|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

Commission file number 1-9924

Citigroup Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) |

| 52-1568099 (I.R.S. Employer Identification No.) |

388 Greenwich Street, New York, NY (Address of principal executive offices) |

| 10013 (Zip code) |

(212) 559-1000 (Registrant's telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: See Exhibit 99.01

Securities registered pursuant to Section 12(g) of the Act: none

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Large accelerated filer x |

| Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) |

| Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Citigroup Inc. common stock held by non-affiliates of Citigroup Inc. on June 30, 2016 was approximately $123.0 billion.

Number of shares of Citigroup Inc. common stock outstanding on January 31, 2017 : 2,770,709,339

Documents Incorporated by Reference: Portions of the registrant's proxy statement for the annual meeting of stockholders scheduled to be held on April 25, 2017, are incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III.

Available on the web at www.citigroup.com

|

FORM 10-K CROSS-REFERENCE INDEX

|

|

|

|

Item Number | Page | ||

|

|

|

|

Part I |

| ||

|

|

|

|

1. |

| Business | 2–30, 120–122, |

|

|

| 125, 152, |

|

|

| 306–307 |

|

|

|

|

1A. |

| Risk Factors | 54–62 |

|

|

|

|

1B. |

| Unresolved Staff Comments | Not Applicable |

|

|

|

|

2. |

| Properties | 306–307 |

|

|

|

|

3. |

| Legal Proceedings-See Note 27 to the Consolidated Financial Statements | 283–291 |

|

|

|

|

4. |

| Mine Safety Disclosures | Not Applicable |

|

|

|

|

Part II |

| ||

|

|

|

|

5. |

| Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | 134–135, 157–159, 308 |

|

|

|

|

6. |

| Selected Financial Data | 8–9 |

|

|

|

|

7. |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 5–32, 64–119 |

|

|

|

|

7A. |

| Quantitative and Qualitative Disclosures About Market Risk | 64–119, 153–155, 179–219, 222–275 |

|

|

|

|

8. |

| Financial Statements and Supplementary Data | 129–305 |

|

|

|

|

9. |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | Not Applicable |

|

|

|

|

9A. |

| Controls and Procedures | 123–124 |

|

|

|

|

9B. |

| Other Information | Not Applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part III |

| ||

|

|

|

|

10. |

| Directors, Executive Officers and Corporate Governance | 310–311* |

|

|

|

|

11. |

| Executive Compensation | ** |

|

|

|

|

12. |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | *** |

|

|

|

|

13. |

| Certain Relationships and Related Transactions and Director Independence | **** |

|

|

|

|

14. |

| Principal Accountant Fees and Services | ***** |

|

|

|

|

|

|

|

|

Part IV |

| ||

|

|

|

|

15. |

| Exhibits and Financial Statement Schedules | 313–317 |

* | For additional information regarding Citigroup's Directors, see "Corporate Governance," "Proposal 1: Election of Directors" and "Section 16(a) Beneficial Ownership Reporting Compliance" in the definitive Proxy Statement for Citigroup's Annual Meeting of Stockholders scheduled to be held on April 25, 2017, to be filed with the SEC (the Proxy Statement), incorporated herein by reference. |

** | See "Compensation Discussion and Analysis," "The Personnel and Compensation Committee Report," and "2016 Summary Compensation Table and Compensation Information" in the Proxy Statement, incorporated herein by reference. |

*** | See "About the Annual Meeting," "Stock Ownership," and "Equity Compensation Plan Information" in the Proxy Statement, incorporated herein by reference. |

**** | See "Corporate Governance-Director Independence," "-Certain Transactions and Relationships, Compensation Committee Interlocks and Insider Participation," and "-Indebtedness" in the Proxy Statement, incorporated herein by reference. |

***** | See "Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm" in the Proxy Statement, incorporated herein by reference. |

CITIGROUP'S

2016

ANNUAL REPORT ON FORM 10-K

OVERVIEW | 2 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 5 |

Executive Summary | 5 |

Summary of Selected Financial Data | 8 |

SEGMENT AND BUSINESS-INCOME (LOSS) AND REVENUES | 10 |

SEGMENT BALANCE SHEET | 12 |

CITICORP | 13 |

Global Consumer Banking | 14 |

North America GCB | 16 |

Latin America GCB | 19 |

Asia GCB | 21 |

Institutional Clients Group | 23 |

Corporate/Other | 28 |

CITI HOLDINGS | 29 |

OFF-BALANCE SHEET ARRANGEMENTS | 31 |

CONTRACTUAL OBLIGATIONS | 32 |

CAPITAL RESOURCES | 33 |

RISK FACTORS | 54 |

Managing Global Risk Table of Contents | 63 |

MANAGING GLOBAL RISK | 64 |

SIGNIFICANT ACCOUNTING POLICIES AND SIGNIFICANT ESTIMATES | 120 |

DISCLOSURE CONTROLS AND PROCEDURES | 123 |

MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING | 124 |

FORWARD-LOOKING STATEMENTS | 125 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM-INTERNAL CONTROL OVER FINANCIAL REPORTING | 126 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM- CONSOLIDATED FINANCIAL STATEMENTS | 127 |

FINANCIAL STATEMENTS AND NOTES TABLE OF CONTENTS | 128 |

CONSOLIDATED FINANCIAL STATEMENTS | 129 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 138 |

FINANCIAL DATA SUPPLEMENT | 305 |

SUPERVISION, REGULATION AND OTHER | 306 |

CORPORATE INFORMATION | 310 |

Citigroup Executive Officers | 310 |

Citigroup Board of Directors | 311 |

1

OVERVIEW

Citigroup's history dates back to the founding of the City

Bank of New York in 1812.

Citigroup is a global diversified financial services holding company whose businesses provide consumers, corporations, governments and institutions with a broad, yet focused, range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, trade and securities services and wealth management. Citi has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions.

At December 31, 2016 , Citi had approximately 219,000 full-time employees, compared to approximately 231,000 full-time employees at December 31, 2015 .

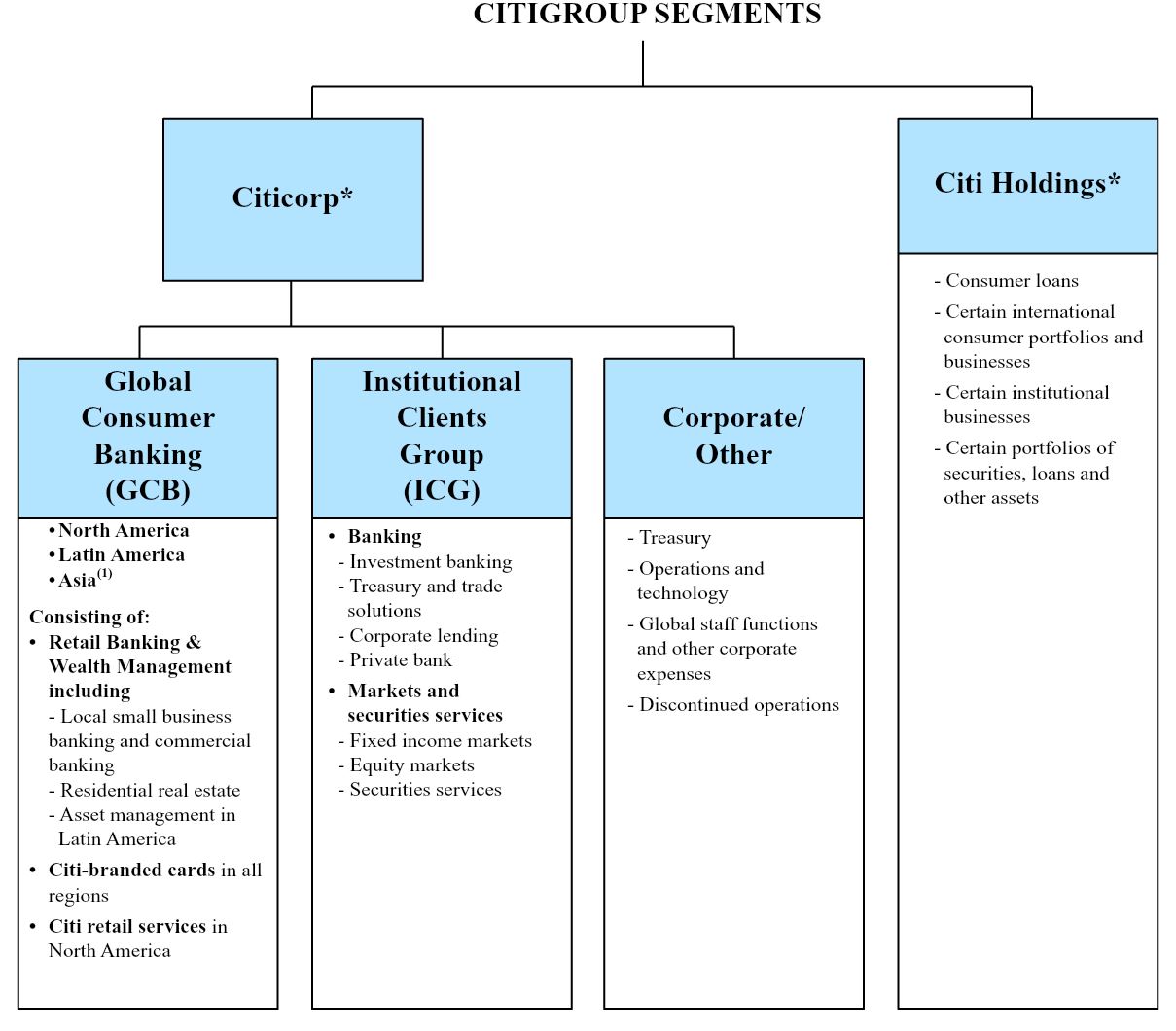

Citigroup currently operates, for management reporting purposes, via two primary business segments: Citicorp, consisting of Citi's Global Consumer Banking businesses and Institutional Clients Group ; and Citi Holdings, consisting of businesses and portfolios of assets that Citigroup has determined are not central to its core Citicorp businesses. For a further description of the business segments and the products and services they provide, see "Citigroup Segments" below, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Note 3 to the Consolidated Financial Statements.

