UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2016

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-13984

MERIDIAN WASTE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| New York | 13-3832215 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S.

Employer Identification No.) |

12540 Broadwell Road, Suite 2104

Milton, GA30004

(Address of principal executive offices)

(678) 871-7457

(Issuer's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, par value $0.025 | The NASDAQ Capital Market | |

| Warrant

to purchase Common Stock (expiring January 30, 2022) | The NASDAQ Capital Market |

Securities

registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☑ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act . ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of registrant's voting and non-voting common equity held by non-affiliates (as defined by Rule 12b-2 of the Exchange Act) computed by reference to the average bid and asked price of such common equity on June 30, 2016, was $18,409,170. As of April 13, 2017, the registrant has one class of common equity, and the number of shares issued and outstanding of such common equity was 6,944,244.

Documents Incorporated By Reference: None.

MERIDIAN WASTE SOLUTIONS, INC.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

| Page | |||

| PART I | |||

| Item 1. | Business | 3 | |

| Item 1A. | Risk Factors | 12 | |

| Item 1B. | Unresolved Staff Comments | 20 | |

| Item 2. | Properties | 20 | |

| Item 3. | Legal Proceedings | 20 | |

| Item 4. | Mine Safety Disclosures | 21 | |

| PART II | |||

| Item 5. | Market for Registrants Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 21 | |

| Item 6 | Selected Financial Data | 25 | |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 25 | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 33 | |

| Item 8. | Financial Statements and Supplementary Data | 33 | |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | ||

| Item 9A. | Controls and Procedures | 34 | |

| Item 9B. | Other Information | 34 | |

| PART III | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 35 | |

| Item 11. | Executive Compensation | 38 | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 | |

| Item 13. | Certain Relationships and Related Transactions, and Direct Independence | 45 | |

| Item 14. | Principal Accountant Fees and Services | 45 | |

| PART IV | |||

| Item 15. | Exhibits, Financial Statement Schedules | 46 | |

| SIGNATURES | 52 | ||

| 2 |

PART I

FORWARD LOOKING STATEMENTS

Except for historical information, this document contains various "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our revenue mix, anticipated costs and expenses, development, relationships with strategic partners and other factors discussed under "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations". These forward-looking statements may include declarations regarding our belief or current expectations of management, such as statements indicating that "we expect," "we anticipate," "we intend," "we believe," and similar language. We caution that any forward-looking statement made by us in this Form 10-K or in other announcements made by us are further qualified by important factors that could cause actual results to differ materially from those projected in the forward-looking statements, including without limitation the risk factors set forth in this Form 10-K beginning on page 12.

Item 1. Business

As used in this Annual Report, "we," "us," "our," "Meridian," "Company" or "our Company" refers to Meridian Waste Solutions, Inc.

Our Company

We, through our operating subsidiaries, are an integrated provider of non-hazardous solid waste collection, transfer and disposal services. We currently have all of our operations in Missouri and Virginia but are looking to expand our presence across the Midwest, South and East regions of the United States.

History

Meridian Waste Solutions, Inc. (the "Company") was incorporated in November 1993 in New York. Prior to October 17, 2014, the Company derived revenue by licensing its trademarks to a third party (the "Legacy Business").

On October 17, 2014, the Company entered into that certain Membership Interest Purchase Agreement (the "Purchase Agreement") by and among Here to Serve Holding Corp., a Delaware corporation, as seller ("Here to Serve"), the Company, as parent, Brooklyn Cheesecake & Dessert Acquisition Corp., a wholly-owned subsidiary of the Company, as buyer (the "Acquisition Corp."), the Chief Executive Officer of the Company (the "Company Executive"), the majority shareholder of the Company (the "Company Majority Shareholder") and certain shareholders of Here to Serve (the "Here to Serve Shareholders"), pursuant to which the Acquisition Corp acquired from Here to Serve all of Here to Serve's right, title and interest in and to (i) 100% of the membership interests of Here to Serve – Missouri Waste Division, LLC d/b/a Meridian Waste, a Missouri limited liability company ("HTS Waste"); (ii) 100% of the membership interests of Here to Serve Technology, LLC, a Georgia limited liability company ("HTS Tech"); and (iii) 100% of the membership interests of Here to Serve Georgia Waste Division, LLC, a Georgia limited liability company ("HTS Waste Georgia", and together with HTS Waste and HTS Tech, collectively, the "Membership Interests"). As consideration for the Membership Interests, on October 31, 2014 (the "Closing Date") (i) the Company issued to Here to Serve 452,707 shares of the Company's common stock (the "HTS Common Stock"); (ii) the Company issued to the holder of Class A Preferred Stock of Here to Serve ("Here to Serve's Class A Preferred Stock") 51 shares of the Company's Series A Preferred Stock (the "Series A Preferred Stock"); (iii) the Company issued to the holder of Class B Preferred Stock of Here to Serve ("Here to Serve's Class B Preferred Stock") an aggregate of 71,120 shares of the Company's Series B Preferred Stock (the "Series B Preferred Stock," together with the HTS Common Stock and the Series A Preferred Stock, the "Purchase Price Shares"); and (iv) the Company assumed certain liabilities.

| 3 |

As further consideration, on the Closing Date of the transaction contemplated under the Purchase Agreement, (i) in satisfaction of all accounts payable and shareholder loans, Here to Serve paid to the Company Majority Shareholder $70,000 and (ii) Here to Serve purchased from the Company Majority Shareholder 11,500 shares of the Company's common stock for a purchase price of $230,000. Pursuant to the Purchase Agreement, to the extent Purchase Price Shares are issued to individual shareholders of Here to Serve at or upon closing of the Purchase Agreement: (i) shares of common stock of Here to Serve held by the individuals listed on Schedule 2.2 of the Purchase Agreement valued at $2,564,374.95 were cancelled in accordance with such Schedule 2.2; (ii) 50,000 shares of Here to Serve's Class A Preferred Stock valued at $1,000 were cancelled; and (iii) 71,120 shares of Here to Serve's Class B Preferred Stock valued at $7,121,000 were cancelled.

The closing of the Purchase Agreement resulted in a change of control of the Company and the Legacy Business was spun out to a shareholder in connection with the same.

On March 27, 2015, the Company filed a Certificate of Amendment of the Certificate of Incorporation to change the name of the Company from Brooklyn Cheesecake & Desserts Company, Inc. to Meridian Waste Solutions, Inc. (the "Name Change"). On April 15, 2015, the Company received approval from FINRA for the Name Change and to change its stock symbol from BCKE to MRDN.

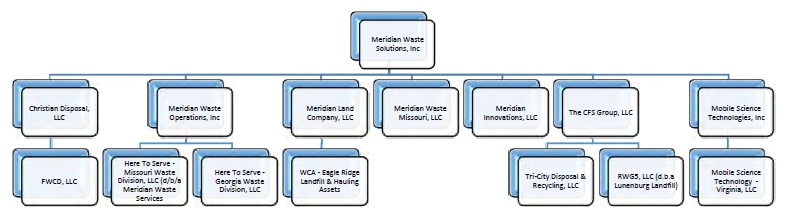

Corporate Structure

Missouri Waste Operations

Here to Serve – Missouri Waste Division, LLC d/b/a Meridian Waste

Here to Serve – Missouri Waste Division, LLC ("HTS Waste") is a non-hazardous solid waste management company providing collection services for approximately 45,000 commercial, industrial and residential customers in Missouri. We own one collection operation based out of Bridgeton, Missouri. Approximately 100% of HTS Waste's 2016 and 2015 revenue was from collection, utilizing over 60 collection vehicles.

