UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

X | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the Fiscal Year Ended May 31, 2018 | |

|

| |

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the transition period from to | |

Commission File Number 000-30368

AMERICAN INTERNATIONAL VENTURES, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware |

| 22-3489463 |

(State or other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No. |

15105 Kestrelglen Way, Lithia, Florida 33547

(Address of Principal Executive Offices) (Zip Code)

813-260-2866

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act: Common Stock $.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer. ¨ Yes x No

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act: ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the proceeding 12 months and (2) has been subject to such filing requirements for the past 90 days.

(1) x Yes ¨ No (2) x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of "accelerated filer" and "large accelerated filer" in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer |

|

| Accelerated filer |

|

Non-accelerated filer |

| (Do not check if a smaller reporting company) | Smaller reporting company | X |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of August 7, 2018, the aggregate market value of the voting and non-voting common equity held by non-affiliates is approximately $2,497,550. This calculation is based upon the last trade of $0.011 of the common stock on August 7, 2018. The number of shares outstanding of the registrant's class of common stock on August 7, 2018 was 360,399,945 shares.

1

EXPLANATORY NOTE

American International Ventures Inc. ("AIVN") previously filed audited quarterly and annual reports up to and including the quarterly period ended February 28, 2017.

Commencing with Form 10-K for annual period ended May 31, 2017, AIVN has filed unaudited voluntary filings of quarterly and annual reports.

2

AMERICAN INTERNATIONAL VENTURES, INC.

FORM 10-K

For the Fiscal Year Ended May 31, 2018

Table of Contents

PART I 4

Item 1. Business 4

Item 1A. Risk Factors. 13

Item 1B. Unresolved Staff Comments 25

Item 2. Properties. 26

Item 3. Legal Proceedings. 26

Item 4. Mine Safety Disclosures. 26

PART II 27

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. 27

Item 6. Selected Financial Data. 28

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. 28

Item 7A. Quantitative and Qualitative Disclosures About Market Risk. 31

Item 8. Financial Statements 32

Item 9A. Controls and Procedures 48

Item 9B. Other Information. 48

PART III 49

Item 10. Directors. Executive Officers. Promoters and Control Persons. 49

Item 11. Executive Compensation. 51

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. 51

Item 13. Certain Relationships and Related Party Transactions. 53

Item 14. Principal Accounting Fees and Services. 53

3

PART I

Item 1. Business

Except as otherwise indicated by the context, references in this Annual Report on Form 10-K to "we," "us" and "our" are to the consolidated business of the Registrant and PGPI.

We conduct our operations in Lithia, Florida, from an office in the home of our chief executive officer and we intend to open an office in Ensenada, Mexico. The present office is occupied at no charge to us. There is no rental agreement for the use of this office. If rent were charged for this space, the amount would be insignificant.

Background .

Originally, on July 16, 1984, we were organized as Lucky Seven Gas and Minerals, Inc., under the laws of the State of Pennsylvania. On June 24, 1996, our name was changed to Lucky Seven Gold Mines, Inc. On January 13, 1998, American Precious Metals, Inc. was formed, under the laws of the State of Delaware. On March 16, 1998, we merged into American Precious Metals, Inc., the surviving corporation. On November 13, 2000, our name was changed to American Global Enterprises, Inc. and on December 21, 2000, our name was changed again to American International Ventures, Inc.

Prior Business Activities .

During 2002, we developed a plan of operations to seek, identify and, if successful, acquire a portfolio of undervalued or sub-economic but prospective mineral properties in the United States, principally gold properties that could be enhanced by performing limited exploratory work on the property. We would then attempt to identify a joint venture partner to further develop the property or otherwise sell the property to an industry participant.

Pursuant to our then business plan, we acquired twenty-eight (28) patented mining claims on the Bruner property located in Nye County, Nevada.

In September 2005, we completed an Exploration and Option to Enter Joint Venture Agreement with Electrum Resources LLC relating to the Bruner property, which agreement was terminated in January 2007. In April 2009, we completed a Property Option Agreement with Patriot Gold Corp., an unaffiliated third party, in which we granted an exclusive option to the Bruner Property (the "Bruner Option"), for eight annual payments totaling $315,000.00 and a balloon payment due to us in April 2016, in the amount of $1,185,000. In addition, we retained a 1.5% net smelter reserve ("NSR") wherein Patriot Gold has the option to purchase 1% of the NSR for an additional $500,000. On October 23, 2015 we completed sale agreement and option agreement with Canamex Gold a Nevada Corporation for $750,000.

Then, we determined to expand our business purpose to seek other business opportunities to review and analyze for purposes of effecting a merger, acquisition or other business combination with an operating company business.

In April 2018, we amended our Certificate of Incorporation to increase our authorized shares of common stock from 400,000,000 shares to 800,000,000 shares.

4

Share Exchange with Placer Gold Prospecting, Inc.

On March 23, 2012, we closed on the Share Exchange Agreement with the shareholders of Placer Gold Prospecting, Inc. (PGPI) pursuant to which we acquired all of the issued and outstanding capital stock of PGPI. The transaction was treated as a reverse merger for accounting purposes. See our Form 8-K/A filed on July 9, 2013 for a more detailed discussion of the Share Exchange Agreement.

Other Business Activity.

As reported in our Form 8-K filed February 8, 2013, effective January 23, 2013, the Company executed a lease agreement to conduct mining operations and other related activities at Section 20-00-00.00 Plot Number 29Z-0-P-1 at Ejido 18 de Marzo, in the City of Ensenada, Baja California, Mexico.

As reported in our Form 8-K filed March 15, 2013, effective March 13, 2013, AIVN executed a lease agreement to conduct mining operations and other related activities on approximately 24 hectors, at the plot number 28 Northwest of Ejido 18 de Marzo, in the city of Ensenada, Baja California, Mexico. Effective March 7, 2013, AIVN incorporated a variable capital corporation in the city of Tijuana, Baja California, Mexico, by the name of AIVN de Mexico the registrant's treating said incorporation of AIVN de Mexico as a subsidiary. The primary purpose of said creation of AIVN de Mexico shall be to conduct mining operations and other related activities. We began searching for drilling operations with our pilot plant in May 2013.

As reported on our Form 8-K filed on April 24, 2013, effective March 23, 2012, our Board of Directors approved and recommended that the company's 2012 Stock Option Plan and the proposed action be submitted to a vote of its shareholders. The record date established by the Board of Directors was October 22, 2012. A majority of stockholders approved the 2012 Stock Option Plan on November 9, 2012.