Throughout this report, "Citigroup," "Citi" and "the Company" refer to Citigroup Inc. and its consolidated subsidiaries.

Additional information about Citigroup is available on Citi's website at www.citigroup.com . Citigroup's recent annual reports on Form 10-K, quarterly reports on Form 10-Q, proxy statements, as well as other filings with the U.S. Securities and Exchange Commission (SEC), are available free of charge through Citi's website by clicking on the "Investors" page and selecting "All SEC Filings." The SEC's website also contains current reports on Form 8-K and other information regarding Citi at www.sec.gov .

Certain reclassifications, including a realignment of certain businesses, have been made to the prior periods' financial statements to conform to the current period's presentation. For information on certain recent such reclassifications, see Note 3 to the Consolidated Financial Statements.

Please see "Risk Factors" below for a discussion of the most significant risks and uncertainties that could impact Citigroup's businesses, financial condition and results of operations.

2

As described above, Citigroup is managed pursuant to the following segments:

(Chart continues on next page.)

3

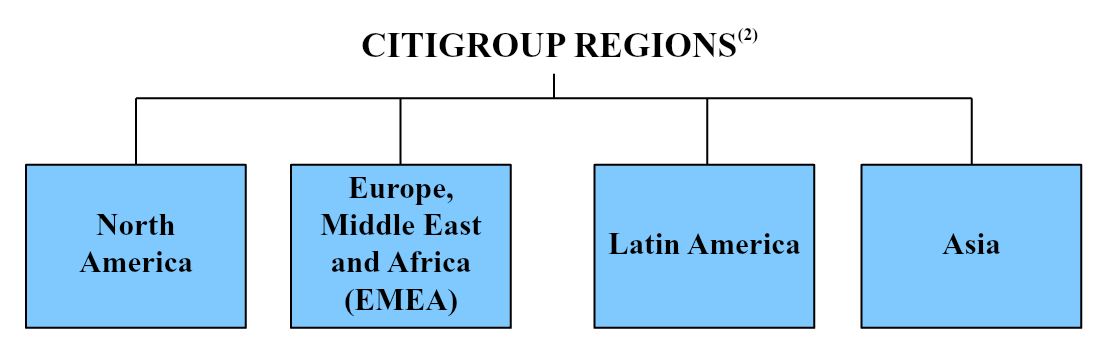

The following are the four regions in which Citigroup operates. The regional results are fully reflected in the segment results above.

* | As announced in April 2016, beginning in the first quarter of 2017, the remaining businesses and portfolios of assets in Citi Holdings will be reported as part of Corporate/Other and Citi Holdings will cease to be a separately reported business segment. For additional information, see "Citicorp" and "Citi Holdings" below. Citi intends to release a revised Quarterly Financial Data Supplement reflecting this realignment prior to the release of its first quarter of 2017 earnings. |

(1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

(2) | North Americ a includes the U.S., Canada and Puerto Rico, Latin America includes Mexico and Asia includes Japan. |

4

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

As described further throughout this Executive Summary, Citi's full year 2016 results of operations reflected solid overall performance and underlying momentum across the franchise, including in several businesses where Citi has been making investments, such as its North America Citi-branded cards business. Citi also continued to demonstrate strong expense discipline, resulting in a Citicorp operating efficiency ratio of 58% in 2016.

In Global Consumer Banking (GCB) , results for the North America Citi-branded cards business reflected the acquisition of the Costco portfolio (late in the second quarter of 2016), but also modest growth in average loans and purchase sales in the remainder of the portfolio. International GCB results reflected revenue growth and positive operating leverage in Mexico, and Citi announced its $1 billion investment in Mexico to be completed by 2020 where it believes it has the opportunity to build upon its strong brand position and scale to lead to improved returns. In Institutional Clients Group (ICG) , Citi generated year-over-year revenue growth, despite the challenging market conditions in the first quarter of 2016 and the volatility in the energy sector earlier in the year.

In Citicorp, loans increased 4% and deposits increased 3%. Excluding the impact of foreign currency translation into U.S. dollars for reporting purposes (FX translation), Citicorp loans increased 6% and deposits increased 5%. (Citi's results of operations excluding the impact of FX translation are non-GAAP financial measures. Citi believes the presentation of its results of operations excluding the impact of FX translation provides a meaningful depiction for investors of the underlying fundamentals of its businesses.) Credit quality remained broadly favorable in every region.

2016 was an important year for Citi in several additional respects. First, Citi Holdings will no longer be reported separately (it will be reported as part of Corporate/Other beginning in the first quarter of 2017). At its peak, Citi Holdings had over $800 billion in assets and in certain quarters generated significant losses. As of December 31, 2016, Citi Holdings' assets of $54 billion constituted only approximately 3% of Citigroup's GAAP assets, and with $87 million of net income in the fourth quarter of 2016, Citi Holdings was profitable for ten consecutive quarters. Accordingly, the results of operations and financial condition of Citigroup are now driven by the core Citicorp franchise.

Second, Citi increased the amount of capital it returned to shareholders during 2016 while at the same time increasing its key regulatory capital metrics (see "Capital Resources" below). During 2016, Citi returned nearly $11.0 billion of capital to common shareholders in the form of dividends and the repurchase of 196 million common shares, including the additional $1.75 billion increase to its common stock repurchase program announced in November 2016. And third, while Citi has more work to do, Citi achieved a significant milestone during 2016 when it received feedback from the

Federal Reserve Board and FDIC that neither agency had found deficiencies in Citi's 2015 resolution plan.

Going into 2017, while economic sentiment has improved, there continues to be much uncertainty, primarily as a result of a new U.S. presidential administration and policies and the anticipated beginning of the exit of the U.K. from the European Union. For a more detailed discussion of the risks and uncertainties that could impact Citi's businesses, results of operations and financial condition during 2017, see each respective business's results of operations, "Risk Factors" and "Managing Global Risk" below. Despite these uncertainties, Citi intends to continue to build on the progress made during 2016 with a focus on further optimizing its performance to benefit shareholders.

2016 Summary Results

Citigroup

Citigroup reported net income of $14.9 billion, or $4.72 per share, compared to $17.2 billion, or $5.40 per share, in the prior year. Results in 2015 included $254 million ($162 million after-tax) of CVA/DVA.

Excluding the impact of CVA/DVA in 2015, Citigroup reported net income of $14.9 billion for 2016, or $4.72 per share, compared to $17.1 billion, or $5.35 per share, in the prior year. (Citi's results of operations excluding the impact of CVA/DVA are non-GAAP financial measures. Citi excludes the impact of CVA/DVA from results for 2015 for consistency with the current year's presentation.) The 13% decrease in net income from the prior year was primarily driven by lower revenues, largely due to the decline in Citi Holdings, partially offset by lower expenses and lower credit costs.

Citi's revenues were $69.9 billion in 2016, a decrease of 8% from the prior year, driven by a 2% decline in Citicorp and a 57% decline in Citi Holdings. Excluding CVA/DVA in 2015 and the impact of FX translation (which increased the reported decline in revenues versus the prior year by approximately $1.7 billion), Citigroup revenues decreased 6% from the prior year, driven by a 56% decrease in Citi Holdings, partially offset by a 1% increase in Citicorp revenues.

As previously announced, in January 2017, Citi signed agreements to effectively exit its U.S. mortgage servicing operations by the end of 2018 and intensify its focus on originations. These transactions are expected to negatively impact Citi's pretax earnings by approximately $400 million, including a loss on sale and certain related transaction costs, in the first quarter of 2017. For additional information on these transactions, see Note 29 to the Consolidated Financial Statements.

Expenses

Citigroup expenses decreased 5% versus the prior year as significantly lower expenses in Citi Holdings, efficiency savings and a benefit from the impact of FX translation were partially offset by ongoing investments in Citicorp (including those referenced above). FX translation increased the reported

5

decline in expenses versus the prior year period by approximately $1.2 billion.

Citicorp expenses increased 1%, reflecting the ongoing investments in the franchise, partially offset by efficiency savings and the benefit from the impact of FX translation.

Citi Holdings' expenses were $3.2 billion, down 43% from the prior year, primarily driven by sales and run-off of Citi Holdings assets and lower legal and repositioning costs.

Credit Costs

Citi's total provisions for credit losses and for benefits and claims of $7.0 billion decreased 12% from the prior year. The decrease was driven by a decrease in net credit losses and a lower provision for benefits and claims due to lower insurance-related business activity within Citi Holdings, partially offset by a net loan loss reserve build, largely driven by North America cards within Citicorp, compared to a net loan loss reserve release in the prior year.

Net credit losses of $6.6 billion declined 10% versus the prior year. Consumer net credit losses declined 14% to

$6.1 billion, mostly reflecting continued improvement in the

North America mortgage portfolio and ongoing divestiture activity within Citi Holdings, partially offset by higher net credit losses in North America cards in Citicorp due to volume growth. Corporate net credit losses increased $267 million to $511 million, mostly related to the energy portfolio in the first half of 2016, with a vast majority of the corporate net credit losses offset by releases of previously established loan loss reserves (for additional information, see " Institutional Clients Group " and "Credit Risk-Corporate Credit" below).

The net build of allowance for loan losses and unfunded lending commitments was $217 million in 2016, compared to a $120 million release in 2015. Citicorp's net reserve build was $680 million, compared to a net loan loss reserve build of $358 million in 2015. The larger net reserve build in 2016 was primarily related to the North America cards franchise, driven primarily by the impact of the Costco portfolio acquisition, volume growth and seasoning and the absence of reserve releases that occurred in 2015 as credit normalized (see " Global Consumer Banking - North America GCB " below), partially offset by a net reserve release in ICG . Overall, Citi expects its credit costs will likely be higher in 2017 as compared to 2016, driven by loan growth and seasoning.

For additional information on Citi's consumer and corporate credit costs and allowance for loan losses, see "Credit Risk" below.

