UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 1-8944

CLIFFS NATURAL RESOURCES INC.

(Exact Name of Registrant as Specified in Its Charter)

| Ohio | 34-1464672 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| 200 Public Square, Cleveland, Ohio | 44114-2315 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant's Telephone Number, Including Area Code: (216) 694-5700

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Shares, par value $0.125 per share | New York Stock Exchange and Professional Segment of NYSE Euronext Paris |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

As of June 30, 2011, the aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant, based on the closing price of $92.45 per share as reported on the New York Stock Exchange - Composite Index, was $13,430,571,403 (excluded from this figure is the voting stock beneficially owned by the registrant's officers and directors).

The number of shares outstanding of the registrant's Common Shares, par value $0.125 per share, was 142,013,534 as of February 13, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement for its annual meeting of shareholders scheduled to be held on May 8, 2012 are incorporated by reference into Part III.

TABLE OF CONTENTS

| Page No. | ||||||

Definitions | 2 | |||||

Part I | ||||||

Item 1. | Business | 5 | ||||

Item 1A. | Risk Factors | 25 | ||||

Item 1B. | Unresolved Staff Comments | 35 | ||||

Item 2. | Properties | 35 | ||||

Item 3. | Legal Proceedings | 47 | ||||

Item 4. | Mine Safety Disclosures | 48 | ||||

Part II | ||||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 49 | ||||

Item 6. | Selected Financial Data | 51 | ||||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 53 | ||||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 94 | ||||

Item 8. | Financial Statements and Supplementary Data | 95 | ||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 183 | ||||

Item 9A. | Controls and Procedures | 183 | ||||

Item 9B. | Other Information | 184 | ||||

Part III | ||||||

Item 10. | Directors, Executive Officers and Corporate Governance | 185 | ||||

Item 11. | Executive Compensation | 185 | ||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 185 | ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 187 | ||||

Item 14. | Principal Accountant Fees and Services | 187 | ||||

Part IV | ||||||

Item 15. | Exhibits and Financial Statement Schedules | 188 | ||||

Signatures | 189 | |||||

Definitions

The following abbreviations or acronyms are used in the text. References in this report to the "Company," "we," "us," "our" and "Cliffs" are to Cliffs Natural Resources Inc. and subsidiaries, collectively. References to "A$" or "AUD" refer to Australian currency, "C$" to Canadian currency and "$" to United States currency.

Abbreviation or acronym | Term | |

Algoma | Essar Steel Algoma Inc. | |

Amapá | Anglo Ferrous Amapá Mineração Ltda. and Anglo Ferrous Logística Amapá Ltda. | |

Anglo | Anglo American plc | |

APBO | Accumulated Postretirement Benefit Obligation | |

ArcelorMittal | ArcelorMittal (as the parent company of ArcelorMittal Mines Canada, ArcelorMittal USA and ArcelorMittal Dofasco, as well as, many other subsidiaries) | |

ArcelorMittal USA | ArcelorMittal USA LLC (including many of its North American affiliates, subsidiaries and representatives. References to ArcelorMittal USA comprise all such relationships unless a specific ArcelorMittal USA entity is referenced) | |

ASC | Accounting Standards Codification | |

AusQuest | AusQuest Limited | |

BART | Best Available Retrofit Technology | |

BHP | BHP Billiton | |

Bloom Lake | Bloom Lake Iron Ore Mine Limited Partnership | |

BNSF | Burlington Northern Santa Fe, LLC | |

CAC | Cliffs Australia Coal Pty Ltd. | |

CAWO | Cliffs Australian Washplant Operations Pty Ltd | |

CERCLA | Comprehensive Environmental Response, Compensation and Liability Act | |

C.F.R. | Cost and Freight | |

C.I.F. | Cost, Insurance and Freight | |

CLCC | Cliffs Logan County Coal LLC | |

Clean Water Act | Federal Water Pollution Control Act | |

Cliffs Erie | Cliffs Erie LLC | |

CN | Canadian Railway Company | |

Cockatoo Island | Cockatoo Island Joint Venture | |

Compensation Committee | Compensation and Organization Committee | |

Consent Order | Administrative Order by Consent | |

Consolidated Thompson | Consolidated Thompson Iron Mining Limited (now known as Cliffs Quebec Iron Mining Limited) | |

CSAPR | Cross State Air Pollution Rule | |

CSXT | CSX Transportation | |

DEP | Department of Environment Protection | |

Directors' Plan | Nonemployee Directors' Compensation Plan, as amended and restated 12/31/2008 | |

Dodd-Frank Act | Dodd-Frank Wall Street Reform and Consumer Protection Act | |

Dofasco | ArcelorMittal Dofasco Inc. | |

EBIT | Earnings before interest and taxes | |

EBITDA | Earnings before interest, taxes, depreciation and amortization | |

EMPI | Executive Management Performance Incentive Plan | |

Empire | Empire Iron Mining Partnership | |

EPA | U.S. Environmental Protection Agency | |

EPS | Earnings per share | |

Exchange Act | Securities Exchange Act of 1934 | |

FASB | Financial Accounting Standards Board | |

FMSH Act | Federal Mine Safety and Health Act 1977 |

2

Abbreviation or acronym | Term | |

F.O.B. | Free on board | |

Freewest | Freewest Resources Canada Inc. (now known as Cliffs Chromite Ontario Inc.) | |

GAAP | Accounting principles generally accepted in the United States | |

GHG | Greenhouse gas | |

Hibbing | Hibbing Taconite Company | |

IASB | International Accounting Standards Board | |

ICE Plan | Amended and Restated Cliffs 2007 Incentive Equity Plan, As Amended | |

IFRS | International Financial Reporting Standards | |

INR | INR Energy, LLC | |

IRS | U.S. Internal Revenue Service | |

Ispat | Ispat Inland Steel Company | |

JORC | Joint Ore Reserves Code | |

LIBOR | London Interbank Offered Rate | |

LIFO | Last-in, first-out | |

LTVSMC | LTV Steel Mining Company | |

MDEQ | Michigan Department of Environmental Quality | |

MMBtu | Million British Thermal Units | |

MP | Minnesota Power, Inc. | |

MPCA | Minnesota Pollution Control Agency | |

MPI | Management Performance Incentive Plan | |

MPSC | Michigan Public Service Commission | |

MRRT | Minerals Resource Rent Tax | |

MSHA | Mine Safety and Health Administration | |

NAAQS | National Ambient Air Quality Standards | |

NBCWA | National Bituminous Coal Wage Agreement | |

NDEP | Nevada Department of Environmental Protection | |

NO 2 | Nitrogen dioxide | |

NO x | Nitrogen oxide | |

Northshore | Northshore Mining Company | |

NPDES | National Pollutant Discharge Elimination System | |

NRD | Natural Resource Damages | |

NYSE | New York Stock Exchange | |

Oak Grove | Oak Grove Resources, LLC | |

OCI | Other comprehensive income | |

OPEB | Other postretirement benefits | |

OPIP | Operations Performance Incentive Plan | |

PBO | Projected benefit obligation | |

Pinnacle | Pinnacle Mining Company, LLC | |

PinnOak | PinnOak Resources, LLC | |

Pluton Resources | Pluton Resources Limited | |

PM 10 | Particulate matter with a diameter smaller than 10 micron | |

Portman | Portman Limited (now known as Cliffs Asia Pacific Iron Ore Holdings Pty Ltd) | |

PPACA | Patient Protection and Affordable Care Act | |

PRP | Potentially responsible party | |

Qcoal | Qcoal Pty Ltd | |

Reconciliation Act | Health Care and Education Reconciliation Act | |

renewaFUEL | renewaFUEL, LLC (now known as Cliffs Michigan Biomass, LLC) | |

Ring of Fire properties | Black Thor, Black Label and Big Daddy chromite deposits | |

