UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-35770

CONTANGO ORE, INC.

(Exact name of registrant as specified in its charter)

DELAWARE |

| 27-3431051 |

(State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) |

| ||

3700 BUFFALO SPEEDWAY, SUITE 925 HOUSTON, TEXAS 77098 | ||

(Address of principal executive offices) | ||

(713) 877-1311

(Registrant 's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ |

| Accelerated filer ☐ |

| Non-accelerated filer ☐ |

| Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The total number of shares of common stock, par value $0.01 per share, outstanding as of May 9, 2017 was 4,903,766.

1

CONTANGO ORE, INC.

TABLE OF CONTENTS

|

|

| |

|

| Page | |

| PART I – FINANCIAL INFORMATION | ||

Item 1. | Financial Statements |

| |

| Consolidated Balance Sheets (unaudited) as of March 31, 2017 and June 30, 2016 | 3 | |

| Consolidated Statements of Operations (unaudited) for the three and nine months ended March 31, 2017 and 2016 | 4 | |

| Consolidated Statements of Cash Flows (unaudited) for the three and nine months ended March 31, 2017 and 2016 | 5 | |

| Consolidated Statement of Shareholders ' Equity (unaudited) for the nine months ended March 31, 2017 | 6 | |

| Notes to the Consolidated Financial Statements (unaudited) | 7 | |

Item 2. | Management 's Discussion and Analysis of Financial Condition and Results of Operations | 17 | |

Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 44 | |

Item 4. | Controls and Procedures | 44 | |

| PART II – OTHER INFORMATION |

| |

Item 1. | Legal Proceedings | 44 | |

Item 1A. | Risk Factors | 44 | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 44 | |

Item 4. | Mine Safety Disclosures | 44 | |

Item 5. | Other Information | 44 | |

Item 6. | Exhibits | 45 | |

All references in this Form 10-Q to the "Company", "CORE", "we", "us" or "our" are to Contango ORE, Inc.

2

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

Item 1 - Financial Statements

March 31, 2017 | June 30, 2016 | |||||||

ASSETS | ||||||||

CURRENT ASSETS: | ||||||||

Cash | $ | 5,647.941 | $ | 1,254,489 | ||||

Prepaid expenses and other | 78,115 | 58,165 | ||||||

Total current assets | 5,726,056 | 1,312,654 | ||||||

OTHER ASSETS: | ||||||||

Investment in Peak Gold, LLC (Note 4) | - | - | ||||||

Total other assets | - | - | ||||||

TOTAL ASSETS | $ | 5,726,056 | $ | 1,312,654 | ||||

LIABILITIES AND SHAREHOLDERS ' EQUITY | ||||||||

CURRENT LIABILITIES: | ||||||||

Accounts payable | $ | 20,644 | $ | 20,854 | ||||

Accrued liabilities | 82,219 | 92,884 | ||||||

Total current liabilities | 102,863 | 113,738 | ||||||

COMMITMENTS AND CONTINGENCIES (NOTE 12) | ||||||||

SHAREHOLDERS ' EQUITY: | ||||||||

Common Stock, $0.01 par value, 30,000,000 shares authorized; 4,910,951 shares issued and 4,903,766 outstanding at March 31, 2017; 3,958,540 shares issued and outstanding at June 30, 2016 | 49,110 | 39,585 | ||||||

Additional paid-in capital | 40,085,530 | 33,434,899 | ||||||

| Treasury shares at cost (7,185 shares at March 31, 2017; and 0 at June 30, 2016) | (171,158 | ) | - | |||||

Accumulated deficit | (34,340,289 | ) | (32,275,568 | ) | ||||

SHAREHOLDERS ' EQUITY | 5,623,193 | 1,198,916 | ||||||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 5,726,056 | $ | 1,312,654 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

3

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended March 31, | Nine Months Ended March 31, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

EXPENSES: | ||||||||||||||||

Claim rentals and minimum royalties | $ | - | $ | - | $ | - | $ | 14,425 | ||||||||

General and administrative expense | 516,929 | 181,257 | 2,064,721 | 935,482 | ||||||||||||

Total expenses | 516,929 | 181,257 | 2,064,721 | 949,907 | ||||||||||||

OTHER EXPENSE | ||||||||||||||||

Loss from equity investment in Peak Gold, LLC (Note 4) | - | - | - | - | ||||||||||||

NET LOSS | $ | (516,929 | ) | $ | (181,257 | ) | $ | (2,064,721 | ) | $ | (949,907 | ) | ||||

LOSS PER SHARE | ||||||||||||||||

Basic and diluted | $ | (0.11 | ) | $ | (0.05 | ) | $ | (0.46 | ) | $ | (0.24 | ) | ||||

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | ||||||||||||||||

Basic and diluted | 4,903,766 | 3,957,640 | 4,509,950 | 3,918,430 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

Net loss | $ | (2,064,721 | ) | $ | (949,907 | ) | ||

Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

Stock-based compensation | 1,372,656 | 437,452 | ||||||

Changes in operating assets and liabilities: | ||||||||

Increase in prepaid expenses | (19,950 | ) | (19,091 | ) | ||||

Decrease in accounts payable and accrued liabilities | (10,875 | ) | (69,163 | ) | ||||

Net cash used in operating activities | (722,890 | ) | (600,709 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Cash paid for shares withheld from employees for payroll tax withholding | (171,158 | ) | - | |||||

| Cash from warrant exercises | 5,287,500 | - | ||||||

| Net cash provided by financing activities | 5,116,342 | - | ||||||

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS | 4,393,452 | (600,709 | ) | |||||

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | 1,254,489 | 1,947,046 | ||||||

CASH AND CASH EQUIVALENTS, END OF PERIOD | $ | 5,647,941 | $ | 1,346,337 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

5

CONTANGO ORE, INC.

CONDENSED CONSOLIDATED STATEMENT OF SHAREHOLDERS ' EQUITY

(Unaudited)

Common Stock | Additional Paid-In | Treasury | Accumulated | Total Shareholders ' | ||||||||||||||||||||

Shares | Amount | Capital | Stock | Deficit | Equity | |||||||||||||||||||

Balance at June 30, 2016 | 3,958,540 | $ | 39,585 | $ | 33,434,899 | $ | - | $ | (32,275,568 | ) | $ | 1,198,916 | ||||||||||||

Stock-based compensation | - | - | 1,372,656 | - | - | 1,372,656 | ||||||||||||||||||

Restricted shares activity | 280,067 | 2,801 | (2,801 | ) | - | - | - | |||||||||||||||||

| Treasury shares withheld for employee taxes | - | - | - | (171,158 | ) | - | (171,158 | ) | ||||||||||||||||

Stock option exercises | 52,174 | 522 | (522 | ) | - | - | - | |||||||||||||||||

Stock warrant exercises | 620,170 | 6,202 | 5,281,298 | - | - | 5,287,500 | ||||||||||||||||||

Net loss for the period | - | - | - | - | (2,064,721 | ) | (2,064,721 | ) | ||||||||||||||||

Balance at March 31, 2017 | 4,910,951 | $ | 49,110 | $ | 40,085,530 | $ | (171,158 | ) | $ | (34,340,289 | ) | $ | 5,623,193 | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

CONTANGO ORE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Unaudited)

1. Organization and Business

Contango ORE, Inc. ("CORE" or the "Company") is a Houston-based company that engages in the exploration in Alaska for gold and associated minerals through a joint venture company, Peak Gold, LLC. The Company was formed on September 1, 2010 as a Delaware corporation for the purpose of engaging in the exploration in the State of Alaska for gold ore and associated minerals. The Company currently has two wholly owned subsidiaries, AU CORE, Inc. and CORE Alaska, LLC. AU CORE, Inc. historically owned unpatented mining claims. Those claims were transferred to the Joint Venture Company in January 2015. CORE participates in the Joint Venture Company through its wholly owned subsidiary, CORE Alaska, LLC.

On November 29, 2010, Contango Mining Company ("Contango Mining"), a wholly owned subsidiary of Contango Oil & Gas Company ("Contango"), assigned its properties and certain other assets and liabilities to Contango. Contango contributed the properties and $3.5 million of cash to the Company, in exchange for approximately 1.6 million shares of the Company's common stock, which were distributed to Contango's shareholders of record. The above transactions occurred among companies under common control and was accounted for as transactions among entities under common control, in accordance with Accounting Standards Codification ("ASC") 805, "Business Combinations" whereby the acquired assets and liabilities were recognized in the financial statements at their carrying amounts.

The Company is still in an exploration stage. The Company 's fiscal year end is June 30.

The properties contributed by Contango included: (i) a 100% leasehold interest in an estimated 675,000 acres (the "Tetlin Lease") from the Tetlin Village Council, the council formed by the governing body for the Native Village of Tetlin, an Alaska Native Tribe (the "Tetlin Village Council"); (ii) approximately 18,021 acres in unpatented mining claims from the state of Alaska for the exploration of gold ore and associated minerals. If any of the properties are placed into commercial production, the Joint Venture Company would be obligated to pay a 3.0% production royalty to Royal Gold, Inc. ("Royal Gold"). On September 29, 2014, Juneau Exploration L.P. ("JEX") sold its 3.0% production royalty to Royal Gold. See Note 10 - Related Party Transactions.

