 to develop natural gas resources. Project plans included two sour-gas purification plants with an aggregate design capacity of 740 million cubic feet per day. A final investment decision was made for the first stage of the project in December 2008, and proved undeveloped reserves were recognized at that time. In the South China Sea, the company has nonoperated working interests of 33 percent in Blocks 16/08 and 16/19 located in the Pearl River Delta Mouth Basin, 25 percent in the QHD-32-6 Field in Bohai Bay and 16 percent in the unitized and producing BZ 25-1 Field in Bohai Bay Block 11/19. Chevron also holds a 50 percent nonoperated working interest in one prospective onshore natural-gas block in the Ordos Basin. |

The joint development of the HZ 25-3 and HZ 25-1 crude-oil fields in Block 16/19 is expected to achieve first production in the third quarter 2009. The maximum total production of approximately 11,000 barrels of crude oil per day is anticipated by early 2011.

| Partitioned Neutral Zone (PNZ): During 2008, the company negotiated a 30-year extension to its agreement with the Kingdom of Saudi Arabia to operate on behalf of the Saudi government its 50 percent interest in the petroleum resources of the onshore area of the PNZ between Saudi Arabia and Kuwait. Under the extension, Chevron has rights to this 50 percent interest in the hydrocarbon resource and pays a royalty and other taxes on the associated volumes produced until 2039. As a result of the contract extension, the company recognized additional proved reserves. During 2008, the company's average net oil-equivalent production was 106,000 barrels per | |||

| day, composed of 103,000 barrels of crude oil and 20 million cubic feet of natural gas. Steam injection for the second phase of a steamflood pilot project is anticipated to begin in mid-2009. This pilot is a unique application of steam injection into a carbonate reservoir and, if successful, could significantly increase heavy oil recovery. | ||||

Philippines: The company holds a 45 percent nonoperated working interest in the Malampaya natural-gas field located 50 miles (80 km) offshore Palawan Island. Net oil-equivalent production in 2008 averaged 26,000 barrels per day, composed of 128 million cubic feet of natural gas and 5,000 barrels of condensate. Chevron also develops and produces geothermal resources under an agreement with the National Power Corporation, a Philippine government-owned company. The combined generating capacity of the facilities is 637 megawatts.

18

d) Indonesia

| Chevron's operated interests in Indonesia are managed by several wholly owned subsidiaries, including PT. Chevron Pacific Indonesia (CPI). CPI holds operated interests of 100 percent in the Rokan and Siak PSCs. Other subsidiaries operate four PSCs in the Kutei Basin, located offshore East Kalimantan, and one PSC in the East Ambalat Block, located offshore northeast Kalimantan. These interests range from 80 percent to 100 percent. Chevron also has nonoperated working interests in a joint venture in Block B in the South Natuna Sea and in the NE Madura III Block in the East Java Sea Basin. Chevron's interests in these PSCs range from 25 percent to 40 percent. |

The company's net oil-equivalent production in 2008 from all of its interests in Indonesia averaged 235,000 barrels per day. The daily oil-equivalent rate comprised 182,000 barrels of crude oil and 319 million cubic feet of natural gas. The largest producing field is Duri, located in the Rokan PSC. Duri has been under steamflood operation since 1985 and is one of the world's largest steamflood developments. The North Duri Development is located in the northern area of the Duri Field and is divided into multiple expansion areas. The Area 12 expansion area started production November 2008. Maximum total daily production from Area 12 is estimated at 34,000 barrels of crude oil in 2012. Proved undeveloped reserves for the North Duri development were recognized in previous years, and reclassification from proved undeveloped to proved developed is scheduled to occur during various stages of sequential completion. The Rokan PSC expires in 2021.

Chevron has plans to develop the Gendalo and Gehem deepwater natural-gas fields located in the Kutei Basin as a single project with one development concept. In October 2008, the company received approval from the government of Indonesia for the final development plans. The Bangka natural-gas project remained under evaluation in 2008 and, based on the evaluation results, may be developed in parallel with Gendalo and Gehem. The development timing is dependent on government approvals, market conditions and the achievement of key project milestones. At the end of 2008, the company had not recognized proved reserves for either of these projects. The company holds an 80 percent operated interest in both.

Also in the Kutei Basin, first production is expected in March 2009 at the Seturian Field, which is providing natural gas to a state-owned refinery. During 2008, the development concept for the 50 percent-owned and operated Sadewa project in the Kutei Basin remained under evaluation. A development decision for Sadewa is expected by year-end 2009.

A drilling campaign continued through 2008 in South Natuna Sea Block B to provide additional supply for long-term gas sales contracts. Additional development drilling in the North Belut Field began in November 2008, with first production expected in fourth quarter 2009. In November 2008, Chevron was awarded 100 percent interests in two exploration blocks in western Papua. Geological studies are planned for 2009 in preparation for 2-D seismic acquisition.

In West Java, Chevron operates the wholly owned Salak geothermal field with a total capacity of 377 megawatts. Also in West Java, Chevron holds a 95 percent interest in a power generation company that operates the Darajat geothermal contract area in Garut with a total capacity of 259 megawatts. Chevron also operates a 95 percent-owned 300-megawatt cogeneration facility in support of CPI's operation in North Duri, Sumatra.

19

| e) | Other International Areas |

The "Other International" region is composed of Latin America, Canada and Europe.

| Argentina: Chevron holds operated interests in several concessions and one exploratory block in the Neuquen and Austral basins. Working interests range from 19 percent to 100 percent. Net oil-equivalent production in 2008 averaged 44,000 barrels per day, composed of 37,000 barrels of crude oil and natural gas liquids and 45 million cubic feet of natural gas. The company also holds a 14 percent interest in the Oleoductos del Valle S.A. pipeline. Brazil: Chevron holds working interests ranging from 30 percent to 52 percent in three deepwater blocks in the Campos Basin. Chevron also holds a 20 percent nonoperated working interest in one block in the Santos Basin. None of these blocks had production in 2008. In Block BC-4, located in the Campos Basin, the company is the operator and has a 52 percent interest in the Frade Field, which is under development as a subsea production design. Proved undeveloped reserves were recorded for the first time in 2005. Partial reclassification to the proved-developed category is scheduled upon production start-up in 2009. Estimated maximum total production of 87,000 oil-equivalent barrels per day is anticipated in 2011. The concession that includes the Frade project expires in 2025. In the partner-operated Campos Basin Block BC-20, two areas - 38 percent-owned Papa-Terra and 30 percent-owned Maromba - were retained for development following the end of the exploration phase of this block. Evaluation of design options continued into |

2009. At the end of 2008, proved reserves had not been recognized for these projects.

In the Santos basin, evaluation of investment options continued into 2009 for the 20 percent-owned and partner-operated Atlanta and Oliva fields. At the end of 2008, proved reserves had not been recognized.

Colombia: The company operates the offshore Chuchupa and the onshore Ballena and Riohacha natural gas fields as part of the Guajira Association contract. In exchange, Chevron receives 43 percent of the production for the remaining life of each field and a variable production volume from a fixed-fee Build-Operate-Maintain-Transfer agreement based on prior Chuchupa capital contributions. Daily net production averaged 209 million cubic feet of natural gas in 2008.