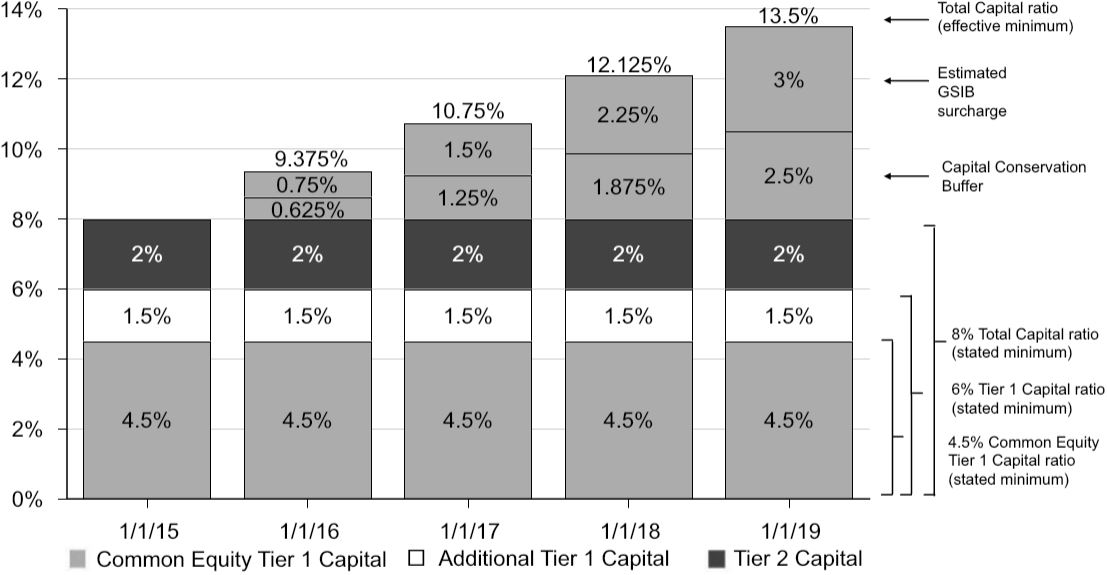

Capital

Citigroup's Tier 1 Capital and Common Equity Tier 1 Capital ratios, on a fully implemented basis, were 14.2% and 12.6% as of December 31, 2016, respectively, compared to 13.5% and 12.1% as of December 31, 2015 (all based on the Basel III Advanced Approaches for determining risk-weighted assets). Citigroup's Supplementary Leverage ratio as of December 31, 2016, on a fully implemented basis, was 7.2%, compared to 7.1% as of December 31, 2015. For additional information on Citi's capital ratios and related components, including the

impact of Citi's DTAs on its capital ratios, see "Capital Resources" below.

Citicorp

Citicorp net income decreased 12% from the prior year to $14.3 billion. CVA/DVA, recorded in ICG , was $269 million ($172 million after-tax) in 2015 (for a summary of CVA/DVA by business within ICG , see " Institutional Clients Group " below). Excluding CVA/DVA in 2015, Citicorp's net income decreased 11% from the prior year, primarily driven by lower revenues, higher expenses and higher credit costs.

Citicorp revenues decreased 2% from the prior year to $66.0 billion, reflecting a 2% decline in GCB revenues and lower revenues in Corporate/Other as ICG revenues were largely unchanged. As referenced above, excluding CVA/DVA in 2015 and the impact of FX translation, Citicorp's revenues increased 1% versus the prior year, as growth in the GCB and ICG franchises were partially offset by lower revenues in Corporate/Other .

GCB revenues of $31.8 billion decreased 2% versus the prior year. Excluding the impact of FX translation, GCB revenues increased 1%, as increases in North America GCB and Latin America GCB were partially offset by a decrease in Asia GCB . North America GCB revenues increased 1% to $20.0 billion, as higher revenues in Citi-branded cards were partially offset by lower retail banking revenues. Citi-branded cards revenues of $8.2 billion were up 5% versus the prior year, mostly reflecting the addition of the Costco portfolio. Citi retail services revenues of $6.4 billion were largely unchanged versus the prior year, as the impact of previously disclosed renewals and extension of several partnerships as well as the absence of revenues from portfolio exits was offset by modest growth in average loans. Retail banking revenues decreased 3% from the prior year to $5.3 billion. Excluding the previously disclosed $110 million gain on the sale of branches in Texas in the prior year, retail banking revenues decreased 1% reflecting lower mortgage revenues, partially offset by higher average loans and checking deposits.

North America GCB average deposits of $183 billion increased 1% year-over-year and average retail loans of $54 billion grew 9%. Average Citi retail services loans of $44 billion increased 1% versus the prior year while retail services purchase sales of $80 billion were unchanged versus the prior year. Average Citi-branded card loans of $73 billion increased 14%, while Citi-branded card purchase sales of $251 billion increased 37% versus the prior year, each including the impact of the Costco portfolio acquisition. For additional information on the results of operations of North America GCB for 2016, see " Global Consumer Banking - North America GCB " below.

International GCB revenues (consisting of Latin America GCB and Asia GCB (which includes the results of operations of GCB activities in certain EMEA countries)) decreased 8% versus the prior year to $11.8 billion, driven by a decline in Latin America GCB (14%) and Asia GCB (2%). Excluding the impact of FX translation, international GCB revenues were unchanged versus the prior year. Latin America GCB revenues increased 1% versus the prior year , as increases in average loan and deposit balances were partially offset by the

6

absence of the previously disclosed $160 million gain (excluding the impact of FX translation, $180 million as reported) related to the sale of Citi's merchant acquiring business in Mexico in the third quarter of 2015.

Asia GCB revenues declined 1% versus the prior year, reflecting lower wealth management revenues driven by weak investor sentiment in early 2016, partially offset by growth in cards revenues. For additional information on the results of operations of Latin America GCB and Asia GCB for 2016, including the impact of FX translation, see " Global Consumer Banking " below. Year-over-year, international GCB average deposits of $117 billion increased 6%, average retail loans of $86 billion decreased 1%, investment assets under management were largely unchanged, average card loans of $23 billion increased 1% and card purchase sales of $90 billion increased 3%, all excluding the impact of FX translation.

ICG revenues were $33.9 billion in 2016, largely unchanged from the prior year as a 4% increase in Markets and securities services was offset by a 5% decrease in Banking revenues (including the impact of $594 of million mark-to-market losses on hedges related to accrual loans within corporate lending, compared to gains of $324 million in the prior year). Excluding CVA/DVA in 2015 and the impact of mark-to-market gains (losses) on loan hedges, ICG revenues increased 3% from the prior year to $34.4 billion, driven by 6% growth in Markets and securities services and 1% growth in Banking revenues.

Banking revenues of $17.1 billion (excluding CVA/DVA in 2015 and the impact of mark-to-market gains (losses) on hedges), were up 1% compared to the prior year, as growth in treasury and trade solutions and private bank were partially offset by lower investment banking revenues. Investment banking revenues of $4.3 billion decreased 6% versus the prior year. Advisory revenues decreased 9% to $1.0 billion, primarily reflecting lower activity during the first half of 2016. Debt underwriting revenues increased 5% to $2.7 billion, as the continued low interest rate environment resulted in strong industry-wide activity in 2016, while equity underwriting revenues decreased 31% to $628 million, largely reflecting an industry-wide slowdown in activity during the year.

Private bank revenues increased 3% (3% excluding CVA/DVA in 2015) to $3.0 billion from the prior year, driven by loan growth and improved deposit spreads, partially offset by lower capital markets activity. Corporate lending revenues declined 46% to $1.2 billion, including $594 million of mark-to-market losses on hedges related to accrual loans compared to a $324 million gain in the prior year. Excluding the mark-to-market impact of loan hedges, corporate lending revenues decreased 3% versus the prior year, primarily driven by a lease financing adjustment in the second quarter of 2016, lower spreads and higher hedging costs. Treasury and trade solutions revenues of $8.1 billion increased 4% versus the prior year. Excluding the impact of FX translation, treasury and trade solutions revenues increased 8%, reflecting continued growth in transaction volumes and fee growth.

Markets and securities services revenues of $17.3 billion, excluding CVA/DVA in 2015, increased 6% from the prior year. Fixed income markets revenues of $13.0 billion

increased 13% (15% excluding CVA/DVA in 2015) from the prior year, driven by growth in both rates and currencies and spread products. Equity markets revenues of $2.9 billion decreased 10% (9% excluding CVA/DVA in 2015) from the prior year, reflecting an industry-wide slowdown in client activity. Securities services revenues of $2.2 billion increased 1% versus the prior year. Excluding the impact of FX translation, securities services revenues increased 5% as increased client activity, higher deposit volumes and improved spreads more than offset the absence of revenues from divested businesses. For additional information on the results of operations of ICG for 2016, see " Institutional Clients Group " below.

Corporate/Other revenues decreased to $410 million from $908 million in the prior year, primarily reflecting the absence of gains from real estate and other asset sales and the equity contribution related to Citi's stake in China Guangfa Bank, which was divested in the third quarter of 2016. For additional information on the results of operations of Corporate/Other for 2016, see " Corporate/Other " below.

Citicorp end-of-period loans increased 4% to $591 billion from the prior year, driven by a 5% increase in consumer loans and a 3% increase in corporate loans. Excluding the impact of FX translation, Citicorp loans grew 6%, with 8% growth in consumer loans and 4% growth in corporate loans.

Citi Holdings

Citi Holdings' net income was $600 million in 2016, compared to $974 million in the prior year. CVA/DVA was negative $15 million (negative $10 million after-tax) in 2015. Excluding the impact of CVA/DVA in the prior year, Citi Holdings' net income was $600 million, compared to $984 million in the prior year, primarily reflecting lower revenues, partially offset lower expenses and lower credit costs. Citi does not expect the same level of net income from Citi Holdings to recur in 2017.

Citi Holdings' revenues were $3.9 billion, down 57% from the prior year. Excluding CVA/DVA in 2015, Citi Holdings' revenues also decreased 57% to $3.9 billion from the prior year, mainly reflecting continued reductions in Citi Holdings assets and lower net gains on asset sales. For additional information on the results of operations of Citi Holdings for 2016, see "Citi Holdings" below.

As noted above, at the end of 2016, Citi Holdings' assets were $54 billion, 33% below the prior year, and represented approximately 3% of Citi's total GAAP assets. Citi Holdings' risk-weighted assets were $104 billion as of December 31, 2016, a decrease of 25% from the prior year, and represented 9% of Citi's risk-weighted assets under Basel III (based on the Advanced Approaches for determining risk-weighted assets).