In September 2012, the Company and JEX entered into an Advisory Agreement in which JEX assisted the Company in acquiring 474 unpatented state of Alaska mining claims consisting of 71,896 acres for the exploration of gold ore and associated minerals in exchange for a 2.0% production royalty on properties acquired after July 1, 2012. If any such properties are placed into commercial production, the Joint Venture Company would be obligated to pay Royal Gold a 2.0% production royalty. On September 29, 2014, JEX sold its 2.0% production royalty to Royal Gold and the Company terminated its Advisory Agreement with JEX. See Note 10 - Related Party Transactions.

On September 29, 2014, the Company entered into a Master Agreement (the "Master Agreement") with Royal Gold, pursuant to which the parties agreed, subject to the satisfaction of various closing conditions, to form a joint venture to advance exploration and development of the Tetlin Properties (as defined below), prospective for gold ore and associated minerals (the "Transactions"). The Transactions closed on January 8, 2015 (the "Closing").

In connection with the Closing, the Company contributed its Tetlin Lease and state of Alaska mining claims near Tok, Alaska (the "Tetlin Property"), together with other property, to Peak Gold, LLC, a newly formed limited liability company (the "Joint Venture Company"). The Joint Venture Company is managed according to a Limited Liability Company Agreement between subsidiaries of Royal Gold and the Company. At the Closing, Royal Gold made an initial investment of $5 million to fund exploration activity. The initial $5 million did not give Royal Gold an equity stake in the Joint Venture Company. Royal Gold has the option to obtain up to 40% economic interest in the joint venture by investing up to $30 million (inclusive of the initial $5 million investment) prior to October 2018. The proceeds of Royal Gold's investment will be used by the Joint Venture Company for additional exploration of the Tetlin Property. Royal Gold serves as the Manager of the Joint Venture Company and initially manages, directs, and controls operations of the Joint Venture Company. As of March 31, 2017, Royal Gold has contributed approximately $20.0 million to the Joint Venture Company and has earned an economic interest of 24.9%.

