|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 1-768

CATERPILLAR INC.

(Exact name of Registrant as specified in its charter)

Delaware |

| 37-0602744 |

(State or other jurisdiction of incorporation) |

| (IRS Employer I.D. No.) |

|

|

|

100 NE Adams Street, Peoria, Illinois |

| 61629 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code: (309) 675-1000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Name of each exchange on which registered |

Common Stock ($1.00 par value) (1) |

| New York Stock Exchange |

9 3/8% Debentures due March 15, 2021 |

| New York Stock Exchange |

8% Debentures due February 15, 2023 |

| New York Stock Exchange |

5.3% Debentures due September 15, 2035 |

| New York Stock Exchange |

|

(1) | In addition to the New York Stock Exchange, Caterpillar common stock is also listed on stock exchanges in France and Switzerland. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x |

| Accelerated filer o |

|

|

|

Non-accelerated filer o |

| Smaller Reporting Company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2015, there were 602,632,543 shares of common stock of the Registrant outstanding, and the aggregate market value of the voting stock held by non-affiliates of the Registrant (assuming only for purposes of this computation that directors and executive officers may be affiliates) was approximately $51.0 billion.

As of December 31, 2015 , there were 582,321,890 shares of common stock of the Registrant outstanding.

Documents Incorporated by Reference

Portions of the documents listed below have been incorporated by reference into the indicated parts of this Form 10-K, as specified in the responses to the item numbers involved.

Part III | 2016 Annual Meeting Proxy Statement (Proxy Statement) to be filed with the Securities and Exchange Commission (SEC) within 120 days after the end of the calendar year. |

|

TABLE OF CONTENTS

|

|

| Page |

|

|

|

|

Part I | Item 1. | Business | 1 |

|

|

|

|

| Item 1A. | Risk Factors | 9 |

|

|

|

|

| Item 1B. | Unresolved Staff Comments | 18 |

|

|

|

|

| Item 1C. | Executive Officers of the Registrant | 19 |

|

|

|

|

| Item 2. | Properties | 19 |

|

|

|

|

| Item 3. | Legal Proceedings | 22 |

|

|

|

|

| Item 4. | Mine Safety Disclosures | 22 |

|

|

|

|

Part II | Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 22 |

|

|

|

|

| Item 6. | Selected Financial Data | 25 |

|

|

|

|

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 26 |

|

|

|

|

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 66 |

|

|

|

|

| Item 8. | Financial Statements and Supplementary Data | 67 |

|

|

|

|

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 149 |

|

|

|

|

| Item 9A. | Controls and Procedures | 149 |

|

|

|

|

| Item 9B. | Other Information | 149 |

|

|

|

|

Part III | Item 10. | Directors, Executive Officers and Corporate Governance | 149 |

|

|

|

|

| Item 11. | Executive Compensation | 150 |

|

|

|

|

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 150 |

|

|

|

|

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 151 |

|

|

|

|

| Item 14. | Principal Accountant Fees and Services | 151 |

|

|

|

|

Part IV | Item 15. | Exhibits and Financial Statement Schedules | 152 |

i

PART I

Item 1. | Business. |

General

Originally organized as Caterpillar Tractor Co. in 1925 in the State of California, our company was reorganized as Caterpillar Inc. in 1986 in the State of Delaware. As used herein, the term "Caterpillar," "we," "us," "our" or "the company" refers to Caterpillar Inc. and its subsidiaries unless designated or identified otherwise.

Overview

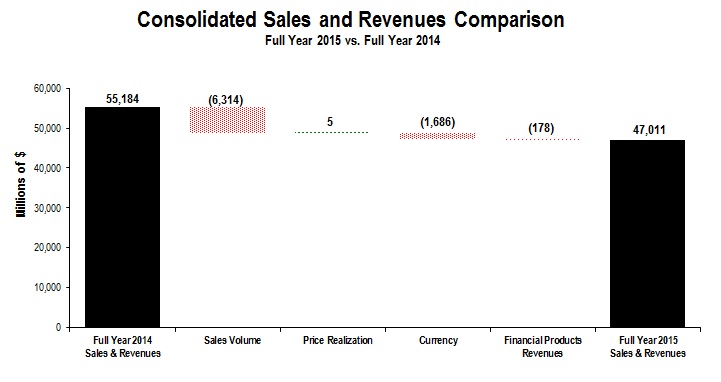

With 2015 sales and revenues of $47.011 billion , Caterpillar is the world's leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company principally operates through its three product segments - Construction Industries, Resource Industries and Energy & Transportation - and also provides financing and related services through its Financial Products segment. Caterpillar is also a leading U.S. exporter. Through a global network of independent dealers and direct sales of certain products, Caterpillar builds long-term relationships with customers around the world.

Currently, we have seven operating segments, of which four are reportable segments and are described below. Further information about our reportable segments, including geographic information, appears in Note 23 - "Segment information" of Part II, Item 8 "Financial Statements and Supplementary Data."

Categories of Business Organization

1. Machinery, Energy & Transportation - Represents the aggregate total of Construction Industries, Resource Industries, Energy & Transportation and All Other operating segments and related corporate items and eliminations.

2. Financial Products - Primarily includes the company's Financial Products Segment. This category includes Caterpillar Financial Services Corporation (Cat Financial), Caterpillar Financial Insurance Services (Insurance Services) and their respective subsidiaries.

Other information about our operations in 2015 , including certain risks associated with our operations, is included in Part II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Construction Industries

Our Construction Industries segment is primarily responsible for supporting customers using machinery in infrastructure and building construction applications. The majority of machine sales in this segment are made in the heavy and general construction, rental, quarry and aggregates markets and mining.

Customer demand for construction machinery has generally been characterized over the past decade by a shift from developed to developing economies. Customers in developing economies often prioritize purchase price in making their investment decisions, while customers in developed economies generally weigh productivity and other performance criteria that contribute to lower lifetime owning and operating costs of a machine. To meet customer expectations in developing economies, Caterpillar developed differentiated product offerings that target customers in those markets, including our SEM brand machines. We believe that these customer-driven product innovations enable us to compete more effectively in developing economies. In those developed economies that are subject to diesel engine emission requirements, we continued our multi-year roll out of products designed to meet those requirements. The majority of Construction Industries' research and development spending in 2015 focused on the next generation of construction machines.

The competitive environment for construction machinery is characterized by some global competitors and many regional and specialized local competitors. Examples of global competitors include Komatsu Ltd., Volvo Construction Equipment (part of the Volvo Group), CNH Industrial N.V., Deere & Company, Hitachi Construction Machinery Co., Ltd., J.C. Bamford Excavators Ltd., Doosan Infracore Co. Ltd., and Hyundai Construction Equipment (part of Hyundai Heavy Industries). As an example of regional and local competitors, our competitors in China also include Guangxi LiuGong Machinery Co., Ltd., Longking Holdings Ltd., Sany Heavy Industry Co., Ltd., Xiamen XGMA Machinery Co., Ltd., XCMG Group, The Shandong Heavy Industry Group Co., Ltd. (Shantui Construction Machinery Co., Ltd.), Strong Construction Machinery Co., Ltd., and

1

Shandong Lingong Construction Machinery Co., Ltd. (part of Volvo Group). Each of these companies has varying product lines that compete with Caterpillar products, and each has varying degrees of regional focus.