7

RESULTS OF OPERATIONS

SUMMARY OF SELECTED FINANCIAL DATA-PAGE 1

Citigroup Inc. and Consolidated Subsidiaries

In millions of dollars, except per-share amounts and ratios | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||

Net interest revenue | $ | 45,104 | | $ | 46,630 | | $ | 47,993 | | $ | 46,793 | | $ | 46,686 | |

Non-interest revenue | 24,771 | | 29,724 | | 29,226 | | 29,931 | | 22,844 | | |||||

Revenues, net of interest expense | $ | 69,875 | | $ | 76,354 | | $ | 77,219 | | $ | 76,724 | | $ | 69,530 | |

Operating expenses | 41,416 | | 43,615 | | 55,051 | | 48,408 | | 50,036 | | |||||

Provisions for credit losses and for benefits and claims | 6,982 | | 7,913 | | 7,467 | | 8,514 | | 11,329 | | |||||

Income from continuing operations before income taxes | $ | 21,477 | | $ | 24,826 | | $ | 14,701 | | $ | 19,802 | | $ | 8,165 | |

Income taxes | 6,444 | | 7,440 | | 7,197 | | 6,186 | | 397 | | |||||

Income from continuing operations | $ | 15,033 | | $ | 17,386 | | $ | 7,504 | | $ | 13,616 | | $ | 7,768 | |

Income (loss) from discontinued operations, net of taxes (1) | (58 | ) | (54 | ) | (2 | ) | 270 | | (58 | ) | |||||

Net income before attribution of noncontrolling interests | $ | 14,975 | | $ | 17,332 | | $ | 7,502 | | $ | 13,886 | | $ | 7,710 | |

Net income attributable to noncontrolling interests | 63 | | 90 | | 192 | | 227 | | 219 | | |||||

Citigroup's net income | $ | 14,912 | | $ | 17,242 | | $ | 7,310 | | $ | 13,659 | | $ | 7,491 | |

Less: |

|

|

|

|

| ||||||||||

Preferred dividends-Basic | $ | 1,077 | | $ | 769 | | $ | 511 | | $ | 194 | | $ | 26 | |

Dividends and undistributed earnings allocated to employee restricted and deferred shares that contain nonforfeitable rights to dividends, applicable to basic EPS | 195 | | 224 | | 111 | | 263 | | 164 | | |||||

Income allocated to unrestricted common shareholders for basic EPS | $ | 13,640 | | $ | 16,249 | | $ | 6,688 | | $ | 13,202 | | $ | 7,301 | |

Add: Other adjustments to income | - | | - | | 1 | | 1 | | 10 | | |||||

Income allocated to unrestricted common shareholders for diluted EPS | $ | 13,640 | | $ | 16,249 | | $ | 6,689 | | $ | 13,203 | | $ | 7,311 | |

Earnings per share |

|

|

|

|

| ||||||||||

Basic |

|

|

|

|

| ||||||||||

Income from continuing operations | $ | 4.74 | | $ | 5.43 | | $ | 2.21 | | $ | 4.26 | | $ | 2.51 | |

Net income | 4.72 | | 5.41 | | 2.21 | | 4.35 | | 2.49 | | |||||

Diluted |

|

|

|

|

| ||||||||||

Income from continuing operations | $ | 4.74 | | $ | 5.42 | | $ | 2.20 | | $ | 4.25 | | $ | 2.44 | |

Net income | 4.72 | | 5.40 | | 2.20 | | 4.34 | | 2.42 | | |||||

Dividends declared per common share | 0.42 | | 0.16 | | 0.04 | | 0.04 | | 0.04 | | |||||

Statement continues on the next page, including notes to the table.

8

SUMMARY OF SELECTED FINANCIAL DATA-PAGE 2

| Citigroup Inc. and Consolidated Subsidiaries |

| |||||||||||||

In millions of dollars, except per-share amounts, ratios and direct staff | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||

At December 31: |

|

|

|

|

| ||||||||||

Total assets | $ | 1,792,077 | | $ | 1,731,210 | | $ | 1,842,181 | | $ | 1,880,035 | | $ | 1,864,328 | |

Total deposits | 929,406 | | 907,887 | | 899,332 | | 968,273 | | 930,560 | | |||||

Long-term debt | 206,178 | | 201,275 | | 223,080 | | 221,116 | | 239,463 | | |||||

Citigroup common stockholders' equity | 205,867 | | 205,139 | | 199,717 | | 197,254 | | 186,155 | | |||||

Total Citigroup stockholders' equity | 225,120 | | 221,857 | | 210,185 | | 203,992 | | 188,717 | | |||||

Direct staff (in thousands) | 219 | | 231 | | 241 | | 251 | | 259 | | |||||

Performance metrics |

|

|

|

|

| ||||||||||

Return on average assets | 0.82 | % | 0.95 | % | 0.39 | % | 0.73 | % | 0.39 | % | |||||

Return on average common stockholders' equity (2) | 6.6 | | 8.1 | | 3.4 | | 7.0 | | 4.1 | | |||||

Return on average total stockholders' equity (2) | 6.5 | | 7.9 | | 3.5 | | 6.9 | | 4.1 | | |||||

Efficiency ratio (Total operating expenses/Total revenues) | 59 | | 57 | | 71 | | 63 | | 72 | | |||||

Basel III ratios-full implementation |

|

|

|

|

| ||||||||||

Common Equity Tier 1 Capital (3) | 12.57 | % | 12.07 | % | 10.57 | % | 10.57 | % | 8.72 | % | |||||

Tier 1 Capital (3) | 14.24 | | 13.49 | | 11.45 | | 11.23 | | 9.03 | | |||||

Total Capital (3) | 16.24 | | 15.30 | | 12.80 | | 12.64 | | 10.81 | | |||||

Supplementary Leverage ratio (4) | 7.22 | | 7.08 | | 5.94 | | 5.42 | | N/A | | |||||

Citigroup common stockholders' equity to assets | 11.49 | % | 11.85 | % | 10.84 | % | 10.49 | % | 9.99 | % | |||||

Total Citigroup stockholders' equity to assets | 12.56 | | 12.82 | | 11.41 | | 10.85 | | 10.12 | | |||||

Dividend payout ratio (5) | 8.9 | | 3.0 | | 1.8 | | 0.9 | | 1.7 | | |||||

Book value per common share | $ | 74.26 | | $ | 69.46 | | $ | 66.05 | | $ | 65.12 | | $ | 61.46 | |

Tangible book value (TBV) per share (6) | $ | 64.57 | | $ | 60.61 | | $ | 56.71 | | $ | 55.19 | | $ | 51.08 | |

Ratio of earnings to fixed charges and preferred stock dividends | 2.54x | 2.89x | | 2.00x | | 2.18x | | 1.39x | | ||||||

(1) | See Note 2 to the Consolidated Financial Statements for additional information on Citi's discontinued operations. |

(2) | The return on average common stockholders' equity is calculated using net income less preferred stock dividends divided by average common stockholders' equity. The return on average total Citigroup stockholders' equity is calculated using net income divided by average Citigroup stockholders' equity. |

(3) | Citi's regulatory capital ratios reflect full implementation of the U.S. Basel III rules. Risk-weighted assets are based on the Basel III Advanced Approaches for determining total risk-weighted assets. |

(4) | Citi's Supplementary Leverage ratio reflects full implementation of the U.S. Basel III rules. |

(5) Dividends declared per common share as a percentage of net income per diluted share.

(6) For information on TBV, see "Capital Resources-Tangible Common Equity, Tangible Book Value Per Share, Book Value Per Share and Returns on Equity" below.

N/A Not Applicable

9

SEGMENT AND BUSINESS-INCOME (LOSS) AND REVENUES

CITIGROUP INCOME

In millions of dollars | 2016 | 2015 | 2014 | % Change | % Change | ||||||||

Income (loss) from continuing operations |

|

|

|

|

| ||||||||

CITICORP |

|

|

|

|

| ||||||||

Global Consumer Banking |

|

|

|

|

| ||||||||

North America | $ | 3,356 | | $ | 4,311 | | $ | 4,488 | | (22 | )% | (4 | )% |

Latin America | 669 | | 868 | | 993 | | (23 | ) | (13 | ) | |||

Asia (1) | 1,083 | | 1,197 | | $ | 1,221 | | (10 | ) | (2 | ) | ||

Total | $ | 5,108 | | $ | 6,376 | | $ | 6,702 | | (20 | )% | (5 | )% |

Institutional Clients Group |

|

|

|

|

| ||||||||

North America | $ | 3,678 | | $ | 3,517 | | $ | 4,155 | | 5 | % | (15 | )% |

EMEA | 2,476 | | 2,340 | | 2,060 | | 6 | | 14 | | |||

Latin America | 1,481 | | 1,393 | | 1,401 | | 6 | | (1 | ) | |||

Asia | 2,293 | | 2,279 | | 2,029 | | 1 | | 12 | | |||

Total | $ | 9,928 | | $ | 9,529 | | $ | 9,645 | | 4 | % | (1 | )% |

Corporate/Other | $ | (609 | ) | $ | 496 | | $ | (5,373 | ) | NM | | NM | |

Total Citicorp | $ | 14,427 | | $ | 16,401 | | $ | 10,974 | | (12 | )% | 49 | % |

Citi Holdings | $ | 606 | | $ | 985 | | $ | (3,470 | ) | (38 | )% | NM | |

Income from continuing operations | $ | 15,033 | | $ | 17,386 | | $ | 7,504 | | (14 | )% | NM | |

Discontinued operations | $ | (58 | ) | $ | (54 | ) | $ | (2 | ) | (7 | )% | NM | |

Net income attributable to noncontrolling interests | 63 | | 90 | | 192 | | (30 | )% | (53 | )% | |||

Citigroup's net income | $ | 14,912 | | $ | 17,242 | | $ | 7,310 | | (14 | )% | NM | |

