UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 1, 2012

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 1-1370

_____________________________________________________________

BRIGGS & STRATTON CORPORATION

(Exact name of registrant as specified in its charter)

Wisconsin |

| 39-0182330 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

12301 West Wirth Street, Wauwatosa, Wisconsin 53222

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: 414-259-5333

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Name of Each Exchange on Which Registered |

Common Stock (par value $0.01 per share) |

| New York Stock Exchange |

Common Share Purchase Rights |

| New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K or any amendment of this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Common Stock held by nonaffiliates of the registrant was approximately $770.1 million based on the reported last sale price of such securities as of December 30, 2011 , the last business day of the most recently completed second fiscal quarter.

Number of Shares of Common Stock Outstanding at August 24, 2012 : 47,842,345 .

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the definitive proxy statement for the Annual Meeting to be held on October 17, 2012.

BRIGGS & STRATTON CORPORATION

FISCAL

2012

FORM 10-K

TABLE OF CONTENTS

|

|

|

PART I | Page | |

Item 1. | Business | 1 |

Item 1A. | Risk Factors | 5 |

Item 1B. | Unresolved Staff Comments | 10 |

Item 2. | Properties | 10 |

Item 3. | Legal Proceedings | 11 |

Item 4. | Mine Safety Disclosures | 12 |

| Executive Officers of the Registrant | 13 |

PART II |

| |

Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 15 |

Item 6. | Selected Financial Data | 16 |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 17 |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 26 |

Item 8. | Financial Statements and Supplementary Data | 28 |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 42 |

Item 9A. | Controls and Procedures | 42 |

Item 9B. | Other Information | 42 |

PART III |

| |

Item 10. | Directors, Executive Officers and Corporate Governance | 42 |

Item 11. | Executive Compensation | 43 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 43 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 43 |

Item 14. | Principal Accountant Fees and Services | 43 |

PART IV |

| |

Item 15. | Exhibits and Financial Statement Schedules | 44 |

| Signatures | 45 |

Cautionary Statement on Forward-Looking Statements

This report contains certain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. The words "believe", "estimate", "expect", "forecast", "intend", "plan", "project", and similar expressions are intended to identify forward-looking statements. The forward-looking statements are based on the Company's current views and assumptions and involve risks and uncertainties that include, among other things, the ability to successfully forecast demand for our products; changes in interest rates and foreign exchange rates; the effects of weather on the purchasing patterns of consumers and original equipment manufacturers (OEMs); actions of engine manufacturers and OEMs with whom we compete; changes in laws and regulations; changes in customer and OEM demand; changes in prices of raw materials and parts that we purchase; changes in domestic and foreign economic conditions; the ability to bring new productive capacity on line efficiently and with good quality; outcomes of legal proceedings and claims; and other factors disclosed from time to time in our SEC filings or otherwise, including the factors discussed in Item 1A, Risk Factors, of the Company's Annual Report on Form 10-K and in its periodic reports on Form 10-Q.

PART I

ITEM 1. | BUSINESS |

Briggs & Stratton (the "Company") is the world's largest producer of air cooled gasoline engines for outdoor power equipment. Briggs & Stratton designs, manufactures, markets and services these products for original equipment manufacturers (OEMs) worldwide. In addition, the Company markets and sells related service parts and accessories for its engines. Briggs & Stratton is recognized worldwide for its strong brand name and a reputation for quality, design, innovation and value.

Through its wholly owned subsidiary, Briggs & Stratton Power Products Group, LLC, Briggs & Stratton is also a leading designer, manufacturer and marketer of generators, pressure washers, snow throwers, lawn and garden powered equipment (primarily riding and walk behind mowers) and related service parts and accessories.

The Company conducts its operations in two reportable segments: Engines and Products. Further information about Briggs & Stratton's business segments is contained in Note 7 of the Notes to Consolidated Financial Statements.

The Company's internet address is www.basco.com. The Company makes available free of charge (other than an investor's own internet access charges) through its Internet website the Company's Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after it electronically files such material with, or furnishes such material to, the Securities and Exchange Commission. Charters of the Audit, Compensation, Finance, Nominating and Governance Committees, Corporate Governance Guidelines, Stock Ownership Guidelines and code of business conduct and ethics contained in the Briggs & Stratton Business Integrity Manual are available on the Company's website and are available in print to any shareholder upon request to the Corporate Secretary.

Engines Segment

General

Briggs & Stratton manufactures four-cycle aluminum alloy gasoline engines with displacements ranging from 125 to 993 cubic centimeters through its Engines segment. The Company's engines are used primarily by the lawn and garden equipment industry, which accounted for 86% of the Engines segment's fiscal 2012 engine sales to OEMs. Major lawn and garden equipment applications include walk-behind lawn mowers, riding lawn mowers, garden tillers and snow throwers. The remaining 14% of engine sales to OEMs in fiscal 2012 were for use on products for industrial, construction, agricultural and other consumer applications, that include generators, pumps and pressure washers. Many retailers specify the Company's engines on the power equipment they sell and the Briggs & Stratton logo is often featured prominently on a product because of the appeal and reputation of the brand.

In fiscal 2012 approximately 29% of the Engines segment net sales were derived from sales in international markets, primarily to customers in Europe. The Company serves its key international markets through its European regional office in Switzerland, its distribution center in the Netherlands and sales and service subsidiaries and offices in Australia, Austria, Brazil, Canada, China, the Czech Republic, England, France, Germany, India, Italy, Japan, Mexico, New Zealand, Poland, Russia, South Africa, Sweden and the United Arab Emirates. Briggs & Stratton is a leading supplier of gasoline engines in developed countries where there is an established lawn and garden equipment market. Briggs & Stratton also exports engines to developing nations where its engines are used in agricultural, marine, construction and other applications. More detailed information about our foreign operations is in Note 7 of the Notes to Consolidated Financial Statements.

The Company's engines are sold primarily by its worldwide sales force through direct interaction with customers. The Company's marketing staff and engineers in the United States provide support and technical assistance to its sales force.

The Engines segment also manufactures replacement engines and service parts and sells them to sales and service distributors. The Company owns its principal international distributors. In the United States the distributors are independently owned and operated.

1

These distributors supply service parts and replacement engines directly to independently owned, authorized service dealers throughout the world. These distributors and service dealers incorporate the Company's commitment to reliability and service.

Customers

The Company's engine sales are primarily to OEMs. The Company's three largest external engine customers in fiscal years 2012, 2011 and 2010 were Husqvarna Outdoor Products Group (HOP), MTD Products Inc. (MTD) and Deere & Company. Engines segment sales to the top three customers combined were 45%, 47% and 48% of Engines segment sales in fiscal 2012, 2011 and 2010, respectively. Under purchasing plans available to all of its gasoline engine customers, Briggs & Stratton typically enters into annual engine supply arrangements.

The Company believes that in fiscal 2012 more than 80% of all lawn and garden powered equipment sold in the United States was sold through mass merchandisers such as The Home Depot, Inc. (The Home Depot), Lowe's Companies, Inc. (Lowe's), Sears Holdings Corporation (Sears) and Wal-Mart Stores, Inc. (Wal-Mart). Given the buying power of the mass merchandisers, Briggs & Stratton, through its customers, has continued to experience pricing pressure; however, the Company attempts to recover increases in commodity costs through increased pricing.

Competition

The Company's major domestic competitors in engine manufacturing are Honda Motor Co., Ltd. (Honda), Kawasaki Heavy Industries, Ltd. (Kawasaki) and Kohler Co. (Kohler). Several Japanese and Chinese small engine manufacturers, of which Honda and Kawasaki are the largest, compete directly with the Company in world markets in the sale of engines to other OEMs and indirectly through their sale of end products.

The Company believes it has a significant share of the worldwide market for engines that power outdoor equipment.