The Construction Industries product portfolio includes the following machines and related parts:

· backhoe loaders |

| · compact wheel loaders |

| · small track-type tractors |

· small wheel loaders |

| · track-type loaders |

| · medium track-type tractors |

· skid steer loaders |

| · mini excavators |

| · select work tools |

· multi-terrain loaders |

| · small, medium and large track excavators |

| · motor graders |

· medium wheel loaders |

| · wheel excavators |

| · telehandlers |

· compact track loaders |

| · pipelayers |

| · mid-tier soil compactors |

Resource Industries

The Resource Industries segment is primarily responsible for supporting customers using machinery in mine and quarry applications. Caterpillar offers mining customers the broadest product range in the industry. We manufacture high productivity equipment for both surface and underground mining operations around the world. Our equipment is used to extract and haul copper, iron ore, coal, oil sands, aggregates, gold and other minerals and ores. In addition to equipment, Resource Industries also develops and sells technology to provide customers fleet management systems, equipment management analytics and autonomous machine capabilities.

Customers in most markets place an emphasis on equipment that is highly productive, reliable and provides the lowest total cost of ownership over the life of the equipment. In some developing markets, customers often prioritize purchase price in making their investment decisions. We believe our ability to control the integration and design of key machine components represents a competitive advantage. Our research and development efforts remain focused on providing mining and quarry customers the lowest total cost of ownership enabled through the highest quality, most productive products in the industry.

The competitive environment for Resource Industries consists of a few larger global competitors that compete in several of the markets that we serve and a substantial number of smaller companies that compete in a more limited range of products, applications, and regional markets. Our global surface competitors include Komatsu Ltd., Joy Global, Inc., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Atlas Copco AB, and Sandvik Mining. Our global underground competitors include Joy Global, Inc., Atlas Copco AB, Sandvik Mining and Zhengzhou Coal Mining Machinery Group Co., Ltd.

The Resource Industries product portfolio includes the following machines and related parts:

· electric rope shovels |

| · large track-type tractors |

| · wheel tractor scrapers |

· draglines |

| · large mining trucks |

| · wheel dozers |

· hydraulic shovels |

| · longwall miners |

| · machinery components |

· track and rotary drills |

| · large wheel loaders |

| · electronics and control systems |

· highwall miners |

| · off-highway trucks |

| · select work tools |

· hard rock vehicles |

| · articulated trucks |

| · hard rock continuous mining systems |

· continuous miners |

| · scoops and haulers |

|

|

Energy & Transportation

Our Energy & Transportation segment supports customers in oil and gas, power generation, marine, rail and industrial applications, including Cat® machines. The product and services portfolio includes reciprocating engines, generator sets, marine propulsion systems, gas turbines and turbine-related services, diesel-electric locomotives and other rail-related products and services.

Regulatory emissions standards of the U.S. Environmental Protection Agency (EPA) and comparable standards in other developed economies have required us to make significant investments in research and development that will continue as new products and similar regulations are introduced over the next several years. We believe that our emissions technology provides a competitive advantage in connection with emissions standards compliance and performance.

2

The competitive environment for reciprocating engines in marine, oil and gas, industrial and electric power generation systems along with turbines consists of a few larger global competitors that compete in a variety of markets that Caterpillar serves, and a substantial number of smaller companies that compete in a limited-size product range, geographic region and/or application. Principal global competitors include Cummins Inc., Rolls-Royce Power System, GE Oil & Gas, GE Power & Water, Deutz AG and Wärtsilä Corp. Other competitors, such as MAN Diesel & Turbo SE, Siemens Energy, Rolls-Royce Marine, Mitsubishi Heavy Industries Ltd., Volvo Penta, Weichai Power Co., Ltd., Kirloskar Oil Engines Limited and other emerging market competitors compete in certain markets in which Caterpillar competes. An additional set of competitors, including Generac Power Systems, Inc., Kohler Co., Inc., Aggreko plc and others, are packagers who source engines and/or other components from domestic and international suppliers and market products regionally and internationally through a variety of distribution channels. In rail-related businesses, our global competitors include GE Transportation, Vossloh AG, Siemens Akteingesellschaft, Alstom Transport SA, and Voestalpine AG. We also compete with other companies on a more limited range of products, services and/or geographic regions.

The Energy & Transportation portfolio includes the following products and related parts:

• | reciprocating engine powered generator sets |

• | reciprocating engines supplied to the industrial industry as well as Caterpillar machinery |

• | integrated systems used in the electric power generation industry |

• | turbines, centrifugal gas compressors and related services |

• | reciprocating engines and integrated systems and solutions for the marine and oil and gas industries |

• | diesel-electric locomotives and components and other rail-related products and services |

Financial Products Segment

The business of our Financial Products segment is primarily conducted by Cat Financial, a wholly owned finance subsidiary of Caterpillar. Cat Financial's primary business is to provide retail and wholesale financing alternatives for Caterpillar products to customers and dealers around the world. Retail financing is primarily comprised of the financing of Caterpillar equipment, machinery and engines. Cat Financial also provides financing for vehicles, power generation facilities and marine vessels that, in most cases, incorporate Caterpillar products. In addition to retail financing, Cat Financial provides wholesale financing to Caterpillar dealers and purchases short-term trade receivables from Caterpillar and its subsidiaries. The various financing plans offered by Cat Financial are primarily designed to increase the opportunity for sales of Caterpillar products and generate financing income for Cat Financial. A significant portion of Cat Financial's activities is conducted in North America. Cat Financial also has offices and subsidiaries in Asia/Pacific, Europe and Latin America.

For over 30 years, Cat Financial has been providing financing in the various markets in which it participates, contributing to its knowledge of asset values, industry trends, product structuring and customer needs.

In certain instances, Cat Financial's operations are subject to supervision and regulation by state, federal and various foreign governmental authorities, and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions which, among other things, (i) regulate credit granting activities and the administration of loans, (ii) establish maximum interest rates, finance charges and other charges, (iii) require disclosures to customers and investors, (iv) govern secured transactions, (v) set collection, foreclosure, repossession and other trade practices and (vi) regulate the use and reporting of information related to a borrower's credit experience. Cat Financial's ability to comply with these and other governmental and legal requirements and restrictions affects its operations.