(1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

NM Not meaningful

10

In millions of dollars | 2016 | 2015 | 2014 | % Change | % Change | ||||||||

CITICORP |

|

|

|

|

| ||||||||

Global Consumer Banking |

|

|

|

|

| ||||||||

North America | $ | 19,956 | | $ | 19,718 | | $ | 19,948 | | 1 | % | (1 | )% |

Latin America | 4,969 | | 5,770 | | 6,557 | | (14 | ) | (12 | ) | |||

Asia (1) | 6,838 | | 7,007 | | 7,791 | | (2 | ) | (10 | ) | |||

Total | $ | 31,763 | | $ | 32,495 | | $ | 34,296 | | (2 | )% | (5 | )% |

Institutional Clients Group |

|

|

|

|

| ||||||||

North America | $ | 12,817 | | $ | 12,980 | | $ | 13,002 | | (1 | )% | - | % |

EMEA | 10,029 | | 9,958 | | 9,511 | | 1 | | 5 | | |||

Latin America | 4,026 | | 4,051 | | 4,218 | | (1 | ) | (4 | ) | |||

Asia | 6,978 | | 7,002 | | 6,581 | | - | | 6 | | |||

Total | $ | 33,850 | | $ | 33,991 | | $ | 33,312 | | - | % | 2 | % |

Corporate/Other | $ | 410 | | $ | 908 | | $ | 303 | | (55 | )% | NM | |

Total Citicorp | $ | 66,023 | | $ | 67,394 | | $ | 67,911 | | (2 | )% | (1 | )% |

Citi Holdings | $ | 3,852 | | $ | 8,960 | | $ | 9,308 | | (57 | )% | (4 | )% |

Total Citigroup net revenues | $ | 69,875 | | $ | 76,354 | | $ | 77,219 | | (8 | )% | (1 | )% |

(1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

NM Not meaningful

11

SEGMENT BALANCE SHEET

(1)In millions of dollars | Global Consumer Banking | Institutional Clients Group | Corporate/Other and consolidating eliminations (2) | Subtotal Citicorp | Citi Holdings | Citigroup Parent company- issued long-term debt and stockholders' equity (3) | Total Citigroup consolidated | ||||||||||||||

Assets |

|

|

|

|

|

|

| ||||||||||||||

Cash and deposits with banks | $ | 9,779 | | $ | 63,697 | | $ | 86,559 | | $ | 160,035 | | $ | 459 | | $ | - | | $ | 160,494 | |

Federal funds sold and securities borrowed or purchased under agreements to resell | 219 | | 236,078 | | - | | 236,297 | | 516 | | - | | 236,813 | | |||||||

Trading account assets | 6,511 | | 234,322 | | 727 | | 241,560 | | 2,365 | | - | | 243,925 | | |||||||

Investments | 9,499 | | 114,044 | | 225,239 | | 348,782 | | 4,522 | | - | | 353,304 | | |||||||

Loans, net of unearned income and |

|

|

|

|

|

|

| ||||||||||||||

allowance for loan losses | 284,089 | | 296,215 | | - | | 580,304 | | 32,005 | | - | | 612,309 | | |||||||

Other assets | 41,922 | | 87,940 | | 42,988 | | 172,850 | | 12,382 | | - | | 185,232 | | |||||||

Liquidity assets (4) | 61,046 | | 243,483 | | (306,049 | ) | (1,520 | ) | 1,520 | | - | | - | | |||||||

Total assets | $ | 413,065 | | $ | 1,275,779 | | $ | 49,464 | | $ | 1,738,308 | | $ | 53,769 | | $ | - | | $ | 1,792,077 | |

Liabilities and equity |

|

|

|

|

|

|

| ||||||||||||||

Total deposits | $ | 301,336 | | $ | 610,368 | | $ | 15,495 | | $ | 927,199 | | $ | 2,207 | | $ | - | | $ | 929,406 | |

Federal funds purchased and securities loaned or sold under agreements to repurchase | 4,120 | | 137,658 | | - | | 141,778 | | 43 | | - | | 141,821 | | |||||||

Trading account liabilities | 16 | | 138,601 | | 46 | | 138,663 | | 382 | | - | | 139,045 | | |||||||

Short-term borrowings | 458 | | 18,242 | | 12,001 | | 30,701 | | - | | - | | 30,701 | | |||||||

Long-term debt (3) | 1,194 | | 31,626 | | 22,176 | | 54,996 | | 3,849 | | 147,333 | | 206,178 | | |||||||

Other liabilities | 18,827 | | 77,961 | | 16,272 | | 113,060 | | 5,723 | | - | | 118,783 | | |||||||

Net inter-segment funding (lending) (3) | 87,114 | | 261,323 | | (17,549 | ) | 330,888 | | 41,565 | | (372,453 | ) | - | | |||||||

Total liabilities | $ | 413,065 | | $ | 1,275,779 | | $ | 48,441 | | $ | 1,737,285 | | $ | 53,769 | | $ | (225,120 | ) | $ | 1,565,934 | |

Total equity (5) | - | | - | | 1,023 | | 1,023 | | - | | 225,120 | | 226,143 | | |||||||

Total liabilities and equity | $ | 413,065 | | $ | 1,275,779 | | $ | 49,464 | | $ | 1,738,308 | | $ | 53,769 | | $ | - | | $ | 1,792,077 | |

(1) | The supplemental information presented in the table above reflects Citigroup's consolidated GAAP balance sheet by reporting segment as of December 31, 2016 . The respective segment information depicts the assets and liabilities managed by each segment as of such date. |

(2) | Consolidating eliminations for total Citigroup and Citigroup parent company assets and liabilities are recorded within Corporate/Other. |

(3) | The total stockholders' equity and the majority of long-term debt of Citigroup reside in the Citigroup parent company Consolidated Balance Sheet. Citigroup allocates stockholders' equity and long-term debt to its businesses through inter-segment allocations as shown above. |

(4) | Represents the attribution of Citigroup's liquidity assets (primarily consisting of cash and available-for-sale securities) to the various businesses based on Liquidity Coverage Ratio (LCR) assumptions. |

(5) | Citicorp equity represents noncontrolling interests. |

12

CITICORP

Citicorp is Citigroup's global bank for consumers and businesses and represents Citi's core franchises. Citicorp is focused on providing best-in-class products and services to customers and leveraging Citigroup's unparalleled global network, including many of the world's emerging economies. Citicorp is physically present in 97 countries and jurisdictions, many for over 100 years, and offers services in over 160 countries and jurisdictions. Citi believes this global network provides a strong foundation for servicing the broad financial services needs of its large multinational clients and for meeting the needs of retail, private banking, commercial, public sector and institutional clients around the world.

Citicorp consists of the following operating businesses: Global Consumer Banking (which consists of consumer banking businesses in North America, Latin America (consisting of Citi's consumer banking businesses in Mexico) and Asia ) and Institutional Clients Group (which includes Banking and Markets and securities services ). Citicorp also includes Corporate/Other . At December 31, 2016, Citicorp had approximately $1.7 trillion of assets and $927 billion of deposits, representing approximately 97% of Citi's total assets and nearly100% of Citi's total deposits.

As announced in April 2016, beginning in the first quarter of 2017, the remaining businesses and portfolios of assets in Citi Holdings will be reported as part of Corporate/Other and Citi Holdings will cease to be a separately reported business segment. These businesses and assets, consisting of approximately $54 billion of assets, $33 billion of loans and $2 billion of deposits, contributed approximately $3.9 billion of revenues, $3.2 billion of expenses and net income of $600 million in 2016. For additional information, see "Citigroup Segments" above and "Citi Holdings" below.

In millions of dollars except as otherwise noted | 2016 | 2015 | 2014 | % Change | % Change | ||||||||

Net interest revenue | $ | 43,066 | | $ | 42,173 | | $ | 42,436 | | 2 | % | (1 | )% |

Non-interest revenue | 22,957 | | 25,221 | | 25,475 | | (9 | ) | (1 | ) | |||

Total revenues, net of interest expense | $ | 66,023 | | $ | 67,394 | | $ | 67,911 | | (2 | )% | (1 | )% |

Provisions for credit losses and for benefits and claims |

|

|

|

|

| ||||||||

Net credit losses | $ | 6,128 | | $ | 5,966 | | $ | 6,787 | | 3 | % | (12 | )% |

Credit reserve build (release) | 643 | | 261 | | (1,225 | ) | NM | | NM | | |||

Provision for loan losses | $ | 6,771 | | $ | 6,227 | | $ | 5,562 | | 9 | % | 12 | % |

Provision for benefits and claims | 105 | | 107 | | 145 | | (2 | ) | (26 | ) | |||

Provision for unfunded lending commitments | 37 | | 97 | | (151 | ) | (62 | ) | NM | | |||

Total provisions for credit losses and for benefits and claims | $ | 6,913 | | $ | 6,431 | | $ | 5,556 | | 7 | % | 16 | % |

Total operating expenses | $ | 38,245 | | $ | 38,044 | | $ | 44,192 | | 1 | % | (14 | )% |

Income from continuing operations before taxes | $ | 20,865 | | $ | 22,919 | | $ | 18,163 | | (9 | )% | 26 | % |

Income taxes | 6,438 | | 6,518 | | 7,189 | | (1 | ) | (9 | ) | |||

Income from continuing operations | $ | 14,427 | | $ | 16,401 | | $ | 10,974 | | (12 | )% | 49 | % |

Income (loss) from discontinued operations, net of taxes | (58 | ) | (54 | ) | (2 | ) | (7 | ) | NM | | |||

Noncontrolling interests | 57 | | 79 | | 186 | | (28 | ) | (58 | ) | |||

Net income | $ | 14,312 | | $ | 16,268 | | $ | 10,786 | | (12 | )% | 51 | % |

Balance Sheet data (in billions of dollars) |

|

|

|

|

| ||||||||

Total end-of-period (EOP) assets | $ | 1,738 | | $ | 1,650 | | $ | 1,704 | | 5 | % | (3 | )% |

Average assets | 1,741 | | 1,705 | | 1,743 | | 2 | | (2 | ) | |||

Return on average assets | 0.82 | % | 0.95 | % | 0.62 | % |

|

| |||||

Efficiency ratio | 58 | | 56 | | 65 | |

|

| |||||

Total EOP loans | $ | 591 | | $ | 569 | | $ | 559 | | 4 | | 2 | |

Total EOP deposits | 927 | | 898 | | 878 | | 3 | | 2 | | |||

NM Not meaningful

13

GLOBAL CONSUMER BANKING

Global Consumer Banking (GCB) provides traditional banking services to retail customers through retail banking, including commercial banking, and Citi-branded cards and Citi retail services (for additional information on these businesses, see "Citigroup Segments" above). GCB is focused on its priority markets in the U.S., Mexico and Asia with 2,649 branches in 19 countries as of December 31, 2016. At December 31, 2016, GCB had approximately $413 billion of assets and $301 billion of deposits.