The Company believes the major areas of competition from all engine manufacturers include product quality, brand, price, delivery and service. Other factors affecting competition are short-term market share objectives, short-term profit objectives, exchange rate fluctuations, technology, product support, distribution strength, and advertising. The Company believes its technology, product value, distribution, marketing, and service reputation have given it strong brand name recognition and enhanced its competitive position.

Seasonality of Demand

Sales of engines to lawn and garden OEMs are highly seasonal because of consumer buying patterns. The majority of lawn and garden equipment is sold during the spring and summer months when most lawn care and gardening activities are performed. Sales of lawn and garden equipment are also influenced by consumer sentiment, employment levels, housing starts and weather conditions. Engine sales in the Company's fiscal third quarter have historically been the highest, while sales in the first fiscal quarter have historically been the lowest.

In order to efficiently use its capital investments and meet seasonal demand for engines, the Company pursues a relatively balanced production schedule throughout the year. The schedule is adjusted to reflect changes in estimated demand, customer inventory levels and other matters outside the control of the Company. Accordingly, inventory levels generally increase during the first and second fiscal quarters in anticipation of customer demand. Inventory levels begin to decrease as sales increase in the third fiscal quarter. This seasonal pattern results in high inventories and low cash flow for the Company in the first, second and the beginning of the third fiscal quarters. The pattern results in higher cash flow in the latter portion of the third fiscal quarter and in the fourth fiscal quarter as inventories are liquidated and receivables are collected.

Manufacturing

The Company manufactures engines and parts at the following locations: Auburn, Alabama; Statesboro, Georgia; Murray, Kentucky; Poplar Bluff, Missouri; Wauwatosa, Wisconsin; and Chongqing, China. Briggs & Stratton has a parts distribution center in Menomonee Falls, Wisconsin.

2

In January 2012, the Company announced plans to close its Ostrava, Czech Republic facility. During fiscal 2012, the Engines segment ceased manufacturing operations at the Ostrava, Czech Republic plant, shifting production to its Murray, Kentucky facility.

In April 2012, the Company announced that production of horizontal shaft engines currently made in the Auburn, Alabama plant will move to the Company's existing production facility in Chongqing, China or be sourced from third parties in Southeast Asia. The Auburn plant will continue to produce V-Twin engines used in riding mowers and other outdoor power applications.

The Company manufactures a majority of the structural components used in its engines, including aluminum die castings, carburetors and ignition systems. The Company purchases certain parts such as piston rings, spark plugs, valves, ductile and grey iron castings, plastic components, some stampings and screw machine parts and smaller quantities of other components. Raw material purchases consist primarily of aluminum and steel. The Company believes its sources of supply are adequate.

The Company has joint ventures with Daihatsu Motor Company for the manufacture of engines in Japan, and with Starting Industrial of Japan for the production of rewind starters and punch press components in the United States.

The Company has a strategic relationship with Mitsubishi Heavy Industries (MHI) for the global distribution of air cooled gasoline engines manufactured by MHI in Japan under Briggs & Stratton's Vanguard brand.

Products Segment

General

Products segment's ("Products") principal product lines include portable and standby generators, pressure washers, snow throwers and lawn and garden power equipment. Products sells its products through multiple channels of retail distribution, including consumer home centers, warehouse clubs, mass merchants and independent dealers. The products segment product lines are marketed under its own brands such as Briggs & Stratton, Snapper, Simplicity, Ferris, Snapper Pro, Murray, Victa as well as other brands such as Craftsman, John Deere, GE, and Troy-Bilt.

In April 2012, the Company announced that beginning in fiscal 2013, it will no longer pursue placement of lawn and garden products at national mass retailers. The Engines segment will continue to support lawn and garden equipment OEMs who provide lawn and garden equipment to these retailers. The Products segment will continue to focus on innovative, higher margin products that are sold through its independent dealer network and regional retailers. The Company will also continue to sell pressure washers and portable and standby generators through the U.S. mass retail channel.

In October 2011, the Company completed the acquisition of Premier Power Equipments and Products Private Ltd. of Tamil Nadu, India, providing a platform for future growth in India.

Products has a network of independent dealers worldwide for the sale and service of snow throwers, standby generators and lawn and garden powered equipment. To support its international business, Products has leveraged the existing Briggs & Stratton worldwide distribution network.

Customers

Historically, Products' major customers have been Lowe's, Sears and Deere & Company. Sales to these three customers combined were 27%, 33% and 34% of Products segment net sales in fiscal 2012, 2011 and 2010, respectively. Other U.S. customers include Wal-Mart,The Home Depot, Tractor Supply Inc., and a network of independent dealers.

Competition

The principal competitive factors in the power products industry include price, service, product performance, brand, innovation and delivery. Products has various competitors, depending on the type of equipment. Primary competitors include: Honda (portable generators, pressure washers and lawn and garden equipment), Generac Power Systems, Inc. (portable generators, standby generators and pressure washers), Alfred Karcher GmbH & Co. (pressure washers), Techtronic Industries (pressure washers and portable generators), Deere & Company (commercial and consumer lawn mowers), MTD (commercial and consumer

3

lawn mowers), The Toro Company (commercial and consumer lawn mowers), Scag Power Equipment, a Division of Metalcraft of Mayville, Inc. (commercial lawn mowers), and HOP (commercial and consumer lawn mowers).

Products believes it has a significant share of the North American market for portable generators and residential pressure washers.

Seasonality of Demand

Products' sales are subject to seasonal patterns. Due to seasonal and regional weather factors, sales of pressure washers and lawn and garden powered equipment are typically higher during the third and fourth fiscal quarters than at other times of the year. Sales of portable generators and snow throwers are typically higher during the first and second fiscal quarters and can spike during weather related power outage events.

Manufacturing

Products' manufacturing facilities are located in Auburn, Alabama; McDonough, Georgia; Munnsville, New York; Wauwatosa, Wisconsin; Sydney, Australia and Coimbatore, India. Products also purchases certain powered equipment under contract manufacturing agreements.

In January 2012, the Company announced plans to close its Newbern, Tennessee facility. During fiscal 2012, Products ceased manufacturing operations at the Newbern, Tennessee facility and moved production to its McDonough, Georgia facility.

In April 2012, the Company announced that it is evaluating alternatives with respect to manufacturing, assembling or sourcing cost effective portable generators beyond 2012. The Company will continue to manufacture portable generators in Auburn through calendar 2012.

Products manufactures core components for its products, where such integration improves operating profitability by providing lower costs.

Products purchases engines from its parent, Briggs & Stratton, as well as from Honda, Kawasaki and Kohler. Products has not experienced any difficulty obtaining necessary engines or other purchased components.

Products assembles products for the international markets at its U.S. and Australian locations and through contract manufacturing agreements with other OEMs and suppliers.

Consolidated

General Information

The Company holds patents on features incorporated in its products; however, the success of the Company's business is not considered to be primarily dependent upon patent protection. The Company owns several trademarks which it believes significantly affect a consumer's choice of outdoor powered equipment and therefore create value. Licenses, franchises and concessions are not a material factor in the Company's business.

For the fiscal years ended July 1, 2012 , July 3, 2011 and June 27, 2010 , the Company spent approximately $19.8 million , $19.5 million and $22.3 million , respectively, on research activities relating to the development of new products or the improvement of existing products.

In April 2012, the Company announced that it would reduce its salaried workforce by approximately 10%. The Company implemented these salaried workforce reductions during fiscal 2012.

The average number of persons employed by the Company during fiscal 2012 was 6,709. Employment ranged from a low of 6,321 in June 2012 to a high of 6,887 in February 2012.

Export Sales

Export sales for fiscal 2012, 2011 and 2010 were $392.7 million (19% of net sales), $428.0 million (20% of net sales) and $344.1 million (17% of net sales), respectively. These sales were principally to customers in European countries.

4

Refer to Note 7 of the Notes to Consolidated Financial Statements for financial information about geographic areas. Also, refer to Item 7A of this Form 10-K and Note 14 of the Notes to Consolidated Financial Statements for information about Briggs & Stratton's foreign exchange risk management.