RTWG | Rio Tinto Working Group | |

SARs | Stock Appreciation Rights |

3

Abbreviation or acronym | Term | |

SEC | U.S. Securities and Exchange Commission | |

Severstal | Severstal North America, Inc. | |

Silver Bay Power | Silver Bay Power Company | |

SIP | State Implementation Plan | |

SMCRA | Surface Mining Control and Reclamation Act | |

SMM | Sonoma Mine Management | |

SO 2 | Sulfur dioxide | |

Sonoma | Sonoma Coal Project | |

Spider | Spider Resources Inc. (now known as Cliffs Chromite Far North Inc.) | |

TCR | The Climate Registry | |

Tilden | Tilden Mining Company L.C. | |

TMDL | Total Maximum Daily Load | |

TSR | Total Shareholder Return | |

UMWA | United Mineworkers of America | |

United Taconite | United Taconite LLC | |

UP 1994 | 1994 Uninsured Pensioner Mortality Table | |

U.S. | United States of America | |

U.S. Steel | United States Steel Corporation | |

USW | United Steelworkers | |

Vale | Companhia Vale do Rio Doce | |

VEBA | Voluntary Employee Benefit Association trusts | |

VIE | Variable interest entity | |

VNQDC Plan | 2005 Voluntary NonQualified Deferred Compensation Plan | |

Wabush | Wabush Mines Joint Venture | |

Weirton | ArcelorMittal Weirton Inc. | |

WEPCO | Wisconsin Electric Power Company | |

Wheeling | Wheeling-Pittsburgh Steel Corporation | |

WISCO | Wuhan Iron and Steel (Group) Corporation |

4

PART I

Item 1. Business.

Introduction

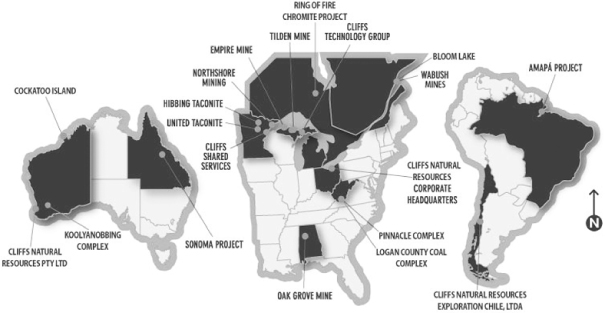

Cliffs Natural Resources Inc. traces its corporate history back to 1847. Today, we are an international mining and natural resources company. A member of the S&P 500 Index, we are a major global iron ore producer and a significant producer of high- and low-volatile metallurgical coal. Driven by the core values of safety, social, environmental and capital stewardship, our Company's associates across the globe endeavor to provide all stakeholders operating and financial transparency. Our Company is organized through a global commercial group responsible for sales and delivery of our products and a global operations group responsible for the production of the minerals that we market. Our Company's operations are organized according to product category and geographic location: U.S. Iron Ore, Eastern Canadian Iron Ore, North American Coal, Asia Pacific Iron Ore, Asia Pacific Coal, Latin American Iron Ore, Ferroalloys, and our Global Exploration Group.

In the U.S., we operate five iron ore mines in Michigan and Minnesota, five metallurgical coal mines located in West Virginia and Alabama and one thermal coal mine located in West Virginia. We also operate two iron ore mines in Eastern Canada that primarily provide iron ore to the seaborne market for Asian steel producers. Our Asia Pacific operations are comprised of two iron ore mining complexes in Western Australia, serving the Asian iron ore markets with direct-shipping fines and lump ore, and a 45 percent economic interest in a coking and thermal coal mine located in Queensland, Australia. In Latin America, we have a 30 percent interest in Amapá, a Brazilian iron ore project, and in Ontario, Canada, we have a major chromite project in the pre-feasibility stage of exploration. In addition, our Global Exploration Group is focused on early involvement in exploration activities to identify new world-class projects for future development or projects that add significant value to existing operations.

Industry Overview

Our business is largely driven by global demand for steelmaking raw materials in both developed and emerging economies. The environment for steelmaking in the U.S. and Canada during 2011 improved over the previous year, but still remained at levels lower than production capability. Steelmaking in Asia, led by China's economy, reached historically high levels in 2011. Global crude steel production, the primary driver of our business, was up approximately five percent in 2011 as compared to 2010. This included increases of approximately nine and seven percent in China and the U.S., respectively, which are the two largest markets for the Company. China produced approximately 683 million metric tons of crude steel in 2011, representing approximately 46 percent of global production.

The rapid growth in steel production in China over recent years has only been partially met by a corresponding increase in domestic Chinese iron ore production. Chinese iron ore deposits, although substantial, are of a lower grade (less than half of the equivalent iron ore content) than the current iron ore supplied from Brazil and Australia.

The world price of iron ore is influenced heavily by international demand, and rising spot market prices for iron ore have reflected this trend in recent years. The rapid growth in Chinese demand has created a market imbalance, which continues to indicate demand is outpacing supply. As a result of increasing spot prices for iron ore, there has been a shift in the industry toward shorter-term pricing arrangements linked to the spot market. Toward the latter half of 2011, spot prices for iron ore partially were impacted by the uncertainty in the world's equity markets, the ongoing sovereign debt crisis in Europe and tighter credit markets in Asia. At the end of 2011 and into 2012, the Chinese monetary policy appears to have somewhat eased and many participants have returned to the market, leading to stabilization of spot prices.

The world market for metallurgical coal is also influenced by international demand. Throughout 2011, reported spot prices in Asia Pacific remained high by historical standards, at times trading above announced quarterly settlement price ranges of $225 to $330 per metric ton.

5

During 2011, capacity utilization among steelmaking facilities in North America demonstrated continued improvement, reaching an average rate of approximately 75 percent at year-end up from an average rate of approximately 70 percent for 2010. The U.S. economy remained stable, sustaining a healthy North American business. High year-over-year crude steel production and iron ore imports in Asia supported demand for our products in the seaborne markets. As a result, we increased production at most of our facilities during 2011.

Growth Strategy and Recent Developments

In 2011, we continued to increase our operating scale and presence as an international mining and natural resources company by maintaining our focus on integration and execution, including the integration of our acquisition of Consolidated Thompson. In addition, we have a number of capital projects underway in all of our reportable business segments. We believe these projects will continue to improve our operational performance, diversify our customer base and extend the reserve life of our portfolio of assets, all of which are necessary to sustain continued growth. As we continue to successfully grow our core mining businesses, we center our decision making on areas that will allow our management focus and allocation of capital resources to be deployed where we believe we can have the most impact for our stakeholders. Throughout 2011, we also reinforced our global reorganization, as our leadership moved to an integrated global management structure.

Specifically, we continued our strategic growth as an international mining and natural resources company through the following transactions in 2011:

Cliffs Chromite Project. In February 2011, we released preliminary project information for potential development of our Black Thor chromite deposit in the McFaulds Lake area of Northern Ontario. This project involves the largest known North American chromite deposit, located in one of the most remote areas of Ontario, the Far North. To date, exploration has consisted of geophysics and diamond drilling to delineate the Black Thor chromite zone. The released project information presented a base case reflecting one set of realistic options for the major inter-related components of the project, from mining of the chromite ore to ferrochrome production. During the course of pre-feasibility, feasibility and detailed design studies, other viable options may be identified and considered.

Consolidated Thompson. In May 2011, we acquired all of the outstanding common shares of Consolidated Thompson for C$17.25 per share in an all-cash transaction including net debt. The acquisition reflects our strategy to build scale by owning expandable and exportable steelmaking raw material assets serving international markets. The properties acquired through the acquisition are in proximity to our existing Canadian operations and will allow us to leverage our port facilities and supply the iron ore produced to the seaborne market. The acquisition also is expected to further diversify our existing customer base. Approval for capital investments totaling over $1.3 billion over the 2011 to 2016 timeframe have been obtained from our Board of Directors for the expansion of the Bloom Lake mine and processing capabilities in order to ramp-up production capacity from 8.0 million to 16.0 million metric tons of iron ore concentrate per year. The approved capital investments also include common infrastructure necessary to support the mine's future production levels.