HTS Waste began non-hazardous waste collection operations in May 2014 upon the acquisition of nearly all of the assets from Meridian Waste Services, LLC that in turn became the core of our operations. From our formation through today, we have begun to create the infrastructure needed to expand our operations through acquisitions and market development opportunities.

Christian Disposal, LLC; FWCD

Effective December 22, 2015, the Company consummated the closing of the Amended and Restated Membership Interest Purchase Agreement, dated October 16, 2015, by and among the Company, Timothy M. Drury, Christian Disposal LLC ("Christian Disposal"), FWCD, LLC ("FWCD"), Missouri Waste and Georgia Waste, as amended by that certain First Amendment thereto, dated December 4, 2015, pursuant to which Christian Disposal became a wholly-owned subsidiary of the Company in exchange for: (i) Thirteen Million Dollars ($13,000,000), subject to working capital adjustment, (ii) 87,500 shares of the Company's Common Stock, (iii) a Convertible Promissory Note in the amount of One Million Two Hundred Fifty Thousand Dollars ($1,250,000), bearing interest at 8% per annum and (iv) an additional purchase price of Two Million Dollars ($2,000,000), due upon completion of an extension under a certain contract to which Christian Disposal is party (the "Additional Purchase Price"), each payable to the former stockholders of Christian Disposal. The Additional Purchase Price will not become due, because an extension was not, and will not be, granted in connection with the relevant contract.

Christian Disposal, along with its subsidiary, FWCD, is a non-hazardous solid waste management company providing collection and transfer services for approximately 35,000 commercial, industrial and residential customers in Missouri. Christian Disposal's collection operation is based out of Winfield, Missouri. Along with operations in Winfield, Christian Disposal operates two transfer stations, in O'Fallon, Missouri and St. Peters, Missouri, and owns one transfer station, in Winfield, Missouri. Almost all of Christian Disposal and FWCD's 2015 revenue and revenue in 2016 was from collection and transfer, utilizing over 35 collection vehicles.

Christian Disposal began non-hazardous waste collection operations in 1978. Our acquisition of Christian Disposal is a key element of our strategy to create the vertically integrated infrastructure needed to expand our operations.

| 4 |

Meridian Land Company, LLC (Assets of Eagle Ridge Landfill & Hauling)

Effective December 22, 2015, Meridian Land Company, LLC ("Meridian Land Company"), a wholly-owned subsidiary of the Company, consummated the closing of that certain Asset Purchase Agreement, dated November 13, 2015, by and between Meridian Land Company and Eagle Ridge Landfill, LLC ("Eagle"), as amended by that certain Amendment to Asset Purchase Agreement, dated December 18, 2015, to which the Company and WCA Waste Corporation are also party, pursuant to which the Company, through Meridian Land Company, purchased from Eagle a landfill in Pike County, Missouri (the "Eagle Ridge Landfill") and substantially all of the assets used by Eagle related to the Eagle Ridge Landfill, including certain debts, in exchange for $9,506,500 in cash, subject to a working capital adjustment.

The Eagle Ridge Landfill is currently permitted to accept municipal solid waste. The Eagle Ridge Landfill is located in Bowling Green, Missouri. Meridian Land Company currently owns 265 acres at Eagle Ridge with 56.7 acres permitted and constructed to receive waste.

In addition to the Eagle Ridge Landfill, the Company operates, through Meridian Land Company, hauling operations in Bowling Green, Missouri, servicing commercial, residential and roll off customers in this market. The Company will be looking to expand its footprint in the market through an aggressive sales and marketing strategy, as well as through additional acquisitions.

Virginia Waste Operations

The CFS Group, LLC; The CFS Disposal & Recycling Services, LLC; RWG5, LLC

On February 15, 2017, the Company consummated the closing of the Membership Interest Purchase Agreement (the "Virginia Purchase Agreement") by and between the Company and Waste Services Industries, LLC ("Seller"), pursuant to which the Company purchased from Seller 100% of the membership interests of The CFS Group, LLC ("CFS"), The CFS Disposal & Recycling Services, LLC ("CFS Disposal"), RWG5, LLC ("RWG5" and, together with CFS and CFS Disposal, the "CFS Companies"), in exchange for the following: (i) $40,000,000 in cash and assumption of certain capital leases, subject to a working capital adjustment in accordance with Section 2.6 of the Virginia Purchase Agreement and (ii) 500,000 shares of the Company's common stock.

Collectively, the CFS Companies are non-hazardous solid waste management companies providing collection and transfer services for more than 30,000 commercial, industrial and residential customers in Virginia, with its main facility in Petersburg, Virginia and satellite facilities in Lunenberg, Virginia and Prince George, Virginia. Along with the collection operation in Petersburg, the CFS Companies operate a transfer station, in Lunenberg, and two owned landfills, in Petersburg and Lunenberg. Approximately 81% of the CFS Companies' 2015 revenue was from collection and transfer, utilizing over 60 collection vehicles.

Our acquisition of the CFS Companies is a key element of our strategy to create the vertically integrated infrastructure needed to expand our operations.

Customers

For the year ended December 31, 2016, the Company had one contract that accounted for approximately 11% of the Company's revenue. This one contract currently runs through March 2019. During the year ended December 31, 2015, the Company had two contracts that accounted for approximately 44% of the Company's revenues, with one of such contracts accounting for approximately 26% and the other such contract accounting for approximately 18% of the Company's revenues.

Collection Services

Meridian, through its subsidiaries, provides solid waste collection services to approximately 65,000 industrial, commercial and residential customers in the Metropolitan St. Louis, Missouri area, and, recently, approximately 33,000 in Virginia. In 2015, our collection revenue consisted of approximately 17% from services provided to industrial customers, 13% from services provided to commercial customers and 70% from services provided to residential customers.

In our commercial collection operations, we supply our customers with waste containers of various types and sizes. These containers are designed so that they can be lifted mechanically and emptied into a collection truck to be transported to a disposal facility. By using these containers, we can service most of our commercial customers with trucks operated by a single employee. Commercial collection services are generally performed under service agreements with a duration of one to five years with possible renewal options. Fees are generally determined by such considerations as individual market factors, collection frequency, the type of equipment we furnish, the type and volume or weight of the waste to be collected, the distance to the disposal facility and the cost of disposal.

Residential solid waste collection services often are performed under contracts with municipalities, which we generally secure by competitive bid and which give us exclusive rights to service all or a portion of the homes in these municipalities. These contracts usually range in duration from one to five years with possible renewal options. Generally, the renewal options are automatic upon the mutual agreement of the municipality and the provider; however, some agreements provide for mandatory re-bidding. Alternatively, residential solid waste collection services may be performed on a subscription basis, in which individual households or homeowners' or similar associations contract directly with us. In either case, the fees received for residential collection are based primarily on market factors, frequency and type of service, the distance to the disposal facility and the cost of disposal.