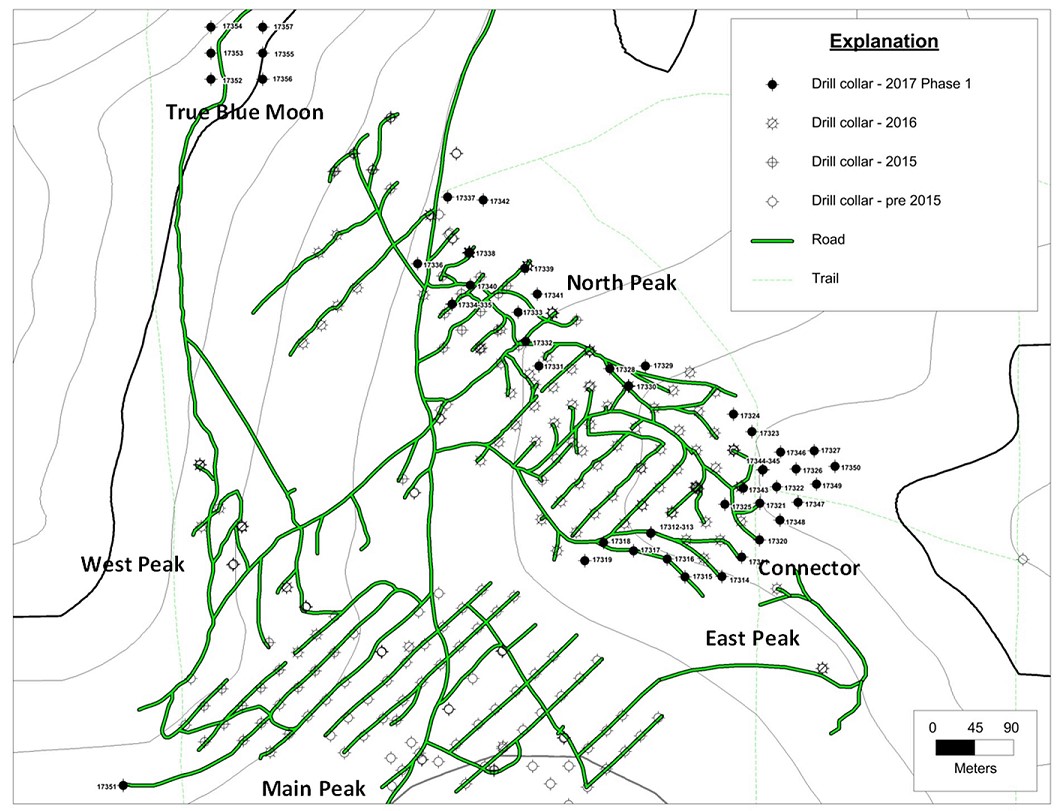

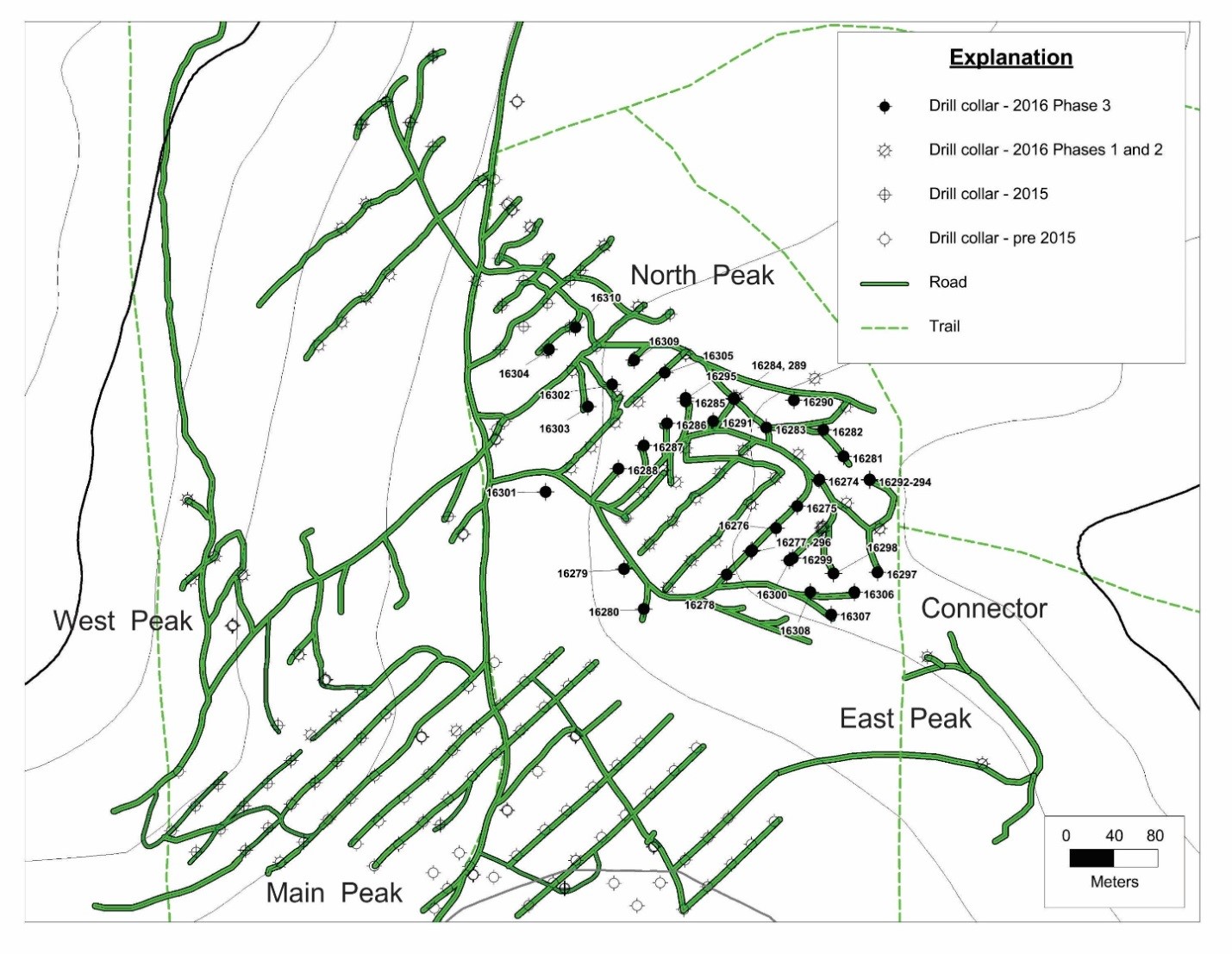

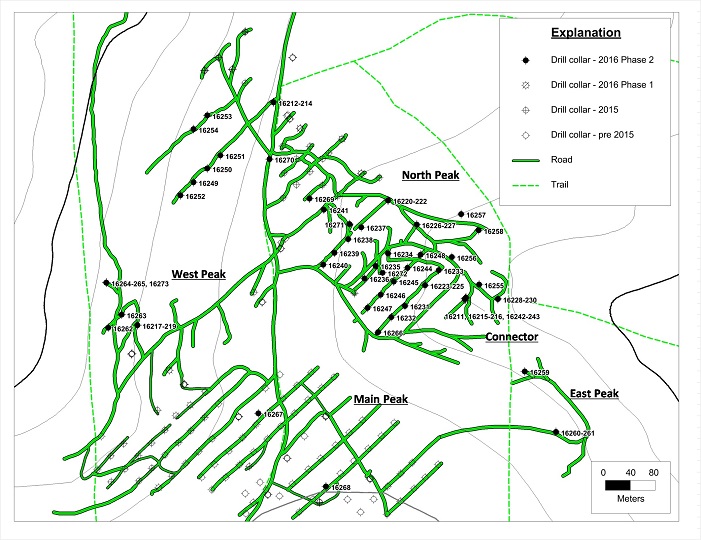

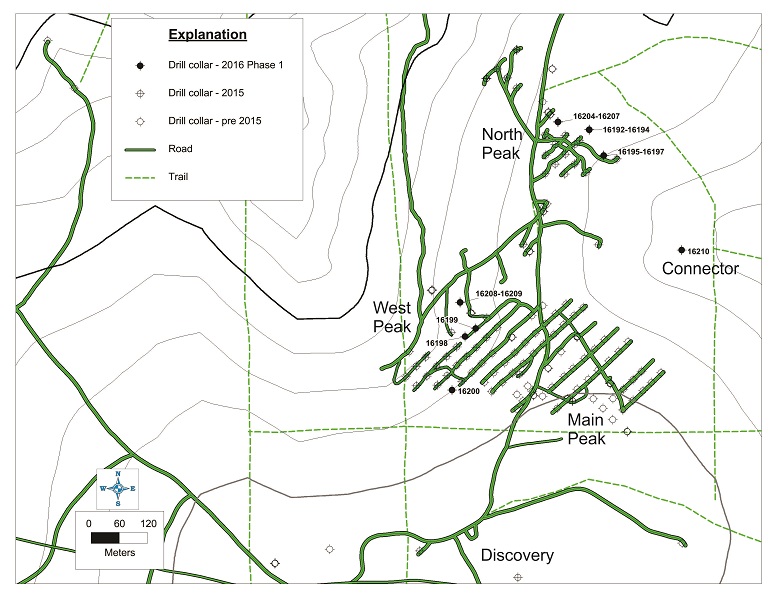

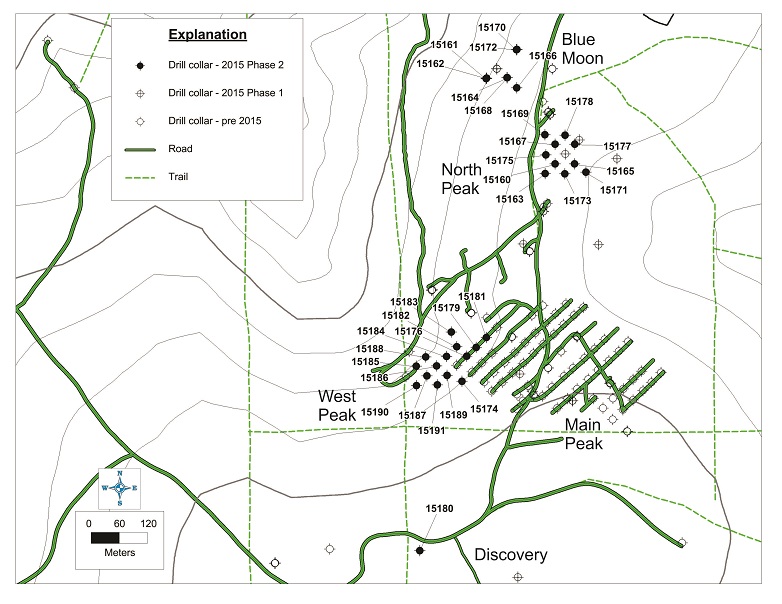

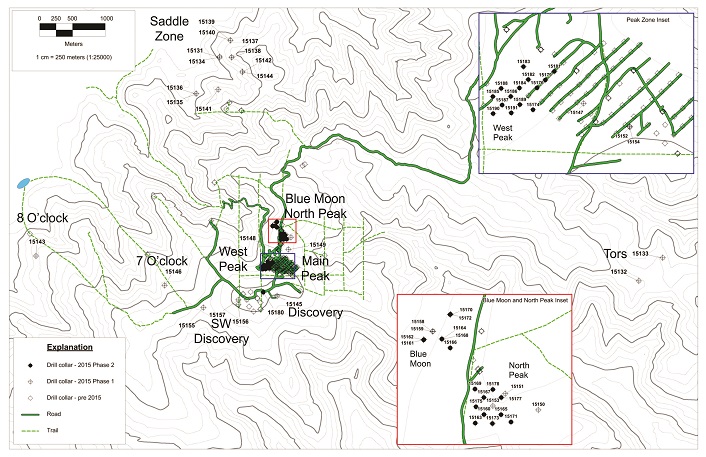

The Company has completed seven years of exploration efforts on the Tetlin Properties, which has resulted in identifying two mineral deposits (Peak and North Peak) and several other gold, silver, and copper prospects. In 2016, three phases of exploration drilling were completed by the Joint Venture Company on the Tetlin Property. During the quarter ended March 31, 2017, the Joint Venture Company initiated Phase I of the 2017 drilling program, which consisted of drilling in the North Peak target area and testing the True Blue Moon target area. During the quarter the Joint Venture Company also acquired 217 unpatented state of Alaska mining claims, consisting of 34,480 acres.

7

2. Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("GAAP") for interim financial information, pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC"), including instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by GAAP for complete annual consolidated financial statements. In the opinion of management, all adjustments considered necessary for a fair statement of the consolidated financial statements have been included. All such adjustments are of a normal recurring nature. The consolidated financial statements should be read in conjunction with the audited financial statements and notes included in the Company 's Form 10-K for the fiscal year ended June 30, 2016. The results of operations for the three and nine months ended March 31, 2017 are not necessarily indicative of the results that may be expected for the fiscal year ending June 30, 2017.

3. Summary of Significant Accounting Policies

The Company 's significant accounting policies are described below.

Management Estimates. The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash Equivalents. Cash equivalents are considered to be highly liquid securities having an original maturity of 90 days or less at the date of acquisition.

Stock-Based Compensation . The Company applies the fair value method of accounting for stock-based compensation. Under this method, compensation cost is measured at the grant date based on the fair value of the award and is recognized over the award vesting period. The Company classifies the benefits of tax deductions in excess of the compensation cost recognized for the options (excess tax benefit) as financing cash flows. The fair value of each option award is estimated as of the date of grant using the Black-Scholes option-pricing model. The fair value of each restricted stock award is equal to the Company's stock price on the date the award is granted.

Income Taxes. The Company follows the liability method of accounting for income taxes under which deferred tax assets and liabilities are recognized for the future tax consequences of (i) temporary differences between the tax basis of assets and liabilities and their reported amounts in the consolidated financial statements and (ii) operating loss and tax credit carry-forwards for tax purposes. Deferred tax assets are reduced by a valuation allowance when, based upon management's estimates, it is more likely than not that a portion of the deferred tax assets will not be realized in a future period. The Company recognized a full valuation allowance as of March 31, 2017 and June 30, 2016 and has not recognized any tax provision or benefit for any of the periods. The Company reviews its tax positions quarterly for tax uncertainties. The Company did not have any uncertain tax positions as of March 31, 2017 or June 30, 2016.

Investment in the Joint Venture Company. The Company's consolidated financial statements include the investment in Peak Gold, LLC which is accounted for under the equity method. The Company has designated one of the three members of the Management Committee and on March 31, 2017 held a 75.1% ownership interest in Peak Gold. Royal Gold will initially serve as the Manager of the Joint Venture Company and will manage, direct, and control operations of the Joint Venture Company. The Company recorded its investment at the historical cost of the assets contributed. The cumulative losses of the Joint Venture Company exceed the historical cost of the assets contributed to the Joint Venture Company; therefore the Company's investment in Peak Gold, LLC as of June 30, 2016 is zero. The portion of the cumulative loss that exceeds the Company's investment will be suspended and recognized against earnings, if any, from the investment in the Joint Venture Company in future periods.

Recently Issued Accounting Pronouncements. In August 2016, the Financial Accounting Standards Board (the "FASB") issued Accounting Standards Update ("ASU") No. 2016-15: Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments. The main objective of this update is to reduce the diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows under Topic 230, Statement of Cash Flows, and other Topics. This update addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice. The eight cash flow updates relate to the following issues: 1) debt prepayment or debt extinguishment costs; 2) settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing; 3) contingent consideration payments made after a business combination; 4) proceeds from the settlement of insurance claims; 5) proceeds from the settlement of corporate-owned life insurance policies, including bank-owned life insurance policies; 6) distributions received from equity method investees; 7) beneficial interest in securitization transactions; and 8) separately identifiable cash flows and application of the predominance principle. The amendments in this update are effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. The Company will continue to assess the impact this may have on its statement of cash flows.

8

In March 2016, the Financial Accounting Standards Board (the "FASB") issued Accounting Standards Update No. 2016-09: Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (ASU 2016-09) . ASU 2016--09 is part of an initiative to reduce complexity in accounting standards. The areas of simplification in ASU 2016--09 involve several aspects of accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. For public entities, ASU 2016-09 is effective for financial statements issued for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years; early application is permitted. The Company adopted this ASU in a prior quarter. The adoption of the standard did not have a material impact on the financial statements.

