UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2009.

OR

¨ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to .

Commission File No. 1-13696.

AK STEEL HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 31-1401455 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

9227 Centre Pointe Drive, West Chester, Ohio | 45069 | |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (513) 425-5000.

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock $.01 Par Value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes T No £ .

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes £ No T .

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £ .

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. T .

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Act.

Large accelerated filer | T | Accelerated filer | £ | |

Non-accelerated filer | £ | Smaller reporting company | £ |

Indicate by check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Securities Exchange Act of 1934. Yes £ No T .

Aggregate market value of the registrant's voting stock held by non-affiliates at June 30, 2009: $2,076,650,398.

At February 19, 2010, there were 109,866,415 shares of the registrant's Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required to be furnished pursuant to Part III of this Form 10-K will be set forth in, and incorporated by reference from, the registrant's definitive proxy statement for the annual meeting of stockholders (the "2010 Proxy Statement"), which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year ended December 31, 2009.

Table of Contents

AK Steel Holding Corporation

Table of Contents

Page | ||

PART I | ||

Item 1. | Business | 1 |

Item 1A. | Risk Factors | 5 |

Item 1B. | Unresolved Staff Comments | 8 |

Item 2. | Properties | 8 |

Item 3. | Legal Proceedings | 9 |

PART II | ||

Item 4. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 10 |

Item 5. | Selected Financial Data | 13 |

Item 6. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 14 |

Item 6A. | Quantitative and Qualitative Disclosure about Market Risk | 36 |

Item 7. | Financial Statements and Supplementary Data | 38 |

Item 8. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 88 |

Item 8A. | Controls and Procedures | 88 |

Item 8B. | Other Information | 91 |

PART III | ||

Item 9. | Directors, Executive Officers and Corporate Governance | 91 |

Item 10. | Executive Compensation | 91 |

Item 11. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 91 |

Item 12. | Certain Relationships and Related Transactions, and Director Independence | 91 |

Item 13. | Principal Accounting Fees and Services | 92 |

PART IV | ||

Item 14. | Exhibits and Financial Statement Schedules | 92 |

i

Table of Contents

(Dollars in millions, except per share and per ton amounts)

PART I

Item 1. | Business. |

Operations Overview

AK Steel Holding Corporation ("AK Holding") is a corporation formed under the laws of Delaware in 1993 and is a fully-integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products through its wholly-owned subsidiary, AK Steel Corporation ("AK Steel" and, together with AK Holding, the "Company"). AK Steel is the successor through merger to Armco Inc., which was formed in 1900.

The Company's operations consist of seven steelmaking and finishing plants located in Indiana, Kentucky, Ohio and Pennsylvania that produce flat-rolled carbon steels, including premium-quality coated, cold-rolled and hot-rolled products, and specialty stainless and electrical steels that are sold in hot band, and sheet and strip form. The Company's operations also include AK Tube LLC ("AK Tube"), which further finishes flat-rolled carbon and stainless steel at two tube plants, one located in Ohio and one located in Indiana, into welded steel tubing used in the automotive, large truck and construction markets. In addition, the Company's operations include European trading companies that buy and sell steel and steel products and other materials.

Customers

In conducting its steel operations, the Company principally directs its marketing efforts toward those customers who require the highest quality flat-rolled steel with precise "just-in-time" delivery and technical support. Management believes that the Company's enhanced product quality and delivery capabilities, and its emphasis on customer technical support and product planning, are critical factors in its ability to serve this segment of the market. The Company's standards of excellence have been embraced by a wide array of diverse customers and, accordingly, no single customer accounted for more than 10% of net sales of the Company during 2009.

The Company's flat-rolled carbon steel products are sold primarily to automotive manufacturers and to customers in the infrastructure and manufacturing markets. This includes electrical transmission, heating, ventilation and air conditioning, and appliances. The Company also sells coated, cold rolled, and hot rolled carbon steel products to distributors, service centers and converters who may further process these products prior to reselling them. To the extent management believes necessary, the Company carries increased inventory levels to meet the requirements of certain of its customers for "just-in-time" delivery.

The Company sells its stainless steel products to manufacturers and their suppliers in the automotive industry, to manufacturers of food handling, chemical processing, pollution control, medical and health equipment and to distributors and service centers. The Company sells electrical steels, which are iron-silicon alloys with unique magnetic properties, primarily to manufacturers of power transmission and distribution transformers and electrical motors and generators in the infrastructure and manufacturing markets.

The Company sells its carbon products principally to customers in the United States. The Company's electrical and stainless steel products are sold both domestically and internationally. The Company's customer base is geographically diverse and, there is no single country outside of the United States as to which sales are material relative to the Company's total sales revenue. The Company attributes revenue from foreign countries based upon the destination of physical shipment of a product. Revenue from direct sales, and sales as a percentage of total sales, in 2009, 2008 and 2007 domestically and internationally were as follows:

Geographic Area | 2009 | 2008 | 2007 | |||||||||||||||||||||

Net Sales | % | Net Sales | % | Net Sales | % | |||||||||||||||||||

United States | $ | 3,309.8 | 81 | % | $ | 6,376.4 | 83 | % | $ | 6,077.9 | 87 | % | ||||||||||||

Foreign Countries | 767.0 | 19 | % | 1,267.9 | 17 | % | 925.1 | 13 | % | |||||||||||||||

Total | $ | 4,076.8 | 100 | % | $ | 7,644.3 | 100 | % | $ | 7,003.0 | 100 | % | ||||||||||||

The Company does not have any material long-lived assets located outside of the United States.

The Company's sales in 2009 were adversely impacted by significantly depressed global economic conditions, and, particularly, declines in the automotive market and construction markets, both residential and non-residential. The effects of the recession on each of the Company's markets resulted in declines in shipments in every product category

1

Table of Contents

for the Company. The most significant decline was felt in the distributors and converters market, due to reduced end-use demand, inventory reduction throughout the supply chain, and falling steel prices, which resulted in a decrease in its percentage of total Company sales as compared to the Company's other two markets.

Despite an absolute reduction in total direct automotive sales from year to year, the Company's direct automotive revenues as a percent of its total business rose to approximately 36% in 2009, compared to 32% in 2008. The relative increase in automotive sales was principally due to that market being the most heavily weighted toward contract business. During downturns, contract business maintains more consistent volumes and provides greater price stability than spot market business because of contractual requirements that limit demand and price volatility. The Company's infrastructure and manufacturing market sales also experienced a reduction in absolute dollars of sales. The percentage of Company revenue attributable to that market increased, however, to 31% of total Company revenue in 2009, from 29% in 2008, primarily as a result of the relatively greater revenue decline in the distributors and converters market.

The following table sets forth the percentage of the Company's net sales attributable to each of its markets:

Years Ended December 31, | ||||||

Market | 2009 | 2008 | 2007 | |||

Automotive | 36% | 32% | 40% | |||

Infrastructure and Manufacturing (a) | 31% | 29% | 26% | |||

Distributors and Converters (a) | 33% | 39% | 34% | |||

(a) | Prior to 2008, the Company historically referred to these markets by somewhat different names. In 2008, the names were updated to simplify them, but the nature of the product sales and customers included in each market was not changed. More specifically, the market previously described as "Appliance, Industrial Machinery and Equipment, and Construction" now is referred to as "Infrastructure and Manufacturing," and the market previously described as "Distributors, Service Centers and Converters" now is referred to as "Distributors and Converters." No change was made to the name of the market described as "Automotive." |

The Company is a party to contracts with all of its major automotive and most of its infrastructure and manufacturing industry customers. These contracts, which are primarily one year in duration, set forth prices to be paid for each product during their term. Approximately 83% of the Company's shipments to current contract customers permit price adjustments to reflect changes in prevailing market conditions or certain energy and raw material costs. Approximately 55% of the Company's shipments of flat-rolled steel products in 2009 were made to contract customers, and the balance of the Company's shipments were made in the spot market at prevailing prices at the time of sale.