Description of Placer Gold Prospecting, Inc.'s Business

For purposes of this section entitled "Description of Placer Gold Prospecting, Inc.'s Business" only, all references to "we," "us," or "our" or "PGPI" refers to PGPI prior to the effectiveness of the Share Exchange.

On January 25, 2012, PGPI was incorporated in the State of Florida, for mining exploration. It has acquired mining claims for approximately 4,050 acres of land, primarily in Nevada, with the intent of reactivating the historical mines that produced gold and silver until shut down in 1942 because of World War II. There is no guarantee that such properties will produce gold or silver in the future or that these properties may have already been depleted, as they were previously mined.

At this time, our primary focus is on gold and silver properties. Gold and silver properties are wasting assets. They eventually become depleted or uneconomical to continue mining. Currently, we have not produced any gold or silver from our properties. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. Our ability to become and remain profitable over the long term depends on our ability to finalize the design, permit, development and profitable extraction and recovery of mineral resources beyond our current planned mine life. If our ability to expand the operations beyond their current planned mined lives doesn't occur we may seek to acquire other precious and base metals properties beyond our current properties. The acquisition of precious and base metals properties and their exploration and development are subject to intense competition. Companies with greater financial resources, larger staff, more experience and more equipment for exploration and development may be in a better position than us to compete for such mineral properties.

5

Below is a list of the claims which PGPI acquired prior to March 23, 2012, the date of reverse acquisition.

Name of Claim |

| Acres |

| Date Acquired |

El Tule |

| 3,070.00 |

| March 14, 2012 |

Capatola |

| 55.50 |

| March 8, 2012 |

Indian Mine |

| 122.00 |

| March 14, 2012 |

Gypsy Mine |

| 160.00 |

| February 18, 2012 |

|

|

|

|

|

Stud Horse Mine |

| 41.26 |

| March 14, 2012 |

TNT Mine |

| 41.26 |

| March 14, 2012 |

Bullfrog Mine |

| 100.00 |

| February 17, 2012 |

Virgilia Mine |

| 60.00 |

| February 17, 2012 |

Reward Monster Mine |

| 80.00 |

| February 20, 2012 |

The following is a list of claims acquired after March 23, 2012:

|

|

|

|

|

Name of Claim |

| Acres |

| Date Acquired |

Turner Ranch |

| 39.73 |

| May 3, 2012 |

Bullfrog #3s |

| 80 |

| May 15, 2012 |

American Metallic Mine |

| 20.7 |

| May 9, 2012 |

Placeritas Mine |

| 432 |

| April 30, 2012 |

Golden Eagle #2 |

| 742.3 |

| July 2, 2012 |

North Star |

| 40 |

| Aug 2, 2012 |

Sale of Mining Claims during Fiscal 2014.

During fiscal year to 2014, we sold certain mining claims to Gold Mining USA, Inc. (OTC -PINK: GMUI) ("GMU"). On February 4, 2014, the Company completed the sale of certain mining claims to GMU in exchange for 5 million shares of common stock of GMU. The Company reserved a 3% net smelter return on the claims. The claims consist of four unpatented claims and are part of eight claims held by the Company known as the "Gypsy Gold Mine." In addition, on June 16, 2014, the Company completed the sale of additional unpatented mining claims to GMU in exchange for 1.5 million shares of common stock of GMU and the Company also reserved a 3% net smelter return. The mining claims consist of twenty two unpatented claims known as "El Tule/Rich Gulch" and remaining four unpatented claims which are part of the "Gypsy Gold Mine" claims. All of the claims are located in Douglas County, Nevada

Under the February 2014 agreement, the parties further agreed that GMU has the option to purchase the remaining four unpatented claims (part of the Gypsy Gold Mine) in exchange for GMU purchasing a convertible debenture in the amount of $1,000,000 from the Company within six months from the closing of the original transaction ("Debenture"). Under the current June agreement, the Company included these four unpatented mining claims as part of the above described transaction, and the parties agreed that the stock consideration (1.5 million shares of common stock of GMU) satisfied the obligation to purchase the Debenture as required under the January 2014 agreement.

15 miles from the town of Tularosa New Mexico, and is accessible through

6

Sale of Bruner Mine. (1) Location: The Bruner mine is located in township 14 north, range 37 east, and encompasses the SE1/4 of section 14, section 23 NE1/4, section 13 SW1/4, and section 24 NE1/4. The Bruner mine is located 76 miles from the town of Fallon Nevada of HWY 361. The Bruner property consists of 28 patented mining claims.

(2) The Bruner was optioned in 2008 to Patriot Gold in Las Vegas which made annual payments to the Company under the Option Agreement. The Bruner Property was sold to Canamex resources U.S., Inc. on October 30, 2015 for $750,000 cash. Canamex also assumed the obligations of the Company to Patriot Gold under the option Agreement. The sale to Canamex was subject to the Company's 1.5% net smelter return (NSR) royalty as well as an underlying royalty of 2.0% to the original project vendor.