Additionally, we rent waste containers and provide collection services to construction, demolition, and industrial sites and some larger commercial locations. We load the containers onto our vehicles and transport them with the waste to a landfill, a transfer station, or a recycling facility for disposal. We refer to this as "roll-off" collection. Roll-off collection services are generally performed on a contractual basis. Contract terms tend to be shorter in length, in some cases having terms of only six months, and may vary according to the customers' underlying projects.

| 5 |

Transfer and Disposal Services

Landfills are the main depository for solid waste in the United States. Solid waste landfills are built, operated, and tied to a state permit under stringent federal, state and local regulations. Currently, solid waste landfills in the United States must be designed, permitted, operated, closed and maintained after closure in compliance with federal, state and local regulations pursuant to Subtitle D of the Resource Conservation and Recovery Act of 1976, as amended. We do not operate any hazardous waste landfills, which may be subject to even greater regulations. Operating a solid waste landfill includes excavating, constructing liners, continually spreading and compacting waste and covering waste with earth or other inert material as required, final capping, closure and post-closure monitoring. The objectives of these operations are to maintain sanitary conditions, to ensure the best possible use of the airspace and to prepare the site so that it can ultimately be used for other end use purposes.

Access to a disposal facility is a necessity for all solid waste management companies. While access to disposal facilities owned or operated by third parties can be obtained, we believe that it is preferable to internalize the waste streams when possible. Meridian is targeting further geographic, as well as operational expansion, by focusing on markets with transfer stations and landfills available for acquisition.

Our transfer stations allow us to consolidate waste for subsequent transfer in larger loads, thereby making disposal in our otherwise remote landfills economically feasible. A transfer station is a facility located near residential and commercial collection routes where collection trucks take the solid waste that has been collected. The waste is unloaded from the collection trucks and reloaded onto larger transfer trucks for transportation to a landfill for final disposal. As an alternative to operating a transfer station directly, we could negotiate the use of a transfer station owned by a private party or operated by a competitor, which may not be as profitable as operating our own transfer station. In addition to increasing our ability to internalize the waste that our collection operations collect, using transfer stations reduces the costs associated with transporting waste to final disposal sites because the trucks we use for transfer have a larger capacity than collection trucks, thus allowing more waste to be transported to the disposal facility on each trip.

Our Operating Strengths

Experienced Leadership

We have a proven and experienced senior management team. Our Chairman and Chief Executive Officer, Jeffrey S. Cosman, and President and Chief Operating Officer, Walter H. Hall, Jr., combine over 35 years of experience in the solid waste industry, including significant experience in local and regional operations, local and regional accounting, mergers & acquisitions, integration and the development of disposal capacity. Members of our team have held senior positions at Republic Services, Advanced Disposal, Southland Waste Services and Browning Ferris Industries. Our team has a proven track record with development and implementation of strategic marketplace plans, sales, safety, acquisitions, and coordination of assets and personnel. While our senior leadership team creates and drives our overall growth strategy, we rely on a decentralized management structure which does not interfere with local management and may afford us the opportunity to capitalize on growth and cost reduction at the local level.

Vertically Integrated Operations

The vertical integration of our operations allows us to manage the waste stream from the point of collection through disposal, which we hope will enable us to maximize profit by controlling costs and gaining competitive advantages, while still providing high-quality service to our customers. In the St. Louis market, because we have integrated our network of collection, transfer and disposal assets, primarily using our own resources, we generate a steady, predictable stream of waste volume and capture an incremental disposal margin. We charge tipping fees to third-party collection service providers for the use of our transfer stations or landfills, providing a source of recurring revenue. We believe the internalization of waste provides us with a significant cost advantage over our competitors, positioning us well to win additional profitable business through new customer acquisition and municipal contract awards. We also believe this vertically integrated structure enables us to quickly and efficiently integrate future acquisitions of transfer stations, collection operations or landfills into our current operations.

Landfill Assets

We now have three active and strategically located landfills at the core of our integrated operations which we believe provides us a significant competitive advantage, in that we do not need to use our competitors' landfills. Our landfills have substantial remaining airspace.

| 6 |

The value of our landfills may be further enhanced by synergies associated with our vertically integrated operations, including our transfer stations, which enable us to cover a greater geographic area surrounding the landfills, and provide competitive advantages in that we would not need to use our competitors' landfills. In our experience there has generally been a shift towards fewer, larger landfills, which has resulted in landfills that are generally located farther from population centers, with waste being transported longer distances between collection and disposal, typically after consolidation at a transfer station. With landfills, transfer stations and collection services in place, we aim to provide vertically integrated operations that cover the substantial geographic area surrounding the landfill.

Acquisition Integration and Municipal Contracts

Our business model contemplates our ability to execute and integrate value-enhancing, tuck-in acquisitions and win new municipal contracts as a core component of our growth.

As a management team, we have experience executing large-scale transactions by direct association with our historical success at Republic Services, Advanced Disposal and Browning Ferris Industries. In addition to significantly expanding our scale of operations, the acquisitions of Christian Disposal and Eagle Ridge Landfill enhanced our geographic footprint by providing us with complementary operations in the state of Missouri. This has helped us realize cost efficiencies through improved internalization by virtue of increased route concentration and more efficient utilization of our assets.

Finally, our management team has demonstrated success in municipal contract bidding, as we currently serve approximately 30 municipalities and townships via contracts, historical arrangements or subscriptions with residents.

Long-Term Contracts

In Missouri, we serve approximately 65,000 residential, commercial, and construction and industrial customers, with no single customer representing more than 11% of revenue in 2016. Our municipal customer relationships are generally supported by contracts ranging from three to seven years in initial duration most with subsequent renewal periods, and we have a historical renewal rate of 100% with such customers. Our standard service agreement is a five-year renewable agreement. We believe our customer relationships, long-term contracts and exceptional retention rate provide us with a high degree of stability as we continue to grow.

Customer Service

We maintain a central focus on customer service and we pride ourselves on trying to consistently exceed our customers' expectations. We believe investing in our customers' satisfaction will ultimately maximize customer loyalty price stability.

Commitment to Safety

The safety of our employees and customers is extremely important to us and we have a strong track record of safety and environmental compliance. We constantly review and assess our policies, practices and procedures in order to create a safer work environment for our employees and to reduce the frequency of workplace injuries.

Our Growth Strategy

Growth of Existing Markets

We believe that as the residential population and number of businesses grow in our existing market, we will see waste volumes increase organically. We seek to remain active and alert with respect to the changing landscapes in the communities in which we already provide service in order obtain long-term contracts for collecting solid waste for residential collection, collection from municipalities, as well as collection from small and large commercial and industrial contracts. Obtaining long-term contracts may enable us to grow our revenue base at the same rate as the underlying economic growth in these markets. Furthermore, securing long-term contracts provides a significant barrier to entry from competitors in these markets.

Expanding into New Markets

Our operating model focuses on vertically integrated operations. We continue to pursue a growth strategy that includes acquiring solid waste companies that complement our existing business. Our goal is to create market-specific, vertically integrated operations consisting of one or more collection operations, transfer stations and landfills.

We plan to start new market development projects in certain disposal-neutral markets in which we will provide services under exclusive arrangements with municipal customers, which facilitates highly-efficient and profitable collection operations and lower capital requirements. We believe this strategic focus positions us to maintain significant share within our target markets, maximize customer retention and benefit from a higher and more stable pricing environment.

| 7 |

Acquisition and Integration

Our revenue model is based on organic growth of operations, the acquisition of established operations in new markets, as well as being able to execute value-adding, tuck-in acquisitions. We hope to direct acquisition efforts towards those markets in which we would be able to provide vertically integrated collection and disposal services and/or provide waste collection services, pursuant to contracts that grant exclusivity. Prior to acquisition, we analyze each prospective target for cost savings through the elimination of inefficiencies and excesses that are typically associated with private companies competing in fragmented industries. We aim to realize synergies from consolidating businesses into our existing operations, which we hope will allow us to reduce capital and expense requirements associated with truck routing, personnel, fleet maintenance, inventories and back-office administration.