In 2009, the automotive industry experienced its worst market conditions in decades. The dramatic downturn in the domestic and global economies, which started in the fall of 2008, significantly reduced demand for light vehicles. As a result, North American light vehicle production in 2009 was substantially below historic levels. Because the automotive market continues to be an important element of the Company's business, reduced North American light vehicle production adversely impacts the Company's total sales and shipments. Lower prices and shipments to the automotive market contributed to a dramatic decrease in the Company's total sales in 2009. Although the Company has seen an improvement in shipments since the low point in 2009, a level of sales significantly below recent historic levels likely will continue throughout 2010. At this point, it is impossible to determine when, or if, the domestic and/or global economies will return to pre-recession levels.

In addition, continued low levels of North American light vehicle production could cause further financial difficulties (including possible bankruptcy filings) for additional automotive manufacturers and suppliers to the automotive industry, many of whom are customers of the Company. The Company could be adversely impacted by such financial difficulties and bankruptcies, including not only reductions in future sales, but also losses associated with an inability to collect outstanding accounts receivables from those customers. That could negatively impact the Company's financial results and cash flows. The Company is continuing to monitor this situation closely and has taken steps to try to mitigate its exposure to such adverse impacts, but because of current market conditions and the volume of business involved, it cannot eliminate these risks entirely.

Raw Materials and Other Inputs

The principal raw materials required for the Company's steel manufacturing operations are iron ore, coal, coke, chrome, nickel, silicon, manganese, zinc, limestone, and carbon and stainless steel scrap. The Company also uses large volumes of natural gas, electricity and oxygen in its steel manufacturing operations. In addition, the Company

2

Table of Contents

historically has purchased approximately 500,000 to 700,000 tons annually of carbon steel slabs from other steel producers to supplement the production from its own steelmaking facilities, though it did not do so in 2009 because of substantially reduced demand for the Company's products. The Company makes most of its purchases of iron ore, coal, coke and oxygen at negotiated prices under annual and multi-year agreements. The Company typically makes purchases of carbon steel slabs, carbon and stainless steel scrap, natural gas, a majority of its electricity, and other raw materials at prevailing market prices, which are subject to price fluctuations in accordance with supply and demand. The Company enters into financial instruments designated as hedges with respect to some purchases of natural gas and certain raw materials, the prices of which may be subject to volatile fluctuations. In 2009, the Company experienced a significant decline in raw material and energy costs, primarily carbon scrap, nickel and natural gas.

To the extent that multi-year contracts are available in the marketplace, the Company has used such contracts to secure adequate sources of supply to satisfy key raw materials needs for the next three to five years. Where multi-year contracts are not available, or are not available on terms acceptable to the Company, the Company continues to seek to secure the remainder of its raw materials needs through annual contracts or spot purchases. The Company also continues to attempt to reduce the risk of future supply shortages by considering equity investments with respect to certain raw materials and by evaluating alternative sources and substitute materials.

The Company currently believes that it either has, or will be able to secure, adequate sources of supply for its raw material and energy requirements for 2010. As a result, however, of lower than normal year-end inventories in 2009, and increased demand beyond the Company's initial projections for 2010, the Company still needs to secure additional volumes of some raw materials, principally iron ore, for 2010. Based on current reduced demand for most raw materials, the Company does not anticipate major shortages in the market unless substantial supply capacity is taken out of the market. The potential exists, however, for production disruptions due to shortages of raw materials in the future. If such a disruption were to occur, it could have a material impact on the Company's financial condition, operations and cash flows.

The Company produces most of the coke it consumes in its blast furnaces, but had also been purchasing approximately 350,000 net tons annually from a third party pursuant to a ten-year supply contract (the "Shenango Coke Contract") which expired on December 31, 2009. In anticipation of the expiration of the Shenango Coke Contract, the Company entered into a long-term agreement with Haverhill North Coke Company ("SunCoke Haverhill"), an affiliate of SunCoke Energy, Inc. ("SunCoke"), to provide the Company with metallurgical-grade coke from the SunCoke Haverhill facility in southern Ohio. Under the agreement, SunCoke Haverhill provides AK Steel with up to 550,000 tons of coke annually. The Company will also benefit under the agreement from electricity co-generated from the heat recovery coke battery. This is in addition to the previously announced project with Middletown Coke Company, Inc., another SunCoke affiliate ("Middletown Coke"), to construct a new state-of-the-art, environmentally friendly heat-recovery coke battery contiguous to the Company's Middletown Works which will be capable of producing 550,000 net tons of metallurgical grade coke annually. It is likely that the Company will need the production from both SunCoke facilities due to reduced production available from, and uncertainties with respect to, the Company's Ashland, Kentucky coke batteries as a result of environmental issues. To the extent the two SunCoke facilities, combined with the Company's existing coke batteries in Ashland, Kentucky and Middletown, Ohio, provide more coke than the Company needs for its steel production, the Company anticipates that it will be able to sell any excess coke in the merchant coke market.

Research and Development

The Company conducts a broad range of research and development activities aimed at improving existing products and manufacturing processes and developing new products and processes. Research and development costs incurred in 2009, 2008 and 2007 were $6.2, $8.1 and $8.0, respectively.

Employees

At December 31, 2009, the Company's operations included approximately 6,500 employees, of which approximately 4,900 are represented by labor unions under various contracts that will expire in the years 2010 through 2013. See discussion under Labor Agreements in the Liquidity and Capital Resources section below for additional information on these agreements. Because of the extraordinary economic conditions which have adversely impacted the Company's business, the Company announced in late 2008 that it would temporarily idle certain facilities and lay off some of its employees. By the end of 2009, most of the idled facilities had been returned to production and most of the laid-off employees had been returned to work. However, some of the Company's facilities continue to be idled and some of its employees continue to be laid off. That circumstance is expected to continue until market conditions improve.

3

Table of Contents

Competition

The Company competes with domestic and foreign flat-rolled carbon, stainless and electrical steel producers (both integrated steel producers and mini-mill producers) and producers of plastics, aluminum and other materials that can be used in lieu of flat-rolled steels in manufactured products. Mini-mills generally offer a narrower range of products than integrated steel mills, but can have some competitive cost advantages as a result of their different production processes and typically non-union work forces. Price, quality, on-time delivery and customer service are the primary competitive factors in the steel industry and vary in relative importance according to the category of product and customer requirements.

Domestic steel producers, including the Company, face significant competition from foreign producers. For a variety of reasons, these foreign producers often are able to sell products in the United States at prices substantially lower than domestic producers. These reasons include lower labor, raw material, energy and regulatory costs, as well as significant government subsidies and preferential trade practices in their home countries. The annual level of imports of foreign steel into the United States also is affected to varying degrees by the strength of demand for steel outside the United States and the relative strength or weakness of the U.S. dollar against various foreign currencies. U.S. imports of finished steel decreased slightly from the 2008 level and accounted for approximately 22% of domestic steel market demand in 2009. By comparison, imports of finished steel accounted for approximately 29% and 27%, respectively, of domestic steel demand in 2008 and 2007.