We also continued to pursue growth opportunities through early involvement in exploration and development activities by partnering with junior mining companies, which provide us low-cost entry points for potentially significant reserve additions.

Business Segments

As a result of the acquisition of Consolidated Thompson, we revised the number of our operating and reportable segments as determined under ASC 280 in 2011. Our company's primary operations are organized and managed according to product category and geographic location: U.S. Iron Ore, Eastern Canadian Iron Ore, North American Coal, Asia Pacific Iron Ore, Asia Pacific Coal, Latin American Iron Ore, Ferroalloys, and Global Exploration Group. Our historical presentation of segment information consisted of three reportable segments: North American Iron Ore, North American Coal and Asia Pacific Iron Ore. Our restated presentation consists of four reportable segments: U.S. Iron Ore, Eastern Canadian Iron Ore, North American Coal and Asia

6

Pacific Iron Ore. The Asia Pacific Coal, Latin American Iron Ore, Ferroalloys and Global Exploration Group operating segments do not meet reportable segment disclosure requirements and therefore are not separately reported.

The U.S. Iron Ore, Eastern Canadian Iron Ore, and North American Coal business segments are headquartered in Cleveland, Ohio. Our Asia Pacific headquarters is located in Perth, Australia, and our Latin American headquarters has been relocated to Santiago, Chile. In addition, the Ferroalloys and Global Exploration Group operating segments currently are managed from our Cleveland, Ohio location.

We evaluate segment performance based on sales margin, defined as revenues less cost of goods sold and operating expenses identifiable to each segment. This measure of operating performance is an effective measurement as we focus on reducing production costs throughout the Company. Financial information about our segments, including financial information about geographic areas, is included in Item 7 and NOTE 2 - SEGMENT REPORTING included in Item 8 of this Annual Report on Form 10-K.

U.S. Iron Ore and Eastern Canadian Iron Ore

We are a major global iron ore producer, primarily selling production from U.S. Iron Ore to integrated steel companies in the U.S. and Canada, and production from Eastern Canadian Iron Ore to the seaborne market for Asian steel producers. We manage and operate five iron ore mines located in Michigan and Minnesota and two iron ore mines in Eastern Canada. The U.S.-based mines and one of the mines in Eastern Canada currently have an annual rated capacity of 38.5 million gross tons of iron ore pellet production, representing 45.4 percent of total pellet production capacity in the U.S. and Canada. Based on our equity ownership in these mines, our share of the annual rated production capacity is currently 30.0 million gross tons, representing 35.4 percent of total annual pellet capacity in the U.S. and Canada. The second iron ore mine that we manage and operate in Eastern Canada currently has an annual rated capacity of 8.0 million gross tons of iron ore concentrate.

The following chart summarizes the estimated annual pellet production capacity and percentage of total U.S. and Canadian pellet production capacity for each of the respective iron ore producers in the U.S. and Canada as of December 31, 2011:

U.S. and Canadian Iron Ore Pellet

Annual Rated Capacity Tonnage

| Current Estimated Capacity (Gross Tons in Millions) | Percent of Total U.S. and Canadian Capacity | |||||||

All Cliffs' managed mines | 38.5 | 45.4 | % | |||||

Other U.S. mines | ||||||||

U.S. Steel's Minnesota ore operations | ||||||||

Minnesota Taconite | 16.0 | 18.9 | ||||||

Keewatin Taconite | 5.2 | 6.1 | ||||||

|

|

|

| |||||

Total U.S. Steel | 21.2 | 25.0 | ||||||

ArcelorMittal USA Minorca mine | 2.8 | 3.3 | ||||||

|

|

|

| |||||

Total other U.S. mines | 24.0 | 28.3 | ||||||

Other Canadian mines | ||||||||

Iron Ore Company of Canada | 13.0 | 15.3 | ||||||

ArcelorMittal Mines Canada | 9.3 | 11.0 | ||||||

|

|

|

| |||||

Total other Canadian mines | 22.3 | 26.3 | ||||||

|

|

|

| |||||

Total U.S. and Canadian mines | 84.8 | 100.0 | % | |||||

|

|

|

| |||||

Our U.S. iron ore production generally is sold pursuant to term supply agreements with various price adjustment provisions, whereas our Eastern Canadian iron ore production is sold pursuant to multi-year and short-term pricing arrangements that are linked to the spot market.

7

For the year ended December 31, 2011, we produced a total of 31.0 million tons of iron ore pellets at U.S. Iron Ore, including 23.7 million tons for our account and 7.3 million tons on behalf of steel company partners of the mines. At Eastern Canadian Iron Ore, we produced a total of 6.9 million metric tons of iron ore pellets and concentrate for the same period, with concentrate production measured from the date of our acquisition of Consolidated Thompson in 2011.

We produce various grades of iron ore pellets, including standard, fluxed and high manganese, for use in our customers' blast furnaces as part of the steelmaking process. The variation in grades results from the specific chemical and metallurgical properties of the ores at each mine and whether or not fluxstone is added in the process. Although the grade or grades of pellets currently delivered to each customer are based on that customer's preferences, which depend in part on the characteristics of the customer's blast furnace operation, in many cases our iron ore pellets can be used interchangeably. Industry demand for the various grades of iron ore pellets depends on each customer's preferences and changes from time to time. In the event that a given mine is operating at full capacity, the terms of most of our pellet supply agreements allow some flexibility in providing our customers iron ore pellets from different mines.

Standard pellets require less processing, are generally the least costly pellets to produce and are called "standard" because no ground fluxstone, such as limestone or dolomite, is added to the iron ore concentrate before turning the concentrates into pellets. In the case of fluxed pellets, fluxstone is added to the concentrate, which produces pellets that can perform at higher productivity levels in the customer's specific blast furnace and will minimize the amount of fluxstone the customer may be required to add to the blast furnace. "High manganese" pellets are the pellets produced at our Wabush operation in Eastern Canada, where there is more natural manganese in the crude ore than is found at our other operations. The manganese contained in the iron ore mined at Wabush cannot be removed entirely during the concentrating process. Wabush produces manganese pellets, both in standard and fluxed grades.

It is not possible to produce pellets with identical physical and chemical properties from each of our mining and processing operations. The grade or grades of pellets purchased by and delivered to each customer are based on that customer's preferences and availability.

Each of our U.S. Iron Ore mines is located near the Great Lakes and both of our Eastern Canadian Iron Ore mines are located near the St. Lawrence Seaway, which is connected to the Great Lakes. The majority of our iron ore pellets and concentrate are transported via railroads to loading ports for shipment via vessel to steelmakers in the U.S., Canada or into the international seaborne market.

Our U.S. Iron Ore sales are influenced by seasonal factors in the first quarter of the year as shipments and sales are restricted by weather conditions on the Great Lakes. During the first quarter, we continue to produce our products, but we cannot ship those products via lake vessel until the conditions on the Great Lakes are navigable, which causes our first quarter inventory levels to rise. Our limited practice of shipping product to ports on the lower Great Lakes or to customers' facilities prior to the transfer of title has somewhat mitigated the seasonal effect on first quarter inventories and sales, as shipment from this point to the customers' operations is not limited by weather-related shipping constraints. At December 31, 2011 and 2010, we had approximately 1.2 million and 0.8 million tons of pellets, respectively, in inventory at lower lakes or customers' facilities.