ITEM 1A. | RISK FACTORS |

In addition to the risks referred to elsewhere in this Annual Report on Form 10-K, the following risks, among others, may have affected, and in the future could affect, the Company and its subsidiaries' business, financial condition or results of operations. Additional risks not discussed or not presently known to the Company or that the Company currently deems insignificant may also impact its business and stock price.

Demand for products fluctuates significantly due to seasonality. In addition, changes in the weather and consumer confidence impact demand.

Sales of our products are subject to seasonal and consumer buying patterns. Consumer demand in our markets can be reduced by unfavorable weather and weak consumer confidence. Although we manufacture throughout the year, our sales are concentrated in the second half of our fiscal year. This operating method requires us to anticipate demand of our customers many months in advance. If we overestimate or underestimate demand during a given year, we may not be able to adjust our production quickly enough to avoid excess or insufficient inventories, and that may in turn limit our ability to maximize our potential sales or maintain optimum working capital levels.

We have only a limited ability to pass through cost increases in our raw materials to our customers during the year.

We generally enter into annual purchasing plans with our largest customers, so our ability to raise our prices during a particular year to reflect increased raw materials costs is limited.

A significant portion of our net sales comes from major customers and the loss of any of these customers would negatively impact our financial results.

In fiscal 2012, our three largest customers accounted for 31% of our consolidated net sales. The loss of a significant portion of the business of one or more of these key customers would significantly impact our net sales and profitability.

Changes in environmental or other laws could require extensive changes in our operations or to our products.

Our operations and products are subject to a variety of foreign, federal, state and local laws and regulations governing, among other things, emissions to air, discharges to water, noise, the generation, handling, storage, transportation, treatment and disposal of waste and other materials and health and safety matters. We do not expect these laws and regulations to have a material adverse effect on us, but we cannot be certain that these or other proposed changes in applicable laws or regulations will not adversely affect our business or financial condition in the future.

Foreign economic conditions and currency rate fluctuations can reduce our sales.

In fiscal 2012 , we derived approximately 30% of our consolidated net sales from international markets, primarily Europe. Weak economic conditions in Europe could reduce our sales and currency fluctuations could adversely affect our sales or profit levels in U.S. dollar terms.

Actions of our competitors could reduce our sales or profits.

Our markets are highly competitive and we have a number of significant competitors in each market. Competitors may reduce their costs, lower their prices or introduce innovative products that could adversely affect our sales or profits. In addition, our competitors may focus on reducing our market share to improve their results.

Disruptions caused by labor disputes or organized labor activities could harm our business.

Currently, approximately 13% of our workforce is represented by labor unions. In addition, we may from time to time experience union organizing activities in our non-union facilities. Disputes with the current labor union

5

or new union organizing activities could lead to work slowdowns or stoppages and make it difficult or impossible for us to meet scheduled delivery times for product shipments to our customers, which could result in loss of business. In addition, union activity could result in higher labor costs, which could harm our financial condition, results of operations and competitive position.

Our level of debt and our ability to obtain debt financing could adversely affect our operating flexibility and put us at a competitive disadvantage.

Our level of debt and the limitations imposed on us by the indenture for the notes and our other credit agreements could have important consequences, including the following:

• | we will have to use a portion of our cash flow from operations for debt service rather than for our operations; |

• | we may not be able to obtain additional debt financing for future working capital, capital expenditures or other corporate purposes or may have to pay more for such financing; |

• | some or all of the debt under our current or future revolving credit facilities will be at a variable interest rate, making us more vulnerable to increases in interest rates; |

• | we could be less able to take advantage of significant business opportunities, such as acquisition opportunities, and to react to changes in market or industry conditions; |

• | we may be more vulnerable to general adverse economic and industry conditions; and |

• | we may be disadvantaged compared to competitors with less leverage. |

The terms of the indenture for the Senior Notes do not fully prohibit us from incurring substantial additional debt in the future and our revolving credit facilities permit additional borrowings, subject to certain conditions. As incremental debt is added to our current debt levels, the related risks we now face could intensify.

We expect to obtain the money to pay our expenses and to pay the principal and interest on the outstanding 6.875% Senior Notes that are due in December 2020, the credit facilities and other debt primarily from our

operations or by refinancing part of our existing debt. Our ability to meet our expenses thus depends on our future performance, which will be affected by financial, business, economic and other factors. We will not be able to control many of these factors, such as economic conditions in the markets where we operate and pressure from competitors. We cannot be certain that the money we earn will be sufficient to allow us to pay principal and interest on our debt and meet our other obligations. If we do not have enough money, we may be required to refinance all or part of our existing debt, sell assets or borrow more money. We cannot guarantee that we will be able to do so on terms acceptable to us. In addition, the terms of existing or future debt agreements, including the revolving credit facilities and our indentures, may restrict us from adopting certain of these alternatives.

We are restricted by the terms of the outstanding Senior Notes and our other debt, which could adversely affect us.

The indenture relating to the Senior Notes and our multicurrency credit agreement include a number of financial and operating restrictions, which may prevent us from capitalizing on business opportunities and taking some corporate actions. These covenants could adversely affect us by limiting our ability to plan for or react to market conditions or to meet our capital needs. These covenants include, among other things, restrictions on our ability to:

• | incur more debt; |

• | pay dividends, redeem stock or make other distributions; |

• | make certain investments; |

• | create liens; |

• | transfer or sell assets; |

• | merge or consolidate; and |

• | enter into transactions with our affiliates. |

In addition, our multicurrency credit agreement contains financial covenants that, among other things, require us to maintain a minimum interest coverage ratio and impose a maximum average leverage ratio.

6

Our failure to comply with the restrictive covenants described above could result in an event of default, which, if not cured or waived, could result in us being required to repay these borrowings before their due date. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected by increased costs and rates.

Current worldwide economic conditions may adversely affect our industry, business and results of operations.

General worldwide economic conditions have experienced a downturn due to the sequential effects of the subprime lending crisis, general credit market crisis, sovereign debt crisis, collateral effects on the finance and banking industries, increased energy costs, concerns about inflation, slower economic activity, decreased consumer confidence, reduced corporate profits and capital spending, adverse business conditions and liquidity concerns. These conditions make it difficult for our customers, our vendors and us to accurately forecast and plan future business activities, and they may cause U.S. and foreign OEMs and consumers to slow spending on our products. We cannot predict the timing or duration of any economic slowdown or the timing or strength of a subsequent economic recovery, worldwide or in the specific end markets we serve. If the consumer and commercial lawn and garden markets significantly deteriorate due to these economic effects, our business, financial condition and results of operations will likely be materially and adversely affected. Additionally, our stock price could decrease if investors have concerns that our business, financial condition and results of operations will be negatively impacted by a worldwide economic downturn.

The ongoing European sovereign debt crisis has caused disruption in global financial markets and is likely to continue to cause economic disruptions, particularly if it leads to any future sovereign debt defaults and/or significant bank failures or defaults in the Eurozone. Despite certain stabilization measures taken by the European Union, the European Central Bank and the International Monetary Fund, yields on government bonds of certain European countries have remained volatile and credit ratings of most European countries have been downgraded by certain of the major rating agencies. The market disruptions in the Eurozone could intensify or spread further, particularly if ongoing stabilization efforts prove insufficient. Continued economic turmoil in the Eurozone could have a significant negative impact on us, both directly through our own global exposures and indirectly due to a decline in general global economic conditions. Further, the effects of the European sovereign debt crisis could be even more significant if they lead to a partial or complete break-up of the European Monetary Union (EMU). The partial or full break-up of the EMU would be unprecedented and its impact highly uncertain. The exit of one or more countries from the EMU or the dissolution of the EMU could lead to redenomination of obligations of obligors in exiting countries. Any such exit and redenomination would cause significant uncertainty with respect to outstanding obligations of counterparties and debtors in any exiting country, whether sovereign or otherwise, and lead to complex, lengthy litigation. The resulting uncertainty and market stress could also cause, among other things, severe disruption to equity markets, significant increases in bond yields generally, potential failure or default of financial institutions, including those of systemic importance, a significant decrease in global liquidity, a freeze-up of global credit markets and worldwide recession. There can be no assurance that the various steps we have taken to protect our business, results of operations and financial condition against the concerns related to the European sovereign debt crisis and/or the partial or full break-up of the EMU will be sufficient.