Pursue Additional Exclusive Municipal Contracts

We intend to devote significant resources to securing additional municipal contracts. Our management team is well versed in bidding for municipal contracts with over 35 years of experience and working knowledge in the solid waste industry and local service areas in existing and target markets. We hope to procure and negotiate additional exclusive municipal contracts, allowing us to maintain stable recurring revenue but also providing a significant barrier to entry to our competitors in those markets.

Invest in Strategic Infrastructure

We will continue to invest in our infrastructure to support growth and increase our margins. Given the long remaining life of our existing landfill, we will invest resources toward its development and enhancement in order to increase our disposal capacity. Similarly, we will continue to evaluate opportunities to maximize the efficiency of our collection operations.

Waste Industry Overview

The non-hazardous solid waste industry can be divided into the following three categories: collection, transfer and disposal services. In our management's experience, companies engaging in collection and/or transfer operations of solid waste typically have lower margins than those additionally performing disposal service operations. By vertically integrating collection, transfer and disposal operations, operators seek to capture significant waste volumes and improve operating margins.

During the past four decades, our industry has experienced periods of substantial consolidation activity; however, we believe significant fragmentation remains. We believe that there are two primary factors that lead to consolidation:

| ● | stringent industry regulations have caused operating and capital costs to rise, with many local industry participants finding these costs difficult to bear and deciding to either close their operations or sell them to larger operators; and |

| ● | larger operators are increasingly pursuing economies of scale by vertically integrating their operations or by utilizing their facility, asset and management infrastructure over larger volumes and, accordingly, larger solid waste collection and disposal companies aim to become more cost-effective and competitive by controlling a larger waste stream and by gaining access to significant financial resources to make acquisitions. |

Competition

The solid waste collection and disposal industry is highly competitive and, following consolidation, remains fragmented, and requires substantial labor and capital resources. The industry presently includes large, publicly-held, national waste companies such as Republic Services, Inc, Waste Connections, Inc., Advanced Disposal, Inc. and Waste Management, Inc., as well as numerous other public and privately-held waste companies. Our existing market and certain of the markets in which we will likely compete are served by one or more of these companies, as well as by numerous privately-held regional and local solid waste companies of varying sizes and resources, some of which have accumulated substantial goodwill in their markets. We also compete with operators of alternative disposal facilities and with counties, municipalities and solid waste districts that maintain their own waste collection and disposal operations. Public sector operations may have financial advantages over us because of potential access to user fees and similar charges, tax revenues and tax-exempt financing.

We compete for collection based primarily on geographic location and the price and quality of our services. From time to time, our competitors may reduce the price of their services in an effort to expand their market share or service areas or to win competitively bid municipal contracts. These practices may cause us to reduce the price of our services or, if we elect not to do so, to lose business.

Our management has observed significant consolidation in the solid waste collection and disposal industry, and, as a result of this perceived consolidation, we encounter competition in our efforts to acquire landfills, transfer stations and collection operations. Competition exists not only for collection, transfer and disposal volume but also for acquisition candidates. We generally compete for acquisition candidates with large, publicly-held waste management companies, private equity backed firms as well as numerous privately-held regional and local solid waste companies of varying sizes and resources. Competition in the disposal industry may also be affected by the increasing national emphasis on recycling and other waste reduction programs, which may reduce the volume of waste deposited in landfills. Accordingly, it may become uneconomical for us to make further acquisitions or we may be unable to locate or acquire suitable acquisition candidates at price levels and on terms and conditions that we consider appropriate, particularly in markets we do not already serve.

| 8 |

Sales and Marketing

We focus our marketing efforts on increasing and extending business with existing customers, as well as increasing our new customer base. Our sales and marketing strategy is to provide prompt, high quality, comprehensive solid waste collection to our customers at competitive prices. We target potential customers of all sizes, from small quantity generators to large companies and municipalities. Because the waste collection and disposal business is a highly localized business, most of our marketing activity is local in nature.

Government Contracts

We are party to contracts with municipalities and other associations and agencies. Many of these contracts are or will be subject to competitive bidding. We may not be the successful bidder, or we may have to substantially lower prices in order to be the successful bidder. In addition, some of our customers may have the right to terminate their contracts with us before the end of the contract term.

Municipalities may annex unincorporated areas within counties where we provide collection services, and as a result, our customers in annexed areas may be required to obtain service from competitors who have been franchised or contracted by the annexing municipalities to provide those services. Some of the local jurisdictions in which we currently operate grant exclusive franchises to collection and disposal companies, others may do so in the future, and we may enter markets where franchises are granted by certain municipalities, thereby reducing the potential market opportunity for us.

Regulation

Our business is subject to extensive and evolving federal, state and local environmental, health, safety and transportation laws and regulations. These laws and regulations are administered by the U.S. Environmental Protection Agency, or EPA, and various other federal, state and local environmental, zoning, air, water, transportation, land use, health and safety agencies. Many of these agencies regularly inspect our operations to monitor compliance with these laws and regulations. Governmental agencies have the authority to enforce compliance with these laws and regulations and to obtain injunctions or impose civil or criminal penalties in cases of violations. We believe that regulation of the waste industry will continue to evolve, and we will adapt to future legal and regulatory requirements to ensure compliance.

The permit for our landfill requires us to post a closure bond, which currently stands at approximately $7.4 million, with premiums in the approximate amount of $250,000.

Our operations are subject to extensive regulation, principally under the federal statutes described below.

The Resource Conservation and Recovery Act of 1976, as amended, or RCRA. RCRA regulates the handling, transportation and disposal of hazardous and non-hazardous wastes and delegates authority to states to develop programs to ensure the safe disposal of solid wastes. On October 9, 1991, the EPA promulgated Solid Waste Disposal Facility Criteria for non-hazardous solid waste landfills under Subtitle D of RCRA. Subtitle D includes location standards, facility design and operating criteria, closure and post-closure requirements, financial assurance standards and groundwater monitoring, as well as corrective action standards, many of which had not commonly been in place or enforced at landfills. Subtitle D applies to all solid waste landfill cells that received waste after October 9, 1991, and, with limited exceptions, required all landfills to meet these requirements by October 9, 1993. All states in which we operate have EPA-approved programs which implemented at least the minimum requirements of Subtitle D and in some states even more stringent requirements.

The Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, or "CERCLA." CERCLA, which is also known as Superfund, addresses problems created by the release or threatened release of hazardous substances (as defined in CERCLA) into the environment. CERCLA's primary mechanism for achieving remediation of such problems is to impose strict joint and several liability for cleanup of disposal sites on current owners and operators of the site, former site owners and operators at the time of disposal and parties who arranged for disposal at the facility ( i.e. , generators of the waste and transporters who select the disposal site). The costs of a CERCLA cleanup can be substantial. In addition to ordering remediation work to be undertaken, federal or state agencies can perform remediation work themselves and seek reimbursement of their costs from potentially liable parties, and may record liens to enforce their cost recovery claims. Beyond cleanup costs, federal and state agencies may also assert claims for damages to natural resources, like groundwater aquifers, surface water bodies and ecosystems. Liability under CERCLA is not dependent on the existence or intentional disposal of "hazardous wastes" (as defined under RCRA), but can also be based upon the release or threatened release, even as a result of lawful, unintentional and non-negligent action, of any one of the more than 700 "hazardous substances" listed by the EPA, even in minute amounts.

| 9 |

The Federal Water Pollution Control Act of 1972, as amended, or the Clean Water Act. This act establishes rules regulating the discharge of pollutants into streams and other waters of the United States (as defined in the Clean Water Act) from a variety of sources, including solid waste disposal sites. If wastewater or stormwater from our transfer stations may be discharged into surface waters, the Clean Water Act requires us to apply for and obtain discharge permits, conduct sampling and monitoring and, under certain circumstances, reduce the quantity of pollutants in those discharges. In 1990, the EPA issued additional rules under the Clean Water Act, which establish standards for management of storm water runoff from landfills and which require landfills that receive, or in the past received, industrial waste to obtain storm water discharge permits. In addition, if a landfill or transfer station discharges wastewater through a sewage system to a publicly-owned treatment works, the facility must comply with discharge limits imposed by the treatment works. Also, if development of a landfill may alter or affect "wetlands," the owner may have to obtain a permit and undertake certain mitigation measures before development may begin. This requirement is likely to affect the construction or expansion of many solid waste disposal sites.

The Clean Air Act of 1970, as amended, or the Clean Air Act. The Clean Air Act provides for increased federal, state and local regulation of the emission of air pollutants. The EPA has applied the Clean Air Act to solid waste landfills and vehicles with heavy duty engines, such as waste collection vehicles. Additionally, in March 1996, the EPA adopted New Source Performance Standards and Emission Guidelines (the "Emission Guidelines") for municipal solid waste landfills to control emissions of landfill gases. These regulations impose limits on air emissions from solid waste landfills. The Emission Guidelines impose two sets of emissions standards, one of which is applicable to all solid waste landfills for which construction, reconstruction or modification was commenced before May 30, 1991. The other applies to all municipal solid waste landfills for which construction, reconstruction or modification was commenced on or after May 30, 1991. These guidelines, combined with the new permitting programs established under the Clean Air Act, could subject solid waste landfills to significant permitting requirements and, in some instances, require installation of gas recovery systems to reduce emissions to allowable limits. The EPA also regulates the emission of hazardous air pollutants from municipal landfills and has promulgated regulations that require measures to monitor and reduce such emissions.

Climate Change . A variety of regulatory developments, proposals or requirements have been introduced that are focused on restricting the emission of carbon dioxide, methane and other gases known as greenhouse gases. Congress has considered legislation directed at reducing greenhouse gas emissions. There has been support in various regions of the country for legislation that requires reductions in greenhouse gas emissions, and some states have already adopted legislation addressing greenhouse gas emissions from various sources. In 2007, the U.S. Supreme Court held in Massachusetts, et al. v. EPA that greenhouse gases are an "air pollutant" under the federal Clean Air Act and, thus, subject to future regulation. In a move toward regulating greenhouse gases, on December 15, 2009, the EPA published its findings that emission of carbon dioxide, methane and other greenhouse gases present an endangerment to human health and the environment because greenhouse gases are, according to EPA, contributing to climate change. On October 30, 2009, the EPA published the greenhouse gas reporting final rule, effective December 29, 2009, which establishes a new comprehensive scheme requiring certain specified industries as well as operators of stationary sources emitting more than established annual thresholds of carbon dioxide-equivalent greenhouse gases to inventory and report their greenhouse gas emissions annually. Municipal solid waste landfills are subject to the rule. In 2009, the EPA also proposed regulations that would require a reduction in emissions of greenhouse gases from motor vehicles. According to the EPA, the final motor vehicle greenhouse gas standards will trigger construction and operating permit requirements for stationary sources that exceed potential-to-emit (PTE) thresholds for regulated pollutants. As a result, the EPA has proposed to tailor these programs such that only large stationary sources, such as electric generating units, cement production facilities, and petroleum refineries will be required to have air permits that authorize greenhouse gas emissions.

The Occupational Safety and Health Act of 1970, as amended, or OSHA. OSHA establishes certain employer responsibilities, including maintenance of a workplace free of recognized hazards likely to cause death or serious injury, compliance with standards promulgated by the Occupational Safety and Health Administration and various record keeping, disclosure and procedural requirements. Various standards, including standards for notices of hazards, safety in excavation and demolition work and the handling of asbestos, may apply to our operations.

Flow Control/Interstate Waste Restrictions. Certain permits and approvals, as well as certain state and local regulations, may limit a landfill or transfer station to accepting waste that originates from specified geographic areas, restrict the importation of out-of-state waste or wastes originating outside the local jurisdiction or otherwise discriminate against non-local waste. From time to time, federal legislation is proposed that would allow some local flow control restrictions. Although no such federal legislation has been enacted to date, if such federal legislation should be enacted in the future, states in which we use landfills could limit or prohibit the importation of out-of-state waste or direct that wastes be handled at specified facilities. These restrictions could also result in higher disposal costs for our collection operations. If we were unable to pass such higher costs through to our customers, our business, financial condition and operating results could be adversely affected.

State and Local Regulation. Each state in which we now operate or may operate in the future has laws and regulations governing the generation, storage, treatment, handling, transportation and disposal of solid waste, occupational safety and health, water and air pollution and, in most cases, the siting, design, operation, maintenance, closure and post-closure maintenance of landfills and transfer stations. State and local permits and approval for these operations may be required and may be subject to periodic renewal, modification or revocation by the issuing agencies. In addition, many states have adopted statutes comparable to, and in some cases more stringent than, CERCLA. These statutes impose requirements for investigation and cleanup of contaminated sites and liability for costs and damages associated with such sites, and some provide for the imposition of liens on property owned by responsible parties. Furthermore, many municipalities also have ordinances, local laws and regulations affecting our operations. These include zoning and health measures that limit solid waste management activities to specified sites or activities, flow control provisions that direct or restrict the delivery of solid wastes to specific facilities, laws that grant the right to establish franchises for collection services and then put such franchises out for bid and bans or other restrictions on the movement of solid wastes into a municipality.

| 10 |

Certain state and local jurisdictions may also seek to enforce flow control restrictions through local legislation or contractually. In certain cases, we may elect not to challenge such restrictions. These restrictions could reduce the volume of waste going to landfills in certain areas, which may adversely affect our ability to operate our landfills at their full capacity and/or reduce the prices that we can charge for landfill disposal services. These restrictions may also result in higher disposal costs for our collection operations. If we were unable to pass such higher costs through to our customers, our business, financial condition and operating results could be adversely affected.

Permits or other land use approvals with respect to a landfill, as well as state or local laws and regulations, may specify the quantity of waste that may be accepted at the landfill during a given time period and/or specify the types of waste that may be accepted at the landfill. Once an operating permit for a landfill is obtained, it must generally be renewed periodically.

There has been an increasing trend at the state and local level to mandate and encourage waste reduction and recycling and to prohibit or restrict the disposal in landfills of certain types of solid wastes, such as construction and demolition debris, yard wastes, food waste, beverage containers, unshredded tires, lead-acid batteries, paper, cardboard and household appliances.

Many states and local jurisdictions have enacted "bad boy" laws that allow the agencies that have jurisdiction over waste services contracts or permits to deny or revoke these contracts or permits based on the applicant's or permit holder's compliance history. Some states and local jurisdictions go further and consider the compliance history of the parent, subsidiaries or affiliated companies, in addition to that of the applicant or permit holder. These laws authorize the agencies to make determinations of an applicant's or permit holder's fitness to be awarded a contract to operate and to deny or revoke a contract or permit because of unfitness unless there is a showing that the applicant or permit holder has been rehabilitated through the adoption of various operating policies and procedures put in place to assure future compliance with applicable laws and regulations.