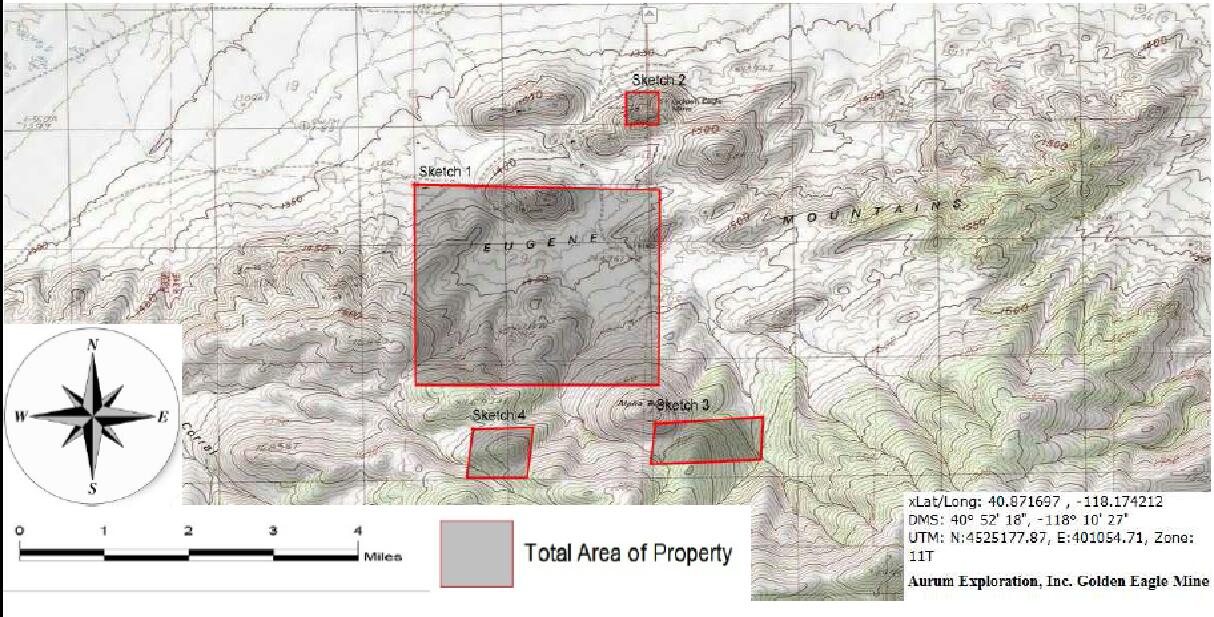

Golden Eagle Placers Mine

(1) Location: The Golden Eagle Placers mine is located in township 35 north, range 34 east, and encompasses the entire section 29. The Golden Eagle mine is located 27.8 miles from the town of Winnemucca, Nevada off HYW 80/Jungo RD.

(2) Description of claim: The Golden Eagle mine consists of 704 acres of patented (fee simple). The annual tax on this property is $146. The property was purchased by American International Ventures, Inc. subsequent to the reverse acquisition of Placer Gold Prospecting, Inc. for $601,000.00 in cash, note, and Company shares. The Company used approximately $68,000 of the Bruner sale proceeds to close its acquisition of Golden Eagle.

(3) History of Previous Operations: The Golden Eagle mine was previously worked back in the 1930's by a large group of miners. The site has an extensive amount of shafts, adits, and tailings that were left by the early group of miners that were in search of gold.

(4) (i) The Golden Eagle mine is an open cast surface deposit with additional subsurface workings. Our company retained the services of Aurum Exploration, and AMEC during the acquisition of this property to obtain all necessary permits and conduct geological evaluations. AMEC is currently working on obtaining all permits for mining and roadways with the assistance of Aurum Exploration. Over $250,000

7

has been spent on the construction of roads leading to the mine, and excavation of two settling ponds. At this time the property is without known reserves and the proposed program is exploratory in nature.

(ii) The Golden Eagle mine has a 2 bedroom house and office, well, gates, and water truck at the site.

5) Gold mineralization is thought to have occurred during periods of fracture and breccia controlled chalcedony sulfide mineralization. Oxidation appears to be related to a deep, wide spread acid leaching event, and by descending supergene fluids along the East Fault. The Vortex Zone, bordering the south end of the Brimstone Zone, is hosted in rocks similar to those at Brimstone, but overprinted with extensive hydrothermal brecciation. Alteration in the Vortex Zone is primarily strong silicification capped with hydrothermal argillic and subordinate acid leach alteration. Mineralization in the Vortex Zone is thought to be related to several pulses of fracturing and hydrothermal brecciation, plus quartz and chalcedonic veining. Vortex is bounded on the east by the East Fault, and is open to the north, west, and south and at depth. Subsequent Acquisition of Claims in Baja California, Mexico.

In January 2013, the Company leased certain claims from the mother of the current President of the Company's Mexican subsidiary which covers 22.5 acres, in Baja California, Mexico for a period of five (5) years. The lease provides a payment of $300 per month. These claims are known as the "Mother Lode" claims. In addition, effective March 13, 2013, the Company executed a lease agreement to conduct mining operations and other related activities on approximately twenty four (24) hectares, at the plot number 28 Northwest of Ejido 18 de Marzo, in the City of Ensenada, Baja California, Mexico (the "Property"). The owner of the Property is Tito Calas Zarate.

The principal provisions of the agreement include:

(1) Term - Four (4) Years;

(2) Rental Payment - $200.00 (US) per month;

(3) Lease Rights - Assignable by the Company;

(4) Improvements - Improvements made by the Company are for the benefit of the Owner;

(5) Maintenance and Repairs - The property must be maintained by the Company to at least its current condition;

(6) Option to Purchase - During the term, the Company has the first option to negotiate and purchase the property.

On December 1, 2015, AIVN de Mexico, S.A. de C.V. ("AIVN Mexico") purchased ten mining concessions commonly known as "Quesaro" for $50,000 cash. AIVN Mexico is a wholly owned subsidiary of Mega Mines, Inc., which in turn is a wholly owned subsidiary of the Company. The concessions are located in Baja, Mexico. The concessions are as follows:

Name | Concession No. | Hectares |

La Sorpresa | 203304 | 90.000 |

La Sorpresa II | 203254 | 265.000 |

La Sorpresa III | 218574 | 71.000 |

LAS III Fraccion 2 Frac I | 227920 | 12.000 |

LAS III Fraccion 2 Frac II | 227921 | 12.000 |

LAS III Fraccion 2 Frac III | 227922 | 72.000 |

El Cid | 219881 | 550.674 |

El Cid 1 | 219882 | 72.000 |

Dolores | 219883 | 1266.150 |

M. Carter | 223403 | 66.6054 |

On December 2, 2016, AIVN purchased Mega Mines LLC forty-five million common shares.

8

The List of gold mining Concessions in the name of Mega Mines LLC located in the State of Michoacán,

Mexico:

Name Concession No. Hectares

LA BONDAD 054-08849 200

EL RINCON 1 232351 200

EL RINCON 2 233553 275

LA HUERTA 054-08883 510

LA CARRETA 236305 207

CTUZ DEL SUR 1 223881 500

LOBOS 2229622 468

LA PERLA 243146 200

Description of our Current Business

Since the acquisition of PGPI, our operations have focused on planning, developing and operating past producing precious metal properties and mines. Specifically, we are now a gold and silver exploration and extraction company, operating primarily in the Baja California through our subsidiary AIVN de Mexico. In addition to our mining claims in Nevada, we also lease certain mining claims in the Baja California, Mexico. The main focus of current activity has been on mining claims in Baja California, Mexico. During June 2013, we commenced limited operations on the mining claims known as the Mother Lode which we acquired in early calendar year 2013. These claims have both placer and hard rock geological characteristics, and we began a pilot program to mine the placer portion of the claim in June 2013. A problem with our mining permit caused us to suspend mining in May 2014. We are addressing this problem and expect to resume mining before the end of our third fiscal quarter 2016. We mine the placer material using heavy equipment and then process the material through a wash mill located on the premises. We purchased a majority of the necessary heavy equipment and mill in 2012. We have not established any proven or probable reserves on this property. On February 20, 2018 the Company acquired as a wholly owned subsidiary GeoEnergy (USA) Inc., GeoAsia Group, GeoFuel (Singapore) PTE LTD, Geo-Qtx Synfuels, Inc International License agreement and Indonesia Joint Venture with PT Bhumi Sriwijaya Perdana Coal for eighty million shares.