Cat Financial's retail leases and installment sale contracts (totaling 53 percent*) include:

• | Tax leases that are classified as either operating or finance leases for financial accounting purposes, depending on the characteristics of the lease. For tax purposes, Cat Financial is considered the owner of the equipment (14 percent*). |

• | Finance (non-tax) leases, where the lessee for tax purposes is considered to be the owner of the equipment during the term of the lease, that either require or allow the customer to purchase the equipment for a fixed price at the end of the term (17 percent*). |

• | Installment sale contracts, which are equipment loans that enable customers to purchase equipment with a down payment or trade-in and structure payments over time (21 percent*). |

3

• | Governmental lease-purchase plans in the U.S. that offer low interest rates and flexible terms to qualified non-federal government agencies (1 percent*). |

Cat Financial's wholesale notes receivable, finance leases and installment sale contracts (totaling 13 percent*) include:

• | Inventory/rental programs, which provide assistance to dealers by financing their new Caterpillar inventory and rental fleets (5 percent*). |

• | Short-term trade receivables Cat Financial purchased from Caterpillar at a discount (8 percent*). |

Cat Financial's retail notes receivables (34 percent*) include:

• | Loans that allow customers and dealers to use their Caterpillar equipment or other assets as collateral to obtain financing. |

*Indicates the percentage of Cat Financial's total portfolio at December 31, 2015. We define total portfolio as total finance receivables (net of unearned income and allowance for credit losses) plus equipment on operating leases, less accumulated depreciation. For more information on the above and Cat Financial's concentration of credit risk, please refer to Note 6 - "Cat Financial Financing Activities" of Part II, Item 8 "Financial Statements and Supplementary Data."

_____________________________

Cat Financial operates in a highly competitive environment, with financing for users of Caterpillar equipment available through a variety of sources, principally commercial banks and finance and leasing companies. Cat Financial's competitors include Wells Fargo Equipment Finance Inc., General Electric Capital Corporation and various other banks and finance companies. In addition, many of our manufacturing competitors own financial subsidiaries such as Volvo Financial Services, Komatsu Financial L.P. and John Deere Capital Corporation that utilize below-market interest rate programs (funded by the manufacturer) to assist machine sales. Caterpillar and Cat Financial work together to provide a broad array of financial merchandising programs around the world to meet these competitive offers.

Cat Financial's financial results are largely dependent upon the ability of Caterpillar dealers to sell equipment and customers' willingness to enter into financing or leasing agreements. It is also affected by, among other things, the availability of funds from its financing sources, general economic conditions such as inflation and market interest rates and its cost of funds relative to its competitors.

Cat Financial has a match-funding policy that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate) of its debt portfolio with the interest rate profile of its receivables portfolio within predetermined ranges on an ongoing basis. In connection with that policy, Cat Financial uses interest rate derivative instruments to modify the debt structure to match assets within the receivables portfolio. This matched funding reduces the volatility of margins between interest-bearing assets and interest-bearing liabilities, regardless of which direction interest rates move. For more information regarding match funding, please see Note 3 - "Derivative financial instruments and risk management" of Part II, Item 8 "Financial Statements and Supplementary Data." See also the risk factors on pages 9 through 18 for general risks associated with our financial products business included in Item 1A. of this Form 10-K.

In managing foreign currency risk for Cat Financial's operations, the objective is to minimize earnings volatility resulting from conversion and the remeasurement of net foreign currency balance sheet positions, and future transactions denominated in foreign currencies. This policy allows the use of foreign currency forward, option and cross currency contracts to offset the risk of currency mismatch between the receivable and debt portfolios, and exchange rate risk associated with future transactions denominated in foreign currencies.

Cat Financial provides financing only when certain criteria are met. Credit decisions are based on a variety of credit quality factors including prior payment experience, customer financial information, credit-rating agency ratings, loan-to-value ratios and other internal metrics. Cat Financial typically maintains a security interest in retail-financed equipment and requires physical damage insurance coverage on financed equipment. Cat Financial finances a significant portion of Caterpillar dealers' sales and inventory of Caterpillar equipment throughout the world. Cat Financial's competitive position is improved by marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers. Under these programs, Caterpillar, or the dealer, funds an amount at the outset of the transaction, which Cat Financial then recognizes as revenue over the term of the financing. We believe that these marketing programs provide Cat Financial a significant competitive advantage in financing Caterpillar products.

4

Caterpillar Insurance Company, a wholly owned subsidiary of Insurance Services, is a U.S. insurance company domiciled in Missouri and primarily regulated by the Missouri Department of Insurance. Caterpillar Insurance Company is licensed to conduct property and casualty insurance business in 50 states and the District of Columbia and, as such, is also regulated in those jurisdictions. The State of Missouri acts as the lead regulatory authority and monitors Caterpillar Insurance Company's financial status to ensure that it is in compliance with minimum solvency requirements, as well as other financial ratios prescribed by the National Association of Insurance Commissioners. Caterpillar Insurance Company is also licensed to conduct insurance business through a branch in Zurich, Switzerland and, as such, is regulated by the Swiss Financial Market Supervisory Authority.

Caterpillar Life Insurance Company, a wholly owned subsidiary of Caterpillar, is a U.S. insurance company domiciled in Missouri and primarily regulated by the Missouri Department of Insurance. Caterpillar Life Insurance Company is licensed to conduct life and accident and health insurance business in 26 states and the District of Columbia and, as such, is also regulated in those jurisdictions. The State of Missouri acts as the lead regulatory authority and it monitors the financial status to ensure that it is in compliance with minimum solvency requirements, as well as other financial ratios prescribed by the National Association of Insurance Commissioners. Caterpillar Life Insurance Company provides stop loss insurance protection to a Missouri Voluntary Employees' Beneficiary Association (VEBA) trust used to fund medical claims of salaried retirees of Caterpillar under the VEBA.

Caterpillar Insurance Co. Ltd., a wholly owned subsidiary of Insurance Services, is a captive insurance company domiciled in Bermuda and regulated by the Bermuda Monetary Authority. Caterpillar Insurance Co. Ltd. is a Class 2 insurer (as defined by the Bermuda Insurance Amendment Act of 1995), which primarily insures its parent and affiliates. The Bermuda Monetary Authority requires an Annual Financial Filing for purposes of monitoring compliance with solvency requirements.

Caterpillar Product Services Corporation (CPSC), a wholly owned subsidiary of Caterpillar, is a warranty company domiciled in Missouri. CPSC previously conducted a machine extended service contract program in Germany and France by providing machine extended warranty reimbursement protection to dealers in Germany and France. The program was discontinued effective January 1, 2013, though CPSC continues to provide extended warranty reimbursement protection under existing contracts.

Caterpillar Insurance Services Corporation, a wholly owned subsidiary of Insurance Services, is a Tennessee insurance brokerage company licensed in all 50 states and the District of Columbia. It provides brokerage services for all property and casualty and life and health lines of business.