U.S. Iron Ore Customers

Our U.S. Iron Ore revenues primarily are derived from sales of iron ore pellets to the North American integrated steel industry, consisting of seven major customers. Generally, we have multi-year supply agreements with our customers. Sales volume under these agreements largely is dependent on customer requirements, and in many cases, we are the sole supplier of iron ore to the customer. Historically, each agreement has contained a base price that is adjusted annually using one or more adjustment factors. Factors that could result in a price adjustment include international pellet prices, measures of general industrial inflation and steel prices. Additionally, certain of our supply agreements have a provision that limits the amount of price increase or decrease in any given year. In 2010, the world's largest iron ore producers moved away from the annual international benchmark pricing mechanism referenced in certain of our customer supply agreements, resulting in

8

a shift in the industry toward shorter-term pricing arrangements linked to the spot market. These changes caused us to assess the impact a change to the historical annual pricing mechanism would have on certain of our larger existing U.S. Iron Ore customer supply agreements and resulted in modifications to certain of our U.S. Iron Ore customer supply agreements for the 2011 contract year. We reached final pricing settlements with a majority of our U.S. Iron Ore customers for the 2011 contract year. However, in some cases we are still working to revise components of the pricing calculations referenced within our supply agreements to incorporate new pricing mechanisms as a result of the changes to historical benchmark pricing.

During 2011, 2010 and 2009, we sold 24.2 million, 23.0 million and 13.7 million tons of iron ore pellets, respectively, from our share of the production from our U.S. Iron Ore mines. The segment's five largest customers together accounted for a total of 83 percent, 91 percent and 92 percent of U.S. Iron Ore product revenues for the years 2011, 2010 and 2009, respectively. Refer to Concentration of Customers within Item 1 - Business , for additional information regarding our major customers.

Eastern Canadian Iron Ore Customers

Our Eastern Canadian Iron Ore revenues are derived from sales of iron ore pellets and concentrate to the seaborne market for Asian steel producers, consisting of one major customer for iron ore concentrate. The iron ore pellets produced by Eastern Canadian Iron Ore are sold to various customers, none of which are considered individually significant. Pricing for our Eastern Canadian Iron Ore customers consists of a mix of multi-year and short-term pricing arrangements that are linked to the spot market. The arrangements primarily use short-term pricing mechanisms of various durations based on spot prices.

During 2011, 2010 and 2009, we sold 7.4 million, 3.3 million and 2.7 million metric tons of iron ore pellets and concentrate, respectively, from our Eastern Canadian Iron Ore mines, with the segment's five largest customers together accounting for a total of 59 percent, 67 percent and 82 percent of Eastern Canadian Iron Ore product revenues, respectively. Refer to Concentration of Customers within Item 1 - Business , for additional information regarding our major customers.

North American Coal

We own and operate five metallurgical coal mines located in West Virginia and Alabama and one thermal coal mine located in West Virginia that currently have a rated capacity of 9.4 million tons of production annually. In 2011, we sold a total of 4.2 million tons, compared with 3.3 million tons in 2010 and 1.9 million tons in 2009. Each of our North American coal mines are positioned near rail or barge lines providing access to international shipping ports, which allows for export of our coal production.

North American Coal Customers

North American Coal's metallurgical coal production is sold to global integrated steel and coke producers in Europe, Latin America and North America, and its thermal coal production is sold to energy companies and distributors in North America and Europe. Approximately 79 percent of our 2011 production and 72 percent of our 2010 production was committed under one-year contracts. At December 31, 2011, approximately 69 percent of our projected 2012 production has been committed under one-year contracts. North American contract negotiations are largely completed, and international contract negotiations recently have begun. The remaining tonnage primarily is pending price negotiations with our international customers, which typically is dependent on settlements of Australian pricing for metallurgical coal. International customer contracts typically are negotiated on a fiscal year basis extending from April 1 through March 31, whereas customer contracts in North America are typically negotiated on a calendar year basis extending from January 1 through December 31.

International and North American sales represented 54 percent and 46 percent, respectively, of our North American Coal sales in 2011. This compares with 55 percent and 45 percent, respectively, in 2010 and 65 percent and 35 percent, respectively, in 2009. The segment's five largest customers together accounted for a total of 58 percent, 62 percent and 75 percent of North American Coal product revenues for the years 2011, 2010 and 2009, respectively. Refer to Concentration of Customers within Item 1 - Business , for additional information regarding our major customers.

9

Asia Pacific Iron Ore

Our Asia Pacific Iron Ore operations are located in Western Australia and include our wholly owned Koolyanobbing complex and our 50 percent equity interest in Cockatoo Island. We serve the Asian iron ore markets with direct-shipping fines and lump ore. Production in 2011 was 8.9 million metric tons, compared with 9.3 million metric tons in 2010 and 8.3 million metric tons in 2009.

These two operations supply a total of three direct-shipping export products to Asia via the global seaborne trade market. Koolyanobbing produces a standard lump and fines product. Cockatoo Island produces a single premium fines product. The lump products are fed directly to blast furnaces, while the fines products are used as sinter feed. The variation in the three export product grades reflects the inherent chemical and physical characteristics of the ore bodies mined as well as the supply requirements of the customers.

Koolyanobbing is a collective term for the operating deposits at Koolyanobbing, Mount Jackson and Windarling. There are approximately 60 miles separating the three mining areas. Banded iron formations host the mineralization, which is predominately hematite and goethite. Each deposit is characterized with different chemical and physical attributes, and in order to achieve customer product quality, ore in varying quantities from each deposit must be blended together. In September 2010, our Board of Directors approved a capital project at our Koolyanobbing operation that is expected to increase production output at Koolyanobbing to approximately 11 million metric tons annually. These improvements are expected to be implemented fully by the beginning of the second half of 2012.

Crushing and blending is undertaken at Koolyanobbing, where the crushing and screening plant is located. Once the blended ore has been crushed and screened into a direct lump and fines shipping product, it is transported by rail approximately 360 miles south to the Port of Esperance for shipment to our customers in Asia.

Cockatoo Island is located off the Kimberley coast of Western Australia, approximately 1,200 miles north of Perth and is only accessible by sea and air. Cockatoo Island produces a single high-grade iron ore product known as Cockatoo Island Premium Fines. The deposit is almost pure hematite and contains very few contaminants enabling the shipping grade to be above 66 percent iron. Ore is mined below the sea level on the southern edge of the island. This is facilitated by a sea wall, which enables mining to a depth of approximately 160 feet below sea level. Ore is crushed and screened on-site to the final product sizing. Vessels berth at the island and the fines product is loaded directly to the ship. Cockatoo Island Premium Fines are highly sought in the global marketplace due to their extremely high iron grade and low valueless mineral content. Production at Cockatoo Island ended during 2008 due to construction on Phase 3 of the seawall, and in April 2009, an unanticipated subsidence of the seawall occurred. As a result, production from the mine was delayed and was not expected to resume until the first half of 2011 once the seawall was completed. However, production at Cockatoo Island resumed earlier than expected during the third quarter of 2010 and continued throughout 2011.

In August 2011, we entered into a term sheet with our joint venture partner, HWE Cockatoo Pty Ltd., to sell our beneficial interest in the mining tenements and certain infrastructure of Cockatoo Island to Pluton Resources. The potential transaction is expected to occur at the end of the current stage of mining, Phase 3, which is anticipated to be complete in late 2012. Due diligence has been completed and the definitive sale agreement is being drafted and negotiated. The definitive sale agreement will be conditional on the receipt of regulatory and third-party consents and the satisfaction of other customary closing conditions.

Asia Pacific Iron Ore Customers

Asia Pacific Iron Ore's production is under contract with steel companies primarily in China and Japan through 2012. Historically, a limited spot market existed for seaborne iron ore as most production has been sold under supply contracts with annual benchmark prices driven from negotiations between the major suppliers and Chinese, Japanese and other Asian steel mills. As discussed above, in 2010, the world's largest iron ore producers moved away from the annual international benchmark pricing mechanism referenced in our customer supply agreements, resulting in a shift in the industry toward shorter-term pricing arrangements linked to the spot market. These changes caused us to assess and renegotiate the terms of our supply agreements with our customers.