The Company's ability to compete has been negatively impacted by the bankruptcies of numerous domestic steel companies, including several former major competitors of the Company, and the subsequent and continuing global steel industry consolidation. Those bankruptcies facilitated the global consolidation of the steel industry by enabling other entities to purchase and operate the facilities of the bankrupt steel companies without accepting any responsibility for most, and in some instances any, pension or healthcare obligations to the retirees of the bankrupt companies. In contrast, the Company has continued to provide pension and healthcare benefits to its retirees, resulting in a competitive disadvantage compared to certain other domestic integrated steel companies and the mini-mills that do not provide such benefits to any or most of their retirees. Over the course of the last several years, however, the Company has negotiated progressive new labor agreements that have significantly reduced total employment costs at all of its union-represented facilities. The new labor agreements have increased the Company's ability to compete in the highly competitive global steel market while, at the same time, enhancing the ability of the Company to continue to support its retirees' pension and healthcare needs. In addition, the Company has eliminated approximately $1.0 billion of its retiree healthcare costs associated with a group of retirees from its Middletown Works as part of the settlement reached with those retirees in October 2007. For a more detailed description of this settlement, see the discussion in the " Legal Contingencies" section of Note 9 to the Consolidated Financial Statements in Item 7 below.

The Company also is facing the likelihood of increased competition from foreign-based and domestic steel producers who have announced plans, or have already started to build or expand steel production and/or finishing facilities in the United States.

Environmental

Information with respect to the Company's environmental compliance, remediation and proceedings may be found in Note 9 to Consolidated Financial Statements in Item 7 of this Form 10-K, which is incorporated herein by reference.

Executive Officers of the Registrant

The following table sets forth the name, age and principal position with the Company of each of its executive officers as of February 19, 2010:

Name | Age | Positions with the Company |

James L. Wainscott | 52 | Chairman of the Board, President and Chief Executive Officer |

David C. Horn | 58 | Senior Vice President, General Counsel and Secretary |

John F. Kaloski | 60 | Senior Vice President, Operations |

Albert E. Ferrara, Jr. | 61 | Vice President, Finance and Chief Financial Officer |

Douglas W. Gant | 51 | Vice President, Sales and Customer Service |

Alan H. McCoy | 58 | Vice President, Government and Public Relations |

Lawrence F. Zizzo, Jr. | 61 | Vice President, Human Resources |

James L. Wainscott was elected Chairman of the Board of Directors of the Company, effective January 1, 2006, and elected President and Chief Executive Officer in October 2003. Previously, Mr. Wainscott had been the Company's

4

Table of Contents

Chief Financial Officer since July 1998. Mr. Wainscott also served as Treasurer from April 1995 until April 2001. He was elected Senior Vice President in January 2000, having previously served as a Vice President from April 1995 until that date. Before joining the Company, Mr. Wainscott held a number of increasingly responsible financial positions for National Steel Corporation, and was elected Treasurer and Assistant Secretary for National Steel in 1993.

David C. Horn was elected Senior Vice President, General Counsel and Secretary in January 2005. Mr. Horn was elected Vice President and General Counsel in April 2001 and assumed the additional position of Secretary in August 2003. Before joining the Company as Assistant General Counsel in December 2000, Mr. Horn was a partner in the Cincinnati-based law firm now known as Frost Brown Todd LLC.

John F. Kaloski was elected Senior Vice President, Operations in January 2005. Mr. Kaloski was named Vice President in April 2003. Prior to joining the Company in October 2002 as Director, Operations Technology, Mr. Kaloski served as a Senior Vice President at National Steel Corporation and held senior management positions at U.S. Steel Corporation.

Albert E. Ferrara, Jr. was elected Vice President, Finance and Chief Financial Officer in November 2003. Mr. Ferrara joined the Company in June 2003 as Director, Strategic Planning and was named Acting Chief Financial Officer in September 2003. Prior to joining the Company, Mr. Ferrara was Vice President, Corporate Development for NS Group, Inc., a tubular products producer, and previously held positions as Senior Vice President and Treasurer with U.S. Steel Corporation and Vice President, Strategic Planning at USX Corporation.

Douglas W. Gant was elected Vice President, Sales and Customer Service in January 2004. From February 2001 until that date, Mr. Gant was Director, Sales and Marketing, having previously served as General Manager, Sales since May 1999. Mr. Gant was a regional sales manager from September 1995 until May 1999.

Alan H. McCoy was elected Vice President, Government and Public Relations in January 1997. From 1994 to 1997, Mr. McCoy was General Manager, Public Relations.

Lawrence F. Zizzo, Jr. was elected Vice President, Human Resources in January 2004. Before joining the Company, Mr. Zizzo was Vice President, Human Resources at National Steel Corporation. Prior to that position, Mr. Zizzo was Regional Director, Human Resources at National Steel.

Available Information

The Company maintains an internet website at www.aksteel.com. Information about the Company is available on the website free of charge, including the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. Information on the Company's website is not incorporated by reference into this report.

Item 1A. | Risk factors. |

The Company cautions readers that its business activities involve risks and uncertainties that could cause actual results to differ materially from those currently expected by management. The most significant of those risks are:

● | Risk of reduced selling prices and shipments associated with a cyclical industry . Historically, the steel industry has been a cyclical industry. The dramatic downturn in the domestic and global economies which began in the fall of 2008 adversely affected demand for the Company's products, which has resulted in lower prices and shipments for such products. Such lower prices and shipments caused a significant reduction in the Company's sales in 2009 and, while there has been some improvement in recent months, it is likely that sales will not return to pre-2009 levels during 2010. This downturn in market conditions also may adversely impact the Company's efforts to negotiate higher prices in 2010 with its contract customers. At this time, it is impossible to determine when or if the domestic and/or global economies will return to pre-recession levels. There thus is a risk of continued adverse impact on demand for the Company's products, the prices for those products, and the Company's sales and shipments of those products as a result of the ongoing weakness in the economy. In addition, global economic conditions remain fragile and the possibility remains that the domestic or global economies may not recover as quickly as we have anticipated, or could even deteriorate, which likely would result in a corresponding fall in demand for the Company's products and negatively impact the Company's business, financial results and cash flows. |

5

Table of Contents

● | Risk of severe financial hardship or bankruptcy of one of more of the Company's major customers. Many, if not most, of the Company's customers have shared the immense financial and operational challenges faced by the Company during the recent intense recession. For example, in 2009 two major automotive manufacturers, General Motors and Chrysler, received billions of dollars in loans from the federal government and went through a bankruptcy reorganization. While both of those companies have emerged from bankruptcy and are operating, the domestic automotive industry continues to experience significantly reduced light vehicle sales compared to recent historic levels. This continued weakness could lead to increased financial difficulties or even bankruptcy filings by other automotive manufacturers and suppliers to the automotive industry, many of whom are customers of the Company. The Company could be adversely impacted by such financial hardship or bankruptcies. The nature of that impact could be not only a reduction in future sales, but also a loss associated with the potential inability to collect all outstanding accounts receivables. Either event could negatively impact the Company's financial results and cash flows. |

● | Risk of reduced demand in key product markets . Although significantly reduced from prior years, the automotive and housing markets remain important elements of the Company's business. Though conditions have improved in recent months, both markets continue to suffer from the severe economic downturn that started in the fall of 2008. If North American automotive production, in general, or by one or more of the Company's major automotive customers in particular, were to be further reduced significantly as a result of this economic downturn or other causes, it likely would negatively affect the Company's sales, financial results and cash flows. Similarly, if demand for the Company's products sold to the housing market were to be further reduced significantly, it could negatively affect the Company's sales, financial results and cash flows. |

● | Risk of increased global steel production and imports . Actions by the Company's foreign or domestic competitors to increase production in and/or exports to the United States could result in an increased supply of steel in the United States, which could result in lower prices for the Company's products and negatively impact the Company's sales, financial results and cash flows. In fact, significant planned increases in production capacity in the United States have been announced by competitors of the Company and new steelmaking and finishing facilities are under construction. In addition, foreign competitors, especially those in China, have substantially increased their production capacity in the last few years. This increased foreign production has contributed to a high level of imports of foreign steel into the United States in recent years and creates a risk of even greater levels of imports, depending upon foreign market and economic conditions, the value of the U.S. dollar relative to other currencies, and other such variables beyond the Company's control. This would adversely affect the Company's sales, financial results and cash flows. |