9

We currently have one full time employee located in Mexico, and five-part time employees in the United States consisting of our Chief Executive Officer, President, Chief Operating Officer, Chief Financial Officer and Chief Technology Officer.

Types of Claims

* a patented mining claim is a mineral claim originally staked on land owned by in the United States Government, where all its associated mineral rights have been secured by the claimant from the U.S. Government in compliance with the laws and procedures relating to such claims, and title to the surface of the claim and the minerals beneath the surface have been transferred from the U.S. Government to the claimant. Annual mining claim assessment work is not required, and the claim is taxable real estate.

* an unpatented mining claim is a mineral claim staked on federal, state or, in the case of severed mineral rights, private land to which a deed from the U.S. Government or other mineral title owner has not been received by the claimant. Unpatented claims give the claimant the exclusive right to explore for and to develop the underlying minerals and use the surface for such purpose. However, the claimant does not own title to either the minerals or the surface, and the claim is subject to annual assessment work requirements and the payment of annual rental fees which are established by the governing authority of the land on which the claim is located. The claim may or may not be subject to production royalties payable to that governing authority.

Exploration Business and Operations

The Company doesn't expect to conduct any mining operations in Nevada during the fiscal year ended May 31, 2018 and there can be no assurance the Company will be able to sell or have the financing to complete the permitting of the Golden Eagle or ever mine in Nevada.

We have accumulated substantial losses and our auditor has issued to us a going concern opinion. We expect to continue to incur losses unless and until we generate sufficient revenue from production to fund continuing operations including exploration and development costs. We expect such losses or the monthly burn rate to be in the range of $40,000 to $60,000. There is no assurance we will be profitable for any quarterly or annual period. We anticipate we will need to raise approximately $5,000,000 to $7,000,000 in the next 12 months to fund our planned exploration expenditures, debt service and general working capital requirements. We plan to raise the financing through debt and/or equity placements. Failure to raise needed financing could result in us having to scale back or discontinue exploration activities or some or all of our business operations.

10

Our Industry

The Gold Market . The market for gold is large, liquid and global. Gold continues to see demand in the jewelry, industrial and health science industries; however, gold's main demand comes in the form of safe haven investment. From economic, political and social uncertainty to a hedge against inflation, gold is, and has long been, considered by many a commodity of refuge from concerns with fiat currencies and their corresponding economies.

The World Gold Council ("WGC"), a leading international gold industry research organization, published on its website that total gold demand for the fourth quarter of 2011 rose 21% to 1,017 metric tonnes (a metric tonne is equal to 2,204.6 pounds) year-on-year. Of this increase, investment demand posted the largest segment increase, more than offsetting the decline in gold jewelry demand. Due to the volatility of the price of gold, however, there is no guarantee that total gold demand will continue to grow at comparable rates in the future.

The Silver Market . Unlike the gold market, demand within the silver market has been predominantly for fabrication – mainly industrial application, photography and jewelry – with investment making up only a small portion of total yearly demand.

Government and Environmental Regulation

Our mining, processing operations and exploration activities are subject to various laws and regulations governing: (i) the protection of the environment, (ii) exploration, (iii) mine safety, development and production, (iv) exports,(v) taxes, (vi) labor standards, (vii) occupational health, (viii) waste disposal, (ix) toxic substances, (x) water rights, (xi) explosives and (xii) other matters. New laws and regulations, amendments to existing laws and regulations or more stringent implementation of existing laws and regulations could have a material adverse impact on us, increase costs, cause a reduction in levels of, or suspension of, production and/or delay or prevent the development of new mining properties.

The governmental agencies and regulators tasked with implementing and enforcing the above laws and regulations include the Bureau of Land Management, the Mine Safety and Health Administration, the Department of Natural Resources and Conservation, and the Bureau of Alcohol, Tobacco, Firearms and Explosives.

We believe we are currently in compliance in all material respects with all applicable environmental laws and regulations. Such compliance requires significant expenditures and increases mine development and operating costs. Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental liability may result from mining activities conducted by others prior to our ownership of a property. To the extent we are subject to uninsured environmental liabilities, the payment of such liabilities would reduce our otherwise available earnings and could have a material adverse effect on our business plan.

Licenses and Permits

Our operations require licenses and permits from various governmental authorities. We believe we hold all material licenses and permits required under applicable laws and regulations and believe we are presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits that may be required to explore and develop our properties, commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.

11

Mine Safety and Health Administration Regulations

Pursuant to Section 1503(a) of the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act, issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities. At the present time we do not plan any operations in 2018/19 in Nevada.

Competition

Because the life of a mine is limited by its mineral reserves, we are continually seeking to replace and expand our reserves through the exploration of existing properties as well as through acquisitions of interests in new properties or of interests in companies which own such properties. We encounter competition from other mining companies in connection with the acquisition of properties and with the engaging and maintaining of qualified industry experienced personnel. This competition may increase the cost of acquiring suitable properties and retaining qualified industry experienced personnel.

The Share Exchange

On March 23, 2012, we (as buyer) entered into, and closed on, a Share Exchange Agreement (the "Exchange Agreement") with the shareholders of Placer Gold Prospecting, Inc. ("PGPI"), a Florida corporation, pursuant to which we acquired all 162,350,000 outstanding shares of common stock of PGPI in exchange for 162,350,000 shares of our common stock (the "Share Exchange"). Immediately prior to the Exchange Agreement, we had 19,354,044 shares of common stock issued and outstanding.