Some state and local authorities enforce certain federal laws in addition to state and local laws and regulations. For example, in some states, RCRA, OSHA, parts of the Clean Air Act and parts of the Clean Water Act are enforced by local or state authorities instead of the EPA, and in some states those laws are enforced jointly by state or local and federal authorities.

Public Utility Regulation. In many states, public authorities regulate the rates that landfill operators may charge.

Seasonality

Based on our industry and our historic trends, we expect our operations to vary seasonally. Typically, revenue will be highest in the second and third calendar quarters and lowest in the first and fourth calendar quarters. These seasonal variations result in fluctuations in waste volumes due to weather conditions and general economic activity. We also expect that our operating expenses may be higher during the winter months due to periodic adverse weather conditions that can slow the collection of waste, resulting in higher labor and operational costs.

Employees

We have approximately 180 full-time employees. None of our employees are represented by a labor union. We have not experienced any work stoppages and we believe that our relations with our employees are good.

Properties

Our principal executive office is located at 12540 Broadwell Road, Suite 2104, Milton, Georgia and is an approximately 3,500 sq. ft. office space rented at a rate of approximately $3,000 per month. We also lease approximately 8,500 sq. ft. of office space rented at a rate of $23,000 per month in Bridgeton, Missouri and approximately 84,000 sq. ft. of office and warehouse space rented at a rate of approximately $50,000 per month in Petersburg, Virginia. Additional space may be required as we expand our business activities, but we do not foresee any significant difficulties in obtaining additional office facilities if deemed necessary.

Our principal property is comprised of land, three landfills, buildings, and equipment owned and/or leased in Missouri and Virginia. These properties are sufficient to meet the Company's current operational needs; however, the Company is exploring the potential acquisition and/or leasing of additional properties pursuant to its growth strategies.

| 11 |

Available Information

We electronically file certain documents with the Securities and Exchange Commission (the SEC). We file annual reports on Form 10-K; quarterly reports on Form 10-Q; and current reports on Form 8-K (as appropriate); along with any related amendments and supplements thereto. From time-to-time, we may also file registration statements and related documents in connection with equity or debt offerings. You may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information regarding the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet website at www.sec.gov that contains reports and other information regarding registrants that file electronically with the SEC.

Item 1A. Risk Factors

RISK FACTORS

You should carefully consider the risks described below, together with all of the other information included in this report, in considering our business and prospects. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. The occurrence of any of the following risks could harm our business, financial condition or results of operations.

RISKS RELATED TO OUR COMPANY AND OUR INDUSTRY

WE ARE SUBJECT TO ENVIRONMENTAL AND SAFETY LAWS, WHICH RESTRICT OUR OPERATIONS AND INCREASE OUR COSTS.

We are subject to extensive federal, state and local laws and regulations relating to environmental protection and occupational safety and health. These include, among other things, laws and regulations governing the use, treatment, storage and disposal of wastes and materials, air quality, water quality and the remediation of contamination associated with the release of hazardous substances. Our compliance with existing regulatory requirements is costly, and continued changes in these regulations could increase our compliance costs. Government laws and regulations often require us to enhance or replace our equipment. We are required to obtain and maintain permits that are subject to strict regulatory requirements and are difficult and costly to obtain and maintain. We may be unable to implement price increases sufficient to offset the cost of complying with these laws and regulations. In addition, regulatory changes could accelerate or increase expenditures for closure and post-closure monitoring at solid waste facilities and obligate us to spend sums over the amounts that we have accrued. In order to develop, expand or operate a landfill or other waste management facility, we must have various facility permits and other governmental approvals, including those relating to zoning, environmental protection and land use. The permits and approvals are often difficult, time consuming and costly to obtain and could contain conditions that limit our operations.

| 12 |

WE MAY BECOME SUBJECT TO ENVIRONMENTAL CLEAN-UP COSTS OR LITIGATION THAT COULD CURTAIL OUR BUSINESS OPERATIONS AND MATERIALLY DECREASE OUR EARNINGS.

CERCLA, and analogous state laws provide for the remediation of contaminated facilities and impose strict joint and several liability for remediation costs on current and former owners or operators of a facility at which there has been a release or a threatened release of a hazardous substance. This liability is also imposed on persons who arrange for the disposal of and who transport such substances to the facility. Hundreds of substances are defined as hazardous under CERCLA and their presence, even in small amounts, can result in substantial liability. The expense of conducting a cleanup can be significant. Notwithstanding our efforts to comply with applicable regulations and to avoid transporting and receiving hazardous substances, we may have liability because these substances may be present in waste collected by us. The actual costs for these liabilities could be significantly greater than the amounts that we might be required to accrue on our financial statements from time to time.

In addition to the costs of complying with environmental regulations, we may incur costs to defend against litigation brought by government agencies and private parties. As a result, we may be required to pay fines or our permits and licenses may be modified or revoked. We may in the future be a defendant in lawsuits brought by governmental agencies and private parties who assert claims alleging environmental damage, personal injury, property damage and/or violations of permits and licenses by us. A significant judgment against us, the loss of a significant permit or license or the imposition of a significant fine could curtail our business operations and may decrease our earnings.

OUR BUSINESS IS CAPITAL INTENSIVE, REQUIRING ONGOING CASH OUTLAYS THAT MAY STRAIN OR CONSUME OUR AVAILABLE CAPITAL AND FORCE US TO SELL ASSETS, INCUR DEBT, OR SELL EQUITY ON UNFAVORABLE TERMS.

Our ability to remain competitive, grow and maintain operations largely depends on our cash flow from operations and access to capital. Maintaining our existing operations and expanding them through internal growth or acquisitions requires large capital expenditures. As we undertake more acquisitions and further expand our operations, the amount we expend on capital will increase. These increases in expenditures may result in lower levels of working capital or require us to finance working capital deficits. We intend to continue to fund our cash needs through cash flow from operations and borrowings under our credit facility, if necessary. However, we may require additional equity or debt financing to fund our growth.

We do not have complete control over our future performance because it is subject to general economic, political, financial, competitive, legislative, regulatory and other factors. It is possible that our business may not generate sufficient cash flow from operations, and we may not otherwise have the capital resources, to allow us to make necessary capital expenditures. If this occurs, we may have to sell assets, restructure our debt or obtain additional equity capital, which could be dilutive to our stockholders. We may not be able to take any of the foregoing actions, and we may not be able to do so on terms favorable to us or our stockholders.

THE COMPANY'S FAILURE TO COMPLY WITH THE RESTRICTIVE COVENANTS AND OTHER OBLIGATIONS UNDER THE CREDIT AGREEMENT MAY RESULT IN THE FORECLOSURE OF THE COMPANY'S OR ITS SUBSIDIARIES' PLEDGED ASSETS AND OTHER ADVERSE CONSEQUENCES.