● | Risk of changes in the cost of raw materials and energy . Approximately 55% of the Company's shipments are pursuant to contracts having durations of six months or more. Approximately 83% of the Company's shipments to contract customers include variable pricing mechanisms to adjust the price or to impose a surcharge based upon changes in certain raw material and energy costs, but those adjustments do not always reflect all of the underlying raw material and energy cost changes. Many of the Company's contracts contain fixed prices that do not allow a pass through of all of the raw material and energy cost increases or decreases. Approximately 45% of the Company's shipments are in the spot market, therefore pricing for these products fluctuates regularly based on prevailing market conditions. Thus, the price at which the Company sells steel will not necessarily change in tandem with changes in its raw material and energy costs. As a result, a significant increase in raw material or energy costs could adversely impact the Company's financial results. This impact can be exacerbated by the Company's "last in, first out" ("LIFO") method for valuing inventories when there are significant changes in the cost of raw materials or energy or in the Company's raw material inventory levels. The impact of LIFO accounting may be particularly significant with respect to period-to-period comparisons. |

● | Risks relating to the supply of raw materials . The Company has certain raw material supply contracts, particularly with respect to iron ore, which have terms providing for minimum annual purchases, subject to exceptions for force majeure and other circumstances impacting the legal enforceability of the contracts. If demand for the Company's products falls for an extended period significantly below what was projected at the time these contracts were entered into, the Company could be required to purchase quantities of raw materials, particularly iron ore, which exceed its |

6

Table of Contents

| anticipated future annual needs. Conversely, however, if demand for the Company's products increases beyond what was projected, there is a risk that the Company would not have adequate supplies of all raw materials under contract and that it might be unable to secure all of the raw materials it needs to meet the increased demand, or to secure them at reasonable prices that will not adversely impact the Company's financial results and cash flows. |

● | Risk of production disruption at the Company . Under normal business conditions, the Company operates its facilities at production levels at or near capacity. High levels of production are important to the Company's financial results because they enable the Company to spread its fixed costs over a greater number of tons. Production disruptions could be caused by the idling of facilities due to reduced demand, such as resulting from the recent economic downturn. Such production disruptions also could be caused by unanticipated plant outages or equipment failures, particularly under circumstances where the Company lacks adequate redundant facilities, such as with respect to its hot mill. Production also could be adversely impacted by transportation or raw material or energy supply disruptions, or poor quality of raw materials, particularly scrap, coal, coke, iron ore, alloys and purchased carbon slabs. This would adversely affect the Company's sales, financial results and cash flows. |

● | Risks associated with the Company's healthcare obligations . The Company provides healthcare coverage to its active employees and its retirees, as well as to certain members of their families. The Company is self-insured with respect to substantially all of its healthcare coverage. While the Company has mitigated its exposure to rising healthcare costs through cost sharing and healthcare cost caps, the cost of providing such healthcare coverage is greater on a relative basis for the Company than for other steel companies against whom the Company competes which either provide a lesser level of benefits, require that their participants pay more for the benefits they receive, or do not provide coverage to as broad a group of participants ( e.g ., they do not provide retiree healthcare benefits). Moreover, litigation has been filed against the Company on behalf of various groups of its retirees alleging that the Company lacked the authority to impose certain cost sharing and healthcare cost caps. If that litigation is successful, it could adversely affect the Company's financial results and could adversely affect the long-term ability of the Company to provide future healthcare benefits. In addition, the potential impacts of federal healthcare legislation could adversely affect the Company's financial condition through increased costs. |

● | Risks associated with the Company's pension obligations . The Company's pension trust is currently underfunded to meet its long-term obligations, primarily as a result of below-expectation investment returns in the early years of the prior decade, as well as the dramatic decline in the financial markets that began in late 2008. The extent of underfunding is directly affected by changes in interest rates and asset returns in the securities markets. It is also affected by the rate and age of employee retirements, along with other actuarial experiences compared to projections. These items affect pension plan assets and the calculation of pension and other postretirement benefit obligations and expenses. Such changes could increase the cost to the Company of those obligations, which could have a material adverse affect on the Company's results and its ability to meet those obligations. In addition, changes in the law, rules, or governmental regulations with respect to pension funding also could materially and adversely affect the cash flow of the Company and its ability to meet its pension and other benefit obligations. In addition, under the method of accounting used by the Company with respect to its pension and other postretirement obligations, the Company is required to recognize into its results of operations, as a non-cash "corridor" adjustment, any unrecognized actuarial net gains or losses that exceed 10% of the larger of projected benefit obligations or plan assets. A corridor charge, if required after a re-measurement of the Company's pension obligations, historically has been recorded in the fourth quarter of the fiscal year. In past years, these corridor charges have had a significant negative impact on the Company's financial statements. |

● | Risk of not timely reaching new labor agreements . The labor agreement with the United Steelworkers of America Local 1865, which represents approximately 750 hourly employees at the Company's West Works located in Ashland, Kentucky, expires on September 1, 2010. The Company intends to negotiate with the union to reach a new, competitive labor agreement in advance of the current expiration date. The Company cannot predict at this time, however, when a new, competitive labor agreement with the union at the Ashland West Works will be reached or what the impact of such an agreement on the Company's operating costs, operating income and cash |

7

Table of Contents

| flow will be. There is the potential of a work stoppage at this location if the Company and the union cannot reach a timely agreement in contract negotiations. If there were to be a work stoppage, it could have a material impact on the Company's operations and financial results.

|

● | Risks associated with major litigation, arbitrations, environmental issues and other contingencies . The Company has described several significant legal and environmental proceedings in Note 9 to the Consolidated Financial Statements in Item 7 of this report. An adverse result in one or more of those proceedings could negatively impact the Company's financial results and cash flows. |

● | Risks associated with environmental compliance . Due to the nature and extent of environmental issues affecting the Company's operations and obligations, changes in application or scope of environmental regulations applicable to the Company could have a significant adverse impact on the Company's operations and financial results and cash flows. |

● | Risks associated with climate change and greenhouse gas emission limitations . The United States has not ratified the 1997 Kyoto Protocol Treaty (the "Kyoto Protocol") and the Company does not produce steel in a country which has ratified that treaty. Negotiations for a treaty which would succeed the Kyoto Protocol are ongoing and it is not known yet what the terms of that successor treaty ultimately will be or if the United States will ratify it. It appears, however, that limitations on greenhouse gas emissions may be imposed in the United States at some point in the future through federally enacted legislation. Bills recently introduced in the United States Congress are aimed at limiting carbon emissions from companies which conduct business that is carbon-intensive. Such bills, if enacted, would apply to the steel industry, generally, and the Company, in particular. Among other potential material items, each bill includes a proposed system of carbon emission credits issued to certain companies, similar to the European Union's existing "cap and trade" system. That said, each of these bills is likely to be altered substantially as they move through the legislative process, making it difficult at this time to forecast what the final legislation, if any, will look like and the resulting effects on the Company. If legislation similar to these bills is enacted, however, the Company likely will suffer negative financial impact as a result of increased energy, environmental and other costs in order to comply with the limitations that would be imposed on greenhouse gas emissions. In addition, depending upon whether similar limitations are imposed globally, the legislation could negatively impact the Company's ability to compete with foreign steel companies situated in areas not subject to such limitations. Unless and until the legislation is enacted and its terms are known, however, the Company cannot reasonably or reliably estimate the impact of such legislation on its financial condition, operating performance or ability to compete. |

● | Risks associated with financial, credit, capital and/or banking markets . In the ordinary course of business, the Company's risks include its ability to access competitive financial, credit, capital and/or banking markets. Currently, the Company believes it has adequate access to these markets to meet its reasonably anticipated business needs. The Company both provides and receives normal trade financing to and from its customers and suppliers. To the extent access to competitive financial, credit, capital and/or banking markets by the Company, or its customers or suppliers, is impaired, the Company's operations, financial results and cash flows could be adversely impacted. |

While the previously listed items represent the most significant risks to the Company, the Company regularly monitors and reports risks to management and the Board of Directors by means of a formal Total Enterprise Risk Management program.