The transaction has been accounted for as a reverse recapitalization, a procedure that treats the transaction as though PGPI had acquired AIVN. Under the accounting for a reverse recapitalization, the assets and liabilities of AIVN were recorded on the books of the continuing company, and the stockholders' equity accounts of AIVN were reorganized to reflect the terms of the Share Exchange. No goodwill or other intangible asset was recognized.

After closing of the Share Exchange, the former shareholders of PGPI now own approximately 89% of our common stock and we own 100% of PGPI. PGPI is in the business of mining exploration and acquisition.

Jack Wagenti, our CEO, at that time, executed the Exchange Agreement on our behalf. Mr. Wagenti was a founder, CEO and director of PGPI, and owned 25 million shares of common stock of PGPI (approx. 16%) at the time of the closing of the Share Exchange (the "Closing"). Frederick Dunne, Jr., one of our directors as of Closing, owned 1,000,000 shares of common stock of PGPI (less than 1%) as of the closing. Arthur Ackerman, one of our directors as of closing, owned 6,000,000 shares of common stock of PGPI (approximately 3.6%) as of the closing.

After giving effect to the Share Exchange, there were 181,695,044 shares of our common stock outstanding, of which approximately 89% are held by the former shareholders of PGPI. Prior to the Share Exchange, we were a shell company with no business operations. As a result of the Share Exchange, we are no longer considered a shell company and there was a change in control of the Company.

The issuance of the shares of our common stock pursuant to the Share Exchange, was made in reliance upon an exemption from registration under the Securities Act of 1933, as amended (the "Securities Act"), pursuant to Regulation D promulgated thereunder. As such, the shares of our common stock may not be offered or sold unless they are registered under the Securities Act or an exemption from the registration requirements of the Securities Act is available.

12

Item 1A. Risk Factors.

Risk Factors

Disclosure Regarding Cautionary Statements.

Forward Looking Statements . Certain of the statements contained in this Annual Report on Form 10-K includes "forward looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"). All statements other than statements of historical facts included in this Form 10-K regarding the Company's financial position, business strategy, and plans and objectives of management for future operations and capital expenditures, and other matters, are forward looking statements. These forward-looking statements are based upon management's expectations of future events. Although we believe the expectations reflected in such forward looking statements are reasonable, there can be no assurances that such expectations will prove to be correct. Additional statements concerning important factors that could cause actual results to differ materially from our expectations ("Cautionary Statements") are disclosed below in the Cautionary Statements section and elsewhere in this Form 10-K. All written and oral forward-looking statements attributable to us or persons acting on our behalf subsequent to the date of this Form 10-K are expressly qualified in their entirety by the Cautionary Statements.

Cautionary Statements . Certain risks and uncertainties are inherent in the Company's business. In addition to other information contained in this Form 10-K, the following Cautionary Statements should be considered when evaluating the forward-looking statements contained in this Form 10-K:

YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING FACTORS, IN ADDITION TO THE OTHER INFORMATION INCLUDED ELSEWHERE IN THIS CURRENT REPORT AND THE DOCUMENTS THAT WE HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. UNLESS THE CONTEXT REQUIRES OTHERWISE, THE USE OF THE COMPANIES, THE COMBINED COMPANY, "US," OR "WE" REFERS TO THE COMBINED COMPANY OF PGPI AND US AFTER GIVING EFFECT TO THE SHARE EXCHANGE. WE HAVE DISCUSSED ALL KNOWN MATERIAL RISKS, HOWEVER, ANY RISKS NOT PRESENTLY KNOWN TO US, IF THEY MATERIALIZE, ALSO MAY ADVERSELY AFFECT US AND OUR STOCK PRICE.

Our business is to engage in exploration and production activities in the precious minerals mining industry, which is a highly speculative activity. An investment in our securities involves a high degree of risk. You should not invest in our securities if you cannot afford to lose your entire investment. In deciding whether you should invest in our securities, you should carefully consider the following information together with all of the other information contained in this Current Report. Any of the following risk factors can cause our business, prospects, financial condition or results of operations to suffer and you to lose all or part of your investment.

Risks Related to Our Business and Financial Condition

Estimates of mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated .

There are numerous uncertainties inherent in estimating quantities of mineralized material such as gold and silver, including many factors beyond our control and no assurance can be given that the recovery of mineralized material will be realized. In general, estimates of mineralized material are based upon a number of factors and assumptions made as of the date on which the estimates were determined, including:

13

o geological and engineering estimates that have inherent uncertainties and the assumed effects of regulation by governmental agencies;

o the judgment of the engineers preparing the estimates;

o estimates of future metals prices and operating costs;

o the quality and quantity of available data;

o the interpretation of that data; and

o the accuracy of various mandated economic assumptions, all of which may vary considerably from actual results.

Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property's return on capital. There can be no assurance that minerals recovered in small scale metallurgical tests will be recovered at production scale.

We may have difficulty meeting our current and future capital requirements .

Our management and our board of directors monitor our overall costs and expenses and, if necessary, adjust our programs and planned expenditures in an attempt to ensure we have sufficient operating capital. We continue to evaluate our costs and planned expenditures for our on-going development and care and maintenance efforts at our mineral properties. The continued development and care and maintenance of our mineral properties will require significant amounts of additional capital. As a result, we may need to explore raising additional capital during fiscal 2014 and beyond so that we can continue to fully fund our planned activities. Our ability to obtain this financing will depend upon, among other things, the price of gold and the industry's perception of its future price. The extraordinary conditions in the global financial and capital markets have currently limited the availability of this funding. Therefore, availability of funding is dependent largely upon factors outside of our control and cannot be accurately predicted. If the disruptions in the global financial and capital markets continue, debt or equity financing may not be available to us on acceptable terms, if at all. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our business, financial condition and exploration activities will be adversely impacted.

We anticipate that our expected near term and long-term financing requirements to continue our operations and to implement our exploration plans is as follows: five to seven million. At this time, we do not have any arrangements for such financing and there can be no assurance we will acquire such financing.

As an "emerging growth company" under the JOBS Act, we are permitted to rely on exemptions from certain disclosure requirements .

We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

o have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

o submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and

o disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive's compensation to median employee compensation.

14

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

The volatility of the price of gold or silver could adversely affect our future operations and, if warranted, our ability to develop our properties.