In November 2015, the FASB issued ASU No. 2015-17: Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes. ASU No. 2015-17 provides guidance on the presentation of deferred income taxes that requires deferred tax assets and liabilities, along with related valuation allowances, to be classified as non-current on the balance sheet. As a result, each tax jurisdiction will now only have one net non-current deferred tax asset or liability. The new guidance does not change the existing requirement that prohibits offsetting deferred tax liabilities from one jurisdiction against deferred tax assets of another jurisdiction. The new guidance is effective for the Company 's fiscal year beginning July 1, 2017 and will only result in a change in presentation of these deferred taxes on our consolidated balance sheets. Early adoption is permitted, and we are currently evaluating the impact of this guidance on our consolidated financial statements.

The Company has evaluated all other recent accounting pronouncements and believes that none of them will have a significant effect on the Company 's consolidated financial statements.

4 . Investment in Peak Gold, LLC

The Company recorded its investment at the historical book value of the assets contributed to the Joint Venture Company which was approximately $1.4 million. As of March 31, 2017, Royal Gold has contributed approximately $20.0 million to the Joint Venture Company, and earned a cumulative economic interest of approximately 24.9%. Of the $20.0 million, $3.0 million was contributed during the quarter ended March 31, 2017. Therefore, as of March 31, 2017, the Company holds a 75.1% economic interest in the Joint Venture Company. As of June 30, 2016, the Company held an 89.0% economic interest in the Joint Venture Company. The Royal Gold Initial Contribution did not entitle Royal Gold to a percentage interest in the Joint Venture Company.

The following table is a roll-forward of our investment in the Joint Venture Company from January 8, 2015 (inception) to March 31, 2017:

Investment | ||||

in Peak Gold, LLC | ||||

Investment balance at June 30, 2014 | $ | - | ||

Investment in Peak Gold, LLC, at inception January 8, 2015 | 1,433,886 | |||

Loss from equity investment in Peak Gold, LLC | (1,433,886 | ) | ||

Investment balance at June 30, 2015 | $ | - | ||

Investment in Peak Gold, LLC | - | |||

Loss from equity investment in Peak Gold, LLC | - | |||

Investment balance at June 30, 2016 | $ | - | ||

Investment in Peak Gold, LLC | - | |||

Loss from equity investment in Peak Gold, LLC | - | |||

Investment balance at March 31, 2017 | $ | - | ||

9

The following table presents the condensed balance sheet for Peak Gold, LLC as of March 31, 2017 and June 30, 2016:

March 31, 2017 | June 30, 2016 | ||||||

ASSETS | |||||||

Cash and cash equivalents | $ | 1,233,727 | $ | 990,698 | |||

Mineral properties | 1,433,886 | 1,433,886 | |||||

TOTAL ASSETS | $ | 2,667,613 | $ | 2,424,584 | |||

| LIABILITIES AND MEMBERS' EQUITY | |||||||

Accounts payable and other liabilities | $ | 1,448,798 | $ | 1,674,956 | |||

TOTAL LIABILITIES | 1,448,798 | 1,674,956 | |||||

MEMBERS' EQUITY | 1,218,815 |

| 749,628 | ||||

TOTAL LIABILITIES AND MEMBERS' EQUITY | $ | 2,667,613 | $ | 2,424,584 | |||

The Company's share of the Joint Venture Company's results of operations for the three and nine months ended March 31, 2017 was a loss of $2.1 million and $7.1 million, respectively. The Company's share in the results of operations for the three and nine months ended March 31, 2016 was a loss of $1.8 million and $6.3 million, respectively. The Peak Gold, LLC loss does not include any provisions related to income taxes as Peak Gold, LLC is treated as a partnership for income tax purposes. As of March 31, 2017 and June 30, 2016, the Company's share of the Joint Venture Company's inception-to-date cumulative loss of $17.9 million and $10.9 million, exceeded the historical book value of our investment in Peak Gold, LLC, of $1.4 million. Therefore, the investment in Peak Gold, LLC had a balance of zero as of March 31, 2017 and June 30, 2016. The Company is currently not obligated to make additional capital contributions to the Joint Venture Company and therefore only records losses up to the point of the initial investment which was $1.4 million. The portion of the cumulative loss that exceeds the Company's investment will be suspended and recognized against earnings, if any, from the Company's investment in the Joint Venture Company in future periods. The suspended losses for the period from inception to March 31, 2017 are $16.5 million. The following table presents the condensed results of operations for Peak Gold, LLC for the three and nine month periods ended March 31, 2017 and 2016:

Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | Inception to Date | |||||||||||||||

March 31, 2017 | March 31, 2016 | March 31, 2017 | March 31, 2016 | March 31, 2017 | |||||||||||||||

EXPENSES: | |||||||||||||||||||

Exploration expense | $ | 2,358,681 | $ | 1,667,889 | $ | 7,591,712 | $ | 5,612,119 | $ | 17,106,300 | |||||||||

General and administrative | 420,157 | 274,454 | 1,239,101 | 829,257 | 3,058,771 | ||||||||||||||

Total expenses | 2,778,838 | 1,942,343 | 8,830,813 | 6,411,376 | 20,165,071 | ||||||||||||||

NET LOSS | $ | 2,778,838 | $ | 1,942,343 | $ | 8,803,813 | $ | 6,411,376 | $ | 20,165,071 | |||||||||

5. Costs Incurred

Costs incurred by the Company to acquire and explore our Tetlin Lease and other properties were as follows:

Three Months Ended March 31, | Six Months Ended March 31, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Exploration costs, claim rentals, and minimum royalties | $ | - | $ | - | $ | - | $ | 14,425 | |||||||

Total costs incurred | $ | - | $ | - | $ | - | $ | 14,425 | |||||||

The Tetlin Lease had an initial ten year term beginning July 2008 which was extended for an additional ten years to July 15, 2028, and for so long thereafter as the Company initiates and continues conducting mining operations on the Tetlin Lease. The prior year expense relates to the amortization of claim rental payments with August 2015 expirations. The Joint Venture Company is responsible for making all future claim rental and minimum royalty payments.

6. Prepaid Expenses

The Company has prepaid expenses of $78,115 and $58,165 as of March 31 , 2017 and June 30, 2016, respectively. Prepaid expenses primarily relate to prepaid insurance costs.

10

7. Loss Per Share

A reconciliation of the components of basic and diluted net loss per share of common stock is presented below:

Three Months Ended March 31, | ||||||||||||||||||||||||

2017 | 2016 | |||||||||||||||||||||||

Loss | Weighted Average Shares | Loss Per Share | Loss | Weighted Average Shares | Loss Per | |||||||||||||||||||

Basic Loss per Share: | ||||||||||||||||||||||||

Net loss attributable to common stock | $ | (516,929 | ) | 4,903,766 | $ | (0.11 | ) | $ | (181,257 | ) | 3,957,640 | $ | (0.05 | ) | ||||||||||

Diluted Loss per Share: | ||||||||||||||||||||||||

Net loss attributable to common stock | $ | (516,929 | ) | 4,903,766 | $ | (0.11 | ) | $ | (181,257 | ) | 3,957,640 | $ | (0.05 | ) | ||||||||||

Nine Months ended March 31, | ||||||||||||||||||||||||

2017 | 2016 | |||||||||||||||||||||||

Loss | Weighted Average Shares | Loss Per Share | Loss | Weighted Average Shares | Loss Per | |||||||||||||||||||

Basic Loss per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net loss attributable to common stock | $ | (2,064,721 | ) | 4,509,950 | $ | (0.46 | ) | $ | (949,907 | ) | 3,918,430 | $ | (0.24 | ) | ||||||||||

Diluted Loss per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net loss attributable to common stock | $ | (2,064,721 | ) | 4,509,950 | $ | (0.46 | ) | $ | (949,907 | ) | 3,918,430 | $ | (0.24 | ) | ||||||||||

Options and warrants to purchase 887,999 and 1,635,999 shares of common stock were outstanding as of March 31, 2017 and June 30, 2016, respectively. These options and warrants were not included in the computation of diluted earnings per share for each of the three and nine month periods ended March 31, 2017 and 2016 because they are anti-dilutive as a result of the Company's net loss for all periods presented.

8. Shareholders ' Equity

The Company 's authorized capital stock consists of 30,000,000 shares of common stock and 15,000,000 shares of preferred stock. As of March 31, 2017, we had 4,903,766 shares of common stock outstanding, including 198,997 shares of unvested restricted stock. The Company also has options and warrants to purchase 887,999 shares of common stock outstanding as of March 31, 2017. No shares of preferred stock have been issued. The remaining restricted stock outstanding will vest between August 2016 and January 2019.

In September 2016, the Company distributed a Private Placement Memorandum to its warrant holders to give them the opportunity to exercise their warrants at a reduced exercise price and receive shares of common stock, par value $0.01 per share of the Company by paying the reduced exercise price in cash and surrendering the original warrants. The offering applied to warrant holders with an exercise price of $10.00 per share originally issued in March 2013. The offering gave the warrant holders the opportunity to exercise the warrants for $9.00 per share. The offer expired on November 15, 2016. In conjunction with the offering a total of 587,500 warrants were exercised resulting in total cash to the Company of $5.3 million. Of the total warrants exercised, 83,334 were exercised by entities controlled by Mr. Brad Juneau, the Company's Chairman, President and Chief Executive Officer. Proceeds from the exercise of the warrants will be used for working capital purposes and for funding future obligations to the Joint Venture Company.