GCB's overall strategy is to leverage Citi's global footprint and seek to be the preeminent bank for the emerging affluent and affluent consumers in large urban centers. In credit cards and in certain retail markets, Citi serves customers in a somewhat broader set of segments and geographies.

In millions of dollars except as otherwise noted | 2016 | 2015 | 2014 | % Change | % Change | ||||||||

Net interest revenue | $ | 26,259 | | $ | 25,984 | | $ | 26,835 | | 1 | % | (3 | )% |

Non-interest revenue | 5,504 | | 6,511 | | 7,461 | | (15 | ) | (13 | ) | |||

Total revenues, net of interest expense | $ | 31,763 | | $ | 32,495 | | $ | 34,296 | | (2 | )% | (5 | )% |

Total operating expenses | $ | 17,516 | | $ | 17,220 | | $ | 18,681 | | 2 | % | (8 | )% |

Net credit losses | $ | 5,612 | | $ | 5,752 | | $ | 6,512 | | (2 | )% | (12 | )% |

Credit reserve build (release) | 707 | | (393 | ) | (1,123 | ) | NM | | 65 | | |||

Provision (release) for unfunded lending commitments | 3 | | 3 | | (25 | ) | - | | NM | | |||

Provision for benefits and claims | 105 | | 107 | | 145 | | (2 | ) | (26 | ) | |||

Provisions for credit losses and for benefits and claims | $ | 6,427 | | $ | 5,469 | | $ | 5,509 | | 18 | % | (1 | )% |

Income from continuing operations before taxes | $ | 7,820 | | $ | 9,806 | | $ | 10,106 | | (20 | )% | (3 | )% |

Income taxes | 2,712 | | 3,430 | | 3,404 | | (21 | ) | 1 | | |||

Income from continuing operations | $ | 5,108 | | $ | 6,376 | | $ | 6,702 | | (20 | )% | (5 | )% |

Noncontrolling interests | 7 | | 10 | | 24 | | (30 | ) | (58 | ) | |||

Net income | $ | 5,101 | | $ | 6,366 | | $ | 6,678 | | (20 | )% | (5 | )% |

Balance Sheet data (in billions of dollars) |

|

|

|

|

| ||||||||

Average assets | $ | 397 | | $ | 379 | | $ | 393 | | 5 | % | (4 | )% |

Return on average assets | 1.28 | % | 1.68 | % | 1.70 | % |

|

| |||||

Efficiency ratio | 55 | | 53 | | 54 | |

|

| |||||

Total EOP assets | $ | 413 | | $ | 381 | | $ | 393 | | 8 | | (3 | ) |

Average deposits | 300 | | 297 | | 300 | | 1 | | (1 | ) | |||

Net credit losses as a percentage of average loans | 2.00 | % | 2.11 | % | 2.32 | % |

|

| |||||

Revenue by business |

|

|

|

|

| ||||||||

Retail banking | $ | 13,039 | | $ | 13,865 | | $ | 14,340 | | (6 | )% | (3 | )% |

Cards (1) | 18,724 | | 18,630 | | 19,956 | | 1 | | (7 | ) | |||

Total | $ | 31,763 | | $ | 32,495 | | $ | 34,296 | | (2 | )% | (5 | )% |

Income from continuing operations by business |

|

|

|

|

| ||||||||

Retail banking | $ | 1,637 | | $ | 2,015 | | $ | 1,741 | | (19 | )% | 16 | % |

Cards (1) | 3,471 | | 4,361 | | 4,961 | | (20 | ) | (12 | ) | |||

Total | $ | 5,108 | | $ | 6,376 | | $ | 6,702 | | (20 | )% | (5 | )% |

Table continues on next page.

14

Foreign currency (FX) translation impact |

|

|

|

|

| ||||||||

Total revenue-as reported | $ | 31,763 | | $ | 32,495 | | $ | 34,296 | | (2 | )% | (5 | )% |

Impact of FX translation (2) | - | | (1,003 | ) | (2,532 | ) |

|

| |||||

Total revenues-ex-FX (3) | $ | 31,763 | | $ | 31,492 | | $ | 31,764 | | 1 | % | (1 | )% |

Total operating expenses-as reported | $ | 17,516 | | $ | 17,220 | | $ | 18,681 | | 2 | % | (8 | )% |

Impact of FX translation (2) | - | | (465 | ) | (1,441 | ) |

|

| |||||

Total operating expenses-ex-FX (3) | $ | 17,516 | | $ | 16,755 | | $ | 17,240 | | 5 | % | (3 | )% |

Total provisions for LLR & PBC-as reported | $ | 6,427 | | $ | 5,469 | | $ | 5,509 | | 18 | % | (1 | )% |

Impact of FX translation (2) | - | | (213 | ) | (613 | ) |

|

| |||||

Total provisions for LLR & PBC-ex-FX (3) | $ | 6,427 | | $ | 5,256 | | $ | 4,896 | | 22 | % | 7 | % |

Net income-as reported | $ | 5,101 | | $ | 6,366 | | $ | 6,678 | | (20 | )% | (5 | )% |

Impact of FX translation (2) | - | | (243 | ) | (333 | ) |

|

| |||||

Net income-ex-FX (3) | $ | 5,101 | | $ | 6,123 | | $ | 6,345 | | (17 | )% | (3 | )% |

(1) | Includes both Citi-branded cards and Citi retail services. |

(2) | Reflects the impact of FX translation into U.S. dollars at the 2016 average exchange rates for all periods presented. |

(3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

NM Not meaningful

15

NORTH AMERICA GCB

North America GCB provides traditional retail banking, including commercial banking, and its Citi-branded cards and Citi retail services card products to retail customers and small to mid-size businesses, as applicable, in the U.S. North America GCB 's U.S. cards product portfolio includes its proprietary portfolio (including the Citi Double Cash, Thank You and Value cards) and co-branded cards (including, among others, American Airlines and Costco) within Citi-branded cards as well as its co-brand and private label relationships (including, among others, Sears, The Home Depot, Macy's and Best Buy) within Citi retail services.

As of December 31, 2016, North America GCB 's 723 retail bank branches are concentrated in the six key metropolitan areas of New York, Chicago, Miami, Washington, D.C., Los Angeles and San Francisco. Also as of December 31, 2016, North America GCB had approximately 10.5 million retail banking customer accounts, $55.3 billion of retail banking loans and $185.0 billion of deposits. In addition, North America GCB had approximately 120.6 million Citi-branded and Citi retail services credit card accounts with $133.3 billion in outstanding card loan balances.

In millions of dollars, except as otherwise noted | 2016 | 2015 | 2014 | % Change 2016 vs. 2015 | % Change | ||||||||

Net interest revenue | $ | 18,327 | | $ | 17,609 | | $ | 17,329 | | 4 | % | 2 | % |

Non-interest revenue | 1,629 | | 2,109 | | 2,619 | | (23 | ) | (19 | ) | |||

Total revenues, net of interest expense | $ | 19,956 | | $ | 19,718 | | $ | 19,948 | | 1 | % | (1 | )% |

Total operating expenses | $ | 10,080 | | $ | 9,381 | | $ | 9,898 | | 7 | % | (5 | )% |

Net credit losses | $ | 3,921 | | $ | 3,751 | | $ | 4,202 | | 5 | % | (11 | )% |

Credit reserve build (release) | 652 | | (337 | ) | (1,241 | ) | NM | | 73 | | |||

Provision for unfunded lending commitments | 6 | | 7 | | (9 | ) | (14 | ) | NM | | |||

Provisions for benefits and claims | 33 | | 38 | | 41 | | (13 | ) | (7 | ) | |||

Provisions for credit losses and for benefits and claims | $ | 4,612 | | $ | 3,459 | | $ | 2,993 | | 33 | % | 16 | % |

Income from continuing operations before taxes | $ | 5,264 | | $ | 6,878 | | $ | 7,057 | | (23 | )% | (3 | )% |

Income taxes | 1,908 | | 2,567 | | 2,569 | | (26 | ) | - | | |||

Income from continuing operations | $ | 3,356 | | $ | 4,311 | | $ | 4,488 | | (22 | )% | (4 | )% |

Noncontrolling interests | (2 | ) | 3 | | 1 | | NM | | NM | | |||

Net income | $ | 3,358 | | $ | 4,308 | | $ | 4,487 | | (22 | )% | (4 | )% |

Balance Sheet data (in billions of dollars) |

|

| |

| |

|

| ||||||

Average assets | $ | 229 | | $ | 209 | | $ | 212 | | 10 | % | (1 | )% |

Return on average assets | 1.47 | % | 2.06 | % | 2.12 | % |

|

| |||||

Efficiency ratio | 51 | | 48 | | 50 | |

|

| |||||

Average deposits | $ | 183.2 | | $ | 180.7 | | $ | 179.5 | | 1 | | 1 | |

Net credit losses as a percentage of average loans | 2.29 | % | 2.39 | % | 2.69 | % |

|

| |||||

Revenue by business |

|

| |

| |

|

| ||||||

Retail banking | $ | 5,295 | | $ | 5,478 | | $ | 5,196 | | (3 | )% | 5 | % |

Citi-branded cards | 8,235 | | 7,809 | | 8,290 | | 5 | | (6 | ) | |||

Citi retail services | 6,426 | | 6,431 | | 6,462 | | - | | - | | |||

Total | $ | 19,956 | | $ | 19,718 | | $ | 19,948 | | 1 | % | (1 | )% |

Income from continuing operations by business |

|

| |

| |

|

| ||||||

Retail banking | $ | 567 | | $ | 715 | | $ | 431 | | (21 | )% | 66 | % |

Citi-branded cards | 1,497 | | 2,075 | | 2,391 | | (28 | ) | (13 | ) | |||

Citi retail services | 1,292 | | 1,521 | | 1,666 | | (15 | ) | (9 | ) | |||

Total | $ | 3,356 | | $ | 4,311 | | $ | 4,488 | | (22 | )% | (4 | )% |

NM Not meaningful

16

2016 vs. 2015

Net income decreased by 22% due to significantly higher cost of credit and higher expenses, partially offset by higher revenues.