The potential for profitability of our operations, the value of our properties and our ability to raise funding to conduct continued exploration and development, if warranted, are directly related to the market prices of gold, silver and other precious metals. The prices of such metals fluctuate widely and are affected by numerous factors beyond our control, including interest rates, expectations for inflation, speculation, currency values (in particular the strength of the U.S. dollar), global and regional demand, political and economic conditions and production costs in major metal producing regions of the world. The price of gold may also have a significant influence on the market price of our common stock and the value of our properties. Our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before the first revenue from production would be received. A decrease in the prices of gold or silver may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold, zinc, lead, copper or silver prices. The prices of gold and silver is affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the sale of gold and silver by central banks, and the political and economic conditions of major gold and silver producing countries throughout the world.

We are in the exploration stage and the nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses .

We have a limited operating history and must be considered in the exploration stage. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

Exploration for and the production of minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future development or mining operations we may conduct will be, subject to all of

15

the operating hazards and risks normally incident to exploring for and development of mineral properties, such as, but not limited to:

o Economically insufficient mineralized material;

o Fluctuation in production costs that make mining uneconomical;

o Labor disputes;

o Unanticipated variations in grade and other geologic problems;

o Environmental hazards;

o Water conditions;

o Difficult surface or underground conditions;

o Industrial accidents;

o Metallurgic and other processing problems;

o Mechanical and equipment performance problems;

o Failure of pit walls or dams;

o Unusual or unexpected rock formations;

o Personal injury, fire, flooding, cave-ins and landslides; and

o Decrease in the value of mineralized material due to lower gold or silver prices.

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have limited insurance to guard against some of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable, or result in additional expenses.

Difficult conditions in the global capital markets and the economy generally may materially adversely affect our business and results of operations, and we do not expect these conditions to improve in the near future.

Our results of operations are materially affected by conditions in the domestic capital markets and the economy generally. The stress experienced by domestic capital markets that began in the second half of 2007 has continued and substantially increased into the present. Since 2012, the availability of financing for junior mineral exploration companies has greatly decreased. Declining commodities prices resulting from a slowdown in the Chinese economy has recently (2105) made financing difficult even for major mining companies. In addition, the fixed-income markets are experiencing a period of extreme volatility which has negatively impacted market liquidity conditions. These factors can affect the value of our mining claims and our ability to acquire necessary financing for our exploration and operating activities.

Title to our properties may be challenged or defective .

Our planned future operations and exploration activities may require amendments to our currently approved permits from various governmental authorities. Our operations are and will continue to be governed by laws and regulations governing prospecting, mineral exploration, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, mining royalties and other matters. There can be no assurance that we will be able to acquire all required licenses, permits, amendments or property rights on reasonable terms or in a timely manner, or at all, and that such terms will not be adversely changed, that required extensions will be granted, or that the issuance of such licenses, permits or property rights will not be challenged by third parties.

We attempt to confirm the validity of our rights of title to, or contract rights with respect to, each mineral property in which we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. Our mineral properties may be subject to prior unregistered agreements, interests or native land claims, and title may be affected by undetected defects. There may be valid challenges to the title of any of the claims comprising our mineral properties that, if successful, could

16

impair possible development and/or operations with respect to such properties in the future. Challenges to permits or property rights, whether successful or unsuccessful; changes to the terms of permits or property rights; or a failure to comply with the terms of any permits or property rights that have been obtained, could have a material adverse effect on our business by delaying or preventing or making continued operations economically unfeasible.

We are subject to complex environmental and other regulatory risks, which could expose us to significant liability and delay, and potentially the suspension or termination of our development efforts .

Compliance with environmental quality requirements and reclamation laws imposed by federal, state, provincial, and local governmental authorities may:

o require significant capital outlays;

o materially affect the economics of a given property;

o cause material changes or delays in our intended activities; and

o potentially expose us to lawsuits.

These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Applicable authorities may require us to prepare and present data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment. The requirements imposed by any such authorities may be costly, time consuming, and may delay operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions, or a termination of operations. We cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on our operations.

Historic mining activities have occurred on certain of our properties. If such historic activities have resulted in releases or threatened releases of regulated substances to the environment, potential for liability may exist under federal or state remediation statutes. Such liability would include remediating any damage that we may have caused, including costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties. Except as discussed in our periodic filings with the SEC, we are not aware of any such claims under these statutes at this time and cannot predict whether any such claims will be asserted in the future.

We may produce air emissions and pollutions that could fall under the jurisdiction of U.S. federal laws .

Under the U.S. Resource Conservation and Recovery Act, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous waste, as well as for closure and post-closure maintenance once they have completed mining activities on a property. Our mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, storage facilities, and the use of mobile sources such as trucks and heavy construction equipment which are subject to review, monitoring and/or control requirements under the Federal Clean Air Act and state air quality laws. Permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the rules.

Legislation has been proposed that would significantly affect the mining industry .

Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872, which governs the unpatented claims that we control with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on the patenting of mining claims, which reduced the security of title provided by unpatented claims such as those on our U.S. properties. If additional legislation is enacted, it could substantially increase the cost

17

of holding unpatented mining claims by requiring payment of royalties and could significantly impair our ability to develop mineral estimates on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims, and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining properties .

Our operations, including on-going exploration drilling programs, require permits from the state and federal governments, including permits for the use of water and for drilling wells for water. We may be unable to obtain these permits in a timely manner, on reasonable terms or on terms that provide us sufficient resources to develop our properties, or at all. Even if we are able to obtain such permits, the time required by the permitting process can be significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties will be adversely affected, which may in turn adversely affect our results of operations, financial condition and cash flows.

Through May 31, 2019, we expect to incur approximately $160,000 in permitting costs. There can be no assurance we will be able to acquire the funding needed.

We may face a shortage of water.

Water is essential in all phases of the exploration, development and operation of mineral properties. With the nature of our operations, water is used in such processes as exploration, drilling, testing, dust suppression, milling and tailings disposal. The lack of available water and the cost of acquisition may make an otherwise viable project economically impossible to complete.

Global climate change is an international concern and could impact our ability to conduct future operations .

Global climate change is an international issue and receives an enormous amount of publicity. We would expect that the imposition of international treaties or federal, state or local laws or regulations pertaining to mandatory reductions in energy consumption or emissions of greenhouse gasses could affect the feasibility of our mining projects and increase our operating costs.

Because access to the mineral property may be restricted by inclement weather or other hazards, we may be delayed in our development efforts .