Rights Plan

On December 19, 2012, the Company adopted a Rights Plan which was amended on March 21, 2013, September 29, 2014, December 18, 2014, and on November 11, 2015. Under the terms of the amended Rights Plan, each right (a "Right") will entitle the holder to purchase 1/100 of a share of Series A Junior Preferred Stock of the Company (the "Preferred Stock") at an exercise price of $80 per share. The Rights will be exercisable and will trade separately from the shares of common stock only if a person or group, other than the Estate of Mr. Kenneth R. Peak and its affiliates, acquires beneficial ownership of 23% or more of the Company's common stock.

11

Under the terms of the Rights Plan, Rights have been distributed as a dividend at the rate of one Right for each share of common stock that was held as of the close of business on December 20, 2012. Stockholders will not receive certificates for the Rights, but the Rights will become part of each share of common stock. An additional Right will be issued along with each share of common stock that is issued or sold by the Company after December 20, 2012. The Rights are scheduled to expire on December 19, 2018.

9. Formation of Joint Venture Company

On January 8, 2015, the Company and Royal Gold, through their wholly-owned subsidiaries, consummated the Transactions contemplated under the Master Agreement, including the formation of a joint venture to advance exploration and development of the Company 's Tetlin Properties, for gold ore and associated minerals prospects.

In connection with the Closing of the Transactions, the Company formed the Joint Venture Company. The Company contributed to the Joint Venture Company its Tetlin properties near Tok, Alaska, together with other property (the "Contributed Assets") with a historical book value of $1.4 million and an agreed fair value of $45.7 million (the "Contributed Assets Value"). At the Closing, the Company and Royal Gold, through their wholly-owned subsidiaries, entered into a Limited Liability Company Agreement for the Joint Venture Company (the "Joint Venture Company LLC Agreement").

Royal Gold serves as manager of the Joint Venture Company ("the Manager") and will initially manage, direct, and control the operations of the Joint Venture Company.

As a condition to the Closing, the Company and the Tetlin Village Council entered into a Stability Agreement dated October 2, 2014, pursuant to which the Company and the Tetlin Village Council, among other things, acknowledged the continued validity of the Tetlin Lease and all its terms notwithstanding any future change in the status of the Tetlin Village Council or the property subject to the Tetlin Lease.

At Closing, Royal Gold, as an initial contribution to the Joint Venture Company, contributed $5 million (the "Royal Gold Initial Contribution"). The Royal Gold Initial Contribution did not entitle Royal Gold to a percentage interest in the Joint Venture Company. Therefore, at Closing, Royal Gold 's percentage interest in the Joint Venture Company equaled 0% and the Company's percentage interest in the Joint Venture Company equaled 100%. In addition, as part of the Closing, Royal Gold paid the Company $750,000 which was utilized to partially reimburse the Company for costs and expenses incurred in the Transactions and is included as an expense reimbursement on our consolidated statements of operations.

The Joint Venture Company's LLC Agreement provides Royal Gold with the right, but not the obligation, to earn a percentage interest in the Joint Venture Company (up to a maximum of 40%) by making additional contributions of capital to the Joint Venture Company of up to $30 million (inclusive of the Royal Gold Initial Contribution of $5 million) during the period beginning on the Closing and ending on October 31, 2018. If Royal Gold funds its full $30 million investment by October 31, 2018, it will receive a percentage interest of 40% in the Joint Venture Company, and the Company will retain a percentage interest of 60% in the Joint Venture Company. From inception through March 31, 2017, Royal Gold has contributed approximately $20.0 million (inclusive of the Royal Gold Initial Contribution of $5 million) to the Joint Venture Company and earned a percentage interest of 24.9%.

The proceeds of Royal Gold 's contributions to the Joint Venture Company (including the Royal Gold Initial Contribution) have been used by the Joint Venture Company to fund further exploration activities on the Tetlin Properties.

Both the Company and Royal Gold will have the right to transfer each of their respective percentage interests in the Joint Venture Company to a third party, subject to certain terms and conditions set forth in the Joint Venture Company's LLC Agreement. If either member intends to transfer all or part of its percentage interest to a bona fide third party purchaser, the other member will have the right to require the transferring member to include in the intended transfer the other member 's proportionate share of its percentage interests at the same purchase price and terms and conditions. Once Royal Gold has earned a 40% interest in the Joint Venture Company, it will have the additional right to require the Company to sell up to 20% of the Company's interest in the Joint Venture Company in a sale of Royal Gold's entire 40% interest to a bona fide third party purchaser. If Royal Gold exercises this right, the Company will be obligated to sell the relevant portion of its percentage interest to a bona fide third party purchaser on the same terms and conditions as the interest being sold by Royal Gold.

After October 31, 2018, or such earlier time as Royal Gold has earned a 40% interest in the Joint Venture Company, the members will contribute funds to approved programs and budgets in proportion to their respective percentage interests in the Joint Venture Company. If a member elects not to contribute to an approved program and budget or elects to contribute less than its proportionate interest, its percentage interest will be recalculated by dividing (i) the sum of (a) the value of its initial contribution plus (b) the total of all of its capital contributions plus (c) the amount of the capital contribution it elects to fund, by (ii) the sum of (a), (b) and (c) above for both members multiplied by 100.

12

The Joint Venture Company is a variable interest entity as defined by FASB ASU No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis . The Company is not the primary beneficiary since it does not currently have the power to direct the activities of the Joint Venture Company. The Company's ownership interest in the Joint Venture Company is therefore accounted under the equity method.

10. Related Party Transactions

Mr. Brad Juneau, the Company's Chairman, President and Chief Executive Officer, is also the sole manager of JEX, a private company involved in the exploration and production of oil and natural gas. JEX was responsible for securing and negotiating the Tetlin Lease and assisting in obtaining other properties and initially engaged Avalon Development Corporation ("Avalon") to conduct mineral exploration activities on the Tetlin Lease. In agreeing to transfer its interests in such properties to Contango Mining, a predecessor of the Company, JEX retained a 3.0% overriding royalty interest in the properties transferred.

In September 2012, the Company and JEX entered into an Advisory Agreement in which JEX provided assistance in acquiring additional properties in Alaska in exchange for an overriding royalty of 2.0% on properties acquired after July 1, 2012.

On September 29, 2014, pursuant to a Royalty Purchase Agreement between JEX and Royal Gold (the "Royalty Purchase Agreement"), JEX sold its entire overriding royalty interest in the Tetlin Property to Royal Gold. On the same date, the Company terminated its Advisory Agreement with JEX.

In September 2016, the Company and JEX entered into a Management Services Agreement effective October 1, 2016. Under the Management Services Agreement, JEX will manage the business and affairs of the Company and its interest in the Joint Venture Company, subject to the direction of the Board, including corporate finance, accounting, budget, SEC reporting, risk management, operations and stockholder relation functions of the Company for an initial term of one year for a monthly fee of $32,000 which includes an allocation of approximately $6,900 for office space and equipment. No part of the fee will be allocated for compensation of Brad Juneau who will be compensated separately as determined by the independent Directors of the Company. JEX will also be reimbursed for its reasonable and necessary costs and expenses of third parties incurred for the Company. In addition, executives of JEX may be granted restricted stock, stock options or other forms of compensation by the independent Directors of the Company. The Company has adopted this management and compensation program because employees of JEX have historically spent significant time and effort in managing and administering the affairs of the Company. While the Company remains a small exploratory stage entity whose shares are publicly traded, the successful drilling program of the Joint Venture Company has required a significant additional allocation of time and effort to the business and affairs of the Company by the three part time executives, two of whom are officers of the Company. The amount of time and expertise required to effectively manage and administer the business and affairs of the Company will continue to be monitored by the Board for necessary adjustments or modifications depending upon the amount of time required to be spent on the business and affairs of the Company by the executives and the progress of the Joint Venture Company in its exploratory programs in Alaska.

11. Stock-Based Compensation

On September 15, 2010, the Company's Board of Directors (the "Board") adopted the Contango ORE, Inc. Equity Compensation Plan (the "2010 Plan"). Under the 2010 Plan, the Board may issue up to 1,000,000 shares of common stock and options to officers, directors, employees or consultants of the Company. Awards made under the 2010 Plan are subject to such restrictions, terms and conditions, including forfeitures, if any, as may be determined by the Board. As of March 31, 2017, there were 198,997 shares of unvested restricted common stock outstanding and options to purchase 307,000 shares of common stock outstanding issued under the 2010 Plan. Stock-based compensation expense for the three and nine months ended March 31, 2017 was $413,006 and $1,372,656, respectively. Stock-based compensation expense for the three and nine months ended March 31, 2016 was $70,232 and $437,452, respectively. The amount of compensation expense recognized does not reflect cash compensation actually received by the individuals during the current period, but rather represents the amount of expense recognized by the Company in accordance with GAAP. All restricted stock grants are expensed over the applicable vesting period based on the fair value at the date the stock is granted. The grant date fair value may differ from the fair value on the date the individual's restricted stock actually vests.