Item 1B. | Unresolved Staff Comments. |

The Company has no unresolved Securities and Exchange Commission staff comments.

Item 2. | Properties . |

The Company is leasing a building in West Chester, Ohio which the Company is using as its corporate headquarters. The lease commenced in 2007 and the initial term is twelve years with two five-year options to extend the lease. The Company continues to own its former headquarters and research buildings, but has razed other surrounding buildings located in Middletown, Ohio. Steelmaking, finishing and tubing operations are conducted at nine facilities located in Indiana, Kentucky, Ohio and Pennsylvania. All of these facilities are owned by the Company, either directly or through wholly-owned subsidiaries.

8

Table of Contents

Middletown Works is situated on approximately 2,400 acres in Middletown, Ohio. It consists of a coke facility, blast furnace, basic oxygen furnaces and continuous caster for the production of carbon steel. Also located at the Middletown site are a hot rolling mill, cold rolling mill, two pickling lines, four annealing facilities, two temper mills and three coating lines for finishing the product.

Ashland Works is located on approximately 600 acres in Ashland, Kentucky. It consists of a coke facility, blast furnace, basic oxygen furnaces and continuous caster for the production of carbon steel. A coating line at Ashland also helps to complete the finishing operation of the material processed at the Middletown plant.

Rockport Works is located on approximately 1,700 acres near Rockport, Indiana. The 1.7 million square-foot plant consists of a state-of-the-art continuous cold rolling mill, a continuous hot-dip galvanizing and galvannealing line, a continuous carbon and stainless steel pickling line, a continuous stainless steel annealing and pickling line, hydrogen annealing facilities and a temper mill.

Butler Works is situated on approximately 1,300 acres in Butler, Pennsylvania. The 3.5 million square-foot plant produces stainless, electrical and carbon steel. Melting takes place in three electric arc furnaces that feed an argon-oxygen decarburization unit. These units feed two double strand continuous casters. The Butler Works also includes a hot rolling mill, annealing and pickling units and two fully automated tandem cold rolling mills. It also has various intermediate and finishing operations for both stainless and electrical steels.

Coshocton Works is located on approximately 650 acres in Coshocton, Ohio. The 570,000 square-foot stainless steel finishing plant contains two Sendzimer mills and two Z-high mills for cold reduction, four annealing and pickling lines, nine bell annealing furnaces, four hydrogen annealing furnaces, two bright annealing lines and other processing equipment, including temper rolling, slitting and packaging facilities.

Mansfield Works is located on approximately 350 acres in Mansfield, Ohio. The 1.1 million square-foot facility produces stainless steel and includes a melt shop with two electric arc furnaces, an argon-oxygen decarburization unit, a thin-slab continuous caster, and a six-stand hot rolling mill.

Zanesville Works is located on 130 acres in Zanesville, Ohio. It consists of a 508,000 square-foot finishing plant for some of the stainless and electrical steel produced at Butler Works and Mansfield Works and has a Sendzimer cold rolling mill, annealing and pickling lines, high temperature box anneal and other decarburization and coating units.

AK Tube's Walbridge plant, located in Ohio, operates six electric resistance weld tube mills and two slitters housed in a 330,000 square foot facility. AK Tube's Columbus plant, located in Indiana, is a 142,000 square-foot facility with eight electric resistance weld and two laser weld tube mills.

Item 3. | Legal Proceedings. |

Information with respect to this item may be found in Note 9 to Consolidated Financial Statements in Item 7 of this Form 10-K, which is incorporated herein by reference.

9

Table of Contents

PART II

Item 4. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

AK Holding's common stock has been listed on the New York Stock Exchange since April 5, 1995 (symbol: AKS). The table below sets forth, for the calendar quarters indicated, the reported high and low sales prices of the common stock:

2009 | 2008 | |||||||||||||||

High | Low | High | Low | |||||||||||||

First Quarter | $ | 13.07 | $ | 5.39 | $ | 57.19 | $ | 34.20 | ||||||||

Second Quarter | $ | 21.70 | $ | 6.81 | $ | 73.07 | $ | 54.21 | ||||||||

Third Quarter | $ | 24.27 | $ | 14.77 | $ | 68.10 | $ | 22.54 | ||||||||

Fourth Quarter | $ | 22.80 | $ | 15.03 | $ | 25.42 | $ | 5.20 | ||||||||

As of February 19, 2010 there were 109,866,415 shares of common stock outstanding and held of record by 5,007 stockholders. The closing stock price on February 19, 2010 was $23.36 per share. Because depositories, brokers and other nominees held many of these shares, the number of record holders is not representative of the number of beneficial holders.

The payment of cash dividends is subject to a restrictive covenant contained in the instruments governing the Company's outstanding senior debt. The covenant allows the payment of dividends, if declared by the Board of Directors, and the redemption or purchase of shares of its outstanding capital stock, subject to a formula that reflects cumulative net earnings. During the period from 2001 to the third quarter of 2007, the Company was not permitted under the formula to pay a cash dividend on its common stock or repurchase its shares as a result of cumulative losses recorded before and during that period. During the third quarter of 2007, the cumulative losses calculated under the formula were eliminated due to the improved financial performance of the Company. Accordingly, since that time, payment of a cash dividend and repurchase of the Company's shares have been permissible under the senior debt covenants. As of December 31, 2009, the limitation on these restricted payments was approximately $55.2. Restrictive covenants also are contained in the instruments governing the Company's $850.0 asset-based revolving credit facility. Under the credit facility covenants, dividends and share repurchases are not restricted unless availability falls below $150.0, at which point dividends would be limited to $12.0 annually and share repurchases would be prohibited. As of December 31, 2009, the availability under the asset-based revolving credit facility of $600.4 significantly exceeds $150.0. Accordingly, there currently are no covenant restrictions on the Company's ability to declare and pay a dividend to its shareholders.

The Company established an initial quarterly common stock dividend rate of $0.05 per share effective with the March 2008 dividend payment. Information concerning the amount and frequency of dividends declared and paid in 2009 and 2008 is as follows:

2009 COMMON STOCK DIVIDENDS | ||||

Record Date | Payment Date | Per Share | ||

February 13, 2009 | March 10, 2009 | $0.05 | ||

May 15, 2009 | June 10, 2009 | $0.05 | ||

August 14, 2009 | September 10, 2009 | $0.05 | ||

November 13, 2009 | December 10, 2009 | $0.05 | ||

Total | $0.20 | |||

2008 COMMON STOCK DIVIDENDS | ||||

Record Date | Payment Date | Per Share | ||

February 15, 2008 | March 10, 2008 | $0.05 | ||

May 16, 2008 | June 10, 2008 | $0.05 | ||

August 15, 2008 | September 10, 2008 | $0.05 | ||

November 14, 2008 | December 10, 2008 | $0.05 | ||

Total | $0.20 | |||

10

Table of Contents

On January 25, 2010, the Company announced that its Board of Directors declared a quarterly cash dividend of $0.05 per share of common stock, payable on March 10, 2010, to shareholders of record on February 12, 2010.

There were no unregistered sales of equity securities in the quarter or year ended December 31, 2009.