We have a material amount of goodwill, which was written-down in fiscal 2011. If we determine that goodwill and other intangible assets have become further impaired in the future, net income in such years may be adversely affected.

At July 1, 2012, goodwill and other intangible assets represented approximately 18% of our total assets. Goodwill represents the excess of cost over the fair market value of net assets acquired in business combinations. We are required to evaluate whether our goodwill and indefinite-lived intangible assets have been impaired on an annual basis, or more frequently if indicators of impairment exist. As discussed in Note 5 of the Company's financial statements included in Item 8 of this report, the Company recorded pre-tax non-cash goodwill impairment charges of $49.5 million in fiscal 2011. The impairment was determined as part of the fair value assessment of goodwill. No goodwill impairment charges were recorded in fiscal 2012. Reductions in our net income caused by any additional write-down of our goodwill or intangible assets could materially adversely affect our results of operations.

7

We are subject to litigation, including product liability and warranty claims, that may adversely affect our business and results of operations.

We are a party to litigation that arises in the normal course of our business operations, including product warranty and liability (strict liability and negligence) claims, patent and trademark matters, contract disputes and environmental, asbestos, employment and other litigation matters. We face an inherent business risk of exposure to product liability and warranty claims in the event that the use of our products is alleged to have resulted in injury or other damage. While we currently maintain general liability and product liability insurance coverage in amounts that we believe are adequate, we cannot be sure that we will be able to maintain this insurance on acceptable terms or that this insurance will provide sufficient coverage against potential liabilities that may arise. Any claims brought against us, with or without merit, may have an adverse effect on our business and results of operations as a result of potential adverse outcomes, the expenses associated with defending such claims, the diversion of our management's resources and time and the potential adverse effect to our business reputation.

Our pension and postretirement benefit plan obligations are currently underfunded, and we may have to make significant cash payments to some or all of these plans, which would reduce the cash available for our businesses.

We have unfunded obligations under our domestic and foreign pension and postretirement benefit plans. As of July 1, 2012, our pension plans were underfunded by approximately $299 million . The funded status of our pension plans is dependent upon many factors, including returns on invested assets, the level of certain market interest rates and the discount rate used to determine pension obligations. Unfavorable returns on the plan assets or unfavorable changes in applicable laws or regulations could materially change the timing and amount of required plan funding, which would reduce the cash available for our businesses. In addition, a decrease in the discount rate used to determine pension obligations could result in an increase in the valuation of pension obligations, which could affect the reported funding status of our pension plans and future contributions, as well as the periodic pension cost in subsequent fiscal years.

Our dependence on, and the price of, raw materials may adversely affect our profits.

The principal raw materials used to produce our products are aluminum, copper and steel. We source raw materials on a global or regional basis, and the prices of those raw materials are susceptible to significant price fluctuations due to supply/demand trends, transportation costs, government regulations and tariffs, changes in currency exchange rates, price controls, the economic climate and other unforeseen circumstances. If we are unable to pass on raw material price increases to our customers, our future profitability may be adversely affected.

We may be adversely affected by health and safety laws and regulations.

We are subject to various laws and regulations relating to the protection of human health and safety and have incurred and will continue to incur capital and other expenditures to comply with these regulations. Failure to comply with regulations could subject us to future liabilities, fines or penalties or the suspension of production.

The operations and success of our Company can be impacted by natural disasters, terrorism, acts of war, international conflict and political and governmental actions, which could harm our business.

Natural disasters, acts or threats of war or terrorism, international conflicts and the actions taken by the United States and other governments in response to such events could cause damage or disrupt our business operations, our suppliers or our customers, and could create political or economic instability, any of which could have an adverse effect on our business. Although it is not possible to predict such events or their consequences, these events could decrease demand for our products, could make it difficult or impossible for us to deliver products or could disrupt our supply chain. We may also be impacted by actions by foreign governments, including currency devaluation, tariffs and nationalization, where our facilities are located, which could disrupt manufacturing and commercial operations. In addition, our foreign operations make us subject to certain U.S. laws and regulations, including the Export Administration Regulations administered by the U.S. Department of Commerce, the trade sanctions laws and regulations administered by the U.S. Department of the Treasury's Office of Foreign Assets Control and the Foreign Corrupt Practices Act. A violation of these laws and regulations could adversely affect our business, financial condition and results of operations.

8

We are subject to tax laws and regulations in many jurisdictions, and the inability to successfully defend claims from taxing authorities could adversely affect our operating results and financial position.

We conduct business in many countries, which requires us to interpret the income tax laws and rulings in each of those taxing jurisdictions. Due to the subjectivity of tax laws between those jurisdictions as well as the subjectivity of factual interpretations, our estimates of income tax liabilities may differ from actual payments or assessments. Claims from taxing authorities related to these differences could have an adverse impact on our operating results and financial position.

If we fail to remain current with changes in gasoline engine technology or if the technology becomes less important to customers in our markets due to the impact of alternative fuels, our results would be negatively affected.

Our ability to remain current with changes in gasoline engine technology may significantly affect our business. Any advances in gasoline engine technology, including the impact of alternative fuels, may inhibit our ability to compete with other manufacturers. Our competitors may also be more effective and efficient at integrating new technologies. In addition, developing new manufacturing technologies and capabilities requires a significant investment of capital. There can be no assurance that our products will remain competitive in the future or that we will continue to be able to timely implement innovative manufacturing technologies.

Through our Products segment, we compete with certain customers of our Engines segment, thereby creating inherent channel conflict that may impact the actions of engine manufacturers and OEMs with whom we compete.

Through our Products segment, we compete with certain customers of our Engines segment. Any further forward integration of our products may strain relationships with OEMs that are significant customers of our Engines segment and have an adverse impact on operating results.

The financial stability of our suppliers and the ability of our suppliers to produce quality materials could adversely affect our ability to obtain timely and cost-effective raw materials.

The loss of certain of our suppliers or interruption of production at certain suppliers from adverse financial conditions, work stoppages, equipment failures or other unfavorable events would adversely affect our ability to obtain raw materials and other inputs used in the manufacturing process. Our cost of purchasing raw materials and other inputs used in the manufacturing process could be higher and could temporarily affect our ability to produce sufficient quantities of its products, which could harm our financial condition, results of operations and competitive position.

We have implemented, and Wisconsin law contains, anti-takeover provisions that may adversely affect the rights of holders of our common stock.

Our articles of incorporation contain provisions that could have the effect of discouraging or making it more difficult for someone to acquire us through a tender offer, a proxy contest or otherwise, even though such an acquisition might be economically beneficial to our shareholders. These provisions include a board of directors divided into three classes of directors serving staggered terms of three years each and the removal of directors only for cause and only with the affirmative vote of a majority of the votes entitled to be cast in an election of directors.

Each currently outstanding share of our common stock includes, and each newly issued share of our common stock will include, a common share purchase right. The rights are attached to and trade with the shares of common stock and are exercisable only under limited circumstances. The rights will become exercisable if a person or group acquires, or announces an intention to acquire, 20% or more of our outstanding common stock, subject to certain exceptions. The rights have some anti-takeover effects and generally will cause substantial dilution to a person or group that attempts to acquire control of us without conditioning the offer on either redemption of the rights or amendment of the rights to prevent this dilution. The rights could have the effect of delaying, deferring or preventing a change of control.

We are subject to the Wisconsin Business Corporation Law, which contains several provisions that could have the effect of discouraging non-negotiated takeover proposals or impeding a business combination.