Restricted Stock. In November 2010, the Company granted 70,429 restricted shares of common stock to its executives and directors and an additional 23,477 restricted shares to a former technical consultant. All of the restricted stock from this grant was fully vested as of March 31, 2017.

In December 2013, the Company's directors, executives, and a former technical consultant were granted an aggregate of 95,000 shares of restricted stock. The restricted stock was set to vest over two years, beginning with one-third vesting on the date of grant. As of March 31, 2017, all of the restricted stock granted in December 2013 was vested.

In November 2014, the Company granted 27,000 restricted shares of common stock to its executives. The restricted stock was originally set to vest over two years, beginning with one-third vesting on the date of grant. In September 2016, the restricted stock agreements were modified. The final one-third of the grant will now vest in January 2019. As of March 31 , 2017, there were 9,000 shares of such restricted stock that remained unvested.

13

In January 2015, the Company granted an aggregate of 30,000 restricted shares of common stock to two of its non-executive directors, 10,000 shares vested immediately and the remaining two-thirds will vest equally over two years. In addition, the Company granted 10,000 restricted shares of common stock to a former technical consultant which vested immediately. The Compensation Committee also elected to immediately vest all of the stock options and restricted stock previously issued to the former technical consultant. As of March 31 , 2017, all of the restricted stock granted in January 2015 was vested .

In September 2015, the Company granted 85,000 restricted shares of common stock to its executives. The restricted stock was originally set to vest over two years, beginning with one-third vesting on the date of grant. In September 2016, the restricted stock agreements for two executives were modified such that the final one-third of their restricted stock grant will vest in January 2019. As of March 31 , 2017, there were 28,332 shares of such restricted stock that remained unvested.

In December 2015, the Company granted 40,000 restricted shares of common stock to two of its non-executive directors. The restricted stock vests over two years, beginning with one-third vesting on the date of grant. As of March 31 , 2017, there were 13,332 shares of such restricted stock that remained unvested.

In August 2016, the Company granted 100,000 restricted shares of common stock to its executives. A portion of the restricted stock granted vests over two years, beginning one-third on the date of grant. The remainder of the restricted stock granted vests in January 2019. As of March 31, 2017, there were 73,333 shares of such restricted stock that remained unvested.

In November 2016, the Company granted 75,000 restricted shares of common stock to its non-executive directors. The restricted stock granted vests in January 2019. As of March 31, 2017, there were 75,000 shares of such restricted stock that remained unvested.

As of March 31 , 2017, the total compensation cost related to unvested awards not yet recognized was $2,632,456. The remaining costs will be recognized over the remaining vesting period of the awards.

14

Stock Options. The option awards listed in the table below have been granted to directors, executives and consultants of the Company:

Option Awards | |||||||

Period Granted |

| Options Granted |

| Weighted Average Exercise Price |

| Vesting Period (7) | Expiration Date |

September 2011 (1) |

| 50,000 |

| $13.13 |

| Vests over two years, beginning with one-third on the grant date. | September 2016 |

July 2012 (2) |

| 100,000 |

| $10.25 |

| Vests over two years, beginning with one-third on the grant date. | July 2017 |

December 2012 (3) |

| 250,000 |

| $10.20 |

| Vests over two years, beginning with one-third on the grant date. | December 2017 |

June 2013 (4) |

| 37,500 |

| $10.00 |

| Vested Immediately | June 2018 |

July 2013 (5) |

| 5,000 |

| $10.00 |

| Vested Immediately | July 2018 |

September 2013 (6) |

| 37,500 |

| $10.01 |

| Vested Immediately | September 2018 |

September 2013 (6) |

| 15,000 |

| $10.01 |

| Vests over two years, beginning with one-third on the grant date. | September 2018 |

(1) The Company granted 40,000 stock options to its directors and executives and an additional 10,000 stock options to a former technical consultant, for services performed during fiscal year 2011. Of the total options granted 15,000 were later forfeited.

(2) The Company granted 75,000 stock options to its directors and executives and an additional 25,000 stock options to a former technical consultant for services performed during fiscal year 2012. Of the total options granted as a part of this grant, 25,000 were later forfeited.

(3) The Company granted 175,000 stock options to its directors and executives and an additional 75,000 stock options to a former technical consultant for services performed during fiscal year 2013. Of the total options granted as a part of this grant, 50,000 were later forfeited.

(4) The Company granted 37,500 stock options to its executives for services performed during fiscal year 2013.

(5) The Company granted 5,000 stock options to an employee of Avalon for services performed during fiscal year 2013.

(6) The Company granted 52,500 stock options to its executives for services performed during the first quarter of fiscal year 2014.

(7) If at any time there occurs a change of control, as defined in the 2010 Plan, any options that are unvested at that time will immediately vest. The Company's Compensation Committee has determined that the Transactions do not constitute a change of control under the 2010 Plan.

15

During the first and second quarter of fiscal year 2017, the Company's current and former executives, directors, and consultants cashless exercised 80,000 and 18,000 stock options, respectively, resulting in the issuance of 42,817 and 9,357 shares of common stock to the exercising parties and no proceeds to the Company. There were no stock option exercises during the quater ended March 31, 2017. The Company applies the fair value method to account for stock option expense. Under this method, cash flows from the exercise of stock options resulting from tax benefits in excess of recognized cumulative compensation cost (excess tax benefits) are classified as financing cash flows. See Note 3 – Summary of Significant Accounting Policies. All employee stock option grants are expensed over the stock option's vesting period based on the fair value at the date the options are granted. The fair value of each option is estimated as of the date of grant using the Black-Scholes options-pricing model. As of March 31, 2017, the stock options had a weighted-average remaining life of approximately 1 year. The total compensation cost related to these options had been fully recognized as of March 31, 2017 as all of the options are fully vested.

A summary of the status of stock options granted under the 2010 Plan as of March 31, 2017 and changes during the nine months then ended, is presented in the table below:

Nine Months Ended March 31, 2017 | |||||||

Shares Under Options | Weighted Average Exercise Price | ||||||

Outstanding, June 30, 2016 | 405,000 | $ | 10.24 | ||||

Granted | - | - | |||||

Exercised | (98,000 | ) | $ | 10.98 | |||

Forfeited | - | - | |||||

Outstanding, March 31, 2017 | 307,000 | $ | 10.00 | ||||

Aggregate intrinsic value | $ | 3,072,620 | |||||

Exercisable, end of period | 307,000 | $ | 10.00 | ||||

Aggregate intrinsic value | $ | 3,072,620 | |||||

Available for grant, end of period | 39,094 | ||||||

12. Commitments and Contingencies

Tetlin Lease . The Tetlin Lease had an initial ten year term beginning July 2008 which was extended for an additional ten years to July 15, 2028, and for so long thereafter as the Joint Venture Company initiates and continues to conduct mining operations on the Tetlin Lease.

Pursuant to the terms of the Tetlin Lease, the Joint Venture Company is required to spend $350,000 per year until July 15, 2018 in exploration costs. However, the Company's exploration expenditures through the 2011 exploration program have satisfied this requirement because exploration funds spent in any year in excess of $350,000 are credited toward future years' exploration cost requirements. Additionally, should the Joint Venture Company derive revenues from the properties covered under the Tetlin Lease, the Joint Venture Company is required to pay the Tetlin Tribal Council a production royalty ranging from 2.0% to 5.0%, depending on the type of metal produced and the year of production. As of March 31, 2017, the Company had paid the Tetlin Village Council $225,000 in exchange for reducing the production royalty payable to them by 0.75%. These payments lowered the production royalty to a range of 1.25% to 4.25%. On or before July 15, 2020, the Tetlin Tribal Council has the option to increase their production royalty by (i) 0.25% by payment to the Joint Venture Company of $150,000, (ii) 0.50% by payment to the Joint Venture Company of $300,000, or (iii) 0.75% by payment to the Joint Venture Company of $450,000. Until such time as production royalties begin, the Joint Venture Company must pay the Tetlin Tribal Council an advance minimum royalty of $50,000 per year. On July 15, 2012, the advance minimum royalty increased to $75,000 per year, and subsequent years are escalated by an inflation adjustment.

Gold Exploration. The Joint Venture Company's Triple Z, TOK/Tetlin, Eagle, Bush, West Fork, and Noah claims are all located on state of Alaska lands. The annual claim rentals on these projects vary based on the age of the claims, and are due and payable in full by November 30 of each year. Annual claims rentals for the 2015-2016 assessment year totaled $125,370. The Joint Venture Company has met the annual labor requirements for the state of Alaska acreage for the next four years, which is the maximum time allowable by Alaska law.

Royal Gold Royalties . Pursuant to the Royalty Purchase Agreement, the Joint Venture Company will pay Royal Gold an overriding royalty of 3.0% should the Joint Venture Company derive revenues from the Tetlin Lease and certain other properties and an overriding royalty of 2.0% should the Joint Venture Company derive revenues from any additional properties.

16

Available Information

General information about the Company can be found on the Company's website at www.contangoore.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports, are available free of charge through our website as soon as reasonably practicable after we file or furnish them to the Securities and Exchange Commission ("SEC").

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the accompanying notes and other information included elsewhere in this Form 10-Q and in our Form 10-K, for the fiscal year ended June 30, 2016, previously filed with the SEC.