Caterpillar's insurance group provides protection for claims under the following programs:

• | Contractual Liability Insurance to Caterpillar and its affiliates, Caterpillar dealers and original equipment manufacturers (OEMs) for extended service contracts (parts and labor) offered by Caterpillar, third party dealers and OEMs. |

• | Cargo insurance for the worldwide cargo risks of Caterpillar products. |

• | Contractors' Equipment Physical Damage Insurance for equipment manufactured by Caterpillar or OEMs, which is leased, rented or sold by third party dealers to customers. |

• | General liability, employer's liability, auto liability and property insurance for Caterpillar. |

• | Retiree Medical Stop Loss Insurance for medical claims under the VEBA. |

• | Brokerage services for property and casualty and life and health business. |

Acquisitions

Information related to acquisitions appears in Note 24 - "Acquisitions" of Part II, Item 8 "Financial Statements and Supplementary Data."

5

Competitive Environment

Caterpillar products and product support services are sold worldwide into a variety of highly competitive markets. In all markets, we compete on the basis of product performance, customer service, quality and price. From time to time, the intensity of competition results in price discounting in a particular industry or region. Such price discounting puts pressure on margins and can negatively impact operating profit. Outside the United States, certain of our competitors enjoy competitive advantages inherent to operating in their home countries or regions.

Raw Materials and Component Products

We source our raw materials and manufactured components from suppliers both domestically and internationally. These purchases include unformed materials and rough and finished parts. Unformed materials include a variety of steel products, which are then cut or formed to shape and machined in our facilities. Rough parts include various sized steel and iron castings and forgings, which are machined to final specification levels inside our facilities. Finished parts are ready to assemble components, which are made either to Caterpillar specifications or to the supplier developed specifications. We machine and assemble some of the components used in our machines, engines and power generation units and to support our after-market dealer parts sales. We also purchase various goods and services used in production, logistics, offices and product development processes. We maintain global strategic sourcing models to meet our global facilities' production needs while building long-term supplier relationships and leveraging enterprise spend. We expect our suppliers to maintain, at all times, industry-leading levels of quality and the ability to timely deliver raw materials and component products for our machine and engine products. We use a variety of agreements with suppliers to protect our intellectual property and processes to monitor and mitigate risks of the supply base causing a business disruption. The risks monitored include supplier financial viability, the ability to increase or decrease production levels, business continuity, quality and delivery.

Patents and Trademarks

Our products are sold primarily under the brands "Caterpillar," "CAT," design versions of "CAT" and "Caterpillar," "Electro-Motive," "FG Wilson," "MaK," "MWM," "Perkins," "Progress Rail," "SEM" and "Solar Turbines." We own a number of patents and trademarks, which have been obtained over a period of years and relate to the products we manufacture and the services we provide. These patents and trademarks have been of value in the growth of our business and may continue to be of value in the future. We do not regard our business as being dependent upon any single patent or group of patents.

Order Backlog

The dollar amount of backlog believed to be firm was approximately $13.0 billion at December 31, 2015 and $17.3 billion at December 31, 2014 . Compared to year-end 2014 , the order backlog declined about $4.3 billion. The decrease was split about evenly across Construction Industries, Energy & Transportation and Resource Industries. Of the total backlog at December 31, 2015 , approximately $4.0 billion was not expected to be filled in 2016.

Dealers and Distributors

Our machines are distributed principally through a worldwide organization of dealers (dealer network), 48 located in the United States and 127 located outside the United States, serving 182 countries and operating 3,593 places of business, including 1,274 dealer rental outlets. Reciprocating engines are sold principally through the dealer network and to other manufacturers for use in products. Some of the reciprocating engines manufactured by our subsidiary Perkins Engines Company Limited, are also sold through its worldwide network of 97 distributors covering 180 countries. The FG Wilson branded electric power generation systems manufactured by our subsidiary Caterpillar Northern Ireland Limited are sold through its worldwide network of 290 distributors located in 145 countries. Some of the large, medium speed reciprocating engines are also sold under the MaK brand through a worldwide network of 19 distributors located in 130 countries.

Our dealers do not deal exclusively with our products; however, in most cases sales and servicing of our products are the dealers' principal business. Some products, primarily turbines and locomotives, are sold directly to end customers through sales forces employed by the company. At times, these employees are assisted by independent sales representatives.

While the large majority of our worldwide dealers are independently owned and operated, we own and operate a dealership in Japan that covers approximately 85% of the Japanese market: Nippon Caterpillar Division. We are currently operating this Japanese dealer directly and its results are reported in the All Other operating segments. There are also three independent dealers in the Southern Region of Japan.

6

For Caterpillar branded products, the company's relationship with each of its independent dealers is memorialized in standard sales and service agreements. Pursuant to this agreement, the company grants the dealer the right to purchase and sell its products and to service the products in a specified geographic service territory. Prices to dealers are established by the company after receiving input from dealers on transactional pricing in the marketplace. The company also agrees to defend its intellectual property and to provide warranty and technical support to the dealer. The agreement further grants the dealer a non-exclusive license to use the company's trademarks, service marks and brand names. In some instances, a separate trademark agreement exists between the company and a dealer.

In exchange for these rights, the agreement obligates the dealer to develop and promote the sale of the company's products to current and prospective customers in the dealer's service territory. Each dealer agrees to employ adequate sales and support personnel to market, sell and promote the company's products, demonstrate and exhibit the products, perform the company's product improvement programs, inform the company concerning any features that might affect the safe operation of any of the company's products and maintain detailed books and records of the dealer's financial condition, sales and inventories and make these books and records available at the company's reasonable request.

These sales and service agreements are terminable at will by either party primarily upon 90 days written notice and provide for termination automatically if the dealer files for bankruptcy protection or upon the occurrence of comparable action seeking protection from creditors.

Research and Development

We have always placed strong emphasis on product-oriented research and development relating to the development of new or improved machines, engines and major components. In 2015 , 2014 and 2013 , we spent $2,165 million, $2,135 million and $2,046 million, or 4.6, 3.9 and 3.7 percent of our sales and revenues, respectively, on our research and development programs.

Employment

As of December 31, 2015 , we employed about 105,700 full-time persons of whom approximately 58,000 were located outside the United States. In the United States, we employed approximately 47,700 employees, most of whom are at-will employees and, therefore, not subject to any type of employment contract or agreement. Full-time employment at the end of 2015 includes approximately 2,100 employees who participated in the U.S. voluntary retirement enhancement program in the U.S. and left the company January 1, 2016. At select business units, certain highly specialized employees have been hired under employment contracts that specify a term of employment and specify pay and other benefits.