Pursuant to the current Credit Agreement, the Lenders have agreed to extend certain credit facilities to the Company, in an aggregate amount not to exceed $89,100,000, consisting of $65,500,000 aggregate principal amount of Tranche A Term Loans (the "Tranche A Term Loans"), $8,600,000 aggregate principal amount of Tranche B Term Loans (the "Tranche B Term Loans"), $10,000,000 aggregate principal amount of MultiDraw Term Loans (the "MDTL Term Loans"), and up to $5,000,000 aggregate principal amount of Revolving Loans (the "Revolving Loans " and, together with the Tranche A Term Loans, Tranche B Term Loans and the MDTL Term Loans, the "Loans"). As of December 31, 2016, we had an outstanding principal balance of $43,195,000 under the Loans as in effect at such time, which is secured by a first position security interest in substantially all of the Company's assets in favor of Goldman Sachs Specialty Group, LP ("GS"), as collateral agent, for the benefit of the lenders and other secured parties. The Credit Agreement requires us to comply with a number of covenants, including restrictive covenants that limit our ability to, among other things: incur additional indebtedness; create or permit liens on assets; make investments; and pay dividends. A breach of any of these covenants or our inability to comply with the required financial ratios set forth in the Credit Agreement and related documents or the occurrence of certain other specified events could result in an event of default under the Credit Agreement (an "Event of Default"). Events of Default under the Credit Agreement also include, without limitation, the Company's failure to make payments when due, defaults under other agreements, bankruptcy, changes of control and termination of a material contract. Due to our recent failures to comply with the leverage ratio and certain other covenants required under the Prior Credit Agreement, we entered into several amendments thereto. Any future Event(s) of Default under the Credit Agreement, could result in the acceleration of all or a substantial portion of our debt, potential foreclosure on our assets and other adverse consequences.

| 13 |

IF THE COMPANY IS NOT ABLE TO MAINTAIN CERTAIN LEVERAGE RATIOS SET FORTH IN THE CREDIT AGREEMENT, WE ME BE UNABLE TO DRAW DOWN ADDITIONAL FUNDS PURSUANT TO THE CREDIT AGREEMENT, AND AS A RESULT, WE MAY NEED TO SEEK OTHER SOURCES OF CAPITAL, WHICH COULD BE ON LESS FAVORABLE TERMS.

As a result of the Company's failure historically to comply with the leverage ratio under the Prior Credit Agreement, the Company was able to draw down additional funds under the Prior Credit Agreement solely as the result of the execution of the Fourth Amendment. Although the Credit Agreement currently provides for increased leverage ratios, in the future, the Company may not be able to draw down additional funds pursuant to the Credit Agreement until such time as either such leverage ratio complies with the requirements of the Credit Agreement and the Company can show that it reasonably expects to be in pro forma compliance with such ratios or the requisite lenders under the Credit Agreement waive such requirement or otherwise consent to advance additional funds (the Lenders under our Credit Agreement having no requirement to grant such a consent or waiver and there can be no assurance that any such consent or waiver would be forthcoming). Due to certain unanticipated delays in integration of landfill operations, including due to flooding in the St. Louis area in December 2015, the Company had historically not been able to maintain the leverage ratios set forth in the Prior Credit Agreement. The Company's ability to maintain leverage ratios under the Credit Agreement may be beyond the Company's control. If the Company is unable to draw down additional funds pursuant to the Credit Agreement, it may be required to seek other sources of capital, and such capital may only be available on terms that are substantially less favorable than the terms of the Credit Agreement.

WE DEPEND ON A LIMITED NUMBER OF CUSTOMERS FOR OUR REVENUE.

At this time, the Company has a municipal contract that accounts for 11% of our long term contracted revenues for the fiscal year ended December 31, 2016. Because we depend on this customer for a large portion of our revenue, a loss of this customer could materially adversely affect our business and financial condition. If this customer were to cease using our services, our business could be materially adversely affected.

GOVERNMENTAL AUTHORITIES MAY ENACT CLIMATE CHANGE REGULATIONS THAT COULD INCREASE OUR COSTS TO OPERATE.

Environmental advocacy groups and regulatory agencies in the United States have been focusing considerable attention on the emissions of greenhouse gases and their potential role in climate change. Congress has considered recent proposed legislation directed at reducing greenhouse gas emissions and President Obama had indicated his support of legislation aimed at reducing greenhouse gases. EPA has proposed rules to regulate greenhouse gases, regional initiatives have formed to control greenhouse gases and certain of the states in which we operate are contemplating air pollution control regulations that are more stringent than existing and proposed federal regulations, in particular the regulation of emissions of greenhouse gases. The adoption of laws and regulations to implement controls of greenhouse gases, including the imposition of fees or taxes, could adversely affect our collection operations. Changing environmental regulations could require us to take any number of actions, including the purchase of emission allowances or installation of additional pollution control technology, and could make some operations less profitable, which could adversely affect our results of operations.

OUR OPERATIONS ARE SUBJECT TO ENVIRONMENTAL, HEALTH AND SAFETY LAWS AND REGULATIONS, AS WELL AS CONTRACTUAL OBLIGATIONS THAT MAY RESULT IN SIGNIFICANT LIABILITIES.

We risk incurring significant environmental liabilities in connection with our use, treatment, storage, transfer and disposal of waste materials. Under applicable environmental laws and regulations, we could be liable if our operations are found to cause environmental damage to our properties or to the property of other landowners, particularly as a result of the contamination of air, drinking water or soil. Under current law, we could also be held liable for damage caused by conditions that existed before we acquired the assets or operations involved. This risk is of particular concern as we execute our growth strategy, partially though acquisitions, because we may be unsuccessful in identifying and assessing potential liabilities during our due diligence investigations. Further, the counterparties in such transactions may be unable to perform their indemnification obligations owed to us. Additionally, we could be liable if we arrange for the transportation, disposal or treatment of hazardous substances that cause environmental contamination, or if a predecessor owner made such arrangements and, under applicable law, we are treated as a successor to the prior owner. Any substantial liability for environmental damage could have a material adverse effect on our financial condition, results of operations and cash flows.

| 14 |

OUR BUSINESS IS SUBJECT TO OPERATIONAL AND SAFETY RISKS, INCLUDING THE RISK OF PERSONAL INJURY TO EMPLOYEES AND OTHERS.

Providing environmental and waste management services, including operating landfills, involves risks such as vehicular accidents and equipment defects, malfunctions and failures. Additionally, there are risks associated with waste mass instability and releases of hazardous materials or odors. There may also be risks presented by the potential for subsurface chemical reactions causing elevated landfill temperatures and increased production of leachate, landfill gas and odors. Any of these risks could potentially result in injury or death of employees and others, a need to shut down or reduce operation of facilities, increased operating expense and exposure to liability for pollution and other environmental damage, and property damage or destruction.

While we seek to minimize our exposure to such risks through comprehensive training, compliance and response and recovery programs, as well as vehicle and equipment maintenance programs, if we were to incur substantial liabilities in excess of any applicable insurance, our business, results of operations and financial condition could be adversely affected. Any such incidents could also adversely impact our reputation and reduce the value of our brand. Additionally, a major operational failure, even if suffered by a competitor, may bring enhanced scrutiny and regulation of our industry, with a corresponding increase in operating expense.

INCREASES IN THE COSTS OF FUEL MAY REDUCE OUR OPERATING MARGINS.

The price and supply of fuel needed to run our collection vehicles is unpredictable and fluctuates based on events outside our control, including geopolitical developments, supply and demand for oil and gas, actions by OPEC and other oil and gas producers, war and unrest in oil producing countries, regional production patterns and environmental concerns. Any significant price escalations or reductions in the supply could increase our operating expenses or interrupt or curtail our operations. Failure to offset all or a portion of any increased fuel costs through increased fees or charges would reduce our operating margins.