17

Cautionary Statement about Forward-Looking Statements

Some of the statements made in this report may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The words and phrases "should be", "will be", "believe", "expect", "anticipate", "estimate", "forecast", "goal" and similar expressions identify forward-looking statements and express our expectations about future events. These include such matters as:

• | The Company's financial position |

• | Business strategy, including outsourcing |

• | Meeting Company forecasts and budgets |

• | Anticipated capital expenditures |

• | Prices of gold and associated minerals |

• | Timing and amount of future discoveries (if any) and production of natural resources on our Tetlin Property |

• | Operating costs and other expenses |

• | Cash flow and anticipated liquidity |

• | Prospect development |

• | New governmental laws and regulations |

Although the Company believes the expectations reflected in such forward-looking statements are reasonable, such expectations may not occur. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results expressed or implied by the forward-looking statements. These factors include among others:

• | Ability to raise capital to fund capital expenditures |

• | Operational constraints and delays |

• | The risks associated with exploring in the mining industry |

• | The timing and successful discovery of natural resources |

• | Availability of capital and the ability to repay indebtedness when due |

• | Declines and variations in the price of gold and associated minerals |

• | Price volatility for natural resources |

• | Availability of operating equipment |

• | Operating hazards attendant to the mining industry |

• | Weather |

• | The ability to find and retain skilled personnel |

• | Restrictions on mining activities |

• | Legislation that may regulate mining activities |

• | Impact of new and potential legislative and regulatory changes on mining operating and safety standards |

• | Uncertainties of any estimates and projections relating to any future production, costs and expenses. |

• | Timely and full receipt of sale proceeds from the sale of any of our mined products (if any) |

• | Stock price and interest rate volatility |

• | Federal and state regulatory developments and approvals |

• | Availability and cost of material and equipment |

• | Actions or inactions of third-parties |

• | Potential mechanical failure or under-performance of facilities and equipment |

• | Environmental risks |

• | Strength and financial resources of competitors |

• | Worldwide economic conditions |

• | Expanded rigorous monitoring and testing requirements |

• | Ability to obtain insurance coverage on commercially reasonable terms |

• | Competition generally and the increasing competitive nature of our industry | |

| • | Risks related to title to properties |

18

You should not unduly rely on these forward-looking statements in this report, as they speak only as of the date of this report. Except as required by law, we undertake no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances occurring after the date of this report or to reflect the occurrence of unanticipated events.

See the information under the heading "Risk Factors" in this Form 10-Q for some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in forward-looking statements.

Overview

The Company is a Houston-based company, whose primary business is the participation in a joint venture to explore in the State of Alaska for gold ore and associated minerals. On January 8, 2015, the Company and Royal Gold, Inc. ("Royal Gold"), through their wholly-owned subsidiaries, consummated the transactions (the "Transactions") contemplated under the Master Agreement, dated as of September 29, 2014 (the "Master Agreement"), including the formation of a joint venture, Peak Gold, LLC (the "Joint Venture Company"), to advance exploration of the Company's Tetlin Property, which is prospective for gold and associated minerals. As of March 31, 2017, the Joint Venture Company had leased or had control over an estimated 843,000 acres for the exploration of gold ore and associated minerals.

Background

Contango Mining Company ("Contango Mining"), a wholly owned subsidiary of Contango Oil & Gas Company ("Contango"), was formed for the purpose of mineral exploration in the State of Alaska. Contango Mining initially acquired a 50% interest in properties from Juneau Exploration, L.P., ("JEX") in exchange for $1 million and a 1.0% overriding royalty interest in the properties under a Joint Exploration Agreement (the "Joint Exploration Agreement"). On September 15, 2010, Contango Mining acquired the remaining 50% interest in the properties by increasing the overriding royalty interest in the properties granted to JEX to 3.0% pursuant to an Amended and Restated Conveyance of Overriding Royalty Interest (the "Amended ORRI Agreement"), and JEX and Contango Mining terminated the Joint Exploration Agreement. JEX assisted the Company in acquiring additional properties in Alaska pursuant to an Advisory Agreement dated September 6, 2012, and the Company granted to JEX a 2% overriding royalty interest in the additional properties acquired. On September 29, 2014, pursuant to a Royalty Purchase Agreement between JEX and Royal Gold (the "Royalty Purchase Agreement"), JEX sold its entire overriding royalty interest in the properties to Royal Gold. On the same date, the Company terminated the Advisory Agreement with JEX.

The Company was formed on September 1, 2010 as a Delaware corporation and on November 29, 2010, Contango Mining assigned all its properties and certain other assets and liabilities to Contango. Contango contributed the properties and $3.5 million of cash to the Company, pursuant to the terms of a Contribution Agreement (the "Contribution Agreement"), in exchange for approximately 1.6 million shares of the Company's common stock. The transactions occurred between companies under common control. Contango then distributed all of the Company's common stock to Contango's stockholders of record as of October 15, 2010, promptly after the effective date of the Company's Registration Statement Form 10 on the basis of one share of common stock for each ten (10) shares of Contango's common stock then outstanding.

In connection with the closing of the Transactions with Royal Gold (the "Closing"), the Company formed Peak Gold, LLC and contributed to the Joint Venture Company its Tetlin Property near Tok, Alaska, together with other personal property (the "Contributed Assets") with a historical cost of $1.4 million and an agreed value of $45.7 million (the "Contributed Assets Value"). At the Closing, the Company and Royal Gold, through their wholly-owned subsidiaries, entered into a Limited Liability Company Agreement for the Joint Venture Company (the "Joint Venture Company LLC Agreement").

Upon Closing, Royal Gold initially invested $5 million to fund exploration activity. The initial $5 million did not give Royal Gold an equity stake in the Joint Venture Company. Royal Gold has the option to earn up to a percentage interest of 40% in the Joint Venture Company by investing up to $30 million (inclusive of the initial $5 million investment) prior to October 2018. As of March 31, 2017, Royal Gold has contributed approximately $20.0 million (including the initial $5 million investment) to the Joint Venture Company and earned a percentage interest of 24.9%. The proceeds of Royal Gold's investment have been and will be used by the Joint Venture Company for additional exploration of the Tetlin Property.

Properties

Since 2009, the Company's primary focus has been the exploration of a mineral lease with the Native Village of Tetlin whose governmental entity is the Tetlin Tribal Council ("Tetlin Tribal Council") for the exploration of minerals near Tok, Alaska on a currently estimated 675,000 acres (the "Tetlin Lease") and almost all of the Company's resources have been directed to that end. All significant work presently conducted by the Company has been directed at exploration of the Tetlin Lease and increasing understanding of the characteristics of, and economics of, any mineralization. There are no known quantifiable mineral reserves on the Tetlin Lease or any of the Company's other properties as defined by the Securities and Exchange Commission ("SEC") Industry Guide 7.

19

The Tetlin Lease originally had a ten year term beginning July 2008 which was extended for an additional ten years to July 15, 2028. If the properties under the Tetlin Lease are placed into commercial production, the Tetlin Lease will be held throughout production and the Company would be obligated to pay a production royalty to the Tetlin, which varies from 2.0% to 5.0%, depending on the type of metal produced and the year of production. In June 2011, the Company paid the Tetlin $75,000 in exchange for reducing the production royalty payable to them by 0.25%. In July 2011, the Company paid the Tetlin Tribal Council an additional $150,000 in exchange for further reducing the production royalty by 0.50%. These payments lowered the production royalty to a range of 1.25% to 4.25%, depending on the type of metal produced and the year of production. On or before July 15, 2020, the Tetlin has the option to increase its production royalty by (i) 0.25% by payment to the Joint Venture Company of $150,000, or (ii) 0.50% by payment to the Joint Venture Company of $300,000, or (iii) 0.75% by payment to the Joint Venture Company of $450,000.

The Joint Venture Company also holds State of Alaska unpatented mining claims for the exploration of gold ore and associated minerals. The Company believes that the Joint Venture Company holds good title to its properties, in accordance with standards generally accepted in the mineral industry. As is customary in the mineral industry, the Company conducted only a preliminary title examination at the time it acquired the Tetlin Lease. The Joint Venture Company conducted a title examination prior to the assignment of the Tetlin Lease to the Joint Venture Company and performed certain curative title work.