Full-Time Employees at Year-End |

|

|

| ||

| 2015 |

| 2014 | ||

Inside U.S. | 47,700 | |

| 50,800 | |

Outside U.S. | 58,000 | |

| 63,400 | |

Total | 105,700 | |

| 114,200 | |

|

|

|

| ||

By Region: |

| |

|

| |

North America | 48,000 | |

| 51,200 | |

EAME | 21,300 | |

| 23,200 | |

Latin America | 12,300 | |

| 14,400 | |

Asia/Pacific | 24,100 | |

| 25,400 | |

Total | 105,700 | |

| 114,200 | |

|

|

|

| ||

As of December 31, 2015 , there were approximately 8,200 U.S. hourly production employees who were covered by collective bargaining agreements with various labor unions, including The United Automobile, Aerospace and Agricultural Implement Workers of America (UAW), The International Association of Machinists and The United Steelworkers. Approximately 6,100 of such employees are covered by collective bargaining agreements with the UAW that expire on March 1, 2017 and December 17, 2018. Outside the United States, the company enters into employment contracts and agreements in those countries in which such relationships are mandatory or customary. The provisions of these agreements generally correspond in each case with the required or customary terms in the subject jurisdiction.

7

Sales and Revenues

Sales and revenues outside the United States were 59 percent of consolidated sales and revenues for 2015 , 62 percent for 2014 and 67 percent for 2013 .

Environmental Matters

The company is regulated by federal, state and international environmental laws governing our use, transport and disposal of substances and control of emissions. In addition to governing our manufacturing and other operations, these laws often impact the development of our products, including, but not limited to, required compliance with air emissions standards applicable to internal combustion engines. We have made, and will continue to make, significant research and development and capital expenditures to comply with these emissions standards.

We are engaged in remedial activities at a number of locations, often with other companies, pursuant to federal and state laws. When it is probable we will pay remedial costs at a site, and those costs can be reasonably estimated, the investigation, remediation, and operating and maintenance costs are accrued against our earnings. Costs are accrued based on consideration of currently available data and information with respect to each individual site, including available technologies, current applicable laws and regulations, and prior remediation experience. Where no amount within a range of estimates is more likely, we accrue the minimum. Where multiple potentially responsible parties are involved, we consider our proportionate share of the probable costs. In formulating the estimate of probable costs, we do not consider amounts expected to be recovered from insurance companies or others. We reassess these accrued amounts on a quarterly basis. The amount recorded for environmental remediation is not material and is included in the line item "Accrued expenses" in Statement 3 - "Consolidated Financial Position at December 31" of Part II, Item 8 "Financial Statements and Supplementary Data." There is no more than a remote chance that a material amount for remedial activities at any individual site, or at all the sites in the aggregate, will be required.

Available Information

The company files electronically with the Securities and Exchange Commission (SEC) required reports on Form 8-K, Form 10-Q, Form 10-K and Form 11-K; proxy materials; ownership reports for insiders as required by Section 16 of the Securities Exchange Act of 1934 (Exchange Act); and registration statements on Forms S-3 and S-8, as necessary; and other forms or reports as required. The public may read and copy any materials the company has filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The company maintains a website (www.Caterpillar.com) and copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished with the SEC are available free of charge through our website (www.Caterpillar.com/secfilings) as soon as reasonably practicable after filing with the SEC. Copies of our board committee charters, our board's Guidelines on Corporate Governance Issues, Worldwide Code of Conduct and other corporate governance information are available on our website (www.Caterpillar.com/governance). The information contained on the company's website is not included in, or incorporated by reference into, this annual report on Form 10-K.

Additional company information may be obtained as follows:

Current information -

• | phone our Information Hotline - (800) 228-7717 (U.S. or Canada) or (858) 764-9492 (outside U.S. or Canada) to request company publications by mail, listen to a summary of Caterpillar's latest financial results and current outlook, or to request a copy of results |

• | request, view or download materials on-line or register for email alerts at www.Caterpillar.com/materialsrequest |

Historical information -

• | view/download on-line at www.Caterpillar.com/historical |

8

Item 1A. | Risk Factors. |

The statements in this section describe the most significant risks to our business and should be considered carefully in conjunction with Part II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the "Notes to Consolidated Financial Statements" of Part II, Item 8 "Financial Statements and Supplementary Data" to this Form 10-K. In addition, the statements in this section and other sections of this Form 10-K, including in Part II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" include "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 and involve uncertainties that could significantly impact results. Forward-looking statements give current expectations or forecasts of future events about the company or our outlook. You can identify forward-looking statements by the fact they do not relate to historical or current facts and by the use of words such as "believe," "expect," "estimate," "anticipate," "will be," "should," "plan," "project," "intend," "could" and similar words or expressions.

Forward-looking statements are based on assumptions and on known risks and uncertainties. Although we believe we have been prudent in our assumptions, any or all of our forward-looking statements may prove to be inaccurate, and we can make no guarantees about our future performance. Should known or unknown risks or uncertainties materialize or underlying assumptions prove inaccurate, actual results could materially differ from past results and/or those anticipated, estimated or projected.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You should, however, consult any subsequent disclosures we make in our filings with the SEC on Form 10-Q or Form 8-K.

The following is a cautionary discussion of risks, uncertainties and assumptions that we believe are significant to our business. In addition to the factors discussed elsewhere in this report, the following are some of the important factors that, individually or in the aggregate, we believe could make our actual results differ materially from those described in any forward-looking statements. It is impossible to predict or identify all such factors and, as a result, you should not consider the following factors to be a complete discussion of risks, uncertainties and assumptions.

Our business is highly sensitive to global and regional economic conditions and economic conditions in the industries we serve.

Our results of operations are materially affected by economic conditions globally and regionally and in the particular industries we serve. The demand for our products and services tends to be cyclical and can be significantly reduced in an economic environment characterized by lower levels of government and business investment, lower levels of business confidence, lower corporate earnings, perceived or actual industry overcapacity, higher unemployment and lower consumer spending. A prolonged period of slow growth may also reduce demand for our products and services. Economic conditions vary across regions and countries, and demand for our products and services generally increases in those regions and countries experiencing economic growth and investment. A change in the global mix of regions and countries experiencing economic growth and investment could have an adverse effect on our business, results of operations and financial condition.

The energy and mining industries are major users of our products, including the coal, iron ore, gold, copper, oil and natural gas industries. Decisions to purchase our products are dependent upon the performance of these industries, which in turn are dependent in part on commodity prices. Prices of commodities in these industries are frequently volatile and can change abruptly and unpredictibly in response to general economic conditions, economic growth, government actions, regulatory actions, commodity inventories, production levels, market expectations and any disruptions in production or distribution. We assume certain prices for key commodities in preparing our general economic and financial outlooks (outlooks). Commodity prices lower than those assumed in our outlooks may negatively impact our business, results of operations and financial condition. Economic conditions affecting the industries we serve may in the future also lead to reduced capital expenditures by our customers. Reduced capital expenditures by our customers are likely to lead to a decrease in the demand for our products and may also result in a decrease in demand for aftermarket parts as customers are likely to extend preventative maintenance schedules and delay major overhauls when possible.

The rates of infrastructure spending, housing starts and commercial construction also play a significant role in our results. Our products are an integral component of these activities, and as these activities decrease, demand for our products may be significantly impacted, which could negatively impact our results. Slower rates of economic growth than anticipated in our outlooks could also adversely impact our business, results of operations and financial condition.