10

Asia Pacific Iron Ore has five-year term supply agreements with steel producers in China and Japan for the sale of production from its Koolyanobbing operations. Production from Cockatoo Island is sold under short-term supply agreements with steel producers in China, Japan, Korea and Taiwan that run to the end of the 2012 production period. The agreements with steel producers in China and Japan account for approximately 75 percent and 25 percent, respectively, of sales volume. Sales volume under the agreements partially is dependent on customer requirements. As a result of the move away from the annual international benchmark pricing mechanism in 2010, we renegotiated the terms of our supply agreements with our Chinese and Japanese Asia Pacific Iron Ore customers, moving to shorter-term pricing mechanisms of various durations based on the average daily spot prices, with certain pricing mechanisms that have a duration of up to a quarter. This change was effective in the first quarter of 2010 for our Chinese customers and the second quarter of 2010 for our Japanese customers. The existing contracts are due to expire at the end of 2012 for our Chinese customers and the end of March 2013 for our Japanese customers. Asia Pacific Iron Ore will be negotiating new contracts in 2012 to cover an extended period.

During 2011, 2010 and 2009, we sold 8.6 million, 9.3 million and 8.5 million metric tons of iron ore, respectively, from our Western Australia mines. No customer comprised more than 10 percent of our consolidated sales in 2011, 2010 or 2009. Asia Pacific Iron Ore's five largest customers accounted for approximately 50 percent of the segment's sales in 2011, 36 percent in 2010 and 39 percent in 2009.

Investments

In addition to our reportable business segments, we are partner to a number of projects, including Amapá in Brazil and Sonoma in Australia, which comprise our Latin American Iron Ore and Asia Pacific Coal operating segments, respectively.

Amapá

We are a 30 percent minority interest owner in Amapá, which consists of an iron ore deposit, a 120-mile railway connecting the mine location to an existing port facility and 71 hectares of real estate on the banks of the Amazon River, reserved for a loading terminal. Amapá initiated production in late December 2007. The remaining 70 percent of Amapá is owned by Anglo.

During 2011, Amapá's annual production totaled 4.8 million metric tons of iron ore fines, compared with 4.0 million metric tons and 2.7 million metric tons in 2010 and 2009, respectively. Anglo has indicated that it expects Amapá will produce and sell 5.7 million metric tons of iron ore fines products in 2012 and 6.1 million metric tons annually once fully operational, which is expected to occur in 2013, based on current capital expenditure levels. The majority of Amapá's production is committed under a long-term supply agreement with an operator of an iron oxide pelletizing plant in the Kingdom of Bahrain.

Sonoma

We own a 45 percent economic interest in Sonoma, located in Queensland, Australia. Production and sales totaled approximately 3.5 million and 3.1 million metric tons of coal, respectively, in 2011. This compares with production and sales of approximately 3.5 million metric tons in 2010, and production and sales of approximately 2.8 million and 3.1 million metric tons, respectively, in 2009. The project is expected to produce approximately 3.7 million metric tons of coal annually in 2012 and beyond. Production is expected to include a mix of approximately two-thirds thermal and one-third metallurgical grade coal. In 2009, Sonoma experienced intrusions in the coal seams, which affected raw coal quality, recoverability in the washing process and ultimately the quantity of metallurgical coal in the production mix. As a result, the geological model for Sonoma has been enhanced to reflect the presence of the intrusions and to refine the mining sequence in order to optimize the mix of metallurgical and thermal coal despite being lower than initially planned levels. On a 100 percent basis, Sonoma has economically recoverable reserves of 21.3 million metric tons. Of the 3.5 million metric tons produced in 2011, approximately 3.1 million metric tons were committed under supply agreements. It is expected that approximately 90 percent of the 3.7 million metric tons expected to be produced in 2012 will be committed under supply agreements.

11

Research and Development

We have been a leader in iron ore mining technology for more than 160 years. We operated some of the first mines on Michigan's Marquette Iron Range and pioneered early open-pit and underground mining methods. From the first application of electrical power in Michigan's underground mines to the use of today's sophisticated computers and global positioning satellite systems, we have been a leader in the application of new technology to the centuries-old business of mineral extraction. Today, our engineering and technical staffs are engaged in full-time technical support of our operations and improvement of existing products.

We are expanding our leadership position in the industry by focusing on high product quality, technical excellence, superior relationships with our customers and partners and improved operational efficiency through cost-saving initiatives. We operate a fully equipped research and development facility in Ishpeming, Michigan, which supports each of our global operations. Our research and development group is staffed with experienced engineers and scientists and is organized to support the geological interpretation, process mineralogy, mine engineering, mineral processing, pyrometallurgy, advanced process control and analytical service disciplines. Our research and development group also is utilized by iron ore pellet customers for laboratory testing and simulation of blast furnace conditions.

Exploration

Our exploration program is integral to our growth strategy. We have several projects and potential opportunities to diversify our products, expand our production volumes and develop large-scale ore bodies through early involvement in exploration activities. We achieve this by partnering with junior mining companies, which provide us low-cost entry points for potentially significant reserve additions. Our global exploration group is led by professional geologists who have the knowledge and experience to identify new projects for future development or projects that add significant value to existing operations. We spent approximately $48.4 million on exploration activities in 2011, and we expect cash expenditures of approximately $90 million on exploration activities in 2012, which we anticipate will provide us with opportunities for significant future potential reserve additions globally.

Concentration of Customers

We had one customer that individually accounted for more than 10 percent of our consolidated product revenue in 2011. In 2010 and 2009, we had three and two customers, respectively, that individually accounted for more than 10 percent of our consolidated product revenue. Total revenue from those customers represented approximately $1.4 billion, $1.8 billion, and $0.8 billion of our total consolidated product revenue in 2011, 2010 and 2009, respectively, and is attributable to our U.S. Iron Ore, Eastern Canadian Iron Ore and North American Coal business segments. The following represents sales revenue from each of those customers as a percentage of our total consolidated product revenue, as well as the portion of product sales for U.S. Iron Ore, Eastern Canadian Iron Ore, and North American Coal that is attributable to each of those customers in 2011, 2010 and 2009, respectively:

| Percentage of Total Product Revenue (1) | ||||||||||||

Customer (2) | 2011 | 2010 | 2009 | |||||||||

ArcelorMittal | 21 | % | 19 | % | 28 | % | ||||||

Algoma | 8 | 11 | 10 | |||||||||

Severstal | 5 | 11 | 8 | |||||||||

|

|

|

|

|

| |||||||

Total | 34 | % | 41 | % | 46 | % | ||||||

|

|

|

|

|

| |||||||

| (1) | Excluding freight and venture partners' cost reimbursements. |

| (2) | Includes subsidiaries of each customer. |

12

| Percentage of U.S. Iron Ore Product Revenue (1) | Percentage of Eastern Canadian Iron Ore Product Revenue (1) | Percentage of North American Coal Product Revenue (1) | ||||||||||||||||||||||||||||||||||

Customer (2) | 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||

ArcelorMittal | 38 | % | 31 | % | 48 | % | 10 | % | 15 | % | 16 | % | 7 | % | 28 | % | 28 | % | ||||||||||||||||||

Algoma | 15 | 21 | 20 | - | - | - | - | 2 | - | |||||||||||||||||||||||||||

Severstal | 8 | 17 | 14 | 4 | 19 | 2 | - | - | 4 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total | 61 | % | 69 | % | 82 | % | 14 | % | 34 | % | 18 | % | 7 | % | 30 | % | 32 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

| (1) | Excluding freight and venture partners' cost reimbursements. |

| (2) | Includes subsidiaries of each customer. |

ArcelorMittal USA

On April 8, 2011, we entered into an Omnibus Agreement with ArcelorMittal USA in order to settle pending arbitrations. The Omnibus Agreement, among other things, amends the Pellet Sale and Purchase Agreement dated December 31, 2002 (the "Supply Agreement") covering the Indiana Harbor East facility. Under the terms of the settlement, the parties established specific pricing levels for 2009 and 2010 pellet sales and revised the pricing calculation for the remainder of the term of the Supply Agreement. It was also agreed that a world market-based pricing mechanism would be used beginning in 2011 and through the remainder of the contract term for the Supply Agreement. As a result of this new pricing, both parties agreed to forego future price re-openers.