The following table summarizes the Tetlin Lease and unpatented mining claims (the "Tetlin Property") held by the Joint Venture Company as of March 31, 2017:

Property |

| Location |

| Commodities |

| Claims |

| Estimated Acres |

| Type | |

Tetlin-Tok |

| Eastern Interior |

| Gold, Copper, Silver |

| 131 |

| 10,900 |

| State Mining Claims | |

Eagle |

| Eastern Interior |

| Gold, Copper, Silver |

| 428 |

| 65,000 |

| State Mining Claims | |

Bush |

| Eastern Interior |

| Gold, Copper, Silver |

| 48 |

| 7,700 |

| State Mining Claims | |

West Fork |

| Eastern Interior |

| Gold, Copper, Silver |

| 48 |

| 7,700 |

| State Mining Claims | |

Triple Z |

| Eastern Interior |

| Gold, Copper, Silver |

| 45 |

| 7,200 |

| State Mining Claims | |

| Noah #1 | Eastern Interior | Gold, Copper, Silver | 224 | 34,400 | State Mining Claims | ||||||

| Noah #2 | Eastern Interior | Gold, Copper, Silver | 217 | 34,500 | State Mining Claims | ||||||

Tetlin-Village |

| Eastern Interior |

| Gold, Copper, Silver |

| - |

| 675,000 |

| Lease | |

|

| TOTALS: |

|

|

| 1,141 |

| 843,400 |

|

| |

Strategy

Partnering with strategic industry participants to expand future exploration work. In connection with an evaluation of the Company's strategic options conducted by the Board of Directors and its financial advisor, the Company determined to continue its exploration activities on the Tetlin Property through a joint venture with an experienced industry participant. As a result, the Company formed the Joint Venture Company pursuant to a Joint Venture Company's LLC Agreement with Royal Gold. Under the Joint Venture Company's LLC Agreement, Royal Gold is appointed as the manager of the Joint Venture Company (the "Manager"), initially, with overall management responsibility for operations of the Joint Venture Company through October 31, 2018, and, thereafter, provided Royal Gold earns at least a forty percent (40%) percentage interest by October 31, 2018. Royal Gold may resign as Manager and can be removed as Manager for a material breach of the Joint Venture Company LLC Agreement, a material failure to perform its obligations as the Manager, a failure to conduct the Joint Venture Company operations in accordance with industry standards and applicable laws, and other limited circumstances. The Manager will manage, and direct the operation of the Joint Venture Company, and will discharge its duties, in accordance with approved programs and budgets. The Manager will implement the decisions of the Management Committee of the Joint Venture Company (the "Management Committee") and will carry out the day-to-day operations of the Joint Venture Company. Except as expressly delegated to the Manager, the Joint Venture Company's LLC Agreement provides that the Management Committee has exclusive authority to determine all management matters related to the Company. Initially, the Management Committee consists of one appointee designated by the Company and two appointees designated by Royal Gold. Each designate on the Management Committee is entitled to one vote. Except for the list of specific actions set forth in the Joint Venture Company's LLC Agreement, the affirmative vote by a majority of designates is required for action.

Structuring Incentives to Drive Behavior . The Company believes that equity ownership aligns the interests of the Company's executives and directors with those of its stockholders. The Company's directors and executives have not received cash compensation for their work for the Company. As of March 31, 2017, the Company's directors and executives beneficially own approximately 15.9% of the Company's common stock. An additional 15.8% of the Company's common stock is beneficially owned by the Estate of Mr. Kenneth R. Peak, the Company's former Chairman, who passed away on April 19, 2013.

20

Restricted Stock. In November 2010, the Company granted 70,429 restricted shares of common stock to its executives and directors and an additional 23,477 restricted shares to a former technical consultant. All of the restricted stock from this grant was fully vested as of March 31, 2017.

In December 2013, the Company's directors, executives, and a former technical consultant were granted an aggregate of 95,000 shares of restricted stock. The restricted stock was set to vest over two years, beginning with one-third vesting on the date of grant. As of March 31, 2017, all of the restricted stock granted in December 2013 was vested.

In November 2014, the Company granted 27,000 restricted shares of common stock to its executives. The restricted stock was originally set to ve st over two years, beginning with one-third vesting on the date of grant. In September 2016, the restricted stock agreements were modified. The final one-third of the grant will now vest in January 2019. As of March 31, 2017, there were 9,000 shares of such restricted stock that remained unvested.

In January 2015, the Company granted an aggregate of 30,000 restricted shares of common stock to two of its non-executive directors, 10,000 shares vested immediately and the remaining two-thirds will vest equally over two years. In addition, the Company g ranted 10,000 restricted shares of common stock to a former technical consultant which vested immediately. The Compensation Committee also elected to immediately vest all of the stock options and restricted stock previously issued to the former technical consultant. As of March 31, 2017, all of the restricted stock granted in January 2015 was vested.

In September 2015, the Company granted 85,000 restricted shares of common stock to its executives. The restricted stock was originally set to vest over two y ears, beginning with one-third vesting on the date of grant. In September 2016, the restricted stock agreements for two executives were modified such that the final one-third of their restricted stock grant will vest in January 2019. As of March 31, 2017, there were 28,332 shares of such restricted stock that remained unvested.

In December 2015, the Company granted 40,000 restricted shares of common stock to two of its non-executive directors. The restricted stock vests over two years, beginning with on e-third vesting on the date of grant. As of March 31, 2017, there were 13,332 shares of such restricted stock that remained unvested.

In August 2016, the Company granted 100,000 restricted shares of common stock to its executives. A portion of the rest ricted stock granted vests over two years, beginning one-third on the date of grant. The remainder of the restricted stock granted vests in January 2019. As of March 31, 2017, there were 73,333 shares of such restricted stock that remained unvested.

In November 2016, the Company granted 75,000 restricted shares of common stock to its non-executive directors. The restricted stock granted vests in January 2019. As of March 31, 2017, there were 75,000 shares of such restricted stock that remained unvested.

21

Stock Options. As of the date of this report, the option awards listed in the table below have been granted to directors, officers, employees and consultants of the Company:

Option Awards | |||||||

Period Granted |

| Options Granted |

| Weighted Average Exercise Price |

| Vesting Period (7) | Expiration Date |

September 2011 (1) |

| 50,000 |

| $13.13 |

| Vests over two years, beginning with one-third on the grant date. | September 2016 |

July 2012 (2) |

| 100,000 |

| $10.25 |

| Vests over two years, beginning with one-third on the grant date. | July 2017 |

December 2012 (3) |

| 250,000 |

| $10.20 |

| Vests over two years, beginning with one-third on the grant date. | December 2017 |

June 2013 (4) |

| 37,500 |

| $10.00 |

| Vested Immediately | June 2018 |

July 2013 (5) |

| 5,000 |

| $10.00 |

| Vested Immediately | July 2018 |

September 2013 (6) |

| 37,500 |

| $10.01 |

| Vested Immediately | September 2018 |

September 2013 (6) |

| 15,000 |

| $10.01 |

| Vests over two years, beginning with one-third on the grant date. | September 2018 |

(1) The Company granted 40,000 stock options to its directors and executives and an additional 10,000 stock options to its technical consultant, the owner of Avalon, for services performed during fiscal year 2011. Of the total options granted 15,000 were later forfeited..

(2) The Company granted 75,000 stock options to its directors and executives and an additional 25,000 stock options to its technical consultant for services performed during fiscal year 2012. Of the total options granted as a part of this grant, 25,000 were later forfeited.

(3) The Company granted 175,000 stock options to its directors and executives and an additional 75,000 stock options to its technical consultant for services performed during fiscal year 2013. Of the total options granted as a part of this grant, 50,000 were later forfeited.

(4) The Company granted 37,500 stock options to its executives for services performed during fiscal year 2013.

(5) The Company granted 5,000 stock options to an employee of Avalon for services performed during fiscal year 2013.

(6) The Company granted 52,500 stock options to its executives for services performed during the first quarter of fiscal year 2014.

(7) If at any time there occurs a change of control, as defined in the 2010 Plan, any options that are unvested at that time will immediately vest. The Company's Compensation Committee has determined that the Transactions do not constitute a change in control under the 2010 Plan.

During the first and second quarter of fiscal year 2017, the Company's current and former executives, directors, and consultants cashless exercised 80,000 and 18,000 stock options, respectively, resulting in the issuance of 42,817 and 9,357 shares of common stock to the exercising parties and no proceeds to the Company. There were no stock otpion exercises during the quarter ended March 31, 2017.

22

Exploration and Mining Property

Exploration and mining rights in Alaska may be acquired in the following manner: public lands, private fee lands, unpatented Federal or State of Alaska mining claims, patented mining claims, and tribal lands. The primary sources for acquisition of these lands are the United States government, through the Bureau of Land Management and the United States Forest Service, the Alaskan state government, tribal governments, and individuals or entities who currently hold title to or lease government and private lands.

Tribal lands are those lands that are under control by sovereign Native American tribes, such as land constituting the Tetlin Lease or Alaska Native corporations established by the Alaska Native Claims Settlement Act of 1971 (ANSCA). Areas that show promise for exploration and mining can be leased or joint ventured with the tribe controlling the land, including land constituting the Tetlin Lease.

The State of Alaska government owns public lands. Mineral resource exploration, development and production are administered primarily by the State Department of Natural Resources. Ownership of the subsurface mineral estate, including alluvial and lode mineral rights, can be acquired by staking a 40 acre or 160 acre mining claim, which right is granted under Alaska Statute Sec. 38.05.185 to 38.05.275, as amended (the "Alaska Mining Law"). The State government continues to own the surface estate, subject to certain rights of ingress and egress owned by the claimant, even though the subsurface can be controlled by a claimant with a right to extract through claim staking. A mining claim is subject to annual assessment work requirements, the payment of annual rental fees and royalties due to the State of Alaska after commencement of commercial production. Both private fee-land and unpatented mining claims and related rights, including rights to use the surface, are subject to permitting requirements of Federal, State, Tribal and local governments.

Gold Exploration

The Joint Venture Company controls an estimated 843,000 acres consisting of the Tetlin Lease and State of Alaska mining claims for the exploration of gold and associated minerals. To date, our gold exploration has concentrated on the Tetlin Lease, with only a limited amount of work performed on the TOK, Eagle, Bush, West Fork, Triple Z, and Noah claims.