9

Changes in government monetary or fiscal policies may negatively impact our results .

Most countries where our products and services are sold have established central banks to regulate monetary systems and influence economic activities, generally by adjusting interest rates. Interest rate changes affect overall economic growth, which affects demand for residential and nonresidential structures, as well as energy and mined products, which in turn affects sales of our products and services that serve these activities. Interest rate changes also affect our customers' ability to finance machine purchases, can change the optimal time to keep machines in a fleet and can impact the ability of our suppliers to finance the production of parts and components necessary to manufacture and support our products. Our outlooks typically include assumptions about interest rates in a number of countries. Increases in interest rates could negatively impact sales and create supply chain inefficiencies.

Central banks and other policy arms of many countries take actions to vary the amount of liquidity and credit available in an economy. Liquidity and credit policies different from those assumed in our outlooks could impact the customers and markets we serve or our suppliers, which could adversely impact our business, results of operations and financial condition.

Changes in monetary and fiscal policies, along with other factors, may cause currency exchange rates to fluctuate. Actions that lead the currency exchange rate of a country where we manufacture products to increase relative to other currencies could reduce the competitiveness of products made in that country, which could adversely affect our competitive position, results of operations and financial condition.

Government policies on taxes and spending also affect our business. Throughout the world, government spending finances a significant portion of infrastructure development, such as highways, airports, sewer and water systems and dams. Tax regulations determine depreciation lives and the amount of money users of our products can retain, both of which influence investment decisions. Unfavorable developments, such as declines in government revenues, decisions to reduce public spending or increases in taxes, could negatively impact our results.

Commodity price changes, component price increases, fluctuations in demand for our products or significant shortages of component products may adversely impact our financial results or our ability to meet commitments to customers.

We are a significant user of steel and many other commodities required for the manufacture of our products. Unanticipated increases in the prices of such commodities would increase our costs, negatively impacting our business, results of operations and financial condition if we are unable to fully offset the effect of these increased costs through price increases, productivity improvements or cost reduction programs.

We rely on suppliers to secure component products, particularly steel, required for the manufacture of our products. A disruption in deliveries to or from suppliers or decreased availability of components or commodities could have an adverse effect on our ability to meet our commitments to customers or increase our operating costs. On the other hand, if demand for our products is less than we expect, we may experience excess inventories and be forced to incur additional charges and our profitability may suffer. Our business, competitive position, results of operations or financial condition could be negatively impacted if supply is insufficient for our operations, if we experience excess inventories or if we are unable to adjust our production schedules or our purchases from suppliers to reflect changes in customer demand and market fluctuations on a timely basis.

Disruptions or volatility in global financial markets could limit our sources of liquidity, or the liquidity of our customers, dealers and suppliers.

Global economic conditions may cause volatility and disruptions in the capital and credit markets. Although we have generated funds from our operations to pay our operating expenses, fund our capital expenditures and support growth, fund our employee retirement benefit programs, pay dividends and buy back stock, continuing to meet these cash requirements over the long-term requires substantial liquidity and access to varied sources of funds, including capital and credit markets. Changes in global economic conditions, including material cost increases and decreases in economic activity in the markets that we serve, and the success of plans to manage cost increases, inventory and other important elements of our business may significantly impact our ability to generate funds from operations. Market volatility, changes in counterparty credit risk, the impact of government intervention in financial markets and general economic conditions may also adversely impact our ability to access capital and credit markets to fund operating needs. Global or regional economic downturns could cause financial markets to decrease the availability of liquidity, credit and credit capacity for certain issuers, including certain of our customers, dealers and suppliers. An inability to access capital and credit markets may have an adverse effect on our business, results of operations, financial condition and competitive position.

10

In addition, demand for our products generally depends on customers' ability to pay for our products, which, in turn, depends on their access to funds. Subject to global economic conditions, customers may experience increased difficulty in generating funds from operations. Capital and credit market volatility and uncertainty may cause financial institutions to revise their lending standards, resulting in decreased access to capital. If capital and credit market volatility occurs, customers' liquidity may decline which, in turn, would reduce their ability to purchase our products.

Our global operations are exposed to political and economic risks, commercial instability and events beyond our control in the countries in which we operate.

Our global operations are dependent upon products manufactured, purchased and sold in the U.S. and internationally, including in countries with political and economic instability. Some countries have greater political and economic volatility and greater vulnerability to infrastructure and labor disruptions than others. Our business could be negatively impacted by adverse fluctuations in freight costs, limitations on shipping and receiving capacity, and other disruptions in the transportation and shipping infrastructure at important geographic points of exit and entry for our products. Operating and seeking to expand business in a number of different regions and countries exposes us to a number of risks, including:

• | multiple and potentially conflicting laws, regulations and policies that are subject to change; |

• | imposition of currency restrictions, restrictions on repatriation of earnings or other restraints; |

• | imposition of burdensome tariffs or quotas; |

• | imposition of new or additional trade and economic sanctions laws imposed by the U.S. or foreign governments; |

• | national and international conflict; |

• | war or terrorist acts; and |

• | political and economic instability or civil unrest that may severely disrupt economic activity in affected countries. |

The occurrence of one or more of these events may negatively impact our business, results of operations and financial condition.

Failure to maintain our credit ratings would increase our cost of borrowing and could adversely affect our cost of funds, liquidity, competitive position and access to capital markets.

Each of Caterpillar's and Cat Financial's costs of borrowing and ability to access the capital markets are affected not only by market conditions but also by the short- and long-term debt ratings assigned to their respective debt by the major credit rating agencies. These ratings are based, in significant part, on each of Caterpillar's and Cat Financial's performance as measured by financial metrics such as net worth and interest coverage and leverage ratios, as well as transparency with rating agencies and timeliness of financial reporting. There can be no assurance that Caterpillar or Cat Financial will be able to maintain their credit ratings and the failure of either Caterpillar or Cat Financial to do so could adversely affect our cost of funds, liquidity, competitive position and access to the capital markets, including restricting, in whole or in part, our access to the commercial paper market. There can be no assurance that the commercial paper market will continue to be a reliable source of short-term financing for Cat Financial or an available source of short-term financing for Caterpillar. An inability to access the capital markets could have an adverse effect on our cash flow, results of operations and financial condition.

Our Financial Products segment is subject to risks associated with the financial services industry.

Cat Financial is significant to our operations and provides financing support to a significant share of our global sales. The inability of Cat Financial to access funds to support its financing activities to our customers could have an adverse effect on our business, results of operations and financial condition.