We are subject to risks and hazards, including environmental hazards, the encountering of unusual or unexpected geological formations, cave-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. As a result, access to our mineral properties may be restricted during parts of the year. During the winter months, heavy snowfall can make it difficult to undertake work programs. Frequent inclement weather in the winter months can make development and mining activities difficult for short periods of time.

We may face a shortage of supplies, equipment and materials .

The mineral industry has experienced from time to time shortages of certain supplies, equipment and materials necessary in the exploration, evaluation, development and production of mineral deposits. The prices at which such supplies and materials are available have also greatly increased. Our planned

18

operations could be subject to delays due to such shortages and further price escalations could increase our costs for such supplies, equipment and materials. Our experience and that of others in the industry is that suppliers are often unable to meet contractual obligations for supplies, equipment, materials, and services, and that alternate sources of supply do not exist.

The market for obtaining desirable properties, investment capital, and outside engineers and consultants is highly competitive .

Presently, we employ a limited number of full-time employees, utilize outside consultants, and in large part rely on the personal efforts of our officers and directors. Our success will depend, in part, upon the ability to attract and retain qualified outside engineers and other professionals to develop and operate our mineral properties, in addition to obtaining investment capital to conduct our mining operations. We believe that we will be able to attract competent employees and consultants, but no assurance can be given that we will be successful in this regard as competition for these professionals is highly competitive. If we are unable to engage and retain the necessary personnel, our business would be materially and adversely affected.

We depend upon a limited number of personnel and the loss of any of these individuals could adversely affect our business .

If any of our current executive employees were to die, become disabled or leave our company, we would be forced to identify and retain individuals to replace them. Messrs. Jack Wagenti, Jerry Scott, Frederick Dunne, Jr. and Arthur Ackerman are our critical employees at this time. In addition to the executives, we rely heavily on a several staff people that have extensive knowledge of our properties and mine plans. There is no assurance that we can find suitable individuals to replace them or to add to our employee base if that becomes necessary. We are entirely dependent on these individuals as our critical personnel at this time. We have no life insurance on any of our employees, and we may be unable to hire a suitable replacement for them on favorable terms, should that become necessary.

We have incurred substantial losses since our inception and may never be profitable .

Since its formation on January 25, 2012, Placer has incurred substantial losses and AIVN has accumulated substantial losses during its existence. In addition, we presently have no revenue. During the reporting period ended May 31, 2018, we had limited revenues from operations and have reported an operating loss from inception of approximately $6,200,000. We expect to continue to incur losses unless and until we generate enough revenue from production to fund continuing operations including exploration and development costs. We expect such losses or the monthly burn rate to be in the range of $40,000 to $60,000. There is no assurance we will be profitable for any quarterly or annual period. Our failure to report profits may adversely affect the price of our common stock and you may lose all or part of your investment.

Our executive management has limited experience in managing a public company registered with the SEC and as such compliance with compliance with the SEC rules will be time consuming, difficult and costly.

Our executive officers have limited experience managing a public company. Thus, it will be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the SEC. We may need to hire additional financial reporting, internal control, and other finance staff to develop and implement appropriate internal controls and reporting procedures.

Some of our executive management have other business activities in which they are engaged concurrently with our operations and therefore may not devote 100% of their business time to our business.

19

Some of our executive officers may engage in other business activities thereby failing to devote all of their business time to our business. Nevertheless, such officers have agreed to devote no less than full time (or up to thirty (30) hours per week) to our operations.

We currently have not entered into forward sales, commodity, derivatives or hedging arrangements with respect to our gold production and as a result we are exposed to the impact of any significant decrease in the gold and silver prices.

Currently, we have produced gold from our pilot plant in Baja California. We have not entered into forward sales, commodity, derivative or hedging arrangements to establish a price in advance for the sale of future production, although we may do so in the future. As a result, we may realize the benefit of any short-term increase in the gold price, but we are not protected against decreases in gold and silver prices, and if gold and silver prices decrease significantly, our expected future revenues may be materially adversely affected.

Our ability to become and remain profitable over the long term will depend on our ability to identify, explore and develop our current and additional properties .

Gold and silver properties are wasting assets. They eventually become depleted or uneconomical to continue mining. Currently, we have not produced any gold or silver from our properties. We are in the exploration stage and potential investors should be aware of the difficulties normally encountered by enterprises in the exploration stage. Our ability to become and remain profitable over the long term depends on our ability to finalize the design, permit, development and profitable extraction and recovery of mineral resources beyond our current planned mine life. If our ability to expand the operations beyond their current planned mined lives doesn't occur, we may seek to acquire other precious and base metals properties beyond our current properties. The acquisition of precious and base metals properties and their exploration and development are subject to intense competition. Companies with greater financial resources, larger staff, more experience and more equipment for exploration and development may be in a better position than us to compete for such mineral properties. If we are unable to find, develop, and economically mine new properties, we most likely will not be profitable on a long-term basis and the price of our common stock may suffer.

Since we have a very limited operating history, investors have little basis to evaluate our ability to operate .

Our activities to date have been focused on raising financing, exploring our properties and preparing those properties for production. Although some of our mine and concentrating facilities have previously operated, these operations were carried out under different ownership and, as a consequence we face all of the risks commonly encountered by other businesses that lack an established operating history, including the need for additional capital and personnel and intense competition. There is no assurance that our business plan will be successful.

The construction of our mines and optimization and continued operation of our mills are subject to all of the risks inherent in construction, start-up and operations .

These risks include potential delays, cost overruns, shortages of material or labor, construction defects, breakdowns and injuries to persons and property. We expect to engage self-employed personnel, subcontractors and material suppliers in connection with the construction and development of our mine projects. While we anticipate taking all measures which we deem reasonable and prudent in connection with construction of the mines and the operation of the mills, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction or operation. Any delays would postpone our anticipated receipt of revenue and adversely affect our operations, which in turn may adversely affect the price of our stock.

20

We do not insure against all of the risks to which we may be subject in our operations.

While we currently maintain insurance against general commercial liability claims and the physical assets at our projects, we do not maintain insurance to cover all of the potential risks associated with our operations. We might be subject to liability for environmental, pollution or other hazards associated with mineral exploration and development, which risks may not be insured against, which may exceed the limits of our insurance coverage, or which we may elect not to insure against because of premium costs or other reasons. We may also not be insured against interruptions to our operations. Losses from these or other events may cause us to incur significant costs which could materially adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

We may require significant additional capital to fund our business plan .