Prior to the execution of the Omnibus Agreement, we executed on March 19, 2007 an umbrella agreement with ArcelorMittal USA that covered significant price and volume matters under three separate pre-existing iron ore pellet supply agreements for ArcelorMittal USA's Cleveland and Indiana Harbor West, Indiana Harbor East and Weirton facilities. Under the umbrella agreement, ArcelorMittal USA was obligated to purchase specified minimum tonnages of iron ore pellets on an aggregate basis from 2006 through 2010. The umbrella agreement set the minimum annual tonnage for ArcelorMittal USA through 2010, with pricing based on the facility to which the pellets were delivered. The terms of the umbrella agreement contained buy-down provisions, which permitted ArcelorMittal USA to reduce its tonnage purchase obligation each year at a specified price per ton, as well as deferral provisions, which permitted ArcelorMittal USA to defer a portion of its annual tonnage purchase obligation. In addition, ArcelorMittal USA was permitted to nominate tonnage for export out of the U.S. to any facility owned by ArcelorMittal USA, but pricing needed to be agreed to by the parties. This ability to nominate tonnage for export ceased upon the expiration of the umbrella agreement at the end of 2010, and most of our contracts have reverted back to a requirements basis.

Our pellet supply agreements with ArcelorMittal USA that were in place prior to executing the umbrella agreement have again become the basis for supplying pellets to ArcelorMittal USA, which is based on customer requirements, except for the Indiana Harbor East facility, which is based on customer excess requirements. As discussed above, the Omnibus Agreement amended the Supply Agreement covering the Indiana Harbor East facility in April 2011. The following table outlines the expiration dates for each of the respective agreements.

Facility | Agreement Expiration | |||

Cleveland Works and Indiana Harbor West facilities | 2016 | |||

Indiana Harbor East facility | 2015 | |||

Weirton facility | 2018 | |||

ArcelorMittal USA is a 62.3 percent equity participant in Hibbing and a 21 percent equity partner in Empire with limited rights and obligations. ArcelorMittal was a 28.6 percent participant in Wabush through its subsidiary Dofasco. On February 1, 2010, we acquired the remaining interest in Wabush, including Dofasco's 28.6 percent interest.

13

In 2011, 2010 and 2009, our U.S. Iron Ore pellet sales to ArcelorMittal USA were 8.7 million, 9.8 million and 7.3 million tons, respectively, and our Eastern Canadian Iron Ore pellet sales to ArcelorMittal USA were 0.7 million, 0.6 million and 0.4 million metric tons, respectively.

Our North American Coal supply agreements with ArcelorMittal run through March 31, and are based on an annual tonnage commitment for the 12-month fiscal period. Contracts are priced on a quarterly basis, with pricing generally in line with Australian pricing for metallurgical coal. In 2011, 2010 and 2009, our North American Coal sales to ArcelorMittal were 0.2 million, 0.8 million and 0.6 million tons, respectively.

Algoma

Algoma is a Canadian steelmaker and a subsidiary of Essar Steel Holdings Limited. We have a 15-year term supply agreement under which we are Algoma's sole supplier of iron ore pellets through 2016. Our annual obligation is limited to 4.0 million tons with our option to supply additional pellets. Historically, pricing under the agreement with Algoma has been based on a formula that includes international pellet prices. During 2010, international pellet prices for blast furnace pellets were redefined through arbitration to use an increase in excess of 95 percent over 2009 prices for seaborne blast furnace pellets. The agreement provides that, in 2011 and 2014, either party may request a price re-opener if prices under the agreement with Algoma differ from a specified benchmark price for the year the price re-opener is requested. We sold 3.7 million, 3.4 million and 2.9 million tons to Algoma in 2011, 2010 and 2009, respectively.

Severstal

Under the agreement with Severstal, we supply all of the customer's blast furnace pellet requirements for its Dearborn, Michigan facility through 2022, subject to specified minimum and maximum requirements in certain years. The terms of the agreement also require supplemental payments to be paid by the customer during the period 2009 through 2013. Pursuant to an amended term sheet entered into on June 19, 2009, the customer exercised the option to defer a portion of the 2009 monthly supplemental payment up to $22.3 million in exchange for interest payments until the deferred amount is repaid in 2013.

On March 31, 2011, Severstal sold its Sparrows Point, Warren and Wheeling facilities to The Renco Group, Inc. The sale of these facilities resulted in the decrease in our sales to this customer as a percentage of our consolidated product revenue in 2011 when compared to 2010 and 2009.

We sold 3.8 million, 5.3 million and 2.3 million tons to Severstal in 2011, 2010 and 2009, respectively.

Competition

Throughout the world, we compete with major and junior mining companies, as well as metals companies, both of which produce steelmaking raw materials, including iron ore and metallurgical coal.

North America

In our U.S. Iron Ore business segment, we primarily sell our product to steel producers with operations in North America. In our Eastern Canadian Iron Ore business segment, we primarily provide our product to the seaborne market for Asian steel producers. We compete directly with steel companies that own interests in iron ore mines, including ArcelorMittal Mines Canada and U.S. Steel Canada Inc., and with major iron ore exporters from Australia.

In the coal industry, our North American Coal business segment competes with many metallurgical coal producers of various sizes, including Alpha Natural Resources, Inc., Patriot Coal Corporation, CONSOL Energy Inc., Arch Coal, Inc., Walter Energy, Inc., Peabody Energy Corp. and other producers located in North America and globally.

A number of factors beyond our control affect the markets in which we sell our coal. Continued demand for our coal and the prices obtained by us primarily depend on the coal consumption patterns of the steel industry in the U.S. and elsewhere around the world, as well as the availability, location, cost of transportation and price of

14

competing coal. Coal consumption patterns are primarily affected by demand, environmental and other governmental regulations, and technological developments. The most important factors on which we compete are delivered price, coal quality characteristics such as heat value, sulfur, ash and moisture content, and reliability of supply. Metallurgical coal, which primarily is used to make coke, a key component in the steelmaking process, generally sells at a premium over steam coal due to its higher quality and value in the steelmaking process.

Asia Pacific

In our Asia Pacific Iron Ore business segment, we export iron ore products to China and Japan in the world seaborne trade. In the Asia Pacific marketplace, we compete with major iron ore exporters from Australia, Brazil and India. These include Anglo, BHP and Fortescue Metals Group Ltd., Rio Tinto plc and Vale, among others.

Sonoma, in which Cliffs owns a 45 percent economic interest, competes with many other global metallurgical and thermal coal producers, including Anglo, Rio Tinto plc, BHP, Teck Resources Limited and Xstrata plc.

Competition in steelmaking raw materials is predicated upon the usual competitive factors of price, availability of supply, product performance, service and transportation cost to the consumer of the raw materials.

As the global steel industry continues to consolidate, a major focus of the consolidation is on the continued life of the integrated steel industry's raw steelmaking operations, including blast furnaces and basic oxygen furnaces that produce raw steel. In addition, other competitive forces have become a large factor in the iron ore business. In particular, electric arc furnaces built by mini-mills, which are steel recyclers, generally produce steel by using scrap steel and reduced-iron products rather than iron ore pellets.

Environment

Our mining and exploration activities are subject to various laws and regulations governing the protection of the environment. We conduct our operations in a manner that is protective of public health and the environment and believe our operations are in compliance with applicable laws and regulations in all material respects.