Continuing to meet Cat Financial's cash requirements over the long-term could require substantial liquidity and access to sources of funds, including capital and credit markets. Cat Financial has continued to maintain access to key global medium term note and commercial paper markets, but there can be no assurance that such markets will continue to represent a reliable source of financing. If global economic conditions were to deteriorate, Cat Financial could face materially higher financing costs, become unable to access adequate funding to operate and grow its business and/or meet its debt service obligations as they mature, and be required to draw upon contractually committed lending agreements and/or by seeking other funding

11

sources. However, there can be no assurance that such agreements and other funding sources would be available or sufficient under extreme market conditions. Any of these events could negatively impact Cat Financial's business, as well as our and Cat Financial's results of operations and financial condition.

Market disruption and volatility may also lead to a number of other risks in connection with these events, including but not limited to:

• | Market developments that may affect customer confidence levels and cause declines in the demand for financing and adverse changes in payment patterns, causing increases in delinquencies and default rates, which could impact Cat Financial's write-offs and provision for credit losses. |

• | The process Cat Financial uses to estimate losses inherent in its credit exposure requires a high degree of management's judgment regarding numerous subjective qualitative factors, including forecasts of economic conditions and how economic predictors might impair the ability of its borrowers to repay their loans. Financial market disruption and volatility may impact the accuracy of these judgments. |

• | Cat Financial's ability to engage in routine funding transactions or borrow from other financial institutions on acceptable terms or at all could be adversely affected by disruptions in the capital markets or other events, including actions by rating agencies and deteriorating investor expectations. |

• | As Cat Financial's counterparties are primarily financial institutions, their ability to perform in accordance with any of its underlying agreements could be adversely affected by market volatility and/or disruptions in financial markets. |

Changes in interest rates or market liquidity conditions could adversely affect Cat Financial's and our earnings and/or cash flow.

Changes in interest rates and market liquidity conditions could have an adverse effect on Cat Financial's and our earnings and cash flows. Because a significant number of the loans made by Cat Financial are made at fixed interest rates, its business is subject to fluctuations in interest rates. Changes in market interest rates may influence its financing costs, returns on financial investments and the valuation of derivative contracts and could reduce its and our earnings and cash flows. Although Cat Financial manages interest rate and market liquidity risks through a variety of techniques, including a match funding program, the selective use of derivatives and a broadly diversified funding program, there can be no assurance that fluctuations in interest rates and market liquidity conditions will not have an adverse effect on its and our earnings and cash flows. If any of the variety of instruments and strategies Cat Financial uses to hedge its exposure to these types of risk is ineffective, we may incur losses. With respect to Insurance Services' investment activities, changes in the equity and bond markets could cause an impairment of the value of its investment portfolio, requiring a negative adjustment to earnings.

An increase in delinquencies, repossessions or net losses of Cat Financial customers could adversely affect its results.

Inherent in the operation of Cat Financial is the credit risk associated with its customers. The creditworthiness of each customer and the rate of delinquencies, repossessions and net losses on customer obligations are directly impacted by several factors, including relevant industry and economic conditions, the availability of capital, the experience and expertise of the customer's management team, commodity prices, political events and the sustained value of the underlying collateral. Any increase in delinquencies, repossessions and net losses on customer obligations could have a material adverse effect on Cat Financial's and our earnings and cash flows. In addition, although Cat Financial evaluates and adjusts its allowance for credit losses related to past due and non-performing receivables on a regular basis, adverse economic conditions or other factors that might cause deterioration of the financial health of its customers could change the timing and level of payments received and thus necessitate an increase in Cat Financial's estimated losses, which could also have a material adverse effect on Cat Financial's and our earnings and cash flows.

New regulations or changes in financial services regulation could adversely impact Caterpillar and Cat Financial.

Cat Financial's operations are highly regulated by governmental authorities in the locations where it operates, which can impose significant additional costs and/or restrictions on its business. In the U.S., for example, certain of Cat Financial's activities are subject to the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank), a comprehensive financial reform act signed into law in July 2010 that includes extensive provisions regulating the financial services industry. As such, Cat Financial has become and could continue to become subject to additional regulatory costs that could be significant and have an adverse effect on Cat Financial's and our results of operations and financial condition. Additional regulations in

12

the U.S. or internationally impacting the financial services industry could also add significant cost or operational constraints that might have an adverse effect on Cat Financial's and our results of operations and financial condition.

We may not realize all of the anticipated benefits of our acquisitions, joint ventures or divestitures, or these benefits may take longer to realize than expected.

In pursuing our business strategy, we routinely evaluate targets and enter into agreements regarding possible acquisitions, divestitures and joint ventures. We often compete with others for the same opportunities. To be successful, we conduct due diligence to identify valuation issues and potential loss contingencies, negotiate transaction terms, complete complex transactions and manage post-closing matters such as the integration of acquired businesses. Our due diligence reviews are subject to the completeness and accuracy of disclosures made by third parties. We may incur unanticipated costs or expenses following a completed acquisition, including post-closing asset impairment charges, expenses associated with eliminating duplicate facilities, litigation, and other liabilities.

The risks associated with our past or future acquisitions also include the following:

• | the business culture of the acquired business may not match well with our culture; |

• | technological and product synergies, economies of scale and cost reductions may not occur as expected; |

• | unforeseen expenses, delays or conditions may be imposed upon the acquisition, including due to required regulatory approvals or consents; |

• | we may acquire or assume unexpected liabilities or be subject to unexpected penalties or other enforcement actions; |

• | faulty assumptions may be made regarding the integration process; |

• | unforeseen difficulties may arise in integrating operations, processes and systems; |

• | higher than expected investments may be required to implement necessary compliance processes and related systems, including IT systems, accounting systems and internal controls over financial reporting; |

• | we may fail to retain, motivate and integrate key management and other employees of the acquired business; |

• | higher than expected costs may arise due to unforeseen changes in tax, trade, environmental, labor, safety, payroll or pension policies in any jurisdiction in which the acquired business conducts its operations; and |

• | we may experience problems in retaining customers and integrating customer bases. |

Many of these factors will be outside of our control and any one of them could result in increased costs, decreases in the amount of expected revenues and diversion of management's time and attention. They may also delay the realization of the benefits we anticipate when we enter into a transaction.

In order to conserve cash for operations, we may undertake acquisitions financed in part through public offerings or private placements of debt or equity securities, or other arrangements. Such acquisition financing could result in a decrease in our earnings and adversely affect other leverage measures. If we issue equity securities or equity-linked securities, the issued securities may have a dilutive effect on the interests of the holders of our common shares.

Failure to implement our acquisition strategy, including successfully integrating acquired businesses, could have an adverse effect on our business, financial condition and results of operations. Furthermore, we make strategic divestitures from time to time. In the case of divestitures, we may agree to indemnify acquiring parties for certain liabilities arising from our former businesses. These divestitures may also result in continued financial involvement in the divested businesses, including through guarantees or other financial arrangements, following the transaction. Lower performance by those divested businesses could affect our future financial results.

13

International trade policies may impact demand for our products and our competitive position.