Revenues increased 1%, reflecting higher revenues in Citi-branded cards, partially offset by lower revenues in retail banking.

Retail banking revenues decreased 3%. Excluding the previously disclosed $110 million gain on sale of branches in Texas in the first quarter of 2015, revenues decreased 1%, primarily driven by lower mortgage revenues. The decline in mortgage revenues was due to lower gain on sale revenues due to lower mortgage originations, lower servicing revenues and lower spreads driven by higher cost of funds. North America GCB expects higher interest rates could negatively impact mortgage revenues in 2017. The decline in mortgage revenues was partially offset by continued volume growth, including growth in average loans (9%) and average checking deposits (9%).

Cards revenues increased 3%. In Citi-branded cards, revenues increased 5%, primarily reflecting the acquisition of the Costco portfolio (completed June 17, 2016) as well as volume growth, partially offset by higher investment-related acquisition and rewards costs and the impact of higher promotional balances. Average loans grew 14% (3% excluding Costco) and purchase sales grew 37% (9% excluding Costco), driven by continued investments in the portfolio. While North America GCB believes it has largely absorbed the impact of higher acquisition and rewards costs as of year-end 2016, it expects the negative impact of higher promotional balances driven by new card accounts in the business could continue to impact Citi-branded cards revenues in the first half of 2017, with this impact abating in the second half of 2017.

Citi retail services revenues were largely unchanged as the impact of the previously disclosed renewal and extension of several partnerships within the portfolio as well as the absence of revenues from portfolio exits were offset by modest growth in average loans. Average loans increased 1%, while purchase sales were largely unchanged. North America GCB expects Citi retail services revenues to continue to reflect the impacts of the more competitive terms of the partnership renewals and the portfolio sales during 2017, partially offset by volume growth.

Expenses increased 7%, primarily due to the Costco acquisition, continued investment spending (including marketing spending), volume growth, higher repositioning charges and regulatory and compliance costs. This increase was partially offset by ongoing efficiency savings, including continued reductions in retail banking branches (7%) in 2016, and lower legal and related costs.

Provisions increased 33%, driven by a net loan loss reserve build ($658 million), compared to a loan loss reserve release in the prior year ($330 million), and higher net credit losses (5%). The net loan loss reserve build mostly reflected reserve builds in the cards portfolios and was primarily driven by the impact of the acquisition of the Costco portfolio, as well as volume growth and seasoning of the portfolios and the absence of nearly $400 million of reserve releases in 2015 as

credit normalized. The reserve build was also due to the estimated impact of proposed regulatory guidelines in July 2016 on third-party debt collections.

The increase in net credit losses was driven by increases in the cards businesses and retail banking. In retail banking, net credit losses grew 38% to $207 million, primarily due to an increase related to Citi's energy and energy-related exposures within the commercial banking portfolio, which was largely offset by releases of previously established loan loss reserves (for information on Citi's energy and energy-related exposures within commercial banking in North America GCB , see "Credit Risk-Commercial Credit" below).

In Citi-branded cards, net credit losses increased 1% to $1.9 billion, driven by volume growth (14% increase in average loans), including the impact of Costco beginning in the fourth quarter of 2016, seasoning and the impact of the regulatory changes on collections. In Citi retail services, net credit losses increased 6% to $1.8 billion, primarily due to portfolio growth and seasoning and the impact of the regulatory changes on collections. North America GCB expects net credit losses in 2017 in cards to reflect the full year impact of the Costco portfolio acquisition, portfolio growth and seasoning and the impact of regulatory changes on collections.

For additional information on North America GCB's retail banking, including commercial banking, and its Citi-branded cards and Citi retail services portfolios, see "Credit Risk-Consumer Credit" below.

2015 vs. 2014

Net income decreased by 4% due to lower loan loss reserve releases and lower revenues, partially offset by lower expenses and lower net credit losses.

Revenues decreased 1%, reflecting lower revenues in Citi-branded cards, partially offset by higher revenues in retail banking. Retail banking revenues increased 5%. The increase was primarily driven by 7% growth in average loans, 9% growth in average checking deposits, improved deposit spreads and slightly higher mortgage origination revenues, partially offset by lower net gains on branch sales (approximately $40 million) and mortgage portfolio sales (approximately $80 million) as well as a lower mortgage repurchase reserve release (approximately $50 million) compared to 2014. Cards revenues decreased 3% due to a 2% decline in average loans, partially offset by a 4% increase in purchase sales. In Citi-branded cards, revenues decreased 6%, primarily reflecting an increase in acquisition and rewards costs, particularly during the second half of 2015, as North America GCB deployed its investment spending to grow its new account acquisitions in its core products. The decrease in Citi-branded cards revenues was also due to the continued impact of lower average loans (down 4%), driven primarily by continued high customer payment rates during the year, partially offset by a 6% increase in purchase sales.

Citi retail services revenues were largely unchanged as the continued impact of lower fuel prices and higher contractual partner payments was offset by the impact of higher spreads. Purchase sales were unchanged as the

17

continued impact of lower fuel prices was offset by volume growth.

Expenses decreased 5%, primarily due to ongoing cost reduction initiatives, including as a result of North America GCB's branch rationalization strategy, and lower repositioning charges, partially offset by increased investment spending (including marketing, among other areas) in Citi-branded cards.

Provisions increased 16% largely due to lower net loan loss reserve releases (74%), partially offset by lower net credit losses (11%). Net credit losses declined in Citi-branded cards (down 14% to $1.9 billion) and in Citi retail services (down 8% to $1.7 billion). The lower loan loss reserve release reflected overall credit stabilization in the cards portfolios during 2015.

18

LATIN AMERICA GCB

Latin America GCB provides traditional retail banking, including commercial banking, and its Citi-branded card products to retail customers and small to mid-size businesses in Mexico through Citibanamex (previously known as Banco Nacional de Mexico, or Banamex), one of Mexico's largest banks.

At December 31, 2016, Latin America GCB had 1,494 retail branches in Mexico, with approximately 27.4 million retail banking customer accounts, $18.3 billion in retail banking loans and $26.4 billion in deposits. In addition, the business had approximately 5.8 million Citi-branded card accounts with $4.8 billion in outstanding loan balances.

In millions of dollars, except as otherwise noted | 2016 | 2015 | 2014 | % Change 2016 vs. 2015 | % Change | ||||||||

Net interest revenue | $ | 3,469 | | $ | 3,885 | | $ | 4,537 | | (11 | )% | (14 | )% |

Non-interest revenue | 1,500 | | 1,885 | | 2,020 | | (20 | ) | (7 | ) | |||

Total revenues, net of interest expense | $ | 4,969 | | $ | 5,770 | | $ | 6,557 | | (14 | )% | (12 | )% |

Total operating expenses | $ | 2,850 | | $ | 3,262 | | $ | 3,583 | | (13 | )% | (9 | )% |

Net credit losses | $ | 1,040 | | $ | 1,280 | | $ | 1,515 | | (19 | )% | (16 | )% |

Credit reserve build (release) | 83 | | 33 | | 128 | | NM | | (74 | ) | |||

Provision (release) for unfunded lending commitments | 1 | | (2 | ) | - | | NM | | - | | |||

Provision for benefits and claims | 72 | | 69 | | 104 | | 4 | | (34 | ) | |||

Provisions for credit losses and for benefits and claims (LLR & PBC) | $ | 1,196 | | $ | 1,380 | | $ | 1,747 | | (13 | )% | (21 | )% |

Income from continuing operations before taxes | $ | 923 | | $ | 1,128 | | $ | 1,227 | | (18 | )% | (8 | )% |

Income taxes | 254 | | 260 | | 234 | | (2 | ) | 11 | | |||

Income from continuing operations | $ | 669 | | $ | 868 | | $ | 993 | | (23 | )% | (13 | )% |

Noncontrolling interests | 5 | | 3 | | 6 | | 67 | | (50 | ) | |||

Net income | $ | 664 | | $ | 865 | | $ | 987 | | (23 | )% | (12 | )% |

Balance Sheet data (in billions of dollars) |

|

| |

| |

|

| ||||||

Average assets | $ | 49 | | $ | 54 | | $ | 63 | | (9 | )% | (14 | )% |

Return on average assets | 1.36 | % | 1.60 | % | 1.57 | % |

|

| |||||

Efficiency ratio | 57 | | 57 | | 55 | |

|

| |||||

Average deposits | $ | 27.3 | | $ | 28.1 | | $ | 30.9 | | (3 | ) | (9 | ) |

Net credit losses as a percentage of average loans | 4.26 | % | 4.81 | % | 4.97 | % |

|

| |||||

Revenue by business |

|

|

|

|

| ||||||||

Retail banking | $ | 3,494 | | $ | 3,981 | | $ | 4,376 | | (12 | )% | (9 | )% |

Citi-branded cards | 1,475 | | 1,789 | | 2,181 | | (18 | ) | (18 | ) | |||

Total | $ | 4,969 | | $ | 5,770 | | $ | 6,557 | | (14 | )% | (12 | )% |

Income from continuing operations by business |

|

| |

| |

|

| ||||||

Retail banking | $ | 390 | | $ | 562 | | $ | 647 | | (31 | )% | (13 | )% |

Citi-branded cards | 279 | | 306 | | 346 | | (9 | ) | (12 | ) | |||

Total | $ | 669 | | $ | 868 | | $ | 993 | | (23 | )% | (13 | )% |

FX translation impact |

|

| |

| |

|

| ||||||

Total revenues-as reported | $ | 4,969 | | $ | 5,770 | | $ | 6,557 | | (14 | )% | (12 | )% |

Impact of FX translation (1) | - | | (874 | ) | (1,825 | ) |

|

| |||||

Total revenues-ex-FX (2) | $ | 4,969 | | $ | 4,896 | | $ | 4,732 | | 1 | % | 3 | % |

Total operating expenses-as reported | $ | 2,850 | | $ | 3,262 | | $ | 3,583 | | (13 | )% | (9 | )% |

Impact of FX translation (1) | - | | (360 | ) | (902 | ) |

|

| |||||

Total operating expenses-ex-FX (2) | $ | 2,850 | | $ | 2,902 | | $ | 2,681 | | (2 | )% | 8 | % |

Provisions for LLR & PBC-as reported | $ | 1,196 | | $ | 1,380 | | $ | 1,747 | | (13 | )% | (21 | )% |

Impact of FX translation (1) | - | | (201 | ) | (497 | ) |

|

| |||||

Provisions for LLR & PBC-ex-FX (2) | $ | 1,196 | | $ | 1,179 | | $ | 1,250 | | 1 | % | (6 | )% |

Net income-as reported | $ | 664 | | $ | 865 | | $ | 987 | | (23 | )% | (12 | )% |

Impact of FX translation (1) | - | | (243 | ) | (320 | ) |

|

| |||||

Net income-ex-FX (2) | $ | 664 | | $ | 622 | | $ | 667 | | 7 | % | (7 | )% |

(1) | Reflects the impact of FX translation into U.S. dollars at the 2016 average exchange rates for all periods presented. |

(2) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

NM Not meaningful

19

The discussion of the results of operations for Latin America GCB below excludes the impact of FX translation for all periods presented. Presentations of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. For a reconciliation of certain of these metrics to the reported results, see the table above.