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares Purchased (1) (2) | Average Price Paid Per Share (1) (2) | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Program (2) | Approximate Dollar Value of Shares that May Yet be Purchased Under the Plans or Programs (2) | ||||||||||||

October 1 through 31, 2009 | 481 | $ | 20.53 | - | ||||||||||||

November 1 through 30, 2009 | - | - | - | |||||||||||||

December 1 through 31, 2009 | - | - | - | |||||||||||||

Total | 481 | $ | 20.53 | - | $ | 125.6 | ||||||||||

(1) | During the quarter, the Company repurchased 481 shares of common stock owned by participants in its restricted stock awards program under the terms of the AK Steel Holding Corporation Stock Incentive Plan. In order to satisfy the requirement that an amount be withheld that is sufficient to pay federal, state and local taxes due upon the vesting of the restricted stock, employees are permitted to have the Company withhold shares having a fair market value equal to the minimum statutory withholding rate which could be imposed on the transaction. The Company repurchases the withheld shares at the average of the reported high and low sales prices on the day the shares are withheld. |

(2) | On October 21, 2008, the Company announced that its Board of Directors had authorized the Company to repurchase, from time to time, up to $150.0 of its outstanding equity securities. This stock repurchase plan superseded and replaced a previous stock repurchase plan announced in 2000. There is no expiration date specified in the Board of Directors' authorization. The Company's ability to purchase shares under this authorization is subject to the same debt covenants discussed above that can restrict dividend payments. |

11

Table of Contents

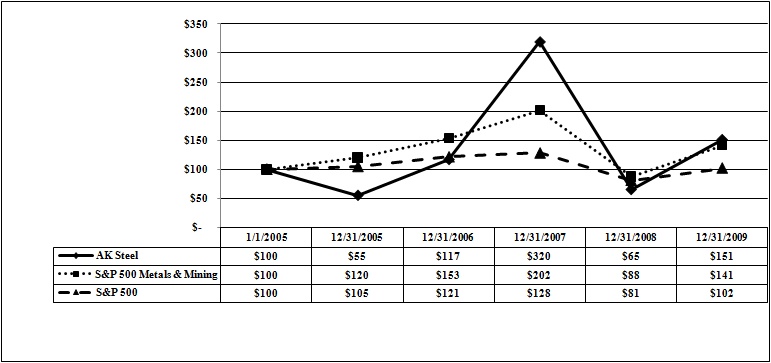

The following graph compares cumulative total stockholder return on the Company's common stock for the five-year period from January 1, 2005 through December 31, 2009 with the cumulative total return for the same period of (i) the Standard & Poor's 500 Stock Index and (ii) S&P 500 Metals & Mining Index. The S&P 500 Metals & Mining Index is made up of AK Steel Holding Corporation, Alcoa Inc., Titanium Metals Corporation, Newmont Mining Corporation, Nucor Corporation, Freeport-McMoRan Copper & Gold Inc., Allegheny Technologies Inc., Cliffs Natural Resources, Inc., and United States Steel Corporation. These comparisons assume an investment of $100 at the commencement of the period and reinvestment of dividends.

Cumulative Total Returns

January 1, 2005 through December 31, 2009

(Value of $100 invested on January 1, 2005)

12

Table of Contents

Item 5. | Selected Financial Data. |

The following selected historical consolidated financial data for each of the five years in the period ended December 31, 2009 have been derived from the Company's audited consolidated financial statements. The selected historical consolidated financial data presented herein are qualified in their entirety by, and should be read in conjunction with, the consolidated financial statements of the Company set forth in Item 7 and "Management's Discussion and Analysis of Financial Condition and Results of Operations" set forth in Item 6.

Years Ended December 31, | ||||||||||||||||||||

2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

(dollars in millions, except per share data) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Net sales | $ | 4,076.8 | $ | 7,644.3 | $ | 7,003.0 | $ | 6,069.0 | $ | 5,647.4 | ||||||||||

Cost of products sold (exclusive of items below) | 3,749.6 | 6,491.1 | 5,919.0 | 5,452.7 | 4,996.8 | |||||||||||||||

Selling and administrative expenses | 192.7 | 223.6 | 223.5 | 207.7 | 208.4 | |||||||||||||||

Depreciation | 204.6 | 202.1 | 196.3 | 194.0 | 196.4 | |||||||||||||||

Other operating items: | ||||||||||||||||||||

Pension and other postretirement benefits corridor charges (1) | - | 660.1 | - | 133.2 | 54.2 | |||||||||||||||

Asset impairment charges (2) | - | - | - | - | 31.7 | |||||||||||||||

Curtailment and labor contract charges (1) | - | 39.4 | 39.8 | 15.8 | 12.9 | |||||||||||||||

Impairment of equity investment (3) | - | - | - | - | 33.9 | |||||||||||||||

Total operating costs | 4,146.9 | 7,616.3 | 6,378.6 | 6,003.4 | 5,534.3 | |||||||||||||||

Operating profit (loss) | (70.1 | ) | 28.0 | 624.4 | 65.6 | 113.1 | ||||||||||||||

Interest expense | 37.0 | 46.5 | 68.3 | 89.1 | 86.8 | |||||||||||||||

Interest income (4) | 2.7 | 10.5 | 32.2 | 21.2 | 9.1 | |||||||||||||||

Other income (expense) | 6.4 | 1.6 | 3.7 | 0.3 | 3.6 | |||||||||||||||

Income (loss) from continuing operations before income tax | (98.0 | ) | (6.4 | ) | 592.0 | (2.0 | ) | 39.0 | ||||||||||||

Income tax provision (benefit) due to state tax law changes | 5.1 | - | (11.4 | ) | 5.7 | 32.6 | ||||||||||||||

Income tax provision (benefit) | (25.1 | ) | (10.9 | ) | 215.0 | (20.8 | ) | 6.2 | ||||||||||||

Net income (loss) from continuing operations | (78.0 | ) | 4.5 | 388.4 | 13.1 | 0.2 | ||||||||||||||

Cumulative effect of accounting change (5) | - | - | - | - | (1.5 | ) | ||||||||||||||

Less: Net income (loss) attributable to non-controlling interest | (3.4 | ) | 0.5 | 0.7 | 1.1 | 1.0 | ||||||||||||||

Net income (loss) attributable to AK Steel Holding Corporation | $ | (74.6 | ) | $ | 4.0 | $ | 387.7 | $ | 12.0 | $ | (2.3 | ) | ||||||||

Basic earnings per share: | ||||||||||||||||||||

Income (loss) from continuing operations | $ | (0.68 | ) | $ | 0.04 | $ | 3.50 | $ | 0.11 | $ | (0.01 | ) | ||||||||

Cumulative effect of accounting change | - | - | - | - | (0.01 | ) | ||||||||||||||

Net income (loss) | $ | (0.68 | ) | $ | 0.04 | $ | 3.50 | $ | 0.11 | $ | (0.02 | ) | ||||||||

Diluted earnings per share: | ||||||||||||||||||||

Income (loss) from continuing operations | $ | (0.68 | ) | $ | 0.04 | $ | 3.46 | $ | 0.11 | $ | (0.01 | ) | ||||||||

Cumulative effect of accounting change | - | - | - | - | (0.01 | ) | ||||||||||||||

Net income (loss) | $ | (0.68 | ) | $ | 0.04 | $ | 3.46 | $ | 0.11 | $ | (0.02 | ) | ||||||||

13

Table of Contents

As of December 31, | ||||||||||||||||||||

2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 461.7 | $ | 562.7 | $ | 713.6 | $ | 519.4 | $ | 519.6 | ||||||||||

Working capital | 889.4 | 1,268.6 | 1,453.9 | 1,616.0 | 1,343.0 | |||||||||||||||

Total assets | 4,274.7 | 4,682.0 | 5,197.4 | 5,517.6 | 5,487.9 | |||||||||||||||

Current portion of long-term debt | 0.7 | 0.7 | 12.7 | - | - | |||||||||||||||

Long-term debt (excluding current portion) | 605.8 | 632.6 | 652.7 | 1,115.2 | 1,114.9 | |||||||||||||||