CHANGES IN INTEREST RATES WOULD AFFECT OUR PROFITABILITY.

Our acquisitions could require us to incur substantial additional indebtedness in the future, which will increase our interest expense. Further, to the extent that these borrowings are subject to variable rates of interest, increases in interest rates will increase our interest expense, which will affect our profitability. We bear exposure to, and are primarily affected by, changes in LIBOR rates.

INCREASES IN THE COSTS OF DISPOSAL MAY REDUCE OUR OPERATING MARGINS.

In 2016, we disposed of approximately 70% of the waste that we collect in landfills operated by others, and that rate may not decrease significantly in the future. We may incur increases in disposal fees paid to third parties. Failure to pass these costs on to our customers may reduce our operating margins. In December 2015, the Company purchased Eagle Ridge Landfill, LLC and, in February 2017, the Company purchased two landfills located in Virginia, as part of the Company's strategy to internalize a majority of its volume. As of July 2016, the Company has begun to move its volume away from third party landfills. Going forward, the Company may not internalize its volume in its own landfills to the extent desired, which may limit the expected savings it anticipated from the acquisition of Eagle Ridge Landfill, LLC and the CFS Group.

INCREASES IN THE COSTS OF LABOR MAY REDUCE OUR OPERATING MARGINS.

We compete with other businesses in our markets for qualified employees. A shortage of qualified employees would require us to enhance our wage and benefits packages to compete more effectively for employees or to hire more expensive temporary employees. Labor is our second largest operating cost, and even relatively small increases in labor costs per employee could materially affect our cost structure. Failure to attract and retain qualified employees, to control our labor costs, or to recover any increased labor costs through increased prices we charge for our services or otherwise offset such increases with cost savings in other areas may reduce our operating margins.

INCREASES IN COSTS OF INSURANCE WOULD REDUCE OUR OPERATING MARGINS.

One of our largest operating costs is for insurance coverage, including general liability, automobile physical damage and liability, property, employment practices, pollution, directors and officers, fiduciary, workers' compensation and employer's liability coverage, as well as umbrella liability policies to provide excess coverage over the underlying limits contained in our primary general liability, automobile liability and employer's liability policies. Changes in our operating experience, such as an increase in accidents or lawsuits or a catastrophic loss, could cause our insurance costs to increase significantly or could cause us to be unable to obtain certain insurance. Increases in insurance costs would reduce our operating margins. Changes in our industry and perceived risks in our business could have a similar effect.

| 15 |

WE MAY NOT BE ABLE TO MAINTAIN SUFFICIENT INSURANCE COVERAGE TO COVER THE RISKS ASSOCIATED WITH OUR OPERATIONS, WHICH COULD RESULT IN UNINSURED LOSSES THAT WOULD ADVERSELY AFFECT OUR FINANCIAL CONDITION.

Integrated non-hazardous waste companies are exposed to a variety of risks that are typically covered by insurance arrangements. However, we may not be able to maintain sufficient insurance coverage to cover the risks associated with our operations for a variety of reasons. Increases in insurance costs and changes in the insurance markets may, given our resources, limit the coverage that we are able to maintain or prevent us from insuring against certain risks. Large or unexpected losses may exceed our policy limits, adversely affecting our results of operations, and may result in the termination or limitation of coverage, exposing us to uninsured losses, thereby adversely affecting our financial condition.

OUR FAILURE TO REMAIN COMPETITIVE WITH OUR NUMEROUS COMPETITORS, SOME OF WHOM HAVE GREATER RESOURCES, COULD ADVERSELY AFFECT OUR ABILITY TO RETAIN EXISTING CUSTOMERS AND OBTAIN FUTURE BUSINESS.

Because our industry is highly competitive, we compete with large companies and municipalities, many of whom have greater financial and operational resources. The non-hazardous solid waste collection and disposal industry includes large national, publicly-traded waste management companies; regional, publicly-held and privately-owned companies; and numerous small, local, privately-owned companies. Additionally, many counties and municipalities operate their own waste collection and disposal facilities and have competitive advantages not available to private enterprises. If we are unable to successfully compete against our competitors, our ability to retain existing customers and obtain future business could be adversely affected.

WE MAY LOSE CONTRACTS THROUGH COMPETITIVE BIDDING, EARLY TERMINATION OR GOVERNMENTAL ACTION, OR WE MAY HAVE TO SUBSTANTIALLY LOWER PRICES IN ORDER TO RETAIN CERTAIN CONTRACTS, ANY OF WHICH WOULD CAUSE OUR REVENUE TO DECLINE.

We are party to contracts with municipalities and other associations and agencies. Many of these contracts are or will be subject to competitive bidding. We may not be the successful bidder, or we may have to substantially lower prices in order to be the successful bidder. In addition, some of our customers may terminate their contracts with us before the end of the contract term. If we are not able to replace revenue from contracts lost through competitive bidding or early termination or from lowering prices or from the renegotiation of existing contracts with other revenue within a reasonable time period, our revenue could decline.

Municipalities may annex unincorporated areas within counties where we provide collection services, and as a result, our customers in annexed areas may be required to obtain service from competitors who have been franchised or contracted by the annexing municipalities to provide those services. Some of the local jurisdictions in which we currently operate grant exclusive franchises to collection and disposal companies, others may do so in the future, and we may enter markets where franchises are granted by certain municipalities. Unless we are awarded a franchise by these municipalities, we will lose customers, which will cause our revenue to decline.

We are currently pursuing through a bidding process the renewal of an agreement to which we are currently party, for the operation of a transfer station, scheduled to expire in the fourth quarter of 2016. If we are not awarded renewal of this agreement, we will be forced to utilize other transfer stations which would cause our revenue to decline.

EFFORTS BY LABOR UNIONS TO ORGANIZE OUR EMPLOYEES COULD DIVERT MANAGEMENT ATTENTION AND INCREASE OUR OPERATING EXPENSES.

We do not have any union representation in our operations. Groups of employees may seek union representation in the future, and the negotiation of collective bargaining agreements could divert management attention and result in increased operating expenses and lower net income. If we are unable to negotiate acceptable collective bargaining agreements, we might have to wait through "cooling off" periods, which are often followed by union-initiated work stoppages, including strikes. Depending on the type and duration of these work stoppages, our operating expenses could increase significantly.

POOR DECISIONS BY OUR REGIONAL AND LOCAL MANAGERS COULD RESULT IN THE LOSS OF CUSTOMERS OR AN INCREASE IN COSTS, OR ADVERSELY AFFECT OUR ABILITY TO OBTAIN FUTURE BUSINESS.

We manage our operations on a decentralized basis. Therefore, regional and local managers have the authority to make many decisions concerning their operations without obtaining prior approval from executive officers. Poor decisions by regional or local managers could result in the loss of customers or an increase in costs, or adversely affect our ability to obtain future business.

| 16 |

WE ARE VULNERABLE TO FACTORS AFFECTING OUR LOCAL MARKETS, WHICH COULD ADVERSELY AFFECT OUR STOCK PRICE RELATIVE TO OUR COMPETITORS.

Because the non-hazardous waste business is local in nature, our business in one or more regions or local markets may be adversely affected by events and economic conditions relating to those regions or markets even if the other regions of the country are not affected. As a result, our financial performance may not compare favorably to our competitors with operations in other regions, and our stock price could be adversely affected by our inability to compete effectively with our competitors.