2016 vs. 2015

Net income increased 7%, driven by higher revenues and lower expenses, partially offset by higher credit costs.

Revenues increased 1%, driven by overall volume growth, largely offset by the absence of a previously disclosed $160 million gain on sale (excluding the impact of FX translation, $180 million as reported) related to the sale of the merchant acquiring business in Mexico in the third quarter of 2015. Excluding this gain, revenues increased 5%, primarily due to higher revenues in retail banking, partially offset by lower revenues in cards.

Retail banking revenues increased 4%. Excluding the gain on sale related to the merchant acquiring business, revenues increased 9%, driven by volume growth, including an increase in average loans (8%) due to higher personal loans, and higher average deposits (12%). Cards revenues decreased 4%, driven by the continued impact of higher payment rates, partially offset by increased purchase sales (8%).

Expenses decreased 2% as lower legal and related expenses, the impact of business divestitures, ongoing efficiency savings and the impact of certain episodic items in 2015 were partially offset by higher repositioning charges and ongoing investment spending. Citi continues to execute on its investment plans for Citibanamex (totaling more than $1 billion over the next several years), including initiatives to modernize the branch network, enhance digital capabilities and upgrade core operating platforms.

Provisions increased 1%, driven by a higher net loan loss reserve build, partially offset by lower net credit losses. The net loan loss reserve build increased $56 million, largely due to volume growth within the personal loan and mortgage portfolios. Net credit losses decreased 5%, largely reflecting continued lower net credit losses in the cards portfolio due to a focus on higher credit quality customers, partially offset by higher net credit losses in the personal loan portfolio. Despite this decrease, Latin America GCB expects net credit losses within its loan portfolios could increase consistent with continued portfolio growth and seasoning. For additional information on Latin America GCB's retail banking, including commercial banking, and its Citi-branded cards portfolios, see "Credit Risk-Consumer Credit" below.

In 2016, Mexico experienced slower economic growth and the value of the peso declined, particularly later in the year, which resulted in higher inflation and negatively impacted consumer confidence. These factors could negatively impact Latin America GCB's results in the near term. For additional information on potential macroeconomic and geopolitical challenges and other risks facing Latin America GCB , see "Risk Factors-Strategic Risks" below.

2015 vs. 2014

Net income decreased 7% as higher expenses were partially offset by higher revenues and lower credit costs.

Revenues increased 3%, primarily due to the gain on sale related to the Mexico merchant acquiring business. Excluding this gain, revenues were largely unchanged as higher retail banking revenues were offset by lower cards revenues. Revenues were also impacted by continued slow economic growth in Mexico during 2015. Retail banking revenues increased 2%, excluding the gain on sale related to the merchant acquiring business. This increase in retail banking revenues reflected volume growth. Cards revenues decreased 2%, primarily due to higher payment rates, as well as muted volumes and ongoing shifts in consumer behavior, including due to the previously disclosed regulatory reforms in Mexico enacted in 2013.

Expenses increased 8%, primarily due to higher regulatory and compliance costs, higher technology spending and mandatory salary increases, partially offset by lower repositioning charges, lower legal and related costs and ongoing efficiency savings.

Provisions declined 6%, driven by a higher net loan loss reserve release. Net credit losses were largely unchanged as higher net credit losses in the commercial banking and small business banking portfolios were offset by the absence of a $71 million charge-off in the fourth quarter of 2014 related to Citi's homebuilder exposure in Mexico. The net loan loss reserve build declined 70%, primarily due to lower builds related to cards, partially offset by the absence of releases related to the homebuilder exposure in 2014.

20

ASIA GCB

Asia GCB provides traditional retail banking, including commercial banking, and its Citi-branded card products to retail customers and small to mid-size businesses, as applicable. As of December 31, 2016, Citi's most significant revenues in the region were from Singapore, Hong Kong, Korea, India, Australia, Taiwan, Indonesia, Thailand, the Philippines and Malaysia. Included within Asia GCB, traditional retail banking and Citi-branded card products are also provided to retail customers in certain EMEA countries, primarily in Poland, Russia and the United Arab Emirates.

At December 31, 2016, on a combined basis, the businesses had 432 retail branches, approximately 16.6 million retail banking customer accounts, $63.0 billion in retail banking loans and $89.9 billion in deposits. In addition, the businesses had approximately 16.3 million Citi-branded card accounts with $17.5 billion in outstanding loan balances.

In millions of dollars, except as otherwise noted (1) | 2016 | 2015 | 2014 | % Change | % Change | ||||||||

Net interest revenue | $ | 4,463 | | $ | 4,490 | | $ | 4,969 | | (1 | )% | (10 | )% |

Non-interest revenue | 2,375 | | 2,517 | | 2,822 | | (6 | ) | (11 | ) | |||

Total revenues, net of interest expense | $ | 6,838 | | $ | 7,007 | | $ | 7,791 | | (2 | )% | (10 | )% |

Total operating expenses | $ | 4,586 | | $ | 4,577 | | $ | 5,200 | | - | % | (12 | )% |

Net credit losses | $ | 651 | | $ | 721 | | $ | 795 | | (10 | )% | (9 | )% |

Credit reserve build (release) | (28 | ) | (89 | ) | (10 | ) | 69 | | NM | | |||

Provision (release) for unfunded lending commitments | (4 | ) | (2 | ) | (16 | ) | (100 | ) | 88 | | |||

Provisions for credit losses | $ | 619 | | $ | 630 | | $ | 769 | | (2 | )% | (18 | )% |

Income from continuing operations before taxes | $ | 1,633 | | $ | 1,800 | | $ | 1,822 | | (9 | )% | (1 | )% |

Income taxes | 550 | | 603 | | 601 | | (9 | ) | - | | |||

Income from continuing operations | $ | 1,083 | | $ | 1,197 | | $ | 1,221 | | (10 | )% | (2 | )% |

Noncontrolling interests | 4 | | 4 | | 17 | | - | | (76 | ) | |||

Net income | $ | 1,079 | | $ | 1,193 | | $ | 1,204 | | (10 | )% | (1 | )% |

Balance Sheet data (in billions of dollars) |

|

| |

| |

|

| ||||||

Average assets | $ | 119 | | $ | 117 | | $ | 119 | | 2 | % | (2 | )% |

Return on average assets | 0.91 | % | 1.02 | % | 1.01 | % |

|

| |||||

Efficiency ratio | 67 | | 65 | | 67 | |

|

| |||||

Average deposits | $ | 89.5 | | $ | 87.7 | | $ | 89.5 | | 2 | | (2 | ) |

Net credit losses as a percentage of average loans | 0.77 | % | 0.81 | % | 0.85 | % |

|

| |||||

Revenue by business |

|

|

|

|

| ||||||||

Retail banking | $ | 4,250 | | $ | 4,406 | | $ | 4,768 | | (4 | )% | (8 | )% |

Citi-branded cards | 2,588 | | 2,601 | | 3,023 | | - | | (14 | ) | |||

Total | $ | 6,838 | | $ | 7,007 | | $ | 7,791 | | (2 | )% | (10 | )% |

Income from continuing operations by business |

|

|

|

|

| ||||||||

Retail banking | $ | 680 | | $ | 738 | | $ | 663 | | (8 | )% | 11 | % |

Citi-branded cards | 403 | | 459 | | 558 | | (12 | ) | (18 | ) | |||

Total | $ | 1,083 | | $ | 1,197 | | $ | 1,221 | | (10 | )% | (2 | )% |

FX translation impact |

|

|

|

|

| ||||||||

Total revenues-as reported | $ | 6,838 | | $ | 7,007 | | $ | 7,791 | | (2 | )% | (10 | )% |

Impact of FX translation (2) | - | | (129 | ) | (707 | ) |

|

| |||||

Total revenues-ex-FX (3) | $ | 6,838 | | $ | 6,878 | | $ | 7,084 | | (1 | )% | (3 | )% |

Total operating expenses-as reported | $ | 4,586 | | $ | 4,577 | | $ | 5,200 | | - | % | (12 | )% |

Impact of FX translation (2) | - | | (105 | ) | (539 | ) |

|

| |||||

Total operating expenses-ex-FX (3) | $ | 4,586 | | $ | 4,472 | | $ | 4,661 | | 3 | % | (4 | )% |

Provisions for credit losses-as reported | $ | 619 | | $ | 630 | | $ | 769 | | (2 | )% | (18 | )% |

Impact of FX translation (2) | - | | (12 | ) | (116 | ) |

|

| |||||

Provisions for credit losses-ex-FX (3) | $ | 619 | | $ | 618 | | $ | 653 | | - | % | (5 | )% |

Net income-as reported | $ | 1,079 | | $ | 1,193 | | $ | 1,204 | | (10 | )% | (1 | )% |

Impact of FX translation (2) | - | | - | | (13 | ) |

|

| |||||

Net income-ex-FX (3) | $ | 1,079 | | $ | 1,193 | | $ | 1,191 | | (10 | )% | - | % |

21