Environmental issues and their management continued to be an important focus at each of our operations throughout 2011. In the construction of our facilities and in their operation, substantial costs have been incurred and will continue to be incurred to avoid undue effect on the environment. Our capital expenditures relating to environmental matters totaled approximately $36 million, $21 million, and $7 million, in 2011, 2010, 2009, respectively. It is estimated that capital expenditures for environmental improvements will total approximately $60 million in 2012. Estimated expenditures in 2012 are comprised of approximately $37 million for projects at our Eastern Canadian Iron Ore operations, $15 million for projects in our U.S. Iron Ore operations and $8 million in our North American Coal operations. Of the $37 million in capital budgeted for Eastern Canadian Iron Ore operations, approximately $23 million is for water treatment and tailings management improvements and fish habitat compensation at the Wabush operations, $10 million is for water treatment improvements at our Bloom Lake operations, and the remaining is for other miscellaneous projects. Of the $15 million in capital budgeted for U.S. Iron Ore operations, approximately $10 million is for air pollution control equipment upgrades at the various mines, with the remaining $5 million for wetland mitigation, water treatment and other miscellaneous projects. The $8 million in capital expenditures budgeted for the North American Coal operations primarily is for water treatment equipment upgrades and miscellaneous projects at Oak Grove and the other mines.

Regulatory Developments

Various governmental bodies are continually promulgating new or amended laws and regulations that affect our company, our customers and our suppliers in many areas, including waste discharge and disposal, the classification of materials and products, air and water discharges, and many other environmental, health and safety matters. Although we believe that our environmental policies and practices are sound and do not expect that the application of any current laws or regulations would reasonably be expected to result in a material adverse effect on our business or financial condition, we cannot predict the collective adverse impact of the expanding body of laws and regulations.

15

Specifically, there are several notable proposed or potential rulemakings or activities that could potentially have a material adverse impact on our facilities in the future depending on their ultimate outcome: Climate Change and GHG Regulation, Regional Haze, NO 2 and SO 2 National Ambient Air Quality Standards, Cross State Air Pollution Rule, Increased Administrative and Legislative Initiatives related to Coal Mining Activities, the Minnesota Mercury Total Maximum Daily Load Implementation, and Selenium Discharge Regulation.

Climate Change and GHG Regulation. With the complexities and uncertainties associated with the U.S. and global navigation of the climate change issue as a whole, one of our significant risks for the future is mandatory carbon legislation. Policymakers are in the design process of carbon regulation at the state, regional, national and international levels. The current regulatory patchwork of carbon compliance schemes present a challenge for multi-facility entities to identify their near-term risks. Amplifying the uncertainty, the dynamic forward outlook for carbon regulation presents a challenge to large industrial companies to assess the long-term net impacts of carbon compliance costs on their operations. Our exposure on this issue includes both the direct and indirect financial risks associated with the regulation of GHG emissions, as well as potential physical risks associated with climate change. We are continuing to review the physical risks related to climate change utilizing a formal risk management process.

Internationally, mechanisms to reduce emissions are being implemented in various countries, with differing designs and stringency, according to resources, economic structure and politics. We expect that momentum to extend carbon regulation following the expiration in 2012 of the first commitment period under the Kyoto Protocol will continue. Australia, Canada and Brazil are all signatories to the Kyoto Protocol. As such, our facilities in each of these countries will be impacted by the Kyoto Protocol, but in varying degrees according to the mechanisms each country establishes for compliance and each country's commitment to reducing emissions. Australia and Canada are considered Annex 1 countries, meaning that they are obligated to reduce their emissions under the Protocol. In contrast, Brazil is not an Annex 1 country and is, therefore, not currently obligated to reduce its GHG emissions. The impact of the Kyoto Protocol on our Canadian operations has recently been brought into question by the December 2011 announcement by the Canadian Environment Minister that Canada would withdraw from the Kyoto Protocol and, furthermore, that Canada would repeal its Kyoto Protocol Implementation Act.

In November 2011, legislation for a carbon tax was passed by the Australian Parliament. The legislation will take effect beginning in July 2012. The carbon tax will apply a fixed price of A$23 per metric ton of CO 2 emissions, with a transition to an emissions trading scheme in 2015 following a fixed-price period of three years. The price will rise by 2.5 percent a year during the fixed-price period. The direct impact of the carbon tax on Cliffs Asia Pacific operations primarily will occur through increased fuel costs. Based on an expected cost, at commencement, the tax is estimated to result in an increase in direct costs of approximately A$5 million per year.

On December 15, 2011, Quebec issued final GHG cap-and-trade regulation based on the Western Climate Initiative guidelines which become effective January 1, 2013. The Quebec GHG emission reduction objective is to reduce GHG emissions by 20 percent below 1990 levels by 2020 (Phase 1). The mining and utility sectors, among others, are sectors included in the cap-and-trade program. The Quebec framework has provisions for "free" allocations for our sector, which will minimize the impact to our business. The estimated direct impact to Cliffs Quebec operations begin at $1 million per year in 2013 and escalate to an estimated $3 million per year in 2020 (Phase 1 of the GHG cap-and-trade program). Additional indirect "pass-through" financial impacts related to energy rates and transportation fuel consumption are estimated to increase our exposure, however, the overall impact is not anticipated to have a material impact on our business.

In the U.S., federal carbon regulation potentially presents a significantly greater impact to our operations. To date, the U.S. has not implemented regulated carbon constraints. In the absence of comprehensive federal carbon regulation, numerous state and regional regulatory initiatives are under development or are becoming effective, thereby creating a disjointed approach to carbon control.

Furthermore, on September 22, 2009, the EPA issued a final GHG Reporting Rule requiring the mandatory reporting of annual GHG emissions from our U.S. iron and coal mining facilities. Sources covered by the rule

16

were required to begin collecting emission data by no later than January 1, 2010. The first annual emission report was submitted to the EPA in September 2011 and will be reported annually. As a founding member of TCR, we have reported our emissions to TCR and published GHG emission information within our Sustainability Reports, following the reporting protocols established by the Global Reporting Initiative.

As an energy-intensive business, our GHG emissions inventory captures a broad range of emissions sources, such as iron ore furnaces and kilns, coal thermal driers, diesel mining equipment and a wholly owned power generation plant, among others. As such, our most significant regulatory risks are: (1) the costs associated with on-site emissions levels and (2) the costs passed through to us from power generators and distillate fuel suppliers.

We believe our exposure can be reduced substantially by numerous factors, including currently contemplated regulatory flexibility mechanisms, such as allowance allocations, fixed process emissions exemptions, offsets, and international provisions; emissions reduction opportunities, including energy efficiency, biofuels, fuel flexibility and methane reduction; and business opportunities associated with new products and technology.

We have proactively worked to develop a comprehensive, enterprise-wide GHG management strategy aimed at considering all significant aspects associated with GHG initiatives to effectively plan for and manage climate change issues, including the risks and opportunities as they relate to the environment, stakeholders, including shareholders and the public, legislative and regulatory developments, operations, products and markets.

Regional Haze. In June 2005, the EPA finalized amendments to its regional haze rules. The rules require states to establish goals and emission reduction strategies for improving visibility in all Class I national parks and wilderness areas. Among the states with Class I areas are Michigan, Minnesota, Alabama and West Virginia where we currently own and manage mining operations. The first phase of the regional haze rule (2008-2018) requires analysis and installation of BART on eligible emission sources and incorporation of BART and associated emission limits into state implementation plans.

Late in 2011, MPCA published a draft supplement to the Regional Haze SIP, which was on public notice until January 2012 and goes before the MPCA Board in March 2012. The EPA must now review and formally approve the Regional Haze SIP. If approved, these requirements will become effective five years after approval.

The supplemental Regional Haze SIP recently put on notice by MPCA also raises questions for the Hibbing and United Taconite facilities. Despite information provided by Hibbing and United Taconite, MPCA proposed NOx emissions limits for these facilities, which past performance testing would show as unachievable. Retrofit NOx controls are not technically and economically available for existing taconite furnaces according to BART criteria. Cliffs will be providing further comments to the MPCA on limits during the public notice period and anticipates resolution of the matter without having to appeal the rule.