9

These provisions include:

• | requiring a supermajority vote of shareholders, in addition to any vote otherwise required, to approve business combinations not meeting adequacy of price standards; |

• | prohibiting some business combinations between an interested shareholder and us for a period of three years, unless the combination was approved by our board of directors prior to the time the shareholder became a 10% or greater beneficial owner of our shares or under some other circumstances; |

• | limiting actions that we can take while a takeover offer for us is being made or after a takeover offer has been publicly announced; and |

• | limiting the voting power of shareholders who own more than 20% of our stock. |

Our common stock is subject to substantial price and volume fluctuations.

The market price of shares of our common stock may be volatile. Among the factors that could affect our common stock price are those previously discussed, as well as:

• | quarterly fluctuation in our operating income and earnings per share results; |

• | decline in demand for our products; |

• | significant strategic actions by our competitors, including new product introductions or technological advances; |

• | fluctuations in interest rates; |

• | cost increases in energy, raw materials or labor; |

• | changes in revenue or earnings estimates or publication of research reports by analysts; and |

• | domestic and international economic and political factors unrelated to our performance. |

In addition, the stock markets have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

ITEM 2. | PROPERTIES |

The Company maintains leased and owned manufacturing, office, warehouse, distribution and testing facilities throughout the world. The Company believes that its owned and leased facilities are adequate to perform its operations in a reasonable manner. As the Company's business is seasonal, additional warehouse space may be leased when inventory levels are at their peak. Facilities in the United States occupy approximately 6.8 million square feet, of which 58% is owned. Facilities outside of the United States occupy approximately 866 thousand square feet, of which 42% is owned. Certain of the Company's facilities are leased through operating and capital lease agreements. See Note 8 to the Consolidated Financial Statements for information on the Company's operating and capital leases.

10

The following table provides information about each of the Company's facilities (exceeding 25,000 square feet) as of July 1, 2012:

|

|

|

|

|

|

|

Location |

| Type of Property |

| Owned/Leased |

| Segment |

U.S. Locations: |

|

|

|

|

|

|

Auburn, Alabama |

| Manufacturing, office and warehouse |

| Owned and Leased |

| Engines, Products |

McDonough, Georgia |

| Manufacturing, office and warehouse |

| Owned and Leased |

| Products |

Statesboro, Georgia |

| Manufacturing, office and warehouse |

| Owned and Leased |

| Engines |

Murray, Kentucky |

| Manufacturing, office and warehouse |

| Owned and Leased |

| Engines |

Poplar Bluff, Missouri |

| Manufacturing, office and warehouse |

| Owned and Leased |

| Engines |

Reno, Nevada |

| Warehouse |

| Leased |

| Products |

Munnsville, New York |

| Manufacturing and office |

| Owned |

| Products |

Sherrill, New York |

| Warehouse |

| Leased |

| Products |

Dyersburg, Tennessee |

| Warehouse |

| Leased |

| Products |

Newbern, Tennessee (1) |

| Manufacturing and office |

| Leased |

| Products |

Grand Prairie, Texas |

| Warehouse |

| Leased |

| Products |

Brookfield, Wisconsin |

| Office |

| Leased |

| Products |

Menomonee Falls, Wisconsin |

| Distribution and office |

| Leased |

| Engines |

Jefferson, Wisconsin |

| Manufacturing and office (held for sale) |

| Owned |

| Products |

Wauwatosa, Wisconsin |

| Manufacturing, office and warehouse |

| Owned |

| Engines, Products, Corporate |

|

|

|

| |||

Non-U.S. Locations: |

|

|

|

|

|

|

Melbourne, Australia |

| Office |

| Leased |

| Engines, Products |

Sydney, Australia |

| Manufacturing and office |

| Leased |

| Products |

Mississauga, Canada |

| Office and warehouse |

| Leased |

| Products |

Chongqing, China |

| Manufacturing, office and warehouse |

| Owned |

| Engines |

Shanghai, China |

| Office and warehouse |

| Leased |

| Engines, Products |

Ostrava, Czech Republic (1) |

| Manufacturing and office (held for sale) |

| Owned |

| Engines, Products |

Nijmegen, Netherlands |

| Distribution and office |

| Leased |

| Engines |

(1) During Fiscal 2012, the Company completed manufacturing operations at its Newbern, Tennessee and Ostrava, Czech Republic facilities.

ITEM 3. | LEGAL PROCEEDINGS |

The Company is subject to various unresolved legal actions that arise in the normal course of its business. These actions typically relate to product liability (including asbestos-related liability), patent and trademark matters, and disputes with customers, suppliers, distributors and dealers, competitors and employees.

Starting with the first complaint in June 2004, various plaintiff groups filed complaints in state and federal courts across the country against the Company and other engine and lawnmower manufacturers alleging that the horsepower labels on the products they purchased were inaccurate and that the Company conspired with other engine and lawnmower manufacturers to conceal the true horsepower of these engines ("Horsepower Class Actions"). On February 24, 2010, the Company entered into a Stipulation of Settlement ("Settlement") that resolves all of the Horsepower Class Actions including all horsepower-labeling claims brought by all persons or entities in the United States who, beginning January 1, 1994 through the date notice of the

11

Settlement is first given, purchased, for use and not for resale, a lawn mower containing a vertical shaft internal combustion engine up to 30 horsepower provided that either the lawn mower or the engine of the lawn mower was manufactured or sold by a defendant.

The Settlement received final court approval on August 16, 2010. The settling defendants as a group agreed to pay an aggregate amount of $51.0 million. However, the monetary contribution of the amount of each of the settling defendants is confidential. In addition, the Company, along with the other settling defendants, agreed to injunctive relief regarding their future horsepower labeling, as well as procedures that will allow purchasers of lawnmower engines to seek a one-year extended warranty free of charge beginning March 1, 2011 for most class members. As part of the Settlement, the Company denies any and all liability and seeks resolution to avoid further protracted and expensive litigation. As a result of the Settlement, the Company recorded a pre-tax charge of $30.6 million in the third quarter of fiscal 2010.

On March 19, 2010, new plaintiffs filed a complaint in the Ontario Superior Court of Justice in Canada (Robert Foster et al. v. Sears Canada, Inc. et al., Docket No. 766-2010). On May 3, 2010, other plaintiffs filed a complaint in the Montreal Superior Court in Canada (Eric Liverman, et al. v. Deere & Company, et al., Docket No. 500-06-000507-109). Both Canadian complaints contain allegations and seek relief under Canadian law that are similar to the Horsepower Class Actions. The Company is evaluating the complaints and has not yet filed an answer or other responsive pleading to either one.

On May 14, 2010, the Company notified retirees and certain retirement eligible employees of various changes to the Company-sponsored retiree medical plans. The purpose of the amendments was to better align the plans offered to both hourly and salaried retirees. On August 16, 2010, a putative class of retirees who retired prior to August 1, 2006 and the United Steel Workers filed a complaint in the U.S. District Court for the Eastern District of Wisconsin (Merrill, Weber, Carpenter, et al; United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO/CLC v. Briggs & Stratton Corporation; Group Insurance Plan of Briggs & Stratton Corporation; and Does 1 through 20, Docket No. 10-C-0700), contesting the Company's right to make these changes. In addition to a request for class certification, the complaint seeks an injunction preventing the alleged unilateral termination or reduction in insurance coverage to the class of retirees, a permanent injunction preventing defendants from ever making changes to the retirees' insurance coverage, restitution with interest (if applicable) and attorneys' fees and costs. The Company moved to dismiss the complaint and believes the changes are within its rights. On April 21, 2011, the district court issued an order granting the Company's motion to dismiss the complaint. The plaintiffs filed a motion with the court to reconsider its order on May 17, 2011, and on August 24, 2011 the court granted the motion and vacated the dismissal of the case. The Company then filed a motion with the court to appeal its decision directly to the U.S. Court of Appeals for the Seventh Circuit, but the court denied this motion on February 29, 2012. Discovery is now proceeding in the case.

Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, the Company believes the unresolved legal actions will not have a material adverse effect on its results of operations, financial position or cash flows.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

12

Executive Officers of the Registrant

Name, Age, Position |

| Business Experience for Past Five Years |

TODD J. TESKE, 47 Chairman, President and Chief Executive Officer (1)(2) |

| Mr. Teske was elected to his current position effective October 2010. He previously was President and Chief Executive Officer from January 2010. He served as President and Chief Operating Officer since September 2008. He previously served as Executive Vice President and Chief Operating Officer since September 2005. He previously served as Senior Vice President and President – Briggs & Stratton Power Products Group, LLC from September 2003 to August 2005. Mr. Teske also serves as a director of Badger Meter, Inc. and Lennox International, Inc. |

|

| |

RANDALL R. CARPENTER, 55 Vice President – Marketing |

| Mr. Carpenter was elected to his current position effective September 2009. He served as Vice President – Marketing since May 2007. He was previously Vice President Marketing and Product Development for Royal Appliance Manufacturing from 2005 to 2007. He was an Independent Marketing Consultant from 2004 to 2005. |

| ||

| ||

| ||

| ||

| ||

|

| |

DAVID G. DEBAETS, 49 Vice President – North American Operations (Engines Group) |

| Mr. DeBaets was elected to his current position effective September 2007. He has served as Vice President and General Manager – Large Engine Division since April 2000. |

| ||

| ||

|

| |

ROBERT F. HEATH, 64 Vice President, General Counsel and Secretary |

| Mr. Heath was elected to his current position effective February 2010. He previously was elected as Secretary January 2002. He has served as Vice President and General Counsel since January 2001. |

| ||

| ||

| ||

|

|

|

ANDREA L. GOLVACH, 41 Vice President – Treasurer |

| Ms. Golvach was elected to her current position effective November 2011 after serving as Vice President of Treasury since May 2011. Prior to joining Briggs & Stratton, she held the position of Director of Finance & Cash Management at Harley-Davidson, Inc., a global motorcycle manufacturer, from December 2007 to May 2011 and Director of Finance & Cash Management for Harley-Davidson Financial Services from August 2005 to December 2007. |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

HAROLD L. REDMAN, 47 Senior Vice President and President – Products Group |

| Mr. Redman was elected to his current position in October 2010. He previously served as Senior Vice President and President – Home Power Products Group since September 2009 after serving as Vice President and President – Home Power Products Group since May 2006. He also served as Senior Vice President – Sales & Marketing – Simplicity Manufacturing, Inc. since July 1995. |

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

WILLIAM H. REITMAN, 56 Senior Vice President – Business Development & Customer Support |

| Mr. Reitman was elected to his current position effective October 2010 after previously serving as Senior Vice President – Sales & Customer Support since September 2007. He previously served as Senior Vice President – Sales & Marketing since May 2006, and Vice President – Sales & Marketing since October 2004. He also served as Vice President – Marketing since November 1995. |

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

13

Name, Age, Position |

| Business Experience for Past Five Years |

DAVID J. RODGERS, 41 Senior Vice President and Chief Financial Officer |

| Mr. Rodgers was elected as Senior Vice President and Chief Financial Officer effective June 28, 2010 after serving as Vice President – Finance since February 2010. He was elected an executive officer in September 2007 and served as Controller from December 2006 to February 2010. He was previously employed by Roundy's Supermarkets, Inc. as Vice President – Corporate Controller from September 2005 to November 2006 and Vice President – Retail Controller from May 2003 to August 2005. |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

THOMAS R. SAVAGE, 64 Senior Vice President – Corporate Development |

| Mr. Savage was elected to his current position effective September 1, 2011. He previously served as Senior Vice President – Administration since 1997. |

| ||

| ||

|

|

|

JOSEPH C. WRIGHT, 53 Senior Vice President and President – Engines Group |

| Mr. Wright was elected to his current position in October 2010. He previously served as Senior Vice President and President – Engine Power Products Group since May 2006 after serving as Vice President and President – Yard Power Products Group since September 2005. He also served as Vice President and General Manager – Lawn and Garden Division from September 2004 to September 2005. He was elected an executive officer effective September 2002. |

|

|

|

EDWARD J. WAJDA, 52 Vice President and General Manager – International |

| Mr. Wajda was elected to his current position effective January 2011. He previously served as Vice President and General Manager – International since July 2008. Prior to joining Briggs & Stratton, he held the position of Senior Vice President – Global Medical Vehicle Group for Oshkosh Corporation, a manufacturer of security vehicles and bodies for access equipment, defense, fire and emergency and commercial uses, since June 2006. |

| ||

| ||

| ||

| ||

| ||

|

|

|

(1) Officer is also a Director of Briggs & Stratton.

(2) Member of the Board of Directors Executive Committee.

Officers are elected annually and serve until they resign, die, are removed, or a different person is appointed to the office.

14

PART II

ITEM 5. | MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Briggs & Stratton common stock and its common share purchase rights are traded on the NYSE under the symbol "BGG". Information required by this Item is incorporated by reference from the "Quarterly Financial Data, Dividend and Market Information" (unaudited), included in Item 8 of this report.

Changes in Securities, Use of Proceeds and Issuer Purchases of Equity Securities

The table below sets forth the information with respect to purchases made by or behalf of the Company of its common stock during the quarterly period ended July 1, 2012 .

2012 Fiscal Month |

| Total Number of Shares Purchased |

| Average Price Paid per Share |

| Total Number of Shares Purchased as Part of a Publicly Announced Program (1) |

| Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program (1) | ||||||

April 2, 2012 to April 29, 2012 |

| 405,400 | |

| $ | 17.66 | |

| 405,400 | |

| $ | 20,153,210 | |

April 30, 2012 to May 27, 2012 |

| 260,556 | |

| 17.65 | |

| 260,556 | |

| 15,554,281 | | ||

May 28, 2012 to July 1, 2012 |

| 284,773 | |

| 17.00 | |

| 284,773 | |

| 10,712,996 | | ||

Total Fourth Quarter |

| 950,729 | |

| $ | 17.46 | |

| 950,729 | |

| $ | 10,712,996 | |

(1) In August 2011, the Board of Directors of the Company authorized up to $50 million in funds for use in a common share repurchase program with an expiration of June 30, 2013.

In August 2012, subsequent to the end of fiscal 2012, the Board of Directors authorized up to an additional $50 million in funds associated with the common share repurchase program and an extension of the expiration date to June 30, 2014. The common share repurchase program authorizes the purchase of shares of the Company's common stock on the open market or in private transactions from time to time, depending on market conditions and certain governing loan covenants.