We will be required to expend significant funds to determine if proven and probable mineral reserves exist at some of our properties, to continue exploration and if warranted, develop our existing properties and to identify and acquire additional properties to diversify our property portfolio. There can be no assurance that any of the development properties we now hold, or which we may acquire, will contain a commercial ore reserve, and therefore, no assurance that we will ever generate a positive cash flow from the sale of production on such properties. In addition, once we decide to place a property into production, risks still exist that the amount and grade of the reserves may be significantly less than predicted. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying and feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the prices of gold and other precious and base metals. Capital markets worldwide have been adversely affected by substantial losses by financial institutions, in turn caused by investments in asset-backed securities. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further mining operations or exploration and development and the possible partial or total loss of our potential interest in our properties.

We have already expended significant capital to explore and identify the best properties for development. We currently have no plans to acquire any new properties at this time, as we have already developed an adequate portfolio and currently have the Golden Eagle acquisition under development. We have already developed the necessary water supply to insure the planned production at the development site.

In addition, we have the mining equipment and started a pilot program on placer claims in Baja California, Mexico. There can be no assurance we will be able to obtain funding for the acquisition of additional claims in Baja California, Mexico. Our future anticipated capital requirements will primarily be for permitting and mining in the amount of eight to ten million. We presently do not have funding available and there can be no assurance we will be able to get funding.

We may need additional capital, and the sale of additional shares or other equity securities could result in additional dilution to our stockholders .

In the future, we may raise capital for our mining operations by issuing equity securities, resulting in the dilution of the ownership interests of our present stockholders. Any future issuance of our equity securities may dilute then-current stockholders' ownership percentages and could also result in a decrease in the fair market value of our equity securities, because our assets would be owned by a larger pool of

21

outstanding equity. We may need to raise additional capital through public or private offerings of our common stock or other securities that are convertible into or exercisable for our common or preferred stock. We may also issue such securities in connection with hiring or retaining employees and consultants (including stock options issued under our equity incentive plans), as payment to providers of goods and services, in connection with future acquisitions or for other business purposes. Such issuances may have a further dilutive effect. Also, the future issuance of any such additional shares of common stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that any such future issuances will not be at a price (or exercise prices) below the price at which shares of the common stock are then traded.

Our operating costs could be adversely affected by inflationary pressures especially to labor and fuel costs .

During periods of high commodity prices, the mining industry typically attempts to increase production. This may cause significant upward price pressures in the operating costs of mining companies especially in skilled labor. The skilled labor needed by the mining industry may be in tight supply and its cost may increase. Many of our competitors have lower costs and their mines are in better locations that may give them a competitive advantage in employee hiring and retention.

The cost of fuel to operate machinery and generate electricity is closely correlated to the price of oil and energy. Increases in and other continued upward price pressures in our operating costs may cause us to generate significantly less operating cash flows than expected which would have an adverse impact to our business.

We will continue to incur losses for the foreseeable future .

Prior to completion of the development and pre-production stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses until such time as we achieve commercial production from our mining operations on our mineral claims. Because of continuing losses, we may exhaust all of our resources and be unable to complete development of our planned mining operations. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to generate profits or continue operations if we are unable to generate significant revenues from future mining of the mineral claims and our business will most likely fail. We expect such losses or the monthly burn rate to be in the range of $ 40,000 to $60,000.

22

Risks Related to Our Common Stock

There currently is only a minimal public market for our Common Stock. Failure to develop or maintain a trading market could negatively affect the value of our Common Stock and make it difficult or impossible for you to sell your shares.

There currently is only a minimal public market for shares of our Common Stock and an active market may never develop. Our Common Stock is quoted on the OTC Markets. The OTC Markets is a thinly traded market and lacks the liquidity of certain other public markets with which some investors may have more experience. We may not ever be able to satisfy the listing requirements for our Common Stock to be listed on an exchange, which are often a more widely-traded and liquid market. Some, but not all, of the factors which may delay or prevent the listing of our Common Stock on a more widely-traded and liquid market include the following: our stockholders' equity may be insufficient; the market value of our outstanding securities may be too low; our net income from operations may be too low; our Common Stock may not be sufficiently widely held; we may not be able to secure market makers for our Common Stock; and we may fail to meet the rules and requirements mandated by the several exchanges and markets to have our Common Stock listed.

We cannot assure you that the Common Stock will become liquid or that it will be listed on a securities exchange.

Until our Common Stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq Stock Market, we expect our Common Stock to remain eligible for quotation on the OTC Markets. In those venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our Common Stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our Common Stock, which may further affect the liquidity of the Common Stock. This would also make it more difficult for us to raise capital.

The application of the "penny stock" rules could adversely affect the market price of our common shares and increase your transaction costs to sell those shares.

The United States Securities and Exchange Commission (the "SEC") has adopted rule 3a51-1 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires:

o that a broker or dealer approve a person's account for transactions in penny stocks, and

o the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

o obtain financial information and investment experience objectives of the person, and

o make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

o sets forth the basis on which the broker or dealer made the suitability determination and

23

o that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

The market price for our common shares is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history and lack of profits which could lead to wide fluctuations in our share price. You may be unable to sell your common shares at or above your purchase price, which may result in substantial losses to you.

The market for our common shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First, as noted above, our common shares are sporadically and thinly traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or "risky" investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our potential products and services. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond our control and may decrease the market price of our common shares, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common shares will be at any time, including as to whether our common shares will sustain their current market prices, or as to what effect that the sale of shares or the availability of common shares for sale at any time will have on the prevailing market price.

We do not pay dividends on our Common Stock.

We have not paid any dividends on our common stock and do not anticipate paying dividends in the foreseeable future. We plan to retain earnings, if any, to finance the development and expansion of our business.

Failure to Achieve and Maintain Effective Internal Controls In Accordance With Section 404 Of The Sarbanes-Oxley Act Of 2002 Could Have A Material Adverse Effect On Our Business And Stock Price.

Section 404 of the Sarbanes-Oxley Act of 2002 ("the Sarbanes-Oxley Act") requires that we establish and maintain an adequate internal control structure and procedures for financial reporting and include a report of management on our internal control over financial reporting in our annual report on Form 10-K. That report must contain an assessment by management of the effectiveness of our internal control over financial reporting and must include disclosure of any material weaknesses in internal control over financial reporting that we have identified.

24

Rule 144 Related Risk.