NO 2 and SO 2 National Ambient Air Quality Standards. During the first half of 2010, the EPA promulgated rules that require states to use a combination of air quality monitoring and computer modeling to determine areas of each state that are in attainment with new NO 2 and SO 2 standards (attainment areas) and those areas that are not in attainment with such standards (nonattainment areas). During the third quarter of 2011, the EPA issued guidance to the regulated community on conducting refined air quality dispersion modeling and implementing the new NO 2 and SO 2 standards. The NO 2 and SO 2 standards have been challenged by various large industry groups. Accordingly, at this time, we are unable to predict the final impact of these standards. During June 2011, our Minnesota iron ore mining operations received a request from the MPCA to develop modeling and compliance plans and timelines by which each facility will demonstrate compliance with present and proposed NAAQS as well as Regional Haze requirements outlined in the State SIP. Compliance must be achieved by June 30, 2017. Cliffs continues to assess options by which to achieve compliance.

Cross State Air Pollution Rule. On July 6, 2011, the EPA promulgated the CSAPR. This rule identifies and limits emissions of SO 2 and NOx from electric generating units in 27 states. Silver Bay Power is subject to a SO 2 and NOx emission cap under this rule, which is designed to assist downwind states in attaining and maintaining compliance with NAAQS for fine particulate matter and ozone. The CSAPR established a Federal Implementation Plan that requires emission reductions in phases, which commence January 1, 2012, and January 1, 2014. Silver Bay Power must meet the allocations for its emissions set by the CSAPR through

17

emission reductions achieved by installing additional controls or fuel switching and/or acquiring additional allocations through an allowance trading program authorized by the CSAPR. Although the D.C. Circuit Court stayed the rule in December 2011, we have analyzed the rule and identified viable options available to Silver Bay Power to minimize financial impacts from the CSAPR once the Court reaches a decision and lifts the stay. The potential direct impact from CSAPR and other new environmental regulations applicable to Silver Bay Power have been assessed and determined not to be material. We will be implementing the strategic plan to minimize the economic impact to Silver Bay Power over the next five years.

Increased Administrative and Legislative Initiatives Related to Coal Mining Activities. Although the focus of significantly increased government activity related to coal mining in the U.S. is generally targeted at eliminating or minimizing the adverse environmental impacts of mountaintop coal mining practices, these initiatives have the potential to impact all types of coal operations, including subsurface longwall mining typically deployed for recovering metallurgical coal. Specifically, the coordinated efforts by various federal agencies to minimize adverse environmental consequences of mountaintop mining have effectively stopped issuance of new permits required by most mining projects in Appalachia. Due to the developing nature of these initiatives and their potential to disrupt even routine necessary mining and water permit practices in the coal industry, we are unable to predict whether these initiatives could have a material effect on our coal operations in the future. We are working closely with our trade associations to monitor the various rulemaking developments in an effort to enable us to develop viable strategies to minimize the financial impact to the business.

Mercury TMDL and Minnesota Taconite Mercury Reduction Strategy. Mercury TMDL regulations are contained in the U.S. Federal Clean Water Act. As a part of Minnesota's Mercury TMDL Implementation Plan, in cooperation with the MPCA, the taconite industry developed a Taconite Mercury Reduction Strategy and signed a voluntary agreement to effectuate its terms. The strategy includes a 75 percent reduction of mercury air emissions from Minnesota pellet plants by 2025 as a target. It recognizes that mercury emission control technology currently does not exist and will be pursued through a research effort. Any developed technology must be economically feasible, not impact pellet quality and not cause excessive corrosion in pellet furnaces, associated duct work and existing wet scrubbers on the furnaces.

According to the voluntary agreement, the mines must proceed with medium- and long-term testing of possible technologies beginning in 2010. Initial testing will be completed on one straight-grate and one grate-kiln furnace among the mines. If technically and economically feasible, developed mercury emission control technology must then be installed on taconite furnaces by 2025. For us, the requirements in the voluntary agreement will apply to our United Taconite and Hibbing facilities. At this point in time, we are unable to predict the potential impacts of the Taconite Mercury Reduction Strategy, as it is just in its research phase with no proven technology yet identified. However, a number of research projects commenced during 2011 as the industry continues to assess options for reduction.

Selenium Discharge Regulation. In West Virginia, new selenium discharge limits became effective on April 5, 2010. State legislation was passed that gives the West Virginia DEP the authority to extend the deadline for facilities to comply with new selenium discharge limits to July 1, 2012, based on application and approval of the extension. We have successfully implemented solutions that manage the discharge of selenium in our coal operations. We do not believe this issue is likely to result in material impacts to North American Coal.

In Michigan, the MDEQ issued a renewed NPDES permit for our Empire Mine in December 2011 and is scheduled to renew the Tilden NPDES permit in 2012. Our Michigan operations at Empire and Tilden are developing compliance strategies to meet new selenium process water limits according to the permit conditions. Empire and Tilden submitted the Selenium Storm Water Management Plan to the MDEQ on December 22, 2011. The Selenium Storm Water Management Plan outlines the activities that will be undertaken from 2011 to 2015 to address selenium in storm water discharges from our Michigan operations. The activities include the evaluation of structural controls, non-structural controls, site specific standards and evaluation of potential impacts to groundwater. Preliminary selenium treatability results from studies in 2011 were positive for the utilization of treatment systems. An initial estimate for full scale implementation of treatment systems as structural selenium controls at both facilities is $35 million dollars and is expected to be expended between 2012 and 2015.

18

Other Developments

Clean Water Act Section 404. In the U.S., Section 404 of the Clean Water Act requires permits from the U.S. Army Corps of Engineers to construct mines and associated projects, such as freshwater impoundments and refuse disposal fills, in areas that affect jurisdictional waters. Any coal mining activity requiring both a Section 404 permit and a SMCRA permit in the Appalachian region currently undergoes an enhanced review from the Army Corps of Engineers, the EPA and the Office of Surface Mining. With the acquisition of the CLCC properties during the third quarter of 2010, we obtained a development surface coal mine project, the Toney Fork No. 3, which is subject to the enhanced review process adopted by federal agencies in 2009 for Section 404 permitting. There are currently two proposed valley fills in the Toney Fork No. 3 plan; therefore, an extensive review process can be expected. We expect on-going negotiations with the EPA will conclude with the issuance of the required Section 404 permit well before construction of the mine is scheduled. The other development surface mine project acquired through the acquisition of CLCC, Toney Fork West, does not require Section 404 permitting. The renewal date for the existing Toney Fork No. 2 permit is May 28, 2015.

For additional information on our environmental matters, refer to Item 3. Legal Proceedings and NOTE 9 - ENVIRONMENTAL AND MINE CLOSURE OBLIGATIONS in Item 8.

Energy

Electricity

WEPCO is the sole supplier of electric power to our Empire and Tilden mines. WEPCO currently provides 300 megawatts of electricity to Empire and Tilden at rates that are regulated by the MPSC. The Empire and Tilden mines are subject to changes in WEPCO's rates, such as base interim rate changes that WEPCO may self-implement and final rate changes that are approved by the MPSC in response to applications filed by WEPCO. These procedures have resulted in several rate increases since 2008, when Empire and Tilden's special contracts for electric service with WEPCO expired. Additionally, Empire and Tilden are subject to frequent changes in WEPCO's power supply adjustment factor. For additional information on the Empire and Tilden rate cases with WEPCO, refer to Item 3. Legal Proceedings .

Electric power for the Hibbing and United Taconite mines is supplied by MP. On September 16, 2008, the mines finalized agreements with terms from November 1, 2008 through December 31, 2015. The agreements were approved by the Minnesota Public Utilities Commission in 2009.

Silver Bay Power Company, a wholly owned subsidiary of ours, with a 115 megawatt power plant, provides the majority of Northshore's energy requirements. Silver Bay Power had an interconnection agreement with MP for backup power. Silver Bay Power entered into an agreement to sell 40 megawatts of excess power capacity to Xcel Energy under a contract that expired in 2011. In March 2008, Northshore reactivated one of its furnaces, resulting in a shortage of electrical power of approximately 10 megawatts. As a result, supplemental electric power is purchased by Northshore from MP under an agreement that is renewable yearly with one-year termination notice required. The contract expired on June 30, 2011, which coincided with the expiration of Silver Bay Power's 40 megawatt sales agreement with Xcel Energy.