Current portion of pension and postretirement benefit obligations | 144.1 | 152.4 | 158.0 | 157.0 | 237.0 | |||||||||||||||

Long-term pension and postretirement benefit obligations (excluding current portion) | 1,856.2 | 2,144.2 | 2,537.2 | 2,927.6 | 3,115.6 | |||||||||||||||

Total stockholders' equity | 880.1 | 970.7 | 877.3 | 419.6 | 222.9 | |||||||||||||||

Cash dividend declared | 22.0 | 22.4 | - | - | - | |||||||||||||||

(1) | Under its method of accounting for pensions and other postretirement benefits, the Company recorded non-cash corridor charges in 2008, 2006 and 2005. Included in 2008 is a curtailment charge of $39.4 associated with a cap imposed on a defined benefit pension plan for salaried employees. Included in 2007 are curtailment charges of $15.1 and $24.7 associated with new labor agreements at the Company's Mansfield Works and Middletown Works, respectively. Included in 2006 is a curtailment charge of $10.8 associated with then-new Butler and Zanesville Works labor agreements and one-time charges of $5.0 related to contract negotiations. Included in 2005 is a curtailment charge of $12.9 associated with the then-new labor agreement at the Company's Ashland Works. See Item 6, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 1 to the consolidated financial statements for additional information. |

(2) | In 2005, the Company recorded an asset impairment charge of $31.7 related to certain previously idled stainless processing equipment at its Butler and Mansfield Works. |

(3) | In 2005, the Company recorded an asset and equity investment impairment charge of $33.9 related to a decision by AK-ISG Steel Coating Company to indefinitely idle its electrogalvanizing line by March 31, 2006. |

(4) | In 2007, the Company recorded $12.5 in interest income as a result of interest received related to the recapitalization of Combined Metals, LLC, a private stainless steel processing company in which AK Steel holds a 40% equity interest. |

(5) | The fourth quarter of 2005 reflected a change within Financial Accounting Standards Board Accounting Standards Codification ("ASC") Subtopic 410-20, "Asset Retirement Obligations", and resulted in the Company recording a charge of $1.5, net of tax. |

Item 6. | Management's Discussion and Analysis of Financial Condition and Results of Operations. |

Operations Overview

The Company's operations consist of seven steelmaking and finishing plants that produce flat-rolled carbon steels, including premium-quality coated, cold-rolled and hot-rolled products, and specialty stainless and electrical steels that are sold in hot band, sheet and strip form. These products are sold to the automotive, infrastructure and manufacturing, and distributors and converters markets. The Company sells its carbon products principally to domestic customers. The Company's electrical and stainless steel products are sold both domestically and, increasingly, internationally. The Company's continuing operations also include two plants operated by AK Tube where flat-rolled carbon and stainless steel is further finished into welded steel tubing. In addition, the Company operates European trading companies that buy and sell steel and steel products and other materials.

Safety, quality and productivity are the focal points of AK Steel's operations and the hallmarks of its success. In 2009, the Company experienced another year of outstanding safety performance and received a variety of awards. The coke plants in Ashland, Kentucky and Middletown, Ohio, were co-recipients in 2009 of the Max Eward Safety Award, which annually recognizes the coke plant with the best safety record in the U.S. among members of the American Coke and Coal Chemicals Institute. The Ashland coke plant received this award for the fourth consecutive year and the Middletown coke plant is now an eight-time recipient of the award. The Company's Zanesville Works was honored in 2009 by the Ohio Bureau of Workers Compensation with three awards for its safety performance. Also in 2009, the Columbus, Indiana and Walbridge, Ohio plants of AK Tube LLC, a wholly-owned subsidiary of the Company, were recognized for their outstanding safety performances in 2008 by the Fabricators & Manufacturers Association, International and CNA Insurance. Furthermore, AK Tube's Columbus, Indiana plant was re-certified as a "Star" site in the Voluntary Protection Program ("VPP") of the Indiana Department of Labor's Occupational Safety

14

Table of Contents

and Health Administration ("OSHA"), a prestigious designation signifying that the excellence of its safety programs exceeded the requirements established by OSHA. AK Tube's Columbus plant has been VPP Star certified since 2006. The Company's Rockport and Zanesville Works experienced no recordable injuries for 2009.

The Company also had outstanding performance with respect to quality in 2009. The Company continued to be recognized in leading surveys for being industry-best in overall quality for carbon, stainless and electrical steels. Jacobson and Associates recently named the Company number one in overall customer satisfaction, quality and delivery. The Company also received a variety of quality awards from customers and others in 2009.

With respect to productivity, the severe downturn in the economy in 2009 resulted in the Company reducing its operations substantially and idling various pieces of equipment and facilities at various times throughout the year. Thus, in 2009 the Company focused on making and finishing its products in the most cost effective manner possible to conserve cash, reduce costs and maximize its competitiveness. As a result of a general improvement in steel demand, the Company was able to increase its production levels at virtually all of its facilities during the second half of 2009.

Despite the downturn in the economy and the need to conserve cash, the Company continued to perform maintenance in 2009 where needed and to invest its capital for the future. For example, the Company invested approximately $27.0 to successfully complete the reline of the hearth and bosh sections for its Middletown Works blast furnace.

Also in 2009, the Company announced that it had reached agreement with Haverhill North Coke Company ("SunCoke Haverhill"), an affiliate of SunCoke Energy, Inc. ("SunCoke") to provide the Company with metallurgical-grade coke from the SunCoke Haverhill facility in southern Ohio. Under the agreement, SunCoke Haverhill provides AK Steel with up to 550,000 tons of coke annually. The Company will also benefit under the agreement from the electricity co-generated from the heat recovery coke battery. This is in addition to the previously announced project with Middletown Coke Company, Inc., another SunCoke affiliate ("Middletown Coke"), to construct a new state-of-the-art, environmentally friendly heat-recovery coke battery contiguous to the Company's Middletown Works which will be capable of producing 550,000 net tons of metallurgical grade coke annually. It is likely that the Company will need the production from both SunCoke facilities due to reduced production available from, and uncertainties with respect to, the Company's Ashland, Kentucky coke batteries as a result of environmental issues. To the extent the two SunCoke facilities, combined with the Company's existing coke batteries in Ashland, Kentucky and Middletown, Ohio, provide more coke than the Company needs for its steel production, the Company anticipates that it will be able to sell any excess coke in the merchant coke market.

2009 Financial Results Overview

The Company faced challenging times throughout 2009 as the entire steel industry was adversely impacted by the significant decline in the domestic and global economies. The Company took immediate and proactive measures to address the challenging economic conditions, including reducing its operations to match customer demand, reducing overhead costs, implementing a five-percent pay cut for all salaried employees until conditions improved at the start of the fourth quarter, locking and freezing the defined benefit plans for its salaried employees, temporary layoffs of hourly and salaried employees, and reducing the size of its salaried workforce by offering an early retirement package and eliminating positions. While 2009 began with weak demand for the Company's products, market conditions improved as the year progressed and the Company improved its financial performance each quarter throughout 2009. The Company achieved both operating profit and net income in the second half of 2009. For the full year, the Company reported an operating loss of $70.1 and a net loss attributable to AK Steel Holding Corporation of $74.6, or $0.68 per share.

The Company reported record low shipments in the first half of 2009 but saw significant improvement in the second half as the recession bottomed out and customer demand began to improve. In fact, the Company finished the year strong with shipments of 1,368,300 tons in the fourth quarter. This still was below the record levels experienced in 2008, but nearly double the record low shipments the Company experienced in the second quarter of 2009.