Government policies on international trade and investment such as import quotas, capital controls or tariffs, whether adopted by individual governments or addressed by regional trade blocs, can affect the demand for our products and services, impact the competitive position of our products or prevent us from being able to sell products in certain countries. The implementation of more restrictive trade policies, such as more detailed inspections, higher tariffs or new barriers to entry, in countries where we sell large quantities of products and services could negatively impact our business, results of operations and financial condition. For example, a government's adoption of "buy national" policies or retaliation by another government against such policies could have a negative impact on our results of operations.

The success of our business depends on our ability to develop, produce and market quality products that meet our customers' needs.

Our business relies on continued global demand for our brands and products. To achieve business goals, we must develop and sell products that appeal to our dealers, OEMs and end-user customers. This is dependent on a number of factors, including our ability to maintain key dealer relationships, our ability to produce products that meet the quality, performance and price expectations of our customers and our ability to develop effective sales, advertising and marketing programs. In addition, our continued success in selling products that appeal to our customers is dependent on leading-edge innovation, with respect to both products and operations, and on the availability and effectiveness of legal protection for our innovation. Failure to continue to deliver high quality, innovative, competitive products to the marketplace, to adequately protect our intellectual property rights, to supply products that meet applicable regulatory requirements, including engine exhaust emission requirements or to predict market demands for, or gain market acceptance of, our products, could have a negative impact on our business, results of operations and financial condition.

We operate in a highly competitive environment, which could adversely affect our sales and pricing.

We operate in a highly competitive environment, and our outlook depends on a forecast of our share of industry sales based on our ability to compete with others in the marketplace. We compete on the basis of a variety of factors, including product performance, customer service, quality and price. There can be no assurance that our products will be able to compete successfully with other companies' products. Thus, our share of industry sales could be reduced due to aggressive pricing or product strategies pursued by competitors, unanticipated product or manufacturing difficulties, our failure to price our products competitively, our failure to produce our products at a competitive cost or an unexpected buildup in competitors' new machine or dealer-owned rental fleets, leading to severe downward pressure on machine rental rates and/or used equipment prices.

Our sales outlook assumes that certain price increases we announce from time to time will be realized in the marketplace. Changes in market acceptance of price increases, changes in market requirements for price discounts, changes in our competitors' behavior or a weak pricing environment attributable to industry overcapacity could have an adverse impact on our business, results of operations and financial condition.

In addition, our results and ability to compete may be impacted negatively by changes in our sales mix. Our outlook assumes a certain geographic mix of sales as well as a certain product mix of sales. If actual results vary from this projected geographic and product mix of sales, our results could be negatively impacted.

We may not realize all of the anticipated benefits from cost-reduction initiatives, cash flow improvement initiatives and efficiency or productivity initiatives.

We are actively engaged in a number of initiatives to increase our productivity, efficiency and cash flow and to reduce costs, which we expect to have a positive effect on our business, competitive position, results of operations and financial condition. For example, we formed the Caterpillar Enterprise System Group in 2013 to implement sustained improvements in our operational efficiency and order-to-delivery processes so that our lead time is better aligned with customer requirements, as well as to reduce waste, further enhance quality and maximize value for our customers. We are also in the process of implementing new enterprise resource planning (ERP) systems in many of our businesses to increase efficiency and harmonize our operations. There can be no assurance that these ERP systems, these initiatives, or others will continue to be beneficial to the extent anticipated, or that the estimated efficiency improvements, incremental cost savings or cash flow improvements will be realized as anticipated or at all. If our new ERP systems are not implemented successfully, it could have an adverse effect on our operations and competitive position.

14

We expect to incur additional restructuring charges as we continue to contemplate cost reduction actions in an effort to optimize our cost structure and may not achieve the anticipated savings and benefits of these actions.

On September 24, 2015, we announced significant restructuring and cost reduction actions to lower our operating costs in response to current economic and business conditions. We expect to take additional restructuring actions through 2018 to optimize our cost structure and improve the efficiency of our operation, which will reduce our profitability in the periods incurred. As a result of these actions, we will likely continue to incur charges, which may include but not be limited to asset impairments, employee termination costs, charges for pension and other postretirement contractual benefits, potential additional pension funding obligations, and pension curtailments, any of which could be significant, and could adversely affect our financial condition and results of operations. In addition, we may not realize anticipated savings or benefits from past or future cost reduction actions in full or in part or within the time periods we expect. We are also subject to the risks of labor unrest, negative publicity and business disruption in connection with our cost reduction actions. Failure to realize anticipated savings or benefits from our cost reduction actions could have a material adverse effect on our business, prospects, financial condition, liquidity, results of operations and cash flows.

Our business is subject to the inventory management decisions and sourcing practices of our dealers and our OEM customers.

We sell finished products primarily through an independent dealer network and directly to OEMs and are subject to risks relating to their inventory management decisions and operational and sourcing practices. Both carry inventories of finished products as part of ongoing operations and adjust those inventories based on their assessments of future needs. Such adjustments may impact our results positively or negatively. If the inventory levels of our dealers and OEM customers are higher than they desire, they may postpone product purchases from us, which could cause our sales to be lower than the end-user demand for our products and negatively impact our results. Similarly, our results could be negatively impacted through the loss of time-sensitive sales if our dealers and OEM customers do not maintain inventory levels sufficient to meet customer demand. Additionally, some of our engine customers are OEMs that manufacture or could in the future manufacture engines for their own products. Despite their engine manufacturing abilities, these customers have chosen to outsource certain types of engine production to us due to the quality of our engine products and in order to reduce costs, eliminate production risks and maintain company focus. However, there can be no assurance that these customers will continue to outsource engine manufacture in the future. Decreased levels of production outsourcing by these customers could result from a number of factors, such as shifts in our customers' business strategies, acquisition by a customer of another engine manufacturer, the inability of third-party suppliers to meet specifications and the emergence of low-cost production opportunities in foreign countries. A significant reduction in the level of engine production outsourcing from our OEM customers could significantly impact our revenues and, accordingly, have an adverse effect on our business, results of operations and financial condition.

We are subject to stringent environmental laws and regulations that impose significant compliance costs.

Our facilities, operations and products are subject to increasingly stringent environmental laws and regulations globally, including laws and regulations governing emissions to noise, air, discharges to water and the generation, handling, storage, transportation, treatment and disposal of non-hazardous and hazardous waste materials. Some environmental laws impose strict, retroactive and joint and several liability for the remediation of the release of hazardous substances, even for conduct that was lawful at the time it occurred, or for the conduct of, or conditions caused by, prior operators, predecessors or other third parties. Failure to comply with environmental laws could expose us to penalties or clean-up costs, civil or criminal liability and sanctions on certain of our activities, as well as damage to property or natural resources. These liabilities, sanctions, damages and remediation efforts related to any non-compliance with such laws and regulations could negatively impact our ability to conduct our operations and our financial condition and results of operations. In addition, there can be no assurances that we will not be adversely affected by costs, liabilities or claims with respect to existing or subsequently acquired operations or under present laws and regulations or those that may be adopted or imposed in the future.