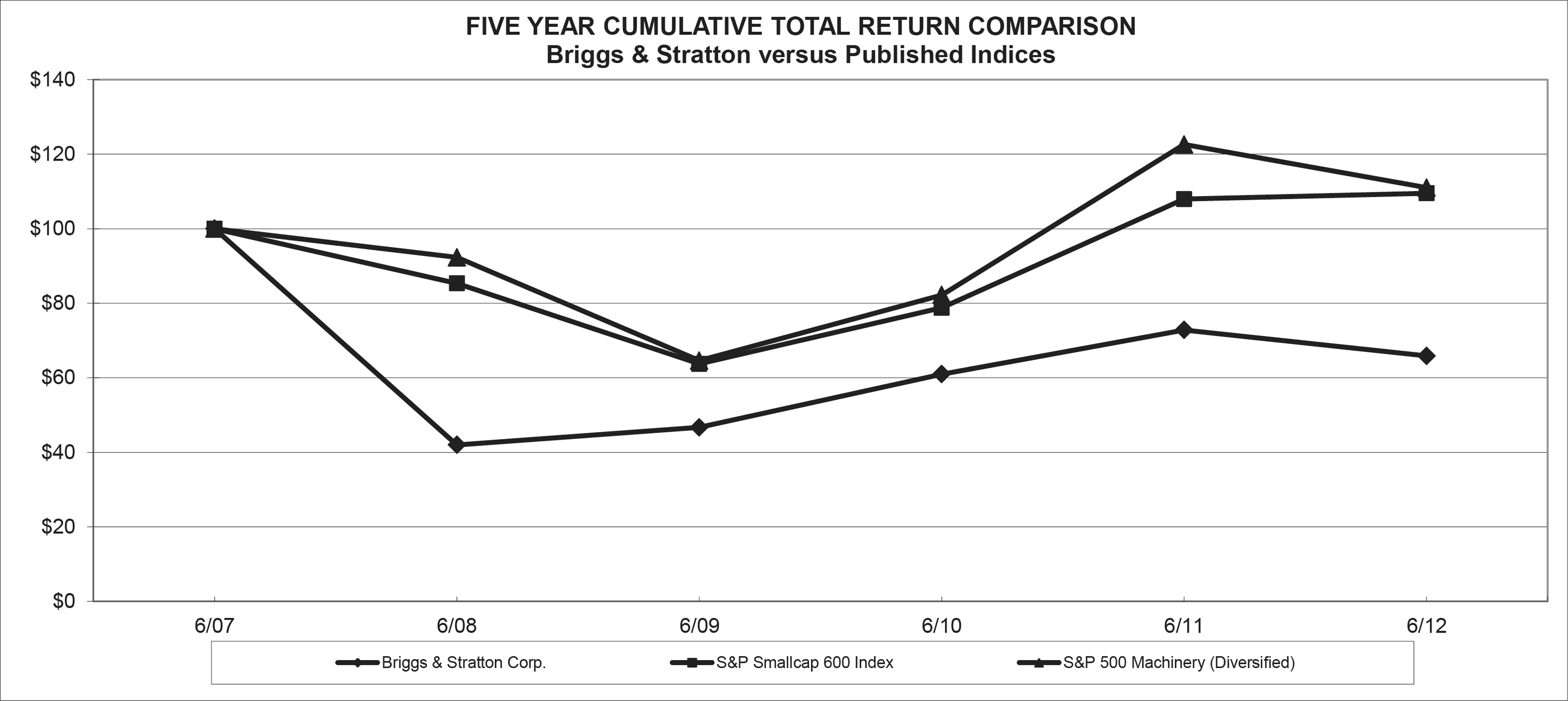

Five-year Stock Performance Graph

The graph below shows the cumulative total stockholder return of an investment of $100 (and the reinvestment of any dividends thereafter) at the close of business on June 30, 2007 in each of Briggs & Stratton common stock, the Standard & Poor's (S&P) Smallcap 600 Index and the S&P Machinery Index.

15

ITEM 6. | SELECTED FINANCIAL DATA |

Fiscal Year |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

| 2008 | ||||||||||

(dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

| ||||||||||

SUMMARY OF OPERATIONS (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

NET SALES |

| $ | 2,066,533 | |

| $ | 2,109,998 | |

| $ | 2,027,872 | |

| $ | 2,092,189 | |

| $ | 2,151,393 | |

GROSS PROFIT |

| 336,725 | |

| 398,316 | |

| 379,935 | |

| 333,679 | |

| 307,316 | | |||||

PROVISION FOR INCOME TAXES |

| 867 | |

| 7,699 | |

| 12,458 | |

| 8,437 | |

| 7,009 | | |||||

NET INCOME |

| 29,006 | |

| 24,355 | |

| 36,615 | |

| 31,972 | |

| 22,600 | | |||||

EARNINGS PER SHARE OF COMMON STOCK: |

|

|

|

|

|

|

|

|

|

| ||||||||||

Basic Earnings |

| 0.58 | |

| 0.49 | |

| 0.73 | |

| 0.64 | |

| 0.46 | | |||||

Diluted Earnings |

| 0.57 | |

| 0.48 | |

| 0.73 | |

| 0.64 | |

| 0.46 | | |||||

PER SHARE OF COMMON STOCK: |

|

|

|

|

|

|

|

|

|

| ||||||||||

Cash Dividends |

| 0.44 | |

| 0.44 | |

| 0.44 | |

| 0.77 | |

| 0.88 | | |||||

Shareholders' Investment |

| $ | 12.91 | |

| $ | 14.85 | |

| $ | 13.10 | |

| $ | 14.01 | |

| $ | 16.90 | |

WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK OUTSTANDING (in 000's) |

| 48,965 | |

| 49,677 | |

| 49,668 | |

| 49,572 | |

| 49,549 | | |||||

DILUTED NUMBER OF SHARES OF COMMON STOCK OUTSTANDING (in 000's) |

| 49,909 | |

| 50,409 | |

| 50,064 | |

| 49,725 | |

| 49,652 | | |||||

OTHER DATA (1) |

|

|

|

|

|

|

|

|

|

| ||||||||||

SHAREHOLDERS' INVESTMENT |

| $ | 631,970 | |

| $ | 737,943 | |

| $ | 650,577 | |

| $ | 694,684 | |

| $ | 837,523 | |

LONG-TERM DEBT |

| 225,000 | |

| 225,000 | |

| - | |

| 281,104 | |

| 365,555 | | |||||

CAPITAL LEASES |

| 133 | |

| 571 | |

| 1,041 | |

| 1,807 | |

| 1,677 | | |||||

TOTAL ASSETS |

| 1,608,231 | |

| 1,666,218 | |

| 1,690,057 | |

| 1,619,023 | |

| 1,833,294 | | |||||

PLANT AND EQUIPMENT |

| 1,026,845 | |

| 1,016,892 | |

| 979,898 | |

| 991,682 | |

| 1,012,987 | | |||||

PLANT AND EQUIPMENT, NET OF ACCUMULATED DEPRECIATION |

| 301,249 | |

| 329,225 | |

| 337,763 | |

| 360,175 | |

| 391,833 | | |||||

PROVISION FOR DEPRECIATION |

| 60,297 | |

| 59,920 | |

| 62,999 | |

| 63,981 | |

| 65,133 | | |||||

EXPENDITURES FOR PLANT AND EQUIPMENT |

| 49,573 | |

| 59,919 | |

| 44,443 | |

| 43,027 | |

| 65,513 | | |||||

WORKING CAPITAL (2) |

| $ | 605,591 | |

| $ | 634,356 | |

| $ | 342,132 | |

| $ | 561,431 | |

| $ | 644,935 | |

Current Ratio |

| 3.0 to 1 | |

| 2.8 to 1 | |

| 1.6 to 1 | |

| 2.9 to 1 | |

| 2.9 to 1 | | |||||

NUMBER OF EMPLOYEES AT YEAR-END |

| 6,321 | |

| 6,716 | |

| 6,362 | |

| 6,847 | |

| 7,145 | | |||||

NUMBER OF SHAREHOLDERS AT YEAR-END |

| 3,184 | |

| 3,289 | |

| 3,453 | |

| 3,509 | |

| 3,545 | | |||||

QUOTED MARKET PRICE: |

|

|

|

|

|

|

|

|

|

| ||||||||||

High |

| $ | 20.81 | |

| $ | 24.18 | |

| $ | 24.26 | |

| $ | 21.51 | |

| $ | 33.40 | |

Low |

| $ | 12.36 | |

| $ | 16.50 | |

| $ | 12.89 | |

| $ | 11.13 | |

| $ | 12.80 | |

(1) | The amounts include the acquisition of Victa Lawncare Pty. Limited since June 30, 2008. |

(2) | Included in working capital as of June 27, 2010 is a Current Maturity of Long-Term Debt of $203.5 million. |

16

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Results of Operations

FISCAL 2012 COMPARED TO FISCAL 2011

Net Sales

Consolidated net sales for fiscal 2012 were $2.1 billion, a decrease of $43.5 million, or 2.1% when compared to fiscal 2011.