15

Table of Contents

Key Factors Generally Impacting Financial Results

The key factor impacting the Company's 2009 financial results was the severe decline in the domestic and global economies which began late in 2008 and continued throughout 2009. Although the Company began to see improvements for the demand for its products in the second half of 2009, overall for the year it experienced a significant decline in demand for all of its products. This severe decline resulted in the Company reducing its operations to try to match customer demand, including periodically idling various operations throughout the year. These steps were required to mitigate the financial impact to the Company and to allow it to manage its working capital in an efficient manner.

2009 Compared to 2008

Shipments

Steel shipments in 2009 were 3,935,500 tons, compared to 5,866,000 tons in 2008. The year-over-year reduction was primarily the result of decreased customer demand throughout the year due to the severe decline in overall economic conditions. Shipments declined in all reported product categories in 2009 compared to 2008, but the percentage of decline was greatest with respect to hot-rolled steel products. As a result, the Company's value-added shipments as a percent of total volume shipped increased to 85.5% in 2009 compared to 80.7% in 2008. Tons shipped by product category for 2009 and 2008, with percent of total shipments, were as follows:

| (tons in thousands) | 2009 | 2008 | ||||||||||||||

Stainless/electrical | 670.0 | 17.0 | % | 957.1 | 16.3 | % | ||||||||||

Coated | 1,791.6 | 45.5 | % | 2,477.8 | 42.2 | % | ||||||||||

Cold-rolled | 821.4 | 20.9 | % | 1,185.2 | 20.2 | % | ||||||||||

Tubular | 83.2 | 2.1 | % | 117.3 | 2.0 | % | ||||||||||

Subtotal value-added shipments | 3,366.2 | 85.5 | % | 4,737.4 | 80.7 | % | ||||||||||

Hot-rolled | 414.4 | 10.5 | % | 949.2 | 16.2 | % | ||||||||||

Secondary | 154.9 | 4.0 | % | 179.4 | 3.1 | % | ||||||||||

Subtotal non value-added shipments | 569.3 | 14.5 | % | 1,128.6 | 19.3 | % | ||||||||||

Total shipments | 3,935.5 | 100.0 | % | 5,866.0 | 100.0 | % | ||||||||||

Net Sales

Net sales in 2009 were $4,076.8, down 47% from the Company's all-time annual record for net sales of $7,644.3 in 2008. The year-to-year decrease resulted from lower selling prices across all of the Company's product categories as a result of the severe decline in the demand for steel products driven by the economic recession. The average selling price was $1,036 per net ton in 2009, compared to $1,303 per net ton in 2008. The Company has variable pricing mechanisms with most of its contract customers, under which both rising and falling commodity costs are passed through to the customer during the life of the contract. The Company had such variable pricing mechanisms with respect to approximately 83% of its contract shipments in 2009. In 2009, the Company experienced a significant decline in its raw material and energy costs. As a consequence, surcharges to customers were reduced and that contributed to both the lower average selling price and the lower net sales for the year.

Net sales to customers outside the United States were $767.0, or 19% of total steel sales, for 2009, compared to $1,267.9, or 17% of total steel sales, for 2008. A substantial majority of the revenue from sales outside of the United States is associated with electrical and stainless steel products. The increase in the percentage of total sales represented by international sales in 2009 was principally due to the fact that domestic sales declined proportionately more than international sales.

Although the percentage of the Company's net sales attributable to the automotive industry increased in 2009 versus 2008, its total volume of direct automotive sales declined. The decline in automotive sales was principally the result of significantly reduced light vehicle production in North America due to the downturn in the economy, which led to reduced orders from the Company's automotive customers. The lowest point of customer demand was in the second quarter of the year, and demand began to increase during the second half of 2009. This increase in demand was buoyed by the United States federal government's "cash for clunkers" program in the third quarter which helped boost

16

Table of Contents

the sale of light vehicles in the United States and subsequently resulted in the need for automotive manufacturers to increase vehicle production, spurring demand for the Company's automotive market products.

The Company likewise experienced a decline in its sales to the infrastructure and manufacturing markets. This decrease also was driven primarily by the decline in global and domestic economies. Sales of the Company's electrical steel products make up a significant component of its infrastructure and manufacturing sales. Those electrical steel sales were down significantly in 2009 principally because of the decline in the United States housing market, which drives the need for new electrical transformers. To a much lesser degree, the Company's electrical steel sales were negatively impacted in the fourth quarter of 2009 by the trade cases initiated in China with respect to grain oriented electrical steel imported from the United States and Russia into China.

The most significant sales decline in 2009 was in the distributors and converters market, particularly with respect to hot-rolled steel shipments. During 2007 and the first half of 2008, spot market pricing in the steel industry rose to unprecedented levels. As a result, the Company elected to increase its sales to the spot market as a means of maximizing its earnings. Starting, however, in the second half of 2008 and continuing through most of 2009, the opposite was true - that is, the spot market price for steel, particularly hot-rolled steel, declined and the Company made a concerted effort to move away from such sales. This led to a disproportionate decline in sales to the distributor and converter market relative to the Company's other markets, which typically are more heavily weighted toward contract sales.

The following table sets forth the percentage of the Company's net sales attributable to each of its markets:

Market | 2009 | 2008 | ||||||

Automotive | 36 | % | 32 | % | ||||

Infrastructure and Manufacturing (a) | 31 | % | 29 | % | ||||

Distributors and Converters (a) | 33 | % | 39 | % | ||||

(a) | Prior to 2008, the Company historically referred to these markets by somewhat different names. In 2008, the names were updated to simplify them, but the nature of the product sales and customers included in each market was not changed. For more information, see the footnote to the table contained in the discussion of Customers in Item 1. |

Operating Profit (Loss) and Adjusted Operating Profit

The Company reported an operating loss for 2009 of $70.1, compared to an operating profit of $28.0 for 2008. Included in 2008 annual results were a pre-tax, non-cash corridor charge and a pre-tax, non-cash pension curtailment charge, which are described more fully below. The exclusion of those charges for 2008 would have resulted in adjusted operating profit of $727.5 for 2008. Exclusion of the non-cash charges from the operating results is presented in order to clarify the effects of those charges on the Company's operating results and to reflect more clearly the operating performance of the Company on a comparative basis for 2009 and 2008.

In 2009, the Company incurred no corridor charges. In 2008, however, the Company incurred a pension corridor charge of $660.1. A corridor charge, if required after a re-measurement of the Company's pension and/or other postretirement obligations, historically has been recorded in the fourth quarter of the year in accordance with the method of accounting for pension and other postretirement benefits which the Company adopted as a result of its merger with Armco Inc. in 1999. Since 2001, the Company has recorded approximately $2.5 billion in non-cash pre-tax corridor charges as a result of this accounting treatment. These corridor charges have had a significant negative impact on the Company's financial statements including a substantial increase in the Company's accumulated deficit. Though these corridor charges have been required in seven of the last nine years, it is impossible to reliably forecast or predict whether they will occur in future years or, if they do, what the magnitude will be. They are driven mainly by events and circumstances beyond the Company's control, primarily changes in interest rates, performance of the financial markets, healthcare cost trends and mortality and retirement experience.

The Company also experienced a pension curtailment charge in 2008. This curtailment charge was the result of salaried workforce cost reductions implemented by the Company. A defined benefit plan covering all salaried employees was "locked and frozen" and was replaced with a defined contribution pension plan. Under the new defined contribution pension plan, the Company makes a fixed percent contribution to the participants' retirement accounts, but no longer guarantees a minimum or specific level of retirement benefit. As a result, the Company was required to recognize in the fourth quarter of 2008 the past service pension expense that previously would have been amortized.

17

Table of Contents

Additional information concerning both the pension corridor charge and the pension curtailment charge is contained in the " Pension & Other Postretirement Employee Benefit Charges " section below.