Engines segment net sales for fiscal 2012 were $1.3 billion, which was lower by $89.6 million or 6.4% compared to fiscal 2011. This decrease in net sales was primarily driven by an 11% reduction in shipment volumes of engines to OEMs for lawn and garden products in the North American and European markets due to drought conditions in North America and economic uncertainty in Europe leading to reduced consumer purchases of lawn and garden equipment and unfavorable foreign exchange of $8.7 million primarily related to the Euro. This was partially offset by increased engine pricing, a favorable mix of product shipped that reflected proportionally larger volumes of units used on snow throwers and portable and standby generators.

Products segment net sales for fiscal 2012 were $952.1 million, an increase of $73.1 million or 8.3% from fiscal 2011. The increase in net sales was primarily due to increased shipments of portable and standby generators due to widespread power outages in the U.S. as a result of landed hurricane Irene and a subsequent snow storm on the United States East Coast earlier in the fiscal year, increased shipments of snow equipment after channel inventories were depleted from the prior selling season, improved pricing, a favorable mix of lawn and garden sales through the dealer channel and favorable foreign exchange of $2.3 million. This increase was partially offset by reduced shipment volumes of riding lawn and garden equipment domestically and reduced volume in the international markets. There were no landed hurricanes in fiscal 2011.

Gross Profit

The consolidated gross profit percentage was 16.3% in fiscal 2012, down from 18.9% in the same period last year.

The Engines segment gross profit percentage for fiscal 2012 was 19.1%, which was 3.7% lower compared to fiscal 2011. The gross profit percentage was unfavorably impacted by 0.8% due to reduced absorption on a 13% reduction in production volumes, 0.5% from unfavorable foreign exchange, 3.0% from higher manufacturing spending associated with rising commodity costs and start-up costs of $8.6 million associated with launching our Phase III emissions compliant engines, and 1.1% due to $14.3 million of restructuring charges. This reduction was partially offset by a 1.7% benefit due to improved engine pricing and a favorable mix of products sold.

The Products segment gross profit percentage for fiscal 2012 was 9.1%, which was 0.3% higher compared to fiscal 2011. The gross profit percentage improved by 3.1% from increased pricing and a favorable mix of lawn and garden sales through the dealer channel, 1.5% due to production operational improvements of $13.9 million and 1.7% resulted from improved absorption on higher production volumes. This was offset by a decrease of 2.8% due to increased commodity costs and 3.2% due to $30.5 million of restructuring charges.

Engineering, Selling, General and Administrative Costs

Engineering, selling, general and administrative expenses were $290.4 million in fiscal 2012, a decrease of $6.7 million or 2.2% from fiscal 2011.

The Engines segment engineering, selling, general and administrative expenses were $179.7 million in fiscal 2012, a decrease of $18.9 million from fiscal 2011 primarily due to lower employee compensation expense and a planned reduction of spend in advertising costs and professional services in response to the softness in the global markets.

17

The Products segment engineering, selling, general and administrative expenses were $110.7 million in fiscal 2012, an increase of $12.2 million from fiscal 2011. The increase was attributable to greater selling expense to support investments in international growth, higher employee compensation expense, and $0.7 million higher bad debt expense recorded in fiscal 2012 primarily attributable to distributors in the European market.

Restructuring Actions

In January 2012, the Company announced plans to reduce manufacturing capacity through closure of its Newbern, Tennessee and Ostrava, Czech Republic plants as well as the reconfiguration of its plant in Poplar Bluff, Missouri. In April 2012, the Company announced plans to further reduce manufacturing costs through consolidation of its Auburn, Alabama manufacturing facility as well as the reduction of approximately 10% of the Company's salaried employees. During fiscal 2012, the Company completed manufacturing operations at its Newbern, Tennessee and Ostrava, Czech Republic plants, carried out the reconfiguration of the Poplar Bluff, Missouri plant and implemented the salaried employee reductions. Pre-tax costs of all restructuring actions totaled $49.9 million in fiscal 2012, of which $44.8 million were included in gross profit as previously mentioned.

Additionally, beginning in fiscal 2013, as previously announced, the Company will no longer pursue placement of lawn and garden products at national mass retailers. The Engines segment will continue to support lawn and garden equipment OEMs who provide lawn and garden equipment to these retailers. The Products segment will continue to focus on innovative, higher margin products that are sold through our network of Simplicity, Snapper and Ferris dealers and regional retailers. The Company will also continue to sell pressure washers and portable and standby generators through the U.S. mass retail channel.

Interest Expense

For fiscal 2012, interest expense was $4.8 million lower compared to fiscal 2011 due to $3.9 million of pre-tax charges associated with the refinancing of Senior Notes in fiscal 2011, which did not recur in fiscal 2012, as well as lower average outstanding borrowings at slightly higher weighted average interest rates in fiscal 2012.

Provision for Income Taxes

The effective tax rate for fiscal 2012 was 2.9% compared to 24.0% reported the same period one year ago. The decrease in the effective tax rate for fiscal 2012 compared to fiscal 2011 was primarily due to a net benefit of $5.6 million associated with restructuring charges incurred in connection with closing the Company's Ostrava plant facility and a net benefit of $5.1 million due to the expiration of a non-U.S. statute of limitation period during fiscal 2012 and the settlement of U.S. audits.

FISCAL 2011 COMPARED TO FISCAL 2010

Net Sales

Consolidated net sales for fiscal 2011 were $2.1 billion, an increase of $82.1 million or 4.0% when compared to fiscal 2010.

Engines segment net sales for fiscal 2011 were approximately $1.4 billion, which was $39.1 million or 2.9% higher than the same period in fiscal 2010 despite a 2.1% decline in total unit shipment volumes. This increase from the same period in fiscal 2010 is primarily due to higher international engine unit shipments, a favorable mix of product shipped that reflected proportionately larger volumes of units used on commercial applications, improved engine pricing and a $4.7 million foreign currency benefit, partially offset by reduced engine shipments primarily to customers in North America.

Products segment net sales for fiscal 2011 were $879.0 million, which was $35.3 million or 4.2% higher than the same period in fiscal 2010. This improvement was primarily due to increased sales in our Australia and Europe markets, partially offset by reduced unit shipment volumes of lawn and garden equipment, pressure washers and portable generators in the domestic market.

18

Gross Profit

The consolidated gross profit percentage was 18.9% in fiscal 2011, up from 18.7% in fiscal 2010.

The Engines segment gross profit percentage was 22.8% for fiscal 2011, an improvement from 22.1% in fiscal 2010. This improvement was due to a favorable mix of products shipped, improved engine pricing, increased manufacturing efficiencies, a $5.4 million foreign currency benefit and increased absorption on 4.0% higher production volumes, partially offset by higher commodity costs and increased manufacturing wages and benefits, including a $9.6 million increase in pension benefits expense.

The Products segment gross profit percentage decreased to 8.8% for fiscal 2011 from 10.2% in fiscal 2010. The decline between years resulted from higher manufacturing spending and budget conscious customers purchasing lower margin units, partially offset by increased sales of premium dealer lawn and garden products, increased unit pricing, and a $7.2 million foreign currency benefit. The increase in manufacturing spending relates to higher commodity costs, manufacturing inefficiencies in the first half of fiscal 2011 in launching new products and increased warranty, and increased freight expenses, partially offset by $8.0 million in incremental cost savings associated with the closure of our Jefferson, Wisconsin manufacturing facility in fiscal 2010.

Engineering, Selling, General and Administrative Costs

Engineering, selling, general and administrative expenses were $297.1 million in fiscal 2011, an increase of $16.9 million or 6% from fiscal 2010.

The Engines segment engineering, selling, general and administrative expenses were $198.6 million in fiscal 2011, an increase of $12.5 million from fiscal 2010. The increase was due to higher international selling expenses and increased salaries and benefits, which included a $7.2 million increase in pension benefits expense.